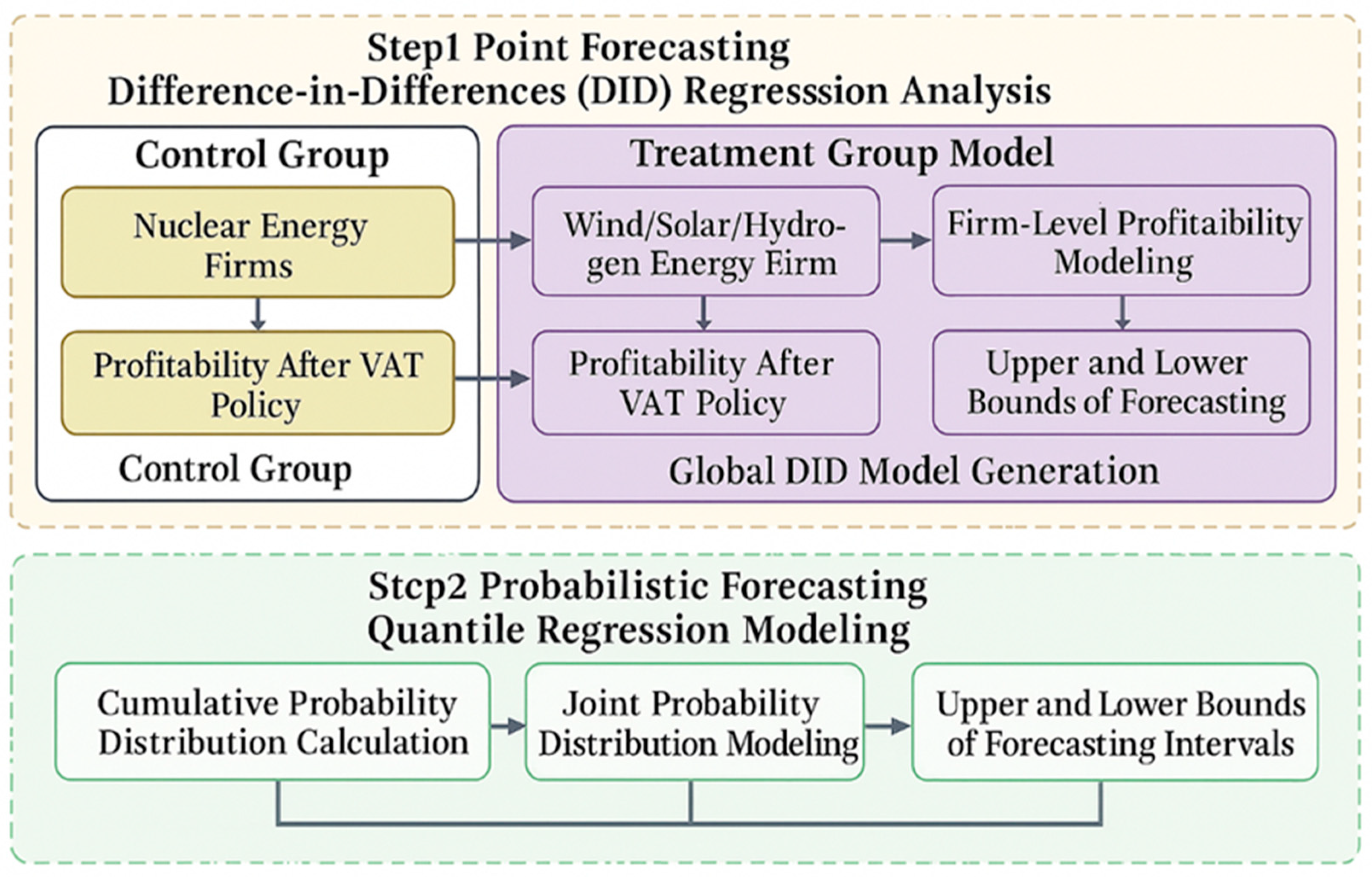

3.2. Difference-in-Difference Model

To evaluate the impact of tax incentives on the renewable energy power generation industry, this study uses a double difference model (DID) model to compare the differences in outcome variables between the “treatment group” and the “control group” before and after the implementation of the policy (2010–2014) and the period after the implementation of the policy (2015–2023) to identify the policy effect and effectively control the unobserved constant differences and common trends. In the early policy period, key tax incentives were gradually implemented in many areas of the renewable energy industry, including VAT exemptions and import tax concessions in wind, solar, and geothermal energy, as well as tax exemptions for nuclear power generation since the mid-1980s [

52,

53].

In contrast, the later policy period (2015–2023) saw a more comprehensive strengthening of tax incentives in the renewable energy sector, especially in photovoltaic and wind power projects, with further increases in VAT exemptions and corporate income tax incentives and greater subsidies for photovoltaic systems. It is worth noting that the policy for the hydrogen industry was further strengthened in 2018 and 2020, with more tax exemptions implemented to accelerate technological innovation and industrial development in the sector. The differences before and after the policy provide a strong basis for comparison of the DID model, which can effectively capture the gradual impact of tax incentives on the growth and technological progress of the new energy power generation industry.

To ensure that this hypothesis is valid, we conducted a parallel-trend test in the empirical analysis to confirm that there was no significant difference in the performance and innovation index trends between the treatment group and the control group before the policy was introduced. Specifically, the inter-group differences in the previous several periods before the policy were visually compared, and statistical tests were used to verify that there was no systematic “expectation effect” to enhance the effectiveness of DID identification. Only under the premise that the parallel-trend assumption is reasonable can the estimation results of the DID model be interpreted as the causal impact of the policy. In terms of data, this study selected panel data of listed companies related to the new energy industry, covering multiple years before and after the implementation of the policy.

Data sources include corporate financial statements and innovation activity databases (for example, using the CSMAR China Securities Market Database to obtain corporate financial and innovation indicators). The sample includes new energy companies affected by the tax incentive policy (treatment group) and similar companies that did not enjoy the policy (control group) in order to construct a suitable comparison. The experimental group is set as wind energy, solar energy, hydrogen, etc.

Specifically, the wind energy, solar energy, and hydrogen industries are areas that are greatly affected by policies because the tax incentives in these areas were strengthened after 2015, especially in 2018 and 2020.

The control group refers to areas that are not directly affected by policies or are relatively less affected by policies, for example, the nuclear energy industry. Although nuclear energy has enjoyed tax incentives since the 1980s, compared with other new energy sources, the nuclear energy industry has experienced fewer policy changes and is relatively less affected by policies. Although geothermal energy has also been supported by policies since 2005, compared with solar energy and wind energy, geothermal energy has a lower industrial scale and marketization, so its policy impact may be smaller.

where

represents the ROE of the

i-th company at time point

t; ROE measures the ratio of a company’s profit to shareholders’ equity and is an important indicator for evaluating a company’s profitability;

is a constant term that represents the base value of the dependent variable when all variables are zero;

is a dummy variable

;

= 1 indicates that the company is in the experimental group (i.e., it enjoys tax incentives), and another value indicates that the company is in the control group (not enjoying tax incentives);

is a coefficient of a variable that represents the baseline level of the experimental group companies when there is no influence of other factors;

indicates the difference before and after the policy is implemented, usually set to 1 in the later period of the policy and 0 in the early period of the policy;

represents the changing trends before and after the policy implementation;

represents the core interaction term of the DID model, which indicates the changes in the experimental group (companies enjoying tax incentives) after the implementation of the policy;

and is the coefficient of the mutual term, which measures the actual impact of the tax incentive policy on the experimental group. If

is significant and positive, it means that the policy has a positive impact on the experimental group.

The control variables are as follows: .

Here,

is the logarithm (log) of firm size. Generally, larger firms may have stronger resources and market influence, so it may have an impact on the dependent variable (ROE).

is the company’s development level (level), which can be understood as the company’s maturity, market share, etc.;

is the square term of the company’s development level and is used to capture nonlinear effects, indicating that the impact of company size and development level on ROE may be increasing or decreasing;

is the company’s growth rate, which measures the rate at which its revenue or output increases and can have a significant impact on ROE;

is the profitability of a company, directly reflecting the impact of its earnings on ROE; and

is a company background, including industry characteristics, company history, etc. These background variables help explain the differences in ROE among different companies.

is a company’s direct investment or capital expenditure and is related to the company’s financial performance (ROE);

is the trend term, which is used to control the long-term trend effect and capture possible systematic changes in the ROE levels of all companies over time; and

is the error term, which represents random factors not explained by the model (

Figure 3).

One of the shortcomings of the above model is that it divides the sample into two periods: pre-policy incentives and post-policy incentives, with 2010–2014 as the pre-incentive period of the policy and 2015–2024 as the post-incentive period of the policy. As well, it uses an experimental group (wind, solar, and photovoltaic) and a control group (nuclear energy), ignoring the individual differences between the groups and the pre- and post-policy trends; therefore, this leads to the occurrence of an estimation of policy bias.

These insights reinforce our findings that while VAT incentives initially boost profitability, their long-term effects depend heavily on complementary innovation and capacity governance mechanisms. To more accurately assess the impact of tax incentives on the new energy power generation industry, this study adopts the DID model and introduces individual fixed effects and time fixed effects into the model to control for inter-firm heterogeneity and the interference of time factors [

54,

55,

56]. Specifically, we use Formulas (2) and (3) as the main regression models for quantifying the different impacts on the experimental and control groups before and after policy implementation [

57].

First, Formula (2) employs an individual fixed-effects model, which controls for time-invariant heterogeneous characteristics across firms, such as firm size, governance structure, and firm type, by introducing individual fixed effects [

58]. These factors may affect firms’ financial performance in the absence of policy interventions; therefore, with individual fixed effects, we are able to exclude the impact of these time-invariant firm characteristics on ROE, thereby improving the accuracy of the estimation results [

59]. The introduction of additional variables further controls for the impact of time factors by capturing factors such as macroeconomic changes or industry policy adjustments that are common to all firms during the study period [

60].

However, relying solely on individual fixed effects does not eliminate the effect of commonality in the time dimension. To address this issue, we further employ the dual fixed-effects model in Formula (3), which introduces time fixed effects in addition to accounting for inter-firm heterogeneity [

61]. By including fixed effects, we can control common changes in all firms each year, such as annual macroeconomic fluctuations, annual adjustments in industry policies, and changes in the external market environment. The introduction of the double fixed-effects model ensures that our estimates of the impact of tax incentives are more precise and avoids potential biases caused by the time factor.

Thus, Formulas (2) and (3) provide a more refined estimation framework by controlling for both individual fixed effects and time fixed effects, which can effectively identify and quantify the impact of tax incentives on the new energy power generation industry, especially in terms of the heterogeneous effects across industries. Through the combination of these two extended models, this study can more accurately assess the differences in policy effects between the experimental group (e.g., wind, solar, and hydrogen industries) and the control group (e.g., nuclear and geothermal energy industries).

where

represents the return on equity of firm

i in year

t;

represents individual fixed effects, which are used to control the characteristics of different enterprises; and

represents the time fixed effect, which is used to control the common impact of time factors on all enterprises.

To ensure the reliability of difference-in-differences (DID) estimation, we rigorously examined whether nuclear energy firms constitute a valid control group for assessing the effects of VAT incentives on renewable energy firms. Despite nuclear firms being outside the direct policy treatment scope, their distinct characteristics—such as high entry barriers, longer construction cycles, and predominance of state ownership—raise concerns about comparability with the treatment group (wind, solar, hydrogen) as follows:

- (1)

Pre-trend analysis of ROE (2010–2014):

Figure 4 illustrates the average ROE (ROE) trends for both treated and control groups during the pre-policy period (2010–2014). The trends exhibit close alignment, with no statistically significant difference in slope or level between the groups. A joint F-test on pre-treatment interaction terms confirms the absence of differential pre-trends (

p = 0.47), supporting the parallel-trends assumption.

- (2)

Covariate balance test (2014):

Table 2 presents the results of a covariate balance test conducted for the year immediately prior to the policy intervention. Key firm-level characteristics—such as firm size (log of total assets), profitability (net profit), leverage ratio, and growth—are statistically indistinguishable between treated and control groups. All differences are insignificant at the 10% level, and standardized mean differences are below 0.1 for all covariates. This further supports the comparability of both groups before treatment.

- (3)

Robustness checks with alternative controls:

To further address potential concerns of unobserved confounding, we re-estimated the DID models using two alternative approaches.

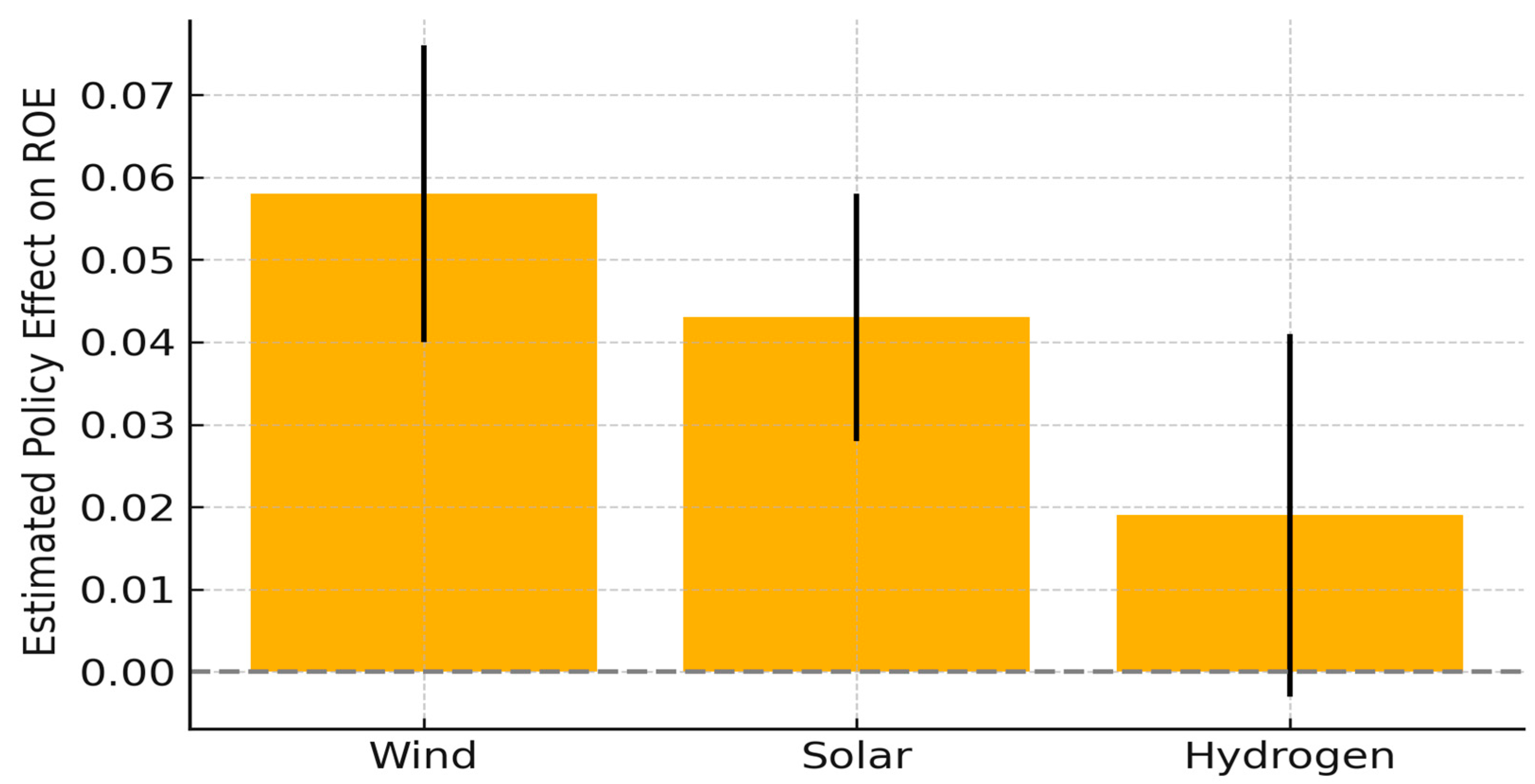

First, we replaced the control group with firms operating in other low-carbon energy sectors, such as geothermal and biomass. The resulting average treatment effect on the treated (ATT) remained positive and significant (ATT = 0.039, p < 0.01).

Second, we conducted a propensity score matching (PSM)-based DID analysis using conventional energy firms (e.g., fossil fuel-based power generation) matched on firm size, ROE, and profitability. The matched DID estimates also yielded significant treatment effects (ATT = 0.041, p < 0.05), reaffirming the robustness of the baseline results.

Parallel-trend test: To further validate the comparability between the treatment group (wind, solar, and hydrogen energy firms) and the control group (nuclear energy firms) prior to the implementation of the VAT incentive policy, we conducted a baseline covariate balance test using firm-level data from 2010 to 2014 (

Table 2).

The mean ROE before the policy was 9.17% for the treatment group and 10.42% for the control group, and the difference is statistically insignificant (t = −1.00, p = 0.317), suggesting no significant pre-policy difference in profitability. Similarly, the market share variable shows no significant difference (p = 0.926), indicating a similar competitive environment in the pre-treatment period.

However, there are notable differences in firm size and revenue: firms in the control group exhibit significantly higher total assets (mean = CNY 25.1 billion) and operating revenue (mean = CNY 9.58 billion) compared to the treatment group. These discrepancies reflect inherent differences in capital intensity and scale between nuclear and renewable energy firms, as previously noted in the literature (e.g., high entry barriers and state ownership in nuclear sector). The level of tax incentives received before 2015 is also significantly higher for nuclear firms.

Despite these observable differences in scale, the core outcome variable (ROE) and key competitive indicators such as market share remain statistically comparable. This supports the assumption of parallel trends in the pre-treatment period and mitigates concerns of severe endogeneity due to structural differences.

To further strengthen our identification strategy, we conduct a series of robustness checks including matched-sample estimation and alternative control group specifications in the subsequent sections.

While nuclear power firms serve as the control group in our main DID specification, we acknowledge potential limitations due to their structural differences compared to wind/solar/hydrogen firms. Nuclear projects typically have longer investment cycles, higher capital intensity, and greater state involvement, which may introduce unobserved confounding factors. To mitigate these concerns, we performed a pre-trend test and balance check, which confirm the validity of the parallel-trend assumption for the outcome variable (ROE). Nonetheless, future research may adopt alternative control groups, such as geothermal or biomass firms, or use matching techniques for enhanced robustness.

3.3. Method of Assessing Change ROE

In order to verify whether the experimental group and the control group have a common growth trend after the implementation of the VAT preferential policy (i.e., the parallel-trend hypothesis), we take the following steps.

First, we estimate the average annual change by estimating the change in ROE (return on net assets) before and after the VAT preferential policy.

To ensure the robustness of the regression model and the replicability of results, this study classifies control variables into two categories, background control variables and direct control variables, based on their nature and timing of influence on corporate profitability. Background control variables refer to structural or long-term factors that are relatively stable over time and likely to influence a firm’s ROE even before the policy intervention. These include firm size (size), industry classification (industry), firm age (age), and region fixed effects (region). These variables are incorporated to control for systemic heterogeneity across firms and macro-level factors unrelated to VAT policy shocks.

Direct control variables are short-term financial indicators that are more likely to be affected by policy changes during the treatment period and directly influence profitability. These include leverage ratio (leverage), asset turnover (turnover), net profit margin (profit margin), and R&D intensity. These indicators reflect the firm’s operational efficiency and innovation input and are used to isolate the policy effect on ROE.

where

represents the baseline ROE before any policy intervention;

represents the interaction term of the four periods before and after the VAT preferential policy;

represents the preferential policy start year;

is the dummy variable and is set as

= 1 for

+ j, if j = −4, −3, −2, −1, 0, and the other situation where

= 0 for j = −1 (the item is omitted in the case of the VAT incentives to ensure that the treatment effects are correlated with the time period prior to the implementation of the VAT incentives and to avoid the problem of multicollinearity between the dummy variables) for the event–time interaction;

represents the progressive effect of VAT incentives over time;

represents a vector of firm-level control variables such as firm size, growth rate, and profitability, which account for confounding factors affecting ROE;

controls for macroeconomic shocks and industry-wide changes affecting all firms over time;

accounts for time-invariant firm-specific characteristics, such as managerial capabilities and operational efficiency; and

–represents unobserved factors that may influence firm profitability.

To further verify the policy effect of ROE changes, we divide the data into two time periods: the early stage of policy implementation (2010–2014) and the late stage of policy implementation (2015–2023). In the early stage of policy implementation (2010–2014), tax incentives were gradually implemented in the fields of wind, solar, and geothermal energy, especially in terms of VAT exemptions and import tax incentives, which promoted the development of new energy industries. At the same time, the tax exemption policy implemented in the nuclear energy field since the mid-1980s played a fundamental role in the growth of the industry.

However, in the late stage of policy implementation (2015–2023), the intensity of tax incentives was significantly strengthened, especially in the fields of photovoltaic and wind power projects. VAT exemptions and corporate income tax incentives were further increased, and the photovoltaic system field also received more fiscal subsidies. In addition, the policy of the hydrogen industry was further strengthened in 2018 and 2020, and more tax exemptions were implemented to promote technological innovation and industrial progress in this field.

Through the difference comparison of the DID model, we can clearly capture the progressive effect of tax incentives in different time periods, thus strongly proving that tax incentives have a positive role in promoting the growth and technological progress of the new energy power generation industry. In this paper, we use the double difference (DID) model for regression analysis.

The basic assumption of the DID model is that the impact of VAT incentives on new energy enterprises will be significantly different before and after implementation. By comparing with the control group, which is not affected by the policy, we can further analyze the long-term impact of the policy on the ROE and technological innovation of enterprises. In the model setting, it helps us evaluate the policy impact of different years, especially for new energy industries such as wind power, solar energy, hydrogen, and nuclear energy. Through this method, we can quantitatively analyze the differences before and after the implementation of the policy and test its statistical significance to provide a basis for further policy formulation.

To further verify the policy effect of ROE changes, we use the double difference (DID) model and divide the data into two time periods: the early period of policy implementation (2010–2014) and the late period of policy implementation (2015–2024). In the early stage of policy implementation, industries such as wind energy, solar energy, and geothermal energy gradually enjoyed tax incentives, such as VAT exemptions and import tax concessions, which promoted the development of the new energy industry. At the same time, the tax exemption policy for the nuclear energy industry since the mid-1980s also laid the foundation for its growth.

In the later stage of policy implementation (2015–2024), the intensity of tax incentives was significantly strengthened, especially in the fields of photovoltaic and wind power. VAT exemptions and corporate income tax preferential policies were further expanded, and fiscal subsidies were also tilted towards photovoltaic systems. In addition, the tax incentive policy for the hydrogen industry was further strengthened in 2018 and 2020, aiming to accelerate technological innovation and industrialization.

To ensure the applicability of the DID model, we first verified whether the ROE growth trend of new energy enterprises and control group enterprises before the implementation of the policy was consistent. The results show that there was no significant difference in the ROE change trend of the two groups of enterprises from 2010 to 2014, which is in line with the parallel-trend hypothesis, thereby ensuring the reliability of causal inference. Specifically, we construct the following regression model:

where

denotes the ROE (ROE) of firm

i at time

t;

is a constant term;

are coefficients for different periods;

are dummy variables for treatment groups in event studies or double differencing (e.g., taking

= j answer 1, otherwise 0) and excluded the reference period where j = −1;

is a control variable of the

coefficient;

and

are time and individual fixed effects; and

is a random error term.

3.4. Assessment of the Time Lag of Tax Incentives

We employ a dynamic difference-in-differences (DID) model to estimate the lagged impact of a value-added tax (VAT) incentive policy on the profitability of China’s new energy firms (measured by ROE) from 2014 to 2023. The policy under study intensified around 2014–2015, providing VAT refunds/exemptions to renewable power companies (wind, solar PV, hydrogen energy) while a comparison group (e.g., nuclear power firms) did not receive new incentives in that period.

This setup creates a quasi-natural experiment, where treated firms benefit from the VAT incentive and control firms do not receive it. We define a treatment group indicator and a post-policy period indicator G (1 for years after the policy intensification, 0 for years before 2015). The DID interaction term captures the average treatment effect on treated firms’ ROE after the policy change.

To analyze time-lagged effects, we estimate dynamic models that allow the treatment effect to vary at different lags. In separate regressions, the dependent variable is the ROE with a forward shift:

for L = 1, 2, 3, 4, 5 years after the policy, representing the policy’s effect in the 1st, 2nd, 3rd, 4th, and 5th year following implementation. By estimating each lag separately (i.e., independent models for each L), we can observe how the policy impact evolves over time without imposing a specific functional form on the dynamics. Our baseline specification is a panel random-effects (RE) model with controls, expressed as

where

is a firm-specific random intercept (capturing time-invariant differences across companies) and

is the idiosyncratic error.

The RE framework allows us to control unobservable firm heterogeneity and common time factors while assuming that individual effects are not correlated with the regressors. We include year fixed effects in practice to absorb macro-shocks common to all firms each year (e.g., economic cycles, energy market trends). This two-way effect modeling (firm and year effects) helps ensure the estimated policy impact is not confounded by other time or firm-specific influences. A Hausman test was conducted to verify that random effects were appropriate; results did not significantly differ from a fixed-effects model, indicating that RE estimates are consistent.

Importantly, we incorporate key control variables to improve estimation accuracy of the policy effect. Two major controls are the firm size (proxied by the natural log of total assets) and market share (the firm’s share of industry output or sales). These factors account for differences in scale and competitive position that might independently affect profitability. By controlling for size and market share, we isolate the tax policy’s effect from the advantage of larger firms or dominant market players.

In addition, following prior studies, we include growth rate (revenue growth) and profit margin (net profit to revenue) as controls, since companies’ growth opportunities and operational efficiency can influence ROE. We also control financial leverage (debt-to-assets ratio, along with its squared term to capture non-linearity), because capital structure can affect profitability and might differ systematically between treated and control groups. All variables are transformed and/or normalized as needed to mitigate outlier influence. By including these covariates, the DID coefficient captures the policy impact net of other firm characteristics, consistent with best practices in policy evaluation.