Hydroprocessed Ester and Fatty Acids to Jet: Are We Heading in the Right Direction for Sustainable Aviation Fuel Production?

Abstract

1. Introduction

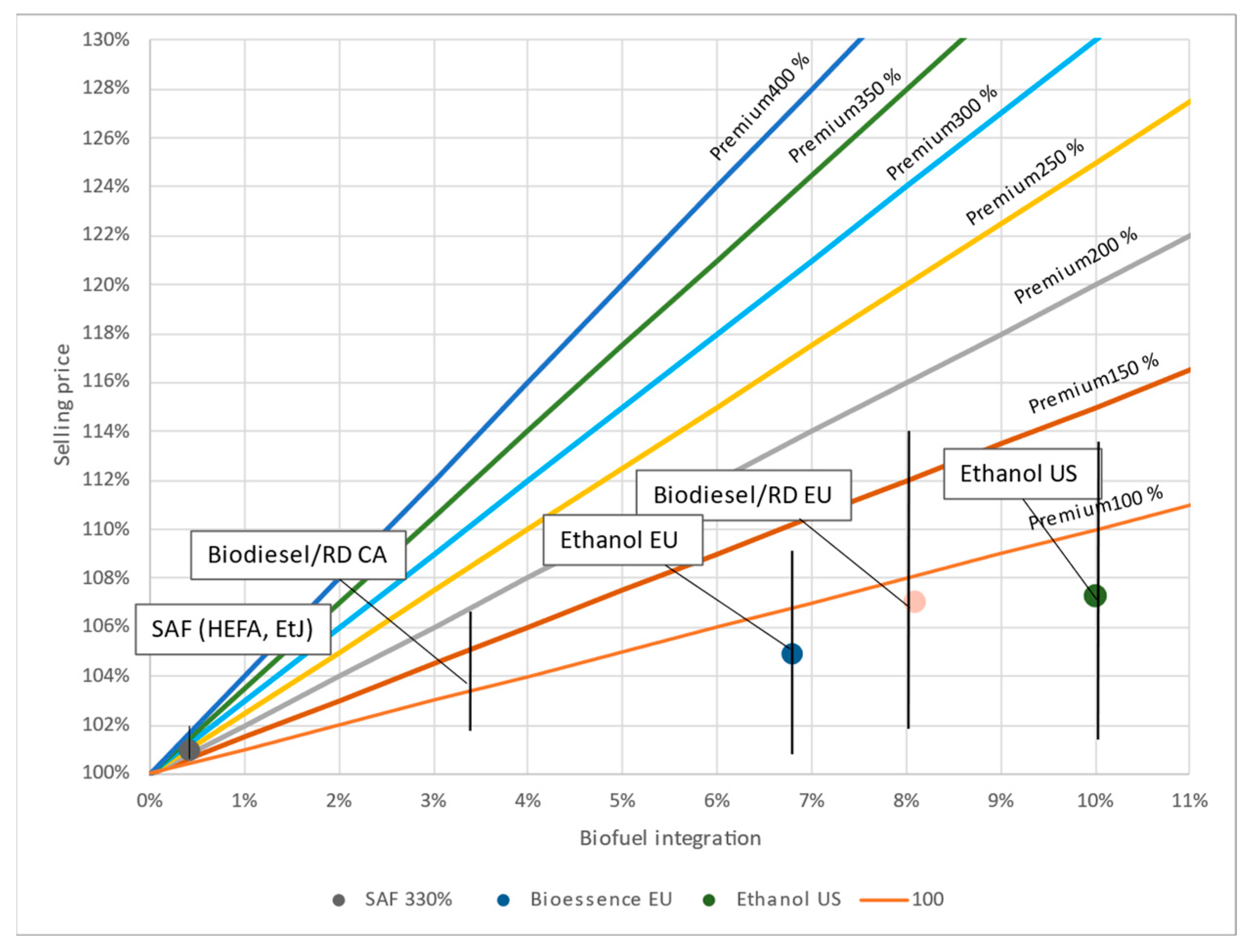

- The effects of biofuel market integration rate on customers’ prices and market barriers for sustainable solution adoption;

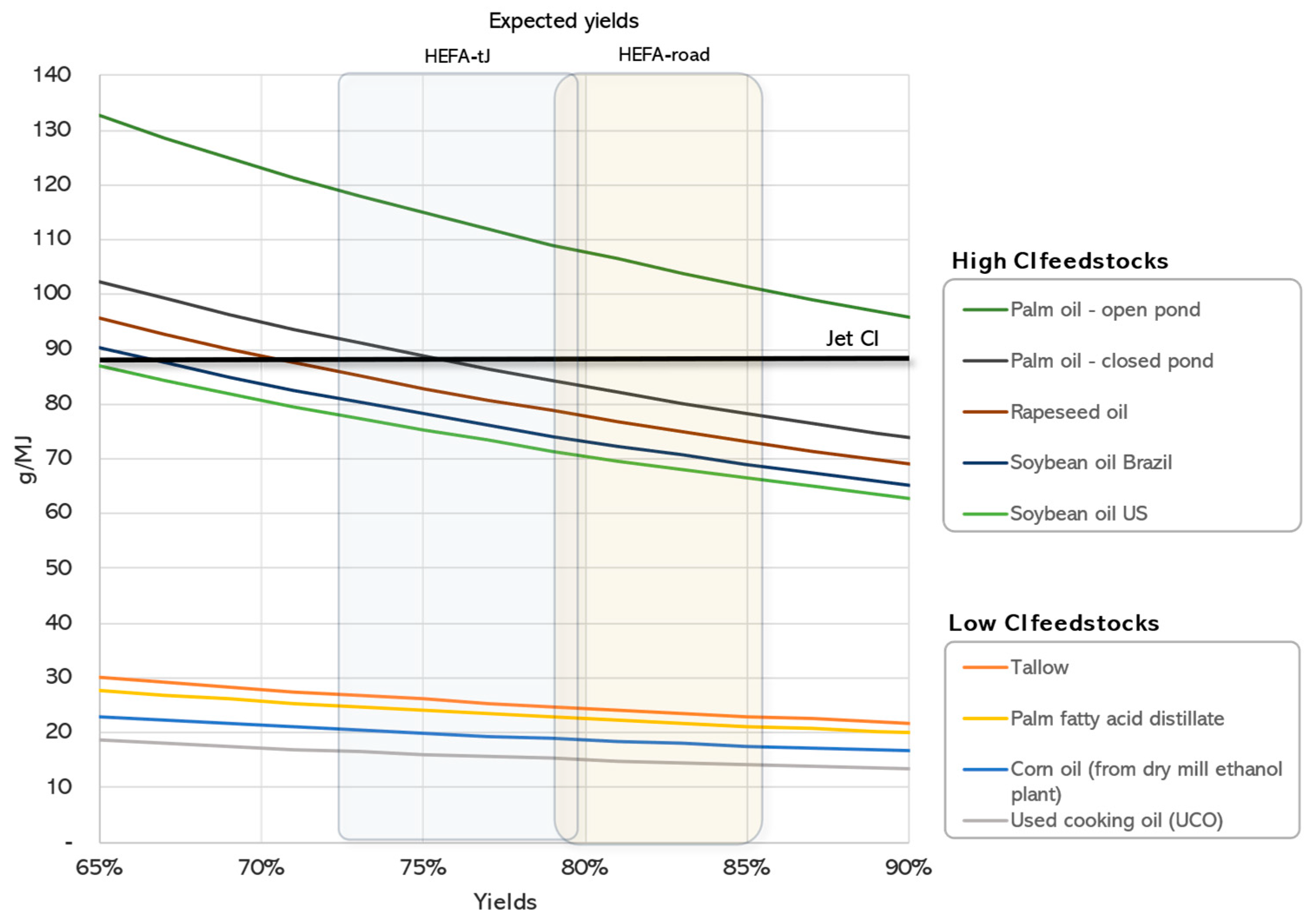

- The impacts of feedstock conversion yield variation on GHG reduction and process viability for different processes;

- The influence of regional land-use changes and local initiatives on the carbon intensity of biofuel and co-products;

- The impacts of feedstock mix, availability, and usage on competitiveness, sustainability, and new technology evaluation;

- Combined economic and sustainability evaluation based on a unique metric (USD/t avoided).

2. Methodology

3. Results

3.1. Rapid Technology Screening Methodologies

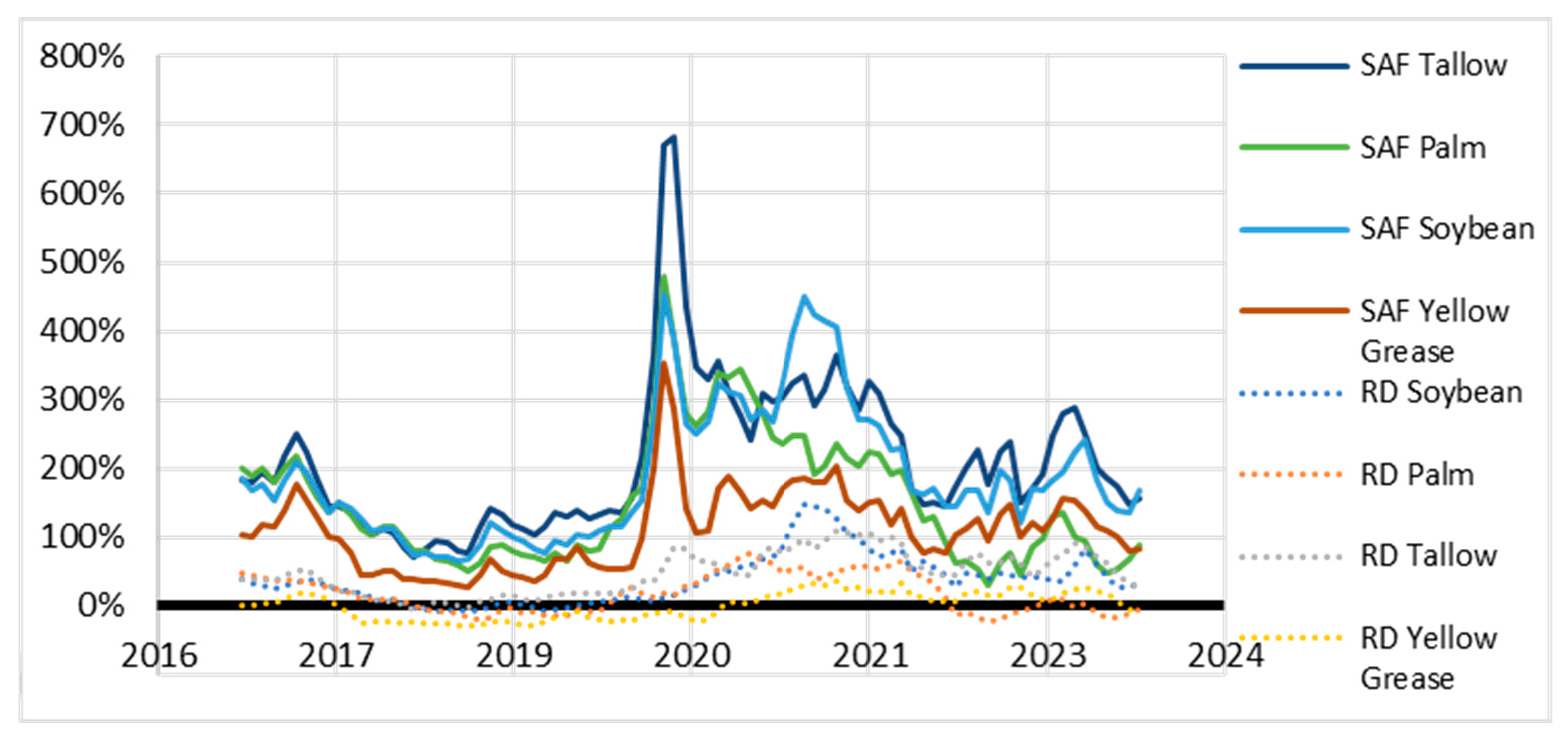

3.1.1. The HEFA-tJ Fuel Market Is Attractive Despite Prohibitive Production Costs

3.1.2. HEFA-Road Has Higher Yield and Selectivity than HEFA-tJ

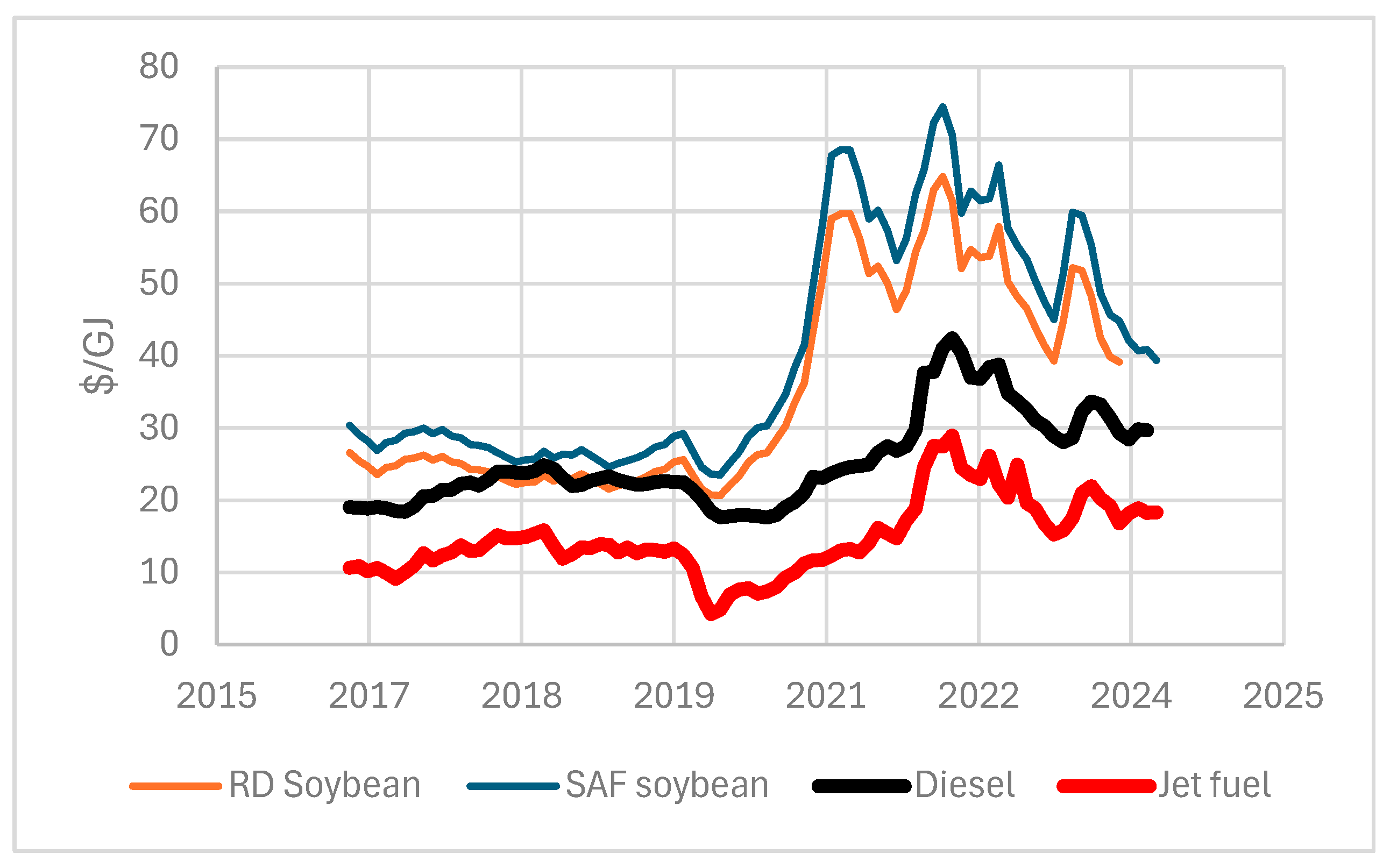

3.1.3. Resource Costs for HEFA-tJ Are Much Higher than Conventional Jet and Diesel Fuel Costs, Implying Low Production Cost Reduction Potential

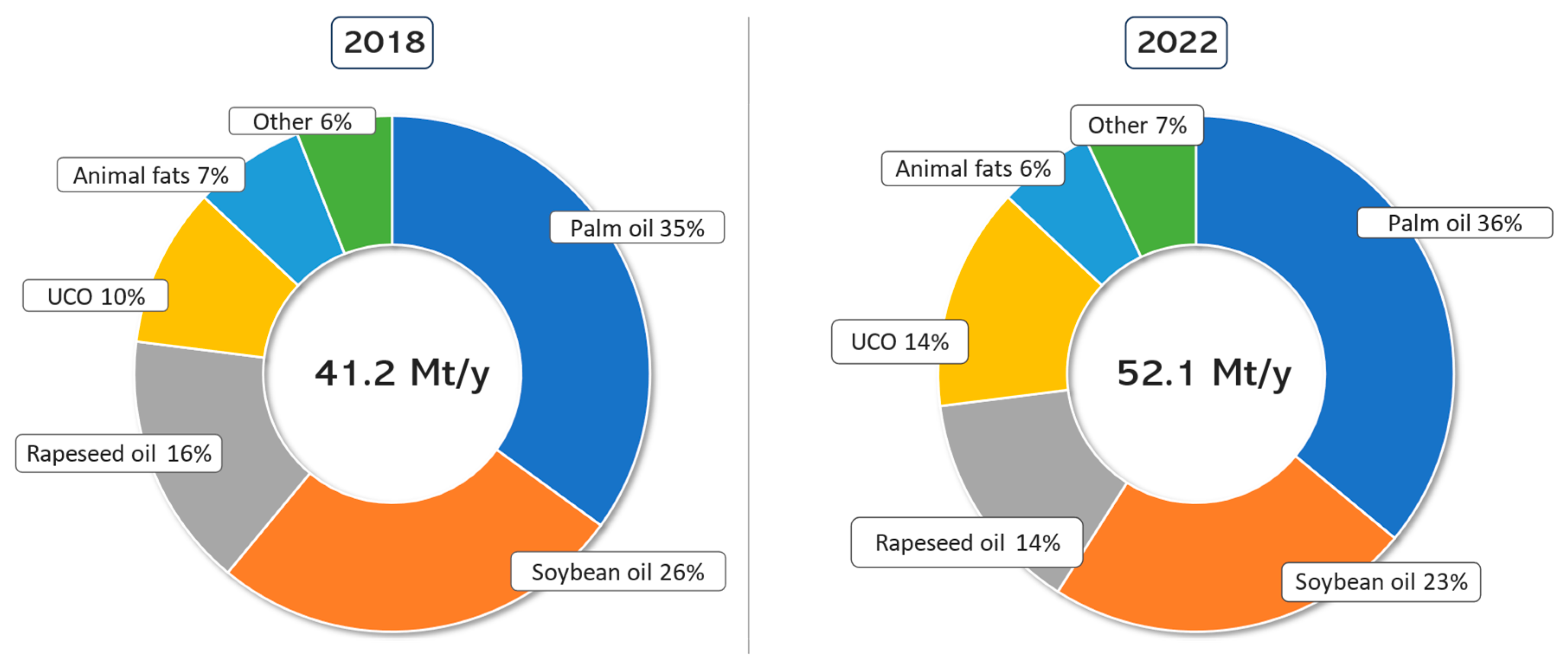

3.2. General Data on Feedstock Sustainability and Availability with Related Insights

3.2.1. Used Cooking Oil (UCO) and Animal Fats (Tallow) Are the Only Resources with a Significant Commercial Deployment That Can Lead to More than 65% Reduction in Carbon Intensity Compared to Conventional Fuel

3.2.2. UCO and Tallow World Availability Cannot Cover Actual HEFA Road Usage

3.2.3. Other Resources Used in Commercial Deployments for the HEFA Pathway Have Mitigated Environmental Impacts

3.2.4. Reducing HEFA-tJ Pathway Carbon Intensity with Other Resources Has Limited Impact

3.2.5. Considerable Efforts Are Being Deployed to Reduce Palm Oil’s Carbon Intensity

3.3. Regional and Market Data Importance for Land Use Change and Sustainability Analysis

3.3.1. iLUC Heated Debates

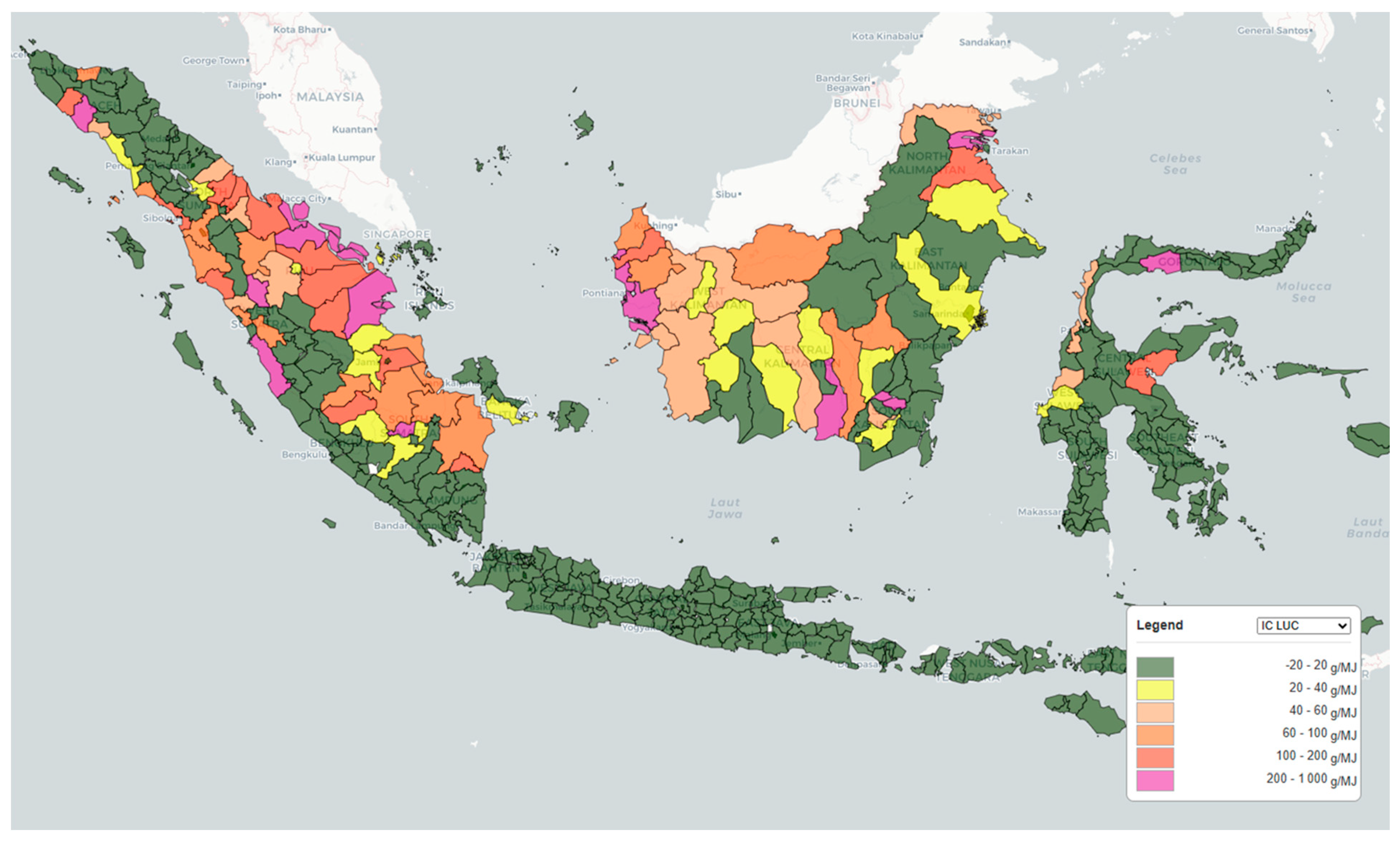

3.3.2. iLUC Model Potential Enhancement with Regional and Up-to-Date Values

3.3.3. CORSIA iLUC Comparison with TRASE LUC

3.3.4. Uncertainties About the Positive Environmental Impact of Animal Fat and Low LUC/iLUC Feedstocks

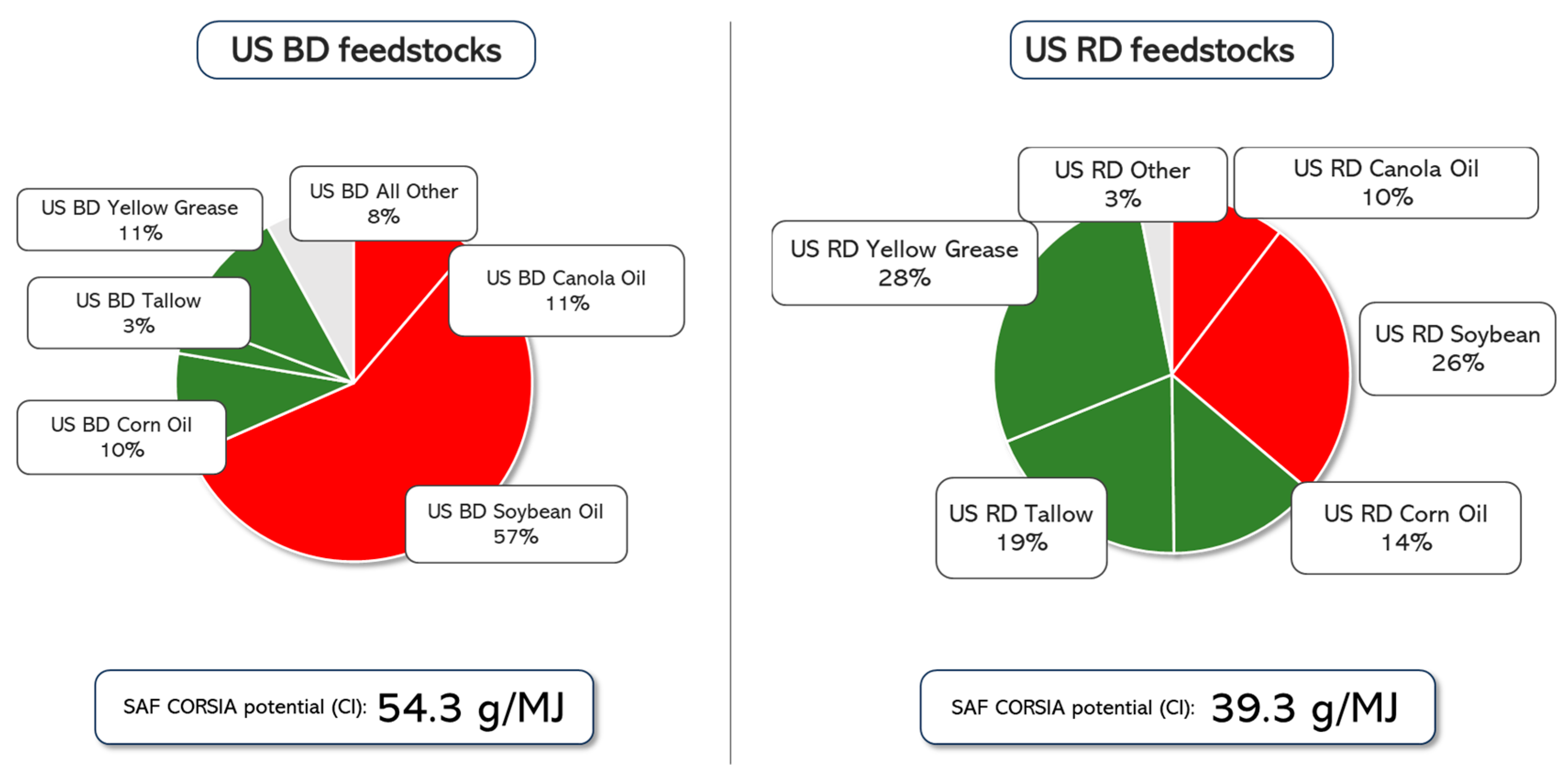

3.3.5. Market Share Importance in Carbon Intensity Evaluation

3.4. Shifting Production from HEFA-Road to HEFA-tJ Can Potentially Reduce the Environmental Benefits of Fuel Production from Vegetable Oils

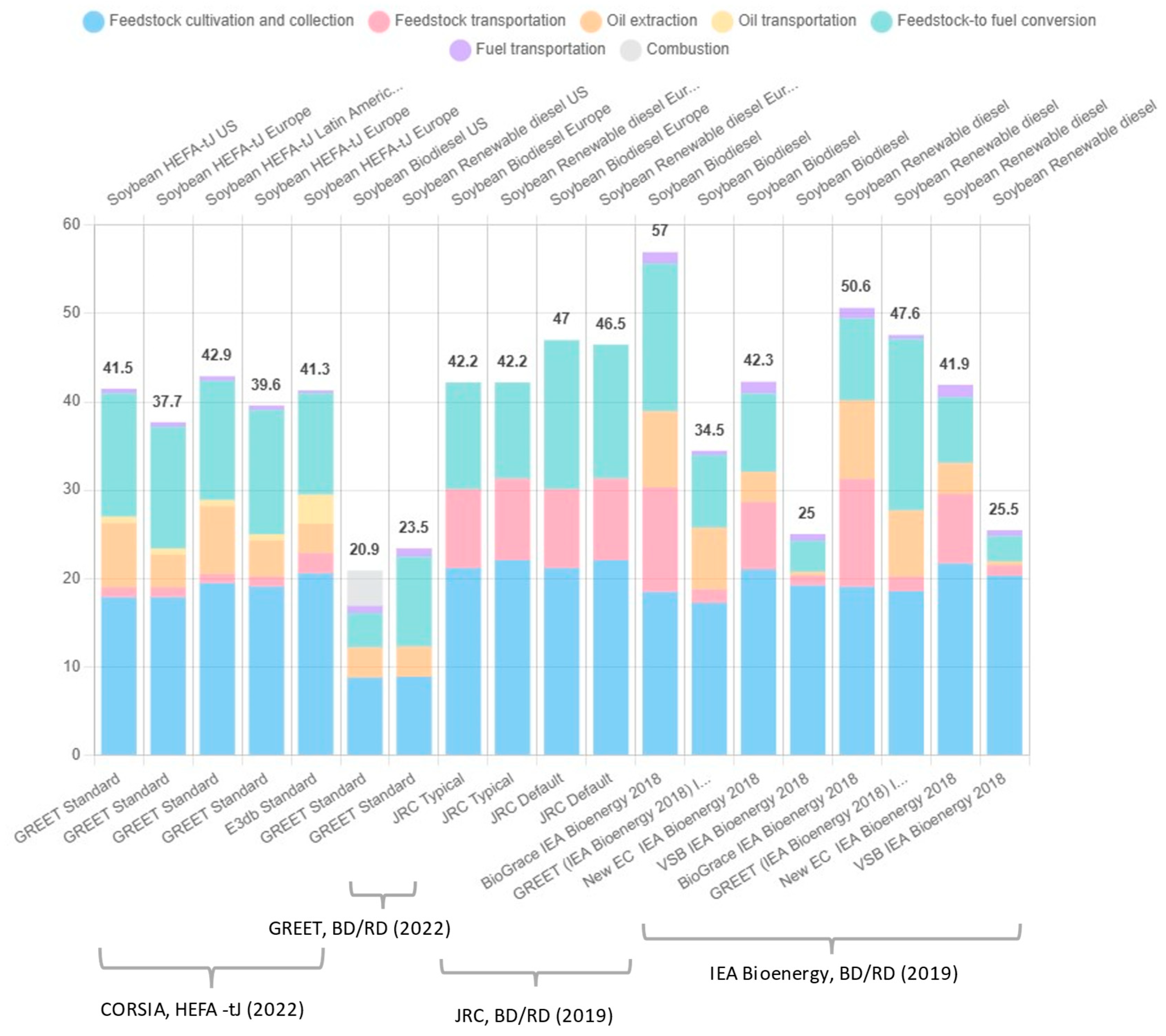

3.4.1. Yield Impacts on Carbon Intensity

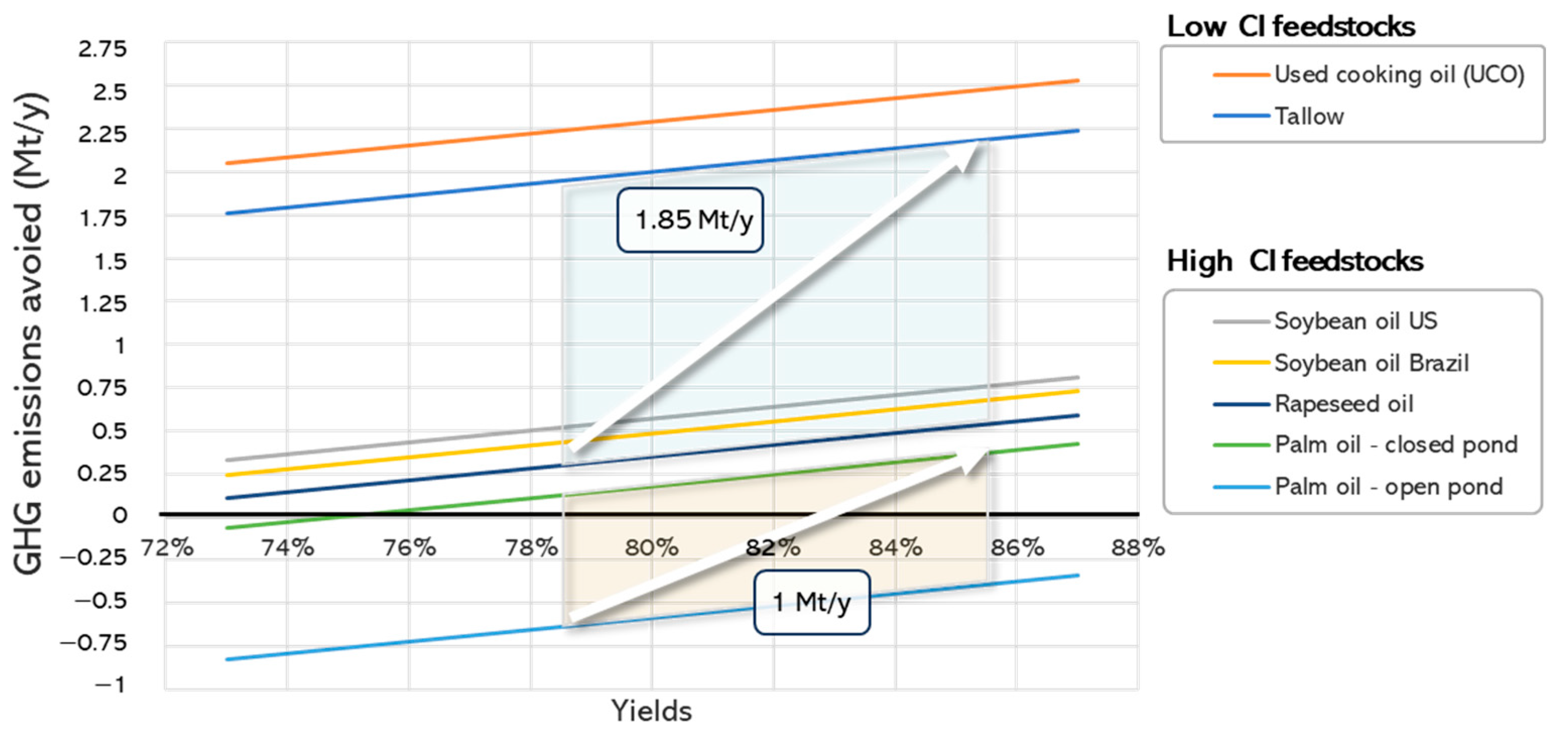

3.4.2. Yield Effects on GHG Reduction

3.5. Technology Adoption and Development to Increase Lipid-Based Fuel GHG Reduction Efficiency and Competitiveness

3.5.1. Reducing Palm Oil Production’s Environmental Impact by Capturing Methane from Effluent Treatment Is a Less Capital-Intensive and More Efficient Way to Reduce Global GHG Emissions than Producing HEFA-tJ

3.5.2. Pyrolysis, Co-Pyrolysis of Lipids and Similar Technologies Scaling-Up Challenges

High-Pressure Liquid Phase Pyrolysis and Catalytic Hydrothermolysis of Lipids

Co-Pyrolysis of Lipids with Cheap and/or Low-CI Feedstocks

3.5.3. Hydrogen Generation and the Importance of Small-Scale Commercial Demonstrations

3.6. Social Costs of Reducing GHG Emissions with Vegetable Oil and Animal Fat Products Are Important

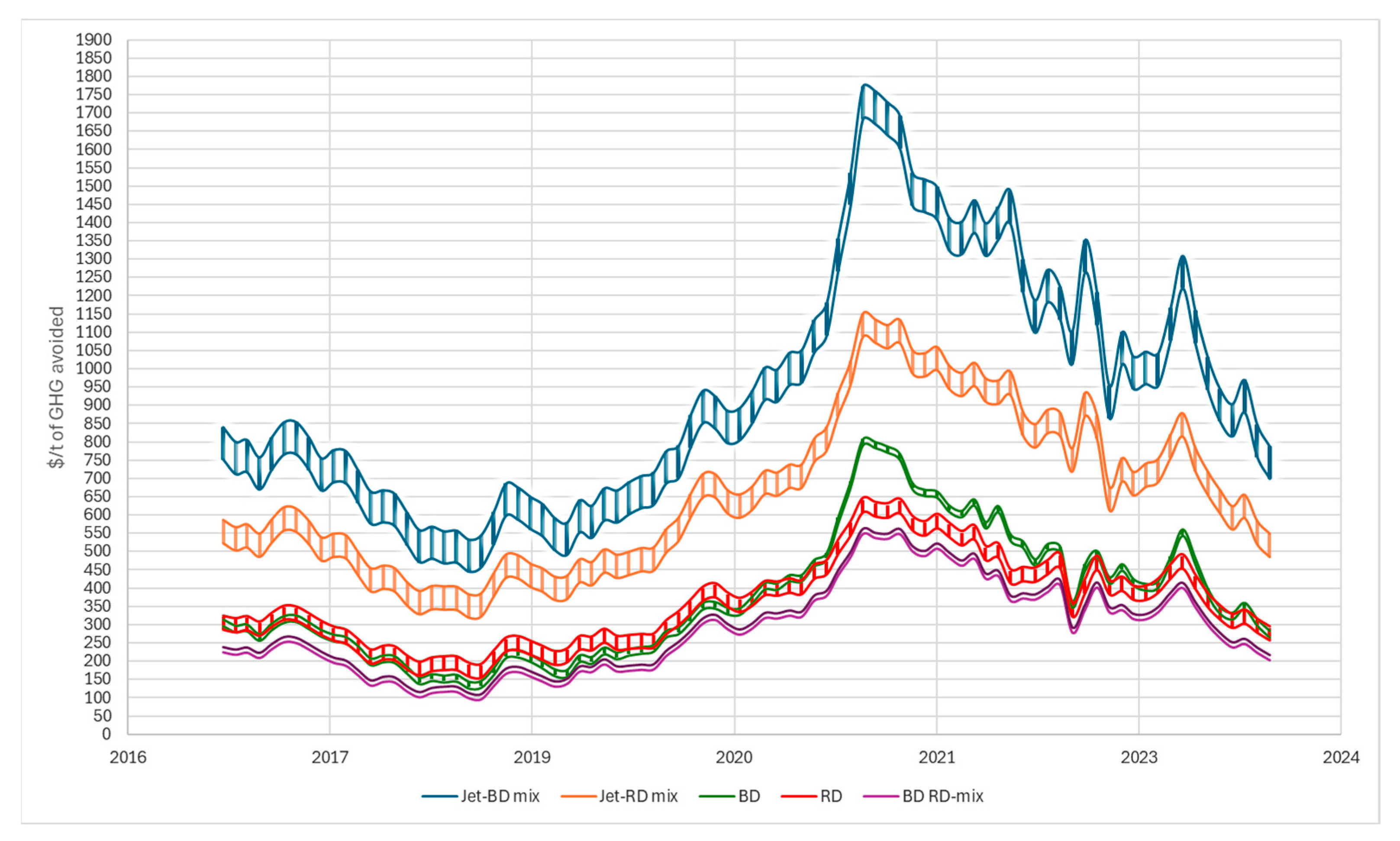

3.6.1. Economic Model for Social Cost Estimation

3.6.2. Carbon Intensity Model for GHG Reduction and Social Cost Estimation

3.6.3. Social Costs of the Different Pathways

4. Discussion

4.1. Fostering Sustainable Development with Data

4.1.1. Fast Technology Screening Methodologies

4.1.2. Geomatic Tools for LUC and Other Applications

4.2. The Role of Different Actors in Maximizing the Climate Offsets of the SAF Production

4.2.1. Lawmakers and Aviation Industries

4.2.2. Takeaway for R&D and R&D Investors

4.2.3. Takeaway for LCA Developers

4.3. Takeaway for the Industry

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Abbreviations

| BD | Biodiesel (fatty acid methyl ester, FAME) |

| BETO | USDOE, Bioenergy Technology Office |

| CI | Carbon intensity |

| CORSIA | Carbon Offsetting and Reduction Scheme for International Aviation |

| EIA | U.S. Energy Information Administration |

| HEFA-tJ | Hydrotreated ester and fatty acid pathway to jet |

| HEFA-road | Hydrotreated ester and fatty acid pathway to renewable diesel (RD) |

| FOGs | Fats, oils, and greases |

| IATA | International Air Transport Association |

| iLUC | Indirect land use changes |

| JRC | Joint Research Center |

| Mt | Million tonnes |

| NREL SOI | National Renewable Energy Laboratory State of Industry |

| PFAD | Palm fatty acid distillate |

| RD | Renewable diesel, also called HVO (hydrogenated vegetable oil) |

| SAF | Sustainable aviation fuels |

| TCI | Total capital investment |

| UCO | Used cooking oil |

| USDA | United States Department of Agriculture |

| USDOE | United States Department of Energy |

References

- Watson, M.J.; Machado, P.G.; da Silva, A.V.; Saltar, Y.; Ribeiro, C.O.; Nascimento, C.A.O.; Dowling, A.W. Sustainable Aviation Fuel Technologies, Costs, Emissions, Policies, and Markets: A Critical Review. J. Clean. Prod. 2024, 449, 141472. [Google Scholar] [CrossRef]

- Calderon, R.O.; Tao, L.; Abdullah, Z. Sustainable Aviation Fuel (SAF) State-of-Industry Report: State of SAF Production Process; NREL: Golden, Colorado, 2024. Available online: https://www.nrel.gov/docs/fy24osti/87802.pdf (accessed on 1 July 2025).

- Nigam, S.; Singer, D. Pathway to SAF—Europe Edition; Sustainable Aviation Futures: Singapore, 2024. [Google Scholar]

- BETO. SAF Grand Challenge Roadmap Flight Plan for Sustainable Aviation Fuel. 2022. Available online: https://www.energy.gov/sites/default/files/2022-09/beto-saf-gc-roadmap-report-sept-2022.pdf (accessed on 29 July 2025).

- European Commission. Regulation of the European Parliament and of the Council on Ensuring a Level Playing Field for Sustainable Air Transport; European Union: Brussels, Belgium, 2021. [Google Scholar]

- European Union Aviation Safety Agency. Current Landscape and Future of SAF Industry EASA Eco. Available online: https://www.easa.europa.eu/eco/eaer/topics/sustainable-aviation-fuels/current-landscape-future-saf-industry (accessed on 9 June 2024).

- IATA. Developing Sustainable Aviation Fuel (SAF). Available online: https://www.iata.org/en/programs/sustainability/sustainable-aviation-fuels/ (accessed on 13 August 2024).

- Neste. Rotterdam refinery Neste. Available online: https://www.neste.com/about-neste/how-we-operate/production/rotterdam-refinery (accessed on 13 August 2024).

- World Energy Paramount. Advanced Alternatives: World Energy Paramount Renewable Fuels Project. 2022. Available online: https://laedc.org/wpcms/wp-content/uploads/2022/06/LAEDC_AlpineReport_FINAL_rvs-06.20.2022.pdf (accessed on 29 July 2025).

- ReFuelEU. “Ajustement à l’objectif 55”: Accroître l’utilisation de carburants plus écologiques dans les secteurs aérien et maritime. Available online: https://www.consilium.europa.eu/fr/infographics/fit-for-55-refueleu-and-fueleu/ (accessed on 9 June 2024).

- Calderon, R.O.; Tao, L.; Abdullah, Z.; Talmadge, M.; Milbrandt, A.; Smolinski, S.; Moriarty, K.; Bhatt, A.; Zhang, Y.; Ravi, V.; et al. Sustainable Aviation Fuel State-of-Industry Report: Hydroprocessed Esters and Fatty Acids Pathway; NREL: Golden, CO, USA, 2024. [Google Scholar]

- Bardon, P.; Massol, O. Decarbonizing Aviation with Sustainable Aviation Fuels: Myths and Realities of the Roadmaps to Net Zero by 2050. Renew. Sustain. Energy Rev. 2025, 211, 115279. [Google Scholar] [CrossRef]

- Braun, M.; Grimme, W.; Oesingmann, K. Pathway to Net Zero: Reviewing Sustainable Aviation Fuels, Environmental Impacts and Pricing. J. Air Transp. Manag. 2024, 117, 102580. [Google Scholar] [CrossRef]

- Doliente, S.S.; Narayan, A.; Tapia, J.F.D.; Samsatli, N.J.; Zhao, Y.; Samsatli, S. Bio-Aviation Fuel: A Comprehensive Review and Analysis of the Supply Chain Components. Front. Energy Res. 2020, 8, 110. [Google Scholar] [CrossRef]

- Wei, H.; Liu, W.; Chen, X.; Yang, Q.; Li, J.; Chen, H. Renewable Bio-Jet Fuel Production for Aviation: A Review. Fuel 2019, 254, 115599. [Google Scholar] [CrossRef]

- Ng, K.S.; Farooq, D.; Yang, A. Global Biorenewable Development Strategies for Sustainable Aviation Fuel Production. Renew. Sustain. Energy Rev. 2021, 150, 111502. [Google Scholar] [CrossRef]

- Perkins, J. Dozens of Ethanol Plants Remain Idle in Early 2021. Successful Farming. 14 January 2021. Available online: https://www.agriculture.com/news/business/dozens-of-ethanol-plants-idle-production-in-early-2021 (accessed on 2 December 2024).

- CORSIA. CORSIA Supporting Document v5, CORSIA Eligible Fuels—Life Cycle Assessment Methodology; v5; International Civil Aviation Organization: Montreal, QC, Canada, 2022; p. 203. [Google Scholar]

- Pearlson, M.; Wollersheim, C.; Hileman, J. A Techno-Economic Review of Hydroprocessed Renewable Esters and Fatty Acids for Jet Fuel Production. Biofuels Bioprod. Biorefining 2013, 7, 89–96. [Google Scholar] [CrossRef]

- Zech, K.M.; Dietrich, S.; Reichmuth, M.; Weindorf, W.; Müller-Langer, F. Techno-Economic Assessment of a Renewable Bio-Jet-Fuel Production Using Power-to-Gas. Appl. Energy 2018, 231, 997–1006. [Google Scholar] [CrossRef]

- Bardon, P.; Massol, O.; Thomas, A. Greening Aviation with Sustainable Aviation Fuels: Insights from Decarbonization Scenarios. J. Environ. Manag. 2025, 374, 123943. [Google Scholar] [CrossRef]

- Gössling, S.; Humpe, A. Net-Zero Aviation: Time for a New Business Model? J. Air Transp. Manag. 2023, 107, 102353. [Google Scholar] [CrossRef]

- Gössling, S.; Humpe, A. Net-Zero Aviation: Transition Barriers and Radical Climate Policy Design Implications. Sci. Total Environ. 2024, 912, 169107. [Google Scholar] [CrossRef]

- Dray, L.; Schäfer, A.W. Cost and Emissions Pathways towards Net-Zero Climate Impacts in Aviation. Nat. Clim. Change 2022, 12, 956–962. [Google Scholar] [CrossRef]

- Bioenergy Technology Office. State of Technology, 2020; DOE: Washington, DC, USA, 2021; p. 168. [Google Scholar]

- Hamberg, K.; Leslie, M.; Walter, C.; Stratton, T.; Markham, D.; Tang, M.; Weatherbed, L. Scaling Solutions, Accelerating the Commercialization of Made-in-Canada Clean Technology; Deloitte: Calgary, BA, Canada, 2023. [Google Scholar]

- Dyk, S.V.; Saddler, J. Progress in the Commercialization of Biojet/Sustainable Aviation Fuels: Technologies, Potential and Challenges Bioenergy; IEA Bioenergy Task 39. 2021. Available online: https://www.ieabioenergy.com/blog/publications/progress-in-the-commercialization-of-biojet-sustainable-aviation-fuels-technologies-potential-and-challenges/ (accessed on 25 April 2024).

- IEA. Ethanol and Gasoline Prices 2019 to April 2022—Charts—Data & Statistics; IEA: Paris, France, 2022; Available online: https://www.iea.org/data-and-statistics/charts/ethanol-and-gasoline-prices-2019-to-april-2022 (accessed on 27 April 2024).

- EIA. U.S. Energy Information Administration—EIA—Independent Statistics and Analysis. Available online: https://www.eia.gov/state/search/?sid=AL#?1=682&2=182&r=false (accessed on 1 February 2025).

- Mauler, L.; Dahrendorf, L.; Duffner, F.; Winter, M.; Leker, J. Cost-Effective Technology Choice in a Decarbonized and Diversified Long-Haul Truck Transportation Sector: A U.S. Case Study. J. Energy Storage 2022, 46, 103891. [Google Scholar] [CrossRef]

- Jadun, P.; McMillan, C.; Steinberg, D.; Muratori, M.; Vimmerstedt, L.; Mai, T. Electrification Futures Study: End-Use Electric Technology Cost and Performance Projections Through 2050; NREL/TP-6A20-70485; National Renewable Energy Laboratory: Golden, CO, USA, 2017. Available online: https://www.nrel.gov/docs/fy18osti/70485.pdf (accessed on 29 July 2025).

- Ledna, C.; Muratori, M.; Yip, A.; Jadun, P.; Hoehne, C.; Podkaminer, K. Assessing Total Cost of Driving Competitiveness of Zero-Emission Trucks. iScience 2024, 27, 109385. [Google Scholar] [CrossRef]

- Link, S.; Stephan, A.; Speth, D.; Plötz, P. Rapidly Declining Costs of Truck Batteries and Fuel Cells Enable Large-Scale Road Freight Electrification. Nat. Energy 2024, 9, 1032–1039. [Google Scholar] [CrossRef]

- Noll, B.; del Val, S.; Schmidt, T.S.; Steffen, B. Analyzing the Competitiveness of Low-Carbon Drive-Technologies in Road-Freight: A Total Cost of Ownership Analysis in Europe. Appl. Energy 2022, 306, 118079. [Google Scholar] [CrossRef]

- Argonne National Laboratory. Hydrogen Delivery Infrastructure Analysis. Available online: https://hdsam.es.anl.gov/index.php (accessed on 17 February 2025).

- Elgowainy, A. Economic and Environmental Perspectives of Hydrogen Infrastructure Deployment Options. Argonne. Presentation to Nasem Committee. 2019. Available online: https://sites.nationalacademies.org/cs/groups/depssite/documents/webpage/deps_195262.pdf (accessed on 29 July 2025).

- HDSAM. Hydrogen Delivery Scenario Analysis Model. Available online: https://hdsam.es.anl.gov/index.php?content=hdsam (accessed on 19 February 2025).

- Connelly, E.; Penev, M.; Elgowainy, A.; Hunter, C. Current Status of Hydrogen Liquefaction Costs. In DOE Hydrogen and Fuel Cells Program Record 19001; Department of Energy: Washington, DC, USA, 2019. Available online: https://www.hydrogen.energy.gov/docs/hydrogenprogramlibraries/pdfs/19001_hydrogen_liquefaction_costs.pdf?sfvrsn=378c2204_1 (accessed on 29 July 2025).

- Ragon, P.-L.; Kelly, S.; Egerstrom, N.; Brito, J.; Sharpe, B.; Allcock, C.; Minjares, R.; Rodriguez, F. Near-Term Infrastructure Deployment to Support Zero-Emission Medium- and Heavy-Duty Vehicles in the United States; International Council on Clean Transportation: Washington, DC, USA, 2023; Available online: https://theicct.org/publication/infrastructure-deployment-mhdv-may23/ (accessed on 19 February 2025).

- Burnham, A.; Gohlke, D.; Rush, L.; Stephens, T.; Zhou, Y.; Delucchi, M.A.; Birky, A.; Hunter, C.; Lin, Z.; Ou, S.; et al. Comprehensive Total Cost of Ownership Quantification for Vehicles with Different Size Classes and Powertrains; ANL/ESD-21/4; Argonne National Lab (ANL): Argonne, IL, USA, 2021. [Google Scholar] [CrossRef]

- Aryanpur, V.; Rogan, F. Decarbonising Road Freight Transport: The Role of Zero-Emission Trucks and Intangible Costs. Sci. Rep. 2024, 14, 2113. [Google Scholar] [CrossRef] [PubMed]

- Tao, L.; Milbrandt, A.; Zhang, Y.; Wang, W.-C. Techno-Economic and Resource Analysis of Hydroprocessed Renewable Jet Fuel. Biotechnol. Biofuels 2017, 10, 261. [Google Scholar] [CrossRef]

- Marker, T.L. Opportunities for Biorenewables in Oil Refineries; UOP. Available on the DOE librairy. 2005. Available online: https://www.osti.gov/servlets/purl/861458-Wv5uum/ (accessed on 29 July 2025).

- Cross, D. Shell’s Powering Progress Strategy. 2022. Available online: https://www.gti.energy/wp-content/uploads/2022/05/01-tcbiomass2022-Keynote-Presentation-Darren-Cross.pdf (accessed on 29 July 2025).

- Digital Refining. Neste Oil Adds NExBTL Renewable Naphtha Suitable for Producing Bioplastics. Available online: https://www.digitalrefining.com/news/1001438/neste-oil-adds-nexbtl-renewable-naphtha-suitable-for-producing-bioplastics (accessed on 9 April 2024).

- Oki, N. Japan’s Mitsui Chemicals Adds New Bio-Petchem Products Latest Market News. Available online: https://www.argusmedia.com/en/news-and-insights/latest-market-news/2508701-japan-s-mitsui-chemicals-adds-new-bio-petchem-products (accessed on 9 April 2024).

- Lim, C.-W. SK Geo Centric Delivers First Shipment of Renewable Benzene to Covestro; Aju Press: Seoul, Republic of Korea, 2022; Available online: https://www.ajupress.com/view/20220620135800806 (accessed on 9 April 2024).

- Kotrba, R. Total Converting Grandpuits Refinery to Produce Renewable Diesel, SAF, Bioplastics, Solar Power; Biobased Diesel Daily: Warren, MN, USA, 2020; Available online: https://www.biobased-diesel.com/post/total-investing-500-million-euros-converting-grandpuits-refinery-to-produce-hvo-saf-bioplastics (accessed on 9 April 2024).

- Honeywell. Honeywell Introduces New Technology to Produce Key Feedstock for Plastics. Available online: https://www.honeywell.com/us/en/press/2022/02/honeywell-introduces-new-technology-to-produce-key-feedstock-for-plastics (accessed on 9 April 2024).

- Zhao, Z.; Jiang, J.; Wang, F. An economic analysis of twenty light olefin production pathways. J. Energy Chem. 2021, 56, 193–202. [Google Scholar] [CrossRef]

- Neste. Borealis Producing Certified Renewable Polypropylene from Neste’s Renewable Propane at Own Facilities in Belgium. Available online: https://www.neste.com/news/borealis-producing-certified-renewable-polypropylene-from-neste-s-renewable-propane-at-own-facilities-in-belgium (accessed on 9 April 2024).

- Neste. Neste Delivers First Batch of 100% Renewable Propane to European Market. Available online: https://www.neste.com/news/neste-delivers-first-batch-of-100-renewable-propane-to-european-market (accessed on 9 April 2024).

- Quantum Commodity Intelligence. Available online: https://www.qcintel.com/ (accessed on 25 April 2024).

- EIA. U.S. Gulf Coast Kerosene-Type Jet Fuel Spot Price FOB (Dollars per Gallon). Available online: https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=EER_EPJK_PF4_RGC_DPG&f=M (accessed on 12 August 2024).

- USDA. US Bioenergy Statistics. 2024. Available online: https://www.ers.usda.gov/data-products/u-s-bioenergy-statistics/ (accessed on 29 July 2025).

- Hofstrand, D. Tracking Biodiesel Profitability Ag Decision Maker. 2024. Available online: https://www.extension.iastate.edu/agdm/energy/html/d1-15.html (accessed on 5 August 2024).

- Carlson, N.A.; Talmadge, M.S.; Singh, A.; Tao, L.; Davis, R. Economic Impact and Risk Analysis of Integrating Sustainable Aviation Fuels into Refineries. Front. Energy Res. 2023, 11, 1223874. [Google Scholar] [CrossRef]

- DOE Alternative Fuels Data Center. Alternative Fuels Data Center: Fuel Properties Comparison. Available online: https://afdc.energy.gov/fuels/properties (accessed on 12 August 2024).

- Prussi, M.; Lee, U.; Wang, M.; Malina, R.; Valin, H.; Taheripour, F.; Velarde, C.; Staples, M.D.; Lonza, L.; Hileman, J.I. CORSIA: The First Internationally Adopted Approach to Calculate Life-Cycle GHG Emissions for Aviation Fuels. Renew. Sustain. Energy Rev. 2021, 150, 111398. [Google Scholar] [CrossRef]

- Unnasch, S. Review of EPA Workshop on Biofuel Greenhouse Gas Modeling; Growth Energy: Washington, DC, USA, 2022. [Google Scholar]

- UFOP. UFOP Report on Global Market Supply 2019–2020. 2020. Available online: https://www.ufop.de/files/1115/7953/1340/WEB_UFOP_Global_Supply_Report_A5_EN_19_20.pdf (accessed on 29 July 2025).

- UFOP. UFOP Report on Global Market Supply 2023–2024. 2024. Available online: https://www.ufop.de/files/8217/0548/9837/UFOP-2116_Report_Global_Market_Supply_A5_EN_23_24_160124.pdf (accessed on 29 July 2025).

- Lange, T. Presentation_Thorsten-Lange_2021-04-14_Neste-SAF.Pdf. 2021. Available online: https://www.europarl.europa.eu/cmsdata/232175/Presentation_Thorsten-Lange_2021-04-14_Neste-SAF.pdf (accessed on 3 November 2022).

- World Economic Forum. Clean Skies for Tomorrow: Sustainable Aviation Fuels as a Pathway to Net-Zero Aviation. 2020. Available online: https://www.weforum.org/publications/clean-skies-for-tomorrow-sustainable-aviation-fuels-as-a-pathway-to-net-zero-aviation/ (accessed on 26 April 2024).

- BioEnergy KDF. Billion-Ton 2023 Data Portal BioEnergy KDF. 2025. Available online: https://bioenergykdf.ornl.gov/bt23-data-portal (accessed on 29 July 2025).

- Stefanucci, D.; Barsali, T. Waste Feedstock Market Analysis. 2022. Available online: https://www.bio4a.eu/wp-content/uploads/2023/08/D-5.3-Waste-Feedstok-Market-Analysis.pdf (accessed on 29 July 2025).

- Canada’s Biojet Supply Chain Initiative. HEFA Production and Feedstock Selection. 2019. Available online: https://cbsci.ca/wp-content/uploads/CBSCI-HEFA-Production-and-Freedstock-Selection-single-page.pdf (accessed on 29 July 2025).

- Schmidt, J.; De Rosa, M. Certified Palm Oil Reduces Greenhouse Gas Emissions Compared to Non-Certified. J. Clean. Prod. 2020, 277, 124045. [Google Scholar] [CrossRef]

- Alcock, T.D.; Salt, D.E.; Wilson, P.; Ramsden, S.J. More Sustainable Vegetable Oil: Balancing Productivity with Carbon Storage Opportunities. Sci. Total Environ. 2022, 829, 154539. [Google Scholar] [CrossRef]

- Yeoh, M.L.; Goh, C.S. Hydrotreated Vegetable Oil Production from Palm Oil Mill Effluents: Status, Opportunities and Challenges. Biofuels Bioprod. Biorefining 2022, 16, 1153–1158. [Google Scholar] [CrossRef]

- Xu, H.; Lee, U.; Wang, M. Life-cycle energy use and greenhouse gas emissions of palm fatty acid distillate derived renewable diesel. Renew. Sustain. Energy Rev. 2020, 134, 110144. [Google Scholar] [CrossRef]

- Neste. Neste Sets Ambitious PFAD Targets: 100% Traceable in 2020. Available online: https://www.neste.com/news/neste-sets-ambitious-pfad-targets-100-traceable-in-2020 (accessed on 13 August 2024).

- Taheripour, F.; Sajedinia, E.; Karami, O. Oilseed Cover Crops for Sustainable Aviation Fuels Production and Reduction in Greenhouse Gas Emissions Through Land Use Savings. Front. Energy Res. 2022, 9, 790421. [Google Scholar] [CrossRef]

- Ritchie, H. Palm Oil. Published online at OurWorldinData.org. 2020. Available online: https://ourworldindata.org/palm-oil (accessed on 29 July 2025).

- Schillaci, C.; Perego, A.; Acutis, M.; Botta, M.; Tadiello, T.; Gabbrielli, M.; Barsali, T.; Tozzi, F.; Chiaramonti, D.; Jones, A. Assessing marginality of Camelina (C. sativa L. Crantz) in rotation with barley production in Southern Europe: A modelling approach. Agric. Ecosyst. Environ. 2023, 357, 108677. [Google Scholar] [CrossRef]

- CORDIS. Initiative Towards Sustainable Kerosene for Aviation FP7; CORDIS European Commission: Luxembourg, 2025; Available online: https://cordis.europa.eu/project/id/308807/reporting (accessed on 29 July 2025).

- Alam, A.; Dwivedi, P. Modeling site suitability and production potential of carinata-based sustainable jet fuel in the southeastern United States. J. Clean. Prod. 2019, 239, 117817. [Google Scholar] [CrossRef]

- Karami, O.; Dwivedi, P.; Lamb, M.; Field, J.M. Economics of Crop Rotations With and Without Carinata for Sustainable Aviation Fuel Production in the SE United States. Front. Energy Res. 2022, 10, 830227. [Google Scholar] [CrossRef]

- Gaveau, D.L.A.; Locatelli, B.; Salim, M.A.; Husnayaen, T.M.; Descals, A.; Angelsen, A.; Meijaard, E.; Sheil, D. Slowing Deforestation in Indonesia Follows Declining Oil Palm Expansion and Lower Oil Prices. PLoS ONE 2022, 17, e0266178. [Google Scholar] [CrossRef]

- Goldman, E.M.J.; Weisse, N.H.; Schneider, M. Estimating the Role of Seven Commodities in Agriculture-Linked Deforestation: Oil Palm, Soy, Cattle, Wood Fiber, Cocoa, Coffee, and Rubber; Technical Note; World Resources Institute: Washington, DC, USA, 2020. [Google Scholar] [CrossRef]

- RSPO. Impact Update 2023; RSPO: Kuala, Malasia, 2023; Available online: https://rspo.org/wp-content/uploads/Impact-Update-2023_.pdf (accessed on 29 July 2025).

- Loh. Biogas Capturing Facilities in Palm Oil Mills: Current Status and Way Forward—Palm Oil Engineering Bulletin. Available online: http://poeb.mpob.gov.my/biogas-capturing-facilities-in-palm-oil-mills-current-status-and-way-forward/ (accessed on 26 March 2024).

- Environment Protection Department (EPD), et Sabah. Guideline on Waste Management (Effluent and Solid Wastes) for Palm Oil Mills in Sabah; Environment Protection Department: Hong Kong, China, 2022. [Google Scholar]

- Taheripour, F.; Mueller, S.; Emery, I.; Karami, O.; Sajedinia, E.; Zhuang, Q.; Wang, M. Biofuels Induced Land Use Change Emissions: The Role of Implemented Land Use Emission Factors. Sustainability 2024, 16, 2729. [Google Scholar] [CrossRef]

- Wang, M. Opportunities for Lowering GHG Emissions of Corn Ethanol. 2022. Available online: https://www.energy.gov/sites/default/files/2022-03/02-beto-gen-1-wksp-wang.pdf (accessed on 29 July 2025).

- Naidu, L.; Moorthy, R.; Huda, M.I.M. The Environmental and Health Sustainability Challenges of Malaysian Palm Oil in the European Union. J. Oil Palm Res. 2024, 36, 1–15. [Google Scholar] [CrossRef]

- Schroeder, K. Waiting for Takeoff Ethanol Producer Magazine. Available online: https://ethanolproducer.com/articles/waiting-for-takeoff (accessed on 5 August 2024).

- O’Malley, J.; Pavlenko, N. Drawbacks of Adopting a ”Similar” LCA Methodology for U.S.; Sustainable Aviation Fuel (SAF): Singapore, 2023; Available online: https://theicct.org/wp-content/uploads/2023/09/ID-16-Briefing-letter-v3.pdf (accessed on 29 July 2025).

- IEA BioEnergy. IEA Bioenergy Webinar—Understanding Indirect Land-Use Change (ILUC) and Why Reality Is a Special Case—Bioenergy. Available online: https://www.ieabioenergy.com/blog/publications/iea-bioenergy-webinar-understanding-indirect-land-use-change-iLUC-and-why-reality-is-a-special-case/ (accessed on 13 August 2024).

- Trase. Brazil Beef—Supply Chain—Explore the Data—Trase; trase.earth: Oxford, UK, 2023; Available online: https://trase.earth/explore/supply-chain/brazil/beef (accessed on 14 October 2024).

- Steinfeld, H.; Gerber, P.; Wassenaar, T.; Castel, V.; Rosales, M.; de Haan, C. Livestock’s Long Shadow. 2006. FAO. Available online: https://www.fao.org/4/a0701e/a0701e.pdf (accessed on 29 July 2025).

- Freitas, G.; Veloso, T.; Chipman, K. US Edged out by Brazil Beef Fat Destined for Biofuels; Energy Connects: London, UK, 2024. [Google Scholar]

- Xu, H.; Ou, L.; Li, Y.; Hawkins, T.R.; Wang, M. Life Cycle Greenhouse Gas Emissions of Biodiesel and Renewable Diesel Production in the United States. Environ. Sci. Technol. 2022, 56, 7512–7521. [Google Scholar] [CrossRef]

- Gerveni, M.; Hubbs, T.; Irving, S. FAME Biodiesel, Renewable Diesel and Biomass-Based Diesel Feedstock Volume Estimates; Farmdoc Daily: Urbana, IL, USA, 2024. [Google Scholar]

- Lee, U.; Kwon, H.; Wu, M.; Wang, M. Retrospective Analysis of the U.S. Corn Ethanol Industry for 2005–2019: Implications for Greenhouse Gas Emission Reductions. Biofuels Bioprod. Biorefining 2021, 15, 1318–1331. [Google Scholar] [CrossRef]

- Edwards, R.; Padella, M.; Giuntoli, J.; Koeble, R.; O’ Connell, A.P.; Bulgheroni, C.; Marelli, L. Definition of Input Data to Assess GHG Default Emissions from Biofuels in EU Legislation: Version 1c—July 2017; JRC Publications Repository: Brussels, Belgium, 2017. [Google Scholar] [CrossRef]

- IEA BioEnergy. Comparison of Biofuel Life Cycle Analysis Tools—Phase 2, Part 1: FAME and HVO/HEFA; IEA: Paris, France, 2018; Available online: https://www.ieabioenergy.com/wp-content/uploads/2019/07/Task-39-CTBE-biofuels-LCA-comparison-Final-Report-Phase-2-Part-1-February-11-2019.pdf (accessed on 29 July 2025).

- Staples, M.D.; Malina, R.; Barrett, S.R.H. The Limits of Bioenergy for Mitigating Global Life-Cycle Greenhouse Gas Emissions from Fossil Fuels. Nat. Energy 2017, 2, 16202. [Google Scholar] [CrossRef]

- Staples, M.D.; Malina, R.; Suresh, P.; Hileman, J.I.; Barrett, S.R.H. Aviation CO2 Emissions Reductions from the Use of Alternative Jet Fuels. Energy Policy 2018, 114, 342–354. [Google Scholar] [CrossRef]

- de Oliveira, C.C.N.; Angelkorte, G.; Rochedo, P.R.R.; Szklo, A. The Role of Biomaterials for the Energy Transition from the Lens of a National Integrated Assessment Model. Clim. Change 2021, 167, 57. [Google Scholar] [CrossRef]

- de Oliveira, C.C.N.; Zotin, M.Z.; Rochedo, P.R.R.; Szklo, A. Achieving Negative Emissions in Plastics Life Cycles through the Conversion of Biomass Feedstock. Biofuels Bioprod. Biorefining 2021, 15, 430–453. [Google Scholar] [CrossRef]

- FORGE Hydrocarbons. FORGE Hydrocarbons Corporation; FORGE Hydrocarbons Corporation: Oakville, ON, Canada, 2024; Available online: http://www.forgehc.com/home.html (accessed on 21 June 2025).

- Bressler, D. Methods for Producing Hydrocarbon Compositions with Reduced Acid Number and for Isolating Short Chain Fatty Acids. U.S. Patent 10995276B2, 4 May 2021. Available online: https://patents.google.com/patent/US10995276B2/en (accessed on 29 June 2025).

- Hiebert, D.R. Decarboxylation and Hydrogenation of Safflower and Rapeseed Oils and Soaps to Produce Diesel Fuels. Master’s Thesis, Montana State University, Bozeman, MT, USA, 1985. Available online: https://scholar.google.com/scholar_lookup?title=Decarboxylation+and+Hydrogenation+of+Safflower+and+Rapeseed+Oils+and+Soaps+to+Produce+Diesel+Fuels&author=Hiebert,+D.R.&publication_year=1985 (accessed on 18 June 2025).

- Cheng, F.W. China Produces Fuels from Vegetable Oil. In Chemical Engineering 1945-01: Vol 52 Iss 1; Access Intelligence LLC. 1945. Available online: https://archive.org/details/sim_chemical-engineering_1945-01_52_1/page/98/mode/2up (accessed on 1 July 2025).

- Chang, C.-C.; Wan, S.-W. China’s Motor Fuels from Tung Oil. Ind. Eng. Chem. 1947, 39, 1543–1548. [Google Scholar] [CrossRef]

- FORGE Hydrocarbons. Forge Hydrocarbons To Build $30M Biofuel Plant In Ontario—Canadian Biomass Magazine. Available online: https://www.canadianbiomassmagazine.ca/forge-hydrocarbons-to-build-30m-biofuel-plant-in-ontario/ (accessed on 15 July 2025).

- European Bioplastics. Bioplastics Market Development Update 2024; European Bioplastics e.V.: Berlin, Germany, 2024; Available online: https://www.european-bioplastics.org/market/ (accessed on 22 June 2025).

- Khedr, M. Bio-Based Polyamide. Phys. Sci. Rev. 2021, 8, 76. [Google Scholar] [CrossRef]

- Eswaran, S.; Subramaniam, S.; Geleynse, S.; Brandt, K.; Wolcott, M.; Zhang, X. Techno-Economic Analysis of Catalytic Hydrothermolysis Pathway for Jet Fuel Production. Renew. Sustain. Energy Rev. 2021, 151, 111516. [Google Scholar] [CrossRef]

- Lam, S.S.; Wan Mahari, W.A.; Ok, Y.S.; Peng, W.; Chong, C.T.; Ma, N.L.; Chase, H.A.; Liew, Z.; Yusup, S.; Kwon, E.E.; et al. Microwave Vacuum Pyrolysis of Waste Plastic and Used Cooking Oil for Simultaneous Waste Reduction and Sustainable Energy Conversion: Recovery of Cleaner Liquid Fuel and Techno-Economic Analysis. Renew. Sustain. Energy Rev. 2019, 115, 109359. [Google Scholar] [CrossRef]

- Omidghane, M.; Bartoli, M.; Asomaning, J.; Xia, L.; Chae, M.; Bressler, D.C. Pyrolysis of Fatty Acids Derived from Hydrolysis of Brown Grease with Biosolids. Environ. Sci. Pollut. Res. Int. 2020, 27, 26395–26405. [Google Scholar] [CrossRef]

- Chen, G.; Liu, C.; Ma, W.; Zhang, X.; Li, Y.; Yan, B.; Zhou, W. Co-Pyrolysis of Corn Cob and Waste Cooking Oil in a Fixed Bed. Bioresour. Technol. 2014, 166, 500–507. [Google Scholar] [CrossRef]

- Wang, Z.; An, S.; Zhao, J.; Sun, P.; Lyu, H.; Kong, W.; Shen, B. Plastic Regulates Its Co-Pyrolysis Process with Biomass: Influencing Factors, Model Calculations, and Mechanisms. Front. Ecol. Evol. 2022, 10, 964936. [Google Scholar] [CrossRef]

- Anshu, K.; Kenttämaa, H.I.; Thengane, S.K. A Comprehensive Review on Co-Pyrolysis of Lignocellulosic Biomass and Polystyrene. Renew. Sustain. Energy Rev. 2024, 205, 114832. [Google Scholar] [CrossRef]

- Engamba Esso, S.B.; Xiong, Z.; Chaiwat, W.; Kamara, M.F.; Longfei, X.; Xu, J.; Ebako, J.; Jiang, L.; Su, S.; Hu, S.; et al. Review on Synergistic Effects during Co-Pyrolysis of Biomass and Plastic Waste: Significance of Operating Conditions and Interaction Mechanism. Biomass Bioenergy 2022, 159, 106415. [Google Scholar] [CrossRef]

- Federal Economic Development Agency for Southern Ontario. Two Renewable Fuel Producers Scale up to Increase Productivity and Economic Growth in Rural Southwestern Ontario; Government of Canada: Ottawa, ON, Canada, 2020. Available online: https://www.canada.ca/en/economic-development-southern-ontario/news/2020/07/two-renewable-fuel-producers-scale-up-to-increase-productivity-and-economic-growth-in-rural-southwestern-ontario.html (accessed on 15 July 2025).

- Wang, Y.; Dai, L.; Fan, L.; Cao, L.; Zhou, Y.; Zhao, Y.; Liu, Y.; Ruan, R. Catalytic Co-Pyrolysis of Waste Vegetable Oil and High Density Polyethylene for Hydrocarbon Fuel Production. Waste Manag. 2017, 61, 276–282. [Google Scholar] [CrossRef] [PubMed]

- Sergius, P.; Prats, A.E. Process of Producing Gasoline and Other Hydrocarbons from Coconut Oil and Related Animal and Vegetable Oils and Fats. US2437438A, 9 March 1948. Available online: https://patents.google.com/patent/US2437438A/en (accessed on 18 June 2025).

- Barbera, E.; Naurzaliyev, R.; Asiedu, A.; Bertucco, A.; Resurreccion, E.P.; Kumar, S. Techno-Economic Analysis and Life-Cycle Assessment of Jet Fuels Production from Waste Cooking Oil via in Situ Catalytic Transfer Hydrogenation. Renew. Energy 2020, 160, 428–449. [Google Scholar] [CrossRef]

- Burli, P.H.; Hartley, D.S.; Thompson, D.N. Woody Feedstocks 2021 State of Technology Report; Idaho National Laboratory: Idaho Falls, ID, USA, 2021. [Google Scholar] [CrossRef]

- Thompson, D.N.; Hartley, D.S.; Wiatrowski, M.R.; Klinger, J.; Paudel, R.; Ou, L.; Cai, H. Techno-Economic and Life-Cycle Analysis of Strategies for Improving Operability and Biomass Quality in Catalytic Fast Pyrolysis of Forest Residues. Next Energy 2025, 7, 100225. [Google Scholar] [CrossRef]

- Besseau, R.; Scarlat, N.; Hurtig, O.; Motola, V.; Bouter, A. Assessing the Carbon Intensity of E-Fuels Production in European Countries: A Temporal Analysis. Appl. Sci. 2024, 14, 10299. [Google Scholar] [CrossRef]

- Nguyen, E.; Olivier, P.; Pera, M.-C.; Pahon, E.; Roche, R. Impacts of Intermittency on Low-Temperature Electrolysis Technologies: A Comprehensive Review. Int. J. Hydrogen Energy 2024, 70, 474–492. [Google Scholar] [CrossRef]

- Pipitone, G.; Zoppi, G.; Pirone, R.; Bensaid, S. Sustainable Aviation Fuel Production Using In-Situ Hydrogen Supply via Aqueous Phase Reforming: A Techno-Economic and Life-Cycle Greenhouse Gas Emissions Assessment. J. Clean. Prod. 2023, 418, 138141. [Google Scholar] [CrossRef]

- Air Liquide. Profits Without Subsidies? 2020. Available online: https://engineering.airliquide.com/sites/engineering/files/2022-07/air_liquide_biodiesel_final.pdf (accessed on 12 October 2024).

- Dutta, A.; Sahir, A.; Tan, E. Process Design and Economics for the Conversion of Lignocellulosic Biomass to Hydrocarbon Fuels: Thermochemical Research Pathways with In Situ and Ex Situ Upgrading of Fast Pyrolysis Vapors; NREL: Golden, Colorado, 2015; p. 275. [Google Scholar]

- Swanson, R.M.; Satrio, J.A.; Brown, R.C. Techno-Economic Analysis of Biofuels Production Based on Gasification 1 Novembre 2010; NREL: Golden, Colorado, 2010. [Google Scholar] [CrossRef]

- Irwin, S. Biodiesel Prices and Profits…Again. Farmdoc Daily 2024, 14, n49. Available online: https://farmdocdaily.illinois.edu/2024/03/biodiesel-prices-and-profits-again.html (accessed on 1 July 2025).

- van Dyk, S.; Saddler, J. Progress in Commercialization of Biojet/Sustainable Aviation Fuels (SAF): Technologies, Potential and Challenges. 2021. Available online: https://www.ieabioenergy.com/wp-content/uploads/2021/06/IEA-Bioenergy-Task-39-Progress-in-the-commercialisation-of-biojet-fuels-May-2021-1.pdf (accessed on 1 July 2025).

- IEA Energy. Will More Wind and Solar PV Capacity Lead to More Generation Curtailment?—Renewable Energy Market Update—June 2023—Analysis; IEA: Paris, France, 2023; Available online: https://www.iea.org/reports/renewable-energy-market-update-june-2023/will-more-wind-and-solar-pv-capacity-lead-to-more-generation-curtailment (accessed on 5 August 2024).

- Ritchie, H.; Rosado, P.; Roser, M. “Energy”. Data Adapted from Ember, Energy Institute. “Data Page: Carbon Intensity of Electricity Generation”, Part of the Following Publication. 2023. Available online: https://ourworldindata.org/grapher/carbon-intensity-electricity (accessed on 1 July 2025).

| Pearlson et al., 2013 [19] | Zech et al., 2018 [20] | |||

|---|---|---|---|---|

| HEFA-tJ | HEFA-Road | HEFA-tJ | HEFA-Road | |

| Jet fuels | 49.4 | 12.8 | 45.4 | 12 |

| Diesel fuels | 23.3 | 68.1 | 8 | 66 |

| Naphtha | 7 | 1.8 | 27 | 4 |

| Refinery gas | 10.2 | 5.8 | 7.2 | 3 |

| Yield without conversion losses | 88 | 90 | 86 | 88 |

| Yield with conversion losses | 79 | 86 | 73 | 84 |

| Region | Feedstock | Core LCA Value | iLUC LCA | Total (g/MJ) |

|---|---|---|---|---|

| Global | Tallow | 22.5 | 0 | 22.5 |

| Global | Used cooking oil | 13.9 | 13.9 | |

| Global | Palm fatty Acid Distillate | 20.7 | 20.7 | |

| Global | Corn oil | 17.2 | 17.2 | |

| USA | Soybean oil | 40.4 | 24.5 | 64.9 |

| Brazil | Soybean oil | 40.4 | 27 | 67.4 |

| EU | Rapeseed oil | 47.4 | 24.1 | 71.5 |

| Malaysia and Indonesia | Palm oil-closed pond | 37.4 | 39.1 | 76.5 |

| Malaysia and Indonesia | Palm oil-open pond | 60 | 39.1 | 99.1 |

| Model | Scope | Shock Size (PJ) | Peatland Conversion Emission Factor (t/ha) | Palm Oil Expansion on Peatland (%) | Considered Parameters | Mathematic Formulation for CI (Simplified) | ||

|---|---|---|---|---|---|---|---|---|

| Peatland Fire (PF) | LUC | Subsidence (S) | ||||||

| GTAP-BIO | Country-level HEFA production | 207.7 | 38.1 | 33 | ? | x | x | (LUC + S)/Shock (25 years) |

| GLOBIUM | - | 90 | 20 | |||||

| CORSIA | 207.7 | 38.1 | 33 | GTAP-BIO + 4.45 g/MJ | ||||

| TRASE | Regional level Palm oil production | - | 90 | Regional data | x | x | x | PF + LUC + S |

| This study | Regional level HEFA production based on palm oil emissions | 460 (BD) | 38.1 | Regional data | ||||

| Unit | Total Palm Oil Production (t/y) | Average CI | Peatland Conversion (% w/o < 2003) | Total Emissions (Mt) (w/o < 2003, Year 2022) | % Indonesian Palm Oil Production (2021) | |||

|---|---|---|---|---|---|---|---|---|

| w < 2003 | w/o < 2003 | 5 Year av. | ||||||

| 30 high producing kabupaten | >430 t/y | 26,626,692 | 59.8 | 44.5 | 74.2 | 10.4 | 41.9 | 63.4 |

| Very high CI | >200 g/MJ | 1,934,031 | 297.7 | 231.1 | 250.6 | 50.5 | 15.7 | 4.6 |

| High CI | 100–200 g/MJ | 2,944,526 | 135.8 | 73.6 | 102.9 | 12.8 | 9.1 | 7 |

| Low CI | <20 g/MJ | 7,373,862 | 8.7 | 7 | 20.2 | 1.3 | 2.2 | 17.6 |

| Sample Size | Average Peatland Fire CI | Average LUC CI | Average Subsidence CI | |||

|---|---|---|---|---|---|---|

| w/o < 2003 | 5 Year av. | w/o < 2003 | 5 Year av. | |||

| 30 high producing kabupaten | 30 | 2 | 29 | 3.4 | 6.2 | 39 |

| Very high CI | 7 | 32.4 | 48.2 | 6.4 | 10.1 | 192.3 |

| High CI | 10 | 6.5 | 39 | 13 | 9.82 | 54.1 |

| Low CI | 9 | 0.01 | 9.7 | 1.2 | 5.2 | 6.4 |

| Reference | Plant Type | Data Type | Capacity kt/y Feedstock | TCI (USD/t Feedstock) | TCI (2024) |

|---|---|---|---|---|---|

| Zech. H. et al., 2018 [20] | HEFA-tJ | Literature | 500 260 116–378 1470 | 396 | 550 |

| Tao. L, et al., 2017 [42] | HEFA-tJ | Literature | 1346 | 1869 | |

| Pearlson, M. et al., 2013 [19] | HEFA-tJ | Literature | 293-619 | 440–937 | |

| Neste [8] | HEFA-tJ | Announcement | 1337 | ||

| World Energy Paramount [9] | HEFA-tJ | Announcement | 1500 | 1337 | |

| TotalEnergy Grandpuits [48] | HEFA-tJ | Announcement | 470 | ~1168 | |

| Hofstrand, D., 2024 [56] | BD | TEA | 106 | 493 | |

| AirLiquide 2022 [126] | BD | Announcement | 50–350 | 315–475 | |

| Our estimates | HEFA-tJ | No SMR included | >1000 | 1200–1600 | |

| Our estimates | RD | No SMR included | 700 | 1080–1440 | |

| Our estimates | BD | 110 | 500–650 |

| Simplified Economic Model Hypothesis | ||

|---|---|---|

| Study period (SP) | 15 | |

| Depreciation | TCI/SP | |

| RI | 7% | %TCI |

| Taxes | 2% | %TCI |

| Maintenance | 5% | %TCI |

| Resource cost hypotheses (by ton of feedstock) | ||

| Methanol cost | 441 | $/t |

| NG cost | 335 | $/t |

| H2 cost | 2000 | $/t |

| Electricity cost | 0.08 | $/kWh |

| Resource Usage Hypothesis for Different Pathways (by Ton of Feedstock) | |||

|---|---|---|---|

| BD | Methanol | 105 | kg/t |

| NG | 46 | kg/t | |

| Electricity | 179 | kWh/t | |

| RD | H2 | 29.8 | kg/t |

| Electricity | 66 | kWh/t | |

| HEFA-tJ | H2 | 35.7 | kg/t |

| Electricity | 66 | kWh/t | |

| CI g/MJ | CI Reduction | MJ/kg Fuel | g/kg of GHG Avoided by Feedstock | |

|---|---|---|---|---|

| HEFA-tJ BD mix | 54.29 | 39% | 40.5 | 1111 |

| HEFA-tJ RD mix | 38.23 | 57% | 40.5 | 1624 |

| BD mix | 43.31 | 52% | 37.37 | 1725 |

| RD mix | 31.12 | 66% | 43.2 | 2236 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Pominville-Racette, M.; Overend, R.; Achouri, I.E.; Abatzoglou, N. Hydroprocessed Ester and Fatty Acids to Jet: Are We Heading in the Right Direction for Sustainable Aviation Fuel Production? Energies 2025, 18, 4156. https://doi.org/10.3390/en18154156

Pominville-Racette M, Overend R, Achouri IE, Abatzoglou N. Hydroprocessed Ester and Fatty Acids to Jet: Are We Heading in the Right Direction for Sustainable Aviation Fuel Production? Energies. 2025; 18(15):4156. https://doi.org/10.3390/en18154156

Chicago/Turabian StylePominville-Racette, Mathieu, Ralph Overend, Inès Esma Achouri, and Nicolas Abatzoglou. 2025. "Hydroprocessed Ester and Fatty Acids to Jet: Are We Heading in the Right Direction for Sustainable Aviation Fuel Production?" Energies 18, no. 15: 4156. https://doi.org/10.3390/en18154156

APA StylePominville-Racette, M., Overend, R., Achouri, I. E., & Abatzoglou, N. (2025). Hydroprocessed Ester and Fatty Acids to Jet: Are We Heading in the Right Direction for Sustainable Aviation Fuel Production? Energies, 18(15), 4156. https://doi.org/10.3390/en18154156