Abstract

With the rapid development of a new power system under the “dual carbon” goal, pumped storage has gained increasing attention for its role in integrating renewable energy and enhancing power system flexibility and security. This study proposes a dynamic benefit evaluation method for pumped storage projects, addressing the limitations of static analyses in capturing the evolving benefit trends. In this paper, the multi-stage dynamic benefit evaluation model was constructed by introducing time-of-use tariffs, periodic capacity pricing mechanism, and ancillary service revenue prediction based on machine learning and the multiple regression method. Sensitivity analysis was applied to explore the impact of key parameter variations on economic indicators. The results show that the benefit structure differs significantly across stages, and with electricity market development, a diversified pattern supported by electricity, capacity, and ancillary service revenues will emerge. The application of the model to an actual operating pumped storage power station yielded an internal rate of return of 8.18%, a payback period of 16.4 years, and a 26% increase in net present value compared with traditional methods. The proposed model expands the theoretical framework for pumped storage benefit evaluation and provides strong support for investment decisions, policy design, and operational strategy optimization.

1. Introduction

As the global climate change problem becomes more and more serious, “dual carbon” has become an important strategic goal for countries to deal with environmental challenges. The United Nations’ Paris Agreement and a series of international agreements on emission reduction have accelerated the transition of the global energy system to a cleaner and low-carbon direction. In this context, environmental issues have become a core topic of global concern, and the optimization of energy structure and green transformation are becoming increasingly urgent. As a major global energy producer and consumer, China formally put forward the “3060 dual carbon” goal in 2020 and, accordingly, proposed to build a new power system with new energy as the main body in order to support the synergistic promotion of energy security, green and low-carbon energy, and high-quality development. In 2022, China realized the landmark achievement of total installed renewable energy capacity exceeding that of coal-fired power. It is expected that China’s total installed capacity of wind and solar power will reach more than 1.2 billion kW by 2030 [1], and large-scale new energy grid connection urgently needs a significant amount of regulating power supply to provide high-quality ancillary services. As a representative of such regulating power supply, the scale of pumped storage is continuously expanding, becoming the main provider of system flexibility and regulation capability.

By the end of 2023, the global installed capacity of pumped storage reached 179.13 GW, of which China accounts for about 28%, ranking first in the world [2]. The commissioned capacity of pumped storage in China has reached 50.94 GW, accomplishing 82% of the “14th Five-Year Plan” target [3], with approximately 180 GW currently under construction. Considering that the construction period of pumped storage power stations (PSPSs) is about 5–6 years, China’s commissioned pumped storage capacity is expected to exceed 230 GW by 2030, nearly twice the planned target of 120 GW. From the perspective of planning space, the development potential for pumped storage in China is approaching saturation. Under the current circumstances, if pumped storage projects are hastily launched without cost control and proper coordination with new energy development and electricity market construction, not only will the investment returns of developers be jeopardized, but the overall electricity costs for society will also increase significantly, leading to considerable waste. Therefore, in order to ensure the scientific and feasibility of investment in pumped storage projects, it is especially necessary to carry out a systematic and accurate benefit evaluation. This not only helps to provide a reliable decision-making basis for policy makers and investment bodies but also promotes the deepening of related theoretical and empirical research. In recent years, a large number of scholars have carried out multi-dimensional research and exploration around the economy, comprehensive benefits, and tariff mechanisms of pumped storage projects.

You et al. proposed a new hybrid fuzzy multi-criteria decision-making method combining the fuzzy optimal worst method and fuzzy TOPSIS for the comprehensive performance evaluation of PSPSs and empirically evaluated the comprehensive performance of four PSPSs in China in terms of economic, social, and environmental aspects [4]. Tan et al. used the fuzzy comprehensive evaluation method to construct a comprehensive evaluation method of the functional, economic, and environmental benefits [5]. Taking a hybrid PSPS as an example, they calculated the comprehensive benefit evaluation grade. Lu et al. adopted various models and algorithms, such as the cloud model and AHP method, to comprehensively evaluate the return on investment of PSPSs in six different regions of China [6]. Yang et al. applied the equivalence substitution principle and a system operation simulation method to evaluate and analyze the operational performance of PSPSs in the new power system, considering four benefit dimensions: system economy, low carbon, flexibility, and reliability [7]. From the above literature, it can be seen that with the transformation and development of the new power system, scholars have recognized the multiple benefits of PSPSs under the new situation. When evaluating their performance, it is necessary to consider various indicators, including economic, technical, and environmental factors. Additionally, regarding the complementary role of pumped storage in the new power system with new energy sources such as wind and solar, some scholars have conducted in-depth discussions on the economic benefits of hybrid systems. Serrano-Canalejo et al. developed and deployed two energy management systems to compare the potential economic benefits of existing PSPSs with the proposed water–wind hybrid power plants [8]. The results show that hybrid power plants not only have good economic feasibility but also significantly increase their participation in the power system. Based on the characteristic of a relatively high proportion of grid connection between wind and solar power, Zhang et al. constructed an economic evaluation model of a wind–photovoltaic–pumped storage hybrid power generation system covering techno-economic, financial, and socio-environmental benefits under different installed capacity scenarios to analyze the relationship between comprehensive economic benefits and installed capacity [9].

The benefits of pumped storage projects are also closely related to the tariff mechanism they adopt. Many countries and regions in the world have established a relatively complete market mechanism, including the electric energy market, ancillary service market, capacity market, and futures option market. The functional value of pumped storage has been gradually quantified [10]. In China, electricity market construction is at a critical stage of constant deepening, and ancillary service market construction is also in its infancy. In the current market environment, pumped storage units are non-market units, and the additional benefits brought by their functioning cannot yet been fully compensated. Wessel et al. used Monte Carlo simulation to explain the revenue uncertainty caused by electricity price fluctuations when conducting an economic evaluation of a semi-underground pumped storage power station in open-pit mines [11]. Martínez-Jaramillo et al. analyzed the use of pumped storage to solve the problem of electricity supply and demand in the transition from nuclear energy to solar energy and hydroelectricity in Switzerland by means of system dynamics and proposed a capacity auction mechanism to smooth the transition process [12]. Li et al. developed a joint optimization scheduling model for pumped storage and wind power to study the two-part tariff mechanism of pumped storage considering wind power integration. They utilized the peak–valley price differences in wind power to verify the rationality and economy of pumped storage charging and discharging strategy [13]. Zhang et al. found that the comprehensive contribution of PSPSs in renewable energy systems is determined by the capacity tariff mechanism, which in turn is influenced by factors such as installed capacity, benefit distribution methods, and site combination modes [14]. Tian et al. found that with the deepening of China’s electricity market, the costs of PSPSs borne by transmission and distribution tariffs have continued to decline [15]. They suggested that the value of pumped storage should be reflected through market mechanisms, thereby eliminating reliance on transmission and distribution mechanism to cover fixed capacity costs and ultimately achieving economic independence.

Existing studies have made substantial progress in comprehensive benefit evaluation methods for PSPSs, gradually achieving quantitative analysis across multiple dimensions including economic, technical, environmental, and social aspects. Meanwhile, electricity market reforms have increasingly been incorporated into benefit evaluations, highlighting the critical impact of ancillary service value and capacity compensation mechanisms on the economic feasibility of pumped storage projects. However, existing studies mostly focus on the dimensional breadth of the benefit evaluation index system and pay insufficient attention to the evolutionary characteristics on the time scale. Most evaluation methods are based on static modeling, which makes it difficult to reveal the dynamic changes in the cost structure and revenue level of PSPSs in the actual operation process, along with the passage of time and the evolution of the electricity market mechanism. Especially in the context of the “double carbon” strategic goal, energy structure adjustment, electricity market mechanism reform, and the continuous evolution of the benefit distribution method have far-reaching impacts on the economics of pumped storage projects, which makes the traditional static assessment method face limitations in reflecting the real economic benefits of the project’s whole life cycle.

Therefore, this paper proposes a dynamic benefit evaluation method for pumped storage. Taking real operating pumped storage projects as the research object, considering the influences of economic, technological, and environmental policies during the evolution of the electricity market, the evaluation stage of pumped storage projects is divided into three periods. Considering the differences in aspects such as the tariff mechanism, electricity revenue, capacity compensation, and ancillary service revenue in each period, respectively, a benefit assessment framework coupled with the evolution of time is constructed. In particular, this study makes up for the shortcomings of existing studies in terms of temporal sequencing, the sensitivity of the market mechanism, and the dynamics of the benefit structure by introducing time-of-use tariffs, periodic capacity pricing mechanism, and an ancillary service revenue prediction model based on machine learning and multiple regression methods. Combined with the sensitivity analysis method, the study also explores the impacts of changes in the annual utilization hours of PSPSs and the proportion of unit capacity participating in the ancillary service market on economic indicators in order to enhance the robustness and practical applicability of the model results. Finally, the evaluation perspective is expanded to discuss the potential impact of macroeconomic uncertainty and environmental externalities on project benefits, aiming to serve the comprehensive and adaptive evaluation needs of pumped storage projects under the “dual carbon” goal. This research not only enriches the theoretical system for evaluating the benefits of pumped storage but also provides policymakers with more operational decision-making references, offering theoretical support and quantitative tools to facilitate the efficient and rational realization of pumped storage value in the new power system.

2. Research Methods

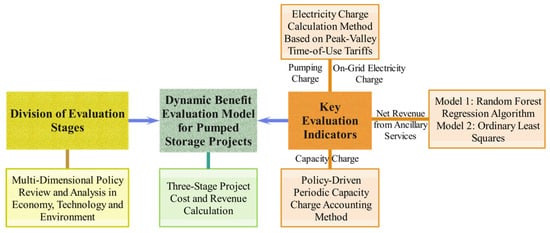

Driven by the “double carbon” goal, pumped storage as a regulating power supply will play an increasingly important role in the transformation of new power systems. In order to scientifically quantify the value of pumped storage under the new circumstances, this study refined existing evaluation methods by incorporating electricity market developments and proposed a dynamic benefit evaluation model. A case study was carried out on an 1800 MW commissioned pumped storage power station in China. The methodological framework adopted in the study is shown in Figure 1.

Figure 1.

Research methodological framework.

2.1. Division of Evaluation Stages for Pumped Storage Projects

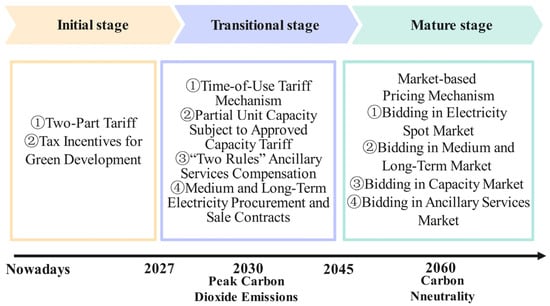

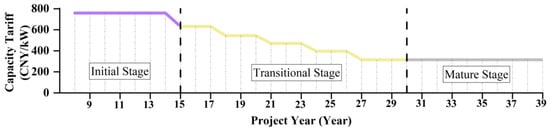

The construction of the new power system is a complex systematic project. The development and improvement of its mechanism characteristics are mainly manifested in different stages of the electricity market evolution. In this process, economic, technological, and environmental policies will have a greater impact on the benefit structure and scale level of pumped storage projects. Based on the evolution of the electricity market, this section categorizes the dynamic evaluation of pumped storage projects into three stages and explains the corresponding pricing mechanisms in the context of policy specifications and market development characteristics. The details are shown in Figure 2.

Figure 2.

The stage division of dynamic benefit evaluation for pumped storage projects.

In the initial stage, the ancillary service market is not yet mature, and the national electricity spot market is only operated in a few areas on a pilot basis. China has introduced “two-part” tariffs represented by capacity and electricity tariffs to compensate for the pumped storage plant’s peak shifting and ancillary services. PSPSs implement 75% of the benchmark coal-fired electricity price as the pumping electricity tariff, while the on-grid electricity tariff is set in accordance with the full benchmark price for coal-fired power. The capacity tariff is approved according to the operating period pricing method based on the principle of making up for the costs and reasonable returns [16]. According to green development tax incentive policies, the water used for PSPSs can be exempt from water resources tax [17].

In the transitional stage, driven by the large-scale development of renewable energy, evolving peak–valley characteristics of the power system, and accelerated electricity market reforms, the marketization of electricity pricing is expected to deepen, gradually leading to the establishment of an effective time-of-use tariff mechanism. PSPSs will use the time-of-use tariff to measure their on-grid electricity generation revenues and pumping costs according to their operating hours. In areas without the electricity spot market, the prices are linked to spot trading in accordance with the basic rules of medium and long-term electricity trading. Specifically, medium and long-term electricity procurement and sale contracts are signed through market-oriented methods, such as bilateral negotiation and centralized trading [18]. In terms of capacity tariff, after comparing the development of capacity markets abroad and the coal-fired capacity pricing mechanism in China [19], the capacity tariff determined by the operating period pricing method cannot compensate for the ancillary service of PSPSs in a targeted way in the long run. This approach also weakens the difference between capacity value and ancillary service value to some extent. Therefore, during this stage, the capacity tariff will be periodically determined based on relevant benefit-sharing mechanisms. At the same time, the scope of ancillary service revenues, as stipulated in the Regulations on Power Grid Connection Operation Management [20] and the Management Measures for Power Ancillary Services [21] (“two rules”) issued by the National Energy Administration, is extended to a wider range of pumped storage projects. This approach supports a smooth transition from a regulated regime to a fully market-oriented phase.

In the mature stage, the complete market-oriented pricing mechanism has formed. The rules of the electricity spot market, medium and long-term market, capacity market, and ancillary service market, including frequency modulation (FM), reserve, reactive power, and black start, have been basically improved. PSPSs can compete with the electricity market at different time dimensions as independent market participants. In addition, they can freely utilize part of the regulating capacity to participate in ancillary service market for a great increase in income from the ancillary service market.

2.2. Calculation Methods of Main Evaluation Indicators

2.2.1. On-Grid Electricity Revenue and Pumping Electricity Cost

With the pilot operation of electricity spot markets advancing across various provinces in China, and the supporting time-based trading mechanisms gradually improving, coal-fired power remains the primary benchmark for tariff formation in non-market units due to the limited market participation of other energy sources. As such, time-of-use tariffs for coal-fired power can, to a certain extent, reflect the characteristics of spot market prices. In this context, this study adopted coal-fired power time-of-use tariffs as a proxy for spot market electricity prices to estimate the on-grid and pumping electricity tariffs of PSPS. Drawing on the existing literature concerning coal-fired power time-of-use tariffs [22,23], and referring to the peak-to-valley period regulations of the directory time-of-use tariff mechanism for the Northern Hebei power grid where the case study power station is located, an interpolation method [24] was applied to conduct the estimation. The calculation principle is as follows:

where is the point to be estimated, and are known adjacent data points, and and are the values of corresponding tariffs.

In the early operational stage of a PSPS, the electricity market is typically characterized by limited price volatility and relatively stable tariff structures. Accordingly, this study adopted the 2.64 peak–valley tariff ratio, which was widely implemented by the Northern Hebei Grid around 2019, as the benchmark for the initial stage. With the advancement of electricity market reform, price signals have gradually strengthened. In the Notice on Further Improving the Time-of-Use Tariff Mechanism issued by the National Development and Reform Commission in 2021, it is clearly stated that in regions where the peak–valley difference rate exceeds 40%, the peak–valley ratio should generally not fall below 4:1, and not below 3:1 in other regions. Combined with the operation of the Northern Hebei Grid in recent years, its peak–valley difference rate has generally approached 40%, with some periods exceeding this level. Therefore, in the subsequent two stages, this study set the peak–valley ratio at no less than 3. For the mature stage, the specific peak–valley tariff ratio was set at 5.7, taking into account the system regulation pressure under high renewable energy penetration scenarios and the actual peak–valley tariff differences observed in some pilot electricity spot markets in Hebei Province, aiming to simulate the potential price signals under such scenarios.

Based on the above-mentioned method and principle, the coal-fired power time-of-use tariff levels under the benchmark price scenario of 0.372 CNY/kWh in Hebei Province were determined for peak–valley tariff ratios of 2.64, 3, and 5.7 (see Table 1). Furthermore, by combining the typical daily operational characteristics of PSPSs across different seasons, the corresponding on-grid electricity revenues and pumping electricity costs were calculated.

Table 1.

Coal-fired power time-of-use tariffs under different peak–valley tariff ratios.

2.2.2. Capacity Charge

In calculating the capacity tariff, this study determined the initial capacity tariff based on the operation period pricing method in the Approved Measures for Pumped Storage Capacity Tariff [25] and used three years as a regulatory period. At the end of each regulatory period, the relevant benefits formed by the power station, as well as the benefits generated by the implementation of pumping and on-grid electricity tariffs, were handled in accordance with the principle of “20% to be shared by the pumped storage power station, and 80% to be deducted in the approval of the capacity tariff for the next regulatory period” so as to allow for the periodic adjustment of the capacity tariff and the calculation of the corresponding capacity charge. The proportion of unit capacity covered by the approved capacity tariff was set at 60%. The specific calculation process is shown in Figure 3.

Figure 3.

Periodic capacity charge accounting method.

2.2.3. Net Revenue from Ancillary Services

Although the compensation mechanism for ancillary services provided by PSPSs has been preliminarily established under China’s current “two rules” framework, it is still unstable due to the differences in the degree of marketization among provinces and the fact that the ancillary service market is still in its infancy in some regions. Against this background, in order to reasonably predict the net revenue from ancillary services of the case study power station, this study selected the data of PSPSs that have been connected to the grid as samples and established a regression model to estimate their potential revenue levels.

Considering that the ancillary service revenue is affected by many factors, and there may be nonlinearity and multicollinearity problems among variables, this paper introduced two methods, random forest regression (RFR) and ordinary least squares (OLS) regression, for comparative analysis. The OLS method, as a classical linear regression model, has good interpretability, and it is suitable for analyzing the linear relationship between variables [26]. The RFR method, as an integrated learning algorithm, has strong nonlinear fitting ability and robustness and can more effectively capture the complex interactions between features [27]. By comparing the regression results of the two models, the robustness and credibility of the prediction results can be enhanced, providing a more reliable quantitative basis for the assessment of ancillary service revenue.

(1) Data sources and pre-processing.

According to relevant literature, the power demand in the electricity market is a key factor affecting the performance of PSPSs [28]. The profitability of PSPSs in the ancillary service market also varies under different generation and pumping operation scenarios [29], with compensation for peak shaving and FM occupying a significant proportion of ancillary service revenues [30,31]. Therefore, six main independent variables were initially identified in this study: the installed capacity of PSPSs (), monthly compensation for peak shaving sub-items of regional power ancillary services (), monthly compensation for FM sub-items of regional power ancillary services (), total electricity consumption in the provinces served by PSPSs (), monthly electricity generation of PSPSs (), and monthly pumping electricity consumption of PSPSs (). The detailed definitions and explanations of these independent variables are shown in Table 2.

Table 2.

Definitions and explanations of independent variables for regression models.

The data used in this study were primarily derived from the operational information and policy documents of multiple commissioned PSPSs in China. Sources included monthly performance assessment data on ancillary service participation issued by the National Energy Administration and regional power trading centers, as well as statistics on the basic situation of electricity ancillary services. Additional data, such as installed capacity, power generation, and pumping electricity consumption, were drawn from industry development reports on pumped storage, while total electricity consumption data were obtained from publications by the National Bureau of Statistics and local statistical offices. The dataset covered the period from January 2022 to December 2023 and focused primarily on eight PSPSs covered by the assessment of the “two rules” (see Table 3). After considering data completeness and accuracy, a total of 192 sample entries were selected for analysis.

Table 3.

An overview of the sample PSPSs.

The eight PSPSs selected in this study are all located in the East China region. Although there are certain limitations in the geographical distribution of the samples, the East China (sample power stations) and North China (the case power station) regions are both power grid areas with high load and a high level of new energy access. Their ancillary service demand characteristics and system regulation pressures are relatively similar, and they have a certain degree of market operation comparability. To ensure the structural stability of the model, this study assumes that the PSPS within the sample share broadly consistent policy environments and operational boundary conditions and can therefore be treated as a homogeneous group for constructing regression models of ancillary service revenue. For power stations involved in cross-provincial dispatching or with unclear service boundaries, it is assumed that the total social electricity consumption of the corresponding provinces can be proportionally allocated based on the proportion of installed capacity, approximately representing the load scale of the regulated object.

In order to ensure the effectiveness and robustness of the regression model, this paper systematically preprocessed the raw data before modeling, mainly including the following aspects:

① Missing value processing.

There were fewer vacant values in the raw data obtained in this study, and the missing values were mainly supplemented by the median filling method [32,33].

② Outlier detection.

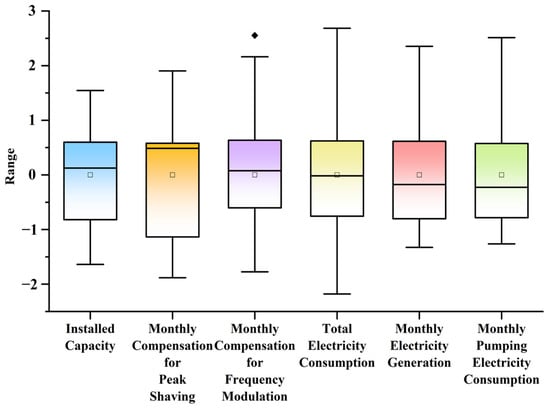

Descriptive statistics conducted using IBM SPSS Statistics, Version 24.0 (IBM Corp., Armonk, NY, USA) revealed that the skewness and kurtosis values of indicators , , and were relatively high, indicating the presence of skewed distributions and outliers that could significantly affect the regression results. In view of the distributional characteristics and the actual economic meaning of these variables, logarithmic transformations were applied prior to modeling, generating new variables, , , and , to improve the distribution of variables and reduce the influence of outliers. The distribution of the six independent variables for indicator datasets is shown in Figure 4.

Figure 4.

Boxplot of standardized independent variables. ♦ An extreme value was observed but considered valid and thus included in the analysis.

③ Correlation analysis.

In this study, the Pearson correlation coefficient was used to test the degree of linear correlation between the dependent variable as well as the independent variables , , , , , and . The analysis revealed that variables and exhibited a significant positive correlation with the dependent variable (correlation coefficients of 0.720 and 0.716, respectively). Variable also showed a moderate positive correlation with , while and displayed relatively weak correlations with . In addition, although was strongly correlated with , it also showed a high correlation with , suggesting a potential multicollinearity issue.

④ Variable screening.

When applying the RFR model for prediction, the algorithm’s foundation on decision trees means that it does not impose strict requirements on data distribution, linearity, or normality [34]. So, retaining a larger set of variables can help improve the model’s performance. On this basis, ancillary service net revenue model 1 incorporated all variables in regression fitting. In contrast, the OLS regression model is more sensitive to multicollinearity [35,36], and thus, the assumptions of normality, linear relationship, and homoscedasticity among variables need to be fully considered in modeling. Drawing on the descriptive statistics and correlation analysis, ancillary service net revenue model 2 retained only three variables, , , and . After preprocessing, the data were partitioned into training and testing sets in a ratio of 80:20.

(2) Ancillary service net revenue model 1.

Model 1 adopts RFR for modeling and analysis, which is a kind of ensemble learning, based on the integration of multiple decision trees, and improves the prediction accuracy and stability of the model through the voting or averaging strategy. It is suitable for handling complex nonlinear relationships among variables. In this study, model development and analysis were conducted in a Python 3 environment, with core algorithms supported by Scikit-learn. To obtain optimal model parameters, grid search combined with five-fold cross-validation was applied for systematic hyperparameter tuning. Once the optimal models were established, predictions were performed on both the training and testing sets, and model performance was evaluated using the coefficient of determination (R2) and mean absolute percentage error (MAPE) to assess explanatory power and generalization effect.

(3) Ancillary service net revenue model 2.

Model 2 employs an OLS regression model as a comparative and interpretable linear regression approach. This model explicitly quantifies the marginal effects of explanatory variables on the dependent variable, making it suitable for a robust interpretation of variable relationships. The modeling process was conducted using the Statsmodels module (Version 0.14.0), in the Python 3.8.8 environment (Anaconda, Inc., Austin, TX, USA), running in Jupyter Notebook (Version 6.4.8).The model fitting results included the coefficients, standard errors, t-statistics, and corresponding p-values for each explanatory variable to assess their statistical significance. Additionally, the adjusted R2 (Adj.R2) was used to evaluate the model’s goodness of fit, while the F-statistic tested overall model significance. The Durbin–Watson (DW) statistic was applied to check for residual autocorrelation, and the Jarque–Bera (JB) test was conducted to assess the normality of residuals. Meanwhile, multicollinearity was pre-controlled during variable selection and further verified using variance inflation factors (VIF).

2.3. Dynamic Benefit Evaluation Model for Pumped Storage Projects

Based on the method contents in Section 2.1 and Section 2.2, this subsection constructs a phased pumped storage project benefit evaluation model. As an example, an operational pumped storage power station in Hebei Province, China, equipped with six 300 MW reversible turbine generators, was selected, with a construction period of 9 years and a production and operation period of 30 years. It is assumed that within 32 years from the completion period, the power station will undergo a 7-year initial stage, a 15-year transitional stage, and a 10-year mature stage. The modeling process and core parameter settings are described below.

2.3.1. The Initial Stage

① Electricity revenues received by the power station in year t of the initial stage.

where is the electricity charge revenue in year t; is the capacity charge revenue in year t; is the on-grid electricity of the pumped storage power station in year t; is the coal-fired power generation benchmark price in year t; is the installed capacity of the power station; and is the capacity tariff in year t.

② Costs of the power station expenditure in year t of the initial stage.

where is the fixed cost; is the variable cost; is the operating cost of the power station excluding the pumping electricity charge, specifically including the repair cost, employee salary and welfare expense, insurance cost, material cost, reservoir fund, water resource fee, and other costs; is the depreciation cost; is the interest expense; is the pumping electricity; and is the comprehensive efficiency of the power station. Specific cost indicators are shown in Table 4.

Table 4.

Key cost indicators of the case study of a pumped storage power station.

2.3.2. The Transitional Stage

① Electricity revenues received by the power station in year t of the transitional stage.

where denotes the ancillary service revenue of the pumped storage power station in year t; denotes the on-grid electricity in the time period h on day d of month m; denotes the calculated peak–valley time-of-use trading tariff for coal-fired power in the Northern Hebei power grid; denotes the approved capacity tariff in the regulatory period; represents the starting year of the current regulatory period, ; and denotes the value of the ancillary service net revenue function of the pumped storage power station in year t.

② Costs of the power station expenditure in year t of the transitional stage.

where denotes the pumping electricity in the time period h on day d of month m, and denotes the calculated time-of-use trading tariff for coal-fired power in the Northern Hebei power grid when the peak–valley ratio takes the values of 2.64 and 3, respectively.

2.3.3. The Mature Stage

① Electricity revenues received by the power station in year t of the mature stage.

where denotes the FM ancillary service revenue, and denotes the reserve ancillary service revenue; denotes the comprehensive FM performance index for time period i; denotes the actual FM mileage for time period i; denotes the corresponding FM mileage settlement price; denotes the awarded FM capacity during this period; denotes the FM capacity clearing price; denotes the reserve capacity invoked during time period i; and denotes the reserve capacity price for the electricity spot market during time period i. In the mature FM market, revenue consists of a capacity charge and a mileage charge. The capacity charge is provided to compensate units for reserving FM capacity, while the mileage charge is determined based on the regulation mileage during actual FM operations.

According to the bulletin on power ancillary services issued by the National Energy Administration and the operational data of PSPSs in the Northern Hebei Grid, the primary ancillary services provided by PSPSs in the research region are FM and reserve, with reserve being the dominant type [37,38]. Therefore, in the market modeling of the mature stage, this paper limits ancillary services to these two types and uses the average market clearing price as the basis for estimation [39,40]. In addition, existing studies have indicated that in a multi-energy collaborative system, when the revenues from participating in the ancillary service market exceed those from the electricity and energy market over a certain period, the pumped storage units in the system will allocate a higher proportion of the capacity to ancillary services [41]. This conclusion shows, to a certain extent, that there is a positive correlation between the level of ancillary service revenues and the proportion of unit capacity of PSPSs participating in the ancillary service market. The mature stage set by this study has the characteristics of the new power system with renewable energy as the main body and multi-energy integration. Its structure and operation logic are consistent with the background described in the above literature, so it can be used as a support basis for the key assumptions. Further referring to the practical experience of countries with more mature electricity market mechanisms, the revenue obtained by PSPSs from the ancillary service market generally accounts for 30% to 70% of their total revenue [42,43]. Based on this, this paper assumed that 50% of the capacity of pumped storage units in the mature stage will participate in the ancillary service market, with a floating range of ±20% for subsequent sensitivity analysis.

Specifically, 50% of the unit’s capacity was designated for participation in the ancillary service market, with 30% declared for FM. The average clearing price for FM mileage was set at 25 CNY/MW, and the clearing price for FM capacity was 35 CNY/MWh. The daily FM operation duration was assumed to be 6 h, with a composite performance factor of 1.5. Additionally, 70% of the capacity participating in the ancillary service market was declared as reserve, with the reserve ancillary service priced at 0.7 CNY/kWh. For PSPS, the portion operating above a 50% load factor was regarded as providing reserve ancillary services.

② Costs of the power station expenditure in year t of the mature stage.

where denotes the pumping electricity in the time period h on day d of month m, and denotes the calculated time-of-use trading tariff for coal-fired power in the Northern Hebei power grid when the peak–valley ratio takes the value of 5.7.

2.3.4. Sensitivity Analysis

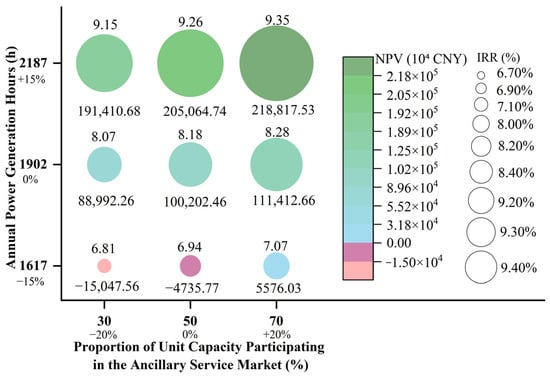

It is important to account for the impact of key parameter uncertainties on the evaluation results when assessing the benefits of pumped storage projects. In order to enhance the robustness and practical applicability of the model results, this study introduced a sensitivity analysis method [44,45] to explore the impact of changes in key variables on the project’s economic indicators, such as the net present value (NPV) and internal rate of return (IRR). In actual operation, the power generation utilization level of PSPSs may fluctuate due to multiple factors, such as the electricity market mechanism, grid scheduling demand, and operation strategy, and there is a deviation between the actual power generation and the design value. According to the operation data of some commissioned power stations [46,47], the annual power generation utilization hours have the possibility of experiencing upward and downward fluctuations. Therefore, this study took the designed annual utilization hours of the case study power station as the baseline and set a fluctuation range of ±15% as a key parameter for sensitivity analysis.

Meanwhile, in the context of new power system construction, with the increasing penetration of renewable energy, PSPSs have become increasingly important in providing ancillary services. In the study, the proportion of unit capacity participating in the ancillary service market was set at 50%, and considering the possibility of future changes in market rules and system demand, the proportion was further set to fluctuate within the range of ±20% as the second sensitivity factor. By combining the annual utilization hours and the proportion of capacity participating in the ancillary service market under different parameters, the impact on NPV and IRR is evaluated, and the response of the model to the key parameters is revealed, which will provide a basis for the subsequent decision-making process on the investment and operation of the pumped storage power station.

3. Results

3.1. Calculation Results of the Main Economic Indicators

3.1.1. On-Grid and Pumping Electricity Charges

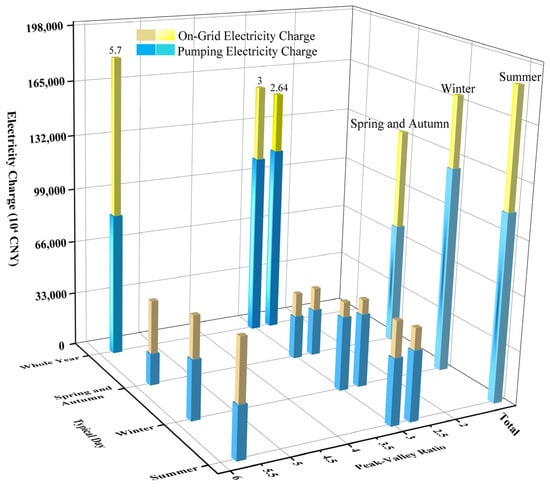

On the basis of considering the peak–valley period of the grid and the differences in the operation of the pumped storage power station in different seasons, the results of the on-grid and pumped electricity charges were calculated using the time-of-use tariff, as shown in Figure 5. In the figure, blue indicates the pumping electricity cost, and yellow indicates the on-grid electricity revenue. The overlap of the yellow columns with the blue columns is covered. The figure shows the portion of the charges where the on-grid electricity revenue exceeds the pumping electricity cost, that is, the electricity benefit.

Figure 5.

On-grid and pumping electricity charges under typical seasonal days and peak–valley ratios.

As can be seen in the figure, there is a significant difference between the on-grid and pumping electricity charges under different seasonal typical days and peak–valley ratios. From the summer perspective, at peak–valley ratios of 2.64, 3, and 5.7, the on-grid electricity generation revenues could reach CNY 555.35 million, CNY 618.32 million, and CNY 690.37 million, respectively, with corresponding pumping electricity costs of CNY 423.75 million, CNY 402.04 million, and CNY 315.17 million. It can be seen that as the peak–valley ratio rises, the electricity generation revenue steadily increases, while the pumping electricity cost shows a decreasing trend, reflecting the improvement in pumped storage operation economy under higher peak–valley ratio conditions. The trends in the two charges in winter are basically the same as in summer, with slightly lower electricity generation revenue but higher pumping electricity cost in winter compared to summer. Notably, when the peak–valley ratio is 5.7, the pumping electricity cost drops to the lowest value in the whole year, further confirming the positive impact of a higher peak–valley ratio on improving the economic performance of the pumped storage power station.

Overall, summarized by the peak–valley ratio dimension for the whole year, as the ratio increases, the differences between the two charges are CNY 358.63 million, CNY 451.68 million, and CNY 949.51 million, respectively, which show the significant impact of the peak–valley ratio on system economic performance. Summarized by seasonal dimensions, the pumped storage power station has the lowest pumping electricity cost in spring and autumn, and the on-grid electricity revenue is relatively low. The difference between the two is CNY 601.75 million. The electricity generation revenue increases significantly in summer. Although the pumping electricity cost is also relatively high, the benefit can reach CNY 723.07 million, which tops the whole year and shows better economy. The electricity generation revenue in winter is CNY 434.95 million, the lowest among all seasons.

3.1.2. Capacity Tariff

The capacity tariff was obtained according to the calculation method presented in Section 2.2.2, and the results are shown in Figure 6. The capacity tariff shows a trend of gradual decrease and eventual stabilization. In the initial stage, the capacity tariff is higher. In the transitional stage, taking into account factors such as the benefit-sharing mechanism and the proportion of units covered by the approved capacity tariff, the tariff shows a periodic decline and eventually stabilizes at a level of about 300 CNY/kW.

Figure 6.

Calculation results of capacity tariffs for case study of pumped storage power station at different stages.

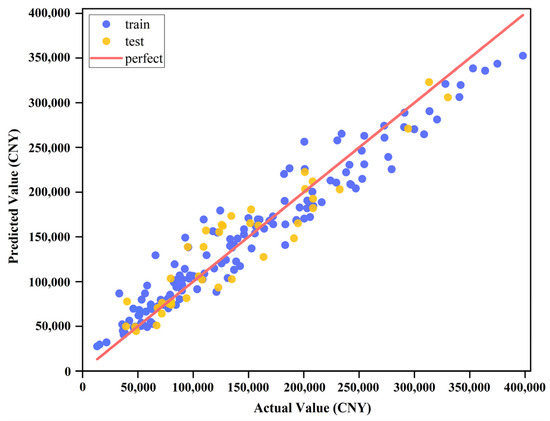

3.1.3. Ancillary Service Net Revenue

Ancillary service net revenue model 1 was developed using the RFR method, and the fitting effect of this model on the training set and test set is shown in Figure 7. The model performs well on the training set, with an R2 value of 0.920, indicating that it has a strong fitting ability for the ancillary service net revenue. On the test set, the R2 value still reaches 0.786, indicating that the model has a good generalization ability and does not show obvious overfitting phenomenon. The MAPEs of the model on the training and test sets are 7.65% and 10.82%, respectively, which are below the acceptable error thresholds, indicating that the RFR model has high relative accuracy in the task of predicting the ancillary service net revenue. In addition, the lower error gap between the training and test sets also shows that the model is more robust.

Figure 7.

Comparison of prediction results between training and testing sets for ancillary service net revenue model 1.

Ancillary service net revenue model 2 employed OLS regression analysis, and the results are shown in Table 5. The Adj.R2 value of the model is 0.854 and the F-statistic corresponds to a significance level of p < 0.001, indicating that the overall regression model is statistically significant and the regression equation has strong explanatory power. At the individual variable level, the ancillary service net revenue of PSPS () shows a significant positive correlation with installed capacity (), monthly electricity generation (), and total electricity consumption (), with p-values all below 0.001. The intercept term is also significant, supporting the validity of the regression assumptions. All variables have VIF values below 2, suggesting no significant multicollinearity and good model explanatory power with strong independence among variables. Residual autocorrelation testing shows a DW statistic of 2.036, close to the theoretical value of 2, indicating no significant first-order autocorrelation and satisfying the linear regression assumption of error independence. Additionally, the JB normality test yields a p-value of 0.402 (>0.05), suggesting that the model residuals approximately follow a normal distribution, further supporting the suitability of OLS. To further verify the model’s predictive ability on new samples, an evaluation was conducted on the testing set, and the results show an R2 value of 0.762, demonstrating reasonable explanatory power, generalization ability, and stable predictive performance.

Table 5.

Regression analysis results of ancillary service net revenue model 2.

In summary, it can be seen that model 1 performs with stronger fitting ability and generalization performance than model 2 on the training and test sets. However, considering that the RFR method offers higher fitting accuracy and stability within the known data range, while OLS regression provides better extrapolation capability and trend-fitting performance, enabling smoother and more controlled predictions in the intervals without sample support and avoiding distortion caused by the lack of extrapolation in RFR, this study adopted the following hybrid modeling strategy for the prediction dataset of the case study of the pumped storage power station:

(1) For prediction points that do not exceed the range of sample values in the training and test sets, model 1 was used for interpolation prediction.

(2) For new sample points that exceed the data boundary, model 2 was used for extrapolation prediction.

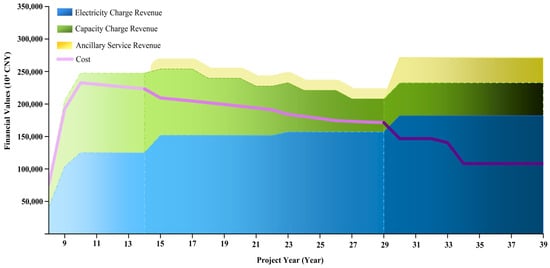

3.2. Calculation Results of the Economic Benefit Evaluation Model

The dynamic efficiency evaluation model of pumped storage projects proposed in Section 2.3 was applied to measure the revenue and cost during the production and operation period of the case study of the power station. The results are shown in Figure 8. As shown in the figure, during the initial stage, the station’s revenue grows rapidly, with electricity and capacity charges serving as the main revenue sources. Although operating costs are relatively high in this stage, the total revenue still exceeds the costs, indicating that the station is able to achieve a certain level of profitability in its early years. In the transitional stage, overall revenue declines due to market fluctuations and adjustments in policy subsidies, with notable volatility observed in capacity charge, while compensation from ancillary services gradually increases. In the mature stage, capacity charge revenue decreases. However, both electricity charge and ancillary service revenue show significant growth. Meanwhile, costs gradually decline, indicating that the power station is able to maintain strong profitability during long-term operation.

Figure 8.

Changes in revenue and cost during the production and operation period of the pumped storage power station.

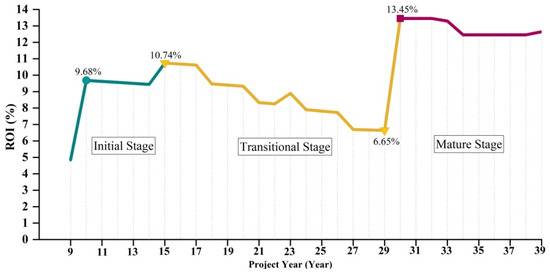

The financial analysis of the pumped storage power station in the case study yields an IRR of 8.18% and a payback period of 16.4 years. The NPV of CNY 1003.70 million was obtained by taking 7% as the base discount rate, which improves its economic efficiency compared with the NPV of CNY 797.66 million in the original method. The return-on-investment (ROI) curve of the pumped storage power station for the whole production and operation period is shown in Figure 9.

Figure 9.

Variation curve of ROI during production and operation period of pumped storage power station.

To explore the impact of key parameter variations on the economic efficiency of pumped storage projects, we also calculated the IRR and NPV of the project under the combined scenarios of different annual power generation utilization hours and the proportion of unit capacity participating in the ancillary service market based on the sensitivity analysis method. The results are shown in Figure 10, showing the sensitivity characteristics of the relevant indicators to parameter changes. With 2187 h of annual utilization, the project shows optimal economics, with the IRR increasing from 9.15% to 9.35% as the capacity proportion increases from 30% to 70%, and the corresponding NPV increases from CNY 1914.11 million to CNY 2188.18 million. As the utilization hours decrease to 1902, both the IRR and NPV decline but remain in the positive range. Moreover, the results indicate a trend where higher participation of unit capacity in the ancillary service market leads to stronger economic performance. Specifically, the IRR increases from 8.07% to 8.28%, while the NPV rises from CNY 889.92 million to CNY 1114.13 million. Under the scenario of 1617 h of annual power generation utilization, the economy drops significantly, with an NPV of CNY −150.48 million and an IRR of 6.81% at a 30% capacity proportion, which is not financially viable. However, when the participation of unit capacity is increased to 70%, the NPV becomes positive at CNY 55.76 million, and the IRR rebounds to 7.07%, which suggests that raising the level of participation in ancillary services can help to alleviate the problem of economic deterioration caused by a low utilization rate.

Figure 10.

Heat map of sensitivity analysis for NPV and IRR of pumped storage project.

4. Discussion

This study develops a dynamic revenue calculation method based on stage division to evaluate the benefits of pumped storage projects in the context of the new power system. Its applicability and effectiveness are validated through an actual case, revealing the evolving patterns of cost and revenue structures and the economic feasibility of PSPSs at different stages. This section presents a specific discussion on the research results of the previous text based on five aspects.

4.1. Discussion on Electricity Benefit

The results presented in Section 3 show that, regarding the electricity benefit, a greater peak–valley difference in the time-of-use tariff leads to a larger gap between the on-grid power generation revenue and pumping electricity cost for the pumped storage power station, thereby resulting in higher electricity benefit. This finding is basically in line with the literature [13] showing that the introduction of peak–valley tariff differentials in the pumped storage two-part tariff mechanism helps optimize the charging and discharging strategies, thus enhancing the market economics and trading competitiveness of the power station. This study further expands on this foundation by analyzing the performance of the power station in terms of electricity benefit under different seasons. The results show that the electricity benefit is the highest in summer and the lowest in winter. This difference may be closely related to the seasonal variation in power load. Generally speaking, the climate is mild in spring and autumn, and the power load is relatively stable, whereas in summer and winter, due to extreme temperatures, the demand for air-conditioning and heating equipment increases significantly, which pushes the power load upward and creates a peak period of power demand. Considering that electricity prices in the market are usually positively correlated with the load level [48], the price rises during the high load period, which increases the on-grid power generation revenue of the pumped storage power station accordingly. In addition, given that the case station is located in Northern China, the seasonal characteristics of wind and solar resources in winter also affect its electricity benefit. Specifically, in the northern region, the wind power output is larger at night in winter, which, together with the photovoltaic output at noon, forms a “high-output period”, making it necessary for the pumped storage power station to synchronize pumping operations at noon and at night in order to assist in the absorption of new energy power. Although this operational arrangement extends the pumping duration, it also significantly increases the pumping electricity cost, which partly offsets the additional generation revenue brought by high load levels. As a result, the overall electricity benefit in winter is actually lower than that in other seasons.

4.2. Discussion on Capacity Charge and Ancillary Service Compensation

In terms of the capacity charge and ancillary service revenue, this study shows that as the operating period of the power station advances, the cost recovery pressure per unit of capacity gradually reduces, and the reliance on capacity charge compensation decreases accordingly, while the revenue generated from ancillary services shows a growing trend. This finding is consistent with the view proposed in reference [15] based on empirical market analysis, which suggests that as market mechanisms continue to improve, compensation for ancillary services is expected to gradually become an important and stable source of revenue for pumped storage power stations.

4.3. Discussion on Sensitivity Analysis of Key Parameters

In terms of sensitivity analysis, the results show that the annual power generation utilization hours, as the core variable determining the direct generation revenue of the power station, has a significant impact on the financial performance of the project. Under the high utilization hour scenario, even if the proportion of unit capacity participating in the ancillary service market is at a low level, the project can still achieve good benefit performance, indicating that ensuring the utilization efficiency of PSPSs’ power generation is the basic prerequisite for realizing investment returns. At the same time, the increase in the proportion of unit capacity participating in the ancillary service market also has a positive effect on the project’s NPV and IRR, especially in the scenario of lower utilization hours, and its compensation effect is more obvious. Against the background of rising new energy penetration and tight conventional peaking resources, expanding the participation of PSPSs in the ancillary service market not only enhances the system value but also provides a realistic path to increase the attractiveness of project investment. Overall, the economics of the pumped storage power station are highly sensitive to the annual utilization hours of power generation and the degree of participation in the ancillary service market. Increasing the capacity participation proportion can, to a certain extent, compensate for the benefit loss brought about by the lack of utilization hours.

4.4. Discussion on Impact of Changes in External Economic Variables on Model Adaptability

The benefit evaluation method of pumped storage projects proposed in this study is mainly based on reasonable expectations of market electricity pricing mechanisms, tax and finance preferential policies, and price levels at this stage. However, changes in future macroeconomic factors will also have a profound impact on the stability of the model structure and results, which is specifically reflected in the following aspects.

(1) Evolution of on-grid electricity tariff mechanism.

By incorporating time-of-use tariff structures implemented by the Northern Hebei Grid at different stages and setting scenario-based variations in peak–valley ratios, the model initially demonstrated its ability to respond to the evolution of the on-grid electricity tariff mechanism and its impact on benefit paths. Considering the trend of high-frequency fluctuations and enhanced time series characteristics in the future electricity spot market, subsequent research can further combine electricity price time series prediction to achieve higher-resolution dynamic coupling analysis.

(2) Changes in policy incentives and subsidy mechanisms.

The current model has incorporated incentives such as current green tax exemptions and peak-shaving capacity rewards into the revenue and cost structure and has good policy traceability. If the above policies are gradually reduced or adjusted in the future, in order to improve the robustness of the model, “policy incentive factors” and scenario interval settings can be further introduced to achieve benefit sensitivity evaluation under multiple policy paths.

(3) Changes in inflation and interest rate levels.

This study adopts a fixed discount rate under the current model settings, assuming stable capital costs throughout the project lifecycle; nevertheless, the model is structurally designed to accommodate adjustments to discounting parameters. If facing a high-inflation or rising-interest-rate macroeconomic environment, the model can incorporate real interest rate dynamics through a flexible discounting mechanism, thereby enhancing its adaptability to financial uncertainty and improving the realism of long-term economic analysis.

(4) Rising construction costs and fluctuations in raw material prices.

Considering the early concentration of pumped storage investment, the model currently adopts the static initial investment assumption to ensure parameter clarity without considering the possible phased increase in the prices of raw materials, equipment, and labor services in the future. Nevertheless, the scalability of the cost input module is retained in the model structure. Subsequently, under the macro background, involving factors such as enhanced inflationary pressure or fluctuations in supply and demand in the industrial chain, a cost prediction model can be established by combining historical cost data and industrial trends to dynamically reflect the changes in capital investment of different macroeconomic scenarios.

4.5. Discussion on Potential Role of Environmental Factors in Project Benefits

It is worth noting that although this study primarily focuses on the dynamic impacts of multidimensional policy and electricity market changes on the pumped storage project benefits, environmental externalities, particularly the growing synergy of pumped storage in new energy integration and system carbon emission reduction under the “dual carbon” goal, are emerging as important implicit variables. These factors are increasingly shaping investment attractiveness and policy incentives and are expected to exert a potential influence on the future economic performance of pumped storage projects.

Pumped storage projects present dual and phased environmental impacts throughout their life cycles. The construction and operation of the main power station and appurtenant projects may lead to significant changes in land and water resources, affecting aspects such as local geological structure, soil properties, and ecosystem composition [49,50]. The construction period is often accompanied by ecological disturbances, changes in hydrological structure, and landscape impacts, which may further induce soil erosion and land degradation. In addition, operations such as tunnel excavation and groundwater extraction involved in the construction process may also increase the frequency of seismic activity and the risk of surface subsidence to a certain extent [51], thus constituting significant negative environmental externalities. During the operation stage, some life cycle assessment studies of PSPSs have shown that the grid mix electricity consumed during the pumping process is the main factor affecting the greenhouse gas emission level and global warming potential of PSPSs [52,53]. Compared with the benefit evaluation stages of pumped storage projects divided by this study, in the initial stage, high-carbon fossil fuels such as traditional coal-fired power still account for a large proportion of the power system, and most of the electricity consumed in the pumping process comes from carbon-intensive energy sources, resulting in PSPSs having limited carbon emission reduction benefits and an insignificant improvement in environmental externalities. In the transitional period, with the continuous expansion of new energy installed capacity, the pumping process is carried out during the peak wind power output at night or the photovoltaic surplus period at noon, and the power source consumed gradually changes from traditional thermal power to renewable energy, thereby effectively reducing the unit greenhouse gas emission level of the process. At the same time, by absorbing and storing the surplus electricity of new energy, pumped storage has slowed down the phenomenon of wind and solar abandonment, improved the overall resource utilization efficiency and low-carbon operation level of the system, and gradually shown positive environmental benefits. In the mature stage, the power structure has achieved a high degree of low carbonization, and pumped storage has become a key regulatory means to support the high proportion of new energy grid connection and stable operation of the system. The pumping process is predominantly powered by low-carbon energy sources, leading to a significant reduction in system carbon intensity and substantially enhancing the environmental benefits of PSPSs. In addition to improving overall system operational efficiency, pumped storage indirectly contributes to carbon reduction by reducing reliance on backup coal-fired units, lowering their start–stop frequency, and facilitating the stable integration of renewable electricity into the grid.

It can be seen that pumped storage will play an increasingly critical supporting role in promoting the decarbonization of the power system, and the synergistic relationship between its environmental benefits and economic benefits will also become increasingly close. Currently, PSPSs generally adopt supporting measures for environmental protection and soil and water conservation during their construction and operation. Investment in these projects also includes dedicated funding for ecological protection. Ecological compensation expenditures and environmental supervision costs have increased the financial pressure of pumped storage projects during the construction phase. At the same time, the gradual introduction of carbon trading markets, green electricity subsidy policies, and environmental performance evaluation systems has provided a possible path for PSPSs to convert emission reduction benefits into environmental values that can be included in cash flow during the operation phase. China’s carbon emissions trading system primarily consists of two mechanisms. The first is a cap-and-trade system for carbon allowances in which emission quotas are allocated to regulated industries based on a national cap and then traded in the market. The second is a project-based voluntary emissions reduction mechanism whereby entities implement voluntary carbon reduction projects that, upon verification by authorized agencies, generate China Certified Emission Reduction eligible for market trading [54]. However, neither of these mechanisms currently accounts for pumped storage, and their environmental benefits are not adequately reflected in the carbon trading market. Therefore, while vigorously developing new energy sources, it is also necessary to reasonably monetize the carbon reduction benefits of PSPSs and form a scientific carbon reduction accounting system and normative standards for pumped storage. Additionally, pumped storage projects should be given equivalent fiscal and tax support policies as new energy projects, such as value-added tax preferential measures applicable to green energy, to enhance the capital recovery capacity and investment enthusiasm of enterprises. Emerging technologies, such as artificial intelligence and big data analysis, can be used to make high-precision predictions and carry out intelligent scheduling of electricity demand, thereby improving the accuracy of carbon emission estimation for pumped storage and enhancing its measurability as well as policy adaptability within low-carbon development strategies.

In general, relying only on a single source of benefit may not be sufficient to support the long-term economics of pumped storage projects, and the synergistic optimization of multiple revenue structures such as electricity revenue, capacity charge, and ancillary service compensation mechanism should be comprehensively considered. In the process of future policy design and market mechanism improvement, the price incentive and capacity value recognition of PSPSs in the ancillary service market should be further strengthened to give full play to the system regulation function and economic potential. The fluctuations in external economic variables faced by pumped storage projects and the environmental attributes they possess should also be regarded as important considerations for the expansion of future dynamic benefit evaluation models.

5. Conclusions

Under the background of the “dual carbon” goal and new power system construction, pumped storage power stations, as an important support for power system flexibility, need to shift their benefit evaluation from traditional static methods to a dynamic perspective that can reflect the evolution of time and market changes. This study focuses on the evolution of the cost and revenue structure of pumped storage projects throughout the entire production and operation period. We developed a multi-stage dynamic benefit evaluation model that incorporates electricity charge, capacity charge, and compensation for ancillary services and systematically analyzed economic performance across different stages. The main findings are as follows:

(1) The electricity benefit of PSPSs increases as the peak–valley difference in time-of-use tariffs expand, showing certain seasonal characteristics. When formulating the operation strategy, the optimal configuration of tariff structure and time distribution should be fully considered to enhance the electricity benefit.

(2) Different from the previous static analysis of the pumped storage project benefits during the production and operation period, we found that the benefit structure of the power station presents significant differences at different stages. As the operation of the power station advances, the cost recovery pressure per unit of capacity is gradually reduced, and the reliance on capacity charge compensation decreases accordingly. At the same time, the revenue from ancillary services grows steadily, ultimately forming a diversified benefit pattern that is supported by three types of revenues: electricity, capacity, and ancillary services.

(3) The proposed pumped storage project dynamic benefit evaluation model was used to calculate the economics of the case study power station. The results show that the station achieved an IRR of 8.18% and a payback period of 16.4 years. Based on a benchmark discount rate of 7%, the NPV reached CNY 1003.70 million, which is higher than the value of CNY 797.66 million obtained using the original method, indicating improved economic benefits.

(4) The economics of PSPSs are highly sensitive to annual power generation utilization hours and the degree of participation in the ancillary service market. Increasing the proportion of unit capacity participating in the ancillary service market can, to a certain extent, make up for the benefit loss caused by low annual utilization hours.

(5) Pumped storage projects exhibit dual and phased environmental impacts throughout the entire life cycle, which may potentially affect their economic performance. In the future, a scientific carbon reduction accounting system and standardized evaluation framework should be established to reasonably monetize their environmental benefits and support sustainable development.

This study still has some limitations. In the regression analysis of the net revenue from ancillary services provided by PSPSs, the data samples used were relatively limited in terms of time span and coverage. As the scope of assessment under the “two rules” continues to expand, future research could improve model fitting accuracy and predictive capability by enlarging the sample size and extending the time dimension. In addition, subsequent studies could incorporate carbon cost accounting and green value evaluation, further developing an optimization framework that integrates the diverse revenue streams and environmental benefits of pumped storage. This would provide a more comprehensive basis for supporting its functional role and investment viability in the new power system.

Supplementary Materials

The following supporting information can be downloaded at: https://www.mdpi.com/article/10.3390/en18112815/s1, Data S1: data1_power generation cost estimation table.csv; Data S2: data2_statement of profit and loss.csv; Data S3: data3_cash flow statement.csv.

Author Contributions

Writing—original draft, C.F.; methodology, C.F.; formal analysis, C.F.; funding acquisition, C.F. and Q.G.; investigation, C.F. and Q.G.; writing—review and editing, Q.G.; conceptualization, Q.G.; visualization, Q.G.; data curation, Q.L.; project administration, Q.L. and F.J.; supervision, F.J. All authors have read and agreed to the published version of the manuscript.

Funding

This work was funded by the Science and Technology Department of Henan Province, grant number 242102320190, and the Hubei Key Laboratory of Construction and Management in Hydropower Engineering (China Three Gorges University), grant number 2023KSD25.

Data Availability Statement

The original contributions presented in this study are included in the Supplementary Materials. Further inquiries can be directed to the corresponding author.

Conflicts of Interest

The authors declare that they have no conflicts of interest.

References

- China Renewable Energy Engineering Institute. China Renewable Energy Development Report 2021; China Water&Power Press: Beijing, China, 2022. [Google Scholar]

- China Renewable Energy Engineering Institute. Development Report of Pumped Storage Industry 2023; China Water&Power Press: Beijing, China, 2024. [Google Scholar]

- National Energy Administration. Medium and Long-Term Development Plan for Pumped Storage (2021–2035). Available online: http://zfxxgk.nea.gov.cn/1310193456_16318589869941n.pdf?eqid=dfb973150005d1960000000364887a20 (accessed on 11 December 2024).

- You, P.; Liu, S.; Guo, S. A hybrid novel fuzzy MCDM method for comprehensive performance evaluation of pumped storage power station in China. Mathematics 2022, 10, 71. [Google Scholar] [CrossRef]

- Tan, Y.; Xie, G.; Xiao, Y.; Luo, Y.; Xie, X.; Wen, M. Comprehensive benefit evaluation of hybrid pumped-storage power stations based on improved rank correlation-entropy weight method. Energies 2022, 15, 8414. [Google Scholar] [CrossRef]

- Lu, Y.; Liu, X.; Zhang, Y.; Yang, Z.; Wu, Y. Investment efficiency assessment model for pumped storage power plants considering grid operation demand under fuzzy environment: A case study in China. Sustainability 2023, 15, 8724. [Google Scholar] [CrossRef]

- Yang, Y.; Yang, Y.; Lu, Q.; Liu, D.; Xie, P.; Wang, M.; Yu, Z.; Liu, Y. Comprehensive evaluation of a pumped storage operation effect considering multidimensional benefits of a new power system. Energies 2024, 17, 4449. [Google Scholar] [CrossRef]

- Serrano-Canalejo, C.; Sarrias-Mena, R.; Garcia-Trivino, P.; Fernandez-Ramirez, L.M. Energy management system design and economic feasibility evaluation for a hybrid wind power/pumped hydroelectric power plant. IEEE Lat. Am. Trans. 2019, 17, 1686–1693. [Google Scholar] [CrossRef]

- Zhang, S.; Yang, W.; Li, X.; Zhao, Z.; Wang, R.; Li, Y. Economic evaluation of wind–pv–pumped storage hybrid system considering carbon emissions. Energy Rep. 2022, 8, 1249–1258. [Google Scholar] [CrossRef]

- Xiao, Y.; Su, Q.; Bresler, F.S.S.; Carroll, R.; Schmitt, J.R.; Olaleye, M. Performance-based regulation model in PJM wholesale markets. In Proceedings of the 2014 IEEE PES General Meeting | Conference & Exposition, National Harbor, MD, USA, 27–31 July 2014; pp. 1–5. [Google Scholar]

- Wessel, M.; Madlener, R.; Hilgers, C. Economic feasibility of semi-underground pumped storage hydropower plants in open-pit mines. Energies 2020, 13, 4178. [Google Scholar] [CrossRef]

- Martínez-Jaramillo, J.E.; Ackere, A.v.; Larsen, E.R. Transitioning towards a 100% solar-hydro based generation: A system dynamic approach. Energy 2022, 239, 122360. [Google Scholar] [CrossRef]

- Li, H.; Zheng, H.; Zhou, B.; Li, G.; Yang, B.; Hu, B.; Ma, M. Two-part tariff of pumped storage power plants for wind power accommodation. Sustainability 2022, 14, 5603. [Google Scholar] [CrossRef]

- Zhang, X.; Lian, J.; Tao, Y.; Ma, C.; Chen, D.; Chen, M.; Xu, B. Capacity tariff mechanism of a pumped hydro storage station: Pricing approaches for reducing benefit allocation unfairness of integrated renewable energy systems. J. Energy Storage 2023, 71, 108156. [Google Scholar] [CrossRef]

- Tian, B.; He, Y.; Zhou, J.; Wang, B.; Wang, Y.; Shi, W. Cost-sharing mechanisms for pumped storage plants at different market stages in China. Renew. Energy 2023, 217, 119183. [Google Scholar] [CrossRef]

- National Development and Reform Commission. Opinions of National Development and Reform Commission on Further Improving the Price Formation Mechanism of Pumped Storage. Available online: https://www.gov.cn/zhengce/zhengceku/2021-05/08/content_5605367.htm (accessed on 10 February 2025).

- The State Council; The People’s Republic of China. Guidelines for Tax and fee Preferentialpolicies Supporting Green Development. Available online: https://www.gov.cn/xinwen/2022-06/01/content_5693350.htm (accessed on 15 March 2025).

- National Development and Reform Commission; National Energy Administration. Notice on the Issuance of “Basic Rules for Medium and Long-Term Electricity Trading”. Available online: https://www.gov.cn/gongbao/content/2020/content_5532632.htm?eqid=a525e5e70000f3be000000046463381e (accessed on 10 March 2025).

- National Development and Reform Commission; National Energy Administration. Notice on the Establishment of Coal Power Capacity Pricing Mechanism. Available online: https://www.gov.cn/zhengce/zhengceku/202311/content_6914744.htm (accessed on 15 December 2024).

- National Energy Administration. Regulations on Power Grid Connection Operation Management. Available online: https://www.cec.org.cn/upload/1/editor/1640768317460.pdf (accessed on 5 January 2025).

- National Energy Administration. Management Measures for Power Ancillary Services. Available online: https://zfxxgk.nea.gov.cn/2021-12/21/c_1310391161.htm (accessed on 5 January 2025).

- Zhao, C.; Ma, L.; Zhai, H. Benefit analysis of pumped storage power station based on peak-valley electricity price. Constr. Econ. 2022, 43, 467–470. [Google Scholar] [CrossRef]

- Ma, L.; Zhai, H.; Yang, W.; Zhao, C. Benefit analysis of pumped storage power station based on spot market. Water Resour. Hydropower Eng. 2023, 54, 283–289. [Google Scholar] [CrossRef]

- Sekulic, A.; Kilibarda, M.; Heuvelink, G.B.M.; Nikolic, M.; Bajat, B. Random Forest Spatial Interpolation. Remote Sens. 2020, 12, 1687. [Google Scholar] [CrossRef]

- National Development and Reform Commission. Regulations on the Approval of Capacity Tariffs for Pumped Storage. Available online: https://www.ndrc.gov.cn/xxgk/zcfb/tz/202105/P020210507591035697887.pdf (accessed on 11 January 2025).

- Anwar, A.; Siddique, M.; Dogan, E.; Sharif, A. The moderating role of renewable and non-renewable energy in environment-income nexus for ASEAN countries: Evidence from Method of Moments Quantile Regression. Renew. Energy 2021, 164, 956–967. [Google Scholar] [CrossRef]

- Schonlau, M.; Zou, R.Y. The random forest algorithm for statistical learning. Stata J. 2020, 20, 3–29. [Google Scholar] [CrossRef]

- Meng, X.; Li, S.; Hu, S.; Tang, W. Influencing factors of pumped storage power stations from the perspectiveof multi-energy complementarity: A case study of Liaoning Qingyuan pumped storage power station. Acta Sci. Nat. Univ. Pekin. 2024, 60, 917–926. [Google Scholar] [CrossRef]

- Menéndez, J.; Fernández-Oro, J.M.; Loredo, J. Economic feasibility of underground pumped storage hydropower plants providing ancillary services. Appl. Sci. 2020, 10, 3947. [Google Scholar] [CrossRef]

- Zhang, Z.; Cong, W.; Liu, S.; Li, C.; Qi, S. Auxiliary service market model considering the participation of pumped-storage power stations in peak shaving. Front. Energy Res. 2022, 10, 915125. [Google Scholar] [CrossRef]

- Chen, J.; Yang, W.; Li, Y.; Liao, Y.; Cheng, Y. Quantifying the performance and compensation of secondary frequency regulation of pumped storage plants considering variable-speed operation. Front. Energy Res. 2024, 12, 1358150. [Google Scholar] [CrossRef]

- Pan, Z.F.; Wang, Y.L.; Wang, K.; Chen, H.T.; Yang, C.H.; Gui, W.H. Imputation of missing values in time series using an adaptive-learned median-filled deep autoencoder. IEEE Trans. Cybern. 2023, 53, 695–706. [Google Scholar] [CrossRef] [PubMed]

- Zossi, B.S.; Medina, F.D.; Duran, T.; Fagre, M.; Barbas, B.F.D.; Elias, A.G. Filling ionospheric monthly medians missing data: A machine learning approach. Proc. R. Soc. A-Math. Phys. Eng. Sci. 2025, 481, 20240566. [Google Scholar] [CrossRef]

- Torres-Sanchez, R.; Navarro-Hellin, H.; Guillamon-Frutos, A.; San-Segundo, R.; Ruiz-Abellón, M.C.; Domingo-Miguel, R. A decision support system for irrigation management: Analysis and implementation of different learning techniques. Water 2020, 12, 548. [Google Scholar] [CrossRef]

- Kroll, C.N.; Song, P. Impact of multicollinearity on small sample hydrologic regression models. Water Resour. Res. 2013, 49, 3756–3769. [Google Scholar] [CrossRef]

- Månsson, K.; Kibria, B.M.G.; Shukur, G.; Sjölander, P. On the estimation of the CO2 emission, economic growth and energy consumption nexus using dynamic OLS in the presence of multicollinearity. Sustainability 2018, 10, 1315. [Google Scholar] [CrossRef]

- Xu, D.; Zhai, G.; Liu, X. Research on the calculation method for the frequency modulation and reserve benefits of pumped-storage station. J. Hydroelectr. Eng. 2001, 3, 1–10. [Google Scholar] [CrossRef]