Electricity Cost Savings in Energy-Intensive Companies: Optimization Framework and Case Study

Abstract

1. Introduction

2. Literature Review

- (1)

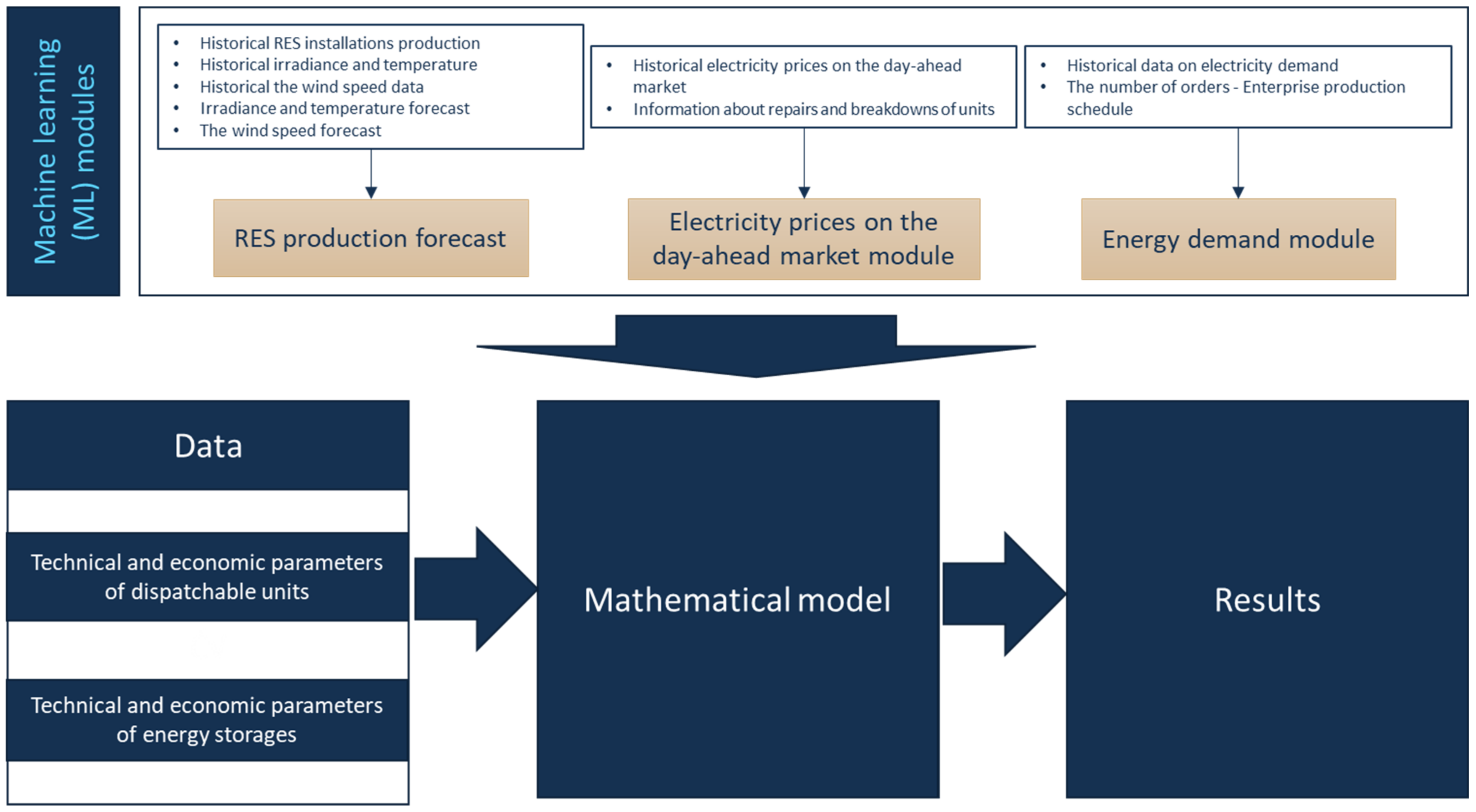

- Proposing a data-driven optimization-based framework to manage and optimize the operation of a hybrid energy system within industries characterized by significant energy demands.

- (2)

- Developing a framework architecture that integrates a mixed-integer linear programming model aimed at minimizing the total operating costs of the system. In addition, it provides the ability to obtain critical input data using additional modules based on machine learning methods.

- (3)

- Showcasing the benefits and applicability of the optimization model via a case study of an energy-intensive company specializing in wood processing and office furniture production.

3. Decision-Support System for Energy-Intensive Enterprises

3.1. Mathematical Model

- Maximum power purchased in a given time step;

- Minimum power purchased in a given time step;

- Maximum power sold in a given time step;

- Minimum power sold in a given time step;

- Binary variable constraint that determines if the system is importing or exporting power in a given time step.

- Maximum power output in a given time step;

- Minimum power output in a given time step;

- Maximum ramp-up in a given time step;

- Maximum ramp-down in a given time step;

- Minimum up times (number of operating hours after starting the unit);

- Minimum down times (number of hours the unit is off);

- Fuel cost calculation in a given time step;

- Binary variable constraints that represent the operating status of the units at a given time step.

- Energy storage inventory balance in a given time step;

- Energy storage capacity limits in a given time step;

- Energy storage charge and discharge limits in a given time step;

- Binary variable constraints that represent the operating status of the energy storage units at a given time step.

- Power output of dispatchable technologies in a given time step;

- Power purchased from the external grid in a given time step;

- Power sold to the external grid in a given time step;

- Battery state of charge in a given time step;

- Energy charged to the storage unit in a given time step;

- Energy discharged from the storage unit in a given time step;

- Total system operating costs;

- Fuel cost of dispatchable technologies in a given time step;

- Fixed and variable costs of dispatchable and non-dispatchable technologies in a given time step;

- Startup and shutdown costs of dispatchable and non-dispatchable technologies;

- Costs of grid interaction (power purchase from the grid and power sold to the grid costs) in a given time step.

3.2. Model Implementation

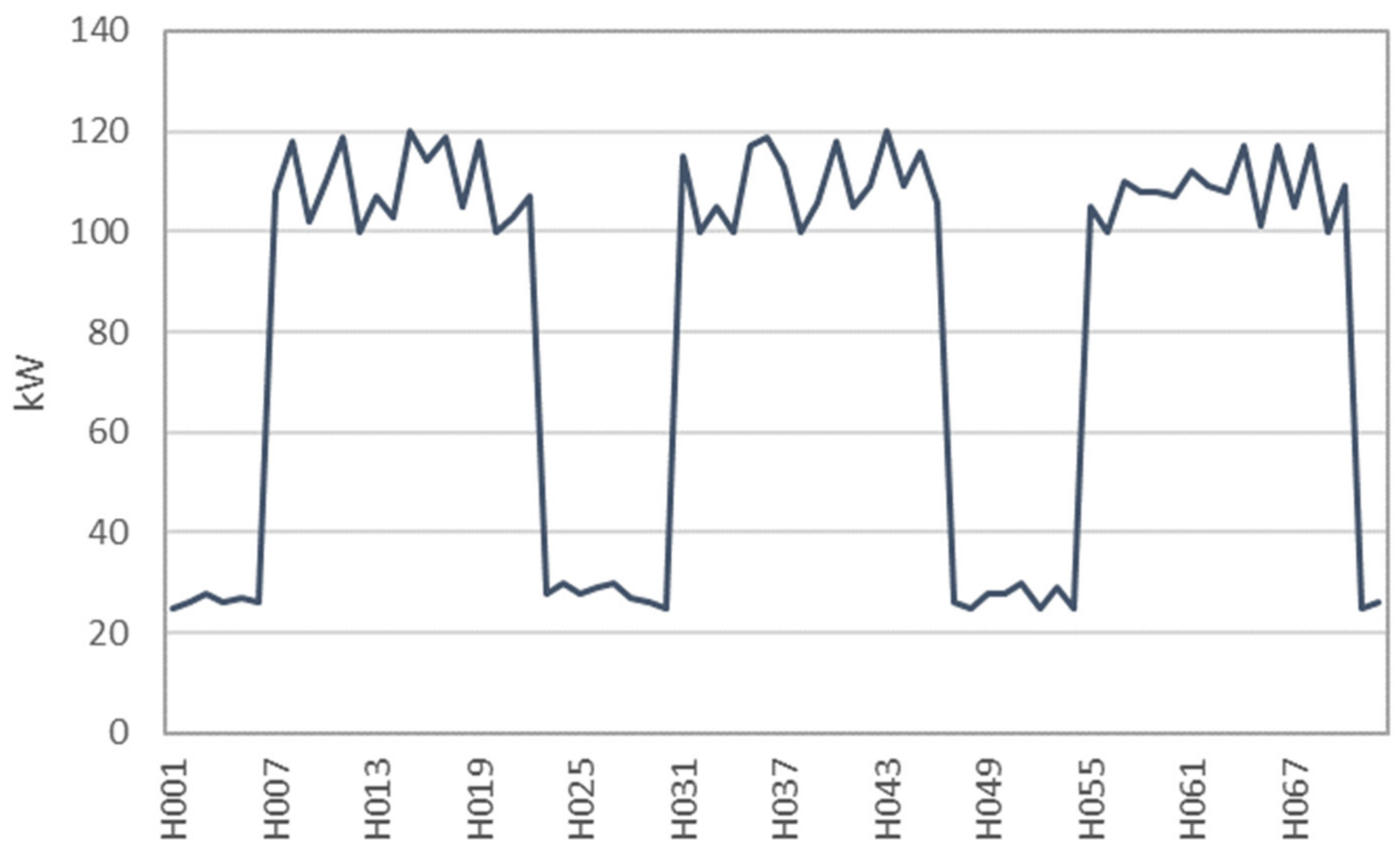

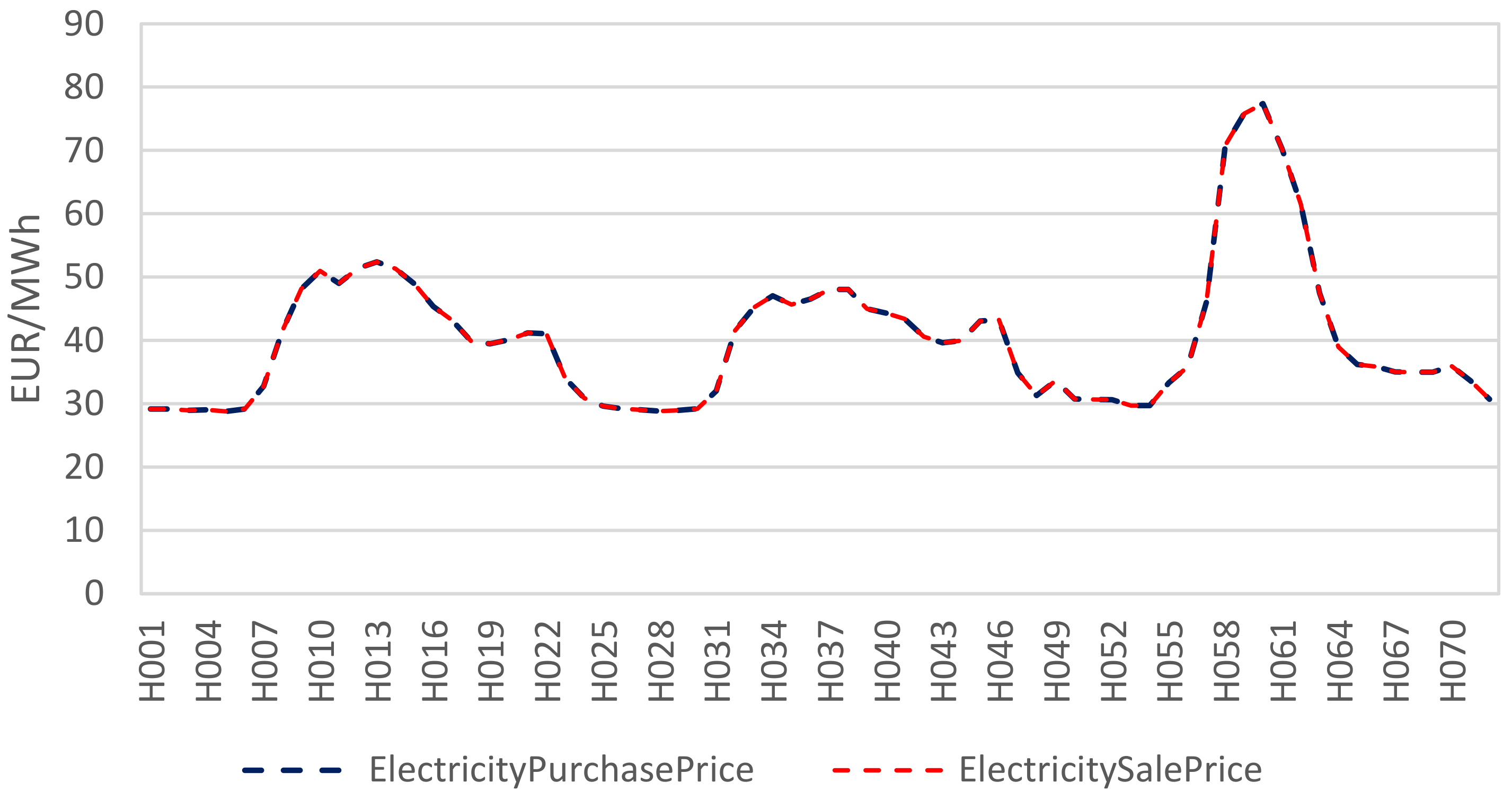

4. Case Study

5. Result and Discussion

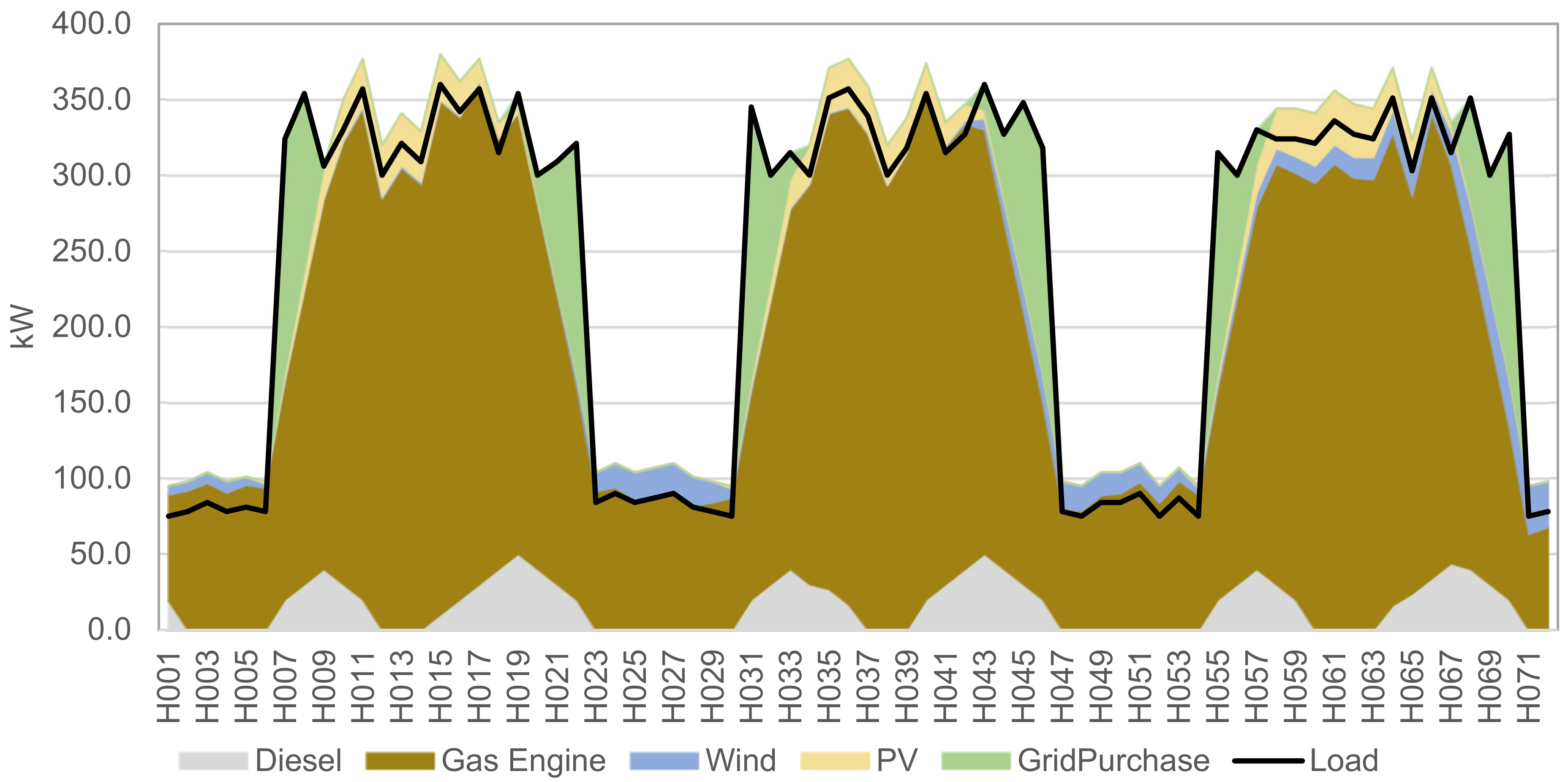

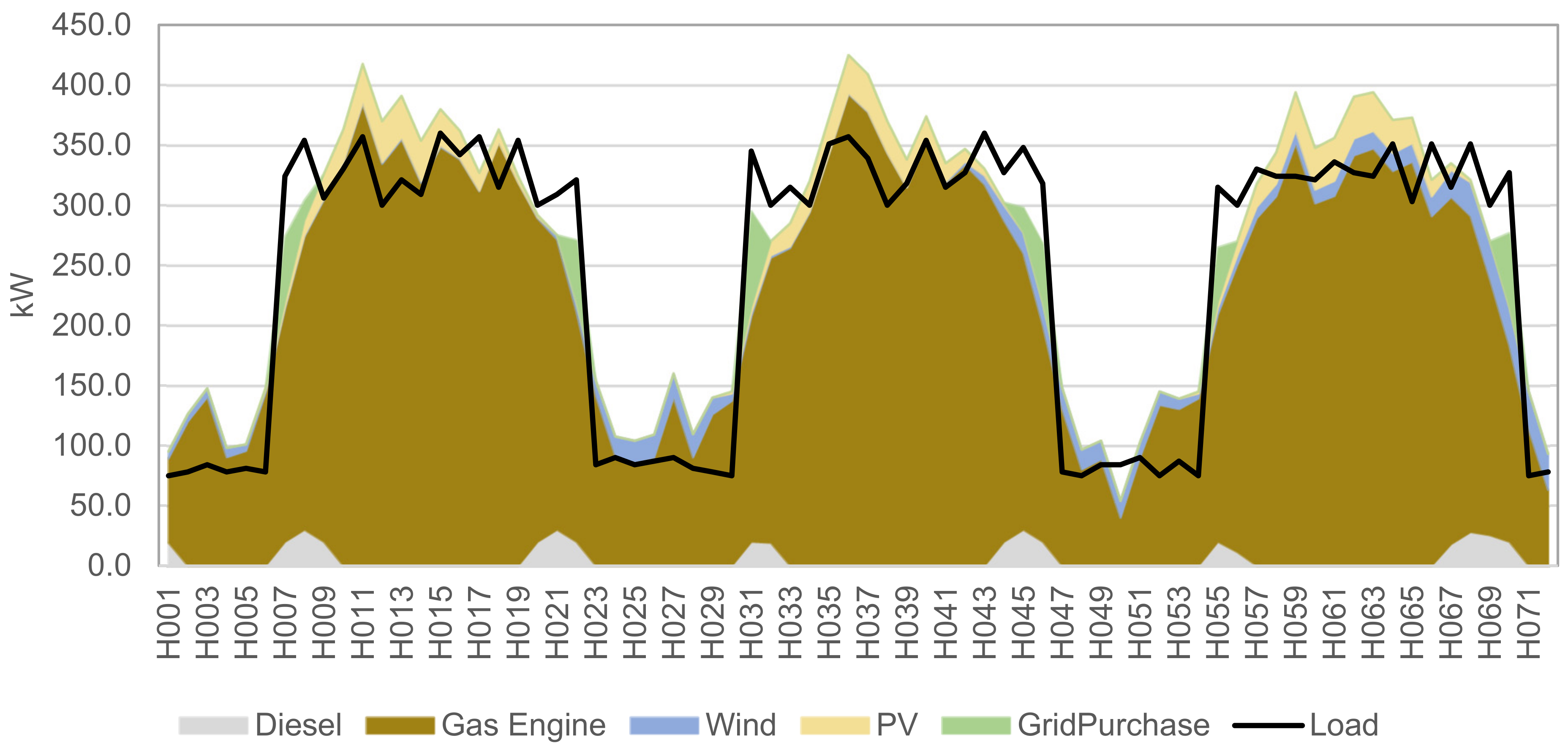

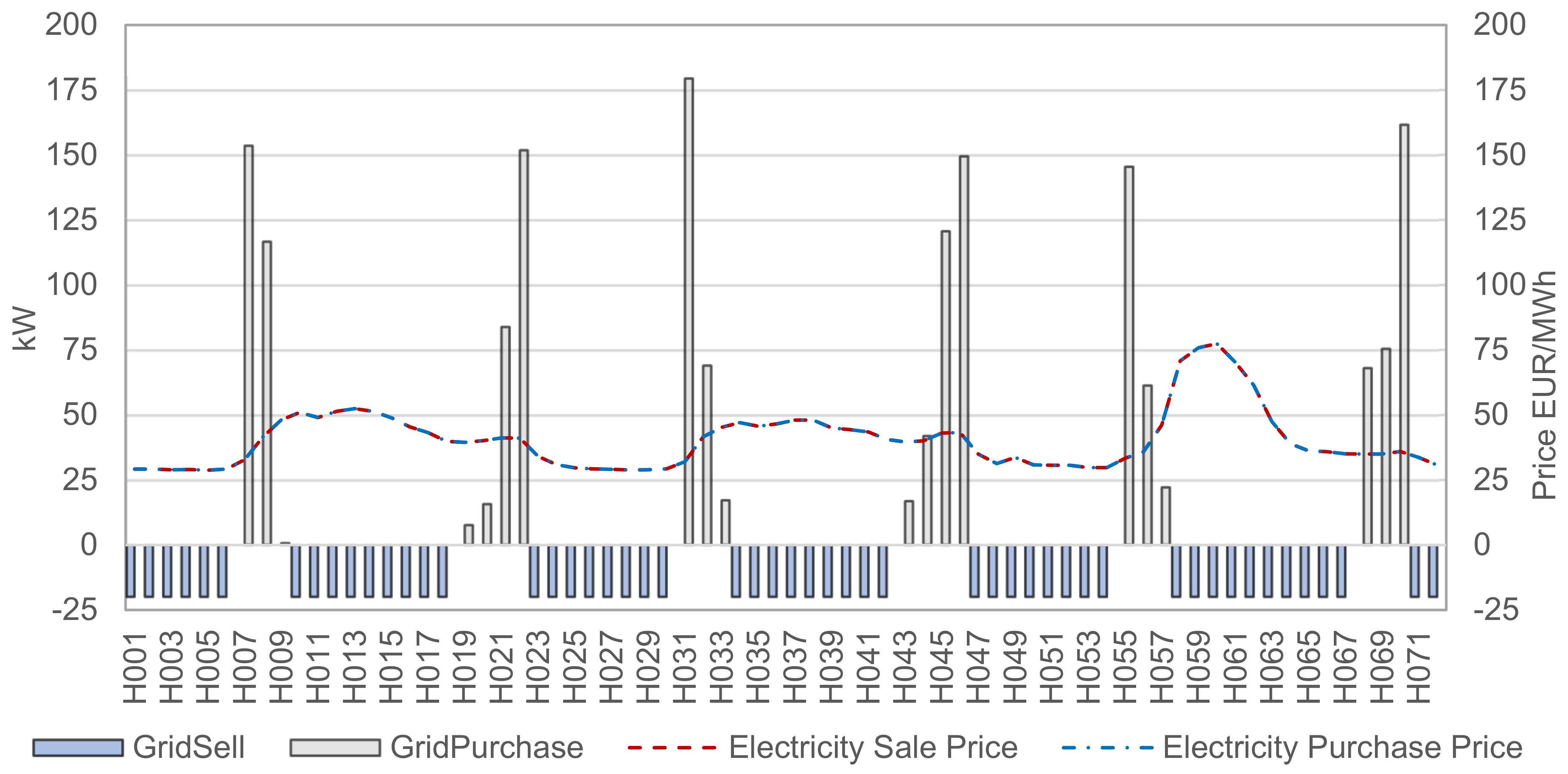

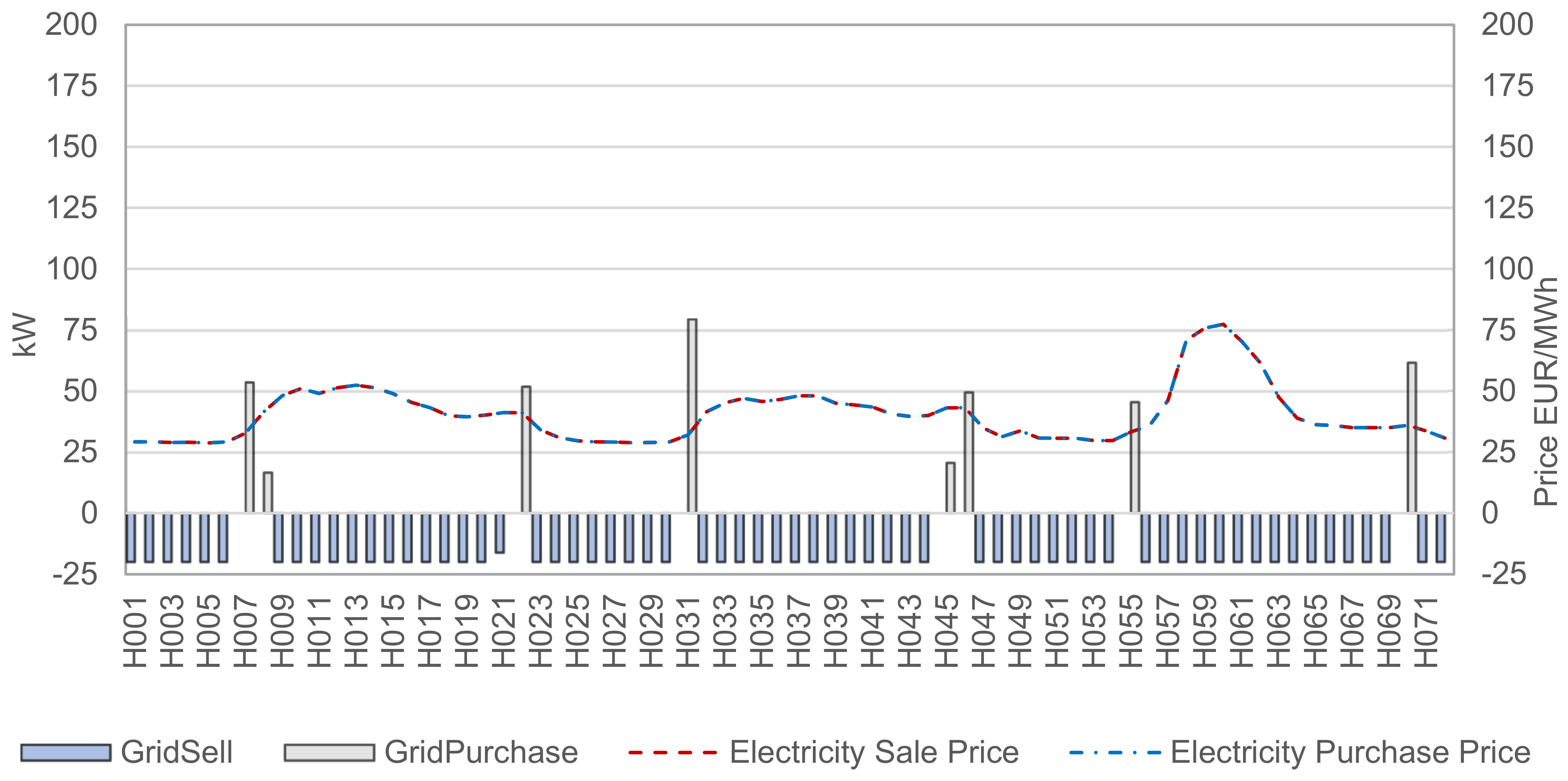

5.1. Electricity Generation Mix

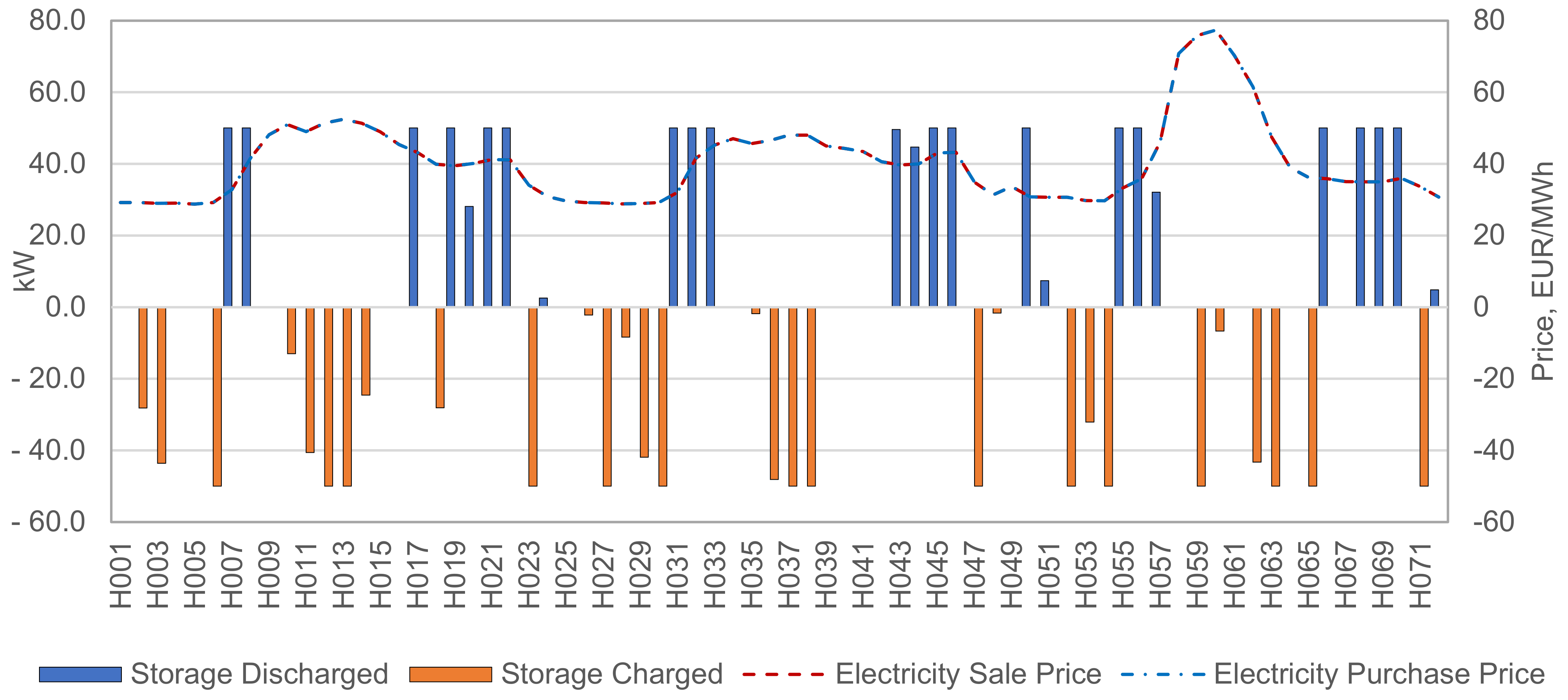

5.2. Battery Energy Storage Integration

5.3. System Operating Costs

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Nurdiawati, A.; Urban, F. Towards Deep Decarbonisation of Energy-Intensive Industries: A Review of Current Status, Technologies and Policies. Energies 2021, 14, 2408. [Google Scholar] [CrossRef]

- Benalcazar, P. Sizing and optimizing the operation of thermal energy storage units in combined heat and power plants: An integrated modelling approach. Energy Convers. Manag. 2021, 242, 114255. [Google Scholar] [CrossRef]

- Mucha-Kuś, K.; Sołysik, M.; Zamasz, K.; Szczepańska-Woszczyna, K. Coopetitive Nature of Energy Communities—The Energy Transition Context. Energies 2021, 14, 931. [Google Scholar] [CrossRef]

- Kriett, P.O.; Salani, M. Optimal control of a residential microgrid. Energy 2012, 42, 321–330. [Google Scholar] [CrossRef]

- Su, W.; Wang, J.; Roh, J. Stochastic Energy Scheduling in Microgrids with Intermittent Renewable Energy Resources. IEEE Trans. Smart Grid 2014, 5, 1876–1883. [Google Scholar] [CrossRef]

- Zhang, Y.; Meng, F.; Wang, R.; Zhu, W.; Zeng, X.-J. A stochastic MPC based approach to integrated energy management in microgrids. Sustain. Cities Soc. 2018, 41, 349–362. [Google Scholar] [CrossRef]

- MansourLakouraj, M.; Shahabi, M.; Shafie-khah, M.; Catalão, J.P.S. Optimal market-based operation of microgrid with the integration of wind turbines, energy storage system and demand response resources. Energy 2022, 239, 122156. [Google Scholar] [CrossRef]

- Ottesen, S.O.; Tomasgard, A. A stochastic model for scheduling energy flexibility in buildings. Energy 2015, 88, 364–376. [Google Scholar] [CrossRef]

- Brahman, F.; Honarmand, M.; Jadid, S. Optimal electrical and thermal Energy management of a residential energy hub, integrating demand response and energy storage system. Energy Build. 2015, 90, 65–75. [Google Scholar] [CrossRef]

- Liu, Y.; Wu, L.; Li, J. Towards accurate modeling of dynamic startup/shutdown and ramping processes of thermal units in unit commitment problems. Energy 2019, 187, 115891. [Google Scholar] [CrossRef]

- Correa-Posada, C.M.; Morales-Espana, G.; Duenas, P.; Sanchez-Martin, P. Dynamic ramping model including intraperiod ramp-rate changes in unit commitment. IEEE Trans Sustain. Energy 2017, 8, 43–50. [Google Scholar] [CrossRef]

- Jin, Z.; Kai, P.; Lei, F.; Tao, D. Data-driven look-ahead unit commitment considering forbidden zones and dynamic ramping rate. IEEE Trans. Ind. Inform. 2018, 15, 3267–3276. [Google Scholar] [CrossRef]

- Srilakshmi, E.; Singh, S.P. Energy regulation of EV using MILP for optimal operation of incentive based prosumer microgrid with uncertainty modelling. Int. J. Electr. Power Energy Syst. 2022, 134, 107353. [Google Scholar] [CrossRef]

- Soares, J.; Ghazvini, M.A.F.; Borges, N.; Vale, Z. A stochastic model for energy resources management considering demand response in smart grids. Electr. Power Syst. Res. 2017, 143, 599–610. [Google Scholar] [CrossRef]

- Carli, R.; Dotoli, M.; Jantzen, J.; Kristensen, M.; Othman, S.B. Energy scheduling of a smart microgrid with shared photovoltaic panels and storage: The case of the Ballen marina in Samsø. Energy 2020, 198, 117188. [Google Scholar] [CrossRef]

- Jiao, X.; Wu, J.; Mao, Y.; Luo, W.; Yan, M. An Optimal Method of Energy Management for Regional Energy System with a Shared Energy Storage. Energies 2023, 16, 886. [Google Scholar] [CrossRef]

- Gomes, I.L.R.; Melicio, R.; Mendes, V.M.F. A novel microgrid support management system based on stochastic mixed-integer linear programming. Energy 2021, 223, 120030. [Google Scholar] [CrossRef]

- Balderrama, S.; Lombardi, F.; Riva, F.; Canedo, W.; Colombo, E.; Quoilin, S. A two-stage linear programming optimization framework for isolated hybrid microgrids in a rural context: The case study of the “El Espino” community. Energy 2019, 188, 116073. [Google Scholar] [CrossRef]

- Domenech, B.; Ferrer-Martí, L.; García, F.; Hidalgo, G.; Pastor, R.; Ponsich, A. Optimizing PV Microgrid Isolated Electrification Projects—A Case Study in Ecuador. Mathematics 2022, 10, 1226. [Google Scholar] [CrossRef]

- Benalcazar, P.; Suski, A.; Kamiński, J. Optimal Sizing and Scheduling of Hybrid Energy Systems: The Cases of Morona Santiago and the Galapagos Islands. Energies 2020, 13, 3933. [Google Scholar] [CrossRef]

- Materi, S.; D’Angola, A.; Renna, P. A dynamic decision model for energy-efficient scheduling of manufacturing system with renewable energy supply. J. Clean. Prod. 2020, 270, 122028. [Google Scholar] [CrossRef]

- Wang, S.; Mason, S.J.; Gangammanavar, H. Stochastic optimization for flow-shop scheduling with on-site renewable energy generation using a case in the United States. Comput. Ind. Eng. 2020, 149, 106812. [Google Scholar] [CrossRef]

- Ommen, T.; Markussen, W.B.; Elmegaard, B. Comparison of linear, mixed integer and non-linear programming methods in energy system dispatch modelling. Energy 2014, 74, 109–118. [Google Scholar] [CrossRef]

- Georgiou, G.S.; Christodoulides, P.; Kalogirou, S.A. Real-time energy convex optimization, via electrical storage, in buildings—A Review. Renew. Energy 2019, 139, 1355–1365. [Google Scholar] [CrossRef]

- Australian Energy Market Operator. Costs and Technical Paramete Review 2023. Available online: https://aemo.com.au/ (accessed on 28 February 2024).

- TGE SA Polish Day-Ahead Market. Available online: https://tge.pl/electricity-dam (accessed on 21 August 2023).

- Peczkis, G.; Przybyła, G.; Zahorulko, A. The electricity market price change in Poland during a period of intensive expansion of renewable energy sources. Rynek Energii 2023, 4, 167. [Google Scholar]

- Pozo, D. Linear battery models for power systems analysis. Electr. Power Syst. Res. 2022, 212, 108565. [Google Scholar] [CrossRef]

- Zhong, H.; Lei, F.; Zhu, W.; Zhang, Z. An operation efficacy-oriented predictive control management for power-redistributable lithium-ion battery pack. Energy 2022, 251, 12385. [Google Scholar] [CrossRef]

- Taha, H.A. Operations Research: An Introduction, 11th ed.; Pearson: London, UK, 2023; ISBN-13: 9780137625727. [Google Scholar]

- Sobotka, A.; Sobotka, P.; Badyda, K. A concept of construction of a forecasting model for electricity prices on the Polish market. Rynek Energii 2019, 1, 140. [Google Scholar]

| Dispatchable Technologies | Rated Power or Rated Energy | Rated Efficiency | Min. Output Power | Max. Power Output | Ramp Up Limit | Ramp Down Limit | CO2 Emission Factor | Minimum Time Up | Minimum Time Down |

|---|---|---|---|---|---|---|---|---|---|

| [kW] | [%] | [% of IC] | [% of IC] | [kW] | [kW] | [kgCO2/kWh] | [h] | [h] | |

| Diesel | 200 | 0.45 | 0.05 | 0.8 | 10 | 10 | 0.76 | 1 | 1 |

| Gas engine | 400 | 0.42 | 0.05 | 1 | 50 | 50 | 0.48 | 2 | 2 |

| Dispatchable Technologies | Fuel Cost | Intercept Fuel Costs | Variable O&M Costs | Fixed O&M Costs | Startup Costs | Shutdown Costs | Power Output from the Previous Planning Horizon (Horizon-1) | Time UP from the Previous Planning Horizon (Horizon-1) | Time Down from the Previous Planning Horizon (Horizon-1) |

|---|---|---|---|---|---|---|---|---|---|

| [EUR/kWh] | [EUR] | [EUR/kWh] | [EUR] | [EUR] | [EUR] | [kW] | [h] | [h] | |

| Diesel | 0.6 | 50 | 16.3 | 5 | 5 | 5 | 0 | 0 | 0 |

| Gas engine | 0.5 | 120 | 13 | 0.3 | 13.2 | 0 | 0 | 0 | 0 |

| Storage Technologies | Rated Power or Rated Energy | Rated Efficiency | Charging Efficiency | Dis- Charging Efficiency | Min. Storage Limit Level | Max. Storage Limit Level | Max. Power Charge Time | Max. Power Discharge Time | Storage Initial Level | Storage O&M Costs |

|---|---|---|---|---|---|---|---|---|---|---|

| [kWh] | [%] | [%] | [%] | [% of IC] | [% of IC] | [h] | [h] | [kWh] | [EUR/kWh] | |

| Battery | 200 | 100 | 98 | 98 | 0 | 100 | 4 | 4 | 0.1 | 0 |

| Cost Category | Cost Component | Case A [EUR] | Case B [EUR] |

|---|---|---|---|

| Variable operations and maintenance costs (non-fuel portion) | Dispatchable technologies VOM costs | 205,685.5 | 223,504.2 |

| Dispatchable technologies startup costs | 48.2 | 48.2 | |

| Dispatchable technologies shutdown costs | 35.0 | 35.0 | |

| PV VOM costs | 9.5 | 9.5 | |

| Wind VOM costs | 14.7 | 14.7 | |

| Storage VOM costs | 0.0 | 0.0 | |

| Fixed operations and maintenance costs | Dispatchable technologies FOM costs | 216.6 | 111.6 |

| Fuel costs | Fuel costs | 18,470.3 | 18,125.8 |

| Electricity costs | Costs of purchasing electricity from the grid | 62,782.2 | 13,860.5 |

| Electricity revenues | Revenue from selling electricity to the grid | −42,397.0 | −51,982.2 |

| Total System Cost [EUR] | 244,865.0 | 203,727.3 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Benalcazar, P.; Malec, M.; Kaszyński, P.; Kamiński, J.; Saługa, P.W. Electricity Cost Savings in Energy-Intensive Companies: Optimization Framework and Case Study. Energies 2024, 17, 1307. https://doi.org/10.3390/en17061307

Benalcazar P, Malec M, Kaszyński P, Kamiński J, Saługa PW. Electricity Cost Savings in Energy-Intensive Companies: Optimization Framework and Case Study. Energies. 2024; 17(6):1307. https://doi.org/10.3390/en17061307

Chicago/Turabian StyleBenalcazar, Pablo, Marcin Malec, Przemysław Kaszyński, Jacek Kamiński, and Piotr W. Saługa. 2024. "Electricity Cost Savings in Energy-Intensive Companies: Optimization Framework and Case Study" Energies 17, no. 6: 1307. https://doi.org/10.3390/en17061307

APA StyleBenalcazar, P., Malec, M., Kaszyński, P., Kamiński, J., & Saługa, P. W. (2024). Electricity Cost Savings in Energy-Intensive Companies: Optimization Framework and Case Study. Energies, 17(6), 1307. https://doi.org/10.3390/en17061307