A Techno-Economic Analysis of Power Generation in Wind Power Plants Through Deep Learning: A Case Study of Türkiye

Abstract

1. Introduction

2. Literature Review

2.1. Related Studies in Wind Power Plant Technical Potential Analysis

2.2. Related Studies in Wind Power Plant Investment and Economic Analysis

3. Materials and Methods

3.1. Weibull Distribution

3.2. Long Short-Term Memory (LSTM)

- Input gate: The input gate allows for the storage of new prediction data in the cell state, which carries data like a communication line within the cells. This layer contains both sigmoid and tanh functions. The sigmoid function is used to decide which data will be updated, while the tanh function is used to generate new data when needed [4,47,48].

- Forget gate: The forget gate evaluates which data should be forgotten and which should be retained from the cell state. A sigmoid activation function, which produces values between 0 and 1, is used to determine how much of the past data should be retained or forgotten. If the function output is 0, the data are forgotten, and if the output is 1, the data are retained and continues to be carried along with the cell state [4,49].

4. Results

4.1. Weibull Results

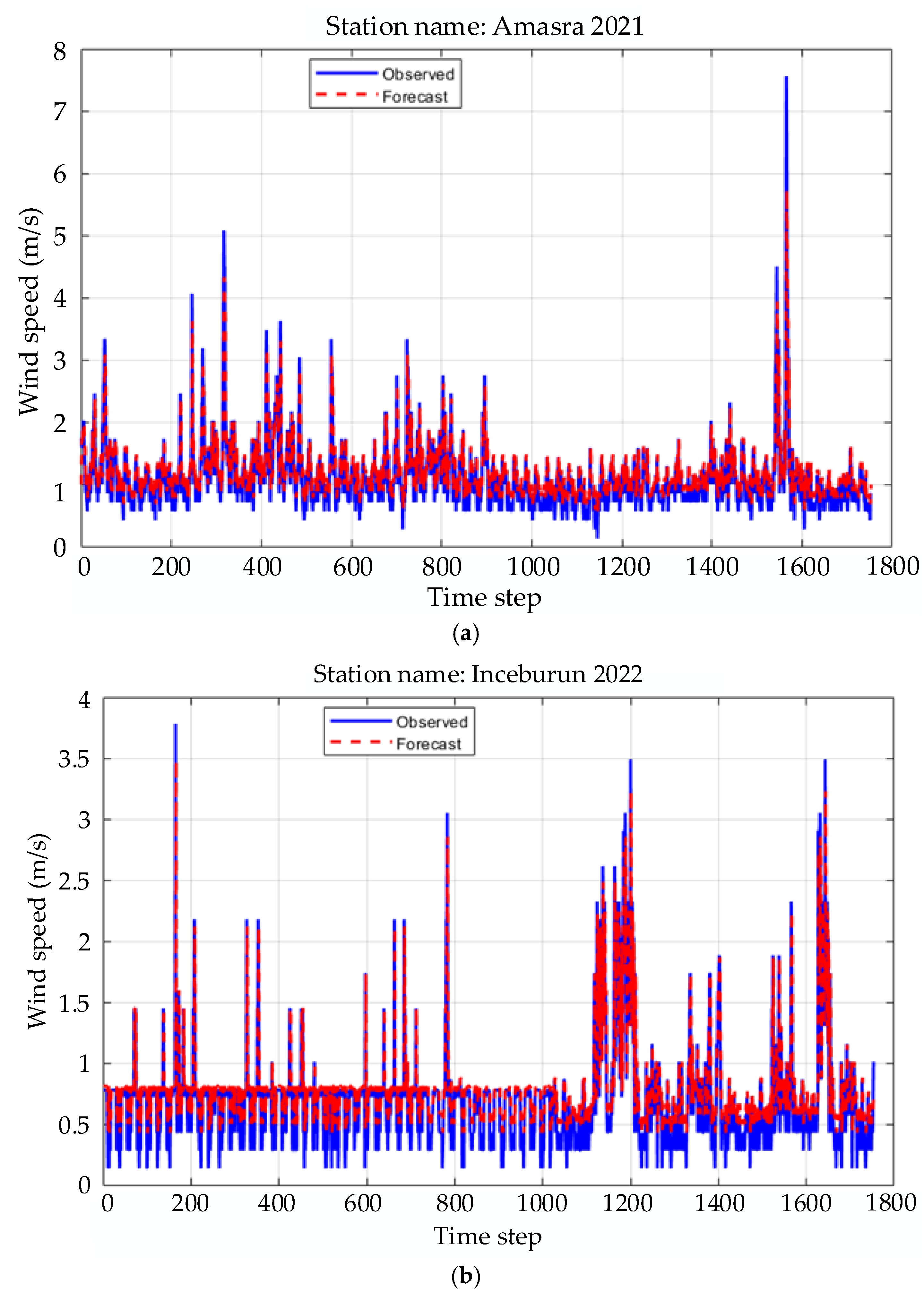

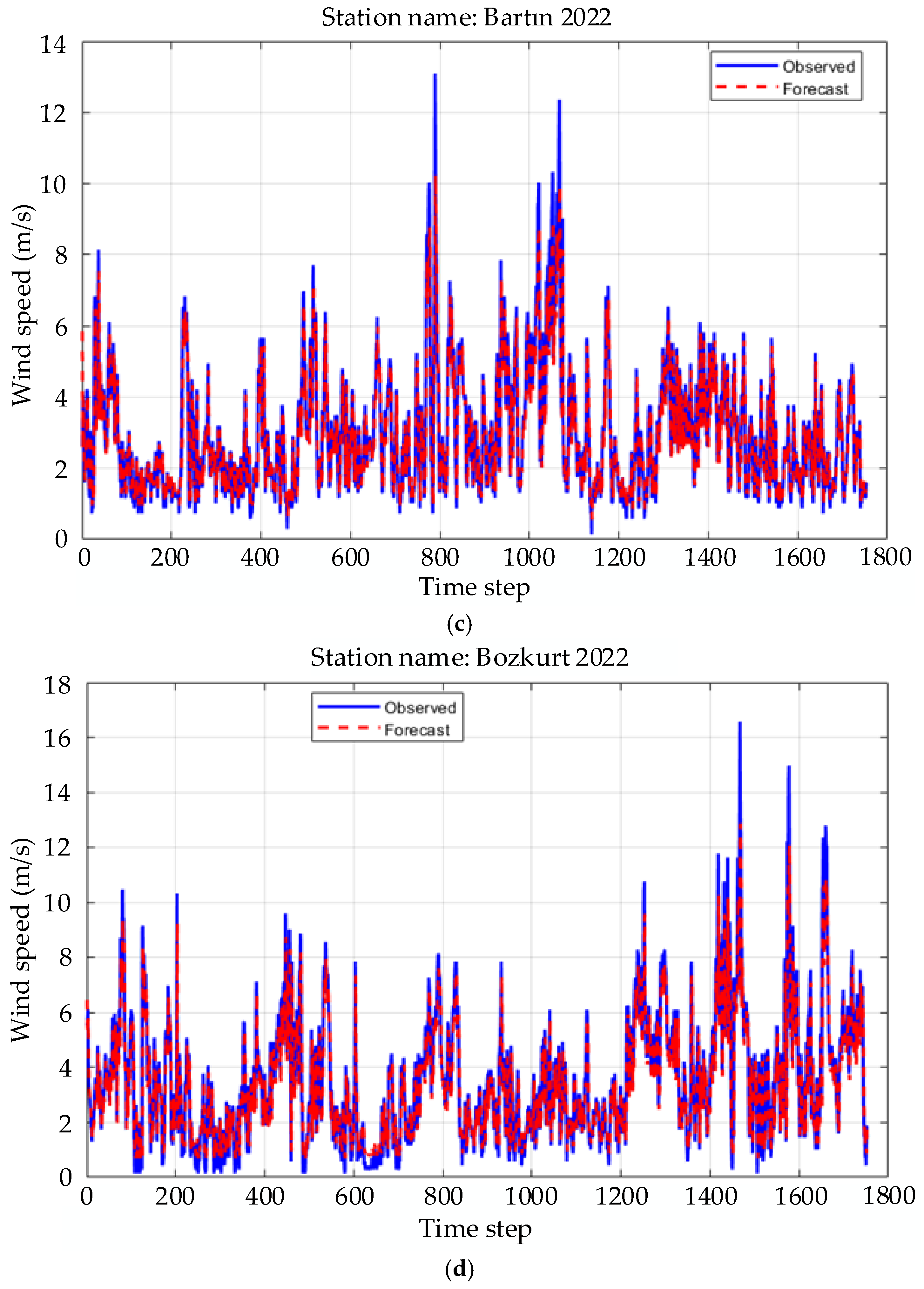

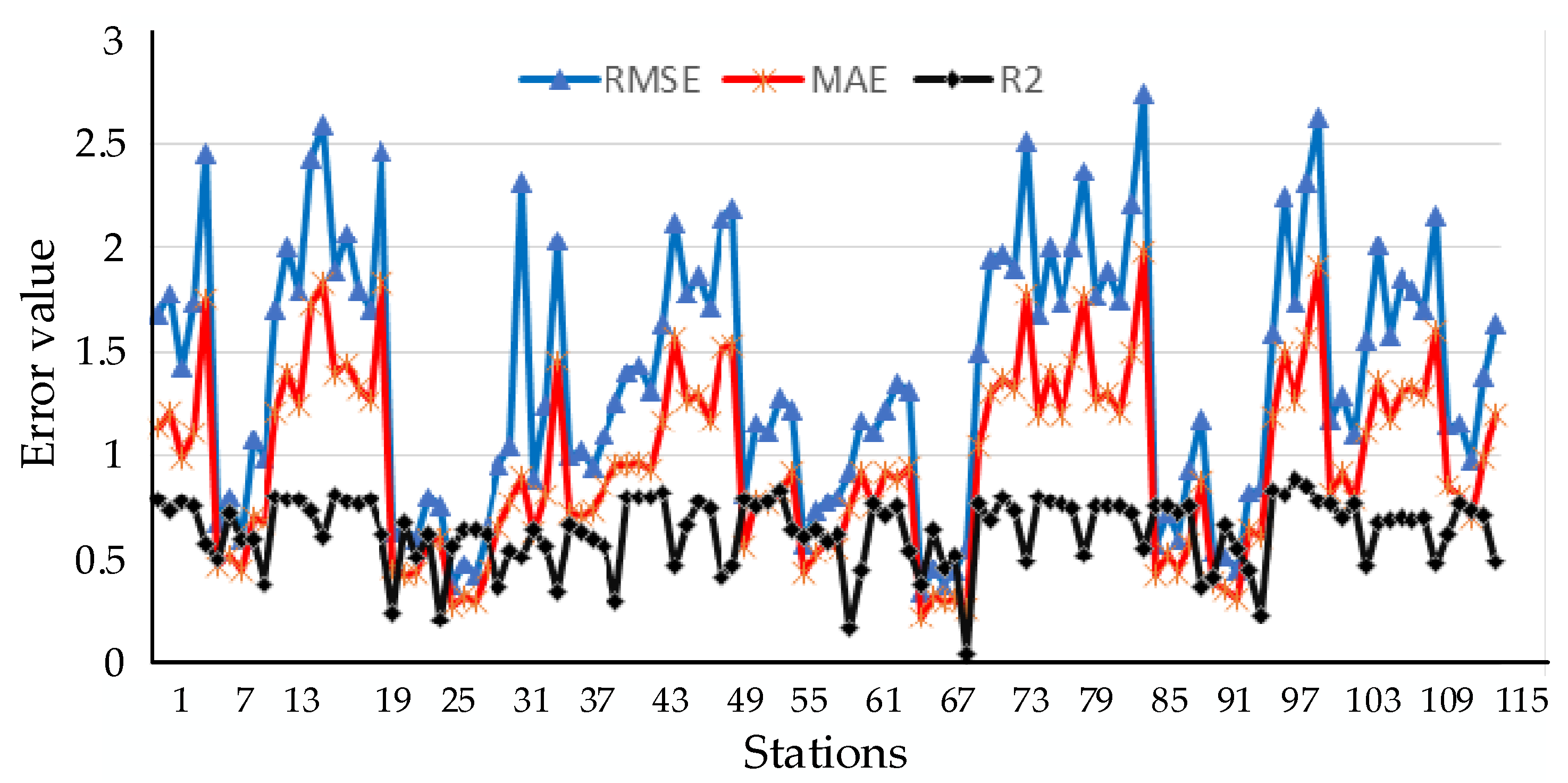

4.2. LSTM Results

4.3. Economical Analysis Results

5. Discussion

6. Conclusions

6.1. Limitations of the Study

6.2. Recommendations for the Future

6.3. Policy Implications

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Abbreviations

| ANN | Artificial Neural Network |

| BiLSTM | Bidirectional Long Short-Term Memory |

| CEEMDAN | Complete Ensemble Empirical Mode Decomposition with Adaptive Noise |

| CNN | Convolutional Neural Network |

| ELMs | Extreme-Learning Machines |

| FNN | Functional Neural Network |

| GRU | Gated Recurrent Unit |

| IRR | Internal rate of return |

| LSTM | Long Short-Term Memory |

| MCDM | Multi-Criteria Decision-Making |

| RMSE | Root Mean Square Error |

| RNN | Recurrent Neural Network |

| RSA | Random Sampling Algorithm |

| SVM | Support Vector Machine |

| WD | Wavelet Decomposition |

| XGBoost | Extreme Gradient Boosting |

Appendix A

References

- Omidkar, A.; Es’haghian, R.; Song, H. Using Machine Learning Methods for Long-Term Technical and Economic Evaluation of Wind Power Plants. Green Energy Resour. 2025, 3, 100115. [Google Scholar] [CrossRef]

- Türkiye Elektrik Üretim-İletim 2023 Yılı İstatistikleri (TEİAŞ). Available online: https://www.teias.gov.tr/turkiye-elektrik-uretim-iletim-istatistikleri (accessed on 15 April 2025).

- Wang, G.; Huang, X.; Li, Y.; Wang, H.; Zhang, X.; Qiu, J. Conv-ELSTM: An Ensemble Deep Learning Approach for Predicting Short-Term Wind Power. IET Renew. Power Gener. 2024, 18, 4084–4096. [Google Scholar] [CrossRef]

- Li, X.; Li, K.; Shen, S.; Tian, Y. Exploring Time Series Models for Wind Speed Forecasting: A Comparative Analysis. Energies 2023, 16, 7785. [Google Scholar] [CrossRef]

- Salamanis, A.; Xanthopoulou, G.; Kehagias, D.; Tzovaras, D. LSTM-Based Deep Learning Models for Long-Term Tourism Demand Forecasting. Electronics 2022, 11, 3681. [Google Scholar] [CrossRef]

- Terzi, A.; Fouquet, R. The Green Industrial Revolution: Lessons from the History of Past Energy Transitions. EconPol Forum 2023, 24, 16–22. [Google Scholar]

- Martinot, E. Renewable Energy Gains Momentum: Global Markets and Policies in the Spotlight. Environ. Sci. Policy Sustain. Dev. 2006, 48, 26–43. [Google Scholar] [CrossRef]

- Wang, Y.; Zou, R.; Liu, F.; Zhang, L.; Zhang, Q.; Liu, Q. A Review of Wind Speed and Wind Power Forecasting with Deep Neural Networks. Appl. Energy 2021, 304, 117766. [Google Scholar] [CrossRef]

- Valdivia-Bautista, S.M.; Domínguez-Navarro, J.A.; Pérez-Cisneros, M.; Vega-Gómez, C.J.; Castillo-Téllez, B. Artificial Intelligence in Wind Speed Forecasting: A Review. Energies 2023, 16, 2457. [Google Scholar] [CrossRef]

- Alkhayat, G.; Mehmood, R. A Review and Taxonomy of Wind and Solar Energy Forecasting Methods Based on Deep Learning. Energy AI 2021, 4, 100060. [Google Scholar] [CrossRef]

- Ayene, S.M.; Yibre, A.M. Wind power prediction based on deep learning models: The case of adama wind farm. Heliyon 2024, 10, e39579. [Google Scholar] [CrossRef]

- He, Y.; Zhang, L.; Guan, T.; Zhang, Z. An Integrated CEEMDAN to Optimize Deep Long Short-Term Memory Model for Wind Speed Forecasting. Energies 2024, 17, 4615. [Google Scholar] [CrossRef]

- Malashin, I.; Tynchenko, V.; Gantimurov, A.; Nelyub, V.; Borodulin, A. Applications of Long Short-Term Memory (LSTM) Networks in Polymeric Sciences: A Review. Polymers 2024, 16, 2607. [Google Scholar] [CrossRef] [PubMed]

- Shirzadi, N.; Nasiri, F.; Menon, R.P.; Monsalvete, P.; Kaifel, A.; Eicker, U. Smart Urban Wind Power Forecasting: Integrating Weibull Distribution, Recurrent Neural Networks, and Numerical Weather Prediction. Energies 2023, 16, 6208. [Google Scholar] [CrossRef]

- Baek, J.-S.; Kang, J.-K.; Park, K.S. Corporate Governance and Firm Value: Evidence from the Korean Financial Crisis. J. Financ. Econ. 2004, 71, 265–313. [Google Scholar] [CrossRef]

- Backhus, J.; Rao, A.R.; Venkatraman, C.; Padmanabhan, A.; Kumar, A.V.; Gupta, C. Equipment Health Assessment: Time Series Analysis for Wind Turbine Performance. Appl. Sci. 2024, 14, 3270. [Google Scholar] [CrossRef]

- Hanifi, S.; Liu, X.; Lin, Z.; Lotfian, S. A Critical Review of Wind Power Forecasting Methods—Past, Present and Future. Energies 2020, 13, 3764. [Google Scholar] [CrossRef]

- Taheri, N.; Tucci, M. Enhancing Regional Wind Power Forecasting through Advanced Machine-Learning and Feature-Selection Techniques. Energies 2024, 17, 5431. [Google Scholar] [CrossRef]

- Elshewey, A.M.; Jamjoom, M.M. Alkhammash, E.H. An enhanced CNN with ResNet50 and LSTM deep learning forecasting model for climate change decision making. Sci. Rep. 2025, 15, 14372. [Google Scholar] [CrossRef]

- Wu, Q.; Guan, F.; Lv, C.; Huang, Y. Ultra-Short-Term Multi-Step Wind Power Forecasting Based on CNN-LSTM. IET Renew. Power Gener. 2021, 15, 1019–1029. [Google Scholar] [CrossRef]

- Duan, J.; Wang, P.; Ma, W.; Tian, X.; Fang, S.; Cheng, Y.; Chang, Y.; Liu, H. Short-Term Wind Power Forecasting Using the Hybrid Model of Improved Variational Mode Decomposition and Correntropy Long Short-Term Memory Neural Network. Energy 2021, 214, 118980. [Google Scholar] [CrossRef]

- Delgado, I.; Fahim, M. Wind Turbine Data Analysis and LSTM-Based Prediction in SCADA System. Energies 2021, 14, 125. [Google Scholar] [CrossRef]

- Díaz, H.; Soares, C.G. A Multi-Criteria Approach to Evaluate Floating Offshore Wind Farms Siting in the Canary Islands (Spain). Energies 2021, 14, 865. [Google Scholar] [CrossRef]

- Shayan, M.E.; Najafi, G.; Ghobadian, B.; Gorjian, S.; Mamat, R.; Ghazali, M.F. Multi-microgrid optimization and energy management under boost voltage converter with Markov prediction chain and dynamic decision algorithm. Renew. Energy 2022, 201, 179–189. [Google Scholar] [CrossRef]

- Shayan, M.E.; Petrollese, M.; Rouhani, S.H.; Mobayen, S.; Zhilenkov, A.; Su, C.L. An innovative two-stage machine learning-based adaptive robust unit commitment strategy for addressing uncertainty in renewable energy systems. Int. J. Electr. Power Energy Syst. 2024, 160, 110087. [Google Scholar] [CrossRef]

- Ali, S.; Lee, S.-M.; Jang, C.-M. Techno-Economic Assessment of Wind Energy Potential at Three Locations in South Korea Using Long-Term Measured Wind Data. Energies 2017, 10, 1442. [Google Scholar] [CrossRef]

- Dalabeeh, A.S.K. Techno-Economic Analysis of Wind Power Generation for Selected Locations in Jordan. Renew. Energy 2019, 101, 1369–1378. [Google Scholar] [CrossRef]

- Adnan, M.; Ahmad, J.; Ali, S.F.; Imran, M. A Techno-Economic Analysis for Power Generation through Wind Energy: A Case Study of Pakistan. Energy Rep. 2021, 7, 1424–1443. [Google Scholar] [CrossRef]

- Gul, M.; Tai, N.; Huang, W.; Nadeem, M.H.; Yu, M. Assessment of Wind Power Potential and Economic Analysis at Hyderabad in Pakistan: Powering to Local Communities Using Wind Power. Sustainability 2019, 11, 1391. [Google Scholar] [CrossRef]

- Adaramola, M.; Paul, S.; Oyedepo, S. Assessment of Electricity Generation and Energy Cost of Wind Energy Conversion Systems in North-Central Nigeria. Energy Convers. Manag. 2011, 52, 3363–3368. [Google Scholar] [CrossRef]

- Odoi-Yorke, F.; Adu, T.F.; Ampimah, B.C.; Atepor, L. Techno-Economic Assessment of a Utility-Scale Wind Power Plant in Ghana. Energy Convers. Manag. X 2023, 18, 100375. [Google Scholar] [CrossRef]

- Shorabeh, S.N.; Firozjaei, H.K.; Firozjaei, M.K.; Jelokhani-Niaraki, M.; Homaee, M.; Nematollahi, O. The Site Selection of Wind Energy Power Plant Using GIS-Multi-Criteria Evaluation from Economic Perspectives. Renew. Sustain. Energy Rev. 2022, 168, 112778. [Google Scholar] [CrossRef]

- Turkish State Meteorological Service. Available online: https://mevbis.mgm.gov.tr/mevbis/ui/index.html#/Workspace (accessed on 15 January 2025).

- Turkish Meteorology General Directorate. Available online: https://www.mgm.gov.tr/FILES/kurumsal/kalibrasyon/ashk.pdf (accessed on 12 January 2025).

- Soyutwind. Available online: https://soyutwind.com/en/soyut-1000-kw-ruzgar-turbini/ (accessed on 31 December 2024).

- Dayi, F.; Yucel, M.; Demirkol, Z.; Cilesiz, A. Management of sustainable investments: A comprehensive financial evaluation of wind energy facilities in Kastamonu. Energy Sustain. Dev. 2024, 81, 101501. [Google Scholar] [CrossRef]

- Masters, G.M. Renewable and Efficient Electric Power Systems; John Wiley and Sons: Hoboken, NJ, USA, 2004. [Google Scholar]

- Turkish State Meteorological Service. Available online: https://mgm.gov.tr/kurumsal/istasyonlarimiz.aspx (accessed on 1 December 2024).

- Singla, N.; Jain, K.; Sharma, S.K. The Beta Generalized Weibull distribution: Properties and applications. Reliab. Eng. Syst. Saf. 2012, 102, 5–15. [Google Scholar] [CrossRef]

- Alrashidi, M. Estimation of Weibull Distribution Parameters for Wind Speed Characteristics Using Neural Network Algorithm. Comput. Mater. Contin. 2023, 75, 1073–1088. [Google Scholar] [CrossRef]

- Serban, A.; Paraschiv, L.S.; Paraschiv, S. Assessment of Wind Energy Potential Based on Weibull and Rayleigh Distribution Models. Energy Rep. 2020, 6, 250–267. [Google Scholar] [CrossRef]

- Sumair, M.; Aized, T.; Gardezi, S.A.R.; ur Rehman, S.U.; Rehman, S.M.S. A Novel Method Developed to Estimate Weibull Parameters. Energy Rep. 2020, 6, 1715–1733. [Google Scholar] [CrossRef]

- Vu, C.C.; Tran, H.H. Performance analysis of methods to estimate Weibull parameters for the compressive strength of concrete. Case Stud. Constr. Mater. 2023, 19, e02330. [Google Scholar] [CrossRef]

- AbdElkader, A.G.; ZainEldin, H.; Saafan, M.M. Optimizing Wind Power Forecasting with RNN-LSTM Models through Grid Search Cross-Validation. Sustain. Comput. Inform. Syst. 2025, 45, 101054. [Google Scholar] [CrossRef]

- Li, G.; Shi, J. On Comparing Three Artificial Neural Networks for Wind Speed Forecasting. Appl. Energy 2010, 87, 2313–2320. [Google Scholar] [CrossRef]

- Dobilas, S. LSTM Recurrent Neural Networks—How to Teach a Network to Remember the Past. Available online: https://towardsdatascience.com/lstm-recurrent-neural-networks-how-to-teach-a-network-to-remember-the-past-55e54c2ff22e/ (accessed on 6 February 2022).

- Al-Selwi, S.M.; Hassan, M.F.; Abdulkadir, S.J.; Muneer, A.; Sumiea, E.H.; Alqushaibi, A.; Ragab, M.G. RNN-LSTM: From applications to modeling techniques and beyond—Systematic review. J. King Saud Univ. Comput. Inf. Sci. 2024, 36, 102068. [Google Scholar] [CrossRef]

- Huang, Q.; Wang, X. A Forecasting Model of Wind Power Based on IPSO–LSTM and Classified Fusi. Energies 2022, 15, 5531. [Google Scholar] [CrossRef]

- Geng, D.; Zhang, H.; Wu, H. Short-Term Wind Speed Prediction Based on Principal Component Analysis and LSTM. Appl. Sci. 2020, 10, 4416. [Google Scholar] [CrossRef]

- Wang, W.; Chen, K.; Bai, Y.; Chen, Y.; Wang, J. New Estimation Method of Wind Power Density With Three-Parameter Weibull Distribution: A Case on Central Inner Mongolia Suburbs. Wind. Energy 2022, 25, 368–386. [Google Scholar] [CrossRef]

- Sedaghat, A.; Alkhatib, F.; Eilaghi, A.; Mehdizadeh, A.; Borvayeh, L.; Mostafaeipour, A.; Jahangiri, M. Optimization of capacity factors based on rated wind speeds of wind turbines. Energy Sources Part A Recovery Util. Environ. Eff. 2020, 46, 6104–6125. [Google Scholar] [CrossRef]

- Shaahid, S.; Al-Hadhrami, L.; Rahman, M. Economic Feasibility of Development of Wind Power Plants in Coastal Locations of Saudi Arabia—A Review. Renew. Sustain. Energy Rev. 2013, 19, 589–597. [Google Scholar] [CrossRef]

- Soyutwind Product Categories. Available online: https://soyutwind.com/en/magaza/ (accessed on 7 February 2025).

- Yildiz, N.; Hemida, H.; Baniotopoulos, C. Operation, Maintenance, and Decommissioning Cost in Life-Cycle Cost Analysis of Floating Wind Turbines. Energies 2024, 17, 1332. [Google Scholar] [CrossRef]

- Mostafaeipour, A.; Jadidi, M.; Mohammadi, K.; Sedaghat, A. An Analysis of Wind Energy Potential and Economic Evaluation in Zahedan, Iran. Renew. Sustain. Energy Rev. 2014, 30, 641–650. [Google Scholar] [CrossRef]

- Gil, M.d.P.; Gomis-Bellmunt, O.; Sumper, A. Technical and Economic Assessment of Offshore Wind Power Plants Based on Variable Frequency Operation of Clusters with a Single Power Converter. Appl. Energy 2014, 125, 218–229. [Google Scholar]

- Mohammadi, K.; Mostafaeipour, A. Economic Feasibility of Developing Wind Turbines in Aligoodarz, Iran. Energy Convers. Manag. 2013, 76, 645–653. [Google Scholar] [CrossRef]

- Teimourian, A.; Bahrami, A.; Teimourian, H.; Vala, M.; Huseyniklioglu, A.O. Assessment of Wind Energy Potential in the Southeastern Province of Iran. Energy Sources, Part A: Recover. Util. Environ. Eff. 2020, 42, 329–343. [Google Scholar] [CrossRef]

- Brigham, E.F.; Houston, J.F. Fundamentals of Financial Management; South-Western Cengage Learning: Mason, OH, USA, 2013. [Google Scholar]

- Gösterge Niteliğindeki Merkez Bankası Kurları. Available online: https://www.tcmb.gov.tr/kurlar/kurlar_tr.html (accessed on 10 January 2025).

- Resmi Gazete (Official Gazette, Presidential Decree No. 3453, Official Gazette No. 31380 dated 30 January 2021. Available online: https://www.resmigazete.gov.tr/eskiler/2021/01/20210130-9.pdf (accessed on 21 March 2025).

- Resmi Gazete (Official Gazette, Presidential Decree No. 7189, Official Gazette No. 32117 dated 1 May 2023). Available online: https://www.resmigazete.gov.tr (accessed on 10 May 2025).

- Resmi Gazete (Official Gazette, Presidential Decree No. 9704, Official Gazette No. 31310 dated 19 November 2020). Available online: https://www.resmigazete.gov.tr/eskiler/2020/11/20201120-6.pdf (accessed on 15 April 2025).

- Trading Economics. Available online: https://tr.tradingeconomics.com/united-states/indicators (accessed on 15 February 2025).

| Hyperparameters | Value |

|---|---|

| Number of layers | 4 |

| Number of training sequences | 7012 |

| Number of test sequences | 1753 |

| Number of iterations | 1000 |

| Time steps | 20 |

| Batch size | 32 |

| Learning rate | 0.001 |

| Epoch | 100 |

| Optimizer | Adam |

| Dropout | 0.2 |

| Output activation function | Linear |

| Loss errors | RMSE, MAE, MAPE, R2 |

| 2020 | 2021 | 2022 | 2023 | 2024 | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| λ | k | λ | k | λ | k | λ | k | λ | k | |

| Akçakoca Fener | 5.2352 | 1.5184 | 5.2863 | 1.5752 | 5.1264 | 1.5454 | 5.0619 | 1.5223 | 3.5191 | 0.9565 |

| Akçakoca | 2.3022 | 1.7731 | 1.9750 | 1.62 | 1.8819 | 1.6349 | 1.8259 | 1.5098 | 1.7798 | 1.4915 |

| Amasra | 6.9025 | 1.6801 | 7.1793 | 1.7058 | 6.5836 | 1.5779 | 6.4787 | 1.4848 | 6.3312 | 1.7054 |

| Bartın Güney | 8.8973 | 1.9063 | 8.9304 | 2.0551 | 8.4958 | 2.0959 | 8.8964 | 1.9653 | 8.7338 | 2.0213 |

| Bartın | 1.7160 | 1.3175 | 1.6162 | 1.2012 | 1.5973 | 1.2145 | 1.7338 | 1.3249 | 1.9754 | 1.5865 |

| Boyabat | 1.8410 | 1.7295 | 1.8442 | 1.5914 | 1.8325 | 1.6544 | 1.7942 | 1.6392 | 1.8864 | 1.4883 |

| Bozkurt | 2.6415 | 1.5737 | 3.3034 | 1.6278 | 2.4420 | 1.5332 | 2.5205 | 1.4339 | 3.8581 | 1.5728 |

| Cide Kuzey | 6.7846 | 2.0077 | 7.2135 | 1.8852 | 7.0273 | 1.9132 | 6.7395 | 1.7269 | 6.9692 | 1.8629 |

| Cide | 4.0229 | 1.3249 | 4.3878 | 1.3927 | 4.1973 | 1.3620 | 4.0849 | 1.2436 | 4.3649 | 1.4666 |

| Çatalzeytin | 2.9877 | 1.7574 | 2.9622 | 1.751 | 2.3902 | 1.3387 | 2.1447 | 1.2254 | 2.2611 | 1.3855 |

| Devrek Acısu | 2.5161 | 1.6004 | 3.6001 | 1.5072 | 2.9557 | 1.3387 | 3.0856 | 1.3206 | 2.9640 | 1.4808 |

| Devrek | 1.9084 | 1.5417 | 2.0146 | 1.4969 | 2.0358 | 1.4943 | 2.0899 | 1.6064 | 2.1475 | 1.4962 |

| Devrekani | 2.3524 | 1.2707 | 3.0625 | 1.386 | 2.6900 | 1.2996 | 2.9341 | 1.4095 | 2.8106 | 1.4037 |

| Düzce | 1.3948 | 1.5314 | 0.9414 | 1.1946 | 0.9535 | 1.2570 | 0.9589 | 1.4132 | 1.1523 | 1.3904 |

| Gerze Köşkburnu | 4.6486 | 1.3208 | 5.5653 | 1.4997 | 6.2263 | 1.5001 | 4.8079 | 1.2417 | 4.8479 | 1.2582 |

| İnebolu Kuzey | 5.8558 | 1.5731 | 6.3520 | 1.5707 | 6.1569 | 1.6266 | 5.7788 | 1.4625 | 5.2540 | 1.5300 |

| İnebolu | 6.7133 | 1.6685 | 7.2290 | 1.696 | 6.6320 | 1.5275 | 7.0996 | 1.6865 | 6.8117 | 1.5873 |

| Karadeniz Ereğli | 2.1102 | 1.4265 | 2.1074 | 1.4001 | 1.8944 | 1.3503 | 2.3283 | 1.5829 | 2.3327 | 1.5008 |

| Kastamonu | 2.2361 | 2.0633 | 2.2831 | 1.9536 | 2.2117 | 2.0340 | 1.6715 | 1.4489 | 1.8226 | 1.5346 |

| Sinop İnceburun | 9.5599 | 1.8117 | 9.4001 | 1.8234 | 9.7082 | 1.7800 | 8.9868 | 1.7642 | 9.8999 | 1.8616 |

| Sinop | 4.0414 | 1.4010 | 3.2821 | 1.2003 | 3.5347 | 1.2904 | 3.2647 | 1.3442 | 4.4477 | 1.5992 |

| Zonguldak Güney | 7.9006 | 2.3516 | 8.0056 | 2.3731 | 7.6824 | 2.3486 | 7.5157 | 2.1094 | 7.6027 | 2.1560 |

| Zonguldak | 3.3865 | 1.7431 | 3.3145 | 1.6222 | 3.0930 | 1.5779 | 3.0758 | 1.4954 | 3.6832 | 1.7977 |

| Power Density | Annual Energy Amount (GW) | Capacity Factor, Including Annual Energy Amount (GW) | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2020 | 2021 | 2022 | 2023 | 2024 | 2020 | 2021 | 2022 | 2023 | 2024 | 2020 | 2021 | 2022 | 2023 | 2024 | |

| Akçakoca Fener | 357.83 | 345.56 | 325.63 | 321.97 | 1226.48 | 12.07 | 11.66 | 10.98 | 10.86 | 41.37 | 3.02 | 2.91 | 2.75 | 2.72 | 10.34 |

| Akçakoca | 23.88 | 17.21 | 14.68 | 15.34 | 17.18 | 0.81 | 0.58 | 0.50 | 0.52 | 0.58 | 0.21 | 0.15 | 0.13 | 0.13 | 0.15 |

| Amasra | 694.54 | 764.26 | 665.59 | 706.72 | 589.57 | 23.43 | 25.78 | 22.45 | 23.84 | 19.89 | 9.37 | 10.31 | 8.98 | 9.54 | 7.95 |

| Bartın Güney | 1258.95 | 1173.95 | 991.53 | 1216.05 | 1027.92 | 42.47 | 39.60 | 33.45 | 41.02 | 34.67 | 17.84 | 16.63 | 14.05 | 17.23 | 14.56 |

| Bartın | 16.88 | 17.84 | 16.71 | 17.19 | 9.42 | 0.57 | 0.60 | 0.56 | 0.58 | 0.32 | 0.15 | 0.16 | 0.15 | 0.16 | 0.09 |

| Boyabat | 12.64 | 14.42 | 13.30 | 12.67 | 15.92 | 0.43 | 0.49 | 0.45 | 0.43 | 0.54 | 0.13 | 0.15 | 0.13 | 0.13 | 0.16 |

| Bozkurt | 43.18 | 79.92 | 35.69 | 44.53 | 34.15 | 1.46 | 2.70 | 1.20 | 1.50 | 1.15 | 0.51 | 0.94 | 0.42 | 0.53 | 0.40 |

| Cide Kuzey | 527.19 | 679.76 | 617.71 | 621.22 | 637.53 | 17.78 | 22.93 | 20.84 | 20.96 | 21.51 | 7.11 | 9.17 | 8.33 | 8.38 | 8.60 |

| Cide | 214.73 | 249.48 | 229.14 | 262.54 | 196.73 | 7.24 | 8.42 | 7.73 | 8.86 | 6.64 | 2.75 | 3.20 | 2.94 | 3.37 | 2.52 |

| Çatalzeytin | 52.82 | 51.74 | 43.98 | 39.50 | 40.77 | 1.78 | 1.75 | 1.48 | 1.33 | 1.38 | 0.45 | 0.44 | 0.37 | 0.33 | 0.34 |

| Devrek Acısu | 36.29 | 117.94 | 83.16 | 97.63 | 67.45 | 1.22 | 3.98 | 2.81 | 3.29 | 2.28 | 0.29 | 0.95 | 0.67 | 0.79 | 0.55 |

| Devrek | 16.87 | 20.93 | 21.67 | 20.67 | 21.62 | 0.57 | 0.71 | 0.73 | 0.70 | 0.73 | 0.17 | 0.20 | 0.21 | 0.20 | 0.21 |

| Devrekani | 47.47 | 85.70 | 67.18 | 72.75 | 56.54 | 1.60 | 2.89 | 2.27 | 2.45 | 1.91 | 0.48 | 0.87 | 0.68 | 0.74 | 0.57 |

| Düzce | 6.66 | 3.58 | 3.25 | 2.53 | 2.57 | 0.22 | 0.12 | 0.11 | 0.09 | 0.09 | 0.06 | 0.03 | 0.03 | 0.02 | 0.02 |

| Gerze Köşkburnu | 333.70 | 439.71 | 615.43 | 429.77 | 902.29 | 11.26 | 14.83 | 20.76 | 14.50 | 30.44 | 3.83 | 5.04 | 7.06 | 4.93 | 10.35 |

| İnebolu Kuzey | 470.76 | 602.42 | 518.04 | 516.21 | 574.17 | 15.88 | 20.32 | 17.47 | 17.41 | 19.37 | 6.67 | 8.53 | 7.34 | 7.31 | 8.13 |

| İnebolu | 645.65 | 786.81 | 719.71 | 751.50 | 673.66 | 21.78 | 26.54 | 24.28 | 25.35 | 22.72 | 8.71 | 10.62 | 9.71 | 10.14 | 9.09 |

| Karadeniz Ereğli | 26.41 | 27.33 | 21.47 | 29.28 | 17.32 | 0.89 | 0.92 | 0.72 | 0.99 | 0.58 | 0.29 | 0.30 | 0.23 | 0.32 | 0.19 |

| Kastamonu | 18.36 | 20.69 | 18.02 | 12.72 | 26.47 | 0.62 | 0.70 | 0.61 | 0.43 | 0.89 | 0.18 | 0.20 | 0.18 | 0.12 | 0.26 |

| Sinop İnceburun | 1662.04 | 1567.13 | 1781.28 | 1429.99 | 1682.36 | 56.06 | 52.86 | 60.09 | 48.24 | 56.75 | 22.99 | 21.67 | 24.64 | 19.78 | 23.27 |

| Sinop | 192.51 | 149.71 | 155.05 | 111.03 | 100.74 | 6.49 | 5.05 | 5.23 | 3.75 | 3.40 | 1.62 | 1.26 | 1.31 | 0.94 | 0.85 |

| Zonguldak Güney | 723.10 | 747.26 | 665.46 | 682.26 | 714.12 | 24.39 | 25.21 | 22.45 | 23.01 | 24.09 | 10.24 | 10.59 | 9.43 | 9.67 | 10.12 |

| Zonguldak | 77.79 | 81.17 | 69.02 | 74.62 | 56.86 | 2.62 | 2.74 | 2.33 | 2.52 | 1.92 | 0.79 | 0.82 | 0.70 | 0.76 | 0.58 |

| Stations | 2020 | 2021 | 2022 | 2023 | 2024 | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| RMSE | MAE | R2 | RMSE | MAE | R2 | RMSE | MAE | R2 | RMSE | MAE | R2 | RMSE | MAE | R2 | |

| Akçakoca Fener | 1.6720 | 1.1263 | 0.7832 | 0.7941 | 0.5965 | 0.6201 | 1.8653 | 1.2862 | 0.7712 | 0.5470 | 0.2618 | 0.0412 | 0.4353 | 0.3088 | 0.5504 |

| Akçakoca | 1.7756 | 1.2055 | 0.7303 | 0.7551 | 0.5966 | 0.2103 | 1.7089 | 1.1596 | 0.743 | 1.4899 | 1.0376 | 0.7665 | 0.8131 | 0.6431 | 0.4383 |

| Amasra | 1.4133 | 0.9795 | 0.7768 | 0.3696 | 0.268 | 0.5622 | 2.1388 | 1.5136 | 0.4082 | 1.9377 | 1.2993 | 0.683 | 0.8434 | 0.6112 | 0.2262 |

| Bartn Güney | 1.7286 | 1.1077 | 0.7499 | 0.4679 | 0.3166 | 0.6436 | 2.1845 | 1.5261 | 0.4625 | 1.9671 | 1.3627 | 0.7977 | 1.5850 | 1.187 | 0.8297 |

| Bartın | 2.4516 | 1.7506 | 0.5674 | 0.4190 | 0.2995 | 0.6424 | 0.8046 | 0.5638 | 0.7809 | 1.8968 | 1.3201 | 0.7295 | 2.2398 | 1.4981 | 0.8067 |

| Boyabat | 0.6679 | 0.4617 | 0.4992 | 0.6498 | 0.445 | 0.6209 | 1.1456 | 0.7827 | 0.7488 | 2.5064 | 1.778 | 0.4824 | 1.7305 | 1.2606 | 0.8804 |

| Bozkurt | 0.7994 | 0.5221 | 0.7186 | 0.9489 | 0.6503 | 0.3587 | 1.1029 | 0.7655 | 0.7749 | 1.6705 | 1.1935 | 0.7924 | 2.3089 | 1.5666 | 0.8507 |

| Cide Kuzey | 0.5975 | 0.442 | 0.5927 | 1.0366 | 0.776 | 0.5357 | 1.2704 | 0.8149 | 0.8257 | 1.9948 | 1.3906 | 0.7759 | 2.6218 | 1.9059 | 0.7673 |

| Cide | 1.0724 | 0.6913 | 0.5954 | 2.3049 | 0.8976 | 0.5012 | 1.2168 | 0.9163 | 0.6429 | 1.7332 | 1.1932 | 0.7574 | 1.1713 | 0.8163 | 0.7616 |

| Çatalzeytin | 0.9893 | 0.668 | 0.3749 | 0.8789 | 0.6231 | 0.6367 | 0.5735 | 0.4279 | 0.6029 | 1.9978 | 1.4539 | 0.7353 | 1.2830 | 0.9189 | 0.6901 |

| Devrek Acısu | 1.6999 | 1.2078 | 0.7992 | 1.2446 | 0.8077 | 0.5569 | 0.7316 | 0.5289 | 0.6358 | 2.3620 | 1.7665 | 0.5197 | 1.0941 | 0.7805 | 0.7653 |

| Devrek | 1.9969 | 1.3973 | 0.7842 | 2.0264 | 1.4505 | 0.3424 | 0.7700 | 0.5811 | 0.5836 | 1.7663 | 1.2663 | 0.7546 | 1.5520 | 1.1116 | 0.4647 |

| Devrekani | 1.7878 | 1.2442 | 0.7792 | 0.9907 | 0.7185 | 0.6603 | 0.7912 | 0.5486 | 0.6163 | 1.8791 | 1.2952 | 0.7537 | 2.0079 | 1.3502 | 0.6735 |

| Düzce | 2.4247 | 1.7189 | 0.7284 | 1.0229 | 0.705 | 0.632 | 0.9194 | 0.7377 | 0.1586 | 1.7398 | 1.2043 | 0.7533 | 1.5774 | 1.1773 | 0.6842 |

| Gerze Köşkburnu | 2.5826 | 1.8324 | 0.6006 | 0.9351 | 0.7273 | 0.5942 | 1.1663 | 0.9197 | 0.4375 | 2.2035 | 1.4917 | 0.7134 | 1.8538 | 1.3119 | 0.696 |

| İneblu Kuzey | 1.8848 | 1.3894 | 0.8028 | 1.0966 | 0.8558 | 0.5564 | 1.1079 | 0.7528 | 0.7635 | 2.7397 | 1.9759 | 0.5465 | 1.7926 | 1.3134 | 0.6829 |

| İnebolu | 2.0576 | 1.4411 | 0.768 | 1.2506 | 0.9453 | 0.2956 | 1.2151 | 0.9154 | 0.7115 | 0.5758 | 0.4167 | 0.7535 | 1.7006 | 1.2857 | 0.6908 |

| Karadeniz Ereğli | 1.7907 | 1.3174 | 0.7656 | 1.3899 | 0.9514 | 0.7937 | 1.3408 | 0.8814 | 0.756 | 0.7224 | 0.5337 | 0.7487 | 2.1473 | 1.6008 | 0.4743 |

| Kastamonu | 1.6921 | 1.2675 | 0.7894 | 1.4287 | 0.9618 | 0.794 | 1.3043 | 0.9376 | 0.5353 | 0.5936 | 0.4271 | 0.7176 | 1.1412 | 0.8454 | 0.6214 |

| Sinop İnceburun | 2.4617 | 1.8243 | 0.6217 | 1.3015 | 0.9235 | 0.7907 | 0.3377 | 0.217 | 0.3738 | 0.9332 | 0.5678 | 0.7553 | 1.1458 | 0.8055 | 0.7668 |

| Sinop | 0.6277 | 0.4485 | 0.2344 | 1.6249 | 1.1566 | 0.817 | 0.4548 | 0.3156 | 0.6406 | 1.1746 | 0.8712 | 0.3599 | 0.9745 | 0.6977 | 0.7307 |

| Zonguldak Güney | 0.6362 | 0.4214 | 0.6675 | 2.1177 | 1.5629 | 0.466 | 0.3713 | 0.2921 | 0.4451 | 0.5329 | 0.38 | 0.4086 | 1.3698 | 0.9883 | 0.7093 |

| Zonguldak | 0.5976 | 0.4269 | 0.5056 | 1.7772 | 1.2574 | 0.6639 | 0.4428 | 0.3027 | 0.5201 | 0.5032 | 0.3493 | 0.663 | 1.6298 | 1.1991 | 0.4865 |

| Year | 2020 | 2021 | 2022 | 2023 | 2024 | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| Stations | λ | k | λ | k | λ | k | λ | k | λ | k |

| Akçakoca Fener | 4.9817 | 1.6762 | 4.5572 | 1.5999 | 7.4169 | 2.1041 | 5.0352 | 2.3896 | 3.8361 | 2.9029 |

| Akçakoca | 3.5460 | 1.8956 | 1.7718 | 2.8574 | 2.0104 | 2.2298 | 2.3565 | 1.5370 | 2.4490 | 1.7952 |

| Amasra | 6.8018 | 1.8067 | 6.3623 | 2.5606 | 6.5689 | 2.6573 | 6.3817 | 1.9881 | 6.7421 | 3.0618 |

| Bartın Güney | 8.2861 | 1.7717 | 8.4108 | 2.0186 | 8.3711 | 2.6680 | 8.4379 | 1.6384 | 8.5310 | 2.3671 |

| Bartın | 2.2011 | 1.5590 | 1.3648 | 2.1472 | 3.2785 | 2.0043 | 4.8683 | 1.5596 | 2.5479 | 1.9050 |

| Boyabat | 1.9411 | 2.1992 | 1.5502 | 2.0483 | 1.5424 | 1.6628 | 1.6928 | 1.7645 | 1.1943 | 1.8046 |

| Bozkurt | 2.0887 | 1.7714 | 2.7820 | 2.3978 | 2.8210 | 1.7652 | 2.5567 | 1.7063 | 2.3297 | 1.8840 |

| Cide Kuzey | 6.8741 | 2.4246 | 6.9673 | 2.2485 | 7.1525 | 1.7419 | 6.6667 | 1.7536 | 6.8468 | 1.9948 |

| Cide | 3.0381 | 1.8316 | 3.0253 | 2.0044 | 3.2491 | 1.9970 | 4.5084 | 1.7490 | 3.3281 | 1.5802 |

| Çatalzeytin | 1.7948 | 2.1821 | 2.3191 | 1.8542 | 1.7171 | 2.1195 | 2.1754 | 1.8012 | 2.3754 | 1.6747 |

| Devrek Acısu | 2.1432 | 1.9614 | 2.8302 | 2.1666 | 1.9380 | 1.8434 | 2.7306 | 2.0970 | 3.0626 | 1.5865 |

| Devrek | 1.9897 | 2.0191 | 1.7631 | 2.6487 | 2.1290 | 1.9685 | 2.1277 | 2.1428 | 2.0279 | 1.7768 |

| Devrekani | 1.7333 | 1.8323 | 2.0999 | 2.2539 | 2.0541 | 2.2113 | 2.1588 | 2.1451 | 2.7046 | 1.7807 |

| Düzce | 1.6594 | 1.8956 | 1.9769 | 1.0112 | 1.8986 | 1.0284 | 1.5529 | 1.3440 | 1.7166 | 1.3539 |

| Gerze Köşkburnu | 4.9046 | 1.1249 | 5.1755 | 1.8286 | 6.2180 | 1.8627 | 4.6951 | 1.4655 | 4.6464 | 1.8396 |

| İnebolu Kuzey | 5.0260 | 1.2109 | 5.3002 | 1.8843 | 5.2443 | 1.5760 | 5.2537 | 1.2615 | 5.2490 | 1.7708 |

| İnebolu | 6.2947 | 1.2845 | 6.2996 | 1.0204 | 6.8608 | 1.4314 | 6.7909 | 1.6974 | 6.9311 | 1.7051 |

| Karadeniz Ereğli | 2.3024 | 1.5344 | 2.1970 | 1.5215 | 2.4640 | 1.6790 | 2.3181 | 1.8888 | 2.3963 | 1.3701 |

| Kastamonu | 2.4609 | 1.1954 | 2.4991 | 1.6033 | 2.8303 | 1.9781 | 1.9264 | 1.9333 | 2.2045 | 1.0141 |

| Sinop İnceburun | 9.5166 | 1.7874 | 10.1004 | 1.5333 | 8.8927 | 1.2373 | 8.3058 | 1.7226 | 9.6427 | 1.6803 |

| Sinop | 4.3779 | 2.1534 | 3.2964 | 1.6264 | 3.8728 | 1.5425 | 3.3632 | 2.3052 | 4.1062 | 1.8566 |

| Zonguldak Güney | 7.3331 | 1.4604 | 7.7764 | 2.1496 | 7.5873 | 2.0063 | 7.3019 | 1.8658 | 7.4670 | 1.8395 |

| Zonguldak | 2.2207 | 1.6510 | 3.6607 | 2.4361 | 2.8680 | 1.9387 | 3.0163 | 2.5915 | 3.4772 | 2.5881 |

| Power Density | Annual Energy Amount (GW) | Capacity Factor, Including Annual Energy Amount (GW) | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2021 | 2022 | 2023 | 2024 | 2025 | 2021 | 2022 | 2023 | 2024 | 2025 | 2021 | 2022 | 2023 | 2024 | 2025 | |

| Akçakoca Fener | 262.01 | 215.75 | 657.27 | 184.99 | 527.81 | 8.84 | 7.28 | 22.17 | 6.24 | 17.80 | 2.21 | 1.82 | 5.54 | 1.56 | 4.45 |

| Akçakoca | 80.22 | 7.25 | 12.43 | 31.93 | 15.64 | 2.71 | 0.24 | 0.42 | 1.08 | 0.53 | 0.70 | 0.06 | 0.11 | 0.28 | 0.14 |

| Amasra | 600.76 | 356.32 | 383.65 | 443.31 | 358.38 | 20.26 | 12.02 | 12.94 | 14.95 | 12.09 | 8.11 | 4.81 | 5.18 | 5.98 | 4.84 |

| Bartın Güney | 1035.74 | 998.75 | 792.17 | 1318.38 | 855.94 | 34.94 | 33.69 | 26.72 | 44.47 | 28.87 | 14.67 | 14.15 | 11.22 | 18.68 | 12.13 |

| Bartın | 25.39 | 4.02 | 59.59 | 274.50 | 63.04 | 0.86 | 0.14 | 2.01 | 9.26 | 2.13 | 0.23 | 0.04 | 0.54 | 2.50 | 0.57 |

| Boyabat | 11.32 | 6.16 | 7.87 | 9.56 | 7.02 | 0.38 | 0.21 | 0.27 | 0.32 | 0.24 | 0.11 | 0.06 | 0.08 | 0.10 | 0.07 |

| Bozkurt | 17.85 | 31.12 | 44.20 | 34.50 | 40.69 | 0.60 | 1.05 | 1.49 | 1.16 | 1.37 | 0.21 | 0.37 | 0.52 | 0.41 | 0.48 |

| Cide Kuzey | 445.82 | 513.72 | 733.62 | 588.60 | 621.89 | 15.04 | 17.33 | 24.75 | 19.85 | 20.98 | 6.02 | 6.93 | 9.90 | 7.94 | 8.39 |

| Cide | 52.61 | 46.82 | 58.23 | 182.69 | 79.81 | 1.77 | 1.58 | 1.96 | 6.16 | 2.69 | 0.67 | 0.60 | 0.75 | 2.34 | 1.02 |

| Çatalzeytin | 9.01 | 23.05 | 8.10 | 19.73 | 10.74 | 0.30 | 0.78 | 0.27 | 0.67 | 0.36 | 0.08 | 0.19 | 0.07 | 0.17 | 0.09 |

| Devrek Acısu | 17.04 | 35.55 | 13.55 | 32.90 | 16.82 | 0.57 | 1.20 | 0.46 | 1.11 | 0.57 | 0.14 | 0.29 | 0.11 | 0.27 | 0.14 |

| Devrek | 13.22 | 7.43 | 16.64 | 15.26 | 18.83 | 0.45 | 0.25 | 0.56 | 0.51 | 0.64 | 0.13 | 0.07 | 0.16 | 0.15 | 0.18 |

| Devrekani | 9.76 | 14.04 | 13.35 | 15.92 | 16.86 | 0.33 | 0.47 | 0.45 | 0.54 | 0.57 | 0.10 | 0.14 | 0.14 | 0.16 | 0.17 |

| Düzce | 8.22 | 56.70 | 47.23 | 11.95 | 21.49 | 0.28 | 1.91 | 1.59 | 0.40 | 0.72 | 0.07 | 0.48 | 0.40 | 0.10 | 0.18 |

| Gerze Köşkburnu | 467.71 | 260.61 | 441.71 | 275.76 | 448.56 | 15.78 | 8.79 | 14.90 | 9.30 | 15.13 | 5.36 | 2.99 | 5.07 | 3.16 | 5.14 |

| İnebolu Kuzey | 524.82 | 269.80 | 337.10 | 538.48 | 282.74 | 17.70 | 9.10 | 11.37 | 18.16 | 9.54 | 7.44 | 3.82 | 4.78 | 7.63 | 4.01 |

| İnebolu | 885.51 | 1774.62 | 901.27 | 651.47 | 667.39 | 29.87 | 59.86 | 30.40 | 21.98 | 22.51 | 11.95 | 23.94 | 12.16 | 8.79 | 9.00 |

| Karadeniz Ereğli | 29.87 | 26.35 | 31.62 | 22.51 | 45.76 | 1.01 | 0.89 | 1.07 | 0.76 | 1.54 | 0.32 | 0.28 | 0.34 | 0.24 | 0.49 |

| Kastamonu | 63.82 | 35.46 | 38.88 | 12.57 | 164.63 | 2.15 | 1.20 | 1.31 | 0.42 | 5.55 | 0.62 | 0.35 | 0.38 | 0.12 | 1.61 |

| Sinop İnceburun | 1515.79 | 2525.29 | 2744.67 | 1166.92 | 1484.91 | 51.13 | 85.18 | 92.58 | 39.36 | 50.09 | 20.96 | 34.93 | 37.96 | 16.14 | 20.54 |

| Sinop | 132.30 | 79.52 | 140.86 | 56.64 | 107.15 | 4.46 | 2.68 | 4.75 | 1.91 | 3.61 | 1.12 | 0.67 | 1.19 | 0.48 | 0.90 |

| Zonguldak Güney | 973.55 | 742.65 | 737.86 | 713.87 | 815.01 | 32.84 | 25.05 | 24.89 | 24.08 | 27.49 | 13.79 | 10.52 | 10.45 | 10.11 | 11.55 |

| Zonguldak | 23.75 | 70.12 | 41.36 | 37.69 | 32.43 | 0.80 | 2.37 | 1.40 | 1.27 | 1.09 | 0.24 | 0.71 | 0.42 | 0.38 | 0.33 |

| Stations | Power Plant Electricity Production (gW) | Total Revenue (USD/gW) | Total Cost USD/gW | Total Net Profit/Loss (USD/gW) | Unit Revenue (USD/kWh) | Unit Cost (USD/kWh) | Unit Net Profit/Loss (USD/kWh) |

|---|---|---|---|---|---|---|---|

| Akçakoca Fener | 30.20 | 418,783 | 827,180 | −408,397 | 0.0139 | 0.0274 | −0.0135 * |

| Akçakoca | 2.10 | 29,121 | 788,214 | −759,093 | 0.0139 | 0.3753 | −0.3615 * |

| Amasra | 93.70 | 1,299,338 | 915,235 | 384,102 | 0.0139 | 0.0098 | 0.0041 |

| Bartın Güney | 178.40 | 2,473,873 | 1,032,689 | 1,441,184 | 0.0139 | 0.0058 | 0.0081 |

| Bartın | 1.50 | 20,801 | 787,382 | −766,581 | 0.0139 | 0.5249 | −0.5111 * |

| Boyabat | 1.30 | 18,027 | 787,104 | −769,077 | 0.0139 | 0.6055 | −0.5916 * |

| Bozkurt | 5.10 | 70,722 | 792,374 | −721,652 | 0.0139 | 0.1554 | −0.1415 * |

| Cide Kuzey | 71.10 | 985,944 | 883,896 | 102,048 | 0.0139 | 0.0124 | 0.0014 |

| Cide | 27.50 | 381,343 | 823,436 | −442,093 | 0.0139 | 0.0299 | −0.0161 * |

| Çatalzeytin | 4.50 | 62,402 | 791,542 | −729,140 | 0.0139 | 0.1759 | −0.1620 * |

| Devrek Acısu | 2.90 | 40,214 | 789,323 | −749,109 | 0.0139 | 0.2722 | −0.2583 * |

| Devrek | 1.70 | 23,574 | 787,659 | −764,085 | 0.0139 | 0.4633 | −0.4495 * |

| Devrekâni | 4.80 | 66,562 | 791,958 | −725,396 | 0.0139 | 0.1650 | −0.1511 * |

| Düzce | 0.60 | 8,320 | 786,134 | −777,813 | 0.0139 | 1.3102 | −1.2964 * |

| Gerze Köşkburnu | 38.30 | 531,106 | 838,412 | −307,306 | 0.0139 | 0.0219 | −0.0080 * |

| İnebolu Kuzey | 66.70 | 924,929 | 877,795 | 47,134 | 0.0139 | 0.0132 | 0.0007 |

| İnebolu | 87.10 | 1,207,816 | 906,083 | 301,732 | 0.0139 | 0.0104 | 0.0035 |

| Karadeniz Ereğli | 2.90 | 40,214 | 789,323 | −749,109 | 0.0139 | 0.2722 | −0.2583 * |

| Kastamonu | 1.80 | 24,961 | 787,798 | −762,837 | 0.0139 | 0.4377 | −0.4238 * |

| Sinop İnceburun | 229.90 | 3,188,023 | 1,104,104 | 2,083,919 | 0.0139 | 0.0048 | 0.0091 |

| Sinop | 16.20 | 224,645 | 807,766 | −583,121 | 0.0139 | 0.0499 | −0.0360 * |

| Zonguldak Güney | 102.40 | 1,419,981 | 927,300 | 492,681 | 0.0139 | 0.0091 | 0.0048 |

| Zonguldak | 7.90 | 109,549 | 796,257 | −686,707 | 0.0139 | 0.1008 | −0.0869 * |

| Power Plant Electricity Generation (GW)) | Total Revenue (USD/GW) | Total Cost (USD/GW) | Total Net Profit/Loss (USD/GW) | Unit Cost (USD/kWh) | Unit Net Profit/Loss (USD/kWh) | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stations | Observed | Forecast | Observed | Forecast | Observed | Forecast | Observed | Forecast | Observed | Forecast | Observed | Forecast |

| Akçakoca-Fener | 29.10 | 22.10 | 1,457,910 | 306,461 | 947,023 | 868,463 | 510,887 | −562,002 | 0.0325 | 0.0393 | 0.0176 | −0.0254 * |

| Akçakoca | 1.50 | 7.00 | 75,150 | 97,069 | 808,747 | 835,778 | −733,597 | −738,709 | 0.5392 | 0.1194 | −0.4891 * | −0.1055 * |

| Amasra | 103.10 | 81.10 | 5,165,310 | 1,124,614 | 1,317,763 | 938,532 | 3,847,547 | 186,081 | 0.0128 | 0.0116 | 0.0373 | 0.0023 |

| Bartın-Güney | 166.30 | 146.70 | 8,331,630 | 2,034,289 | 1,634,395 | 1,029,500 | 6,697,235 | 1,004,789 | 0.0098 | 0.0070 | 0.0403 | 0.0068 |

| Bartın | 1.60 | 2.30 | 80,160 | 139,150 | 809,248 | 839,986 | −729,088 | −700,836 | 0.5058 | 0.3652 | −0.4557 * | −0.3047 * |

| Boyabat | 1.50 | 1.10 | 75,150 | 15,254 | 808,747 | 827,596 | −733,597 | −812,343 | 0.5392 | 0.7524 | −0.4891 * | −0.7385 * |

| Bozkurt | 9.40 | 2.10 | 470,940 | 29,121 | 848,326 | 828,983 | −377,386 | −799,862 | 0.0902 | 0.3948 | −0.0401 * | −0.3809 * |

| Cide Kuzey | 91.70 | 60.20 | 4,594,170 | 834,793 | 1,260,649 | 909,550 | 3,333,521 | −74,757 | 0.0137 | 0.0151 | 0.0364 | −0.0012 * |

| Cide | 32.00 | 6.70 | 1,603,200 | 92,909 | 961,552 | 835,362 | 641,648 | −74.453 | 0.0300 | 0.1247 | 0.0201 | −0.1108 * |

| * Çatalzeytin | 4.40 | 0.80 | 220,440 | 11,094 | 823,276 | 827,180 | −602,836 | −816,087 | 0.1871 | 1.0340 | −0.1370 * | −1.0201 * |

| Devrek-Acısu | 9.50 | 1.40 | 475,950 | 19,414 | 848,827 | 828,012 | −372,877 | −808,598 | 0.0894 | 0.5914 | −0.0393 * | −0.5776 * |

| Devrek | 2.00 | 1.30 | 100,200 | 18,027 | 811,252 | 827,874 | −711,052 | −809,847 | 0.4056 | 0.6368 | −0.3555 * | −0.6230 * |

| Devrekâni | 8.70 | 1.00 | 435,870 | 13,867 | 844,819 | 827,458 | −408,949 | −813,591 | 0.0971 | 0.8275 | −0.0470 * | −0.8136 * |

| Düzce | 0.30 | 0.70 | 15,030 | 9,707 | 802,735 | 827,042 | −787,705 | −817,335 | 2.6758 | 1.1815 | −2.6257 * | −1.1676 * |

| Gerze-Köşkburnu | 50.40 | 53.60 | 2,525,040 | 743,271 | 1,053,736 | 900,398 | 1,471,304 | −157,127 | 0.0209 | 0.0168 | 0.0292 | −0.0029 * |

| İnebolu Kuzey | 85.30 | 74.40 | 4,273,530 | 1,031,705 | 1,228,585 | 929,241 | 3,044,945 | 102,463 | 0.0144 | 0.0125 | 0.0357 | 0.0014 |

| İnebolu | 106.20 | 119.50 | 5,320,620 | 1,657,107 | 1,333,294 | 991,782 | 3,987,326 | 665,325 | 0.0126 | 0.0083 | 0.0375 | 0.0056 |

| Karadeniz-Ereğli | 3.00 | 3.20 | 150,300 | 44,374 | 816,262 | 830,508 | −665,962 | −786,134 | 0.2721 | 0.2595 | −0.2220 * | −0.2457 * |

| Kastamonu | 2.00 | 6.20 | 100,200 | 85,975 | 811,252 | 834,668 | −711,052 | −748,693 | 0.4056 | 0.1346 | −0.3555 * | −0.1208 * |

| Sinop-İnceburun | 239.80 | 209.60 | 10,856,670 | 2,906,523 | 1,886,899 | 1,116,723 | 8,969,771 | 1,789,800 | 0.0087 | 0.0053 | 0.0414 | 0.0085 |

| Sinop | 12.60 | 11.20 | 631,260 | 155,310 | 864,358 | 841,602 | −233,098 | −686,292 | 0.0686 | 0.0751 | −0.0185 * | −0.0613 * |

| Zonguldak Güney | 105.90 | 137.90 | 5,305,590 | 1,912,259 | 1,331,791 | 1,017,297 | 3,973,799 | 894,962 | 0.0126 | 0.0074 | 0.0375 | 0.0065 |

| Zonguldak | 8.20 | 2.40 | 410,820 | 33,281 | 842,314 | 829,399 | −431,494 | −796,118 | 0.1027 | 0.3456 | −0.0526 * | −0.3317 * |

| Power Plant Electricity Generation (GW) | Total Revenue (USD/GW) | Total Cost (USD/GW) | Total Net Profit/Loss (USD/GW) | Unit Cost (USD/kWh) | Unit Net Profit/Loss (USD/kWh) | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stations | Observed | Forecast | Observed | Forecast | Observed | Forecast | Observed | Forecast | Observed | Forecast | Observed | Forecast |

| Akçakoca-Fener | 27.50 | 18.20 | 1,377,750 | 911,820 | 995,094 | 945,832 | 382,656 | −34,012 | 0.0362 | 0.0520 | 0.0139 | −0.0019 * |

| Akçakoca | 1.30 | 0.60 | 65,130 | 30,060 | 863,832 | 840,642 | −798,702 | −810,582 | 0.6645 | 1.4011 | −0.6144 * | −1.3510 * |

| Amasra | 89.80 | 48.10 | 4,498,980 | 2,409,810 | 1,307,217 | 1,078,617 | 3,191,763 | 1.331,193 | 0.0146 | 0.0224 | 0.0355 | 0.0277 |

| Bartın-Güney | 140.50 | 141.50 | 7,039,050 | 7,089,150 | 1,561,224 | 1,546,551 | 5,477,826 | 5,542,599 | 0.0111 | 0.0109 | 0.0390 | 0.0392 |

| Bartın | 1.50 | 0.40 | 75,150 | 24,200 | 864,834 | 840,056 | −789,684 | −815,856 | 0.5766 | 2.1001 | −0.5265 * | −2.0396 * |

| Boyabat | 1.30 | 0.60 | 65,130 | 30,060 | 863,832 | 840,642 | −798,702 | −810,582 | 0.6645 | 1.4011 | −0.6144 * | −1.3510 * |

| Bozkurt | 4.20 | 3.70 | 210,420 | 185,370 | 878,361 | 856,173 | −667,941 | −670,803 | 0.2091 | 0.2314 | −0.1590 * | −0.1813 * |

| Cide Kuzey | 83.30 | 69.30 | 4,173,330 | 3,471,930 | 1,274,652 | 1,184,829 | 2,898,678 | 2,287,101 | 0.0153 | 0.0171 | 0.0348 | 0.0330 |

| Cide | 29.40 | 6.00 | 1,472,940 | 300,600 | 1,004,613 | 867,696 | 468,327 | −567,096 | 0.0342 | 0.1446 | 0.0159 | −0.0945 * |

| Çatalzeytin | 3.70 | 1.90 | 185,370 | 95,190 | 875,856 | 847,155 | −690,486 | −751,965 | 0.2367 | 0.4459 | −0.1866 * | −0.3958 * |

| Devrek-Acısu | 6.70 | 2.90 | 335,670 | 145,290 | 890,886 | 852,165 | −555,216 | −706,875 | 0.1330 | 0.2938 | −0.0829 * | −0.2437 * |

| Devrek | 2.10 | 0.70 | 105,210 | 35,070 | 867,840 | 841,143 | −762,630 | −806,073 | 0.4133 | 1.2016 | −0.3632 * | −1.1515 * |

| Devrekâni | 6.80 | 1.40 | 340,680 | 70,140 | 891,387 | 844,650 | −550,707 | −774,510 | 0.1311 | 0.6033 | −0.0810 * | −0.5532 * |

| Düzce | 0.30 | 4.80 | 15,030 | 240,480 | 858,822 | 861,684 | −843,792 | −621,204 | 2.8627 | 0.1795 | −2.8126 * | −0.1294 * |

| Gerze-Köşkburnu | 70.60 | 29.90 | 3,537,060 | 1,497,990 | 1,211,025 | 987,435 | 2,326,035 | 510,555 | 0.0172 | 0.0330 | 0.0329 | 0.0171 |

| İnebolu Kuzey | 73.40 | 38.20 | 3,677,340 | 1,913,820 | 1,225,053 | 1,029,018 | 2,452,287 | 884,802 | 0.0167 | 0.0269 | 0.0334 | 0.0232 |

| İnebolu | 97.10 | 239.40 | 4,864,710 | 11,993,940 | 1,343,790 | 2,037,030 | 3,520,920 | 9,956,910 | 0.0138 | 0.0085 | 0.0363 | 0.0416 |

| Karadeniz-Ereğli | 2.30 | 2.80 | 115,230 | 140,280 | 868,842 | 851,664 | −753,612 | −711,384 | 0.3778 | 0.3042 | −0.3277 * | −0.2541 * |

| Kastamonu | 1.80 | 3.50 | 90,180 | 175,350 | 866,337 | 855,171 | −776,157 | −679821 | 0.4813 | 0.2443 | −0.4312 * | −0.1942 * |

| Sinop-İnceburun | 246.40 | 349.30 | 12,344,640 | 17,499,930 | 2,091,783 | 2,587,629 | 10,252,857 | 14,912,301 | 0.0085 | 0.0074 | 0.0416 | 0.0427 |

| Sinop | 13.10 | 6.70 | 656,310 | 335,670 | 922,950 | 871,203 | −266,640 | −535,533 | 0.0705 | 0.1300 | −0.0204 * | −0.0799 * |

| Zonguldak Güney | 94.30 | 105.20 | 4724,430 | 5,270,520 | 1,329,762 | 1,364,688 | 3,394,668 | 3,905,832 | 0.0141 | 0.0130 | 0.0360 | 0.0371 |

| Zonguldak | 7.00 | 7.10 | 350,700 | 355,710 | 892,389 | 873,207 | −541,689 | −517,497 | 0.1275 | 0.1230 | −0.0774 * | −0.0729 * |

| Power Plant Electricity Generation (GW) | Total Revenue (USD/GW) | Total Cost (USD/GW) | Total Net Profit/Loss (USD/GW) | Unit Cost (USD/kWh) | Unit Net Profit/Loss (USD/kWh) | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stations | Observed | Forecast | Observed | Forecast | Observed | Forecast | Observed | Forecast | Observed | Forecast | Observed | Forecast |

| Akçakoca-Fener | 27.20 | 55.40 | 1,645,600 | 2,775,540 | 1,092,605 | 1,192,030 | 552,995 | 1,583,510 | 0.0402 | 0.0215 | 0.0203 | 0.0286 |

| Akçakoca | 1.30 | 1.10 | 78,650 | 55,110 | 935,910 | 901,781 | −857,260 | −846,671 | 0.7199 | 0.8198 | −0.6594 * | −0.7697 * |

| Amasra | 95.40 | 51.80 | 5,771,700 | 2,595,180 | 1,505,215 | 1,155,788 | 4,266,485 | 1,439,392 | 0.0158 | 0.0223 | 0.0447 | 0.0278 |

| Bartın-Güney | 172.30 | 112.20 | 10,424,150 | 5,621,220 | 1,970,460 | 1,458,392 | 8,453,690 | 4,162,828 | 0.0114 | 0.0130 | 0.0491 | 0.0371 |

| Bartın | 1.60 | 5.40 | 96,800 | 326,700 | 937,725 | 928,940 | −840,925 | −602,240 | 0.5861 | 0.1720 | −0.5256 * | −0.1115 * |

| Boyabat | 1.30 | 0.80 | 78,650 | 40,080 | 935,910 | 900,278 | −857,260 | −860,198 | 0.7199 | 1.1253 | −0.6594 * | −1.0752 * |

| Bozkurt | 5.30 | 5.20 | 320,650 | 260,520 | 960,110 | 922,322 | −639,460 | −661,802 | 0.1812 | 0.1774 | −0.1207 * | −0.1273 * |

| Cide Kuzey | 83.80 | 99.00 | 5,069,900 | 4,959,900 | 1,435,035 | 1,392,260 | 3,634,865 | 3,567,640 | 0.0171 | 0.0141 | 0.0434 | 0.0360 |

| Cide | 33.70 | 7.50 | 2,038,850 | 375,750 | 1,131,930 | 933,845 | 906,920 | −558,095 | 0.0336 | 0.1245 | 0.0269 | −0.0744 * |

| * Çatalzeytin | 3.30 | 0.70 | 199,650 | 35,070 | 948,010 | 899,777 | −748,360 | −864,707 | 0.2873 | 1.2854 | −0.2268 * | −1.2353 * |

| Devrek-Acısu | 7.90 | 1.10 | 477,950 | 55,110 | 975,840 | 901,781 | −497,890 | −846,671 | 0.1235 | 0.8198 | −0.0630 * | −0.7697 * |

| Devrek | 2.00 | 1.60 | 121,000 | 80,160 | 940,145 | 904,286 | −819,145 | −824,126 | 0.4701 | 0.5652 | −0.4096 * | −0.5151 * |

| Devrekâni | 7.40 | 1.40 | 447,700 | 70,140 | 972,815 | 903,284 | −525,115 | −833,144 | 0.1315 | 0.6452 | −0.0710 * | −0.5951 * |

| Düzce | 0.20 | 4.00 | 12,100 | 200,400 | 929,255 | 916,310 | −917,155 | −715,910 | 4.6463 | 0.2291 | −4.5858 * | −0.1790 * |

| Gerze-Köşkburnu | 49.30 | 50.70 | 2,982,650 | 2,540,070 | 1,226,310 | 1,150,277 | 1,756,340 | 1,389,793 | 0.0249 | 0.0227 | 0.0356 | 0.0274 |

| İnebolu Kuzey | 73.10 | 47.80 | 4,422,550 | 2,394,780 | 1,370,300 | 1,135,748 | 3,052,250 | 1,259,032 | 0.0187 | 0.0238 | 0.0418 | 0.0263 |

| İnebolu | 101.40 | 121.60 | 6,134,700 | 6,092,160 | 1,541,515 | 1,505,486 | 4,593,185 | 4,586,674 | 0.0152 | 0.0124 | 0.0453 | 0.0377 |

| Karadeniz-Ereğli | 3.20 | 3.40 | 193,600 | 170,340 | 947,405 | 913,304 | −753,805 | −742,964 | 0.2961 | 0.2686 | −0.2356 * | −0.2185 * |

| Kastamonu | 1.20 | 3.80 | 72,600 | 190,380 | 935,305 | 915,308 | −862,705 | −724,928 | 0.7794 | 0.2409 | −0.7189 * | −0.1908 * |

| Sinop-İnceburun | 197.80 | 379.60 | 11,966,900 | 19,017,960 | 2,124,735 | 2,798,066 | 9,842,165 | 16,219,894 | 0.0107 | 0.0074 | 0.0498 | 0.0427 |

| Sinop | 9.40 | 11.90 | 568,700 | 596,190 | 984,915 | 955,889 | −416,215 | −359,699 | 0.1048 | 0.0803 | −0.0443 * | −0.0302 * |

| Zonguldak Güney | 96.70 | 104.50 | 5,850,350 | 5,235,450 | 1,513,080 | 1,419,815 | 4,337,270 | 3,815,635 | 0.0156 | 0.0136 | 0.0449 | 0.0365 |

| Zonguldak | 7.60 | 4.20 | 459,800 | 210,420 | 974,025 | 917,312 | −514,225 | −706,892 | 0.1282 | 0.2184 | −0.0677 * | −0.1683 * |

| Power Plant Electricity Generation (GW) | Total Revenue (USD/GW) | Total Cost (USD/GW) | Total Net Profit/Loss (USD/GW) | Unit Cost (USD/kWh) | Unit Net Profit/Loss (USD/kWh) | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stations | Observed | Forecast | Observed | Forecast | Observed | Forecast | Observed | Forecast | Observed | Forecast | Observed | Forecast |

| Akçakoca-Fener | 103.40 | 15.60 | 6,255,700 | 943,800 | 1,585,169 | 1,083,808 | 4,670,531 | −140,008 | 0.0153 | 0.0695 | 0.0452 | −0.0090 * |

| Akçakoca | 1.50 | 2.80 | 90,750 | 169,400 | 968,674 | 971,468 | −877,924 | −802,068 | 0.6458 | 0.3470 | −0.5853 * | −0.2865 * |

| Amasra | 79.50 | 59.80 | 4,809,750 | 3,617,900 | 1,440,574 | 1,316,318 | 3,369,176 | 2,301,582 | 0.0181 | 0.0220 | 0.0424 | 0.0385 |

| Bartın-Güney | 145.60 | 186.80 | 8,808,800 | 11,301,400 | 1,840,479 | 2,084,668 | 6,968,321 | 9,216,732 | 0.0126 | 0.0112 | 0.0479 | 0.0493 |

| Bartın | 0.90 | 25.00 | 54,450 | 1,512,500 | 965,044 | 1,105,778 | −910,594 | 406,722 | 1.0723 | 0.0442 | −1.0118 * | 0.0163 |

| Boyabat | 1.60 | 1.00 | 96,800 | 60,500 | 969,279 | 960,578 | −872,479 | −900,078 | 0.6058 | 0.9606 | −0.5453 * | −0.9001 * |

| Bozkurt | 4.00 | 4.10 | 242,000 | 248,050 | 983,799 | 979,333 | −741,799 | −731,283 | 0.2459 | 0.2389 | −0.1854 * | −0.1784 * |

| Cide Kuzey | 86.00 | 79.40 | 5,203,000 | 4,803,700 | 1,479,899 | 1,434,898 | 3,723,101 | 3,368,802 | 0.0172 | 0.0181 | 0.0433 | 0.0424 |

| Cide | 25.20 | 23.40 | 1,524,600 | 1,415,700 | 1,112,059 | 1,096,098 | 412,541 | 319,602 | 0.0441 | 0.0468 | 0.0164 | 0.0137 |

| * Çatalzeytin | 3.40 | 1.70 | 205,700 | 102,850 | 980,169 | 964,813 | −774,469 | −861,963 | 0.2883 | 0.5675 | −0.2278 * | −0.5070 * |

| Devrek-Acısu | 5.50 | 2.70 | 332,750 | 163,350 | 992,874 | 970,863 | −660,124 | −807,513 | 0.1805 | 0.3596 | −0.1200 * | −0.2991 * |

| Devrek | 2.10 | 1.50 | 127,050 | 90,750 | 972,304 | 963,603 | −845,254 | −872,853 | 0.4630 | 0.6424 | −0.4025 * | −0.5819 * |

| Devrekâni | 5.70 | 1.60 | 344,850 | 96,800 | 994,084 | 964,208 | −649,234 | −867,408 | 0.1744 | 0.6026 | −0.1139 * | −0.5421 * |

| Düzce | 0.20 | 1.00 | 12,100 | 60,500 | 960,809 | 960,578 | −948,709 | −900,078 | 4.8040 | 0.9606 | −4.7435 * | −0.9001 * |

| Gerze-Köşkburnu | 103.50 | 31.60 | 6,261,750 | 1,911,800 | 1,585,774 | 1,145,708 | 4,675,976 | 766,092 | 0.0153 | 0.0363 | 0.0452 | 0.0242 |

| İnebolu Kuzey | 81.30 | 76.30 | 4,918,650 | 4,616,150 | 1,451,464 | 1,416,143 | 3,467,186 | 3,200,007 | 0.0179 | 0.0186 | 0.0426 | 0.0419 |

| İnebolu | 90.90 | 87.90 | 5,499,450 | 5,317,950 | 1,509,544 | 1,486,323 | 3,989,906 | 3,831,627 | 0.0166 | 0.0169 | 0.0439 | 0.0436 |

| Karadeniz-Ereğli | 1.90 | 2.40 | 114,950 | 145,200 | 971,094 | 969,048 | −856,144 | −823,848 | 0.5111 | 0.4038 | −0.4506 * | −0.3433 * |

| Kastamonu | 2.60 | 1.20 | 157,300 | 72,600 | 975,329 | 961,788 | −818,029 | −889,188 | 0.3751 | 0.8015 | −0.3146 * | −0.7410 * |

| Sinop-İnceburun | 232.70 | 161.40 | 14,078,350 | 9,764,700 | 2,367,434 | 1,930,998 | 11,710,916 | 7,833,702 | 0.0102 | 0.0120 | 0.0503 | 0.0485 |

| Sinop | 8.50 | 4.80 | 514,250 | 290,400 | 1,011,024 | 983,568 | −496,774 | −693,168 | 0.1189 | 0.2049 | −0.0584 * | −0.1444 * |

| Zonguldak Güney | 101.20 | 101.10 | 6,122,600 | 6,116,550 | 1,571,859 | 1,566,183 | 4,550,741 | 4,550,367 | 0.0155 | 0.0155 | 0.0450 | 0.0450 |

| Zonguldak | 5.80 | 3.80 | 350,900 | 229,900 | 994,689 | 977,518 | −643,789 | −747,618 | 0.1715 | 0.2572 | −0.1110 * | −0.1967 * |

| Stations | Power Plant Electricity Generation (GW) | Total Revenue (USD/GW) | Total Cost (USD/GW) | Total Net Profit/Loss (USD/GW) | Unit Revenue (USD/kWh) | Unit Cost (USD/kWh) | Unit Net Profit/Loss (USD/kWh) |

|---|---|---|---|---|---|---|---|

| Akçakoca Fener | 44.50 | 2,692,250 | 1,303,177 | 1,389,073 | 0.0605 | 0.0293 | 0.0312 |

| Akçakoca | 1.40 | 84,700 | 1,005,952 | −921,252 | 0.0605 | 0.7185 | −0.6580 * |

| Amasra | 48.40 | 2,928,200 | 1,290,302 | 1,637,898 | 0.0605 | 0.0267 | 0.0338 |

| Bartın Güney | 121.30 | 7,338,650 | 1,731,347 | 5,607,303 | 0.0605 | 0.0143 | 0.0462 |

| Bartın | 5.70 | 344,850 | 1,031,967 | −687,117 | 0.0605 | 0,1810 | −0.1205 * |

| Boyabat | 0.70 | 42,350 | 1,001,717 | −959,367 | 0.0605 | 1.4310 | −1.3705 * |

| Bozkurt | 4.80 | 290,400 | 1,026,522 | −736,122 | 0.0605 | 0.2139 | −0.1534 * |

| Cide Kuzey | 83.90 | 5,075,950 | 1,505,077 | 3,570,873 | 0.0605 | 0.0179 | 0.0426 |

| Cide | 10.20 | 617,100 | 1,059,192 | −442,092 | 0.0605 | 0.1038 | −0.0433 * |

| Çatalzeytin | 0.90 | 54,450 | 1,002,927 | −948,477 | 0.0605 | 1.1144 | −1.0539 * |

| Devrek Acısu | 1.40 | 84,700 | 1,005,952 | −921,252 | 0.0605 | 0.7185 | −0.6580 * |

| Devrek | 1.80 | 108,900 | 1,008,372 | −899,472 | 0.0605 | 0.5602 | −0.4997 * |

| Devrekani | 1.70 | 102,850 | 1,007,767 | −904,917 | 0.0605 | 0.5928 | −0.5323 * |

| Düzce | 1.80 | 108,900 | 1,008,372 | −899,472 | 0.0605 | 0.5602 | −0.4997 * |

| Gerze Köşkburnu | 51.40 | 3,109,700 | 1,308,452 | 1,801,248 | 0.0605 | 0.0255 | 0.0350 |

| İnebolu Kuzey | 40.10 | 2,426,050 | 1,240,087 | 1,185,963 | 0.0605 | 0.0309 | 0.0296 |

| İnebolu | 90.00 | 5,445,000 | 1,541,982 | 3,903,018 | 0.0605 | 0.0171 | 0.0434 |

| Karadeniz Ereğli | 4.90 | 296,450 | 1,027,127 | −730,677 | 0.0605 | 0.2096 | −0.1491 * |

| Kastamonu | 16.10 | 974,050 | 1,094,887 | −120,837 | 0.0605 | 0.0680 | −0.0075 * |

| Sinop İnceburun | 205.40 | 12,426,700 | 2,240,152 | 10,186,548 | 0.0605 | 0.0109 | 0.0496 |

| Sinop | 9.00 | 544,500 | 1,051,932 | −507,432 | 0.0605 | 0.1169 | −0.0564 * |

| Zonguldak Güney | 115.50 | 6,987,750 | 1,696,257 | 5,291,493 | 0.0605 | 0.0147 | 0.0458 |

| Zonguldak | 3.30 | 199,650 | 1,017,447 | −817,797 | 0.0605 | 0.3083 | −0.2478 * |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Demirkol, Z.; Dayi, F.; Erdoğdu, A.; Yanik, A.; Benek, A. A Techno-Economic Analysis of Power Generation in Wind Power Plants Through Deep Learning: A Case Study of Türkiye. Energies 2025, 18, 2632. https://doi.org/10.3390/en18102632

Demirkol Z, Dayi F, Erdoğdu A, Yanik A, Benek A. A Techno-Economic Analysis of Power Generation in Wind Power Plants Through Deep Learning: A Case Study of Türkiye. Energies. 2025; 18(10):2632. https://doi.org/10.3390/en18102632

Chicago/Turabian StyleDemirkol, Ziya, Faruk Dayi, Aylin Erdoğdu, Ahmet Yanik, and Ayhan Benek. 2025. "A Techno-Economic Analysis of Power Generation in Wind Power Plants Through Deep Learning: A Case Study of Türkiye" Energies 18, no. 10: 2632. https://doi.org/10.3390/en18102632

APA StyleDemirkol, Z., Dayi, F., Erdoğdu, A., Yanik, A., & Benek, A. (2025). A Techno-Economic Analysis of Power Generation in Wind Power Plants Through Deep Learning: A Case Study of Türkiye. Energies, 18(10), 2632. https://doi.org/10.3390/en18102632