Residual Biomass Gasification for Small-Scale Decentralized Electricity Production: Business Models for Lower Societal Costs

Abstract

1. Introduction

2. Materials and Methods

2.1. Literature Review

2.1.1. Economic Assessment of Small-Scale Biomass Gasification for Electricity Generation

2.1.2. Barriers and Challenges to Small-Scale Biomass Gasification

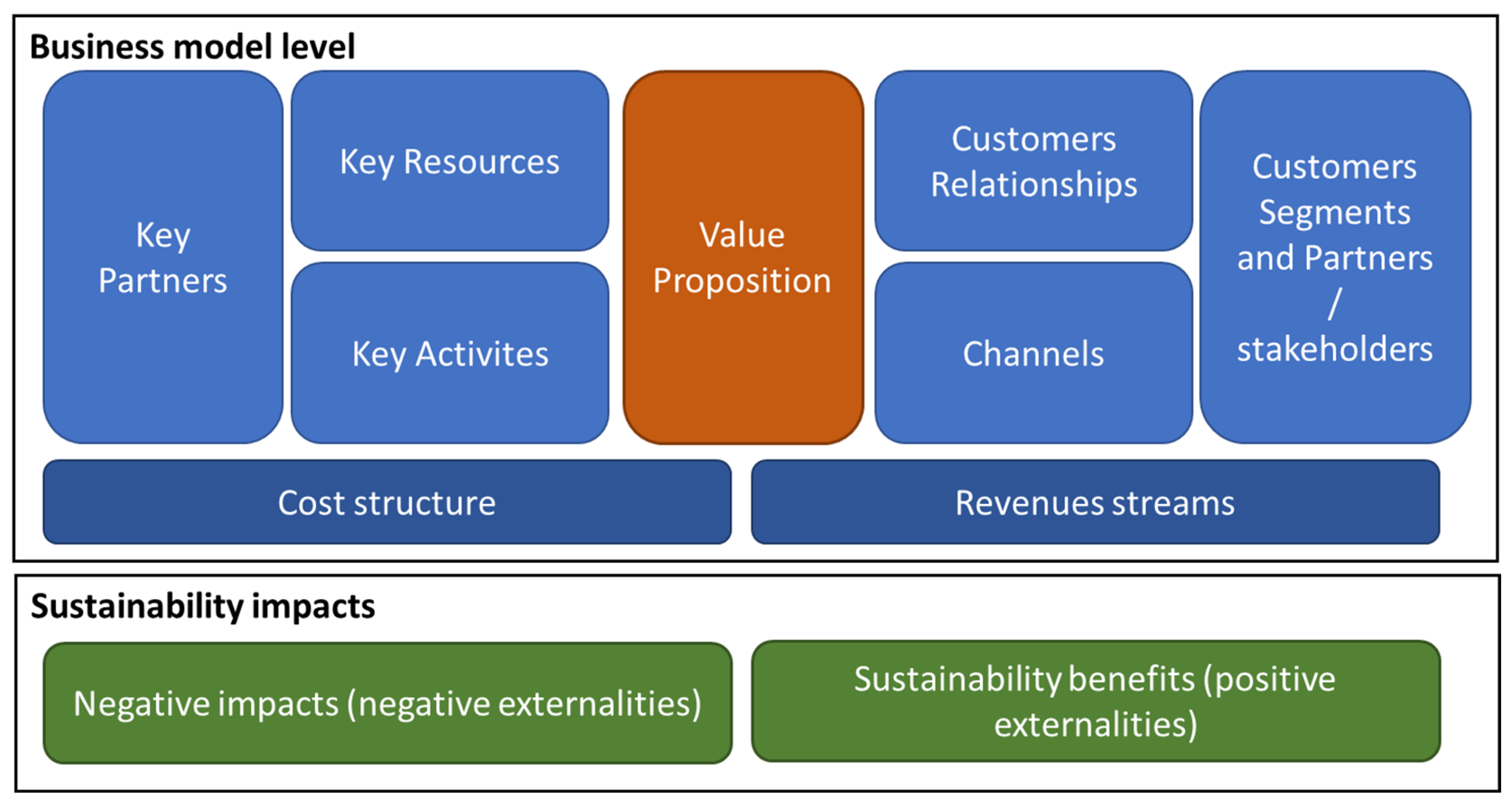

2.1.3. Sustainable Business Models

2.1.4. Life-Cycle Costs, LCOEs, and External Costs

2.2. Methods

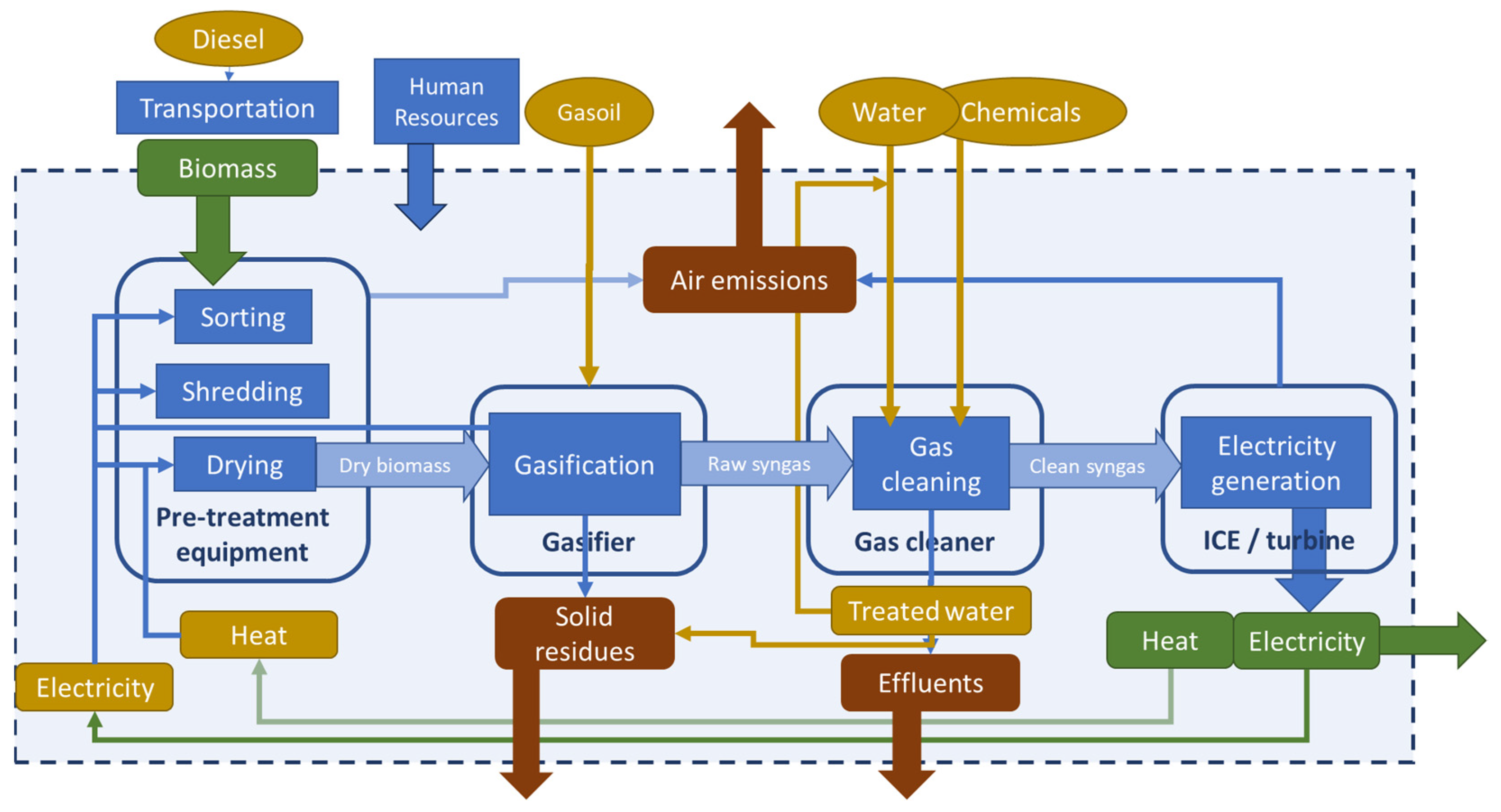

2.2.1. Elaboration of Tool to Calculate LCOE and Externalities of Small-Scale Electricity Generation from Biomass Gasification

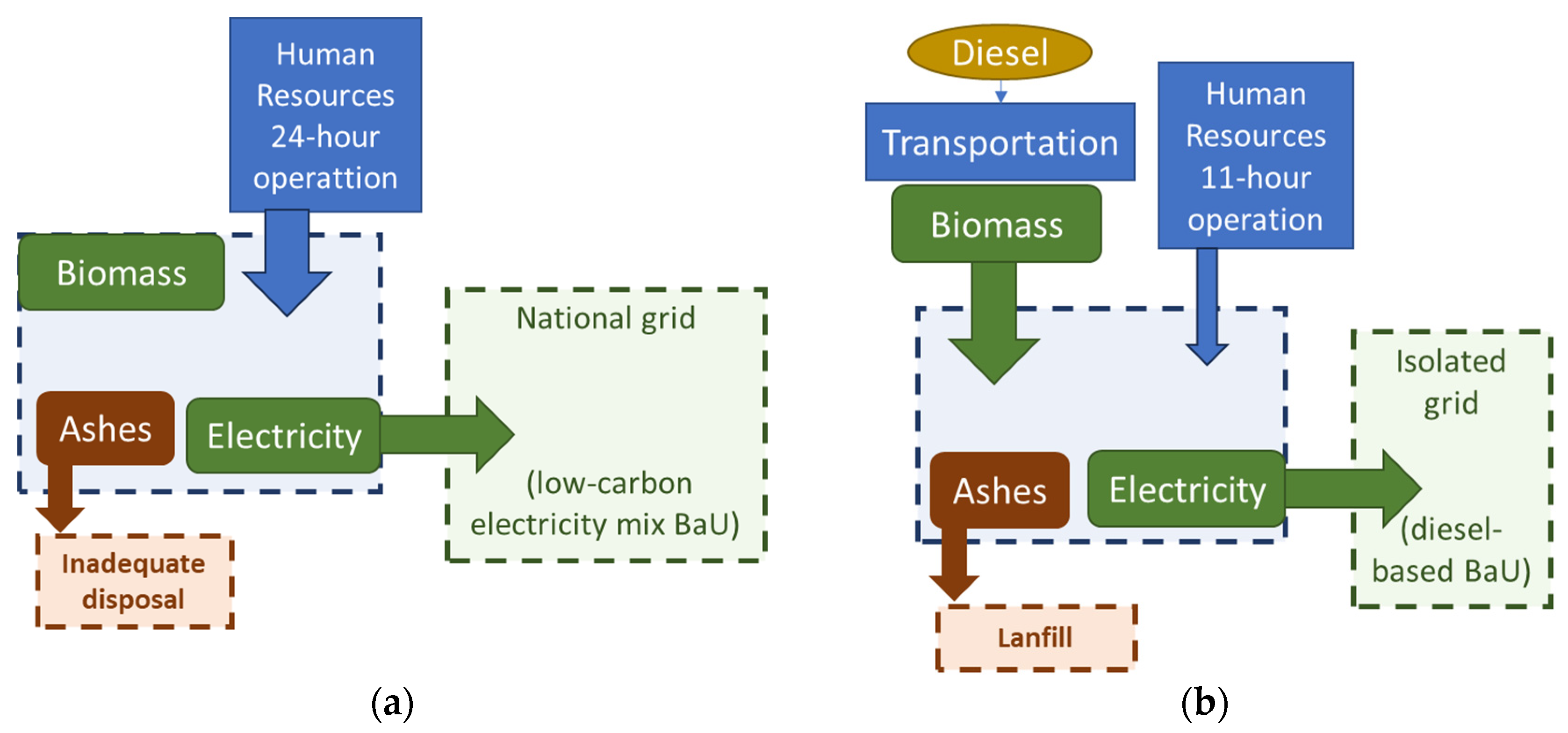

2.2.2. Definition of the Case Studies

2.2.3. Data Collection, System Dimensioning, and Financial Assumptions

3. Results

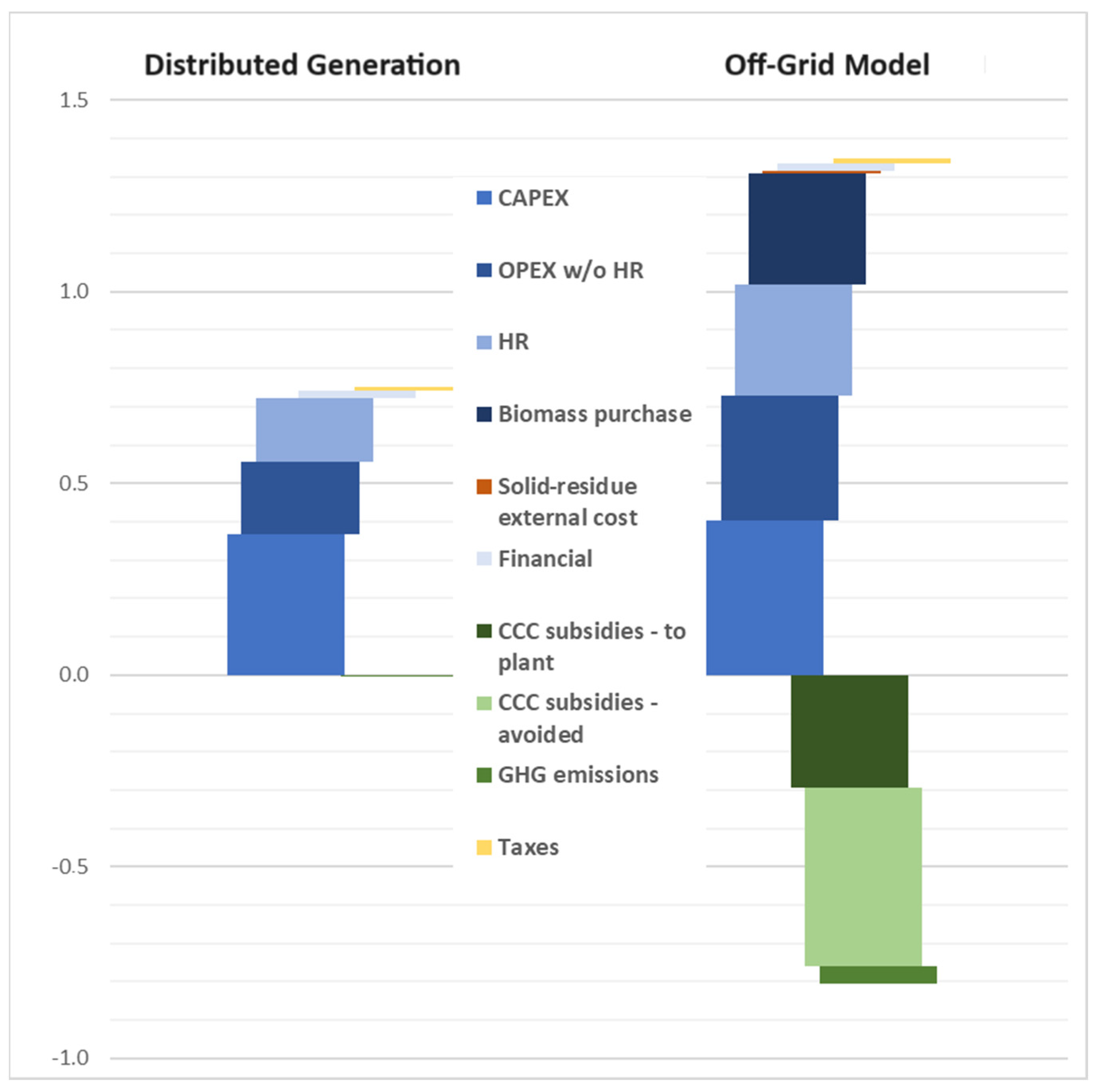

3.1. Life-Cycle Costs of Electricity Production

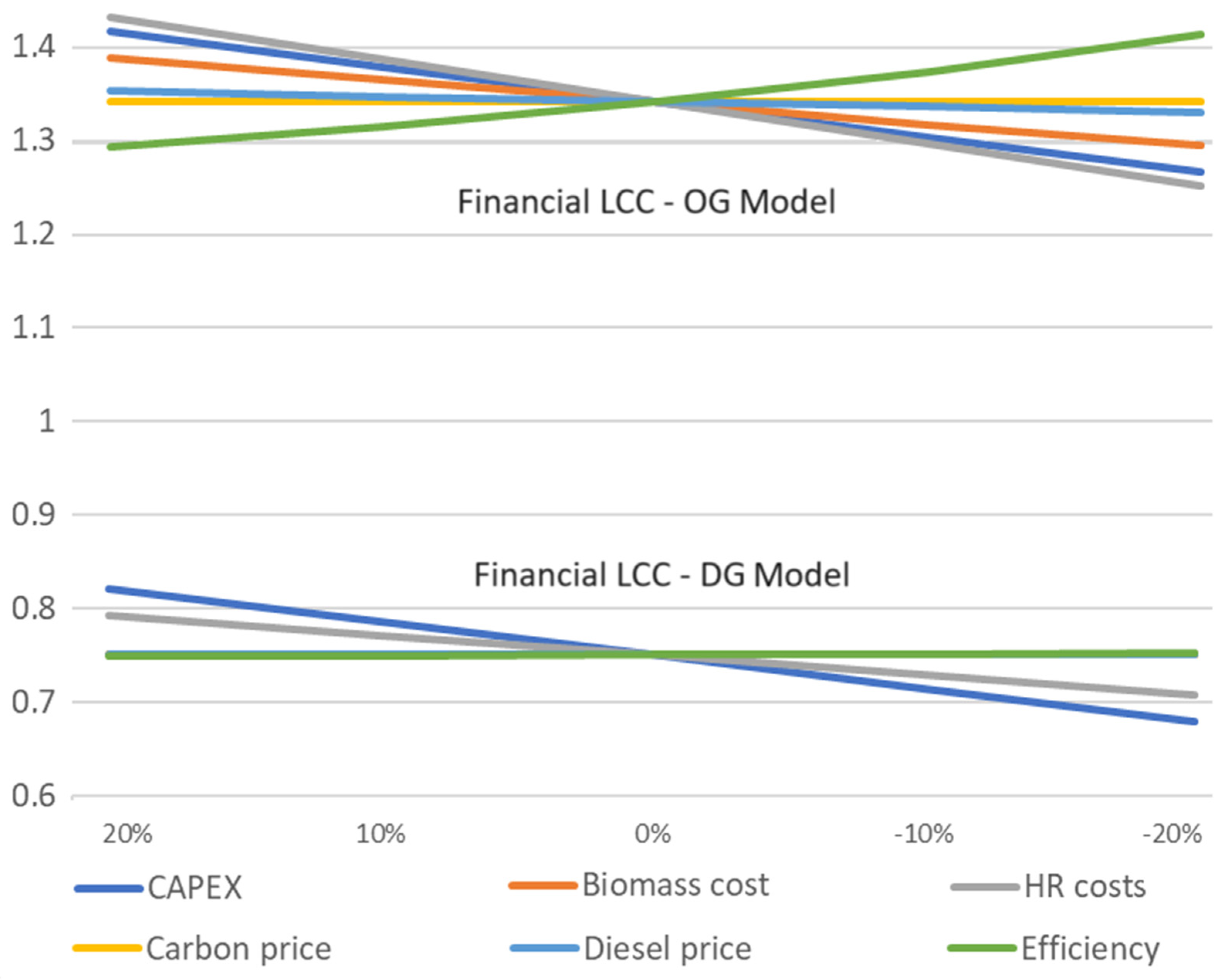

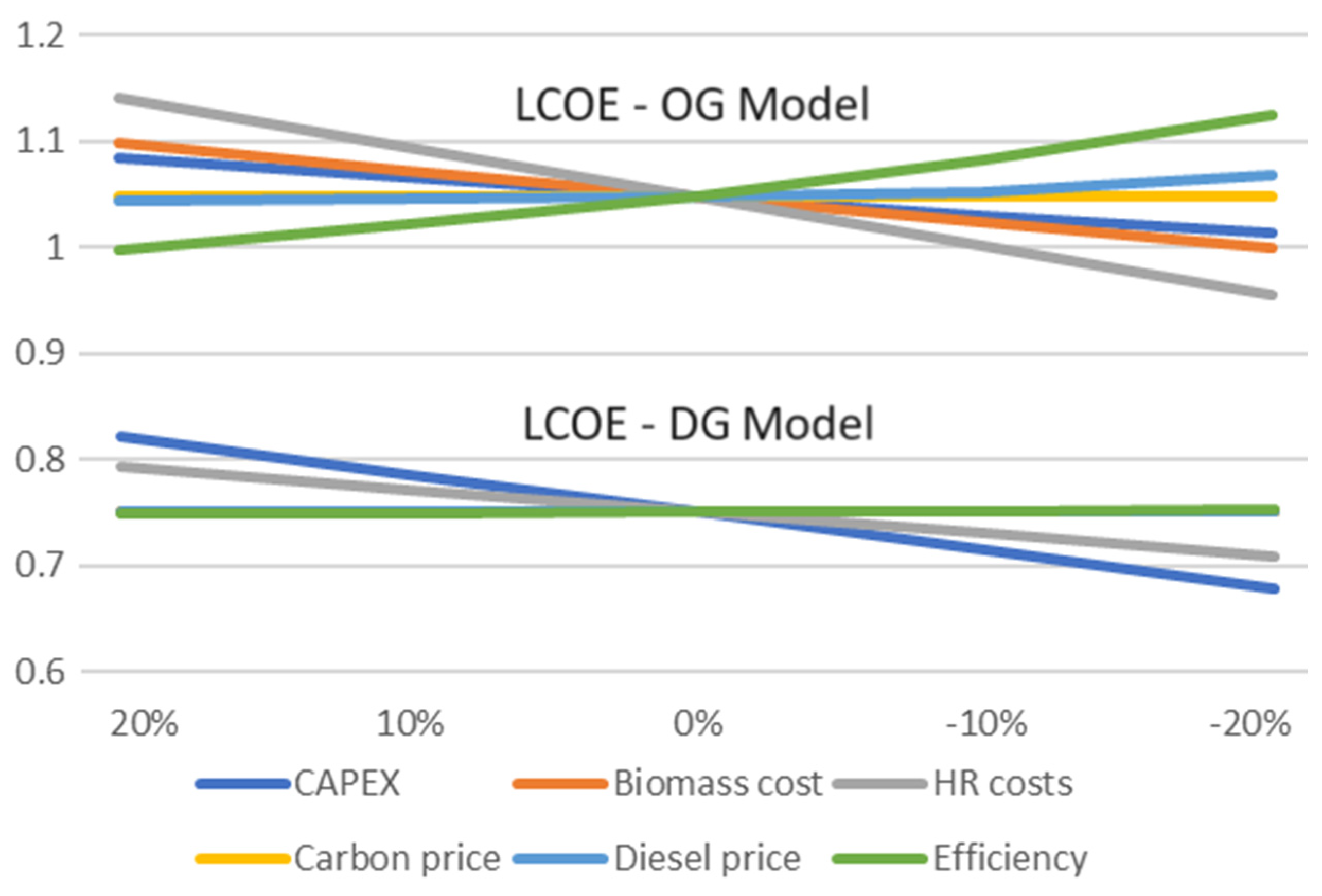

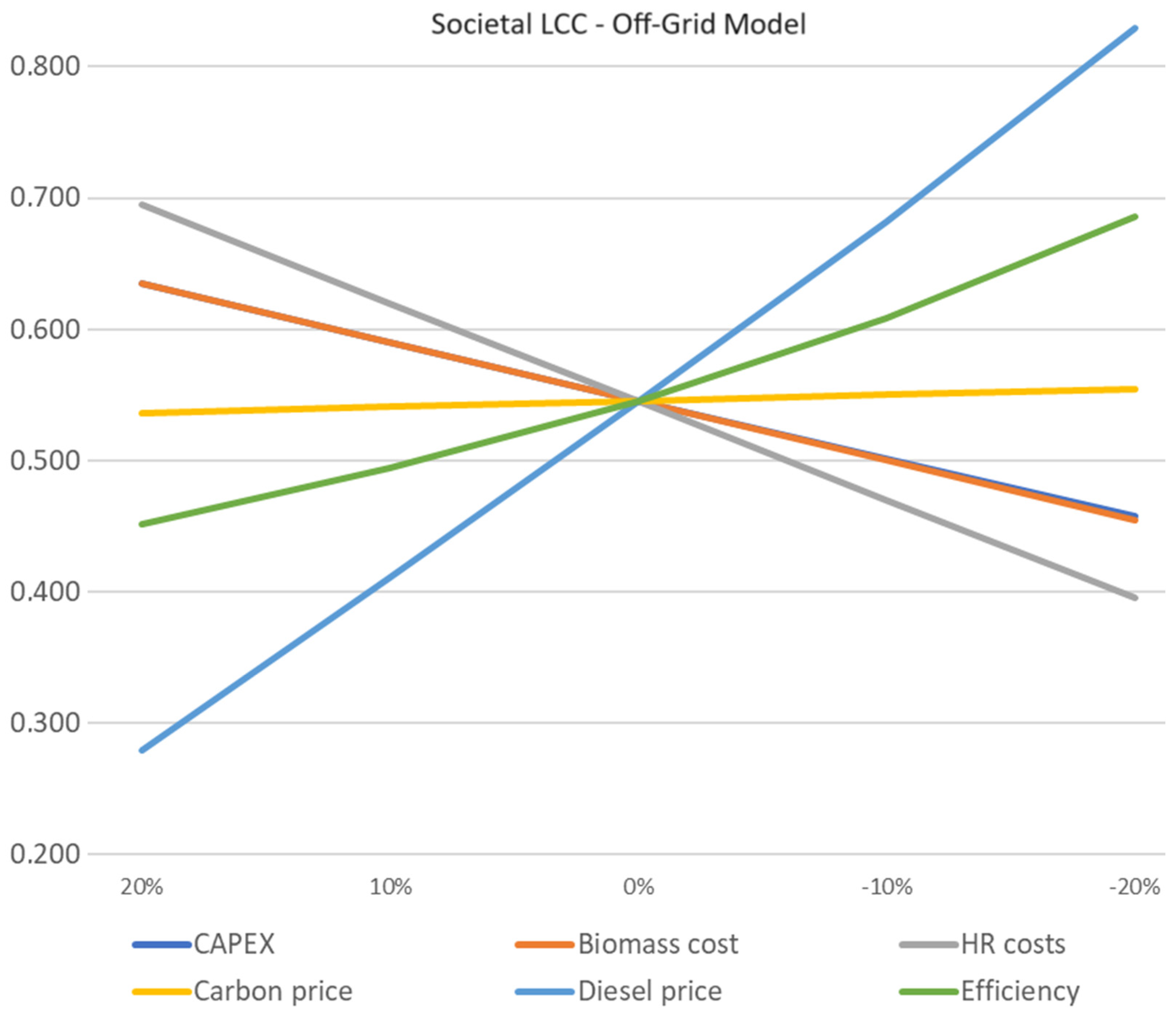

3.2. Sensitivity Analysis

4. Discussion

5. Conclusions

Supplementary Materials

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

| CAPEX—All Values in BRL | DG | OG | Comments |

|---|---|---|---|

| Gasification equipment | 2,668,000 | 2,668,000 | |

| Pre-treatment system | 184,000 | 184,000 | Reference cost: BRL 400/kW |

| Drying system | 276,000 | 276,000 | Reference cost: BRL 600/kW |

| Gasification reactor | 1,840,000 | 1,840,000 | Reference cost: BRL 4000/kW |

| Gas-cleaning system | 368,000 | 368,000 | Reference cost: BRL 800/kW |

| ICE | 828,000 | 828,000 | Reference cost: BRL 1800/kW |

| Balance of plant | 1,223,600 | 1,223,600 | 35% of the total equipment cost, an average of 25%, and 45% of the references used |

| Equipment transportation | 50,000 | 200,000 | Higher costs are due to the remoteness of the isolated grid |

| Engineering | 400,000 | 400,000 | Engineering costs based on commercial offer from W2E Energia |

| Administrative costs | 100,000 | 300,000 | Evaluation based on experience |

| TOTAL—BRL | 5,269,600 | 5,619,600 | |

| TOTAL—BRL/kW | 11,456 | 12,217 |

| OPEX—All Values in BRL | DG | OG | Comments |

|---|---|---|---|

| Energy needs of the system | Considered in the energy balance | ||

| FIXED OPEX | 414,640 | 774,000 | |

| Human resources | 264,000 | 576,000 | Four operators for 8 h operation—adjusted to daily operation hours. Average monthly salary: BRL 4000 |

| Consumables | 46,000 | 46,000 | 100 BRL/kW |

| Equipment maintenance | 92,000 | 92,000 | 200 BRL/kW |

| Administration | 12,640 | 60,000 | Higher costs are due to regulation/PPA management |

| VARIABLE OPEX | 26,688 | 419,197 | |

| Consumables | 17,546 | 18,133 | 0.01 BRL/kWh |

| Solid-residue handling | 9142 | - | Landfill fee: 100 BRL/ton |

| Biomass purchases | 0 | 304,760 | 100 BRL/ton |

| Biomass transportation | 0 | 96,304 | Based on diesel consumption for biomass transportation |

| TOTAL | 441,328 | 1,193,197 | Total value per year |

| Values in kgCO2eq/kWh | DG | OG | Sources and Comments |

|---|---|---|---|

| Agricultural production | This stage is out of the scope of this study | ||

| Biomass transportation | 0 | 0.02 | Calculated considering 2 tons of biomass per truck, 2 km/L of diesel consumption of truck, 10 km transportation (20 km both ways), IPCC [104] Emission Factor of Diesel of 0.074 kgCO2e/MJ, 595 kWh produced per ton of biomass |

| Construction phase | 0.027 | Calculated based on [41] | |

| Gasification process and electricity production | 0.0204 | Calculated based on [40]: non-biogenic emissions from gasification and power production processes | |

| Water treatment | 0.0068 | Calculated based on the methodology in [41], which evaluated CH4 emissions from wastewater treatment and the use of 9.8 L of water per kWh [102] | |

| Avoided emissions from BaU electricity | 0.1 | 0.666 | Calculated based on data from [103] |

References

- IPCC. Sixth Assessment Report: Synthesis Report. Intergovernmental Panel of Climate Change. 2022. Available online: https://www.ipcc.ch/report/ar6/wg3/ (accessed on 20 January 2023).

- Baasch, S. Energy transition with biomass residues and waste: Regional-scale potential and conflicts. A case study from North Hesse, Germany. J. Environ. Policy Plan. 2021, 23, 243–255. [Google Scholar] [CrossRef]

- Lonergan, K.E.; Suter, N.; Sansavini, G. Energy systems modeling for just transitions. Energy Policy 2023, 183, 113791. [Google Scholar] [CrossRef]

- Kilinc-Ata, N.; Proskuryakova, L.N. Empirical analysis of the Russian power industry’s transition to sustainability. Util. Policy 2023, 82, 101586. [Google Scholar] [CrossRef]

- Cordeiro, N.K.; Cardoso, K.P.S.; Mata, T.C.; Barbosa, J.A.; Gonçalves, A.C., Jr. Gestão de Resíduos Agrícolas como forma de redução dos impactos ambientais. Rev. Ciências Ambient. 2020, 14, 2. [Google Scholar] [CrossRef]

- Basu, P. Biomass Gasification and Pyrolysis Practical Design and Theory; Elsevier: Oxford, UK; Academic Press: Cambridge, MA, USA, 2010; Available online: http://refhub.elsevier.com/S0306-2619(17)31094-2/h0005 (accessed on 10 June 2023).

- Benedetti, V.; Patuzzi, F.; Baratieri, M. Characterization of char from biomass gasification and its similarities with activated carbon in adsorption applications. Appl. Energy 2018, 227, 92–99. [Google Scholar] [CrossRef]

- Faaij, A.; van Ree, R.; Waldheim, L.; Olsson, E.; Oudhuis, A.; van Wijk, A.; Daey-Ouwens, C.; Turkenburg, W. Gasification of biomass wastes and residues for electricity production. Biomass Bioenergy 1997, 12, 387–407. [Google Scholar] [CrossRef]

- Elsner, W.; Wysocki, M.; Niegodajew, P.; Borecki, R. Experimental and economic study of small-scale CHP installation equipped with downdraft gasifier and internal combustion engine. Appl. Energy 2017, 202, 213–227. [Google Scholar] [CrossRef]

- Ferreira, E.T.d.F.; Balestieri, J.A.P. Comparative analysis of waste-to-energy alternatives for a low-capacity power plant in Brazil. Waste Manag. Res. 2018, 36, 247–258. [Google Scholar] [CrossRef]

- Klavins, M.; Bisters, V.; Burlakovs, J. Small Scale Gasification Application and Perspectives in Circular Economy. Environ. Clim. Technol. 2018, 22, 42–54. [Google Scholar] [CrossRef]

- Priall, O.; Gogulancea, V.; Brandoni, C.; Hewitt, N.; Johnston, C.; Onofrei, G.; Huang, Y. Modelling and experimental investigation of small-scale gasification CHP units for enhancing the use of local biowaste. Waste Manag. 2021, 136, 174–183. [Google Scholar] [CrossRef]

- Belgiorno, V.; De Feo, G.; Della Rocca, C.; Napoli, R.M.A. Energy from gasification of solid wastes. Waste Manag. 2003, 23, 1–15. [Google Scholar] [CrossRef] [PubMed]

- Khoo, H.H. Life cycle impact assessment of various waste conversion technologies. Waste Manag. 2009, 29, 1892–1900. [Google Scholar] [CrossRef] [PubMed]

- Bisht, A.S.; Thakur, N.S. Small scale biomass gasification plants for electricity generation in India: Resources, installation, technical aspects, sustainability criteria policy. Renew. Energy Focus 2019, 28, 112–126. [Google Scholar] [CrossRef]

- Dowaki, K.; Mori, S.; Fukushima, C.; Asai, N.A. Comprehensive Economic Analysis of Biomass Gasification Systems. Electr. Eng. Jpn. 2005, 153, 52–63. [Google Scholar] [CrossRef]

- González, C.A.D.; Pacheco Sandoval, L. Sustainability aspects of biomass gasification systems for small power generation. Renew. Sustain. Energy Rev. 2020, 134, 110180. [Google Scholar] [CrossRef]

- You, S.; Tong, H.; Armin-Hoiland, J.; Tong, Y.W.; Wang, C.-H. Techno-economic and greenhouse gas savings assessment of decentralized biomass gasification for electrifying the rural areas of Indonesia. Appl. Energy 2017, 208, 495–510. [Google Scholar] [CrossRef]

- Aberilla, J.M.; Gallego-Schmid, A.; Azapagic, A. Environmental sustainability of small-scale biomass power technologies for agricultural communities in developing countries. Renew. Energy 2019, 141, 493–506. [Google Scholar] [CrossRef]

- Sansaniwal, S.K.; Rosen, M.A.; Tyagi, S.K. Global challenges in the sustainable development of biomass gasification: An overview. Renew. Sustain. Energy Rev. 2017, 80, 23–43. [Google Scholar] [CrossRef]

- United Nations. Financing for Sustainable Development Report 2023—Financing Sustainable Transformations. 2023. Available online: https://desapublications.un.org/publications/financing-sustainable-development-report-2023 (accessed on 10 October 2023).

- Callan, S.; Thomas, J. Environmental Economics: Theory, Policy and Applications; South Western College: Chula Vista, CA, USA, 2010. [Google Scholar]

- Zott, C.; Amit, R.; Massa, L. The Business Model: Recent Developments and Future Research. J. Manag. 2011, 37, 1019–1042. [Google Scholar] [CrossRef]

- Bolton, R.; Foxon, T.J. A socio-technical perspective on low carbon investment challenges—Insights for UK energy policy. Environ. Innov. Soc. Transit. 2015, 14, 165–181. [Google Scholar] [CrossRef]

- Boons, F.; Ludeke-Freund, F. Business Models for Sustainable Innovation: State of the Art and Steps towards a Research Agenda. J. Clean. Prod. 2013, 45, 9–19. [Google Scholar] [CrossRef]

- Antikainen, M.; Valkokari, K. A framework for sustainable circular business model innovation. Technol. Innov. Manag. Rev. 2016, 6, 5–12. [Google Scholar] [CrossRef]

- Otoo, M.; Gebrezgabher, S.; Drechsel, P.; Rao, K.C. Defining and Analyzing RRR Business Cases and Models. In Resource Recovery from Waste—Business Models for Energy, Nutrients and Water Reuse in Low and Middle-Income Countries; Drechsel, P., Ed.; Routledge: New York, NY, USA, 2018. [Google Scholar]

- Freitas, K.T.; Souza, R.C.R.; Seye, O.; Santos, E.C.S.; Xavier, D.J.C.; Bacellar, A.A. Custo de geração de energia elétrica em comunidade isolada do Amazonas: Estudo preliminar do projeto NERAM. Rev. Bras. De Energ. 2006, 12, 1. Available online: https://www.cdeam.ufam.edu.br/images/Publicacoes_e_artigos/2006/2006_Art_5_CDEAM.pdf (accessed on 30 September 2023).

- Ince, P.J.; Bilek, E.M.; Dietenberger, M.A. Modeling Integrated Biomass Gasification Business Concepts. Research Paper FPL-RP-660; U.S. Department of Agriculture, Forest Service, Forest Products Laboratory: Madison, WI, USA, 2011; 36p. Available online: https://www.fpl.fs.usda.gov/documnts/fplrp/fpl_rp660.pdf (accessed on 25 November 2022).

- Yagi, K.; Nakata, T. Economic analysis on small-scale forest biomass gasification considering geographical resources distribution and technical characteristics. Biomass Bioenergy 2011, 35, 2883–2892. [Google Scholar] [CrossRef]

- Buchholz, T.; Da Silva, I.; Furtado, J. Power from wood gasifiers in Uganda: A 250 kW and 10 kW case study. Proc. Inst. Civ. Eng. Energy 2012, 165, 181–196. [Google Scholar] [CrossRef]

- Bhattacharyya, S.C. Viability of off-grid electricity supply using rice husk: A case study from South Asia. Biomass Bioenergy 2014, 68, 44–54. [Google Scholar] [CrossRef]

- Pode, R.; Diouf, B.; Pode, G. Sustainable rural electrification using rice husk biomass energy: A case study of Cambodia. Renew. Sustain. Energy Rev. 2015, 44, 530–542. [Google Scholar] [CrossRef]

- Field, J.L.; Tanger, P.; Shackley, S.J.; Haefele, S.M. Agricultural residue gasification for low-cost, low-carbon decentralized power: An empirical case study in Cambodia. Appl. Energy 2016, 177, 612–624. [Google Scholar] [CrossRef]

- Naqvi, M.; Yan, J.; Dahlquist, E.; Naqvi, S.R. Waste Biomass Gasification Based off-grid Electricity Generation: A Case Study in Pakistan. Energy Procedia 2016, 103, 406–412. [Google Scholar] [CrossRef]

- Pode, R.; Pode, G.; Diouf, B. Solution to sustainable rural electrification in Myanmar. Renew. Sustain. Energy Rev. 2016, 59, 107–59118. [Google Scholar] [CrossRef]

- Arranz-Piera, P.; Kemausuor, F.; Darkwah, L.; Edjekumhene, I.; Cortes, J.; Velo, E. Mini-grid electricity service based on local agricultural residues: Feasibility study in rural Ghana. Energy 2018, 153, 443–454. [Google Scholar] [CrossRef]

- Gojiya, A.; Deb, D.; Iyer, K.K.R. Feasibility study of power generation from agricultural residue in comparison with soil incorporation of residue. Renew. Energy 2018, 134, 416–425. [Google Scholar] [CrossRef]

- Pérez, J.F.; Osorio, L.F.; Aguledo, A.F. A technical-economic analysis of wood gasification for decentralized power generation in colombian forest cores. Int. J. Renew. Energy Res. 2018, 8, 1071–1084. [Google Scholar] [CrossRef]

- Singh, A.; Basak, P. Conceptualization and techno-economic evaluation of microgrid based on PV/Biomass in Indian scenario. J. Clean. Prod. 2021, 317, 128378. [Google Scholar] [CrossRef]

- Yang, Q.; Zhou, H.; Zhang, X.; Nielsen, C.P.; Li, J.; Lu, X.; Yanga, H.; Chen, H. Hybrid life-cycle assessment for energy consumption and greenhouse gas emissions of a typical biomass gasification power plant in China. J. Clean. Prod. 2018, 205, 661–671. [Google Scholar] [CrossRef]

- Naqvi, M.; Yan, J.; Dahlquist, E.; Naqvi, S.R. Off-grid electricity generation using mixed biomass compost: A scenario-based study with sensitivity analysis. Appl. Energy 2017, 201, 363–370. [Google Scholar] [CrossRef]

- Cardoso, J.S.; Silva, V.; Eusébio, D.; Lima Azevedo, I.; Tarelho, L.A.C. Techno-economic analysis of forest biomass blends gasification for small-scale power production facilities in the Azores. Fuel 2020, 279, 118552. [Google Scholar] [CrossRef]

- Copa, J.R.; Tuna, C.E.; Silveira, J.L.; Boloy, R.A.M.; Brito, P.; Silva, V.; Cardoso, J.; Eusébio, D. Techno-Economic Assessment of the Use of Syngas Generated from Biomass to Feed an Internal Combustion Engine. Energies 2020, 13, 3097. [Google Scholar] [CrossRef]

- Indrawan, N.; Simkins, B.; Kumar, A.; Huhnke, R.L. Economics of Distributed Power Generation via Gasification of Biomass and Municipal Solid Waste. Energies 2020, 13, 3703. [Google Scholar] [CrossRef]

- Naqvi, S.R.; Naqvi, M.; Ammar Taqvi, S.A.; Iqbal, F.; Inayat, A.; Khoja, A.H.; Mehran, M.T.; Ayoub, M.; Shahbaz, M.; Saidina Amin, N.A. Agro-industrial residue Gasification feasibility in Captive Power Plants: A South-Asian Case Study. Energy 2020, 214, 118952. [Google Scholar] [CrossRef]

- Susanto, H.; Suria, T.; Pranolo, S.H. Economic analysis of biomass gasification for generating electricity in rural areas in Indonesia. IOP Conf. Ser. Mater. Sci. Eng. 2018, 334, 012012. [Google Scholar] [CrossRef]

- Colantoni, A.; Villarini, M.; Monarca, D.; Carlini, M.; Mosconi, E.M.; Bocci, E.; Hamedani, S.R. Economic analysis and risk assessment of biomass gasification CHP systems of different sizes through Monte Carlo simulation. Energy Rep. 2021, 7, 1954–1961. [Google Scholar] [CrossRef]

- Qamar, M.A.; Javed, A.; Liaquat, R.; Hassan, M. Techno-economic modeling of biomass gasification plants for small industries in Pakistan. Biomass Convers. Biorefin. 2021, 13, 8999–9009. [Google Scholar] [CrossRef]

- Barry, F.; Sawadogo, M.; Ouédraogo, I.W.; Bologo/Traoré, M.; Dogot, T. Geographical and economic assessment of feedstock availability for biomass gasification in Burkina Faso. Energy Convers. Manag. X 2022, 13, 100163. [Google Scholar] [CrossRef]

- Dafiqurrohman, H.; Safitri, K.A.; Setyawan, M.I.B.; Surjosatyo, A.; Aziz, M. Gasification of rice wastes toward green and sustainable energy production: A review. J. Clean. Prod. 2022, 366, 132926. [Google Scholar] [CrossRef]

- Odoi-Yorke, F.; Osei, L.K.; Gyamfi, E.; Adaramola, M.S. Assessment of crop residues for off-grid rural electrification options in Ghana. Sci. Afr. 2022, 18, e01435. [Google Scholar] [CrossRef]

- Balcioglu, G.; Jeswani, H.K.; Azapa, A. Energy from forest residues in Turkey: An environmental and economic life cycle assessment of different technologies. Sci. Total Environ. 2023, 874, 162316. [Google Scholar] [CrossRef] [PubMed]

- Teixeira Coelho, S.; Gómez, M.; La Rovere, E. Biomass Residues as Energy Source to Improve Energy Access and Local Economic Activity in Low HDI Regions of Brazil and Colombia (BREA). Glob. Netw. Energy Sustain. Dev. 2015. [CrossRef]

- Abouemara, K.; Shahbaz, M.; Mckay, G.; Al-Ansari, T. The review of power generation from integrated biomass gasification and solid oxide fuel cells: Current status and future directions. Fuel 2024, 360, 130511. [Google Scholar] [CrossRef]

- Moretti, C.; Corona, B.; Rühlin, V.; Götz, T.; Junginger, M.; Brunner, T.; Obernberger, I.; Shen, L. Combining Biomass Gasification and Solid Oxide Fuel Cell for Heat and Power Generation: An Early-Stage Life Cycle Assessment. Energies 2020, 13, 2773. [Google Scholar] [CrossRef]

- Jeswani, H.K.; Whiting, A.; Martin, A.; Azapagic, A. Environmental and economic sustainability of poultry litter gasification for electricity and heat generation. Waste Manag. 2019, 95, 182–191. [Google Scholar] [CrossRef] [PubMed]

- Ghosh, D.; Sagar, A.; Kishore, V.V.N. Scaling up biomass gasifier use: An application-specific approach. Energy Policy 2006, 34, 1566–1582. [Google Scholar] [CrossRef]

- Littlejohns, J.V.; Butler, J.; Luque, L.; Kannangara, M.; Totolo, S. Analysis of the performance of an integrated small-scale biomass gasification system in a Canadian context. Biomass Convers. Biorefinery 2019, 10, 311–323. [Google Scholar] [CrossRef]

- Ruiz, J.A.; Juárez, M.C.; Morales, M.P.; Muñoz, P.; Mendívil, M.A. Biomass gasification for electricity generation: Review of current technology barriers. Renew. Sustain. Energy Rev. 2013, 18, 174–183. [Google Scholar] [CrossRef]

- Kumar, A.; Jones, D.D.; Hanna, M.A. Thermochemical biomass gasification: A review of the current status of the technology. Energies 2009, 2, 556–581. [Google Scholar] [CrossRef]

- Baba, Y.; Pandyaswargo, A.H.; Onoda, H. An analysis of the current status of woody biomass gasification power generation in japan. Energies 2020, 13, 4903. [Google Scholar] [CrossRef]

- Rahman, M.M.; Henriksen, U.B.; Ciolkosz, D. Startup process, safety and risk assessment of biomass gasification for off-grid rural electrification. Sci. Rep. 2023, 13, 21395. [Google Scholar] [CrossRef]

- Kirkels, A.F.; Verbong, G.P.J. Biomass gasification: Still promising? A 30-year global overview. Renew. Sustain. Energy Rev. 2011, 15, 471–481. [Google Scholar] [CrossRef]

- Barry, F.; Sawadogo, M.; Bologo(Traoré), M.; Ouédraogo, I.W.K.; Dogot, T. Key Barriers to the Adoption of Biomass Gasification in Burkina Faso. Sustainability 2021, 13, 7324. [Google Scholar] [CrossRef]

- Engelken, M.; Römer, B.; Drescher, M.; Welpe, I.M.; Picot, A. Comparing drivers, barriers, and opportunities of business models for renewable energies: A review. Renew. Sustain. Energy Rev. 2016, 60, 795–809. [Google Scholar] [CrossRef]

- Osterwalder, A.; Pigneur, Y. Business Model Generation: A Handbook for Visionaries, Game Changers and Challengers; John Wiley and Sons, Inc.: Hoboken, NJ, USA, 2010. [Google Scholar]

- Lüdeke-Freund, F. Sustainable entrepreneurship, innovation, and business models: Integrative framework and propositions for future research. Bus. Strategy Environ. 2020, 29, 665–681. [Google Scholar] [CrossRef]

- Mignon, I.; Bankel, A. Sustainable business models and innovation strategies to realize them: A review of 87 empirical cases. Bus. Strategy Environ. 2023, 32, 1357–1372. [Google Scholar] [CrossRef]

- Bidmon, C.M.; Knab, S.F. The three roles of business models in societal transitions: New linkages between business model and transition research. J. Clean. Prod. 2018, 178, 903–916. [Google Scholar] [CrossRef]

- Souza, R.C. Modelos de Negócios para Micro e Minigeração Distribuída Fotovoltaica no Brasil: Características e Impactos com a Alteração da Compensação da Energia. Master’s Thesis, Federal University of Rio de Janeiro, Rio de Janeiro, Brazil, 2020. Available online: http://www.ppe.ufrj.br/images/RodrigoCampos.pdf (accessed on 20 August 2023).

- Avilés, C.A.; Oliva, H.S.; Watts, D. Single-dwelling and community renewable microgrids: Optimal sizing and energy management for new business models. Appl. Energy 2019, 254, 113665. [Google Scholar] [CrossRef]

- Evans, S.; Vladimirova, D.; Holgado, M.; Van Fossen, K.; Yang, M.; Silva, E.A.; Barlow, C.Y. Business Model Innovation for Sustainability: Towards a Unified Perspective for Creation of Sustainable Business Models. Bus. Strategy Environ. 2017, 26, 597–608. [Google Scholar] [CrossRef]

- Donner, M.; de Vries, H. How to innovate business models for a circular bio-economy? Bus. Strategy Environ. 2021, 30, 1932–1947. [Google Scholar] [CrossRef]

- Goffetti, G.; Böckin, D.; Baumann, H.; Tillman, A.-M.; Zobel, T. Towards sustainable business models with a novel life cycle assessment method. Bus. Strategy Environ. 2022, 31, 2019–2035. [Google Scholar] [CrossRef]

- Drechsel, P.; Otoo, M.; Rao, K.C.; Hanjra, M.A. Business Models for a circular economy: Linking waste management and sanitation with agriculture. In Resource Recovery from Waste—Business Model for Energy, Nutrient and Water Reuse in Low- and Middle-income Countries; Routledge: New York, NY, USA, 2018. [Google Scholar]

- Hunkeler, D.; Lichtenvort, K.; Rebitzer, G. (Eds.) Environmental Life Cycle Costing; SETAC: Pensacola, FL, USA; CRC Press: Boca Raton, FL, USA, 2008. [Google Scholar]

- Larsson, S.; Fantazzini, D.; Davidsson, S.; Kullander, S.; Höök, M. Reviewing electricity production cost assessments. Renew. Sustain. Energy Rev. 2014, 30, 170–183. [Google Scholar] [CrossRef]

- Roth, I.; Ambs, L. Incorporating externalities into a full cost approach to electric power generation life-cycle costing. Energy 2004, 29, 2125–2144. [Google Scholar] [CrossRef]

- Albalawi, O.H.; Houshyar, A.; White, B.E. Developing a quantitative model to evaluate power plants based on their environmental impact. Electr. J. 2020, 33, 106777. [Google Scholar] [CrossRef]

- De Jong, P.; Kiperstok, A.; Torres, E.A. Economic and environmental analysis of electricity generation technologies in Brazil. Renew. Sustain. Energy Rev. 2015, 52, 725–739. [Google Scholar] [CrossRef]

- Feng, Y.; Liu, G.; Zhang, L.; Casazza, M. Review on pollution damage costs accounting. Sci. Total Environ. 2021, 783, 147074. [Google Scholar] [CrossRef] [PubMed]

- Pownall, T.; Soutar, I.; Mitchell, C. Re-Designing GB’s Electricity Market Design: A Conceptual Framework Which Recognizes the Value of Distributed Energy Resources. Energies 2021, 14, 1124. [Google Scholar] [CrossRef]

- Driesen, J.; Belmans, R. Distributed generation: Challenges and possible solutions. In Proceedings of the 2006 IEEE Power Engineering Society General Meeting, Montreal, QC, Canada, 18–22 June 2006. [Google Scholar] [CrossRef]

- Motta, R.S. Manual para Valoração Econômica de Recursos Ambientais; Ministério do Meio Ambiente: Brasília, Brazil, 1998; 218p, Available online: https://edisciplinas.usp.br/pluginfile.php/8021307/mod_resource/content/1/manual-para-valoracao-economica-de-recursos-ambientais.pdf (accessed on 31 January 2024).

- Burger, S.P.; Luke, M. Business models for distributed energy resources: A review and empirical analysis. Energy Policy 2017, 109, 230–248. [Google Scholar] [CrossRef]

- Brasil. Lei n° 14.300 de 6 de Janeiro de 2022. 2022. Available online: https://in.gov.br/en/web/dou/-/lei-n-14.300-de-6-de-janeiro-de-2022-372467821 (accessed on 10 January 2023).

- ONS. Plano Annual de Operação dos Sistemas Isolados para 2021. DPL-REL-0250/2020. 2020. Available online: https://www.ons.org.br/AcervoDigitalDocumentosEPublicacoes/DPL-REL-0250-2020%20-%20PEN%20SISOL%202021.pdf (accessed on 3 January 2023).

- Teixeira, M.A.; Escobar Palacio, J.C.; Sotomonte, C.R.; Silva Lora, E.E.; Venturini, O.J.; Aßmann, D. Assaí—An energy view on an Amazon residue. Biomass Bioenergy 2013, 58, 76–86. [Google Scholar] [CrossRef]

- Antonopoulos, I.-S.; Karagiannidis, A.; Gkouletsos, A.; Perkoulidis, G. Modelling of a downdraft gasifier fed by agricultural residues. Waste Manag. 2012, 32, 710–718. [Google Scholar] [CrossRef]

- Gabbrielli, R.; Seggiani, M.; Frigo, S.; Vitolo, M.P.; Raggio, G.; Puccioni, F. Validation of a Small Scale Woody Biomass Downdraft Gasification Plant Coupled with Gas Engine. Chem. Eng. Trans. 2016, 50, 241–246. [Google Scholar] [CrossRef]

- Pacioni, T.R.; Soares, D.; Domenico, M.D.; Rosa, M.F.; Moreira, R.d.F.P.M.; José, H.J. Bio-syngas production from agro-industrial biomass residues by steam gasification. Waste Manag. 2016, 58, 221–229. [Google Scholar] [CrossRef] [PubMed]

- Bhoi, P.R.; Huhnke, R.L.; Kumar, A.; Thapa, S.; Indrawan, N. Scale-up of a downdraft gasifier system for commercial scale mobile power generation. Renew. Energy 2018, 118, 25–33. [Google Scholar] [CrossRef]

- Raman, P.; Ram, N.K. Performance analysis of an internal combustion engine operated on producer gas, in comparison with the performance of the natural gas and diesel engines. Energy 2013, 63, 317–333. [Google Scholar] [CrossRef]

- Safarian, S.; Unnthorsson, R.; Richter, C. Performance analysis and environmental assessment of small-scale waste biomass gasification integrated CHP in Iceland. Energy 2020, 197, 117268. [Google Scholar] [CrossRef]

- Atnaw, S.M.; Kueh, S.C.; Sulaiman, S.A. Study on Tar Generated from Downdraft Gasification of Oil Palm Fronds. Sci. World J. 2014, 2014, 497830. [Google Scholar] [CrossRef]

- Cleary, J.; Caspersen, J.P. Comparing the life cycle impacts of using harvest residue as feedstock for small- and large-scale bioenergy systems (part I). Energy 2015, 88, 917–926. [Google Scholar] [CrossRef]

- Vonk, G.; Piriou, B.; Felipe Dos Santos, P.; Wolbert, D.; Vaïtilingom, G. Comparative analysis of wood and solid recovered fuels gasification in a downdraft fixed bed reactor. Waste Manag. 2019, 85, 106–120. [Google Scholar] [CrossRef] [PubMed]

- Fauzi, M.A.; Setyono, P.; Pranolo, S.H. Environmental assessment of a small power plant based on palm kernel shell gasification. AIP Conf. Proc. 2020, 2296, 020038. [Google Scholar] [CrossRef]

- Kataki, S.; Hazarika, S.; Baruah, D.C. Assessment of by-products of bioenergy systems (anaerobic digestion and gasification) as potential crop nutrient. Waste Manag. 2017, 59, 102–117. [Google Scholar] [CrossRef] [PubMed]

- Ahmed, O.Y.; Ries, M.J.; Northrop, W.F. Emissions factors from distributed, small-scale biomass gasification power generation: Comparison to open burning and large-scale biomass power generation. Atmos. Environ. 2019, 200, 221–227. [Google Scholar] [CrossRef]

- EPE. 2021—Ano-Base 2020. Available online: https://www.epe.gov.br/sites-pt/publicacoes-dados-abertos/publicacoes/PublicacoesArquivos/publicacao-160/topico-168/Anu%C3%A1rio_2021.pdf (accessed on 3 January 2022).

- IPCC. IPCC Guidelines for National Greenhouse Gas Inventories, Prepared by the National Greenhouse Gas Inventories Programme; Eggleston, H.S., Buendia, L., Miwa, K., Ngara, T., Tanabe, K., Eds.; IGES: Hayama, Japan; Available online: https://www.ipcc-nggip.iges.or.jp/public/2006gl/vol2 (accessed on 10 November 2022).

- Briones-Hidrovo, A.; Copa, J.; Tarelho, L.A.C.; Gonçalves, C.; Pacheco da Costa, T.; Dias, A.C. Environmental and energy performance of residual forest biomass for electricity generation: Gasification vs. combustion. J. Clean. Prod. 2021, 289, 125680. [Google Scholar] [CrossRef]

- Parascanu, M.M.; Kaltschmitt, M.; Rödl, A.; Sooreanu, G.; Sánchez-Silva, L. Life cycle assessment of electricity generation from combustion and gasification of biomass in Mexico. Sustain. Prod. Consum. 2021, 27, 72–85. [Google Scholar] [CrossRef]

- Dasappa, S.; Subbukrishna DNm Suresh, K.C.; Paul, P.J.; Prabhu, G.S. Operational experience on a grid connected 100 kWe biomass gasification power plant in Karnataka, India. Energy Sustain. Dev. 2011, 15, 231–239. [Google Scholar] [CrossRef]

- EPE. 2023 Projeções dos Preços dos Combustíveis Líquidos para Atendimento aos Sistemas Isolados e Usinas da Região Sul. Available online: https://www.epe.gov.br/sites-pt/publicacoes-dados-abertos/publicacoes/PublicacoesArquivos/publicacao-769/Caderno%20de%20Proje%C3%A7%C3%A3o%20Pre%C3%A7os%20Combust%C3%ADveis%20para%20SI%20em%202024.pdf (accessed on 2 January 2024).

- ANEEL. Resolução ANEEL no 1.016/2022. 2022. Available online: https://www2.aneel.gov.br/cedoc/ren20221016.html (accessed on 10 September 2023).

- EPE. Estudos do Plano Decenal de Expansão de Energia 2031—Parâmetros de Custos –Geração e Transmissão. 2022. Available online: https://www.epe.gov.br/sites-pt/publicacoes-dados-abertos/publicacoes/PublicacoesArquivos/publicacao-607/topico-591/Caderno%20de%20Par%C3%A2metros%20de%20Custos%20-%20PDE2031.pdf (accessed on 1 October 2023).

- IRENA. Renewable Energy Technologies: Cost Analysis Series. Biomass for Power Generation. 2012. Available online: http://www.ecowrex.org/document/re-technologies-cost-analysis-biomass-0 (accessed on 20 November 2023).

- UNDP. Study of Available Business Models of Biomass Gasification Power Projects in India; UNDP: New Delhi, India, 2013; Available online: https://www.undp.org/india/publications/study-available-business-models-biomass-gasification-power-projects-india (accessed on 4 October 2023).

| Element | Distributed Generation | Off-Grid |

|---|---|---|

| Value proposition |

|

|

| Key partners |

|

|

| Key resources |

|

|

| Key activities |

|

|

| Customer segments |

|

|

| Customer relationships |

|

|

| Channels |

|

|

| Cost structure |

|

|

| Revenue streams |

|

|

| Positive Externalities |

|

|

| Negative Externalities |

|

|

| Values | Comments | Sources | |

|---|---|---|---|

| Overall biomass to electricity efficiency of the system | 16–25% | Value chosen: 18%, considering internal energy needs (heat and electricity) | [12,32,35,37,38,40,46,90,91,92,93] |

| Low Heating Value (LHV) of biomass | 10–25 MJ/ton | 20 MJ/ton assumed | [9,32,33,35,37,38,91] |

| Moisture content of biomass | 20–60% | The energy yield considers the original moisture content (30% assumed) | Same as energy efficiency and LHV |

Consumables

| Some works consider fuel oil, charcoal, and electricity for startup. Water use is between 0.06 and 18 L/kWh. Acetone represents 20% of the syngas-cleaning solution | This work considered a 100 kW diesel genset for startup and shutdown, for 7 min each, with water use of 9.8 L/kWh | [13,31,41,45,93,94,95] |

| Solid residues | 9–31 kg of ashes per ton of biomass, some tar from syngas treatment | 31 kg considered | [96,97,98,99] |

| Biochar production | Considered in some works, up to 180 kg/ton of biomass | Not considered in this study | [7,18,96,99,100] |

| GHG emissions | Excluding biogenic emissions: 0.0578 kgCO2eq/kWh | 0.027—construction phase 0.02—operation phase 0.004—startup and close down 0.0068—water treatment 0.02—transportation of biomass (OG) | [40,41,101] See Appendix A for more information |

| Avoided GHG emissions | Avoided electricity substitution | 0.1 kgCO2eq/kWh (DG) 0.666 kgCO2eq/kWh (OG) | [102,103] See Appendix A for more information |

| Biomass transportation | 0.02 kgCO2eq/kWh (DG) | See Appendix A for more information |

| Al Costs in BRL/kWh | Residual Biomass Gasification | Diesel-Based | |

|---|---|---|---|

| DG | OG | ||

| Financial LCC | 0.752 | 1.344 | 1.917 |

| Subsidies | −0.296 | −1.027 | |

| LCOE | 0.752 | 1.116 | 0.889 |

| External LCC—avoided subsidies | 0.000 | −0.465 | |

| External LCC—GHG costs | −0.005 | −0.044 | |

| External LCC—solid residues | 0.007 | ||

| Societal LCC | 0.747 | 0.545 | |

| Ref. | Authors | Year | Country | LCC * in USD/kWh | Comments |

|---|---|---|---|---|---|

| [28] | Freitas et al. | 2006 | Brazil | 0.17 | Local currency was used: BRL 0.37. 2006 exchange rate USD 1 = BRL 2.15 |

| [30] | Yagi and Nakata | 2011 | Japan | 0.17–0.45 | Differences depend mostly on the type of feedstock and the transportation distance |

| [31] | Buchholtz et al. | 2012 | Uganda | 0.18–0.34 | 250 kW and 10 kW system case studies |

| [110] | IRENA | 2012 | N/A | 0.06–0.29 | 0.24 for 600 kW gasifier with ICE |

| [32] | Bhattacharya | 2014 | India | 0.40–0.49 | 0.24 with a 100% CAPEX subsidy |

| [35] | Naqvi et al. | 2016 | Pakistan | 0.28–0.45 | Variation depending on the type of biomass, capacity factor, plant load |

| [42] | Naqvi et al. | 2017 | Pakistan | 0.29–0.40 | Feedstock is a mix of poultry manure and rice hulls |

| [18] | You et al. | 2017 | Indonesia | 0.06–0.46 | Considers the sale of biochar (500 USD/ton) |

| [37] | Arranz-Piera et al. | 2018 | Ghana | 0.09–0.35 | 100% CAPEX subsidy/0% subsidy with 15% IRR |

| [39] | Pérez et al. | 2018 | Colombia | 0.10–0.41 | Forest residues, diverse systems from 500 kW to 2 MW |

| [47] | Susanto et al. | 2018 | Indonesia | 0.09–0.16 | 45 kW, CAPEX considered 600 USD/kW |

| [46] | Naqvi et al. | 2020 | Pakistan | 0.10–0.12 | Variation depending on the cost of rice husk and capacity factor |

| [52] | Odoi-Yorke et al. | 2022 | Ghana | 0.29–0.34 | 100 kW; diverse crop residues; biomass cost: 2 USD/ton |

| [51] | Dafiqurrohman | 2022 | Nigeria | 0.07–0.11 | Captive generation, mix of rice husks and plastic waste |

| [53] | Balcioglu | 2023 | Turkey | 0.98–1.35 | High costs of forest residues considered (30 and 90 USD/ton) |

| This study | 2024 | Brazil | 0.15–0.27 | DG model Financial LCC–OG model Financial LCC. Maximum values obtained by sensitivity analysis: 0.21–0.40 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Desclaux, L.; Pereira, A.O., Jr. Residual Biomass Gasification for Small-Scale Decentralized Electricity Production: Business Models for Lower Societal Costs. Energies 2024, 17, 1868. https://doi.org/10.3390/en17081868

Desclaux L, Pereira AO Jr. Residual Biomass Gasification for Small-Scale Decentralized Electricity Production: Business Models for Lower Societal Costs. Energies. 2024; 17(8):1868. https://doi.org/10.3390/en17081868

Chicago/Turabian StyleDesclaux, Laurene, and Amaro Olimpio Pereira, Jr. 2024. "Residual Biomass Gasification for Small-Scale Decentralized Electricity Production: Business Models for Lower Societal Costs" Energies 17, no. 8: 1868. https://doi.org/10.3390/en17081868

APA StyleDesclaux, L., & Pereira, A. O., Jr. (2024). Residual Biomass Gasification for Small-Scale Decentralized Electricity Production: Business Models for Lower Societal Costs. Energies, 17(8), 1868. https://doi.org/10.3390/en17081868