1. Introduction

With the growing problem of global climate change, the development of renewable energy has become a key initiative in the global energy transition. The United States has introduced a series of incentives to promote the development of renewable energy, including the federal-level production tax credit (PTC), investment tax credit (ITC) and renewables portfolio standards (RPS). In Europe, the Guarantee of Origin (GO) mechanism has been implemented, which is essentially a voluntary market for renewable energy, mainly to meet the voluntary consumption of green power by enterprises or residential users, or to meet the carbon emission reduction targets of suppliers. In the future, with the implementation of the EU carbon border adjustment mechanism (CBAM), European cement, aluminum, fertilizer and other industries purchasing green power can be used for electricity carbon emission credits. China has clearly put forward the dual carbon goals, i.e., to achieve carbon peaking by 2030 and carbon neutrality by 2060, which provides a clear policy direction for the development of renewable energy. Green power trading was launched in 2021. It refers to the green power and the corresponding environmental value, i.e., tradable green certificate (TGC), to meet the needs of market participants. The conditions for the main power generation side of the green power trading for wind power and photovoltaic power generation projects are ripe and can be gradually expanded to meet the conditions of other renewable energy. In August 2024, China proposed to strengthen the clean and efficient use of fossil energy, vigorously develop non-fossil energy and accelerate the construction of a new type of energy system, which will strongly support the flourishing development of green power [

1]. At the same time, China emphasized the importance of sound market-based mechanisms for green transformation and suggested strengthening policy synergies for market-based mechanisms such as green power, TGC and carbon emission trading (CET) [

2,

3].

The environmental value of green power is usually not included in the peak and off-peak tariff mechanism and its specific implementation needs to be in line with relevant national and local policies and regulations. In order to fully reflect the environmental value and to ensure the smooth and orderly operation of the market, the trading price and the upper and lower limits of the environmental value should be reasonably set with reference to the supply and demand of green power products, and consideration should be given to gradually abolishing the upper and lower price limits as the market gradually matures. The trading price of green power should fully reflect the dual attributes of its electrical energy value and environmental value. Among them, the electricity price implements the coal-fired benchmark price (a price set by the NDRC based on the market price of coal-fired electricity in China). The environmental value of green power is mainly realized through green power trading, TGC trading or carbon offsetting in the CET market, reflecting the zero-carbon emission characteristics of green power.

The environmental value is the value of the environmental attributes of green power, the portion of the price of green power that is higher than the regular price of electricity, and it refers to the additional cost of choosing renewable energy sources compared to traditional energy sources or technology that would have produced more greenhouse gas emissions. Higher costs on the production side are reflected on the consumer side, where the environmental value means that consumers pay extra for choosing green power. Since the launch of the green power trading pilot in September 2021, the environmental value in the National Grid region was initially about 0.03 to 0.05 CNY/kWh, while in the Southern Grid region, it was about 0.03 CNY/kWh. By the first half of 2024, the trading price of green power has exceeded 0.4 CNY/kWh, of which the environmental value per kWh is mostly between 0.01 and 0.05 CNY/kWh in most provinces. Green power trading has become a concerted action for the global response to climate change and the promotion of green and low-carbon transformation, and the effect of carbon emission reduction in China’s power industry is increasingly obvious. Therefore, it is very important to calculate the environmental value [

4]. The above environmental value is calculated by the difference between the green power transaction price and the local coal electricity benchmark price or the average market transaction price [

5]. China began voluntary TGC in 2017, the main purpose of which is to replace financial subsidies. In terms of TGC volume, by the end of December 2024, the cumulative transaction volume of China’s TGC has exceeded 553 million since 2017. In terms of TGC price, from January to August 2023, the average price of par TGC in the State Grid business area is 0.025 CNY/kWh. Green power has the characteristics of near-zero carbon emission, which makes it play a unique role in the field of enterprise carbon emission management. In the carbon emission accounting, enterprises can use green power to offset carbon emissions, thus becoming one of the important means of carbon emission quota compliance. In the CET market, the environmental value of green power is reflected in the form of carbon price [

6]. Through this conversion mechanism, the environmental value can be accurately estimated, which provides new ideas and tools for enterprises in the process of low-carbon transformation and carbon emission management.

In the context of the green power boom, there are still significant challenges in measuring and demonstrating the environmental benefits of green power, despite its key role in reducing emissions and combating climate change. First, the current pricing mechanism is still inadequate and the pricing mechanism of green power has not fully reflected its environmental value. As the only proof of environmental value, the TGC’s transparency and standardization still need to be improved to strengthen price monitoring and guide the trading price of TGC to operate in a reasonable range [

7]. Additionally, the validity of TGC is 2 years, and the single-transaction limit prevents duplicate gains, but also limits market flexibility [

8]. Second, there are many obstacles in the cross-provincial consumption of green power, which affect the realization of the environmental value. There is an imbalance in the distribution of green power supply between provinces and regions, and the demand for green power in some provinces has not yet been fully developed, resulting in an unbalanced state of supply and demand within the province. The lagging construction of power grids in some regions has affected the transmission and consumption of green power, thus hindering the effective realization of environmental value [

9]. Third, the connection between the green power trading market and the CET market is not smooth, which makes it difficult to fully reflect the environmental value of green power in the CET market. Although the environmental value can theoretically offset carbon emissions, the national CET market does not recognize green power.

Therefore, research on the standards and mechanisms of the environmental value of green power plays an important role in improving the market recognition of green power and promoting sustainable development. Taking China as a typical case, this study analyzes the criteria and mechanism of the environmental value of green power from the perspective of the marginal carbon abatement cost of thermal power, i.e., the increased economic cost of each unit of carbon reduction by thermal power enterprises, designs the environmental value mechanism of green power from the perspective of the carbon emission reduction cost of thermal power, and constructs the quantitative environmental value model. It analyses the emission reduction value of green power replacing various types of thermal power units, promotes the low-carbon transformation of the energy structure, optimizes the market price mechanism of green power, enhances the competitiveness and market share of green power, and then provides theoretical support and policy guidance for realizing the energy goals of sustainable development. Through the model of measuring the environmental value of green power by the marginal carbon abatement cost of thermal power, it provides a transferable methodological tool for high-carbon energy-dominated countries, which can be dynamically adjusted according to the actual situation of each country’s power supply structure, the maturity of the CET market and other parameters, and can be targeted to quantify the environmental value of green power in other countries or regions.

2. Literature Review

Existing research on green power mainly focuses on the trading mechanism of the green power trading market, the environmental value of green power, and research on the interface mechanism between the green power trading market and the CET market.

In terms of green power trading market trading mechanism, literature [

10] constructs a system dynamics model of green power participation in power market trading, and the prediction results show that in 2026–2030, the price of green power has a linear upward trend, and the installed capacity of green power has increased significantly. Literature [

11] establishes a green power trading system with core features such as efficient consensus, on-chain transactions and identity authentication based on blockchain technology. Literature [

12] constructs the business framework of the bidding integrated enterprise and the green power enterprise, and establishes a two-layer optimization model of green power decomposition considering the market force suppression, and the simulation results of the examples show that the model can achieve the suppression of the market force of the bidding integrated enterprise through the optimal formulation of the electricity decomposition curves of the green power transaction. Literature [

4] analyses the coupling mechanism between the green power trading market and the electricity market, and constructs a non-cooperative game model on the “source-grid-load” side, and the results of the study show that the share of green power generation influences the behavioral decisions of market participants. Literature [

13] constructs a southern regional green power trading market system that considers the entire life cycle of new energy and proposes key mechanisms, including price mechanism, settlement mechanism, multi-cost power supply trading on the same platform, capacity guarantee mechanism and TGC management mechanism.

In terms of the environmental value of green power, literature [

14] proposes a dual account management mechanism that can distinguish between the circulation of green power environmental value records and the verification process, which realizes the complete process of verifying the environmental value as well as the unidirectional connection between the transaction and verification functions. Literature [

15] constructs an electricity and carbon linkage trading mechanism for producers and consumers considering the environmental value, and the results of the study showed that the reduction of free quota will improve the equilibrium price of the CET market and better reveal the environmental value of new energy power. Literature [

16] proposes a feed-in tariff measurement model based on capacity compensation and green power value, reflecting hydropower capacity costs and environmental value. Literature [

17] proposes a real-time electricity–CET accounting method that considers the impact of green power and TGC trading, and the simulation results of the arithmetic example show that the method can reflect the amount of carbon emission credits of TGC and green power in real time, and avoid the problem of double-counting environmental value.

In terms of the mechanism for linking the green power trading market with the CET market, literature [

18] suggests that green power directly deducts the corresponding amount of electricity in indirect emission accounting, and suggests that different types of TGC generated from green power projects should be set up with different time limits, and that TGC within six years of stock projects can be used for linking to the CET market. The proposed mechanism provides a reference basis for the high-quality development of China’s electricity–CET market coupling. Literature [

19] establishes an interaction model between the carbon trading market and green power policy from the perspective of policy interaction mechanism, and found that China’s carbon trading market interacts with green power grid access policy, green certificate trading and green power trading through price linkage and supply–demand relationship. Literature [

20] uses a system dynamics model combined with carbon measurement methods to simulate and analyze the Guangdong electricity and CET market. The research deconstructs the complex mechanism of green power trading and CET market interaction, and proposes a research method to optimize the coupling mechanism of the electricity and CET market. Literature [

21] analyzed the interaction of “electricity-CET-TGC” from the perspective of market actors’ decision making and market mechanism, and constructed a synergistic model of the “electricity-CET-TGC” market mechanism using a system dynamics model. The research found that a scenario that considered multiple market reform measures enhanced the role of the CET market in the structural transformation of the electricity market and increased the competitiveness of renewable electricity. Literature [

22] studies the correlation relationship of the electricity–CET market and its value transmission mechanism from both static and dynamic dimensions, and proposes a synergistic development path for the electricity–CET market. Literature [

23] proposes a mutual recognition mechanism between green power trading and carbon emissions from electricity consumption with TGC as a link, and constructs a master–slave game model for day-ahead retail market trading that considers the linkage between the green power trading market and the CET market. The simulation results show that the model can promote the consumption of new energy power and thus reduce carbon emissions.

From the above analysis, it is clear that the focus of green power research to date has been mainly on the market trading mechanism and the interface between different markets, while the discussion of the environmental value is relatively weak. There is a lack of existing research that systematically analyses the intrinsic links between thermal power and green power from the perspective of carbon emission reduction. At the same time, for the environmental value, although it has been recognized that its development status and problems exist, there has not yet been an in-depth and comprehensive exploration of how to design a scientific and reasonable environmental value mechanism from the unique perspective of thermal power carbon reduction cost, as well as the construction of an accurate quantitative model.

3. Research Objectives

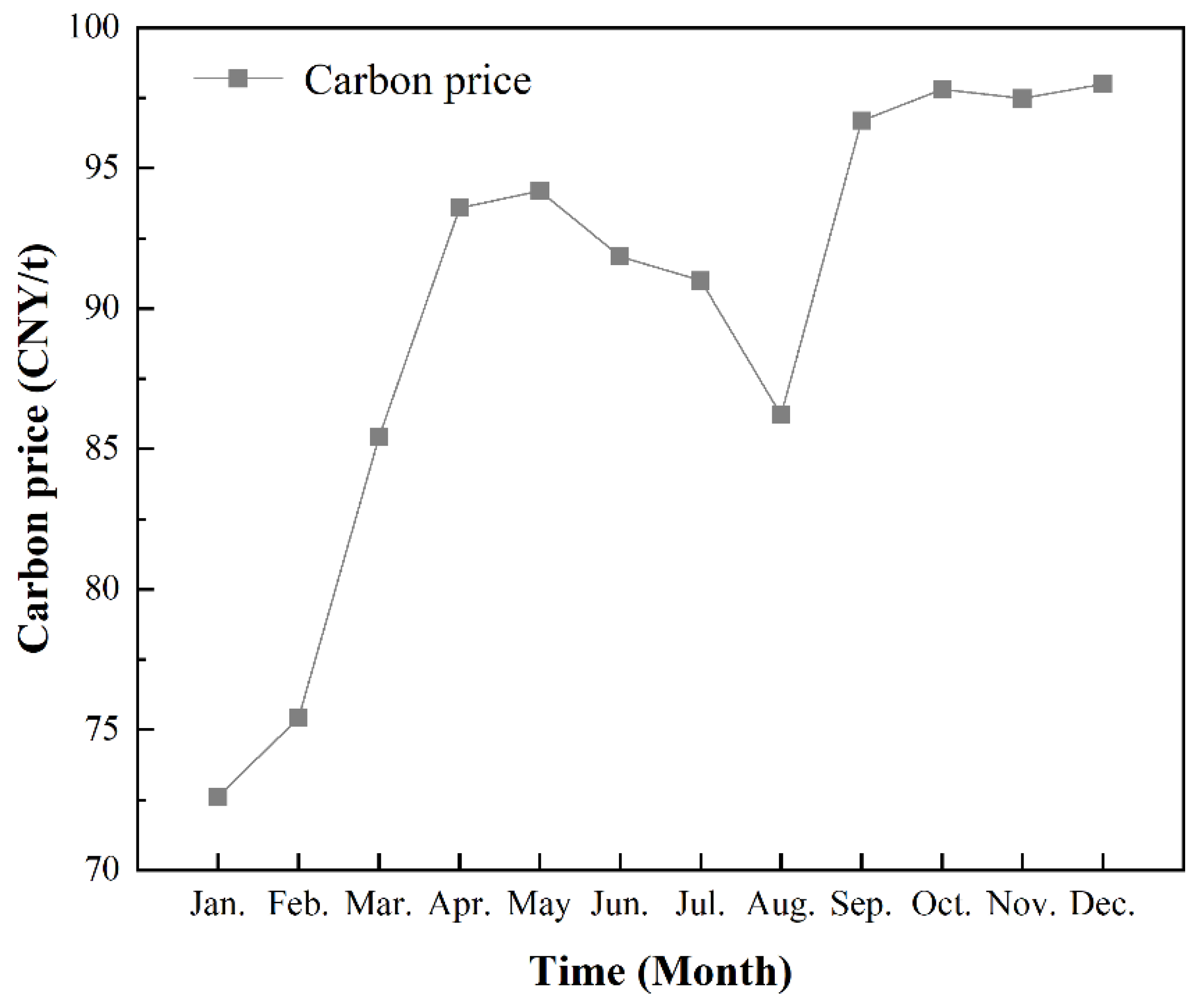

3.1. Coupling Relationship Between Green Power Trading Market and CET Market

The importance of both green power trading and CET as market mechanisms in promoting the realization of China’s “double carbon” goals and the transformation of green and low-carbon energy is indisputable. Despite the fact that they play different policy roles independently, they also exhibit a certain coupling interaction relationship. From a policy perspective, China has issued policy documents ” [

1,

24], emphasizing the need to strengthen policy coordination of market-oriented mechanisms such as green electricity, TGC and CET trading. The objective of this study is to establish a correlation between the green electricity market and the CET market. The promulgation of relevant documentation indicates that the synergistic coupling between the green power trading market and the CET market represents a significant developmental trajectory for China’s green power trading market and CET market. Moreover, it provides policy guidance and assurance for the coupling development of the two markets.

With regard to the specific coupling methods of the green power trading market and the CET market, it is evident that the current green power trading market and the CET market primarily achieve the coupling of the green power trading market and the CET market through the green power offset carbon emissions accounting mechanism. In the context of enterprise carbon emission accounting, the carbon emission generated by purchased power constitutes a significant source for calculating enterprise-wide carbon emission. It is evident that the zero-carbon attribute of green power is pivotal in this context. Enterprises included in the CET market assessment who purchase green power and utilize it accordingly can expect to see a reduction in their own carbon emissions. The interrelation between the green power trading market and the CET market under the green power carbon accounting offset mechanism is illustrated in

Figure 1.

In practice, green power is not yet permitted to directly offset carbon emissions in the national CET market. However, local pilot CET markets, including those in Beijing, Shanghai, Tianjin, Hubei and Shenzhen, have authorized the use of green power for this purpose. It is evident that, in the context of the coupling method, two predominant coupling methods have been identified in the green power trading market and the CET market within the designated pilot area. The initial approach entails the exclusion of carbon emissions from green power when calculating total carbon emissions. For instance, the municipalities of Shanghai and Beijing adjust the carbon emission factor of green power to 0, or directly regulate the manner in which the carbon emission of green power is calculated to 0. In Tianjin, the amount of green power purchased from the grid is directly deducted, thereby rendering the carbon emission of green power zero in the actual calculation. A second method involves the offset of actual carbon emissions with the carbon reduction corresponding to green power. For instance, Hubei Province and Shenzhen have adopted measures that permit enterprises with unfulfilled quotas to utilize the emission reduction corresponding to green power to offset carbon emissions, thereby promoting CET market quota compliance. The development practice of relevant pilot provinces and cities has strengthened the connection and coordination between the CET market and the green power trading market, improved the enthusiasm of local enterprises to purchase green power, and further promoted the coupling of the green power and CET market.

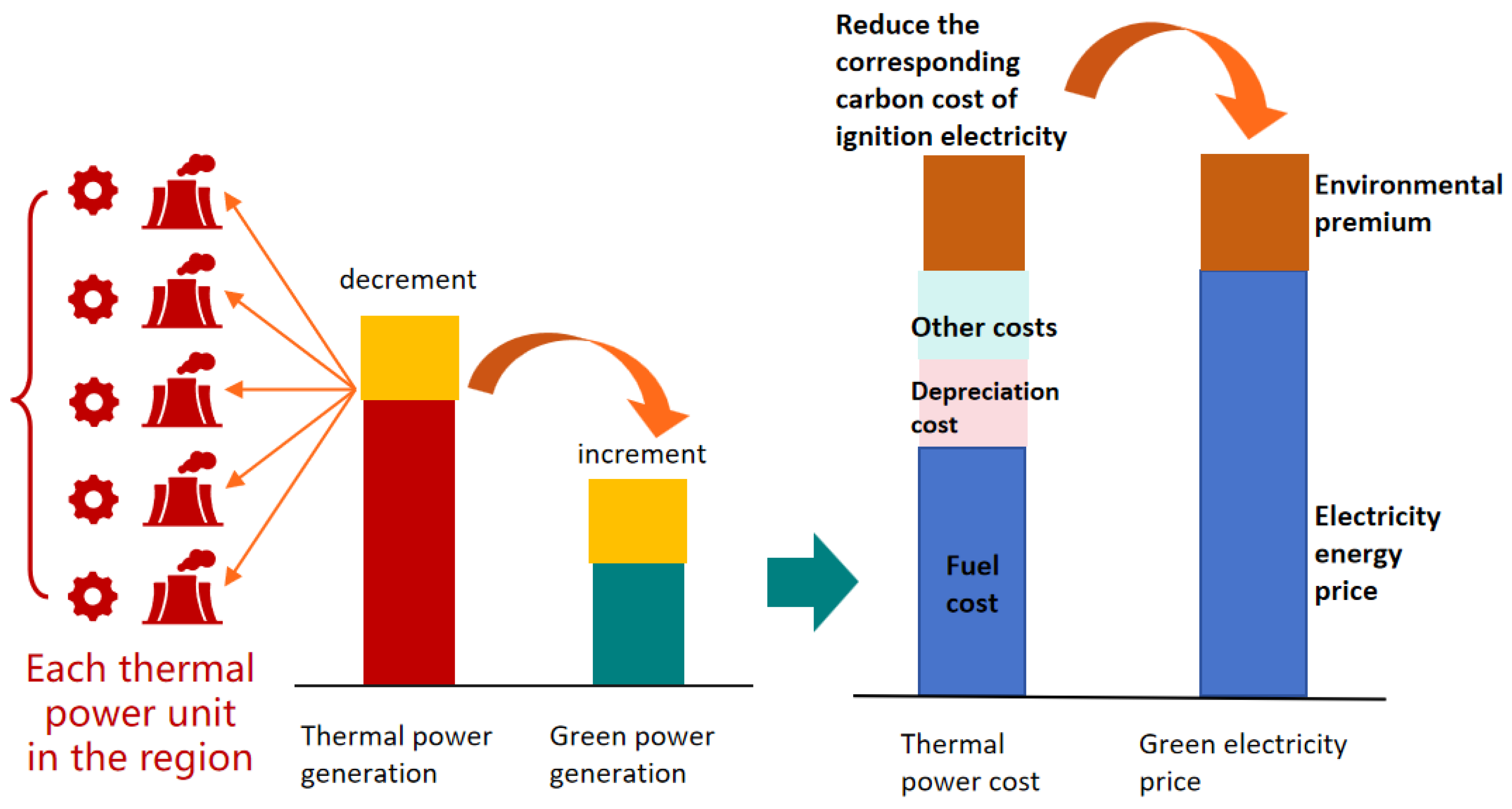

3.2. Analysis of the Relationship Between Green Power Environmental Value and Carbon Emission Reduction Cost

The present paper proposes a novel approach to analyzing and calculating the environmental value from the perspective of carbon emission reduction cost, based on the coupling of the green power trading market and the CET market. The price of green power comprises two constituent elements: the price of electricity and the environmental value. The price of electricity is defined as the production and operational costs of green power, which is typically the benchmark price of coal. The environmental value is indicative of the environmental attribute value of green power, representing the portion of the green power price that exceeds that of conventional electricity. The present study explores the correlation between the marginal carbon reduction cost of thermal power and the environmental value.

The cost of thermal power can be divided into two categories: generation cost and management cost. The primary components of power generation cost comprise the costs of thermal power fuel and thermal power unit depreciation. The term “governance costs” is used to refer to the financial outlay required for the reduction of carbon emissions from thermal power enterprises [

25,

26]. In the context of the enterprise, the entire process of thermal power trading, from the procurement of coal to the final disposal of waste, is subject to stringent regulations pertaining to carbon emissions. Consequently, coal-fired units are compelled to adhere to more stringent standards with regard to carbon emissions. Furthermore, within the framework of the CET market trading mechanism, the government allocates specific carbon quotas to thermal power generation enterprises. In the event that the actual carbon emissions of thermal power generation enterprises exceed the carbon quota issued, it is incumbent upon them to purchase carbon quotas in the CET market in order to fulfill the contract. In turn, this results in an increase in the cost of thermal power generation enterprises and is reflected in the electricity price [

27].

As a renewable energy source, green power is characterized by its low carbon emissions and minimal release of greenhouse gases and other pollutants during the power generation process, thereby exhibiting favorable environmental attributes. In the context of the integration of the green power trading market and the CET market, the calculation of green power in terms of carbon emissions is typically negligible, resulting in a carbon cost of zero. Consequently, traditional thermal power generation enterprises are compelled to confront low-carbon transformation due to the influence of carbon costs. This transformation leads to an augmentation in the proportion of renewable energy power, thereby conferring a certain alternative role to green power in relation to thermal power.

In scenarios where a specific amount of power generation is in operation, priority is given to green power over the grid. In instances where green power exceeds one degree of electricity, the resultant thermal power is reduced by one degree of electricity. Consequently, this leads to a decrease in the carbon dioxide emissions associated with the respective thermal power. The carbon emissions reduced by green power in comparison with thermal power can be quantified as specific carbon emission reduction benefits in the CET market, which has a certain economic value. This economic value is indicative of the environmental value of green power relative to thermal power. It can be utilized to calculate the environmental value of green power, as demonstrated in

Figure 2.

The green power environmental value mechanism, which incorporates a reduction in carbon emissions, provides a novel approach to the quantification of the environmental value. This is based on the costs of reducing carbon emissions and successfully transforms the environmental value of green power into actual emission reduction benefits. This process not only promotes the increase of green power generation, but also lays a solid foundation for building a clean and low-carbon renewable energy system.

5. Results and Discussion

5.1. Analysis of Power Generation of Different Units

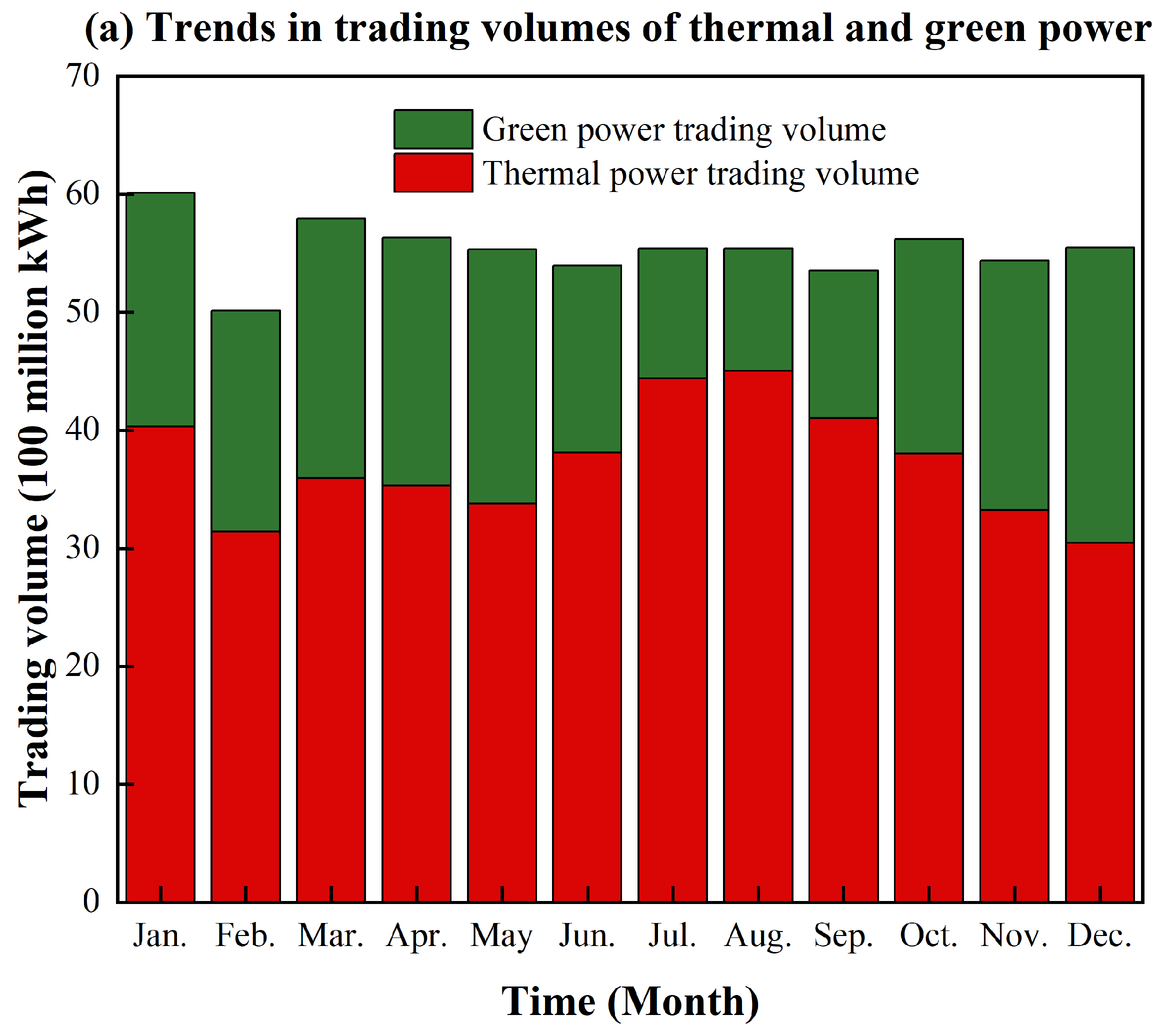

Figure 3a shows the generation of thermal and green power units, and overall, the trading volume of thermal and green power shows an opposite trend. Specifically, affected by the supply and demand, both thermal power trading volume and green power trading volume showed a decreasing trend in January–February 2024, decreasing by 22.08% and 5.36%, respectively. Thermal power trading volume fluctuated and increased in March–August 2024, rising from 3597 million kWh to 4502 million kWh; whereas green power showed a trend of increasing and then decreasing, from 2195 million kWh to 1038 million kWh; this is because the renewable energy power generated by wind and solar energy can choose to participate in the green power market by the way of the certificate and electricity bundle (with environmental attributes), or can choose to participate in the traditional electricity market by the way of the certificate and electricity separation (does not have the environmental attributes, because of its environmental attributes, i.e., the TGC participates in the TGC market). The volume of participation in the green electricity market is lower in this period, while the volume of participation in the traditional electricity market by choosing the separation of electricity and certificates is higher. Thermal power trading volume showed a downward trend from September to December 2024, decreasing to 3044 million kWh, while green power trading volume showed an upward trend, increasing to 2503 million kWh.

Figure 3b shows the share of thermal and green power trading volume as 67% and 33%, respectively. Among them, thermal power trading volume consists of the trading volume from four types of generating units, namely, above 300 MW coal-fired units, 300 MW and below coal-fired units, gas-fired units and unconventional coal-fired units, which are 44%, 18%, 3% and 2%, respectively. Coal-fired units above 300 MW are the main component of thermal power, and large coal-fired units occupy an important position in energy supply due to high power generation efficiency and lower unit cost of power generation. Coal-fired units of 300 MW and below are still in operation in the region due to earlier construction, but their share is gradually decreasing with the improvement of environmental protection requirements and the adjustment of energy structure. Gas-fired units account for 3%. Although gas-fired units are clean and efficient, the relatively high cost of natural gas limits their large-scale development. Unconventional coal-fired units accounted for 2%; the fuel used by such units (such as coal gangue, coal slurry, etc.) is of relatively poor quality, and the power generation efficiency and environmental performance are inferior to that of conventional coal-fired units, making their share relatively low.

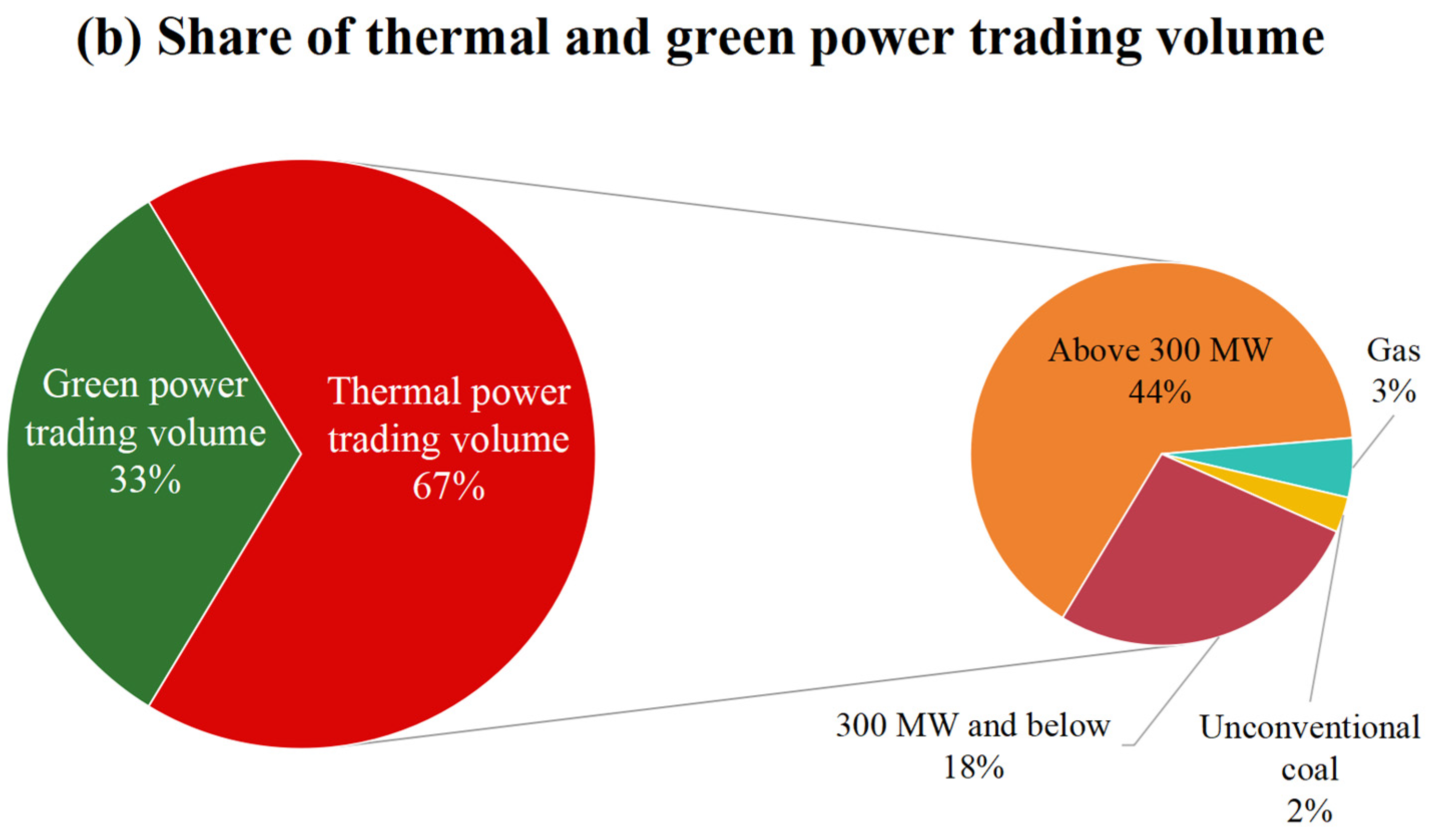

Figure 4 shows the average price of monthly transactions in the national CET market in 2024, and it can be seen that from January to May 2024, the carbon price showed an upward trend, from 72.6147 CNY/t (≈10.07 USD/t) to 94.1973 CNY/t (≈13.06 USD/t), an increase of 29.72%; the reason is that China have stipulated that the allocation of quotas would gradually shift from “free allocation” to “compensated allocation”, and the scarcity of quotas in the CET market became more and more obvious in February 2024 [

30]. The expansion of the national CET market has covered the cement, iron and steel, and electrolytic aluminum industries, and enterprises are purchasing quotas in advance, thus increasing short-term demand. From June to August 2024, the carbon price showed a downward trend, from 91.85 CNY/t (≈12.74 USD/t) to 86.21 CNY/t (≈11.95 USD/t), a decrease of 6.14%. This is because 2024 quota surplus companies, concerned about future tightening of the carry-over policy (e.g., a downward adjustment of the free quota ratio), chose to sell quota at high levels in the summer to lock in profits, leading to a surge in market supply. The 2024 carbon price shows an upward trend from September to December, rising from 96.69 CNY/t (≈13.41 USD/t) to 98 CNY/t (≈13.59 USD/t), an increase of 1.33%; the reason is that the power industry needs to complete quota clearing by the end of December, and enterprises focus on purchasing to boost demand.

The fluctuations in carbon prices reflect the fact that the market mechanism of the CET market is gradually coming into play. Enterprises adjust their carbon emission behavior and quota trading strategies according to market price signals and their own production needs. The guiding effect of the price mechanism on resource allocation in the CET market is gradually emerging, helping to promote energy conservation, emission reduction and energy structure transformation among enterprises.

5.2. Analysis of the Results of Quantifying the Value of the Green Power Environment

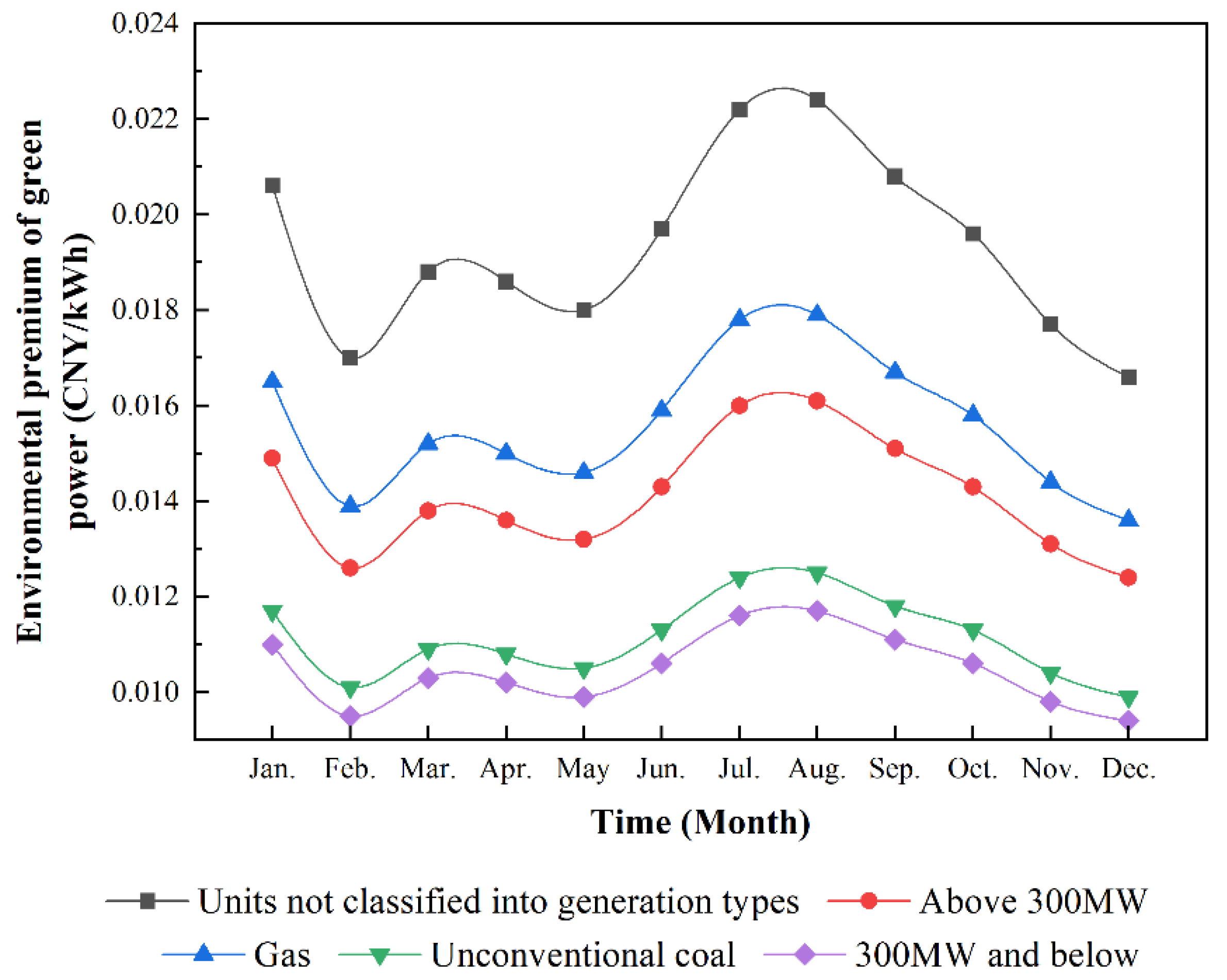

As can be seen in

Figure 5, the trend of the environmental value in the region fluctuates between 0.0166 CNY/kWh (≈0.0023 USD/kWh) and 0.0222 CNY/kWh (≈0.0031 USD/kWh) when not broken down by generation type. Specifically, the environmental value decreased in January–February 2024, falling to 0.0170 CNY/kWh (≈0.0024 USD/kWh); it showed a fluctuating upward trend in March–August 2024, rising to 0.0224 CNY/kWh (≈0.0031 USD/kWh) and a downward trend in September–December 2024, falling to 0.0166 CNY/kWh (≈0.0023 USD/kWh).

By unit type, the environmental value for coal-fired units above 300 MW fluctuates in the range of 0.0124 CNY/kWh (≈0.0017 USD/kWh)~0.0161 CNY/kWh (≈0.0022 USD/kWh). Specifically, from January to February 2024, the environmental value decreases to 0.0126 CNY/kWh (≈0.0017 USD/kWh); from March to August 2024, the environmental value shows a fluctuating upward trend to 0.0161 CNY/kWh (≈0.0022 USD/kWh); and from September to December 2024, the environmental value shows a decreasing trend to 0.0124 CNY/kWh (≈0.0017 USD/kWh). Compared to units not classified by generation type, coal-fired units above 300 MW have a lower environmental value.

The environmental value for gas-fired units fluctuates between 0.0136 CNY/kWh (≈0.0019 USD/kWh) and 0.0179 CNY/kWh (≈0.0025 USD/kWh). Specifically, from January to February 2024, the environmental value also shows a decreasing trend, falling to 0.0139 CNY/kWh (≈0.0019 USD/kWh); from March to August 2024, the environmental value shows a fluctuating increasing trend, rising to 0.0179 CNY/kWh (≈0.0025 USD/kWh); and from September to December 2024, the environmental value shows a decreasing trend, falling to 0.0136 CNY/kWh (≈0.0019 USD/kWh). Compared with the environmental value for coal-fired units above 300 MW and units not classified by generation type, the environmental value for gas-fired units is intermediate, which is because gas-fired units burn more completely and cleanly than coal and other traditional fossil fuel generation, and the pollutants such as sulfur dioxide, nitrogen oxides and particulate matter are far lower than those produced by coal-fired generation. In addition, the carbon intensity of gas-fired units is also relatively low, which helps to reduce greenhouse gas emissions and has certain benefits in combating climate change, so it has a certain environmental value.

The environmental value for unconventional coal-fired units fluctuates from 0.0099 CNY/kWh (≈0.0014 USD/kWh) to 0.0125 CNY/kWh (≈0.0017 USD/kWh). Specifically, the environmental value decreases to 0.0101 CNY/kWh (≈0.0014 USD/kWh) in January–February 2024; the environmental value shows a fluctuating upward trend to 0.0125 CNY/kWh (≈0.0017 USD/kWh) in March–August 2024; and the environmental value shows a decreasing trend to 0.0099 CNY/kWh (≈0.0014 USD/kWh) in September–December 2024. Compared to the environmental values of units not classified by generation type, coal-fired units above 300 MW and gas-fired units, the environmental values of unconventional coal-fired units are relatively low; this is because unconventional coal-fired units usually have gaps in energy conversion efficiency and other aspects compared to traditional large and high-efficiency coal-fired units and gas-fired units, which leads to their poor performance in terms of the environmental benefits of energy use, and makes it difficult to increase the environmental values.

The environmental value for units with a capacity of 300 MW or less fluctuates between 0.0094 CNY/kWh (≈0.0013 USD/kWh) and 0.0117 CNY/kWh (≈0.0016 USD/kWh). Specifically, the environmental value decreases to 0.0095 CNY/kWh (≈0.0013 USD/kWh) in January–February 2024; the environmental value shows a fluctuating upward trend to 0.0117 CNY/kWh (≈0.0016 USD/kWh) in March–August 2024, and the environmental value shows a decreasing trend to 0.0094 CNY/kWh (≈0.0013 USD/kWh) in September–December 2024. Compared to the environmental values of coal-fired units above 300 MW, units not classified by generation type and gas-fired units, the environmental value of units of 300 MW and below is the smallest. This is because many generating units of 300 MW and below use coal as the main fuel and even after desulphurization, denitrification and other treatments, the pollutants and carbon emissions in their combustion products are still high and the gap between them and the other units in terms of environmental benefits is obvious and the environmental value is also lower.

Combined with

Figure 3 and

Figure 5, it can be seen that the fluctuation trend of the environmental value and the thermal power trading volume are basically consistent, and it is not difficult to see that when the thermal power trading volume is higher, the carbon dioxide emitted will also increase, which in turn increases the cost of carbon quota trading and increases the level of the environmental value.

5.3. Analysis of Granger Test Results

The smoothness of the variable data needs to be tested before using the Granger causality test, and the study uses the Dickey–Fuller method. Thermal power trading volume, carbon price and environmental value are smooth series, as shown in

Table 2.

The results of the Granger causality test of the environmental value with thermal power trading volume and carbon price are shown in

Table 3, which indicates that the environmental value is in a bidirectional causal relationship with thermal power trading volume and carbon price. This proves the rationality of using thermal power trading volume and carbon price to measure the environmental value.

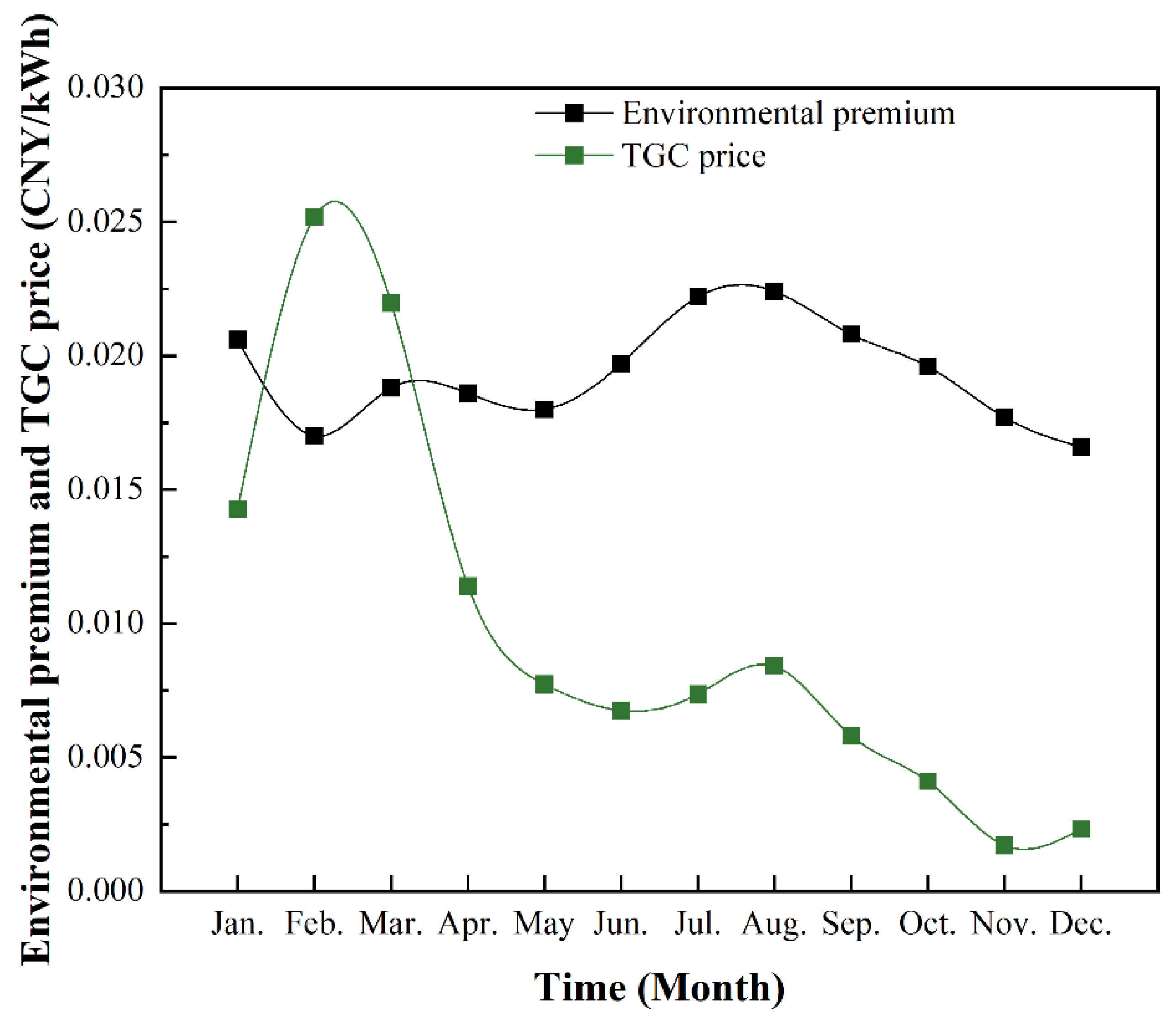

5.4. Comparative Analysis of Environmental Value and TGC Price

At present, the environmental value of green power is mainly reflected by the TGC price, which defines the environmental value of green power from the perspective of environmental attributes. According to the data of 2024, the average price of TGC transactions in Beijing Power Trading Center is 0.0075 CNY/kWh (≈0.0010 USD/kWh), while the average price of TGC transactions in China’s TGC trading platform is 0.0070 CNY/kWh (≈0.0010 USD/kWh). However, the environmental value of green power in this paper, which is based on the marginal carbon abatement costs of thermal power units, is defined from the perspective of abatement attributes. As shown in

Figure 6, by comparing the TGC price with the environmental value measured in this paper, it can be seen that the environmental value based on the marginal carbon abatement costs of thermal power units is slightly higher than the TGC price. This phenomenon indicates that the competitive advantage of the CET market in reflecting environmental value is still stronger than that of the TGC market and the green power trading market.

Although both the TGC and CET markets reflect environmental value through market mechanisms, the CET market is significantly more mature than the TGC market. The TGC market is currently oversupplied, resulting in a relatively low average price for TGC transactions, which does not fully reflect the true environmental value of green power. In contrast, the environmental value of green power based on marginal carbon abatement cost accounting not only takes into account the need for synergistic development of electricity and carbon, but also focuses on long-term sustainable development goals. This accounting method can reflect the environmental benefits of green power more comprehensively, which can help promote the transformation from dual control for energy consumption to dual control for carbon emissions in China, and better support the realization of the carbon peaking and carbon neutrality (double carbon) goals.