Understanding Reference-Dependent Behaviors in Determining Electricity Consumption of Korean Households: Empirical Evidence and Policy Implications

Abstract

1. Introduction

2. Literature Review

3. Method: Theoretical Background, Data, and Statistical Model

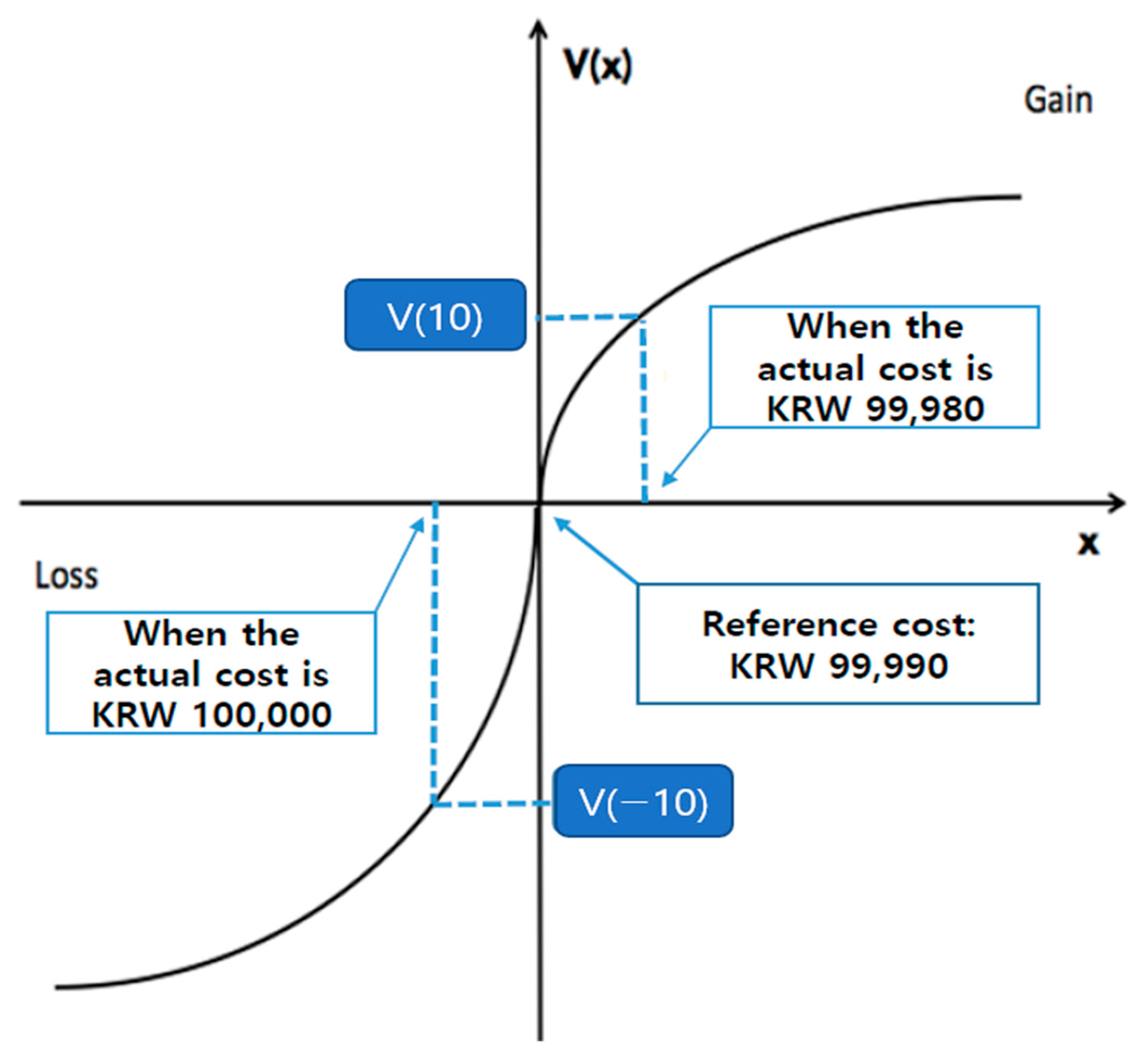

3.1. Theoretical Concept and Framework

3.2. Data

3.3. Empirical Modelling: Relevant Variables and a Probit Model

4. Results

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

References

- Gozales-Torres, M.; Perez-Lambard, L.; Coronel, J.F.; Maestre, I.R.; Pablo, B. Activity and Efficiency Trends for the Residential Sector across Countries. Energy Build. 2022, 273, 112428. [Google Scholar] [CrossRef]

- Statistics of Korea. Available online: https://www.index.go.kr/unity/potal/main/EachDtlPageDetail.do?idx_cd=2781 (accessed on 25 February 2025).

- IEA Data Services. Available online: https://www.iea.org/countries/korea/efficiency-demand (accessed on 25 February 2025).

- Spurlock, A.C. Loss-Aversion and Time-Differentiated Electricity Pricing. Lawrence Berkeley National Laboratory, Contract No. DE-AC02-05CH11231 with the U.S. Department of Energy. 2015. Available online: https://www.osti.gov/servlets/purl/1248927 (accessed on 3 March 2025).

- Ghesla, C.; Grieder, M.; Schmitz, J.; Stadelmann, M. Pro-Environmental Incentives and Loss-Aversion: A Field Experiment on Electricity Saving Behavior. Energy Policy 2020, 137, 111131. [Google Scholar] [CrossRef]

- Keefer, Q.; Rustamov, G. Limited Attention in Residential Energy Markets: A Regression Discontinuity Approach. Empir. Econ. 2018, 55, 993–1017. [Google Scholar] [CrossRef]

- Curley, C.; Rustamov, G.; Harrison, N.; Venable, M. Susceptibility to Inattention: Unpacking Who is Susceptible to Inattention in Energy-Based Electronic Billing. Rev. Policy Res. 2020, 37, 744–764. [Google Scholar] [CrossRef]

- Allcott, H. Social norm and energy conservation. J. Public Econ. 2011, 99, 1082–1095. [Google Scholar] [CrossRef]

- Choi, S.; Denzau, A.; Hwang, S. Do Households Conserve Electricity When They Receive Signals of Greater Consumption than Neighbours? The Korean case. Energy 2021, 225, 120292. [Google Scholar] [CrossRef]

- Mutumbi, U.; Thondhlana, G.; Ruwanza, S. The Status of Household Electricity Use Behaviour Research in South Africa between 2000 and 2022. Energies 2022, 15, 9018. [Google Scholar] [CrossRef]

- Kahneman, D.; Tversky, A. Prospect Theory: An Analysis of Decision under Risk. Econometrica 1979, 47, 263–291. [Google Scholar] [CrossRef]

- Zhang, Y.; Ma, W.; Du, P.; Li, S.; Gao, K.; Wang, Y.; Liu, Y.; Zhan, B.; Yu, D.; Zhang, J.; et al. Powering the Future: Unraveling Residential Building Characteristics for Accurate Prediction of Total Electricity Consumption during Summer Heat. Appl. Energy 2024, 376, 124146. [Google Scholar] [CrossRef]

- Karatasou, S.; Santamouris, M. Socio-economic Status and Residential Energy Consumption: A Latent Variable Approach. Energy Build. 2019, 198, 100–105. [Google Scholar] [CrossRef]

- Zhang, S.; Guo, Q.; Smyth, R.; Yao, Y. Extreme Temperatures and Residential Electricity Consumption: Evidence from Chinese Households. Energy Econ. 2022, 107, 105890. [Google Scholar] [CrossRef]

- Soava, G.; Mehedintu, A.; Sterpu, M.; Grecu, E. The Impact of the COVID-19 Pandemic on Electricity Consumption and Economic Growth in Romania. Energies 2021, 14, 2394. [Google Scholar] [CrossRef]

- Allcott, H.; Mullainathan, S. Behavioral Science and Energy Policy. Science 2010, 327, 1204–1205. [Google Scholar] [CrossRef]

- Ito, K. Do Consumers Respond to Marginal or Average Price? Evidence from Nonlinear Electricity Pricing. Am. Econ. Rev. 2014, 104, 537–563. [Google Scholar] [CrossRef]

- Jachimowicz, J.M.; Hauser, O.; O’Brien, J.; Sherman, E.; Galinsky, A.D. People Use Less Energy When They Think Their Neighbour’s Care About the Environment. Harvard Business Review. 2019. Available online: https://hbr.org/2019/01/research-people-use-less-energy-when-they-think-their-neighbors-care-about-the-environment (accessed on 25 February 2025).

- Gill, D.; Prowse, V. A Structural Analysis of Disappointment Aversion in a Real Effort Competition. Am. Econ. Rev. 2012, 102, 469–503. [Google Scholar] [CrossRef]

- Heath, C.; Larrick, R.P.; Wu, G. Goals as Reference Points. Cogn. Psychol. 1999, 38, 79–109. [Google Scholar] [CrossRef]

- Kőszegi, B.; Rabin, M. A Model of Reference-Dependent Preferences. Q. J. Econ. 2006, 121, 1133–1165. [Google Scholar]

- Chetty, R.; Szeidl, A. Consumption Commitments: A Foundation for Reference-Dependent Preferences and Habit Formation. Econometrica 2016, 84, 855–890. [Google Scholar] [CrossRef]

- Thomas, M.; Morwitz, V. Penny Wise and Pound Foolish: The Left-Digit Effect in Price Cognition. J. Consum. Res. 2005, 32, 54–64. [Google Scholar] [CrossRef]

- DellaVigna, S. Psychology and Economics: Evidence from the Field. J. Econ. Lit. 2009, 47, 315–372. [Google Scholar] [CrossRef]

- Lacetera, N.; Pope, D.G.; Sydnor, J.R. Heuristic Thinking and Limited Attention in the Car Market. Am. Econ. Rev. 2012, 102, 2206–2236. [Google Scholar] [CrossRef]

- Crawford, V.P.; Meng, J. New York City Cab Drivers’ Labor Supply Revisited: Reference-Dependent Preferences with Rational-Expectations Targets for Hours and Income. Am. Econ. Rev. 2011, 101, 1912–1932. [Google Scholar] [CrossRef]

- Ito, K.; Ida, T.; Tanaka, M. Moral Suasion and Economic Incentives: Field Experimental Evidence from Energy Demand. Am. Econ. J. Econ. Policy 2018, 10, 240–267. [Google Scholar] [CrossRef]

- Appiah, K.M.; Gyening, K.E.; Teye, K.P.; Frimpong, C.; Nsowa, A. The Implications of Energy Literacy on energy Savings Behavior: A Model of Contingent Effects of Energy Value and Attitude. Energy Rep. 2023, 10, 72–85. [Google Scholar] [CrossRef]

- Mizobuchi, K.; Takeuchi, K. Replacement or Additional Purchase: The Impact of Energy-Efficient Appliances on Household Electricity Saving under Public Pressures. Energy Policy 2016, 93, 137–148. [Google Scholar] [CrossRef]

| Block | 1 | 2 | 3 | 4 | 5 | 6 |

|---|---|---|---|---|---|---|

| Quantity Consumed (KWh) | ≤100 | 101–200 | 201–300 | 301–400 | 401–500 | Over 500 |

| Base Rate (KRW) | 410 | 730 | 1260 | 3170 | 6060 | 10,760 |

| Running Rate (KRW) | 57.6 | 98.9 | 147.3 | 215.6 | 325.70 | 574.6 |

| Variables | Obs. | Mean | Std. | Min. | Max. |

|---|---|---|---|---|---|

| Electricity Consumption | 49,920 | 275.80 | 106.50 | 0 | 2122 |

| Electricity Cost | 49,920 | 37,929.3 | 32,239.1 | 0 | 1,164,269.7 |

| Area of House (Dwelling) 1 | 49,920 | 19.19 | 11.70 | 1 | 55 |

| Number of Households | 49,920 | 2.99 | 1.25 | 1 | 8 |

| Income 2 | 49,920 | 3.03 | 1.45 | 1 | 9 |

| Heating Degree Days | 49,920 | 234.3 | 248.7 | 0 | 780.7 |

| Cooling Degree Days | 49,920 | 69.25 | 94.87 | 0 | 300.6 |

| Explanatory Variables | is Represented as One of the Followings, | |||||

|---|---|---|---|---|---|---|

| Actual Cost > | 1.978 ** | 1.465 ** | 1.858 ** | 1.985 ** | 1.956 ** | 1.929 ** |

| (0.024) | (0.023) | (0.022) | (0.023) | (0.023) | (0.022) | |

| Actual KW > | 1.260 ** | 1.390 ** | 1.238 ** | 1.157 ** | 1.171 ** | 1.181 ** |

| (0.029) | (0.016) | (0.025) | (0.027) | (0.027) | (0.026) | |

| Cooling Degree Days | −0.002 ** | −0.003 ** | −0.002 ** | −0.002 ** | −0.002 ** | −0.002 ** |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| Heating Degree Days | −0.001 ** | −0.001 ** | −0.001 ** | −0.001 ** | −0.001 ** | −0.001 ** |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| Annual Income | −0.009 | −0.01 * | −0.007 | −0.006 | −0.006 | 0.005 |

| (0.006) | (0.005) | (0.006) | (0.006) | (0.006) | (0.006) | |

| Constant | −2.378 ** | −1.669 ** | −2.111 ** | −2.274 ** | −2.163 ** | −2.166 ** |

| (0.051) | (0.043) | (0.048) | (0.050) | (0.049) | (0.049) | |

| Observations | 49,920 | 49,920 | 49,920 | 49,920 | 49,920 | 49,920 |

| Pseudo R2 | 0.483 | 0.363 | 0.469 | 0.477 | 0.476 | 0.472 |

| LR Chi2 | 33,368.5 | 25,098.6 | 32,411.8 | 32,934.7 | 32,897.0 | 32,622.1 |

| AIC | 0.716 | 0.882 | 0.735 | 0.725 | 0.726 | 0.731 |

| BIC | −504,183.2 | −495,913.3 | −503,226.4 | −503,749.4 | −503,711.7 | −503,436.7 |

| Explanatory Variables | is Represented as One of the Followings, | |||||

|---|---|---|---|---|---|---|

| Actual Cost > | 1.327 ** | 1.003 ** | 1.308 ** | 1.870 ** | 1.352 ** | 1.338 ** |

| (0.030) | (0.020) | (0.026) | (0.034) | (0.028) | (0.026) | |

| Actual KW > | 0.911 ** | 1.334 ** | 0.961 ** | 0.549 ** | 0.902 ** | 0.949 ** |

| (0.028) | (0.017) | (0.025) | (0.031) | (0.026) | (0.025) | |

| Cooling Degree Days | −0.002 ** | −0.002 ** | −0.002 ** | −0.002 ** | −0.002 ** | −0.002 ** |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| Heating Degree Days | −0.001 ** | −0.001 ** | −0.001 ** | −0.001 ** | −0.001 ** | −0.001 ** |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| Annual Income | −0.003 | −0.008 * | −0.007 | −0.002 | −0.002 | 0.001 |

| (0.005) | (0.005) | (0.005) | (0.005) | (0.005) | (0.005) | |

| Constant | −1.562 ** | −1.629 ** | −1.580 ** | −1.653 ** | −1.560 ** | −1.578 ** |

| (0.042) | (0.042) | (0.042) | (0.043) | (0.042) | (0.042) | |

| Observations | 49,920 | 49,920 | 49,920 | 49,920 | 49,920 | 49,920 |

| Pseudo R2 | 0.35 | 0.324 | 0.350 | 0.377 | 0.350 | 0.351 |

| LR Chi2 | 24,198.5 | 22,419.7 | 24,240.3 | 26,122.7 | 24,175.9 | 24,316.8 |

| AIC | 0.900 | 0.936 | 0.899 | 0.861 | 0.900 | 0.898 |

| BIC | −49,5013.2 | −493,234.3 | −495,055.0 | −496,937.3 | −494,990.6 | −495,131.5 |

| Explanatory Variables | is Represented as One of the Followings, | |||||

|---|---|---|---|---|---|---|

| Actual Cost > | 1.484 ** | 1.602 ** | 1.453 ** | 1.163 ** | 1.480 ** | 1.470 ** |

| (0.027) | (0.017) | (0.027) | (0.023) | (0.027) | (0.027) | |

| Actual KW > | 1.192 ** | 1.276 ** | 1.184 ** | 1.188 ** | 1.181 ** | 1.184 ** |

| (0.017) | (0.016) | (0.017) | (0.016) | (0.017) | (0.017) | |

| Cooling Degree Days | −0.003 ** | −0.003 ** | −0.003 ** | −0.002 ** | −0.003 ** | −0.003 ** |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| Heating Degree Days | −0.001 ** | −0.001 ** | −0.001 ** | −0.001 ** | −0.001 ** | −0.001 ** |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| Annual Income | −0.013 * | −0.006 * | −0.012 * | −0.010 | −0.012 * | 0.011 * |

| (0.005) | (0.005) | (0.005) | (0.005) | (0.005) | (0.005) | |

| Constant | −2.060 ** | −1.498 ** | −2.018 ** | −1.744 ** | −2.045 ** | −2.045 ** |

| (0.050) | (0.040) | (0.045) | (0.042) | (0.045) | (0.045) | |

| Observations | 49,920 | 49,920 | 49,920 | 49,920 | 49,920 | 49,920 |

| Pseudo R2 | 0.358 | 0.289 | 0.355 | 0.332 | 0.356 | 0.355 |

| LR Chi2 | 24,780.8 | 19,999.3 | 24,585.7 | 22,997.6 | 24,634.8 | 24,568.1 |

| AIC | 0.888 | 0.984 | 0.892 | 0.924 | 0.891 | 0.893 |

| BIC | −495,595.4 | −490,814.0 | −495,400.4 | −493,811.3 | −495,449.4 | −495,382.8 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Park, J.; Choi, S. Understanding Reference-Dependent Behaviors in Determining Electricity Consumption of Korean Households: Empirical Evidence and Policy Implications. Energies 2025, 18, 2686. https://doi.org/10.3390/en18112686

Park J, Choi S. Understanding Reference-Dependent Behaviors in Determining Electricity Consumption of Korean Households: Empirical Evidence and Policy Implications. Energies. 2025; 18(11):2686. https://doi.org/10.3390/en18112686

Chicago/Turabian StylePark, Jiyong, and Sunghee Choi. 2025. "Understanding Reference-Dependent Behaviors in Determining Electricity Consumption of Korean Households: Empirical Evidence and Policy Implications" Energies 18, no. 11: 2686. https://doi.org/10.3390/en18112686

APA StylePark, J., & Choi, S. (2025). Understanding Reference-Dependent Behaviors in Determining Electricity Consumption of Korean Households: Empirical Evidence and Policy Implications. Energies, 18(11), 2686. https://doi.org/10.3390/en18112686