1. Introduction

In 2022, global energy markets encountered an extraordinary surge in price levels with consequences that are expected to have a lasting impact for years to come. The evident price increase was not attributed to a single factor but rather resulted from a sequence of events starting in 2021.

Firstly, following the economic slowdown caused by the COVID-19 pandemic, the end of the lockdown resulted in the rapid recovery of various industries and businesses. Removing restrictions on mobility and travel led to a revival of the transport sector. Companies that had previously been blocked by lockdown protocols were finally able to resume their activities. As a result, demand for all forms of fossil fuels increased by at least 5% in 2021. In this situation, insufficient supply puts increased pressure on the global supply chain, consequently affecting energy prices [

1].

Secondly, major natural gas suppliers such as Gazprom reduced their short-term volumes and did not refill their storage facilities in Europe to the levels seen in previous years. This shortage exacerbated the market reaction when, in December 2021, Europe was struck by negative temperatures [

1].

Thirdly, weather-related events had a major impact on the trends of demand and electricity production. Some of the major impacts included droughts in Brazil, which significantly reduced hydropower production, causing imports of liquefied natural gas (LNG) to increase threefold from the previous year. In addition, heat waves in France reduced the availability of nuclear power, due to the limitations of the allowed temperature at which the water that is cooling a reactor can be returned to a river. Moreover, lower-than-average wind speeds affected overall wind power output in Europe [

1].

Further reasons that have increased the pressure on energy prices include the postponement of some maintenance work until 2021 due to the pandemic, leading to disruptions in energy supply. For example, natural gas markets have been affected by unplanned outages at LNG liquefaction plants, unforeseen repair work and various project delays [

1].

The already pronounced strain on the global supply chain and energy price dynamics experienced an escalation on 24 February 2022, when Russia invaded Ukraine. This event not only caused tremendous damage to the Ukrainian energy sector but also had a far-reaching impact on the global energy system, disrupting supply and demand dynamics and severing long-standing trade relationships. Russia is the world’s largest exporter of fossil fuels, particularly important for Europe, where in 2021, one in five units of energy was supplied from Russia. The substantial reliance of European nations on Russian resources, coupled with the constrained availability of alternative energy sources, has subjected the energy supply to considerable strain. Moreover, Russia has sought to use its position as an export leader to influence European countries, exposing consumers to higher energy bills and supply shortages. Europe, in turn, imposed sanctions on fuel imports as a tool of political pressure and a sign of support for Ukraine, thus seeking to reduce Russian energy export revenues and discourage them from further aggression. These actions have cut off one of the main arteries of global energy trade, demonstrating the extreme vulnerability, fragility and unsustainability of the energy system, having significant and widespread consequences in various sectors [

1].

As European electricity prices are closely linked to wholesale gas prices, both commodities have experienced significant spikes and volatility. For instance, in the first quarter of 2022, the average monthly wholesale gas price exceeded 120 EUR/MWh, which was six times the historical average [

2].

High energy prices had a major impact on inflation, exacerbating a phenomenon of energy poverty and food insecurity, with the greatest burden falling on poorer households. Nearly 100 million people faced the risk of reusing firewood for cooking instead of cleaner and healthier alternatives. Furthermore, several industries have been unable to withstand rising energy costs, leading to reduced operations, factory closures, financial insolvency and ultimately contributing to the recession [

1].

The energy crisis and its consequences led to a reassessment of energy security needs in many countries and a profound shift in the investment landscape. At the 26th Conference of the Parties (COP26), governments made a set of commitments to sustainability and redefined their energy strategies. The European Commission published the REPowerEU plan, which aimed to end Europe’s dependence on Russian fossil fuels well before 2030 [

1].

One of the strategies formulated by the European Commission in line with the REPowerEU plan aimed to accelerate and facilitate authorization procedures for Power Purchase Agreements (PPAs), thus reducing one of the major obstacles to their development. Through PPAs, energy consumers can be protected from energy price spikes while contributing to the development of environmentally friendly technologies. PPAs are long-term bilateral contracts for the purchase and sale of a certain amount of electricity. In most cases, this energy is generated by renewable sources such as photovoltaic (PV) installations or wind turbines [

1,

3].

The importance of PPAs as a tool to stabilize prices and contribute to the achievement of clean energy is evident in some of the European Commission’s actions. For example, the Commission, in cooperation with the European Investment Bank (EIB), planned to set up a technical advice facility within the InvestEU Advisory Hub to support renewable energy projects financed through PPAs and increase their total volume. By increasing the number of PPAs, the share of renewables in the grid will increase, leading to reduced dependence on fossil fuels and increased energy security [

4,

5].

Nevertheless, the volatility in the energy market in 2022, affecting all sectors of the economy, has not spared the PPA market either. The energy crisis has not only increased the price of PPAs but has also resulted in significant changes in their structure. For instance, Zeigo and S&P speculated that depending on the market, PPA prices in the first quarter of 2022 increased even by 10–15% [

6]. Evidently, such an environment was not ideal for the negotiation of PPAs, which influenced the formation of new trends related to certain parameters, such as the duration of the PPA or pricing mechanisms. In addition, risk management and the development of an appropriate purchasing strategy became even more important [

1].

Besides PPAs, the literature offers alternative means of optimizing other energy systems. For instance, in [

7], a novel peer-to-peer energy-sharing framework for coordinated energy management in building communities, aiming for economic and sustainable development, is offered. Through a non-cooperative energy-sharing game, the paper establishes a generalized Nash equilibrium independent of energy-sharing payments, ensuring fairness. The paper in [

8] presents two innovative strategies for determining household preferences in a peer-to-peer (P2P) local energy market, assessing their impact on trading dynamics. The first approach aligns surplus power with demand among participants, whereas the second method considers their proximity within the network. The influence of bilateral trading preferences on both the price and quantity of energy exchanged is evaluated for each strategy. A hybrid policy-based reinforcement learning (HPRL) approach for optimal energy management in an island with transmission-constrained settings is presented in [

9], together with an island energy hub (IEH) model enabling efficient energy utilization and supply.

The historical context of energy price spikes serves as a backdrop for understanding the challenges and opportunities that PPAs face in mitigating such occurrences. By examining past instances of price volatility, such as those triggered by geopolitical events or supply disruptions, we pinpoint the vulnerabilities within traditional energy procurement methods. This, in turn, underscores the importance of PPAs as a mechanism for hedging against price fluctuations, providing stability in energy costs and fostering resilience in the face of market uncertainties. Through a direct linkage between historical price spikes and the need for more robust risk management strategies, this study aims to illuminate the pivotal role that PPAs play in navigating the dynamic landscape of energy markets. This paper seeks to analyze the evolving risk associated with PPAs from 2020 to 2023, particularly in light of events in 2022, to determine if PPAs continue to provide robust protection against energy price spikes, enhance energy budget stability and facilitate savings for off-takers. It assesses the probability of PPA prices surpassing market prices amidst shifting market dynamics and aims to comprehensively identify and mitigate risks associated with PPAs to optimize off-taker protection.

This paper begins with a state-of-the-art review of Power Purchase Agreements (PPAs), as presented in

Section 2, including their definition and main types. Due to their greater complexity, this paper focuses on off-site PPAs. Subsequently,

Section 3 analyzes the risks associated with PPAs and the most popular strategies for mitigating them. In

Section 4, a market study of PPAs is presented, centering on the evolution of PPAs in 2022 influenced by the energy crisis.

Section 4 also examines new trends in 2023 to compare how parameters associated with PPAs changed in response to the relative decline and stabilization of electricity prices.

Section 5 contains the risk evaluation, using Monte Carlo simulation to assess the probability of PPA prices surpassing the market price from 2020 to 2023.

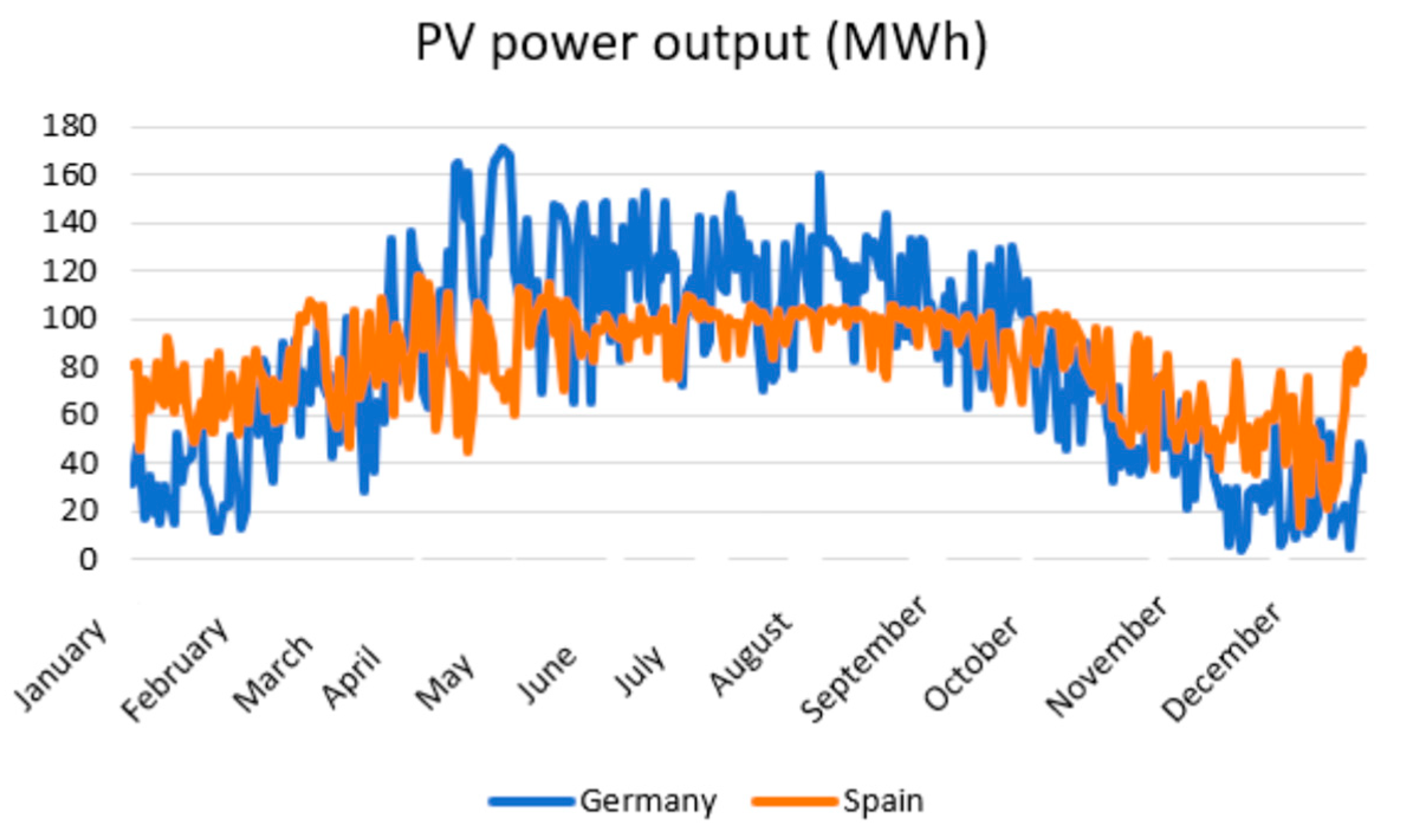

Section 5 also determines the benefits of these contracts before, during and after the energy crisis. In the simulations, Spain, known for its prominent role in PPA agreements, and Germany, with differing market characteristics and fewer PPA agreements, are analyzed.

Section 5 concludes with a summary of the simulation results and a discussion. In

Section 6, a discussion of the outcomes of the paper is offered. This paper ends with

Section 7, presenting a conclusion of all the findings.

2. PPA Definition and Typology

Power Purchase Agreements (PPAs) are long-term bilateral contracts for the purchase and sale of a certain amount of electricity, typically from renewable sources at an agreed tariff. PPAs are also an effective financial instrument, providing price stabilization, reducing price risk and allowing for budget planning. Of the many types of PPAs, the fundamental and best-known division is between on-site and off-site PPAs. On-site PPAs are typically smaller projects, such as PV panels on rooftops or windmills, located on the off-taker’s premise. In the case of off-site PPAs, the installation is located far from the consumer, which means that electricity must be transported through the distribution network. Off-site PPAs are usually larger projects, such as wind turbine fields with high power output and large amounts of energy, which must be balanced during periods of under- and overproduction. This paper focuses on off-site PPAs, due to their greater complexity [

3,

10].

Selecting the most suitable PPA for a particular company is crucial to avoid being tied into long-term contracts with a power price far above the market price. PPAs can be divided by several criteria, as shown in

Table 1 and further explained below.

In off-site PPAs, energy is generated remotely from the end user and transported through the distribution network. Two types of PPAs can be distinguished based on the delivery point: at the exit point and at the entry point.

In a PPA with delivery at the exit point, where the consumer’s facility connects to the grid, the seller is responsible for transporting electricity through the distribution network. This option is less common due to the complexities of managing two suppliers at one connection point.

The alternative is a PPA with delivery at the entry point, where the production facility connects to the grid. Here, the seller is not accountable for transporting electricity to the end user, and energy sent through the distribution network is settled differently.

Under a PPA with delivery at the entry point, two options exist for settling the energy transmitted via the distribution line: physical through sleeving and financial through swaps.

In a sleeving PPA, energy generated from a renewable power plant is integrated into a conventional power supply contract by a supplier. Here, the supplier assumes responsibility for balancing the energy supply and managing related pricing aspects.

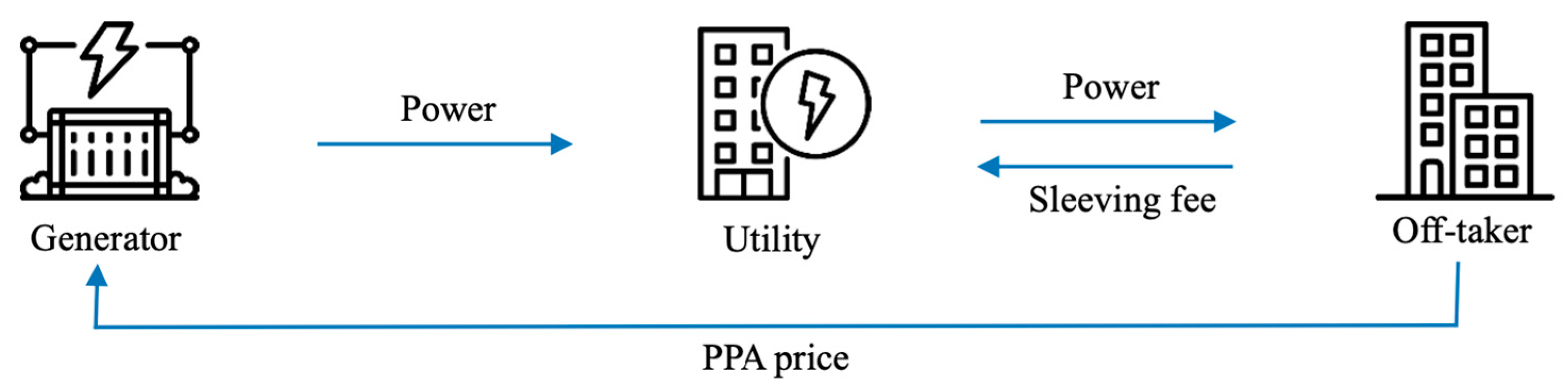

Figure 1 illustrates the scheme of a sleeving PPA.

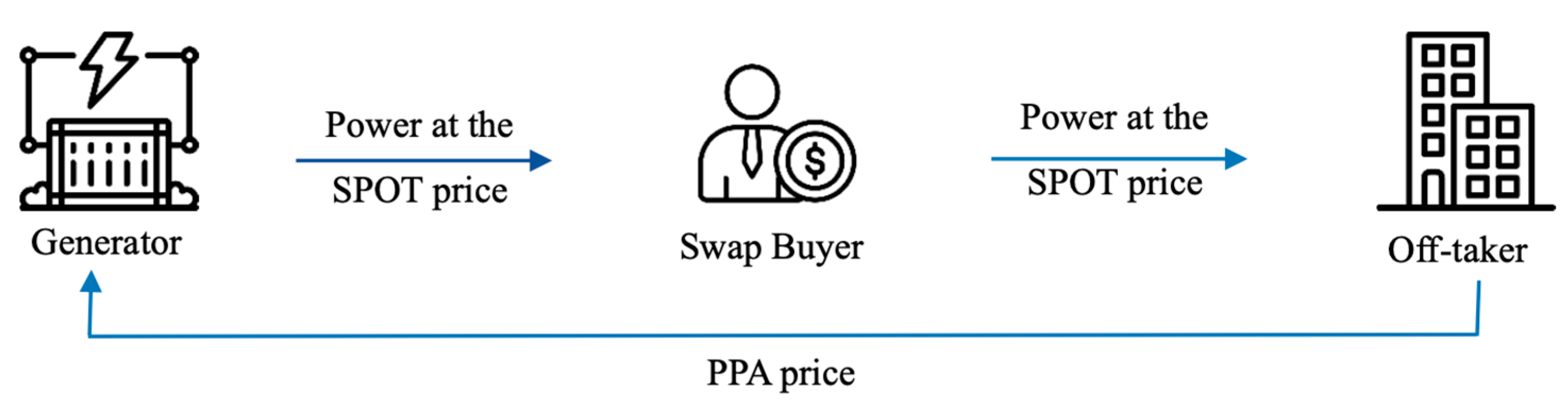

Alternatively, energy transmitted through the distribution network can be settled through swaps. In this model, a third party purchases energy at the entry point at SPOT prices and resells it at the exit point at the same SPOT prices. Energy is sold and bought at the same spot price for each MWh, rendering these transactions neutral.

Figure 2 depicts a scheme of a PPA financed through swaps.

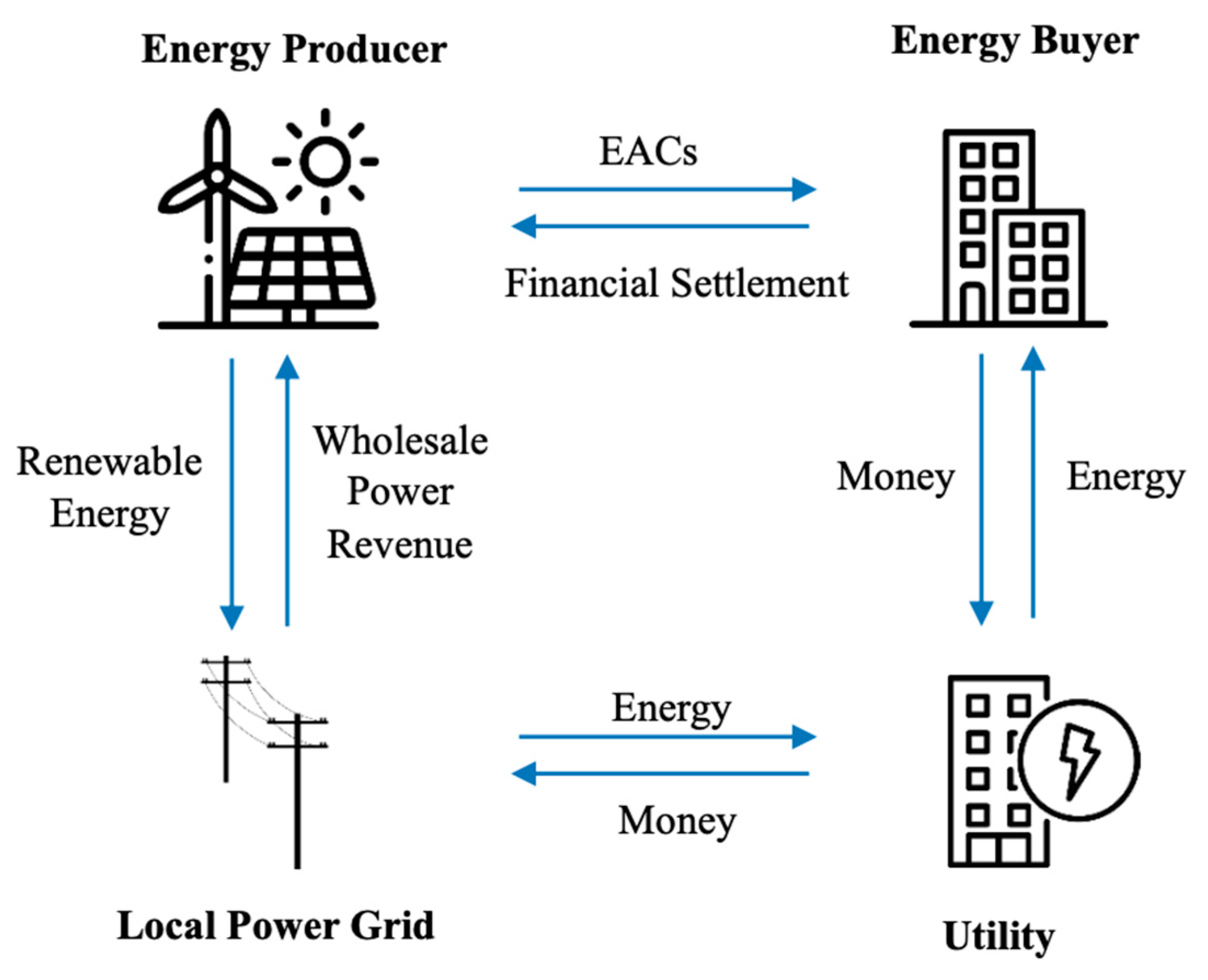

One type of a financial PPA is the Virtual Power Purchase Agreement (VPPA), also referred to as a contract for difference (CfD) or fixed-flow financial swap. Unlike physical PPAs, a VPPA primarily functions as a financial instrument and does not entail the physical transfer of energy from the project developer to the buyer. The agreement entails mutual agreement between parties on a fixed PPA price and a predetermined settlement period, typically a month or quarter. During this period, the developer sells energy on the wholesale market at a variable market price, determined at a specific clearing point like a hub or load zone. The developer then calculates the difference between the variable market price and the predetermined VPPA price, usually for each hour of the billing period. If the cumulative value is positive at the end of the period, the developer pays the buyer the difference. Conversely, if the cumulative value is negative, the buyer pays the developer the amount of the discrepancy. This structural framework ensures that the project consistently receives the agreed VPPA price for each megawatt hour, thereby enhancing the financial stability of all involved parties.

Virtual Power Purchase Agreements offer significant benefits to both energy buyers and project developers. For buyers, a key advantage lies in the ability to acquire Energy Attribute Certificates (EACs), which serve as confirmation of the renewable origin of electricity. Each EAC provides detailed information on the generation of 1 MWh of electricity, including when, where and how it was produced. By purchasing EACs, companies and end users can verify the green nature of their energy consumption. EACs are issued, sold and cancelled through a central registry, typically managed by the transmission system operator (TSO). In Europe, the predominant system revolves around Guarantees of Origin (GOs), which are issued, traded and cancelled within countries participating in the European Energy Certificate Scheme (EECS). This system is operational in over 20 European countries, such as France, Sweden and Germany. In contrast, the United States and Canada utilize Renewable Energy Certificates (RECs), while International Renewable Energy Certificates (I-RECs) are adopted in countries lacking an EAC system. These frameworks facilitate the transparent tracking and verification of renewable energy generation, ensuring reliable mechanisms for promoting and supporting sustainable energy practices.

Figure 3 represents a scheme of the Virtual Power Purchase Agreement.

The third criterion in

Table 1 distinguishes PPAs based on their delivery profile, categorizing them as pay-as-produced (PAP), baseload and pay-as-consumed PPAs. These types not only vary in their supply profiles but also in the risks assumed by the energy buyer and supplier.

The most prevalent structure is the pay-as-produced (PAP) Power Purchase Agreement, where the energy consumer commits to purchasing all or a predetermined portion of the energy generated by the renewable installation. Typically, energy is sold at a fixed price, although some volume may be determined by the SPOT market. Under this contract, the customer bears the entire risk of any mismatch between their actual consumption and the renewable energy produced. They are obligated to purchase all energy generated, even if consumption is lower, and must buy energy on the SPOT market during shortages or resell excess energy produced.

Another contract type based on the delivery profile is the baseload PPA, where the supplier agrees to provide a fixed amount of energy every hour of the day for a specified period. Here, the supplier is responsible for balancing surpluses or shortages to maintain a consistent energy profile over the agreed timeframe. While the consumer shares some risk, as they may consume more or less than the set baseload profile, they benefit from the certainty of receiving a predetermined amount of energy.

The pay-as-consumed PPA adjusts energy generation to reflect the customer’s consumption pattern, eliminating profile risk for the energy buyer. This contract type is particularly advantageous for buyers as it places the burden of managing energy production fluctuations solely on the energy producer.

In discussions about PPAs, it is crucial to define the concepts of balancing energy and residual energy. Balancing energy refers to the discrepancy between projected production and the actual production profile. If there is an excess of energy, part of the balancing energy, termed long volume, must be sold back to the grid. Conversely, if production falls short, the balancing energy, termed short volume, must be purchased additionally from the grid. Residual energy, on the other hand, denotes the difference between projected production and the consumption profile. For instance, if a customer consumes 50 GWh per year but enters a PPA for 30 GWh, the remaining 20 GWh sourced from the grid constitutes residual energy.

When entering a PPA, negotiations also cover balancing and residual energy services. These services can be provided by the supplier covered by the PPA or by another supplier chosen through a separate bidding process. Opting for a single supplier carries the risk of long-term commitment, while involving multiple suppliers adds complexity but allows for flexibility in changing the balancing service provider during the PPA duration.

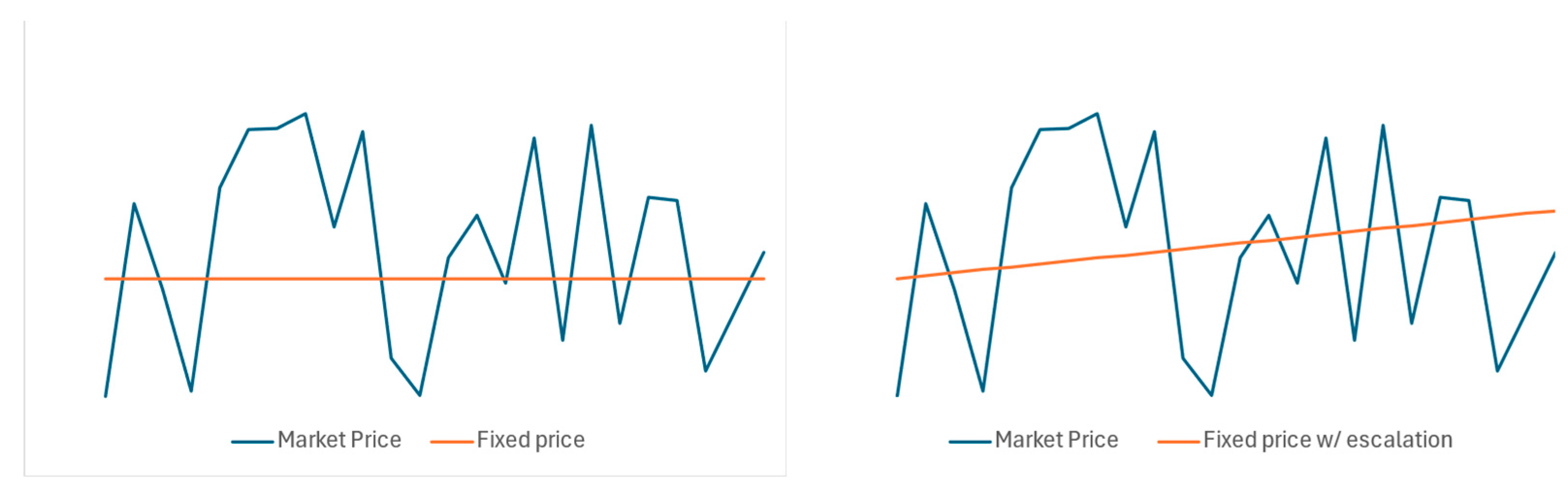

PPAs are distinguished by various pricing mechanisms, with the most prevalent being the fixed-price PPA, which can further be categorized into a one-shot fixed-price PPA and a fixed-price PPA with escalation.

A one-shot fixed-price PPA entails a predetermined fixed electricity price for the entire contract duration. While advantageous for the seller due to steady profits, it poses a significant price risk for the customer. If market prices decline, the PPA price may become financially unsustainable, particularly given the long-term nature of PPAs. Being locked into a multi-year contract with a price higher than market rates can jeopardize a company’s competitiveness and even lead to bankruptcy.

On the other hand, a fixed-price PPA with escalation involves a fixed energy price for the initial period, followed by annual increases determined by a predetermined rate or external benchmark. Although this arrangement provides some protection against market fluctuations, it still carries the risk of yearly price hikes.

Figure 4 illustrates these pricing mechanisms graphically.

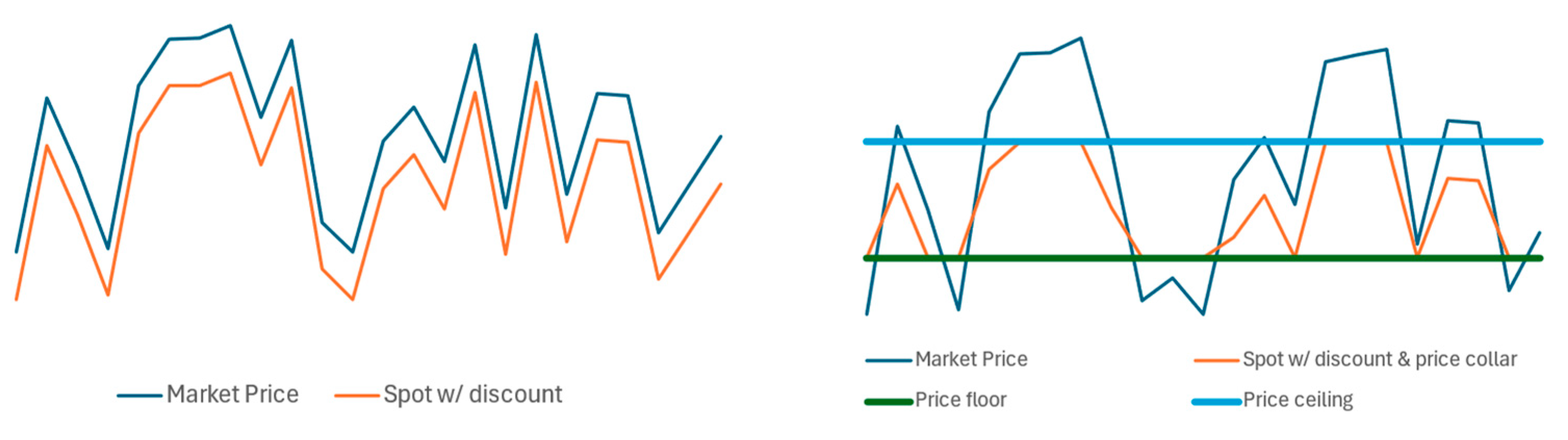

Another alternative pricing mechanism for PPAs involves setting the price as a discount to the market price, either spot or future. The negotiated percentage discount is specified in the PPA, allowing for a more accurate reflection of real-time market prices, which fluctuate based on supply and demand dynamics. This type of contract enables buyers to track market prices while benefiting from purchasing electricity at a reduced rate, potentially offering a cost advantage.

PPAs with a price discount to the market can incorporate additional features such as price ceilings, price floors and price collars. A price ceiling sets an upper limit on the price of electricity the buyer must pay, providing protection against excessive prices during periods of market volatility. Conversely, a price floor establishes the minimum price the seller receives for generated electricity, ensuring a baseline level of revenue even during times of low market prices. A price collar combines both a ceiling and a floor, defining a price range within which electricity prices fluctuate. This arrangement offers both buyers and sellers a level of price certainty and protection from extreme price swings, stabilizing revenue streams and mitigating risks associated with market volatility.

Figure 5 illustrates a PPA with spot indexation featuring a discount and the same mechanisms with a price collar.

The geographic scope is a crucial criterion in distinguishing PPAs, with cross-border PPAs being a notable category. These agreements involve the purchase of electricity generated in a country different from where the customer is located. In Europe, cross-border PPAs are predominantly VPPAs, while physical cross-border PPAs are theoretically possible but have not yet been confirmed in the market. The complexity and time-consuming nature of concluding physical cross-border PPAs stem from the requirement for multiple supply contracts. Despite their potential, cross-border PPAs entail significant basis risk, which hinges on the price correlation between the production and consumption markets. A higher correlation mitigates basis risk, emphasizing the importance of market dynamics in such agreements.

3. Risk of PPAs and Mitigation Strategies

Power Purchase Agreements have emerged as a popular solution, offering the prospect of price stabilization and the ability to reinforce sustainability commitments through the procurement of Energy Attribute Certificates (EACs). Despite their undeniable attractiveness, it is important to remember that PPAs are not without inherent risks, as elucidated below:

Price risk is often defined as a PPA going “out-of-the-money”, which means that a customer buys electricity at a higher price than the power from the grid. Clients can adopt certain strategies to address a price risk, including implementing alternative pricing mechanisms, such as collars or SPOT prices with indexation [

3,

11].

Shape risk/profile risk arises from the unpredictability of the timing of renewable energy generation, while the total power output may align with expectations. Shape risk is completely borne by the supplier in pay-as-consumed PPAs [

3,

11].

Volume risk stems from the uncertainty associated with a power plant’s ability to achieve the projected volume, estimated based on long-term meteorological data typically 20–30 years. One mitigation strategy is through a multi-technology PPA or multi-location PPA. By entering into such agreements, the client can reduce the amount of energy required for purchase, simultaneously minimizing market volatility exposure [

3,

11].

Cannibalization refers to the scenario where renewable energy sources “cannibalize” their own profits. In times of an abundance of renewable energy sources, there is a rapid surge in energy production from these technologies, leading to a decrease in the price at which they are sold [

12].

Operational risk arises when renewable energy systems fail to meet predefined operational availability levels due to malfunctioning processes, personnel or equipment issues or system problems. One strategy for mitigating operational risk is via the Proxy Generation VPPA, in which the size of the contract is determined by the amount of power the plant could deliver to the grid if it operated at the maximum equipment capacity and in accordance with the best operating practices [

11,

13,

14].

Balancing risk refers to the vulnerability to power system costs resulting from disparities between forecasted and actual renewable energy production. Mitigating balancing risks can involve strategies such as implementing a multi-technology PPA or engaging an external entity, like a utility, to consolidate assets into a resource pool for balancing risk management [

15,

16].

Basis risk is mainly related to VPPAs and arises from disparities in market prices at the power producer’s location and the power consumer’s location. Mitigating this risk involves securing supply contracts referencing established indices, like the Nordic Power Exchange price index (Nordpool). Additionally, cross-border VPPAs are executed in countries with highly correlated markets to minimize basis risk [

17,

18].

Credit risk and counterparty risk—Credit risk refers to the uncertainty of whether the buyer will meet their payment obligations on time or at all. Counterparty risk is the likelihood that one of the parties involved in the transaction will not fulfil their contractual obligations. Strategies to mitigate these risks include credit support, such as credit insurance, letters of credit (LoCs) and parent company guarantees (PCGs) [

16,

19].

Non-market risks arise from non-energy market events that can impact the outcomes of PPA contracts, such as regulatory changes, incentive adjustments or fluctuations in various cost factors that can result in losses for PPA parties. A risk mitigation strategy may involve incorporating a clause in the agreement promoting good faith renegotiation, stipulating that in the event of a significant change, both the energy off-taker and the project owner are obligated to convene a meeting and make a genuine attempt to discuss modifications [

3,

11].

Upon outlining and analyzing the inherent risks tied to Power Purchase Agreements (PPAs), it becomes apparent that they entail a degree of uncertainty. However, from the off-taker’s viewpoint, certain risks can be mitigated by shifting them to other stakeholders, such as the PPA developer or electricity supplier. Moreover, various strategies exist to concurrently address multiple risks, such as shaping risk, operational risk, balancing risk and price risk.

Table 2 outlines these key mitigation strategies, indicating the corresponding risks they alleviate.

4. PPA Market in 2022

A significant challenge for renewable project developers in 2022 was the rising LCOE (Levelized Cost of Electricity) and higher project costs driven by inflation. The LCOE represents the expenses associated with a power generation facility over its lifetime, including both initial capital expenditures (CAPEX) and the present value of ongoing operating expenses (OPEX). Over the past two years, the investment costs of new PV power plants and onshore wind farms have increased by 15% to 25%. This shift has posed challenges for the development of renewable technologies and is reflected in the rising prices of PPAs. The growth in investment costs can be attributed to several factors. Firstly, the cost of materials and components required for the construction of renewable assets has seen a significant rise. For example, materials for producing PV panels, such as steel, copper, aluminum and polysilicon, increased by approximately 300% from 2020 to 2022. Secondly, the expenses associated with engineering, procurement and construction (EPC) contracts for renewable assets have increased. Thirdly, the rise in interest rates has created greater difficulties in securing financing for renewable projects, with a 2% increase in interest rates in 2022 [

20].

Despite the most turbulent year in recent energy market history, the number and volume of PPAs remained relatively stable. According to Pexapark data, disclosed contract volumes declined by 21% from 10.7 GW in 2021 to 8.4 GW in 2022. However, the number of transactions increased by 4.5% from 154 in 2021 to 161 in 2022. Moreover, corporate PPAs accounted for the vast majority, comprising 80% of the total number of transactions and 83% of contracted volumes in 2022 [

21].

The significant increase in the share of intermittent renewables in the grid mix, coupled with the sharp rise in spot, intraday and balancing electricity prices, has led to another important trend—the escalation of balancing costs. In the aftermath of the energy crisis, balancing costs exceeded 10 EUR/MWh in many markets. Sellers have often faced greater challenges when negotiating balancing agreements compared to conventional PPAs. Due to the same factors, the problem of cannibalization, mentioned in

Section 3, has also increased, where the simultaneous production of renewable resources has resulted in lower prices for energy producers [

3,

21].

In addition, alternative price models such as partial fixed price, partial variable price or inflation-linked PPAs gained popularity in 2022. Such pricing mechanisms indicate that consumers have adopted a proactive strategy to counter market volatility and, by choosing more complex pricing mechanisms, want to protect themselves from large price spikes [

21].

Another observable trend in the field of PPAs caused by the energy crisis is the significant escalation of counterparty risk and credit risk. Counterparty risk has emerged as a key contributor to the collapse of many PPAs in 2022, mainly attributed to challenges in reaching a consensus on adequate credit support. Moreover, elevated market volatility has also increased the level of regulatory risk associated with new regulations designed to shield consumers from sudden price spikes. One example of such regulations is the EU-wide revenue cap of 180 EUR/MWh introduced by the European Commission in September 2022. This regulatory change has raised numerous concerns about its potential impact on Power Purchase Agreement revenues and investors’ expected returns on investment [

21].

Energy price spikes have also caused an increase in backwardation, a price phenomenon in which the futures price of a commodity is lower than the expected spot price at the time of delivery. For traders and investors, backwardation is a signal that the current price is too high, and the spot price is expected to eventually fall as the futures contract approaches expiration. The backwardation curve is very important for PPAs because it affects their duration and price. Significant backwardation has led to a price divergence between short- and long-term PPAs, resulting in significantly higher prices for the former. This phenomenon resulted in a high level of interest among power producers in choosing short-term hedges over the usually high-demanded long-term PPA [

21]. It is apparent that despite the volatile market landscape in 2022, the PPA’s popularity has not declined.

Section 5 will examine how the risks associated with these contracts have changed over this period.

5. Risk Assessment

A risk assessment of the off-site PPA project was conducted using Monte Carlo analysis, which is a multivariate modelling technique that uses multiple variables to predict possible outcomes. This statistical tool is used to generate probability distributions or to assess the risk of an investment or event. The Monte Carlo simulation tool uses historical price data for a specific market and, by performing a selected number of iterations, checks the probability of the PPA price being more expensive than the market price. To analyze the impact of the energy crisis on PPA risk, three sets of simulations were run—in 2020, before the pandemic and then Russia’s war with Ukraine, in 2022, when the impact of the energy crisis was more apparent and in 2023, when energy prices gradually fell and relatively stabilized. For the risk assessment, two distinct markets have been selected: Germany and Spain. These countries differ in terms of the composition of their energy mix, dependence on Russian fossil resources, advances in renewable energy technologies and maturity of PPA markets. This choice was made to provide a comprehensive perspective on the impact of the energy crisis on different European countries. Before starting the Monte Carlo simulation, the following input data had to be defined:

Hourly power output from renewable installation for a year at the selected location: To obtain the initial data inputs, energy production was assumed to come from a PV installation. Utilizing the European Commission’s Geographical Information System, which gathers hourly radiation and PV power production data from 2005 to 2020 for European countries, two locations were chosen—one in Germany and one in Spain—by specifying their longitude and latitude. Hourly energy production data from PV panels for the years 2018 to 2020 were collected for these specified sites to create an average energy production profile for the region over a three-year span. These data were generated considering the optimal PV module conditions such as azimuth and tilt. Based on expertise from E&C Consultants, it was assumed that the PV installation would yield 30 GWh per year. The hourly production of the PV plant was then calculated by multiplying the hourly profile for each location by the determined power output of 30 GWh. Additionally, the PPAs considered in the simulation were baseload PPAs [

22].

Figure 6 illustrates the hourly PV production in Germany and Spain.

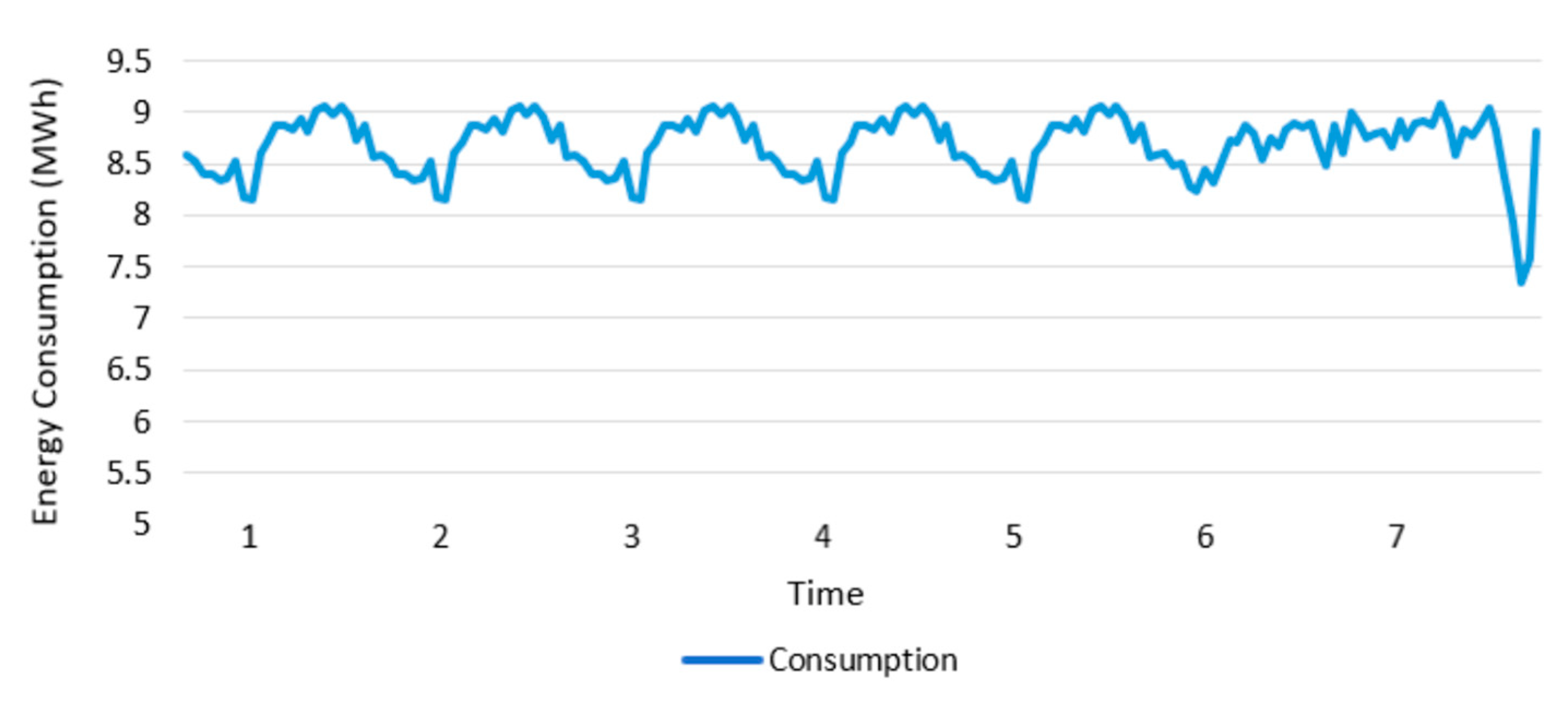

The hourly energy consumption of a hypothetical client for one year: It was assumed that 50% of the customer’s energy consumption would be met by energy generated by the PPA plant, resulting in a consumption of 60 GWh. The consumption profile of a hypothetical customer, shown in

Figure 7, was the same for Germany and Spain. Analyzing this graph, a consistent trend can be observed each day—an increase in energy consumption at midday and a decrease at night.

Energy market information for the selected country: Historical energy prices were sourced from the European Energy Exchange (EEX), an energy trading platform for the German market in Europe, and OMIE, the entity in the Iberian energy market in Spain, known as “Operador del Mercado Ibérico de Energía—Polo Español, S.A”.

PPA prices offered in Germany and Spain in 2020, 2022 and 2023 and balancing costs: This study considered PPA prices from the fourth quarter of 2020 and 2022 and the second quarter of 2023, utilizing the LevelTen PPA Price Index, which is derived from the 10% most competitive bids in a given market. It is important to note that in the simulation, the profiles of PV production and customer energy consumption remain constant across iterations, while the price profile varies. This price profile is generated in two stages: firstly, using one year of future calendar price quotes to calculate an average future price and its standard deviation, and secondly, by generating an hourly price profile for one year based on historical SPOT prices and the Gaussian future price distribution. This iterative process results in the most probable profile and price after a fixed number of iterations.

Balancing costs are determined by the TSO due to the imbalance between the hourly e-program, which represents expected consumption for the next day, and actual volumes at 15 min intervals. Detailed balancing costs are difficult to obtain and were assumed based on the market research [

23,

24]. Moreover, to determine balancing costs for each simulation, assumptions were made based on several factors, namely, the greater the share of an asset in the system imbalance, the higher the balancing cost, and an increasing capacity of RES with intermittent generation raises the balancing costs.

Table 3 presents the adopted PPA prices in Germany and Spain and balancing costs, the latter being the same in both countries.

Based on the production profiles for previously defined locations, baseload PPA models were generated for Germany and Spain, as illustrated in

Figure 8.

The analysis tracks PPA-related risks from 2020 to 2023, assessing the impact of the energy crisis on the market. It examines the landscape before the crisis in 2020, analyzes the crisis in 2022, and evaluates recent developments in 2023 to gauge the current situation. Key factors include customer savings and the risk of PPA prices exceeding market prices. Six simulations, each with 500 iterations, were conducted based on adopted assumptions. Results are summarized in

Table 4 (Germany) and

Table 5 (Spain).

The first row of

Table 4 and

Table 5 show the average PPA price paid per MWh depending on a certain point in time. The following algorithm was used.

where

is the price paid by the client with a PPA [EUR/MWh],

is PPA generation [MWh],

is the client consumption [MWh],

is the PPA price [EUR/MWh],

is the balancing costs [EUR/MWh] and

is the spot market price [EUR/MWh].

The next row in

Table 4 and

Table 5 shows the price without a PPA, which is derived from the Monte Carlo simulation and represents the probable price deduced from historical data and expected future prices. Then, the cost of the PPA is displayed, which is calculated as the PPA price multiplied by the total volume of energy delivered under the PPA. Subsequently, the total cost of reselling or purchasing energy to the grid is presented. These costs are substantial for two reasons. Firstly, only 50% of the customer’s needs are met by the energy produced under the PPA, and the rest is the residual energy that must be purchased in addition. Secondly, the discrepancy between the customer’s consumption profile and the production profile of the PV plant leads to the requirement of imbalances’ settlement in the SPOT market. The simulation analyzes baseload PPA contracts, which specify the energy supply in the capacity blocks. For this reason, these contracts require a significant amount of energy to be traded on the SPOT market and involve greater exposure to energy price volatility.

Table 4 and

Table 5 also provide information on the net cost of PPAs compared to the total cost without them, showing how much the client has saved by entering into this agreement. In the last row of the table, the probability of the PPA “going out of the money” is presented, showing the likelihood of the market price being lower than the PPA price.

When examining the numbers, it becomes clear that both Germany and Spain have recorded the greatest potential for savings in 2020. This phenomenon can be attributed to lower PPA basis prices and balancing costs, which created a beneficial difference between the market price and PPA price.

In 2022, during the energy crisis, there was a significant decrease in potential cost savings, both in Germany and Spain. Several factors contributed to this change. Firstly, the analysis incorporated notably high balancing costs, which led to an increase in the PPA price. Secondly, the PPA price itself was considerably higher compared to two years prior. Considering all these factors, this narrowed the gap between the market price and the PPA price.

An intriguing situation emerged in 2023, when Germany experienced an increase in PPA savings, while Spain saw a decrease. It should be noted that the level of balancing costs in both years was the same at 15 EUR/MWh in both countries. However, Germany’s PPA price dropped from 90 EUR/MWh in 2022 to 75 EUR/MWh in 2023. Spain, on the other hand, kept its PPA price steady at 46 EUR/MWh. This phenomenon may indicate the potential impact of the introduction of a price cap in Spain, which stabilized and reduced electricity prices in the country. These measures could result in the market price being closer to the PPA price, thus reducing the benefits of it. Nevertheless, PPAs continued to offer consumers a reasonable financial choice, even in the face of market fluctuations and uncertainty, as evidenced by the positive values obtained in the assessment [

25].

Another significant outcome revealed in the simulation is the value of the risk associated with the possibility of Power Purchase Agreements “going out of the money”. One notable finding is that the risk levels in both chosen countries were similar in 2020 and 2022. Despite the earlier pointed-out distinctions in their reliance on Russian fossil fuel imports and the progress of the PPA market, the changes in risk show a parallel pattern. The risk of the PPA price exceeding the market price was 23.30% in Germany and 21% in Spain in 2020.

The risk of PPAs “going out of money” substantially increased in 2022 during the energy crisis. Notably, it rose more for Spain than for Germany. At the same time, the price of a PPA in Spain increased by 12 EUR/MWh from 34 EUR/MWh to 46 EUR/MWh, and in Germany, it almost doubled, from 49 EUR/MWh to 90 EUR/MWh. Such an increase for the Spanish market could be caused by the introduction of a price cap that lowered and stabilized energy prices, increasing the risk that a higher PPA price would surpass the market price.

Looking at 2023, different trends for Germany and Spain emerge. In the case of the first selected country, risk significantly decreased and reached the lowest level from all simulations. The higher and more volatile market prices, coupled with a lower PPA price, provided a significant protective buffer, ensuring a favourable PPA price compared to the market price. On the other hand, the risk of PPAs becoming financially unviable in 2023 stayed relatively constant in Spain compared to the previous year. It is important to highlight that the proposed PPA price and balancing costs remained unchanged between 2022 and 2023. Additionally, the previously mentioned price cap impacted the market price already in 2022, thus creating a similar market environment. The maximum level of risk that the PPA price would exceed the market price was 35%, indicating relatively positive results.

6. Discussion

In 2022, renewable energy project developers faced significant challenges, partly driven by the increase in the Levelized Cost of Electricity (LCOE) and rising project costs due to inflation. For instance, capital expenditures for new PV power plants and onshore wind farms surged by 15% to 25%. This escalation could have been attributed, in part, to the escalating costs of materials and the expenses linked to the engineering, procurement and construction of renewable projects. This shift presented a hurdle for the advancement of renewable technologies and manifested itself in higher PPA prices.

Another factor contributing to the elevated pricing of PPAs was the heightened costs associated with balancing and shaping the energy profiles within PPAs. This challenge was exacerbated by the intermittent nature of energy generation from RES and the limited flexibility of the grid. Consequently, negotiations related to balancing costs became a pivotal aspect of the PPA agreement process, whereas in the past, they played a more marginal role. Moreover, this growth of renewables and the lack of grid flexibility have led to another phenomenon known as cannibalization. Renewables have begun to cannibalize their own profits, putting additional strain on renewable projects and PPAs.

The environment in 2022 was also filled with uncertainties and concerns related to anticipated regulatory changes. Governments, to protect consumers from extreme energy prices, introduced various measures, including price caps. In September 2022, the European Commission announced a European-wide revenue cap set at 180 EUR/MWh. This regulatory change raised numerous concerns regarding its potential impact on revenue from PPAs and the expected returns on investments. There were fears that such regulatory changes could potentially reduce incentives for green energy providers to engage in PPAs.

Adjustments in legislation were also a contributing factor to the shift in the supply and demand dynamics of EACs (Energy Attribute Certificates), resulting in a drastic price increase of nearly 500% in Europe over the past two years. An example of such a change was the implementation of a 97% tax on income derived from the sale of Guarantees of Origin (GOs) for renewable energy producers in Poland. This substantial tax burden has the potential to create a situation where the profits from selling Guarantees of Origin are overshadowed by the associated procedural costs. As a result, some certificate producers may choose to stop their sales, potentially reducing their availability and subsequently causing an increase in PPA prices.

Additionally, the energy crisis played a role in driving up backwardation, a pricing phenomenon where the futures price of a commodity is lower than the expected spot price at the time of delivery. Backwardation signals that the current price is too high and will eventually decrease as the futures contract nears its expiration date. The backwardation curve is crucial for determining PPA prices and contract durations. The significant backwardation in 2022 led to price disparities between short-term and long-term PPAs, with short-term contracts being valued considerably higher than their typically more expensive long-term counterparts. This situation generated significant interest among energy producers in choosing short-term deals. Moreover, in 2022, credit risk became a more significant challenge in the context of higher interest rates. Investors encountered greater difficulty in securing financing for renewable projects.

All the developments above, which led to rising prices and increased PPA risks, cast doubts on the long-term profitability of Power Purchase Agreements. As the costs of these contracts continued to climb, investors, businesses and institutions began to analyze thoroughly the long-term advantages associated with such agreements.

By historical standards, a market characterized by significant volatility and price instability is not an ideal environment for contracting. Nevertheless, despite this turbulent period, there was no decline in the number or volume of PPAs, and activity in this sector remained consistently high. The main reason for this phenomenon was the companies’ proactive approach to hedging against fluctuations in energy prices. Many corporations opted for long-term PPAs instead of securing energy supplies for the near future. Some of these companies entered into these PPAs as a strategic move to achieve an averaging effect and protect themselves from excessive contract prices in the first year. This higher activity in 2022 was mainly driven by corporate players, who accounted for 80% of the total number of deals and 83% of contracted volumes in 2022.

The continuing popularity of PPAs can be attributed to the increased adoption of more flexible PPA models and applied strategies to mitigate the associated risks. Both parties involved in PPAs have taken measures to protect themselves from adverse scenarios through various mechanisms.

One solution that gained popularity in 2022 was alternative pricing mechanisms, such as inflation-linked prices, price floors, collars or hybrid systems. These mechanisms were designed to guard against both very high and very low energy prices, ensuring that the PPA price remains more closely aligned with market dynamics. Furthermore, in 2022, multi-technology or multi-location PPAs became increasingly popular. By opting for a PPA that covers multiple technologies or locations, customers could reduce their energy procurement commitments while concurrently limiting their exposure to market volatility. This approach partially helped diversify their risk across volume, price and profile.

Moreover, new types of agreements were introduced, including Proxy-Gen PPAs with Volume Firming Agreements. In Proxy-Gen VPPAs, the contract size is determined based on the energy the renewable plant can deliver to the grid at the maximum equipment efficiency and optimal operating conditions. This incentivizes renewable plant owners to maximize their performance. These Proxy Generation VPPAs could be complemented with Volume Firming Agreements, shifting risk management responsibilities to third parties, such as insurance companies. Despite the higher costs, this solution effectively mitigates various types of risks, including price, shape, volume and operational risks.

To assess how the risk associated with Power Purchase Agreements changed in response to the energy crisis, this paper analyzed two examples: the Spanish market, a leader in PPAs, and the German market, which had fewer PPAs and a different market characteristic. The analysis involved conducting Monte Carlo simulations for three periods: before the energy crisis in 2020, during the crisis in 2022 and in 2023.

After studying the simulation results, it was demonstrated, firstly, that the challenging market conditions in 2022 led to a decrease in cost savings generated from PPAs and an increase in associated risks. This confirmed the statement that the energy crisis hurt the risks associated with PPAs. However, even in the difficult energy landscape of 2022, which created the least favourable conditions for contracting, the risk of PPA prices exceeding market prices remained relatively low, accounting for about one-third of scenarios. Furthermore, engaging in PPAs still resulted in significant cost savings compared to conventional energy purchases from the grid. Additionally, when assessing the profitability, having PPAs in the first few years can offset higher prices in the future. In such cases, considering the entire PPA energy budget, it may be lower than purchasing energy from the grid over the entire period. Very importantly, PPAs also contribute to the development of sustainable technologies and can bring significant savings to a company through the purchase of Energy Attribute Certificates and carbon tax reductions.

These findings demonstrate why PPA activity did not decrease in 2022 and even increased, with these trends continuing into 2023. By the end of August 2023, the signed volumes reached 9.5 GW in 166 deals, surpassing last year’s figure of 162. This is a clear indicator of a potential new record in 2023, especially considering the expected increase in activity during the last quarter of the year when many contracts rush to conclusion before year-end.

Despite market volatility, this study highlighted the effectiveness of PPAs in mitigating energy price spikes. Positive benefits were consistently observed with PPAs in all scenarios, even in challenging market conditions with frequent price fluctuations. The risk of PPA prices exceeding market prices remained relatively low and manageable, emphasizing their controlled nature during the periods examined. Notwithstanding the challenges posed by rising PPA prices and the associated risks stemming from the energy crisis, this study has demonstrated that Power Purchase Agreements remain compelling instruments for ensuring stability and predictability in long-term energy costs. These agreements have proven their effectiveness in shielding against energy price fluctuations, facilitating price stabilization, enabling budget planning and actively supporting the adoption of sustainable technologies. The events of 2022 underscored the importance of conducting thorough risk assessments prior to entering into PPAs and selecting the PPA type that aligns with the company’s risk appetite. Nevertheless, the surge in PPA activity witnessed in 2023 serves as a further testament to their enduring value and resilience in the evolving energy landscape. PPAs continue to play a pivotal role in shaping the future of sustainable energy solutions.

7. Conclusions

After analyzing the results of the simulations, several conclusions emerge. Firstly, the challenging market situation in 2022 led to a decrease in generated savings from PPAs and an increase in associated risks, thus confirming the statement that the energy crisis hurt PPA-related risks. Secondly, even in this difficult energy landscape, the risk that the PPA prices would exceed market prices remained relatively low, accounting for about one-third of the scenarios. Furthermore, engaging in PPAs continued to yield significant cost savings compared to conventional grid power purchases. Furthermore, while evaluating the profitability of PPAs, it is crucial to consider the situation when the savings from having a PPA in the first few years can offset higher prices in the future. Then, taking the entire PPA energy budget into account, it may be lower than buying energy from the grid for the entire period.

Very importantly, PPAs also contribute to the development of sustainable technologies and can bring significant savings to a company through the purchase of Energy Attribute Certificates and carbon tax reductions. Despite the challenges posed by rising PPA prices and the associated risks stemming from the energy crisis, this study has demonstrated that Power Purchase Agreements remain compelling instruments for ensuring stability and predictability in long-term energy costs. These agreements have proven their effectiveness in shielding against energy price fluctuations, facilitating price stabilization, enabling budget planning and actively supporting the adoption of sustainable technologies.

PPAs hold significant practical implications for both energy buyers and sellers, offering opportunities for cost savings, risk mitigation and sustainable energy procurement. For practitioners engaging in PPAs, several key recommendations emerge from current research findings. Before engaging in a PPA, a comprehensive risk assessment to identify and mitigate potential risks such as energy price fluctuations, regulatory changes and project uncertainties should be performed, using tools like Monte Carlo simulations for informed decision-making. Also, PPA portfolios should be diversified by exploring alternative pricing mechanisms, multi-technology agreements and innovative contract structures to spread risk, optimize cost savings and enhance resilience against market volatility. Flexibility and adaptability in PPA negotiations to accommodate changing market conditions, regulatory landscapes and technological advancements should be kept in mind. Robust monitoring and evaluation mechanisms to track PPA performance must be established to assess adherence to contract terms and measure sustainability goals.

We acknowledge several limitations in our study. Firstly, our simulations are based on specific assumptions regarding PV plant production, customer consumption and PPA prices. Altering these parameters could change the associated risks. For instance, a higher PPA price offered to the customer might increase transaction risk. Moreover, our analysis assumes steady customer consumption, whereas highly variable consumption or intermittent plant operation could impact PPA contract parameters differently. Additionally, our Monte Carlo simulation does not account for historical relationships between future and spot prices for consecutive periods, potentially underestimating market uncertainties.

In future research, we aim to expand the scope of the Monte Carlo simulation, by including different profiles of consumer demand, namely consumers with high variable demand. Also, we intend to explore the influence of a wider range of PPA price variations.