A Scoping Review of Flexibility Markets in the Power Sector: Models, Mechanisms, and Business Perspectives

Abstract

1. Introduction

2. Materials and Methods

2.1. Protocol and Registration

2.2. Eligibility Criteria

- Type of publication: Eligible documents included peer-reviewed journal articles and conference papers.

- Source quality and accessibility: Grey literature, technical reports, and non-peer-reviewed sources were excluded. Only articles with full-text access and a valid DOI were included.

- Thematic scope: Studies concentrated on energy flexibility marketplaces, flexibility methods, coordinating techniques, enabling technology, and business models.

- Language: Only studies published in English were considered.

2.3. Information Sources and Search Strategy

- In Web of Science (WoS), we employed the terms “Flexibility Markets” and “Peer to Peer review”, resulting in 319 records.

- In Scopus, we applied the query “TITLE-ABS (flexibility AND markets AND energy) AND KEY (flexibility AND market)”, limited to journals and conferences, which yielded 543 results.

- In IEEE Xplore, we used as search parameters “(“Document Title”: Flexibility markets) OR (“Publication Title”: Flexibility market) OR (“Author Keywords”: Flexibility market)”, and restricted to journals and conference proceedings, retrieving 501 documents.

2.4. Selection Process

- Identification: Duplicate records were removed based on DOI and title matching, reducing the dataset to 1302 articles.

- Screening: This stage involved two steps. First, a language filter was applied and titles were screened to retain only English-language publications and exclude clearly unrelated topics, resulting in 743 articles. Second, records containing irrelevant keywords or whose abstracts were misaligned with the research scope were excluded, yielding a final set of 243 articles.

2.5. Data Charting Process

- PRISMA-ScR principles to ensure replicability and methodological transparency.

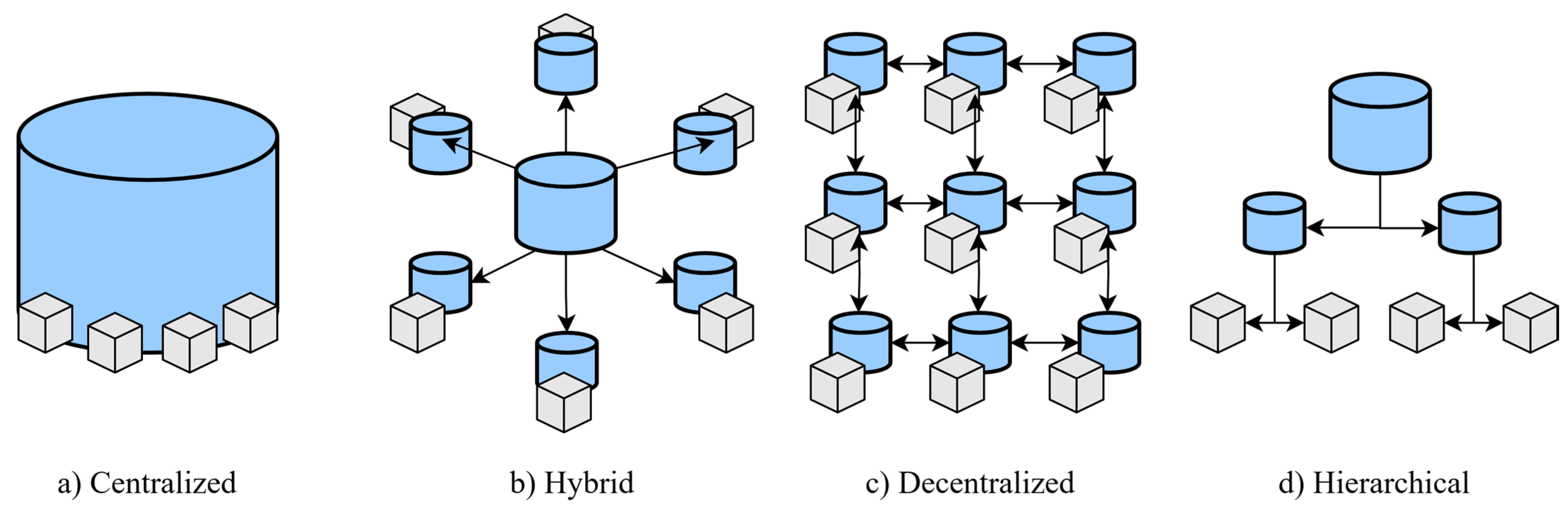

- TEAM Framework (Technology–Economy–Actor–Market) to examine actor interactions, coordination models, and systemic architectures in flexibility markets. This framework integrates concepts such as Moore’s metaphor, coordination theory, and value modelling, allowing analysis across technical, economic, and institutional dimensions according to the Business Ecosystem Architecture Modelling [10]. For instance, it captures whether coordination is centralized or distributed, what level of market integration is pursued, and how actors relate within the system. Ref. [11] illustrates a comparable application to peer-to-peer energy markets, which, although governed differently, share key functional traits with flexibility markets (e.g., decentralized control and value exchange).

- Business Model Canvas to identify economic mechanisms and organizational aspects of flexibility markets. This includes value propositions, customer segments, revenue structures, and cost models. While prior reviews [3,12,13,14] have applied simplified or case-specific versions of the BMC, our approach uses a comprehensive and comparative structure across all included articles.

2.6. Critical Appraisal and Synthesis of Results

3. Results

3.1. Overview of Included Studies

3.2. Flexibility Conceptualization

3.2.1. Definition

3.2.2. Metrics

- Capacity and power availability: Quantifies the amount of flexible energy or power that can be traded. Common indicators include ramp-up/down rates, dispatchability, curtailed energy, and load shift volume. This is the most widely used category, especially in capacity planning and operational scheduling.

- Temporal responsiveness: Captures how quickly and accurately a resource reacts to control signals, using metrics like response time, ramp rate, delay, and activation window. This is the second prominent group, especially in short-term operations.

- Cost–benefit metrics: Relate flexibility provision to economic performance, using activation cost, market revenues, and profit margins. These metrics are central to techno-economic evaluations and business model assessments.

- Reliability and variability: Assess the likelihood that flexibility will be available when needed. Probabilistic indicators such as Lack of Ramp Probability (LORP) and Insufficient Ramping Resource Expectation (IRRE) are used under high shares of renewables.

- Market and clearing performance: Evaluate how flexibility affects system efficiency and price signals. Key indicators include Market Clearing Price (MCP), activation ratio, and convergence time. This category features prominently in market design and simulation studies.

- Capacity adequacy under uncertainty: Focuses on system robustness to operate securely under uncertainty. Metrics like System Capability Ramp (SCR) and Ramping Capability Shortage Expectations (RCSE) are used in stress-test scenarios and long-term planning, though only a few studies apply them.

- Technical and grid-level indicators: This category connects flexibility to grid performance and includes voltage deviations and RES hosting capacity. These are essential for distribution system operators (DSOs) and grid reinforcement planning.

3.3. Modelling Assumptions and Interoperability

3.3.1. Rationality

- Perfect rationality or symmetry: Agents have full information, unlimited computational capacity, and act to maximize utility or profit.

- Bounded rationality: Agents operate under limited information or cognitive constraints, often following heuristics or behavioural rules.

- Unspecified: The model does not explicitly state how agent decisions are determined.

3.3.2. Perfect Information

3.3.3. Grid Constraints

- Detailed grid constraints: These studies incorporate full power flow models, typically using IEEE standard test systems (e.g., 13, 33, or 69-bus systems [98]) or advanced test cases like Simbench [99]. Formulations such as AC-OPF, DC-OPF [100], and LinDistFlow [101] are employed to integrate line limits, voltage constraints, and nodal balances directly into the optimization process. Flexibility is treated as a control variable constraint by network states, allowing spatial and temporal feasibility assessments.

- Post-optimization validation: Some studies exclude grid constraints during optimization, but validate results afterward through power flow simulations [103]. This ensures physical feasibility without embedding complexity in the main model.

- Narrative or qualitative consideration: These works acknowledge grid limitations, such as voltage, congestion, or capacity problems, but do not include mathematical representation. Often focused on qualitative insights, market design concepts, or regulatory or institutional frameworks, this group accounts for 61.3% (149) of the reviewed articles.

- No consideration of grid constraints: A total of 62 studies (25.5%) omit any reference to grid limitations, focusing on market mechanisms, actor behaviour, or economic outcomes. While useful for exploratory modelling, this omission reduces operational realism, especially when flexibility is intended for grid services like congestion management and voltage control.

3.3.4. Tariffs

3.3.5. Modelling Approaches and Algorithms

3.3.6. Interoperability

3.3.7. Technology Readiness Level

3.4. Market Participants and Enablers

3.4.1. Aggregation

3.4.2. Time Scale

3.4.3. Agent

3.5. Transactional and Coordination Aspects

3.5.1. Coordination Paradigms

3.5.2. Optimization Level of Coordination

- Global optimization: Global or system-wide optimization typically appears in centralized or bilevel frameworks, where a single authority (e.g., TSO or DSO) optimizes the activation and allocation of all available flexibility resources. These models aim to maximize social welfare, minimize system costs, and enforce network constraints holistically. They offer high efficiency and clear visibility over system dynamics but rely on complete information and pose scalability challenges in large, distributed systems.

- Distributed optimization: In contrast, distributed optimization leverages multi-agent systems, where each actor (aggregator, prosumer, DSO, etc.) solves its own local problem, potentially exchanging information through a coordination protocol. Methods include dual decomposition, Alternating Direction Method Of Multipliers (ADMM), and iterative pricing schemes. This approach reflects real-world decentralization and improves scalability, but requires convergence guarantees, robust communication, and often approximate solutions.

- Rule-based heuristics: Many pilot projects, regulatory sandboxes, and early-stage demonstrations rely on heuristic or rule-based methods for coordination. These may involve static priorities, time-of-use rules, and simple threshold-based activation. While not optimal in a mathematical sense, heuristics are pragmatic, transparent, and easily implementable, making them useful in uncertain or evolving regulatory contexts.

- Stackelberg and game-theoretic models: To capture strategic behaviour or sequential decision making, some studies use Stackelberg games, leader–follower models, and other game-theoretic frameworks. These allow one agent (e.g., a DSO) to anticipate responses from others (e.g., aggregators) and design coordination accordingly. Such models are valuable for studying incentives and market power but are computationally intensive and often limited to theoretical analysis or stylized case studies.

3.5.3. Strategic Behaviour

3.6. Business Model Analysis

3.6.1. Value Proposition

3.6.2. Customer Segments

3.6.3. Channels

3.6.4. Cost Structure

3.6.5. Revenue Streams

3.6.6. Actor-Specific Differentiation

4. Discussion

4.1. Main Findings and Emerging Patterns

4.2. Methodological Weaknesses

4.3. Thematic Gaps in the Literature

4.4. Implications for Practice and Policy

4.5. Future Research Directions and Priorities

- Integration of uncertainty in modelling frameworks: While several studies recognize the stochastic nature of flexibility provision, uncertainty is often abstracted away or addressed through simplified sensitivity analyses. Future work should advance the use of stochastic optimization, scenario-based modelling, and probabilistic simulation techniques to reflect real-world conditions such as renewable variability, price volatility, and user behaviour. As demonstrated in Section 3.3.5, only a minority of studies incorporate robust scenario generation or risk-adjusted planning. This limits the capacity of current models to support investment decisions and market design under high-renewables and decentralized scenarios.

- Behavioural and socio-economic modelling of end-users: Many studies assume passive or price-responsive behaviour, overlooking the heterogeneity of preferences, routines, and barriers that affect user participation. The literature underrepresents aspects such as comfort boundaries, rebound effects, and behavioural inertia. Future research should incorporate agent-based simulations, behavioural economics, and co-creation methods to capture the dynamic interaction between incentives and actual user responses. This is particularly relevant in low-voltage grids and energy communities, where social acceptance and perceived fairness can make or break flexibility mechanisms.

- Realistic cost structures and economic viability: A key gap lies in the simplification of cost models, which often include only activation costs while ignoring transaction costs, ICT investments, user onboarding, coordination, and platform maintenance. As shown in Section 3.6.4, cost realism is especially poor in early-stage models (TRLs 1–3), limiting their use for scalability assessment. Future research must adopt more granular and comprehensive cost typologies, possibly aligned with techno-economic assessment (TEA) and total cost of ownership (TCO) frameworks. Exploring cost-efficiency trade-offs across flexibility types and deployment models (e.g., centralized vs. distributed) would be particularly valuable.

- Interoperability, standardization, and platform architecture: Despite the centrality of digital infrastructure, interoperability is addressed in less than 40% of the reviewed studies (Section 3.3.6). This hinders the replicability and integration of flexibility platforms across jurisdictions. Future research should investigate open standards, layered architectures, and interface protocols, such as USEF, OpenADR, and CIM, not only from a technical perspective, but also from a governance and business model perspective. Platform design should be evaluated not only for performance, but also for data ownership, user trust, and regulatory alignment.

- Equity, risk-sharing, and institutional feasibility: As discussed in Section 3.6 and Section 4.3, the distribution of costs, benefits, and control remains largely unexplored. Future studies should analyze how flexibility mechanisms impact different user groups, especially vulnerable consumers, SMEs, and non-participating actors. Mechanisms for risk-sharing, fair remuneration, and revenue stacking across DSOs, TSOs, and aggregators need to be designed and evaluated, considering both efficiency and fairness. This also includes assessing institutional arrangements, such as role allocation, accountability, and dispute resolution in multi-actor flexibility schemes.

- Empirical validation, experimentation, and international comparison: Only a small fraction of the reviewed studies rely on real-world data, pilot results, or cross-country comparisons. Model assumptions are often insufficiently validated, leading to a mismatch between simulated performance and observed dynamics. There is a need for greater emphasis on learning from demonstration projects, regulatory sandboxes, and real-world trials—especially for evaluating market design, user response, and platform operation. Furthermore, comparative studies between countries or regions can uncover contextual dependencies and transferability limits, helping to design flexibility mechanisms that are both scalable and locally adapted.

- Enhancing load restoration strategies through cross-sector flexibility. Recent developments suggest promising avenues in coordinating the flexibility of buildings and electric buses during restoration scenarios. Leveraging thermal inertia and the spatiotemporal mobility of electric vehicles could significantly enhance grid resilience. Future studies should investigate fair allocation mechanisms, integrate sustainability metrics, and assess the societal impacts of prolonged outages, particularly in the context of decentralized energy transportation networks.

- Integrating cooperative game-theoretic approaches and multi-agent coordination. Emerging research highlights the potential of cooperative strategies based on asymmetric negotiation to optimize interactions among heterogeneous agents—such as renewable generators, storage systems, and building loads. These approaches enable fair profit allocation, preserve agent privacy, and improve solving efficiency through advanced distributed algorithms. Exploring such models may provide more realistic, privacy-preserving, and computationally scalable coordination mechanisms for future flexibility markets.

5. Conclusions

Supplementary Materials

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Abbreviations

| ABM | Agent-Based Models |

| ADMM | Alternating Direction Method of Multipliers |

| BMC | Business Model Canvas |

| BSUoS | Balancing Services Use-of-System |

| CBA | Cost–Benefit Analysis |

| CIM | Common Information Model |

| DA | Day-ahead |

| DER | Distributed Energy Resources |

| DSO | Distribution System Operator |

| DUoS | Distribution Use-of-System |

| EV | Electric Vehicle |

| FMP | Flexibility Market Platform |

| FSP | Flexibility Service Provider |

| HEMS | Home Energy Management System |

| IoT | Internet of Things |

| IRRE | Insufficient Ramping Resource Expectation |

| LFM | Local Flexibility Market |

| LMP | Locational Marginal Pricing |

| LORP | Lack of Ramp Probability |

| LP | Linear Programming |

| MCP | Market Clearing Price |

| MILP | Mixed Integer Linear Programming |

| NPV | Net Present Value |

| OPF | Optimal Power Flow |

| OpenADR | Open Automated Demand Response |

| PRISMA-ScR | Preferred Reporting Items for Systematic Reviews and Meta-Analyses extension for Scoping Reviews |

| P2P | Peer-to-Peer |

| QoS | Quality of Service |

| RES | Renewable Energy Sources |

| RT | Real-time |

| SCR | System Capability Ramp |

| SGAM | Smart Grid Architecture Model |

| SO | System Operator |

| TEAM | Technological, Economic, Actor and Market |

| ToU | Time-of-Use |

| TNUoS | Transmission Network Use-of-System |

| TRL | Technology Readiness Level |

| TSO | Transmission System Operator |

| USEF | Universal Smart Energy Framework |

| VPP | Virtual Power Plant |

| WoS | Web of Science |

Appendix A

| Section | Column | Type | Description |

|---|---|---|---|

| General Data | Authors | Free text | List of all authors |

| Title | Free text | Full paper title | |

| Year | Numeric | Year of publication | |

| Source title | Free text | Journal or conference proceedings | |

| DOI | Text | Digital Object Identifier (if available) | |

| Objective and research question | Paper type | Choice | Review, Modelling, Empirical, Experimental |

| Research question | Free text | What problem or research gap does the paper aim to address? | |

| Future work | Free text | Open questions or future work proposed by the authors | |

| Flexibility | Definition | Free text | How is flexibility defined? |

| Type | Choice | Explicit/Implicit | |

| Metrics | Free text | e.g., ramp rate, time response | |

| Modelling assumptions | Rationality | Choice | Perfect/Bounded/Not specified |

| Information symmetry | Boolean | Do all agents share the same information? | |

| Grid constraints | Free text | Are physical grid limits included? | |

| Tariffs | Free text | e.g., Static, dynamic, ToU, real-time tariffs. | |

| Algorithms | Free text | e.g., LP, MILP, AI, heuristic, agent-based, game theory. | |

| Technology Readiness Level | Numeric | TRL 1 (basic research) to TRL 9 (commercial deployment) | |

| Interoperability | Standard used | Free text | e.g., OpenADR, IEC 61850, Modbus, OpenFMB. |

| Market participants and enablers | Aggregation level | Choice | Household, SME, Industry, Community, Aggregator, VPP |

| Time scale addressed | Free text | e.g., Intra-day, Day-ahead, Weekly, Seasonal. | |

| Agent | Choice | Consumer, Prosumer, Aggregator, DSO, TSO, Grid Operator | |

| Flexibility role | Choice | Provider, Requester, Coordinator, Enabler | |

| Coordination paradigms | Choice | Centralized, Decentralized, Hierarchical, Peer-to-peer | |

| Level of coordination | Choice | Local, Regional, System-wide; Distributed vs. Global | |

| Strategic behaviour | Free text | Any modelling of gaming, bidding strategy, selfish behaviour | |

| Business Model | Value proposition | Free text | What value or benefit is provided, and to whom? |

| Customer segments | Free text | e.g., Individuals, DSOs, communities, etc. | |

| Channel | Free text | e.g., Platforms, aggregators, etc. | |

| Cost structure | Free text | e.g., CAPEX, OPEX, cost- vs. value-driven. | |

| Revenue streams | Free text | Fixed/dynamic pricing, incentives, savings | |

| Results, conclusions and recommendations | Main findings | Free text | What are the key insights, results or takeaways from the study? |

| Limitations | Free text | What are the limitations, caveats or uncertainties? | |

| Benefits and risks | Free text | How are risks/rewards distributed among actors? | |

| Rating | Choice | High/Medium/Low | |

| Notes | Free text | Any extra comments |

References

- Singh, R.; Vijay, R.; Mathuria, P.; Bhakar, R. Local Flexibility Markets in the Context of Reactive Power Provision by Distributed Energy Resources. In Proceedings of the 2022 4th International Conference on Energy, Power and Environment (ICEPE), Shillong, India, 29 April–1 May 2022; IEEE: Piscataway, NJ, USA, 2022; pp. 1–6. [Google Scholar] [CrossRef]

- Pourghaderi, N.; Fotuhi-Firuzabad, M.; Moeini-Aghtaie, M.; Kabirifar, M. Energy and Flexibility Scheduling of DERs under TVPP’s Supervision using Market-Based Framework. In Proceedings of the 2020 IEEE 4th International Conference on Intelligent Energy and Power Systems (IEPS), Istanbul, Türkiye, 7–11 September 2020; IEEE: Piscataway, NJ, USA, 2020; pp. 169–174. [Google Scholar] [CrossRef]

- Lynch, P.; Power, J.; Hickey, R.; Messervey, T. Business model strategies: Flexibility trade in emerging low voltage distribution networks. JESI 2017, 4, 380–391. [Google Scholar] [CrossRef]

- Villar, J.; Bessa, R.; Matos, M. Flexibility products and markets: Literature review. Electr. Power Syst. Res. 2018, 154, 329–340. [Google Scholar] [CrossRef]

- Ziras, C.; Zepter, J.M.; Pechrak, S.; Tsaousoglou, G. Designing a local flexibility market for buying back capacity from electricity consumers connected to the distribution network. Util. Policy 2025, 93, 101889. [Google Scholar] [CrossRef]

- Morstyn, T.; Teytelboym, A.; McCulloch, M.D. Designing Decentralized Markets for Distribution System Flexibility. IEEE Trans. Power Syst. 2019, 34, 2128–2139. [Google Scholar] [CrossRef]

- Valarezo, O.; Gómez, T.; Chaves-Avila, J.P.; Lind, L.; Correa, M.; Ulrich Ziegler, D.; Escobar, R. Analysis of New Flexibility Market Models in Europe. Energies 2021, 14, 3521. [Google Scholar] [CrossRef]

- Wang, S.; Tan, X.; Liu, T.; Tsang, D.H.K. Aggregation of Demand-Side Flexibility in Electricity Markets: Negative Impact Analysis and Mitigation Method. IEEE Trans. Smart Grid 2021, 12, 774–786. [Google Scholar] [CrossRef]

- Forouli, A.; Bakirtzis, E.A.; Papazoglou, G.; Oureilidis, K.; Gkountis, V.; Candido, L.; Ferrer, E.D.; Biskas, P. Assessment of Demand Side Flexibility in European Electricity Markets: A Country Level Review. Energies 2021, 14, 2324. [Google Scholar] [CrossRef]

- Wieringa, R.J.; Engelsman, W.; Gordijn, J.; Ionita, D. A Business Ecosystem Architecture Modeling Framework. In Proceedings of the 2019 IEEE 21st Conference on Business Informatics (CBI), Moscow, Russia, 15–17 July 2019; IEEE: Piscataway, NJ, USA, 2019; pp. 147–156. [Google Scholar] [CrossRef]

- Capper, T.; Gorbatcheva, A.; Mustafa, M.A.; Bahloul, M.; Schwidtal, J.M.; Chitchyan, R.; Andoni, M.; Robu, V.; Montakhabi, M.; Scott, I.J.; et al. Peer-to-peer, community self-consumption, and transactive energy: A systematic literature review of local energy market models. Renew. Sustain. Energy Rev. 2022, 162, 112403. [Google Scholar] [CrossRef]

- Hamwi, M.; Lizarralde, I.; Legardeur, J. Demand response business model canvas: A tool for flexibility creation in the electricity markets. J. Clean. Prod. 2021, 282, 124539. [Google Scholar] [CrossRef]

- Mladenov, V.; Chobanov, V.; Ivanova, V. DSO flexibility services Business Model Canvas. In Proceedings of the 2022 14th Electrical Engineering Faculty Conference (BulEF), Varna, Bulgaria, 15–17 September 2022; IEEE: Piscataway, NJ, USA, 2022; pp. 1–5. [Google Scholar] [CrossRef]

- Okur, O.; Heijnen, P.; Lukszo, Z. Aggregator’s Business Models: Challenges Faced by Different Roles. In Proceedings of the 2020 IEEE PES Innovative Smart Grid Technologies Europe (ISGT-Europe), The Hague, The Netherlands, 26–28 October 2020; IEEE: Piscataway, NJ, USA, 2020; pp. 484–488. [Google Scholar] [CrossRef]

- Kapassa, E.; Touloupou, M.; Themistocleous, M. Local Electricity and Flexibility Markets: SWOT Analysis and Recommendations. In Proceedings of the 2021 6th International Conference on Smart and Sustainable Technologies (SpliTech), Bol and Split, Croatia, 8–11 September 2021; IEEE: Piscataway, NJ, USA, 2021; pp. 1–6. [Google Scholar] [CrossRef]

- Ma, J.; Silva, V.; Belhomme, R.; Kirschen, D.S.; Ochoa, L.F. Evaluating and Planning Flexibility in Sustainable Power Systems. IEEE Trans. Sustain. Energy 2013, 4, 200–209. [Google Scholar] [CrossRef]

- Hadi, M.B.; Moeini-Aghtaie, M.; Khoshjahan, M.; Dehghanian, P. A Comprehensive Review on Power System Flexibility: Concept, Services, and Products. IEEE Access 2022, 10, 99257–99267. [Google Scholar] [CrossRef]

- Khajeh, H.; Firoozi, H.; Laaksonen, H.; Shafie-khah, M. A New Local Market Structure for Meeting Customer-Level Flexibility Needs. In Proceedings of the 2020 International Conference on Smart Energy Systems and Technologies (SEST), Istanbul, Türkiye, 7–9 September 2020; IEEE: Piscataway, NJ, USA, 2020; pp. 1–6. [Google Scholar] [CrossRef]

- Kara, G.; Tomasgard, A.; Farahmand, H. Characterizing flexibility in power markets and systems. Util. Policy 2022, 75, 101349. [Google Scholar] [CrossRef]

- Liu, R.; Wang, X.; Zhao, H.; Wang, Y. Distribution System Congestion Management Based on Local Flexibility Market. In Proceedings of the 2021 6th Asia Conference on Power and Electrical Engineering (ACPEE), Chongqing, China, 8–11 April 2021; IEEE: Piscataway, NJ, USA, 2021; pp. 1023–1029. [Google Scholar] [CrossRef]

- Aghdam, F.H.; Zavodovski, A.; Rasti, M.; Pongracz, E. Virtual Energy Storage Systems and their Participation in Day-ahead and Flexibility Markets. In Proceedings of the 2024 IEEE PES Innovative Smart Grid Technologies Europe (ISGT EUROPE), Dubrovnik, Croatia, 14–17 October 2024; IEEE: Piscataway, NJ, USA, 2024; pp. 1–5. [Google Scholar] [CrossRef]

- Gu, N.; Cui, J.; Wu, C. A general Nash Bargaining solution to the TSO-DSOs coordinated flexibility trading market. Electr. Power Syst. Res. 2022, 212, 108329. [Google Scholar] [CrossRef]

- Rodrigues, L.; Ganesan, K.; Retorta, F.; Coelho, F.; Mello, J.; Villar, J.; Bessa, R. Review of Commercial Flexibility Products and Market Platforms. In Proceedings of the 2024 20th International Conference on the European Energy Market (EEM), Istanbul, Türkiye, 10–12 June 2024; IEEE: Piscataway, NJ, USA, 2024; pp. 1–6. [Google Scholar] [CrossRef]

- Golmohamadi, H.; Larsen, K.G.; Jensen, P.G.; Hasrat, I.R. Integration of flexibility potentials of district heating systems into electricity markets: A review. Renew. Sustain. Energy Rev. 2022, 159, 112200. [Google Scholar] [CrossRef]

- Cervone, A.; Falvo, M.C. Transmission grid flexibility assessment in electricity market: Bulk system indices for the operational planning. In Proceedings of the 2nd IET Renewable Power Generation Conference (RPG 2013), Beijing, China, 9–11 September 2013; Institution of Engineering and Technology: Stevenage, UK; p. 2.45. [Google Scholar] [CrossRef]

- Hennig, R.; Tindemans, S.H.; De Vries, L. Market Failures in Local Flexibility Market Proposals for Distribution Network Congestion Management. In Proceedings of the 2022 18th International Conference on the European Energy Market (EEM), Ljubljana, Slovenia, 13–15 September 2022; IEEE: Piscataway, NJ, USA, 2022; pp. 1–6. [Google Scholar] [CrossRef]

- Ge, X.; Kremers, E.; Yadack, M.; Eicker, U. Simulation-supported quantification of flexibility: Assessing the potential for blocks of buildings to participate in demand response markets. In Proceedings of the 2019 16th International Conference on the European Energy Market (EEM), Ljubljana, Slovenia, 18–20 September 2019; IEEE: Piscataway, NJ, USA, 2019; pp. 1–6. [Google Scholar] [CrossRef]

- Vicente-Pastor, A.; Nieto-Martin, J.; Bunn, D.W.; Laur, A. Evaluation of Flexibility Markets for Retailer–DSO–TSO Coordination. IEEE Trans. Power Syst. 2019, 34, 2003–2012. [Google Scholar] [CrossRef]

- Paredes, A.; Aguado, J.A. Coordinated Trading of Capacity and Balancing Products in Multi-Area Local Flexibility Markets. In Proceedings of the 2022 IEEE Electrical Power and Energy Conference (EPEC), Victoria, BC, Canada, 5–7 December 2022; IEEE: Piscataway, NJ, USA, 2022; pp. 348–353. [Google Scholar] [CrossRef]

- García-Muñoz, F.; Martín, S.S.; Eichman, J. Empowering Energy Communities by A User-Centric Model for Self-Managed Congestion via Local P2P and Flexibility Markets. In Proceedings of the 2024 20th International Conference on the European Energy Market (EEM), Istanbul, Türkiye, 10–12 June 2024; IEEE: Piscataway, NJ, USA, 2024; pp. 1–5. [Google Scholar] [CrossRef]

- Borne, O.; Petit, M.; Perez, Y. Market Integration Vs Temporal Granularity: How To Provide Needed Flexibility Resources? In Proceedings of the 2017 IEEE PES Innovative Smart Grid Technologies Conference Europe (ISGT-Europe), Turin, Italy, 26–29 September 2017. [Google Scholar]

- Khorasany, M.; Najafi-Ghalelou, A.; Razzaghi, R. A Framework for Joint Scheduling and Power Trading of Prosumers in Transactive Markets. IEEE Trans. Sustain. Energy 2021, 12, 955–965. [Google Scholar] [CrossRef]

- Rozentale, L.; Kalnbalkite, A.; Blumberga, D. Aggregator as a new electricity market player: (Case study of Latvia). In Proceedings of the 2020 IEEE 61th International Scientific Conference on Power and Electrical Engineering of Riga Technical University (RTUCON), Riga, Latvia, 5–7 November 2020; IEEE: Piscataway, NJ, USA, 2020; pp. 1–6. [Google Scholar] [CrossRef]

- Mello, J.; Villar, J. Integrating flexibility and energy local markets with wholesale balancing responsibilities in the context of renewable energy communities. Energy 2023, 282, 128853. [Google Scholar] [CrossRef]

- Khojasteh, M.; Faria, P.; Lezama, F.; Vale, Z. A novel adaptive robust model for scheduling distributed energy resources in local electricity and flexibility markets. Appl. Energy 2023, 342, 121144. [Google Scholar] [CrossRef]

- Rahmati, I.; Akbari Foroud, A. Two Amendments for Reserve Procurement in Electricity Markets to Enhance Real-Time Compatibility and Boost Flexibility. Iran J. Sci. Technol. Trans. Electr. Eng. 2023, 47, 1081–1100. [Google Scholar] [CrossRef]

- Tang, H.; Wang, S. Multi-level optimal dispatch strategy and profit-sharing mechanism for unlocking energy flexibilities of non-residential building clusters in electricity markets of multiple flexibility services. Renew. Energy 2022, 201, 35–45. [Google Scholar] [CrossRef]

- Bagheritabar, M.; Hakimi, S.M.; Derakhshan, G.; Rezaee Jordehi, A. A three-stage optimization framework for unlocking demand-side flexibility in highly renewable electricity grids. Energy 2025, 320, 135158. [Google Scholar] [CrossRef]

- Marques, L.; Sanjab, A. Strategic behavior in TSO-DSO coordinated flexibility markets: A Nash equilibrium and efficiency analysis. Sustain. Energy Grids Netw. 2024, 39, 101476. [Google Scholar] [CrossRef]

- Zobiri, F.; Gama, M.; Nikova, S.; Deconinck, G. Residential flexibility characterization and trading using secure Multiparty Computation. Int. J. Electr. Power Energy Syst. 2024, 155, 109604. [Google Scholar] [CrossRef]

- Stawska, A.; Romero, N.; De Weerdt, M.; Verzijlbergh, R. Demand response: For congestion management or for grid balancing? Energy Policy 2021, 148, 111920. [Google Scholar] [CrossRef]

- Marques, L.; Sanjab, A.; Mou, Y.; Le Cadre, H.; Kessels, K. Grid Impact Aware TSO-DSO Market Models for Flexibility Procurement: Coordination, Pricing Efficiency, and Information Sharing. IEEE Trans. Power Syst. 2023, 38, 1920–1933. [Google Scholar] [CrossRef]

- Khomami, H.P.; Fonteijn, R.; Geelen, D. Flexibility Market Design for Congestion Management in Smart Distribution Grids: The Dutch Demonstration of the Interflex Project. In Proceedings of the 2020 IEEE PES Innovative Smart Grid Technologies Europe (ISGT-Europe), The Hague, The Netherlands, 26–28 October 2020; IEEE: Piscataway, NJ, USA, 2020; pp. 1191–1195. [Google Scholar] [CrossRef]

- Dominguez, J.A.; Sabir, S.; Henao, N.; Agbossou, K.; Oviedo-Cepeda, J.C.; Campillo, J. ORFLEX: Open Platform for Rapid Testing and Deploying Local Flexibility Markets. In Proceedings of the IECON 2024—50th Annual Conference of the IEEE Industrial Electronics Society, Chicago, IL, USA, 3–6 November 2024; IEEE: Piscataway, NJ, USA, 2024; pp. 1–6. [Google Scholar] [CrossRef]

- Bobo, L.; Delikaraoglou, S.; Vespermann, N.; Kazempour, J.; Pinson, P. Offering Strategy of a Flexibility Aggregator in a Balancing Market Using Asymmetric Block Offers. In Proceedings of the 2018 Power Systems Computation Conference (PSCC), Dublin, Ireland, 11–15 June 2018; IEEE: Piscataway, NJ, USA, 2018; pp. 1–7. [Google Scholar] [CrossRef]

- Mladenov, V.; Chobanov, V.; Bobochikov, T.; Van, T.V.; Gazioglu, I.; Rey, T.; Wuilloud, G. Trading process and flexibility energy service exchange. In Proceedings of the 2021 13th Electrical Engineering Faculty Conference (BulEF), Varna, Bulgaria, 8–11 September 2021; IEEE: Piscataway, NJ, USA, 2021; pp. 1–5. [Google Scholar] [CrossRef]

- Jin, L.; Zhang, S.; Zhu, J.; Tang, L.; Zheng, L. Research on Local Flexibility Resources Participating in Power Balance Based on Traffic Light Mechanism. In Proceedings of the 2023 6th International Conference on Energy, Electrical and Power Engineering (CEEPE), Guangzhou, China, 12–14 May 2023; IEEE: Piscataway, NJ, USA, 2023; pp. 1568–1573. [Google Scholar] [CrossRef]

- Khandelwal, M.; Mathuria, P.; Bhakar, R. State-of-Art on Flexibility Services in Electricity Markets. In Proceedings of the 2018 8th IEEE India International Conference on Power Electronics (IICPE), Jaipur, India, 13–15 December 2018; IEEE: Piscataway, NJ, USA, 2018; pp. 1–6. [Google Scholar] [CrossRef]

- Park, H.; Ko, W. A Bi-Level Scheduling Model of the Distribution System With a Distribution Company and Virtual Power Plants Considering Grid Flexibility. IEEE Access 2022, 10, 36711–36724. [Google Scholar] [CrossRef]

- Ziras, C.; Heinrich, C.; Bindner, H.W. Why baselines are not suited for local flexibility markets. Renew. Sustain. Energy Rev. 2021, 135, 110357. [Google Scholar] [CrossRef]

- Bagherzadeh, L.; Kamwa, I.; Alharthi, Y.Z. Hybrid strategy of flexibility regulation and economic energy management in the power system including renewable energy hubs based on coordination of transmission and distribution system operators. Energy Rep. 2024, 12, 1025–1043. [Google Scholar] [CrossRef]

- Seklos, K.; Efthymiopoulos, N.; Michalas, A.; Dimitriou, T.; Vergados, D.J.; Vergados, D.D. Distribution Grid Compatible Renewable Energy Through Optimal Exploitation of Bottom Up Flexibility. In Proceedings of the 2023 14th International Conference on Information, Intelligence, Systems & Applications (IISA), Volos, Greece, 10–12 July 2023; IEEE: Piscataway, NJ, USA, 2023; pp. 1–7. [Google Scholar] [CrossRef]

- Ackermann, T.; Tröster, E.; Hülsmann, L.; Ohl, U.; Koch, M. Effectiveness of different flexibility options and innovative network technologies for the use in the BDEW traffic light concept, on the basis of a German distribution grid. In Proceedings of the CIGRÉ 2019—International Council on Large Electric Systems, Study Committee C6 (Active Distribution Systems and Distributed Energy Resources), Paris, France, 26–31 August 2019. [Google Scholar]

- Fournely, C.; Pecjak, M.; Smolej, T.; Turk, A.; Neumann, C. Flexibility markets in the EU: Emerging approaches and new options for market design. In Proceedings of the 2022 18th International Conference on the European Energy Market (EEM), Ljubljana, Slovenia, 13–15 September 2022; IEEE: Piscataway, NJ, USA, 2022; pp. 1–7. [Google Scholar] [CrossRef]

- Anaya, K.L.; Pollitt, M.G. How to Procure Flexibility Services within the Electricity Distribution System: Lessons from an International Review of Innovation Projects. Energies 2021, 14, 4475. [Google Scholar] [CrossRef]

- Seklos, K.; Tsaousoglou, G.; Steriotis, K.; Efthymiopoulos, N.; Makris, P.; Varvarigos, E. Designing a Distribution Level Flexibility Market using Mechanism Design and Optimal Power Flow. In Proceedings of the 2020 International Conference on Smart Energy Systems and Technologies (SEST), Istanbul, Türkiye, 7–9 September 2020; IEEE: Piscataway, NJ, USA, 2020; pp. 1–6. [Google Scholar] [CrossRef]

- Cruz-De-Jesus, E.; Martinez-Ramos, J.L.; Marano-Marcolini, A.; Garcia-Santacruz, C. Provision of Flexibility Services to the Distribution System Operator by Local Energy Communities. In Proceedings of the 2023 IEEE International Conference on Environment and Electrical Engineering and 2023 IEEE Industrial and Commercial Power Systems Europe (EEEIC/I&CPS Europe), Madrid, Spain, 6–9 June 2023; IEEE: Piscataway, NJ, USA, 2023; pp. 1–6. [Google Scholar] [CrossRef]

- Alavijeh, N.M.; Ghazvini, M.A.F.; Steen, D.; Tuan, L.A.; Carlson, O. Key Drivers and Future Scenarios of Local Energy and Flexibility Markets. In Proceedings of the 2021 IEEE Madrid PowerTech, Madrid, Spain, 28 June–2 July 2021; IEEE: Piscataway, NJ, USA, 2021; pp. 1–6. [Google Scholar] [CrossRef]

- Minniti, S.; Haque, N.; Nguyen, P.; Pemen, G. Local Markets for Flexibility Trading: Key Stages and Enablers. Energies 2018, 11, 3074. [Google Scholar] [CrossRef]

- Bouloumpasis, I.; Mirzaei Alavijeh, N.; Steen, D.; Le, A.T. Local flexibility market framework for grid support services to distribution networks. Electr. Eng. 2022, 104, 401–419. [Google Scholar] [CrossRef]

- Afzal, Z.; Ekstedt, M.; Müller, N.; Mukherjee, P. Security Challenges in Energy Flexibility Markets: A Threat Modelling-Based Cyber-Security Analysis. Electronics 2024, 13, 4522. [Google Scholar] [CrossRef]

- Heilmann, E.; Klempp, N.; Wetzel, H. Design of regional flexibility markets for electricity: A product classification framework for and application to German pilot projects. Util. Policy 2020, 67, 101133. [Google Scholar] [CrossRef]

- Najafi-Ghalelou, A.; Khorasany, M.; Azim, M.I.; Razzaghi, R. Optimal Scheduling of Distributed Energy Resources Aggregators in Energy and Flexibility Markets. In Proceedings of the 2024 IEEE 34th Australasian Universities Power Engineering Conference (AUPEC), Sydney, Australia, 20–22 November 2024; IEEE: Piscataway, NJ, USA, 2024; pp. 1–6. [Google Scholar] [CrossRef]

- Savelli, I.; Bokkisam, H.R.; Cuffe, P.; Morstyn, T. On-demand energy flexibility market via smart contracts to help reduce balancing costs in Great Britain. Energy Econ. 2023, 126, 106931. [Google Scholar] [CrossRef]

- Olle, P.P.; Pellerin, B.; Skonnord, O.H.; Ottesen, S.O. A Business Case for Flexibility Market Operators Using Algorithms for Improved Market Efficiency. In Proceedings of the 2022 18th International Conference on the European Energy Market (EEM), Ljubljana, Slovenia, 13–15 September 2022; IEEE: Piscataway, NJ, USA, 2022; pp. 1–5. [Google Scholar] [CrossRef]

- Gonzalez, N.; Calatayud, P.; Arcos, L.; Trujillo, A.; Pellicer, M.G.; Quijano-Lopez, A. Optimal Participation of Aggregated Residential Customers in Flexibility Markets. In Proceedings of the 2020 8th International Conference on Smart Grid (icSmartGrid), Paris, France, 17–19 June 2020; IEEE: Piscataway, NJ, USA, 2020; pp. 43–47. [Google Scholar] [CrossRef]

- Lazović, Đ.; Đurišić, Ž. Advanced Flexibility Support through DSO-Coordinated Participation of DER Aggregators in the Balancing Market. Energies 2023, 16, 3440. [Google Scholar] [CrossRef]

- Eid, C.; Codani, P.; Perez, Y.; Reneses, J.; Hakvoort, R. Managing electric flexibility from Distributed Energy Resources: A review of incentives for market design. Renew. Sustain. Energy Rev. 2016, 64, 237–247. [Google Scholar] [CrossRef]

- Mantilla, N.; Toquica, D.; Oviedo, J.C.; Henao, N.; Agbossou, K. Clustering Alternatives in Market-Clearing for Transactive Energy Flexibility Spot Markets. In Proceedings of the 2024 International Conference on Smart Energy Systems and Technologies (SEST), Torino, Italy, 10–12 September 2024; IEEE: Piscataway, NJ, USA, 2024; pp. 1–6. [Google Scholar] [CrossRef]

- Sheykhha, M.R.; Nazar, M.S. The Scheduling of Operations in a Competitive Local Energy Market Under Constraints of Flexibility. In Proceedings of the 2023 13th Smart Grid Conference (SGC), Tehran, Iran, 5–6 December 2023; IEEE: Piscataway, NJ, USA, 2023; pp. 1–6. [Google Scholar] [CrossRef]

- Mansouri, S.A.; Nematbakhsh, E.; Ramos, A.; Tostado-Véliz, M.; Aguado, J.A.; Aghaei, J. A Robust ADMM-Enabled Optimization Framework for Decentralized Coordination of Microgrids. IEEE Trans. Ind. Inf. 2025, 21, 1479–1488. [Google Scholar] [CrossRef]

- Kouzelis, K.; Tan, Z.H.; Bak-Jensen, B.; Pillai, J.R.; Ritchie, E. Estimation of Residential Heat Pump Consumption for Flexibility Market Applications. IEEE Trans. Smart Grid 2015, 6, 1852–1864. [Google Scholar] [CrossRef]

- Lattanzio, G.; Viganò, G.; Rossi, M. Italian Regulatory Framework for Grid Flexibility: Weaknesses and Potential Enhancements. In Proceedings of the 2024 AEIT International Annual Conference (AEIT), Trento, Italy, 25–27 September 2024; IEEE: Piscataway, NJ, USA, 2024; pp. 1–6. [Google Scholar] [CrossRef]

- Kathirgamanathan, A.; Péan, T.; Zhang, K.; De Rosa, M.; Salom, J.; Kummert, M.; Finn, D.P. Towards standardising market-independent indicators for quantifying energy flexibility in buildings. Energy Build. 2020, 220, 110027. [Google Scholar] [CrossRef]

- Talaeizadeh, V.; Shayanfar, H.; Aghaei, J. Prioritization of transmission and distribution system operator collaboration for improved flexibility provision in energy markets. Int. J. Electr. Power Energy Syst. 2023, 154, 109386. [Google Scholar] [CrossRef]

- Papazoglou, G.K.; Forouli, A.A.; Bakirtzis, E.A.; Biskas, P.N.; Bakirtzis, A.G. Day-ahead local flexibility market for active and reactive power with linearized network constraints. Electr. Power Syst. Res. 2022, 212, 108317. [Google Scholar] [CrossRef]

- Efthymiopoulos, N.; Makris, P.; Tsaousoglou, G.; Steriotis, K.; Vergados, D.J.; Khaksari, A.; Herre, L.; Lacort, V.; Martinez, G.; Lorente, E.L.; et al. FLEXGRID—A novel smart grid architecture that facilitates high-RES penetration through innovative flexibility markets towards efficient stakeholder interaction. Open Res. Eur. 2023, 1, 128. [Google Scholar]

- Höckner, J.; Voswinkel, S.; Weber, C. Market distortions in flexibility markets caused by renewable subsidies: The case for side payments. Energy Policy 2020, 137, 111135. [Google Scholar] [CrossRef]

- Khajeh, H.; Firoozi, H.; Hesamzadeh, M.R.; Laaksonen, H.; Shafie-Khah, M. A Local Capacity Market Providing Local and System-Wide Flexibility Services. IEEE Access 2021, 9, 52336–52351. [Google Scholar] [CrossRef]

- Pourghaderi, N.; Fotuhi-Firuzabad, M.; Moeini-Aghtaie, M.; Kabirifar, M.; Lehtonen, M. Exploiting DERs’ Flexibility Provision in Distribution and Transmission Systems Interface. IEEE Trans. Power Syst. 2023, 38, 1963–1977. [Google Scholar] [CrossRef]

- Esterl, T.; Leimgruber, L.; Ferhatbegovic, T.; Zottl, A.; Krottenthaler, M.; Weiss, B. Aggregating the Flexibility of Heat Pumps and Thermal Storage Systems in Austria. In Proceedings of the 5th International Conference on Smart Cities and Green ICT Systems, Rome, Italy, 23–25 April 2016; SCITEPRESS—Science and and Technology Publications: Setúbal, Portugal, 2016; pp. 372–377. [Google Scholar] [CrossRef]

- Knez, K.; Blažič, B. Analysis of the Impact of Q(U) Curve and Flexibility on the Integration of PVs in a Low-Voltage Network. In Proceedings of the 2024 International Conference on Diagnostics in Electrical Engineering (Diagnostika), Pilsen, Czech Republic, 9–11 October 2024; IEEE: Piscataway, NJ, USA, 2024; pp. 1–4. [Google Scholar] [CrossRef]

- Wu, Z.; Wang, J.; Zhong, H.; Gao, F.; Pu, T.; Tan, C.-W.; Chen, X.; Li, G.; Zhao, H.; Zhou, M.; et al. Sharing Economy in Local Energy Markets. J. Mod. Power Syst. Clean Energy 2023, 11, 714–726. [Google Scholar] [CrossRef]

- Gonzalez Venegas, F.; Petit, M.; Perez, Y. Can DERs fully participate in emerging local flexibility tenders? In Proceedings of the 2019 16th International Conference on the European Energy Market (EEM), Ljubljana, Slovenia, 18–20 September 2019; IEEE: Piscataway, NJ, USA, 2019; pp. 1–5. [Google Scholar] [CrossRef]

- Hajati, M.; Sheikh-El-Eslami, M.K.; Delkhosh, H. Maximizing social welfare in local flexibility markets by integrating the value of flexibility loss (VOFL). Electr. Power Syst. Res. 2024, 235, 110840. [Google Scholar] [CrossRef]

- Kara, G.; Pisciella, P.; Tomasgard, A.; Farahmand, H.; Crespo Del Granado, P. Stochastic local flexibility market design, bidding, and dispatch for distribution grid operations. Energy 2022, 253, 123989. [Google Scholar] [CrossRef]

- Babagheibi, M.; Jadid, S.; Kazemi, A. An Incentive-based robust flexibility market for congestion management of an active distribution system to use the free capacity of Microgrids. Appl. Energy 2023, 336, 120832. [Google Scholar] [CrossRef]

- Bender, J.; Fait, L.; Wetzel, H. Acceptance of demand-side flexibility in the residential heating sector—Evidence from a stated choice experiment in Germany. Energy Policy 2024, 191, 114145. [Google Scholar] [CrossRef]

- Gonzalez Venegas, F.; Petit, M.; Perez, Y. Active integration of electric vehicles into distribution grids: Barriers and frameworks for flexibility services. Renew. Sustain. Energy Rev. 2021, 145, 111060. [Google Scholar] [CrossRef]

- Anaya, K.L.; Pollitt, M.G. The Role of Regulators in Promoting the Procurement of Flexibility Services within the Electricity Distribution System: A Survey of Seven Leading Countries. Energies 2021, 14, 4073. [Google Scholar] [CrossRef]

- Ottesen, S.Ø.; Haug, M.; Nygård, H.S. A Framework for Offering Short-Term Demand-Side Flexibility to a Flexibility Marketplace. Energies 2020, 13, 3612. [Google Scholar] [CrossRef]

- Paredes, Á.; Aguado, J.A.; Rodríguez, P. Uncertainty-Aware Trading of Congestion and Imbalance Mitigation Services for Multi-DSO Local Flexibility Markets. IEEE Trans. Sustain. Energy 2023, 14, 2133–2146. [Google Scholar] [CrossRef]

- Yao, M.; Moradi, Z.; Pirouzi, S.; Marzband, M.; Baziar, A. Stochastic Economic Operation of Coupling Unit of Flexi-Renewable Virtual Power Plant and Electric Spring in the Smart Distribution Network. IEEE Access 2023, 11, 75979–75992. [Google Scholar] [CrossRef]

- Herre, L.; Kovala, T.; Söder, L.; Lindh, C. Flexibility now or later?—Impact of market timing on flexibility and social welfare of demand response. Electr. J. 2022, 35, 107159. [Google Scholar] [CrossRef]

- Nizami, M.S.H.; Hossain, M.J.; Mahmud, K. A Nested Transactive Energy Market Model to Trade Demand-Side Flexibility of Residential Consumers. IEEE Trans. Smart Grid 2021, 12, 479–490. [Google Scholar] [CrossRef]

- Ma, Y.; Zhang, C.; Mi, Z.; Zhang, L.; Parisio, A. Secondary flexibility market mechanism design and response behavior analysis among multi-microgrids with high proportional BTM-RERs. Appl. Energy 2024, 367, 123345. [Google Scholar] [CrossRef]

- How organizational culture boosts strategic flexibility: Market orientation and industry 4.0 enhance the effect. Strateg. Dir. 2023, 39, 9–11. [CrossRef]

- Dai, S.; Mansouri, S.A.; Huang, S.; Alharthi, Y.Z.; Wu, Y.; Bagherzadeh, L. A multi-stage techno-economic model for harnessing flexibility from IoT-enabled appliances and smart charging systems: Developing a competitive local flexibility market using Stackelberg game theory. Appl. Energy 2024, 373, 123868. [Google Scholar] [CrossRef]

- Gaumnitz, F.; Ulbig, A.; Attar, M.; Repo, S. Towards a framework for modelling market-based congestion management in distribution grids. In Proceedings of the 2022 IEEE PES Innovative Smart Grid Technologies Conference Europe (ISGT-Europe), Novi Sad, Serbia, 18–21 October 2022; IEEE: Piscataway, NJ, USA, 2022; pp. 1–6. [Google Scholar] [CrossRef]

- Birk, S.; Talari, S.; Gebbran, D.; Ketter, W.; Schneiders, T. Clearing and Pricing for Network-Aware Local Flexibility Markets using Distributed Optimization. In Proceedings of the 2023 IEEE Belgrade PowerTech, Belgrade, Serbia, 25–29 June 2023; IEEE: Piscataway, NJ, USA, 2023; pp. 1–6. [Google Scholar] [CrossRef]

- Pediaditis, P.; Ziras, C.; Papadaskalopoulos, D.; Hatziargyriou, N. Synergies between Distribution Use-of-System Tariffs and Local Flexibility Markets. In Proceedings of the 2022 International Conference on Smart Energy Systems and Technologies (SEST), Eindhoven, The Netherlands, 5–7 September 2022; IEEE: Piscataway, NJ, USA, 2022; pp. 1–6. [Google Scholar] [CrossRef]

- Paredes, A.; Aguado, J.A. Capacity and Energy Local Flexibility Markets for Imbalance and Congestion Management. In Proceedings of the 2021 IEEE International Smart Cities Conference (ISC2), Manchester, UK, 7–10 September 2021; IEEE: Piscataway, NJ, USA, 2021; pp. 1–7. [Google Scholar] [CrossRef]

- Pečjak, M.; Fournely, C.; Lakić, E. A novel approach for flexibility trading in the distribution network. In Proceedings of the 2023 19th International Conference on the European Energy Market (EEM), Lappeenranta, Finland, 6–8 June 2023; IEEE: Piscataway, NJ, USA, 2023; pp. 1–6. [Google Scholar] [CrossRef]

- Feron, B.; Monti, A. An agent based approach for Virtual Power Plant valuing thermal flexibility in energy markets. In Proceedings of the 2017 IEEE Manchester PowerTech, Manchester, UK, 18–22 June 2017; IEEE: Piscataway, NJ, USA, 2017; pp. 1–6. [Google Scholar] [CrossRef]

- Ma, Z.; Jorgensen, B.N. Energy flexibility of the commercial greenhouse growers: The potential and benefits of participating in the electricity market. In Proceedings of the 2018 IEEE Power & Energy Society Innovative Smart Grid Technologies Conference (ISGT), Washington, DC, USA, 19–22 February 2018; IEEE: Piscataway, NJ, USA, 2018; pp. 1–5. [Google Scholar] [CrossRef]

- Zade, M.; Incedag, Y.; El-Baz, W.; Tzscheutschler, P.; Wagner, U. Prosumer Integration in Flexibility Markets: A Bid Development and Pricing Model. In Proceedings of the 2018 2nd IEEE Conference on Energy Internet and Energy System Integration (EI2), Beijing, China, 20–22 October 2018; IEEE: Piscataway, NJ, USA, 2018; pp. 1–9. [Google Scholar] [CrossRef]

- Earl, J.; Fell, M.J. Electric vehicle manufacturers’ perceptions of the market potential for demand-side flexibility using electric vehicles in the United Kingdom. Energy Policy 2019, 129, 646–652. [Google Scholar] [CrossRef]

- Ottesen, S.Ø.; Tomasgard, A.; Fleten, S.-E. Multi market bidding strategies for demand side flexibility aggregators in electricity markets. Energy 2018, 149, 120–134. [Google Scholar] [CrossRef]

- Torriti, J.; Yunusov, T. It’s only a matter of time: Flexibility, activities and time of use tariffs in the United Kingdom. Energy Res. Soc. Sci. 2020, 69, 101697. [Google Scholar] [CrossRef]

- Tveten, Å.G.; Bolkesjø, T.F.; Ilieva, I. Increased demand-side flexibility: Market effects and impacts on variable renewable energy integration. Int. J. Sustain. Energy Plan. Manag. 2016, 11, 33–50. [Google Scholar] [CrossRef]

- Olivella-Rosell, P.; Lloret-Gallego, P.; Munné-Collado, Í.; Villafafila-Robles, R.; Sumper, A.; Ottessen, S.; Rajasekharan, J.; Bremdal, B. Local Flexibility Market Design for Aggregators Providing Multiple Flexibility Services at Distribution Network Level. Energies 2018, 11, 822. [Google Scholar] [CrossRef]

- Bouloumpasis, I.; Steen, D.; Tuan, L.A. Congestion Management using Local Flexibility Markets: Recent Development and Challenges. In Proceedings of the 2019 IEEE PES Innovative Smart Grid Technologies Europe (ISGT-Europe), Bucharest, Romania, 16–19 June 2019; IEEE: Piscataway, NJ, USA, 2019; pp. 1–5. [Google Scholar] [CrossRef]

- Domínguez, R.; Oggioni, G.; Smeers, Y. Reserve procurement and flexibility services in power systems with high renewable capacity: Effects of integration on different market designs. Int. J. Electr. Power Energy Syst. 2019, 113, 1014–1034. [Google Scholar] [CrossRef]

- Ma, Z.; Knotzer, A.; Billanes, J.D.; Jørgensen, B.N. A literature review of energy flexibility in district heating with a survey of the stakeholders’ participation. Renew. Sustain. Energy Rev. 2020, 123, 109750. [Google Scholar] [CrossRef]

- Natale, N.; Pilo, F.; Pisano, G.; Soma, G.G. Market Participation of Distributed Energy Resources for offering Flexibility Services. In Proceedings of the 2020 17th International Conference on the European Energy Market (EEM), Stockholm, Sweden, 16–18 September 2020; IEEE: Piscataway, NJ, USA, 2020; pp. 1–5. [Google Scholar] [CrossRef]

- Correa-Florez, C.A.; Michiorri, A.; Kariniotakis, G. Optimal Participation of Residential Aggregators in Energy and Local Flexibility Markets. IEEE Trans. Smart Grid 2020, 11, 1644–1656. [Google Scholar] [CrossRef]

- Ilieva, I.; Bremdal, B. Implementing local flexibility markets and the uptake of electric vehicles—The case for Norway. In Proceedings of the 2020 6th IEEE International Energy Conference (ENERGYCon), Gammarth, Tunisia, 28 September–1 October 2020; IEEE: Piscataway, NJ, USA, 2020; pp. 1047–1052. [Google Scholar] [CrossRef]

- Badanjak, D.; Pandzic, H. Battery Storage Participation in Reactive and Proactive Distribution-Level Flexibility Markets. IEEE Access 2021, 9, 122322–122334. [Google Scholar] [CrossRef]

- Oleinikova, I.; Obushevs, A. Market design for electricity ensuring operational flexibility. In Proceedings of the 2015 IEEE 5th International Conference on Power Engineering, Energy and Electrical Drives (POWERENG), Riga, Latvia, 11–13 May 2015; IEEE: Piscataway, NJ, USA, 2015; pp. 239–243. [Google Scholar] [CrossRef]

- Moreno, M.A.; Usaola, J. Technical constraints and flexibility management in smart grids. In Proceedings of the 2015 12th International Conference on the European Energy Market (EEM), Lisbon, Portugal, 19–22 May 2015; IEEE: Piscataway, NJ, USA, 2015; pp. 1–5. [Google Scholar] [CrossRef]

- Iria, J.P.; Soares, F.J.; Matos, M.A. Trading small prosumers flexibility in the day-ahead energy market. In Proceedings of the 2017 IEEE Power & Energy Society General Meeting, Chicago, IL, USA, 16–20 July 2017; IEEE: Piscataway, NJ, USA, 2017; pp. 1–5. [Google Scholar] [CrossRef]

- Bierling, P.W.; Fonteijn, R.; Nguyen, P.H. Review of multi-BRP, aggregator settlement models at large-scale connections in the European electricity system. In Proceedings of the 2018 53rd International Universities Power Engineering Conference (UPEC), Glasgow, UK, 4–7 September 2018; IEEE: Piscataway, NJ, USA, 2018; pp. 1–6. [Google Scholar] [CrossRef]

- Corchero, C.; Nunez-del-Toro, C.; Paradell, P.; del-Rosario-Calaf, G. Integrating Ancillary Services From Demand Side Management and Distributed Generation: An Optimal Model. In Proceedings of the 2018 International Conference on Smart Energy Systems and Technologies (SEST), Sevilla, Spain, 10–12 September 2018; IEEE: Piscataway, NJ, USA, 2018; pp. 1–6. [Google Scholar] [CrossRef]

- Mamounakis, I.; Efthymiopoulos, N.; Vergados, D.J.; Tsaousoglou, G.; Makris, P.; Varvarigos, E.M. A pricing scheme for electric utility’s participation in day-ahead and real-time flexibility energy markets. J. Mod. Power Syst. Clean Energy 2019, 7, 1294–1306. [Google Scholar] [CrossRef]

- Wohlfarth, K.; Klingler, A.-L.; Eichhammer, W. The flexibility deployment of the service sector—A demand response modelling approach coupled with evidence from a market research survey. Energy Strategy Rev. 2020, 28, 100460. [Google Scholar] [CrossRef]

- Guerrero Alonso, J.I.; Personal, E.; García, S.; Parejo, A.; Rossi, M.; García, A.; Delfino, F.; Pérez, R.; León, C. Flexibility Services Based on OpenADR Protocol for DSO Level. Sensors 2020, 20, 6266. [Google Scholar] [CrossRef] [PubMed]

- Barbero, M.; Corchero, C.; Canals Casals, L.; Igualada, L.; Heredia, F.-J. Critical evaluation of European balancing markets to enable the participation of Demand Aggregators. Appl. Energy 2020, 264, 114707. [Google Scholar] [CrossRef]

- Coelho, A.; Iria, J.; Soares, F. Network-secure bidding optimization of aggregators of multi-energy systems in electricity, gas, and carbon markets. Appl. Energy 2021, 301, 117460. [Google Scholar] [CrossRef]

- Eid, C.; Codani, P.; Chen, Y.; Perez, Y.; Hakvoort, R. Aggregation of demand side flexibility in a smart grid: A review for European market design. In Proceedings of the 2015 12th International Conference on the European Energy Market (EEM), Lisbon, Portugal, 19–22 May 2015; IEEE: Piscataway, NJ, USA, 2015; pp. 1–5. [Google Scholar] [CrossRef]

- Alahäivälä, A.; Corbishley, J.; Ekström, J.; Jokisalo, J.; Lehtonen, M. A control framework for the utilization of heating load flexibility in a day-ahead market. Electr. Power Syst. Res. 2017, 145, 44–54. [Google Scholar] [CrossRef]

- Koraki, D.; Strunz, K. Wind and Solar Power Integration in Electricity Markets and Distribution Networks Through Service-Centric Virtual Power Plants. IEEE Trans. Power Syst. 2018, 33, 473–485. [Google Scholar] [CrossRef]

- Fonteijn, R.; Van Cuijk, T.; Nguyen, P.H.; Morren, J.; Slootweg, J.G. Flexibility for congestion management: A demonstration of a multi-mechanism approach. In Proceedings of the 2018 IEEE PES Innovative Smart Grid Technologies Conference Europe (ISGT-Europe), Sarajevo, Bosnia and Herzegovina, 21–25 October 2018; IEEE: Piscataway, NJ, USA, 2018; pp. 1–6. [Google Scholar] [CrossRef]

- Luo, G.; He, Y.; Zhao, C.; Zhang, X.; Lin, S.; Zhao, Y. Coordinated Wholesale and Retail Market Mechanism for Providing Demand-side Flexibility. In Proceedings of the 2019 IEEE Sustainable Power and Energy Conference (iSPEC), Beijing, China, 21–23 November 2019; IEEE: Piscataway, NJ, USA, 2019; pp. 2569–2574. [Google Scholar] [CrossRef]

- Chakraborty, S.; Hernandez-Leal, P.; Kaisers, M. An Exchange Mechanism to Coordinate Flexibility in Residential Energy Cooperatives. In Proceedings of the 2019 IEEE International Conference on Industrial Technology (ICIT), Melbourne, Australia, 13–15 February 2019; IEEE: Piscataway, NJ, USA, 2019; pp. 595–600. [Google Scholar] [CrossRef]

- Di Somma, M.; Graditi, G.; Siano, P. Optimal Bidding Strategy for a DER Aggregator in the Day-Ahead Market in the Presence of Demand Flexibility. IEEE Trans. Ind. Electron. 2019, 66, 1509–1519. [Google Scholar] [CrossRef]

- Akrami, A.; Doostizadeh, M.; Aminifar, F. Power system flexibility: An overview of emergence to evolution. J. Mod. Power Syst. Clean Energy 2019, 7, 987–1007. [Google Scholar] [CrossRef]

- Heinrich, C.; Ziras, C.; Syrri, A.L.A.; Bindner, H.W. EcoGrid 2.0: A large-scale field trial of a local flexibility market. Appl. Energy 2020, 261, 114399. [Google Scholar] [CrossRef]

- Tsaousoglou, G.; Giraldo, J.S.; Pinson, P.; Paterakis, N.G. Mechanism Design for Fair and Efficient DSO Flexibility Markets. IEEE Trans. Smart Grid 2021, 12, 2249–2260. [Google Scholar] [CrossRef]

- Mays, J. Missing incentives for flexibility in wholesale electricity markets. Energy Policy 2021, 149, 112010. [Google Scholar] [CrossRef]

- Pressmair, G.; Kapassa, E.; Casado-Mansilla, D.; Borges, C.E.; Themistocleous, M. Overcoming barriers for the adoption of Local Energy and Flexibility Markets: A user-centric and hybrid model. J. Clean. Prod. 2021, 317, 128323. [Google Scholar] [CrossRef] [PubMed]

- Schmitt, C.; Gaumnitz, F.; Blank, A.; Rebenaque, O.; Dronne, T.; Martin, A.; Vassilopoulos, P.; Moser, A.; Roques, F. Framework for Deterministic Assessment of Risk-Averse Participation in Local Flexibility Markets. Energies 2021, 14, 3012. [Google Scholar] [CrossRef]

- Niewiadomski, W.; Baczyńska, A. Advanced Flexibility Market for System Services Based on TSO–DSO Coordination and Usage of Distributed Resources. Energies 2021, 14, 5439. [Google Scholar] [CrossRef]

- Mancini, F.; Cimaglia, J.; Lo Basso, G.; Romano, S. Implementation and Simulation of Real Load Shifting Scenarios Based on a Flexibility Price Market Strategy—The Italian Residential Sector as a Case Study. Energies 2021, 14, 3080. [Google Scholar] [CrossRef]

- Alizadeh, M.; Chang, T.-H.; Scaglione, A. On Modeling and Marketing the Demand Flexibility of Deferrable Loads at the Wholesale Level. In Proceedings of the 2013 46th Hawaii International Conference on System Sciences, Wailea, HI, USA, 7–10 January 2013; IEEE: Piscataway, NJ, USA, 2013; pp. 2177–2186. [Google Scholar] [CrossRef]

- Sandels, C.; Hagelberg, M.; Nordstrom, L. Analysis on the profitability of demand flexibility on the swedish peak power reserve market. In Proceedings of the 2013 IEEE PES Innovative Smart Grid Technologies Conference (ISGT), Washington, DC, USA, 24–27 February 2013; IEEE: Piscataway, NJ, USA, 2013; pp. 1–6. [Google Scholar] [CrossRef]

- Roos, A.; Ottesen, S.Ø.; Bolkesjø, T.F. Modeling Consumer Flexibility of an Aggregator Participating in the Wholesale Power Market and the Regulation Capacity Market. Energy Procedia 2014, 58, 79–86. [Google Scholar] [CrossRef]

- Knezovic, K.; Marinelli, M.; Codani, P.; Perez, Y. Distribution grid services and flexibility provision by electric vehicles: A review of options. In Proceedings of the 2015 50th International Universities Power Engineering Conference (UPEC), Stoke-on-Trent, UK, 1–4 September 2015; IEEE: Piscataway, NJ, USA, 2015; pp. 1–6. [Google Scholar] [CrossRef]

- Faia, R.; Pinto, T.; Vale, Z.; Corchado, J.M. A Local Electricity Market Model for DSO Flexibility Trading. In Proceedings of the 2019 16th International Conference on the European Energy Market (EEM), Ljubljana, Slovenia, 18–20 September 2019; IEEE: Piscataway, NJ, USA, 2019; pp. 1–5. [Google Scholar] [CrossRef]

- Grzanic, M.; Capuder, T. The Value of Prosumers’ Flexibility under Different Electricity Market Conditions: Case Studies of Denmark and Croatia. In Proceedings of the 2019 IEEE PES GTD Grand International Conference and Exposition Asia (GTD Asia), Bangkok, Thailand, 19–23 March 2019; IEEE: Piscataway, NJ, USA, 2019; pp. 616–621. [Google Scholar] [CrossRef]

- Jin, X.; Wu, Q.; Jia, H. Local flexibility markets: Literature review on concepts, models and clearing methods. Appl. Energy 2020, 261, 114387. [Google Scholar] [CrossRef]

- Zabaleta, K.; Casado-Mansilla, D.; Kapassa, E.; Borges, C.E.; Presmair, G.; Themistocleous, M.; Lopez-de-Ipina, D. Barriers to Widespread the Adoption of Electric Flexibility Markets: A Triangulation Approach. In Proceedings of the 2020 5th International Conference on Smart and Sustainable Technologies (SpliTech), Split and Bol, Croatia, 1–4 July 2020; IEEE: Piscataway, NJ, USA, 2020; pp. 1–7. [Google Scholar] [CrossRef]

- Shen, F.; Wu, Q.; Jin, X.; Zhou, B.; Li, C.; Xu, Y. ADMM-based market clearing and optimal flexibility bidding of distribution-level flexibility market for day-ahead congestion management of distribution networks. Int. J. Electr. Power Energy Syst. 2020, 123, 106266. [Google Scholar] [CrossRef]

- Schittekatte, T.; Meeus, L. Flexibility markets: Q&A with project pioneers. Util. Policy 2020, 63, 101017. [Google Scholar] [CrossRef]

- Badanjak, D.; Pandžić, H. Distribution-Level Flexibility Markets—A Review of Trends, Research Projects, Key Stakeholders and Open Questions. Energies 2021, 14, 6622. [Google Scholar] [CrossRef]

- Bjarghov, S.; Kalantar-Neyestanaki, M.; Cherkaoui, R.; Farahmand, H. Battery Degradation-Aware Congestion Management in Local Flexibility Markets. In Proceedings of the 2021 IEEE Madrid PowerTech, Madrid, Spain, 28 June–2 July 2021; IEEE: Piscataway, NJ, USA, 2021; pp. 1–6. [Google Scholar] [CrossRef]

- Menci, S.P.; Herndler, B.; Kupzog, F.; Zweistra, M.; Steegh, R.; Willems, M. Scalability and Replicability Analysis of Grid Management Services in Low Voltage Networks in Local Flexibility Markets: An InterFlex analysis. In Proceedings of the 2021 IEEE Madrid PowerTech, Madrid, Spain, 28 June–2 July 2021; IEEE: Piscataway, NJ, USA, 2021; pp. 1–6. [Google Scholar] [CrossRef]

- Lystbæk, N.; Gregersen, M.; Shaker, H.R. Review of Energy Portfolio Optimization in Energy Markets Considering Flexibility of Power-to-X. Sustainability 2023, 15, 4422. [Google Scholar] [CrossRef]

- Subramanyam, S.A.; Khadria, D.; Bak-Jensen, B.; Anvari-Moghaddam, A. A Market-driven Approach for Unlocking Flexibility Potentials in Eco-Industrial Clusters. In Proceedings of the 2024 IEEE International Humanitarian Technologies Conference (IHTC), Bari, Italy, 27–30 November 2024; IEEE: Piscataway, NJ, USA, 2024; pp. 1–7. [Google Scholar] [CrossRef]

- Krstevski, P.; Mateska, A.K.; Borozan, S. Models for Integration of Flexibility Sources in Regional Electricity Markets. In Proceedings of the 2022 57th International Scientific Conference on Information, Communication and Energy Systems and Technologies (ICEST), Orhid, North Macedonia, 16–18 June 2022; IEEE: Piscataway, NJ, USA, 2022; pp. 1–4. [Google Scholar] [CrossRef]

- Zikos, S.; Malavazos, C.; Dimitriadou, I.; Timplalexis, C.; Fernández, G.; Ioannidis, D.; Tzovaras, D. Local Energy and Flexibility Markets: State of the art and technological gap analysis. In Proceedings of the 2023 8th International Conference on Smart and Sustainable Technologies (SpliTech), Split and Bol, Croatia, 20–23 June 2023; IEEE: Piscataway, NJ, USA, 2023; pp. 1–6. [Google Scholar] [CrossRef]

- Jiang, T.; Shen, Z.; Jin, X.; Zhang, R.; Parisio, A.; Li, X.; Kou, X. Solution to Coordination of Transmission and Distribution for Renewable Energy Integration into Power Grids: An Integrated Flexibility Market. CSEE JPES 2023, 9, 444–458. [Google Scholar] [CrossRef]

- Muller, N.; Heussen, K.; Afzal, Z.; Ekstedt, M.; Eliasson, P. Threat Scenarios and Monitoring Requirements for Cyber-Physical Systems of Flexibility Markets. In Proceedings of the 2022 IEEE PES Generation, Transmission and Distribution Conference and Exposition—Latin America (IEEE PES GTD Latin America), La Paz, Bolivia, 20–22 October 2022; IEEE: Piscataway, NJ, USA, 2022; pp. 1–6. [Google Scholar] [CrossRef]

- Sun, Q.; Li, X.; Wang, L.; Wang, H.; Cao, X.; Chen, S.; Zhang, K. Economic Optimal Scheduling of Electricity-Hydrogen Coupled Virtual Power Plant Considering Stochastic Flexibility Evaluation. In Proceedings of the 2023 5th International Conference on Power and Energy Technology (ICPET), Tianjin, China, 27–30 July 2023; IEEE: Piscataway, NJ, USA, 2023; pp. 1301–1306. [Google Scholar] [CrossRef]

- Shi, X.; Xu, Y.; Guo, Q.; Sun, H. Optimal Dispatch Based on Aggregated Operation Region of EV Considering Spatio-Temporal Distribution. IEEE Trans. Sustain. Energy 2022, 13, 715–731. [Google Scholar] [CrossRef]

- Taheri, S.; Kekatos, V.; Veeramachaneni, S.; Zhang, B. Data-Driven Modeling of Aggregate Flexibility Under Uncertain and Non-Convex Device Models. IEEE Trans. Smart Grid 2022, 13, 4572–4582. [Google Scholar] [CrossRef]

- Srivastava, A.; Zhao, J.; Zhu, H.; Ding, F.; Lei, S.; Zografopoulos, I.; Haider, R.; Vahedi, S.; Wang, W.; Valverde, G.; et al. Distribution System Behind-the-Meter DERs: Estimation, Uncertainty Quantification, and Control. IEEE Trans. Power Syst. 2025, 40, 1060–1077. [Google Scholar] [CrossRef]

- Vagropoulos, S.I.; Biskas, P.N.; Bakirtzis, A.G. Market-based TSO-DSO coordination for enhanced flexibility services provision. Electr. Power Syst. Res. 2022, 208, 107883. [Google Scholar] [CrossRef]

- Kumaran Nalini, B.; You, Z.; Zade, M.; Tzscheutschler, P.; Wagner, U. OpenTUMFlex: A flexibility quantification and pricing mechanism for prosumer participation in local flexibility markets. Int. J. Electr. Power Energy Syst. 2022, 143, 108382. [Google Scholar] [CrossRef]

- Khorasany, M.; Shokri Gazafroudi, A.; Razzaghi, R.; Morstyn, T.; Shafie-khah, M. A framework for participation of prosumers in peer-to-peer energy trading and flexibility markets. Appl. Energy 2022, 314, 118907. [Google Scholar] [CrossRef]

- Huang, C.; Zhang, M.; Wang, C.; Xie, N.; Yuan, Z. An interactive two-stage retail electricity market for microgrids with peer-to-peer flexibility trading. Appl. Energy 2022, 320, 119085. [Google Scholar] [CrossRef]

- Lustenberger, M.; Bellizio, F.; Cai, H.; Heer, P.; Ziras, C. Introducing price feedback of local flexibility markets into distribution network planning. Electr. Power Syst. Res. 2024, 236, 110686. [Google Scholar] [CrossRef]

- Turdybek, B.; Tostado-Véliz, M.; Mansouri, S.A.; Rezaee Jordehi, A.; Jurado, F. A local electricity market mechanism for flexibility provision in industrial parks involving Heterogenous flexible loads. Appl. Energy 2024, 359, 122748. [Google Scholar] [CrossRef]

- Nolzen, N.; Leenders, L.; Bardow, A. Flexibility-expansion planning of multi-energy systems by energy storage for participating in balancing-power markets. Front. Energy Res. 2023, 11, 1225564. [Google Scholar] [CrossRef]

- Mirzaei Alavijeh, N.; Steen, D.; Le, A.T.; Nyström, S. Capacity limitation based local flexibility market for congestion management in distribution networks: Design and challenges. Int. J. Electr. Power Energy Syst. 2024, 156, 109742. [Google Scholar] [CrossRef]

- Heibatollahpour, V.; Lashkarara, A.; Joorabian, M. A three-stage chance-constraint model for co-optimization of transmission and distribution networks operation considering flexibility provision by smart buildings. Sustain. Energy Grids Netw. 2024, 38, 101370. [Google Scholar] [CrossRef]

- Wanapinit, N.; Thomsen, J.; Weidlich, A. Integrating flexibility provision into operation planning: A generic framework to assess potentials and bid prices of end-users. Energy 2022, 261, 125261. [Google Scholar] [CrossRef]

- Huynh, T.; Schmidt, F.; Thiem, S.; Kautz, M.; Steinke, F.; Niessen, S. Local energy markets for thermal-electric energy systems considering energy carrier dependency and energy storage systems. Smart Energy 2022, 6, 100065. [Google Scholar] [CrossRef]

- Mehinovic, A.; Zajc, M.; Suljanovic, N. Interpretation and Quantification of the Flexibility Sources Location on the Flexibility Service in the Distribution Grid. Energies 2023, 16, 590. [Google Scholar] [CrossRef]

- Tang, H.; Wang, S.; Li, H. Flexibility categorization, sources, capabilities and technologies for energy-flexible and grid-responsive buildings: State-of-the-art and future perspective. Energy 2021, 219, 119598. [Google Scholar] [CrossRef]

- Zeiselmair, A.; Köppl, S. Constrained Optimization as the Allocation Method in Local Flexibility Markets. Energies 2021, 14, 3932. [Google Scholar] [CrossRef]

- Sanjab, A.; De Almeida Terça, G. Grid-Impact Aware P2P Trading and Implications on Flexibility Markets. In Proceedings of the 2024 IEEE PES Innovative Smart Grid Technologies Europe (ISGT EUROPE), Dubrovnik, Croatia, 14–17 October 2024; IEEE: Piscataway, NJ, USA, 2024; pp. 1–6. [Google Scholar] [CrossRef]

- Khaksari, A.; Steriotis, K.; Makris, P.; Tsaousoglou, G.; Efthymiopoulos, N.; Varvarigos, E. Electricity market equilibria analysis on the value of demand-side flexibility portfolios’ mix and the strategic demand aggregators’ market power. Sustain. Energy Grids Netw. 2024, 38, 101399. [Google Scholar] [CrossRef]

- Koltsaklis, N.E.; Knápek, J. Integrated market scheduling with flexibility options. Renew. Sustain. Energy Rev. 2025, 208, 115020. [Google Scholar] [CrossRef]

- Paredes, Á.; Aguado, J.A. On the Assessment of the Flexibility Region in Inter-DSO Local Markets. In Proceedings of the 2023 IEEE Belgrade PowerTech, Belgrade, Serbia, 26–29 June 2023; IEEE: Piscataway, NJ, USA, 2023; pp. 1–6. [Google Scholar] [CrossRef]

- Lind, L.; Chaves-Ávila, J.P.; Valarezo, O.; Sanjab, A.; Olmos, L. Baseline methods for distributed flexibility in power systems considering resource, market, and product characteristics. Util. Policy 2024, 86, 101688. [Google Scholar] [CrossRef]

- Mansouri, S.A.; Nematbakhsh, E.; Jordehi, A.R.; Marzband, M.; Tostado-Véliz, M.; Jurado, F. An interval-based nested optimization framework for deriving flexibility from smart buildings and electric vehicle fleets in the TSO-DSO coordination. Appl. Energy 2023, 341, 121062. [Google Scholar] [CrossRef]

- McCulloch, M.; Dierenbach, J.; Baatar, M.; Graeber, D.; Tolstrup, K.; Fanta, S.; Zobernig, V. How interoperability of flexibility platforms enables market design opportunities. In Proceedings of the 2023 19th International Conference on the European Energy Market (EEM), Lappeenranta, Finland, 6–8 June 2023; IEEE: Piscataway, NJ, USA, 2023; pp. 1–4. [Google Scholar] [CrossRef]

- Viganò, G.; Lattanzio, G.; Rossi, M. Review of Main Projects, Characteristics and Challenges in Flexibility Markets for Services Addressed to Electricity Distribution Network. Energies 2024, 17, 2781. [Google Scholar] [CrossRef]

- Wang, Q.; Hodge, B.-M. Enhancing Power System Operational Flexibility With Flexible Ramping Products: A Review. IEEE Trans. Ind. Inf. 2017, 13, 1652–1664. [Google Scholar] [CrossRef]

- Lopes, F. From Wholesale Energy Markets to Local Flexibility Markets: Structure, Models and Operation. In Local Electricity Markets; Elsevier: Amsterdam, The Netherlands, 2021; pp. 37–61. [Google Scholar] [CrossRef]

- Tina, G.M.; Conti, S.; Soma, G.G.; De Fiore, S.; Panto, A. Aggregation Platform to Maximize the Utilization of Distributed Energy Resources’ Flexibility. In Proceedings of the 2022 Workshop on Blockchain for Renewables Integration (BLORIN), Palermo, Italy, 2–3 September 2022; IEEE: Piscataway, NJ, USA, 2022; pp. 25–30. [Google Scholar] [CrossRef]

- Madina, C.; Gonzalez-Garrido, A.; Gomez-Arriola, I.; Santos-Mugica, M.; Kuusela, P.; Tamminen, A.; Mehnert, S. GLocalFlex, New Flexibility Solutions and Services. Cross-Pilot Overarching Business Use Cases. In Proceedings of the 2024 20th International Conference on the European Energy Market (EEM), Istanbul, Türkiye, 10–12 June 2024; IEEE: Piscataway, NJ, USA, 2024; pp. 1–6. [Google Scholar] [CrossRef]

- Kraft, O.; Pohl, O.; Häger, U.; Heussen, K.; Müller, N.; Afzal, Z.; Ekstedt, M.; Farahmand, H.; Ivanko, D.; Singh, A.; et al. Development and Implementation of a Holistic Flexibility Market Architecture. In Proceedings of the 2022 IEEE Power & Energy Society Innovative Smart Grid Technologies Conference (ISGT), New Orleans, LA, USA, 4–7 April 2022; IEEE: Piscataway, NJ, USA, 2022; pp. 1–5. [Google Scholar] [CrossRef]

- Farrukh, F.; Pellerin, B. Business ecosystem of local flexibility platforms with corresponding business models in a digital energy system. In Proceedings of the 2022 IEEE 7th International Energy Conference (ENERGYCON), Riga, Latvia, 9–12 May 2022; IEEE: Piscataway, NJ, USA, 2022; pp. 1–6. [Google Scholar] [CrossRef]

- Vannoni, A.; Rodio, C.; Corsetti, E. Optimizing Local Markets for Ancillary Services Procurement: A Case Study on Flexibility Markets in Italy. In Proceedings of the 2024 20th International Conference on the European Energy Market (EEM), Istanbul, Türkiye, 10–12 June 2024; IEEE: Piscataway, NJ, USA, 2024; pp. 1–6. [Google Scholar] [CrossRef]

- Bauer, D.; Abele, E.; Ahrens, R.; Bauernhansl, T.; Fridgen, G.; Jarke, M.; Keller, F.; Keller, R.; Pullmann, J.; Reiners, R.; et al. Flexible IT-platform to Synchronize Energy Demands with Volatile Markets. Procedia CIRP 2017, 63, 318–323. [Google Scholar] [CrossRef]

- Cheng, L.; Huang, P.; Zhang, M.; Yang, R.; Wang, Y. Optimizing Electricity Markets Through Game-Theoretical Methods: Strategic and Policy Implications for Power Purchasing and Generation Enterprises. Mathematics 2025, 13, 373. [Google Scholar] [CrossRef]

- Tricco, A.C.; Lillie, E.; Zarin, W.; O’Brien, K.K.; Colquhoun, H.; Levac, D.; Moher, D.; Peters, M.D.; Horsley, T.; Weeks, L.; et al. PRISMA Extension for Scoping Reviews (PRISMAScR): Checklist and Explanation. Ann. Intern. Med. 2018, 169, 467–473. [Google Scholar] [CrossRef]

| Category | Metrics | References |

|---|---|---|

| Capacity and power availability | Flexibility Ramp-Up | [4,17,19] |

| Flexibility Ramp-Down | [4,17,19] | |

| Load shift volume | [1,20] | |

| Curtailed energy | [21] | |

| Energy capacity | [22] | |

| Dispatchability | [4,17] | |

| Power | [2,23,24,25,26,27,28,29,30,31,32,33,34,35,36,37,38,39,40,41] | |

| Temporal responsiveness | Response Time | [6,20,22,28,31,42,43,44,45,46,47,48,49,50,51,52,53] |

| Ramp Rate | [15,42,50,54,55,56,57] | |

| Delay | [8,14,18,58,59,60] | |

| Start-up Time | [17] | |

| Activation Window | [17] | |

| Cost–benefit metrics | Activation cost | [21,42,48,50,51,61,62] |

| Market revenue | [9,63,64] | |

| Profit margin | [3,21,63,65] | |

| Reliability and variability | IRRE | [4,19] |

| LORP | [4,19] | |

| Market and Clearing Performance | MCP | [66] |

| Activation ratio | [5,67] | |

| Social welfare | [19,34,68,69,70,71,72,73,74,75,76,77,78] | |

| Efficiency | [5,20,24,28,51,57,66,73,79,80,81,82,83,84,85,86,87,88,89,90,91] | |

| Convergence time | [92,93] | |

| Capacity adequacy under uncertainty | SCR | [17,94] |

| RCSE | [17] | |

| Technical and grid-level indicators | Voltage deviation | [37,38,95,96,97] |

| Hosting capacity | [78,97,98] |

| Category | References |

|---|---|

| ToU and dynamic tariffs | [2,9,16,18,20,25,27,32,50,68,104,105,106,107,108,109] |

| Wholesale electricity market prices | [8,14,31,43,46,56,78,81,84,102,110,111,112,113,114,115,116,117,118] |

| Network access tariffs | [3,15,28,33,41,53,55,66,72,74,89,91,95,119,120,121,122,123,124,125,126,127,128] |

| Hybrid remuneration schemes | [6,45,58,62,129,130,131,132,133,134,135,136,137,138,139,140,141,142,143] |

| Tariffs as operational signals | [4,7,12,48,59,79,144,145,146,147,148,149,150,151,152,153,154,155,156] |

| Category | References |

|---|---|

| Conventional optimization algorithms | [12,15,18,19,21,25,29,30,33,34,37,38,44,48,51,54,61,62,66,67,69,71,73,74,76,77,79,80,84,89,91,98,103,105,106,111,117,119,125,131,132,133,134,136,137,140,141,143,147,149,157,158,159,160,161,162,163,164,165,166,167,168,169,170,171,172,173,174,175,176,177,178,179,180] |

| Game-theoretic and equilibrium models | [42,83,159,161,181] |

| Agent-based models | [27,63,83,89,103,167] |

| Machine learning and heuristic methods | [18,40,96,103,182,183] |

| Distributed optimization techniques | [41,76,93,126] |

| Stochastic optimization methods | [64,66,93,117,118,121,172,184,185,186] |

| Timescale | Purpose | Applications |

|---|---|---|

| Long term | Strategic planning and system adequacy | Annual system planning, capacity remuneration mechanisms, regulatory tariffs, and incentive schemes |