3.2. Minimum Selling Price

The minimum selling price or break-even price of a techno-economic evaluation represents the price at which the targeted product of the BtL process should be sold so that, at the end of the plant’s lifetime, its net present value is equal to zero.

For the main business case of the present study, in which jet fuel is the targeted product, a discounted cash flow analysis (

Supplementary Materials—Table S8) was carried out by integrating all the above-mentioned cost estimations and a MJSP equal to 1.83 €/L was calculated.

The thermocatalytic part of the proposed value chain is, in essence, a HEFA plant with microbial oil (TAGs) as feedstock instead of other typical oils. Therefore, taking into account the advantage of the availability of such plants at the commercial level and the similarity of the produced microbial oil with typical HEFA feeds [

30], an additional business case is introduced, in which the hydrotreatment of the produced microbial oil is performed in such an external plant. In this case, the crude microbial oil is the end product of the process, and the thermocatalytic part is excluded from the BtL concept and the capital investment. The rationale is not only the avoidance of the construction costs for a new refinery but also to take advantage of the large existing refining infrastructure and experience. In the absence of the hydrotreatment/hydrocracking unit, the estimated TCI of the microbial oil scenario drops to around €527 million, while the annual operating costs are slightly influenced since the majority of them are sourcing from the process steps prior to the hydrotreatment unit (

Supplementary Materials—Section D). A discounted cash flow analysis for the microbial oil scenario was performed with the updated boundary conditions, and a Minimum Oil Selling Price (MOSP) equal to 1.32 €/L was obtained (

Supplementary Materials—Table S9).

The TCI, the annual operating costs, and the mass balances that were utilized for the discounted cash flow analysis of each business case are presented in

Table 12. The economic assumptions presented in

Table 9 were kept common for both scenarios.

3.3. Sensitivity Analysis

Sensitivity analysis is probably the most critical aspect of the techno-economic analysis since it not only allows the impact evaluation of various process parameters on the financial performance of the concept but also limits, in a way, the effect of incorrect initial economic assumptions and sources of uncertainty.

Section 3.3.1 is dedicated to the assessment of the influence that selected process parameters have on the MJSP formation.

Section 3.3.2 presents the estimations regarding the discounted payback period and NPV of both business cases by increasing the potential selling price of jet fuel and microbial oil starting from MJSP and MOSP, respectively.

3.3.1. Minimum Jet Selling Price (MJSP)

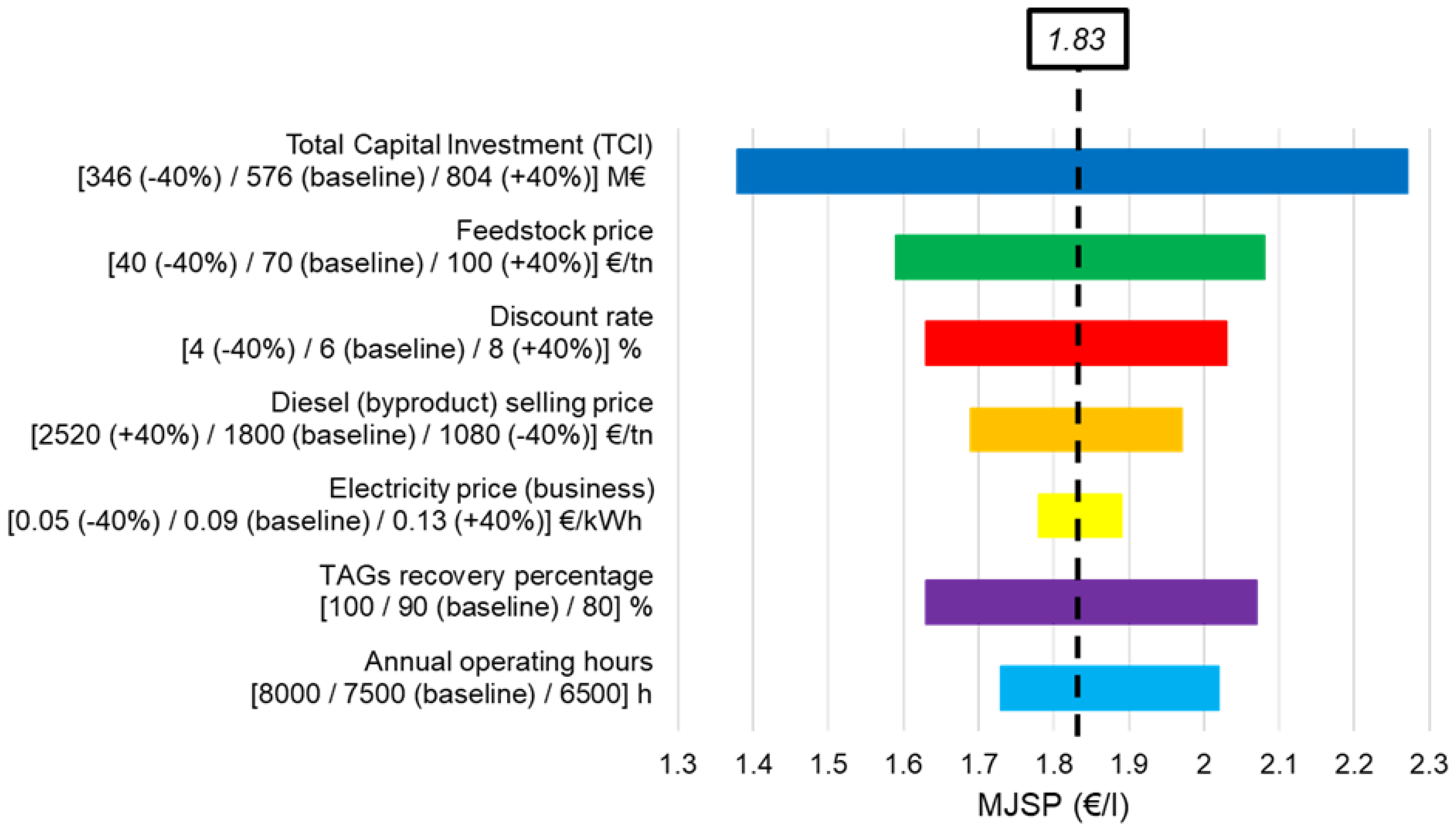

The impact of ±40% variations in baseline TCI, feedstock price, discount rate, diesel selling price, and electricity price on the MJSP is investigated. TAG recovery percentage (from their intracellular form) in the DSP and annual operating hours complete the set of selected parameters for the sensitivity analysis (

Figure 8).

TCI and feedstock costs are the parameters with the largest impact on the formation of MJSP and, consequently, the main cost drivers of the process. Considering that an MJSP below 2 €/L would be the minimum prerequisite for competitiveness, TCI below €650 million and feedstock costs below 100 €/t would be desirable for the financial sustainability of the concept. A TCI below €500, and the involvement of cheap feedstock (e.g., biogenic wastes) could move the MJSP in the very competitive advanced biofuels range of 1–1.5 €/L. The relatively low electrical requirements of the examined BtL concept reflect the small impact of the electricity price on the MJSP. Thus, utilization of RES electricity (even in cases that are more expensive than fossil) for further carbon footprint reduction of the plant seems affordable. Moreover, the TAG recovery percentage (DSP efficiency) seems critical for the performance of the whole unit. Although 100% recovery is rather unattainable even in large-scale applications, percentages below 70–80% seem prohibitive for process economics. The assumed maximization of the jet fraction at diesel’s expense leads to an unimpressive effect of the diesel selling price on MJSP, but non-negligible as well since diesel remains the main by-product of the process. A rather remarkable influence on the computed MJSP is also observed from the applied discount rate, while the plant on-stream factor should be over 80% (i.e., >7000 annual operating hours).

3.3.2. Discounted Payback Period and NPV

Discounted payback period provides the number of years it takes to break even from undertaking the initial capital investment by discounting future cash flows and considering the time value of money. NPV is the difference between the present value of cash inflows and the present value of cash outflows over the plant’s lifetime. A positive NPV is a good initial indication of a potential investment, while a negative one is the opposite. Both discounted payback period and NPV are valuable metrics for the feasibility and profitability of a given project. The shorter the discounted payback period and the higher the net present value, the better for the potential investment.

A sensitivity analysis based on these two parameters is performed for the jet fuel and the microbial oil business cases in order to assess the specifications of the concept and compare the potential of each investment. A fixed selling price increase rate is applied for the jet fuel and the microbial oil starting from the MJSP and MOSP, respectively (

Figure 9).

The microbial oil scenario seems, as expected, the most attractive business case, presenting the highest potential in terms of minimization of the payback period and maximization of the NPV. Of course, there is still some distance to cover between the conventional (fossil) fuels prices and the potential selling prices of their low-carbon replacements that would ensure the feasibility and profitability of such BtL investments. However, it becomes apparent that new BtL investments should target intermediate products (e.g., microbial oil) that can be exploited by current refineries (directly or via co-processing) rather than final products (e.g., jet fuel) that require brand-new hydrotreatment facilities. The latter would entail higher risks for the financial sustainability of novel large-scale BtL plants. The connection of newly established sustainable BtL pathways with the current need of commercial refineries to decarbonize their activities via the exploitation of the large existing refining infrastructure could pave the way towards the validation of claims that the next two decades will be dominated by technologies handling advanced feedstock and by refineries that act as hubs of low-carbon oils [

64].

3.4. Benchmarking with the Dominant SAF Technologies

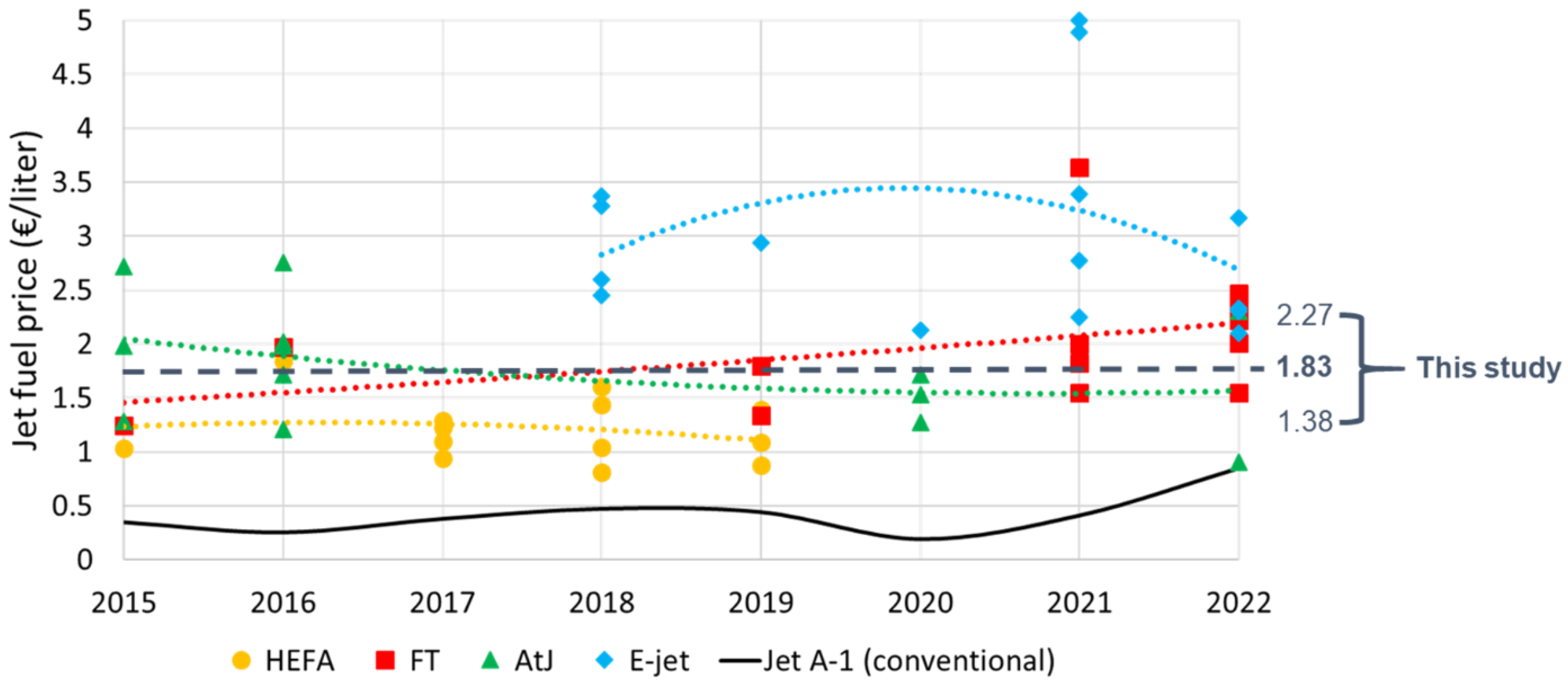

This section aims to conduct an evaluation of the concept presented within this study in terms of financial capabilities and competitiveness compared to the current dominant SAF technologies (i.e., HEFA, FT, AtJ, e-fuels) [

6]. MJSP has been elected as an appropriate indicator for this purpose since it is a metric that is often used for the primary economic assessment of a BtL technology and allows for comparison with relevant techno-economic studies. However, direct comparisons with other techno-economic studies are not proper due to possible differentiations in assumed methodology, boundary conditions, or scale. On the contrary, aggregated data that take into account multiple studies seem more suitable for the formation of a holistic perspective and an apt judgment regarding the estimated range of each technology. Hence, the findings of a recent SAFs review study [

10] are exploited for positioning the MJSP of the present work among a set of MJSP predictions for dominant SAF technologies. The global average price evolution of conventional jet fuel (Jet A-1) in recent years is attached as well, extracted from [

65] (

Figure 10).

HEFA-produced SAF is the most cost-competitive option and the only route so far that can consistently compete with conventional jet fuel prices. With selling prices below 1.00 €/L seeming attainable, HEFA has already penetrated the market and can be considered the only state-of-the-art commercial SAF. The respective trend lines for the semi-commercialized FT and AtJ routes, which are also the technologies of greater interest in the context of this study, lie well within the range of 1.50–2.00 €/L. The feedstock flexibility of these two routes results in some deviations regarding the estimation of their production costs, but it is rather safe to claim that cost-effective feedstock can lead to cost-competitive FT and AtJ implementations. The recent establishment of the world’s first ethanol to SAF (AtJ) commercial production facility by LanzaJet [

66] acts as a proof for the latter claim and is a breakthrough towards the involvement and accelerated scale-up of additional pathways, apart from HEFA, for the commercial uptake of SAFs. Finally, the e-jet trend line moves around 3.00 €/L and illustrates the current uncertainty that characterizes this kind of fuel [

67]. Almost every recent techno-economic study struggles to determine affordable e-jet production costs at present, but they all highlight the significant cost reduction potential in the future, driven mainly by reductions in hydrogen and green electricity prices [

68].

The obtained baseline MJSP of 1.83 €/L reveals the preliminary ability of the concept of this study to be financially competitive. The calculated MJSP of 1.83 €/L is within the range of the respective prices from the dominant BtL technologies (1.50–2.00 €/L). According to the performed sensitivity analysis of

Section 3.3.1, favorable economic conditions can drop the MJSP up to 1.38 €/L, while unfavorable economic conditions can raise this value to 2.27 €/L. Another factor that should be considered for the financial assessment of the proposed pathway is that the proof of concept has just been carried out at the pilot scale (Technology Readiness Level—TRL 5) within the BioSFerA project [

14], while the technological maturity of FT and AtJ pathways are at pre-commercial level (TRL 8–9). Thus, there is rather more room for improvement in terms of technical performance and, subsequently, financial efficiency compared to more established technologies. Aiming to provide an overview of the production costs for the BtL scheme of this study and to identify the aspects to be improved, the calculated MJSP is presented in the form of levelized production costs and compared with the respective cost breakdowns of FT and AtJ gasification-driven pathways, as derived from relevant studies [

34,

59] (

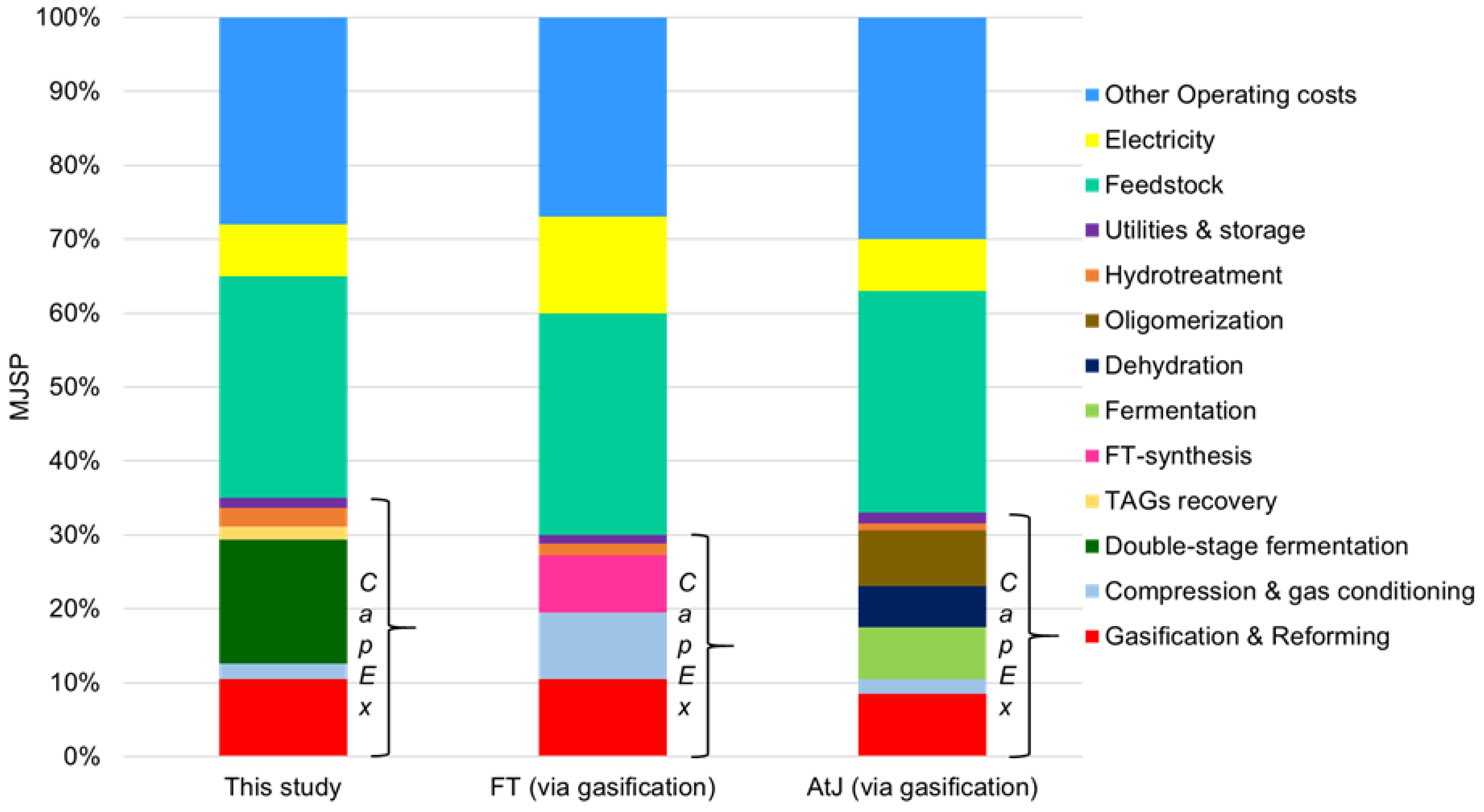

Figure 11).

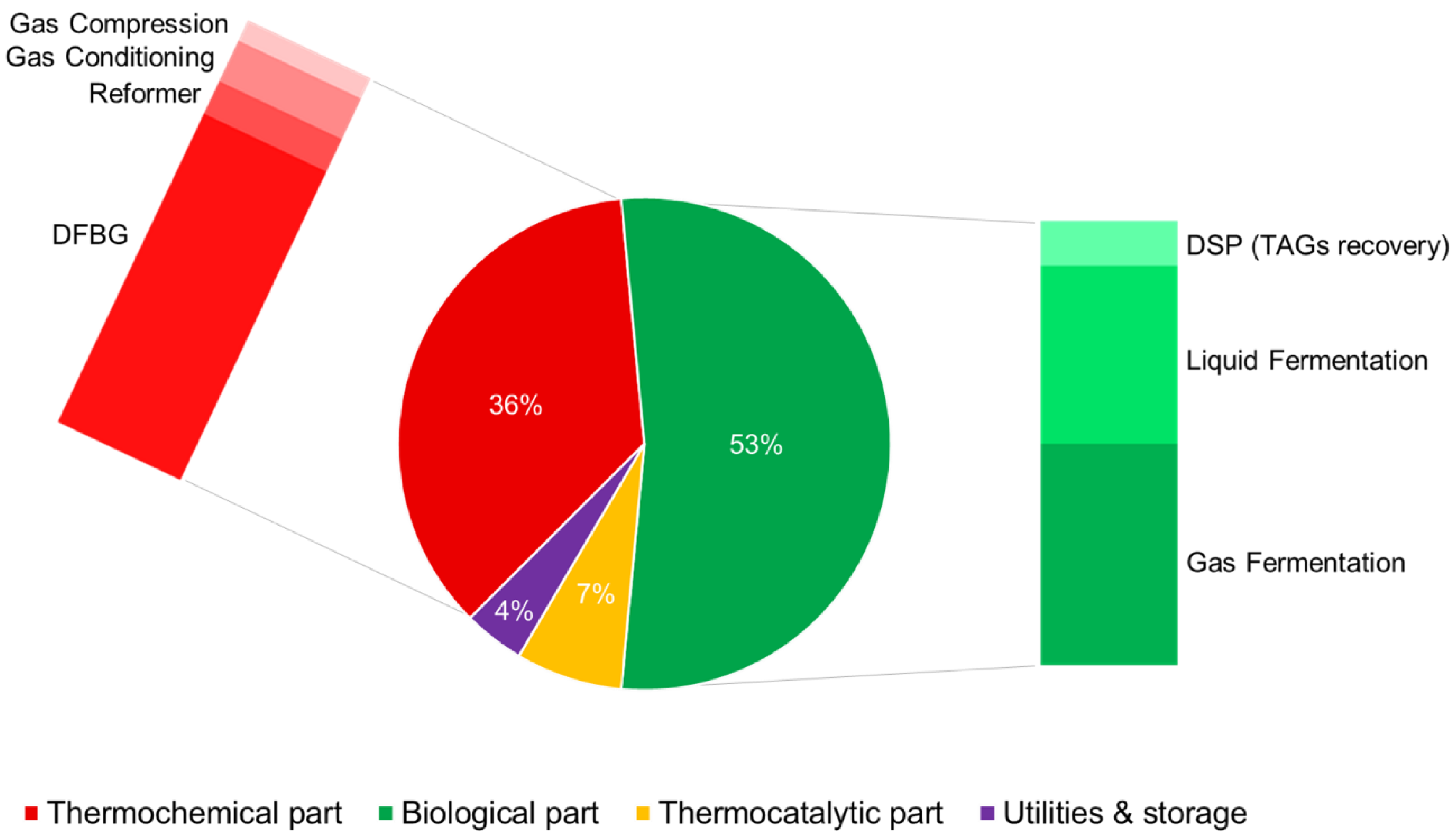

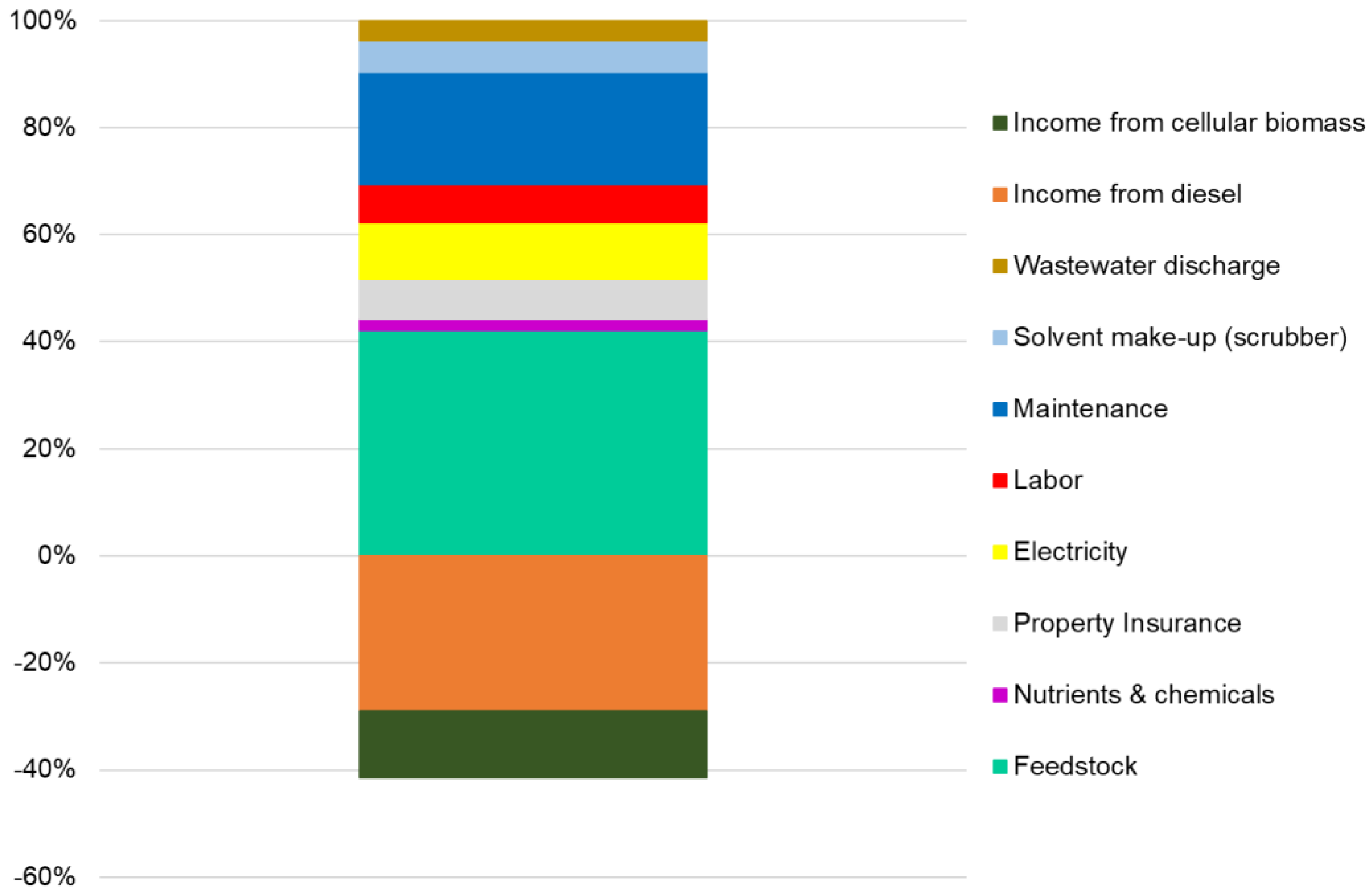

Taking into account this study’s estimated MJSP (1.83 €/L) as well as the respective positioning of FT’s and AtJ’s MJSPs, mainly in the range of 1.50–2.00 €/L (

Figure 10), a qualitative insight into the allocation of their production costs is provided in

Figure 11. All three BtL routes present pretty similar distribution regarding the envisaged production costs of the final biofuels. As expected for BtL plants that target advanced feedstock, the CapEx (return on investment) and the feedstock costs combined account for at least 60% of the production costs in each technology. While the feedstock capabilities and the relevant costs are the same for each pathway due to the common presence of gasification at the start of each process, the different terms of gas handling and fuel synthesis reveal the individual specifications of each route. Despite the FT process being the value chain with the fewest conversion steps, the strict specifications of FT synthesis (i.e., proper H

2/CO ratio, exhaustive acid gas removal, and high gas pressures/temperatures) burden the overall production costs with extensive equipment for gas conditioning and heavy electricity requirements. Gasification-driven AtJ is a process that, similarly to the concept of this study, is based on milder temperatures, pressures, and subsequently reduced electricity expenses. However, the multiple conversion steps lead to inevitable large capital expenses for this technology as well. Thus, the two dominant technologies usually result in similar production costs in total (

Figure 10) and the regulator concerning their competitiveness seems to be the feedstock purchase cost.

The examined concept of this study aims to reach competitive performance levels by avoiding the strict specifications of FT or the several unit operations of the AtJ route that raise the total production costs. Although the simulated BtL scheme seems able to provide equal liquid biofuel yields [

15] with FT and AtJ based on reduced operational costs, the initially estimated capital investment of the concept seems as demanding as for the other technologies (30–35% of the levelized production costs). This is mainly due to the large working volumes of the double-stage fermentation and, subsequently, the large, required number of bioreactors. Of course, as already mentioned in

Section 3.1.1, higher obtained productivities and concentrations for acetic acid/TAGs production can drastically reduce the capital costs of double-stage fermentation and upgrade the financial competitiveness of the concept.

To sum up, the investigated BtL scheme of the present study appears capable of providing an initially competitive pathway to add to the established and already pre-commercial level FT and AtJ technologies. The reduction of the envisaged capital costs for the biological part via the optimization of the acetic acid/TAGs productivities and concentrations should be the priority on the way to the potential scale-up of the concept. In general, gasification-driven BtL technologies seem adequate to play a leading role in the deployment of SAF production technologies since they usually offer the valuable aspect of feedstock flexibility (forestry/agricultural residues, biogenic wastes, etc.) which can be critical for the implementation of low-cost feedstock scenarios and subsequently the production of advanced biofuels at affordable costs. Finally, it should not be overlooked that BtL based on gasification has yet to be commercialized. Hence, a pioneer plant is expected to be more costly to build and operate than a Nth plant (beneficial scale effect).