Innovative Business Models Towards Sustainable Energy Development: Assessing Benefits, Risks, and Optimal Approaches of Blockchain Exploitation in the Energy Transition

Abstract

1. Introduction

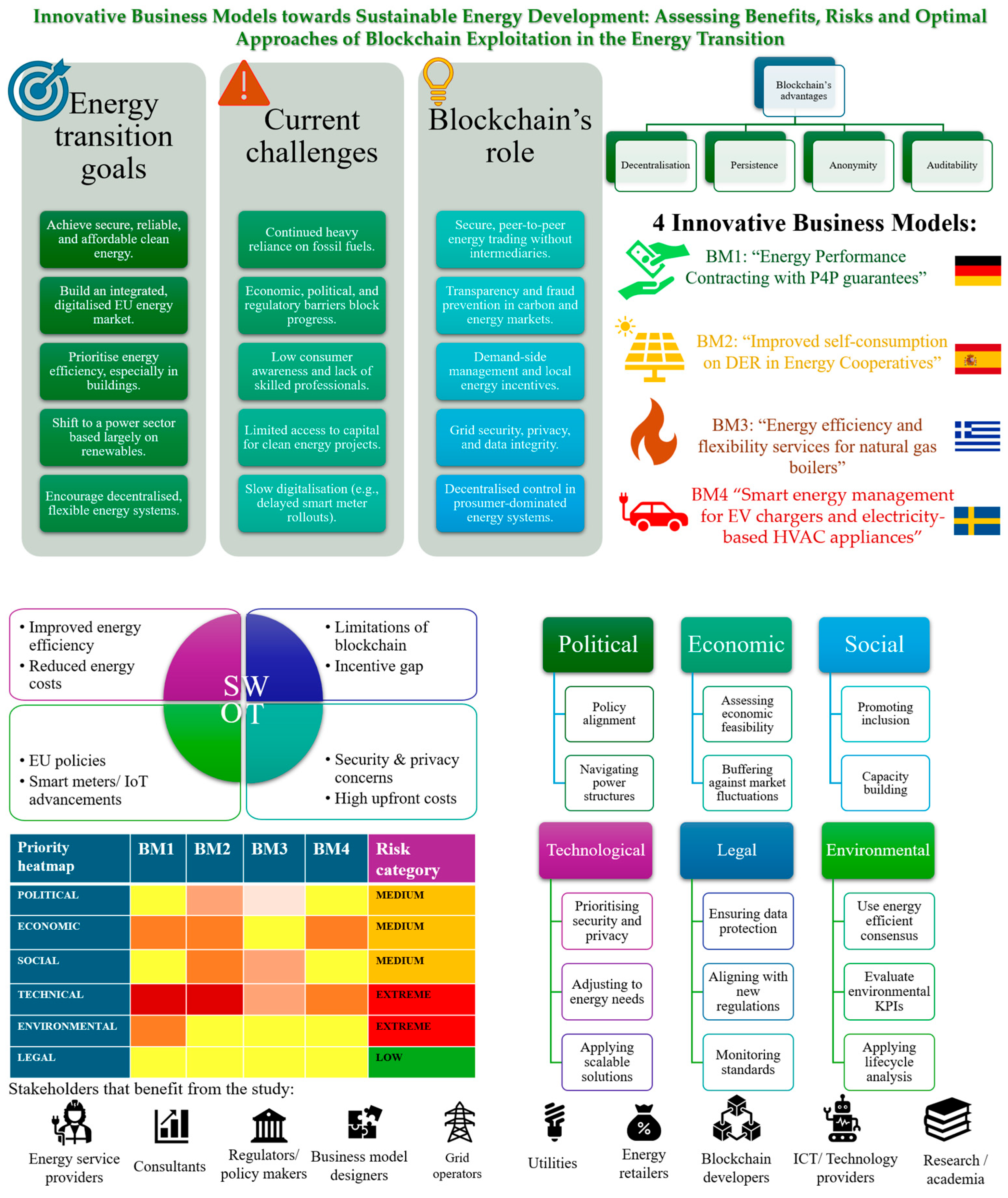

- Materials and Methods: The second section of this paper demonstrates the tools and the methodological steps followed to identify and propose optimal approaches of exploitation of blockchain in the energy sector through innovative business models.

- Results: Relevant works from the literature, as well as projects and initiatives from the industry, are investigated in the third section. The business models of the InEExS project are described. SWOT analysis for each business model is conducted. Risks of blockchain adoption are recognised and assessed.

- Discussion: The results are discussed, and mitigation strategies for the identified risks, towards optimised blockchain exploitation, are proposed.

- Conclusions: Conclusions are drawn, and potential prospects for further research are presented.

2. Materials and Methods

3. Results

3.1. Blockchain Applications in the Energy Field

3.1.1. The Blockchain Technology

3.1.2. Classification of Application Areas of Blockchain in Energy

3.2. Overview of the Business Models and SWOT Analysis

3.3. Identification and Qualitative Assessment of Risks of Blockchain Adoption

- The probability of the risks’ occurrence, expressed through three probability levels: UNLIKELY, MODERATE, and VERY LIKELY.

- The estimation of the risks’ impact, expressed through three impact levels: LOW, MEDIUM, and HIGH.

4. Discussion

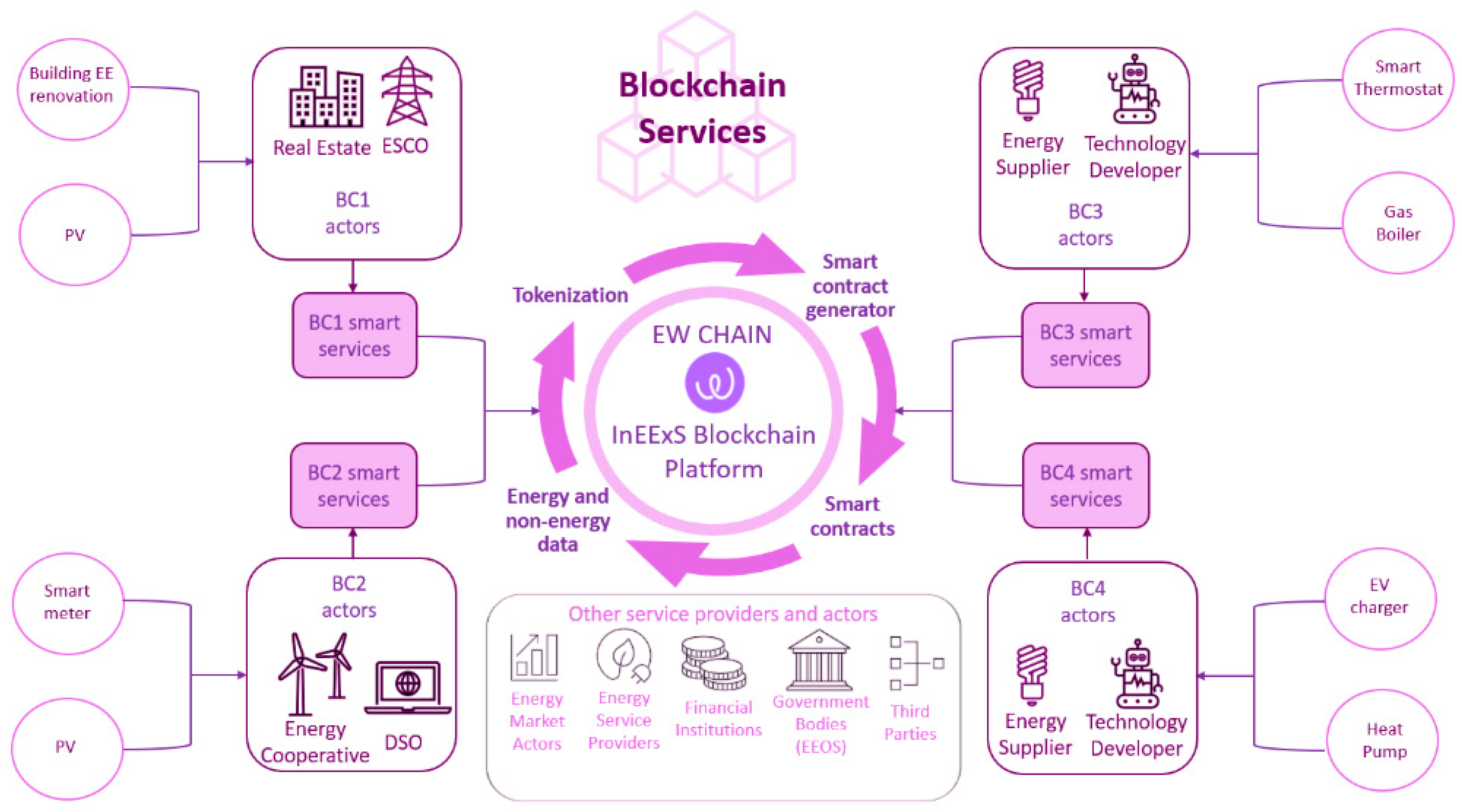

- Blockchain platform: More specifically, the platform Energy Web (EW Chain) [2] is the world’s first open-source enterprise blockchain platform tailored to the needs of the energy sector. As mentioned, the EW-chain is a PoA public blockchain derived from Ethereum blockchain technology, ensuring low energy consumption and efficiency. Since it is EVM-based, solidity can be used to materialise the business logic of each business model into a new smart contract. The Decentralized Data Exchange (DDEx) service supports high-volume, low-latency on-chain transactions, and the DID-based authentication and authorization mechanism provides for trusted and secure participation in energy transactions. The EW chain can be scaled up to support any energy-related use case and will be employed to record the output of all energy service transactions. EW Chain has extremely low transaction costs, stemming from its low instantaneous power draw that is about 7.5 kilowatts, with 50 validator nodes spread across the globe. In comparison, Ethereum draws roughly 1,000,000 times more power, and Bitcoin consumes roughly 2.2 million times more power than EW Chain.

- Smart Contracts service: The Smart Contracts generator follows the factory contract [185] pattern [“https://research.csiro.au/blockchainpatterns/general-patterns/contract-structural-patterns/factory-contract/, accessed on 18 June 2025”] and allows for increased security during the contracts generation, legal compliance and interoperable reporting of energy KPIs. The currently existing paper-based Service Level Agreements (SLAs) for meeting energy KPIs will meet their digital twin on the EW chain, moving closer to legally binding smart contracts. This bridging between the off-chain physical agreement and the on-chain smart contract will enforce secure storage and execution of the SLAs as well as the auditability of historical transactions related to the legal contract and the contract itself in an interoperable fashion. It is important to note that while InEExS contracts aim to enhance transparency and legal clarity, the legal enforceability of any contract, ultimately depends on the jurisdiction in which it is subject to interpretation and enforcement—in our case the InEExS business cases.

- Tokenisation service: extension service of the EW Chain, which has already been deployed in commercial applications to allow token holders to pay for decentralized application services, by using the native cryptocurrency of the EW Chain that is the Energy Web Token (EWT). Within InEExS, EWTs will also be used to tokenize the verified savings and flexibility as contribution of participants in energy services transactions.

- (1)

- Standardisation of grid integration frameworks for renewables and distributed energy sources, involving the creation of national frameworks for integrating renewables and DERs into the grid, ensuring uniform rules for feed-in tariffs and clear guidelines for P2P energy trading through blockchain technology.

- (2)

- Development of GDPR-compliant energy data platforms, involving the creation of secure, interoperable blockchain-based platforms for energy-data sharing that comply with GDPR while enabling real-time optimisation.

- (3)

- Providing consistent support for energy communities by ensuring legal recognition and providing administrative and financial support for energy communities, while also promoting energy efficient behaviour and self-consumption optimisation through blockchain exploitation.

- (4)

- Updating building regulations by revising national building codes to mandate retrofits for energy efficiency and provide financial incentives for compliance that can be combined with P4P guarantees enabled through blockchain.

- (5)

- Enabling demand response and consumer-compensation mechanisms by establishing clear national frameworks and blockchain-based compensation mechanisms for consumer participation in demand-response programs.

- (6)

- Balancing natural gas transition policies by incorporating interim support for improving natural gas systems during the transition to renewable energy.

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Papapostolou, A.; Mexis, F.D.; Karakosta, C.; Psarras, J. A Multicriteria Tool to Support Decision-Making in the Early Stages of Energy Efficiency Investments. In International Conference on Decision Support System Technology; Springer International Publishing: Cham, Switzerland, 2022; pp. 190–202. [Google Scholar] [CrossRef]

- European Commission. The European Green Deal. Available online: https://commission.europa.eu/strategy-and-policy/priorities-2019-2024/european-green-deal_en (accessed on 10 March 2024).

- Harichandan, S.; Kar, S.K.; Bansal, R.; Mishra, S.K.; Balathanigaimani, M.S.; Dash, M. Energy transition research: A bibliometric mapping of current findings and direction for future research. Clean. Prod. Lett. 2022, 3, 100026. [Google Scholar] [CrossRef]

- Maruf, M.N.I.; Mahmud, S.; Pasarín, I.S.; Giani, F.; Degrave, A.; Guerra, C.F.; Lopez, S.; Mesonero, I. Demonstrating clean energy transition scenarios in sector-coupled and renewable-based energy communities. Open Res. Eur. 2023, 3, 193. [Google Scholar] [CrossRef] [PubMed]

- Karakosta, C.; Papapostolou, A. Energy efficiency trends in the Greek building sector: A participatory approach. EuroMediterr. J. Env. Integr. 2023, 8, 3–13. [Google Scholar] [CrossRef]

- Bagaini, A.; Colelli, F.; Croci, E.; Molteni, T. Assessing the relevance of barriers to energy efficiency implementation in the building and transport sectors in eight European countries. Electr. J. 2020, 33, 106820. [Google Scholar] [CrossRef] [PubMed]

- Painuly, J.P.; Wohlgemuth, N. Renewable energy technologies: Barriers and policy implications. In Renewable-Energy-Driven Future; Elsevier: Amsterdam, The Netherlands, 2021; pp. 539–562. [Google Scholar] [CrossRef]

- Hanke, F.; Lowitzsch, J. Empowering Vulnerable Consumers to Join Renewable Energy Communities—Towards an Inclusive Design of the Clean Energy Package. Energies 2020, 13, 1615. [Google Scholar] [CrossRef]

- Vogel, J.A.; Lundqvist, P.; Arias, J. Categorizing Barriers to Energy Efficiency in Buildings. Energy Procedia 2015, 75, 2839–2845. [Google Scholar] [CrossRef]

- Bürer, M.J.; de Lapparent, M.; Capezzali, M.; Carpita, M. Governance Drivers and Barriers for Business Model Transformation in the Energy Sector. In Swiss Energy Governance; Springer International Publishing: Cham, Switzerland, 2022; pp. 195–243. [Google Scholar] [CrossRef]

- Papapostolou, A.; Divolis, S.; Marinakis, V. Identifying Barriers Hindering the Application of Blockchain in the Energy Sector: Pestle and SWOT Analyses. In Proceedings of the International Scientific Conference EMAN Economics & Management: How to Cope with Disrupted Times, Ljubljana, Slovenia, 23 March 2023; Association of Economists and Managers of the Balkans—UdEkoM Balkan: Belgrade, Serbia, 2023; pp. 1–8. [Google Scholar] [CrossRef]

- European Union Agency for the Cooperation of Energy Regulators (ACER). Clean Energy Package. Available online: https://documents.acer.europa.eu/en/Electricity/CLEAN_ENERGY_PACKAGE (accessed on 11 March 2024).

- Faber, R.; Dück, L.-M.; Reichwein, D. Germany’s Delayed Electricity Smart Meter Rollout and Its Implications on Innovation, Infrastructure, Integration, and Social Acceptance: An Ex-Post Analysis. 2023. Available online: https://bitcoin.org/bitcoin.pdf (accessed on 18 June 2025).

- Pandiyan, P.; Saravanan, S.; Usha, K.; Kannadasan, R.; Alsharif, M.H.; Kim, M.-K. Technological advancements toward smart energy management in smart cities. Energy Rep. 2023, 10, 648–677. [Google Scholar] [CrossRef]

- Guo, H.; Yu, X. A survey on blockchain technology and its security. Blockchain Res. Appl. 2022, 3, 100067. [Google Scholar] [CrossRef]

- Nakamoto, S. Bitcoin: A Peer-to-Peer Electronic Cash System. Available online: www.bitcoin.org (accessed on 18 June 2025).

- Tripathi, G.; Ahad, M.A.; Casalino, G. A comprehensive review of blockchain technology: Underlying principles and historical background with future challenges. Decis. Anal. J. 2023, 9, 100344. [Google Scholar] [CrossRef]

- Diestelmeier, L. Changing power: Shifting the role of electricity consumers with blockchain technology—Policy implications for EU electricity law. Energy Policy 2019, 128, 189–196. [Google Scholar] [CrossRef]

- Lei, Y.-T.; Ma, C.-Q.; Mirza, N.; Ren, Y.-S.; Narayan, S.W.; Chen, X.-Q. A renewable energy microgrids trading management platform based on permissioned blockchain. Energy Econ. 2022, 115, 106375. [Google Scholar] [CrossRef]

- Hajizadeh, A.; Hakimi, S.M. Blockchain in decentralized demand-side control of microgrids. In Blockchain-Based Smart Grids; Elsevier: Amsterdam, The Netherlands, 2020; pp. 145–167. [Google Scholar] [CrossRef]

- Abouyoussef, M.; Ismail, M. Blockchain-based Networking Strategy for Privacy-Preserving Demand Side Management. In Proceedings of the ICC 2021—IEEE International Conference on Communications, Montreal, QC, Canada, 14–23 June 2021; pp. 1–6. [Google Scholar] [CrossRef]

- Mihaylov, M.; Razo-Zapata, I.; Nowé, A. NRGcoin—A Blockchain-based Reward Mechanism for Both Production and Consumption of Renewable Energy. In Transforming Climate Finance and Green Investment with Blockchains; Elsevier: Amsterdam, The Netherlands, 2018; pp. 111–131. [Google Scholar] [CrossRef]

- Koasidis, K.; Marinakis, V.; Nikas, A.; Chira, K.; Flamos, A.; Doukas, H. Monetising behavioural change as a policy measure to support energy management in the residential sector: A case study in Greece. Energy Policy 2022, 161, 112759. [Google Scholar] [CrossRef]

- Kim, M.; Lee, J.; Oh, J.; Park, K.; Park, Y.; Park, K. Blockchain based energy trading scheme for vehicle-to-vehicle using decentralized identifiers. Appl. Energy 2022, 322, 119445. [Google Scholar] [CrossRef]

- Huang, X.; Zhang, Y.; Li, D.; Han, L. An optimal scheduling algorithm for hybrid EV charging scenario using consortium blockchains. Future Gener. Comput. Syst. 2019, 91, 555–562. [Google Scholar] [CrossRef]

- Niavis, H.; Laskari, M.; Fergadiotou, I. Trusted DBL: A Blockchain-based Digital Twin for Sustainable and Interoperable Building Performance Evaluation. In Proceedings of the 2022 7th International Conference on Smart and Sustainable Technologies (SpliTech), Split/Bol, Croatia, 5–8 July 2022; pp. 1–6. [Google Scholar] [CrossRef]

- Fu, Y.; Yu, F.R.; Li, C.; Luan, T.H.; Zhang, Y. Vehicular Blockchain-Based Collective Learning for Connected and Autonomous Vehicles. IEEE Wirel. Commun. 2020, 27, 197–203. [Google Scholar] [CrossRef]

- Li, L.; Liu, J.; Cheng, L.; Qiu, S.; Wang, W.; Zhang, X.; Zhang, Z. CreditCoin: A Privacy-Preserving Blockchain-Based Incentive Announcement Network for Communications of Smart Vehicles. IEEE Trans. Intell. Transp. Syst. 2018, 19, 2204–2220. [Google Scholar] [CrossRef]

- Al Sadawi, A.; Madani, B.; Saboor, S.; Ndiaye, M.; Abu-Lebdeh, G. A comprehensive hierarchical blockchain system for carbon emission trading utilizing blockchain of things and smart contract. Technol. Forecast. Soc. Chang. 2021, 173, 121124. [Google Scholar] [CrossRef]

- Blumberg, G.; Sibilla, M. A Carbon Accounting and Trading Platform for the uk Construction Industry. Energies 2023, 16, 1566. [Google Scholar] [CrossRef]

- Ahl, A.; Goto, M.; Yarime, M.; Tanaka, K.; Sagawa, D. Challenges and opportunities of blockchain energy applications: Interrelatedness among technological, economic, social, environmental, and institutional dimensions. Renew. Sustain. Energy Rev. 2022, 166, 112623. [Google Scholar] [CrossRef]

- Erturk, E.; Lopez, D.; Yu, W.Y. Benefits and Risks of Using Blockchain in Smart Energy: A Literature Review; Academy of Taiwan Information Systems Research: Taiwan, China, 2019. [Google Scholar] [CrossRef]

- Bürer, M.J.; de Lapparent, M.; Pallotta, V.; Capezzali, M.; Carpita, M. Use cases for Blockchain in the Energy Industry Opportunities of emerging business models and related risks. Comput. Ind. Eng. 2019, 137, 106002. [Google Scholar] [CrossRef]

- Van Cutsem, O.; Dac, D.H.; Boudou, P.; Kayal, M. Cooperative energy management of a community of smart-buildings: A Blockchain approach. Int. J. Electr. Power Energy Syst. 2020, 117, 105643. [Google Scholar] [CrossRef]

- Kumari, A.; Kakkar, R.; Gupta, R.; Agrawal, S.; Tanwar, S.; Alqahtani, F.; Tolba, A.; Raboaca, M.S.; Manea, D.L. Blockchain-Driven Real-Time Incentive Approach for Energy Management System. Mathematics 2023, 11, 928. [Google Scholar] [CrossRef]

- Tseng, L.; Yao, X.; Otoum, S.; Aloqaily, M.; Jararweh, Y. Blockchain-based database in an IoT environment: Challenges, opportunities, and analysis. Clust. Comput. 2020, 23, 2151–2165. [Google Scholar] [CrossRef]

- Zakaret, C.; Peladarinos, N.; Cheimaras, V.; Tserepas, E.; Papageorgas, P.; Aillerie, M.; Piromalis, D.; Agavanakis, K. Blockchain and Secure Element, a Hybrid Approach for Secure Energy Smart Meter Gateways. Sensors 2022, 22, 9664. [Google Scholar] [CrossRef] [PubMed]

- Zhang, S.; Rong, J.; Wang, B. A privacy protection scheme of smart meter for decentralized smart home environment based on consortium blockchain. Int. J. Electr. Power Energy Syst. 2020, 121, 106140. [Google Scholar] [CrossRef]

- Teufel, B.; Sentic, A.; Barmet, M. Blockchain energy: Blockchain in future energy systems. J. Electron. Sci. Technol. 2019, 17, 100011. [Google Scholar] [CrossRef]

- Mylrea, M.; Gourisetti, S.N.G. Blockchain for smart grid resilience: Exchanging distributed energy at speed, scale and security. In Proceedings of the 2017 Resilience Week (RWS), Wilmington, DE, USA, 18–22 September 2017; pp. 18–23. [Google Scholar] [CrossRef]

- Sadhya, V.; Sadhya, H. Barriers to Adoption of Blockchain Technology Barriers to Adoption of Blockchain Technology Completed Research. 2018. Available online: https://aisel.aisnet.org/amcis2018/AdoptionDiff/Presentations/20 (accessed on 18 June 2025).

- Borkovcová, A.; Černá, M.; Sokolová, M. Blockchain in the Energy Sector—Systematic Review. Sustainability 2022, 14, 14793. [Google Scholar] [CrossRef]

- Fovino, I.N.; Andreadou, N.; Geneiatakis, D.; Giuliani, R.; Kounelis, I.; Lucas, A.; Marinopoulos, A.; Martin, T.; Poursanidis, I.; Soupionis, I.; et al. Lockchain in the Energy Sector. WP3, Use Cases Identification and Analysis; Publications Office of the European Union: Luxembourg, 2021. [Google Scholar]

- Egunjobi, O.O.; Gomes, A.; Egwim, C.N.; Morais, H. A systematic review of blockchain for energy applications. e-Prime-Adv. Electr. Eng. Electron. Energy 2024, 9, 100751. [Google Scholar] [CrossRef]

- Khezami, N.; Gharbi, N.; Neji, B.; Braiek, N.B. Blockchain Technology Implementation in the Energy Sector: Comprehensive Literature Review and Mapping. Sustainability 2022, 14, 15826. [Google Scholar] [CrossRef]

- Zhou, J.; Wu, Y.; Liu, F.; Tao, Y.; Gao, J. Prospects and obstacles analysis of applying blockchain technology to power trading using a deeply improved model based on the DEMATEL approach. Sustain. Cities Soc. 2021, 70, 102910. [Google Scholar] [CrossRef]

- Institute for European Energy and Climate Policy (IEECP). InEExS—Innovative Energy (Efficiency) Service Models for Sector Integration via Blockchain. Available online: https://ieecp.org/projects/ineexs/ (accessed on 11 March 2024).

- ResearchGate. Available online: https://www.researchgate.net/ (accessed on 11 December 2024).

- Scopus. Available online: https://www.elsevier.com/products/scopus (accessed on 11 December 2024).

- IEEExplore. Available online: https://ieeexplore.ieee.org/Xplore/home.jsp (accessed on 11 December 2024).

- European Commission. Available online: https://commission.europa.eu/index_en (accessed on 11 December 2024).

- Kangas, J.; Kurttila, M.; Kajanus, M.; Kangas, A. Evaluating the management strategies of a forestland estate—The S-O-S approach. J. Env. Manag. 2003, 69, 349–358. [Google Scholar] [CrossRef] [PubMed]

- Zahari, A.R.; Romli, F.I. Analysis of suborbital flight operation using PESTLE. J. Atmos. Sol. Terr. Phys. 2019, 192, 104901. [Google Scholar] [CrossRef]

- Ghazinoory, S.; Abdi, M.; Azadegan-Mehr, M. Swot methodology: A state-of-the-art review for the past, a framework for the future/SSGG METODOLOGIJA: PRAEITIES IR ATEITIES ANALIZĖ. J. Bus. Econ. Manag. 2011, 12, 24–48. [Google Scholar] [CrossRef]

- Yusup, M.; Suhaepi, M.I.; Ramadhan, R. Blockchain Technology for Cashless Investments and Transactions in Digital Era with SWOT Approach. Blockchain Front. Technol. 2022, 2, 17–23. [Google Scholar] [CrossRef]

- Firsova, N.; Abrhám, J. Economic perspectives of the Blockchain technology: Application of a SWOT analysis. Terra Econ. 2021, 19, 78–90. [Google Scholar] [CrossRef]

- Yusuf, F.; Sari, R.; Yusgiantoro, P.; Soesilo, T. Stakeholders’ Perceptions of the Peer-to-Peer Energy Trading Model Using Blockchain Technology in Indonesia. Energies 2024, 17, 4956. [Google Scholar] [CrossRef]

- Andreoulaki, I.; Papapostolou, A.; Marinakis, V. Evaluating the Barriers to Blockchain Adoption in the Energy Sector: A Multicriteria Approach Using the Analytical Hierarchy Process for Group Decision Making. Energies 2024, 17, 1278. [Google Scholar] [CrossRef]

- Hosseini Dehshiri, S.J.; Amiri, M.; Bamakan, S.M.H. Evaluating the blockchain technology strategies for reducing renewable energy development risks using a novel integrated decision framework. Energy 2024, 289, 129987. [Google Scholar] [CrossRef]

- Vionis, P.; Kotsilieris, T. The Potential of Blockchain Technology and Smart Contracts in the Energy Sector: A Review. Appl. Sci. 2023, 14, 253. [Google Scholar] [CrossRef]

- Duijm, N.J. Recommendations on the use and design of risk matrices. Saf. Sci. 2015, 76, 21–31. [Google Scholar] [CrossRef]

- Chen, C.; Zhao, Y.; Ma, B. Three-Dimensional Risk Matrix for Risk Assessment of Tailings Storage Facility Failure: Theory and a Case Study. Geotech. Geol. Eng. 2024, 42, 1811–1833. [Google Scholar] [CrossRef]

- Lemmens, S.M.P.; van Balen, V.A.L.; Röselaers, Y.C.M.; Scheepers, H.C.J.; Spaanderman, M.E.A. The risk matrix approach: A helpful tool weighing probability and impact when deciding on preventive and diagnostic interventions. BMC Health Serv. Res. 2022, 22, 218. [Google Scholar] [CrossRef] [PubMed]

- Jensen, R.C.; Bird, R.L.; Nichols, B.W. Risk Assessment Matrices for Workplace Hazards: Design for Usability. Int. J. Environ. Res. Public Health 2022, 19, 2763. [Google Scholar] [CrossRef] [PubMed]

- Ibrahim, N.A.; Alwi, S.R.W.; Manan, Z.A.; Mustaffa, A.A.; Kidam, K. Risk matrix approach of extreme temperature and precipitation for renewable energy systems in Malaysia. Energy 2022, 254, 124471. [Google Scholar] [CrossRef]

- Gür, B.; Yavuz, Ş.; Çakir, A.D.; Köse, D.A. Determination of Hazards and Risks in a Solar Power Plant Using the Matrix Risk Analysis. Eur. J. Sci. Technol. 2021, 23, 497–511. [Google Scholar] [CrossRef]

- Li, W.; He, M.; Haiquan, S. An Overview of Blockchain Technology: Applications, Challenges and Future Trends. In Proceedings of the 2021 IEEE 11th International Conference on Electronics Information and Emergency Communication (ICEIEC)2021 IEEE 11th International Conference on Electronics Information and Emergency Communication (ICEIEC), Beijing, China, 18–20 June 2021; pp. 31–39. [Google Scholar] [CrossRef]

- Xie, M.; Liu, J.; Chen, S.; Lin, M. A survey on blockchain consensus mechanism: Research overview, current advances and future directions. Int. J. Intell. Comput. Cybern. 2023, 16, 314–340. [Google Scholar] [CrossRef]

- Bouraga, S. A taxonomy of blockchain consensus protocols: A survey and classification framework. Expert Syst. Appl. 2021, 168, 114384. [Google Scholar] [CrossRef]

- Zhou, Q.; Huang, H.; Zheng, Z.; Bian, J. Solutions to Scalability of Blockchain: A Survey. IEEE Access 2020, 8, 16440–16455. [Google Scholar] [CrossRef]

- Appasani, B.; Mishra, S.K.; Jha, A.V.; Mishra, S.K.; Enescu, F.M.; Sorlei, I.S.; Bîrleanu, F.G.; Takorabet, N.; Thounthong, P.; Bizon, N. Blockchain-Enabled Smart Grid Applications: Architecture, Challenges, and Solutions. Sustainability 2022, 14, 8801. [Google Scholar] [CrossRef]

- Habib, G.; Sharma, S.; Ibrahim, S.; Ahmad, I.; Qureshi, S.; Ishfaq, M. Blockchain Technology: Benefits, Challenges, Applications, and Integration of Blockchain Technology with Cloud Computing. Future Internet 2022, 14, 341. [Google Scholar] [CrossRef]

- Hameed, B.I. Blockchain and Cryptocurrencies Technology: A survey. JOIV Int. J. Inform. Vis. 2019, 3, 355–360. [Google Scholar] [CrossRef]

- Yang, Z.; Zhu, C.; Zhu, Y.; Li, X. Blockchain technology in building environmental sustainability: A systematic literature review and future perspectives. Build Env. 2023, 245, 110970. [Google Scholar] [CrossRef]

- Bernabe, J.B.; Canovas, J.L.; Hernandez-Ramos, J.L.; Moreno, R.T.; Skarmeta, A. Privacy-Preserving Solutions for Blockchain: Review and Challenges. IEEE Access 2019, 7, 164908–164940. [Google Scholar] [CrossRef]

- Bao, Z.; Wang, K.; Zhang, W. An Auditable and Secure Model for Permissioned Blockchain. In Proceedings of the 2019 International Electronics Communication Conference, Okinawa, Japan, 7–9 July 2019; ACM: New York, NY, USA, 2019; pp. 139–145. [Google Scholar] [CrossRef]

- Popoola, O.; Rodrigues, M.; Marchang, J.; Shenfield, A.; Ikpehia, A.; Popoola, J. A critical literature review of security and privacy in smart home healthcare schemes adopting IoT & blockchain: Problems, Challenges and Solutions. Blockchain Res. Appl. 2023, 5, 100178. [Google Scholar] [CrossRef]

- Mollajafari, S.; Bechkoum, K. Blockchain Technology and Related Security Risks: Towards a Seven-Layer Perspective and Taxonomy. Sustainability 2023, 15, 13401. [Google Scholar] [CrossRef]

- Hussein, Z.; Salama, M.A.; El-Rahman, S.A. Evolution of blockchain consensus algorithms: A review on the latest milestones of blockchain consensus algorithms. Cybersecurity 2023, 6, 30. [Google Scholar] [CrossRef]

- Wendl, M.; Doan, M.H.; Sassen, R. The environmental impact of cryptocurrencies using proof of work and proof of stake consensus algorithms: A systematic review. J. Environ. Manag. 2023, 326, 116530. [Google Scholar] [CrossRef] [PubMed]

- Saleh, F. Blockchain without Waste: Proof-of-Stake. Rev. Financ. Stud. 2021, 34, 1156–1190. [Google Scholar] [CrossRef]

- Islam, M.M.; In, H.P. Decentralized Global Copyright System Based on Consortium Blockchain with Proof of Authority. IEEE Access 2023, 11, 43101–43115. [Google Scholar] [CrossRef]

- Chikezie, U.; Karacolak, T.; Prado, J.C.D. Examining the Applicability of Blockchain to the Smart Grid Using Proof-of-Authority Consensus. In Proceedings of the 2021 IEEE 9th International Conference on Smart Energy Grid Engineering (SEGE), Oshawa, ON, Canada, 11–13 August 2021; pp. 19–25. [Google Scholar] [CrossRef]

- Yang, J.; Dai, J.; Gooi, H.B.; Nguyen, H.D.; Paudel, A. A Proof-of-Authority Blockchain-Based Distributed Control System for Islanded Microgrids. IEEE Trans Ind. Inf. 2022, 18, 8287–8297. [Google Scholar] [CrossRef]

- Wang, Q.; Su, M. Integrating blockchain technology into the energy sector—From theory of blockchain to research and application of energy blockchain. Comput. Sci. Rev. 2020, 37, 100275. [Google Scholar] [CrossRef]

- Wu, J.; Tran, N. Application of Blockchain Technology in Sustainable Energy Systems: An Overview. Sustainability 2018, 10, 93067. [Google Scholar] [CrossRef]

- Afzal, M.; Li, J.; Amin, W.; Huang, Q.; Umer, K.; Ahmad, S.A.; Ahmad, F.; Raza, A. Role of blockchain technology in transactive energy market: A review. Sustain. Energy Technol. Assess. 2022, 53, 102646. [Google Scholar] [CrossRef]

- Wang, L.; Jiang, S.; Shi, Y.; Du, X.; Xiao, Y.; Ma, Y.; Yi, X.; Zhang, Y.; Li, M. Blockchain-based dynamic energy management mode for distributed energy system with high penetration of renewable energy. Int. J. Electr. Power Energy Syst. 2023, 148, 108933. [Google Scholar] [CrossRef]

- Zhang, T.; Yang, J.; Jin, K.; Jing, T. Local power consumption method of distributed photovoltaic generation in rural distribution network based on blockchain. IET Gener. Transm. Distrib. 2023, 17, 1409–1418. [Google Scholar] [CrossRef]

- Rajasekar, V.; Sathya, K. Blockchain utility in renewable energy. In Blockchain-Based Systems for the Modern Energy Grid; Elsevier: Amsterdam, The Netherlands, 2023; pp. 115–134. [Google Scholar] [CrossRef]

- Cui, M.; Feng, T.; Wang, H. How can blockchain be integrated into renewable energy?—A bibliometric-based analysis. Energy Strategy Rev. 2023, 50, 101207. [Google Scholar] [CrossRef]

- Moniruzzaman, M.; Yassine, A.; Benlamri, R. Blockchain and cooperative game theory for peer-to-peer energy trading in smart grids. Int. J. Electr. Power Energy Syst. 2023, 151, 109111. [Google Scholar] [CrossRef]

- Chen, Y.; Li, Y.; Chen, Q.; Wang, X.; Li, T.; Tan, C. Energy trading scheme based on consortium blockchain and game theory. Comput. Stand. Interfaces 2023, 84, 103699. [Google Scholar] [CrossRef]

- Wang, B.; Xu, L.; Wang, J. A privacy-preserving trading strategy for blockchain-based P2P electricity transactions. Appl. Energy 2023, 335, 120664. [Google Scholar] [CrossRef]

- Wang, D.; Du, X.; Zhang, H.; Wang, Q. Blockchain Enabled Credible Energy Trading at the Edge of the Internet of Things. Mathematics 2023, 11, 630. [Google Scholar] [CrossRef]

- Baig, M.J.A.; Iqbal, M.T.; Jamil, M.; Khan, J. Blockchain-Based Peer-to-Peer Energy Trading System Using Open-Source Angular Framework and Hypertext Transfer Protocol. Electronics 2023, 12, 287. [Google Scholar] [CrossRef]

- Zhou, X.; Wang, B.; Guo, Q.; Sun, H.; Pan, Z.; Tian, N. Bidirectional Privacy-Preserving Network- Constrained Peer-to-Peer Energy Trading Based on Secure Multiparty Computation and Blockchain. IEEE Trans. Power Syst. 2024, 39, 602–613. [Google Scholar] [CrossRef]

- Yu, J.; Liu, J.; Wen, Y.; Yu, X. Economic Optimal Coordinated Dispatch of Power for Community Users Considering Shared Energy Storage and Demand Response under Blockchain. Sustainability 2023, 15, 6620. [Google Scholar] [CrossRef]

- Liu, J.; Sun, J.; Yuan, H.; Su, Y.; Feng, S.; Lu, C. Behavior analysis of photovoltaic-storage-use value chain game evolution in blockchain environment. Energy 2022, 260, 125182. [Google Scholar] [CrossRef]

- Mohammadi, F.; Sanjari, M.; Saif, M. A Real-Time Blockchain-Based State Estimation System for Battery Energy Storage Systems. In Proceedings of the 2022 IEEE Kansas Power and Energy Conference (KPEC), Manhattan, KS, USA, 25–26 April 2022; pp. 1–4. [Google Scholar] [CrossRef]

- Habbak, H.; Baza, M.; Mahmoud, M.M.E.A.; Metwally, K.; Mattar, A.; Salama, G.I. Privacy-Preserving Charging Coordination Scheme for Smart Power Grids Using a Blockchain. Energies 2022, 15, 8996. [Google Scholar] [CrossRef]

- Khan, K.; Hassan, F.; Koo, J.; Mohammed, M.A.; Hasan, Y.; Muhammad, D.; Chowdhry, B.S.; Qureshi, N.M. Blockchain-based applications and energy effective electric vehicle charging—A systematic literature review, challenges, comparative analysis and opportunities. Comput. Electr. Eng. 2023, 112, 108959. [Google Scholar] [CrossRef]

- Cavalcante, I.; Júnior, J.; Manzolli, J.A.; Almeida, L.; Pungo, M.; Guzman, C.P.; Morais, H. Electric Vehicles Charging Using Photovoltaic Energy Surplus: A Framework Based on Blockchain. Energies 2023, 16, 2694. [Google Scholar] [CrossRef]

- Cabrera-Gutiérrez, A.J.; Castillo, E.; Escobar-Molero, A.; Cruz-Cozar, J.; Morales, D.P.; Parrilla, L. Blockchain-Based Services Implemented in a Microservices Architecture Using a Trusted Platform Module Applied to Electric Vehicle Charging Stations. Energies 2023, 16, 4285. [Google Scholar] [CrossRef]

- Zhang, T.; Feng, T.; Cui, M. Smart contract design and process optimization of carbon trading based on blockchain: The case of China’s electric power sector. J. Clean. Prod. 2023, 397, 136509. [Google Scholar] [CrossRef]

- Yu, X.; Wang, X. Research on Carbon-Trading Model of Urban Public Transport Based on Blockchain Technology. Energies 2023, 16, 2606. [Google Scholar] [CrossRef]

- Li, Z.; Xu, X.; Bai, Q.; Chen, C.; Wang, H.; Xia, P. Implications of information sharing on blockchain adoption in reducing carbon emissions: A mean–variance analysis. Transp. Res. E Logist. Transp. Rev. 2023, 178, 103254. [Google Scholar] [CrossRef]

- Zhu, J.; Feng, T.; Lu, Y.; Jiang, W. Using blockchain or not? A focal firm’s blockchain strategy in the context of carbon emission reduction technology innovation. Bus. Strategy Environ. 2024, 33, 3505–3531. [Google Scholar] [CrossRef]

- Zanghi, E.; Filho, M.B.D.C.; de Souza, J.C.S. Collaborative smart energy metering system inspired by blockchain technology. Int. J. Innov. Sci. 2024, 16, 227–243. [Google Scholar] [CrossRef]

- Singh, M.; Ahmed, S.; Sharma, S.; Singh, S.; Yoon, B. BSEMS—A Blockchain-Based Smart Energy Measurement System. Sensors 2023, 23, 8086. [Google Scholar] [CrossRef] [PubMed]

- Khan, A.A.; Laghari, A.A.; Rashid, M.; Li, H.; Javed, A.R.; Gadekallu, T.R. Artificial intelligence and blockchain technology for secure smart grid and power distribution Automation: A State-of-the-Art Review. Sustain. Energy Technol. Assess. 2023, 57, 103282. [Google Scholar] [CrossRef]

- Ribeiro da Silva, E.; Lohmer, J.; Rohla, M.; Angelis, J. Unleashing the circular economy in the electric vehicle battery supply chain: A case study on data sharing and blockchain potential. Resour. Conserv. Recycl. 2023, 193, 106969. [Google Scholar] [CrossRef]

- Brooklyn Microgrid. Brooklyn Microgrid—Community Powered Energy. Available online: https://www.brooklyn.energy/ (accessed on 12 March 2024).

- EnergyChain. Available online: https://energychain.ca/ (accessed on 18 June 2025).

- NRGcoin—Smart Contract for Green Energy. Available online: https://nrgcoin.org/ (accessed on 12 March 2024).

- SolarCoin. Available online: https://solarcoin.org/ (accessed on 12 March 2024).

- PowerLedger. Available online: https://www.powerledger.io/platform (accessed on 12 March 2024).

- TwinERGY—#DigitalTwin. Available online: https://www.twinergy.eu/ (accessed on 12 March 2024).

- Energy Web. Sonnen Leverages Energy Web Chain, EW Origin for Virtual Power Plant That Saves Wind Energy, Reduces Grid Congestion. Available online: https://medium.com/energy-web-insights/sonnen-leverages-energy-web-chain-ew-origin-for-virtual-power-plant-that-saves-wind-energy-862d54df4bed (accessed on 12 March 2024).

- Green Wallet. Available online: http://greenenergywallet.com/ (accessed on 12 March 2024).

- Energy Blockchain Labs Inc.—IBM. Available online: https://www.ibm.com/case-studies/energy-blockchain-labs-inc (accessed on 12 March 2024).

- Pylon Network.—Together We’ll Shine Brighter. Available online: https://pylon.network/ (accessed on 12 March 2024).

- European Commission. Launch of the European Blockchain Regulatory Sandbox. Available online: https://digital-strategy.ec.europa.eu/en/news/launch-european-blockchain-regulatory-sandbox (accessed on 12 March 2024).

- European Commission. European Blockchain Regulatory Sandbox for Distributed Ledger Technologies. Available online: https://ec.europa.eu/digital-building-blocks/sites/display/EBSI/Sandbox+Project (accessed on 12 March 2024).

- Küfeoğlu, S.; Liu, G.; Anaya, K.; Pollitt, M.G. Digitalisation and New Business Models in Energy Sector Digitalisation and New Business Models in Energy Sector Digitalisation and New Business Models in Energy Sector. 2019. Available online: www.eprg.group.cam.ac.uk (accessed on 18 June 2025).

- European Commission. Energy Efficiency Directive. Available online: https://energy.ec.europa.eu/topics/energy-efficiency/energy-efficiency-targets-directive-and-rules/energy-efficiency-directive_en (accessed on 10 March 2024).

- Hansen, S.J.; Langlois, P.; Bertoldi, P. ESCOs Around the World; River Publishers: Aalborg, Denmark, 2020. [Google Scholar] [CrossRef]

- Bertoldi, P.; Boza-Kiss, B. Analysis of barriers and drivers for the development of the ESCO markets in Europe. Energy Policy 2017, 107, 345–355. [Google Scholar] [CrossRef]

- Mika, B.; Goudz, A. Blockchain-technology in the energy industry: Blockchain as a driver of the energy revolution? With focus on the situation in Germany. Energy Syst. 2021, 12, 285–355. [Google Scholar] [CrossRef]

- Kuhlmann, A.; Burger, C.; Richard, P.; Weinmann, J. Blockchain in der Energiewende; Eine Umfrage unter Führungskräften der deutschen Energiewirtschaft; Deutsche Energie-Agentur GmbH: Berlin, Germany, 2016. [Google Scholar]

- International Energy Agency. Case Study: Energy Savings Meter Programme in Germany. Available online: https://www.iea.org/articles/case-study-energy-savings-meter-programme-in-germany (accessed on 13 March 2024).

- Tzani, D.; Stavrakas, V.; Santini, M.; Thomas, S.; Rosenow, J.; Flamos, A. Pioneering a performance-based future for energy efficiency: Lessons learnt from a comparative review analysis of pay-for-performance programmes. Renew. Sustain. Energy Rev. 2022, 158, 112162. [Google Scholar] [CrossRef]

- Moser, R.; Xia-Bauer, C.; Thema, J.; Vondung, F. Solar Prosumers in the German Energy Transition: A Multi-Level Perspective Analysis of the German ‘Mieterstrom’ Model. Energies 2021, 14, 1188. [Google Scholar] [CrossRef]

- International Energy Agency. Federal Subsidy for Efficient Buildings (BEG) by KfW. Available online: https://www.iea.org/policies/14957-federal-subsidy-for-efficient-buildings-beg-by-kfw (accessed on 13 March 2024).

- National Case Study Report #4: Germany’s Delayed Electricity Smart Meter Rollout and Its Implications on Innovation, Infrastructure, iIntegration, and Social Acceptance. Available online: https://www.ecologic.eu/sites/default/files/publication/2023/33007-Case-Study_4-German-delayed-smartmeter-rollout.pdf (accessed on 18 June 2025).

- D’Oca, S.; Ferrante, A.; Ferrer, C.; Pernetti, R.; Gralka, A.; Sebastian, R.; op ‘t Veld, P. Technical, Financial, and Social Barriers and Challenges in Deep Building Renovation: Integration of Lessons Learned from the H2020 Cluster Projects. Buildings 2018, 8, 174. [Google Scholar] [CrossRef]

- Tzani, D.; Exintaveloni, D.S.; Stavrakas, V.; Flamos, A. Devising policy strategies for the deployment of energy efficiency Pay-for-Performance programmes in the European Union. Energy Policy 2023, 178, 113593. [Google Scholar] [CrossRef]

- European Council. The General Data Protection Regulation. Available online: https://www.consilium.europa.eu/en/policies/data-protection/data-protection-regulation/ (accessed on 13 March 2024).

- Bundesministerium der Justiz. Bundesdatenschutzgesetz. Available online: https://www.gesetze-im-internet.de/bdsg_2018/ (accessed on 13 March 2024).

- Gallego-Castillo, C.; Heleno, M.; Victoria, M. Self-consumption for energy communities in Spain: A regional analysis under the new legal framework. Energy Policy 2021, 150, 112144. [Google Scholar] [CrossRef]

- Barbaro, S.; Napoli, G. Energy Communities in Urban Areas: Comparison of Energy Strategy and Economic Feasibility in Italy and Spain. Land 2023, 12, 1282. [Google Scholar] [CrossRef]

- Fernández, J.M.R.; Payán, M.B.; Santos, J.M.R. Profitability of household photovoltaic self-consumption in Spain. J. Clean. Prod. 2021, 279, 123439. [Google Scholar] [CrossRef]

- Prol, J.L.; Steininger, K.W. Photovoltaic self-consumption regulation in Spain: Profitability analysis and alternative regulation schemes. Energy Policy 2017, 108, 742–754. [Google Scholar] [CrossRef]

- Lowitzsch, J.; Hoicka, C.E.; van Tulder, F.J. Renewable energy communities under the 2019 European Clean Energy Package—Governance model for the energy clusters of the future? Renew. Sustain. Energy Rev. 2020, 122, 109489. [Google Scholar] [CrossRef]

- Petrovich, B.; Kubli, M. Energy communities for companies: Executives’ preferences for local and renewable energy procurement. Renew. Sustain. Energy Rev. 2023, 184, 113506. [Google Scholar] [CrossRef]

- Vernay, A.-L.; Sebi, C.; Arroyo, F. Energy community business models and their impact on the energy transition: Lessons learnt from France. Energy Policy 2023, 175, 113473. [Google Scholar] [CrossRef]

- De Lotto, R.; Micciché, C.; Venco, E.M.; Bonaiti, A.; De Napoli, R. Energy Communities: Technical, Legislative, Organizational, and Planning Features. Energies 2022, 15, 1731. [Google Scholar] [CrossRef]

- Lazdins, R.; Mutule, A.; Zalostiba, D. PV Energy Communities—Challenges and Barriers from a Consumer Perspective: A Literature Review. Energies 2021, 14, 4873. [Google Scholar] [CrossRef]

- Energy, D.-G.F. Exploring the Main Barriers and Action Drivers for the Uptake of Energy Communities: Take-Aways from Our Policy Workshop. Available online: https://energy-communities-repository.ec.europa.eu/energy-communities-repository-news-and-events/energy-communities-repository-news/exploring-main-barriers-and-action-drivers-uptake-energy-communities-take-aways-our-policy-workshop-2023-06-05_en (accessed on 13 March 2024).

- European Commission. Energy Performance of Buildings Directive. Available online: https://energy.ec.europa.eu/topics/energy-efficiency/energy-efficient-buildings/energy-performance-buildings-directive_en (accessed on 12 March 2024).

- Androutsopoulos, A.; Giakoumaki, A. Implementation of the EPBD Greece—Status in 2020. 2020. Available online: https://build-up.ec.europa.eu/sites/default/files/content/ca-epbd-iv-greece-2018.pdf (accessed on 18 July 2025).

- Neofytou, H.; Sarafidis, Y.; Gkonis, N.; Mirasgedis, S.; Askounis, D. Energy Efficiency contribution to sustainable development: A multi-criteria approach in Greece. Energy Sources Part B Econ. Plan. Policy 2020, 15, 572–604. [Google Scholar] [CrossRef]

- International Energy Agency. Energy Transitions Indicators. Available online: https://www.iea.org/articles/energy-transitions-indicators (accessed on 13 March 2024).

- Borges, C.E.; Kapassa, E.; Touloupou, M.; Macón, J.L.; Casado-Mansilla, D. Blockchain application in P2P energy markets: Social and legal aspects. Connect. Sci. 2022, 34, 1066–1088. [Google Scholar] [CrossRef]

- Zhang, M.; Eliassen, F.; Taherkordi, A.; Jacobsen, H.-A.; Chung, H.-M.; Zhang, Y. Demand–Response Games for Peer-to-Peer Energy Trading with the Hyperledger Blockchain. IEEE Trans. Syst. Man Cybern. Syst. 2022, 52, 19–31. [Google Scholar] [CrossRef]

- Aggarwal, S.; Kumar, N. A Consortium Blockchain-Based Energy Trading for Demand Response Management in Vehicle-to-Grid. IEEE Trans. Veh. Technol. 2021, 70, 9480–9494. [Google Scholar] [CrossRef]

- Zahoor, A.; Mahmood, K.; Shamshad, S.; Saleem, M.A.; Ayub, M.F.; Conti, M.; Das, A.K. An access control scheme in IoT-enabled Smart-Grid systems using blockchain and PUF. Internet Things 2023, 22, 100708. [Google Scholar] [CrossRef]

- Tyagi, A.K.; Dananjayan, S.; Agarwal, D.; Ahmed, H.F.T. Blockchain—Internet of Things Applications: Opportunities and Challenges for Industry 4.0 and Society 5.0. Sensors 2023, 23, 947. [Google Scholar] [CrossRef] [PubMed]

- Li, X.; Wang, W.; Gu, H. Redesign of sharing charging system for electric vehicles using blockchain technology. J. Clean. Prod. 2023, 415, 137775. [Google Scholar] [CrossRef]

- Jajini, M.; Kamaraj, N.; Santhiya, M.; Chellam, S. Blockchain-enabled electric vehicle charging. In Blockchain-Based Systems for the Modern Energy Grid; Elsevier: Amsterdam, The Netherlands, 2023; pp. 189–201. [Google Scholar] [CrossRef]

- Song, J.G.; Kang, E.S.; Shin, H.W.; Jang, J.W. A Smart Contract-Based P2P Energy Trading System with Dynamic Pricing on Ethereum Blockchain. Sensors 2021, 21, 1985. [Google Scholar] [CrossRef] [PubMed]

- Dedalus—Bringing Comfort and Power Connection for Everyday Living. Available online: https://dedalus-horizon.eu/ (accessed on 27 May 2025).

- BRIGHT. Available online: https://www.brightproject.eu/ (accessed on 27 May 2025).

- SunContract NFT Marketplace. Available online: https://suncontract.org/ (accessed on 27 May 2025).

- Platone—Platform for Operation of Distribution Networks. Available online: https://www.platone-h2020.eu/ (accessed on 27 May 2025).

- Parity H2020. Available online: https://parity-h2020.eu/ (accessed on 12 March 2024).

- Flexible Energy Production, Demand and Storage-based Virtual Power Plants for Electricity Markets and Resilient DSO Operation. Available online: https://fever-h2020.eu/ (accessed on 27 May 2025).

- SENDER: Sustainable Consumer Engagement and Demand Response. Available online: https://www.sender-h2020.eu/ (accessed on 3 July 2024).

- Tal.Markt. Available online: https://talmarkt.wsw-online.de/ (accessed on 27 May 2025).

- Prosume. Available online: https://prosume.io/ (accessed on 27 May 2025).

- SunExhange. Available online: https://sunexchange.com/ (accessed on 27 May 2025).

- Morstyn, T.; Farrell, N.; Darby, S.J.; McCulloch, M.D. Using peer-to-peer energy-trading platforms to incentivize prosumers to form federated power plants. Nat. Energy 2018, 3, 94–101. [Google Scholar] [CrossRef]

- Danzi, P.; Angjelichinoski, M.; Stefanovic, C.; Popovski, P. Distributed proportional-fairness control in microgrids via blockchain smart contracts. In Proceedings of the 2017 IEEE International Conference on Smart Grid Communications (SmartGridComm), Dresden, Germany, 23–27 October 2017; pp. 45–51. [Google Scholar] [CrossRef]

- Lundqvist, T.; de Blanche, A.; Andersson, H.R.H. Thing-to-thing electricity micro payments using blockchain technology. In Proceedings of the 2017 Global Internet of Things Summit (GIoTS), Geneva, Switzerland, 6–9 June 2017; pp. 1–6. [Google Scholar] [CrossRef]

- Bogusz, C.I. ‘A Bad Apple Went Away’: Exploring Resilience Among Bitcoin Entrepreneurs ‘A BAD APPLE WENT AWAY’: Exploring Resilience Among Bitcoin Entrepreneurs Research in Progress. 2015. Available online: https://www.researchgate.net/publication/303919102 (accessed on 18 June 2025).

- Egelund-Müller, B.; Elsman, M.; Henglein, F.; Ross, O. Automated Execution of Financial Contracts on Blockchains. Bus. Inf. Syst. Eng. 2017, 59, 457–467. [Google Scholar] [CrossRef]

- Brilliantova, V.; Thurner, T.W. Blockchain and the future of energy. Technol. Soc. 2019, 57, 38–45. [Google Scholar] [CrossRef]

- Campbell, N.; Ryan, L.; Rozite, V.; Lees, E.; Heffner, G. Capturing the Multiple Benefits of Energy Efficiency; International Energy Agency: Paris, France, 2015. [Google Scholar]

- Alkhateeb, A.; Catal, C.; Kar, G.; Mishra, A. Hybrid Blockchain Platforms for the Internet of Things (IoT): A Systematic Literature Review. Sensors 2022, 22, 1304. [Google Scholar] [CrossRef] [PubMed]

- Mu, C.; Ding, T.; Yang, M.; Huang, Y.; Jia, W.; Shen, X. Peer-to-peer energy trading based on a hybrid blockchain system. Energy Rep. 2023, 9, 124–128. [Google Scholar] [CrossRef]

- Daghmehchi Firoozjaei, M.; Ghorbani, A.; Kim, H.; Song, J. Hy-Bridge: A Hybrid Blockchain for Privacy-Preserving and Trustful Energy Transactions in Internet-of-Things Platforms. Sensors 2020, 20, 928. [Google Scholar] [CrossRef] [PubMed]

- Subramanian, G.; Thampy, A.S. Implementation of Hybrid Blockchain in a Pre-Owned Electric Vehicle Supply Chain. IEEE Access 2021, 9, 82435–82454. [Google Scholar] [CrossRef]

- Jeon, J.M.; Hong, C.S. A Study on Utilization of Hybrid Blockchain for Energy Sharing in Micro-Grid. In Proceedings of the 2019 20th Asia-Pacific Network Operations and Management Symposium (APNOMS), Matsue, Japan, 18–20 September 2019; pp. 1–4. [Google Scholar] [CrossRef]

- Energy Web. Available online: https://www.energyweb.org/ (accessed on 13 March 2024).

- Grigg, I. The Ricardian contract. In Proceedings of the First IEEE International Workshop on Electronic Contracting, San Diego, CA, USA, 6 July 2004; pp. 25–31. [Google Scholar] [CrossRef]

- Abdelhamid, M.M.; Sliman, L.; Djemaa, R.B.; Salem, B.A. ABISchain: Towards a Secure and Scalable Blockchain Using Swarm-based Pruning. In 2023 Australasian Computer Science Week; ACM: New York, NY, USA, 2023; pp. 28–35. [Google Scholar] [CrossRef]

- Zhou, K.; Wang, C.; Wang, X.; Chen, S.; Cheng, H. A Novel Scheme to Improve the Scalability of Bitcoin Combining IPFS with Block Compression. IEEE Trans. Netw. Serv. Manag. 2022, 19, 3694–3705. [Google Scholar] [CrossRef]

- Hashim, F.; Shuaib, K.; Zaki, N. Sharding for Scalable Blockchain Networks. SN Comput. Sci. 2022, 4, 2. [Google Scholar] [CrossRef]

- Musungate, B.N.; Candan, B.; Cabuk, U.C.; Dalkilic, G. Sidechains: Highlights and Challenges. In Proceedings of the 2019 Innovations in Intelligent Systems and Applications Conference (ASYU), Izmir, Turkey, 31 October–2 November 2019; pp. 1–5. [Google Scholar] [CrossRef]

- Gao, Y.; Kawai, S.; Nobuhara, H. Scalable Blockchain Protocol Based on Proof of Stake and Sharding. J. Adv. Comput. Intell. Intell. Inform. 2019, 23, 856–863. [Google Scholar] [CrossRef]

- Khan, D.; Jung, L.T.; Hashmani, M.A. Systematic Literature Review of Challenges in Blockchain Scalability. Appl. Sci. 2021, 11, 9372. [Google Scholar] [CrossRef]

- Davies, J. Enhanced scalability and privacy for blockchain data using Merklized transactions. Front. Blockchain 2023, 6, 1222614. [Google Scholar] [CrossRef]

- Zhang, Z.; Yu, G.; Sun, C.; Wang, X.; Wang, Y.; Zhang, M.; Ni, W.; Liu, R.P.; Reeves, A.; Georgalas, N. TbDd: A new trust-based, DRL-driven framework for blockchain sharding in IoT. Comput. Netw. 2024, 244, 110343. [Google Scholar] [CrossRef]

- Masama, B. Centralised Consensus VS Decentralised Consensus—Lessons from the Heavenly Blockchain. SSRN Electron. J. 2024. [Google Scholar] [CrossRef]

- Regulation (EU) 2023/2854 of the European Parliament and of the Council of 13 December 2023 on Harmonised Rules on Fair Access to and Use of Data and Amending Regulation (EU) 2017/2394 and Directive (EU) 2020/1828 (Data Act) (Text with EEA Relevance). Available online: https://eur-lex.europa.eu/eli/reg/2023/2854/oj/eng (accessed on 28 May 2025).

- Guidelines 02/2025 on Processing of Personal Data Through Blockchain Technologies. Available online: https://www.edpb.europa.eu/our-work-tools/documents/public-consultations/2025/guidelines-022025-processing-personal-data_en (accessed on 28 May 2025).

- Data Act Explained—European Commission. Available online: https://digital-strategy.ec.europa.eu/en/factpages/data-act-explained (accessed on 28 May 2025).

- EU Data Act|Article 36, Essential Requirements Regarding Smart Contracts for Executing Data Sharing Agreements. Available online: https://www.eu-data-act.com/Data_Act_Article_36.html (accessed on 28 May 2025).

- Directive (EU) 2019/2161 of the European Parliament and of the Council of 27 November 2019 amending Council Directive 93/13/EEC and Directives 98/6/EC, 2005/29/EC and 2011/83/EU of the European Parliament and of the Council as Regards the Better Enforcement and Modernisation of Union Consumer Protection Rules (Text with EEA Relevance). Available online: https://eur-lex.europa.eu/eli/dir/2019/2161/oj (accessed on 28 May 2025).

- Regulation (EU) 2024/1183 of the European Parliament and of the Council of 11 April 2024 Amending Regulation (EU) No 910/2014 as Regards Establishing the European Digital Identity Framework. Available online: https://eur-lex.europa.eu/eli/reg/2024/1183/oj/eng (accessed on 28 May 2025).

- Real Decreto-Ley 15/2018, de 5 de octubre, de Medidas Urgentes Para la Transición Energética y la Protección de los Consumidores. Available online: https://www.icab.es/es/actualidad/noticias/noticia/Real-Decreto-Ley-15-2018-de-5-de-octubre-de-medidas-urgentes-para-la-transicion-energetica-y-la-proteccion-de-los-consumidores/ (accessed on 28 May 2025).

- Self-Consumption Regulations—IDAE. Available online: https://www.idae.es/en/technologies/renewable-energies/self-consumption-office/self-consumption-regulations (accessed on 28 May 2025).

- Solarpaket I—Bundesministerium fur Wirtschaft und Energie. Available online: https://www.bundeswirtschaftsministerium.de/Navigation/DE/Home/home.html (accessed on 28 May 2025).

- Segate, R.V. Drafting a Cybersecurity Standard for Outer Space Missions: On Critical Infrastructure, China, and the Indispensability of a Global Inclusive Approach. J. Asian Secur. Int. Aff. 2024, 11, 345–375. [Google Scholar] [CrossRef]

- Jia, X.; Xu, J.; Han, M.; Zhang, Q.; Zhang, L.; Chen, X. International Standardization of Blockchain and Distributed Ledger Technology: Overlaps, Gaps and Challenges. Comput. Model. Eng. Sci. 2023, 137, 1491–1523. [Google Scholar] [CrossRef]

- CENELEC—Digital Society—Emerging Technologies. Available online: https://www.cencenelec.eu/areas-of-work/cenelec-sectors/digital-society-cenelec/emerging-technologies/ (accessed on 20 January 2025).

- CEN—CEN/CLC/JTC 19—Blockchain and Distributed Ledger Technologies. Available online: https://standards.cencenelec.eu/dyn/www/f?p=205:7:0::::FSP_ORG_ID:2702172&cs=148F2B917E4B67BCFD6FE36CE0EA923AC (accessed on 20 January 2025).

- Recommendations for Successful Adoption in Europe of Emerging Technical Standards on Distributed Ledger/Blockchain Technologies. September 2018. Available online: https://www.cencenelec.eu/media/CEN-CENELEC/Areas%20of%20Work/CEN%20sectors/Digital%20Society/Emerging%20technologies/fg-bdlt-white_paper-version1-2.pdf (accessed on 20 January 2025).

- ISO/TC 307; Blockchain and Distributed Ledger Technologies. Available online: https://www.iso.org/committee/6266604.html (accessed on 20 January 2025).

- ISO 22739:2024; Blockchain and Distributed Ledger Technologies—Vocabulary. Available online: https://www.iso.org/standard/82208.html (accessed on 20 January 2025).

- Adolph, M. ITU Standards for Blockchain and Distributed Ledger Technology—ITU Telecommunication Standardization Bureau. Available online: https://www.wipo.int/edocs/mdocs/classifications/en/wipo_ip_cws_bc_ge_19/wipo_ip_cws_bc_session_4_adolph.pdf (accessed on 20 January 2025).

- IEEE Blockchain -Standards. Available online: https://blockchain.ieee.org/standards (accessed on 20 January 2025).

- EUOS—EU Observatory for ICT Standardisation: ‘Blockchain’. Powered by StandICT.eu. Available online: https://standict.eu/blockchain/287 (accessed on 19 January 2025).

- ETSI—Permissioned Distributed Ledgers (PDL). Available online: https://www.etsi.org/technologies/permissioned-distributed-ledgers (accessed on 20 January 2025).

- European Commission—Shaping Europe’s Digital Future—Blockchain Standards. Available online: https://digital-strategy.ec.europa.eu/en/policies/blockchain-standards (accessed on 20 January 2025).

- Enwerem, U.C.; Chukwudebe, G.A. Regulation and Standardization of Blockchain Technology for Improved Benefit Realization. In The International Conference on Emerging Applications and Technologies for Industry 4.0; Springer International Publishing: Cham, Switzerland, 2021; pp. 240–253. [Google Scholar] [CrossRef]

- Qin, M.; Wu, T.; Ma, X.; Albu, L.L.; Umar, M. Are energy consumption and carbon emission caused by Bitcoin? A novel time-varying technique. Econ. Anal. Policy 2023, 80, 109–120. [Google Scholar] [CrossRef]

- Zimba, A.; Phiri, K.O.; Mulenga, M.; Mukupa, G. Blockchain Technology and Energy Efficiency: A Systematic Literature Review of Consensus Mechanisms, Architectural Innovations, and Sustainable Solutions. Discov. Anal. 2025. [Google Scholar] [CrossRef]

- Asif, R.; Hassan, S.R. Shaping the future of Ethereum: Exploring energy consumption in Proof-of-Work and Proof-of-Stake consensus. Front. Blockchain 2023, 6, 1151724. [Google Scholar] [CrossRef]

- De Vries, A. Cryptocurrencies on the road to sustainability: Ethereum paving the way for Bitcoin. Patterns 2023, 4, 100633. [Google Scholar] [CrossRef] [PubMed]

- Liu, Y.; Li, Z.; Huang, L. The application of blockchain technology in smart sustainable energy business model. Energy Rep. 2022, 8, 7063–7070. [Google Scholar] [CrossRef]

- Malhotra, A.; O’Neill, H.; Stowell, P. Thinking strategically about blockchain adoption and risk mitigation. Bus. Horiz. 2022, 65, 159–171. [Google Scholar] [CrossRef]

- Prewett, K.W.; Prescott, G.L.; Phillips, K. Blockchain adoption is inevitable—Barriers and risks remain. J. Corp. Account. Financ. 2020, 31, 21–28. [Google Scholar] [CrossRef]

| Focus Area | Key Findings | Study |

|---|---|---|

| Benefits of blockchain as an alternative to digital payments and cryptocurrency investment business. | With internationally recognized safeguards of confidentiality and the ease of conducting investment transactions and activities without payment, the weaknesses and threats can be controlled for more investors to enter the world. | [55] |

| Analysis of the economic perspectives of the blockchain technology in agricultural business. | Blockchain technology has big opportunities in agricultural business and agri-food supply chain in the digital economy; however, there is a research gap related to financing the blockchain implementation and cooperation between businesses and the authorities. | [56] |

| Measurement of the stakeholders’ perceptions of the P2P energy trading model using blockchain technology. | The P2P energy trading model using blockchain technology is believed by stakeholders to provide greater benefits to the user community, expand opportunities to consume renewable energy, and contribute to reducing climate change in Indonesia. | [57] |

| Evaluating the barriers to blockchain adoption in the energy sector using the SWOT and PESTLE tools and the Analytical Hierarchy Process for Group Decision Making. | Main barriers include legal issues, particularly complex regulations, followed by technological security risks, sociopolitical risk aversion, and high initial costs. The SWOT analysis further helped stakeholders provide a comprehensive understanding of the advantages, challenges, and risks involved, and it guided the development of strategies to address these barriers. | [58] |

| Evaluating the blockchain technology strategies for reducing renewable energy development risks. Integration of SWOT analysis and hybrid MCDM methods in the proposed framework. | The key finding is that blockchain technology can help reduce renewable energy development risks by creating a decentralized energy system, lowering costs, and eliminating monopolies. | [59] |

| Examination of the current state of blockchain and smart contracts technology in the energy sector, focusing on use cases, key challenges, and potential solutions through SWOT. | The adoption of smart contracts and blockchain in the energy sector offers significant potential for enhancing efficiency, security, and transparency, but successful implementation depends on addressing challenges such as high initial costs, technical complexities, and evolving legal requirements through strategic planning, stakeholder collaboration, and the development of flexible frameworks. | [60] |

| Criterion | Average Rating | |

|---|---|---|

| 1 | Alignment of organizational strategy of the replicant with the developed business model | 4.33/5 |

| 2 | Intimacy level between stakeholder and replicant (collaboration in the past and trust between them) | 4.33/5 |

| 3 | Possibility of further replication of the project’s activities and outputs | 4.33/5 |

| 4 | The time frame in which the technologies will be implemented by the replicants | 4.00/5 |

| 5 | Technical capacity (availability of experts) of the replicant to implement technologies | 3.83/5 |

| 6 | Country of the replicant | 3.50/5 |

| Characteristic | Description |

|---|---|

| Decentralisation | Traditional centralised transaction systems require validation from a central trusted entity, resulting in performance bottlenecks. In contrast, blockchain eliminates the need for a third-party central trusted agency, since data consistency is ensured by the consensus algorithm [71,72]. |

| Persistence | Transactions are swiftly validated, and honest nodes reject invalid transactions. Once included in the blockchain, it is nearly impossible to delete or rollback transactions. Any blocks containing invalid transactions can be promptly identified [73]. |

| Anonymity | Users interact with the blockchain using generated addresses, preserving their real identities. However, perfect privacy preservation is not guaranteed due to inherent limitations [74,75]. |

| Auditability | Every transaction refers to previously implemented transactions that have not been spent yet. When these transactions are added to the blockchain, their status changes from unspent to spent. This facilitates straightforward validation and the tracing of transactions [74,76]. |

| Area of Implementation | Related Publications |

|---|---|

| Smart grids | [19,20,40,83,84,86,87] |

| Renewable energy sources | [19,22,59,88,89,90,91] |

| Energy trading | [19,24,92,93,94,95,96,97] |

| Energy storage | [98,99,100,101] |

| Electric and smart vehicles | [24,27,28,102,103,104] |

| Carbon trading | [29,30,105,106,107,108] |

| Smart metering | [37,38,109,110] |

| Project | Use of Blockchain | Areas of Blockchain Exploitation | Source |

|---|---|---|---|

| Brooklyn Microgrid (BMG) | The project enables energy trading through a mobile app acting as a local energy marketplace. Participants purchase local solar energy credits, and excess solar energy is sold via auction. | Smart grids Energy trading Renewable energy sources | [113] |

| EnergyChain | EnergyChain is based on a private blockchain made to serve energy grid applications; track and notarize utilities data for rebates, certifications, and incentive systems; and even track land, building, and environmental data. | Smart grids | [114] |

| NRGcoin | The NRGcoin is a rewarding mechanism for green energy, relying on blockchain-based smart contracts. | Renewable energy sources | [115] |

| SolarCoin | This cryptocurrency is distributed as a reward for solar installations. | Renewable energy sources | [116] |

| Powerledger | The Powerledger platform enables flexibility and energy trading, combined with traceability of energy use. | Energy trading Smart grids Renewable energy sources | [117] |

| TwinERGY | TwinERGY empowers citizens and communities to track their energy use and to proactively participate in the market. | Energy trading | [118] |

| VPP by Sonnen and EWchain | The Virtual Power Plant (VPP) consists of distributed residential energy storage systems, forming a network that is able to absorb excess wind power and therefore preventing limitation of renewable energy by storing wind energy when it is abundant. | Energy storage Smart grids | [119] |

| Green Energy Wallet | Green Energy Wallet contributes to balancing the grid by connecting EVs and household batteries to a large energy storage system. | Electric and smart vehicles Energy storage | [120] |

| IBM blockchain | IBM has developed a decentralized platform for trading carbon credits and other environmental attributes. | Emission trading | [121] |

| Pylon Network | Pylon is a startup that has developed a neutral database based on blockchain to store the users’ energy consumption and production data, enabling them to control over their data and to whom they want to share it with. | Smart metering | [122] |

| Business Model | Country | Value Proposition (What?) | Targeted Customer (Who?) | Value Creation/Value Delivery (How?) |

|---|---|---|---|---|

| Energy Performance Contracting with Pay-for-Performance (P4P) guarantees | Germany | Combing MRV concept with Pay-for-Performance schemes for renovation projects | ESCOs Real estate companies | Smart-metering infrastructure for EV chargers, PV panels, heat pumps. Tokenisation of savings through blockchain |

| Improved self-consumption on DER in energy cooperatives | Spain | Shared local production of solar energy and optimisation of self-consumption | Energy community (mainly residential sector) | Tokens as rewarding mechanisms to incentivise self-consumption |

| Energy efficiency and flexibility services for natural gas boilers | Greece | Upgrade of the energy efficiency of heating systems | Retail consumers Energy utilities Natural gas boilers installers | IoT controller connected with legacy heating devices (natural gas boilers) |

| Smart energy management for EV chargers and electricity-based HVAC appliances | Two locations to be selected (most likely Nordic countries) | Cost reduction of residential charging and heating based on variable pricing, flexibility services on the TSO and DSO levels | Households with interconnected smart appliances EV (charger) manufacturers Heating and cooling manufacturers Energy retailers | Tokenisation of flexibility services, cloud-to-cloud connectivity of distributed energy resources and real time monitoring |

| Strengths | Weaknesses |

|---|---|

| Reduced energy use and increase in self-consumption Combination of MRV with Pay-for-Performance Use of more efficient technology Reduction of the carbon footprint of real estate companies’ portfolio Promotion of the application of smart tools in Germany’s residential sector Fair rewards for energy savings | Lack of economic incentive for the tenants to maximise the consumption of PV power Irreversibility of mistakes in blockchain (e.g., data deletion) Scalability issue of blockchain Limited speed of blockchain |

| Opportunities | Threats |

| EED and EPBD Increased renewable production Need for the improvement of the sustainability of the real estate portfolio ESCO market in Germany Mieterstrom model Rollout of smart metering infrastructure | Slow roll out of smart meters Lengthy payback ratios for deep renovation High upfront costs GDPR BDSG Lack of established standards Security threats |

| Strengths | Weaknesses |

|---|---|

| Reduced energy bills for the households. Increase in PV power consumption produced in the municipality. Reduction of energy loss in the electricity system. Increased financial benefits for the energy community. Faster payback period for the installation investment. No upfront investment from energy consumers (AaS). Improved energy literacy of the households. Interactive platform allowing households to be active energy system participants. Blockchain exploitation. | Lack of economic incentive for the tenants to maximise the consumption of PV power. Irreversibility of mistakes in blockchain (e.g., data deletion). Scalability issue of blockchain. Limited speed of blockchain. |

| Opportunities | Threats |

| Digitalisation trend in the energy sector Need for integration of prosumers in the energy market. Willingness of citizens to participate in energy communities. EU and Spanish regulation on energy communities. New regulations on collective self-consumption. Incentives by national and regional governments. Socially and financially vulnerable groups. | Security threats of blockchain such as cyber-attacks and deanonymisation techniques. Competition of energy communities with large electric producers. Long administrative processes. Lack of understanding or technical expertise. Investment costs. Electricity prices. |

| Strengths | Weaknesses |

|---|---|

| Reduced energy use, costs, and emissions for end clients Improved thermal comfort No upfront investment needed (AaS) Improved customer trust through consumption transparency Tracking of energy consumption Verified calculation method of energy savings, approved by regulatory bodies Custom MRV approach for residential heating Gradual repayment | Reduced energy use, costs, and emissions for end clients Improved thermal comfort No upfront investment needed (AaS) Improved customer trust through consumption transparency Tracking of energy consumption Verified calculation method of energy savings, approved by regulatory bodies Custom MRV approach for residential heating Gradual repayment |

| Opportunities | Threats |

| Digitalisation trends in energy services Energy efficiency potential of the building sector in Greece Need for transparent tracking of energy consumption Development of IoT enabling connection of smart appliances | Security issues and threats Possible hesitance and/or unwillingness of the users to share data |

| Strengths | Weaknesses |

|---|---|

| Reduced cost of electricity for end customers Maximised self-consumption Minimised CO2 impact Increased margins (e.g., electricity sales) for B2C companies and manufacturers Decreased volatility risk on wholesale market New forms of revenue New sources of flexibility for TSO and DSO | Irreversibility of mistakes in blockchain (e.g., data deletion) Scalability issue of blockchain Limited speed of blockchain |

| Opportunities | Threats |

| Digitalisation trend in energy services Need for timely and efficient demand response Need for interconnection of smart appliances Need for smart EV charging services | Possible hesitance and/or unwillingness of the users to share data The scalability of the business model might be impeded if variable pricing is not offered to consumers by all energy companies |

| Category | Common aspects among business models | Business models where these aspects have greater influence |

| Strengths | Reduced energy use and carbon footprint | All |

| No upfront investment/as-a-service models | BM2, BM3 | |

| Higher self-consumption and cheaper bills | BM1, BM3, BM4 | |

| Weaknesses | Limitations of blockchain: irreversibility, limited throughput, scalability | All |

| Tenant incentive gap for maximising on-site PV | BM1, BM2 | |

| Opportunities | Europe-wide digitisation and prosumer policies (EU Green Deal, EED/EPBD revisions, national energy-community laws) | All |

| Rapid rollout of smart devices/IoT | All | |

| Threats | Cyber-security and data-privacy concerns | All |

| User scepticism/data-sharing hesitance | All | |

| High upfront or administrative costs | BM1, BM2 |

| BM1 | BM2 | BM3 | BM4 | |

|---|---|---|---|---|

| Political | 1 | 2 | 0 | 1 |

| Economic | 3 | 3 | 1 | 3 |

| Social | 1 | 3 | 2 | 1 |

| Technological | 4 | 4 | 2 | 3 |

| Legal | 3 | 1 | 1 | 1 |

| Environmental | 1 | 1 | 1 | 1 |

| 0 = very low priority | 1 = low priority | 2 = medium priority | 3 = high priority | 4 = very high priority |

| Business Model | Estimated Energy Savings on the First Year | Energy Savings by the End of the Project Lifetime (MWh) | Carbon Reduction by the End of the Project Lifetime (tnCO2) | Cost Savings by the End of the Project Lifetime (Euros) | Annual Growth Rate | Project Lifetime (Years) | Net Present Value (Euros) |

|---|---|---|---|---|---|---|---|

| BM1 | 365 | 62,800 | 25,700 1 | 20,702,000 | 25% | 20 | 99,500 |

| BM2 | 825 | 82,000 | 21,320 2 | 4,507,900 | 10% | 25 | 978,750 |

| BM3 | 4500 | 341,600 | 68,320 3 | 11,957,300 | 20% | 15 | 5,946,300 |

| BM4 | 2520 | 647,500 | 32,375 4 | 123,023,000 | 30% | 15 | 16,694,000 |

| BC | No. of Meetings | No. of Participants | Type of Stakeholders |

|---|---|---|---|

| 1 | 6 | 12 | Energy experts, real estate managers, legal experts, and technical experts. |

| 2 | 5 | 26 | IT experts, legal experts, energy experts, technology providers, public sector, Art. 7-obligated parties, and academia. |

| 3 | 6 | 30 | Public sector, energy experts, technology providers, real estate managers, and academia. |

| 4 | 5 | 27 | Energy experts, energy services providers, system integrators, technology providers, public sector, and investors. |

| IMPACT | |||

|---|---|---|---|

| LOW | MEDIUM | HIGH | |

| PROBABILITY | |||

| VERY LIKELY | LOW | MEDIUM | EXTREME |

| MODERATE | LOW | MEDIUM | MEDIUM |

| UNLIEKLY | LOW | LOW | LOW |

| Risk Description | Probability | Impact | Risk Level |

|---|---|---|---|

| Political | MODERATE | MEDIUM | MEDIUM |

| Economic | VERY LIKELY | MEDIUM | MEDIUM |

| Social | MODERATE | MEDIUM | MEDIUM |

| Technological | VERY LIKELY | HIGH | EXTREME |

| Legal | VERY LIKELY | HIGH | EXTREME |

| Environmental | UNLIKELY | MEDIUM | LOW |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Papapostolou, A.; Andreoulaki, I.; Anagnostopoulos, F.; Divolis, S.; Niavis, H.; Vavilis, S.; Marinakis, V. Innovative Business Models Towards Sustainable Energy Development: Assessing Benefits, Risks, and Optimal Approaches of Blockchain Exploitation in the Energy Transition. Energies 2025, 18, 4191. https://doi.org/10.3390/en18154191

Papapostolou A, Andreoulaki I, Anagnostopoulos F, Divolis S, Niavis H, Vavilis S, Marinakis V. Innovative Business Models Towards Sustainable Energy Development: Assessing Benefits, Risks, and Optimal Approaches of Blockchain Exploitation in the Energy Transition. Energies. 2025; 18(15):4191. https://doi.org/10.3390/en18154191

Chicago/Turabian StylePapapostolou, Aikaterini, Ioanna Andreoulaki, Filippos Anagnostopoulos, Sokratis Divolis, Harris Niavis, Sokratis Vavilis, and Vangelis Marinakis. 2025. "Innovative Business Models Towards Sustainable Energy Development: Assessing Benefits, Risks, and Optimal Approaches of Blockchain Exploitation in the Energy Transition" Energies 18, no. 15: 4191. https://doi.org/10.3390/en18154191

APA StylePapapostolou, A., Andreoulaki, I., Anagnostopoulos, F., Divolis, S., Niavis, H., Vavilis, S., & Marinakis, V. (2025). Innovative Business Models Towards Sustainable Energy Development: Assessing Benefits, Risks, and Optimal Approaches of Blockchain Exploitation in the Energy Transition. Energies, 18(15), 4191. https://doi.org/10.3390/en18154191