Analysis for the Implementation of Surplus Hydropower for Green Hydrogen Production in Ecuador

Abstract

1. Introduction

2. Methods

2.1. Identification of the Main Contributors to the Generation of Hydroelectric Power in Ecuador

2.2. Analysis of Surplus Energy Potential for Green Hydrogen Production in the Main Hydroelectric Plants

2.3. Application of the Autoregressive Model for Projecting Surplus Energy

2.4. Estimation of Potential Green Hydrogen Production

3. Results

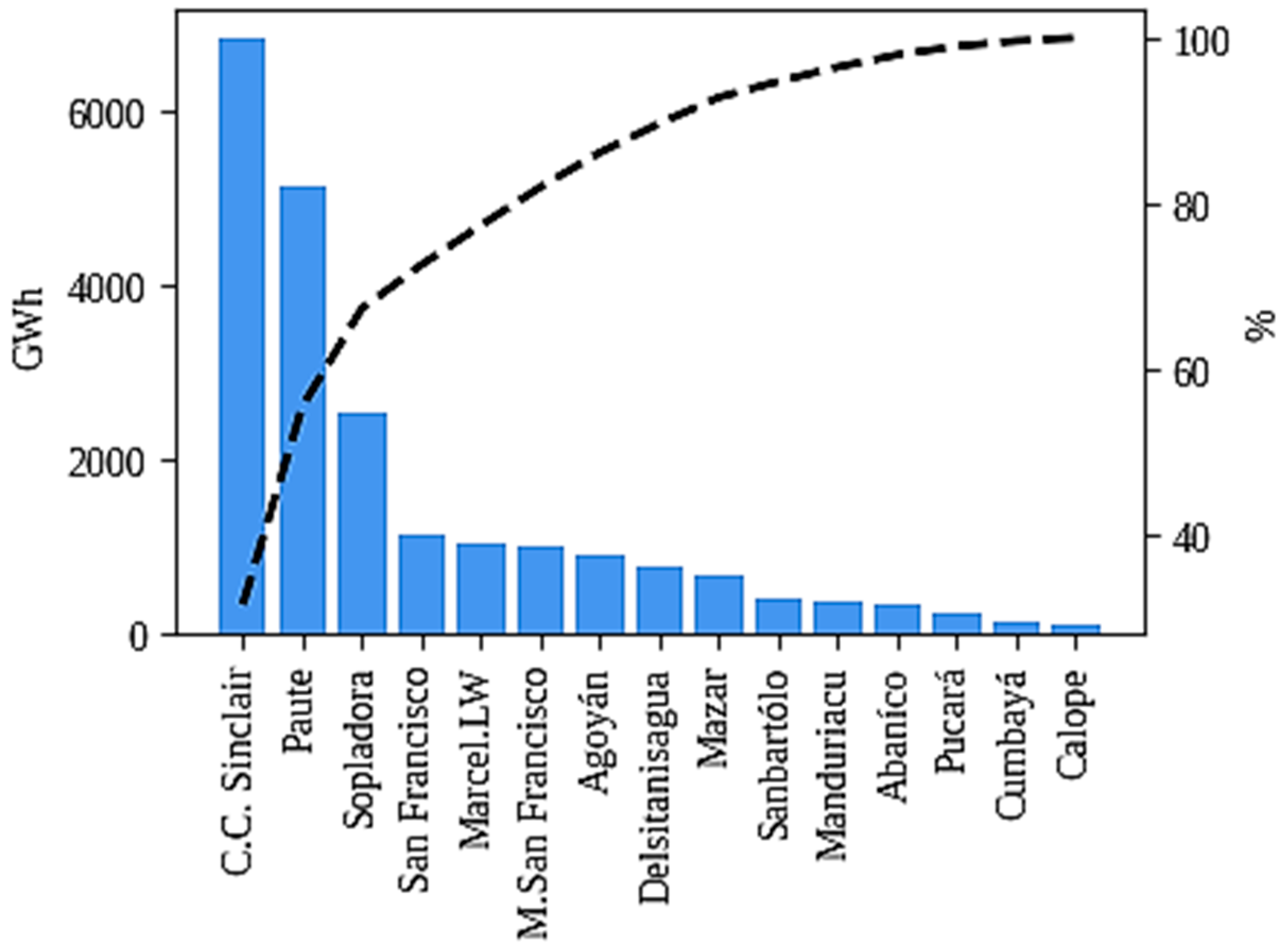

3.1. Pareto Analysis Findings

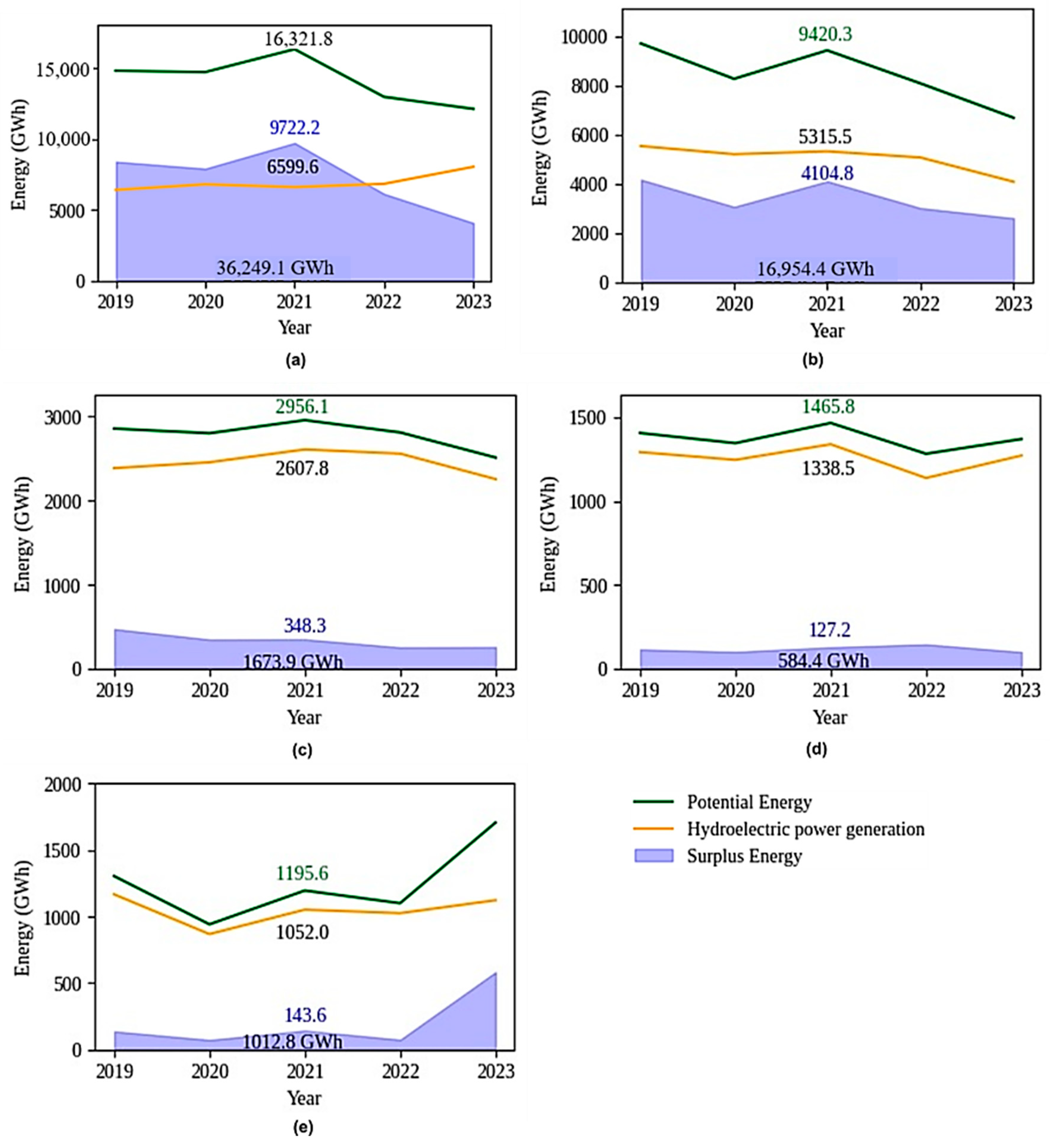

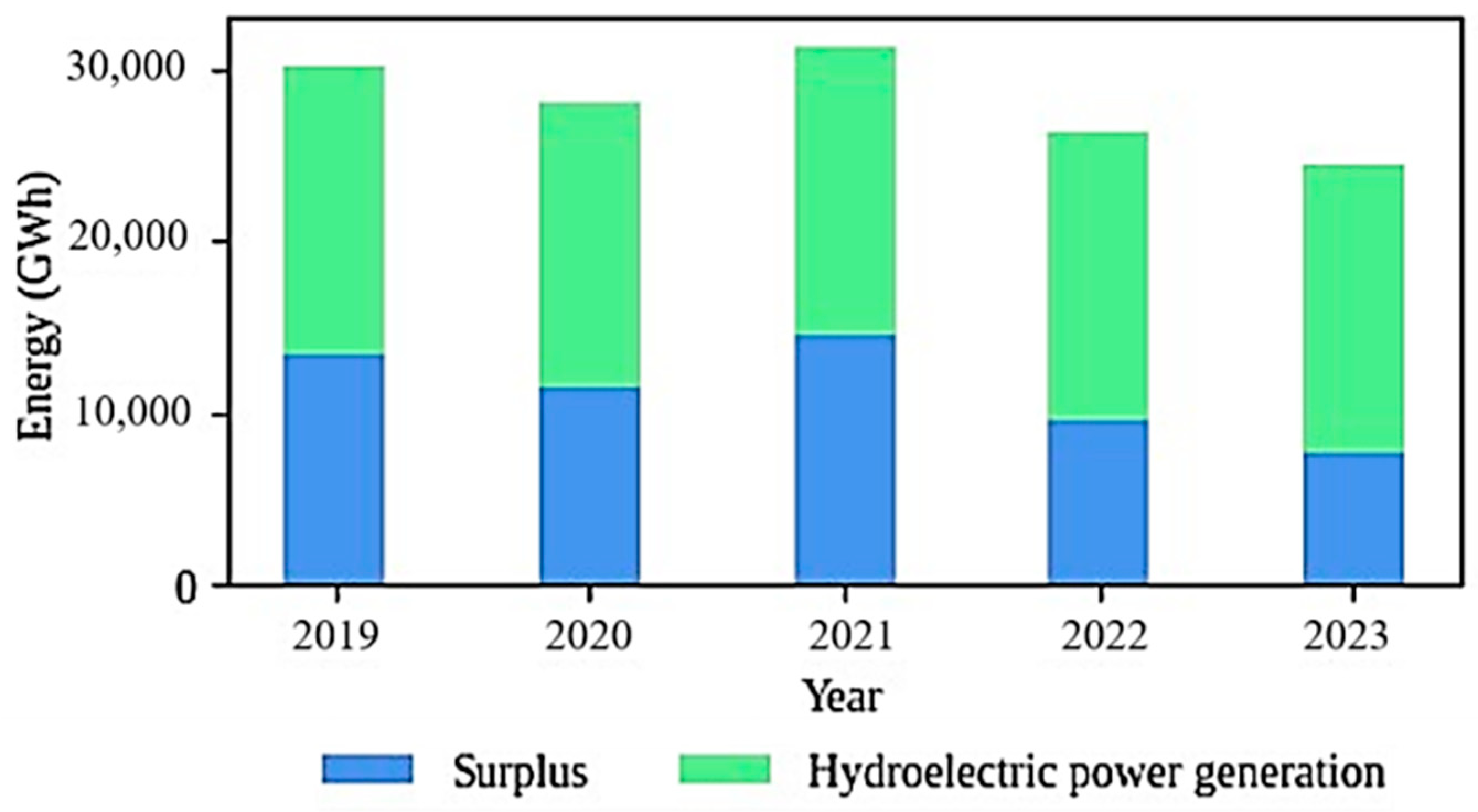

3.2. Assessing the Potential of Surplus Energy at Hydroelectric Plants of Ecuador

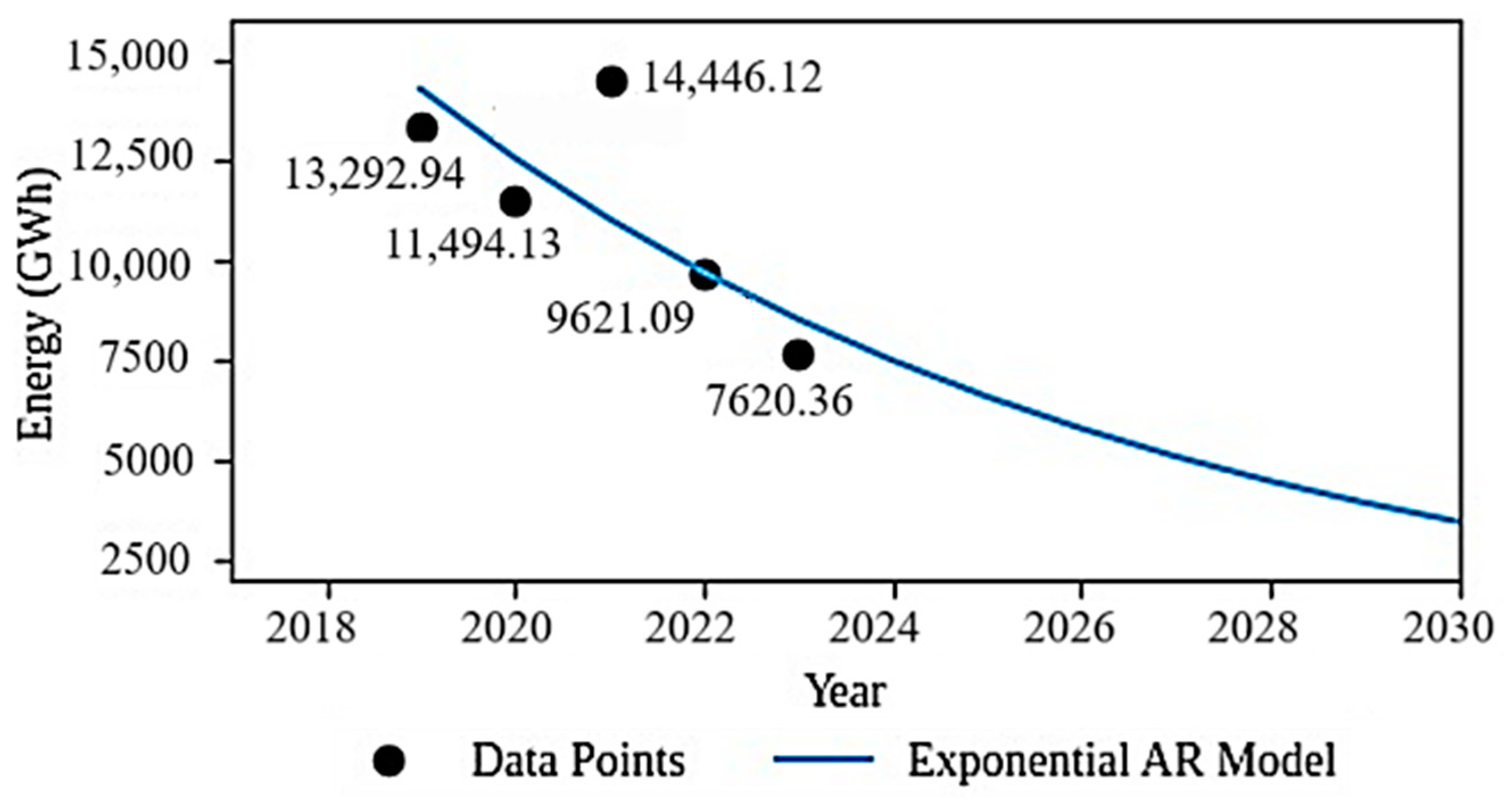

3.3. Adjustment and Projection Using the AR Model

3.4. Green Hydrogen Production from Surplus Energy Projection

4. Discussion

5. Conclusions

- Identification of high-impact hydroelectric plants through Pareto analysis, which determined that Coca Codo Sinclair, Paute, and other major plants account for the majority of Ecuador’s surplus energy. These plants represent key resources for supporting green hydrogen initiatives, given their substantial surplus capacity;

- Projection of surplus energy availability using an AR(1) stochastic model, which indicates a gradual decline in surplus energy up to 2030. The results estimate an annual hydroelectric energy surplus in Ecuador, ranging from 7475 to 3445 GWh over the next five years, which could be allocated for green hydrogen production. This decline highlights the importance of developing adaptive management strategies and integrating complementary renewable resources to sustain hydrogen production levels over time;

- The estimation of hydrogen production potential based on PEM electrolysis reveals a viable opportunity to convert surplus energy into green hydrogen. However, the analysis highlights challenges posed by the anticipated reduction in surplus energy, emphasizing the need for further investments in energy storage and infrastructure to maximize resource utilization.

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Abreviations

| AR(1) | First-Order Autoregressive Model |

| CENACE | Centro Nacional de Control de Energía (National Energy Control Center) |

| BNE | Balance Energético Nacional (National Energy Balance) |

| Eteo | Theoretical energy |

| Esurplus | Surplus energy |

| Qi | Volumetric flow rate of water available (m3/s) |

| Et | Net energy produced by turbines (GWh) |

| H | Vertical distance between the reservoir and turbine outlets (m) |

| ηtr | % Efficiency of turbines |

| ηg | % Efficiency of generators |

| ρ | Density of water (kg/m3) |

| g | Acceleration due to gravity (m/s²) |

| Xt | Series value at time t |

| ϕ1 | Autoregressive coefficient |

| ϵt | Random error term |

| c | Constant |

References

- Uday, S.; Arindam, B. Energy and Sustainability. In The Oxford Handbook of Environmental and Natural Resources Law in India; Oxford Academic: Oxford, UK, 2024; pp. 767–782. [Google Scholar]

- Knobloch, F.; Pollitt, H.; Chewpreecha, U.; Daioglou, V.; Mercure, J.-F. Simulating the deep decarbonisation of residential heating for limiting global warming to 1.5 °C. Energy Effic. 2018, 12, 521–550. [Google Scholar] [CrossRef]

- Züttel, A.; Mauron, P.; Kato, S.; Callini, E.; Holzer, M.; Huang, J. Storage of Renewable Energy by Reduction of CO₂ with Hydrogen. CHIMIA 2014, 69, 264–268. [Google Scholar] [CrossRef] [PubMed]

- Ahmed, O.; Nha, M.; Ahmed, E.; Mahmoud, H.; Amer, A.-H. Hydrogen production, storage, utilization, and environmental impacts: A review. Environ. Chem. Lett. 2022, 20, 153–188. [Google Scholar]

- Martino, M.; Ruocco, C.; Meloni, E.; Pullumbi, P.; Palma, V. Main Hydrogen Production Processes: An Overview. Catalysts 2021, 11, 50547. [Google Scholar] [CrossRef]

- Sharma, M.; Tyagi, V.V.; Kouser, R.; Kumari, K.; Chopra, K.; Kothari, R. Green Hydrogen and Climatic Change: Current Status and Future Outlook. Green Hydrog. Econ. Environ. Sustain. 2024, 2, 31–54. [Google Scholar]

- Li, Z.; Huang, Z.; Su, Y. New media environment, environmental regulation and corporate green technology innovation: Evidence from China. Energy Econ. 2023, 119, 106545. [Google Scholar] [CrossRef]

- Yilmaz, F. Design and performance analysis of hydro and wind-based power and hydrogen generation system for sustainable development. Sustain. Energy Technol. Assess. 2024, 64, 103742. [Google Scholar] [CrossRef]

- Rabiee, A.; Keane, A.; Soroudi, A. Green hydrogen: A new flexibility source for security constrained scheduling of power systems with renewable energies. Int. J. Hydrogen Energy 2021, 46, 37. [Google Scholar] [CrossRef]

- Zalamea, J. Despacho Hidrotérmico de Mediano Plazo aplicado al Complejo Hidroeléctrico Paute Integral. Energía 2021, 18, 95–105. [Google Scholar] [CrossRef]

- Simoes, F.; Santos, D.M. A SWOT Analysis of the Green Hydrogen Market. Energies 2024, 17, 3114. [Google Scholar] [CrossRef]

- Ingale, G.U.; Kwon, H.-M.; Jeong, S.; Park, D.; Kim, W.; Bang, B.; Lim, Y.-I.; Kim, S.W.; Kang, Y.-B.; Mun, J.; et al. Assessment of Greenhouse Gas Emissions from Hydrogen Production Processes: Turquoise Hydrogen vs. Steam Methane Reforming. Energies 2022, 15, 8679. [Google Scholar] [CrossRef]

- Ministerio de Energía y Minas. Hoja de Ruta del Hidrógeno Verde en Ecuador; La Incre S.A.: Quito, Ecuador, 2023. [Google Scholar]

- Stoica, D.; Mihaescu, L.; Lazaroiu, G. Green Hydrogen, a Solution for Replacing Fossil Fuels to Reduce CO₂ Emissions. Processes 2024, 12, 1651. [Google Scholar] [CrossRef]

- Karayel, G.K.; Dincer, I. A study on green hydrogen production potential of Canada with onshore and offshore wind power. J. Clean. Prod. 2024, 437, 1501. [Google Scholar] [CrossRef]

- Yu, Q.; Dai, S.; Shen, P.; Deng, W. Hydrogen Energy in Electrical Power Systems: A Review and Future Outlook. Electronics 2024, 13, 3370. [Google Scholar] [CrossRef]

- Wenchao, C.; Xin, D.; Chen, R.; Zhang, J.Z.Y.; Fu, H. Thermodynamic destabilization and kinetic optimization for the de-/hydrogenation of Mg85Ni15 alloy by tailoring Mg(In) and Mg2Ni(In) double solid solution. Int. J. Hydrogen Energy 2023, 960, 170551. [Google Scholar]

- Hosseini, S.E.; Abdul Wahid, M. Hydrogen production from renewable and sustainable energy resources: Promising green energy carrier for clean development. Renew. Sustain. Energy Rev. 2016, 57, 850–866. [Google Scholar] [CrossRef]

- Ansoleaga Villegas, I. El Mercado del Hidrógeno en Noruega; ICEX España Exportación e Inversiones: Oslo, España, 2022. [Google Scholar]

- Tholen, L.; Leipprand, A.; Kiyar, D.; Maier, S.; Küper, M.; Adisorn, T.; Fischer, A. The Green Hydrogen Puzzle: Towards a German Policy Framework for Industry. Sustainability 2021, 13, 12626. [Google Scholar] [CrossRef]

- Valdez Ibarra, J.J.; De la Salinas, L.R.; García Cedeño, J.A.; Maldonado Ibarra, G.E. Transporte de Hidrógeno: Energía limpia para Latinoamérica. Reincisol 2024, 3, 953–971. [Google Scholar] [CrossRef]

- Abbas, M.; Hassan, Q.; Sohrabi, V.; Tohidi, S.; Jaszczur, M.; Abdulrahman, I.S.; Salman, H. Techno-Economic Analysis for Clean Hydrogen Production Using Solar Energy Under Varied Climate Conditions. Int. J. Hydrogen Energy 2023, 48, 2929–2948. [Google Scholar] [CrossRef]

- Denk, K.; Kodým, R.; Hnát, J.; Paidar, M.; Zitka, J.; Bouzek, K. Alkaline Water Electrolysis—Investigation of the Charge Transport Limitations Across the Separator Under Low KOH Concentration. ECS Meet. Abstr. 2023, MA2023-01, 1750. [Google Scholar] [CrossRef]

- Shokrollahi, M.; Teymouri, N.; Ashrafi, O.; Navarri, P.; Khojasteh-Salkuyeh, Y. Methane Pyrolysis as a Potential Game Changer for Hydrogen Economy: Techno-Economic Assessment and GHG Emissions. Int. J. Hydrogen Energy 2024, 66, 337–353. [Google Scholar] [CrossRef]

- Walker, G. Hydrogen Storage Technologies; Woodhead Publishing Series in Electronic and Optical Materials; Woodhead Publishing: Sutton, UK, 2008; pp. 3–17. [Google Scholar]

- Liu, Q.; Hong, H.Y.J.; Jin, H.; Cai, R. Experimental Investigation of Hydrogen Production Integrated with Methanol Steam Reforming and Middle-Temperature Solar Thermal Energy. Appl. Energy 2009, 155, 155–162. [Google Scholar] [CrossRef]

- Baykara, S.Z. Hydrogen Production by Direct Solar Thermal Decomposition of Water, Possibilities for Improvement of Process Efficiency. Int. J. Hydrogen Energy 2004, 29, 1451–1458. [Google Scholar] [CrossRef]

- Olateju, B.; Kumar, A. Hydrogen Production from Wind Energy in Western Canada for Upgrading Bitumen from Oil Sands. Energy 2011, 36, 6326–6339. [Google Scholar] [CrossRef]

- Zamfirescu, C.; Dincer, I.; Stern, M.; Wagar, W. Exergetic, Environmental and Economic Analyses of Small-Capacity Concentrated Solar-Driven Heat Engines for Power and Heat Cogeneration. Int. J. Energy Res. 2011, 35, 397–408. [Google Scholar] [CrossRef]

- Alizadeh, S.; Parhizi, Z.; Alibak, A.; Vaferi, B.; Hosseini, S. Predicting the Hydrogen Uptake Ability of a Wide Range of Zeolites Utilizing Supervised Machine Learning Methods. Int. J. Hydrogen Energy 2022, 47, 21782–21793. [Google Scholar] [CrossRef]

- Hunt, J.D.; Lima, G.M.; Belchior, F.N.; Villena, J.E.N.; Domingos, J.L.; Freitas, M.A.V. Hybrid electrical energy generation from hydropower, solar photovoltaic and hydrogen. Int. J. Hydrogen Energy 2024, 53, 602–612. [Google Scholar]

- Han, J.; Wang, J.; He, Z.; An, Q.; Song, Y.; Mujeeb, A.; Tan, C.-W.; Gao, F. Hydrogen-powered smart grid resilience. Energy Convers. Econ. 2023, 4, 89–104. [Google Scholar] [CrossRef]

- Naqvi, S.; Tariq, R.; Hameed, Z.; Ali, I.; Taqvi, S.; Naqvi, M.; Niazi, M.; Noor, T.; Farooq, W. Pyrolysis of High-Ash Sewage Sludge: Thermo-Kinetic Study Using TGA and Artificial Neural Networks. Fuel 2018, 222, 529–538. [Google Scholar] [CrossRef]

- Cook, B.; Hagen, C. Techno-Economic Analysis of Biomass Gasification for Hydrogen Production in Three US-Based Case Studies. Int. J. Hydrogen Energy 2024, 49, 202–218. [Google Scholar] [CrossRef]

- Nouwe, E.; Onwudili, J. Comparative Techno-Economic Modelling of Large-Scale Thermochemical Biohydrogen Production Technologies to Fuel Public Buses: A Case Study of West Midlands Region of England. Renew. Energy 2022, 177, 704–716. [Google Scholar] [CrossRef]

- Hardana, H.; Adiwibowo, P.; Sunitiyoso, Y.; Kurniawan, T. Financial Viability Analysis for Green Hydrogen Production Opportunity from Hydropower Plant’s Excess Power in Indonesia. Int. J. Renew. Energy Dev. 2024, 13, 846–863. [Google Scholar] [CrossRef]

- Reksten, A.; Thomassen, M.; Moller-Holst, S.; Sundseth, K. Projecting the Future Cost of PEM and Alkaline Water Electrolysers; A CAPEX Model Including Electrolyser Plant Size and Technology Development. Int. J. Hydrogen Energy 2022, 47, 38106–38113. [Google Scholar] [CrossRef]

- Zwickl-Bernhard, S.; Auer, H. Green Hydrogen from Hydropower: A Non-Cooperative Modeling Approach Assessing the Profitability Gap and Future Business Cases. Energy Strategy Rev. 2022, 39, 100912. [Google Scholar] [CrossRef]

- Abdin, Z. Bridging the Energy Future: The Role and Potential of Hydrogen Co-Firing with Natural Gas. J. Clean. Prod. 2024, 140, 140724. [Google Scholar] [CrossRef]

- Idowu, A.; Ohikhuare, O.M.; Chowdhury, M.A. Does Industrialization Trigger Carbon Emissions Through Energy Consumption? Evidence from OPEC Countries and High Industrialised Countries. Quant. Financ. Econ. 2023, 7, 165–186. [Google Scholar] [CrossRef]

- Cheng, J.; Jiang, Y. How Can Carbon Markets Drive the Development of Renewable Energy Sector? Empirical Evidence from China. Data Sci. Financ. Econ. 2024, 4, 249–269. [Google Scholar] [CrossRef]

- Cenace. Operador Nacional de Electricidad. Informe Anual Producción Energética 2019; Cenace: Quito, Ecuador, 2020. [Google Scholar]

- Cenace. Operador Nacional de Electricidad. Informe Anual Producción Energética 2020; Cenace: Quito, Ecuador, 2021. [Google Scholar]

- Cenace. Operador Nacional de Electricidad. Informe Anual Producción Energética 2021; Cenace: Quito, Ecuador, 2022. [Google Scholar]

- Cenace. Operador Nacional de Electricidad. Informe Anual Producción Energética 2022; Cenace: Quito, Ecuador, 2023. [Google Scholar]

- Cenace. Operador Nacional de Electricidad. Informe Anual Producción Energética 2023; Cenace: Quito, Ecuador, 2024. [Google Scholar]

- Ministerio de Energía y Minas. Balance Energético Nacional 2019; Ministerio de Energía y Minas: Quito, Ecuador, 2020. [Google Scholar]

- Ministerio de Energía y Minas. Balance Energético Nacional 2023; Ministerio de Energía y Minas: Quito, Ecuador, 2024. [Google Scholar]

- Newman, M.E.J. Power Laws, Pareto Distributions and Zipf’s Law. Contemp. Phys. 2005, 46, 323–351. [Google Scholar] [CrossRef]

- Juran, J.M. Juran on Quality by Design: The New Steps for Planning Quality into Goods and Services; The Free Press: New York, NY, USA, 1992. [Google Scholar]

- Samuelson, P.A.; Nordhaus, W.D. Economics; McGraw-Hill: New York, NY, USA, 2009. [Google Scholar]

- Porter, M.E. Competitive Advantage: Creating and Sustaining Superior Performance; Free Press: New York, NY, USA, 1985. [Google Scholar]

- Cobaner, M.; Haktanir, T.; Kisi, O. Prediction of Hydropower Energy Using ANN for the Feasibility of Hydropower Plant Installation to an Existing Irrigation Dam. Water Resour. Manag. 2008, 22, 757–774. [Google Scholar] [CrossRef]

- Susilowati, Y.; Irasari, P.; Susatyo, A. Study of Hydroelectric Power Plant Potential of Mahakam River Basin East Kalimantan Indonesia. In Proceedings of the 2019 International Conference on Sustainable Energy Engineering and Application (ICSEEA), Tangerang, Indonesia, 23–24 October 2019. [Google Scholar]

- Dimas, M.; Etanto, K.; Wijayanto, H.; Pranoto, S.; Hermawan, I.; Idris, M. Analysis of the effect of high falling water on the performance of hydroelectric power plants using whirpool type turbines. JTTM 2024, 5, 149–157. [Google Scholar]

- Khayal, O.M.E.S. Review and Technical Study of Hydroelectric Power Generation. In ResearchGate Preprints; Nile Valley University: Atbara, Sudan, 2019. [Google Scholar] [CrossRef]

- Barragán Escandón, A.; Arostegui Gutiérrez, S.; Zalamea León, E.; Serrano Guerrero, X. Green Hydrogen from Hydroelectric Energy: Assessing the Potential at the Abanico Power Plant in Morona Santiago Province. Renew. Energy Power Qual. J. 2024, 22, 1. [Google Scholar] [CrossRef] [PubMed]

- Viola, L.; De Queiróz Lamas, W.; Silveira, J.L. Environmental studies of green hydrogen production by electrolytic process: A comparison of the use of electricity from solar PV, wind energy, and hydroelectric plants. Int. J. Hydrogen Energy 2023, 48, 36584–36604. [Google Scholar]

- Jafarova, H.; Aliyev, R. Applications of Autoregressive Process for Forecasting of Some Stock Indexes. In Studies in Fuzziness and Soft Computing; Springer: Cham, Switzerland, 2022; pp. 271–278. [Google Scholar]

- Takalo, R.; Hytti, H.; Ihalainen, H. Tutorial on Univariate Autoregressive Spectral Analysis. J. Clin. Monit. Comput. 2005, 19, 6. [Google Scholar] [CrossRef] [PubMed]

- Krone, T.; Albers, C.J.; Timmerman, M. A comparative simulation study of AR(1) estimators in short time series. Qual. Quant. 2016, 51, 1–21. [Google Scholar] [CrossRef] [PubMed]

- Campbell-Stanway, C.; Becerra, V.; Pranbhu, S.; Bull, J. Investigating the Role of Byproduct Oxygen in UK-Based Future Scenario Models for Green Hydrogen Electrolysis. Energies 2024, 17, 281. [Google Scholar] [CrossRef]

- Carmo, M.; Fritz, D.; Mergel, J.; Stolten, D. A Comprehensive Review on PEM Water Electrolysis. Int. J. Hydrogen Energy 2013, 38, 4901–4934. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Pinchao, P.; Torres, A.; Yánez, M.; Reina, S.; Cando, E. Analysis for the Implementation of Surplus Hydropower for Green Hydrogen Production in Ecuador. Energies 2024, 17, 6051. https://doi.org/10.3390/en17236051

Pinchao P, Torres A, Yánez M, Reina S, Cando E. Analysis for the Implementation of Surplus Hydropower for Green Hydrogen Production in Ecuador. Energies. 2024; 17(23):6051. https://doi.org/10.3390/en17236051

Chicago/Turabian StylePinchao, Paul, Alejandra Torres, Marco Yánez, Salvatore Reina, and Edgar Cando. 2024. "Analysis for the Implementation of Surplus Hydropower for Green Hydrogen Production in Ecuador" Energies 17, no. 23: 6051. https://doi.org/10.3390/en17236051

APA StylePinchao, P., Torres, A., Yánez, M., Reina, S., & Cando, E. (2024). Analysis for the Implementation of Surplus Hydropower for Green Hydrogen Production in Ecuador. Energies, 17(23), 6051. https://doi.org/10.3390/en17236051