Economy or Climate? Impact of Policy Uncertainty on Price Volatility of China’s Carbon Emission Trading Markets

Abstract

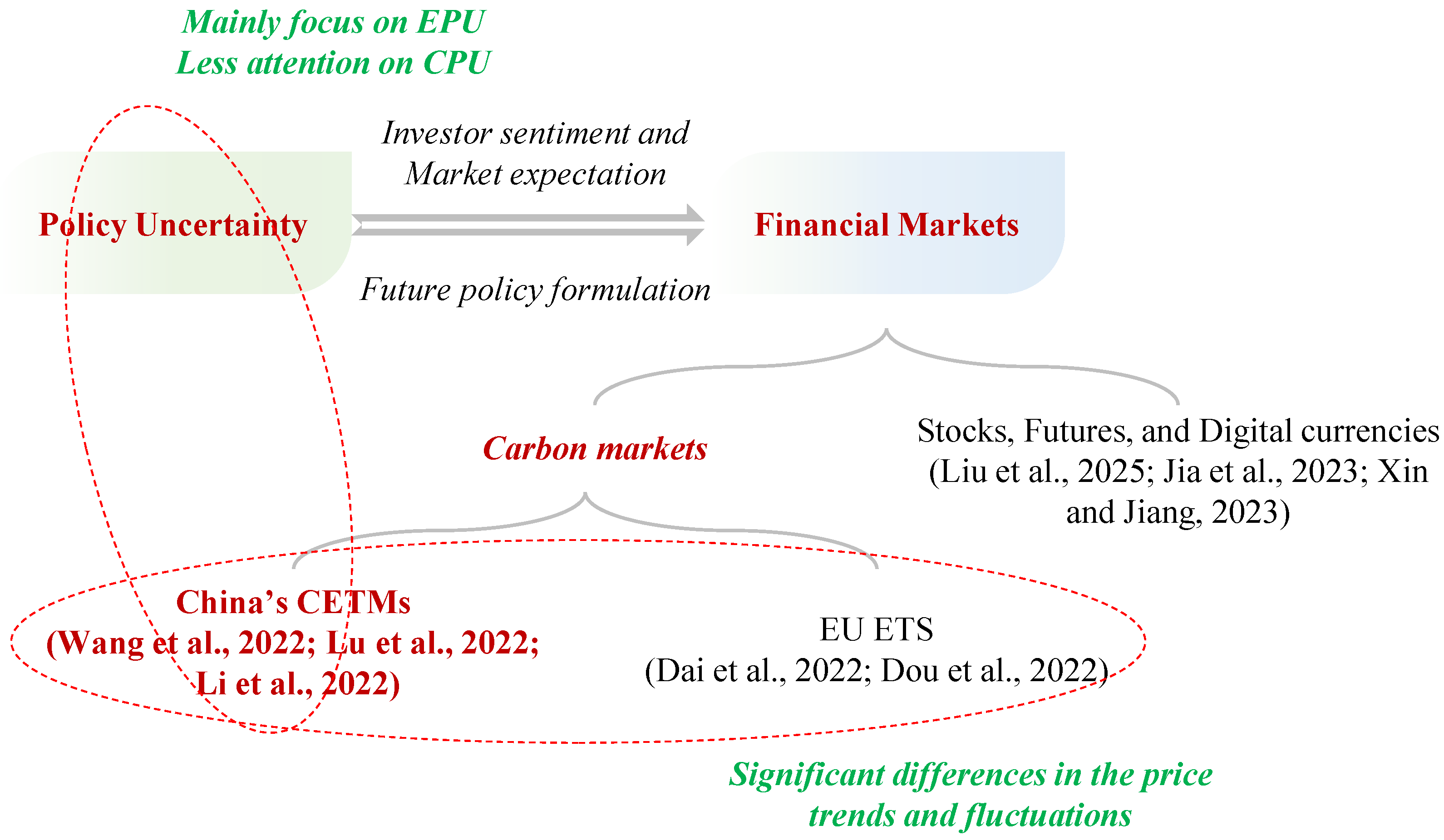

:1. Introduction

- We innovatively incorporated the CPU to study the influencing factors of CETM price volatility, which breaks through the limitations of existing research that mainly focuses on EPU.

- We proposed the GARCH-MIDAS model to process mixed-frequency data, which compensates for the shortcomings of previous research on simple processing methods for high-frequency data.

- We conducted a phase-comparative analysis on the heterogeneous impact of policy uncertainty on CETM price volatility, which can reflect the role of establishment for the national CETM.

2. Methodology and Data Sources

2.1. GARCH-MIDAS Model

2.2. Data Sources

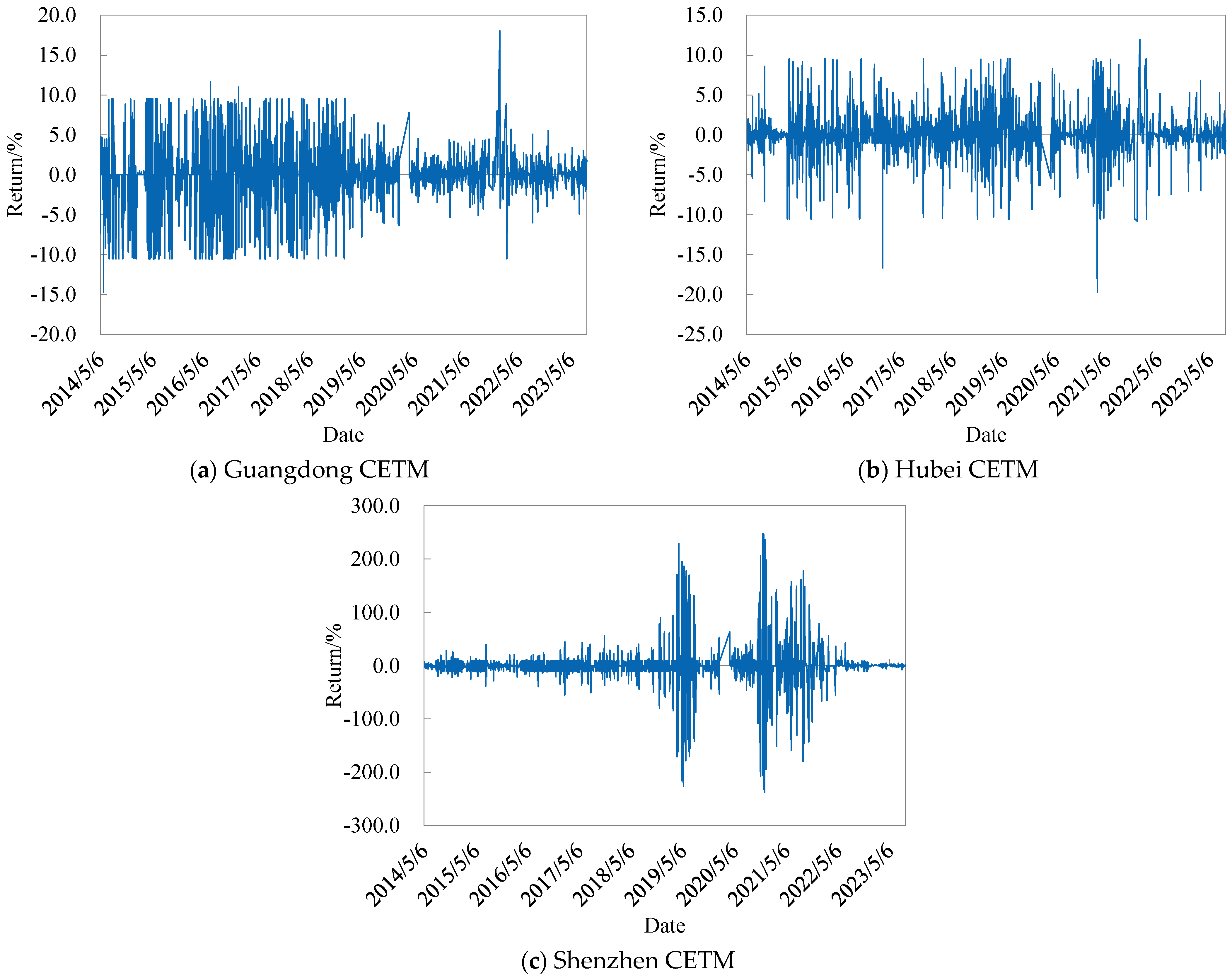

2.2.1. CETM Price Data

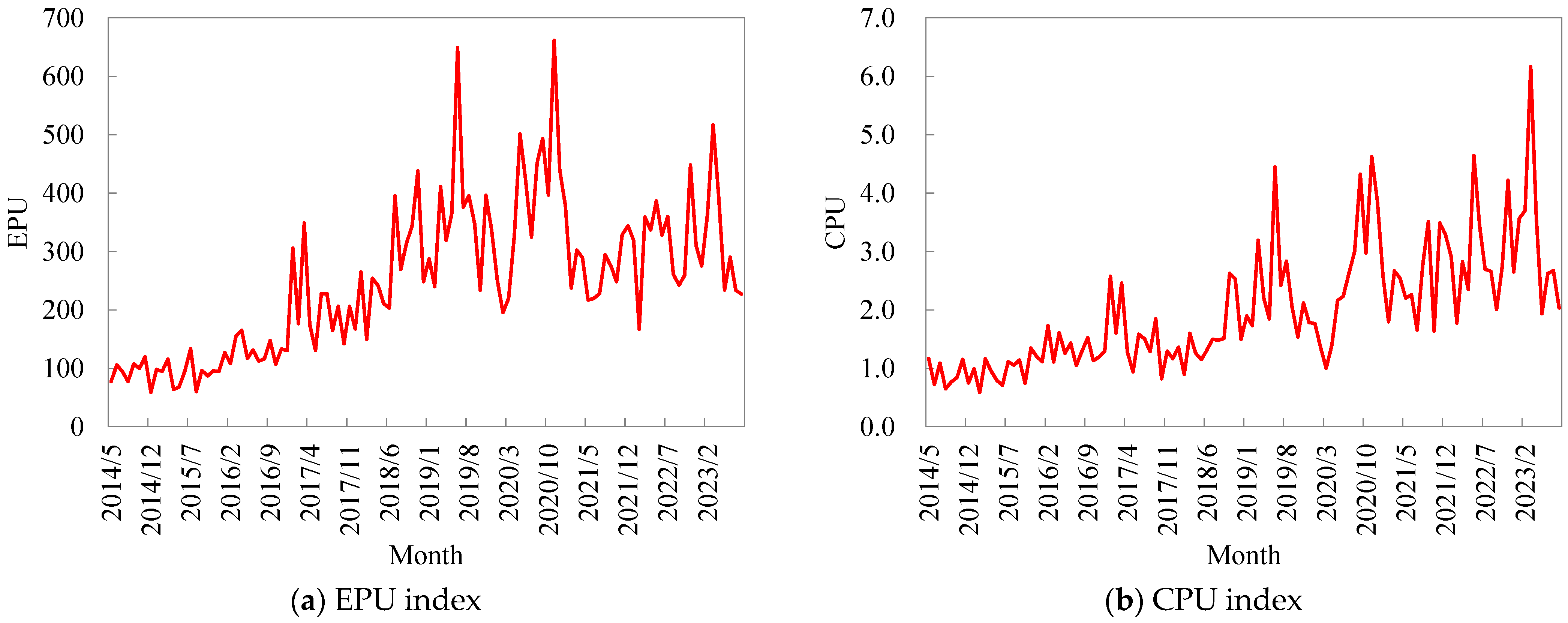

2.2.2. Policy Uncertainty Index

- (1)

- First peak in early 2017

- (2)

- Second peak in mid-2019

- (3)

- Third peak in the latter half of 2020

- (4)

- Fourth peak in early 2023

3. Empirical Analysis

3.1. Descriptive Statistics

3.2. Stability Test and ARCH Effect Test

3.3. Analysis of the Impact of Policy Uncertainty on CETM Price Volatility

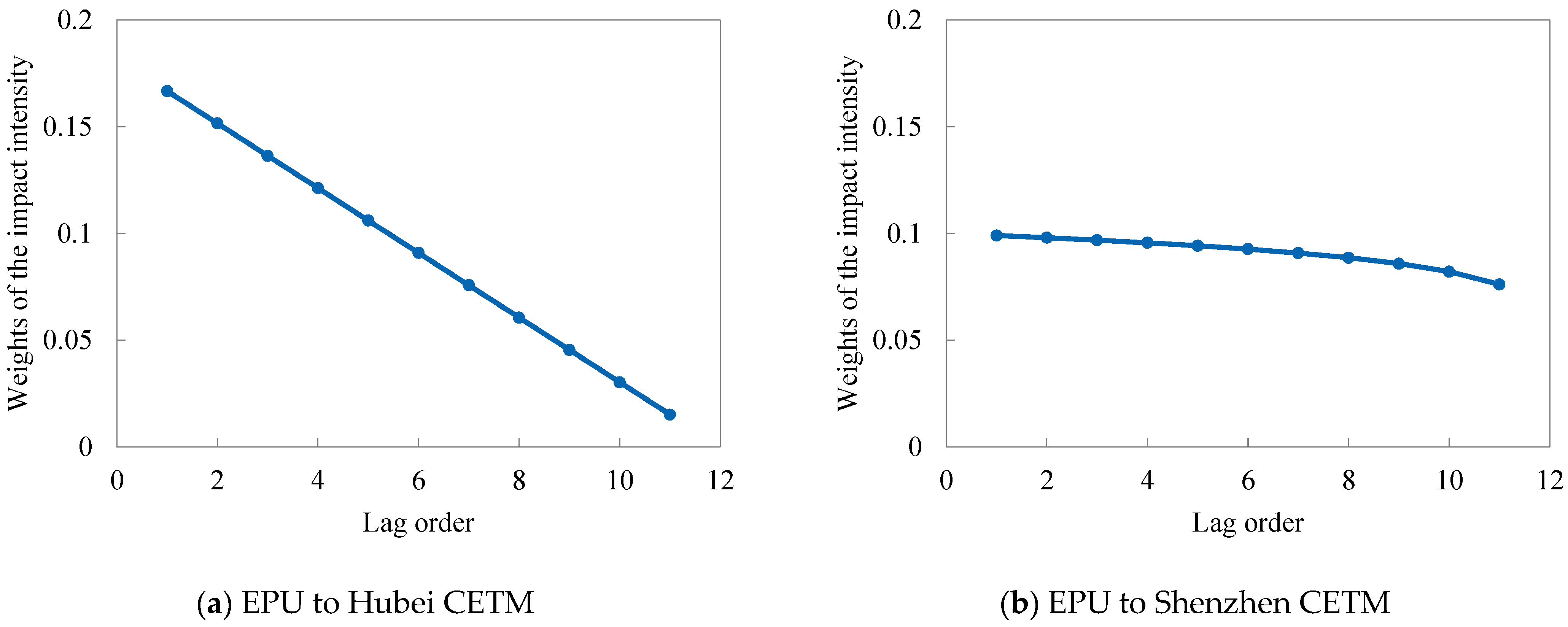

3.3.1. Impact of EPU on CETM Price Volatility

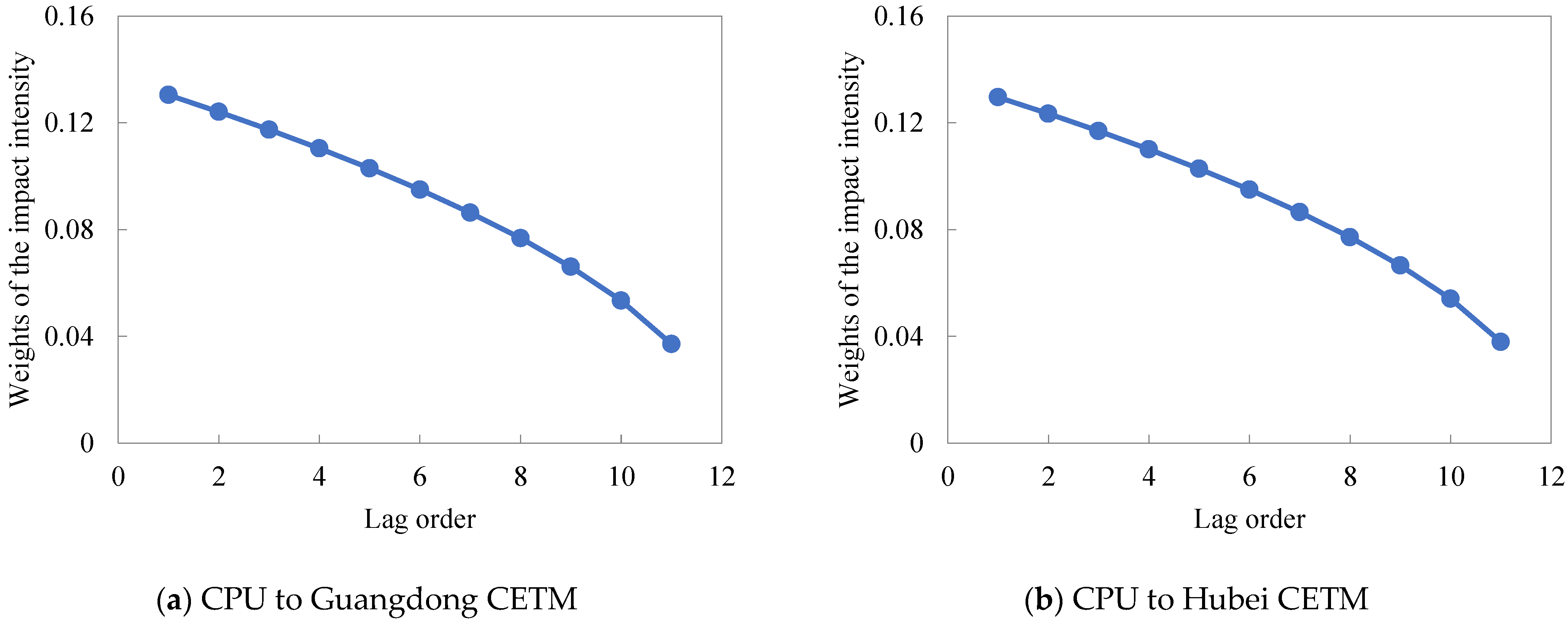

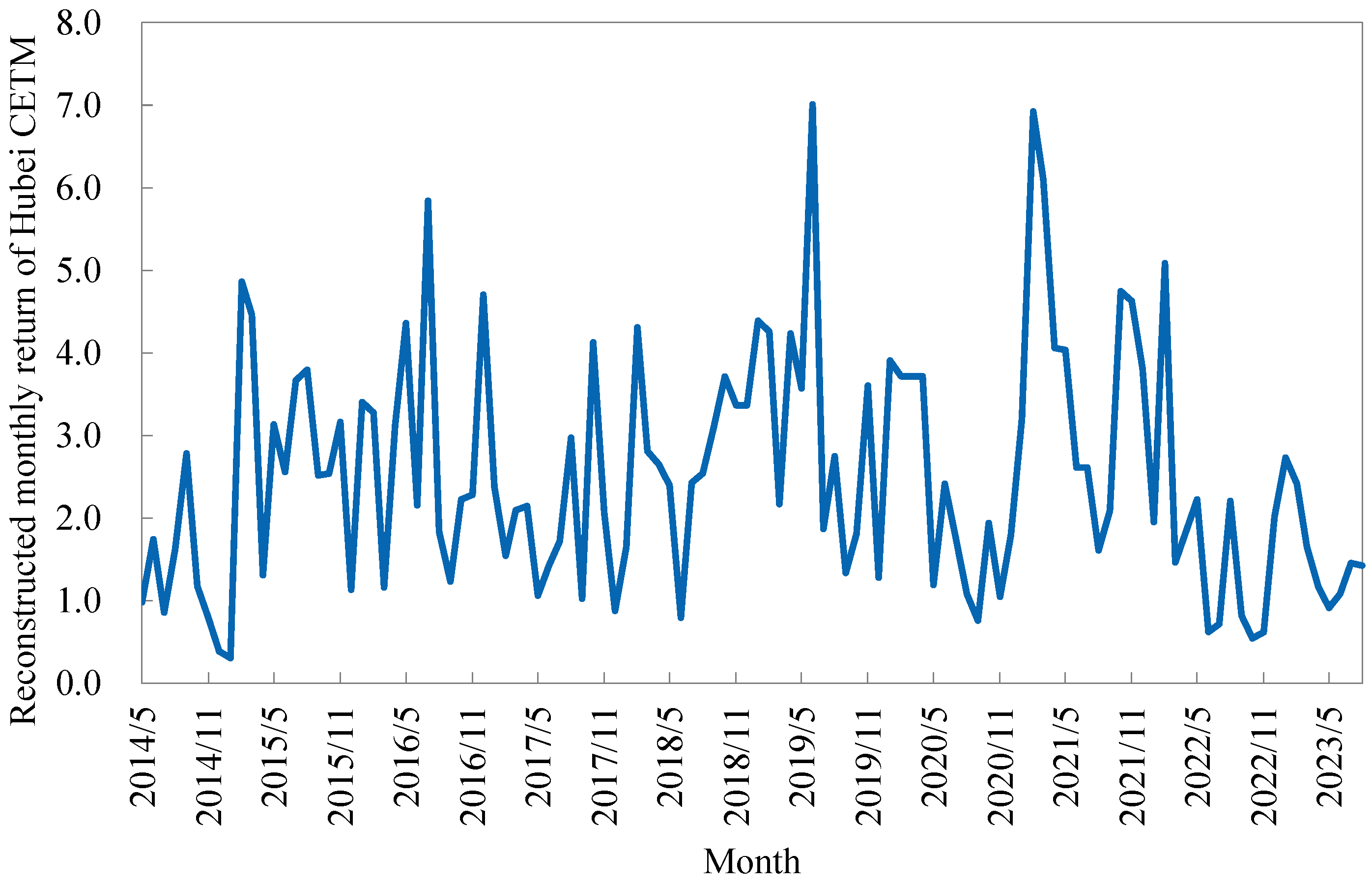

3.3.2. Impact of CPU on CETM Price Volatility

3.3.3. Phased Analysis

- First phase (from 5 May 2014 to 15 July 2021);

- Second phase (from 16 July 2021 to 25 August 2023).

3.3.4. Robustness Test

- EPU

- 2.

- CPU

4. Conclusions

- (1)

- Policy uncertainty has a significant impact on the CETM price, and the impact of different types of policy uncertainties on the price fluctuation of each CETM shows obvious heterogeneity. Depending on the perfect market trading and security system, the Hubei CETM actively investigates and develops the market price stability mechanism. Consequently, the market price fluctuation exhibits a declining trend regardless of the cycle of EPU or CPU. On the contrary, Guangdong CETM price volatility is more reliant on the supremacy of climate policies and is constrained by the effects of economic policies. Conversely, the impact of the COVID-19 epidemic and Sino-US trade tensions is inextricably linked to the significant volatility of the price in Shenzhen CETM.

- (2)

- In terms of stages, the impact of policy uncertainty on local pilot CETMs before and after the establishment of the national CETM is also different. Before the establishment of the national CETM, the market liquidity of Guangdong and Shenzhen was relatively weak, and the impact of macroeconomic policy adjustments on micro market participants was not significant. On the contrary, the CPU was the main factor leading to the price fluctuation of the pilot CETM in the first stage. After the establishment of the national CETM, the uncertainty of economic and climate policies gradually declined, and the impact on the price fluctuation of Guangdong and Hubei CETMs was not significant. On the contrary, the price of Shenzhen CETM still showed a high volatility trend, which was opposite to the change direction of policy uncertainty.

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Nejat, P.; Jomehzadeh, F.; Taheri, M.M.; Gohari, M.; Majid, M.Z.A. A global review of energy consumption, CO2 emissions and policy in the residential sector (with an overview of the top ten CO2 emitting countries). Renew. Sustain. Energy Rev. 2015, 43, 843–862. [Google Scholar] [CrossRef]

- Zhao, Y.; Su, Q.; Li, B.; Zhang, Y.; Wang, X.; Zhao, H.; Guo, S. Have those countries declaring “zero carbon” or “carbon neutral” climate goals achieved carbon emissions-economic growth decoupling? J. Clean. Prod. 2022, 363, 132450. [Google Scholar] [CrossRef]

- Wang, H.; Feng, T.; Zhong, C. Effectiveness of CO2 cost pass-through to electricity prices under “electricity-carbon” market coupling in China. Energy 2023, 266, 126387. [Google Scholar] [CrossRef]

- Tang, C.; Wu, Y.; Liu, X. Does China’s national carbon market play a role? Evidence from corporate ESG performance. Econ. Anal. Policy 2025, 85, 1053–1064. [Google Scholar] [CrossRef]

- Li, M.; Ma, X.; Jia, J.; Zhu, C. Risk spillovers between the financial market and macroeconomic sectors under mixed-frequency information: A frequency domain perspective. Int. Rev. Econ. Financ. 2025, 99, 103976. [Google Scholar] [CrossRef]

- Chen, Z.; Zhang, L.; Wang, C. Does climate policy uncertainty affect Chinese stock market volatility? Int. Rev. Econ. Financ. 2023, 84, 369–381. [Google Scholar] [CrossRef]

- Liu, H.; Yu, J.; Tang, G.; Chen, J. External trade policy uncertainty, corporate risk exposure, and stock market volatility. China Econ. Rev. 2025, 89, 102331. [Google Scholar] [CrossRef]

- Jia, L.; Xu, R.; Wu, J.; Song, M.; Chen, X. Impacts of geopolitical risk and economic policy uncertainty on metal futures price volatility: Evidence from China. Resour. Policy 2023, 87, 104328. [Google Scholar] [CrossRef]

- Xin, B.; Jiang, K. Economic uncertainty, central bank digital currency, and negative interest rate policy. J. Manag. Sci. Eng. 2023, 8, 430–452. [Google Scholar] [CrossRef]

- Yan, J.; Işık, C. Assessing the risk spillover effects between the Chinese carbon market and the US-China energy market. Heliyon 2025, 11, e41186. [Google Scholar] [CrossRef]

- Tan, X.; Sirichand, K.; Vivian, A.; Wang, X. How connected is the carbon market to energy and financial markets? A systematic analysis of spillovers and dynamics. Energy Econ. 2020, 90, 104870. [Google Scholar] [CrossRef]

- Zhao, Y.; Zhou, Z.; Zhang, K.; Huo, Y.; Sun, D.; Zhao, H.; Sun, J.; Guo, S. Research on spillover effect between carbon market and electricity market: Evidence from Northern Europe. Energy 2023, 263, 126107. [Google Scholar] [CrossRef]

- Song, Y.; Liu, T.; Liang, D.; Li, Y.; Song, X. A Fuzzy Stochastic Model for Carbon Price Prediction Under the Effect of Demand-related Policy in China’s Carbon Market. Ecol. Econ. 2019, 157, 253–265. [Google Scholar] [CrossRef]

- Dai, P.-F.; Xiong, X.; Huynh, T.L.D.; Wang, J. The impact of economic policy uncertainties on the volatility of European carbon market. J. Commod. Mark. 2022, 26, 100208. [Google Scholar] [CrossRef]

- Dou, Y.; Li, Y.; Dong, K.; Ren, X. Dynamic linkages between economic policy uncertainty and the carbon futures market: Does Covid-19 pandemic matter? Resour. Policy 2022, 75, 102455. [Google Scholar] [CrossRef]

- Wang, K.-H.; Liu, L.; Zhong, Y.; Lobonţ, O.-R. Economic policy uncertainty and carbon emission trading market: A China’s perspective. Energy Econ. 2022, 115, 106342. [Google Scholar] [CrossRef]

- Lu, H.; Gao, Q.; Li, M. Does economic policy uncertainty outperform macroeconomic factor and financial market uncertainty in forecasting carbon emission price volatility? Evidence from China. Appl. Econ. 2022, 55, 2156470. [Google Scholar] [CrossRef]

- Li, X.; Li, Z.; Su, C.-W.; Umar, M.; Shao, X. Exploring the asymmetric impact of economic policy uncertainty on China’s carbon emissions trading market price: Do different types of uncertainty matter? Technol. Forecast. Soc. Chang. 2022, 178, 121601. [Google Scholar] [CrossRef]

- Liu, W.; Liu, Y.; Wen, F.; Gong, X. Climate policy uncertainty and analyst earnings forecasts: Evidence from the Chinese energy sector. Int. Rev. Financ. Anal. 2025, 100, 103960. [Google Scholar] [CrossRef]

- Lv, W.; Li, B. Climate policy uncertainty and stock market volatility: Evidence from different sectors. Financ. Res. Lett. 2023, 51, 103506. [Google Scholar] [CrossRef]

- Ding, S.; Wang, A.; Cui, T.; Du, A.M. Renaissance of climate policy uncertainty: The effects of U.S. presidential election on energy markets volatility. Int. Rev. Econ. Financ. 2025, 98, 103866. [Google Scholar] [CrossRef]

- Xing, X.; Chen, Y.; Wang, X.; Li, B.; Deng, J. The impact of national carbon market establishment on risk transmission among carbon and energy markets in China: A systemic importance analysis. Financ. Res. Lett. 2023, 57, 104219. [Google Scholar] [CrossRef]

- Tang, C.; Yang, G.; Liu, X. Risk spillover within the carbon-energy system—New evidence considering China’s national carbon market. Econ. Anal. Policy 2024, 81, 1227–1240. [Google Scholar] [CrossRef]

- Engle, R.; Ghysels, E.; Sohn, B. Stock Market Volatility and Macroeconomic Fundamentals. Rev. Econ. Stat. 2013, 95, 776–797. [Google Scholar] [CrossRef]

- Wang, Y.; Wang, Z.; Tang, N. Comparative Study on Efficiency of China’s Pilot Carbon Trading Market Based on Sharpe Ratio. Sci. Technol. Manag. Land Resour. 2022, 39, 9–19. [Google Scholar]

- Liu, T.; Guan, X.; Wei, Y.; Xue, S.; Xu, L. Impact of economic policy uncertainty on the volatility of China’s emission trading scheme pilots. Energy Econ. 2023, 121, 106626. [Google Scholar] [CrossRef]

- Wang, R.; Yuan, J.; Xu, H.; Ning, W. Measurement and empirical study on Value-at-Risk of China carbon market. China Soft Sci. 2023, 7, 142–150. [Google Scholar]

- Baker, S.; Bloom, N.; Davis, S. Measuring Economic Policy Uncertainty. Q. J. Econ. 2016, 131, 1593–1636. [Google Scholar] [CrossRef]

- Ji, Q.; Ma, D.; Zhai, P.; Fan, Y.; Zhang, D. Global climate policy uncertainty and financial markets. J. Int. Financ. Mark. Inst. Money 2024, 95, 102047. [Google Scholar] [CrossRef]

- Li, Y.; Wang, H.; Liu, X. On Relationship Between EU Climate Change Economic Policy Uncertainty(EPU) and Carbon Prices: Keyword Valuation Based on Mood Variables. Sci. Technol. Manag. Land Resour. 2023, 40, 74–84. [Google Scholar]

- Davis, S.; Liu, D.; Sheng, X. Economic Policy Uncertainty in China Since 1949: The View from Mainland Newspapers. In Proceedings of the Fourth Annual IMF-Atlanta Fed Research Workshop on China’s Economy Atlanta, Atlanta, GA, USA, 19 September 2019. [Google Scholar]

- Ren, X.; Zhang, X.; Yan, C.; Gozgor, G. Climate policy uncertainty and firm-level total factor productivity: Evidence from China. Energy Econ. 2022, 113, 106209. [Google Scholar] [CrossRef]

- Ma, Y.-R.; Liu, Z.; Ma, D.; Zhai, P.; Guo, K.; Zhang, D.; Ji, Q. A news-based climate policy uncertainty index for China. Sci. Data 2023, 10, 881. [Google Scholar] [CrossRef] [PubMed]

- Du, Q.; Ma, M.; Lu, C.; Wang, X.; Bai, L. Assessing the impact of emission trading scheme and carbon tax in the building sector: An embodied carbon perspective. Environ. Impact Assess. Rev. 2025, 111, 107732. [Google Scholar] [CrossRef]

- Du, Q.; Wan, Z.; Yang, M.; Wang, X.; Bai, L. Dynamic integrated simulation of carbon emission reduction potential in China’s building sector. Sustain. Cities Soc. 2024, 116, 105944. [Google Scholar] [CrossRef]

- Jia, Z.; Wen, S.; Wu, R. Synergistic effect of emission trading scheme and carbon tax: A CGE model-based study in China. Environ. Impact Assess. Rev. 2025, 110, 107699. [Google Scholar] [CrossRef]

| Indicators | Sample Size | Mean | Std. | Skewness | Kurtosis | J-B Statistic |

|---|---|---|---|---|---|---|

| Guangdong CETM (GD) | 2108 | 0.0064 | 3.8781 | −0.2717 | 4.8729 | 334.0300 *** |

| Hubei CETM (HB) | 2108 | 0.0310 | 2.8337 | −0.2974 | 8.0481 | 2269.3900 *** |

| Shenzhen CETM (SZ) | 2108 | −0.0072 | 32.5613 | 0.2544 | 25.0100 | 42,572.70 *** |

| EPU | 112 | 249.4170 | 127.7827 | 0.6474 | 3.2671 | 8.1577 ** |

| CPU | 112 | 1.9902 | 1.0418 | 1.2003 | 4.5979 | 38.8073 *** |

| Indicators | ADF Test Coefficient |

|---|---|

| GD | −17.1025 *** |

| HB | −18.9692 *** |

| SZ | −21.1067 *** |

| Indicators | ARCH-LM Test Coefficient |

|---|---|

| GD | 284.3823 *** |

| HB | 253.1755 *** |

| SZ | 269.2509 *** |

| Parameter | EPU-GD | EPU-HB | EPU-SZ |

|---|---|---|---|

| 0.0005 (1.2279) | 0.0004 (1.0506) | 0.0014 (0.5177) | |

| 0.0815 *** (23.7710) | 0.4076 *** (13.7750) | 0.1125 *** (18.9740) | |

| 0.9180 *** (389.3700) | 0.5431 *** (33.8900) | 0.8821 *** (229.9900) | |

| 1.305 × 10−5 (0.2068) | −0.0002 ** (−1.9889) | 0.0929 * (1.6805) | |

| 3.0208 *** (4.8702) | 1.0013 *** (8.6656) | 1.1098 *** (3.6347) | |

| −1.5406 × 10−5 (−0.2068) | 0.0026 ** (2.5163) | −0.0695 (−1.5976) | |

| LLF | 3302.78 | 3662.23 | 379.836 |

| AIC | −6593.55 | −7312.45 | −747.673 |

| BIC | −6560.25 | −7279.15 | −717.365 |

| Parameter | CPU-GD | CPU-HB | CPU-SZ |

|---|---|---|---|

| 0.0082 (1.3977) | −0.0004 (−0.5704) | 0.0197 (0.7382) | |

| 0.4988 *** (6.5277) | 0.5080 *** (7.6480) | 1.2498 *** (18.4242) | |

| 0.2386 *** (5.0112) | 0.2508 *** (5.0300) | 1.6776 *** (13.4730) | |

| 0.2387 *** (3.5098) | −0.2161 *** (3.5426) | 2.0924 (0.2109) | |

| 1.5239 *** (4.9171) | 1.5126 *** (4.3543) | 1.0139 *** (5.2322) | |

| 0.0019 ** (4.4499) | 0.0015 ** (4.6302) | −0.0834 (−0.6721) | |

| LLF | 1886.52 | 1935.54 | 294.75 |

| AIC | −3712.33 | −3859.08 | −629.88 |

| BIC | −3667.50 | −3828.97 | −590.01 |

| CETMs | Average Transaction Price in 2021 | |

|---|---|---|

| Before the Establishment of the National CETM | After the Establishment of the National CETM | |

| Guangdong | 35.44 | 43.22 |

| Hubei | 30.29 | 38.79 |

| Shenzhen | 10.61 | 12.96 |

| Parameter | Phase 1 | Phase 2 | ||||

|---|---|---|---|---|---|---|

| EPU-GD | EPU-HB | EPU-SZ | EPU-GD | EPU-HB | EPU-SZ | |

| 0.0009 (1.4151) | 0.0004 (0.7885) | −0.0001 (−0.0518) | 0.0003 (0.1914) | 0.0016 (1.6054) | 0.0158 (0.9345) | |

| 0.0598 *** (16.9820) | 0.3573 *** (11.9020) | 0.1375 *** (19.4010) | 0.1617 *** (3.5941) | 0.5971 *** (8.3943) | 0.0547 *** (5.2612) | |

| 0.9402 *** (267.0300) | 0.5870 *** (33.5150) | 0.8586 *** (189.2700) | 0.8286 *** (18.2740) | 0.3696 *** (15.9910) | 0.9453 *** (82.6310) | |

| 0.0633 (1.5436) | −0.0002 *** (−2.6153) | 0.1858 (0.8649) | 0.0005 (1.1636) | −0.0012 (−0.5442) | −0.0280 *** (−3.5681) | |

| 1.4220 *** (4.4380) | 38.4100 (0.3118) | 3.2426 *** (3.5827) | 2.7896 *** (2.7458) | 5.5438 ** (2.0541) | 5.5914 (0.5596) | |

| −0.0541 (−1.5027) | 0.0026 *** (2.9604) | −0.1522 (−0.8558) | −0.0015 (−1.1557) | 0.0111 (0.5443) | 0.3375 *** (9.2812) | |

| LLF | 2884.06 | 3148.44 | 381.06 | 433.66 | 473.33 | 34.93 |

| AIC | −5756.12 | −6284.88 | −750.12 | −855.33 | −934.66 | −57.85 |

| BIC | −5723.52 | −6252.28 | −717.52 | −835.16 | −914.50 | −37.68 |

| Parameter | Phase 1 | Phase 2 | ||||

|---|---|---|---|---|---|---|

| CPU-GD | CPU-HB | CPU-SZ | CPU-GD | CPU-HB | CPU-SZ | |

| 0.0009 ** (1.8655) | 0.0003 (0.6644) | 4.1937 × 10−5 (0.0151) | 0.0014 (0.8188) | 0.0009 (1.0801) | 0.0180 (1.4125) | |

| 0.3320 *** (8.6684) | 0.3597 *** (11.9090) | 0.1209 *** (18.4790) | 0.2447 *** (2.8028) | 0.6385 *** (11.3170) | 0.0663 *** (15.0060) | |

| 0.5220 *** (13.6140) | 0.5792 *** (31.3400) | 0.8727 *** (233.2900) | 0.7303 *** (9.1242) | 0.3310 *** (8.6724) | 0.9336 *** (207.1000) | |

| −0.0025 *** (−5.8531) | −0.0005 ** (−2.5271) | 0.1723 * (1.6461) | 0.0011 (0.9342) | −0.0013 (−0.6143) | −0.2613 *** (−2.5841) | |

| 1.5000 *** (9.7236) | 4.0787 (1.4060) | 1.0718 *** (5.0516) | 1.0010 *** (10.4200) | 47.2900 (1.2773) | 1.0011 *** (10.1580) | |

| 0.0056 *** (5.9253) | 0.0025 *** (3.1221) | −0.1348 (−1.6038) | −0.0009 (−0.6986) | 0.0055 (0.6131) | 1.0834 *** (3.6336) | |

| LLF | 2933.48 | 3150.50 | 376.39 | 439.78 | 475.36 | 45.14 |

| AIC | −5854.97 | −6289.00 | −740.78 | −867.56 | −938.72 | −78.28 |

| BIC | −5822.37 | −6256.40 | −708.18 | −847.39 | −918.55 | −58.11 |

| Phase | EPU-GD | EPU-HB | EPU-SZ | CPU-GD | CPU-HB | CPU-SZ |

|---|---|---|---|---|---|---|

| Phase 1 | - | ↓ | - | ↓ | ↓ | ↑ |

| Phase 2 | - | - | ↓ | - | - | ↓ |

| Full cycle | - | ↓ | ↑ | ↓ | ↓ | - |

| Parameter | AEPU-HB | ACPU-HB |

|---|---|---|

| 0.0006 (1.3534) | −0.0004 (−0.7106) | |

| 0.3952 *** (14.0400) | 0.6128 *** (8.1223) | |

| 0.5602 *** (37.2150) | 0.2872 *** (5.2267) | |

| −0.0003 ** (−2.3573) | −0.2426 *** (3.9100) | |

| 43.5440 (0.3592) | 1.5210 *** (4.39063) | |

| 0.0037 ** (2.4388) | 0.0016 *** (5.9302) | |

| LLF | 3668.51 | 2090.78 |

| AIC | −7325.02 | −3943.26 |

| BIC | −7291.72 | −3930.55 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chen, Z.; Gao, X.; Chen, N.; Zhao, Y.; Guo, S. Economy or Climate? Impact of Policy Uncertainty on Price Volatility of China’s Carbon Emission Trading Markets. Energies 2025, 18, 2448. https://doi.org/10.3390/en18102448

Chen Z, Gao X, Chen N, Zhao Y, Guo S. Economy or Climate? Impact of Policy Uncertainty on Price Volatility of China’s Carbon Emission Trading Markets. Energies. 2025; 18(10):2448. https://doi.org/10.3390/en18102448

Chicago/Turabian StyleChen, Zhuoer, Xiaohai Gao, Nan Chen, Yihang Zhao, and Sen Guo. 2025. "Economy or Climate? Impact of Policy Uncertainty on Price Volatility of China’s Carbon Emission Trading Markets" Energies 18, no. 10: 2448. https://doi.org/10.3390/en18102448

APA StyleChen, Z., Gao, X., Chen, N., Zhao, Y., & Guo, S. (2025). Economy or Climate? Impact of Policy Uncertainty on Price Volatility of China’s Carbon Emission Trading Markets. Energies, 18(10), 2448. https://doi.org/10.3390/en18102448