Research on Energy Security in the EU from a Trade Perspective: A Historical Analysis from 1991 to 2021

Abstract

1. Introduction

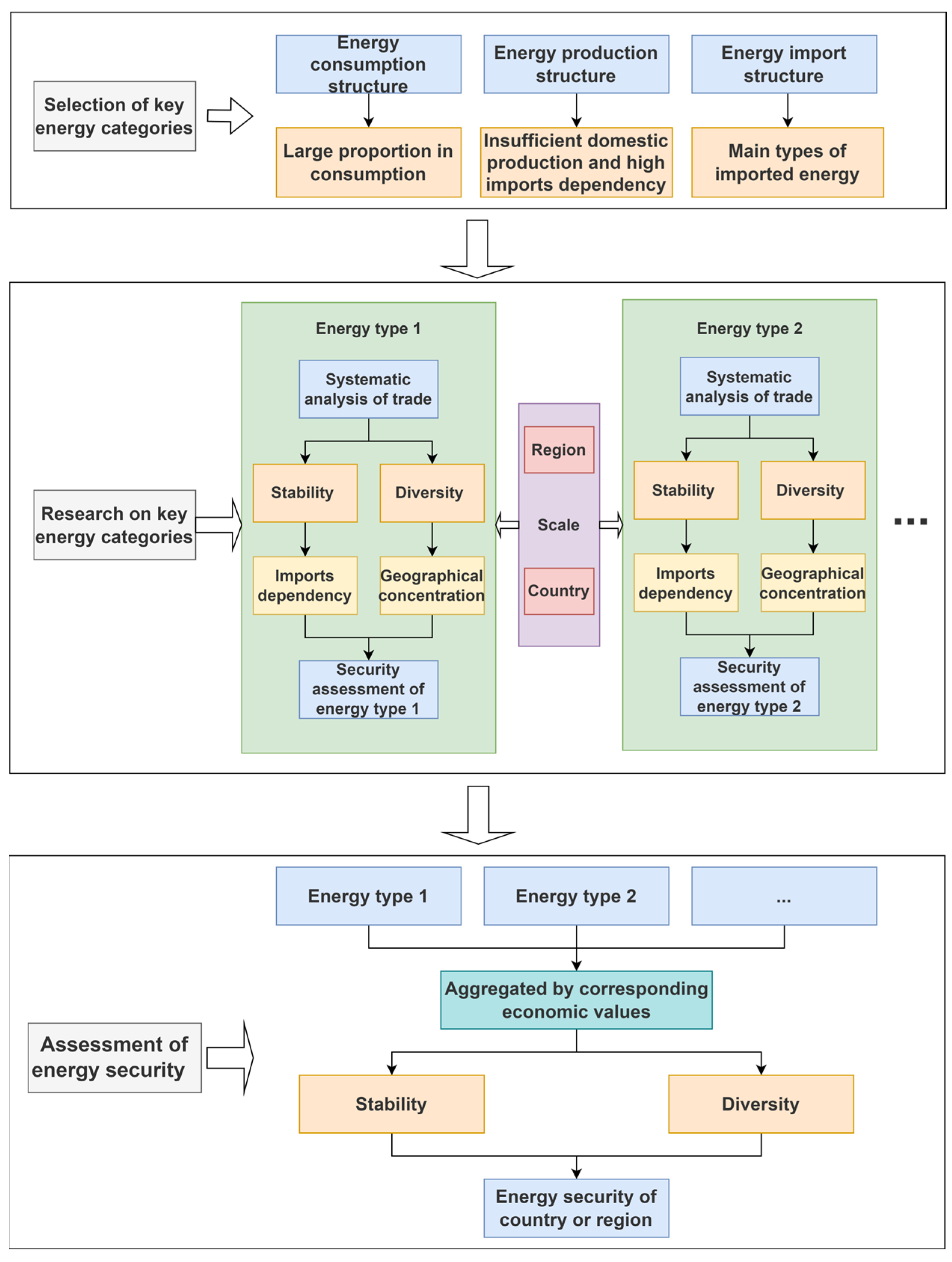

2. Conceptual Framework of Energy Security from the Perspective of Trade

2.1. Theoretical Background

2.2. Conceptual Framework

2.3. Data Sources

3. Results

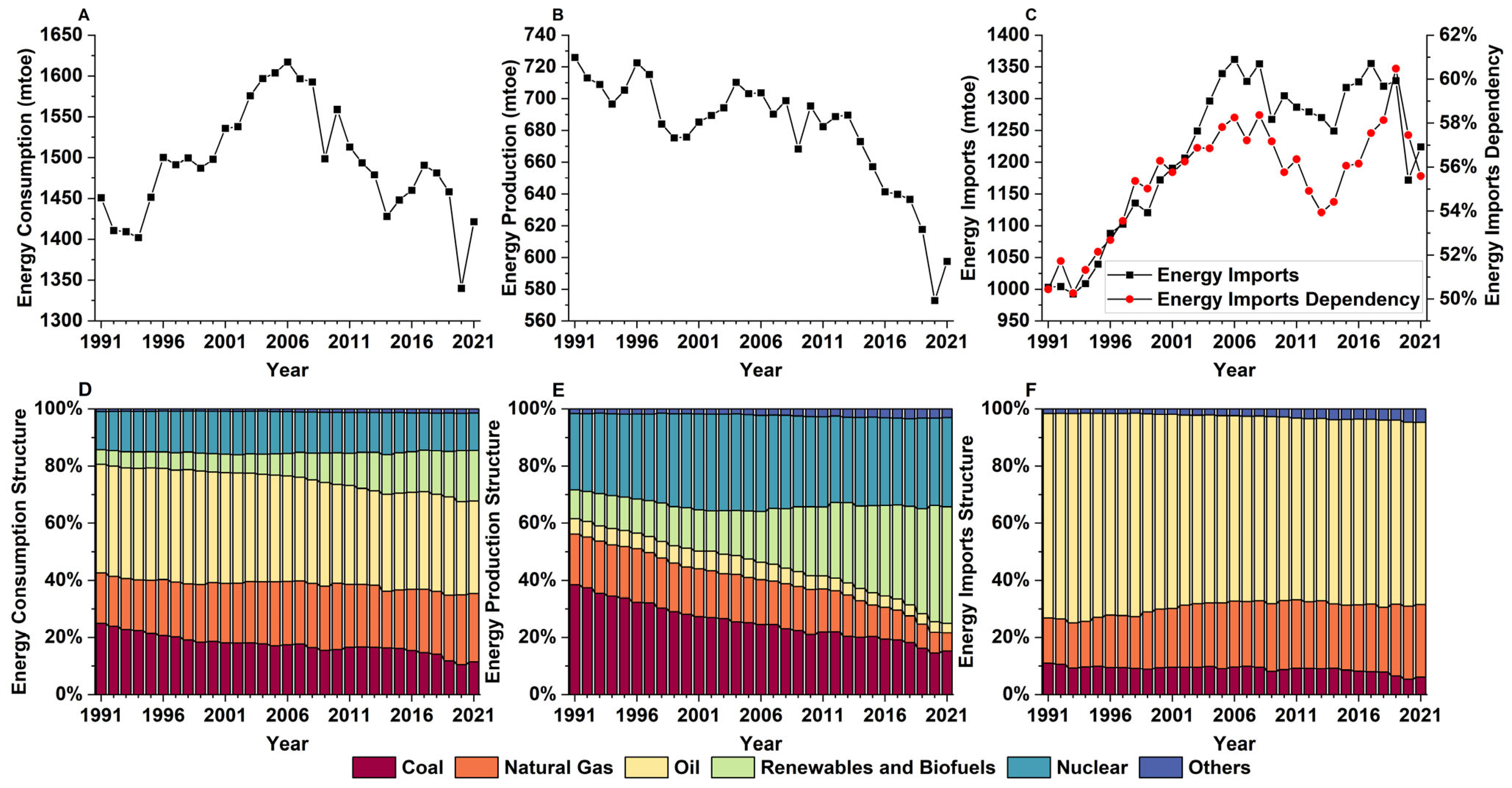

3.1. EU’s Energy Supply and Demand Structure

3.2. The Stability and Diversity of EU’s Energy Import

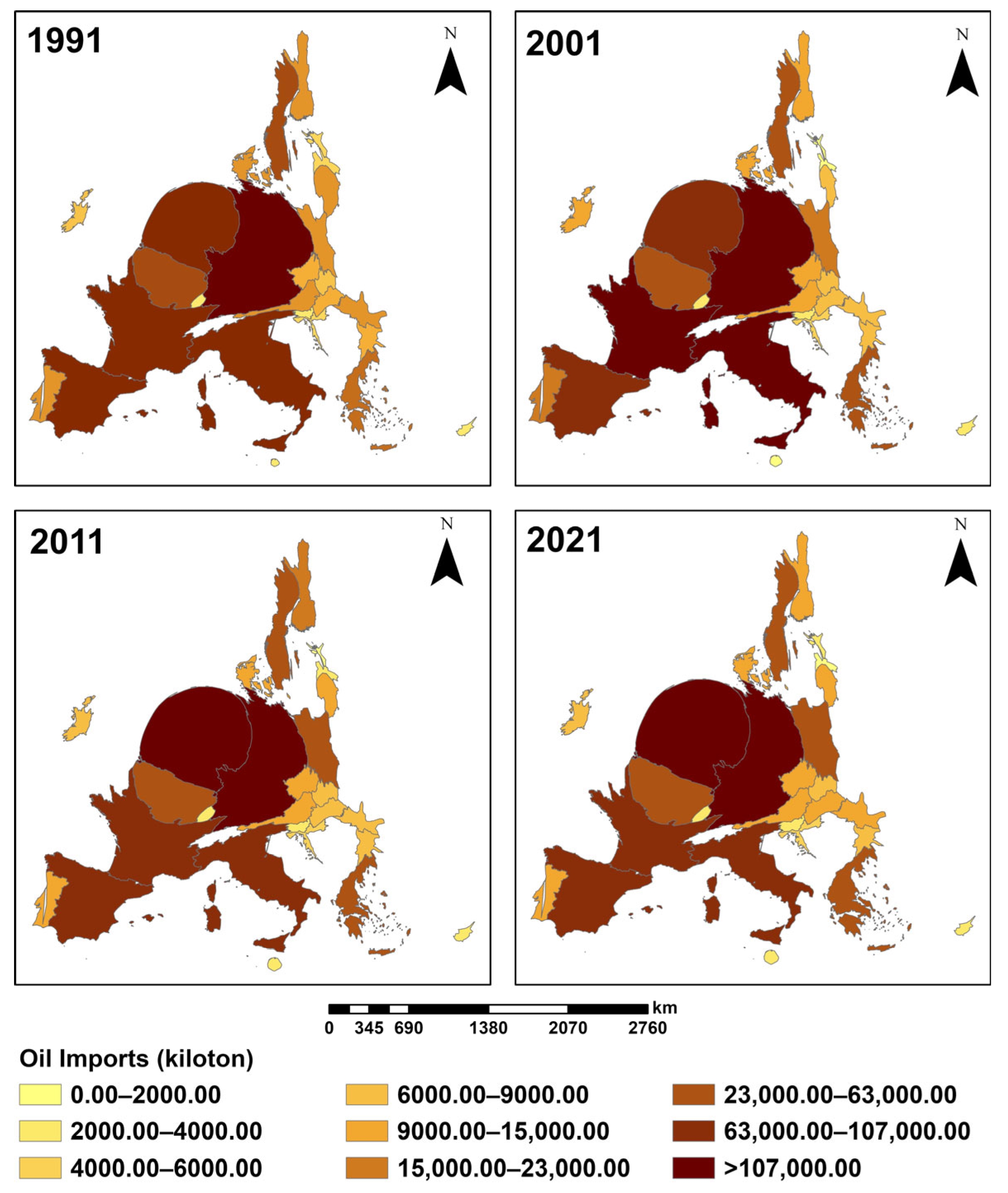

3.2.1. Oil Import

3.2.2. Natural Gas Import

3.3. Evaluation of Energy Security from a Trade Perspective

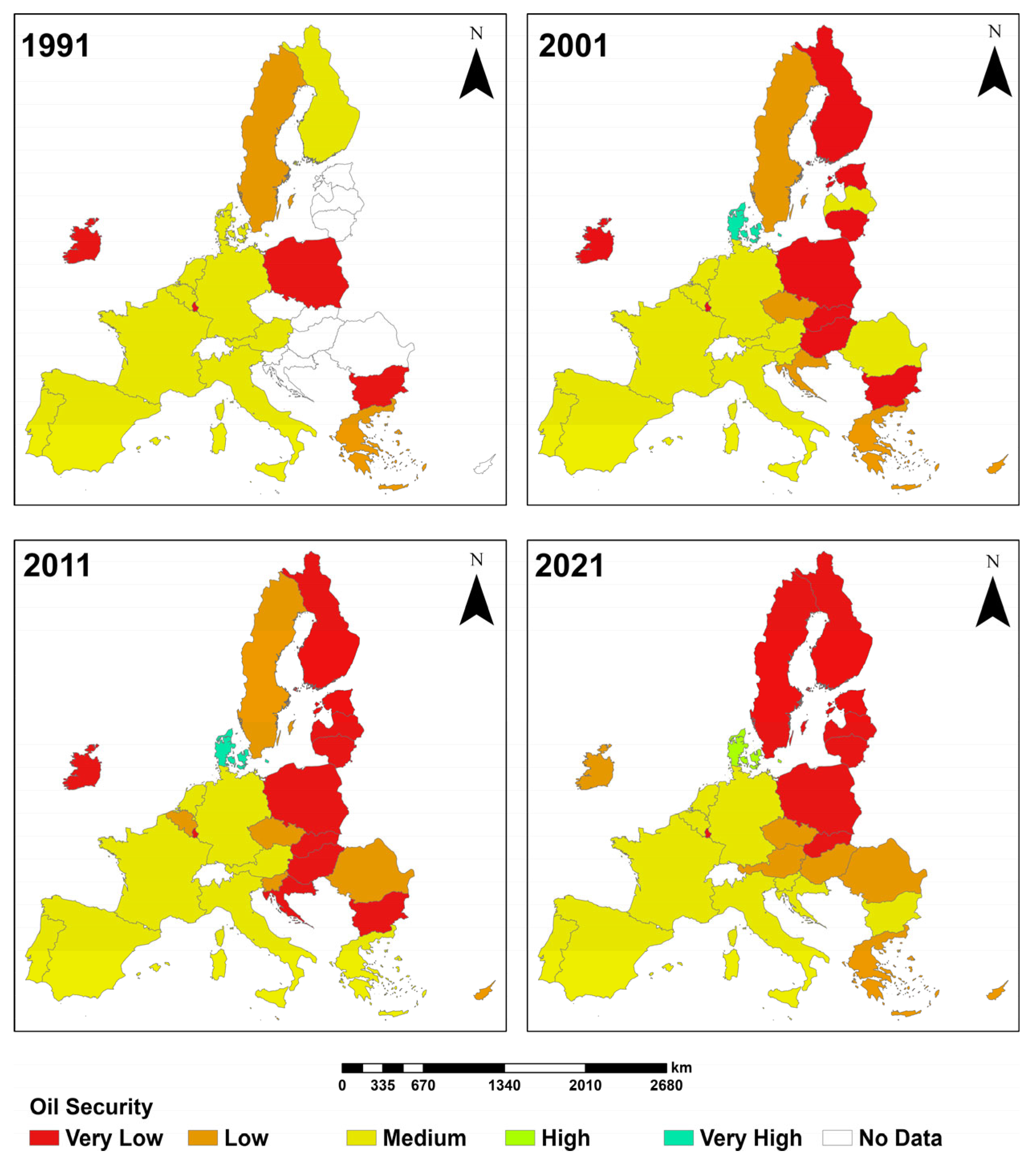

3.3.1. Oil Security

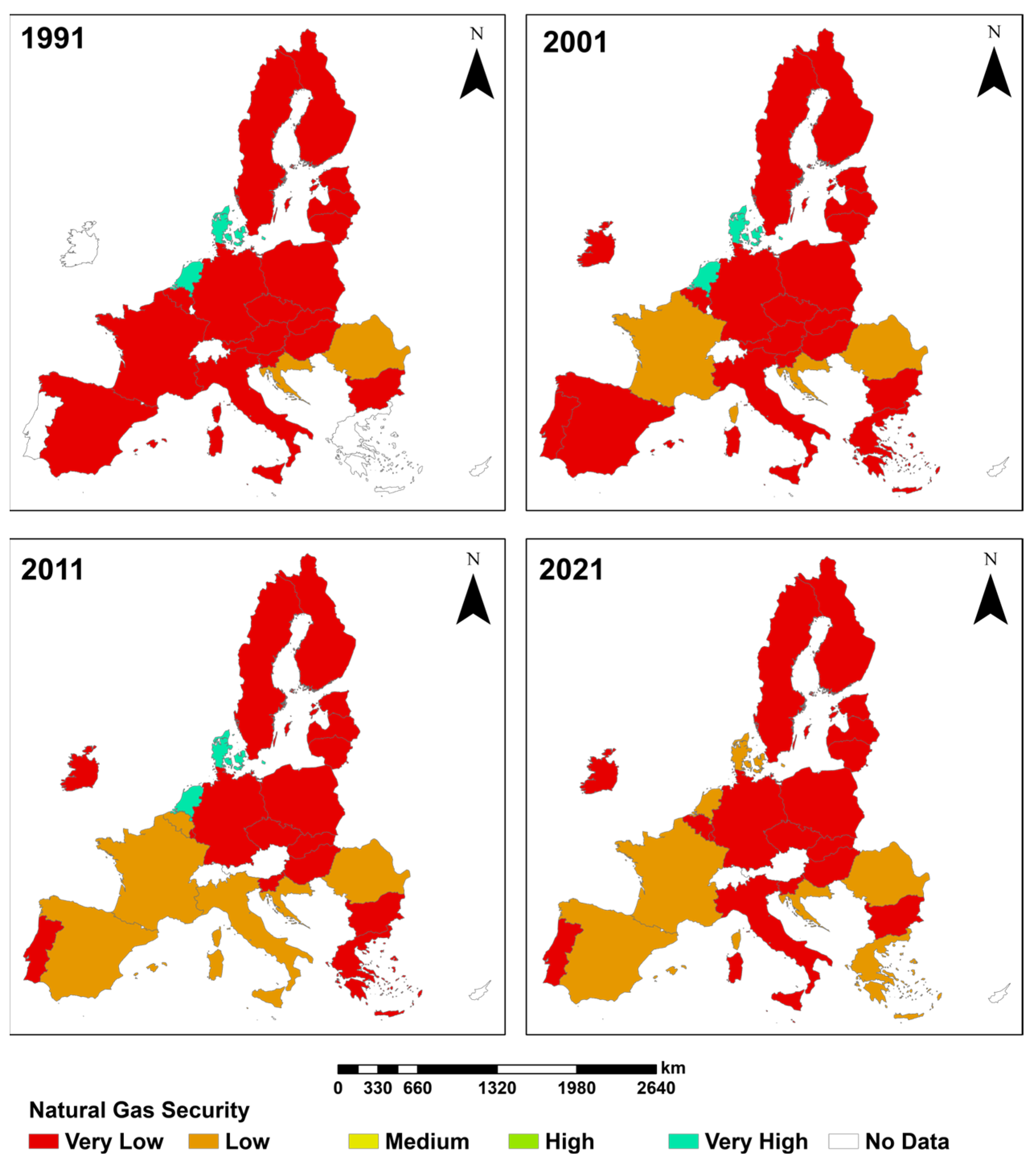

3.3.2. Natural Gas Security

3.3.3. Energy Security

4. Discussion, Conclusions, and Policy Suggestions

4.1. Discussion

4.2. Conclusions

4.3. Policy Suggestions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Martchamadol, J.; Kumar, S. Thailand’s Energy Security Indicators. Renew. Sustain. Energy Rev. 2012, 16, 6103–6122. [Google Scholar] [CrossRef]

- Chester, L. Conceptualising Energy Security and Making Explicit Its Polysemic Nature. Energy Policy 2010, 38, 887–895. [Google Scholar] [CrossRef]

- Sovacool, B.K. (Ed.) The Routledge Handbook of Energy Security; Routledge: London, UK, 2011; ISBN 978-0-415-59117-1. [Google Scholar]

- Demski, C.; Poortinga, W.; Pidgeon, N. Exploring Public Perceptions of Energy Security Risks in the UK. Energy Policy 2014, 66, 369–378. [Google Scholar] [CrossRef]

- Bompard, E.; Carpignano, A.; Erriquez, M.; Grosso, D.; Pession, M.; Profumo, F. National Energy Security Assessment in a Geopolitical Perspective. Energy 2017, 130, 144–154. [Google Scholar] [CrossRef]

- Ellabban, O.; Abu-Rub, H.; Blaabjerg, F. Renewable Energy Resources: Current Status, Future Prospects and Their Enabling Technology. Renew. Sustain. Energy Rev. 2014, 39, 748–764. [Google Scholar] [CrossRef]

- Escribano Francés, G.; Marín-Quemada, J.M.; San Martín González, E. RES and Risk: Renewable Energy’s Contribution to Energy Security. A Portfolio-Based Approach. Renew. Sustain. Energy Rev. 2013, 26, 549–559. [Google Scholar] [CrossRef]

- Vivoda, V. Evaluating Energy Security in the Asia-Pacific Region: A Novel Methodological Approach. Energy Policy 2010, 38, 5258–5263. [Google Scholar] [CrossRef]

- Ang, B.W.; Choong, W.L.; Ng, T.S. Energy Security: Definitions, Dimensions and Indexes. Renew. Sustain. Energy Rev. 2015, 42, 1077–1093. [Google Scholar] [CrossRef]

- Cherp, A.; Jewell, J. The Concept of Energy Security: Beyond the Four As. Energy Policy 2014, 75, 415–421. [Google Scholar] [CrossRef]

- Statistical Review of World Energy 2024. Available online: https://www.energyinst.org/statistical-review (accessed on 15 June 2025).

- BP Statistical Review of World Energy 2021. Available online: https://www.bp.com/content/dam/bp/business-sites/en/global/corporate/pdfs/energy-economics/statistical-review/bp-stats-review-2021-full-report.pdf (accessed on 15 June 2025).

- Casier, T. The Rise of Energy to the Top of the EU-Russia Agenda: From Interdependence to Dependence? Geopolitics 2011, 16, 536–552. [Google Scholar] [CrossRef]

- Cui, L.; Yue, S.; Nghiem, X.-H.; Duan, M. Exploring the Risk and Economic Vulnerability of Global Energy Supply Chain Interruption in the Context of Russo-Ukrainian War. Resour. Policy 2023, 81, 103373. [Google Scholar] [CrossRef]

- Hussain, S.A.; Razi, F.; Hewage, K.; Sadiq, R. The Perspective of Energy Poverty and 1st Energy Crisis of Green Transition. Energy 2023, 275, 127487. [Google Scholar] [CrossRef]

- Farghali, M.; Osman, A.I.; Mohamed, I.M.A.; Chen, Z.; Chen, L.; Ihara, I.; Yap, P.-S.; Rooney, D.W. Strategies to Save Energy in the Context of the Energy Crisis: A Review. Environ. Chem. Lett. 2023, 21, 2003–2039. [Google Scholar] [CrossRef] [PubMed]

- Azzuni, A.; Breyer, C. Definitions and Dimensions of Energy Security: A Literature Review. WIREs Energy Environ. 2018, 7, e268. [Google Scholar] [CrossRef]

- Strojny, J.; Krakowiak-Bal, A.; Knaga, J.; Kacorzyk, P. Energy Security: A Conceptual Overview. Energies 2023, 16, 5042. [Google Scholar] [CrossRef]

- International Energy Agency Towards a Sustainable Energy Future 2001. International Energy Agency Towards a Sustainable Energy Future 2001. Available online: https://www.iea.org/reports/towards-a-sustainable-energy-future (accessed on 18 March 2025).

- European Commission Green Paper: Towards a European Strategy for the Security of Energy Supply 2000. Available online: https://op.europa.eu/en/publication-detail/-/publication/0ef8d03f-7c54-41b6-ab89-6b93e61fd37c/language-en (accessed on 19 March 2025).

- Andrews, C.J. Energy Security as a Rationale for Governmental Action. IEEE Technol. Soc. Mag. 2005, 24, 16–25. [Google Scholar] [CrossRef]

- Intharak, N.; Julay, J.H.; Nakanishi, S.; Matsumoto, T.; Mat Sahid, E.J.; Ormeno Aquino, A.G.; Aponte, A.A. A Quest for Energy Security in the 21st Century: Resources and Constraints; Inst. of Energy Economics: Tokyo, Japan, 2007; ISBN 978-4-931482-35-7. [Google Scholar]

- Rodríguez-Fernández, L.; Carvajal, A.B.F.; De Tejada, V.F. Improving the Concept of Energy Security in an Energy Transition Environment: Application to the Gas Sector in the European Union. Extr. Ind. Soc. 2022, 9, 101045. [Google Scholar] [CrossRef]

- Winzer, C. Conceptualizing Energy Security. Energy Policy 2012, 46, 36–48. [Google Scholar] [CrossRef]

- Cox, E. Assessing Long-Term Energy Security: The Case of Electricity in the United Kingdom. Renew. Sustain. Energy Rev. 2018, 82, 2287–2299. [Google Scholar] [CrossRef]

- Designing Indicators of Long-Term Energy Supply Security. Available online: https://publicaties.ecn.nl/PdfFetch.aspx?nr=ECN-C--04-007 (accessed on 4 May 2025).

- Matsumoto, K.; Doumpos, M.; Andriosopoulos, K. Historical Energy Security Performance in EU Countries. Renew. Sustain. Energy Rev. 2018, 82, 1737–1748. [Google Scholar] [CrossRef]

- Chalvatzis, K.J.; Ioannidis, A. Energy Supply Security in the EU: Benchmarking Diversity and Dependence of Primary Energy. Appl. Energy 2017, 207, 465–476. [Google Scholar] [CrossRef]

- Cohen, G.; Joutz, F.; Loungani, P. Measuring Energy Security: Trends in the Diversification of Oil and Natural Gas Supplies. Energy Policy 2011, 39, 4860–4869. [Google Scholar] [CrossRef]

- Yu, Z.; Li, J.; Yang, G. A Review of Energy Security Index Dimensions and Organization. Energy Res. Lett. 2022, 3, 1–5. [Google Scholar] [CrossRef]

- Narula, K.; Reddy, B.S. Three Blind Men and an Elephant: The Case of Energy Indices to Measure Energy Security and Energy Sustainability. Energy 2015, 80, 148–158. [Google Scholar] [CrossRef]

- Axon, C.J.; Darton, R.C. Sustainability and Risk—A Review of Energy Security. Sustain. Prod. Consum. 2021, 27, 1195–1204. [Google Scholar] [CrossRef]

- U.S. Chamber of Commerce’s Global Energy Institute Index of U.S. Energy Security Risk: Assessing America’s Vulnerabilities in a Global Energy Market 2020. Available online: https://www.uschamber.com/energy/index-of-us-energy-security-risk-assessing-americas-vulnerabilities-global-energy-market (accessed on 10 May 2025).

- Jewell, J. The IEA Model of Short-Term Energy Security (MOSES): Primary Energy Sources and Secondary Fuels. IEA Energy Papers 2011, 17, 1–43. [Google Scholar] [CrossRef]

- Rabbi, M.F.; Popp, J.; Máté, D.; Kovács, S. Energy Security and Energy Transition to Achieve Carbon Neutrality. Energies 2022, 15, 8126. [Google Scholar] [CrossRef]

- Lambert, L.A.; Tayah, J.; Lee-Schmid, C.; Abdalla, M.; Abdallah, I.; Ali, A.H.M.; Esmail, S.; Ahmed, W. The EU’s Natural Gas Cold War and Diversification Challenges. Energy Strategy Rev. 2022, 43, 100934. [Google Scholar] [CrossRef]

- Rokicki, T.; Bórawski, P.; Szeberényi, A. The Impact of the 2020–2022 Crises on EU Countries’ Independence from Energy Imports, Particularly from Russia. Energies 2023, 16, 6629. [Google Scholar] [CrossRef]

- Zhang, X.; Meng, X.; Su, C.W. The Security of Energy Import: Do Economic Policy Uncertainty and Geopolitical Risk Really Matter? Econ. Anal. Policy 2024, 82, 377–388. [Google Scholar] [CrossRef]

- Costantini, V.; Gracceva, F.; Markandya, A.; Vicini, G. Security of Energy Supply: Comparing Scenarios from a European Perspective. Energy Policy 2007, 35, 210–226. [Google Scholar] [CrossRef]

- Lehocký, F.; Rusnák, J. Regional Specialization and Geographic Concentration: Experiences from Slovak Industry. Misc. Geogr. 2016, 20, 5–13. [Google Scholar] [CrossRef]

- Berndt, E.R. Energy Price Increases and the Productivity Measurement. Annu. Rev. Energy 1978, 3, 225–273. [Google Scholar] [CrossRef]

- Cleveland, C.J.; Kaufmann, R.K.; Stern, D.I. Aggregation and the Role of Energy in the Economy. Ecol. Econ. 2000, 32, 301–317. [Google Scholar] [CrossRef]

- Liao, H.; Wei, Y.-M. China’s Energy Consumption: A Perspective from Divisia Aggregation Approach. Energy 2010, 35, 28–34. [Google Scholar] [CrossRef]

- U.S. Department of Justice and the Federal Trade Commission Horizontal Merger Guidelines 2010. Available online: https://www.justice.gov/atr/horizontal-merger-guidelines-08192010#5c (accessed on 15 April 2025).

- Eurostat. Available online: https://ec.europa.eu/eurostat/en (accessed on 15 June 2025).

- IEA. Available online: https://www.iea.org/data-and-statistics/data-product/energy-prices (accessed on 15 June 2025).

- Paraschiv, S.; Paraschiv, L.S. Trends of Carbon Dioxide (CO2) Emissions from Fossil Fuels Combustion (Coal, Gas and Oil) in the EU Member States from 1960 to 2018. Energy Rep. 2020, 6, 237–242. [Google Scholar] [CrossRef]

- Nitoiu, C. Towards Conflict or Cooperation? The Ukraine Crisis and EU-Russia Relations. Southeast Eur. Black Sea Stud. 2016, 16, 375–390. [Google Scholar] [CrossRef][Green Version]

- Landry, P. The EU Strategy for Gas Security: Threats, Vulnerabilities and Processes. Energy Policy 2020, 144, 111507. [Google Scholar] [CrossRef]

- Van Thienen-Visser, K.; Breunese, J.N. Induced Seismicity of the Groningen Gas Field: History and Recent Developments. Lead. Edge 2015, 34, 664–671. [Google Scholar] [CrossRef]

- Elbassoussy, A. European Energy Security Dilemma: Major Challenges and Confrontation Strategies. Rev. Econ. Political Sci. 2019, 4, 321–343. [Google Scholar] [CrossRef]

- Streimikiene, D.; Siksnelyte-Butkiene, I.; Lekavicius, V. Energy Diversification and Security in the EU: Comparative Assessment in Different EU Regions. Economies 2023, 11, 83. [Google Scholar] [CrossRef]

- Lekavičius, V.; Balsiūnaitė, R.; Bobinaitė, V.; Konstantinavičiūtė, I.; Rimkūnaitė, K.; Štreimikienė, D.; Tarvydas, D. The Diversification of Energy Resources and Equipment Imports in the European Union. Energy 2024, 307, 132595. [Google Scholar] [CrossRef]

- Gajdzik, B.; Wolniak, R.; Nagaj, R.; Žuromskaitė-Nagaj, B.; Grebski, W.W. The Influence of the Global Energy Crisis on Energy Efficiency: A Comprehensive Analysis. Energies 2024, 17, 947. [Google Scholar] [CrossRef]

- Gajdzik, B.; Wolniak, R.; Nagaj, R.; Žuromskaitė-Nagaj, B.; Grebski, W. Energy Waste as a Side-Effect of Photovoltaic Development: Net Impact of Photovoltaics on CO2 Emissions in European Union Countries. Energies 2024, 18, 78. [Google Scholar] [CrossRef]

- Bachanek, K.H.; Drożdż, W.; Kolon, M. Development of Renewable Energy Sources in Poland and Stability of Power Grids—Challenges, Technologies, and Adaptation Strategies. Energies 2025, 18, 2036. [Google Scholar] [CrossRef]

- Do, H.X.; Nepal, R.; Pham, S.D.; Jamasb, T. Electricity Market Crisis in Europe and Cross Border Price Effects: A Quantile Return Connectedness Analysis. Energy Econ. 2024, 135, 107633. [Google Scholar] [CrossRef]

- Thanh, T.T.; Ha, L.T.; Dung, H.P.; Huong, T.T.L. Impacts of Digitalization on Energy Security: Evidence from European Countries. Environ. Dev. Sustain. 2023, 25, 11599–11644. [Google Scholar] [CrossRef] [PubMed]

- Mišík, M. The EU Needs to Improve Its External Energy Security. Energy Policy 2022, 165, 112930. [Google Scholar] [CrossRef]

| Geographical Concentration | <1500 | 1500–2500 | >2500 | |

|---|---|---|---|---|

| Import Dependency | ||||

| <0 | Very high | Very high | Very high | |

| 0–50% | High | Medium | Low | |

| >50% | Medium | Low | Very low | |

| 1991 | 2001 | 2011 | 2021 | ||||

|---|---|---|---|---|---|---|---|

| Partner | Share | Partner | Share | Partner | Share | Partner | Share |

| Saudi Arabia | 12.15% | Russia | 20.61% | Russia | 27.54% | Russia | 22.56% |

| Libya | 8.38% | Norway | 10.60% | UK | 6.00% | US | 6.98% |

| Iran | 7.61% | UK | 8.96% | Norway | 5.54% | Norway | 6.76% |

| UK | 7.42% | Saudi Arabia | 7.13% | Saudi Arabia | 5.44% | Libya | 4.74% |

| Norway | 6.39% | Libya | 6.27% | Kazakhstan | 3.85% | Kazakhstan | 4.69% |

| Nigeria | 4.79% | Iran | 3.94% | Iran | 3.64% | Iraq | 4.21% |

| Algeria | 4.14% | Algeria | 3.51% | Nigeria | 3.54% | UK | 4.15% |

| Russia | 3.87% | Nigeria | 3.22% | Azerbaijan | 3.11% | Saudi Arabia | 4.04% |

| Mexico | 2.43% | Syria | 2.70% | US | 2.59% | Nigeria | 3.86% |

| Egypt | 1.76% | Iraq | 2.54% | Iraq | 2.25% | Azerbaijan | 2.65% |

| Sum | 58.95% | Sum | 69.48% | Sum | 63.49% | Sum | 64.63% |

| 1991 | 2001 | 2011 | 2021 | ||||

|---|---|---|---|---|---|---|---|

| Partner | Share | Partner | Share | Partner | Share | Partner | Share |

| Russia | 67.32% | Russia | 46.84% | Russia | 36.36% | Russia | 44.15% |

| Algeria | 19.44% | Norway | 20.64% | Norway | 22.82% | Norway | 16.32% |

| Norway | 11.87% | Algeria | 19.73% | Algeria | 14.39% | Algeria | 12.28% |

| Libya | 0.88% | UK | 4.98% | Qatar | 5.95% | US | 5.65% |

| Sum | 99.52% | Sum | 92.19% | Sum | 79.53% | Sum | 78.40% |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Li, Q.; Song, Z. Research on Energy Security in the EU from a Trade Perspective: A Historical Analysis from 1991 to 2021. Energies 2025, 18, 3801. https://doi.org/10.3390/en18143801

Li Q, Song Z. Research on Energy Security in the EU from a Trade Perspective: A Historical Analysis from 1991 to 2021. Energies. 2025; 18(14):3801. https://doi.org/10.3390/en18143801

Chicago/Turabian StyleLi, Quanxiao, and Zhouying Song. 2025. "Research on Energy Security in the EU from a Trade Perspective: A Historical Analysis from 1991 to 2021" Energies 18, no. 14: 3801. https://doi.org/10.3390/en18143801

APA StyleLi, Q., & Song, Z. (2025). Research on Energy Security in the EU from a Trade Perspective: A Historical Analysis from 1991 to 2021. Energies, 18(14), 3801. https://doi.org/10.3390/en18143801