Detailed Forecast for the Development of Electric Trucks and Tractor Units and Their Power Demand in Hamburg by 2050

Abstract

1. Introduction

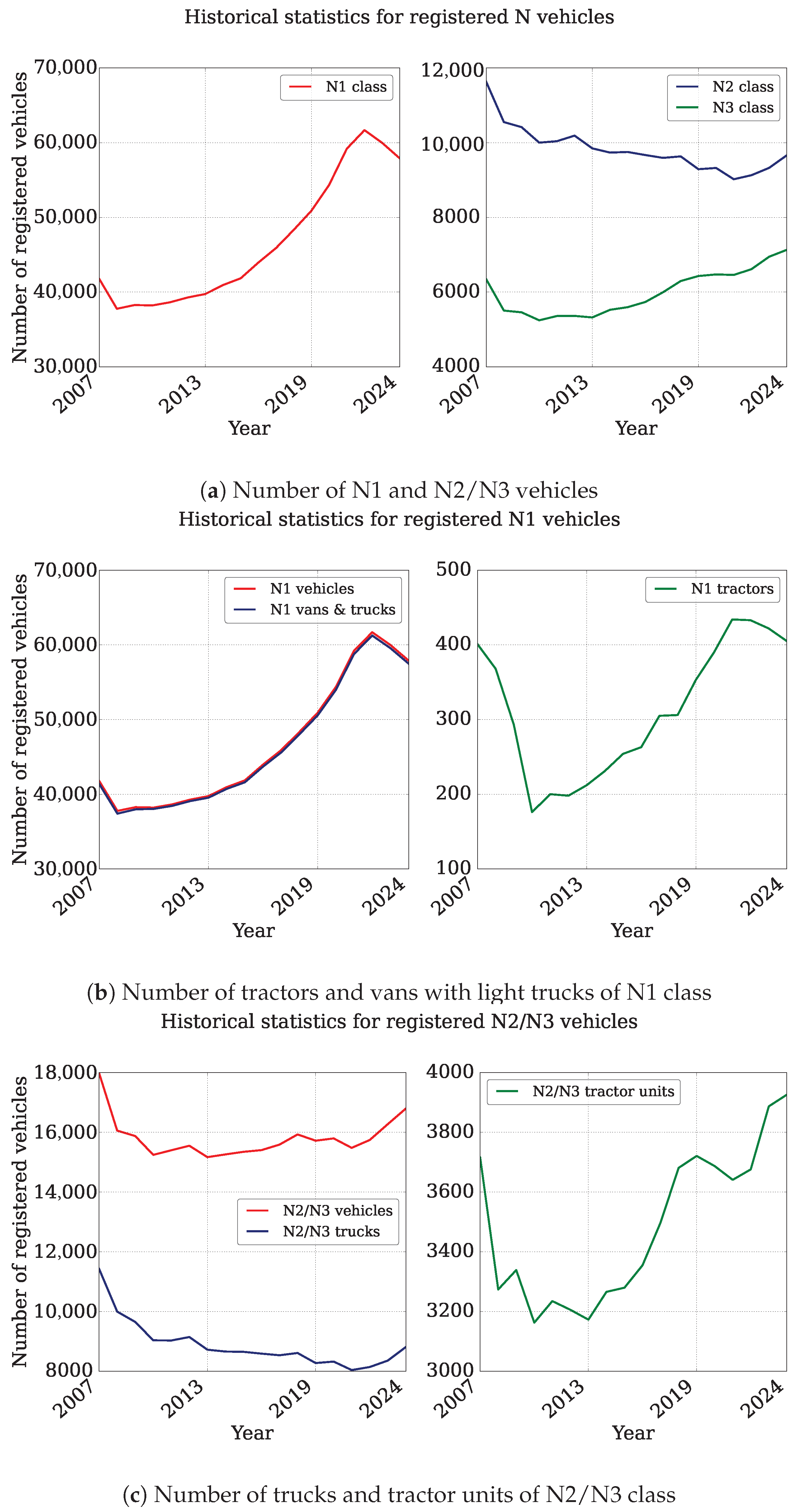

1.1. Classification of Trucks and Tractor Units

- Class N1: vehicles with a permissible total mass of up to 3.5 tons. Small delivery vans and light trucks are the most common in this category.

- Class N2: vehicles with a permissible total mass from 3.5 to 12 tons. Medium-sized trucks and commercial vehicles used for urban distribution are the most common.

- Class N3: vehicles with a permissible total mass over 12 tons. Heavy trucks, tractor units for large trailers, and long-haul transport vehicles are the most common.

- Trucks: motor vehicles for freight transport or with a specific purpose.

- Vans: trucks with integrated driver cabins.

- Semi-trailer tractors: tractors intended primarily for towing semi-trailers.

- Road tractors: tractors intended primarily for towing trailers, besides semi-trailers.

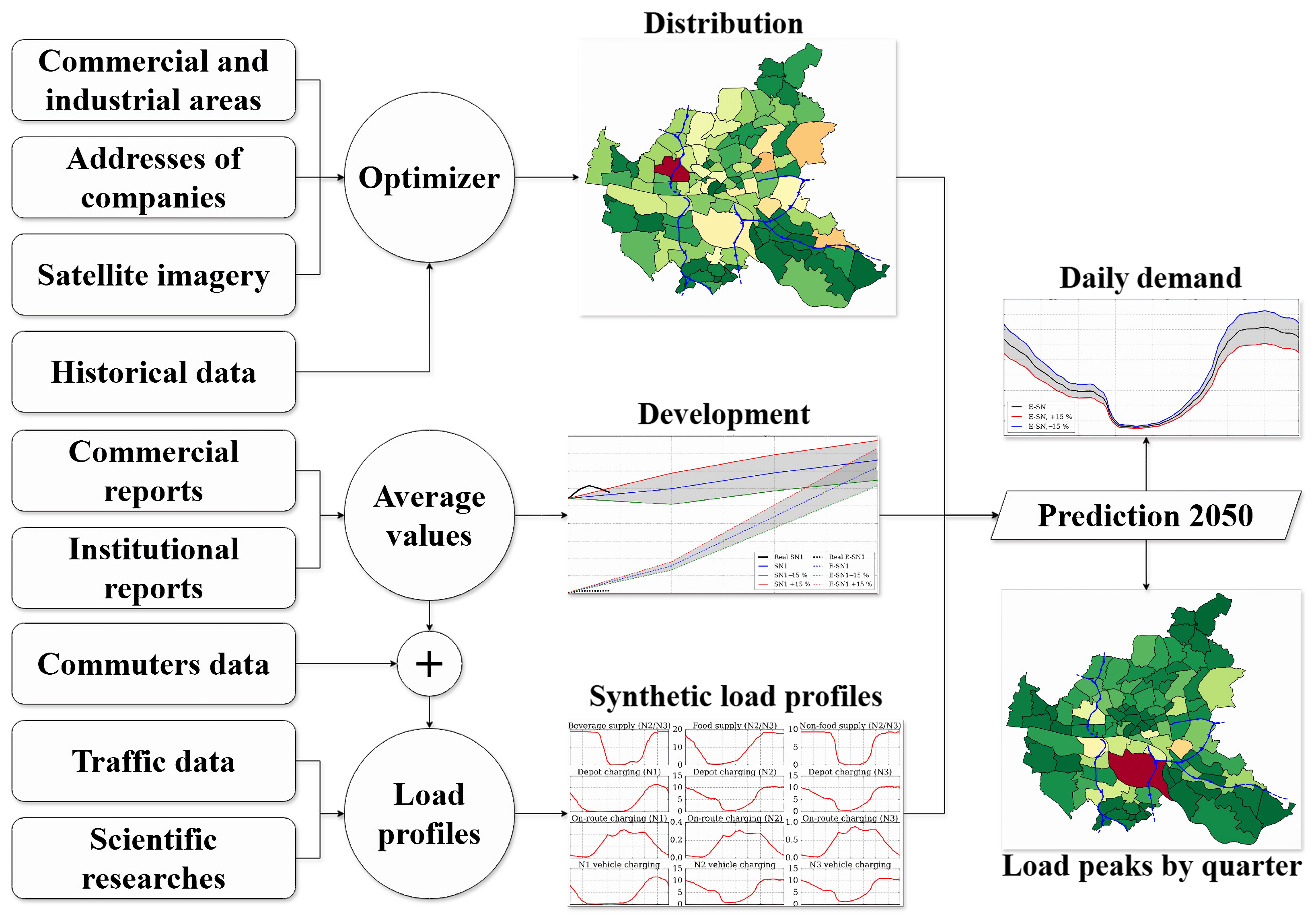

1.2. Contribution of the Paper

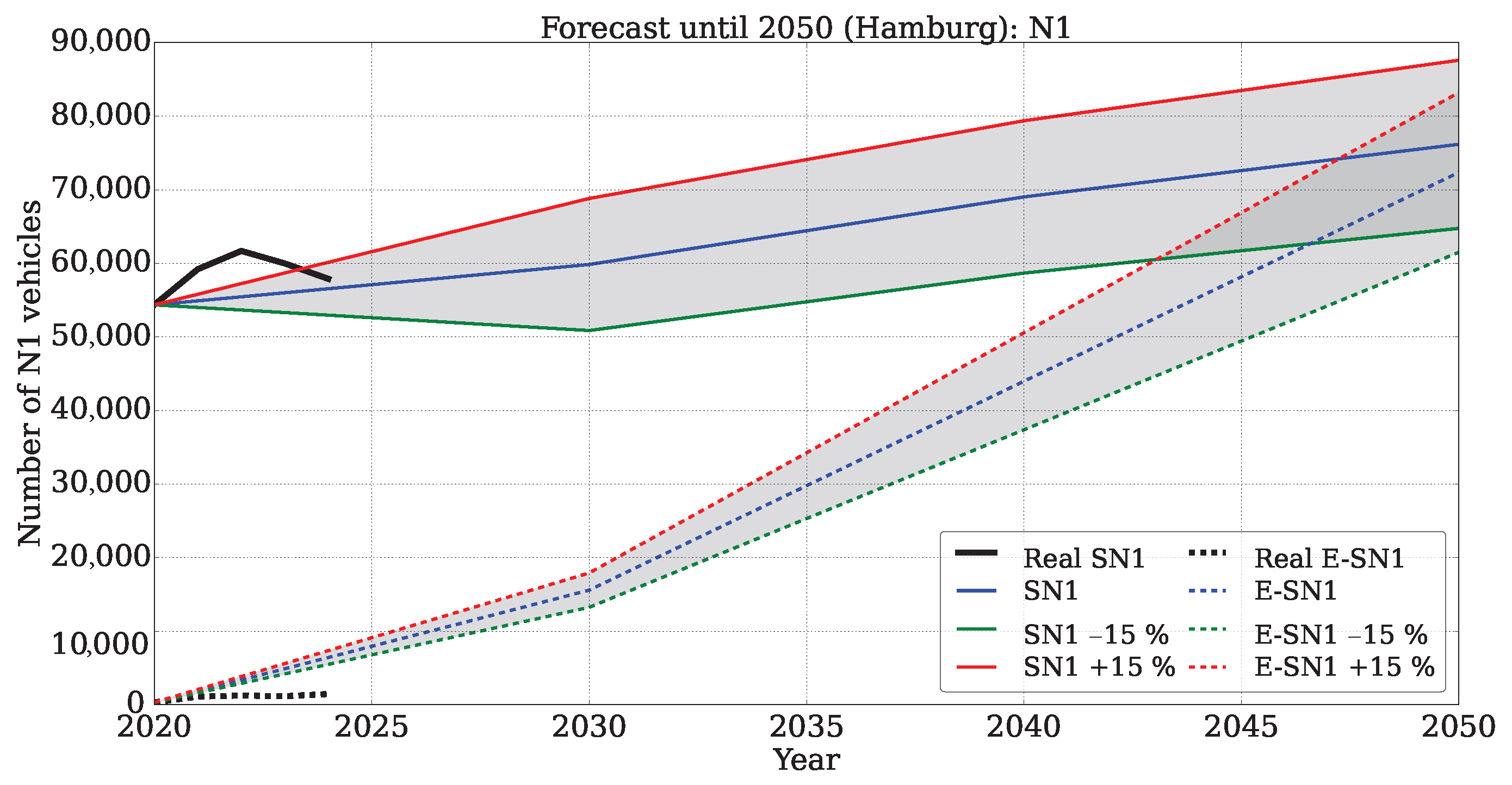

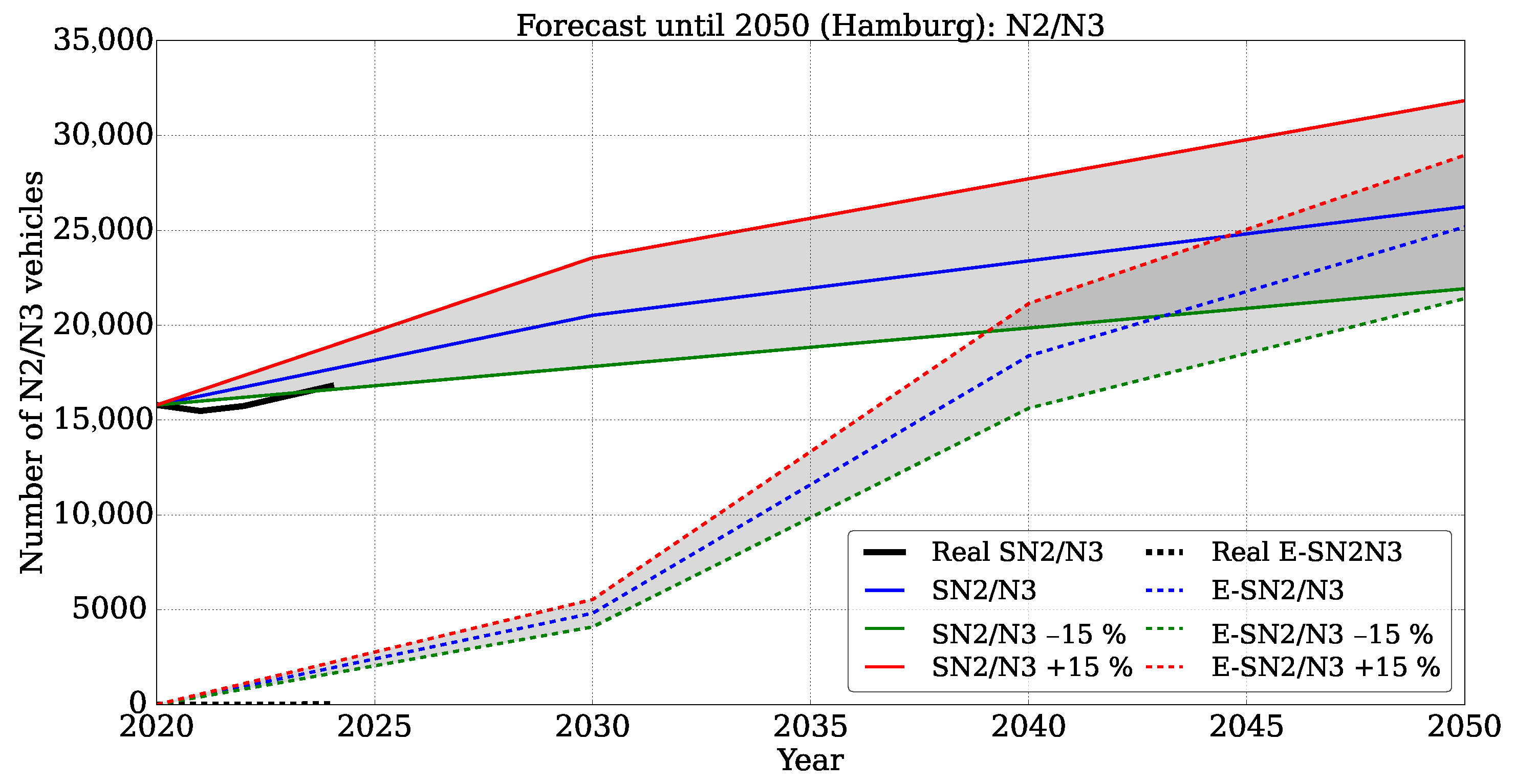

- Main scenarios (SN1 and SN2/N3), including the electrified part (E-SN1, E-SN2/N3);

- Pessimistic scenarios (SN1 +15% and SN2/N3 +15%), including the electrified part (E-SN1 +15%, E-SN2/N3 +15%);

- Optimistic scenarios (SN1 −15% and SN2/N3 −15%), including the electrified part (E-SN1 −15%, E-SN2/N3 −15%).

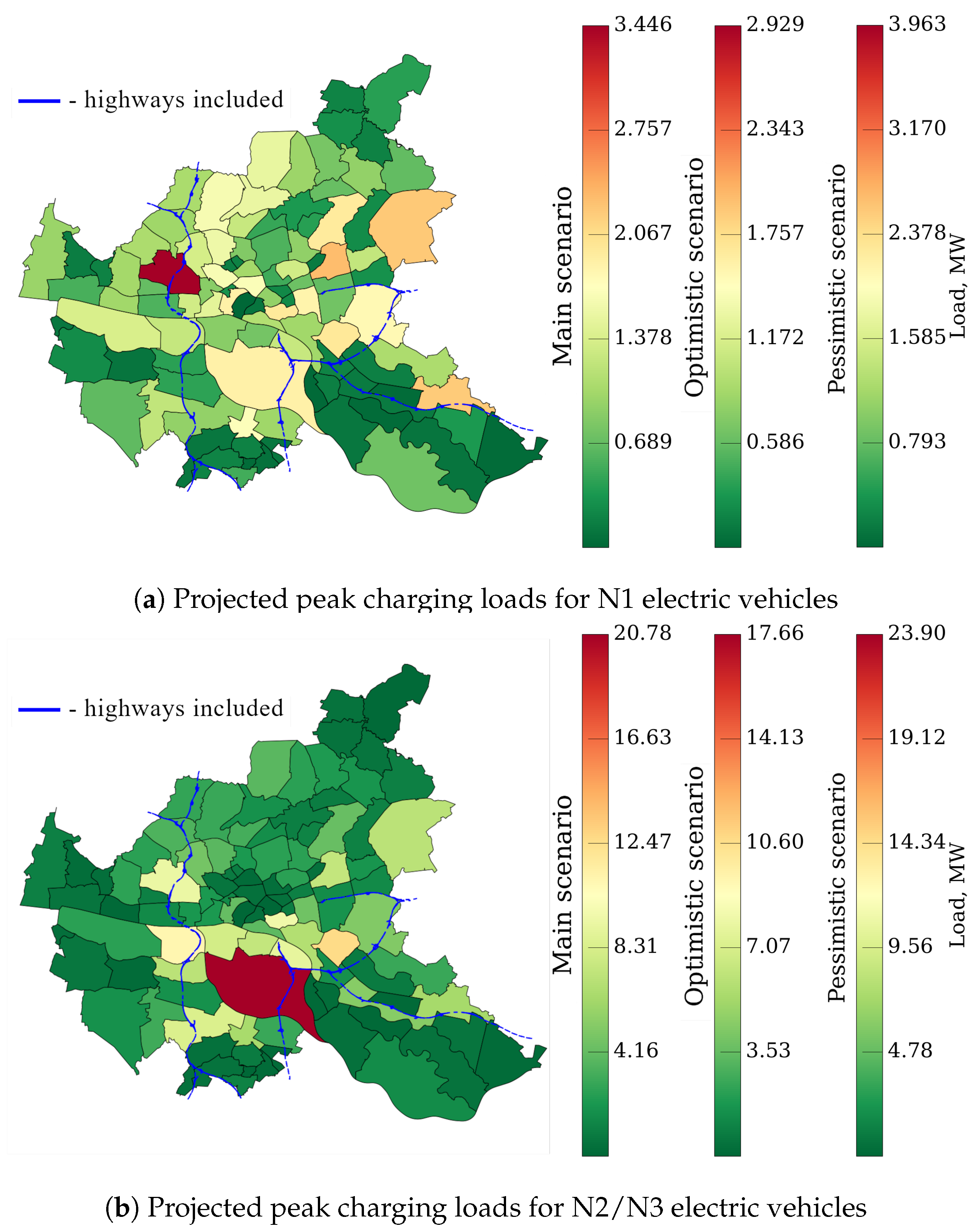

- Prediction of N class vehicle development in Hamburg up to 2050, based on a comprehensive meta-study approach.

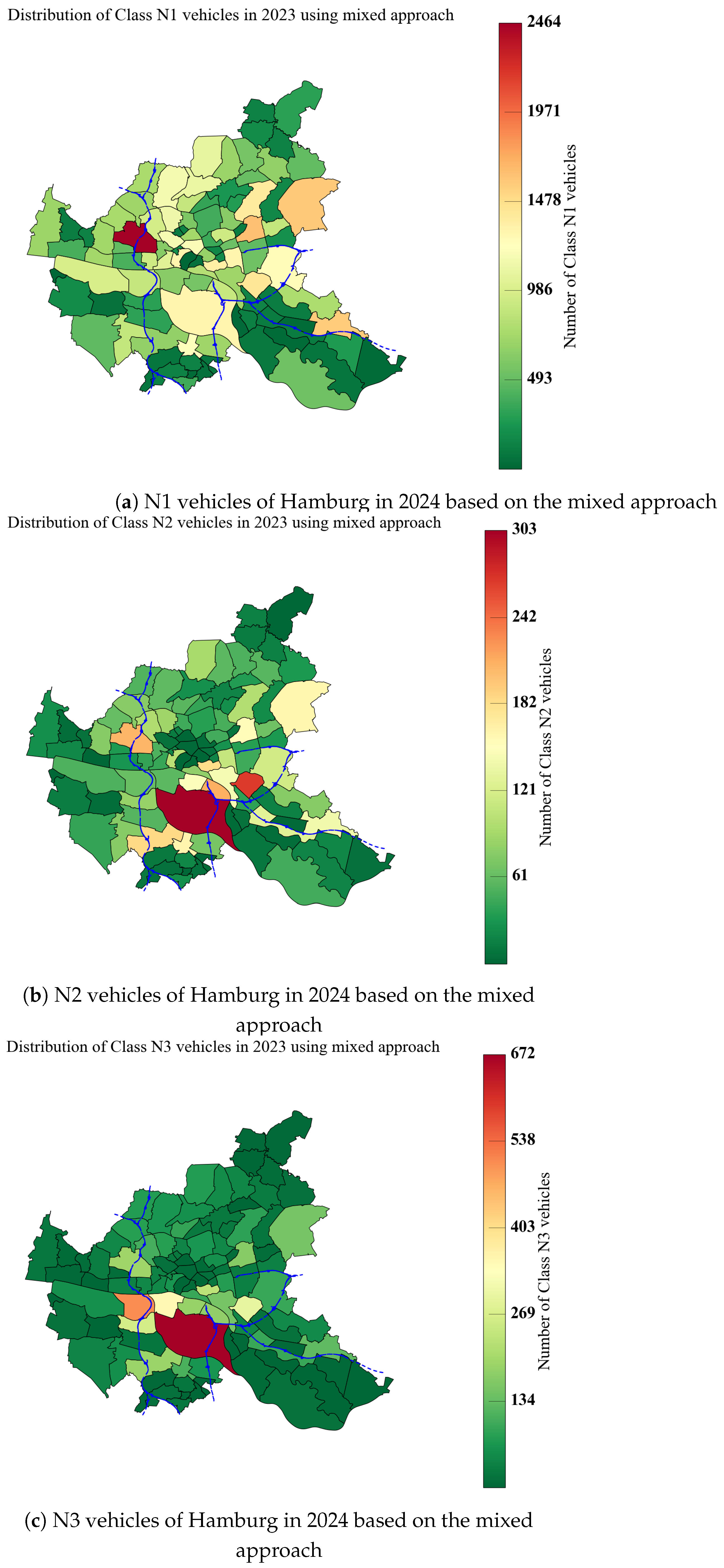

- Development of a methodology for analyzing the geographical distribution of electric heavy-duty vehicles at a granular city-quarter level.

- Detailed forecast of power demand associated with electric heavy-duty vehicles for each of Hamburg’s 103 city quarters by 2050.

1.3. Organization of the Paper

2. Historical Data and Statistics

2.1. Trend of New Registrations

2.2. Distribution by Economic Sector

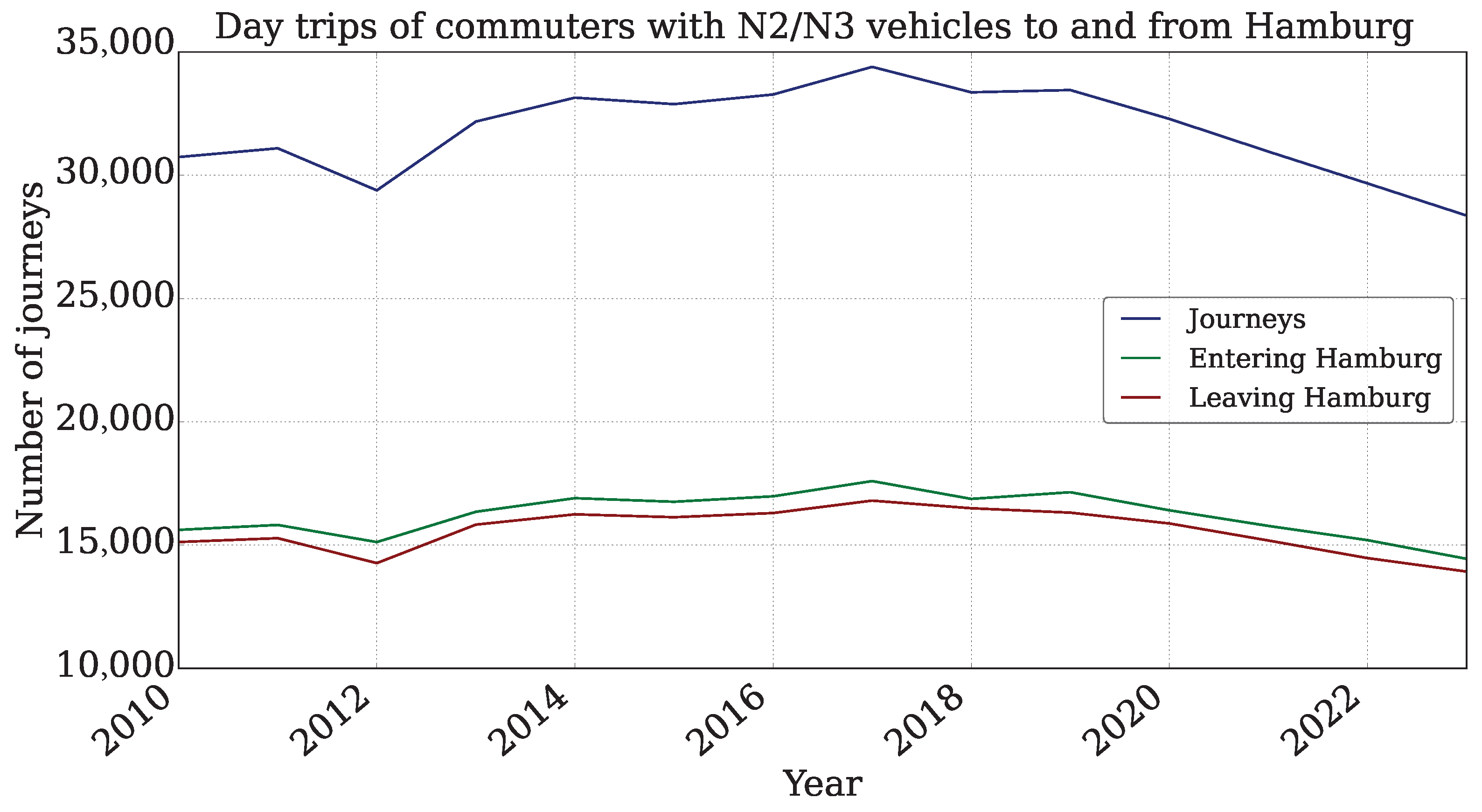

2.3. Traffic Activity and Commuters

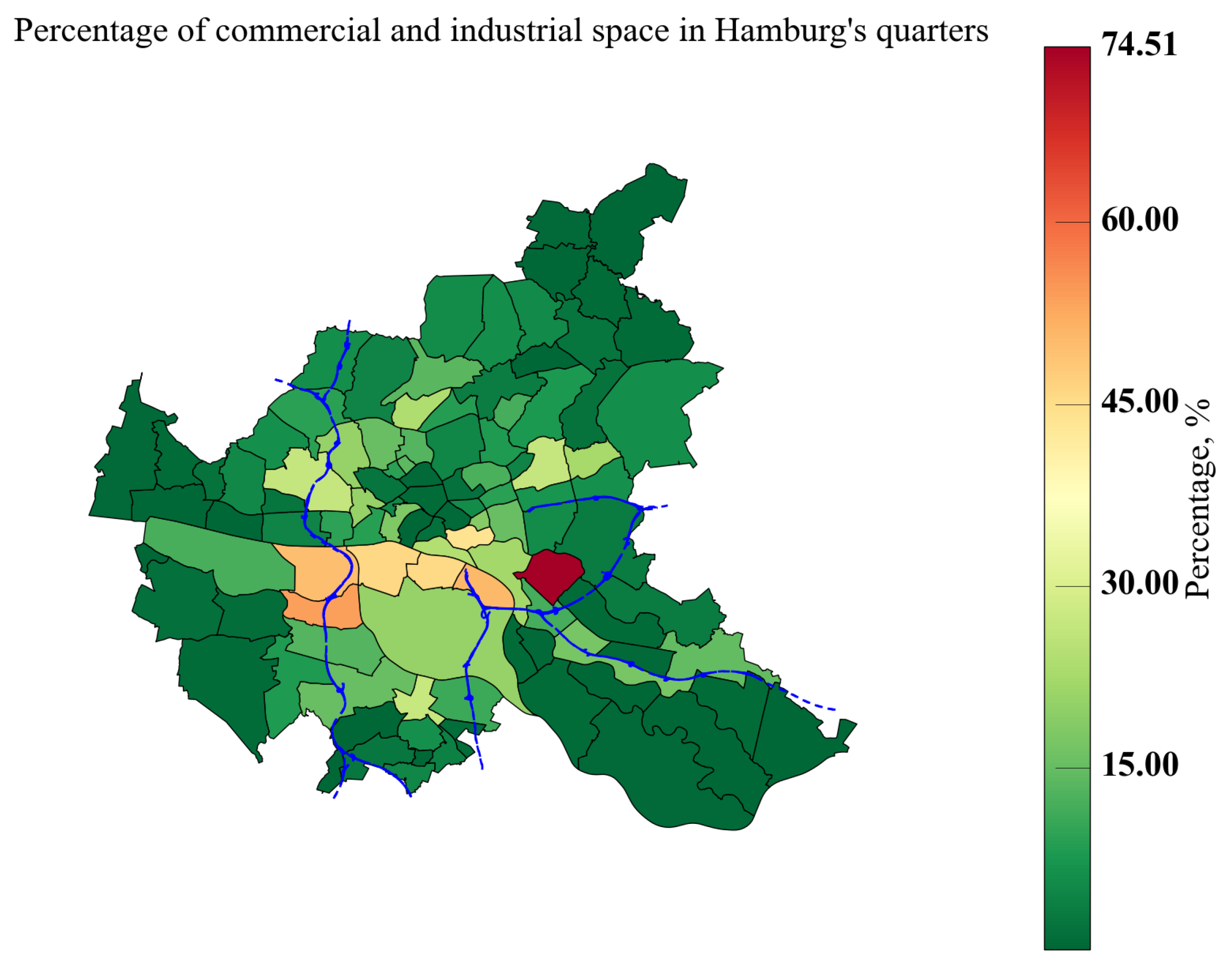

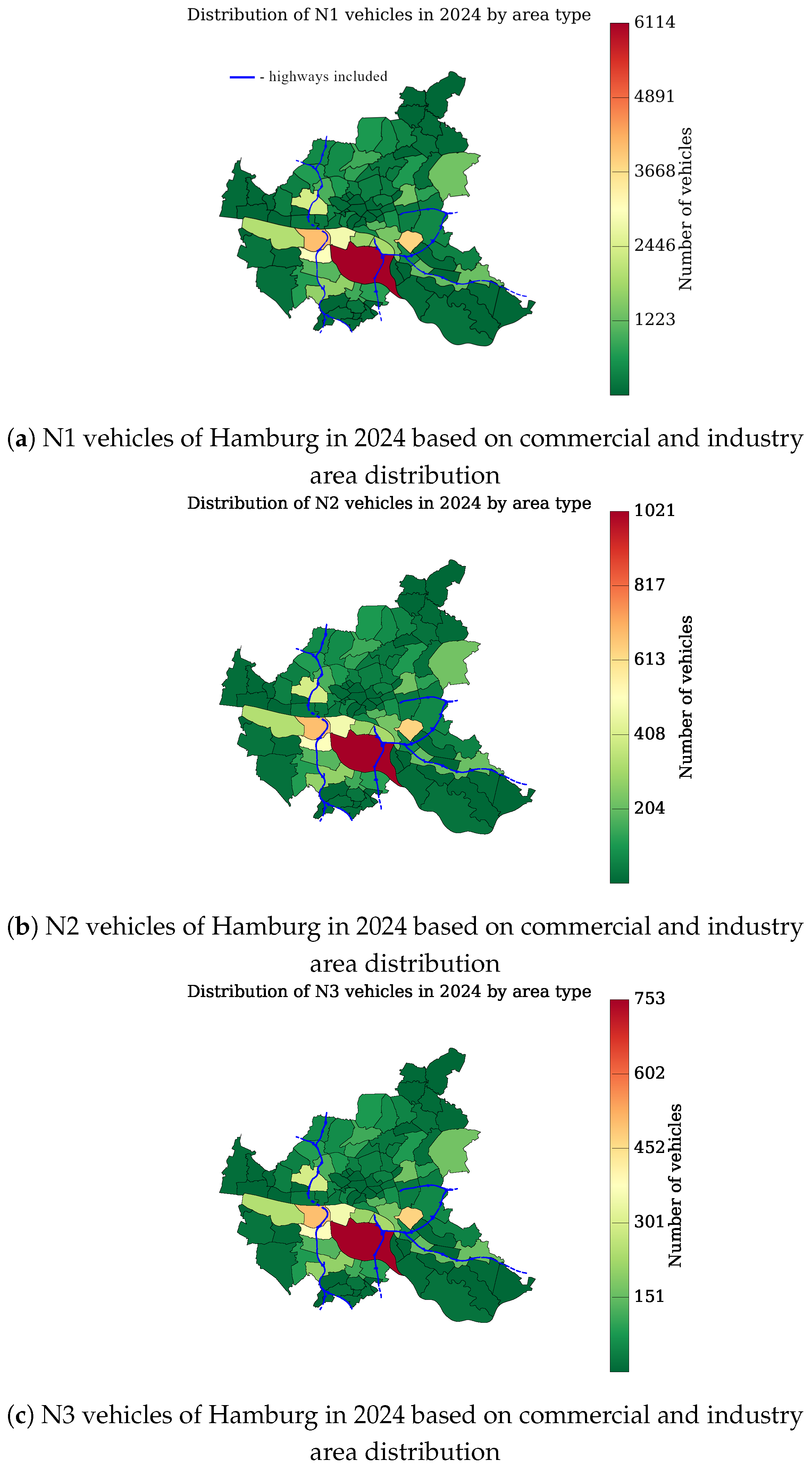

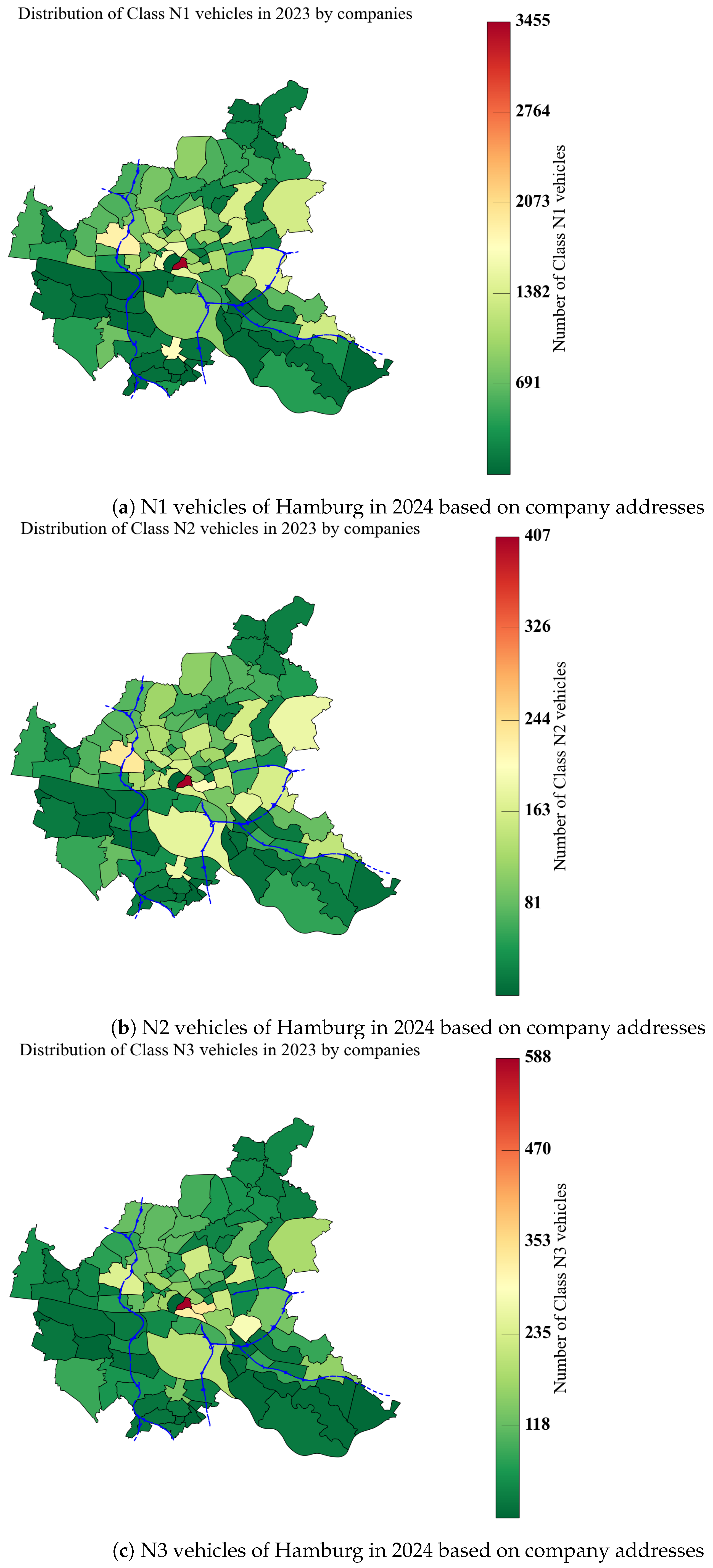

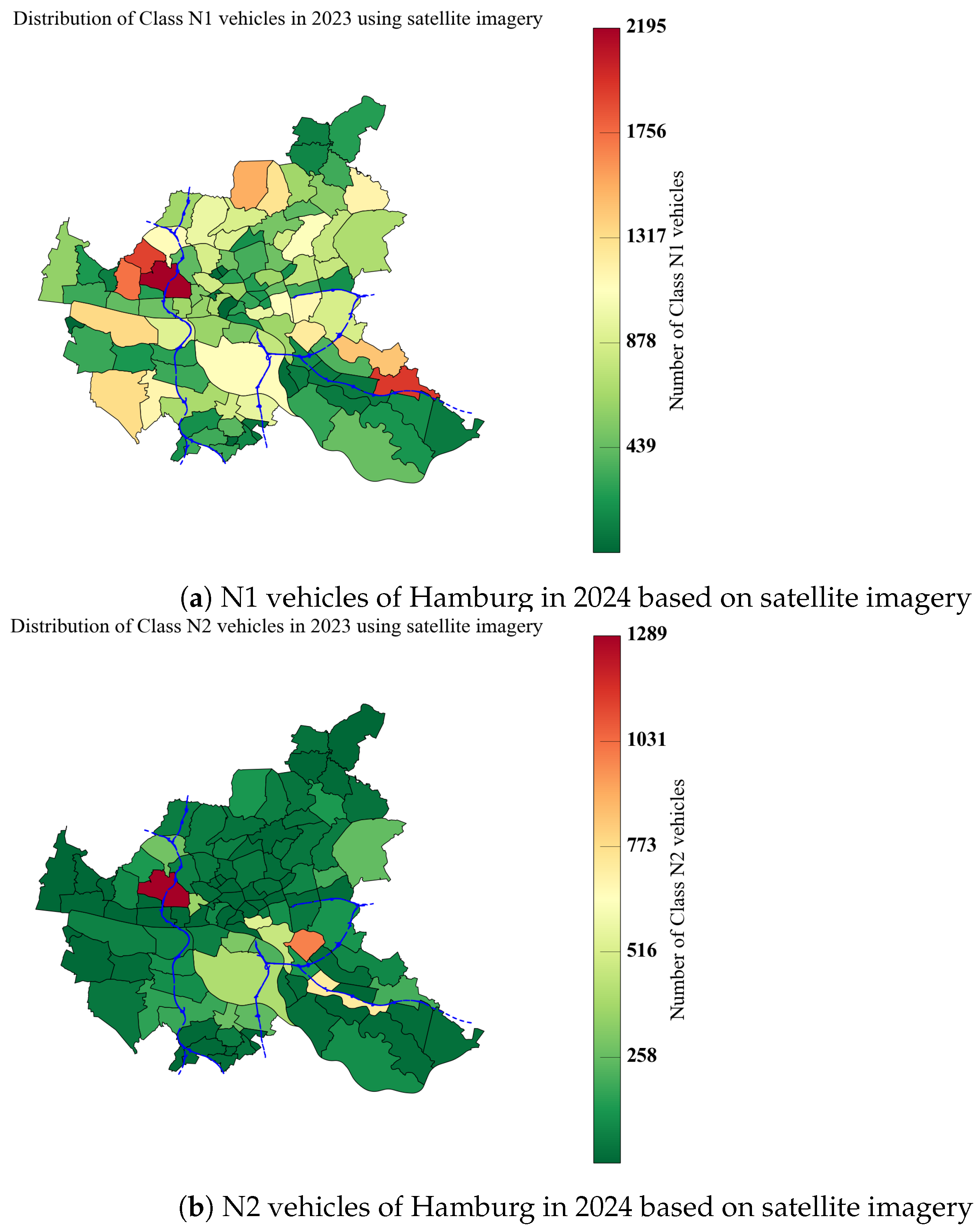

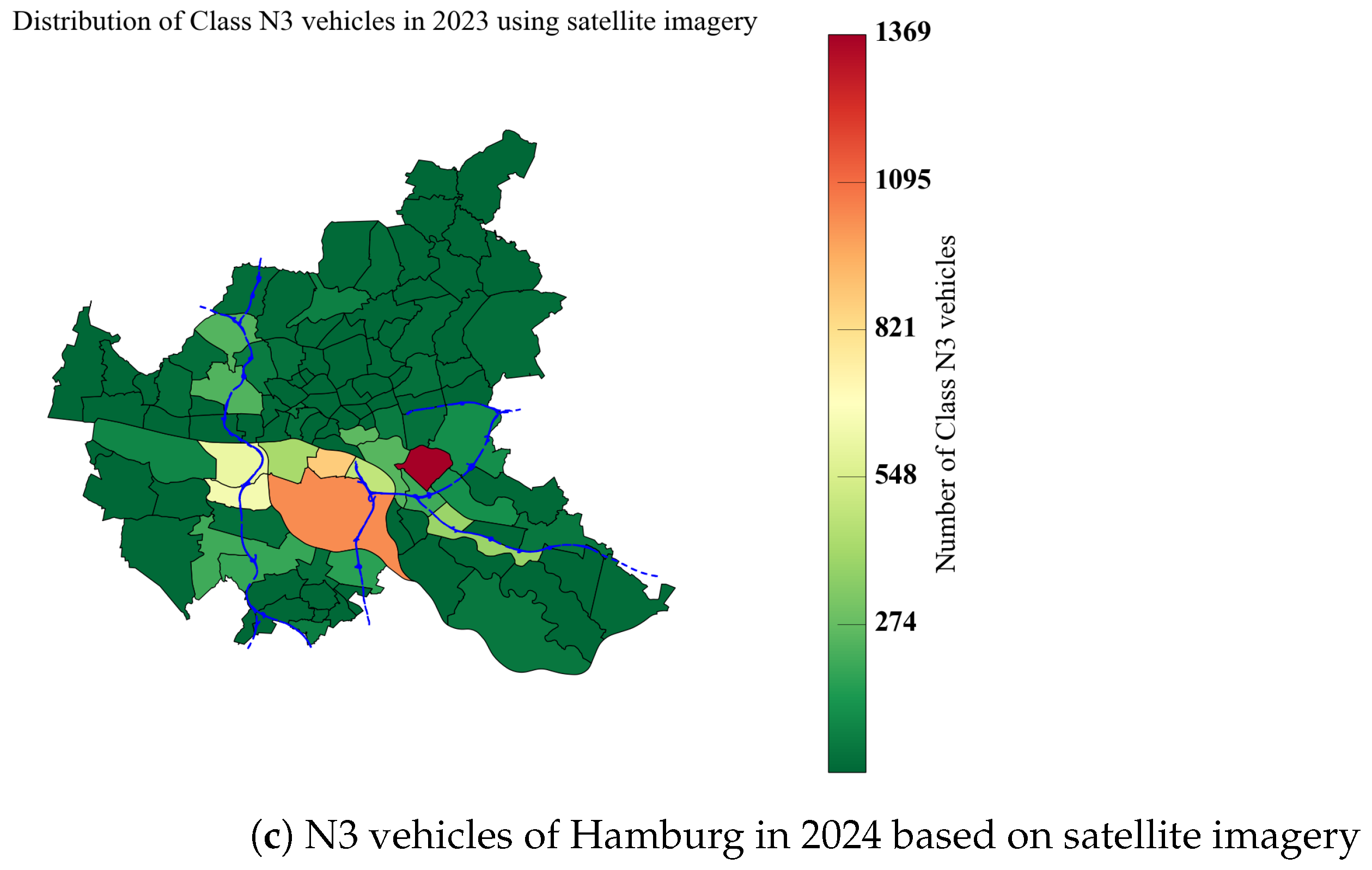

3. Distribution by City Quarters

- Commercial and industrial areas in each quarter from the Hamburg Real Estate Market Report 2020, which provides information on the distribution of these areas [33].

- Company address data from the Hamburg Telephone Directory [34] for each quarter is examined and taken into account.

- Estimation of the number of trucks and tractor units parked in parking lots in each quarter using satellite imagery [35]. Truck dealer parking lots are excluded.

MILP-Based Approach of Distribution by City Quarters

4. Ramp-Up Scenarios in Hamburg

4.1. Ramp-Up of N1 Vehicles

4.2. Ramp-Up of N2/N3 Vehicles

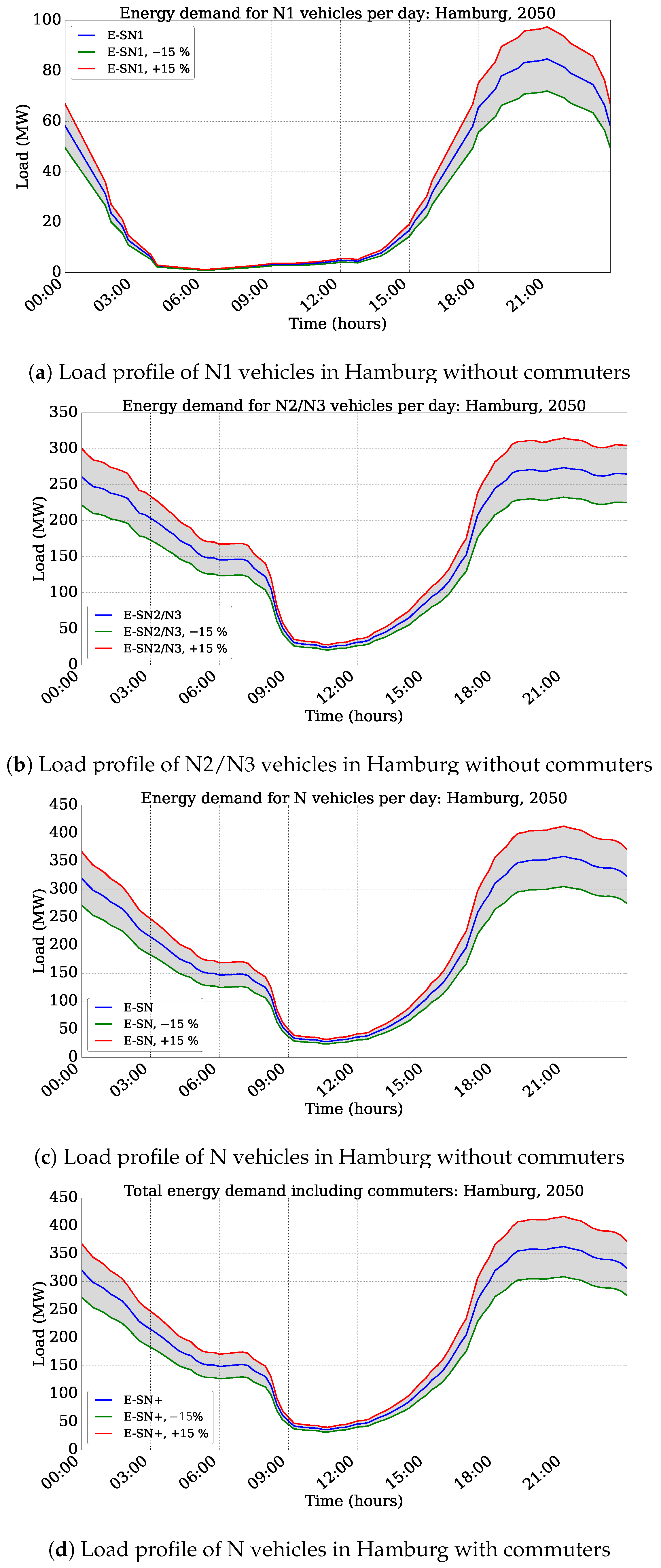

5. Power Demand Scenarios in Hamburg

- Figure 12b displays unit depot charging profiles for N1, N2, and N3 vehicle classes. These reflect the assumption that the majority of vehicles (94% for N1 and 87% for N2/N3) charge overnight at depot locations.

- Figure 12c contains unit on-route charging profiles of N vehicles during working hours, assuming a smaller share of vehicles (6% for N1 and 13% for N2/N3) charges outside depots at public or semi-public stations.

- Figure 12d corresponds to the sum of all the profiles presented.

Total Power Demand by 2050

6. Conclusions

- Substation-level grid analysis: analysis in which aggregate quarter-level load forecasts could be mapped onto the distribution network to quantify necessary capacity expansions.

- Charging infrastructure planning: an optimized charger siting that may be determined by integrating geospatial demand patterns, grid constraints, and vehicle mobility data.

- Smart load management studies: studies in which the impacts of demand-response mechanisms and charging schedules on peak stability and grid stability could be evaluated.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Transport and Environment (T&E). A Roadmap for Electric Truck Charging Infrastructure Deployment. 2020. Available online: https://te-cdn.ams3.cdn.digitaloceanspaces.com/files/2020_02_RechargeEU_trucks_paper.pdf (accessed on 10 June 2024).

- Wissenschaftliche Beratung und Begleitung des BMVI zur Weiterentwicklung der Mobilitäts- und Kraftstoffstrategie (MKS). Use Cases für Klimafreundliche Nutzfahrzeuge. Available online: https://www.klimafreundliche-nutzfahrzeuge.de/use-cases-zum-aufbau-von-privater-und-oeffentlicher-tank-und-ladeinfrastruktur-fuer-emissionsfreie-nutzfahrzeuge/ (accessed on 7 June 2024).

- Statista: Anzahl der Lastkraftwagen mit Alternativen Antrieben in Deutschland in den Jahren 2020 bis 2024. Available online: https://de.statista.com/statistik/daten/studie/259803/umfrage/lkw-bestand-mit-alternativen-antrieben-in-deutschland/ (accessed on 10 February 2025).

- Öko-Institut e.V. StratES—Szenarien für die Elektrifizierung des Straßengüterverkehrs. 2024. Available online: https://www.oeko.de/fileadmin/oekodoc/StratES-Szenarien-Elektrifizierung-Strassengueterverkehr.pdf (accessed on 6 June 2024).

- Agora Energiewende. Klimaneutrales Deutschland. Available online: https://www.agora-energiewende.de/publikationen/klimaneutrales-deutschland-szenariopfade (accessed on 10 February 2025).

- Agora Energiewende. Klimaneutrales Deutschland 2045. Available online: https://www.agora-energiewende.de/publikationen/klimaneutrales-deutschland-2045-1 (accessed on 6 June 2024).

- Strategy&. Truck Study 2024. Available online: https://www.strategyand.pwc.com/de/en/industries/transport/truck-study.html (accessed on 10 February 2025).

- Statista Market Insights. Commercial Vehicles—Germany. Available online: https://www.statista.com/outlook/mmo/commercial-vehicles/germany (accessed on 10 February 2025).

- Verkehrsprognose 2040 im Auftrag des Bundesministeriums für Digitales und Verkehr (BMDV). Available online: https://www.bmv.de/SharedDocs/DE/Anlage/G/BVWP/verkehrsprognose-2040-band-1-1-Z-gesamtueberblick.pdf?__blob=publicationFile (accessed on 10 February 2025).

- NOW GmbH. Market Development of Climate-Friendly Technologies in Heavy-Duty Road Freight Transport. Available online: https://www.klimafreundliche-nutzfahrzeuge.de/wp-content/uploads/2023/05/BroschuereNOWCleanroom_ENG_web.pdf (accessed on 10 February 2025).

- Climate Change Committee. Analysis to Identify the EV Charging Requirement for Vans. Available online: https://www.theccc.org.uk/wp-content/uploads/2022/09/Analysis-to-identify-the-EV-charging-requirements-for-vans-Element-Energy.pdf (accessed on 10 February 2025).

- Gestaltung des MKS Referenzszenarios für die Periode 2021 bis 2035 (REF-2020). Available online: https://m-five.de/publikationsartikel/gestaltung-des-mks-referenzszenarios-fuer-die-periode-2021-bis-2035 (accessed on 10 February 2025).

- Dietmannsberger, M.; Meyer, M.F.; Schumann, M.; Schulz, D. Metastudie Elektromobilität—Anforderungen an das Stromnetz Durch Elektromobilität, Insbesondere Elektrobusse; Helmut Schmidt University: Hamburg, Germany, 2017; ISBN 978-3-86818-095-4. [Google Scholar]

- Then, J.; Agalgaonkar, A.P.; Muttaqi, K.M. Planning for Medium- and Heavy-Duty Electric Vehicle Charging Infrastructure in Distribution Networks to Support Long-Range Electric Truck. Energies 2025, 18, 785. [Google Scholar] [CrossRef]

- Diaz-Cachinero, P.; Contreras, J.; Muñoz-Hernandez, J.I.; Pourakbari-Kasmaei, M.; Lehtonen, M. Electric vehicle routing and charging management in road transportation and power distribution systems: An iterative multistage approach. Expert Syst. Appl. 2025, 290, 128274. [Google Scholar] [CrossRef]

- Tietz, T.; Fay, T.-A.; Schlenther, T.; Göhlich, D. Electric Long-Haul Trucks and High-Power Charging: Modelling and Analysis of the Required Infrastructure in Germany. World Electr. Veh. J. 2025, 16, 96. [Google Scholar] [CrossRef]

- Richtlinie 2007/46/EG des Europäischen Parlaments und des Rates vom 5. September 2007 zur Schaffung eines Rahmens für die Genehmigung von Kraftfahrzeugen und Kraftfahrzeuganhängern Sowie von Systemen, Bauteilen und Selbstständigen Technischen Einheiten für diese Fahrzeuge. Available online: https://eur-lex.europa.eu/legal-content/DE/TXT/?uri=CELEX:32007L0046 (accessed on 19 April 2023).

- Richtlinie 97/27/EG des Europäischen Parlaments und des Rates vom 22. Juli 1997 über die Massen und Abmessungen Bestimmter Klassen von Kraftfahrzeugen und Kraftfahrzeuganhängern und zur Änderung der Richtlinie 70/156/EWG. Available online: https://op.europa.eu/de/publication-detail/-/publication/ae116d9b-10cd-4780-87cb-aad6832ea80a (accessed on 19 April 2023).

- Cieslik, W.; Antczak, W. Research of Load Impact on Energy Consumption in an Electric Delivery Vehicle Based on Real Driving Conditions: Guidance for Electrification of Light-Duty Vehicle Fleet. Energies 2023, 16, 775. [Google Scholar] [CrossRef]

- Muratori, M.; Borlaug, B. Perspectives on Charging Medium- and Heavy-Duty Electric Vehicles. United States. 2022. Available online: https://www.osti.gov/biblio/1840708 (accessed on 6 June 2024).

- Kraftfahrt-Bundesamt (KBA). Bestand nach Haltergruppen und Wirtschaftszweigen (FZ 23). Available online: https://www.kba.de/DE/Statistik/Produktkatalog/produkte/Fahrzeuge/fz23_b_uebersicht.html (accessed on 10 February 2025).

- Kraftfahrt-Bundesamt (KBA). Produkte der Statistik. Available online: https://www.kba.de/DE/Statistik/Produktkatalog/produktkatalog_node.html;jsessionid=191556CA8794145E9E8B44B0113485EB.live11293 (accessed on 24 August 2024).

- Kraftfahrt-Bundesamt (KBA). Systematisierung von Kraftfahrzeugen und ihren Anhängern. Available online: https://www.kba.de/DE/Statistik/Verzeichnisse/systematische_verzeichnisse_inhalt.html (accessed on 6 June 2024).

- Kraftfahrt-Bundesamt (KBA). Pressemitteilung Nr. 08/2024: Der Fahrzeugbestand am 1. Januar 2024. Available online: https://www.kba.de/DE/Presse/Pressemitteilungen/Fahrzeugbestand/2023/pm08_fz_bestand_pm_komplett.html (accessed on 8 June 2024).

- Kraftfahrt-Bundesamt (KBA). Bestand nach Fahrzeugklassen und Aufbauarten. Available online: https://www.kba.de/DE/Statistik/Fahrzeuge/fz_methodik/fz_methodische_erlaueterungen_202402_pdf.pdf?__blob=publicationFile&v=2 (accessed on 20 January 2025).

- Boehnke, J.; Gholami, E.; Nayak, A. Preparing for a future COVID-19 wave: Insights and limitations from a data-driven evaluation of non-pharmaceutical interventions in Germany. Sci. Rep. 2020, 10, 20084. [Google Scholar] [CrossRef]

- Emiliozzi, S.; Ferriani, F.; Gazzani, A. The European Energy Crisis and the Consequences for the Global Natural Gas Market. SSRN Electron. J. 2023, 1–46. [Google Scholar] [CrossRef]

- Behörde für Verkehr und Mobilitätswende (BVM): Projekte und Initiativen. 2018. Available online: https://www.hamburg.de/politik-und-verwaltung/behoerden/bvm/projekte-und-initiativen (accessed on 10 February 2025).

- Hamburg Port Authority. Straßenverkehrsbericht 2018: Hafenverkehr Erfassen, Verstehen und Verändern. 2019. Available online: https://www.hamburg-port-authority.de/fileadmin/user_upload/Strassenverkehrsbericht2018.pdf (accessed on 8 June 2024).

- Metadaten: Verkehrszählstellen Hamburg. Available online: https://suche.transparenz.hamburg.de/dataset/verkehrszaehlstellen-hamburg11 (accessed on 2 July 2025).

- Kindl, A.; Niemeier, E.; Wilhelm, S.; Benda, L.; Nöppert, J.; Winter, M.; Steindl, A.; Demtschenko, R. Wissenschaftliche Beratung des BMVI zur Mobilitäts- und Kraftstoffstrategie. Schlussbericht zur Studie Fahrradparken an Bahnhöfen. ORLIS Repositorium, Germany. 2019. Available online: https://orlis.difu.de/items/54bef5d9-7c97-41c8-a275-f8d2d656d6a5 (accessed on 6 June 2024).

- Schriftliche Kleine Anfrage des Abgeordneten Dennis Thering (CDU) vom 16.04.19 und Antwort des Senats. 2019. Available online: https://www.buergerschaft-hh.de/parldok/dokument/66450/entwicklung_der_zulassungszahlen_von_pkw_lkw_und_kraftraedern_in_hamburg_im_1_quartal_2019.pdf (accessed on 6 June 2024).

- Immobilienmarktbericht Hamburg 2020: Gewerbe- und Industrieflächen. Available online: https://www.hamburg.de/contentblob/13894842/8f3b529e265b0f91e0726750e8c25064/data/d-immobilienmarktbericht-2020.pdf (accessed on 6 June 2024).

- Das Telefonbuch. Alles in einem. Available online: https://www.telefonbuch.de/ (accessed on 6 June 2024).

- Google Maps. Available online: https://www.google.com/maps (accessed on 6 June 2024).

- Hamburger Wirtschaftszahlen. Kammerzugehörige Unternehmen nach Bezirken. Available online: https://www.ihk.de/hamburg/produktmarken/beratung-service/konjunktur-statistik/hamburger-wirtschaft-zahlen/bezirke-3676930 (accessed on 6 June 2024).

- Gurobi 11.0: Every Solution, Globally Optimized. Available online: https://www.gurobi.com/ (accessed on 19 June 2024).

- BALM. Verkehrsprognose. Available online: https://www.balm.bund.de/DE/Themen/Verkehrswirtschaft/Verkehrsprognose/verkehrsprognose_node.html (accessed on 30 January 2025).

- Gao, Z.; Lin, Z.; Franzese, O. Energy Consumption and Cost Savings of Truck Electrification for Heavy-Duty Vehicle Applications. Transp. Res. Rec. 2017, 2628, 99–109. [Google Scholar] [CrossRef]

- European Electric Vehicle Charging Infrastructure Masterplan; ACEA. 2023. Available online: https://www.acea.auto/publication/european-electric-vehicle-charging-infrastructure-masterplan/ (accessed on 6 June 2024).

- KEP-Studie 2022: Analyse des Marktes in Deutschland. Available online: https://www.forschungsinformationssystem.de/servlet/is/Entry.555924.Display/ (accessed on 6 June 2024).

- Handelsdaten.de. Lebensmittelhandel: Anteile der Warengruppen an Fläche, Umsatz und Ertrag Eines Supermarkts in Deutschland im Jahr 2021 (in Prozent). Available online: https://www.handelsdaten.de/lebensmittelhandel/anteile-warengruppen-flache-umsatz-ertrag-supermarkt (accessed on 6 June 2024).

- Pitra, G.; Sastry, M. Impact Analysis of Duck Curve Phenomena with Renewable Energies and Storage Technologies. J. Eng. Res. Sci. 2022, 1, 52–60. [Google Scholar] [CrossRef]

| Sector | N1 | N2 | N3 | N |

|---|---|---|---|---|

| Agriculture, forestry, and fishing | 1.0% | 2.3% | <0.1% | 0.9% |

| Mining and quarrying | <0.1% | <0.1% | 0.1% | <0.1% |

| Manufacturing, production of goods | 0.1% | 9.1% | 10.5% | 4.4% |

| Energy supply | 2.6% | <0.1% | <0.1% | 1.5% |

| Water supply and disposal | 0.2% | <0.1% | 4.3% | 1.3% |

| Building trade, construction | 6.6% | 6.0% | 3.4% | 5.6% |

| Wholesale, retail trade, and repair services | 5.0% | 17.6% | 9.8% | 8.3% |

| Transportation, warehousing | 1.5% | 10.2% | 17.5% | 7.3% |

| Hospitality, accommodation, gastronomy | 0.3% | <0.1% | 1.1% | 0.4% |

| Information and communication | 0.5% | <0.1% | <0.1% | 0.3% |

| Financial and insurance services | 0.1% | <0.1% | <0.1% | 0.1% |

| Real estate, housing | 1.7% | <0.1% | <0.1% | 1.0% |

| Freelance, scientific and technical services | 0.1% | 0.3% | 0.6% | 0.3% |

| Specific commercial services | 23.6% | 17.1% | 0.4% | 16.0% |

| Public administration, social security | 1.4% | 0.1% | <0.1% | 0.8% |

| Education and teaching | 0.1% | <0.1% | <0.1% | <0.1% |

| Health and social services | 0.8% | <0.1% | <0.1% | 0.5% |

| Art, entertainment, relaxation | 0.3% | <0.1% | <0.1% | 0.2% |

| Provision of miscellaneous services | 15.1% | 10.8% | 50.8% | 24.5% |

| Extraterritorial organizations | 0.1% | <0.1% | <0.1% | 0.1% |

| Private and employee-related usage | 38.9% | 26.6% | 1.2% | 26.3% |

| Unknown | 0.1% | <0.1% | 0.2% | 0.1% |

| Authors | Title and Type of Report | Date | Vehicle | Source |

|---|---|---|---|---|

| Strategy&A | Battery electric trucks on the rise: Development | September 2024 | N2/N3 | [7] |

| Statista Market Insights | Trucks: Unit Sales | January 2025 | N2/N3 | [8] |

| Statista Market Insights | Light Commercial Vehicles: Unit Sales | January 2025 | N1 | [8] |

| Trimode, Intraplan | “Verkehrsprognose 2040“ (Traffic forecast 2040): Development | October 2024 | N | [9] |

| Agora Energiewende | “Klimaneutrales Deutschland“ (Climate-neutral Germany): Development | December 2024 | N2/N3 | [5] |

| Öko-Institut | “StratES”: Development | August 2023 | N2/N3 | [4] |

| M-Five GmbH, Fraunhofer, TUHH, PTV | “REF-2020”: Development | March 2022 | N | [12] |

| Agora Energiewende | “Klimaneutrales Deutschland 2045“ (Climate-neutral Germany 2045): Development | July 2021 | N1 | [6] |

| NOW GmbH | “Evaluation of the 2022 Cleanroom Talks with truck manufacturers”: Development | May 2023 | N3 | [10] |

| Climate Change Committee | Analysis to identify the EV charging requirement for vans: Development | August 2022 | N1 | [11] |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Avdevičius, E.; Jahic, A.; Schulz, D. Detailed Forecast for the Development of Electric Trucks and Tractor Units and Their Power Demand in Hamburg by 2050. Energies 2025, 18, 3719. https://doi.org/10.3390/en18143719

Avdevičius E, Jahic A, Schulz D. Detailed Forecast for the Development of Electric Trucks and Tractor Units and Their Power Demand in Hamburg by 2050. Energies. 2025; 18(14):3719. https://doi.org/10.3390/en18143719

Chicago/Turabian StyleAvdevičius, Edvard, Amra Jahic, and Detlef Schulz. 2025. "Detailed Forecast for the Development of Electric Trucks and Tractor Units and Their Power Demand in Hamburg by 2050" Energies 18, no. 14: 3719. https://doi.org/10.3390/en18143719

APA StyleAvdevičius, E., Jahic, A., & Schulz, D. (2025). Detailed Forecast for the Development of Electric Trucks and Tractor Units and Their Power Demand in Hamburg by 2050. Energies, 18(14), 3719. https://doi.org/10.3390/en18143719