Operating Costs in the Polish Energy Sector: Challenges for Capital Groups

Abstract

1. Introduction

2. Literature Review

3. Materials and Methods

3.1. Methods and Sources of Information Used

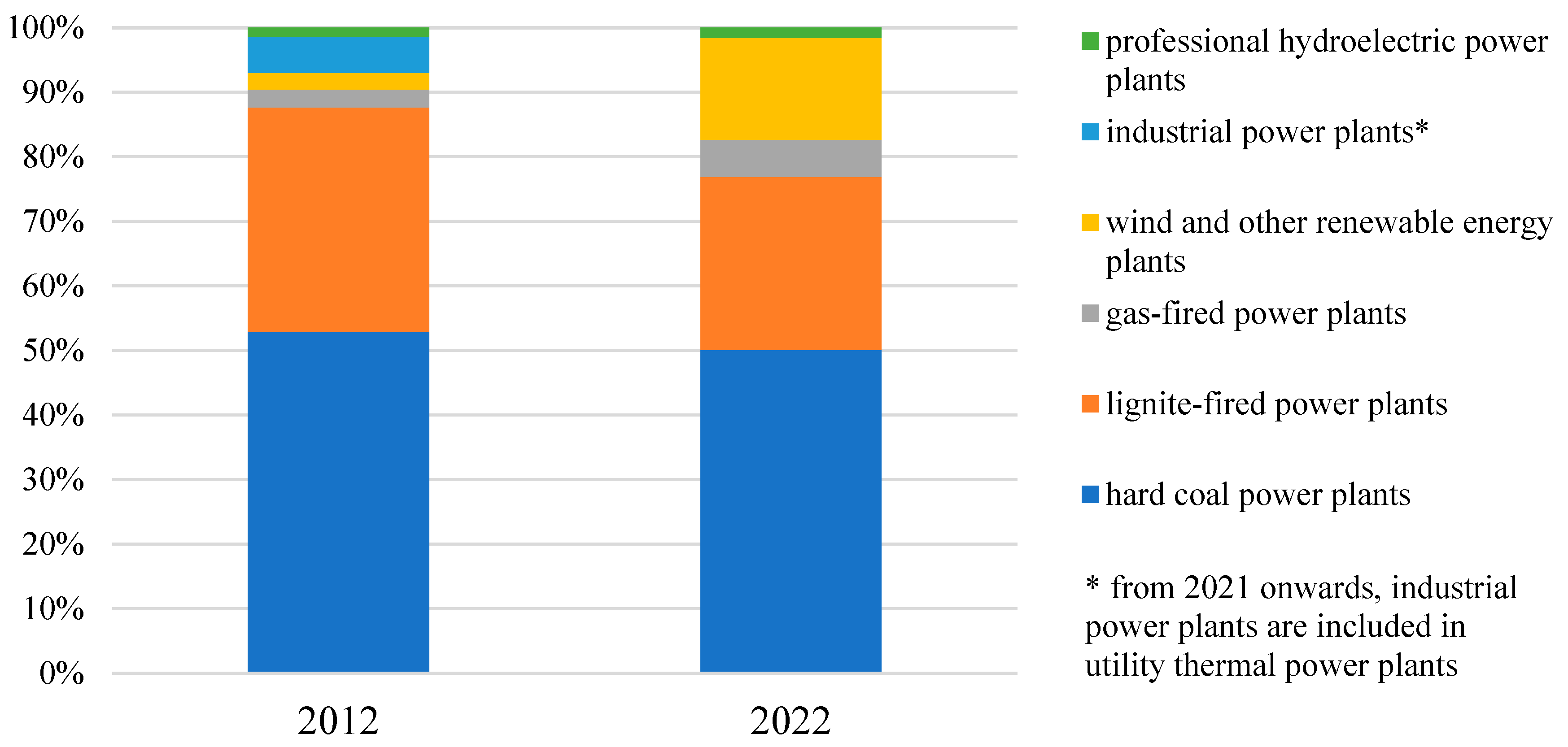

3.2. Characteristics of the Energy Sector in Poland

4. Results

4.1. Cost Structure of the Groups’ Activities as Derived from the Individual and Consolidated Financial Report

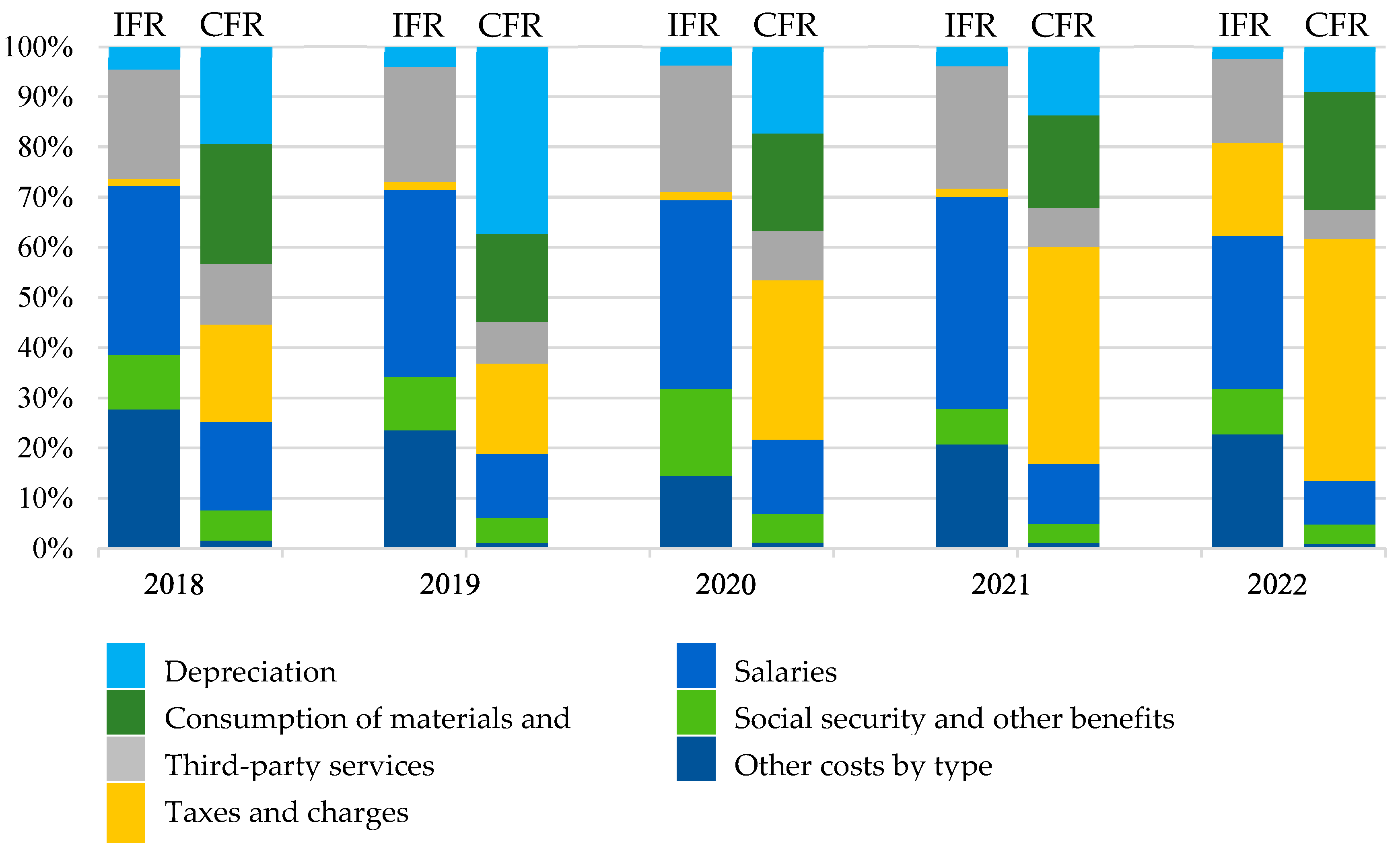

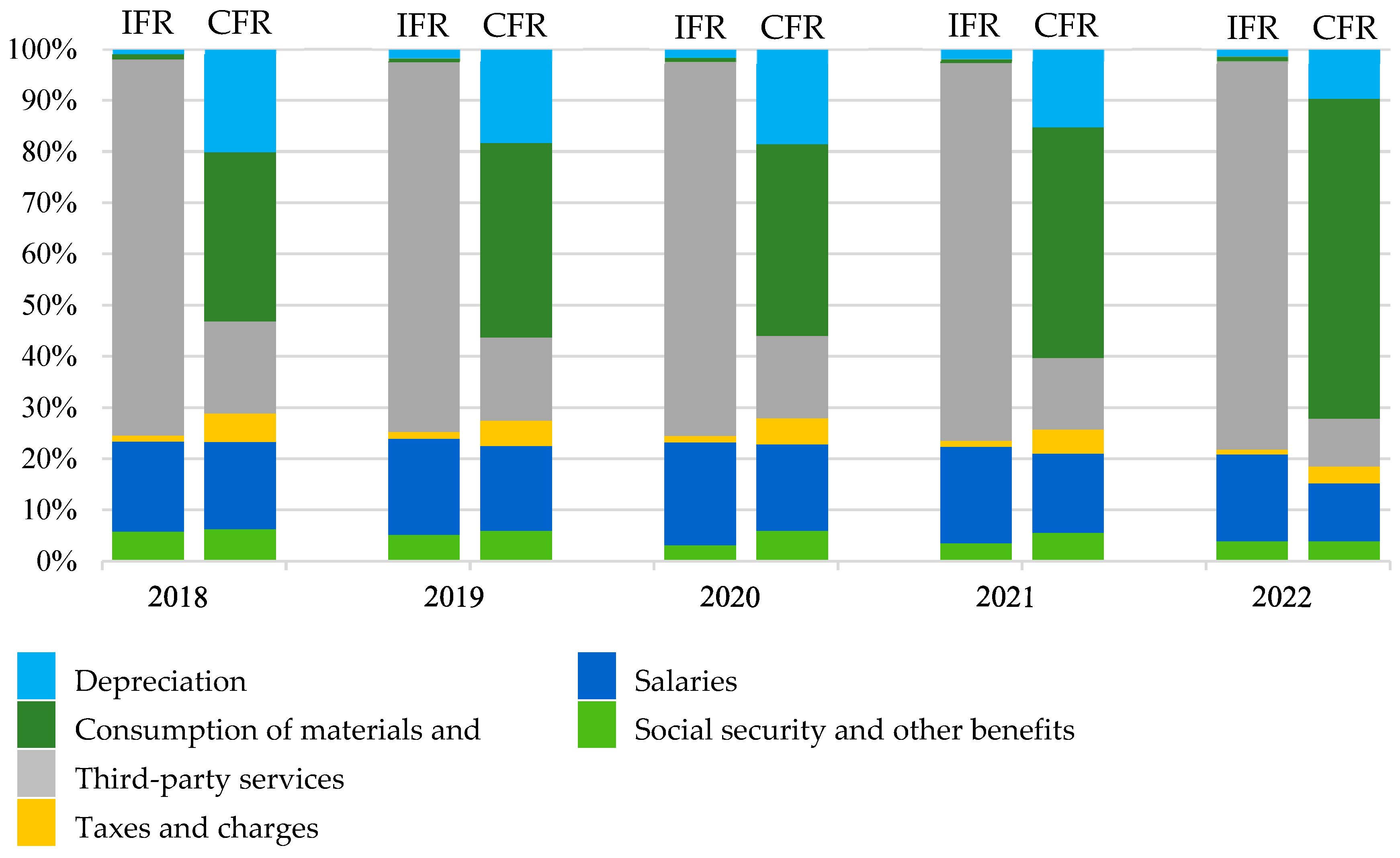

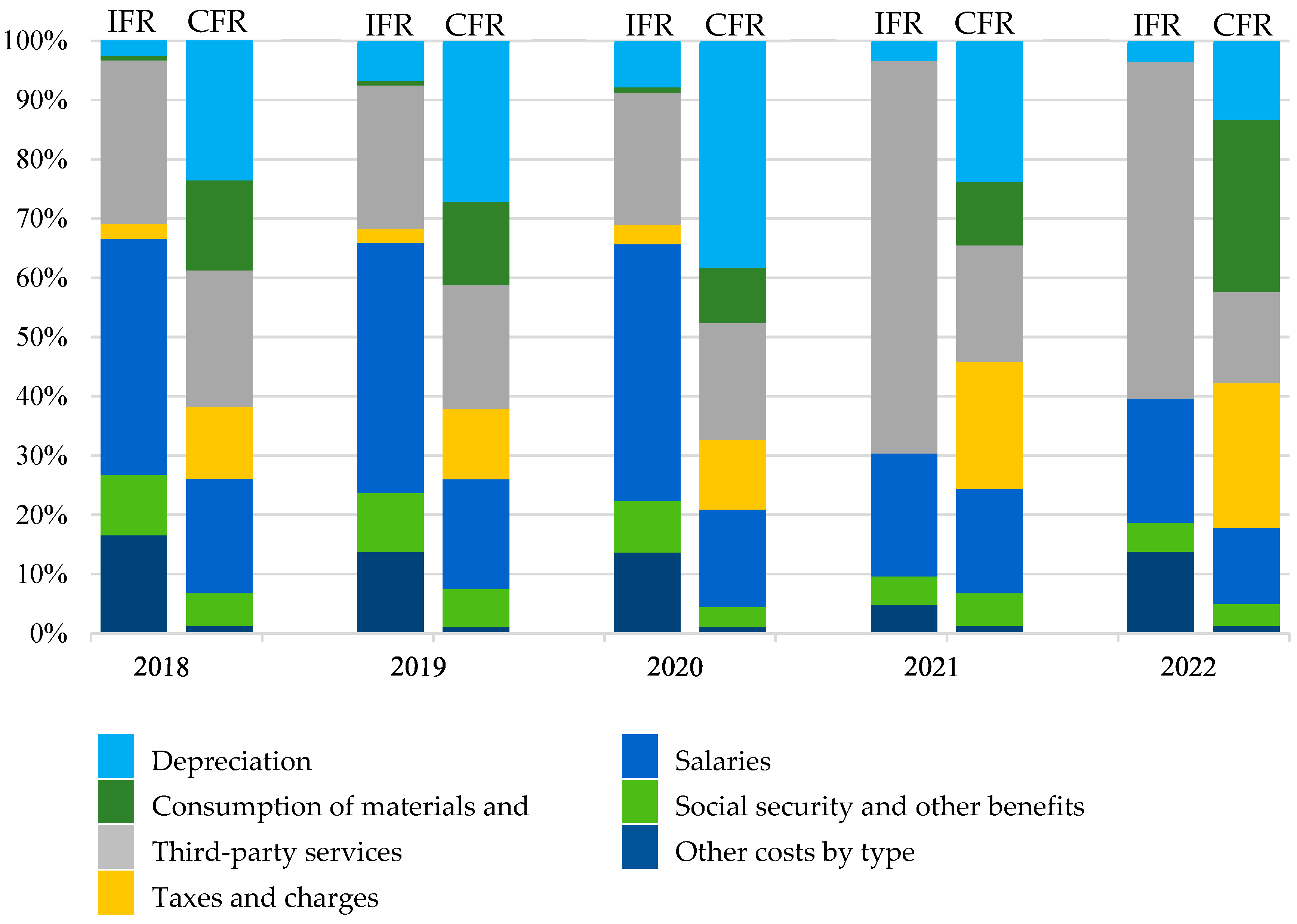

4.2. Groups’ Structure of Costs by Type as Derived from the Individual and Consolidated Financial Report

5. Discussion

6. Summary and Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Hass-Symotiuk, M. Rachunkowość Finansowa Przedsiębiorstwa od Jego Powstania do Likwidacji [Financial Accounting of an Enterprise from Its Establishment to Liquidation]; Wolters Kluwer: Warszawa, Poland, 2022. [Google Scholar]

- Pfaff, J. Rachunkowość Finansowa z Uwzględnieniem MSSF [Financial Accounting Including IFRS]; PWN: Warszawa, Poland, 2020. [Google Scholar]

- Sobańska, I.; Walińska, E. Przyczynek do postrzegania struktury współczesnego systemu rachunkowości [A Contribution to Perceiving the Structure of the Modern Accounting System]. Theor. J. Account. 2018, 96, 1–12. [Google Scholar]

- Aly, I.M.; Kimmel, P.D.; Weygandt, J.J. Managerial Accounting: Tools for Business Decision-Making, 6th ed.; Wiley: Toronto, ON, Canada, 2021. [Google Scholar]

- Ikromovich, I.F. Tax Accounting: Theory and Practice. Int. J. Multicult. Multireligious Underst. 2022, 9, 21–35. [Google Scholar]

- Wojtkowska-Łodej, G. (Ed.) Transformacja Rynków Energii: Gospodarka–Klimat–Technologia–Regulacje [Transformation of Energy Markets: Economy–Climate–Technology–Regulations]; Oficyna Wydawnicza SGH: Warszawa, Poland, 2022; pp. 19–20. [Google Scholar]

- Davtyan, V.; Khachikyan, S.; Valeeva, Y. An assessment of the sustainability and security of energy system: An analysis of the energy trilemma index on the example of Russia, Kazakhstan, and Armenia. Energy Policy J. 2023, 26, 45–60. [Google Scholar] [CrossRef]

- Świderska, G.K.; Więcław, W. Sprawozdanie Finansowe bez Tajemnic [Financial Statements Without Secrets]; Difin: Warszawa, Poland, 2008; pp. 1–16. [Google Scholar]

- Maruszczak, K. Rola Sprawozdań Finansowych w Procesie Podejmowania Decyzji w Przedsiębiorstwie [The Role of Financial Statements in Decision-Making Processes in the Enterprise]; Prawnicza i Ekonomiczna Biblioteka Cyfrowa, Wydział Prawa, Administracji i Ekonomii Uniwersytetu Wrocławskiego: Wrocław, Poland, 2015; p. 85. [Google Scholar]

- Żukowska, H. (Ed.) Sprawozdawczość Finansowa w Systemie Wymiany Informacji i Bezpieczeństwa Obrotu Gospodarczego [Financial Reporting in the System of Information Exchange and the Security of Economic Transactions]; Wydawnictwo KUL: Lublin, Poland, 2016; p. 29. [Google Scholar]

- Tkocz-Wolny, K. Sprawozdanie finansowe przedsiębiorstwa jako forma prezentacji informacji ekonomicznej [The Financial Statement of an Enterprise as a Form of Presenting Economic Information]; Econ. Stud. Sci. J. UE 2016, 287, 111–122. [Google Scholar]

- Kamiński, R. Sprawozdawczość Finansowa Przedsiębiorstwa w Regulacjach Polskich i Międzynarodowych [Financial Reporting of an Enterprise in Polish and International Regulations]; Wydawnictwo Naukowe UAM: Poznań, Poland, 2015; pp. 13–14. [Google Scholar]

- Garbusewicz, W.; Remlein, M. Sprawozdanie Finansowe Przedsiębiorstwa Jednostkowe i Skonsolidowane [Financial Statements of a Company: Standalone and Consolidated]; PWE: Warszawa, Poland, 2011; p. 33. [Google Scholar]

- Rozporządzenie Komisji (WE) Nr 1126/2008 z Dnia 3 Listopada 2008 r. Przyjmujące Określone Międzynarodowe Standardy Rachunkowości (MSR1) Zgodnie z Rozporządzeniem (WE) nr 1606/2002 Parlamentu Europejskiego i Rady Wraz z Rozporządzeniami Zmieniającymi [Commission Regulation (EC) No 1126/2008 of 3 November 2008 Adopting Certain International Accounting Standards (IAS) in Accordance with Regulation (EC) No 1606/2002 of the European Parliament and of the Council, Along with Amending Regulations]. Available online: https://eur-lex.europa.eu/legal-content/EN/ALL/?uri=CELEX%3A32008R1126 (accessed on 21 July 2024).

- Rówińska, M. Cechy jakościowe sprawozdania finansowego jednostek gospodarczych [Qualitative Characteristics of the Financial Statements of Business Entities]. Sci. J. Univ. Szczec. Financ. Financ. Mark. Insur. 2013, 376, 45–60. [Google Scholar]

- Tokarski, M. Sprawozdanie Finansowe–Niedoskonałe Źródło Informacji o Sytuacji Finansowej Przedsiębiorstwa [Financial Statement–An Imperfect Source of Information About the Financial Situation of an Enterprise]; Przedsiębiorczość Edukacja [Entrepreneurship Education]: Toruń, Poland, 2009; p. 179. [Google Scholar]

- Ustawa z Dnia 29 Września 1994 r. o Rachunkowości (tj. Dz. U. z 2023 r. poz. 120.) [Act of 29 September 1994 on Accounting (As Amended, Journal of Laws of 2023, item 120)]. Available online: https://isap.sejm.gov.pl/isap.nsf/download.xsp/WDU19941210591/U/D19940591Lj.pdf (accessed on 27 November 2024).

- Abad, C.; Laffarga, J.; Garcia-Borbolla, A.; Larran, M.; Pinero, J.M.; Garrod, N. An evaluation of the value relevance of consolidated versus unconsolidated accounting information: Evidence from quoted Spanish firms. J. Int. Financ. Manag. Account. 2000, 11, 156–177. [Google Scholar] [CrossRef]

- Larran, M.; Rees, W. Private Disclosure in the Spanish capital market: Evidence from financial analysts and investor relations directors. Span. J. Financ. Account. 2003, 115, 116–152. [Google Scholar] [CrossRef]

- Niskanen, J.; Kinnunen, J.; Kasanen, E. A note on the information content of parent company versus consolidated earnings in Finland. Eur. Account. Rev. 1998, 7, 31–40. [Google Scholar] [CrossRef]

- Muller, V.-O. Value relevance of consolidated versus parent company financial statements: Evidence from the largest three European capital markets. Account. Manag. Inf. Syst. 2011, 10, 326–350. [Google Scholar]

- Goncharov, I.; Werner, J.R.; Zimmermann, J. Legislative demands and economic realities: Company and group accounts compared. Int. J. Account. 2009, 44, 334–362. [Google Scholar] [CrossRef]

- Harris, T.S.; Lang, M.; Moller, H.P. The Value Relevance of German Accounting Measures: An Empirical Analysis. J. Account. Res. 1994, 32, 187–209. [Google Scholar] [CrossRef]

- Choi, F.D.S.; Mueller, G.G. International Accounting; Prentice-Hall: Hoboken, NJ, USA, 1992. [Google Scholar]

- Delvaille, P.; Ebbers, G.; Saccon, C. International Financial Reporting Convergence: Evidence from Three Continental European Countries. Account. Eur. 2005, 2, 137–164. [Google Scholar] [CrossRef]

- Lamb, M.; Nobes, C.; Roberts, A. International Variations in the Connection Between Tax and Financial Reporting. Account. Bus. Res. 1998, 28, 173–188. [Google Scholar] [CrossRef]

- Macías, M.; Muiño, F. Examining dual accounting systems in Europe. Int. J. Account. 2011, 46, 51–78. [Google Scholar] [CrossRef][Green Version]

- Nobes, C. Towards a general model of the reasons for international differences in financial reporting. Abacus 1998, 34, 162–187. [Google Scholar] [CrossRef]

- Oliveras, E.; Puig, X. The Changing Relationship between Tax and Financial Reporting in Spain. Account. Eur. 2005, 2, 195–207. [Google Scholar] [CrossRef]

- Busari, K.; Bagudo, M.M. Comparing the Value Relevance of Selected Accounting Information in Consolidated and Separate Financial Statements: The Case of Nigerian Listed Financial Service Firms. J. Econ. Sustain. 2021, 3, 16–32. [Google Scholar] [CrossRef]

- Sotti, F. The value relevance of consolidated and separate financial statements: Are non-controlling interests relevant? Afr. J. Bus. Manag. 2018, 12, 329–337. [Google Scholar]

- Shamki, D.; Abdulrahman, A. Net Income, Book Value and Cash Flows: The Value Relevance in Jordanian Economic Sectors. Int. J. Bus. Soc. Res. 2011, 1, 123–135. [Google Scholar]

- Carini, C.; Teodori, C. Making Financial Sustainability Measurement More Relevant: An Analysis of Consolidated Financial Statements. In Financial Sustainability of Public Sector Entities; Caruana, J., Brusca, I., Caperchione, E., Cohen, S., Manes Rossi, F., Eds.; Public Sector Financial Management; Palgrave Macmillan: Cham, Switzerland, 2019. [Google Scholar] [CrossRef]

- Kargin, S. The impact of IFRS on the value relevance of accounting information: Evidence from Turkish firms. Int. J. Econ. Financ. 2013, 5, 71–80. [Google Scholar] [CrossRef]

- Okafor, O.N.; Anderson, M.; Warsame, H. IFRS and value relevance; Evidence based on Canadian adoption. Int. J. Manag. Financ. 2016, 12, 1–46. [Google Scholar]

- Zulu, M.; de Klerk, M.; Oberholster, J.G.I. A comparison of the value relevance of interim and annual financial statements. S. Afr. J. Econ. Manag. Sci. 2017, 20, 1–11. [Google Scholar] [CrossRef]

- Chen, Z.; Lu, A. A Market-Based Funding Liquidity Measure. Rev. Asset Pricing Stud. 2019, 9, 356–393. [Google Scholar] [CrossRef]

- Comporek, M. Jakość wyników finansowych raportowanych w sprawozdaniach finansowych grup kapitałowych [Quality of Financial Results Reported in Financial Statements of Capital Groups]. Financ. Financ. Law 2023, 2, 1–15. [Google Scholar]

- Borowiec, L.; Kacprzak, M.; Król, A. Information Value of Individual and Consolidated Financial Statements for Indicative Liquidity Assessment of Polish Energy Groups in 2018–2021. Energies 2023, 16, 3670. [Google Scholar] [CrossRef]

- Sekerez, V.; Spasić, D. Some challenges in the consolidation of unrealized intra-group profits and losses. Facta Univ. Ser. Econ. Organ. 2023, 20, 221–233. [Google Scholar] [CrossRef]

- Amalia, F.R.; Pradipta, N.A.; Uzliawati, L. Analysis of PASK 65 implementation and its challenges in the consolidated financial statements of pt MAYORA INDAHTBK and subsidiaries. J. Econ. Bus. Account. 2024, 7, 1–12. [Google Scholar]

- Mickowic, A.; Wouters, M. Energy costs information in manufacturing companies: A systematic literature review. J. Clean. Prod. 2020, 254, 119927. [Google Scholar] [CrossRef]

- Leventakos, K.; Dagoumas, A.S. Financial Analysis of European Energy Companies. Macro Manag. Public Policies 2019, 1, 29–40. [Google Scholar] [CrossRef]

- Capece, G.; Di Pillo, F.; Levialdi, N. The Performance Assessment of Energy Companies. APCBEE Procedia 2013, 5, 265–270. [Google Scholar] [CrossRef][Green Version]

- Zamasz, K. Energy company in a competitive energy market. Energy Policy J. 2018, 21, 46. [Google Scholar] [CrossRef]

- Bunea, O.I.; Corbos, R.A.; Popescu, R.I. Influence of some financial indicators on return on equity ratio in the Romanian energy sector—A competitive approach using a DuPont-based analysis. Energy 2019, 189, 116251. [Google Scholar] [CrossRef]

- Goldmann, K.; Zawadzki, A. Financial Sector Analysis of Companies in the Energy Industry Listed on the Warsaw Stock Exchange. Energies 2022, 15, 8770. [Google Scholar] [CrossRef]

- Franc-Dąbrowska, J.; Mądra-Sawicka, M.; Milewska, A. Energy Sector Risk and Cost of Capital Assessment—Companies and Investors Perspective. Energies 2021, 14, 1613. [Google Scholar] [CrossRef]

- Bednarski, L. Analiza Finansowa w Przedsiębiorstwie [Financial Analysis in an Enterprise]; PWE: Warszawa, Poland, 2007; pp. 18–22. [Google Scholar]

- Szczęsny, W. Finanse Zarys Wykładu [Finance: Lecture Outline]; Difin: Warszawa, Poland, 2010; p. 218. [Google Scholar]

- Pomykalska, B.; Pomykalski, P. Analiza Finansowa Przedsiębiorstwa [Financial Analysis of an Enterprise]; PWN: Warszawa, Poland, 2007; p. 32. [Google Scholar]

- Pabiniak, D. Istota bezpieczeństwa energetycznego i jego zagrożenia [The Essence of Energy Security and Its Threats]. Stud. Adm. Secur. 2020, 9, 1–15. [Google Scholar]

- Trocka, M. Przychody i koszty związane z ich osiągnięciem w przedsiębiorstwie [Revenues and Costs Related to Their Achievement in an Enterprise]. In Rachunkowość Finansowa Przedsiębiorstwa od Jego Powstania do Likwidacji [Financial Accounting of an Enterprise from Its Establishment to Liquidation]; Hass-Symotiuk, M., Ed.; Wolters Kluwer: Warszawa, Poland, 2018; pp. 353–363. [Google Scholar]

- Baran, W. (Ed.) Rachunek zysków i strat [Profit and Loss Statement]. In Podstawy Rachunkowości. Sprawozdanie Finansowe. Zasady. Etyka [Basics of Accounting. Financial Statements. Principles. Ethics]; Difin: Warszawa, Poland, 2014; pp. 170–171. [Google Scholar]

- Dyktus, J. Sprawozdawczość i Analiza Finansowa [Financial Reporting and Analysis]; Difin: Warszawa, Poland, 2017. [Google Scholar]

- Świderska, G. Zrozumieć sprawozdanie finansowe [Understanding Financial Statements]; Wolters Kluwer: Warszawa, Poland, 2022. [Google Scholar]

- Mierzejewska, W. Koopetycja w Grupach Kapitałowych: Cechy, Determinanty, Efekty [Coopetition in Capital Groups: Features, Determinants, Effects]; Oficyna Wydawnicza SGH: Warszawa, Poland, 2020. [Google Scholar]

- Energii S, A.R. Statystyka Elektroenergetyki Polskiej 2022 [Polish Power Industry Statistics 2022]; Agencja Rynku Energii S.A.: Warszawa, Poland, 2023; Available online: https://www.are.waw.pl/badania-statystyczne (accessed on 7 April 2024).

- Energetyki, U.R. Biuletyn Urzędu Regulacji Energetyki [Bulletin of the Energy Regulatory Office]. 2023, 01/2023(116), 29 September 2023. Available online: https://www.ure.gov.pl/pl/urzad/informacje-ogolne/edukacja-i-komunikacja/publikacje/biuletyn-urzedu-regula/11383,Biuletyn-Urzedu-Regulacji-Energetyki-2023.html (accessed on 7 April 2024).

- Energetyki, U.R. Biuletyn Urzędu Regulacji Energetyki [Bulletin of the Energy Regulatory Office]. 2013, 02/2013(84), 3 June 2013. Available online: https://www.ure.gov.pl/pl/urzad/informacje-ogolne/edukacja-i-komunikacja/publikacje/biuletyn-urzedu-regula/5185,Biuletyn-Urzedu-Regulacji-Energetyki-2013.html (accessed on 7 April 2024).

- Ministerstwo Aktywów Państwowych. Transformacja Sektora Elektroenergetycznego w Polsce. Wydzielenie Wytwórczych Aktywów Węglowych ze Spółek z Udziałem Skarbu Państwa [Transformation of the Power Sector in Poland: Separation of Coal Assets from State-Owned Companies]; Ministerstwo Aktywów Państwowych: Warszawa, Poland, 2021. Available online: https://www.gov.pl/web/aktywa-panstwowe/nabe-staje-sie-faktem (accessed on 20 April 2024).

- PKN ORLEN Sfinalizował Przejęcie Grupy ENERGA [PKN ORLEN Finalizes Acquisition of ENERGA Group]. Available online: https://www.orlen.pl/pl/o-firmie/media/komunikaty-prasowe/2020/kwiecien/pkn-orlen-sfinalizowal-przejecie-grupy-energa (accessed on 22 May 2024).

- Sprawozdania Finansowe Grupy Kapitałowej PGE [Financial Statements of the PGE Group]. Available online: https://www.gkpge.pl/dla-inwestorow/akcje/dane-finansowe (accessed on 4 April 2024).

- Sprawozdania Finansowe Grupy Kapitałowej ENEA [Financial Statements of the ENEA Group]. Available online: https://ir.enea.pl/lista-raportow/kategoria/3612/raporty-okresowe (accessed on 4 April 2024).

- Sprawozdania Finansowe Grupy Kapitałowej ENERGA [Financial Statements of the ENERGA Group]. Available online: https://ir.energa.pl/pl/releases/4437 (accessed on 4 April 2024).

- Sprawozdania Finansowe Grupy Kapitałowej TAURON [Financial Statements of the TAURON Group]. Available online: https://www.tauron.pl/tauron/relacje-inwestorskie/raporty-okresowe (accessed on 4 April 2024).

| Stage | Activities |

|---|---|

| The research objective and research hypothesis were formulated in the introduction of the article after defining the research gap based on a critical review of the literature. The research questions concern the assessment of the information values of individual and consolidated financial statements in terms of information on incurred costs. The research problem was set in the energy sector, due to its role in the economy and society. |

| The multiple case study method was chosen for the research. It allows for a detailed analysis of individual entities in terms of reported cost information. The multiple case study allows for a wide range of analysis and comparability of the studied objects. On the other hand, this method has weaknesses concerning the possibility of making generalisations due to the limited number of observations. The method of document analysis was used, in particular, individual and consolidated financial reports of the studied capital groups. |

| The selection of entities for the study was purposeful. The study covered all four Polish energy capital groups, which together hold almost 100% of the electricity production and distribution market. The study assumed that taking into account the years 2018–2022 would be sufficient to capture the basic trends influencing changes in the size and structure of costs. The period studied includes both the COVID-19 pandemic and the outbreak of the war in Ukraine, which significantly affected the operating costs of energy companies, not only in Poland. The characteristics of the energy sector in Poland, which constitutes the background for the study, are presented in a broader time horizon. |

| The analysis of information on the costs of the entities and capital groups studied was carried out in an Excel spreadsheet. The preliminary and ratio financial analysis and its tools were used. The narrative method was used in the discussion of the results to formulate conclusions and recommendations. The conclusions indicated the limitations of the study and other possible directions of research. |

| Costs | 2018 | 2019 | 2020 | 2021 | 2022 | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| PLN ** Million | % | PLN Million | % | PLN Million | % | PLN Million | % | PLN Million | % | |

| PGE SA—Individual Financial Report | ||||||||||

| core operating activities | 10,873.0 | 92.3 | 14,347.0 | 82.1 | 26,824.0 | 98.0 | 35,317.0 | 99.8 | 34,612.0 | 99.4 |

| Result from other operating activities * | 28.0 | 0.2 | 20.0 | 0.1 | 5.0 | 0.0 | 0.0 | 0.0 | 171.0 | 0.5 |

| Financial | 885.0 | 7.5 | 3 099.0 | 17.7 | 532.0 | 1.9 | 80.0 | 0.2 | 49.0 | 0.1 |

| Total | 11,786.0 | 100 | 17,466.0 | 100 | 27,361.0 | 100 | 35,397.0 | 100 | 34,832.0 | 100 |

| PGE Group—Consolidated Financial Report | ||||||||||

| core operating activities | 23,477.0 | 98.2 | 42,594.0 | 98.9 | 44,292.0 | 98.6 | 51,664.0 | 98.9 | 71,088.0 | 99.5 |

| Result from other operating activities * | 0.0 | 0.0 | 0.0 | 0.0 | 66.0 | 0.1 | 0.0 | 0.0 | 0.0 | 0.0 |

| Financial | 436.0 | 1.8 | 475.0 | 1.1 | 557.0 | 1.2 | 579.0 | 1.1 | 383.0 | 0.5 |

| Total | 23,913.0 | 100 | 43,069.0 | 100 | 44,915.0 | 100 | 52,243.0 | 100 | 71,471.0 | 100 |

| Costs | 2018 | 2019 | 2020 | 2021 | 2022 | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| PLN Million | % | PLN Million | % | PLN Million | % | PLN Million | % | PLN Million | % | |

| Enea SA—Individual Financial Report | ||||||||||

| Core operating activities | 4732.2 | 93.4 | 5772.4 | 94.3 | 6346.4 | 94.9 | 7457.5 | 96.8 | 11,993.1 | 96.9 |

| Result from other operating activities * | 70.2 | 1.3 | 66.3 | 1.0 | 64.9 | 0.9 | 61.2 | 0.8 | 103.2 | 0.8 |

| Financial | 265.3 | 5.2 | 285.8 | 4.7 | 275.9 | 4.2 | 179.5 | 2.4 | 286.2 | 2.3 |

| Total | 5067.7 | 100 | 6124.5 | 100 | 6687.2 | 100 | 7698.2 | 100 | 12,382.5 | 100 |

| ENEA Group—Consolidated Financial Report | ||||||||||

| Core operating activities | 11,754.4 | 96.3 | 14,663.7 | 96.2 | 16,548.5 | 97.0 | 18,980.9 | 98.2 | 29,008.8 | 98.3 |

| Result from other operating activities * | 168.7 | 1.2 | 148.4 | 0.9 | 173.8 | 1.0 | 127.3 | 0.7 | 223.4 | 0.8 |

| Financial | 302.9 | 2.5 | 441.9 | 2.9 | 346.3 | 2.0 | 214.8 | 1.1 | 276.6 | 0.9 |

| Total | 12,226.0 | 100 | 15,254.0 | 100 | 17,068.6 | 100 | 19,323.0 | 100 | 29,508.8 | 100 |

| Costs | 2018 | 2019 | 2020 | 2021 | 2022 | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| PLN Million | % | PLN Million | % | PLN Million | % | PLN Million | % | PLN Million | % | |

| Energa SA—Individual Financial Report | ||||||||||

| core operating activities | 155.0 | 29.8 | 159.0 | 29.3 | 178.0 | 20.1 | 154.0 | 37.2 | 163.0 | 34.8 |

| Result from other operating activities * | 14.0 | 2.7 | 22.0 | 4.1 | 30.0 | 3.4 | 9.0 | 2.2 | 10.0 | 2.2 |

| Financial | 351.0 | 67.5 | 361.0 | 66.6 | 674.0 | 76.5 | 250.0 | 60.6 | 295.0 | 63.0 |

| Total | 520.0 | 100 | 542.0 | 100 | 882.0 | 100 | 413.0 | 100 | 468.0 | 100 |

| ENERGA Group—Consolidated Financial Report | ||||||||||

| core operating activities | 8993.0 | 93.2 | 11,674.0 | 91.8 | 12,028.0 | 93.2 | 12,249.0 | 95.1 | 19,178.0 | 93.8 |

| Result from other operating activities * | 272.0 | 2.8 | 284.0 | 2.2 | 183.0 | 1.4 | 379.0 | 2.9 | 844.0 | 4.1 |

| Financial | 382.0 | 4.0 | 762.0 | 6.0 | 696.0 | 5.4 | 268.0 | 2.0 | 429.0 | 2.1 |

| Total | 9647.0 | 100 | 12,720.0 | 100 | 12,907.0 | 100 | 12,896.0 | 100 | 20,451.0 | 100 |

| Costs | 2018 | 2019 | 2020 | 2021 | 2022 | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| PLN Million | % | PLN Million | % | PLN Million | % | PLN Million | % | PLN Million | % | |

| Tauron SA—Individual Financial Report | ||||||||||

| core operating activities | 8592.1 | 74.6 | 10,576.8 | 84.3 | 12,239.9 | 74.4 | 18,168.0 | 89.8 | 29,126.0 | 91.8 |

| Result from other operating activities * | 3.9 | 0.0 | 2.7 | 0.0 | 10.5 | 0.1 | 3.0 | 0.0 | 8.0 | 0.0 |

| Financial | 2923.2 | 25.4 | 1975.3 | 15.7 | 4189.2 | 25.5 | 2059.0 | 10.2 | 2608.0 | 8.2 |

| Total | 11,519.2 | 100 | 12,554.8 | 100 | 16,439.6 | 100 | 20,230.0 | 100 | 31,742.0 | 100 |

| Tauron Group—Consolidated Financial Report | ||||||||||

| core operating activities | 17,546.4 | 98.2 | 20,422.4 | 98.1 | 21,802.6 | 96.3 | 24,820.0 | 98.3 | 35,940.0 | 97.1 |

| Result from other operating activities * | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| Financial | 321.5 | 1.8 | 392.4 | 1.9 | 831.6 | 3.7 | 420.0 | 1.7 | 1070.0 | 2.9 |

| Total | 17,867.9 | 100 | 20,814.8 | 100 | 22,634.2 | 100 | 25,240.0 | 100 | 37,010.0 | 100 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Borowiec, L.; Wyrzykowska, B.; Kacprzak, M.; Król, A.; Wolińska, E. Operating Costs in the Polish Energy Sector: Challenges for Capital Groups. Energies 2024, 17, 6033. https://doi.org/10.3390/en17236033

Borowiec L, Wyrzykowska B, Kacprzak M, Król A, Wolińska E. Operating Costs in the Polish Energy Sector: Challenges for Capital Groups. Energies. 2024; 17(23):6033. https://doi.org/10.3390/en17236033

Chicago/Turabian StyleBorowiec, Leszek, Barbara Wyrzykowska, Marzena Kacprzak, Agnieszka Król, and Emilia Wolińska. 2024. "Operating Costs in the Polish Energy Sector: Challenges for Capital Groups" Energies 17, no. 23: 6033. https://doi.org/10.3390/en17236033

APA StyleBorowiec, L., Wyrzykowska, B., Kacprzak, M., Król, A., & Wolińska, E. (2024). Operating Costs in the Polish Energy Sector: Challenges for Capital Groups. Energies, 17(23), 6033. https://doi.org/10.3390/en17236033