Capacity Configuration and Benefit Assessment of Deep-Sea Wind–Hydrogen System Considering Dynamic Hydrogen Price

Abstract

1. Introduction

2. Literature Review

2.1. Capacity Optimization

2.2. Comprehensive Benefits

3. Capacity Configuration Model

3.1. Optimization Objectives

- (1)

- Initial investment cost:

- (2)

- System operation and maintenance costs:

- (3)

- Cost of replacing electrolytic cell:

- (4)

- Profits from deep-sea wind-power hydrogen production system:

3.2. Constraints

- (1)

- Electrolyzer power constraints:

- (2)

- Wind power balance constraints:

- (3)

- Capacity constraints of deep-sea wind-power hydrogen production systems:

- (4)

- Power constraints of electrochemical energy storage:

4. Comprehensive Benefit Evaluation Model

4.1. Calculation of Comprehensive Benefit Evaluation Index Weights

4.1.1. Calculation of Subjective Weights of Indicators Based on Fuzzy SWARA Method

4.1.2. Calculation of Objective Weights of Indicators Based on Fuzzy Entropy Weight Method

4.2. Construction of Comprehensive Benefit Evaluation Model for Deep-Sea Wind-Power Hydrogen Production

- (1)

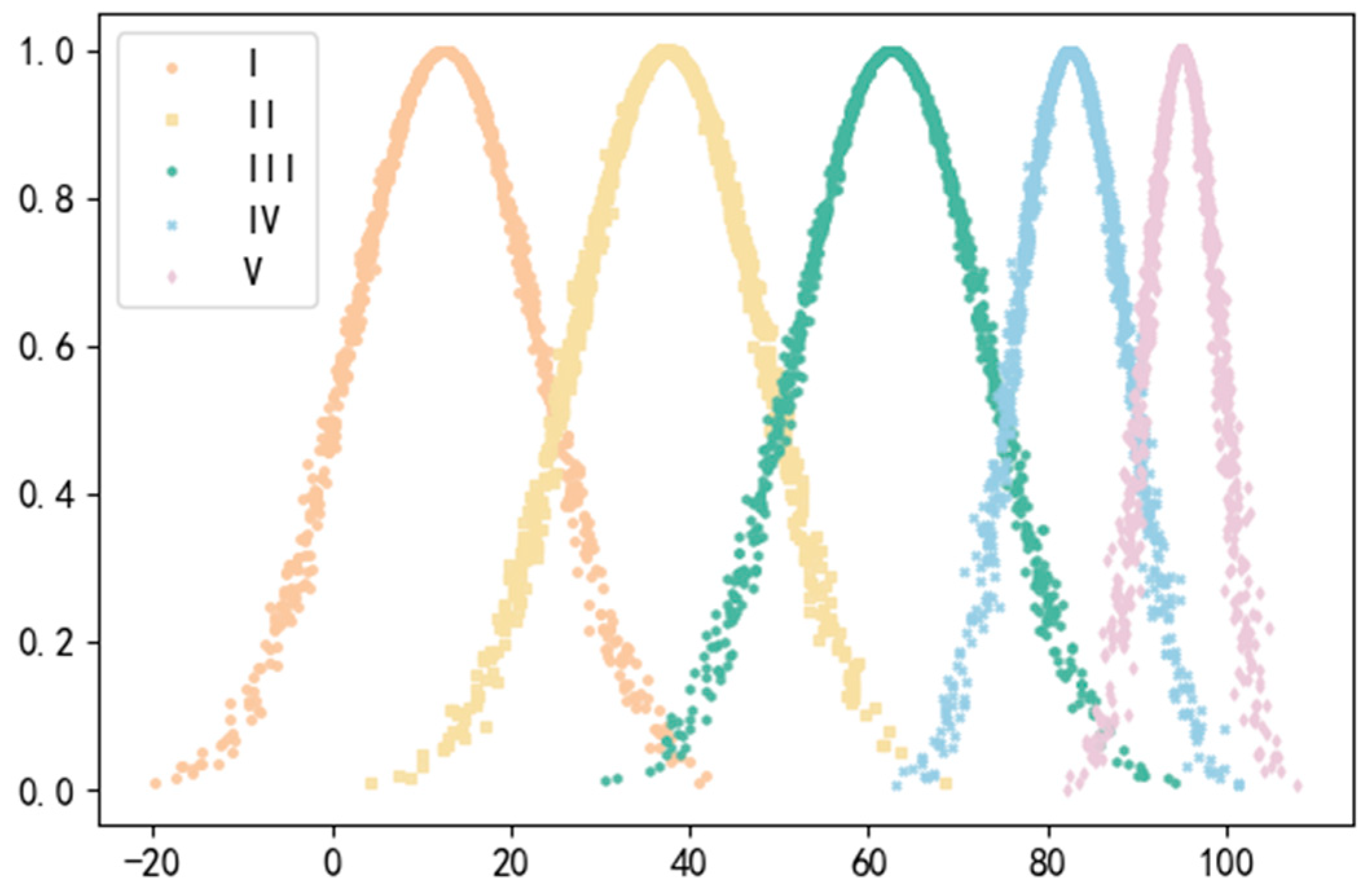

- Determine the rating level and evaluation criteria

- (2)

- Determine the indicator evaluation cloud model

- (3)

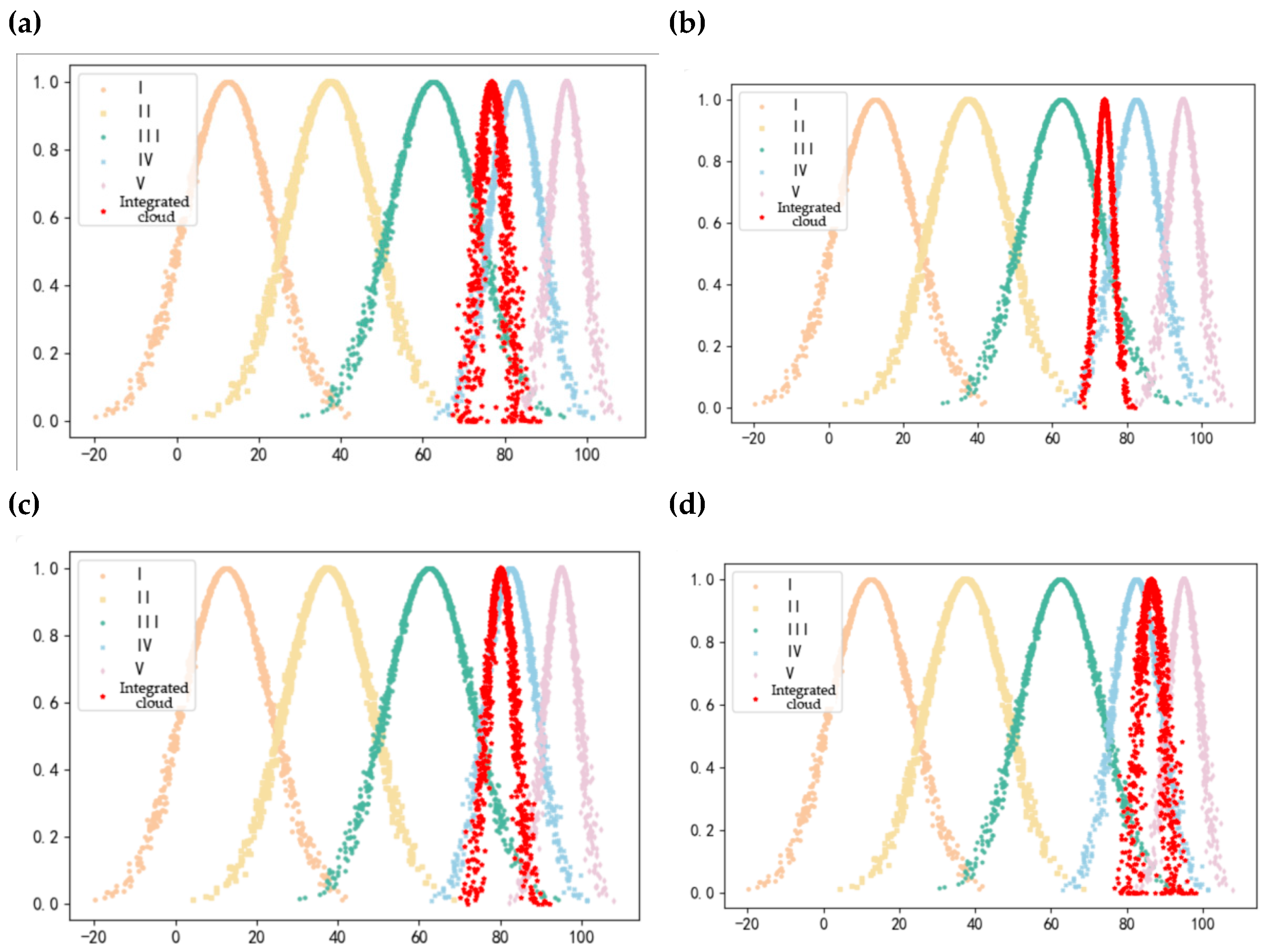

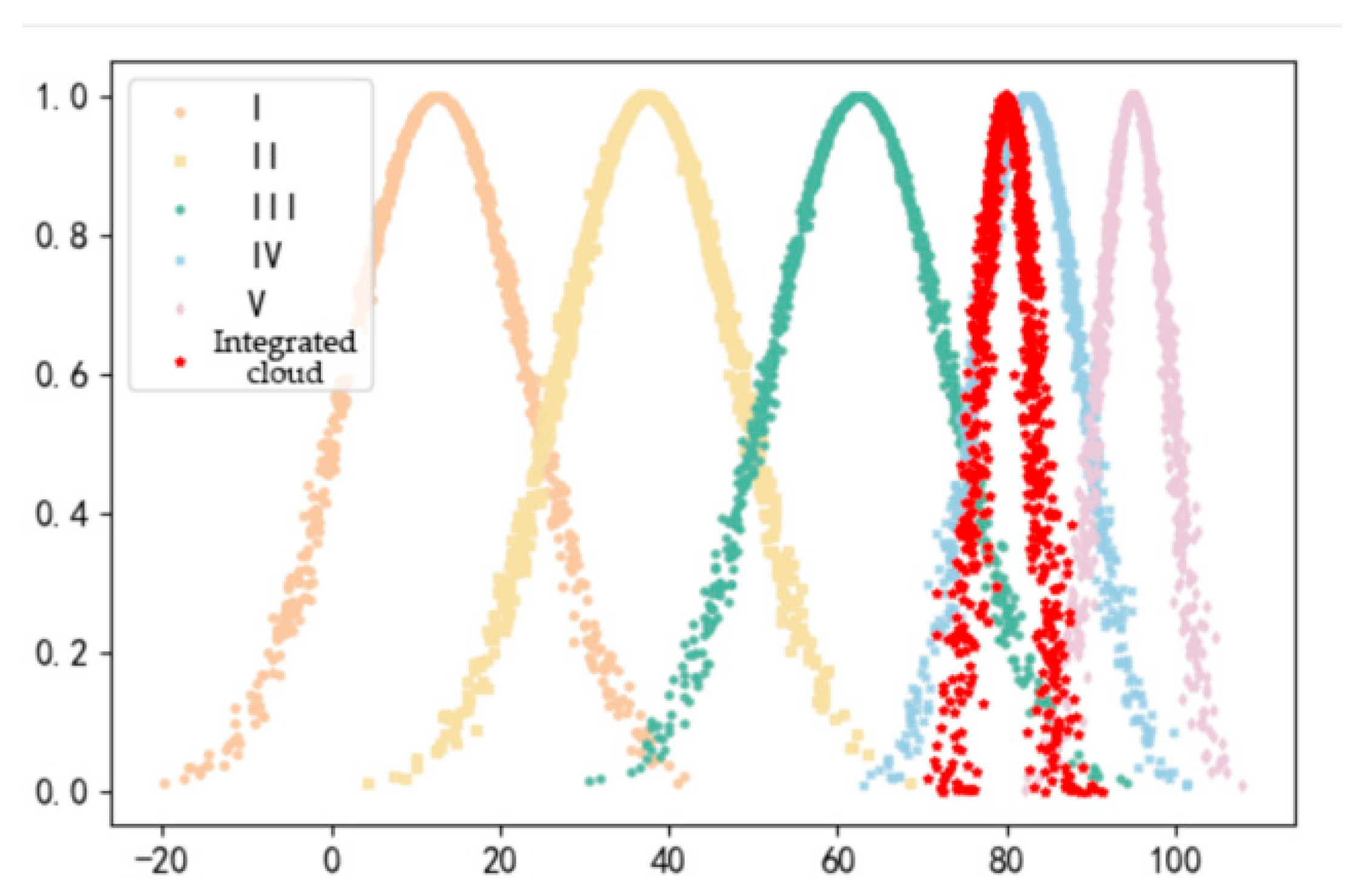

- Computing comprehensive evaluation cloud

- (4)

- Determine the evaluation results

5. Numerical Experiments

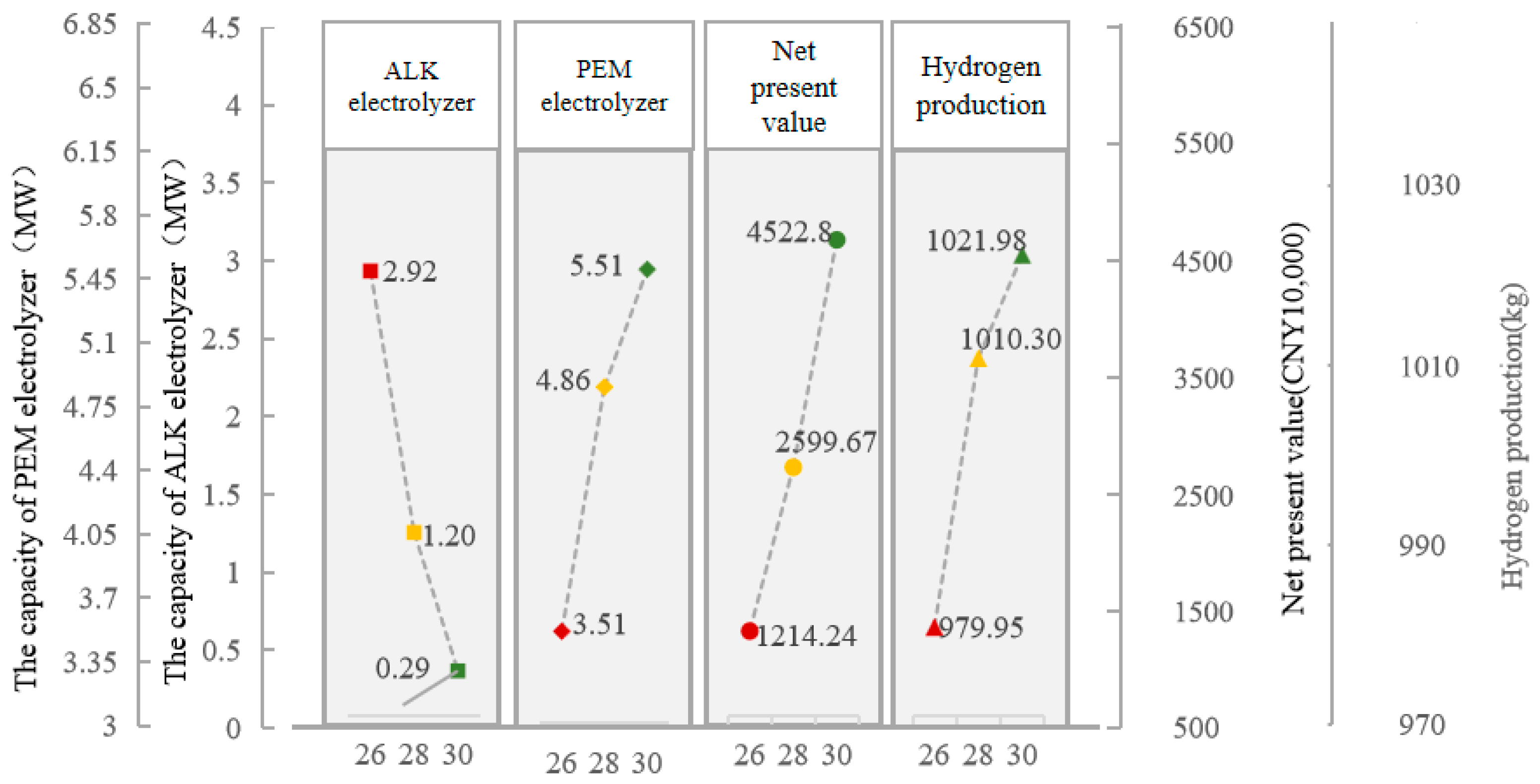

5.1. Capacity Configuration Results

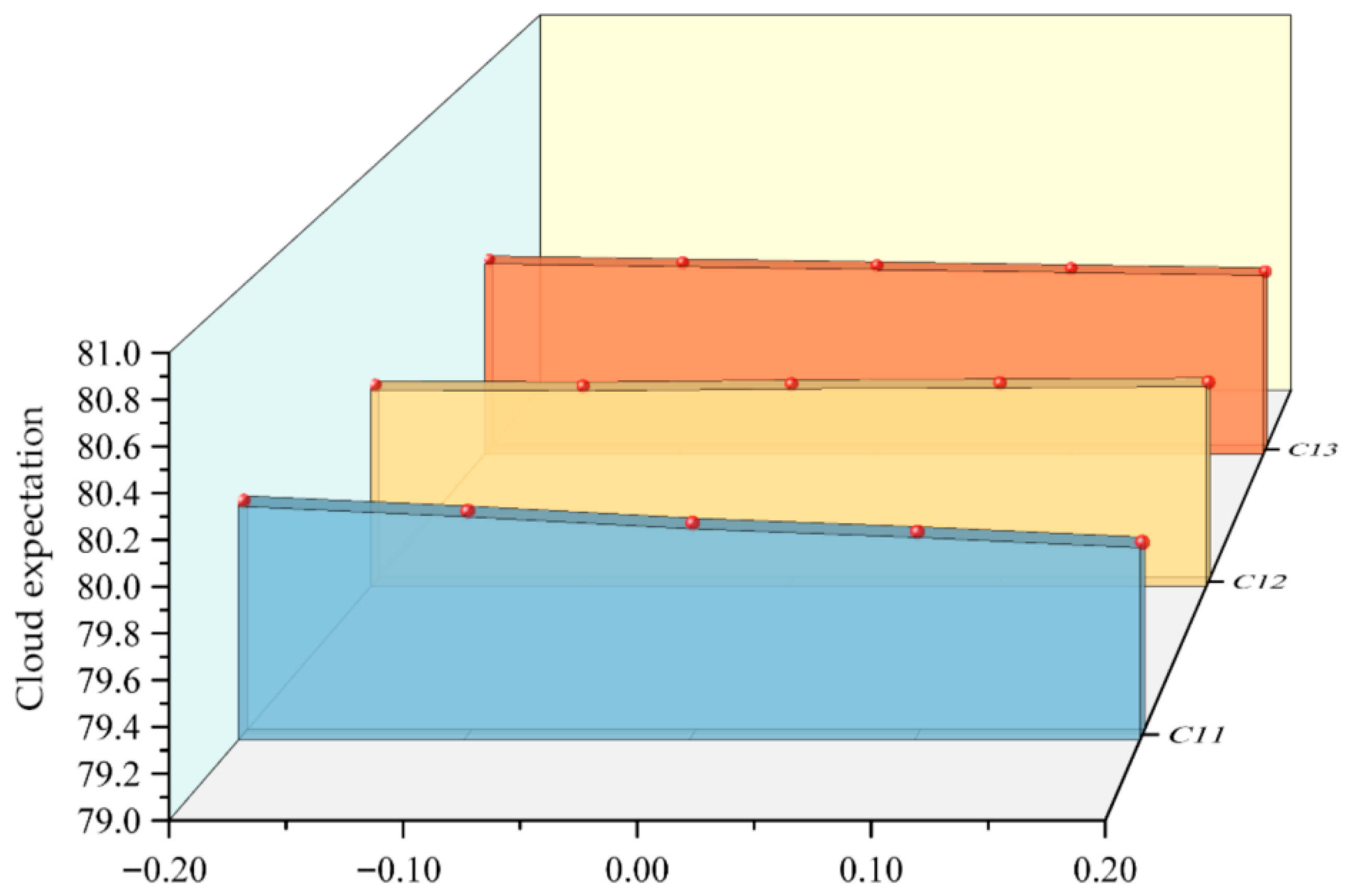

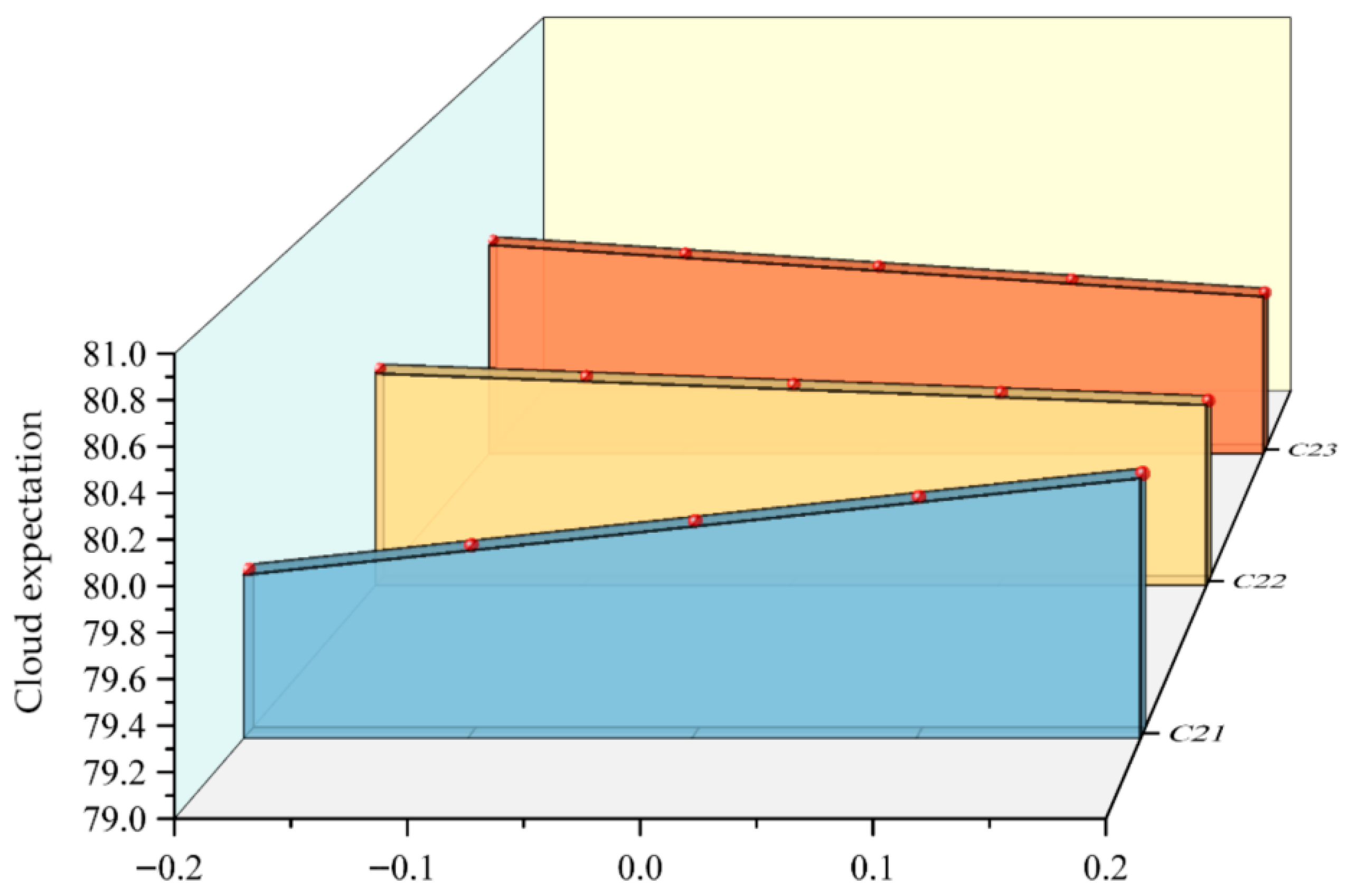

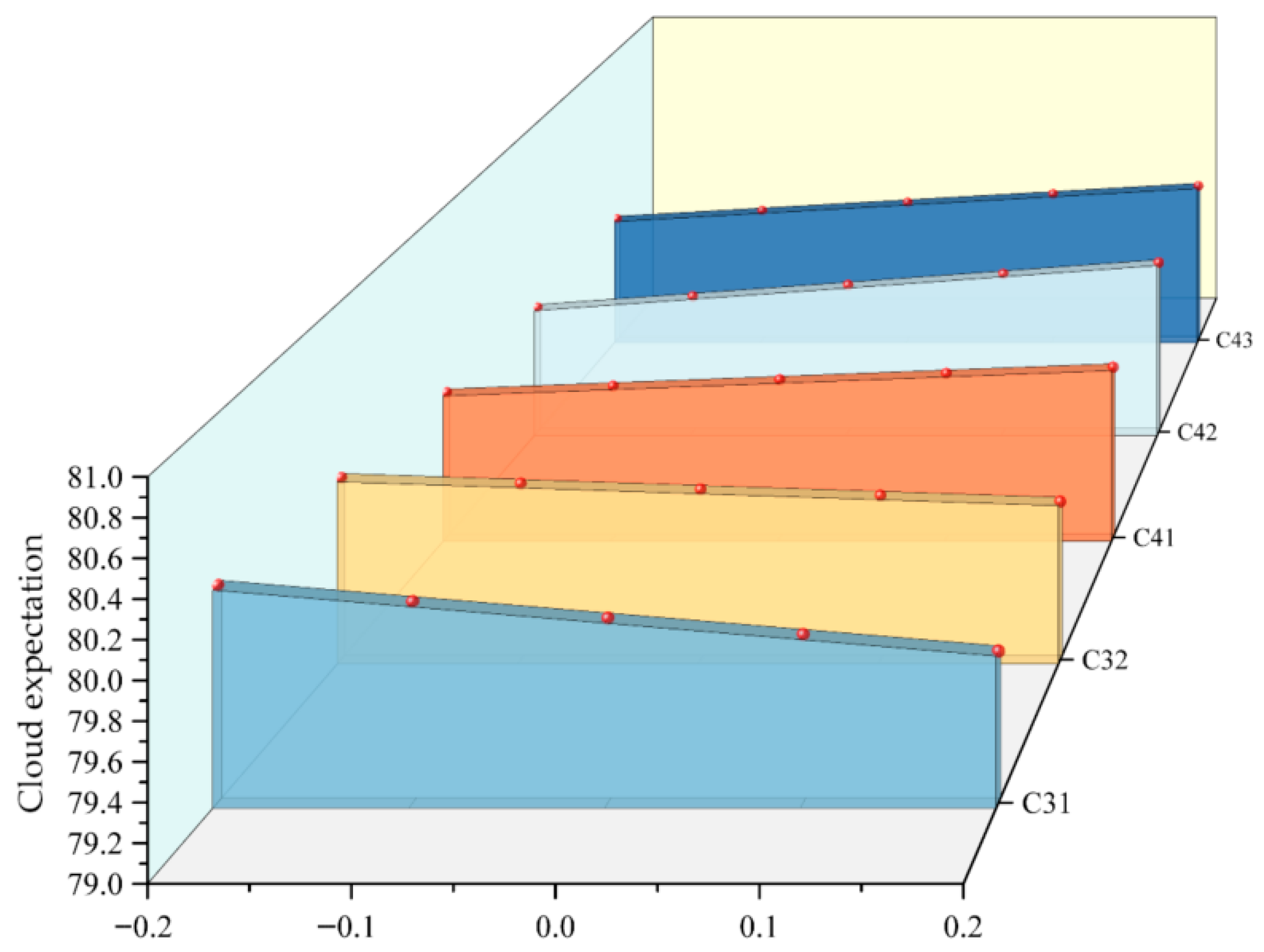

5.2. Comprehensive Benefit Evaluation Results

5.3. Sensitivity Analysis

6. Conclusions

7. Discussion

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Rathi, T.; Pinto, J.; Zhang, Q. Strategic low-carbon hydrogen supply chain planning under market price uncertainty. Comput. Aided Chem. Eng. 2023, 52, 3357–3362. [Google Scholar]

- Liu, W.; Wan, Y.; Zhang, Y.; Liu, Q. Design and implementation of China Hydrogen Price Index system. Clean Energy 2023, 7, 148–156. [Google Scholar] [CrossRef]

- Yang, X.; Dong, X.; Kong, Z.; Jiang, Q.; Wang, T. Research on the construction of a natural gas price index in China. Energy Strategy Rev. 2020, 30, 100521. [Google Scholar] [CrossRef]

- Wen, Y.; Zhang, J.; Yu, X.; Wang, Q. Current situation and trend of global carbon emission and carbon market and its impact on my country. China Invest. 2024, Z5, 70–74. [Google Scholar]

- Energy Transitions Commission. Energy and economic assessment of LH2, NH3, TOL/MCH and H0-DBT/H18-DBT for large-scale hydrogen transport. Mater. Today Sustain. 2025, 7, 101187. [Google Scholar]

- Jin, Z.; Wang, Z.; Li, Y.; Wang, Y.; Zhang, Y. Development Status, Challenges and Prospects of Offshore Wind Power Hydrogen Production Industry in China. South. Energy Constr. 2025, 12, 33–41. [Google Scholar]

- Xu, C.; Li, P.; Zhang, W.; Li, Q.; Wei, Y. Planning for Offshore Integrated Energy Islands with Electricity-Carbon-Hydrogen-Methanol Synergy. South. Energy Constr. 2025, 12, 52–66. [Google Scholar]

- Jiang, D.; Jia, Y.; Lu, Q.; Hong, W.; Shen, R. Application Prospects of Hydrogen Energy in Integrated Energy Systems. Electr. Power 2020, 53, 135–142. [Google Scholar]

- Zhou, Z.; Cai, G.; Huang, Y.; Bai, R.; Nie, S.; Chen, X. Spatial and temporal evolution of cost-competitive offshore hydrogen in China: A techno-economic analysis. Renew. Sustain. Energy Rev. 2024, 203, 1.1–1.15. [Google Scholar] [CrossRef]

- Zhang, W.; Xu, C. Capacity configuration optimization of photovoltaic-battery-electrolysis hybrid system for hydrogen generation considering dynamic efficiency and cost learning. Energy Convers. Econ. 2024, 5, 78–92. [Google Scholar] [CrossRef]

- Zhang, G.; Gwan, X. A wind-hydrogen energy storage system model for massive wind energy curtailment. Int. J. Hydrogen Energy 2014, 39, 1243–1252. [Google Scholar] [CrossRef]

- Nagasawa, K.; Davidson, F.T.; Lloyd, A.C.; Webber, M.E. Impacts of renewable hydrogen production from wind energy in electricity markets on potential hydrogen demand for light-duty vehicles. Appl. Energy 2019, 235, 1001–1016. [Google Scholar] [CrossRef]

- Jiang, Y.; Huang, W.; Yang, G. Electrolysis plant size optimization and benefit analysis of a far offshore wind-hydrogen system based on information gap decision theory and chance constraints programming. Int. J. Hydrogen Energy 2022, 47, 5720–5732. [Google Scholar] [CrossRef]

- Xu, F.; Li, X.; Jin, C. Optimal capacity configuration and dynamic pricing strategy of a shared hybrid hydrogen energy storage system for integrated energy system alliance: A bi-level programming approach. Int. J. Hydrogen Energy 2024, 69, 331–346. [Google Scholar] [CrossRef]

- Yang, B.; Zhang, Z.; Su, S.; Li, J.; Wang, J.; Zhang, R.; Shu, H.; Ren, Y.; Jiang, L.; Sang, Y. Optimal scheduling of wind-photovoltaic-hydrogen system with alkaline and proton exchange membrane electrolyzer. J. Power Sources 2024, 614, 235010. [Google Scholar] [CrossRef]

- Gonçalo, C.; Rui, C. Hydrogen production from offshore wind parks: Current situation and future perspectives. Appl. Sci. 2021, 11, 5561. [Google Scholar] [CrossRef]

- Guo, Y.; Qi, P.; Zhang, Q.; Li, M.; Liu, J.; Sun, H. Control strategy for hydrogen production system using HTO-based hybrid electrolyzers. Energy Rep. 2025, 13, 2354–2364. [Google Scholar] [CrossRef]

- Zhou, Z.; Zhang, S.; Zhong, Y.; Sun, Z.; Peng, Y. A predictive control method for multi-electrolyzer off-grid hybrid hydrogen production systems with photovoltaic power prediction. Int. J. Hydrogen Energy 2024, 84, 383–393. [Google Scholar] [CrossRef]

- Zhang, Y.; Li, L.; Liu, X. Comprehensive evaluation method of operation benefits of integrated energy system considering uncertainty. Renew. Energy 2019, 37, 1671–1678. [Google Scholar]

- Li, J. Evaluation of the socio-economic and environmental benefits of hydrogen energy storage technology under the dual carbon model. China New Technol. New Prod. 2023, 16, 142–145. [Google Scholar]

- Li, C.; Gao, Y.; Liu, H.; Zhai, R. Energy, exergy, environmental, and economic analysis of a novel hydrogen production system integrating concentrated photovoltaic thermal collectors and wind turbines. Energy 2025, 322, 135670. [Google Scholar] [CrossRef]

- Zhao, H.; Xiang, H. Risk assessment of offshore wind power hydrogen production based on spherical fuzzy set and cumulative prospect theory-TOPSIS. Int. J. Hydrogen Energy 2024, 73, 475–489. [Google Scholar] [CrossRef]

- Thengane, S.K.; Hoadley, A.; Bhattacharya, S.; Mitra, S.; Bandyopadhyay, S. Cost-benefit analysis of different hydrogen production technologies using AHP and Fuzzy AHP. Int. J. Hydrogen Energy 2014, 39, 15293–15306. [Google Scholar] [CrossRef]

- Yu, H.; Shao, Z.; Hou, M.; Yi, B.; Duan, F. Research progress and development suggestions for hydrogen production by water electrolysis. China Eng. Sci. 2021, 23, 146–152. [Google Scholar] [CrossRef]

- Ma, X.; Zhang, S.; He, Y.; Zhu, Y.; Wang, Z. Research status and application prospects of PEM water electrolysis hydrogen production technology. Acta Energiae Solaris Sin. 2022, 43, 420–427. [Google Scholar]

- Zhang, H. Review of research on alkaline water electrolysis hydrogen production device model. Sol. Energy 2024, 5, 34–41. [Google Scholar]

- Song, J.; Gao, J.; Liang, D.; Li, G.; Deng, Z. Review of modeling research on proton exchange membrane electrolysis hydrogen production system. Electr. Power Constr. 2024, 45, 58–78. [Google Scholar]

- Chen, B.; Xie, H.; Liu, T.; Lan, C.; Lin, W. Research progress on advanced hydrogen production principles and technologies under the background of carbon neutrality. Eng. Sci. Technol. 2022, 54, 106–116. [Google Scholar]

- Zupok, S.; Chomać-Pierzecka, E.; Dmowski, A.; Dyrka, S.; Hordyj, A. A Review of Key Factors Shaping the Development of the US Wind Energy Market in the Context of Contemporary Challenges. Energies 2025, 18, 4224. [Google Scholar] [CrossRef]

- Lochhead, R.; Donnelly, O.; Carroll, J. System-Level Offshore Wind Energy and Hydrogen Generation Availability and Operations and Maintenance Costs. Wind 2024, 4, 135–154. [Google Scholar] [CrossRef]

- Kumar, S.; Himabindu, V. Hydrogen production by PEM water electrolysis-A review. Mater. Sci. Energy Technol. 2019, 2, 442–454. [Google Scholar]

- Li, D.; Sun, T.; Yi, C.; Gao, W.; Li, S. Research on the development of deep sea floating wind power technology. China Eng. Science 2025, 27, 108–122. [Google Scholar]

- Rahn, C.D.; Wang, C.Y. Battery Systems Engineering; John Wiley & Son: Chichester, UK, 2013. [Google Scholar]

- Xu, C.; Wang, L.; Shi, C.; Qin, G.; Liu, J.; Liu, Q.; Liu, C. Medium-to long-term hydrogen supply-demand structure and carbon emissions simulation in China under multiple scenarios. Adv. Clim. Chang. Res. 2025, 21, 1–14. [Google Scholar]

- Jang, D.; Kim, K.; Kim, K.H.; Kang, S. Techno-economic analysis and Monte Carlo simulation for green hydrogen production using offshore wind power plant. Energy Convers. Manag. 2022, 263, 115695. [Google Scholar] [CrossRef]

- Wang, X.; Zhao, B.; Huang, M.; Ye, R. Comparison of large-scale long-distance offshore wind power transmission schemes and key technologies for integrated design. Glob. Energy Interconnect. 2019, 2, 138–145. [Google Scholar]

- Cheng, B.; Xu, Z.; Xing, Y.; Xinlong, Z. Economic comparison of submarine AC/DC cable transmission systems. Electr. Power Constr. 2014, 35, 131–136. [Google Scholar]

- Zhu, X.; Hu, X.; Shi, N.; Zhang, Y.; Zhong, W. Long-term capacity optimization of electricity-hydrogen coupled microgrid considering dynamic efficiency of hydrogen storage. High Volt. Eng. 2023, 49, 1128–1139. [Google Scholar]

- Huang, J.; Balcombe, P.; Feng, Z. Technical and economic analysis of different colours of producing hydrogen in China. Fuel 2023, 337, 127227. [Google Scholar] [CrossRef]

- Ministry of Finance and National Oceanic Administration. Notice on issuing the Adjustment of standards for levying use fees of sea areas and uninhabited islands. Gaz. Minist. Financ. People’s Repub. China 2018, 4, 14–15. [Google Scholar]

| Evaluation Language | Triangular Intuitionistic Fuzzy Numbers <(a, b, c); µ, v> |

|---|---|

| Relatively important | (2.0, 2.2, 2.4; 0.05, 0.9) |

| Relatively important | (1.8,2.0,2.2;0.1, 0.8) |

| Relatively important | (1.6,1.8,2.0; 0.2, 0.6) |

| Relatively important | (1.4,1.6,1.8; 0.6, 0.2) |

| Slightly more important | (1.2,1.4,1.6; 0.8, 0.1) |

| Relatively minor | (1.0,1.2,1.4; 0.9, 0.05) |

| Relatively equally important | (1.0,1.0,1.0; 1,0) |

| Scenario | Hydrogen Price (CNY/kg) | Scenario Description |

|---|---|---|

| Optimism | 30 | The hydrogen energy industry is developing rapidly, hydrogen energy terminal application technology is advanced and mature, and the demand for hydrogen is increasing rapidly. Affected by market supply and demand, the price of hydrogen has increased slightly from the current benchmark price. |

| Benchmarks | 28 | We maintain the hydrogen price under the current policy subsidies. |

| Pessimistic | 26 | The development of hydrogen energy terminal industry is limited. As the cost of hydrogen production decreases, the price of hydrogen continues to decline. |

| Parameter | Data |

|---|---|

| Fan installed capacity/kW | 10,000 |

| Floating wind turbine/CNY/kW) | 16,000 |

| Offshore platform/(CNY/kW) | 815 |

| 35 kv array cable/(10,000 CNY/km) | 50 |

| 220 kv high voltage cable/(10,000 CNY/km) | 450 |

| 675 v–1035 v rectifier/(CNY/kW) | 476 |

| Offshore booster station/(CNY/kW) | 500 |

| Converter station/(CNY/kW) | 2000 |

| Seawater lifting pump/(10,000 CNY/unit) | 5 |

| Seawater desalination container/(10,000 CNY/set) | 150 |

| Fresh water purification system/(10,000 CNY/set) | 150 |

| Electrochemical energy storage/(CNY/kWh) | 1000 |

| Electrolyzer unit scale/MW | 1 |

| Alkaline electrolyzer/(CNY/kW) | 2100 nn |

| Proton exchange membrane electrolyzer/(CNY/kW) | 5000 |

| Hydrogen purification system/(10,000 CNY/set) | 50 |

| Hydrogen buffer tank/(10,000 CNY/m3) | 2 |

| Sea area use fee/(10,000 CNY/hectare) | 300 |

| Hydrogen Price | Wind Power Installed Capacity (MW) | Alkaline Electrolyzer Capacity (MW) | PEM Electrolyzer Capacity (MW) | Annual Hydrogen Production (kg) | Net Present Value (10,000 CNY) |

|---|---|---|---|---|---|

| 30 | 10 | 0.29 | 5.51 | 1,021,980.34 | 4522.80 |

| 28 | 10 | 1.2 | 4.86 | 1,010,304.07 | 2599.67 |

| 26 | 10 | 2.92 | 3.51 | 979,949.40 | 1214.42 |

| First Level Indicator | Secondary Indicators | Unit | Nature | Data |

|---|---|---|---|---|

| Economic Benefit C1 | C11 | CNY/kg | Cost Type | (30.94, 31.27, 32.13) |

| C12 | CNY100,000 | Income | (1214.24, 2599.67, 4522.8) | |

| C13 | % | Income | (19%, 30%, 39%) | |

| Technical Benefit C2 | C21 | % | Income | (90%, 90%, 90%) |

| C22 | % | Income | (63%, 66%, 67%) | |

| C23 | point | Income | (5.67, 7.33, 8.67; 0.8, 0.1) | |

| Environmental Benefit C3 | C31 | ton | Income | (55,716, 55,720, 55,723) |

| C32 | ton | Income | (2783.07, 2869.26, 2902.42) | |

| Social Benefits C4 | C41 | point | Income | (6.67, 7.67, 8.33; 0.6, 0.3) |

| C42 | point | Income | (7.67, 8.33, 9.33; 0.6, 0.3) | |

| C43 | point | Income | (8.00, 8.67, 9.67; 0.6, 0.3) |

| Index | Expert 1 | Expert 2 | Expert 3 | Expert 4 |

|---|---|---|---|---|

| C11 | (1.0, 1.2, 1.4; 0.9, 0.05) | (1.0, 1.2, 1.4; 0.9, 0.05) | (1.0, 1.2, 1.4; 0.9, 0.05) | (1.0, 1.2, 1.4; 0.9, 0.05) |

| C12 | (1.0, 1.0, 1.0; 1, 0) | (1.0, 1.0, 1.0; 1, 0) | (1.0, 1.0, 1.0; 1, 0) | (1.2, 1.4, 1.6; 0.8, 0.1) |

| C13 | (1.6, 1.8, 2.0; 0.2, 0.6) | (1.2, 1.4, 1.6; 0.8, 0.1) | (1.2, 1.4, 1.6; 0.8, 0.1) | (1.6, 1.8, 2.0; 0.2, 0.6) |

| C21 | (1.2, 1.4, 1.6; 0.8, 0.1) | (1.2, 1.4, 1.6; 0.8, 0.1) | (1.2, 1.4, 1.6; 0.8, 0.1) | (1.0, 1.0, 1.0; 1, 0) |

| C22 | (1.2, 1.4, 1.6; 0.8, 0.1) | (1.2, 1.4, 1.6; 0.8, 0.1) | (1.0, 1.2, 1.4; 0.9, 0.05) | (1.0, 1.2, 1.4; 0.9, 0.05) |

| C23 | (1.2, 1.4, 1.6; 0.8, 0.1) | (1.6, 1.8, 2.0; 0.2, 0.6) | (1.0, 1.2, 1.4; 0.9, 0.05) | (1.2, 1.4, 1.6; 0.8, 0.1) |

| C31 | (1.2, 1.4, 1.6; 0.8, 0.1) | (1.8, 2.0, 2.2; 0.1, 0.8) | (1.2, 1.4, 1.6; 0.8, 0.1) | (1.2, 1.4, 1.6; 0.8, 0.1) |

| C32 | (1.0, 1.2, 1.4; 0.9, 0.05) | (1.2, 1.4, 1.6; 0.8, 0.1) | (1.0, 1.2, 1.4; 0.9, 0.05) | (1.0, 1.2, 1.4; 0.9, 0.05) |

| C41 | (1.0, 1.2, 1.4; 0.9, 0.05) | (1.0, 1.2, 1.4; 0.9, 0.05) | (1.0, 1.2, 1.4; 0.9, 0.05) | (1.0, 1.2, 1.4; 0.9, 0.05) |

| C42 | (1.4, 1.6, 1.8; 0.6, 0.2) | (1.4, 1.6, 1.8; 0.6, 0.2) | (1.2, 1.4, 1.6; 0.8, 0.1) | (1.2, 1.4, 1.6; 0.8, 0.1) |

| C43 | (1.0, 1.0, 1.0; 1, 0) | (1.0, 1.0, 1.0; 1, 0) | (1.0, 1.0, 1.0; 1, 0) | (2.0, 2.2, 2.4; 0.05, 0.9) |

| Rating | Value Range | Digital Features |

|---|---|---|

| Low efficiency | [0, 25) | (12.50, 10.62, 0.50) |

| Relatively low efficiency | [25, 50) | (37.50, 10.62, 0.50) |

| Benchmark benefits | [50, 75) | (62.50, 10.62, 0.50) |

| Relatively high efficiency | [75, 90) | (82.50, 6.37, 0.50) |

| High efficiency | [90, 100] | (95.00, 4.25, 0.50) |

| Primary Indicators and Their Numerical Characteristics | Secondary Indicators and Their Numerical Characteristics | |

|---|---|---|

| Comprehensive benefits of deep-sea wind-power hydrogen production (79.94, 3.29, 0.85) | C1 (76.76, 3.36, 1.06) | C11 (76.1, 2.90, 1.10) |

| C12 (80.4, 3.60, 0.99) | ||

| C13 (78.6, 78.6, 1.16) | ||

| C2 (80.03, 3.51, 0.66) | C21 (90.7, 2.31, 0.44) | |

| C22 (76.5, 4.76, 0.64) | ||

| C23 (72.5, 2.75, 0.94) | ||

| Comprehensive benefits of deep-sea wind-power hydrogen production (79.94, 3.29, 0.85) | C3 (73.94, 2.41, 0.24) | C31 (70.7, 2.31, 0.16) |

| C32 (76.8, 2.51, 0.32) | ||

| C4 (86.38, 3.43, 1.19) | C31 (84.0, 3.51, 1.10) | |

| C32 (88.3, 3.13, 1.42) | ||

| C33 (87.1, 3.63, 1.05) |

| Similarity | Low Efficiency | Relatively Low Efficiency | Benchmark Benefits | Relatively High Efficiency | High Efficiency |

|---|---|---|---|---|---|

| Integrated Benefits | 0.0000 | 0.0006 | 0.2718 | 0.8395 | 0.0181 |

| Economic Benefits | 0.0000 | 0.0018 | 0.4115 | 0.6542 | 0.0034 |

| Technical Benefits | 0.0000 | 0.0006 | 0.2707 | 0.8319 | 0.0224 |

| Environmental Benefits | 0.0000 | 0.0034 | 0.5542 | 0.4349 | 0.0001 |

| Social Benefits | 0.0000 | 0.0001 | 0.092 7 | 0.7538 | 0.2352 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Fu, C.; Lan, L.; Qian, Y.; Chen, P.; Shi, Z.; Zhang, X.; Xu, C.; Dong, R. Capacity Configuration and Benefit Assessment of Deep-Sea Wind–Hydrogen System Considering Dynamic Hydrogen Price. Energies 2025, 18, 5175. https://doi.org/10.3390/en18195175

Fu C, Lan L, Qian Y, Chen P, Shi Z, Zhang X, Xu C, Dong R. Capacity Configuration and Benefit Assessment of Deep-Sea Wind–Hydrogen System Considering Dynamic Hydrogen Price. Energies. 2025; 18(19):5175. https://doi.org/10.3390/en18195175

Chicago/Turabian StyleFu, Chen, Li Lan, Yanyuan Qian, Peng Chen, Zhonghao Shi, Xinghao Zhang, Chuanbo Xu, and Ruoyi Dong. 2025. "Capacity Configuration and Benefit Assessment of Deep-Sea Wind–Hydrogen System Considering Dynamic Hydrogen Price" Energies 18, no. 19: 5175. https://doi.org/10.3390/en18195175

APA StyleFu, C., Lan, L., Qian, Y., Chen, P., Shi, Z., Zhang, X., Xu, C., & Dong, R. (2025). Capacity Configuration and Benefit Assessment of Deep-Sea Wind–Hydrogen System Considering Dynamic Hydrogen Price. Energies, 18(19), 5175. https://doi.org/10.3390/en18195175