Optimal Bidding Strategies for the Participation of Aggregators in Energy Flexibility Markets

Abstract

1. Introduction

- They deal with the aggregation’s trading issues only, without including the flexibility service in the optimization process;

- They neglect important parameters accounting for technical aspects and constraints of resources’ operation (e.g., response time);

- They do not consider the need for flexibility in the aggregators’ estimation, in terms of both quantity and price, to make appropriate offers to the market.

2. The Role of the Aggregator in Flexibility Markets

- The aggregator engages different types of active and passive customers by signing contracts based on their typical load profiles and features to gather flexibility.

- For each fixed time interval, the customers offer flexibility in terms of a couple of values representing “quantity and price”, where “quantity” can be identified by an active power variation for a given time interval, associated with a “price” (monetary reward). It is important to remark that the feasibility of the different customers’ offers/availability is not under the aggregator’s responsibility. In other words, the feasibility check of the proposed active power variations provided by the customers is only the task of some of them, considering the types of loads, generators, and storage available to the customers.

- From the FM viewpoint, the aggregator sells the available cluster power variations obtained thanks to the flexibility provided by the customers by offering price–quantity bids. The profits are shared between the aggregator and the customers, according to a “profit-seeking” approach.

- Before the market closure, they have to decide the optimal price–quantity bids to be sent to the market for all the periods within the trading horizon, according to the offers/availability of the PTAs;

- They must decide the optimal schedules for every flexible unit (i.e., PTA) in their portfolio.

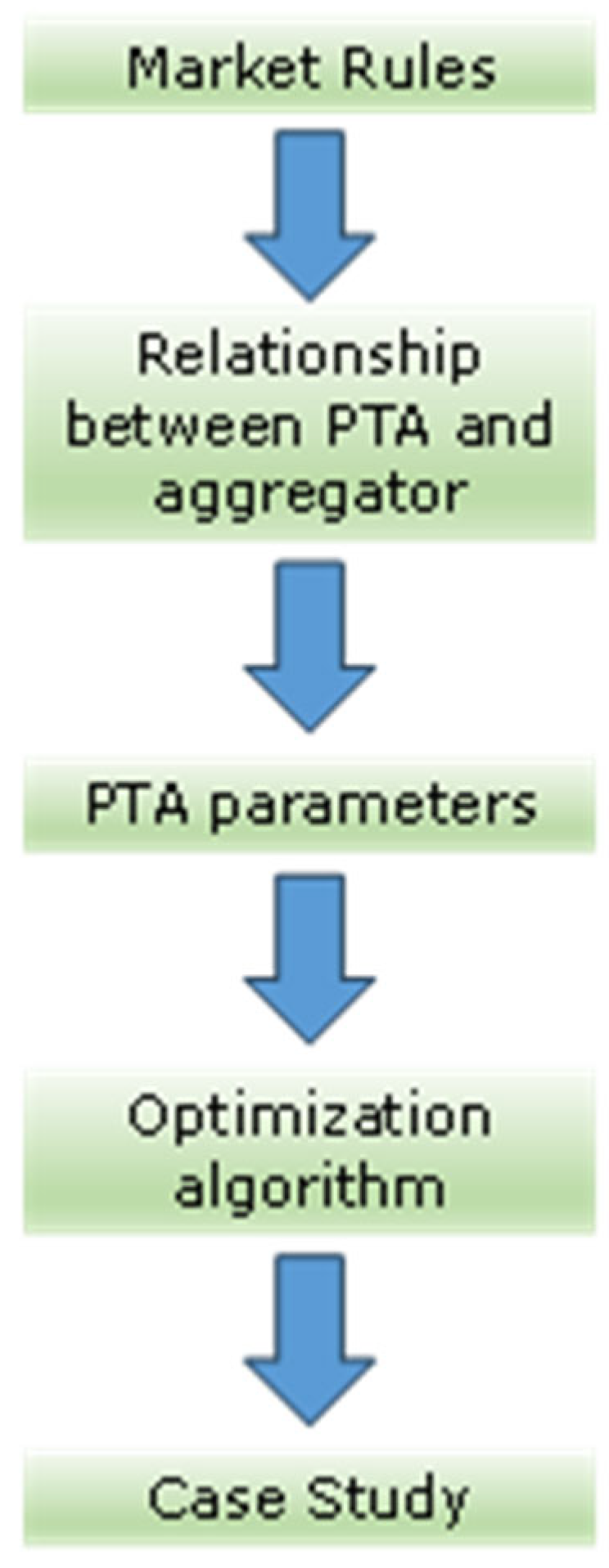

- Definition of market rules to establish the rules governing how the aggregate can operate in the FM.

- Definition of the relationship between PTAs and aggregator; this is useful to define how PTAs can contribute to the aggregation in a profitable way for all the stakeholders.

- Definition of main PTA parameters; this is useful to specify the features and metrics of the PTAs.

- Definition of a suitable optimization algorithm; an algorithm can be created to optimize the performance of the aggregate, as will be described in the next section.

- Case study and numerical analysis, with the aim of analyzing the effectiveness of the implementation, performing quantitative assessments to validate the results.

3. Optimal Bidding Strategy: Mathematical Formulation

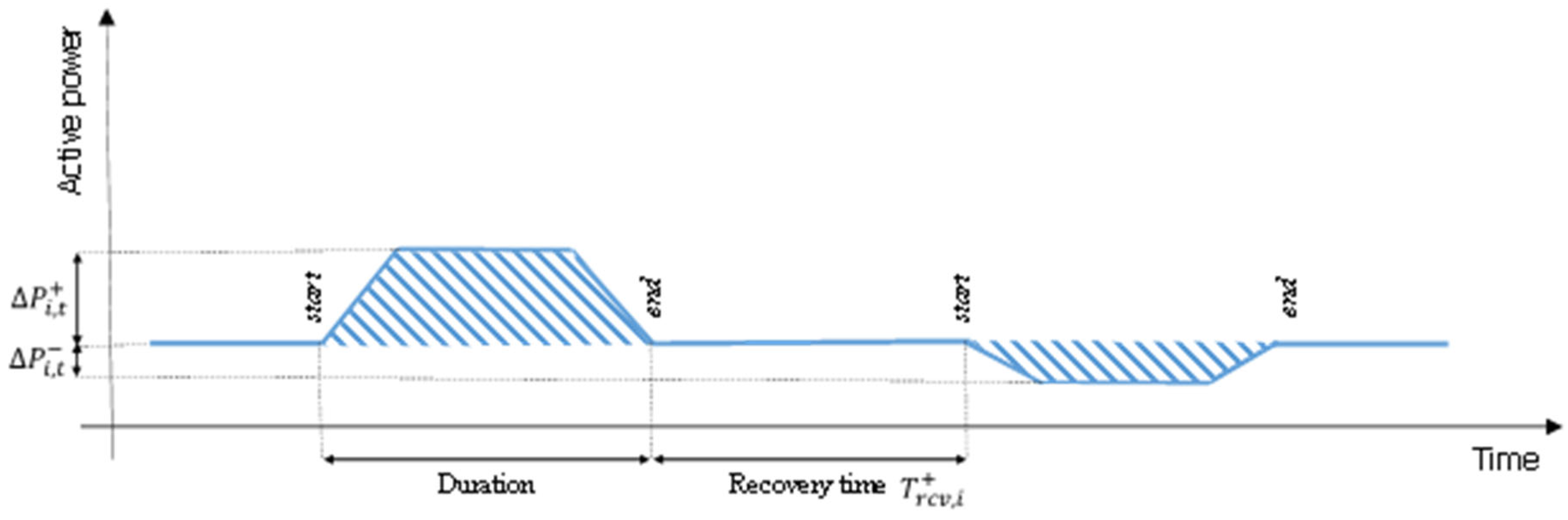

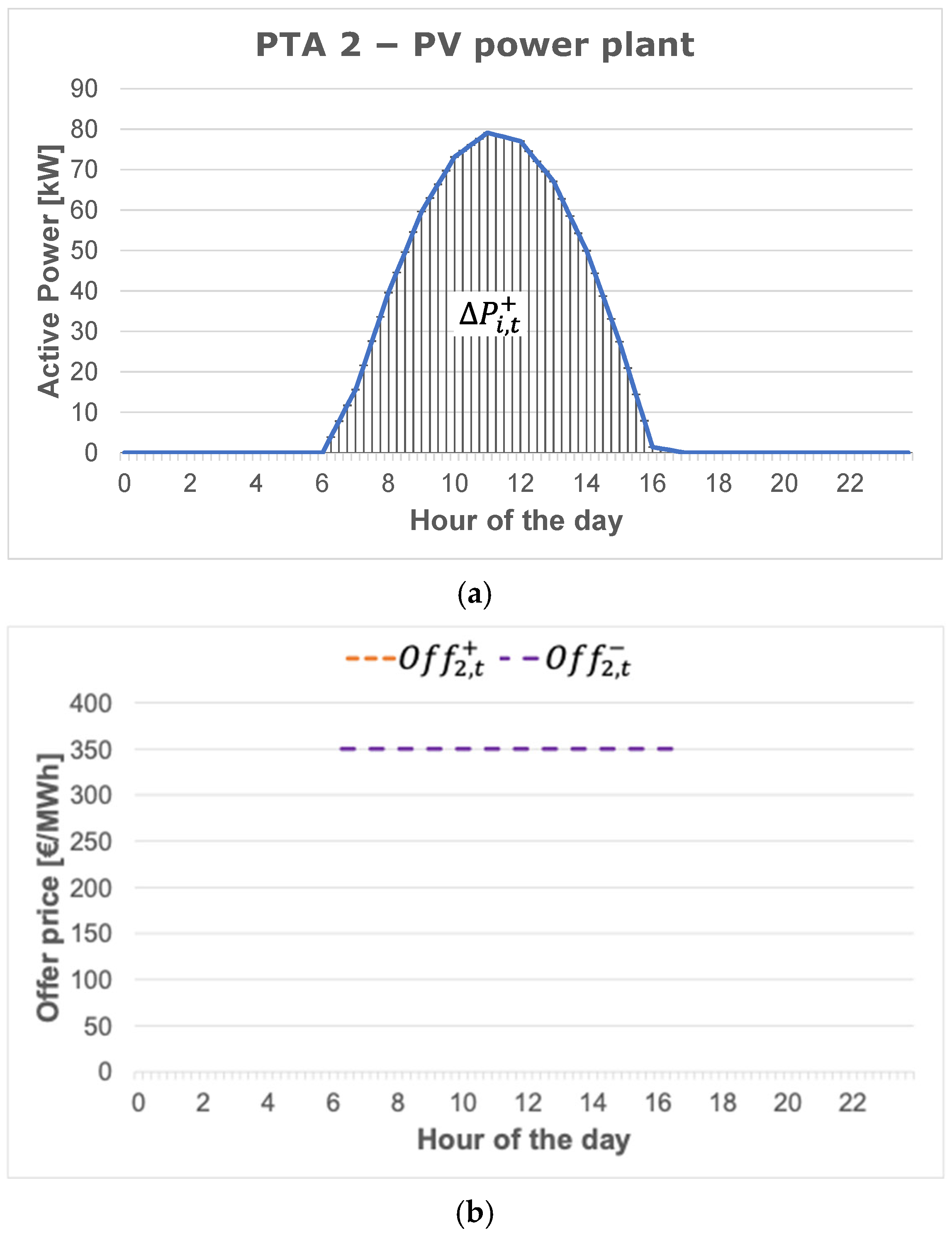

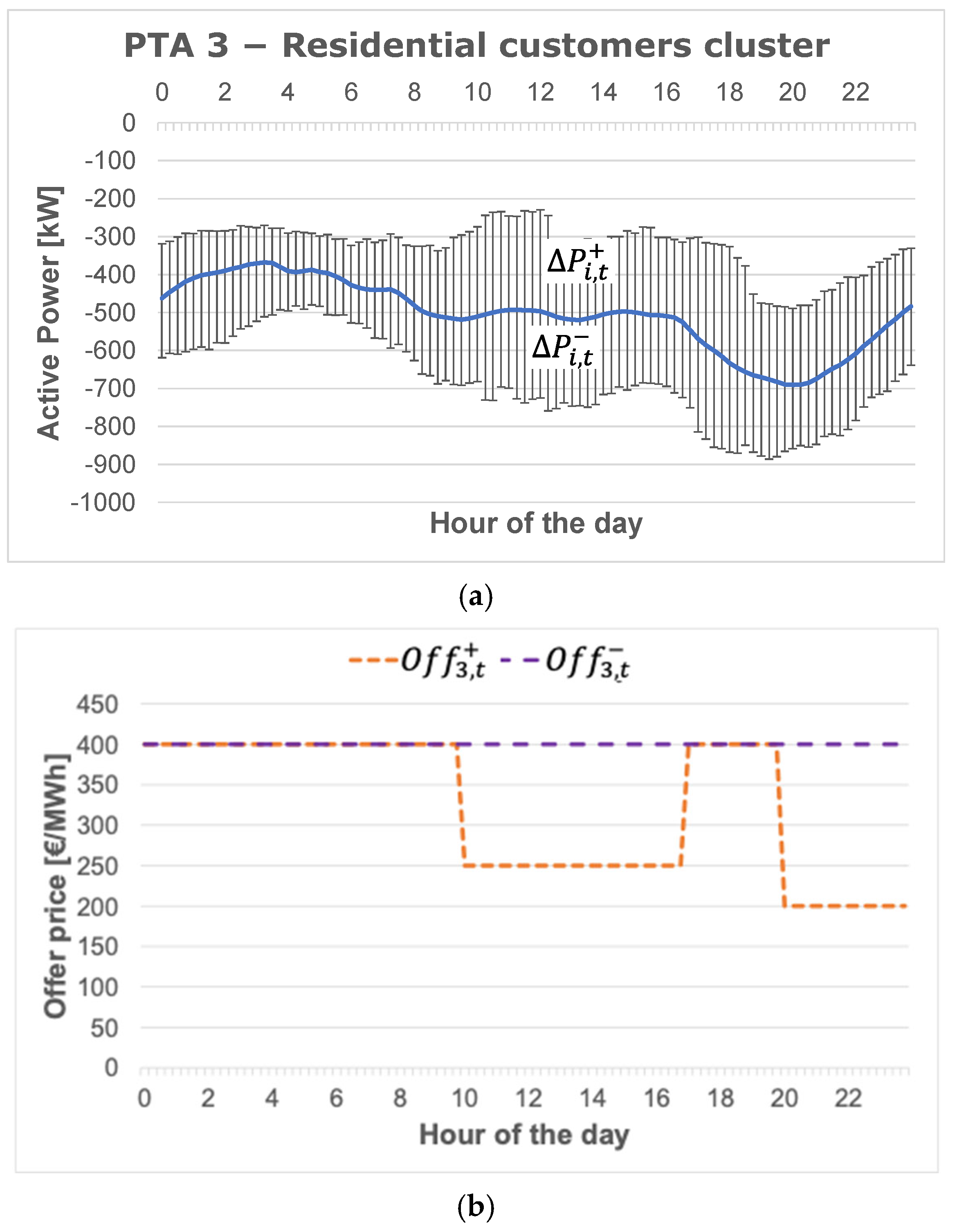

- The availability of a single PTA included in the aggregator’s portfolio, defined by the maximum power variation available in all the time intervals, in terms of power increase or decrease (Figure 3);

- Maximum/minimum duration and recovery time of the power variations (Figure 3) for all the PTAs;

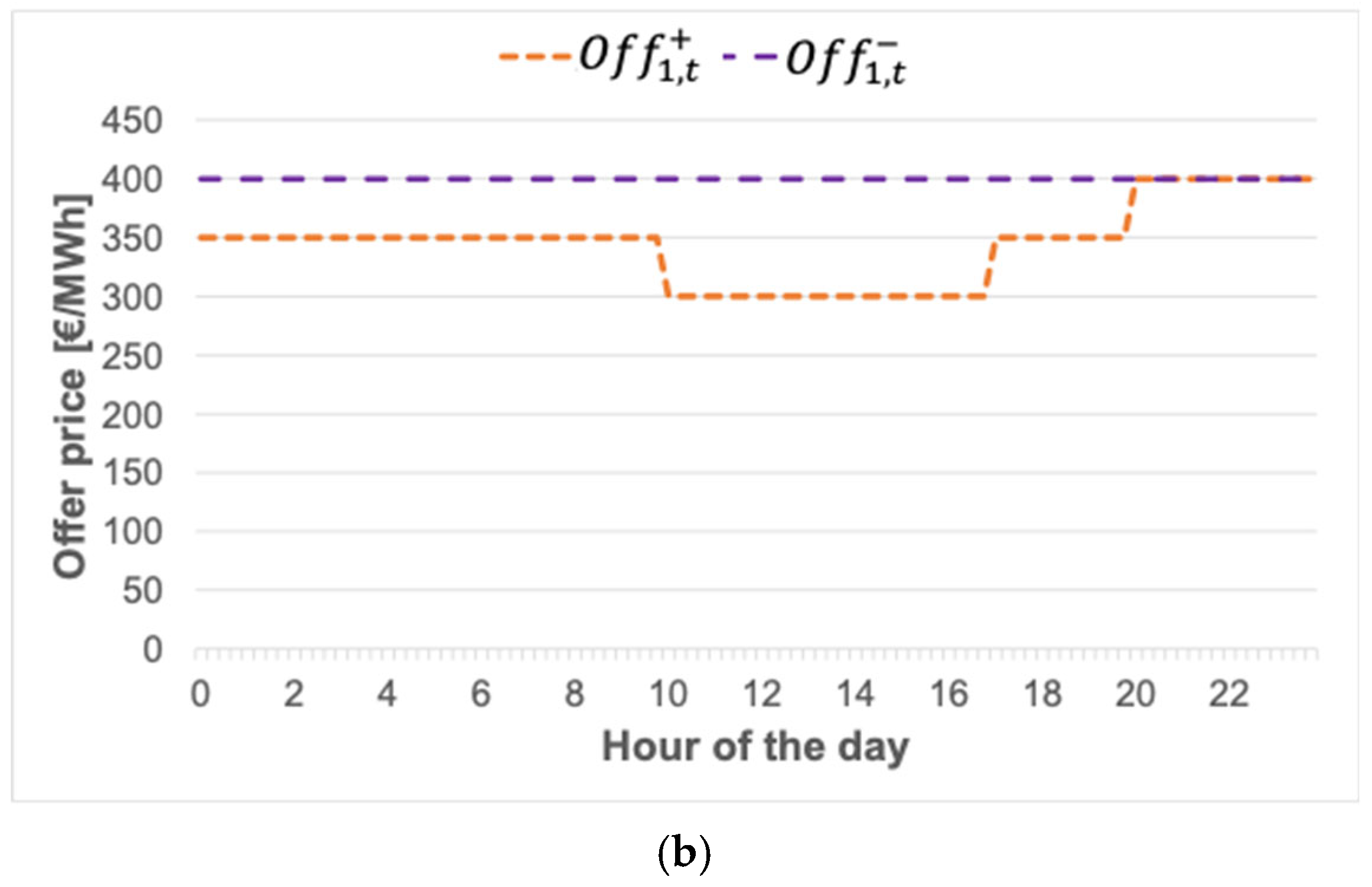

- Fixed cost and bid price submitted by all PTAs to the aggregator;

- FM price (estimated value) considered for the aggregate power increase or decrease;

- Aggregate power minimum variation and minimum duration (market constraints on the aggregation).

- Variables (integer and real).

- Optimization function.

- Constraints, which can be divided into “time constraints” and “market constraints”.

3.1. Physical Variables (Active Powers)

3.2. Status Variables

- “Start PTA up status” (active power increase), , which relates to time t, when the i-th PTA starts its power increase, as defined in (3):

- “Start PTA down status” (active power decrease), , which relates to time t, when the i-th PTA starts its power decrease, as defined in (4):

- “End PTA up status” (active power increase), , which relates to time t, when the i-th PTA ends its power increase, as defined in (5):

- “End PTA down status” (active power decrease), , which relates to time t, when the i-th PTA ends its power decrease, as defined in (6):

3.3. Cost Functions

- A fixed cost, which includes the amount that cannot be related to each PTA power variation;

- A variable cost, which regards the power variation offered by each PTA.

3.4. Objective Function

3.5. Constraints

- Maximum duration of the PTA power variation;

- Minimum duration of the PTA power variation;

- Recovery time, i.e., the time interval between two subsequent power variations.

3.6. Procedure’s Output

- (a)

- Run in the “increase power mode”, considering constraints 20a;

- (b)

- Run in the “decrease power mode”, considering constraints 20b;

4. Results and Discussion Related to a Case Study

4.1. Case Study

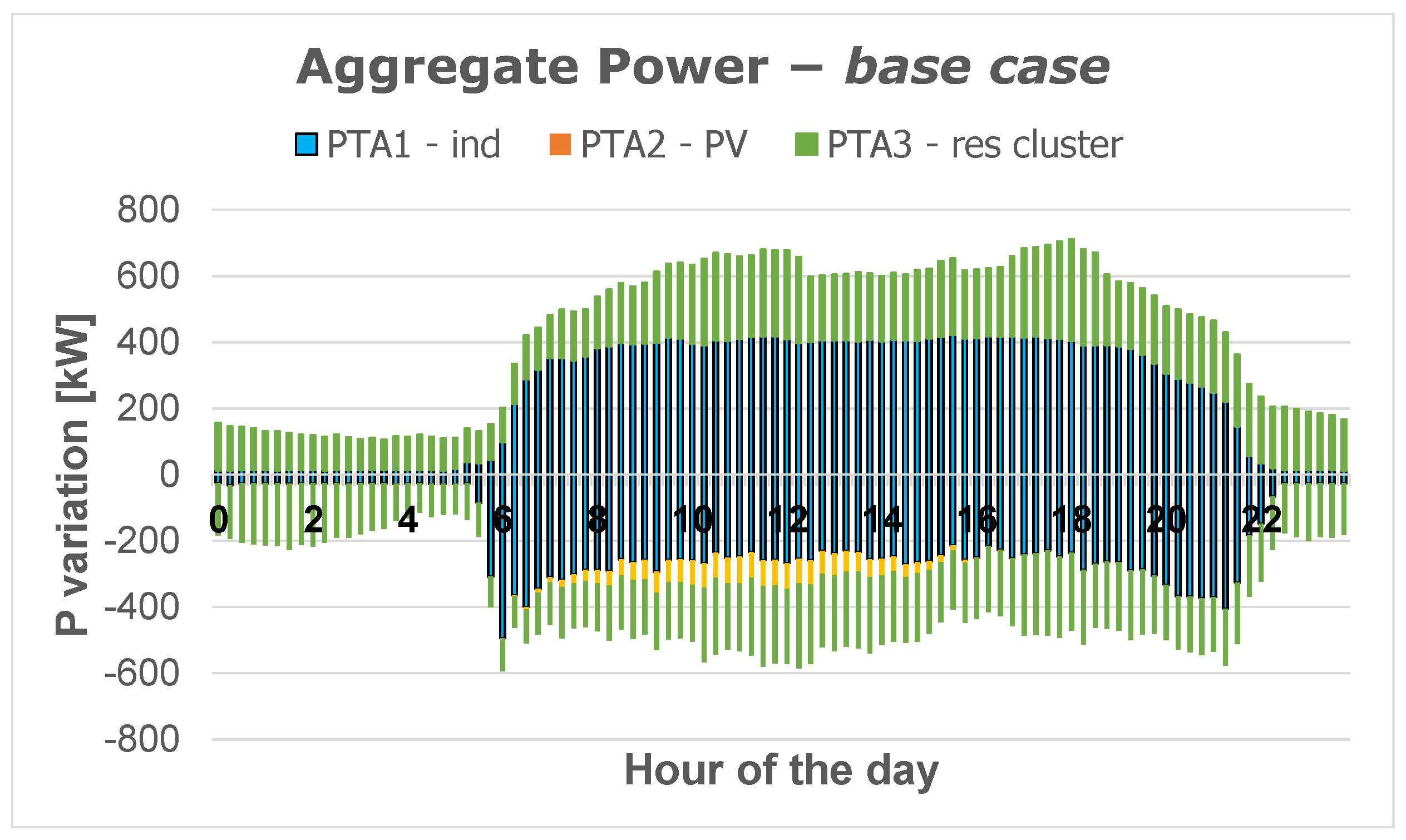

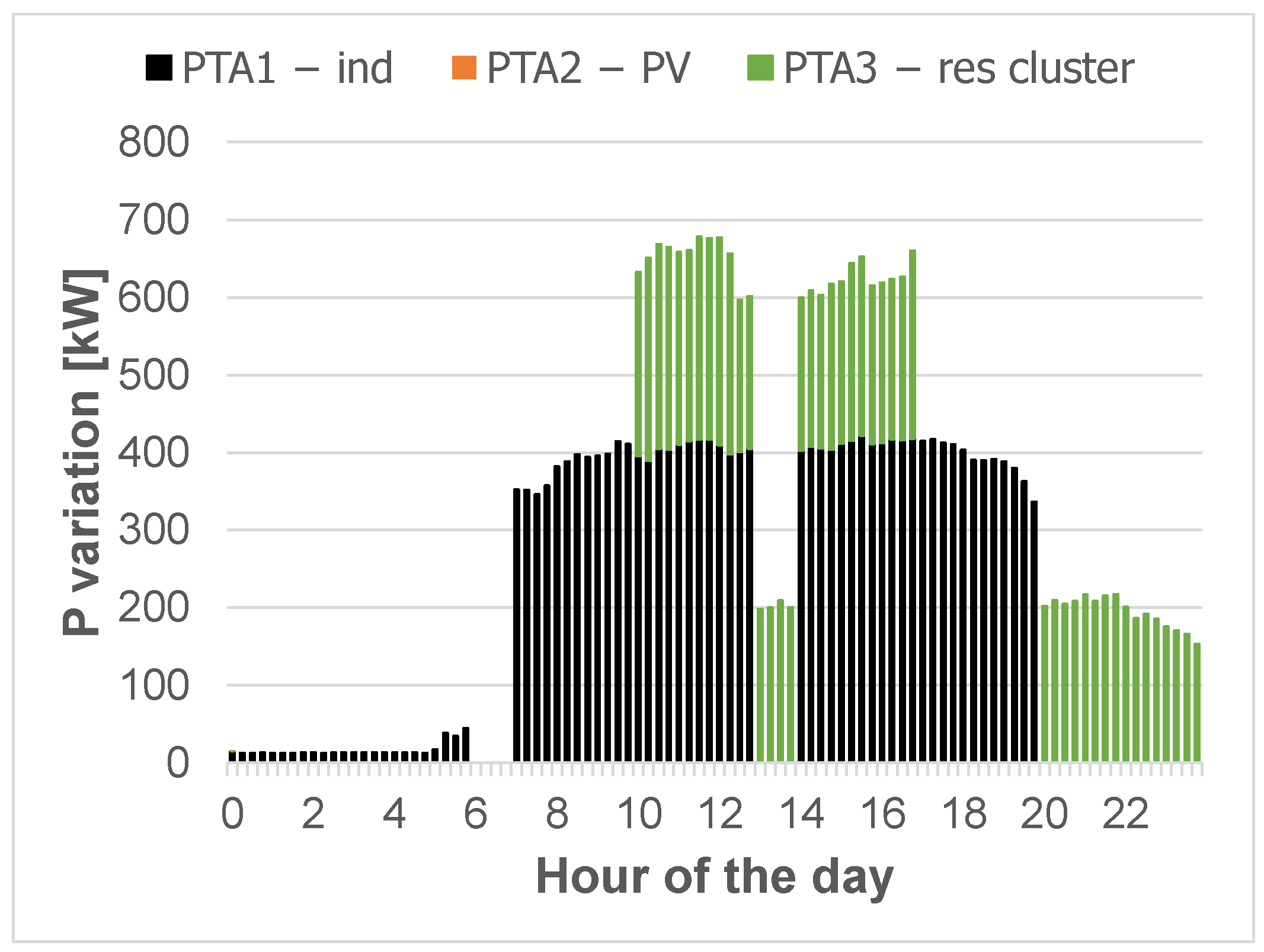

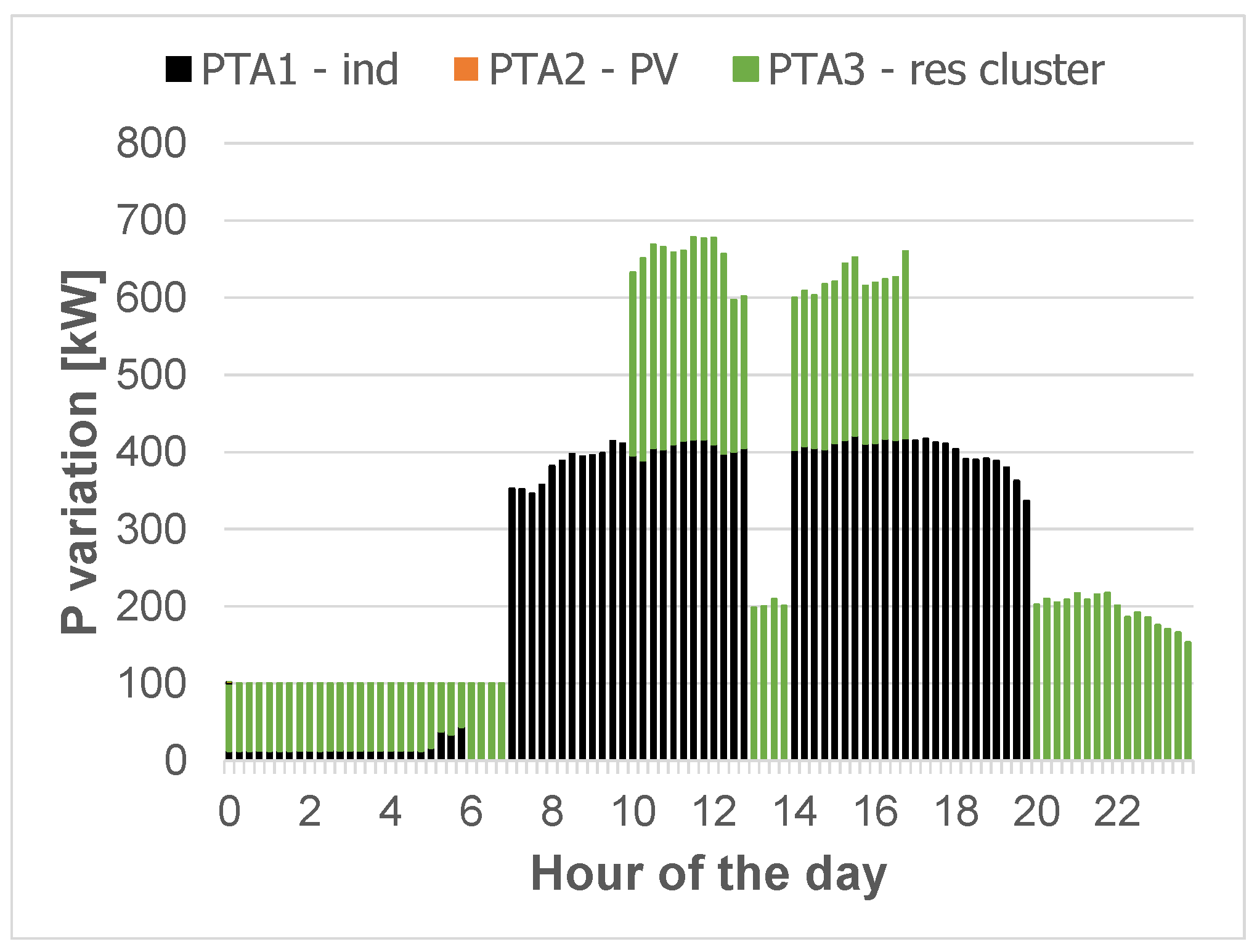

- PTA 1, represented by an industrial load.

- PTA 2, including a PV generator.

- PTA 3, including a cluster of 1,135 residential customers. These customers have been clustered according to their similar characteristics in terms of “availability” and “prices” offered to the aggregator.

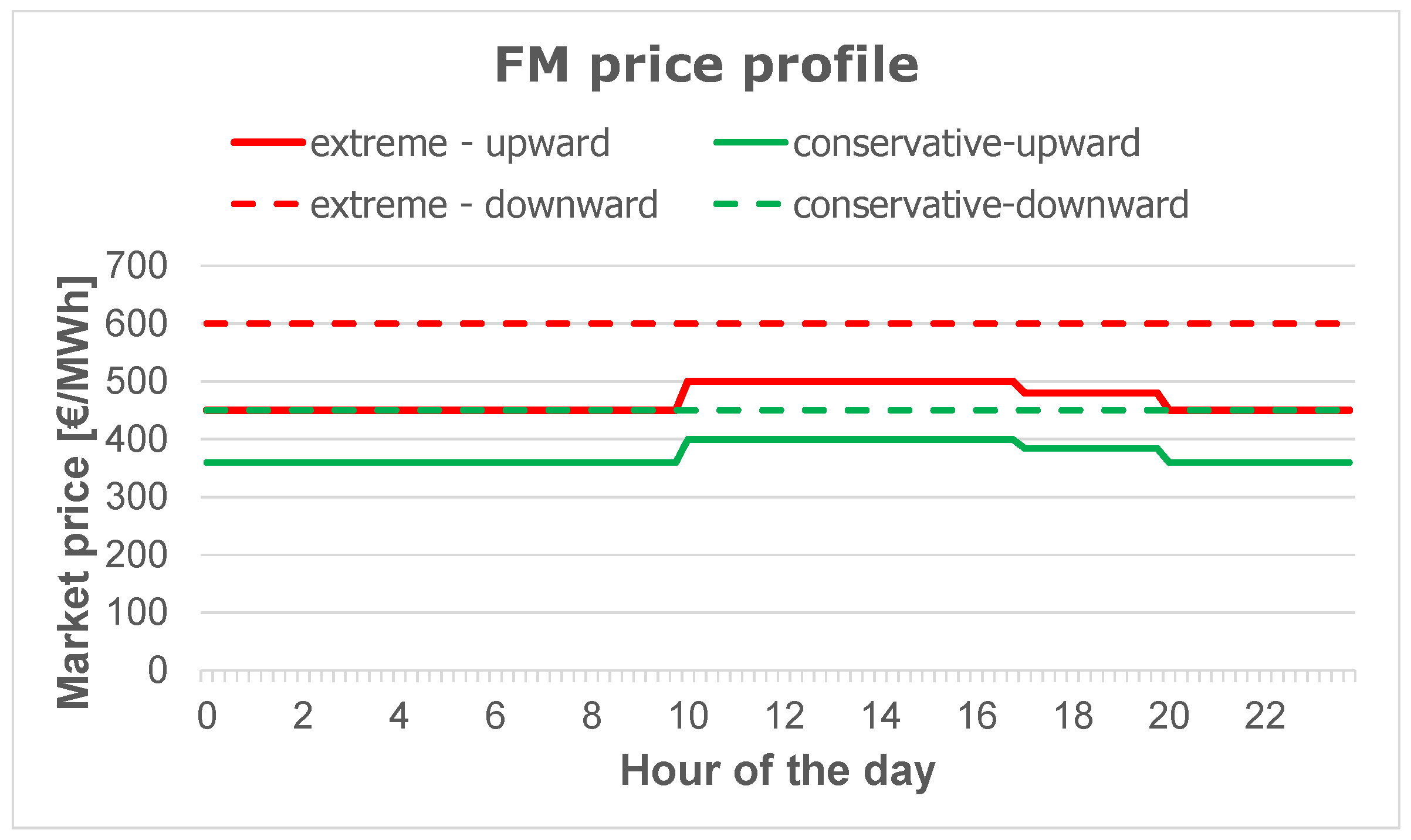

- An “average” FM price profile referred to the average clearing price in the FM during a given time period (e.g., one month/year);

- An “extreme” (“conservative”) FM price profile, calculated with reference to the “maximum” (“minimum”) clearing price in the FM during the same period.

4.2. Results

5. Conclusions and Future Developments

- The main aggregation trading issues do not include the flexibility service in the optimization process;

- Important parameters accounting for technical aspects and constraints of resources’ operation (e.g., response time) are neglected.

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Nomenclature

| Acronyms | |

| PTA | Participant to the Aggregation; |

| EU | European Union; |

| RES | Renewable Energy Source; |

| DSO | Distribution System Operator; |

| AS | Ancillary Service; |

| ASM | Ancillary Services Market; |

| FM | Flexibility Market; |

| SG | Smart Grid; |

| MILP | Mixed-Integer Linear Programming; |

| OF | Objective Function; |

| OPF | Optimal Power Flow; |

| DER | Distributed Energy Resource; |

| MG | Micro Grid; |

| LEC | Local Energy Community; |

| USEF | Universal Smart Energy Framework; |

| SQP | Sequential Quadratic Programming. |

Indexes | |

| Δt | Time interval (e.g., 0.25 h if the trading horizon is divided in time steps of 15 min); |

| Nint | Number of time intervals in the trading horizon; |

| NPTA | Number of participants in the aggregation; |

| T | Set of time intervals in the trading horizon; |

| t | Time during the trading horizon. |

Parameters | |

| Maximum power variation available for the i-th PTA at time t, in terms of power increase (positive variation); | |

| Maximum power variation available for the i-th PTA at time t, in terms of power reduction (negative variation); | |

| Maximum duration of a positive power variation in the i-th PTA; | |

| Maximum duration of a negative power variation in the i-th PTA; | |

| Minimum duration of a positive power variation in the i-th PTA; | |

| Minimum duration of a negative power variation in the i-th PTA; | |

| Recovery time of a positive power variation in the i-th PTA; | |

| Recovery time of a negative power variation in the i-th PTA; | |

| Fixed switch-on cost of the i-th PTA to contribute to the aggregated power increase; | |

| Fixed switch-on cost of the i-th PTA to contribute to the aggregated power decrease; | |

| Bid price submitted by the i-th PTA to the aggregator to increase the power at time t; | |

| Bid price submitted by the i-th PTA to the aggregator to decrease the power at time t; | |

| FM price considered for the aggregate power increase at time t; | |

| FM price considered for the aggregate power decrease at time t; | |

| Aggregate minimum power variation limit, used when the aggregate power increases; | |

| Aggregate minimum power variation limit, used when the aggregate power decreases; | |

| Tm | Minimum duration for the aggregate power variation. |

Variables | |

| “End PTA down status” (power decrease) that indicates the time, t, at which the i-th PTA ends the power decrease; | |

| “End PTA up status” (power increase) that indicates the time, t, at which the i-th PTA ends the power increase; | |

| “Start PTA down status” (power decrease) that indicates the time, t, at which th i-th PTA starts the power decrease; | |

| “Start PTA up status” (power increase) that indicates the time, t, at which the i-th PTA starts the power increase; | |

| Power variation in the i-th PTA at time t. | |

Quantities used in the optimization’s formulation | |

| A | )) used to define the optimization constraints in terms of linear inequalities; |

| b | ) used to define the constraints in terms of linear inequalities; |

| Fixed cost of the i-th PTA; | |

| Variable cost of the i-th PTA at time t; | |

| c | element regards the constraint of minimum duration for the aggregate power variation; |

| Ctot | Aggregator’s total cost, summing the fixed and variable costs sustained for all the PTAs in the trading horizon; |

| Rt | Aggregator’s revenue in the FM at time t; |

| x | × 1) of the physical variables (power variations); |

| LB | × 1) with the lower bounds for variables x; |

| UB | × 1) with the upper bounds for variables x; |

| OFopt | Objective function adopted (aggregator’s profit); |

| Rtot | Total aggregator’s revenues, summing the FM aggregator’s revenue in all trading horizons. |

References

- Silva, N. Tracing the transition from Passive to Active Distribution Networks. 2017. Available online: https://www.incite-itn.eu/blog/tracing-the-transition-from-passive-to-active-distribution-networks/ (accessed on 18 May 2025).

- Tina, G.M.; Cavalieri, S.; Soma, G.G.; Viano, G.; De Fiore, S.; Grillo, P.; Distefano, L. Main features of an aggregator’s platform for the management of distributed energy resources—PASCAL project case study. In Proceedings of the 2020 AEIT International Annual Conference (AEIT), Catania, Italy, 23–25 September 2020; pp. 1–6. [Google Scholar]

- Minniti, S.; Haque, N.; Nguyen, P.; Pemen, G. Pemen, Energies, Local markets for flexibility trading: Key stages and enablers. Energies 2018, 11, 3074. [Google Scholar] [CrossRef]

- Celli, G.; Pilo, F.; Pisano, G.; Ruggeri, S.; Soma, G.G. Risk-oriented planning for flexibility-based distribution system development. Sustain. Energy Grids Netw. 2022, 30, 100594. [Google Scholar] [CrossRef]

- Beckstedde, E.; Meeus, L. From ‘fit and forget’ to ‘flex or regret’ in distribution grids: Dealing with congestion in European distribution grids. IEEE Power Energy Mag. 2023, 21, 45–52. [Google Scholar] [CrossRef]

- Celli, G.; Pisano, G.; Ruggeri, S.; Soma, G.G.; Pilo, F.; Papa, C.; Pregagnoli, C.; de Carolis, L.; Ferrero, S.; Cazzato, F. Distribution Systems as Catalysts for Energy Transition Embedding Flexibility in Large-Scale Applications. IEEE Access 2024, 12, 92227–92240. [Google Scholar] [CrossRef]

- Eid, C.; Codani, P.; Perez, Y.; Reneses, J.; Hakvoort, R. Managing electric flexibility from distributed energy resources: A review of incentives for market design. Renew. Sustain. Energy Rev. 2016, 64, 237–247. [Google Scholar] [CrossRef]

- Carreiro, A.M.; Jorge, H.M.; Antunes, C.H. Energy management systems aggregators: A literature survey. Renew. Sustain. Energy Rev. 2017, 73, 1160–1172. [Google Scholar] [CrossRef]

- Asimakopoulou, G.E.; Hatziargyriou, N.D. Evaluation of economic benefits of DER aggregation. IEEE Trans. Sustain. Energy 2017, 9, 499–510. [Google Scholar] [CrossRef]

- Nizami, M.S.H.; Hossain, M.J.; Mahmud, K.; Ravishankar, J. Energy cost optimization and DER scheduling for unified energy management system of residential neighbourhood. In Proceedings of the 2018 IEEE International Conference on Environment and Electrical Engineering and 2018 IEEE Industrial and Commercial Power Systems Europe (EEEIC / I&CPS Europe), Palermo, Italy, 12–15 June 2018; pp. 1–6. [Google Scholar]

- Nizami, M.S.H.; Hossain, M.J.; Amin, B.M.R.; Kashif, M.; Fernandez, E.; Mahmud, K. Transactive energy trading of residential prosumers using battery energy storage systems. In Proceedings of the IEEE PowerTech2019, Milan, Italy, 23–27 June 2019; pp. 1–6. [Google Scholar]

- Hatziargyriou, N.; Asimakopoulou, G.E. DER integration through a monopoly DER aggregator. Energy Policy 2020, 137, 111124. [Google Scholar] [CrossRef]

- Parvania, M.; Fotuhi-Firuzabad, M.; Shahidehpour, M. Optimal demand response aggregation in wholesale electricity markets. IEEE Trans. Smart Grid 2013, 4, 1957–1965. [Google Scholar] [CrossRef]

- La Bella, A.; Falsone, A.; Ioli, D.; Prandini, M.; Scattolini, R. A mixed-integer distributed approach to prosumers aggregation for providing balancing services. Int. J. Electr. Power Energy Syst. 2021, 133, 107228. [Google Scholar] [CrossRef]

- Chen, S.; Chen, Q.; Xu, Y. Strategic bidding and compensation mechanism for a load aggregator with direct thermostat control capabilities. IEEE Trans. Smart Grid 2018, 9, 2327–2336. [Google Scholar] [CrossRef]

- Prat, E.; Dukovska, I.; Herre, L.; Nellikkath, R.; Thoma, M.; Chatzivasileiadis, S. Network-Aware Flexibility Requests for Distribution-Level Flexibility Markets. IEEE Trans. Power Syst. 2024, 39, 2641–2652. [Google Scholar] [CrossRef]

- Dib, M.; Abdallah, R.; Dib, O. Optimization Approach for the Aggregation of Flexible Consumers. Electronics 2022, 11, 628. [Google Scholar] [CrossRef]

- Bandeira, M.B.; Faulwasser, T.; Engelmann, A. An ADP framework for flexibility and cost aggregation: Guarantees and open problems. Electr. Power Syst. Res. 2024, 234, 110818. [Google Scholar] [CrossRef]

- Rasouli, V.; Gomes, Á.; Antunes, C.H. An optimization model to characterize the aggregated flexibility responsiveness of residential end-users. Int. J. Electr. Power Energy Syst. 2023, 144, 108563. [Google Scholar] [CrossRef]

- Good, N.; Mancarella, P. Flexibility in multi-energy communities with electrical and thermal storage: A stochastic, robust approach for multi-service demand response. IEEE Trans. Smart Grid 2019, 10, 503–513. [Google Scholar] [CrossRef]

- Dietrich, K.; Latorre, L.M.; Olmos, L.; Ramos, A. Modelling and assessing the impacts of self-supply and market-revenue driven Virtual Power Plants. Electr. Power Syst. Res. 2015, 119, 462–470. [Google Scholar] [CrossRef]

- Jin, X.; Wu, Q.; Jia, H. Local flexibility markets: Literature review on concepts, models and clearing methods. Appl. Energy 2020, 261, 114387. [Google Scholar] [CrossRef]

- Alrumayh, O.; Bhattacharya, K. Flexibility of residential loads for demand response provisions in smart grid. IEEE Trans. Smart Grid 2019, 10, 6284–6297. [Google Scholar] [CrossRef]

- Hu, S.; Xiang, Y.; Liu, J.; Gu, C.; Zhang, X.; Tian, Y.; Liu, Z.; Xiong, J. Agent-based coordinated operation strategy for active distribution network with distributed energy resources. IEEE Trans. Ind. Appl. 2019, 55, 3310–3320. [Google Scholar] [CrossRef]

- Lu, X.; Qiu, J.; Zhang, C.; Lei, G.; Zhu, J. Seizing unconventional arbitrage opportunities in virtual power plants: A profitable and flexible recruitment approach. Appl. Energy 2024, 358, 122628. [Google Scholar] [CrossRef]

- Lu, X.; Qiu, J.; Zhang, C.; Lei, G.; Zhu, J. Assembly and Competition for Virtual Power Plants With Multiple ESPs Through a “Recruitment-Participation” Approach. IEEE Trans. Power Syst. 2024, 39, 4382–4396. [Google Scholar] [CrossRef]

- Zoeller, H.; Reischboeck, M.; Henselmeyer, S. Managing volatility in distribution networks with active network management. In Proceedings of the CIRED Workshop, Helsinki, Finland, 4–15 June 2016; pp. 1–4. [Google Scholar]

- USEF. White Paper: Flexibility Deployment in Europe; USEF: Lexington, KY, USA, 2021. [Google Scholar]

- USEF. Position Paper Flexibility Value Chain; USEF: Lexington, KY, USA, 2018. [Google Scholar]

- Ottesen, S.Ø.; Tomasgard, A.; Fleten, S.E. Multi market bidding strategies for demand side flexibility aggregators in electricity markets. Energy 2018, 149, 120–134. [Google Scholar] [CrossRef]

- Mathworks, “Optimization toolbox User’s Guide”; MathWorks: Natick, MA, USA, 2022.

- Boggs, P.T.; Tolle, J.W. Sequential Quadratic Programming for Large-Scale Nonlinear Optimization. J. Comput. Appl. Math. 2000, 124, 123–137. [Google Scholar] [CrossRef]

| PTA Type | |||||||

|---|---|---|---|---|---|---|---|

| 1—Industrial load | 0 | 6 h | 6 h | 15 min | 15 min | 1 | 1 |

| 2—PV generator | 0 | ∞ | ∞ | 15 min | 15 min | 0 | 0 |

| 3—Cluster of residential customers | 0 | ∞ | ∞ | 15 min | 15 min | 0 | 0 |

| FM Price Scenarios | |||

|---|---|---|---|

| Extreme | Conservative | ||

| Aggregator Cost (to the PTAs) | Aggregator Profit | ||

| base case—upward | EUR 3.3 k | EUR 1.6 k | EUR 0.6 k |

| base case—downward | EUR 3.8 k | EUR 1.9 k | EUR 0.5 k |

| FM Price Scenario | ||

|---|---|---|

| Extreme | Conservative | |

| optimization case—upward | EUR 1.5 k (−7.4%) | EUR 0.7 k (+6.5%) EUR 0.6 k (+2.6%) [Pmin = 100 kW] |

| optimization case—downward | EUR 1.7 k (−10.3%) | EUR 0.5 k (−10.0%) |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Soma, G.G.; Tina, G.M.; Conti, S. Optimal Bidding Strategies for the Participation of Aggregators in Energy Flexibility Markets. Energies 2025, 18, 2870. https://doi.org/10.3390/en18112870

Soma GG, Tina GM, Conti S. Optimal Bidding Strategies for the Participation of Aggregators in Energy Flexibility Markets. Energies. 2025; 18(11):2870. https://doi.org/10.3390/en18112870

Chicago/Turabian StyleSoma, Gian Giuseppe, Giuseppe Marco Tina, and Stefania Conti. 2025. "Optimal Bidding Strategies for the Participation of Aggregators in Energy Flexibility Markets" Energies 18, no. 11: 2870. https://doi.org/10.3390/en18112870

APA StyleSoma, G. G., Tina, G. M., & Conti, S. (2025). Optimal Bidding Strategies for the Participation of Aggregators in Energy Flexibility Markets. Energies, 18(11), 2870. https://doi.org/10.3390/en18112870