Assessing the Implications of Integrating Small Modular Reactors in Modern Power Systems

Abstract

1. Introduction

1.1. Background and Motivation

1.2. Overview of SMRs

1.3. Literature Review

1.4. Research Gap

1.5. Scope of This Work and Main Contributions

- (a)

- A scenario-based simulation analysis to investigate the potential operational and economic implications arising from the construction and operation of SMR units in Greece is conducted. To the best of the authors’ knowledge, this is the first time that the impact of integrating this novel power generation technology in modern power systems and wholesale electricity markets under different penetration levels is assessed in quantitative terms for a long-term horizon. Our goal is to provide an accurate view of the tangible benefits that these units may bring to the power system operation and, in turn, the society welfare, in terms of mitigating the dependence on natural gas imports, reducing carbon emissions and associated costs, as well as examining potential electricity cost savings for end-consumers. The long-term economic viability of such innovative power generation projects is also investigated from the investor’s perspective through a detailed economic valuation analysis. While the Greek power system and electricity market serve as our case study, this analysis offers valuable insights into the multi-dimensional benefits of this new power generation technology, enabling similar analyses in other regions.

- (b)

- Despite the long-term perspective of this analysis, all relevant wholesale electricity market processes, namely Day-Ahead Market (DAM), Integrated Scheduling Process (ISP) and Real-Time Balancing Energy Market (RTBEM) are sequentially simulated on a daily basis under finest time resolution ranging from 1 h (DAM) to 30-min (ISP) and down to 15-min (RTBEM). This allows for the effective modeling of the large set of inter-temporal constraints pertaining to the system and generating units’ actual operation and, therefore, provides a realistic assessment of their impact on the market solution results as well as on the long-term economic viability of SMR units. This is achieved by using a powerful market simulation software tool, which emulates the detailed functionalities of the official optimization solvers used by the associated Greek electricity market and power system operation institutions (Market/System Operators) for solving the actual Greek wholesale electricity market.

2. Methodology

2.1. Types of SMR Units in This Study

2.1.1. NUWARDTM

2.1.2. VOYGRTM

2.1.3. BWRX-300

2.1.4. ARC-100

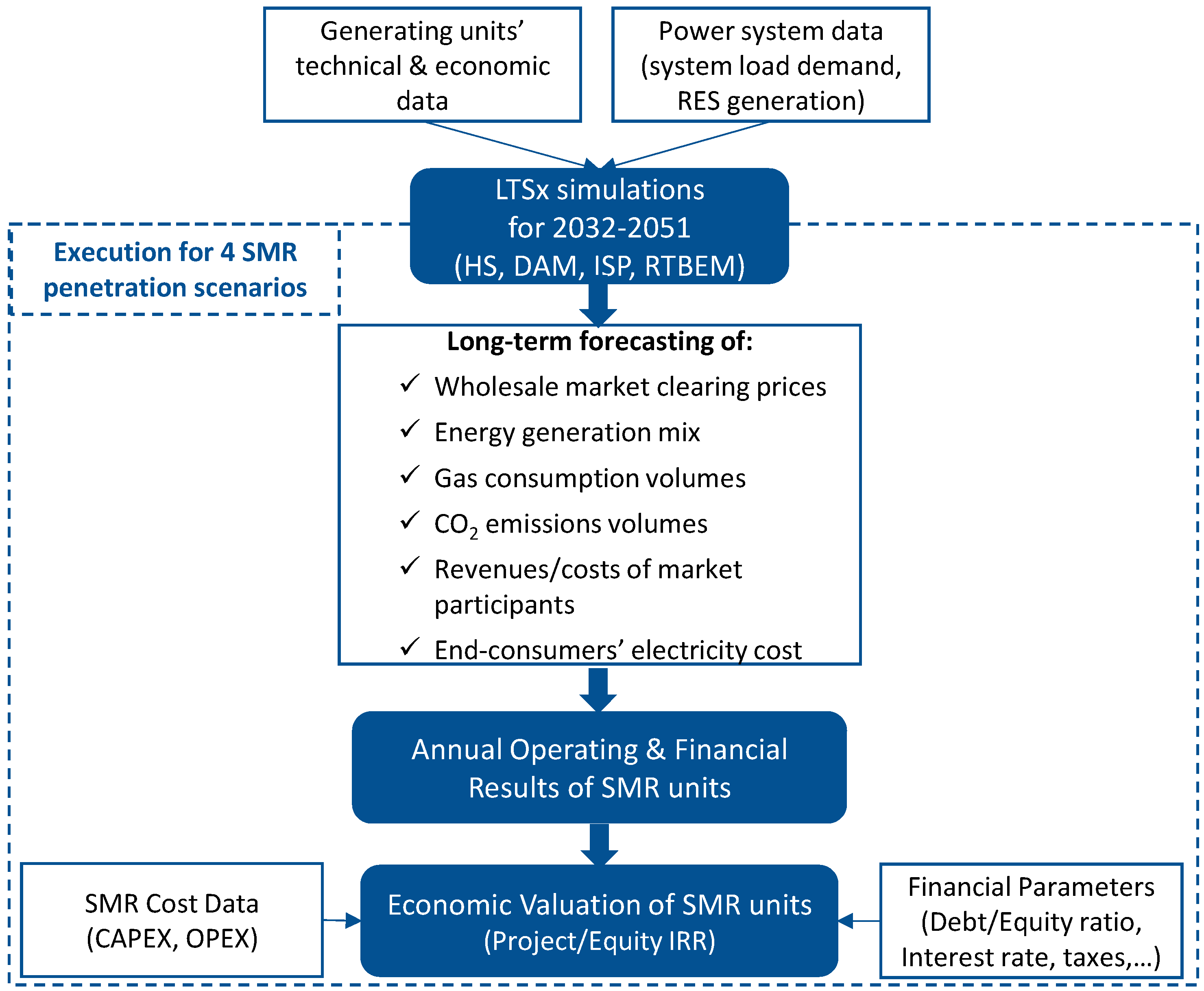

2.2. Methodological Approach

2.3. Software Tool

- Hydrothermal Scheduling (HS),

- Day-Ahead Market (DAM),

- Integrated Scheduling Process (ISP), and

- Real-Time Balancing Energy Market (RTBEM).

- i.

- Unit technical data: e.g., technical maximum power output (in MW), technical minimum power output (in MW), ramp-rates (in MW/min), minimum up/down times (in hours/minutes), unit availabilities, etc.,

- ii.

- Unit economic data: e.g., energy offers of the market participants (thermal units, hydro units, RES, imports, exports, storage units, etc.), reserve offers of the generating units, variable fuel cost, CO2 emissions cost, variable operating and maintenance cost, etc.

- iii.

- System data: e.g., system load demand, system reserve requirements, etc.

3. Case Study

3.1. Scenarios Configuration

3.2. Simulation Assumptions

3.2.1. SMR Units’ Data

3.2.2. System Load Demand

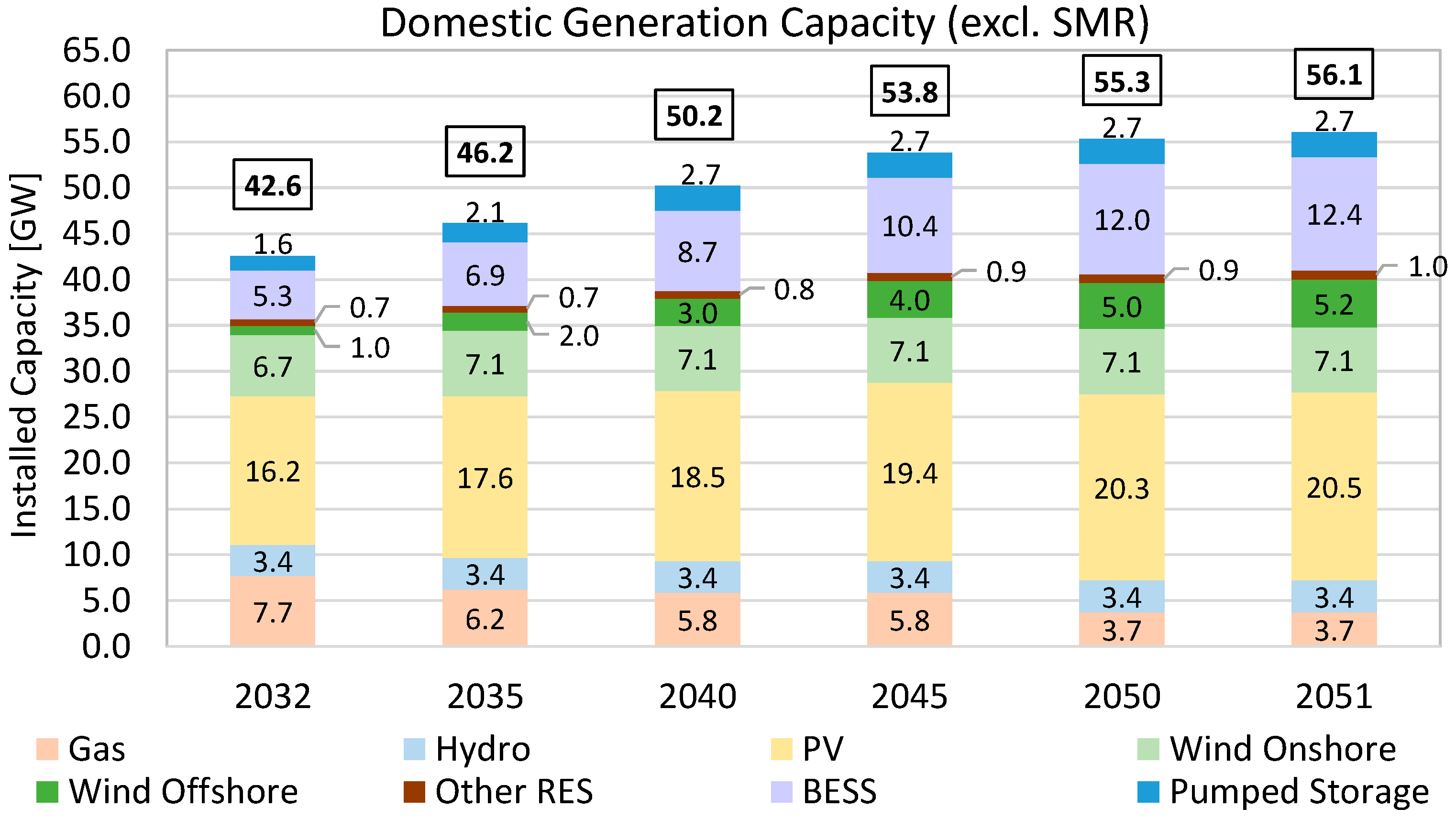

3.2.3. Domestic Generation Capacity

3.2.4. Modeling of RES Generation

- i.

- Annual RES generation uncertainty: In order to model the fact that RES generation profiles may change from year to year due to differentiated climatic conditions, actual hourly electricity generation profiles of wind and PV units of the Greek power system from a past four-year period were adopted, expressed in injected MWh/installed MW or, equivalently, in p.u. For each individual RES technology, these profiles are rolled every four years in hourly time step covering the entire study horizon (2032–2051) and the resulted RES generation data are used in the DAM solution framework. This is similar to the modeling technique adopted by ENTSO-E to incorporate climatic years in its European Resource Adequacy Assessment (ERAA) Study [49].

- ii.

- Integration of short-term RES generation forecasting error: Time-series of random system imbalances in appropriate time resolution for the scheduling phase (30-min for ISP) and the dispatch phase (15-min for RTBEM) based on the statistical properties of historical system imbalances timeseries (empirical cumulative distribution function of the associated load and RES short-term forecasting errors) were created by the software tool by applying the methodology described in [50]. A smoothing function was then applied on the derived 30-min/15-min imbalances in order to perfectly simulate the system imbalances that appear during the actual power system operation, and which follow a smooth variation profile without oscillating between negative and positive values in consecutive time intervals. This modeling technique incorporates appropriate short-term RES generation forecasting errors to be addressed in the relevant market segments (ISP, RTBEM) and provides a realistic integration of the short-term RES generation uncertainty.

3.2.5. Commodities (Gas and CO2) Prices

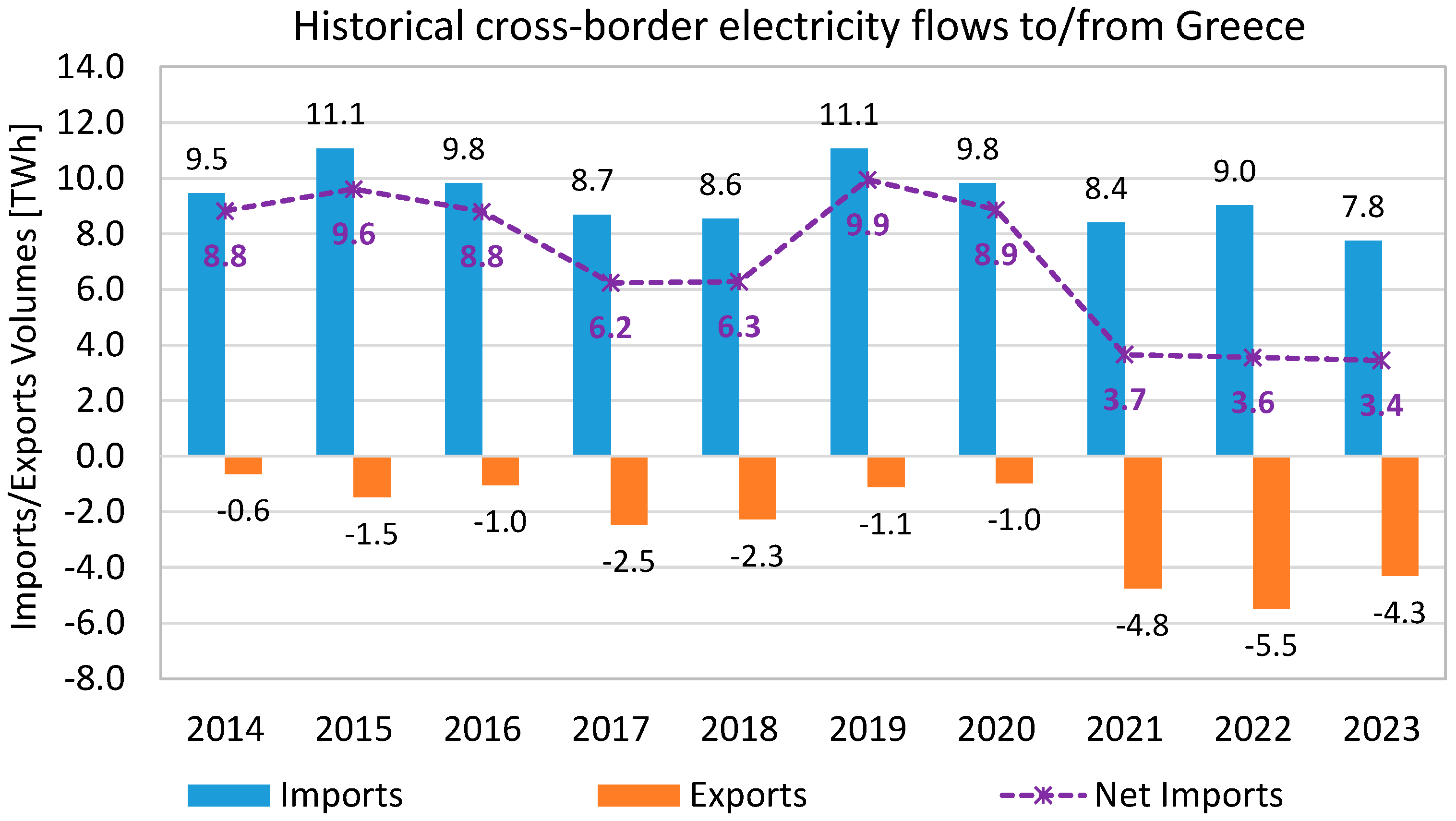

3.2.6. Cross-Border Interconnections

- a new 1000-MW cross-border line interconnecting Greece and Cyprus (also called “Great Sea Interconnector”), which is considered to become commercially available in January 2030,

- a new 200-MW cross-border line interconnecting Greece and Albania, which is considered to become commercially available in January 2032,

- a new 600-MW cross-border line interconnecting Greece and Turkey, which is considered to become commercially available in January 2032,

- a new 1000-MW (DC) cross-border line interconnecting Greece and Italy, which is considered to become commercially available in January 2035.

3.3. Simulation Results

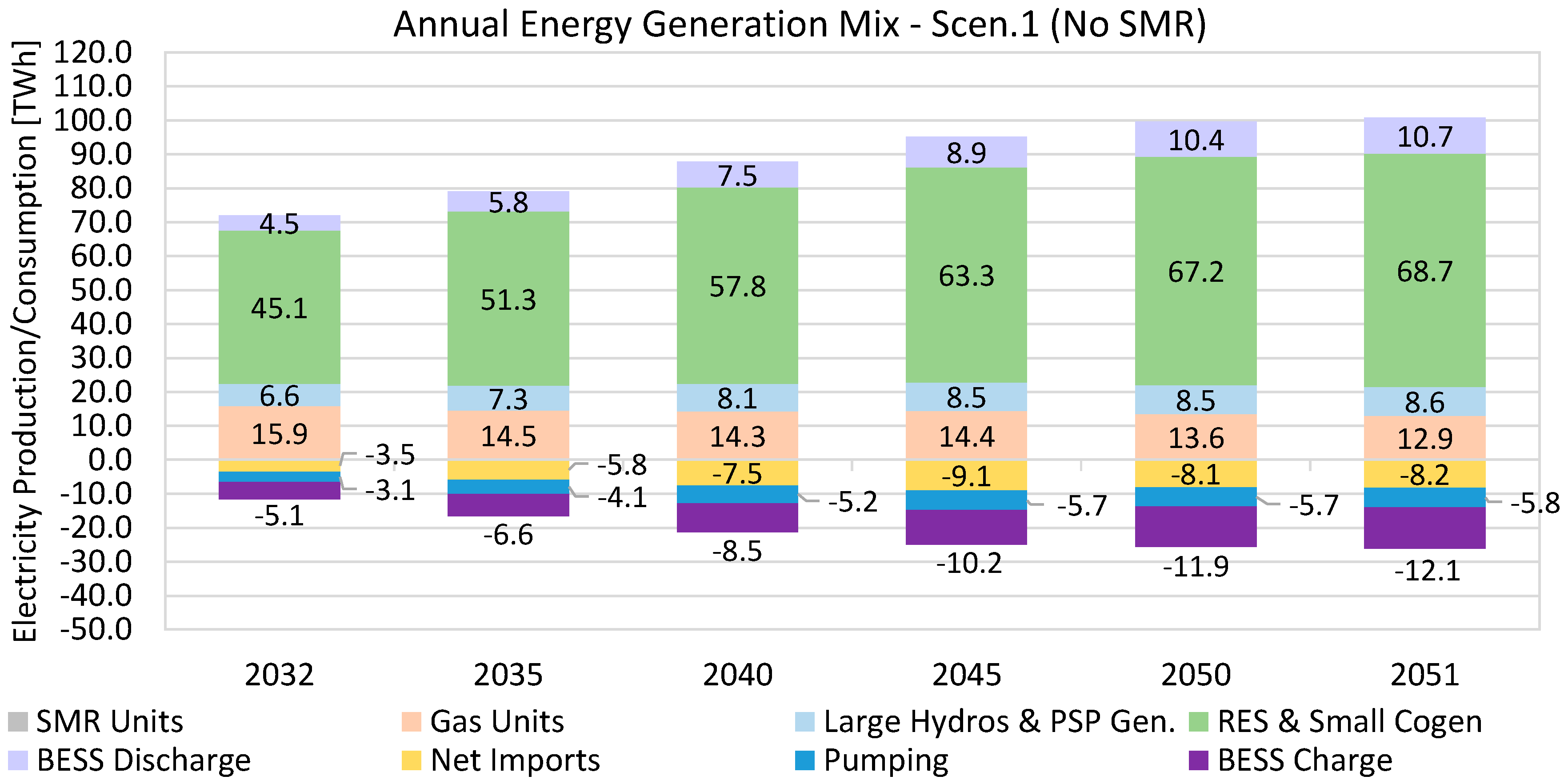

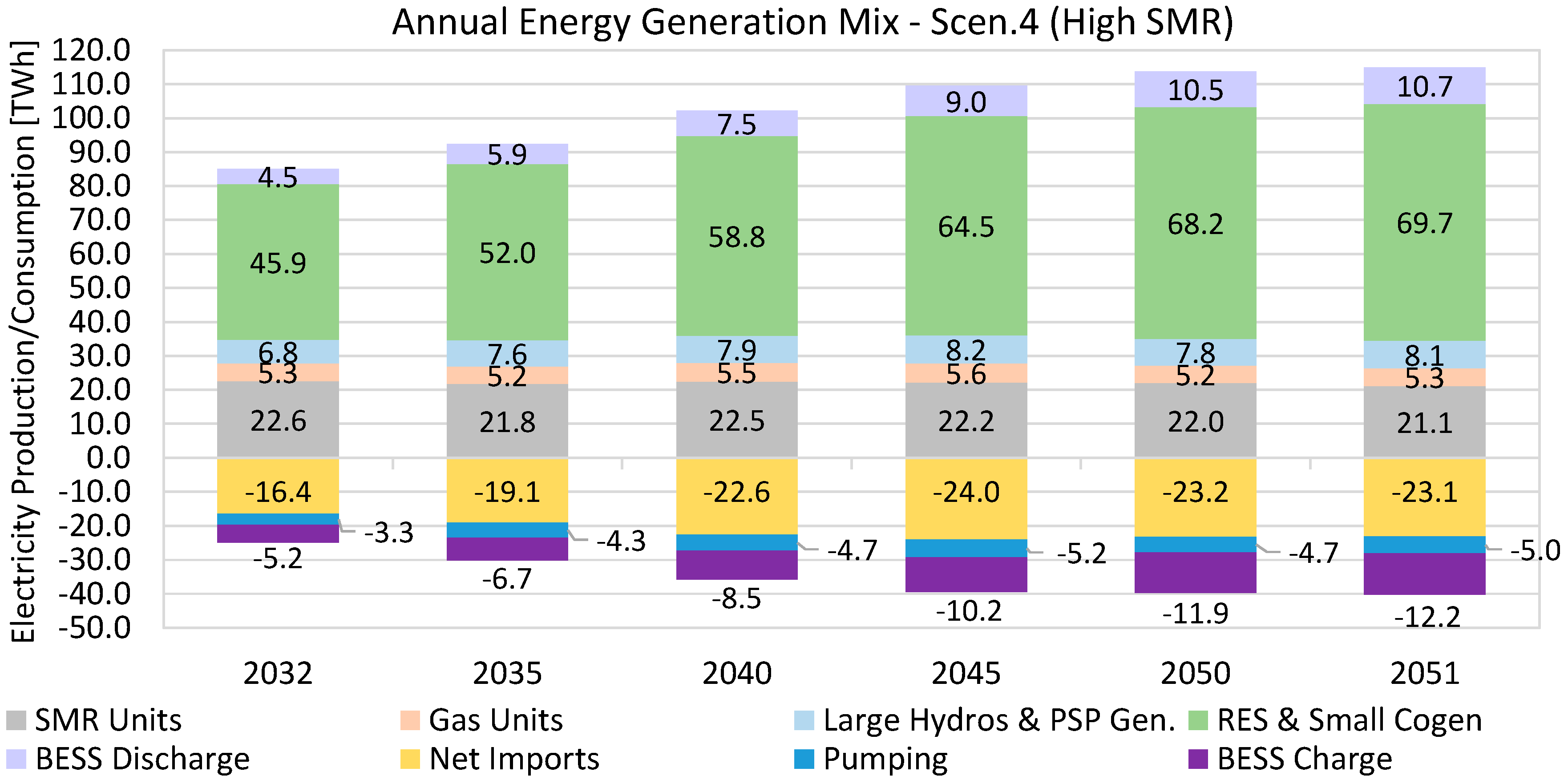

3.3.1. Energy Generation Mix

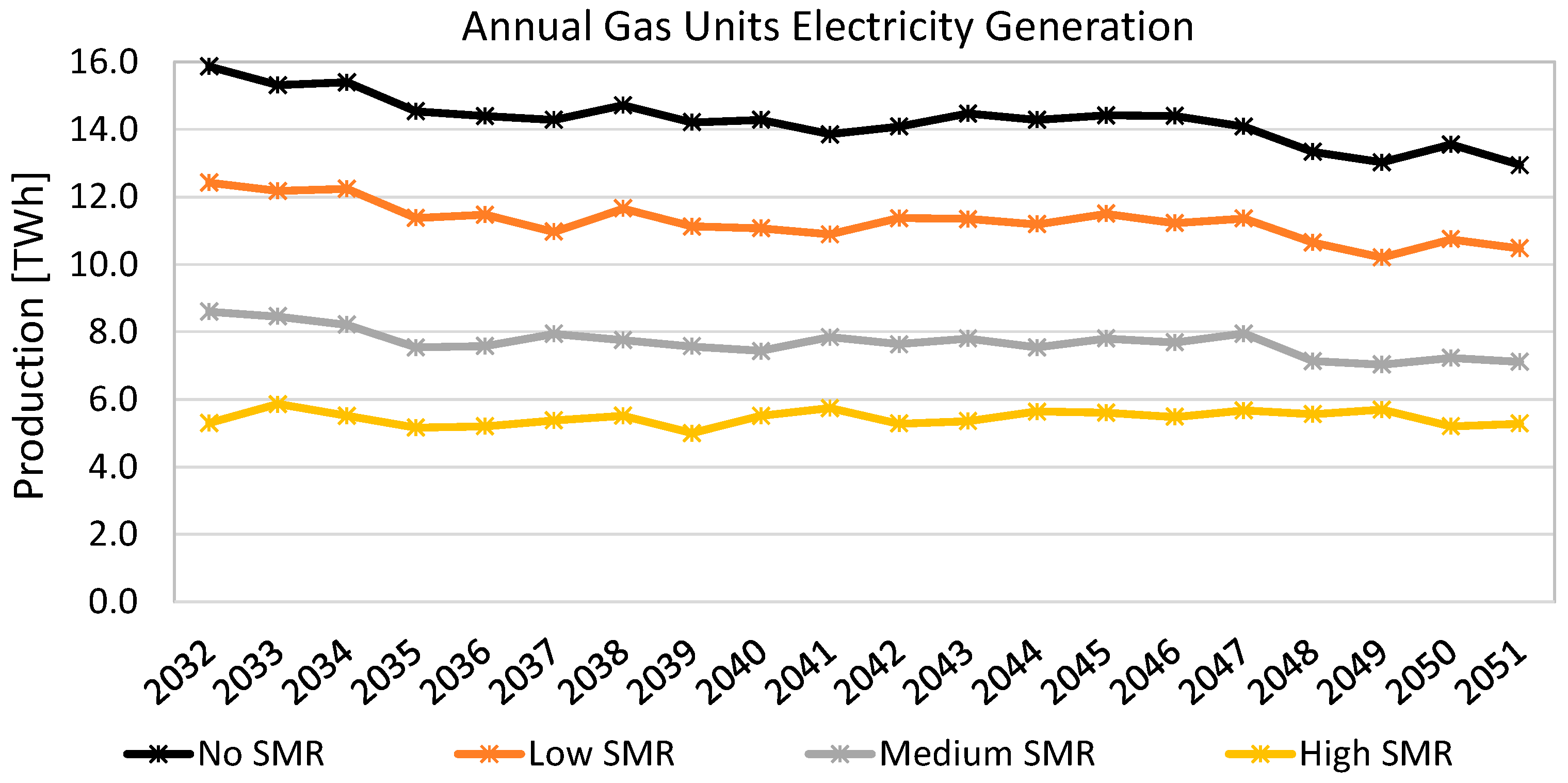

3.3.2. NG Consumption and CO2 Emissions

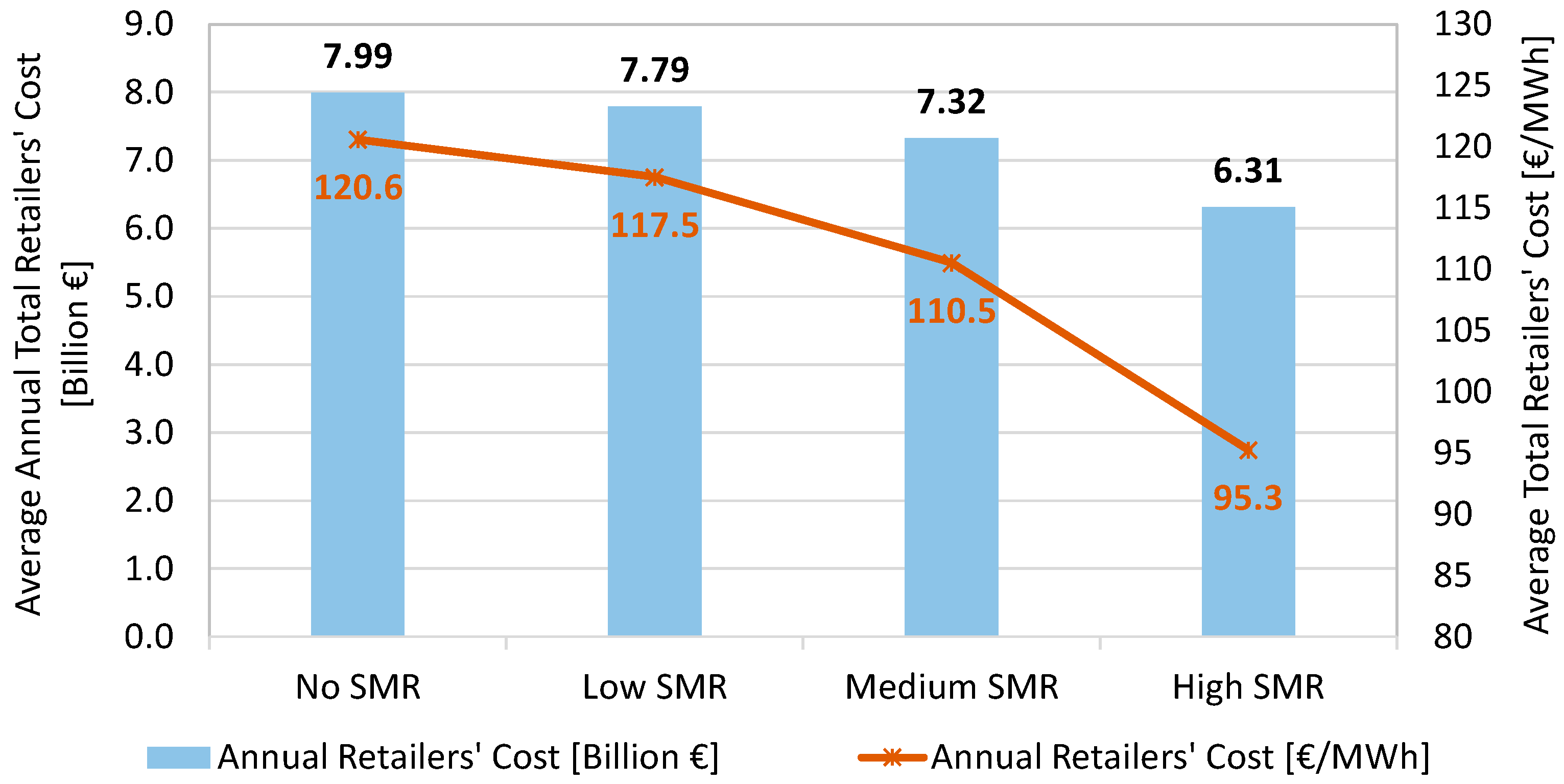

3.3.3. End-Consumers’ Electricity Cost

3.3.4. Economic Valuation Analysis

- i.

- Investment and O&M cost data

- –

- The economic valuation period is equal to 20 years (2032–2051).

- –

- A salvage value equal to 30% of the initial CAPEX is considered in the last year of the project economic valuation to model the remaining value of the SMR unit beyond the 20-year study period, since the average useful lifespan of a typical nuclear unit exceeds 50–60 years.

- –

- A debt/equity ratio equal to 80%/20% has been considered for project financing. Following current conditions for energy-related projects financing, the cost of equity is considered equal to 10.0% and the cost of debt (interest rate) is considered equal to 5.0%.

- –

- The corporate tax rate is taken equal to 22% for the whole valuation period.

- ii.

- Economic valuation results

4. Conclusions and Future Research

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Abbreviations

| BESS | Battery Energy Storage System |

| BRP | Balance Responsible Party |

| BWR | Boiling Water Reactor |

| CAPEX | Capital Expenditure |

| CCGT | Combined Cycle Gas Turbine |

| DAM | Day-Ahead Market |

| ENTSO-E | European Network of Transmission System Operators for Electricity |

| ERAA | European Resource Adequacy Assessment |

| EU | European Union |

| IRR | Internal Rate of Return |

| ISP | Integrated Scheduling Process |

| LCOE | Levelized Cost of Electricity |

| LOCA | Loss of Coolant Accident |

| LTSx | Long-Term Scheduling Extended |

| LWR | Light-Water Reactor |

| MILP | Mixed Integer Linear Programming |

| NECP | National Energy and Climate Plan |

| NPP | Nuclear Power Plant |

| NPV | Net Present Value |

| NSSS | Nuclear Steam Supply System |

| O&M | Operation and Maintenance |

| PV | Photovoltaic |

| PWR | Pressurized Water Reactor |

| RES | Renewable Energy Sources |

| RPV | Reactor Pressure Vessel |

| RTBEM | Real-Time Balancing Energy Market |

| SFR | Sodium Fast Reactor |

| SMR | Small Modular Reactor |

| TSO | Transmission System Operator |

| TYNDP | Ten-Year Network Development Plan |

| UA | Uplift Account |

References

- United Nations Environment Programme. Emissions Gap Report 2024: No More Hot Air … Please! With a Massive Gap Between Rhetoric and Reality, Countries Draft New Climate Commitments; Technical Report; United Nations Environment Programme: Nairobi, Kenya, 2024. [Google Scholar]

- International Atomic Energy Agency. Small Modular Reactors: Advances in SMR Developments 2024; Technical Report; International Atomic Energy Agency: Vienna, Austria, 2024. [Google Scholar]

- Lee, J.I.K. Review of Small Modular Reactors: Challenges in Safety and Economy to Success. Korean J. Chem. Eng. 2024, 41, 2761–2780. [Google Scholar] [CrossRef]

- Lloyd, C.A.; Roulstone, A. A methodology to determine SMR build schedule and the impact of modularization. In Proceedings of the 2018 26th International Conference on Nuclear Engineering, London, UK, 22–26 July 2018. [Google Scholar]

- Nuclear Energy Agency. Small Modular Reactors: Challenges and Opportunities; Technical Report, OECD 2021 Edition; Nuclear Energy Agency: Paris, France, 2021. [Google Scholar]

- Chalkiadakis, N.; Stamatakis, E.; Varvayanni, M.; Stubos, A.; Tzamalis, G.; Tsoutsos, T. A new path towards sustainable energy transition: Techno-economic feasibility of a complete hybrid Small Modular Reactor/Hydrogen (SMR/H2) energy system. Energies 2023, 16, 6257. [Google Scholar] [CrossRef]

- Jenkins, J.D.; Zhou, Z.; Ponciroli, R.; Vilim, R.B.; Ganda, F.; De Sisternes, F.; Botterud, A. The benefits of nuclear flexibility in power system operations with renewable energy. Appl. Energy 2018, 222, 872–884. [Google Scholar] [CrossRef]

- Loisel, R.; Alexeeva, V.; Zucker, A.; Shropshire, D. Load-following with nuclear power: Market effects and welfare implications. Prog. Nucl. Energy 2018, 109, 280–292. [Google Scholar] [CrossRef]

- Lynch, A.; Perez, Y.; Gabriel, S.; Mathonniere, G. Nuclear fleet flexibility: Modeling and impacts on power systems with renewable energy. Appl. Energy 2022, 314, 118903. [Google Scholar] [CrossRef]

- Rečka, L.; Ščasný, M. Brown coal and nuclear energy deployment: Effects on fuel-mix, carbon targets, and external costs in the Czech Republic up to 2050. Fuel 2018, 216, 494–502. [Google Scholar] [CrossRef]

- Zhang, J.; Leng, R.; Chen, M.; Tian, X.; Zhang, N. The future role of nuclear power in the coal dominated power system: The case of Shandong. J. Clean. Prod. 2020, 256, 120744. [Google Scholar] [CrossRef]

- Cany, C.; Mansilla, C.; Da Costa, P.; Mathonnière, G.; Duquesnoy, T.; Baschwitz, A. Nuclear and intermittent renewables: Two compatible supply options? The case of the French power mix. Energy Policy 2016, 95, 135–146. [Google Scholar] [CrossRef]

- Čepin, M. Evaluation of the power system reliability if a nuclear power plant is replaced with wind power plants. Reliab. Eng. Syst. Saf. 2019, 185, 455–464. [Google Scholar] [CrossRef]

- Karaveli, A.B.; Soytas, U.; Akinoglu, B.G. Comparison of large scale solar PV (photovoltaic) and nuclear power plant investments in an emerging market. Energy 2015, 84, 656–665. [Google Scholar] [CrossRef]

- Hussein, E.M.A. Emerging small modular nuclear power reactors: A critical review. Phys. Open 2020, 5, 100038. [Google Scholar] [CrossRef]

- Vinoya, C.L.; Ubando, A.T.; Culaba, A.B.; Chen, W.H. State-of-the-Art Review of Small Modular Reactors. Energies 2023, 16, 3224. [Google Scholar] [CrossRef]

- Michaelson, D.; Jiang, J. Review of integration of small modular reactors in renewable energy microgrids. Renew. Sustain. Energy Rev. 2021, 152, 111638. [Google Scholar] [CrossRef]

- Vargas-Salgado, C.; Berna-Escriche, C.; Escrivá-Castells, A.; Alfonso-Solar, D. Optimization of the electricity generation mix using economic criteria with zero-emissions for stand-alone systems: Case applied to Grand Canary Island in Spain. Prog. Nucl. Energy 2022, 151, 104329. [Google Scholar] [CrossRef]

- Shrestha, R.; Wagner, D.; Al-Anbagi, I. Fuzzy AHP-based siting of small modular reactors for power generation in the smart grid. In Proceedings of the 2018 IEEE Electrical Power and Energy Conference (EPEC), Toronto, ON, Canada, 10–11 October 2018. [Google Scholar]

- Gao, S.; Huang, G.; Zhang, X.; Chen, J.; Han, D. SMR siting for the electricity system management. J. Clean. Prod. 2021, 297, 126621. [Google Scholar] [CrossRef]

- Mignacca, B.; Locatelli, G. Economics and finance of Small Modular Reactors: A systematic review and research agenda. Renew. Sustain. Energy Rev. 2020, 118, 109519. [Google Scholar] [CrossRef]

- Van Hee, N.; Peremans, H.; Nimmegeers, P. Economic potential and barriers of small modular reactors in Europe. Renew. Sustain. Energy Rev. 2024, 203, 114743. [Google Scholar] [CrossRef]

- Black, G.A.; Aydogan, F.; Koerner, C.L. Economic viability of light water small modular nuclear reactors: General methodology and vendor data. Renew. Sustain. Energy Rev. 2019, 103, 248–258. [Google Scholar] [CrossRef]

- Alonso, G.; Bilbao, S.; Del Valle, E. Economic competitiveness of small modular reactors versus coal and combined cycle plants. Energy 2016, 116, 867–879. [Google Scholar] [CrossRef]

- Asuega, A.; Limb, B.J.; Quinn, J.C. Techno-economic analysis of advanced small modular nuclear reactors. Appl. Energy 2023, 334, 120669. [Google Scholar] [CrossRef]

- Nian, V.; Zhong, S. Economic feasibility of flexible energy productions by small modular reactors from the perspective of integrated planning. Prog. Nucl. Energy 2020, 118, 103106. [Google Scholar] [CrossRef]

- Sadeghi, K.; Ghazaie, S.H.; Sokolova, E.; Fedorovich, E.; Shirani, A. Comprehensive techno-economic analysis of integrated nuclear power plant equipped with various hybrid desalination systems. Desalination 2020, 493, 114623. [Google Scholar] [CrossRef]

- Rahman, J.; Zhang, J. Optimization of nuclear-Renewable hybrid energy system operation in forward electricity market. In Proceedings of the 2021 IEEE Green Technologies Conference (GreenTech), Denver, CO, USA, 7–9 April 2021. [Google Scholar]

- Locatelli, G.; Boarin, S.; Fiordaliso, A.; Ricotti, M.E. Load following of Small Modular Reactors (SMR) by cogeneration of hydrogen: A techno-economic analysis. Energy 2018, 148, 494–505. [Google Scholar] [CrossRef]

- Hill, D.; Martin, A.; Martin-Nelson, N.; Granger, C.; Memmott, M.; Powell, K.; Hedengren, J. Techno-economic sensitivity analysis for combined design and operation of a small modular reactor hybrid energy system. Int. J. Thermofluids 2022, 16, 100191. [Google Scholar] [CrossRef]

- Dong, Z.; Li, B.; Li, J.; Guo, Z.; Huang, X.; Zhang, Y.; Zhang, Z. Flexible control of nuclear cogeneration plants for balancing intermittent renewables. Energy 2021, 221, 119906. [Google Scholar] [CrossRef]

- Poudel, B.; Gokaraju, R. Small modular reactor (SMR) based hybrid energy system for electricity & district heating. IEEE Trans. Energy Convers. 2021, 36, 2794–2802. [Google Scholar]

- Poudel, B.; Gokaraju, R. Optimal operation of SMR-RES hybrid energy system for electricity & district heating. IEEE Trans. Energy Convers. 2021, 36, 3146–3155. [Google Scholar]

- International Atomic Energy Agency. Advances in Small Modular Reactor Technology Developments; 2022 Edition Booklet; International Atomic Energy Agency: Vienna, Austria, 2022. [Google Scholar]

- International Atomic Energy Agency. Status Report—NUWARDTM (EDF lead consortium); Technical Report; International Atomic Energy Agency: Paris, France, 2019. [Google Scholar]

- International Atomic Energy Agency. Status Report—NuScale SMR (NuScale Power, LLC); Technical Report; International Atomic Energy Agency: New York, NY, USA, 2020. [Google Scholar]

- International Atomic Energy Agency. Status Report—BWRX-300 (GE Hitachi and Hitachi GE Nuclear Energy); Technical Report; International Atomic Energy Agency: New York, NY, USA, 2019. [Google Scholar]

- ARC Clean Technology. ARC-100 Technical Summary; Technical Report; ARC Clean Technology: Saint John, NB, Canada, 2023. [Google Scholar]

- Simoglou, C.K.; Biskas, P.N. Investigating the long-term benefits of EU Electricity Highways: The case of the Green Aegean Interconnector. Sustain. Energy Grids Netw. 2024, 40, 101558. [Google Scholar] [CrossRef]

- Hellenic Energy Exchange. Day-Ahead Market and Intra-Day Market Trading Rulebook. June 2024. Available online: https://www.enexgroup.gr/documents/20126/144557/Spot_Trading_Rulebook_v2.2_en.pdf (accessed on 17 April 2025).

- Greek Independent Power Transmission Operator (ADMIE). Balancing Market Rulebook, February 2024. Available online: https://www.admie.gr/sites/default/files/users/dda/KAE/Balancing%20Market%20Rulebook_v14.pdf (accessed on 17 April 2025).

- Hellenic Energy Exchange. Day-Ahead Market and Intra-Day Markets Trading Decisions. 2020. Available online: https://www.enexgroup.gr/web/guest/trading-rulebooks (accessed on 17 April 2025).

- Greek Independent Power Transmission Operator. Methodologies and Technical Decisions. 2020. Available online: https://www.admie.gr/en/market/regulatory-framework/methodologia-kai-tehnikes-apofaseis (accessed on 17 April 2025).

- Brooke, A.; Kendrick, D.; Meeraus, A. GAMS User’s Guide; Scientific Press: Redwood City, CA, USA, 1990; Available online: http://www.gams.com/docs/document.htm (accessed on 17 April 2025).

- Sovacool, B.K. Valuing the greenhouse gas emissions from nuclear power: A critical survey. Energy Policy 2008, 36, 2950–2963. [Google Scholar] [CrossRef]

- Baldi, S.; Drocourt, D. Nuward SMR—Leading the Way to a Carbon-Free World; Électricité de France Technical Report; EDF: London, UK, 2023. [Google Scholar]

- Greek Independent Power Transmission Operator. Monthly Energy Bulletin, December 2023. Available online: https://www.admie.gr/sites/default/files/attached-files/type-file/2024/02/Energy_Report_202312_v2_en_0.pdf (accessed on 17 April 2025).

- Greek Independent Power Transmission Operator. 2024. Ten-Year Development Plan of Hellenic Electricity Transmission System for the Period 2025–2034 (Preliminary Draft Version Under Public Consultation), March 2024. Available online: https://www.admie.gr/en/anakoinoseis/diaboyleyseis/public-consultation-preliminary-draft-ten-year-development-plan-hets-2 (accessed on 17 April 2025). (In Greek).

- European Network of Transmission System Operators for Electricity (ENTSO-E). European Resource Adequacy Assessment Study 2022. Available online: https://www.entsoe.eu/outlooks/eraa/ (accessed on 17 April 2025).

- Ma, X.; Sun, Y.; Fang, H. Scenario generation of wind power based on statistical uncertainty and variability. IEEE Trans. Sustain. Energy 2013, 4, 894–904. [Google Scholar] [CrossRef]

- Intercontinental Exchange (ICE). Dutch TTF Natural Gas Futures. Available online: https://www.ice.com/products/27996665/Dutch-TTF-Natural-Gas-Futures/data?marketId=5878892 (accessed on 17 April 2025).

- European Energy Exchange (EEX). EEX EUA Futures. Available online: https://www.eex.com/en/market-data/market-data-hub/environmentals/futures (accessed on 17 April 2025).

- NREL. Annual Technology Baseline (ATB) Data for Nuclear. 2024. Available online: https://atb.nrel.gov/electricity/2024/nuclear (accessed on 17 April 2025).

- Abou-Jaoude, A.; Larsen, L.; Guaita, N.; Trivedi, I.; Josek, F.; Lohse, C.; Hoffman, E.; Stauff, N.; Shirvan, K.; Stein, A. Meta-Analysis of Advanced Nuclear Reactor Cost Estimations; Technical Report; Idaho National Laboratory: Idaho Falls, ID, USA, 2024. Available online: https://www.osti.gov/biblio/2371533 (accessed on 17 April 2025).

| Ref. | Geographical Area | Qualitative/Quantitative Analysis | NPP/SMR | Stand-Alone (S)/ Hybrid (H) System | Use of Simulation? | Detailed Modeling of Electricity Market Operation? | Study Horizon | Temporal Resolution | Economic Aspects Addressed ? | Economic Viability Analysis of Nuclear Assets? |

|---|---|---|---|---|---|---|---|---|---|---|

| [7] | USA | Quantitative | NPP | S | YES | YES | 1 year | 1 h | NO | NO |

| [8] | Europe | Quantitative | NPP | S | YES | NO | 2 years | 1 h | YES | NO |

| [9] | France | Quantitative | NPP | S | YES | NO | 1 year | 1 h | YES | NO |

| [10] | Czech Republic | Quantitative | NPP | S | YES | NO | 35 years | - | Partially | NO |

| [11] | China | Quantitative | NPP | S | YES | NO | 1 year | 1 h | NO | NO |

| [12] | France | Quantitative | NPP | S | NO | NO | 1 year | - | YES | NO |

| [13] | Slovenia | Quantitative | NPP | S | YES | NO | 1 year | - | NO | NO |

| [14] | Turkey | Quantitative | NPP | S | NO | NO | 30 years | - | NO | NO |

| [15] | - | Qualitative | SMR | S | NO | NO | - | - | - | - |

| [16] | - | Qualitative | SMR | S | NO | NO | - | - | - | - |

| [17] | - | Qualitative | SMR | S & H | NO | NO | - | - | - | - |

| [18] | Spain | Quantitative | SMR | S | YES | NO | 25 years | - | YES | NO |

| [19] | Canada | Quantitative | SMR | S | YES | NO | - | - | NO | NO |

| [20] | Canada | Quantitative | SMR | S | YES | NO | 15 years | 5 years | NO | NO |

| [21] | - | Qualitative | SMR | S | NO | NO | - | - | YES | - |

| [22] | - | Qualitative | SMR | S | NO | NO | - | - | YES | - |

| [23] | - | Quantitative | SMR | S | NO | NO | - | - | Partially | - |

| [24] | - | Quantitative | SMR | S | NO | NO | - | - | YES | NO |

| [25] | - | Quantitative | SMR | S | NO | NO | - | - | YES | NO |

| [26] | - | Quantitative | SMR | H | NO | NO | 40 years | - | YES | NO |

| [27] | - | Quantitative | SMR | H | YES | NO | 15 years | - | YES | NO |

| [28] | - | Quantitative | SMR | H | YES | DAM only | 1 day | 1 h | NO | NO |

| [29] | - | Quantitative | SMR | H | NO | NO | - | - | YES | NO |

| [30] | - | Quantitative | SMR | H | YES | NO | 360–500 h | 1 h | YES | NO |

| [31] | - | Quantitative | SMR | H | YES | NO | 12 h | 1 s | NO | NO |

| [32] | - | Quantitative | SMR | H | YES | NO | 1 day | 15-min | NO | NO |

| [33] | - | Quantitative | SMR | H | YES | NO | 1 month | 15-min | NO | NO |

| This paper | Greece | Quantitative | SMR | S | YES | YES (DAM, ISP, RTBEM) | 20 years | 1 h/ 30-min/15-min | YES | YES |

| SMR Type | Scenario Name/SMR Installed Capacity [MW]— Number of SMR Units | |||

|---|---|---|---|---|

| Scen. 1 No SMR (0 MW) | Scen. 2 Low SMR (648 MW) | Scen. 3 Medium SMR (1564 MW) | Scen. 4 High SMR (3088 MW) | |

| NUWARD (340 MW) | x | ✓ (1) | ✓ (1) | ✓ (1) |

| VOYGR (4/12 × 77 MW) | x | ✓ (1: 4 × 77) | ✓ (1: 12 × 77) | ✓ (2: 12 × 77) |

| BWRX-300 (300 MW) | x | x | ✓ (1) | ✓ (2) |

| ARC-100 (100 MW) | x | x | x | ✓ (3) |

| SMR Type | Pmax [MW] | Pmin [MW] | Ramp-Rate [MW/min] | CO2 Rate [tn/MWh] | Fuel Supply Cost [€/kg] | Fuel LHV [GJ/kgr] | Fuel Cycle [Months] | Thermal Efficiency [%] | Fuel Variable Cost [€/MWhe] |

|---|---|---|---|---|---|---|---|---|---|

| NUWARD | 340 | 64 | 17.0 | 0.0120 | 830.5 | 3400 | 24 | 32.0 | 2.75 |

| VOYGR 4 × 77 | 308 | 154 | 15.4 | 0.0109 | 18 | 36.0 | 2.44 | ||

| VOYGR 12 × 77 | 924 | 462 | 46.2 | 0.0163 | 18 | 36.0 | 2.44 | ||

| BWRX-300 | 300 | 135 | 15.0 | 0.0326 | 12 | 35.0 | 2.51 | ||

| ARC-100 | 100 | 50 | 5.0 | 0.0102 | 2670 | 9680 | 240 | 40.0 | 2.48 |

| CAPEX [$/kW] | Fixed O&M [$/kW-y] | Project IRR [%] | Equity IRR [%] | ||||

|---|---|---|---|---|---|---|---|

| Low SMR | Medium SMR | High SMR | Low SMR | Medium SMR | High SMR | ||

| 5900 | 118 | 13.0 | 12.3 | 9.7 | 30.2 | 26.9 | 18.5 |

| 136 | 12.7 | 12.0 | 9.4 | 29.2 | 26.0 | 17.7 | |

| 216 | 11.5 | 10.9 | 8.2 | 24.8 | 22.0 | 14.0 | |

| 9300 | 118 | 7.7 | 7.3 | 5.5 | 12.9 | 11.5 | 6.6 |

| 136 | 7.5 | 7.1 | 5.3 | 12.4 | 11.0 | 6.1 | |

| 216 | 6.7 | 6.3 | 4.3 | 10.1 | 8.8 | 4.1 | |

| 12,500 | 118 | 5.2 | 4.9 | 3.2 | 5.9 | 5.2 | 1.7 |

| 136 | 5.0 | 4.7 | 3.0 | 5.6 | 4.8 | 1.4 | |

| 216 | 4.3 | 4.0 | 2.1 | 4.0 | 3.3 | 0.0 | |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Simoglou, C.K.; Kaissas, I.M.; Biskas, P.N. Assessing the Implications of Integrating Small Modular Reactors in Modern Power Systems. Energies 2025, 18, 2578. https://doi.org/10.3390/en18102578

Simoglou CK, Kaissas IM, Biskas PN. Assessing the Implications of Integrating Small Modular Reactors in Modern Power Systems. Energies. 2025; 18(10):2578. https://doi.org/10.3390/en18102578

Chicago/Turabian StyleSimoglou, Christos K., Ioannis M. Kaissas, and Pandelis N. Biskas. 2025. "Assessing the Implications of Integrating Small Modular Reactors in Modern Power Systems" Energies 18, no. 10: 2578. https://doi.org/10.3390/en18102578

APA StyleSimoglou, C. K., Kaissas, I. M., & Biskas, P. N. (2025). Assessing the Implications of Integrating Small Modular Reactors in Modern Power Systems. Energies, 18(10), 2578. https://doi.org/10.3390/en18102578