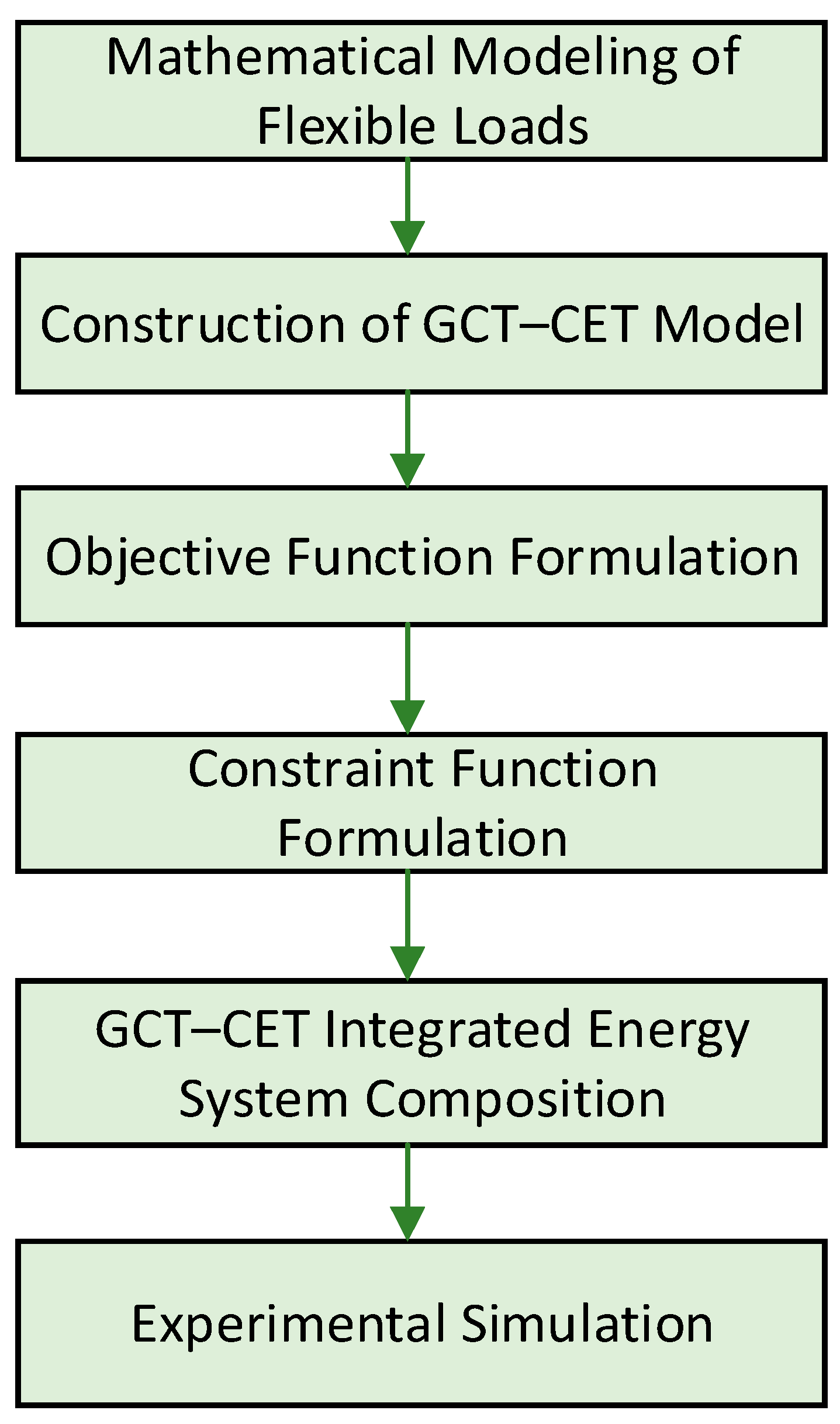

GCT–CET Integrated Flexible Load Control Method for IES

Abstract

1. Introduction

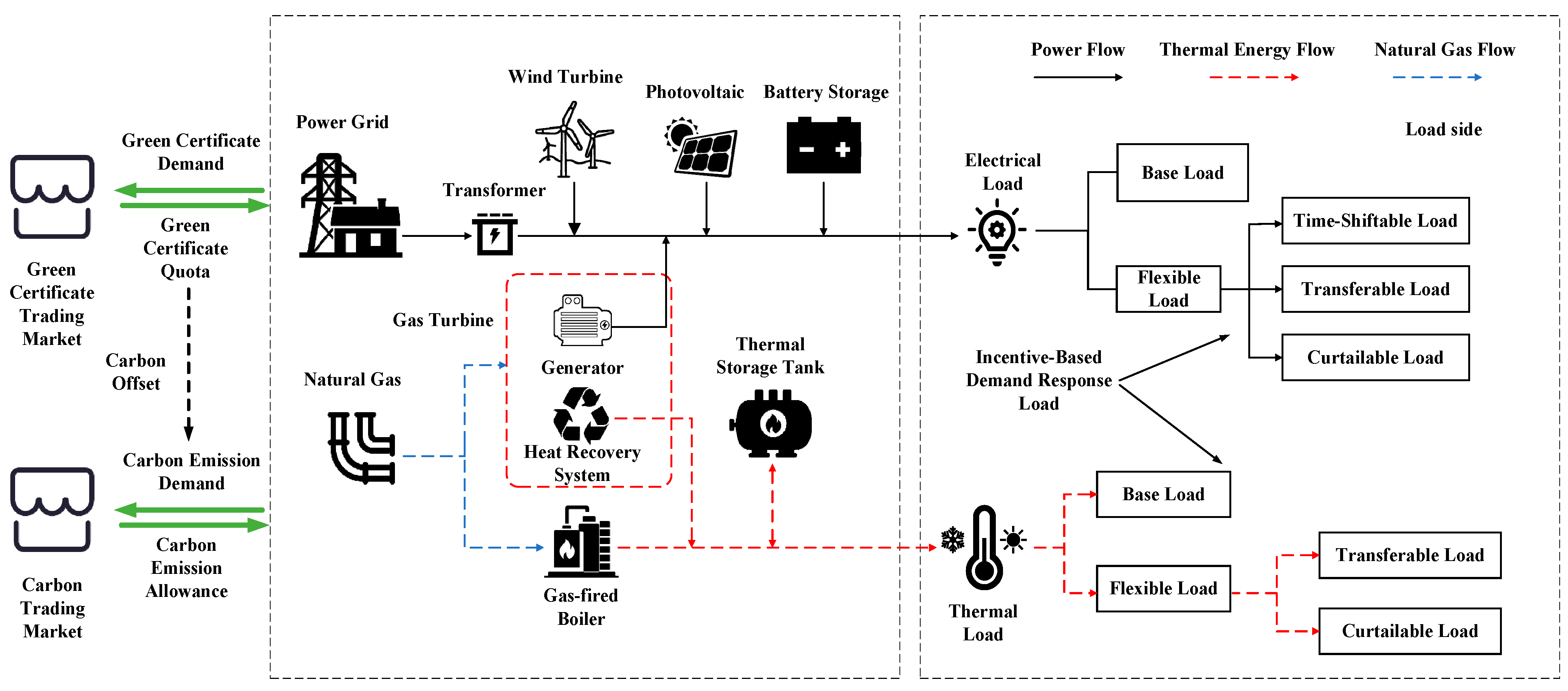

2. Flexible Load Modeling for Integrated Energy Systems

2.1. Incentive-Based Integrated Demand Response Model

2.1.1. Time-Shiftable Load

2.1.2. Transferable Load

2.1.3. Curtailable Load

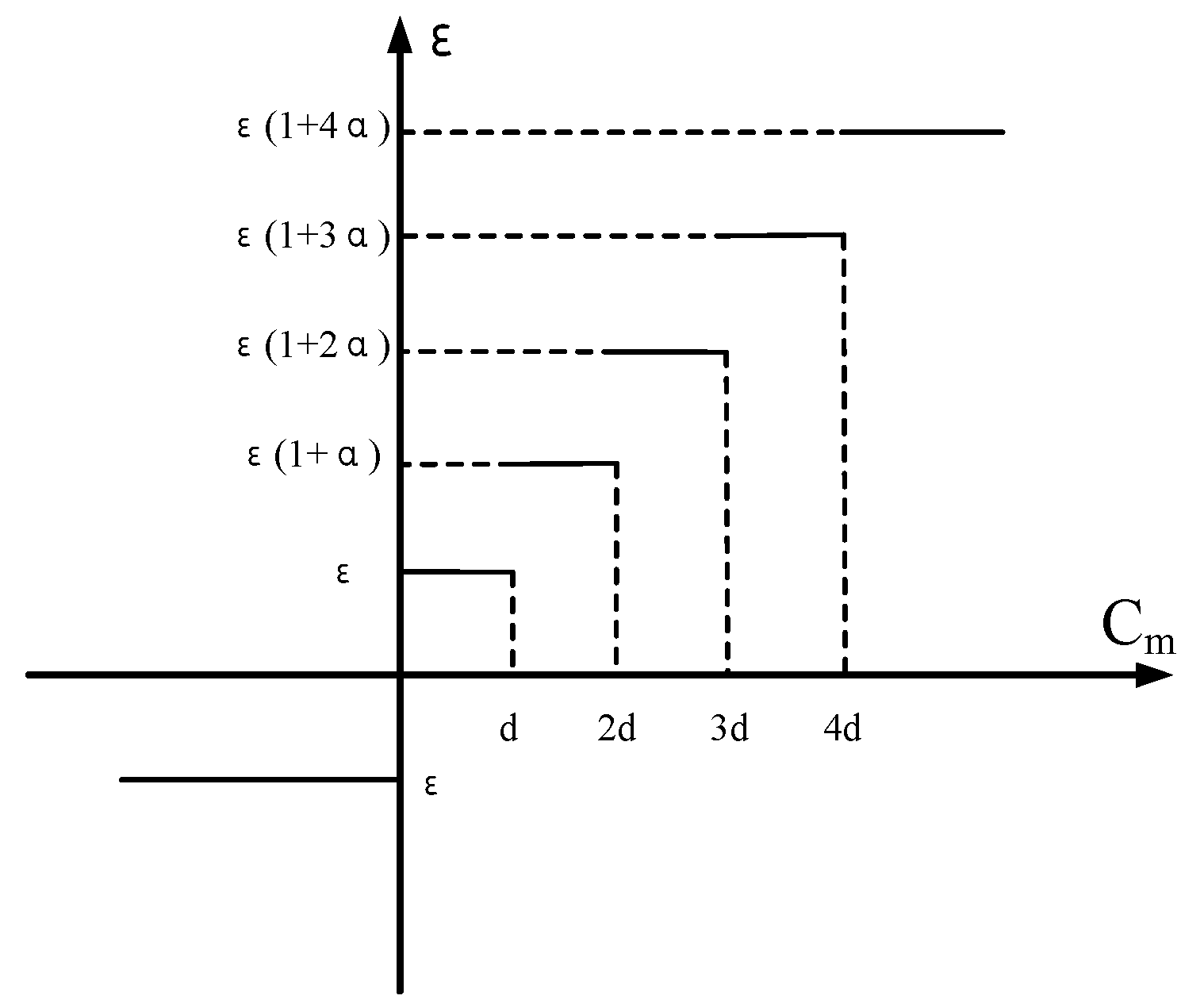

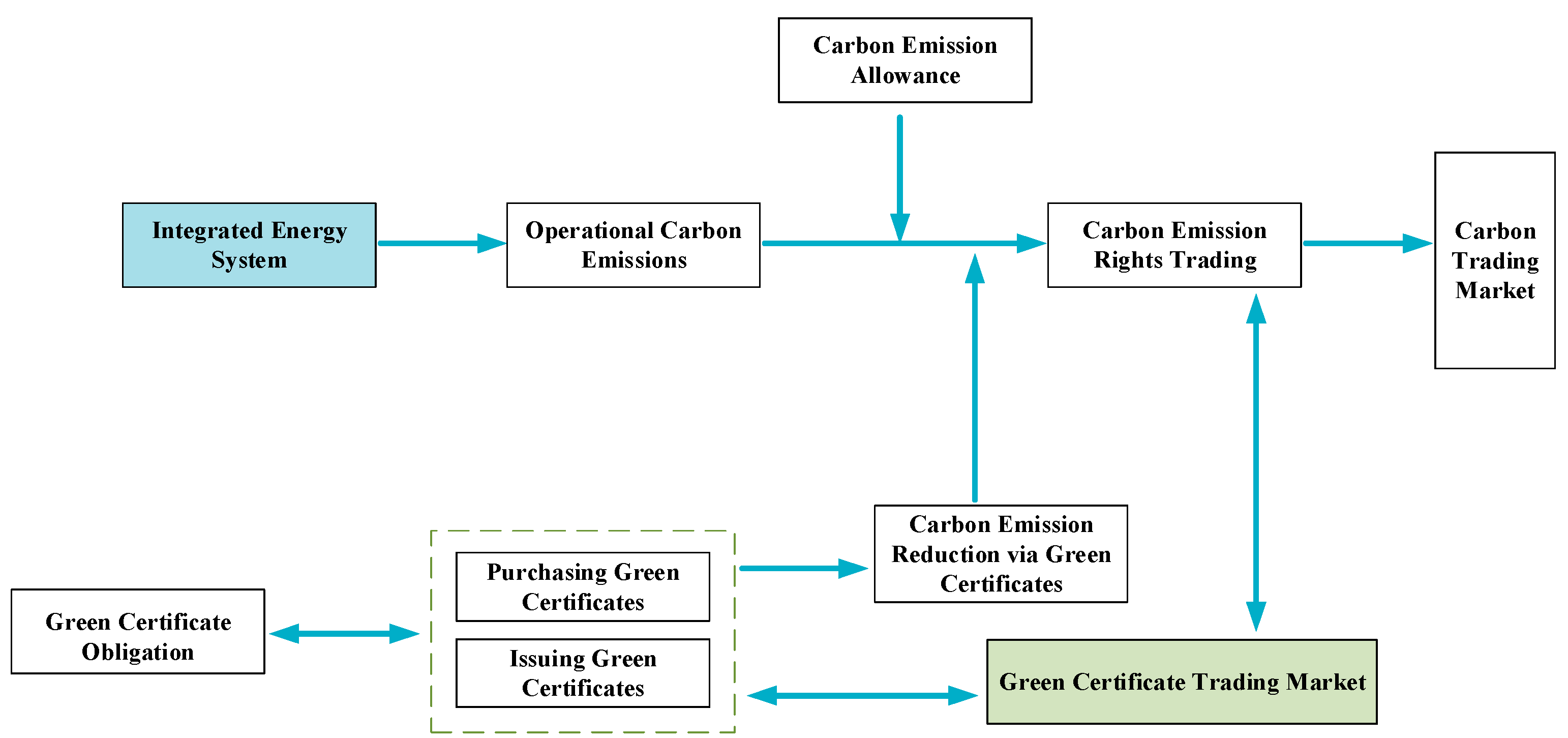

2.2. Green Certificate–Tiered Carbon Emission Trading Interaction Mechanism Model

2.2.1. Tiered Carbon Trading Mechanism

2.2.2. Green Certificate Trading Mechanism

2.2.3. Green Certificate–Tiered Carbon Emission Trading Interaction Mechanism

3. Optimal Dispatch Model for Integrated Energy Systems Considering Green Certificate–Tiered Carbon Emission Trading Interaction

3.1. Low-Carbon Economic Optimization Objective Function

3.2. Electric and Thermal Network Constraints

3.2.1. Electric Network Constraints

3.2.2. Thermal Network Constraints

4. Experimental Setup and Results Analysis

4.1. Experimental Setup

4.1.1. Simulation Software and Hardware

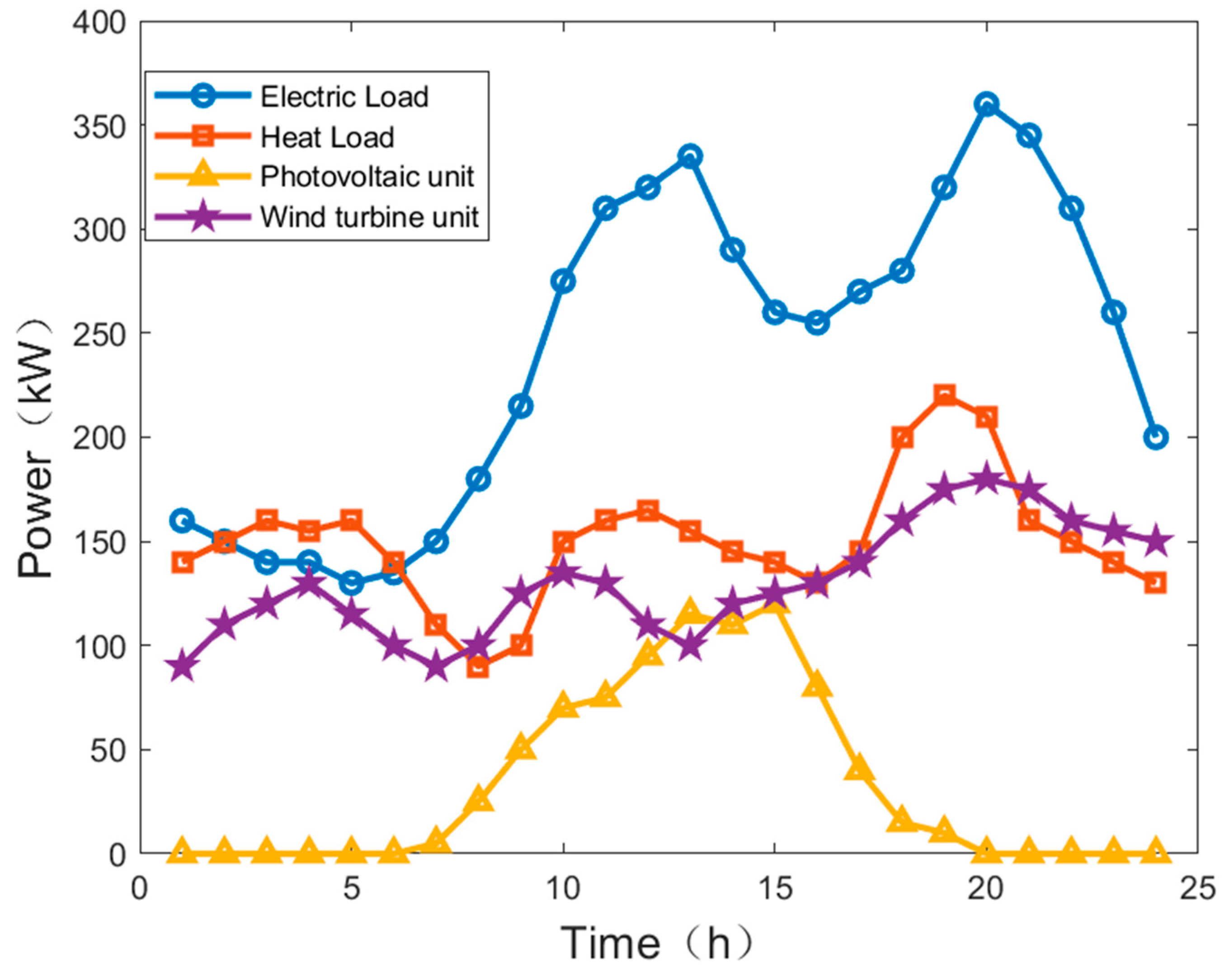

4.1.2. Data Description

4.1.3. Parameter Settings

4.2. Comparative Analysis Across Scenarios

4.2.1. Effectiveness Analysis of Carbon Trading Mechanism

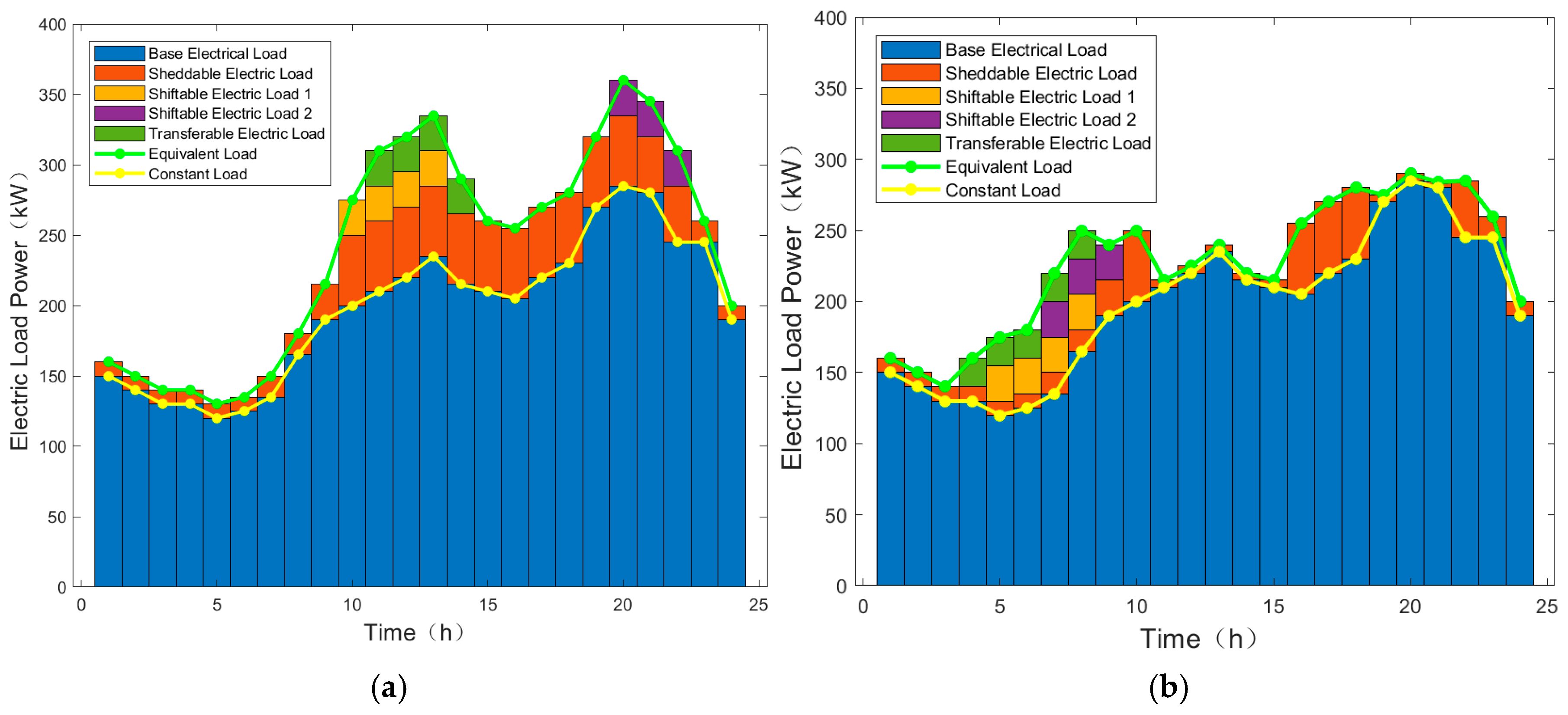

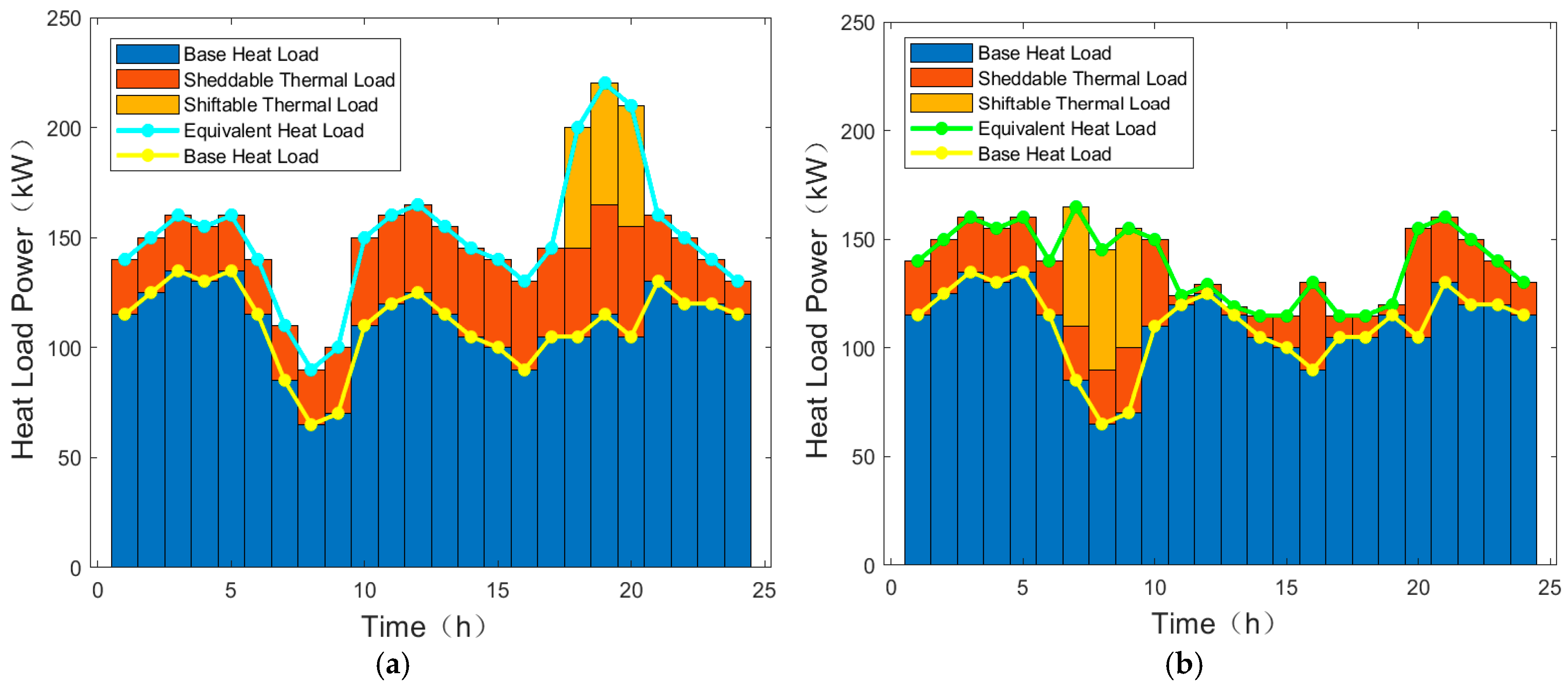

4.2.2. Effectiveness Analysis of Flexible Load Integration

4.2.3. Impact of Flexible Loads on Low-Carbon Economic Dispatch

4.2.4. Effectiveness Analysis of Green Certificate Trading Mechanism

4.2.5. Effectiveness Analysis of Green Certificate–Tiered Carbon Trading Interaction

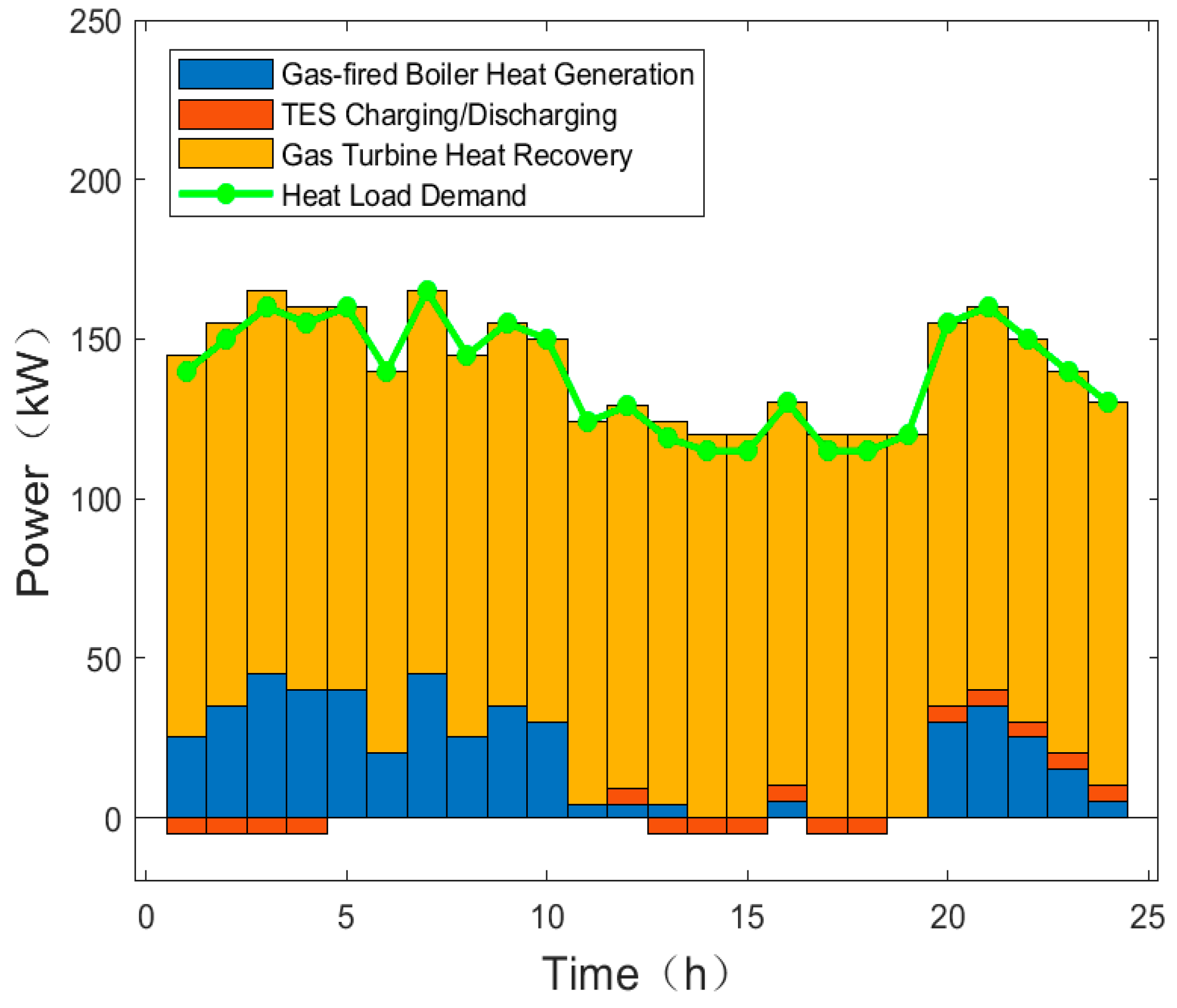

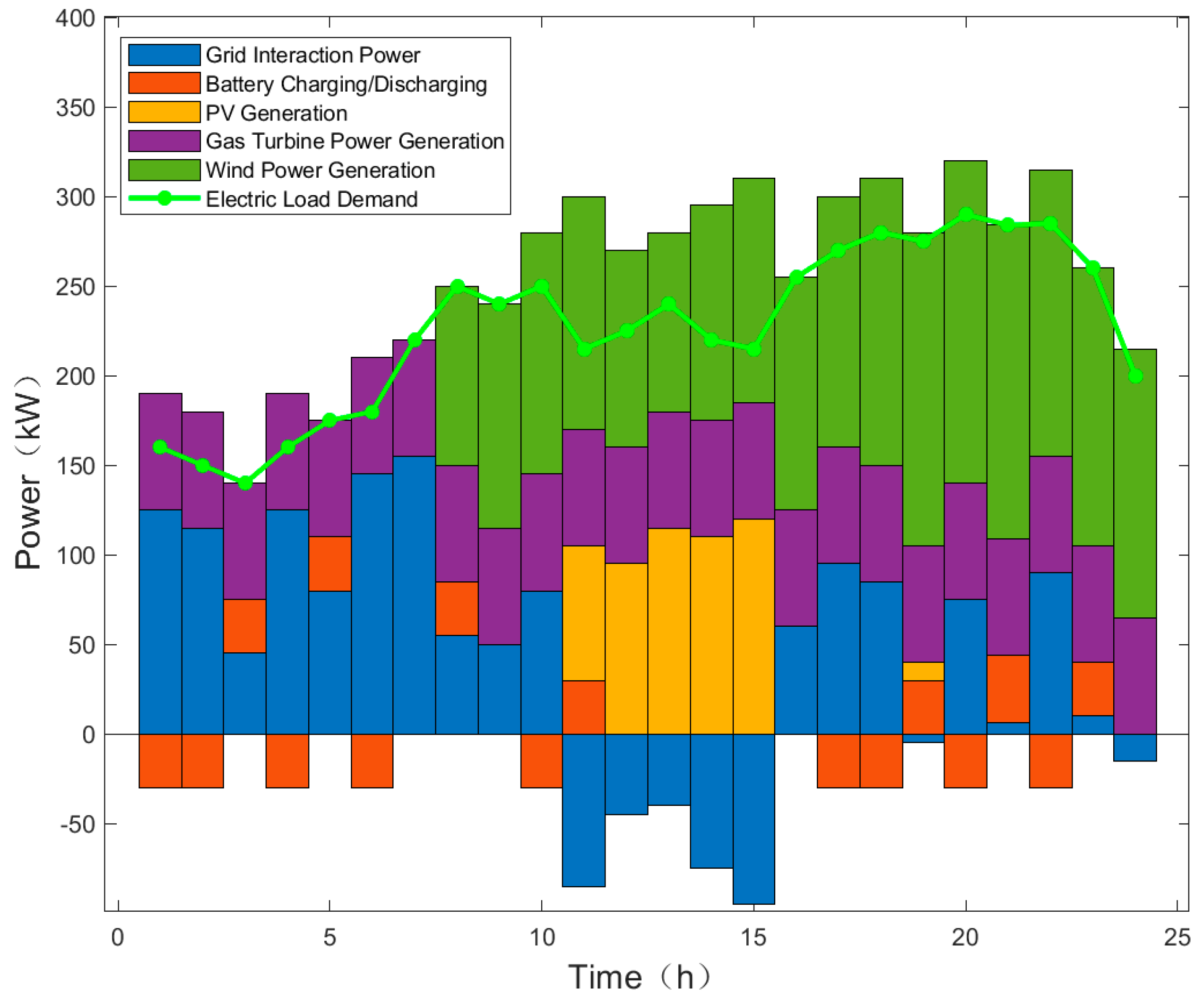

4.3. Optimal Operation Analysis

5. Discussion and Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Zhang, S.B.; He, F.; Li, B.F. Research on the Optimal Scheduling of Multi-Microgrid Double-Layer Game Considering Fair Carbon Trading Strategy in the Green Certificate Trading Market. IEEE Access 2024, 12, 161620–161636. [Google Scholar] [CrossRef]

- Li, Y.F.; Wang, W.Q.; Kou, Y.; Zhu, S.L. Considering Green Certificate-Carbon Joint Trading and Demand Response Itegrated Energy System Economic Operation. Acta Energiae Solaris Sin. 2023, 44, 538–546. [Google Scholar]

- Yang, D.F.; Liu, H.W.; Sun, Y.; Li, B.J.; Liu, C.; Liu, X.J. Multi-agent Joint Peak Regulation Optimal Scheduling Considering Green Certificate Trading Mechanism and Deep Peak Regulation Green Certificate Trading Mechanism and Deep Peak Regulation. Power Syst. Technol. 2024, 48, 100–112. [Google Scholar]

- Qin, T.; Liu, H.D.; Wang, J.Q.; Feng, Z.Q.; Fang, W. Carbon Trading Based Low-carbon Economic Dispatch for Integrated Electricity-Heat-Gas Energy System. Autom. Electr. Power Syst. 2018, 42, 8–13. [Google Scholar]

- Xue, K.Y.; Chu, Y.; Ling, Z.; Li, Z.L. Low–carbon economic optimal dispatch of integrated energy system considering flexible load. Renew. Energy Resour. 2018, 42, 8–13. [Google Scholar]

- Wei, Z.N.; Zhang, S.D.; Sun, G.Q.; Xu, X.H.; Chen, S.; Chen, S. Carbon Trading Based Low-carbon Economic Operation for Integrated Electricity and Natural Gas Energy System. Autom. Electr. Power Syst. 2016, 40, 9–16. [Google Scholar]

- Chen, J.; Gui, W.; Huang, Y. The impact of the establishment of carbon emission trade exchange on carbon emission efficiency. Environ. Sci. Pollut. Res. 2023, 30, 19845–19859. [Google Scholar] [CrossRef]

- Liu, X.J.; Nie, F.J.; Yang, D.F.; Wang, Y.; Xu, Y. Low Carbon Economic Dispatch of Integrated Energy Systems Considering Green Certificates-carbon Trading Mechanism Under CCPP-P2G Joint Operation Model. Power Syst. Technol. 2023, 47, 2207–2222. [Google Scholar]

- Liu, K.Z.; Dai, Y.H.; Zhao, Q.L.; Wu, Z.S.; Dong, M. New Energy Interprovincial Trading Model Considering Carbon-green Certificate Trading Mechanism. Proc. CSU-EPSA 2023, 35, 9–19. [Google Scholar]

- Luo, Z.; Qin, J.H.; Liang, J.Y.; Shen, F.; Liu, H.Z.; Zhao, M.; Wang, J.H. Day-ahead optimal scheduling of integrated energy system with carbon-green certificate coordinated trading mechanism. Electr. Power Autom. Equip. 2021, 41, 248–255. [Google Scholar]

- Yuan, G.L.; Liu, P.D.; Tang, F.B.; Tian, W.L. Source-load coordination optimal scheduling considering green power certificate and carbon trading mechanisms. Acta Energiae Solaris Sin. 2022, 43, 190–195. [Google Scholar]

- Li, J.F.; Zou, N.; Li, W.D.; Wu, J.; Zhang, M.K. Analysis of local green power certificate, carbon emission and electricity joint trading considering demand flexibility. Power Syst. Technol. 2023, 47, 3164–3173. [Google Scholar] [CrossRef]

- Liang, N.; Miao, M.; Xu, H.H.; Zheng, F.; Fang, Q. Bi-Level Optimal Scheduling of Integrated Energy System Considering Green Certificates-Caebon Emission Trading Mechanism. Acta Energiae Solaris Sin. 2024, 45, 312–322. [Google Scholar]

- Cui, Y.; Zeng, P.; Zhong, W.Z.; Cui, W.L.; Zhao, Y.T. Low-carbon economic dispatch of electricity-gas-heat integrated energy system based on ladder-type carbon trading. Electr. Power Autom. Equip. 2021, 41, 10–17. [Google Scholar]

- Li, J.H.; Zhu, M.S.; Lu, Y.J.; Huang, Y.J.; Wu, T. Review on Optimal Scheduling of Integrated Energy Systems. Power Syst. Technol. 2021, 45, 2256–2269. [Google Scholar]

- Bai, X.Y.; Fan, Y.F.; Liu, Y.J.; Song, Y.L. Wind power storage virtual power plant considering reliability and flexibility tiered capacity configuration. Power Syst. Prot. Control 2022, 50, 11–24. [Google Scholar]

- Huang, W.D.; Li, Y.; Li, J.Y.; Liu, Y.; Wu, F.; Wang, Z.Z. Multi-time scale joint optimal scheduling for wind-photovoltaic-electrochemical energy storage-pumped storage considering renewable energy uncertainty. Electr. Power Autom. Equip. 2023, 43, 91–98. [Google Scholar]

- Liu, Z.G.; Xiao, Z.F.; Wu, Y.F.; Hou, H.; Xu, T.; Zhang, Q.Y. Integrated optimal dispatching strategy considering power generation and consumption interaction. IEEE Access 2020, 9, 1338–1349. [Google Scholar] [CrossRef]

- Fan, H.; Lu, J.Y.; Lu, X.X. Coordinated planning of multi-region integrated energy system considering incentive demand response. Electr. Meas. Instrum. 2023, 60, 117–124+187. [Google Scholar]

- Liu, R.H.; Li, Y.; Yang, X.; Li, Y.F.; Sun, G.P.; Shi, S.S. Two-Stage Optimal Scheduling of Community Integrated Energy System Considering Demand Response. Acta Energiae Solaris Sin. 2021, 42, 46–54. [Google Scholar]

- Yang, D.F.; Xu, Y.; Jiang, C. Multiple Time-Scale Coordinated Scheduling of Combined Electro-Thermal System Considering Multi-Type Demand Response. Acta Energiae Solaris Sin. 2021, 42, 282–289. [Google Scholar]

- Zhu, X.X.; Liu, Z.T.; Xue, J.F.; Hu, M.; Han, Z.H.; Wu, D. Optimal Scheduling of Integrated Energy System with Flexible Load Participation. Acta Energiae Solaris Sin. 2023, 44, 29–38. [Google Scholar]

- Song, X.T.; Shi, Q.Q.; Ju, Y.T.; Ge, H.C.; Zhang, J.H.; Lu, Y.W.; Yu, K.Y. Review on Low-carbon Planning and Operation of Integrated Energy System. High Volt. Eng. 2024, 50, 1053–1066. [Google Scholar]

- Xu, L.; Xu, Y.T.; Yuan, X.F.; Xiong, W.; Lu, Z.Y. Low-Carbon Dispatching of Hydrogen-Based Integrated Energy Systems Considering Dynamic Carbon Emissions. Power Syst. Clean Energy 2025, 41, 120–129. [Google Scholar]

- Mo, J.S.; Yan, G.X.; Song, N.; Yuan, M.Y. Review of Demand Response-based Optimal Scheduling of Electric and Thermal Integrated Energy Systems. Adv. Eng. Sci. 2025, 57, 296–307. [Google Scholar]

- Li, R.H.; Li, Z.L.; Yang, X.; Sun, G.P.; Li, L.H. Optlmal Dispatch of Community Integrated Energysystem Conidering User-Side Flexible Load. Acta Eenrgiae Solaris Sin. 2019, 40, 2842–2850. [Google Scholar]

- Chen, Q.B.; Yang, G.H.; Geng, L.Q.; Su, J. Low-Carbon Operation Scheduling of Integrated Energy System Considering Source-Load Uncertainty and Flexible Loads. Acta Energiae Solaris Sin. 2025, 46, 183–192. [Google Scholar]

- Zhao, W.Z.; Chen, Z.Q. Optimization of energy storage system capacity allocation considering flexible load. Sci. Technol. Eng. 2024, 24, 12977–12984. [Google Scholar]

- Chen, Z.; Hu, Z.J.; Weng, C.H.; Li, T.G. Multi-stage planning of park-level integrated energy system based on ladder-type carbon trading mechanism. Electr. Power Autom. Equip. 2021, 41, 148–155. [Google Scholar]

- Zhao, Z.Y.; Li, X.X. Low-Carbon Economic Dispatch Based on Ladder Carbon Trading Virtual Power Plant Considering Carbon Capture Power Plant and Power-to-Gas. Power Gener. Technol. 2023, 44, 769–780. [Google Scholar]

- Shang, N.; Chen, Z.; Lu, Z.L.; Leng, Y. Interaction Principle and Cohesive Mechanism Between Electricity Market, Carbon Market and Green Power Certificate Market. Power Syst. Technol. 2023, 47, 142–154. [Google Scholar]

- Lu, X.Y.; Zhang, R.D.; Sun, J.H. Exploring the Strategies and Effects of Green Certificates in Promoting New Energy Development. Adv. Econ. Manag. Political Sci. 2024, 93, 75–79. [Google Scholar] [CrossRef]

- Kilinc-Ata, N.; Rahman, M.P. Digitalization and financial development contribution to the green energy transition in Malaysia: Findings from the BARDL approach. Nat. Resour. Forum 2024, 1–19. Available online: https://onlinelibrary.wiley.com/doi/10.1111/1477-8947.12509 (accessed on 1 June 2025). [CrossRef]

- Liu, Y.X.; Zhang, K.X.; Chen, S.S.; Zhou, Y.; Chen, J.W. GRO-Bagging Day-Ahead Power Curve Forecasting Model Based on Multi-Cycle Feature Extraction. IEEE Access 2024, 12, 98584–98598. [Google Scholar] [CrossRef]

- Yao, J.M.; Zhao, S.Q.; Wei, Z.Y.; Zhang, H. Day-ahead dispatch and its fast solution method of power system based on scenario analysis. Electr. Power Autom. Equip. 2022, 42, 102–110. [Google Scholar]

- Wang, Z.S.; Shi, Y.; Tang, Y.M.; Men, X.Y.; Cao, J.; Wang, H.F. Low Carbon Economy Operation and Energy Efficiency Analysis of Integrated Energy Systems Considering LCA Energy Chain and Carbon Trading Mechanism. Proc. CSEE 2019, 39, 1614–1626. [Google Scholar]

| Type | Min Power (kW) | Max Power (kW) | Operating Cost (CNY/kWh) |

|---|---|---|---|

| Main Grid | 0 | 160 | Forecast value |

| Wind Turbine | 0 | Forecast value | 0.3 |

| Photovoltaic (PV) | 0 | Forecast value | 0.55 |

| Gas Turbine (Power) | 0 | 65 | Forecast value |

| Gas Turbine (Heat) | 0 | 160 | Forecast value |

| Gas Boiler | 0 | 100 | Forecast value |

| Load Type | (h) | (CNY/kWh) | ||

|---|---|---|---|---|

| Transferable Power Load | 5 | 15~30 kW | 04:00~22:00 | 0.3 |

| Load Type | (CNY/kWh) | |||

|---|---|---|---|---|

| Shiftable Electric Load 1 | 10:00 | 4 | 05:00~21:00 | 0.2 |

| Shiftable Electric Load 2 | 19:00 | 3 | 07:00~23:00 | 0.2 |

| Shiftable Thermal Load | 18:00 | 3 | 05:00~21:00 | 0.1 |

| Load Type | (h) | (h) | (Max Times) | (CNY/kWh) |

|---|---|---|---|---|

| Curtailable Electric Load | 2 | 5 | 8 | 0.4 |

| Curtailable Thermal Load | 2 | 5 | 8 | 0.2 |

| Period | Time Slot | Price (CNY/kWh) |

|---|---|---|

| Off-Peak | 0:00~7:00 | 0.22 |

| Mid-Peak | 7:00~10:00 15:00~18:00 21:00~24:00 | 0.42 |

| Peak | 10:00~15:00 18:00~21:00 | 0.65 |

| Energy Type | () | () | Total Emission Factor () | Carbon Allowance |

|---|---|---|---|---|

| Coal Power (Grid) | 1303.0 | 0 | 1303.0 | 798.0 |

| Natural Gas | 116.4 | 448.3 | 564.7 | 424.0 |

| Wind Power | 43.0 | 0 | 43.0 | 78.0 |

| Solar PV | 54.5 | 0 | 154.5 | 78.0 |

| Energy Storage | 91.3 | 0 | 91.3 | 0 |

| Parameter | λ (CNY) | ρ | δ (Certificates/MWh) | κ (t/Certificate) |

|---|---|---|---|---|

| Set Value | 100.00 | 0.52 | 1.00 | 0.05 |

| Scenario ID | Carbon Trading | Green Certificate Trading | Green Certificate–Carbon Trading Interaction | Flexible Electric Load | Flexible Thermal Load |

|---|---|---|---|---|---|

| Scenario 1 | × | × | × | × | × |

| Scenario 2 | √ | × | × | × | × |

| Scenario 3 | × | × | × | √ | × |

| Scenario 4 | √ | × | × | √ | × |

| Scenario 5 | × | × | × | √ | √ |

| Scenario 6 | √ | × | × | √ | √ |

| Scenario 7 | √ | √ | × | √ | √ |

| Scenario 8 | √ | √ | √ | √ | √ |

| Scenario ID | Carbon Emissions | Carbon Trading Cost (CNY) | Electricity Purchase Cost (CNY) | Renewable Energy Output (kWh) | Wind/PV O and M Cost (CNY) | Compensation Cost (CNY) | Total Cost (CNY) |

|---|---|---|---|---|---|---|---|

| Scenario 1 | 918.7 | 275.6 | 720.4 | 2895.0 | 999.8 | 0.0 | 3318.7 |

| Scenario 2 | 464.4 | 94.9 | 422.1 | 3690.7 | 1298.0 | 0.0 | 3179.9 |

| Scenario 3 | 961.9 | 288.6 | 554.8 | 2895.0 | 999.8 | 205.4 | 3182.9 |

| Scenario 4 | 217.7 | 36.3 | 160.2 | 3655.0 | 1250.3 | 201.8 | 3007.1 |

| Scenario 5 | 945.9 | 283.8 | 542.7 | 2895.0 | 999.8 | 247.6 | 3141.4 |

| Scenario 6 | 201.7 | 33.3 | 148.1 | 3655.0 | 1250.3 | 244.0 | 2967.5 |

| Scenario 7 | 331.8 | 61.2 | 161.6 | 3845.0 | 1353.5 | 244.0 | 2874.3 |

| Scenario 8 | 173.2 | 28.0 | 161.6 | 3925.0 | 1377.5 | 244.0 | 2719.3 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liu, Y.; Wang, Y.; Yang, Y.; Zhang, K.; Sun, Y.; Hou, C.; Dongye, Z.; Chen, J. GCT–CET Integrated Flexible Load Control Method for IES. Energies 2025, 18, 3667. https://doi.org/10.3390/en18143667

Liu Y, Wang Y, Yang Y, Zhang K, Sun Y, Hou C, Dongye Z, Chen J. GCT–CET Integrated Flexible Load Control Method for IES. Energies. 2025; 18(14):3667. https://doi.org/10.3390/en18143667

Chicago/Turabian StyleLiu, Yaoxian, Yuanyuan Wang, Yiqi Yang, Kaixin Zhang, Yue Sun, Cong Hou, Zhonghao Dongye, and Jingwen Chen. 2025. "GCT–CET Integrated Flexible Load Control Method for IES" Energies 18, no. 14: 3667. https://doi.org/10.3390/en18143667

APA StyleLiu, Y., Wang, Y., Yang, Y., Zhang, K., Sun, Y., Hou, C., Dongye, Z., & Chen, J. (2025). GCT–CET Integrated Flexible Load Control Method for IES. Energies, 18(14), 3667. https://doi.org/10.3390/en18143667