Abstract

This research aims to test the impact of environmental taxes on pollution emissions in 38 OECD countries from 1995 to 2022. The study used an econometric strategy of panel data (FMOLS, DOLS, quantile regression, and the GMM system). The variable of environmental taxes showed a negative externality between taxation and carbon dioxide emissions, reflecting that taxation stimulated an increase in carbon dioxide emissions. The econometric results also indicate that renewable energy and trade aim to decrease pollution emissions, improving environmental degradation.

1. Introduction

Over the last few years, global warming, the climate crisis, soil erosion, and biodiversity changes have concerned society. International organizations such as the EU, the United Nations, and the OECD have raised awareness of these issues through international conferences and reports to achieve sustainability goals. In this context, EU and OECD countries have sought to implement measures to achieve sustainable development practices. Thus, fiscal policy and renewable energy consumption contribute to sustainable development.

This research assesses the relationship between environmental taxes and carbon dioxide emissions for all 38 OECD countries. In addition, we analyze the impact of economic growth, renewable energy, and trade on carbon dioxide emissions.

There is no unanimous agreement on the impact of environmental taxes and pollution emissions. As a rule, studies accept that the effects of ecological taxes translate into externalities. Many studies show that, by implementing environmental taxes, international taxation reduces climate change. However, some studies demonstrate that ecological taxes create negative externalities that promote climate change. Empirical studies (e.g., Máté et al. [1]; Özmen and Mutascu [2]; Šikić and Hodžić [3], Ibe et al. [4]) use panel data, for example, for European Union countries, OECD countries, G7 economies, or even time series applied to a case study of just one country.

For instance, the empirical study of Shammre et al. [5] considered 34 OECD countries using dynamic panel data such as the GMM-system estimator. They concluded that the lagged variable of carbon dioxide emissions positively affects the long-run effect. The equation for environmental taxes shows that the taxation coefficient negatively impacts carbon dioxide emissions. The patterns of environmental technologies and urban population positively and negatively correlate with CO2 emissions.

The various international summits on the environment have promoted sustainable development and its SDG objectives, which are defined in the 2030 Agenda on sustainability. In this context, we saw the promotion of the assumptions of the circular economy and the replacement of fossil fuels with renewable energy. Over the last two decades, empirical studies have shown that renewable energies are negatively correlated with pollution emissions in general, revealing that the consumption of renewable energies makes it possible to achieve decarbonization and environmental improvement.

Another central area of research is the relationship between economic growth and carbon dioxide emissions, namely the environmental Kuznets curve. Thus, economic science argues that the link between economic growth and pollution emissions depends on the level of development of countries. Therefore, as a rule, developed economies are more concerned about climate change and seek to respond to sustainability challenges. In this context, scientific articles usually refer to two alternative currents: the Haven Pollution Hypothesis and the Pollution Halo Hypothesis. The Pollution Halo Hypothesis currently demonstrates that international trade and investment make it possible to explain the internationalization process associated with innovation and product differentiation.

In terms of research, we are interested in answering the following research questions: (i) To what extent does economic growth stimulate the ecological system or degradation of the environment in OECD countries?; (ii) Do environmental taxes act as positive or negative externalities of climate change in OECD countries?; (iii) To what extent do renewable energies promote environmental improvement in OECD countries; and (iv) To what extent does trade stimulate (decrease) greenhouse and gas emissions?

In this context, this investigation aims to evaluate the effect of environmental taxes on pollution emissions in the long run. Then, we use the dynamic panel data (the GMM system) and the panel cointegration (FMOLS and DOLS), which we allow to tend to the behavior of the variables used in this study. Furthermore, in this research, the utilization of quantile regressions allows us to infer whether the variables used maintain the tendency or if it is changed across all quantiles used.

This research aims to contribute to the literature in four distinct ways. First, we present a survey of empirical studies on the impact of economic growth and the environmental Kuznets curve. In our research, we are interested in understanding the extent to which economic growth stimulates climate change in OECD countries. Second, we discuss and evaluate the relationship between environmental taxes and carbon dioxide emissions. The literature argues that environmental taxes and international and environmental taxation contribute to reducing carbon dioxide emissions and the greenhouse effect. However, some studies find a different position, demonstrating that imposing environmental taxes can stimulate negative externalities. Thirdly, it is essential to understand whether renewable energies contribute to reducing the greenhouse effect in OECD countries, as is usually advanced in the literature. Fourthly, trade flows between OECD countries are explained by theories of comparative advantages associated with the Haven Pollution Hypothesis, where the greenhouse effect increases, or, on the contrary, trade flows between OECD countries are explained by product differentiation, which reduces the greenhouse effect.

This investigation can provide information to policymakers for the improvement of the environment in general, and in this case study in particular.

Regarding the structure of this scientific article, Section 2 presents the literature review, where a set of articles that evaluate the various connections between the topic under study are selected. The methodology, data, and formulation of hypotheses to be tested in the econometric study are in Section 3. In Section 4, the empirical results and their discussion are presented in Section 4, and finally, we focus on the conclusions and recommendations regarding the research carried out in Section 5.

2. Literature Review

This section presents the main conclusions from previous studies that considered the relationship between economic growth, environmental taxes, trade, renewable energy, and pollution emissions. As Balsalobre-Lorente et al. [6] and Leal and Marques [7] referred to, the environmental Kuznets curve (EKC) depends on two distinct moments, namely, the pre-industrial moment and the post-industrial period. Therefore, economic theory argues that when economies are in a development phase, countries are already concerned about environmental issues and usually comply with environmental rules and standards, thus contributing to the concept of sustainable development defined throughout the various ecological summits and the 2030 Agenda for Sustainable Development.

2.1. The Role of Economic Growth in Climate Change

Energy and environmental economics studies demonstrate that economic growth can stimulate climate change and the greenhouse effect. Thus, the work of Savranlar et al. [8], Dogan et al. [9] and Sultana et al. [10] demonstrate that there is a positive correlation between economic growth and pollution emissions. The environmental Kuznets curve (EKC) was divulged by Grossman and Krueger [11] and Dinda [12]. Furthermore, it is understood that economic growth may be associated with environmental damage, as explained by the Haven Pollution Hypothesis (PHH) theory, or, on the contrary, it may be related to innovative development practices described by the Pollution Halo Hypothesis for example, when the international trade or foreign direct investment are negatively associated with pollution emissions. Below, we refer to recent studies illustrating the linkage between economic growth and the EKC.

Using quantile regressions, Wu et al. [13] demonstrated an N-shaped curve between income and carbon dioxide emissions between quantiles 0.50 and 0.95. Then, agglomeration and urbanization factors also influence carbon dioxide emissions.

Nair and Maiti [14] found the Kuznets environmental curve’s assumptions for India’s case.

The recent empirical study by Preciado et al. [15] applied the EKC hypothesis to Latin American countries. Thus, the expectations of the inverted U-shaped curve by Preciado et al. [15] were verified in Bolivia, Colombia, and the Dominican Republic.

2.2. The Link Between Environmental Taxes and Climate Change

Some studies (Maté et al. [1]; Shammre et al. [5]; Murad et al. [16]; Manta et al. [17]) state that the relationship between environmental taxes and carbon dioxide emissions is inconclusive and controversial, i.e., it depends on the level of externality. So, it is a synonym of positive externality when the environmental taxes aim to decrease carbon dioxide emissions. However, Pigou [18], or more recently, the Green Paradox by the economist Sinn [19], associated taxation and the environment shows that there can be a positive relationship between taxation and the environment; in this case, there exists a negative externality since there is environmental degradation. As Sinn [19] referred, environmental legislation can cause the opposite of what is desirable: the increase in fossil energy and, consequently, the increase in carbon dioxide emissions.

Most studies report that environmental taxes promote environmental improvements regarding the relationship between ecological taxes and pollution emissions. The studies by Ahmad et al. [20], Bozatli and Akca [21], and Kafeel et al. [22] support this conclusion. However, several empirical literature studies have also found a positive relationship between environmental taxes and carbon dioxide emissions. In this context, Özmen and Mutascu [2], Ibe et al. [4], and Murad et al. [16] state that this relationship is inconclusive.

Silajdzic and Mehic [23] tested the impact of environmental taxes on carbon dioxide emissions for the experience transition economies. Using the panel cointegration model, the authors demonstrated that the EKC is confirmed. Furthermore, ecological taxes positively affect carbon dioxide emissions, reflecting that taxation can be a negative externality and increase pollution emissions.

The study of Maté et al. [1] used a GMM-system estimator applied to OECD countries and non-OECD countries, and it showed that environmental taxes increased carbon dioxide emissions. Furthermore, the authors validate the environmental Kuznets curve (EKC) hypothesis.

Özmen and Mutascu [2] used a quantile regression to test EU countries. The authors demonstrated that income per capita and squared income per capita are consistent with the environmental Kuznets curve (EKC) predictions. They used two indicators to evaluate the effect of environmental taxes on carbon dioxide emissions, i.e., transport taxes and energy taxes’ impacts on carbon dioxide emissions. The results demonstrated that transport taxes stimulate climate change and greenhouse gas emissions. However, energy taxes aim to decrease carbon dioxide emissions and improve the environment.

The effect of environmental tax on energy consumption was investigated by Šikić and Hodžić [3] using Pooled Mean Group and Mean Group estimators for the EU countries. The results show that greenhouse gas emissions and economic growth positively impact energy consumption in the long run. However, environmental taxes decrease energy consumption.

Considering the South African experience in the empirical study by Ibe et al. [4] compared with the ARDL model, the econometric results demonstrated that population growth and environmental taxes are positively correlated with pollution emissions in the short and long run.

2.3. The Impact of Trade on Climate Change

Two different perspectives explain the effect of trade on carbon dioxide emissions. In the first stage, we can refer to the comparative advantages, and trade theory considers a positive association between trade and pollution emissions. This argument is described by the Heckscher-Ohlin trade model or, more recently, by Copeland and Taylor [24]. Copeland and Taylor’s model describes the relationship between the North and South countries. The second category of models is explained by new trade theories based on monopolistic competition and product differentiation (e.g., Gürtzgen and Rauscher [25]; Haupt [26]; Echazu and Heintzelman [27]; Mehra and Kohli [28]). In general, these models consider the arguments of intra-industry trade that innovation and product differentiation of goods and services aim to decrease pollution emissions.

Considering the empirical evidence, we observe that a decrease in environmental damage can support the effect of trade intensity, openness to trade, or intra-industry trade. In this context, the studies of Leitão and Balogh [29], Roy [30], and Leitão [31] found a negative effect of trade on carbon dioxide emissions. New trade theories explain this result and reflect the improvement of the environment.

The empirical study of Leitão [31] using the ARDL model, quantile regressions, and cointegration models showed that trade and economic growth seek to decrease climate change and the greenhouse effect. The variable of non-renewable energy consumption is directly related to carbon dioxide emissions.

Another interesting contribution considering emerging countries is the empirical work of Zhou et al. [32]. The authors used models like panel cointegration, ARDL, and Driscoll–Kray regression. The empirical results showed that economic growth and trade improve environmental damage. In this case, economic development and trade are negatively correlated with carbon dioxide emissions. Furthermore, the authors found that energy consumption is directly related to carbon dioxide emissions, i.e., stimulates pollution emissions. In the last decade, numerous studies have argued that renewable energy sources can reduce climate change and the greenhouse effect. Below, we reference some studies that illustrate that renewable energy consumption makes it possible to reduce carbon dioxide emissions (e.g., Dogan et al. [9], Tran [33]).

Matenda et al. [34] investigated the experience of South Africa with a cointegration model (FMOLS and DOLS), and their results showed that globalization, economic growth, fossil fuel energy consumption, and technological innovation are positively correlated with carbon dioxide emissions. Then, according to these results, climate change and greenhouse gas emissions increased. However, Matenda et al. [34] demonstrated that renewable energy aims to reduce environmental damage.

The Black Sea Economic Cooperation (BSEC) countries were investigated by Dilanchiev et al. [35]. The study applied panel cointegration methods, and the results demonstrated that urbanization and carbon dioxide emissions are negatively associated with renewable energy.

2.4. The Effect of Renewable Energy on Environmental Improvements

The study of Wang et al. [36] evaluated the effect of renewable energy, non-renewable energy, agriculture, economic growth and carbon dioxide emissions by sub-Saharan African countries. The authors applied a dynamic panel (GMM-DIF and GMM system), FGLS estimator, and quantile regressions, and their results reveal that renewable energy stimulates environmental improvement. Economic growth, energy consumption, and agriculture positively impact carbon dioxide emissions, reflecting an increase in carbon dioxide emissions.

Considering the effect of corruption, renewable energy, growth, and carbon dioxide emissions, the study of Leitão [31] used a panel cointegration (FMOLS and DOLS), and the econometric results demonstrated that economic growth and corruption are positively associated with carbon dioxide emissions. Nevertheless, renewable energy and trade aim to decrease carbon dioxide emissions.

Kuldasheva and Salahodjaev [37] considered the impacts of renewable energy and carbon dioxide emissions using fixed effects, random effects, and dynamic panel data (GMM system). Considering the econometric model, the authors demonstrated that the lagged variable of CO2 presents a positive sign, showing that pollution emissions increase in the long run. However, renewable energy negatively correlates with carbon dioxide emissions, reflecting that clean energy promotes environmental improvement. This empirical study also confirms the EKC hypothesis.

Another study by Salahodjaev and Sadikov [38] revealed that the lagged variable of pollution emissions presents a positive effect, showing that carbon dioxide emissions increased in the long run. Nevertheless, renewable energy and government size aim to decrease climate change.

3. Data and Methodology

The relationship between environmental taxes and carbon dioxide emissions is relatively new in energy economics (e.g., Özmen and Mutascu [2], Ibe et al. [4], and Murad et al. [16]). However, as we refer to in the literature review, the effects of environmental taxes are controversial and inconclusive. However, there is a consensus in the literature that environmental taxes stimulate externalities in the environment. Our study also considers the effects of renewable energy, economic growth, and open trade on carbon dioxide emissions. The econometric strategy utilizes panel data from 38 OECD countries (namely Austria, Australia, Belgium, Canada, Colombia, Chile, Costa Rica, Czech Republic, Denmark, Estonia, France, Finland, Greece, Germany, Hungary, Iceland, Ireland, Israel, Italy, Japan, Korea, Latvia, Lithuania, Luxembourg, Mexico, Norway, New Zealand, Netherlands, Poland, Portugal, Slovenia, Slovakia, Switzerland, Spain, Turkey, USA, United Kingdom) for the period 1995–2022.

As an economic strategy, we applied the dynamic panel data (GMM system) developed by Blundell and Bond [39] because this estimator aims to solve endogeneity. The Sargan test gives information about the quality of instruments used in this regression. Moreover, the GMM system also includes statistical information about serial autocorrelations, considering the Arellano and Bover [40] test.

This empirical study also used the panel cointegration models FMOLS and DOLS to examine the long-term relationship between explanatory variables (environmental taxes, income per capita, renewable energy, and international trade) and the dependent variable (carbon dioxide emissions). We also considered the Pedroni cointegration test to observe cointegration between the variables used in this investigation.

This study considers the panel unit root test (e.g., Im, Pesaran, and Shin [41]) and the second-generation unit root test (Pesaran [42]) to test cross-sectional dependence.

Furthermore, to test the properties of variables, we applied the multicollinearity test (variance inflation factor-VIF), cross-sectional dependence test, and Pairwise Dumitrescu Hurlin [43]. We also used the quantile regression analysis between environmental taxes, economic growth, renewable energy, and international trade on carbon dioxide emissions.

3.1. Hypotheses Formulated

Below, we present the hypotheses to be tested in this research according to the literature review and the theoretical models.

Hypothesis 1:

Economic growth is directly associated with climate change.

In general, the literature states that economic activities can contribute to the degradation of the environment (e.g., Tran [33], Adeleye et al. [44], Zhu et al. [45], and Abbas et al. [46]). Moreover, the empirical studies of Savranlar et al. [8], Dogan et al. [9] and Sultana et al. [10] also found a positive effect of economic growth on carbon dioxide emissions. The theory of the environmental Kuznets curve (EKC) proposed, for example, by Grossman and Krueger [11] and Dinda [12], supports this hypothesis.

GDP-gross domestic product per capita expressed in US dollars, from the World Bank indicators.

Hypothesis 2:

Environmental taxes increase (decrease) greenhouse emissions.

As observed through the literature review, there are two different perspectives.

Thus, the studies by Maté et al. [1], Özmen and Mutascu [2], and Ibe et al. [4] demonstrate that environmental taxes promote negative externalities by increasing carbon dioxide emissions.

A different perspective is presented by the studies of Savranlar et al. [8], Shammre et al. [5], and Saqib et al. [47], showing that environmental taxes contribute to decarbonization and ecological improvement.

Theoretically, the models of Pigou [18] or the Green Paradox model proposed by Sinn [19] allow us to justify the two positions presented previously.

ENTAXES represents environmental taxes and the percentage of per capita income of OECD environmentally related tax revenue.

Hypothesis 3:

Renewable energies stimulate environmental improvement in OECD countries.

As observed in the previous section, cleaner energies allow the reduction of greenhouse gas emissions and encourage sustainable development. The studies by Leitão [31], Matenda et al. [34], Wang et al. [36], and Kuldasheva and Salahodjaev [37] demonstrate that there is a negative relationship between renewable energy and carbon dioxide emissions. The use of renewable energy and sustainable practices is supported by international conventions on the environment and sustainability promoted by the EU, the United Nations, and the OECD.

Hypothesis 4:

International trade promotes the reduction of carbon dioxide emissions; on the contrary, it accentuates environmental degradation.

Regarding the relationship between trade and carbon dioxide emissions, we found that there are different perspectives. On the one hand, trade may be associated with increased polluting emissions, which the Heckscher-Ohlin model and the Haven Pollution Hypothesis explain. However, there are studies such as Gürtzgen and Rauscher [25], Haupt [26], Echazu and Heintzelman [27], Mehra and Kohli [28], Roy [30] and Leitão and Balogh [29] that defend a negative correlation between trade and carbon dioxide emissions, reflecting that trade is associated with innovation and product differentiation.

3.2. Model Specification and Definition of Variables

Below, we formulate the following general equation, considering the variables used in this research:

LogCO2 = β0 + β1LogGDPit + β2LogENTAXESit + β3LogREWit + β4LogTRADEit + δt + ηit + εit

The dependent variable is carbon dioxide emissions (LogCO2), and the explanatory variables are economic growth (LogGDP), environmental taxes (LogENTAXES), renewable energy consumption (LogREW), and openness to trade (LogTRADE). The constant term is represented by β0. The common deterministic trend assumes δt, ηit states the unobserved time and the error term by εit. Then, the expected signs are β1 > 0, β2 > 0, or β2 < 0, β3 < 0, and β4 > 0, or β4 < 0. All variables are presented in the logarithmic form.

The second equation represents the dynamic panel data equation:

LogCO2 = β0 + β1LogCO2t−1 + β2LogGDPit + β3LogENTAXESit + β4LogREWit + β5LogTRADEit + δt + ηit + εit

The quantile regression assumes the following equation:

Q (LogCO2it) = (La) + β1τLogGDPit + β2τLogENTAXESit + β3τLogREWit + β4τLogTRADEit + µit

Equation (3) (La) represents the model’s constant, and τ represents the model’s independent variables.

In Table 1, we present the description and the sources of the variables used in this study.

Table 1.

Description of variables and sources.

4. Results

The econometric results consider the effects of economic growth, environmental taxes, renewable energy, and openness to trade on carbon dioxide emissions. This section begins to observe the properties of variables, namely descriptive statistics, multicollinearity, cointegration of variables, and panel unit root tests. Panel cointegration (FMOLS and DOLS), quantile regression (QR), and the dynamic panel data (GMM system) model were applied to study the determinants of carbon dioxide emission in OECD countries. Moreover, we also consider Dumitrescu and Hurlin’s [43] methodology to assess the unidirectional or bidirectional causality between the variables used in this research.

4.1. General Statistics and Descriptive Statistics

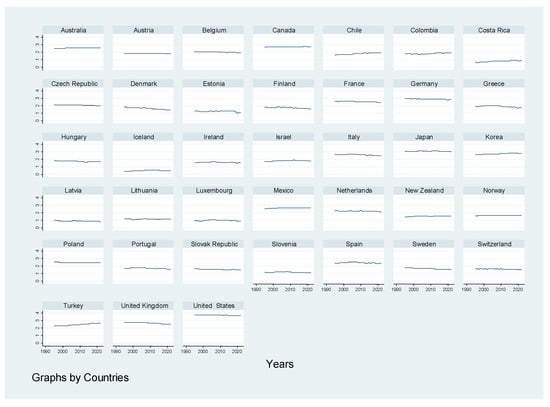

Figure 1 shows the distribution of carbon dioxide emissions for the 38 OECD countries in logarithmic form. According to the World Bank dataset, the countries with the highest carbon dioxide emissions are Canada, France, Germany, Italy, Japan, Korea, Mexico, Poland, Turkey, the United Kingdom, and the United States.

Figure 1.

Carbon dioxide emissions of 38 OECD countries in logarithm form. Source: Own composition from the World Bank indicators database.

In Table 2, we can view the descriptive statistics of the variables under study. The variables under study, income per capita (LogGDP) and environmental taxes (LogENTAXES), present the highest maximum values. Furthermore, it should be noted that kurtosis shows a positive tendency for all variables and asymmetric negative values, namely, environmental taxes (LogENTAXES) and renewable energy (LogREW).

Table 2.

Descriptive statistics.

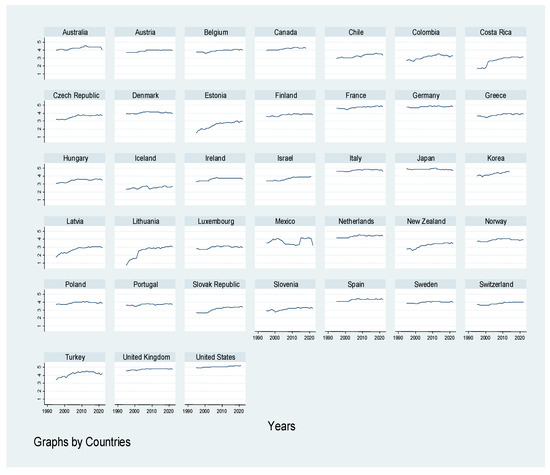

Figure 2 presents the distribution of environmental taxes for the 38 OECD countries in logarithmic form. According to the OECD dataset, the countries with the highest environmental tax are Australia, France, Germany, Italy, Japan, Korea, Netherlands, Poland, Turkey, the United Kingdom, and the United States.

Figure 2.

Environmental tax to 38 OECD countries in logarithm form. Source: Own composition from OECD database.

The variance inflation test is presented in Table 3. It is possible to conclude that the income per capita (LogGDP), environmental taxes (LogENTAXES), renewable energy (LogREW), and openness to trade (LogTRADE) do not have problems of multicollinearity between them.

Table 3.

Multicollinearity test—VIF (variance inflation test).

Table 4 presents the unit root test using the criterion of Im, Pesaran, and Shin [41]. All variables considered in this research are stationary in first differences. In the next step, we will consider the cointegration test.

Table 4.

Panel unit root test.

The Pedroni [48] cointegration test is considered in Table 5. The results show statistical significance at within-dimensional and between-dimensional levels, revealing cointegration among the variables applied in this investigation.

Table 5.

Pedroni residual cointegration test.

The cross-section test is considered in Table 6. The results show statistical significance at a 1% level using Pesaran [42], demonstrating that the variables in this research have cross-dependence. Then, according to these results, the second-generation unit root panel test must be applied.

Table 6.

Cross-section test.

Table 7 presents the results for stationarity using the second-generation criterion (CIPS test), including constant and trend. The variables of carbon dioxide emissions (LogCO2), economic growth (LogGDP), environmental taxes (LogENTAXES), renewable energy (LogREW), and openness to trade (LogTRADE) are stationary according to critical values of reference.

Table 7.

CIPS test—second-generation unit root criterion.

4.2. Econometric Results and Interpretation

Table 8 reports the econometric results using the panel cointegration FMOLS—Fully Modified Least Squares—and DOLS—Dynamic Least Squares. The results between these estimators are similar.

Table 8.

Panel cointegration.

The coefficient of economic growth (LogGDP) is statistically significant at a 1% level and positively affects carbon dioxide emissions. This result reveals that economic growth is associated with greenhouse gas emissions and climate change. The empirical studies of Savranlar et al. [8], Dogan et al. [9] and Sultana et al. [10] also found a positive effect of economic growth on carbon dioxide emissions.

Regarding the effect of environmental taxes (LogENTAXES) on carbon dioxide emissions, we observe a positive impact of environmental taxes on pollution emissions, and the variable is statistically significant at the 1% and 10% levels, respectively. This result is explained by negative externality, showing that fiscal policy increases carbon dioxide emissions. This result has support from previous studies such as Maté et al. [1], Özmen and Mutascu [2], and Ibe et al. [4].

Several studies (e.g., Dogan et al. [9]; Tran [33]) demonstrate that the consumption of renewable energy allows achieving environmental improvements and air quality. Our results are along these lines. The coefficient of renewable energy (LogREW) hurts carbon dioxide emissions and is statistically significant at the 1% level. Studies by Leitão [31] and Matenda et al. [34] found the same trend.

The variable of openness to trade (LogTRADE) reduces carbon dioxide emissions, with statistics significant at 1%. This result is described by innovation and product differentiation of goods and services and aims to decrease pollution emissions (e.g., Gürtzgen and Rauscher [25]; Haupt [26]; Echazu and Heintzelman [27]; Mehra and Kohli [28]. The previous empirical studies of Leitão and Balogh [29] and Roy [30]) also defend this argument.

Table 9 presents the estimates obtained using quantile regression (QR) from 25%, 50%, 75%, and 90% for each coefficient.

Table 9.

Panel quantile regressions.

The per capita income variable (LogGDP) presents statistical significance at 10% and 1% in the quartiles, 50%, 75%, and 90%. In the 75% and 90% quartiles, the variable positively affects carbon dioxide emissions, demonstrating that the OECD countries and their economic activities are associated with greenhouse gas emissions. The studies by Savranlar et al. [8], Dogan et al. [9], Sultana et al. [10], and Leitão [31] also found the same trend.

Regarding environmental taxes (LogENTAXES), the econometric results positively affect pollution emissions, reflecting a negative externality. The variable is statistically significant at 1% across the all-quantile regressions in the analysis. The empirical studies of Maté et al. [1], Özmen and Mutascu [2], and Ibe et al. [4] also found similar results. Furthermore, the result is in line with the theses of Pigou [18] and Sinn [19], which highlight that environmental taxes can have an undesirable effect compared to what was expected.

The studies by Sultana et al. [10], Matenda et al. [34], Leitão [49], and Balsalobre et al. [50] demonstrate that renewable energy reduces carbon dioxide emissions and improves environmental quality. Our results find this effect across the quantile regressions. The coefficient is statistically significant at a 1% level in the quartile regression for 25%, 50%, and 75%, respectively.

The coefficient of international trade (LogTRADE) has a negative effect, with statistical significance at 1% for all quartiles. Based on our results, global trade is explained by innovation and product differentiation, and trade aims to decrease environmental and ecological problems. Therefore, Leitão and Balogh [29], Roy [30], and Leitão [31] found a negative effect of trade on carbon dioxide emissions, and they give support to our result.

Next, we present the econometric results using the dynamic panel, allowing us to assess the adjustment capacity of OECD economies in the face of carbon dioxide emissions. Thus, the GMM system will enable us to observe whether the OECD economies follow a smooth adjustment of carbon dioxide emissions or whether, on the contrary, the adjustment of the economies is associated with the increase in carbon dioxide emissions and the issues of asymmetries between the economies.

Table 10 shows the impact of economic growth, environmental taxes, renewable energy, and trade on carbon dioxide emissions using dynamic panel data (GMM system).

Table 10.

GMM-system estimator.

The lagged variable of carbon dioxide emissions (LogCO2t−1) aims to evaluate the long-run effects. According to our results, in the long run, carbon dioxide emissions and pollution emissions will increase. The studies of Maté et al. [1], Shammre et al. [5], Wang et al. [36], Leitão and Balsolobre-Lorente [51] and Jiang and Khan [52] also found a positive sign.

The coefficient of economic growth (LogGDP) positively affects carbon dioxide emissions, reflecting that economic activities stimulate climate change and pollution emissions. This result supports Ibe et al. [4] and Leitão and Balsolobre-Lorente’s [51] studies.

The coefficient of environmental taxes (LogENTAXES) demonstrates that fiscal policy stimulates negative externalities. The variable presents statistically significant at a 1% level. As we referred, the studies of Maté et al. [1], Ibe et al. [4], and Özmen and Mutascu [2] also present a positive effect of environmental taxes on carbon dioxide emissions.

According to previous studies, the renewable energy variable (LogREW) stimulates the improvement of environmental damage.

The coefficient of international trade (LogTRADE) negatively affects carbon dioxide emissions. According to international trade theories, this result reveals innovations and product differentiation that aim to decrease pollution emissions.

Finally, Arellano-Bond’s [53] serial correlation tests do not present autocorrelation problems (AR2—second order). Also, the Sargan test allows us to infer that the instruments used are adequate.

In the next step, we present the bidirectional and unidirectional causality between the variables considered in this investigation based on the methodology of Dumitrescu and Hurlin [43]. The recent studies of Zhou et al. [32], Li and Ayub [54], and Georgescu et al. [55] used this methodology.

Table 11 shows a bidirectional relationship between environmental taxes (LogENTAXES) and carbon dioxide emissions (LogCO2). The empirical study of Zhou et al. [32] also found some conclusions. We also observe a bidirectional relationship between openness to trade (LogTRADE) and renewable energy (LogREW).

Table 11.

Causality between the variables using the methodology of Dumitrescu and Hurlin [43].

The results demonstrate a unidirectional relationship between carbon dioxide emissions (LogCO2) and economic growth (LogGDP). Georgescu et al. [55] also found the exact relationship between the variables.

Furthermore, we observe a unidirectional causality between carbon dioxide emissions (LogCO2) and renewable energy (LogREW). The openness to trade (LogTRADE) presents a unidirectional relationship between carbon dioxide emissions (LogCO2) and economic growth (LogGDP).

Finally, we observe a unidirectional relationship between renewable energy (LogREW) and environmental taxes (LogENTAXES). There is a unidirectional relationship between openness to trade (LogTRADE) and environmental taxes (LogENTAXES).

Next, we present the conclusions section of this investigation, which highlights the results and recommendations for policymakers. Moreover, we refer to some contributions for future work.

5. Conclusions

This research considers the relationship between environmental taxes and carbon dioxide emissions for 38 OECD countries. This article also reflects the effects of international trade, economic growth, and renewable energy on carbon dioxide emissions. This study establishes a link between environmental economics and international taxation. However, it is essential to notice the existence of some areas that border regional and international economics. From a theoretical and empirical study point of view, we seek to discuss the various interdependence relationships between the variables used in this investigation.

Considering the empirical analysis, the study evaluated the properties of the variables used in this study, namely the unit root test, Pedroni [48] cointegration test, and multicollinearity test. Then, it was necessary to verify second-generation unit root tests (CIPS test). In this context, it is concluded that the variables of carbon dioxide emissions, environmental taxes, renewable energies, international trade, and economic growth present stationary data, considering the first-generation tests. However, the Pesaran test [42] shows that the variables in this research have cross-dependence. In this line, the second-generation unit root test (CIPS test) was used, and it was verified that the variables are stationary, considering this methodology.

Regarding the econometric model specification, different estimators were used in panel data (cointegration models—FMOLS, DOLS, quantile regressions, and the GMM system). Consequently, the aim is to observe whether the behavior of the independent variables maintains the same trend or if there is a change in the coefficients using different estimation techniques, and it is concluded that the coefficients maintain the same trend. The long-term effects were obtained by FMOLS, DOLS cointegration models, and the GMM system.

Our results show that environmental taxes stimulate carbon dioxide emissions and climate change. This result demonstrates that negative externalities are explained by taxation. In this line, the taxes showed asymmetry in environmental degradation. This result is based on the hypothesis that environmental taxes increase greenhouse gas emissions. The empirical studies of Maté et al. [1], Özmen and Mutascu [2], and Ibe et al. [4] defend that environmental taxes push negative externalities.

As shown, the lagged variable of carbon dioxide emissions presented a positive signal, explaining that in the long term, carbon dioxide emissions appear to increase. The empirical studies of Maté et al. [1], Shammre et al. [5], Wang et al. [36], Leitão and Balsolobre-Lorente [51] and Jiang and Khan [52] also present a positive effect of carbon dioxide emission on the long run.

An interesting conclusion is that international trade reduces carbon dioxide emissions, demonstrating that trade flows in relationship between the 38 OECD countries are based on assumptions associated with innovation and product differentiation, as justified by the study by Gürtzgen and Rauscher [25], Haupt [26], Echazu and Heintzelman [27], Mehra and Kohli [28], Roy [30] and Leitão and Balogh [29]. According to the results obtained, it is possible to conclude that hypothesis 4 was validated.

Renewable energies allow us to improve air quality and the environment. In fact, previous studies demonstrated that there is a negative link between renewable energies and carbon dioxide emissions. As we demonstrate, these results are supported by studies by Matenda et al. [34], Wang et al. [36], Leitão [31], and Kuldasheva and Salahodjaev [37]. Moreover, this result is supported by international environmental and sustainability conventions, which the EU (European Union), the United Nations, and the OECD promote. Indeed, these international organizations aim to contribute to sustainable development.

Furthermore, the methodology of Dumitrescu and Hurlin [43] and Leitão [49] showed a bidirectional relationship between environmental taxes (LogENTAXES) and carbon dioxide emissions (LogCO2) and a bidirectional relationship between openness to trade (LogTRADE) and renewable energy (LogREW). In this context, we can refer to the studies by Ahmed et al. [56] and Onwe et al. [57] that also used this methodology.

Recommendations and Further Research

In this subsection, we present some implications for economic and social policy. According to our study, policymakers should be aware that environmental taxes can give rise to negative externalities. Our results demonstrate that international taxation via the implementation of environmental taxes has an undesirable effect; that is, it stimulates an increase in carbon dioxide emissions and environmental degradation. In this sense, greater fiscal harmonization is necessary for the environment and, consequently, an incentive for countries and companies that comply with sustainable measures.

Another important implication for the economy and society is related to the fact that cleaner energies contribute to environmental improvement. Several studies have advanced this conclusion, and it fits in with the various assumptions defined in the 2030 Agenda for Sustainability.

Regarding trade flows, it has already been stated that our results are associated with innovation and product differentiation practices, contributing to environmental improvement and reducing the greenhouse effect.

This research, like any other work, has limitations, so we present some perspectives for future research work below. Therefore, it will be interesting to compare the econometric results not only to the 38 OECD countries but also to establish some degree of comparison with the 27 EU and G7 economies. We also believe that the impact of the composite of economic complexity (Balsolobre-Lorente [53]), the human development index (Leitão [49]), renewable energies, and natural resources should be introduced in future work in econometric models, in addition to and upstream of environmental taxes on carbon dioxide emissions.

Furthermore, it seems interesting to introduce the urban population and foreign direct investment as control variables in future studies. As in previous studies, evaluating the relationship between variables and pollutant emissions and correlating them with the theoretical Kuznets environmental curve (EKC) and the Pollution Haven Hypothesis versus the Pollution Halo hypothesis will be interesting.

On the other hand, it is essential to assess the short and long-term effects and disaggregate economies by different levels of development. In this context, the panel ARDL model and the GMM-system estimator appear to be more effective econometric strategies for assessing short- and long-term effects (Leitão and Balsolobre-Lorente [51], Shammre et al. [5], Wang et al. [36], Maté et al. [1] and Jiang and Khan [52]).

The perspective of the regional and urban economy with industrial concentration and cluster flows with scale economies can be explored in future work to complement the analysis presented. The study revealed that environmental taxes promote asymmetries in the environment among the OECD countries. It may be interesting to subdivide the analysis regarding the level of development of the economies.

Funding

This research received no external funding.

Data Availability Statement

The data used in this research were collected from the World Bank World Development Indicators and the OECD. These are available in open access.

Conflicts of Interest

The author declares no conflicts of interest.

References

- Máté, D.; Torok, L.; Kiss, J.T. The Impacts of Energy Supply and Environmental Taxation on Carbon Intensity. Technol. Econ. Dev. Econ. 2023, 29, 1195–1215. [Google Scholar] [CrossRef]

- Özmen, I.; Mutascu, M. Don’t look earth: Environmental taxes effect on CO2 emissions, evidence from moments quantile regression for EU countries. Environ. Dev. Sustain. 2025, 27, 4619–4658. [Google Scholar] [CrossRef]

- Šikić, T.F.; Hodžić, S. Can environmental taxes decrease final energy consumption in the old and new EU countries? Econ. Res.-Ekonom. Istraz. 2023, 36, 2271968. [Google Scholar] [CrossRef]

- Ibe, G.I.; Ezeaku, H.C.; Okpara, I.I.; Eze, E.F.; Igwemeka, E.; Ubani, O. Asymmetric effect of environmental tax on CO2 emissions embodied in domestic final demand in South Africa: A NARDL approach. Afr. Dev. Rev. 2024, 36, 55–69. [Google Scholar] [CrossRef]

- Al Shammre, A.S.; Benhamed, A.; Ben-Salha, O.; Jaidi, Z. Do Environmental Taxes Affect Carbon Dioxide Emissions in OECD Countries? Evidence from the Dynamic Panel Threshold Model. Systems 2023, 11, 307. [Google Scholar] [CrossRef]

- Balsalobre-Lorente, D.; Leitão, N.C.; Bekun, F.V. Fresh Validation of the Low Carbon Development Hypothesis under the EKC Scheme in Portugal, Italy, Greece and Spain. Energies 2021, 14, 250. [Google Scholar] [CrossRef]

- Leal, P.H.; Marques, A.C. The evolution of the environmental Kuznets curve hypothesis assessment: A literature review under a critical analysis perspective. Heliyon 2022, 8, e11521. [Google Scholar] [CrossRef]

- Savranlar, B.; Ertas, S.A.; Aslan, A. The role of environmental tax on the environmental quality in EU counties: Evidence from panel vector autoregression approach. Environ. Sci. Pollut. Res. 2024, 31, 35769–35778. [Google Scholar] [CrossRef] [PubMed]

- Dogan, B.; Chu, L.K.; Ghosh, S.; Truong, H.H.D.; Balsalobre-Lorente, D. How environmental taxes and carbon emissions are related in the G7 economies? Renew. Energy 2022, 187, 645–656. [Google Scholar] [CrossRef]

- Sultana, T.; Hossain, M.S.; Voumik, L.C.; Raihan, A. Does globalization escalate carbon emissions? Empirical evidence from selected next-11countries. Energy Rep. 2023, 10, 86–98. [Google Scholar] [CrossRef]

- Grossman, G.; Krueger, A. Environmental Impacts of a North American Free Trade Agreement; Research Working Paper 1991, No. 3194; NBER (National Bureau of Economics): Cambridge, MA, USA, 1991. [Google Scholar] [CrossRef]

- Dinda, S. Environmental Kuznets Curve Hypothesis: A Survey. Ecol. Econ. 2004, 49, 431–455. [Google Scholar] [CrossRef]

- Wu, R.; Xie, Z.; Wang, J.; Wang, S. Estimating the environmental Kuznets curve and its influencing factors of CO emissions: Insights from development stages and rebound effects. Appl. Geogr. 2025, 174, 103475. [Google Scholar] [CrossRef]

- Nair, A.; Mait, S. Revisiting Environmental Kuznets Curve (EKC) and Renewable Energy Consumption in India. Asian J. Econ. Bus. Account. 2025, 25, 387–396. [Google Scholar] [CrossRef]

- Preciado, A.L.J.; García, J.A.; Aké, S.C.; Martínez, F.V. On the Latin America Evidence for the Environmental Kuznets Curve: A Two-Stage Approach using K-means Clustering and Polynomial Regression. Int. J. Energy Econ. Policy 2025, 2, 409–420. [Google Scholar] [CrossRef]

- Murad, S.M.W.; Rahman, A.; Mohsin, A.K.M. From policy to progress: Environmental taxation to mitigate air pollution in OECD countries. J. Environ. Manag. 2025, 374, 124143. [Google Scholar] [CrossRef]

- Manta, A.G.; Doran, M.N.; Bădîrcea, R.M.; Badareu, G.; Țăran, A.M. Does the implementation of a Pigouvian tax be considered an effective approach to address climate change mitigation? Econ. Anal. Policy 2023, 80, 1719–1731. [Google Scholar] [CrossRef]

- Pigou, A.C. A Study in Public Finance, 2nd ed.; Macmillan: London, UK, 1929. [Google Scholar]

- Sinn, H.W. Public Policies against Global Warming: A Supply Side Approach. Int. Tax Public Financ. 2008, 15, 360–394. [Google Scholar] [CrossRef]

- Ahmad, M.; Li, F.X.; Wu, Q. Carbon taxes and emission trading systems: Which one is more effective in reducing carbon emissions?—A meta-analysis. J. Clean. Prod. 2023, 476, 143761. [Google Scholar] [CrossRef]

- Bozatli, O.; Akca, H. The effects of environmental taxes, renewable energy consumption and environmental technology on the ecological footprint: Evidence from advanced panel data analysis. J. Environ. Manag. 2023, 345, 118857. [Google Scholar] [CrossRef]

- Kafeel, K.; Zhou, J.; Phetkhammai, M.; Heyan, L.; Khan, S. Green Innovation and Environmental Quality in OECD Countries: The Mediating Role of Renewable Energy and Carbon Taxes. Environ. Sci. Pollut. Res. 2024, 31, 2214–2227. [Google Scholar] [CrossRef]

- Silajdzic, S.; Mehic, E. Do Environmental Taxes Pay Off? The Impact of Energy and Transport Taxes on CO2 Emissions in Transition Economies. South East Eur. J. Econ. Bus. 2018, 13, 126–143. [Google Scholar] [CrossRef]

- Copeland, B.R.; Taylor, M.S. North-South Trade and the Environment. Q. J. Econ. 1994, 109, 755–787. [Google Scholar] [CrossRef]

- Gürtzgen, N.; Rauscher, M. Environmental Policy, Intra-Industry Trade and Transfrontier Pollution. Environ. Resour. Econ. 2000, 17, 59–71. [Google Scholar] [CrossRef]

- Haupt, A. Environmental Policy in Open Economies and Monopolistic Competition. Environ. Resour. Econ. 2006, 33, 143–167. [Google Scholar] [CrossRef]

- Echazu, L.; Heintzelman, M. Environmental regulation and love for variety. Rev. Int. Econ. 2018, 27, 413–429. [Google Scholar] [CrossRef]

- Mehra, M.K.; Kohli, D. Environmental regulation and intra-industry trade. Int. Econ. J. 2018, 32, 133–160. [Google Scholar] [CrossRef]

- Leitão, N.C.; Balogh, J.M. The impact of intra-industry trade on carbon dioxide emissions: The case of the European Union. Agric. Econ. 2020, 66, 203–214. [Google Scholar] [CrossRef]

- Roy, J. On the Environmental Consequences of Intraindustry Trade. J. Environ. Econ. Manag. 2017, 83, 50–67. [Google Scholar] [CrossRef]

- Leitão, N.C. Testing the role of trade on carbon dioxide emissions in Portugal. Economies 2021, 9, 22. [Google Scholar] [CrossRef]

- Zhou, R.; Guan, S.; He, B. The Impact of Trade Openness on Carbon Emissions: Empirical Evidence from Emerging Countries. Energies 2025, 18, 697. [Google Scholar] [CrossRef]

- Tran, H.V. Asymmetric Role of Economic Growth, Globalization, Green Growth, and Renewable Energy in Achieving Environmental Sustainability. Emerg. Sci. J. 2023, 8, 449–462. [Google Scholar] [CrossRef]

- Matenda, F.R.; Raihan, A.; Zhou, H.; Sibanda, M. The influence of economic growth, fossil and renewable energy, technological innovation, and globalisation on carbon dioxide emissions in South Africa. Carbon Res. 2024, 3, 69. [Google Scholar] [CrossRef]

- Dilanchiev, A.; Nuta, F.; Khan, I.; Khan, H. Urbanization, renewable energy production, and carbon dioxide emission in BSEC member states: Implications for climate change mitigation and energy markets. Environ. Sci. Pollut. Res. 2023, 30, 67338–67350. [Google Scholar] [CrossRef]

- Wang, J.; Jiang, C.; Li, M.; Zhang, S.; Zhang, X. Renewable energy, agriculture, and carbon dioxide emissions nexus: Implications for sustainable development in sub-Saharan African countries. Sustain. Environ. Res. 2023, 33, 31. [Google Scholar] [CrossRef]

- Kuldasheva, Z.; Salahodjaev, R. Renewable Energy and CO2 Emissions: Evidence from Rapidly Urbanizing Countries. J. Knowl. Econ. 2023, 14, 1077–1090. [Google Scholar] [CrossRef]

- Salahodjaev, R.; Sadikov, A. Examining the Nexus Between Renewable Energy, CO2 Emissions, and Economic Factors: Implications for Countries Marked by High Rates of Coronary Heart Disease. Energies 2024, 17, 6057. [Google Scholar] [CrossRef]

- Blundell, R. and Bond, S. Initial Conditions and Moment Restrictions in Dynamic Panel Data Models. J. Econ. 1998, 87, 115–143. [Google Scholar] [CrossRef]

- Arellano, M.; Bover, O. Another Look at the Instrumental Variable Estimation of Error-Component Models. J. Econ. 1995, 68, 29–52. [Google Scholar] [CrossRef]

- Im, K.S.; Pesaran, M.H.; Shin, Y. Testing for Unit Roots in Heterogeneous Panels. J. Econom. 2003, 115, 53–74. [Google Scholar] [CrossRef]

- Pesaran, M.H. A Simple Panel Unit Root Test in the Presence of Cross Section Dependence. J. Appl. Econ. 2007, 22, 265–312. [Google Scholar] [CrossRef]

- Dumitrescu, E.-I.; Hurlin, C. Testing for Granger Non-Causality in Heterogeneous Panels. Econ. Model. 2012, 29, 1450–1460. [Google Scholar] [CrossRef]

- Adeleye, B.N.; Akam, D.; Inuwa, D.; James HTBasila, D. Does globalization and energy usage influence carbon emissions in South Asia? An empirical revisit of the debate. Environ. Sci. Pollut. Res. 2023, 30, 36190–36207. [Google Scholar] [CrossRef]

- Zhu, Y.; Taylor, D.; Wang, Z. The Role of Environmental Taxes on Carbon Emissions in Countries Aiming for Net-Zero Carbon Emissions: Does Renewable Energy Consumption Matter? Renew. Energy 2023, 218, 1192339. [Google Scholar] [CrossRef]

- Abbas, M.; Yang, L.; Lahr, M.L. Globalization’s effects on South Asia’s carbon emissions, 1996–2019: A multidimensional panel data perspective via FGLS. Human. Soc. Sci. Commun. 2024, 11, 1171. [Google Scholar] [CrossRef]

- Saqib, N.; Radulescu, M.; Usman, M.; Balsalobre-Lorente, D.; Cilan, T. Environmental Technology, Economic Complexity, Renewable Electricity, Environmental Taxes and CO2 Emissions: Implications for Low-Carbon Future in G-10 bloc. Heliyon 2023, 9, e16457. [Google Scholar] [CrossRef] [PubMed]

- Pedroni, P. Critical values for cointegration tests in heterogeneous panels with multiple regressors. Oxf. Bull. Econ. Stat. 1999, 61, 653–670. [Google Scholar] [CrossRef]

- Leitão, N.C. The Link between Human Development, Foreign Direct Investment, Renewable Energy, and Carbon Dioxide Emissions in G7 Economies. Energies 2024, 17, 978. [Google Scholar] [CrossRef]

- Balsalobre-Lorente, D.; Parente, C.C.S.; Leitão, N.C.; Cantos, C.J.M. The Influence of Economic Complexity Processes and Renewable Energy on CO2 emissions of BRICS. What About Industry 4.0? Resour. Policy 2023, 82, 103547. [Google Scholar] [CrossRef]

- Leitão, N.C.; Lorente, D.B. The Linkage between Economic Growth, Renewable Energy, Tourism, CO2 Emissions, and International Trade: The Evidence for the European Union. Energies 2020, 13, 4838. [Google Scholar] [CrossRef]

- Jiang, Y.; Khan, H. The relationship between renewable energy consumption, technological innovations, and carbon dioxide emission: Evidence from two-step system GMM. Environ. Sci. Pollut. Res. 2023, 30, 4187–4202. [Google Scholar] [CrossRef]

- Arellano, M.; Bond, S. Some Tests of Specification for Panel Data: Monte Carlo Evidence and an Application to Employment Equations. Rev. Econ. Stud. 1991, 58, 277–297. [Google Scholar] [CrossRef]

- Li, C.; Ayub, B. The green response of financial inclusion, infrastructure development and renewable energy to the environmental sustainability: A newly evidence from OECD economies. PLoS ONE 2025, 20, e0314731. [Google Scholar] [CrossRef] [PubMed]

- Georgescu, I.A.; Oprea, S.V.; Bara, A. Analyzing Causality and Cointegration of Macroeconomics and Energy-Related Factors of Nordic and SEE European Countries. J. Bus. Econ. Manag. 2024, 25, 494–515. [Google Scholar] [CrossRef]

- Ahmed, N.; Sheikh, A.A.; Hamid, Z.; Senkus, P.; Borda, R.C.; Wysokińska-Senkus, A.; Glabiszewski, W. Exploring the Causal Relationship among Green Taxes, Energy Intensity, and Energy Consumption in Nordic Countries: Dumitrescu and Hurlin Causality Approach. Energies 2022, 15, 5199. [Google Scholar] [CrossRef]

- Joshua Chukwuma Onwe, J.C.; Bandyopadhyay, A.; Hamid, I.; Rej, S.; Hossain, M.E. Environment sustainability through energy transition and globalization in G7 countries: What role does environmental tax play? Renew. Energy 2023, 218, 119302. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).