Increasing the Voltage—Sequencing Decarbonisation with Green Power and Efficiency †

Abstract

1. Introduction

1.1. Background

1.2. Problem Statement and Research Gap: Assessing the Renewable Energy Demand

1.3. Contribution and Research Approach

- (i)

- to understand the actual demand for renewable energies;

- (ii)

- to determine where (by whom) they are needed;

- (iii)

- to estimate the approximate timeline—

- What amount of greenhouse gas (GHG) reductions do German manufacturing companies aim to achieve by 2025, and what measures are planned to reach these targets?

- What is the level of ambition set by these companies for GHG reductions by 2030, and how does it compare to the political sector targets for industry?

- Do the renewable energy requirements, derived from the companies’ decarbonisation targets, align with the policy frameworks and expansion plans at the national level?

- What gaps exist between the renewable energy needs of manufacturing companies and the projected availability according to political planning?

2. Methodology

3. Results

3.1. The Year 2025 as a Key Milestone in Industrial Decarbonisation

- Whether industry indeed structures decarbonisation in 5-year plans (or in short-term plans “to get it over with”);

- What motives companies have to decarbonise;

- On which basis they make their decarbonisation decisions;

- Most importantly, by how much they plan to reduce their GHG emissions by 2025;

- By which means (with respect to 2019 as the last full business year, which today often serves as the base year, given that it was the last “normal” year before the pandemic and the war hit).

3.2. Companies’ GHG Reduction Targets and Measures for 2025

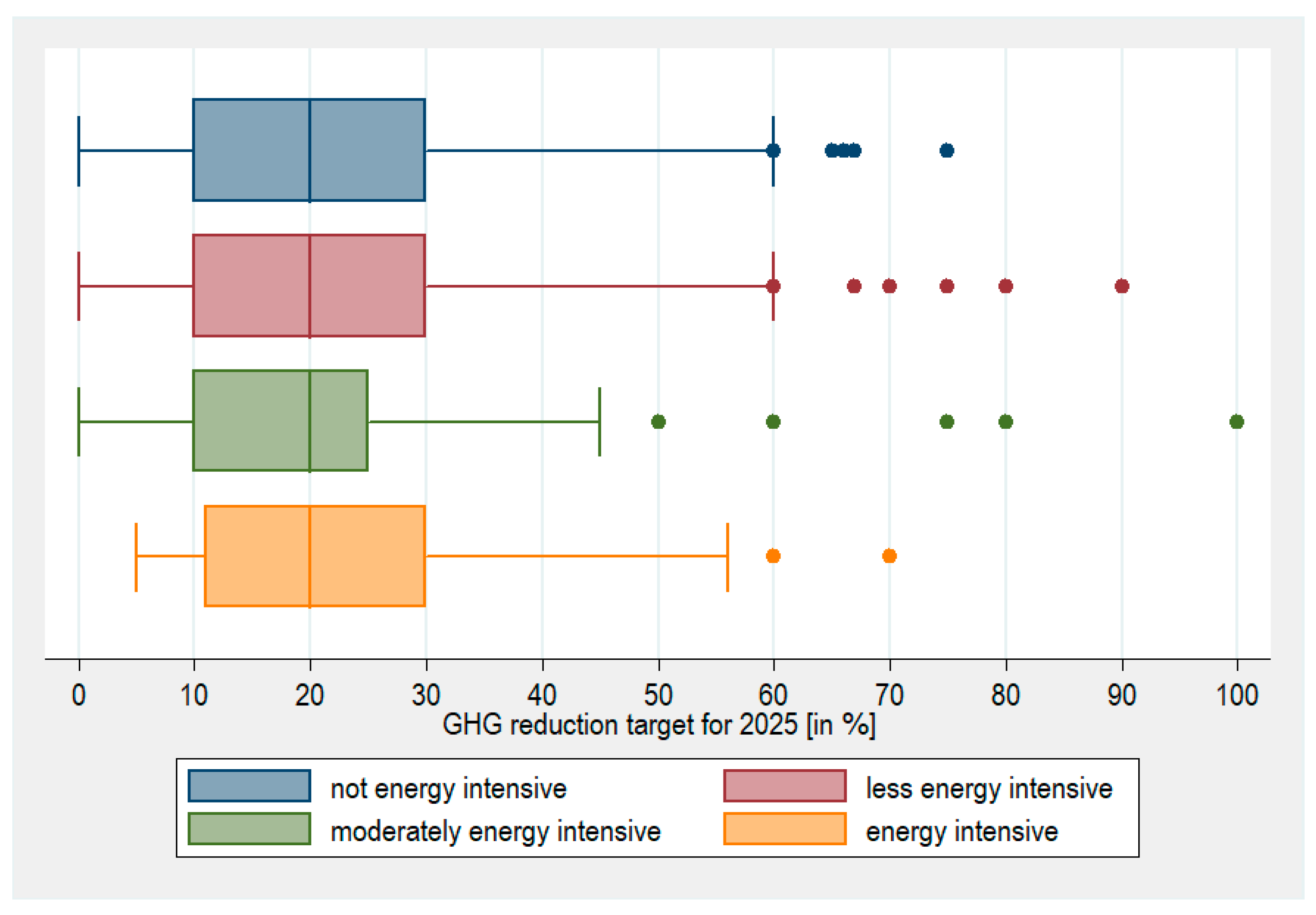

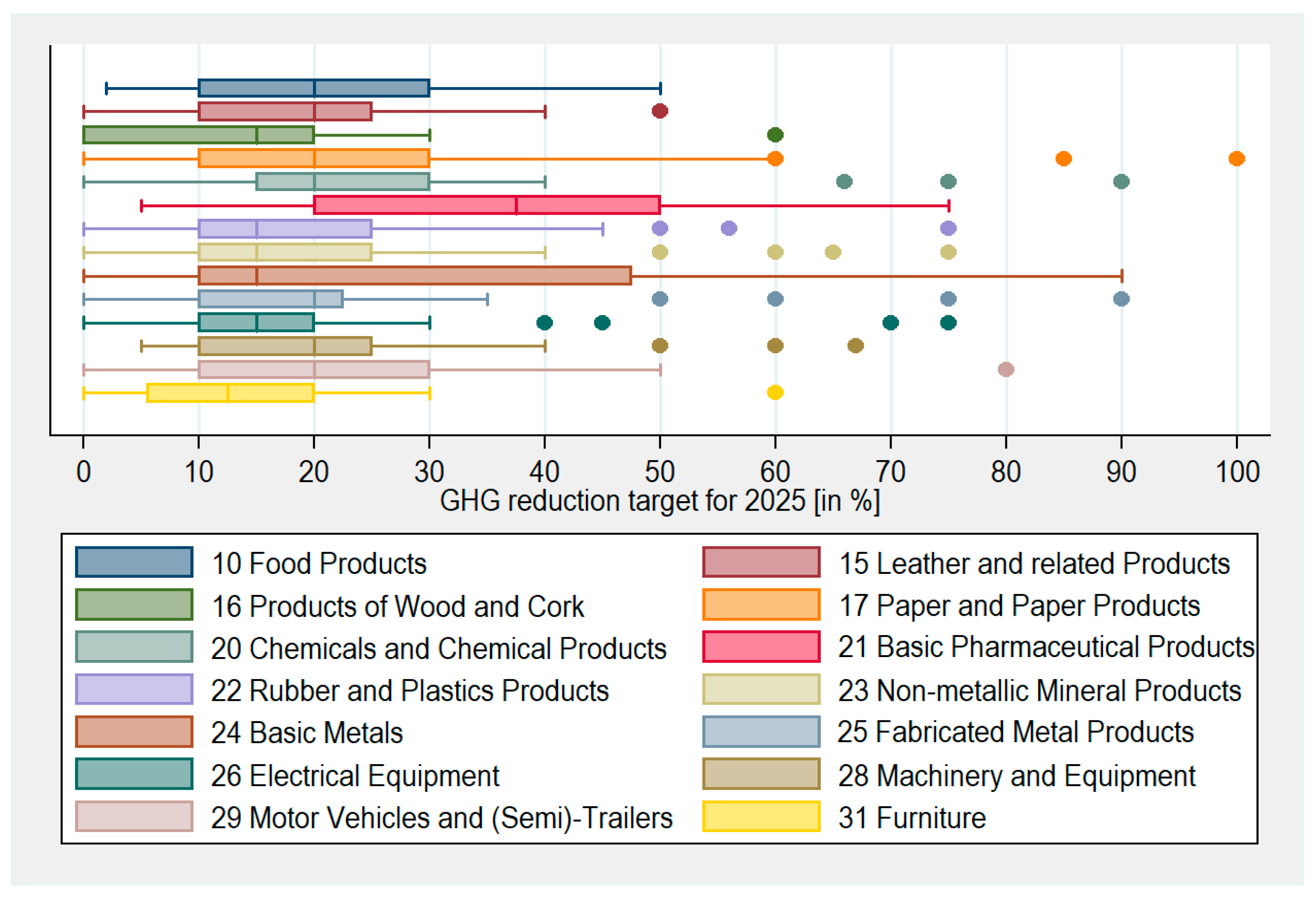

3.2.1. Bandwidth of Companies’ Decarbonisation Ambitions for 2025

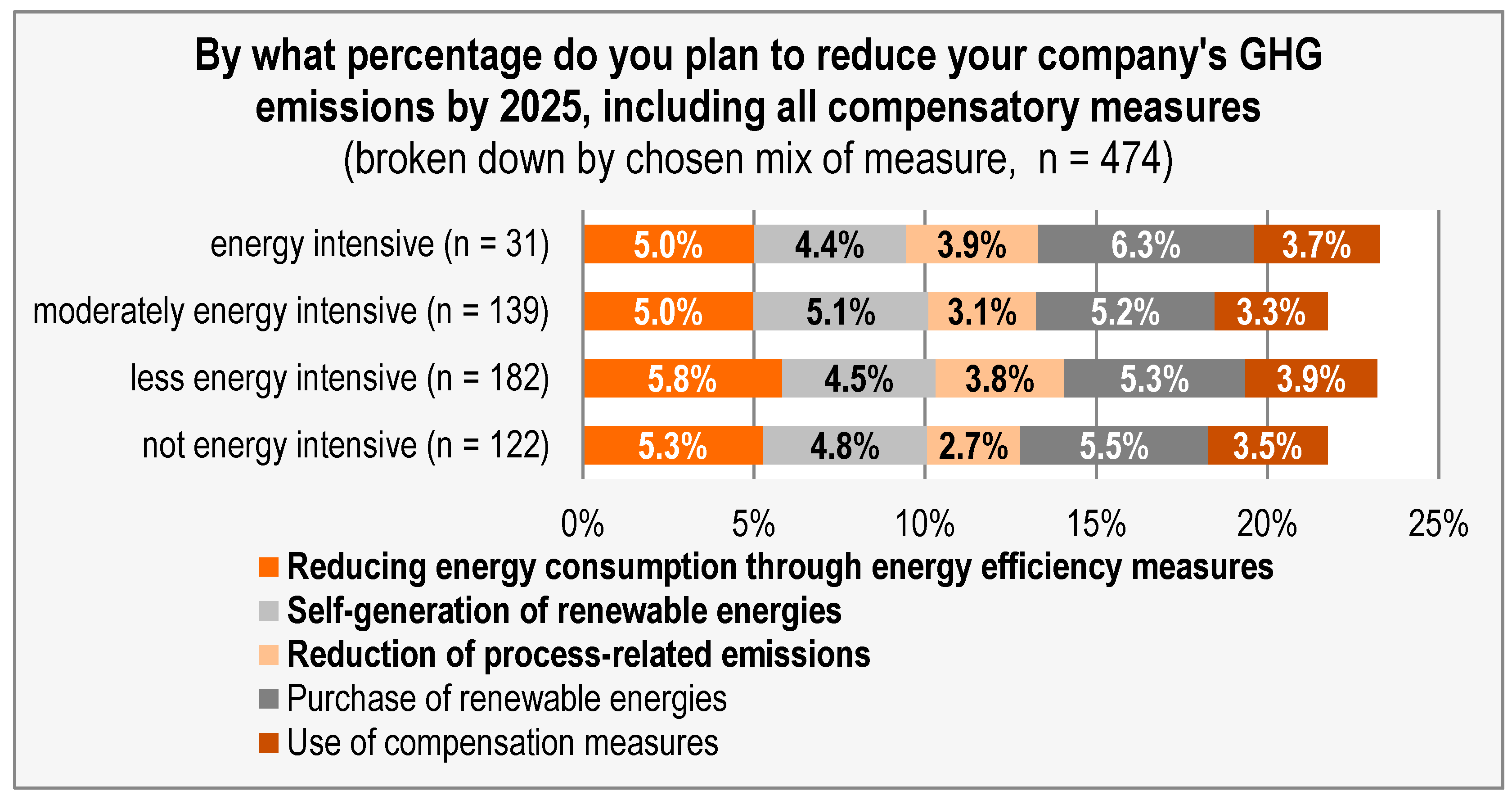

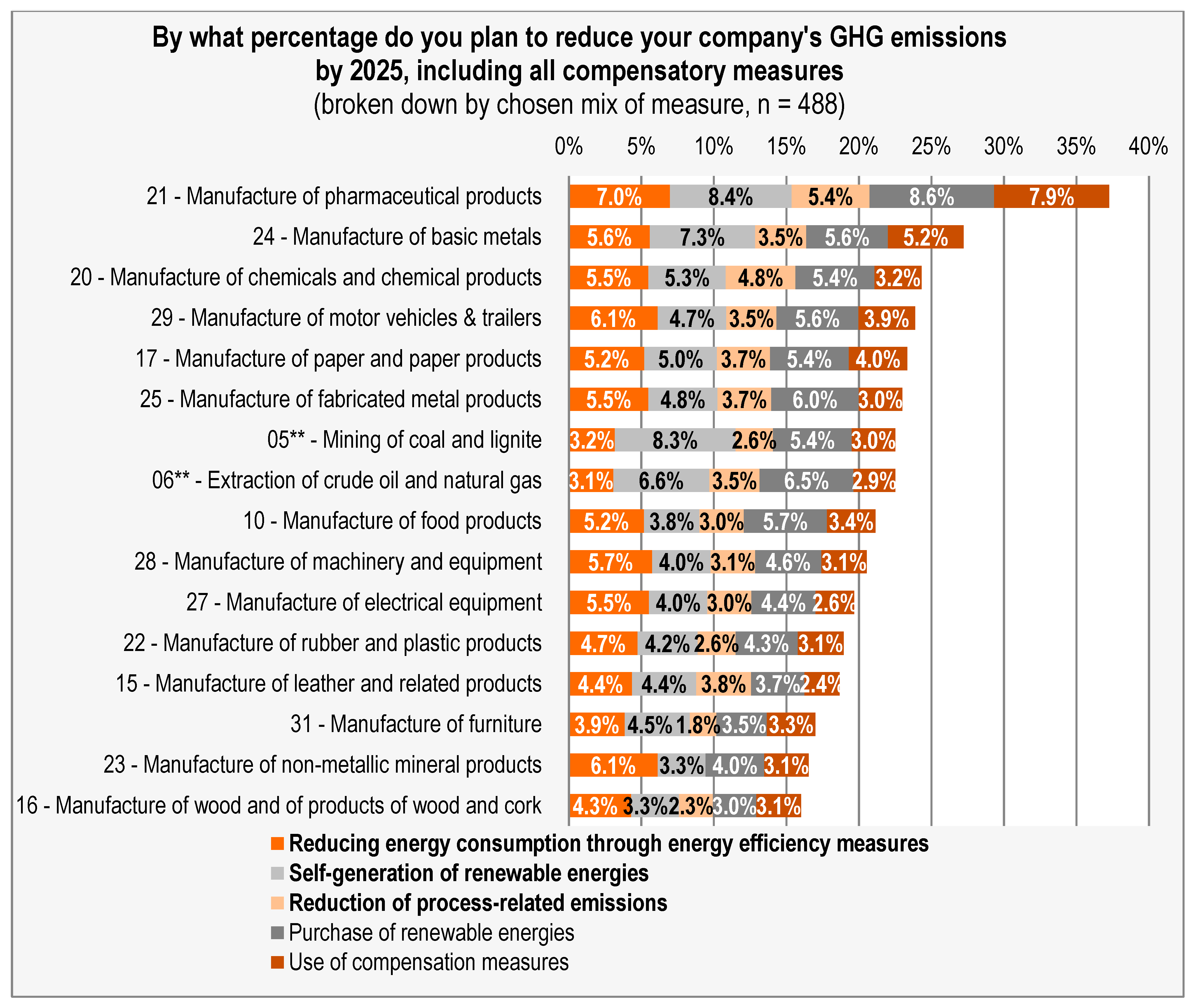

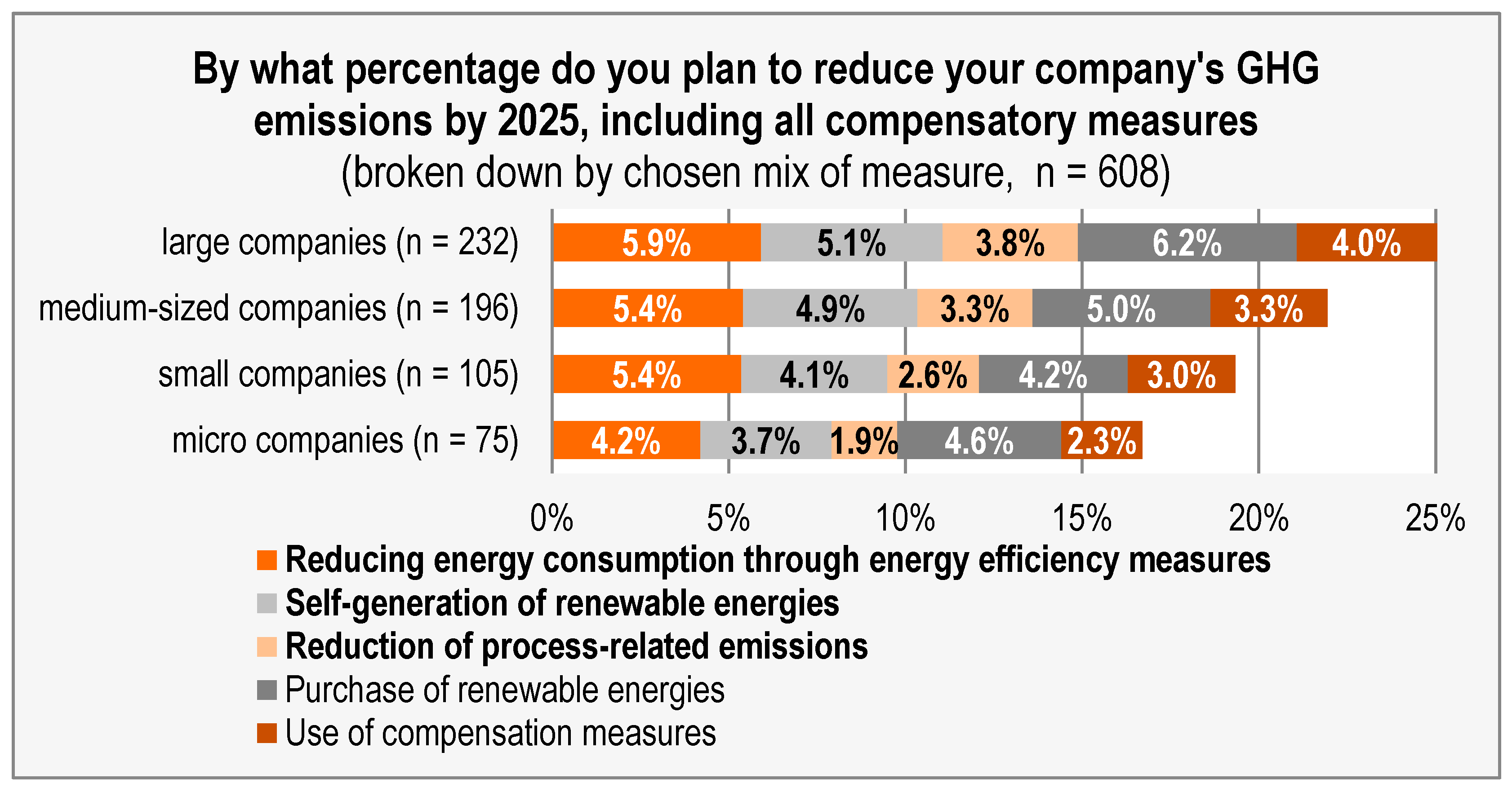

3.2.2. Planned Mix of Companies’ Measures to Achieve 2025 Decarbonisation Goals

- What the measures “do”: reduction measures save energy, resources, and process emissions; substitution measures replace fossil energy sources with renewable energy sources; compensation measures do not avoid the emission but prevent them either from causing harm or compensate their effect by alternative means.

- Where the measures “take place”: Measures that can be implemented on-site (energy efficiency measures, self-generation of renewables or process decarbonisation) give the company more control and also address the desire for resilience from hikes in energy, resource and emission prices or supply shocks. Off-site measures refer to the purchase of renewable energy and any type of off-site compensation. Off-site measures have in common that the company depends on someone else with respect to availability and prices. They cement the status quo in terms of resiliency or, in terms of compensation, increase dependence on a steady stream of viable compensation projects at a potentially increasing price and also the risk of bad press [69].

3.3. Comparison of 2025 and 2030 GHG Reduction Targets

3.4. Putting Industry’s GHG Saving Goals in Political Context

4. Discussion

4.1. Implications for Energy Policy and Industrial Strategy

4.2. Implications for Monitoring and Scenario Modelling

- Sector weighting: calculate the proportion of each sector’s energy consumption relative to the entire industry and use this as a weighting factor for individual observations.

- Size adjustment: apply a weighting factor reflecting the proportion of MSMEs within each sector, accounting for differences in ambition levels by company size.

4.3. Decarbonisability and Mechanism Proposal

5. Conclusions

5.1. Summary of Findings

5.2. Practical and Policy Implications

5.3. Limitations and Future Research

5.4. Final Remarks

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Abbreviations

| CATI | Computer-Assisted Telephone Interviewing |

| CCCE | Covenant of Companies for Climate and Energy |

| CCUS | Carbon Capture, Storage and Use |

| CERs | Certified emission reductions |

| CO2 | Carbon [dioxide] |

| DACCS | Direct Air Carbon Capture and Storage |

| EEI | Energy Efficiency Index of German Industry |

| EEP | Institute for Energy Efficiency in Production |

| EIB | European Investment Bank |

| EWI | Energiewirtschaftliches Institut an der Universität zu Köln |

| GHG | Greenhouse gas |

| GW | Gigawatt |

| GWh | Gigawatt hours |

| IHK | Industrie- und Handelskammer |

| ICDC | Intended Company-Determined Contributions |

| INDC | Intended Nationally Determined Contributions |

| KfW | Kreditanstalt für Wiederaufbau |

| MSMEs | Micro-, small and medium-sized companies |

| MWh | Megawatt hours |

| NZC | NetZeroCities |

| P2X | Power-to-x |

| PJ | Petajoule |

| PV | Photovoltaic |

| SBTi | Science-Based Target Initiative |

| TWh | Terawatt hours |

| UNECE | United Nations Economic Commission for Europe |

| Wh | Watthours |

References

- United Nations Framework Convention on Climate Change. Global Climate Action-NAZCA. Available online: https://climateaction.unfccc.int/ (accessed on 28 December 2022).

- Science Based Targets Initiative (SBTi) Companies Taking Action. Available online: https://sciencebasedtargets.org/companies-taking-action (accessed on 30 March 2025).

- Net Zero Tracker. Net Zero Tracker Beta. Available online: https://zerotracker.net/ (accessed on 30 March 2025).

- Climate Action Tracker. CAT Net Zero Target Evaluations. Available online: https://climateactiontracker.org/global/cat-net-zero-target-evaluations/ (accessed on 30 March 2025).

- United Nations Framework Convention on Climate Change. Paris Agreement. 2015. Available online: https://unfccc.int/sites/default/files/english_paris_agreement.pdf (accessed on 30 March 2025).

- Net Zero Cities. The NZC Project. Available online: https://netzerocities.eu/the-netzerocities-project/ (accessed on 30 March 2025).

- European Commission. Covenant of Companies for Climate and Energy. Available online: https://covenant-of-companies.ec.europa.eu/about_en (accessed on 27 November 2023).

- Buettner, S.M. Roadmap to Neutrality-What Foundational Questions Need Answering to Determine One’s Ideal Decarbonisation Strategy. Energies 2022, 15, 3126. [Google Scholar] [CrossRef]

- Buettner, S.M.; Wang, D. An Approach to Reducing the Greenhouse Gas Footprint in the Manufacturing Industry: Determinants for an Economic Assessment of Industrial Decarbonisation Measures; University of Stuttgart: Stuttgart, Germany, 2022. [Google Scholar] [CrossRef]

- EEP Energy Efficiency Index Winter Survey 2021/22-70 Percent of Companies Want to Offer Their Products in a Climate-Neutral Way (23 February 2022). Institute for Energy Efficiency in Production, University of Stuttgart. 2022. Available online: https://www.eep.uni-stuttgart.de/en/institute/news/news/Energy-Efficiency-Index-winter-survey-2021-22---70-percent-of-companies-want-to-offer-their-products-in-a-climate-neutral-way/ (accessed on 30 March 2025).

- World Resources Institute. Greenhouse Gas Protocol. FAQ. Available online: https://ghgprotocol.org/sites/default/files/standards_supporting/FAQ.pdf (accessed on 30 March 2025).

- IEA. World Energy Balances Highlights. Available online: https://www.iea.org/data-and-statistics/data-product/world-energy-balances-highlights# (accessed on 30 March 2025).

- Stratmann, K. Erste Unternehmen Kapitulieren vor Hohen Gas- und Strompreisen–Was die Politik nun Tun Will. Handelsblatt. 1 January 2022. Available online: https://www.handelsblatt.com/politik/deutschland/strom-und-gas-erste-unternehmen-kapitulieren-vor-hohen-gas-und-strompreisen-was-die-politik-nun-tun-will/27935982.html (accessed on 30 March 2025).

- Olk, J.; Stratmann, K. Warum Deutsche Firmen Jetzt vor der Deindustrialisierung Warnen. Handelsblatt. 7 September 2022. Available online: https://www.handelsblatt.com/politik/deutschland/energiekrise-warum-deutsche-firmen-jetzt-vor-der-deindustrialisierung-warnen/28662604.html (accessed on 30 March 2025).

- Stratmann, K. Unternehmen Fordern Konsequente Klimapolitik von Neuer Regierung. Handelsblatt. 10 March 2025. Available online: https://www.handelsblatt.com/politik/deutschland/energiewende-unternehmen-fordern-konsequente-klimapolitik-von-neuer-regierung/100111322.html (accessed on 30 March 2025).

- Blume, J.; Herwartz, C.; Kuchenbecker, T.; Stratmann, K.; Wermke, C.; Witsch, K. Nach der Gasknappheit Droht die Stromknappheit–Wie die Dürre Europas Versorgung Gefährdet. Handelsblatt. 15 August 2022. Available online: https://www.handelsblatt.com/politik/international/energie-nach-der-gasknappheit-droht-die-stromknappheit-wie-die-duerre-europas-versorgung-gefaehrdet/28600886.html (accessed on 30 March 2025).

- Redaktion Handelsblatt. Möglicher Gaslieferstopp: Wie sich die Industrie auf den Worst Case Vorbereitet. Handelsblatt. 28 April 2022. Available online: https://www.handelsblatt.com/unternehmen/industrie/energie-moeglicher-gaslieferstopp-wie-sich-die-industrie-auf-den-worst-case-vorbereitet/28282380.html (accessed on 30 March 2025).

- WDR. Wer Bekommt noch Gas im Ernstfall: Privathaushalte oder Industrie? WDR. 29 April 2022. Available online: https://www1.wdr.de/nachrichten/gasmangel-industrie-privathaushalte-prioritaet-100.html (accessed on 22 December 2022).

- Bücker, T. Notfallplan bei Lieferstopp: Wer als Erstes auf Gas Verzichten müsste. tagesschau. 30 March 2022. Available online: https://www.tagesschau.de/wirtschaft/verbraucher/gas-notfallplan-bundesnetzagentur-101.html (accessed on 22 December 2022).

- Hennes, W. Gefährliche Energieabhängigkeit. Erdgas: Was Deutschlands Industrie Droht, Wenn Russland Nicht Mehr Liefert. aktiv-online. 7 April 2022. Available online: https://www.aktiv-online.de/news/erdgas-was-deutschlands-industrie-droht-wenn-russland-nicht-mehr-liefert-16774 (accessed on 30 March 2025).

- Käckenhoff, T.; Eckert, V.; Steitz, C. As German Gas Rationing Looms, Industry Begs Exemptions. Reuters. 9 August 2022. Available online: https://www.reuters.com/business/energy/german-gas-rationing-looms-industry-begs-exemptions-2022-08-09/ (accessed on 30 March 2025).

- Noé, M. Multiaufsichtsrat Karl-Ludwig Kley “Gas erst bei den Privaten Abschalten, dann bei der Industrie“. Manager Magazin 5/2022. 27 April 2022. Available online: https://www.manager-magazin.de/unternehmen/industrie/karl-ludwig-kley-von-eon-und-lufthansa-ueber-gas-embargo-russland-und-handel-mit-china-a-2519cd38-0002-0001-0000-000201341036 (accessed on 30 March 2025).

- Roider, H. Gas: Empörung über Eon-Aussagen zum Gas-Vorrang. Energie & Management. 28 April 2022. Available online: https://www.energie-und-management.de/nachrichten/gas/detail/empoerung-ueber-eon-aussagen-zum-gas-vorrang-152812 (accessed on 30 March 2025).

- Schneider, J. Falls zu Wenig im Speicher ist-Wem Wird zuerst das Gas Abgestellt? zdfheute. 2 July 2022. Available online: https://www.zdf.de/nachrichten/politik/gas-versorgungsengpass-ukraine-krieg-russland-100.html (accessed on 22 December 2022).

- Dürr, F. Stromnetz am Anschlag: App warnt und ruft Baden-Württemberg zum Stromsparen auf. Stuttgarter Zeitung. 7 December 2022. Available online: https://www.stuttgarter-zeitung.de/inhalt.stromnetz-am-anschlag-app-warnt-und-ruft-baden-wuerttemberg-zum-stromsparen-auf.283685b8-3789-443c-b626-5da57cee3e22.html (accessed on 30 March 2025).

- Wissenschaftliche° Dienste. Dekarbonisierung und Sektorkopplung; Dokumentation WD 8-3000-064/18; Deutscher Bundestag: Berlin, Germany, 2018; p. 28. Available online: https://www.bundestag.de/resource/blob/565028/e7ff379935a919e8dd0d80b522b2352a/WD-8-064-18-pdf-data.pdf (accessed on 30 March 2025).

- Wissenschaftliche Dienste. Aktueller Begriff: Power to Gas; Nr. 10/12 (16. Mai 2012) Aktualisierte Fassung vom 11. Dezember 2012; Deutscher Bundestag: Berlin, Germany, 2012; p. 2. Available online: http://www.bundestag.de/blob/192428/c2cf809dd7287c6e8096c23caee03210/power_to_gas-data.pdf (accessed on 30 March 2025).

- Federal Ministry of Education and Research. How the Kopernikus Project P2X Converts Renewable Electricity into Plastics and Fuels, Gases and Heat. Available online: https://www.kopernikus-projekte.de/en/projects/p2x (accessed on 30 March 2025).

- Kasten, P.; Heinemann, C. Electricity-Based Fuels—The Future of PtX; Öko-Institut e.V.: Berlin, Germany, 2020; Available online: https://www.oeko.de/en/publications/electricity-based-fuels-the-future-of-ptx (accessed on 8 May 2025).

- NSW Government. Do I Get the Same Fuel Economy out of E10 as Regular Unleaded Petrol? E10 Facts. Available online: https://www.nsw.gov.au/driving-boating-and-transport/e10-fuel/e10-facts#toc-do-i-get-the-same-fuel-economy-out-of-e10-as-regular-unleaded-petrol (accessed on 30 March 2025).

- Statistisches Bundesamt (Destatis). Industrie, Verarbeitendes Gewerbe: Bedeutung der Energieintensiven Industriezweige in Deutschland. Available online: https://www.destatis.de/DE/Themen/Branchen-Unternehmen/Industrie-Verarbeitendes-Gewerbe/produktionsindex-energieintensive-branchen.html (accessed on 30 March 2025).

- Zajonz, M.; Wolff, K. Daten-Überblick: Vom Fossilen zum Ökostrom. ZDF. 21 December 2022. Available online: https://www.zdf.de/nachrichten/wirtschaft/erdgas-oekostrom-erneuerbare-energien-deutschland-daten-100.html (accessed on 26 December 2022).

- Stratmann, K.; Witsch, K. Stromlücke droht: Deutschland muss ab Sofort bis 2029 täglich Sechs neue Windräder Errichten. Handelsblatt. 28 December 2022. Available online: https://www.handelsblatt.com/unternehmen/energie/erneuerbare-energien-stromluecke-droht-deutschland-muss-ab-sofort-bis-2029-taeglich-sechs-neue-windraeder-errichten/28881822.html (accessed on 30 March 2025).

- dpa. Bundestag Beschließt mehr Tempo für Erneuerbare Energien. Handelsblatt. 3 March 2023. Available online: https://www.handelsblatt.com/politik/deutschland/energiewende-bundestag-beschliesst-mehr-tempo-fuer-erneuerbare-energien/29015988.html (accessed on 30 March 2025).

- dpa. Einzelhandel Beklagt Genehmigungsdauer für Solardächer und Ladesäulen. heise online. 20 January 2024. Available online: https://www.heise.de/news/Einzelhandel-beklagt-Genehmigungsdauer-fuer-Solardaecher-und-Ladesaeulen-9603742.html (accessed on 11 March 2024).

- dpa. Genehmigungen für Windräder stimmen Branche Optimistisch. Handelsblatt. 15 January 2025. Available online: https://www.handelsblatt.com/unternehmen/energie/erneuerbare-energien-genehmigungen-fuer-windraeder-stimmen-branche-optimistisch/100100900.html?utm_source=chatgpt.com (accessed on 30 March 2025).

- Witsch, B.F.K.; Hubik, F.; Wermke, I.; Müller, A.; Koenen, J. Immer mehr Konzerne Kappen Klimaziele–Was den Wandel Bremst. Handelsblatt. 12 June 2024. Available online: https://www.handelsblatt.com/unternehmen/energie/transformation-immer-mehr-konzerne-kappen-klimaziele-was-den-wandel-bremst-01/100040478.html (accessed on 30 March 2025).

- Müller, K. Es ist Schon viel Erreicht: Die Energiewirtschaft Steht bei der Transformation gut da. Handelsblatt Live. 31 January 2025. Available online: https://live.handelsblatt.com/es-ist-schon-viel-erreicht-die-energiewirtschaft-steht-bei-der-transformation-gut-da/ (accessed on 30 March 2025).

- Sprenger, T.; Schäfer, F. EWI-Analyse: Implikationen des Geplanten Zubaus Erneuerbarer Energien Gemäß Osterpaket und EEG 2023; Energiewirtschaftliches Institut an der Universität zu Köln (EWI) gGmbH: Köln, Germany, 2022; p. 14. Available online: https://www.ewi.uni-koeln.de/cms/wp-content/uploads/2022/12/221228_EWI-Analyse-Implikationen_Osterpaket_und_EEG_2023.pdf (accessed on 30 March 2025).

- Energie & Management. Dekarbonisierung bei BASF würde Strombedarf verdreifachen. Energie & Management. 4 November 2019. Available online: https://www.energie-und-management.de/nachrichten/handel/emission/detail/dekarbonisierung-bei-basf-wuerde-strombedarf-verdreifachen-133689 (accessed on 28 December 2022).

- Lenné, D. BASF-Chef zur Dekarbonisierung: Strombedarf Wird sich Vervierfachen. piqd. 13 December 2020. Available online: https://www.piqd.de/klimawandel/basf-chef-zur-dekarbonisierung-strombedarf-wird-sich-vervierfachen (accessed on 30 March 2025).

- Haupt, C. BASF Ermittelt CO2-Fußabdruck aller Verkausprodukte. BASF. 28 July 2020. Available online: https://www.basf.com/global/de/media/news-releases/2020/07/p-20-260.html (accessed on 30 March 2025).

- Joint News Release: Vattenfall and BASF Participate in Offshore wind Farm Tender Hollandse Kust West. BASF. 22 April 2022. Available online: https://www.basf.com/global/en/media/news-releases/2022/04/p-22-209.html (accessed on 30 March 2025).

- BASF. BASF, SABIC and Linde Start Construction of the World’s First Demonstration Plant for Large-Scale Electrically Heated Steam Cracker Furnaces. BASF News Release. 1 September 2022. Available online: https://www.basf.com/us/en/who-we-are/sustainability/whats-new/sustainability-news/2022/basf-sabic-and-linde-start-construction-of-the-worlds-first-demonstration-plant-for-large-scale-electrically-heated-steam-cracker-furnaces (accessed on 8 May 2025).

- Bignion, C.; Hülden, O. Die Herstellung von Stahl. Futura. 6 March 2021. Available online: https://www.futura-sciences.com/de/die-herstellung-von-stahl_1776/ (accessed on 30 March 2025).

- Wille, J. Wie Stahl grün Wird. Klimareporter. 18 November 2019. Available online: https://www.klimareporter.de/finanzen-wirtschaft/wie-stahl-gruen-wird (accessed on 30 March 2025).

- RWE and ArcelorMittal Intend to Jointly Build and Operate Offshore Wind Farms and Hydrogen Facilities, for Low-Emissions Steelmaking. Arcelor Mittal. 22 June 2022. Available online: https://corporate.arcelormittal.com/media/news-articles/rwe-and-arcelormittal-intend-to-jointly-build-and-operate-offshore-wind-farms-and-hydrogen-facilities-for-low-emissions-steelmaking-1 (accessed on 30 March 2025).

- Covestro and ENGIE Sign Supply Agreement for Green Power in Belgium. Covestro. 24 March 2021. Available online: https://www.covestro.com/investors/news/covestro-and-engie-sign-supply-agreement-for-green-power-in-belgium/ (accessed on 30 March 2025).

- Statkraft. Statkraft Supplies a Further 300 GWh of Green Power to Cement Manufacturer OPTERRA Since Beginning of April. Statkraft Newsroom. 20 April 2022. Available online: https://www.statkraft.com/newsroom/news-and-stories/2022/statkraft-supplies-Opterra-with-renewable-energy/ (accessed on 8 May 2025).

- Delanote, J.; de Souza Silva, F.N. EIB Investment Survey 2022: European Union Overview; European Investment Bank (EIB): Luxembourg, 2023. [Google Scholar] [CrossRef]

- Kindsmüller, A.; Werkle, G. Klimaschutz in Unternehmen im Rheinland. Ergebniszusammenfassung aus Einer Umfrage im März und April 2023; IHK Initiative Rheinland: Düsseldorf, Germany, 2023; Available online: https://www.ihk.de/blueprint/servlet/resource/blob/5898266/a517e5e761f8b8656b72d5ed63540d15/ihk-studie-klimaschutz-rheinland-data.pdf (accessed on 30 March 2025).

- Sailer, U. Klimaneutrale Unternehmen. Management, Steuerung, Technologien; Narr Francke Attempto Verlag: Tübingen, Germany, 2024; Volume 1134-2, p. 130. [Google Scholar]

- KfW Research. KfW-Klimabarometer 2024. KfW Bankengruppe. 26 November 2024. Available online: https://www.kfw.de/%C3%9Cber-die-KfW/Newsroom/Aktuelles/News-Details_830272.html (accessed on 30 March 2025).

- Climate Risks and Consequences of Climate Change 2023: Study on the Potential of German Industry and Solutions Based on Innovation and Changes to Portfolios; KPMG: Amstelveen, The Netherlands, 2023; Available online: https://hub.kpmg.de/en/climate-risks-and-consequences-of-climate-change-2023?utm_campaign=Klimastudie%20-%20sektor%C3%BCbergreifend (accessed on 30 March 2025).

- Wiertzema, H.; Svensson, E.; Harvey, S. Bottom–Up Assessment Framework for Electrification Options in Energy-Intensive Process Industries. Front. Energy Res. 2020, 8, 192. [Google Scholar] [CrossRef]

- Fleiter, T.; Rehfeldt, M.; Herbst, A.; Elsland, R.; Klingler, A.-L.; Manz, P.; Eidelloth, S. A methodology for bottom-up modelling of energy transitions in the industry sector: The FORECAST model. Energy Strategy Rev. 2018, 22, 237–254. [Google Scholar] [CrossRef]

- Neuwirth, M.; Fleiter, T.; Hofmann, R. Modelling the transformation of energy-intensive industries based on site-specific investment decisions. Sci. Rep. 2024, 14, 30552. [Google Scholar] [CrossRef] [PubMed]

- Flauger, J.; Knitterscheidt, K.; Witsch, K.; Stratmann, K. So gefährdet die Regierung mit falschen Prognosen Deutschlands Energiezukunft. Handelsblatt, 16 April 2021. Available online: https://www.handelsblatt.com/technik/thespark/die-oekostromluecke-so-gefaehrdet-die-regierung-mit-falschen-prognosen-deutschlands-energiezukunft/27093874.html?utm_source=chatgpt.com (accessed on 30 March 2025).

- Lichter, J. Der Aufbau der Wasserstoffwirtschaft in Deutschland. Herausforderungen und Lösungsansätze; Handelsblatt Research Institute: Düsseldorf, Germany, 2021; Available online: https://www.handelsblatt.com/downloads/27768652/3/wasserstoffstudie.pdf (accessed on 30 March 2025).

- Charly, A.; Caulfield, B. Transport emission modelling based on a bottom-up approach to facilitate sustainable transport planning. Sustain. Futures 2025, 9, 100435. [Google Scholar] [CrossRef]

- Buettner, S.M.; Schneider, C.; König, W.; Nulty, H.M.; Piccolroaz, C.; Sauer, A. How do German manufacturers react to the increasing societal pressure for decarbonisation? Appl. Sci. 2022, 12, 543. [Google Scholar] [CrossRef]

- EEP. Der Energieeffizienz-Index der Deutschen Industrie. Umfrageergebnisse 1. Halbjahr 2020; Institut für Energieeffizienz in der Produktion, Universität Stuttgart: Stuttgart, Germany, 2020; Available online: https://www.eep.uni-stuttgart.de/eei/archiv-aeltere-erhebungen/ (accessed on 30 March 2025).

- EEP. Der Energieeffizienz-Index der Deutschen Industrie. Umfrageergebnisse 2. Halbjahr 2020; Institut für Energieeffizienz in der Produktion, Universität Stuttgart: Stuttgart, Germany, 2020; Available online: https://www.eep.uni-stuttgart.de/eei/archiv-aeltere-erhebungen/ (accessed on 30 March 2025).

- European Commission. Commission Recommendation of 6 May 2003 Concerning the Definition of Micro, Small and Medium-Sized Enterprises (2003/361/EC). Off. J. Eur. Union 2003, L124, 36–41. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A32003H0361 (accessed on 30 March 2025).

- Statistisches Bundesamt (Destatis). Unternehmen, Tätige Personen, Umsatz und Weitere Betriebs- und Volkswirtschaftliche Kennzahlen: Deutschland, Jahre, Unternehmensgröße, Wirtschaftszweige. Statistik für Kleine und Mittlere Unternehmen (48121-0002). Available online: https://www-genesis.destatis.de/genesis/online?operation=ergebnistabelleUmfang&levelindex=2&levelid=1653665551356&downloadname=48121-0002#abreadcrumb (accessed on 27 May 2022).

- UNECE. Building Resilient Energy Systems: Technical Considerations and Actions for Achieving Greater Energy Security, Affordability and Net-Zero in the ECE Region. United Nations Economic Commission for Europe. Committee on Sustainable Energy. 31st Session. CSE-31/2022/INF.2 rev 1. 2023. Available online: https://unece.org/sed/documents/2023/04/building-resilient-energy-systems-technical-considerations-and-actions (accessed on 30 March 2025).

- Buettner, S.M.; König, W.; Vierhub-Lorenz, F.; Gilles, M. What Motivates Companies to Take the Decision to Decarbonise? Preprints 2022, 2022100395. [Google Scholar] [CrossRef]

- Buettner, S.M.; König, W. Determining the ideal mix—(finding out) what range of measures is best for one’s business. In Proceedings of the ACEEE Summer Study, Digital, Washington, DC, USA, 13–15 July 2021; Available online: https://www.aceee.org/sites/default/files/pdfs/ssi21/panel-2/Buettner.pdf (accessed on 30 March 2025).

- Schneider, J. Negativpreis von Foodwatch: Goldener Windbeutel geht an Rewe-Produkt. ZDF, 14 December 2021. Available online: https://www.zdf.de/nachrichten/wirtschaft/goldener-windbeutel-2021-rewe-klimaneutral-100.html (accessed on 27 November 2022).

- From Ambition to impact: How Companies Are Reducing Emissions at Scale with Science-Based Targets; Science Based Targets: London, UK, 2020; Available online: https://sciencebasedtargets.org/resources/files/SBTiProgressReport2020.pdf (accessed on 30 March 2025).

- Umweltbundesamt (UBA). Indicator: Greenhouse Gas Emissions. Available online: https://www.umweltbundesamt.de/en/data/environmental-indicators/indicator-greenhouse-gas-emissions#at-a-glance (accessed on 30 March 2025).

- Umweltbundesamt (UBA). Entwicklung der Treibhausgasemissionen in Deutschland 2010–2019. Available online: https://www.umweltbundesamt.de/sites/default/files/medien/421/bilder/1_entwicklung_der_treibhausgasemissionen_in_deutschland_0.jpg (accessed on 23 August 2022).

- The Federal Government of Germany. Climate Action Programme 2030. Available online: https://www.bundesregierung.de/breg-en/issues/climate-action (accessed on 30 March 2025).

- Drosihn, D. Übersicht zur Entwicklung der Energiebedingten Emissionen und Brennstoffeinsätze in Deutschland 1990–2020; Umweltbundesamt: Dessau-Roßlau, Germany, 2022; p. 9. Available online: https://www.umweltbundesamt.de/publikationen/uebersicht-zur-entwicklung-der-energiebedingten (accessed on 30 March 2025).

- eon. Durchschnittliche Photovoltaik-Leistung & PV-Erträge in Deutschland. Available online: https://www.eon.de/de/pk/solar/kwp-bedeutung-umrechnung.html (accessed on 30 March 2025).

- Stiftung Unternehmen Wald. Wie viel Kohlendioxid (CO2) Speichert der Baum bzw. der Wald. Available online: https://www.wald.de/waldwissen/wie-viel-kohlendioxid-co2-speichert-der-wald-bzw-ein-baum/ (accessed on 30 March 2025).

- Hertwig, M.; Werner, A.; Buettner, S.M.; Klingler, A.-L.; Schnabel, F.; Hölzle, K.; Rietdorf, C.; Kiemel, S.; Ebongue, Y.E.; Sadjjadi-Ortlieb, B.V.; et al. Roadmap Klimaneutrale Produktion: Handreichungen für die Transformation zur klimaneutralen Produktion in Baden-Württemberg; Umwelttechnik Baden-Württemberg: Stuttgart, Germany, 2024; Available online: https://www.umwelttechnik-bw.de/de/klimaneutralitaet#roadmap-studie (accessed on 30 March 2025).

- Statistisches Bundesamt (Destatis). Energieverbrauch der Unternehmen im Verarbeitenden Gewerbe 2019: Deutschland, Jahre, Nutzung des Energieverbrauchs, Wirtschaftszweige, Energiequellen (GENESIS-Tabelle 43531-0001). Available online: https://www-genesis.destatis.de/genesis/online?operation=table&code=43531-0001 (accessed on 30 March 2025).

- Statistisches Bundesamt (Destatis). Treibhausgas-Emissionen 2019: Deutschland, Jahre, Emissionsquellen, Treibhausgasarten, Wirtschaftsbereiche (GENESIS-Tabelle 85111-0005). Available online: https://www-genesis.destatis.de/genesis/online?operation=table&code=85111-0005 (accessed on 30 March 2025).

- EEP. Der Energieeffizienz-Index der Deutschen Industrie. Umfrageergebnisse 2. Halbjahr 2024; Institut für Energieeffizienz in der Produktion, Universität Stuttgart: Stuttgart, Germany, 2024; Available online: https://www.eep.uni-stuttgart.de/eei/archiv-aeltere-erhebungen/ (accessed on 30 March 2025).

- UNFCCC. COP28 Agreement Signals “Beginning of the End” of the Fossil Fuel Era. 13 December 2023. Available online: https://unfccc.int/news/cop28-agreement-signals-beginning-of-the-end-of-the-fossil-fuel-era (accessed on 30 March 2025).

- UNECE. Advancing Energy Resilience and Decarbonization Across the ECE Region: Analysis of Macro-Level Status quo and Action Points for the Industrial Sector. ECE/ENERGY/GE.6/2023/5. United Nations Economic Commission for Europe. Group of Experts on Energy Efficiency. Tenth Session. 2023. Available online: https://unece.org/sed/documents/2023/10/working-documents/advancing-energy-resilience-and-decarbonization-across-ece (accessed on 12 February 2024).

- Buettner, S.M. How Can Climate Neutrality Be Achieved for Industry? A Multi-Perspective Analysis. Ph.D. Thesis, Eberhard-Karls-Universität Tübingen, Tübingen, Germany, 2023. [Google Scholar] [CrossRef]

| Company Size | Number of Employees | Revenue in Million EUR | Total Population (N) | Observations (n) | Percentage of Sample | ||

|---|---|---|---|---|---|---|---|

| 2020/1 | 2020/2 | 2020/1 | 2020/2 | ||||

| Micro | 0–9 | ≤2 | 124,904 | 113 | 107 | 13.2% | 12.4% |

| Small | 10–49 | >2 to ≤10 | 52,282 | 154 | 195 | 18.0% | 22.6% |

| Medium | 50–249 | >10 to ≤50 | 15,282 | 279 | 262 | 32.6% | 30.3% |

| Large | >249 | >50 | 5300 | 311 | 300 | 36.3% | 34.7% |

| Total | 197,768 | 857 | 864 | 100% | 100% | ||

| Energy Intensity Class | Energy Intensity Interval (in Wh/EUR) | Observations | Percentage | ||

|---|---|---|---|---|---|

| 2020/1 | 2020/2 | 2020/1 | 2020/2 | ||

| Not energy-intensive | 0 to <10 | 151 | 141 | 23.1% | 20.9% |

| Less energy-intensive | 10 to <100 | 243 | 242 | 37.2% | 35.8% |

| Moderately energy-intensive | 100 to <1000 | 198 | 215 | 30.3% | 31.8% |

| Energy-intensive | 1000 to <10,000 | 44 | 69 | 6.7% | 10.2% |

| Very energy-intensive | ≥10,000 | 17 | 9 | 2.6% | 1.3% |

| Total | 653 | 676 | 100.0% | 100.0% | |

| NACE Code | Sector | Total Population (N) | Observations (n) | Percentage n (N) | ||

|---|---|---|---|---|---|---|

| 2020/1 | 2020/2 | 2020/1 | 2020/2 | |||

| 05 ** | Mining of coal and lignite | ~ | 8 | 4 | ~ | ~ |

| 06 ** | Extraction of crude petroleum and natural gas | 5 | 13 | 11 | 260.00% | 220.00% |

| 08 | Other mining and quarrying | 1438 | 12 | 13 | 0.83% | 0.90% |

| 10 | Manufacture of food products | 26,897 | 31 | 27 | 0.12% | 0.10% |

| 11 | Manufacture of beverages | 2435 | 19 | 16 | 0.78% | 0.66% |

| 12 | Manufacture of tobacco products | 62 | 8 | 7 | 12.90% | 11.29% |

| 13 | Manufacture of textiles | 4637 | 18 | 19 | 0.39% | 0.41% |

| 14 | Manufacture of worn apparel | 3306 | 14 | 11 | 0.42% | 0.33% |

| 15 | Manufacture of leather and related products | 1371 | 34 | 32 | 2.48% | 2.33% |

| 16 | Manufacture of wood and of products of wood and cork, except furniture; manufacture of articles of straw and plaiting materials | 12,944 | 39 | 49 | 0.30% | 0.38% |

| 17 | Manufacture of paper and paper products | 1558 | 53 | 36 | 3.40% | 2.31% |

| 18 | Printing and reproduction of recorded media | 10,986 | 24 | 27 | 0.22% | 0.25% |

| 19 | Manufacture of coke and refined petroleum products | 89 | 13 | 13 | 14.61% | 14.61% |

| 20 | Manufacture of chemicals and chemical products | 3280 | 48 | 52 | 1.46% | 1.58% |

| 21 | Manufacture of basic pharmaceutical products and pharmaceutical preparations | 554 | 26 | 31 | 4.69% | 5.60% |

| 22 | Manufacture of rubber and plastic products | 7090 | 64 | 54 | 0.90% | 0.76% |

| 23 | Manufacture of other non-metallic mineral products | 9908 | 44 | 44 | 0.44% | 0.44% |

| 24 | Manufacture of basic metals | 2374 | 42 | 41 | 1.77% | 1.73% |

| 25 | Manufacture of fabricated metal products, except machinery and equipment | 44,106 | 64 | 75 | 0.15% | 0.17% |

| 26 | Manufacture of computer, electronic and optical products | 7935 | 21 | 23 | 0.26% | 0.29% |

| 27 | Manufacture of electrical equipment | 6036 | 66 | 56 | 1.09% | 0.93% |

| 28 | Manufacture of machinery and equipment n.e.c. | 15,964 | 72 | 74 | 0.45% | 0.46% |

| 29 | Manufacture of motor vehicles, trailers and semi-trailers | 2769 | 49 | 60 | 1.77% | 2.17% |

| 30 | Manufacture of other transport equipment | 1276 | 15 | 24 | 1.18% | 1.88% |

| 31 | Manufacture of furniture | 10,826 | 29 | 24 | 0.27% | 0.22% |

| 32 | Other manufacturing | 19,985 | 30 | 38 | 0.15% | 0.19% |

| Total | 197,831 | 856 | 861 | 0.43% | 0.44% | |

| 2019 | 2025 | 2030 | 2025–2030 | n2025 | n2030 | |

|---|---|---|---|---|---|---|

| micro company | 0 | 16.8% | 25.1% | 8.2% | 75 | 38 |

| small company | 0 | 19.3% | 24.5% | 5.1% | 105 | 80 |

| medium-sized company | 0 | 22.0% | 28.4% | 6.4% | 196 | 135 |

| large company | 0 | 25.2% | 28.3% | 3.1% | 232 | 162 |

| Overall | 0% | 22.1% | 27.3% | 5.2% | 610 | 415 |

| 2019 | 2025 | 2030 | 2025–2030 | n2025 | n2030 | |

|---|---|---|---|---|---|---|

| not energy-intensive | 0 | 21.8% | 31.9% | 10.1% | 122 | 67 |

| less energy-intensive | 0 | 23.2% | 28.2% | 4.9% | 182 | 126 |

| moderately energy-intensive | 0 | 21.8% | 26.8% | 5.1% | 139 | 106 |

| energy-intensive | 0 | 24.3% | 26.4% | 2.2% | 31 | 27 |

| Overall | 0% | 22.1% | 27.3% | 5.2% | 610 | 415 |

| 2019 | 2025 | 2030 | 2025–2030 | n2025 | n2030 | |

| 27—Manufacture of electrical equipment | 0 | 19.8% | 23.0% | 3.2% | 35 | 22 |

| 17—Manufacture of paper and paper products | 0 | 23.6% | 23.3% | −0.3% | 36 | 21 |

| 20—Manufacture of chemicals and chemical products | 0 | 24.3% | 24.1% | −0.2% | 38 | 26 |

| 28—Manufacture of machinery and equipment | 0 | 20.7% | 25.4% | 4.7% | 56 | 37 |

| 23—Manufacture of non-metallic mineral products | 0 | 21.7% | 26.1% | 4.4% | 33 | 20 |

| 25—Manufacture of fabricated metal products | 0 | 23.0% | 26.4% | 3.4% | 44 | 37 |

| 24—Manufacture of basic metals | 0 | 27.2% | 28.7% | 1.5% | 32 | 20 |

| 06—Extraction of crude oil and natural gas | 0 | 22.5% | 32.5% | 10.0% | 8 | 8 |

| 29—Manufacture of motor vehicles and (semi-)trailers | 0 | 23.9% | 32.5% | 8.6% | 39 | 29 |

| 22—Manufacture of rubber and plastic products | 0 | 18.9% | 36.6% | 17.7% | 45 | 25 |

| Overall | 0% | 22.1% | 27.3% | 5.2% | 610 | 415 |

| CO2 Equivalents (in Million Tonnes) | 1990 | 2019 | 2025 | 2030 |

|---|---|---|---|---|

| Absolute and Policy Target Emissions for Industry | 284 | 187 | 140 | |

| Absolute if measures are implemented as planned | 146 | 136 | ||

| Absolute savings of planned measures | +97 | 0 | −41 | −51 |

| %-change compared to 2019 | 52% | 0 | −22.1% | −27.3% |

| %-change compared to 1990 | 0 | −34% | −49% | −52% |

| Political Target (overall) | −65% |

| Measure | in % | in Mio t CO2-eq. | in TWh | ca. Equivalent to |

|---|---|---|---|---|

| Energy Efficiency | 5.4% | 10.2 | ~75 | |

| Self-generation of renewable energies | 4.7% | 8.8 | ~65 | 380 km2 photovoltaic |

| Reduction of process-related emissions | 3.2% | 6.0 | ||

| Purchase of renewable energy | 5.3% | 9.9 | ~73 | 9700 wind turbines |

| Compensation | 3.4% | 6.3 | 10,000 km2 forest | |

| Other | 0.1% | 0.0 | ||

| Estimated total GHG savings Industry | 22.1% | 41 | ~138/~75 |

| German Manufacturing Industry [in 2019] | Energy Consumption [78] | Total GHG Emissions [79] | CO2 emissions (Energy-Related) | CO2 Emissions (Process-Related) |

|---|---|---|---|---|

| The individual sectors’ weight [in %] of the total manufacturing industry | in % | in % | in % | in % |

| 05/06/08—Mining and quarrying | 1.88% | 3.56% | 4.45% | 0.13% |

| 10/11/12—Production of food, beverages and tobacco | 6.26% | 4.86% | 5.67% | 0.05% |

| 13/14/15—Textiles, clothing, leather and leather goods | 0.46% | 0.65% | 0.78% | 0.00% |

| 16—Products of Wood and Corks | 2.34% | 4.30% | 5.50% | 0.00% |

| 17—Manufacture of paper and paper products | 6.73% | 6.28% | 8.05% | 0.01% |

| 18—Printing and reproduction of recorded media | 0.41% | 0.27% | 0.27% | 0.26% |

| 19—Manufacture of coke and refined petroleum products | 10.08% | 13.86% | 16.68% | 4.36% |

| 20—Manufacture of chemicals and chemical products | 28.73% | 14.66% | 14.98% | 11.96% |

| 21—Manufacture of pharmaceutical products | 0.61% | 0.38% | 0.48% | 0.01% |

| 22—Manufacture of rubber and plastic products | 2.23% | 1.03% | 1.28% | 0.12% |

| 23—Manufacture of non-metallic mineral products | 7.46% | 16.92% | 10.22% | 42.98% |

| 24—Metal production and processing/Basic Metals | 22.39% | 26.87% | 24.00% | 39.15% |

| 25—Manufacture of fabricated metal products | 2.35% | 1.32% | 1.51% | 0.50% |

| 26—Manufacture of computer, electronic and optical products | 0.75% | 0.34% | 0.30% | 0.11% |

| 27—Manufacture of electrical equipment | 0.71% | 0.33% | 0.35% | 0.02% |

| 28—Manufacture of machinery and equipment | 1.96% | 0.93% | 1.17% | 0.04% |

| 29—Manufacture of motor vehicles and (semi-)trailers | 3.77% | 2.43% | 3.07% | 0.10% |

| 30—Manufacture of other transport equipment | 0.32% | 0.17% | 0.20% | 0.05% |

| 31/32—Manufacture of furniture and other goods | 0.56% | 0.85% | 1.04% | 0.14% |

| Total | 100% | 100% | 100% | 100% |

| Aggregated weight of the 11 core industries (highlighted bold above) | 78.70% | 75.11% | 70.18% | 94.89% |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Buettner, S.M.; Döpp, J.; Strauch, L.; Gilles, M.; König, W.; Klingler, A.-L. Increasing the Voltage—Sequencing Decarbonisation with Green Power and Efficiency. Energies 2025, 18, 2752. https://doi.org/10.3390/en18112752

Buettner SM, Döpp J, Strauch L, Gilles M, König W, Klingler A-L. Increasing the Voltage—Sequencing Decarbonisation with Green Power and Efficiency. Energies. 2025; 18(11):2752. https://doi.org/10.3390/en18112752

Chicago/Turabian StyleBuettner, Stefan M., Josefine Döpp, Liane Strauch, Marina Gilles, Werner König, and Anna-Lena Klingler. 2025. "Increasing the Voltage—Sequencing Decarbonisation with Green Power and Efficiency" Energies 18, no. 11: 2752. https://doi.org/10.3390/en18112752

APA StyleBuettner, S. M., Döpp, J., Strauch, L., Gilles, M., König, W., & Klingler, A.-L. (2025). Increasing the Voltage—Sequencing Decarbonisation with Green Power and Efficiency. Energies, 18(11), 2752. https://doi.org/10.3390/en18112752