Abstract

This paper systematically examines the key developmental stages of China’s new energy vehicle (NEV) charging and battery swapping industry, analyzing technological breakthroughs, market expansion, and policy support in each phase. The study identifies three distinct stages: the initial exploration phase (before 2014), the comprehensive deployment phase (2014–2020), and the high-quality development phase (since 2021). The industry has established a diverse energy replenishment system centered on charging infrastructure, with battery swapping serving as a complementary approach. Policy implementation has yielded significant achievements, including rapid infrastructure expansion, continuous technological upgrades, innovative business models, and improved user experiences. However, persistent challenges remain, such as insufficient standardization, unprofitable business models, and coordination barriers between stakeholders. The paper forecasts future development trajectories, including the widespread adoption of high-power charging technology, intelligent charging system upgrades, integration of Solar Power, Energy Storage, and EV Charging, diversified operational ecosystems for charging/swapping facilities, deep integration of virtual power plants, and the construction of comprehensive energy stations. Policy recommendations emphasize strengthening standardization, optimizing regional coordination and subsidy mechanisms, enhancing participation in virtual power plant frameworks, promoting the interoperability of charging/swapping infrastructure, and advancing environmental sustainability through resource recycling.

1. Introduction

Driven by the global energy transition and carbon neutrality goals, the global NEV industry is ushering in unprecedented development opportunities. According to the annual report “Global Electric Vehicle Outlook 2025” released by the International Energy Agency (IEA), the global penetration rate of NEVs is expected to reach more than 25% in 2025, and China will exceed 50%, becoming the world’s largest NEV market [1]. By the end of 2024, there will be 31.4 million NEVs in China, accounting for 8.90% of the total number of vehicles [2]. The rapid development of NEVs in China has brought huge demand to the charging and swapping industry. In addition to battery electric vehicles (BEVs), fuel cell electric vehicles (FCEVs) are also a significant technological route within the NEV sector. Research highlights that FCEVs offer unique advantages in terms of long-range capability and rapid refueling, particularly in the commercial vehicle segment, and are expected to complement the existing charging and swapping ecosystem [3,4,5].

As a key link connecting NEVs and energy transition, the development of the charging and swapping industry is not only related to the promotion and popularization of NEVs, but also will have a profound impact on the transformation of energy structure and the realization of carbon neutrality goals. In recent years, the development of China’s NEV charging and swapping industry has achieved remarkable results. By the end of 2024, China had built a total of 12.818 million charging piles and 4443 battery swap stations, forming the world’s largest charging network, and the fast charging technology capable of reaching 80% battery capacity in 15 min had achieved mass production and commercial application [6]. However, the development of our country’s charging and swapping industry still faces many challenges: on the one hand, the regional distribution of charging and swapping facilities is uneven [7], and the difference in facility density between the developed eastern regions and the central and western regions is significant; on the other hand, the lack of compatibility standards, such as battery swap interfaces and battery specifications, leads to the inability of different brands of battery swap facilities to communicate with each other [8]. In addition, the utilization rate of battery swap stations is low [9], and the profit model is not yet mature, which restricts the large-scale development of the industry.

This paper focuses on the core issue of the high-quality development of the charging and swapping industry, systematically reviews the development process of China’s NEV charging and swapping industry, evaluates the implementation effect of industrial policies, and predicts the future development trend by drawing on the advanced experience of the European Union and the United States, so as to provide certain reference values for policy formulation, industrial development, and academic research.

This paper finds that China’s NEV charging and swapping industry has gone through three complete stages of development from exploration to maturity, and the implementation of relevant industrial policies has achieved remarkable results, including the rapid expansion of charging and swapping infrastructure, continuous upgrading of technology, diversified innovation and exploration of business models, and continuous improvement of user experience, but at the same time it faces problems such as insufficient standardization, difficulties in making business models profitable, and obstacles to synergy. Combined with the trend of industry technological innovation, this paper predicts that China’s NEV charging and swapping industry will develop in the direction of popularization of high-power charging technology, intelligent charging system upgrades, integration of optical storage and charging, ecological diversification of charging and swapping facilities, deep integration of virtual power plants, and construction of integrated energy stations, along with promotion of the interconnection of charging and swapping infrastructure, and strengthening of environmental protection and resource recycling.

The structure of this paper is as follows: The first part reviews the development process of China’s charging and swapping industry policy and analyzes the characteristics of the three stages from the exploration period to the comprehensive layout to the high-quality development. The second part evaluates the implementation effect of China’s new energy charging and swapping industry policy, including the achievements and shortcomings. The third part draws on international experience; compares the charging and swapping policies and technical routes of the European Union, the United States, and other regions; and analyzes the industrial development experience that can be used for reference. The fourth part looks forward to the future development trend and discusses the popularization of high-power charging technology, the upgrading of intelligent charging systems, the integration of optical storage and charging, and going overseas. The concluding section summarizes the conclusions of the study and makes policy recommendations.

2. Literature Review

Scholars at home and abroad have conducted effective research on the development of China’s charging and swapping industry or charging and swapping infrastructure from different perspectives. This research includes the following.

2.1. On the Development Status of China’s NEV Charging and Swapping Infrastructure

The development status of China’s NEV charging and swapping infrastructure has shown a rapid growth trend. With the popularization of NEVs, key indicators, such as the distribution, type, and utilization rate, of charging piles have changed significantly.

In terms of charging methods, they can be classified into wired and wireless types. The wireless approach is primarily based on magnetic coupling, which has already reached a considerable level of technological maturity and has seen commercial demonstrations in autonomous driving applications [10]. However, due to unresolved electromagnetic–thermal safety issues, large-scale implementation will require more time [11].

In terms of the distribution of charging piles, the study by Hopkins et al. (2023) pointed out that despite the increase in the speed of charging infrastructure laying, there is still uncertainty in the market, and there is an uneven distribution of charging piles and the market tends to serve early adopters [12]. Hu (2019) shows that the acceleration of urbanization and the limitation of urban space pose new challenges to the layout of charging piles [13].

In terms of the type of charging pile, there are two main types of slow charging and fast charging on the market. Research by Mastoi et al. (2022) shows that the layout of fast charging stations needs to consider economic benefits and grid impacts, while slow charging stations pay more attention to convenience and penetration [14].

In terms of usage, research by Funke et al. (2019) [15] shows that public charging infrastructure as an alternative to home charging is only necessary in some densely populated areas. In addition, framework conditions vary widely from country to country, and as a result, country-specific findings in the literature can only be transferred to other countries on a limited basis.

In terms of policy support, research by Rongkai Chen et al. (2023) [16] simulates the effects of multiple incentive policies, including investment subsidies, construction subsidies, operation subsidies, user charging subsidies, and policy mixes, on electric vehicle charging infrastructure (EVCI) deployment. The results reveal that investment subsidies are quite effective but have more pronounced marginal diminishing effects. Both construction and operation subsidies have had a steady and positive impact. Implementing the two incentives as a policy mix can exert complementary effects, but a careful cost–benefit analysis is needed to prevent incentive saturation. The effect of charging subsidies is not as significant as other incentives. Finally, incentive policies should be implemented for a long time and adjusted for different markets and stages to optimize effectiveness.

The research of Le and He (2019) [17] shows that the coordination of NEV industry policies has a significant impact on market penetration. Policymakers should pay attention to the diversity of business models when promoting the application of policies and adopt a combination of measures in infrastructure construction to promote the development of the NEV market.

Overall, the development status of China’s NEV charging and swapping infrastructure shows a positive trend, but it also faces challenges such as uneven distribution, type selection, utilization rate optimization, and policy coordination.

2.2. On the Development Trend of China’s NEV Charging and Swapping Infrastructure

The development trend of China’s NEV charging and swapping infrastructure is affected by many factors, including technological progress, policy guidance, and market demand. In terms of technological advancements, with the transition to zero-emission and ultra-low-emission electric vehicles, information technology for charging station infrastructure, distributed energy generation units, and government policy support have become crucial. Studies have shown that the planning and technical development of charging station infrastructure can improve the design and implementation of charging stations [14]. In addition, the optimal location of fast charging stations is determined based on economic benefits and grid impact, suggesting that the construction of charging stations in the future will be more focused on efficiency and economic benefits [18]. Studies also show that focusing on deploying fast charging networks and wireless charging technologies highlights the lack of technological advancements in the current charging infrastructure. Maximizing EV performance and range encompasses advancements in lightweight materials, aerodynamic improvements, and the integration of advanced driver-assistance systems [19].

In terms of policy guidance, China has issued more than 100 policies for the NEV industry since 2009. The study finds that policy coordination has a significant impact on the market penetration effect, and it is proposed that the combination of “fiscal and taxation + regulation + guidance” measures should be adopted in infrastructure construction, and the subsidy should be gradually transferred to the charging services of operating enterprises [17]. In addition, to ensure equitable deployment of charging infrastructure, social equity needs to be considered, ensuring that all communities and individuals can enjoy the benefits of investment through local target setting, economic incentives, and policy incentives [12].

In terms of market demand, the mass adoption of EV charging networks needs to consider the increasing penetration of EVs in the long term as well as highly dynamic and location-dependent demand and grid constraints. The study proposes an approach to dynamic charging network design, i.e., how to optimize the location of charging stations at different time stages and the number of chargers within each station to accommodate the increase in EV penetration [20].

In recent years, some scholars have also focused on the planning and policy support of hydrogen refueling infrastructure for fuel cell electric vehicles (FCEVs), investigating its application prospects in the commercial vehicle sector and the challenges of building an effective refueling network. Although this paper mainly focuses on charging and battery swapping modes, the development of FCEV refueling systems plays a significant complementary role in improving the overall energy supply system for NEVs in China [21,22].

To sum up, the development trend of China’s NEV charging and swapping infrastructure will develop in the direction of more advanced technology, more coordinated policies, and more adaptable markets. The charging infrastructure of the future will be smarter and more efficient, while ensuring fairness and broad market penetration.

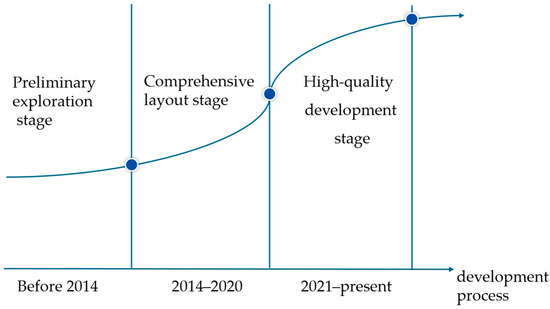

3. Review of the Development Process of China’s NEV Charging and Swapping Industry

China’s NEV charging and swapping industry has experienced a complete development cycle from germination to outbreak, from exploration to maturity, forming a diversified energy supplement pattern of “charging as the mainstay, supplemented by battery swapping”. The development of this industry not only solves the problem of battery life anxiety of NEVs, but also becomes an important support for promoting China’s energy transition and achieving carbon neutrality goals. According to the different characteristics of industrial development, it can be divided into three stages shown in Figure 1: the initial exploration stage (before 2014), the comprehensive layout stage (2014–2020), and the high-quality development stage (2021–present). Each stage has its own unique policy orientation, technical route and market pattern, which together constitute a complete development map of China’s charging and swapping industry.

Figure 1.

Schematic diagram of the developmental stages of China’s NEV charging and swapping industry.

This section explores the characteristics of China’s NEV charging and battery swapping industry at different development stages, using the SCP analytical framework to analyze the impact of government policies as an external shock on the market structure, conduct, and performance. The SCP model, established by the Harvard industrial economists Bain and Scherer, provides a systematic analytical framework that examines external shocks through three dimensions: market structure, conduct, and performance. This framework enables both detailed examination of specific elements and systematic analysis through its logical structure of “Structure–Conduct–Performance.” The fundamental premise of the SCP framework is that market structure determines corporate behavior in the market, and this corporate behavior in turn determines the economic performance of the market across various dimensions.

3.1. Preliminary Exploration Stage (Before 2014): Policy Guidance, State-Owned Enterprise Leadership, and Business Model Exploration

Before 2014, China’s new energy charging and swapping industry was in the initial exploration stage, and the core characteristics of this stage were strong policy guidance, state-owned-enterprise-led pilot construction, and preliminary exploration of business models. China’s charging and swapping industry emerged in close connection with the development of the NEV industry. Early government policies strategically positioned the charging and swapping infrastructure as an integral component of the NEV industry’s supporting framework. These initial exploratory efforts laid the foundation for the subsequent growth of China’s charging and swapping industry.

At the policy level, in 2009, the General Office of the State Council issued the “Automobile Industry Adjustment and Revitalization Plan”, which proposed for the first time to “establish a fast charging network for electric vehicles and accelerate the construction of public charging facilities in public places such as parking lots” [23]. Subsequently, in 2012, the Ministry of Science and Technology issued the “Twelfth Five-Year Plan for the Development of Electric Vehicle Science and Technology”, which clearly proposed to formulate and improve the electric vehicle charging interface, charging communication protocol, charger technical standards, charging station design specifications, etc. [24], providing a technical standard basis for the charging and swapping industry. The policies at this stage were mostly based on the electric vehicle industry policy and were mainly based on macro-strategies, such as industrial adjustment plans and strategic emerging industry development plans, and lacked detailed plans and descriptions for charging and swapping infrastructure.

In terms of technical route selection, during the period from 2010 to 2012, the State Grid (headquartered in Beijing, China) and China Southern Power Grid (headquartered in Guangzhou, China) led the pilot construction of the battery swap mode. In 2010, the State Grid built 11 standardized electric vehicle charging and swapping stations, and 22 charging and swapping stations entered the construction stage [25]. In 2012, the State Grid proposed to lead the battery swap mode of passenger cars in accordance with the operation mode of “battery swap as the mainstay, plug charging as the supplement, centralized charging, and unified distribution”. China Southern Power Grid cooperated with Israel’s Better Place (a multinational electric vehicle charging and swapping technology service company headquartered in Tel Aviv, Israel) in Guangzhou to build a battery swap station in Guangzhou to explore the battery swap technology route [26]. However, the development of the battery swap mode at this stage was limited due to problems such as inconsistent standards, high costs, and poor compatibility.

In terms of market structure, the construction of charging and swapping infrastructure is mainly led by state-owned enterprises. According to statistics, by the end of 2014, China had built a total of 780 charging and swapping stations and 31,000 AC and DC charging piles, and the China Grid Company had built 618 charging and swapping stations, with a total of 24,000 charging piles [27], accounting for 79.23% and 77.42% of the country, respectively. The participation of private enterprises was low, and the operation mode of charging and swapping facilities was not yet mature. At the same time, the charging and swapping facilities at this stage mainly served the public sector, such as buses and taxis, and the private market had not yet been opened.

In terms of business model exploration, there were many attempts at this stage. BYD (headquartered in Shenzhen, China) once experimented with the battery swap mode (for example, the Pengcheng Taxi Company headquartered in Shenzhen, China, used E6 battery swap in 2010) [28], but gave up due to battery standardization and high costs and switched to charging mode; Tesla (headquartered in Austin, TX, USA) launched the 93 s fast battery swapping technology in 2013, but due to the high costs and the inability to share special-shaped batteries across vehicle models [29], it strategically abandoned the battery swap technology route and operation mode in 2014. These early attempts provided valuable experience for the development of the subsequent charging and swapping business model.

3.2. Comprehensive Layout Stage (2014–2020): Charging Mode Dominance, Market Openness, and Technological Progress

From 2014 to 2020, China’s new energy charging and swapping industry entered a comprehensive layout stage, and the core characteristics of this stage are the establishment of the dominant position of charging mode, the introduction of social capital in the open market, and the gradual popularization of fast charging technology. As the State Grid adjusted the strategic direction of charging and battery swapping, the charging mode became the mainstream and the development of the battery swapping mode was slow, forming a development pattern of “charging first, supplemented by battery swapping”.

In terms of policy support, in May 2014, the State Grid issued the “Opinions on Doing a Good Job in the Service of Electric Vehicle Charging and Swapping Facilities”, which clearly supports the participation of social capital in the charging pile market. In November of the same year, the Ministry of Science and Technology, the Ministry of Finance, the Ministry of Industry and Information Technology, and the National Development and Reform Commission jointly issued the Notice on Incentives for the Construction of NEV Charging Facilities, encouraging the use of a public–private partnership model (PPP model) to guide social capital to participate in the construction of charging infrastructure [30]. The introduction of this policy marked the beginning of a comprehensive deployment phase for China’s charging and battery swap industry dominated by the charging mode. In September 2015, the General Office of the State Council issued the “Guiding Opinions on Accelerating the Construction of Electric Vehicle Charging Infrastructure” and the “Guidelines for the Development of Electric Vehicle Charging Infrastructure (2015–2020)”, proposing to build 4.8 million charging piles and 12,000 charging stations by 2020, with a vehicle-to-pile ratio of 1:1 to meet the charging needs of 5 million electric vehicles [31,32]. In 2018, the Ministry of Finance’s policy further shifted, shifting local subsidies from purchase to charging infrastructure construction and operation, and strengthened policy guidance.

In terms of market opening, after 2014, the construction of charging piles shifted from state-owned enterprises to private capital influx. The rise of private operators such as special calls and star charging formed a three-legged pattern with the State Grid. According to the data, by the end of 2020, the number of public charging piles in the country was 807,000, of which 207,000 were operated by special calls, 205,000 were operated by Star Charging, and 181,000 were operated by the State Grid, accounting for 73.5% of the total number of public charging piles [33]. However, despite the policy of encouraging the participation of private capital, there were still many obstacles to the implementation. By the end of 2020, there were 1.681 million charging piles in the country, including 807,000 public charging piles and 874,000 private charging piles [33]. This was far from the target of “more than 4.8 million distributed charging piles by 2020” required by the “Guidelines for the Development of Electric Vehicle Charging Infrastructure (2015–2020)”, with a completion rate of only 35%. At the end of 2020, the number of NEVs was 4.92 million [34], and the vehicle-to-pile ratio was about 2.9:1, far from the 1:1 ratio of the policy target.

In terms of technological progress, breakthroughs were made in fast charging technology at this stage. Tesla launched 240 kW superchargers in 2015, and the State Grid mainly used DC piles (which made up 46% of its charging piles in 2020). In December 2015, the National Standards Committee issued the “Connecting Device for Conductive Charging of Electric Vehicles” (GB/T 20234-2015) [35] to standardize the unified standard of charging interfaces for NEVs, but at the end of 2020 there were still “information barriers”, which third-party platforms (such as AutoNavi map access to 96% of charging pile information [36]) had to be relied on to solve.

In terms of business model, this stage formed a whole industry chain layout of “equipment manufacturing–charging operations–solution provision”. TeLD (headquartered in Qingdao, China) slowed its expansion pace while collaborating with social capital (e.g., the State-adjustment Fund) and Huawei (headquartered in Shenzhen, China) to enhance technological capabilities. Star Charge (headquartered in Changzhou, China), leveraging resources from the Wanbang Group (headquartered in Changzhou, China) rapidly risen to capture a market share of 25% [33]. However, the investment in the construction of charging piles is large, the return cycle is long, the industry as a whole is still in a state of loss, and the profit model of operators is not yet fully mature.

In the evolution of the charging and swapping pattern, the charging mode gradually dominated at this stage. At the beginning of 2014, the State Grid proposed to optimize the planning and layout of the charging and swapping service network in accordance with the principle of “leading fast charging, taking into account slow charging, guiding battery swapping, and being economical and practical”, marking the fact that the charging mode had become the mainstream. The battery swap mode has only been applied to specific models of a few companies (such as NIO Inc. headquartered in Shanghai, China) due to the slow development of car companies fighting their own battles and the difficulty of battery standardization.

3.3. High-Quality Development Stage (2021–Present): Technological Innovation, Revival of Battery Swap Mode, and Integration of Vehicle Network

Since 2021, China’s new energy charging and swapping industry has entered a stage of high-quality development, and the core characteristics of this stage are the acceleration of technological innovation, the revival of the battery swapping mode, and the integration of vehicles and networks, which has become a new trend.

In terms of technological innovation, the high-voltage fast charging platform technology of 800 V and above represented a breakthrough. In 2021, GAC Aion (headquartered in Guangzhou, China) released ultra-fast battery technology and the A480 supercharging pile, proposing “5 min of charging and 200 km of range [37]”. In March 2025, BYD launched the “Super e Platform” technology matrix to achieve the world’s first “global kilovolt high-voltage architecture” for passenger cars, fully upgrading the battery, motor, power supply, and thermal management system to a 1000 V platform and increasing the charging speed to “2 km per second”. As of June 2025, China’s major NEV manufacturers have released more than 50 models of 800 V and above high-voltage platforms. The popularization of supercharging technology has promoted the upgrading of charging facilities; for instance, the single-day discharge capacity of the Shenzhen Lianhuashan supercharging station reaches 13,000 kWh, and the maximum discharge power is 2160 kW [38], while Huawei has launched a 600 kW liquid-cooled supercharger that supports all models in the 200–1000 V voltage range. In addition, significant progress has also been made in battery swapping technology, such as the chocolate battery swap block launched by CATL, which claims to be suitable for 80% of the world’s pure electric platform models that have been launched and will be launched in the next three years, and NIO’s fourth-generation battery swap station can serve multiple brand models at the same time.

In terms of the revival of the battery swap mode, this stage presents the characteristics of multi-subject participation and multi-scenario application. Since the first battery swap station was put into operation on 20 May 2018, NIO has deployed 3343 battery swap stations across the country, including 989 highway battery swap stations, forming a high-speed battery swap network of “9 vertical, 9 horizontal and 14 urban agglomerations” [39]. At the same time, NIO has encrypted the layout of charging piles and battery swap stations through the “Power Up County and County Connection Plan” (including charging county and battery swap county pass), so that “where oil trucks can go, trams can go” [40]. For example, For example, State Power Investment Corporation (SPIC, headquartered in Beijing, China) aimed to construct 4000 new battery swap stations by 2025 as part of its efforts to expand EV infrastructure [41], Geely (headquartered in Hangzhou, China) planed to operate 5000 smart battery swap stations around the world by 2025 [42], and Sinopec (headquartered in Beijing, China) planed to build 5000 charging and swapping stations by 2025 [43]. Battery swapping applications have expanded from passenger vehicles to commercial vehicle such as heavy-duty trucks and logistics vehicles. For example, Qiji Battery Swap Yangluo Hub Station (based in Wuhan, China) operated by CATL (headquartered in Ningde, China) can provide battery swap services for 200 heavy-duty trucks daily, with each swap offering a driving range of 350 to 800 km [44].

In terms of vehicle-to-grid integration, V2G (Vehicle-to-Grid), a technology enabling electric vehicles to supply power back to the grid, has transitioned from the proof-of-concept phase to large-scale deployment. In March 2025, Shenzhen launched the country’s largest vehicle network interactive measurement, covering more than 760 charging stations, 18,000 charging piles, and 17,000 vehicles participating in the city, with an interactive electricity of 88,000 kWh, and car owners can receive a subsidy of CNY 4 per kilowatt-hour of electricity, which is much higher than the charging cost of CNY 0.4 for trough electricity [45]. In March 2025, the National Development and Reform Commission and other departments jointly issued the “Notice on the First Batch of Pilot Large-scale Application of Vehicle-Network Interaction” (Fagaiban Energy [2025], No. 241), which included nine cities, including Shanghai, in the first batch of pilot cities, and planned to initially build a technical standard system by 2025 and achieve large-scale application by 2030, providing tens of millions of kilowatts of two-way regulation capacity for the power grid [46]. For example, NIO’s first integrated PV storage and charging station in Suzhou is equipped with 1 battery swap station, 14 charging spaces, 22 energy storage batteries, and a 50 kW photovoltaic power generation system, which can generate 51,700 kWh of green electricity per year and reduce carbon emissions by 51.54 tons [47].

In terms of policy support, in 2025, the Ministry of Finance, the Ministry of Industry and Information Technology, and the Ministry of Transport jointly issued the “Notice on Carrying out the Pilot Application for Filling the Shortcomings of County-level Charging and Swapping Facilities in 2025”, which plans to support 75 pilot counties, and the central government will provide financial support for projects such as the construction and operation of public charging and swapping facilities and the transformation of distribution networks [48]. The pilot encourages the application of new technologies and converts the number of standard piles for V2G projects with obvious demonstration effects according to a specific coefficient. At the same time, the policy emphasizes direct data connection and interconnection and requires public charging and swapping facilities in pilot counties to upload operation data to the clearing platform in real time by direct connection to strengthen supervision.

In terms of market structure, the charging and swapping industry has formed a diversified competition pattern. In the field of charging, special calls, star charging, and the State Grid still dominate, but emerging companies such as Huawei and China Southern Power Grid are also accelerating their layout. In the field of battery swapping, companies such as NIO and CATL have become the main force, among which NIO is in a leading position in the market. At the same time, the integration of the charging and swapping industry with energy, transportation, the Internet, and other fields is deepening, such as Huawei’s cooperation with TeLD, NIO, and other enterprises to provide intelligent charging solutions, and AutoNavi Map accesses the real-time information of 96% of operators to provide users with convenient charging services.

3.4. Comparison of the Development Characteristics of the Three Stages

On the whole, the differences between the three stages of development of China’s NEV charging and swapping industry mainly lie in the change in the relationship between policy and market interaction, which are shown in Table 1. In the initial exploration stage, the policy was mainly based on directional guidance, the market participation was low, and the construction of charging and swapping facilities was mainly led by state-owned enterprises. In the comprehensive layout stage, in the construction of charging facilities a large number of subsidies were received and market participation increased, but the development of the battery swap mode was slow due to unclear policies. In the stage of high-quality development, policies are more precise, charging and swapping are developing in parallel, the standard system is gradually being improved, and financial subsidies are combined with market-oriented operation, forming a diversified charging and swapping industry ecology.

Table 1.

Comparison of the development stages of China’s new energy charging and swapping industry.

4. Analysis of the Implementation Effect of China’s NEV Charging and Swapping Industry Policy

4.1. Analysis of the Effectiveness of Policy Implementation

The implementation of China’s charging and swapping industry policy has achieved remarkable results, mainly reflected in the following aspects:

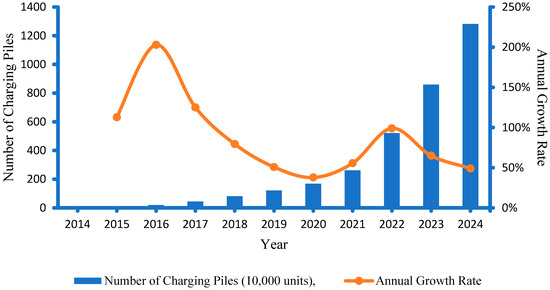

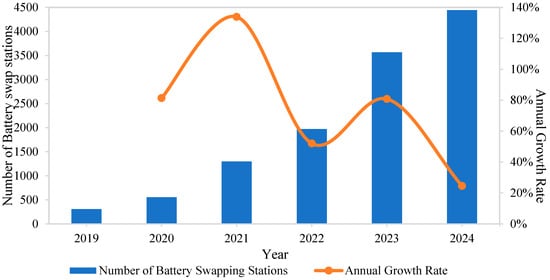

First of all, the scale of charging and swapping infrastructure is growing rapidly. By the end of 2024, China had built a total of 12.818 million charging piles and 4443 battery swap stations, forming the world’s largest charging and swapping network [49]. The number of charging piles increased from 31,000 in 2014 to about 12.8 million in 2024, with an average annual compound growth rate of 82.66% (The calculation follows the formula: A × (1 + N)10 = B, where A = 31,000 (initial value in 2014) and B = 12,818,000 (final value in 2024). Solving this yields N = 82.66%), as shown in Figure 2 below. The number of battery swap stations has increased from 306 in 2019 to 4443 in 2024, with an average annual growth rate of more than 30%, as illustrated in Figure 3 below.

Figure 2.

The number and trend of charging piles in China from 2014 to 2024. Source: China Electric Vehicle Charging Infrastructure Promotion Alliance, https://evcipa.org.cn/ (accessed on 20 June 2025).

Figure 3.

The number and trend of battery swap stations in China from 2019 to 2024. Source: China Electric Vehicle Charging Infrastructure Promotion Alliance, https://evcipa.org.cn/ (accessed on 20 June 2025).

Secondly, the county connection project of battery swapping is advancing rapidly. Benefiting from the rapid advancement of battery swap technology, as shown in Table 2 below, NIO Inc. unveiled an ambitious “County-to-County Battery Swap Plan.” Ac-cording to the plan, the battery swap county project will be divided into three phases: by 30 June 2025, 14 provincial-level administrative regions in Beijing, Shanghai, Guangdong, Jiangsu, Zhejiang, Anhui, Hubei, Shandong, Sichuan, Henan, Fujian, Tianjin, Chongqing, and Macao will be completed, and more than 1200 county-level administrative districts will be connected; before 31 December 2025, 13 provincial-level administrative regions in Hunan, Hebei, Shaanxi, Guangxi, Yunnan, Guizhou, Jiangxi, Hainan, Shanxi, Jilin, Liaoning, Gansu, and Ningxia will be newly completed. So far, NIO have completed the full coverage of battery swap stations in 27 provincial-level administrative regions and more than 2300 county-level administrative regions. And from 2026, the construction of battery swap stations in the remaining provincial-level administrative regions will be accelerated. By the end of May 2025, NIO had built 26,377 charging piles, connected more than 1.26 million third-party charging piles, and built 3343 battery swap stations across the country, covering nearly 1000 districts and counties across the country [39]. As of May 2025, NIO has realized the county-to-county connection of battery swapping in six provinces and cities: Beijing, Shanghai, Zhejiang, Jiangsu, Guangdong, and Tianjin, building a global battery charging and swapping service ecosystem from cities to counties and towns [50].

Table 2.

Overview of NIO’s battery swap stations over the past generations.

Third, the battery swap standard system has been gradually improved. On 28 November 2024, the national standard “Technical Requirements for Battery Swap Service for Operating Pure Electric Vehicles” (GB/T 45098-2024) was released and was to be implemented on 1 March 2025 [51]. The standard puts forward specific requirements for the location of the swap station, the compatibility of the swap, the service process, etc., and fills the standard gap in our country in the field of operating pure electric vehicle swap services.

Fourth, progress has been made in the exploration of business model innovation. NIO’s BaaS (Battery as a Service) model has been recognized by the market, and its BaaS penetration rate (the proportion of NIO users using BaaS services relative to the total number of NIO users) reached 60% in 2024 [52]. CATL launched the “Chocolate Battery Swap Block”, which adopts a standardized design to achieve cross-model compatibility. In addition, the virtual power plant model has also begun to explore applications in the field of battery swapping, such as NIO’s cooperation with the State Grid and China Southern Power Grid, whose battery swap stations have realized charging during the trough hours at night and discharging to the grid during peak hours during the day, which can not only realize the effective dispatch of electric energy, but also make profits in the market through electric energy trading.

Fifth, technological innovation has yielded fruitful results. Enhancing scientific and technological innovation capabilities is one of the key measures for China to promote green economic development [53]. Along with the growth of China’s NEV industry, continuous technological innovations in the NEV charging and battery swapping sector have emerged. CATL’s “Shenxing Super Rechargeable Battery” realizes the lithium iron phosphate 4C supercharging technology and can be charged in 10 min and has a range of 400 km [54]. NIO’s battery swap technology has been shortened from 9 min in the first generation of battery swap stations to less than 3 min now. At the same time, the integrated technology of photovoltaic storage, charging, and swapping is also developing rapidly, as in the integrated energy station jointly built by CATL and Sinopec, which organically combines charging, battery swapping, photovoltaic power generation, and energy storage systems.

Overall, the implementation of China’s NEV charging and swapping industry policy has effectively promoted the rapid expansion of charging and swapping infrastructure, continuous upgrading of technology, business model innovation and exploration, and continuous improvement of user experience, providing strong support for the development of China’s NEV industry.

4.2. Analysis of Problems Encountered in Policy Implementation

The implementation of battery swapping policies in China has yielded significant progress; however, several critical challenges persist.

First of all, the degree of standardization of battery swapping is insufficient. While China introduced the Technical Requirements for Battery Swap Service for the Operation of Pure Electric Vehicles (GB/T 45098-2024) [51] in 2024, there are still problems in actual implementation, such as inconsistent interfaces and different battery specifications. For instance, incompatible interfaces and battery specifications across brands—such as NIO, Ledao, and Firefly—result in stations requiring multiple battery types. Furthermore, the absence of standardized protocols for battery cascade utilization (e.g., repurposing used batteries for secondary applications) impedes the long-term viability of the battery swapping model.

Second, it is difficult for the business model to make a profit. The capital-intensive nature of battery swapping infrastructure poses significant financial risks. The cost of NIO’s first-generation battery swap station is about CNY 3 million, and the third-generation battery swap station is reduced to CNY 1.5 million (excluding batteries and operating costs) [55]. According to estimates, each battery swap station needs an average of 60–70 orders per day to achieve breakeven, but in 2024 there will be a total of 87,000 battery swaps, with an average of about 28 orders per station per day, which is more than half of the breakeven point [56], and the profitability of NIO’s battery swap business is far away. NIO’s 2024 financial losses widened to CNY 22.66 billion, with an asset–liability ratio of 84%, largely attributable to heavy investments in its battery swap network [57]. At the same time, charging facilities are also facing profitability problems, some charging stations are “hard to find” during holidays, and the daily utilization rate is low.

The profitability challenges of the battery swapping model are a transient characteristic of its current development phase. As the model becomes more widespread in the future, profitability is expected to improve. First, compared to the charging model, the battery swapping approach for energy replenishment in China’s NEV sector emerged relatively late. Industry standards for battery swapping, such as the Technical Requirements for Battery Swapping Services for Commercial Battery Electric Vehicles (GB/T 45098-2024) [51], were only released on 8 November 2024 and were to take effect on 1 March 2025, lagging nearly nine years behind the charging industry standard, Connection Devices for Conductive Charging of Electric Vehicles (GB/T 20234-2015) [35], which was released on 28 December 2015 and implemented on 1 January 2016. Currently, the battery swapping industry remains in its early development stage. Second, NIO, a pioneer in the battery swapping model, positioned its flagship brand with an average selling price of CNY 342,000 in 2024—far exceeding the average price of CNY 169,000 for passenger vehicles in China’s overall automotive market [58]. To expand its consumer base across broader price segments, NIO launched two sub-brands—Lièdao (Le Dao) in the second half of 2024 and Yinghuochong (Firefly) in the first half of 2025—with product pricing covering the CNY 200,000–300,000 and CNY 100,000–200,000 ranges, respectively. These segments target a significantly larger audience than NIO’s flagship brand. With the growth of these sub-brands, the scale of battery swapping vehicles is expected to expand rapidly, thereby increasing the overall scale of battery swapping services. Third, the construction cost of NIO’s fourth-generation battery swapping stations has been significantly reduced, while compatibility has improved substantially. These stations not only support all NIO models but also accommodate third-party brands such as Changan, Geely, and Chery. This broader compatibility further expands the user base for battery swapping services.

Third, there are obvious barriers to synergy. Disputes over revenue distribution among automakers, battery manufacturers, and energy providers have led to a fragmented battery swap network. For example, BYD’s proprietary blade battery technology is incompatible with broader industry standards. In addition, the coordination between the battery swap station and the power grid is insufficient, and it is difficult to give full play to the role of the battery swap station in the peak regulation of the power grid.

Fourth, regional development is unbalanced. The charging and swapping facilities in the first-tier cities and the new first-tier cities are relatively complete, but the coverage rate of charging and swapping facilities in the third- and fourth-tier cities and county areas is low. Data from the China Charging Alliance revealed that, by 2024, 68.8% of public charging stations would be concentrated in developed provinces like Guangdong, Zhejiang, and Shanghai, while county-level regions would account for less than 5% of the total coverage [49]. This uneven distribution exacerbates accessibility gaps and undermines national electrification goals.

Fifth, there is a contradiction between technology iteration and the battery swap network. With rapid advancements in battery technology, such as the adoption of 800 V high-voltage platforms and solid-state batteries with energy densities of 400–600 Wh/kg, the battery swap network needs to be continuously upgraded to adapt to new battery specifications and increase operating costs. For example, industry-leading power battery manufacturers such as CATL (headquartered in Ningde, China), Gotion High-Tech (headquartered in Hefei, China), and SVOLT (headquartered in Ganzhou, China) are increasing the development of solid-state batteries with energy densities of 400–600 Wh/kg, which will pose new challenges to existing battery swap networks.

In summary, the primary challenges confronting China’s battery swapping industry include inadequate standardization, financial unsustainability, collaboration barriers, regional imbalances, and technological misalignment, which restrict the further development of the charging and swapping industry.

5. Reference from International Experience in the Development of China’s NEV Charging and Swapping Industry

5.1. The EU Experience

The EU has developed extensive expertise in the deployment of charging and battery swapping infrastructure, as evidenced by the following key strategies:

First of all, government policies vigorously advance infrastructure construction. The EU has implemented binding regulations to accelerate infrastructure deployment. The Alternative Fuels Infrastructure Regulation (AFIR), adopted in July 2023, requires member states to build fast charging stations every 60 km on motorways, covering the core network of the Trans-European Transport Network (TEN-T) by 2025 and expanding to the entire network by 2030 [59]. In October 2022, the German government approved a plan to rapidly expand EV charging stations and intends to invest EUR 6.3 billion over three years to increase the number of EV charging stations nationwide 14-fold to 1 million by 2030 [60,61]. Similarly, the UK’s EV Infrastructure Strategy (2022) allocated at least GBP 1.6 billion to expand the charging network, with plans to increase the number of EV charging stations tenfold to 300,000 by 2030 [62].

Second, the unification of standards promotes industrial collaboration. The European Automobile Manufacturers’ Association (ACEA) has proposed the CCS (Combined Charging System) charging standard, which integrates AC and DC charging into one unified system [63]. The standard connector is designed as a combined socket with integrated AC and DC interfaces on the physical interface, which can be compatible with three charging modes: single-phase AC charging, three-phase AC charging, and DC charging, providing standard and flexible charging options for electric vehicles. As the mainstream charging standard of the European Union, CCS makes it mandatory for car companies to be compatible to avoid interface confusion. This standardized approach significantly reduces the construction and operating costs of charging and swapping facilities and improves the user experience.

Third, government–enterprise cooperation accelerates the sinking of charging and swapping infrastructure. Sweden has accelerated the layout of battery swapping through government–enterprise cooperation. On 17 November 2022, the first battery swap station jointly built by Sweden and NIO was officially launched at the Varberg battery swap station. In October 2023, the French government added an additional EUR 200 million in public subsidies to the “Charging Infrastructure Program” to support the installation of home and street charging piles and the development of dedicated charging stations for heavy-duty trucks, while the tax credit for households to purchase and install charging piles will be increased from EUR 300 to EUR 500 [64]. These cooperation models have effectively solved the problem of infrastructure sinking and improved the coverage of charging and swapping facilities in third- and fourth-tier cities and rural areas.

Fourth, user-centric policies contribute to enhancing the user service experience for service providers. The EU Alternative Fuel Infrastructure Regulation (AFIR) emphasizes user-friendly policies to improve service quality. Charging points must accept electronic payments across devices; for public charging points with an output power of 50 kW, the charging price charged by the operator should be based on the electricity price per kWh; and for public charging points with an output power of less than 50 kW, the operator should provide clear and convenient price information at the charging stations they operate, including the charging price per kWh, charging price per minute, price per charge, and all price components. These requirements for payment facilitation and price transparency of charging facilities are conducive to improving the user experience. This user-oriented policy design has significantly improved the utilization rate and user satisfaction of charging and swapping facilities.

The EU’s success in advancing EV infrastructure hinges on four pillars: regulatory mandates to drive deployment, standardized interfaces to ensure interoperability, public–private partnerships to extend accessibility, and user-centric policies to optimize service quality. These strategies provide valuable insights for China’s charging and swapping industry, particularly in addressing regional disparities and fostering cross-sector collaboration.

5.2. The US Experience

The United States has also accumulated rich experience in the construction of charging and swapping infrastructure, which is mainly reflected in the following aspects:

First, the federal and state coordinated policies promote industrial development. In 2022, the Biden administration established the National Electric Vehicle Infrastructure Initiative (NEVI) [65] to provide states with a total of USD 5 billion in funding to build a national network of 500,000 charging stations along highways across the United States, as well as USD 2.5 billion in competitive grants to support charging facilities in the community. California’s Zero Emission Vehicle (ZEV) Act mandates that all vehicles sold by car companies must be zero-emission vehicles by 2035, driving demand for battery charging. This kind of coordinated policy design between the federal and state governments effectively solves the problem of regional differences in policy implementation and improves the implementation effect of policies.

Second, technology iteration is combined with market selection. Tesla tried the battery swap mode but finally abandoned it in 2015 because the battery swap had no price advantage over superfast charging and did not gain consumer support. In 2025, Tesla will restart the Model S battery swap pilot combined with the supercharging network to reduce the load on the grid, reflecting the need for a flexible technical route to adapt to the needs of the market. This combination of technology iteration and market selection provides a useful reference for the development of China’s charging and swapping industry.

Third, there is open and shared business model innovation. Tesla has opened up its supercharging network (for instance, partnering with Ford headquartered in Dearborn, MI, USA and GM headquartered in Detroit, MI, USA) to make a profit through service fee and credit transactions. According to an analysis by Goldman Sachs, an American investment bank, Tesla earns an extra USD 25 billion a year by opening up its charging network [66]. This open and shared business model innovation effectively solves the problem of the low utilization rate of charging piles and improves the economic benefits of infrastructure.

Fourth, virtual power plants (VPPs) are combined with charging and swapping. In 2021, Tesla partnered with Pacific Gas and Electric Company (PG&E, headquartered in Oakland, CA, USA) to officially launch its first official virtual power plant project [67]. The project pays eligible Powerwall users to deliver additional power to the grid in the event of an outage. Multiple powerwalls work at the same time to create a “virtual power plant” that helps the grid maintain power in the event of an emergency or energy shortage. Registered Powerwall virtual power plant users can earn an additional USD 2 incentive for every kWh of electricity provided to the grid during a specified “event”. At present, the project has been expanded to the Southern California Edison Company (SCE) service area, with a total capacity of more than 100 MW. By smoothing out grid fluctuations, virtual power plants can achieve the role of “peak shaving and valley filling”, from which energy storage equipment manufacturers, users, and power grids can all benefit, which inspires Chinese charging and swapping station operators to carry out similar explorations.

The core of the US experience is the combination of federal and state coordinated policies to promote industrial development, the combination of technology iteration and market selection, the innovation of open and shared business models, and the combination of virtual power plants and battery charging and swapping, which have important reference value for the development of China’s battery charging and swapping industry.

5.3. Enlightenment of International Experience for China

Through the analysis of the experience of the European Union and the United States, the following enlightenment for the development of China’s charging and battery swapping industry can be extracted:

First, enhance policy enforceability and industry standardization. China must prioritize the harmonization of cross-regional and cross-brand charging/battery swapping standards (for instance, by referring to the EU CCS protocol promotion mechanism) to avoid interface confusion and battery specification differentiation. Policymakers should incentivize automakers’ participation in standard-setting processes to avoid fragmentation of technical routes.

Second, promote regional coordination and subsidies. We can learn from the Swedish government–enterprise cooperation model and guide the sinking of battery swap facilities through local subsidies (such as third- and fourth-tier cities). At the same time, it is necessary to establish a linkage mechanism between federal and local policies to avoid imbalances in regional development. For example, with reference to the synergy between ZEV and federal subsidies in California, we will promote the layout of battery swap facilities in key areas.

Third, balance technology and market dynamics, avoiding over-reliance on single technologies (e.g., early battery swap pilot failures) and combining the complementary development of overcharging and battery swapping. At the same time, according to different user groups and usage scenarios, differentiated charging and swapping service models can be designed to meet diverse needs.

Fourth, improve user convenience. Promote the interconnection of payment systems and platforms (e.g., EU contactless payment requirements) to reduce the operational burden on users. At the same time, optimize the layout of charging and swapping facilities, improve coverage and convenience of use, and eliminate “range anxiety”.

Fifth, explore diversified profit models. Drawing on Tesla’s business model of opening up the supercharging network, profits can be made through service fees and credit transactions. At the same time, battery swap stations can participate in a virtual power plant, using the peak-to-valley electricity price difference and peak shaving services to generate revenue. For example, NIO has connected 68 battery swap stations in Suzhou to the State Grid’s new power load management system to form a virtual power plant with an adjustable capacity of no less than 20,000 kilowatts [68], which not only optimizes the user-side resource aggregation strategy but also improves the economic benefits of the battery swap stations.

The international experiences of the EU and US underscore five strategic priorities for China: enforcing standardized policies, fostering regional equity through subsidies, balancing technological and market dynamics, enhancing user convenience, and innovating profit models. These insights provide actionable frameworks to resolve China’s infrastructure development challenges, ensuring sustainable growth in the charging and battery swapping sector.

6. Trend Outlook for the Development of China’s NEV Charging and Swapping Industry

6.1. Outlook for Industry Trends

Based on the analysis of the industrial development process and international experience, China’s charging and swapping industry will show the following development trends in the future:

First, high-power charging technology will be popularized. With the rapid growth of NEVs, high-power charging technology will become the key to solving the problem of long waiting times for charging. China’s ultra-fast charging standard is expected to become a common choice around the world. The “Notice on Promoting the Scientific Planning and Construction of High-power Charging Facilities” jointly issued by the National Development and Reform Commission and four other departments proposes that by the end of 2027 we will strive to have more than 100,000 high-power charging facilities nationwide, while high-power charging facilities with a single-gun charging power of more than 250 kW will be further popularized and service quality and technology applications will be iteratively upgraded [69]. High-power charging equipment is relatively expensive, it requires larger spaces for equipment matching and installation. Meanwhile, the cost needed for power capacity increase, construction, operation, and maintenance is high. Nevertheless, its economic viability will gradually improve with technological progress and scale effects.

The second trend is the upgrading of the intelligent charging system. The smart charging system will be upgraded from “plug and charge” to “plug and play”, reducing user operation steps and improving the charging experience. Charging and swapping facilities will be deeply integrated with technologies such as the Internet of Things, big data, and artificial intelligence to achieve intelligent scheduling, intelligent operation and maintenance, and intelligent services. Charging and swapping facilities will transform from a single function to a multi-functional integration, integrating with catering, entertainment, shopping, automobile services, and other industries to improve service experience and profitability.

The third trend is the integrated development of optical storage and charging. To achieve the “dual carbon” goals, China is improving its approach to deploying rooftop distributed photovoltaic systems. With support from financial and hybrid policies, the owner-built model generates the highest expected utility [70]. The integration of photovoltaic, energy storage, and charging (PV–storage–charging integration) has emerged as an important development direction for charging and battery swapping infrastructure. Through the construction of photovoltaic power generation and energy storage facilities, the charging cost will be reduced and the proportion of green electricity consumption will be increased. With the station + terminal as the link, the charging network deeply links vehicles, batteries, energy, and people, forming a multi-member interactive management system, including, for instance, two-way power distribution, distributed green electricity, smart energy storage, electric vehicle charging and discharging, and electric heat conversion. This not only improves the economy of charging and swapping facilities, but also provides a new way for renewable energy consumption.

Fourth, the operation ecology of charging and swapping facilities will be diversified. The operation of charging and swapping facilities will change from a single charging model to a diversified service model. Charging and swapping facilities will become an important part of urban infrastructure and will be deeply integrated with urban planning, transportation planning, and energy planning. Charging facility operators will transform from simple infrastructure providers to diversified roles, such as energy service providers, data service providers, and platform service providers, and expand value-added services and business models.

Fifth, charging and swapping facilities will have the opportunity to go overseas. With the maturity and cost advantage of China’s charging and swapping technology, charging and swapping facilities going overseas will become a new growth point. CATL has cooperated with European car companies through standardized battery modules (such as chocolate battery swaps) and has implemented heavy-truck battery swap projects in Shanghai Port and Xiamen Port [71]. China should seize this opportunity to promote the internationalization of China’s charging and swapping standards and expand overseas markets. Especially in the countries along the “Belt and Road”, charging and swapping facilities have broad prospects for going overseas.

Sixth, there is the in-depth integration of virtual power plants and charging and swapping. The battery swap station will be transformed from a simple energy supplement facility to a “flexible buffer zone” of the power grid and participate in the peak regulation of the power grid through “peak shaving and valley filling” to alleviate the contradiction between local power supply and demand. According to statistics, 20 batteries in a battery swap station can form a small energy storage station with 2000 kWh of electricity, which has energy storage attributes and can be charged during the valley electricity price period to reduce the overall operating cost.

Seventh, the construction and promotion of integrated energy stations is another trend. The integrated energy station jointly built by CATL and Sinopec organically combines charging, battery swapping, photovoltaic power generation, and energy storage systems to form an energy synergy model of “photovoltaic storage, EV charging and battery swapping plus virtual power plant”. In the future, this kind of integrated energy station will become the development trend of charging and swapping infrastructure, which can improve the efficiency of land resource utilization on the one hand and meet diversified energy needs at the same time. According to statistics, a battery swap station occupies an area of about three parking spaces but can serve hundreds of vehicles, saving more than 60% of land costs compared with charging stations of the same scale, and has more promotion value in urban core areas where land resources are scarce.

In the future, China’s charging and swapping industry will develop in the direction of popularization of high-power charging, intelligent charging system upgrades, integration of optical storage and charging, diversification of operation ecology of charging and swapping facilities, overseas charging and swapping facilities, in-depth integration of virtual power plants and charging and swapping, and construction and promotion of integrated energy stations so as to form a more perfect, efficient, and sustainable charging and swapping infrastructure system.

6.2. Policy Development Direction

Based on the industrial development trend and international experience, China’s charging and swapping industry policy will be adjusted in the following directions in the future:

First of all, standardization will be strengthened. Policymakers will prioritize accelerating the development of unified standards, such as battery size, interface protocols, and communication protocols, and enforce compatibility among automotive manufacturers and avoid the differentiation of technical routes. At the same time, for new technologies such as solid-state batteries, special battery swap standards are formulated to ensure the compatibility of technology iteration with the existing battery swap network. High-power charging protocols will also be standardized.

Second, regional coordination and subsidy mechanisms will be optimized. The policy will promote regional coordination and avoid duplication of construction and waste of resources. Tailored subsidy mechanisms will be designed to align with regional characteristics, and different subsidy mechanisms will be designed to improve the accuracy and effectiveness of policies. For instance, subsidies for battery swaps could be tied to battery recycling (for example, a recycling certificate is required for a subsidy of CNY 0.5 for each battery swap), learn from the market-driven path, and rely on the differences in electric energy prices, ancillary service income, and capacity compensation to form a closed loop and reduce policy dependence.

Third, the participation mechanism of virtual power plants can be improved. The rules and standards for battery swap stations for participation in virtual power plants can be clarified and market transparency and revenue certainty can be improved. At the same time, through the design of the electricity price mechanism, battery swap stations can be guided to participate in the peak regulation of the power grid and improve the efficiency of energy utilization. For example, Shandong pioneered the “government and e-commerce” tripartite coordination mechanism, and the Shandong Provincial Development and Reform Commission, the Shandong Provincial Energy Bureau, and Shandong Electric Power jointly carried out special training and established a special class for the development of virtual power plants to ensure the implementation of policy standards [72].

Fourth, the interconnection of charging and swapping infrastructure will be promoted. This policy will promote the interconnection of charging and swapping facilities, break brand barriers, and improve convenience for users. At the same time, a unified payment system and service platform will be established to simplify the user operation process. For example, NIO’s charging network has served more than 200 car brand users, with a total of more than 600,000 registered users, and has cooperated with 20 brands to realize the interconnection of the charging network.

Fifth, environmental protection and resource recycling will be strengthened. This policy will strengthen the management of the whole life cycle of batteries, promote the cascade utilization of retired batteries, and reduce resource waste and environmental pollution. At the same time, mandatory standards for battery recycling and disposal have been formulated to raise environmental protection requirements. For example, Hainan has begun to plan battery recycling plants, while the policy needs to clarify tax incentives or mandatory requirements for battery cascade utilization.

In the future, China’s charging and swapping industry policies will be adjusted in the direction of strengthening standardization, optimizing regional coordination and subsidy mechanisms, improving the participation mechanism of virtual power plants, promoting the interconnection of charging and swapping infrastructure, and strengthening environmental protection and resource recycling so as to provide more powerful policy support for the development of the charging and swapping industry.

7. Conclusions and Implications

7.1. Conclusions

China’s NEV charging and swapping industry has evolved through distinct phases—from initial exploration to comprehensive strategic deployment and now to high-quality development—forming a diversified energy supplement system with “charging as the mainstay, battery swapping as the supplement”. By the end of 2024, China had installed 12.818 million charging piles and 4443 battery swap stations, forming the world’s largest charging network and providing solid support for the development of China’s NEV industry.

Significant achievements have been realized in policy implementation, including the rapid growth of infrastructure scale, the rapid advancement of the county-to-county connection project of battery swapping, the gradual improvement of the battery swap standard system, and the exploration of business model innovation. However, problems such as insufficient standardization, difficulty in making business models profitable, obstacles to collaboration, unbalanced regional development, and the contradiction between technology iteration and battery swapping networks still restrict the further development of the charging and swapping industry.

The international experience provides a useful reference for the development of China’s charging and swapping industry. The EU has advanced infrastructure development through mandatory regulations, promotes industrial collaboration through unified standards, accelerates infrastructure sinking through government–enterprise cooperation, and improves service experience through user-oriented cooperation. The United States has provided new ideas for the development of China’s battery charging and swapping industry through the coordinated policies of the federal and state governments, the combination of technology iteration and market selection, the innovation of open and shared business models, and the combination of virtual power plants and battery charging and swapping.

In the future, China’s battery charging and swapping industry will develop in the direction of the integration of solid-state batteries and battery swapping modes, the deep integration of virtual power plants and battery charging and swapping, the construction and promotion of integrated energy stations, the first breakthrough in the field of battery swapping modes in the field of commercial vehicles, and the popularization of the vehicle battery separation mode. At the same time, the policy will be adjusted in the direction of strengthening standardization and mandatory unification, optimizing regional coordination and subsidy mechanisms, improving the participation mechanism of virtual power plants, promoting the interconnection of charging and swapping infrastructure, and strengthening environmental protection and resource recycling so as to provide more powerful policy support for the development of the charging and swapping industry.

7.2. Revelation

The development of China’s charging and swapping industry needs to be optimized from the following aspects:

First of all, promoting standardization and mandatory unification is the key to the development of the charging and swapping industry. It is necessary to speed up the formulation of unified standards, such as battery size, interface protocols, and communication protocols, and force car companies to be compatible and avoid the differentiation of technical routes. At the same time, for new technologies such as solid-state batteries, special battery swap standards are formulated to ensure the compatibility of technology iteration with the existing battery swap network. You can refer to the EU CCS agreement promotion mechanism to establish a cross-regional and cross-brand standardization system.

Secondly, exploring diversified profit models is the key to solving the profitability difficulties of business models. We can learn from Tesla’s business model of opening up the supercharging network to achieve profitability through service fee and point transactions. At the same time, we should promote the participation of battery swap stations in virtual power plants, use the peak-to-valley electricity price difference and peak shaving services to create revenue, optimize the resource aggregation strategy on the user side, and improve the economic benefits of battery swap stations.

Third, strengthening synergy and ecological construction is the guarantee for the sustainable development of the charging and swapping industry. It is necessary to build an ecological alliance of car companies, battery manufacturers, energy companies, and financial institutions to promote the co-construction and sharing of battery swap facilities. For example, CATL and other car companies launched the “chocolate battery swap block” and SAIC and PetroChina jointly built an integrated energy station, both of which are positive practices of industrial synergy. At the same time, the policy needs to provide initial subsidies or pilot support to reduce barriers to synergy.

Fourth, balancing technology iteration and battery swap network upgrading is the foundation for the long-term development of the battery charging and swapping industry. It is necessary to avoid over-reliance on a single technology and combine the complementary development of supercharging and battery swapping. At the same time, according to different user groups and usage scenarios, differentiated charging and swapping service models are designed to meet diverse needs. For example, NIO has begun to adapt semi-solid-state batteries (150 kWh version) to some battery swap stations and will further expand the scope of adaptation in the future to balance technology iteration and battery swap network upgrades.

Fifth, improving user convenience and service experience is the key to the marketization of the charging and swapping industry. It is necessary to promote the interconnection between the payment system and the platform to reduce the operational burden on users. At the same time, it is necessary to optimize the layout of charging and swapping facilities, improve coverage and convenience of use, and eliminate “range anxiety”. NIO’s charging network has more than 6 million registered users, serving more than 200 car brand users and cooperating with 20 brands to realize the interconnection of the charging network and improve user convenience and service experience.

The development of China’s charging and swapping industry needs to be optimized in multiple dimensions, such as standardization, business model, collaboration, technology iteration, and user experience, so as to form a more complete, efficient, and sustainable charging and swapping infrastructure system to provide strong support for the development of the NEV industry.

Author Contributions

Conceptualization, F.W.; methodology, F.W. and Q.Z.; software, Q.Z.; validation, F.W. and Q.Z.; formal analysis, F.W. and Q.Z.; investigation, Q.Z.; resources, Q.Z.; data curation, Q.Z.; writing—original draft preparation, Q.Z.; writing—review and editing, F.W.; visualization, Q.Z.; supervision, F.W.; project administration, F.W.; funding acquisition, F.W. All authors have read and agreed to the published version of the manuscript.

Funding

The authors acknowledge financial support from the General Project of National Philosophy and Social Sciences Foundation in 2022: Driving effects, potential impacts and coordinating pathways of the forcing mechanism from China’s “dual carbon” targets on its high-quality economic development [grant number: 22BJY127].

Data Availability Statement

No new data were created or analyzed in this study.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- International Energy Agency. Global EV Outlook 2025. Available online: https://www.iea.org/reports/global-ev-outlook-2025 (accessed on 15 July 2025).

- China News Agency. As of the End of 2024, the Number of NEVs in China Has Reached 31.4 Million. Available online: https://www.chinanews.com.cn/gn/2025/01-17/10355104.shtml (accessed on 15 July 2025).

- Jia, C.; Liu, W.; He, H.; Chau, K.T. Superior energy management for fuel cell vehicles guided by improved DDPG algorithm: Integrating driving intention speed prediction and health-aware control. Appl. Energy 2025, 394, 126195. [Google Scholar] [CrossRef]

- Li, K.; Zhou, J.; Jia, C.; Yi, F.; Zhang, C. Energy sources durability energy management for fuel cell hybrid electric bus based on deep reinforcement learning considering future terrain information. Int. J. Hydrogen Energy 2024, 52, 821–833. [Google Scholar] [CrossRef]

- Jia, C.; Liu, W.; He, H.; Chau, K.T. Deep reinforcement learning-based energy management strategy for fuel cell buses integrating future road information and cabin comfort control. Energy Convers. Manag. 2024, 321, 119032. [Google Scholar] [CrossRef]

- Xinhua News Net. The Ministry of Industry and Information Technology: It Will Formulate Guiding Opinions on Promoting the Development of the Battery—Swapping Mode. Available online: https://www.news.cn/auto/20250124/9bef8e93ba374d0b9dd0b9eb09d0e59d/c.html (accessed on 15 July 2025).

- China Automotive Technology and Research Center, Nissan (China) Investment Co., Ltd.; Dongfeng Motor Co., Ltd. Blue Book on NEVs: Report on the Development of China’s NEV Industry, 1st ed.; Social Sciences Academic Press: Beijing, China, 2024; pp. 33–34. [Google Scholar]

- Luan, X. Shen (Shanghai) Focuses on the Two Sessions: How to Address Insufficient and Incompatible Charging and Battery Swapping Infrastructure for NEVs? Available online: https://www.thepaper.cn/newsDetail_forward_26559946 (accessed on 15 July 2025).

- Ma, T.; Yu, D. Research and Recommendations on the Development of Battery Swapping Mode for NEVs in China. Available online: https://mp.weixin.qq.com/s/9yZBI90XK9okYBprMlitsA (accessed on 15 July 2025).

- Niu, S.; Zhao, Q.; Chen, H.; Niu, S.; Jian, L. Noncooperative Metal Object Detection Using Pole-to-Pole EM Distribution Characteristics for Wireless EV Charger Employing DD Coils. IEEE Trans. Ind. Electron. 2024, 71, 6335–6344. [Google Scholar] [CrossRef]

- Niu, S.; Jia, Q.; Hu, Y.; Yang, C.; Jian, L. Safety Management Technologies for Wireless Electric Vehicle Charging Systems: A Review. Electronics 2025, 14, 2380. [Google Scholar] [CrossRef]