How Responsible Are Energy and Utilities Companies in Terms of Sustainability and Economic Development?

Abstract

1. Introduction

2. Literature Review

3. Materials and Methods

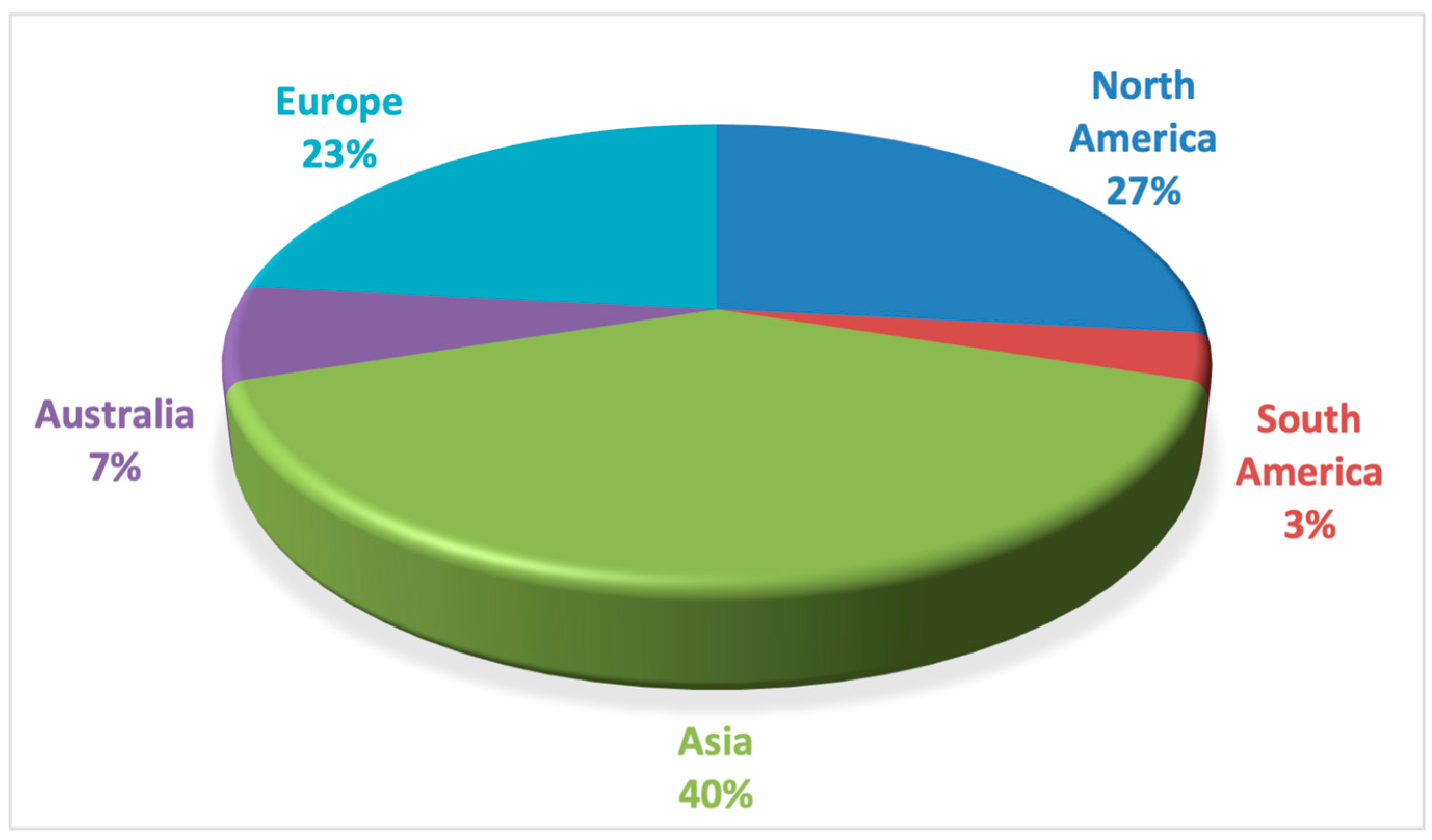

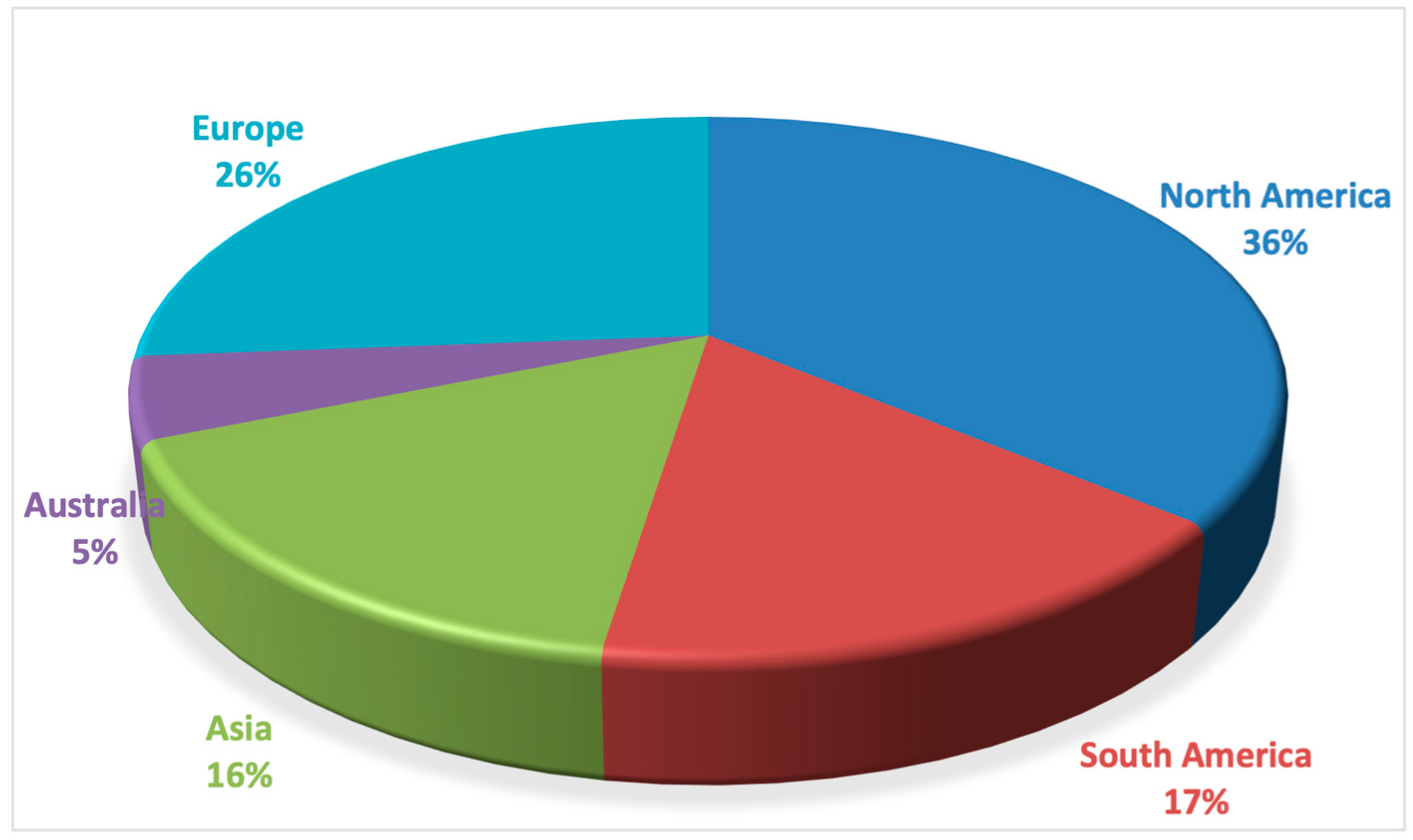

3.1. Data and Sample

3.2. Methodology

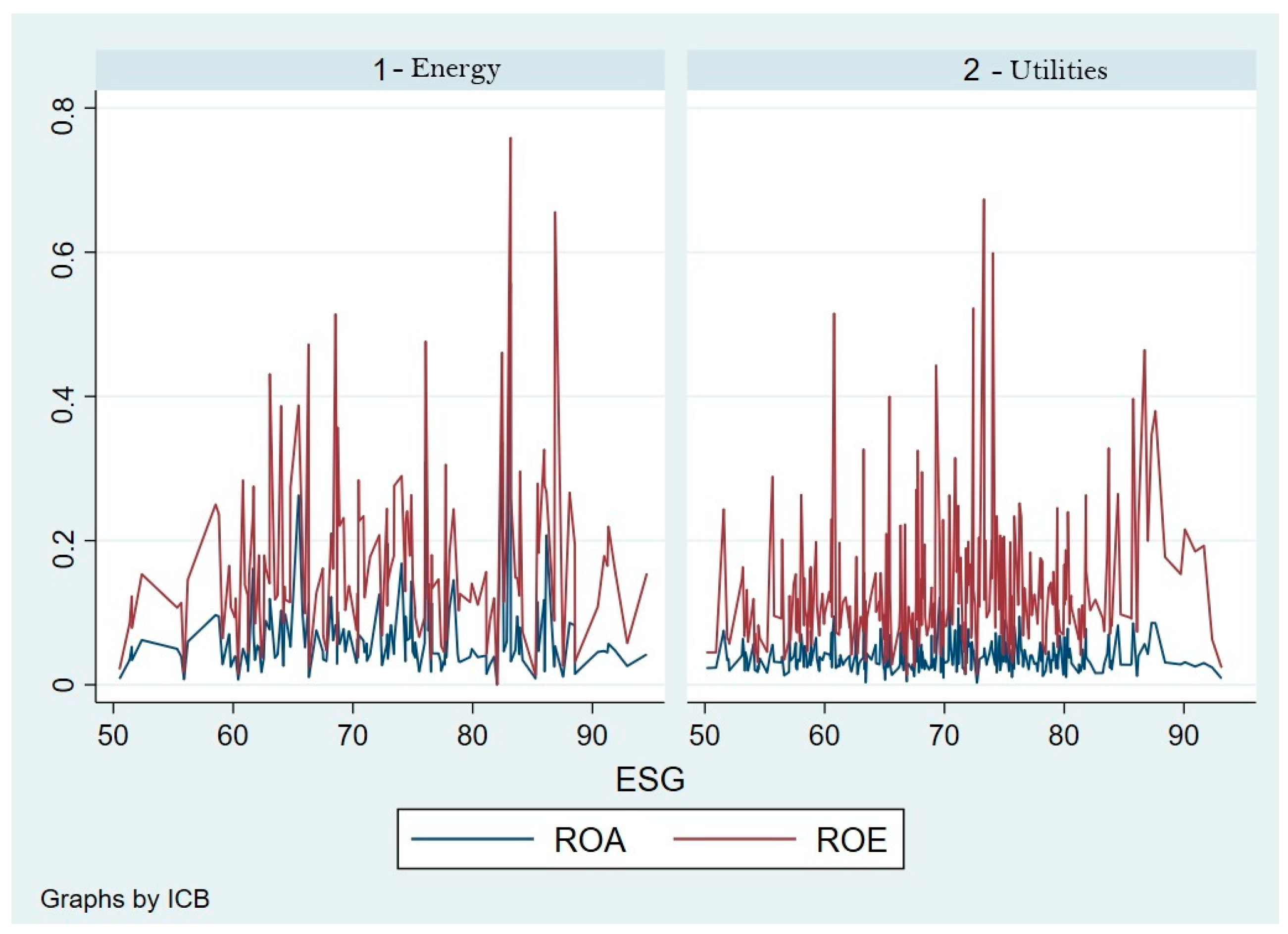

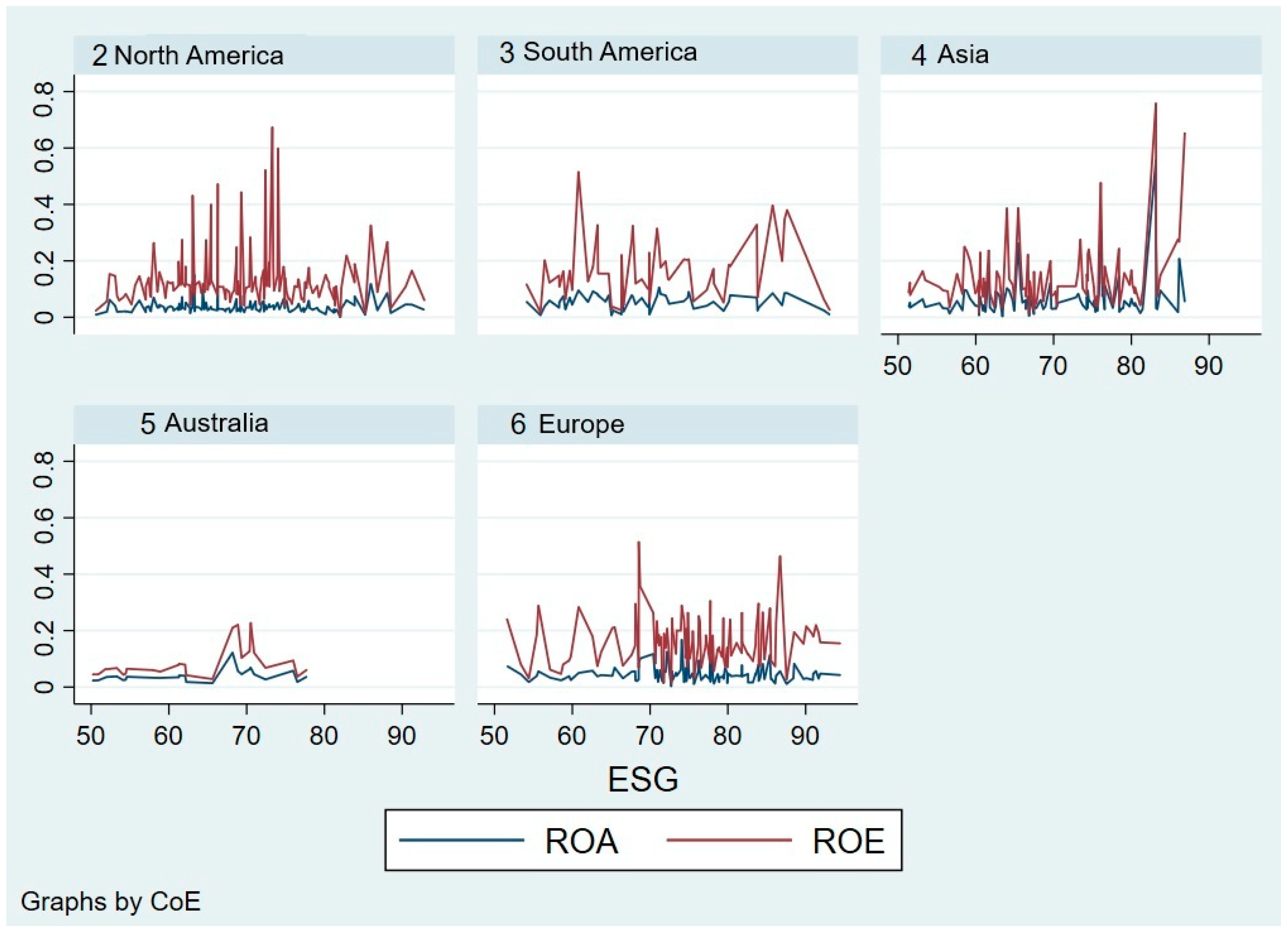

4. Results

5. Discussion

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Kolk, A. The social responsibility of international business: From ethics and the environment to CSR and sustainable deveopment. J. World Bus. 2016, 51, 23–34. [Google Scholar] [CrossRef]

- Meyer, D.; Fauser, J.; Hertweck, D. Business Model Transformation in the German Energy Sector: Key Drivers and Barriers. ISPRS Ann. Photogramm. Remote Sens. Spat. Inf. Sci. 2021, VIII-4/W1-2021, 73–80. [Google Scholar] [CrossRef]

- D’Amore, G.; Testa, M.; Lepore, L. How is the utilities sector contributing to building a sustainable future? A systematic literature review of sustainability practices. Sustainability 2023, 16, 374. [Google Scholar] [CrossRef]

- Global Sustainable Investment Alliance. Global Sustainable Investment Review 2020; Global Sustainable Investment Alliance: Sydney, Australia, 2021. Available online: https://www.gsi-alliance.org/wp-content/uploads/2021/08/GSIR-20201.pdf (accessed on 10 October 2024).

- European Commission. Directive on Non-Financial Reporting; European Commission: Brussels, Belgium, 2019. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX:32014L0095 (accessed on 10 October 2024).

- Eccles, R.G.; Ioannou, I.; Serafeim, G. The impact of corporate sustainability on organizational processes and performance. Manag. Sci. 2014, 60, 2835–2857. [Google Scholar] [CrossRef]

- International Energy Agency (IEA). Energy Sector CO2 Emissions; International Energy Agency: Paris, France, 2020. Available online: https://www.iea.org/reports/global-energy-review-2020 (accessed on 10 October 2024).

- Wüstenhagen, R.; Menichetti, E. Strategic choices for renewable energy investment: Conceptual framework and opportunities for further research. Energy Policy 2012, 40, 7455–7463. [Google Scholar] [CrossRef]

- Moser, S.C. Adaptation challenges and opportunities for the energy sector. Energy Res. Social Sci. 2020, 60, 101309. [Google Scholar] [CrossRef]

- Giese, G.; Lee, L.E.; Melas, D.; Nagy, Z.; Nishikawa, L. Foundations of ESG investing: How ESG affects equity valuation, risk, and performance. J. Portf. Manag. 2019, 45, 69–83. [Google Scholar] [CrossRef]

- Kotsantonis, S.; Serafeim, G.; Rebeca, P. ESG integration in investment management: Myths and realities. J. Appl. Corp. Financ. 2016, 28, 10–16. [Google Scholar] [CrossRef]

- Nicolo, G.; Zampone, G.; Sannino, G.; Tiron-Tudor, A. Worldwide evidence of corporate governance influence on ESG disclosure in the utilities sector. Util. Policy 2023, 82, 101549. [Google Scholar] [CrossRef]

- United Nations. Paris Agreement; United Nations: New York, NY, USA, 2015; Available online: https://unfccc.int/process-and-meetings/the-paris-agreement/the-paris-agreement (accessed on 15 October 2024).

- Manes-Rossi, F.; Nicolo’, G. Exploring sustainable development goals reporting practices: From symbolic to substantive approaches—Evidence from the energy sector. Corp. Social Responsib. Environ. Manag. 2022, 29, 1799–1815. [Google Scholar] [CrossRef]

- International Renewable Energy Agency (IRENA). Renewable Energy Statistics 2020; International Renewable Energy Agency (IRENA): Masdar City, United Arab Emirates, 2020; Available online: https://www.irena.org/publications/2020/Jul/Renewable-energy-statistics-2020 (accessed on 15 October 2024).

- Bhattarai, U.; Maraseni, T.; Apan, A. Assay of renewable energy transition: A systematic literature review. Sci. Total Environ. 2022, 833, 155159. [Google Scholar] [CrossRef]

- Talan, G.; Sharma, G.D.; Pereira, V.; Muschert, G.W. From ESG to holistic value addition: Rethinking sustainable investment from the lens of stakeholder theory. Int. Rev. Econ. Financ. 2024, 96, 103530. [Google Scholar] [CrossRef]

- García-Sánchez, I.-M.; Gómez-Miranda, M.E.; David, F.; Rodríguez-Ariza, L. Analyst coverage and forecast accuracy when CSR reports improve stakeholder engagement: The Global Reporting Initiative-International Finance Corporation disclosure strategy. Corp. Soc. Responsib. Environ. Manag. 2019, 26, 1392–1406. [Google Scholar] [CrossRef]

- Luo, L.; Tang, Q. The real effects of ESG reporting and GRI standards on carbon mitigation: International evidence. Bus. Strategy Environ. 2023, 32, 2985–3000. [Google Scholar] [CrossRef]

- Delmas, M.A.; Burbano, V.C. The drivers of greenwashing. Calif. Manag. Rev. 2011, 54, 64–87. [Google Scholar] [CrossRef]

- Gielen, D.; Boshell, F.; Saygin, D.; Bazilian, M.D.; Wagner, N.; Gorini, R. The role of renewable energy in the global energy transformation. Energy Strategy Rev. 2019, 24, 38–50. [Google Scholar] [CrossRef]

- Friede, G.; Busch, T.; Bassen, A. ESG and financial performance: Aggregated evidence from more than 2000 empirical studies. J. Sustain. Financ. Investig. 2015, 5, 210–233. [Google Scholar] [CrossRef]

- Zeng, Y.; Yang, H.; Luo, X. Balancing sustainability and profitability in the energy industry. Energy Econ. 2021, 95, 105138. [Google Scholar] [CrossRef]

- Sovacool, B.K.; Del Rio, D.F.; Zhang, W. The political economy of net-zero transitions: Policy drivers, barriers, and justice benefits to decarbonization in eight carbon-neutral countries. J. Environ. Manag. 2023, 347, 119154. [Google Scholar] [CrossRef]

- Sovacool, B.K.; Geels, F.W. Further reflections on the temporalities of energy transitions: A response to critics. Energy Res. Soc. Sci. 2016, 22, 232–237. [Google Scholar] [CrossRef]

- Hategan, V.P.; Hategan, C.D. Sustainable leadership: Philosophical and practical approach in organizations. Sustainability 2021, 13, 7918. [Google Scholar] [CrossRef]

- Kolk, A.; Pinkse, J. The integration of corporate social responsibility in international and sustainability strategies. J. World Bus. 2017, 51, 23–34. [Google Scholar] [CrossRef]

- Eccles, R.G.; Lee, L.E.; Stroehle, J.C. The social origins of ESG: An analysis of Innovest and KLD. Organ. Environ. 2020, 33, 575–596. [Google Scholar] [CrossRef]

- Flammer, C.; Hong, B.; Minor, D.B. Corporate governance and the rise of integrating sustainability into the board agenda. J. Financ. Econ. 2019, 133, 67–90. [Google Scholar] [CrossRef]

- Handoyo, S.; Anas, S. The effect of environmental, social, and governance (ESG) on firm performance: The moderating role of country regulatory quality and government effectiveness in ASEAN. Cogent Bus. Manag. 2024, 11, 2371071. [Google Scholar] [CrossRef]

- Ziolo, M.; Tirca, D.M.; Novo-Corti, I. Editorial: Sustainable finance for the blue economy. Front. Environ. Sci. 2024, 12, 1388406. [Google Scholar] [CrossRef]

- Boffo, R.; Patalano, R. ESG Investing: Practices, Progress and Challenges; OECD Publishing: Paris, France, 2020; Available online: https://www.oecd-ilibrary.org/docserver/5504598c-en.pdf?expires=1733652211&id=id&accname=guest&checksum=AEF7B9A6088075D0C54E9C1FD0A44E77 (accessed on 1 November 2024).

- European Commission. The European Green Deal; European Commission: Brussels, Belgium, 2020. Available online: https://ec.europa.eu/info/strategy/priorities-2019-2024/european-green-deal_en (accessed on 1 October 2024).

- Andrews, R.N.; Johnson, E. Energy use, behavioral change, and business organizations: Reviewing recent findings and proposing a future research agenda. Energy Res. Soc. Sci. 2016, 11, 195–208. [Google Scholar] [CrossRef]

- Jones, A.W. Perceived barriers and policy solutions in clean energy infrastructure investment. J. Clean. Prod. 2015, 104, 297–304. [Google Scholar] [CrossRef]

- Krivačić, D.; Janković, S. Sustainability Reporting During the Pandemic: Current State and Expectations for the Future. J. Account. Manag. 2021, 11, 51–64. Available online: https://hrcak.srce.hr/file/393763 (accessed on 20 October 2024).

- Yergin, D. The New Map: Energy, Climate, and the Clash of Nations; Penguin Press: New York, NY, USA, 2020. [Google Scholar]

- Porter, M.E.; Kramer, M.R. Creating Shared Value. Harv. Bus. Rev. 2019, 89, 62–77. Available online: https://hbr.org/2011/01/the-big-idea-creating-shared-value (accessed on 20 October 2024).

- Crane, A.; Matten, D.; Spence, L.J. Corporate Social Responsibility: Readings and Cases in a Global Context, 4th ed.; Routledge: London, UK, 2020. [Google Scholar]

- Bridge, G.; Bouzarovski, S.; Bradshaw, M.; Eyre, N. Energy infrastructure and the politics of transition. Energy Policy 2018, 123, 146–152. [Google Scholar] [CrossRef]

- Berg, F.; Koelbel, J.F.; Rigobon, R. Aggregate confusion: The divergence of ESG ratings. Rev. Financ. 2022, 26, 1315–1344. [Google Scholar] [CrossRef]

- Erhart, S. Take it with a pinch of salt—ESG rating of stocks and stock indices. Int. Rev. Financ. Anal. 2022, 83, 102308. [Google Scholar] [CrossRef] [PubMed]

- Dumrose, M.; Rink, S.; Eckert, J. Disaggregating confusion? The EU Taxonomy and its relation to ESG rating. Financ. Res. Lett. 2022, 48, 102928. [Google Scholar] [CrossRef]

- European Parliament and of the Council. Regulation (EU) 2020/852 of the European Parliament and of the Council of 18 June 2020 on the Establishment of a Framework to Facilitate Sustainable Investment, and Amending Regulation (EU) 2019/2088; European Parliament and of the Council: Strasbourg, France, 2020; Available online: https://eur-lex.europa.eu/eli/reg/2020/852/oj (accessed on 26 November 2024).

- Refinitiv. ESG Scores in Eikon: Methodology and Use Cases; Refinitiv: New York, NY, USA, 2021; Available online: https://www.refinitiv.com/en/sustainable-finance/esg-scores (accessed on 26 September 2024).

- Clark, G.L.; Feiner, A.; Viehs, M. From the Stockholder to the Stakeholder: How Sustainability Can Drive Financial Outperformance; University of Oxford: Oxford, UK, 2015; Available online: https://ssrn.com/abstract=2508281 (accessed on 26 September 2024). [CrossRef]

- Hategan, C.D.; Pitorac, R.I.; Milu, N.D. Assessment of the mandatory non-financial reporting of Romanian companies in the circular economy context. Int. J. Environ. Res. Public Health 2021, 18, 12899. [Google Scholar] [CrossRef] [PubMed]

- International Energy Agency. World Energy Outlook 2022; International Energy Agency: Paris, France, 2022; Available online: https://www.iea.org/reports/world-energy-outlook-2022 (accessed on 15 October 2024).

- Gonzalez-Benito, J.; Gonzalez-Benito, O. Environmental proactivity and firm performance: The moderating effect of the competitive environment. J. Bus. Res. 2010, 63, 228–235. [Google Scholar] [CrossRef]

- Porter, M.E.; Kramer, M.R. Strategy and Society: The Link Between Competitive Advantage and Corporate Social Responsibility. Harv. Bus. Rev. 2006, 84, 78–92. Available online: https://hbr.org/2006/12/strategy-and-society-the-link-between-competitive-advantage-and-corporate-social-responsibility (accessed on 15 October 2024).

- Ioannou, I.; Serafeim, G. The Effect of Corporate Social Responsibility on Investment Recommendations: An International Survey. Financ. Anal. J. 2012, 68, 36–54. [Google Scholar] [CrossRef]

- Forrest, S.A.; Waghorn, J. The Goldman Sachs energy ESG index: Integrating environmental, social and governance factors into energy industry analysis. In Responsible Investment; Sullivan, R., Mackenzie, C., Eds.; Routledge: London, UK, 2017; pp. 110–121. [Google Scholar]

- IRENA. World Energy Transitions Outlook 2021; International Renewable Energy Agency: Masdar City, United Arab Emirates, 2021; Available online: https://www.irena.org/publications/2021/Jun/World-Energy-Transitions-Outlook-2021 (accessed on 15 October 2024).

- Karwowski, M.; Raulinajtys-Grzybek, M. The application of corporate social responsibility (CSR) actions for mitigation of environmental, social, corporate governance (ESG) and reputational risk in integrated reports. Corp. Soc. Responsib. Environ. Manag. 2021, 28, 1270–1284. [Google Scholar] [CrossRef]

- Alareeni, B.A.; Hamdan, A. ESG impact on performance of US S&P 500-listed firms. Corp. Gov. Int. J. Bus. Soc. 2020, 20, 1409–1428. [Google Scholar] [CrossRef]

- Yousaf, M.; Dey, S.K. Best proxy to determine firm performance using financial ratios: A CHAID approach. Rev. Econ. Perspect. 2022, 22, 219–239. [Google Scholar] [CrossRef]

- Muhmad, S.N.; Muhamad, R. Sustainable business practices and financial performance during pre-and post-SDG adoption periods: A systematic review. J. Sustain. Financ. Investig. 2021, 11, 291–309. [Google Scholar] [CrossRef]

- Puente De La Vega Caceres, A. Drivers of value creation and the effect of ESG risk rating on investor perceptions through financial metrics. Sustainability 2024, 16, 5347. [Google Scholar] [CrossRef]

- European Commission. Fit for 55: Delivering the EU’s 2030 Climate Target on the Way to Climate Neutrality; European Commission: Brussels, Belgium, 2021. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/HTML/?uri=CELEX%3A52021DC0550 (accessed on 20 October 2024).

- United Nations. Transforming Our World: The 2030 Agenda for Sustainable Development; United Nations: New York, NY, USA. Available online: https://sustainabledevelopment.un.org/post2015/transformingourworld (accessed on 20 October 2024).

- Garrido, A. Social responsibility and energy access: A rights-based perspective. Energy Policy 2021, 149, 112057. [Google Scholar] [CrossRef]

- International Labour Organization (ILO). Safety and Health at Work in the Energy Sector; International Labour Organization (ILO): Geneva, Switzerland, 2020; Available online: https://www.ilo.org/global/topics/safety-and-health-at-work/lang--en/index.htm (accessed on 20 October 2024).

- European Parliament and the Council. Directive (EU) 2022/2464 of the European Parliament and of the Council of 14 December 2022 Amending Regulation (EU) No 537/2014, Directive 2004/109/EC, Directive 2006/43/EC and Directive 2013/34/EU, as Regards Corporate Sustainability Reporting; European Parliament and the Council: Strasbourg, France, 2022; Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A32022L2464 (accessed on 26 November 2024).

- European Commission Delegated. Regulation (EU) 2023/2772 Supplementing Directive 2013/34/EU of the European Parliament and of the Council as Regards Sustainability Reporting Standards; European Commission: Brussels, Belgium, 2023. Available online: https://eur-lex.europa.eu/eli/reg_del/2023/2772/oj (accessed on 26 November 2024).

- Wheeler, D.; Elkington, J. The end of the corporate environmental report? Or the advent of cybernetic sustainability reporting and communication. Bus. Strategy Environ. 2001, 10, 1–14. [Google Scholar] [CrossRef]

| Indicator | Code | Description |

|---|---|---|

| Return on Assets | ROA | Expressed as a percentage based on information from the annual financial statements. |

| Return on Equity | ROE | Expressed as a percentage based on the information from the annual financial statements. |

| Environmental, Social, and Governance | ESG | ESG scores are based on the Refinitiv Eikon database. |

| Continent of Exchange | COE | COE refers to the continent where the stock exchange on which a company is listed is located. This is a geographic variable used to identify the location of stock exchanges (e.g., Europe, Asia, North America, etc.), expressed by numbers from 1 to 6. |

| Industry Classification Benchmark | ICB | Energy companies—code 1. Utilities companies—code 2. |

| Total Assets | TA | TA represents the total sum of all assets owned by a company, including fixed assets (equipment, real estate) and current assets (cash, receivables). It is a key indicator for assessing the size and financial stability of a company. |

| Code | Obs. | Mean | Stand Dev | Min | Max |

|---|---|---|---|---|---|

| ROA | 455 | 0.0479 | 0.0422 | 0.0004 | 0.5573 |

| ROE | 455 | 0.1426 | 0.1008 | 0.0008 | 0.7584 |

| ESG | 455 | 70.6865 | 9.7058 | 50.1127 | 94.5429 |

| COE | 455 | 3.7802 | 1.5692 | 2 | 6 |

| TA | 455 | 41,720.1 | 60,175.96 | 568.579 | 393,969.4 |

| ICB | 455 | 1.6703 | 0.4706 | 1 | 2 |

| Code | Obs. | Mean | Stand Dev | Min | Max |

|---|---|---|---|---|---|

| ROA | 150 | 0.0658 | 0.0636 | 0.0004 | 0.5573 |

| ROE | 150 | 0.1677 | 0.1165 | 0.0008 | 0.7584 |

| ESG | 150 | 73.3287 | 10.1195 | 50.1127 | 94.5429 |

| COE | 150 | 3.9666 | 1.4536 | 2 | 6 |

| TA | 150 | 50,221.73 | 82,108.81 | 568.579 | 393,969.4 |

| Code | Obs. | Mean | Stand Dev | Min | Max |

|---|---|---|---|---|---|

| ROA | 305 | 0.0391 | 0.0210 | 0.0028 | 0.1497 |

| ROE | 305 | 0.1302 | 0.0898 | 0.01324 | 0.6732 |

| ESG | 305 | 69.8788 | 9.4079 | 50.1127 | 93.1470 |

| COE | 305 | 3.6885 | 1.6175 | 2 | 6 |

| TA | 305 | 37,538.9 | 45,280.2 | 1250.8 | 235,310.4 |

| COE | ROA | ROE | ESG | ICB | TA | |

|---|---|---|---|---|---|---|

| 2. North America Obs.150 (40E+110U) | Mean | 0.0370 | 0.1320 | 69.2929 | 1.73 | 45,374.33 |

| Min | 0.0004 | 0.0008 | 50.5072 | 1 | 568.57 | |

| Max | 0.1497 | 0.6732 | 92.9017 | 2 | 178,086.00 | |

| 3. South America Obs. 55 (5E+50U) | Mean | 0.0549 | 0.1654 | 70.6952 | 1.90 | 11,251.87 |

| Min | 0.007 | 0.0179 | 54.0609 | 1 | 1449.46 | |

| Max | 0.1060 | 0.5149 | 93.1473 | 2 | 36,854.68 | |

| 4. Asia Obs. 110 (60E+50U) | Mean | 0.0630 | 0.1400 | 69.1447 | 1.45 | 54,343.55 |

| Min | 0.0032 | 0.0132 | 51.3638 | 1 | 1158.62 | |

| Max | 0.5573 | 0.7584 | 86.8771 | 2 | 393,969.40 | |

| 5. Australia Obs. 25 (2E+3U) | Mean | 0.0398 | 0.0855 | 62.8715 | 1.6 | 14,399.67 |

| Min | 0.0137 | 0.0283 | 50.1127 | 1 | 3158.89 | |

| Max | 0.1218 | 0.2275 | 77.7932 | 2 | 59,321.00 | |

| 6. Europe Obs.115 (35E+80U) | Mean | 0.0463 | 0.1604 | 75.6735 | 1.69 | 45,390.11 |

| Min | 0.0028 | 0.0143 | 51.5701 | 1 | 1250.83 | |

| Max | 0.1708 | 0.5143 | 94.5439 | 2 | 235,310.40 |

| Code | ROA | ROE | ESG | COE | TA | ICB |

|---|---|---|---|---|---|---|

| ROA | 1 | |||||

| ROE | 0.6329 *** | 1 | ||||

| ESG | 0.0926 ** | 0.1722 *** | 1 | |||

| COE | 0.0772 | 0.0640 | 0.1980 *** | 1 | ||

| TA | −0.1704 *** | −0.0787 * | 0.1026 ** | 0.0173 | 1 | |

| ICB | −0.2974 *** | −0.1748 *** | −0.1140 ** | −0.0834 * | −0.0232 | 1 |

| ROA—Dependent variable | |||||||

| Sample | Obs | R-squared | Wald chi2 | ln_ESG | COE | ln_TA | ICB |

| All | 455 | 0.64 | 6442.47 *** | 0.0440 (5.71) *** | 0.0005 (1.59) * | −0.0101 (−6.05) *** | −0.02443 (−2.73) *** |

| Energy | 150 | 0.58 | 84.71 *** | 0.0449 (4.57) *** | 0.0041 (3.57) *** | −0.0144 (−3.97) *** | |

| Utilities | 305 | 0.80 | 4161.87 *** | 0.0245 (13.28) *** | −0.0002 (−1.22) | −0.0064 (−8.86) *** | |

| ROE—Dependent variable | |||||||

| Sample | Obs | R-squared | Wald chi2 | ln_ESG | COE | ln_TA | ICB |

| All | 455 | 0.68 | 32011.68 *** | 0.0723 (7.31) *** | 0.0013 (0.97) | −0.1009 (−4.05) *** | −0.0362 (−1.69) * |

| Energy | 150 | 0.70 | 62.13 *** | 0.0774 (6.24) *** | 0.0068 (2.19) *** | −0.0192 (−4.50) *** | |

| Utilities | 305 | 0.68 | 2015.12 *** | 0.0394 (4.94) *** | 0.0004 (0.30) | −0.0038 (−1.26) | |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Fometescu, A.; Hategan, C.-D.; Pitorac, R.-I. How Responsible Are Energy and Utilities Companies in Terms of Sustainability and Economic Development? Energies 2024, 17, 6209. https://doi.org/10.3390/en17236209

Fometescu A, Hategan C-D, Pitorac R-I. How Responsible Are Energy and Utilities Companies in Terms of Sustainability and Economic Development? Energies. 2024; 17(23):6209. https://doi.org/10.3390/en17236209

Chicago/Turabian StyleFometescu, Adelina, Camelia-Daniela Hategan, and Ruxandra-Ioana Pitorac. 2024. "How Responsible Are Energy and Utilities Companies in Terms of Sustainability and Economic Development?" Energies 17, no. 23: 6209. https://doi.org/10.3390/en17236209

APA StyleFometescu, A., Hategan, C.-D., & Pitorac, R.-I. (2024). How Responsible Are Energy and Utilities Companies in Terms of Sustainability and Economic Development? Energies, 17(23), 6209. https://doi.org/10.3390/en17236209