The Green Mirage: The EU’s Complex Relationship with Palm Oil Biodiesel in the Context of Environmental Narratives and Global Trade Dynamics

Abstract

1. Introduction

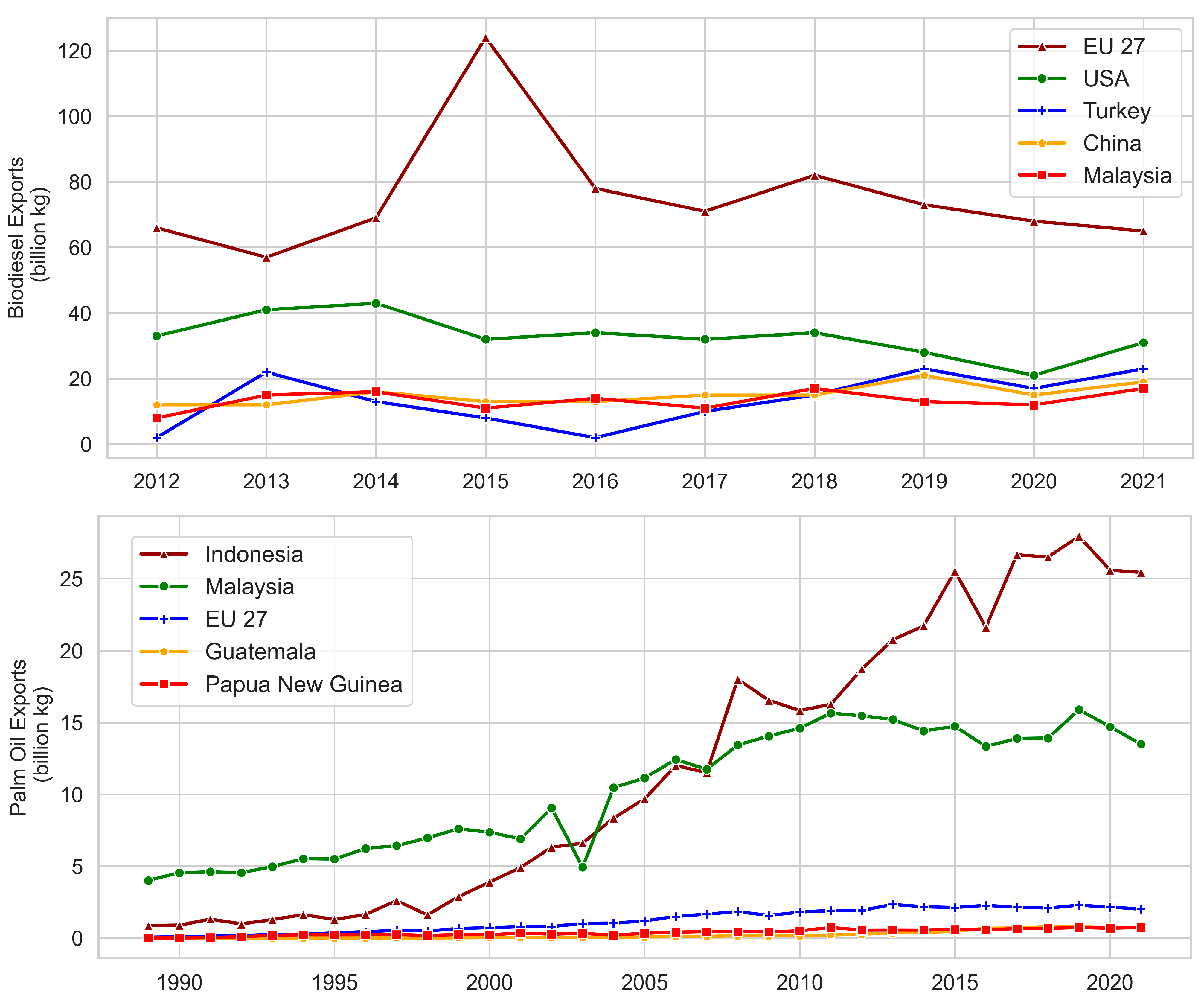

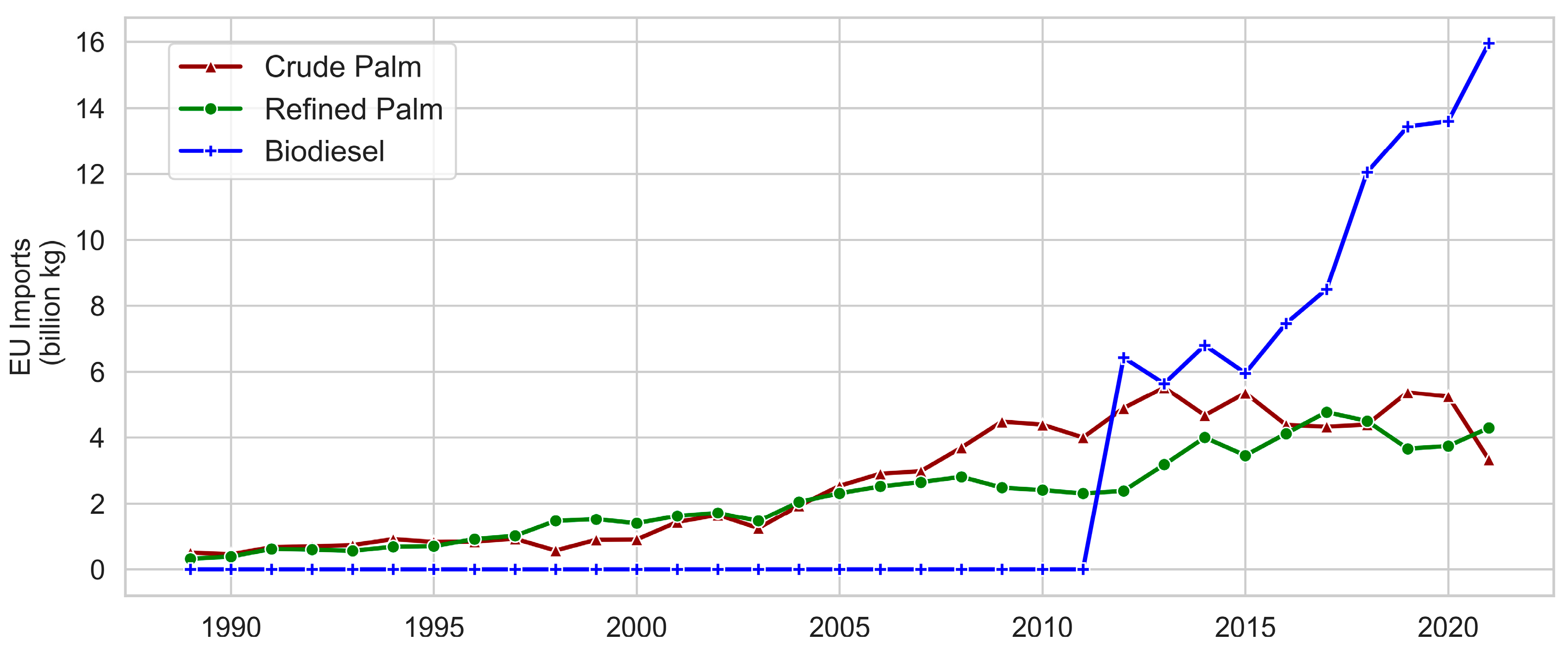

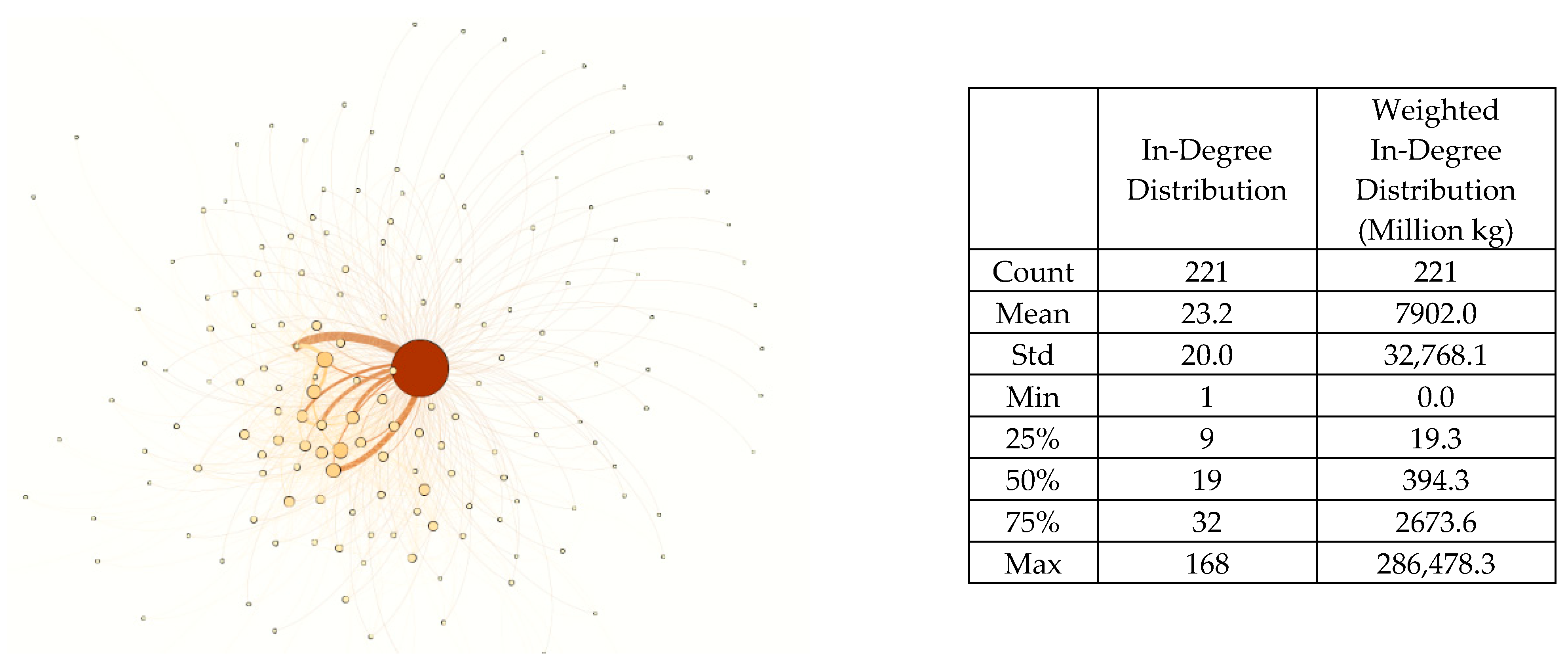

2. Palm Oil Biodiesel Market Dynamics and the EU

3. Data and Methods

4. Results

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- IEA. Transport. 2023. Available online: https://www.iea.org/topics/transport (accessed on 2 February 2023).

- EUR-Lex. Directive 2003/30/EC of the European Parliament and of the Council of 8 May 2003 on the Promotion of the Use of Biofuels or Other Renewable Fuels for Transport. 2003. Available online: https://eur-lex.europa.eu/legal-content/EN/ALL/?uri=celex%3A32003L0030 (accessed on 2 February 2023).

- Altiparmak, S.O. Arctic Drilling in the United States energy revolution context: An accumulated story in environment vs energy contradiction. Energy Policy 2021, 156, 112459. [Google Scholar] [CrossRef]

- Indonesia LTS-LCCR INDONESIA Long-Term Strategy for Low Carbon and Climate Resilience 2050. 2021. Available online: https://unfccc.int/sites/default/files/resource/Indonesia_LTS-LCCR_2021.pdf (accessed on 2 February 2023).

- Valin, H.; Peters, D.; van den Berg, M.; Frank, S.; Havlik, P.; Forsell, N.; Hamelinck, C.; Pirker, J.; Mosnier, A.; Balkovic, J.; et al. The Land Use Change Impact of Biofuels Consumed in the EU Quantification of Area and Greenhouse Gas Impacts; Ecofys: Utrecht, The Netherland, 2015. [Google Scholar]

- Transport & Environment. Why Is Palm Oil Bad? 2023. Available online: https://www.transportenvironment.org/challenges/energy/biofuels/why-is-palm-oil-biodiesel-%20bad/ (accessed on 2 February 2023).

- WTO. DS480: European Union—Anti-Dumping Measures on Biodiesel from Indonesia. 2018. Available online: https://www.wto.org/english/tratop_e/dispu_e/cases_e/ds480_e.htm (accessed on 19 October 2023).

- EUR-Lex. Directive (EU) 2018/2001 of the European Parliament and of the Council of 11 December 2018 on the Promotion of the use of Energy from Renewable Sources (Recast) (Text with EEA Relevance). 2018. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=uriserv:OJ.L_.2018.328.01.0082.01.ENG&toc=OJ:L:2018:328:TOC (accessed on 2 February 2023).

- EUR-Lex. Proposal for a Directive of the European Parliament and of the Council amending Directive (EU) 2018/2001 of the European Parliament and of the Council, Regulation (EU) 2018/1999 of the European Parliament and of the Council and Directive 98/70/EC of the E. 2021. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A52021PC0557 (accessed on 2 February 2023).

- WTO. DS593: European Union—Certain Measures Concerning Palm Oil and Oil Palm Crop-Based Biofuels. 2020. Available online: https://www.wto.org/english/tratop_e/dispu_e/cases_e/ds593_e.htm (accessed on 2 October 2023).

- Mekhilef, S.; Siga, S.; Saidur, R. A review on palm oil biodiesel as a source of renewable fuel. Renew. Sustain. Energy Rev. 2011, 15, 1937–1949. [Google Scholar] [CrossRef]

- Dey, S.; Reang, N.M.; Das, P.K.; Deb, M.A. comprehensive study on prospects of economy, environment, and efficiency of palm oil biodiesel as a renewable fuel. J. Clean. Prod. 2021, 286, 124981. [Google Scholar] [CrossRef]

- Gourich, W.; Chan, E.; Ng, W.Z.; Obon, A.A.; Maran, K.; Ong, Y.H.; Lee, C.L.; Tan, J.; Song, C.P. Life cycle benefits of enzymatic biodiesel co-produced in palm oil mills from sludge palm oil as renewable fuel for rural electrification. Appl. Energy 2022, 325, 119928. [Google Scholar] [CrossRef]

- Pasqualino, J.C.; Montane, D.; Salvado, J. Synergic effects of biodiesel in the biodegradability of fossil-derived fuels. Biomass Bioenergy 2006, 30, 874–879. [Google Scholar] [CrossRef]

- Nutongkaew, P.; Waewsak, J.; Riansut, W.; Kongruang, C.; Gagnon, Y. The potential of palm oil production as a pathway to energy security in T Thailand. Sustain. Energy Technol. Assess. 2019, 35, 189–205. [Google Scholar] [CrossRef]

- Acosta, P.; Curt, M.D. Understanding the expansion of oil palm cultivation: A case-study in Papua. J. Clean. Prod. 2019, 219, 199–216. [Google Scholar] [CrossRef]

- Eremeeva, A.M.; Ilyushin, Y.V. Automation of the control system for drying grain crops of the technological process for obtaining biodiesel fuels. Sci. Rep. 2023, 13, 14956. [Google Scholar] [CrossRef]

- Mattsson, B.; Cederberg, C.; Blix, L. Agricultural land use in life cycle assessment (LCA): Case studies of three vegetable oil crops. J. Clean. Prod. 2000, 8, 283–292. [Google Scholar] [CrossRef]

- USDA. Oilseeds: World Markets and Trade. 2023. Available online: https://apps.fas.usda.gov/psdonline/circulars/oilseeds.pdf (accessed on 2 February 2023).

- Oosterveer, P. Promoting sustainable palm oil: Viewed from a global networks and flows perspective. J. Clean. Prod. 2015, 107, 146–153. [Google Scholar] [CrossRef]

- Oosterveer, P.; Adjei, B.E.; Vellema, S.; Slingerland, M. Global sustainability standards and food security: Exploring unintended effects of voluntary certification in palm oil. Glob. Food Secur. 2014, 3, 220–226. [Google Scholar] [CrossRef]

- Azhar, B.; Saadun, N.; Prideaux, M.; Lindenmayer, D.B. The global palm oil sector must change to save biodiversity and improve food security in the tropics. J. Environ. Manag. 2017, 203, 457–466. [Google Scholar] [CrossRef] [PubMed]

- Lam, M.K.; Lee, K.T. Production of Biodiesel Using Palm Oil. In Biofuels: Alternative Feedstocks and Conversion Processes; Pandey, A., Larroche, C., Ricke, S.C., Eds.; Elsevier: Amsterdam, The Netherlands, 2011; pp. 353–374. [Google Scholar]

- Choong, C.G.; McKay, A. Sustainability in the Malaysian palm oil industry. J. Clean. Prod. 2014, 85, 258–264. [Google Scholar] [CrossRef]

- Kadarusman, Y.B.; Herabadi, A.G. Improving Sustainable Development within Indonesian Palm Oil: The Importance of the Reward System. Sustain. Dev. 2018, 26, 422–434. [Google Scholar] [CrossRef]

- Siangjaeo, S.; Gheewala, S.H.; Unnanon, K.; Chidthaisong, A. Implications of land use change on the life cycle greenhouse gas emissions from palm biodiesel production in Thailand. Energy Sustain. Dev. 2011, 15, 1–7. [Google Scholar] [CrossRef]

- Mukherjee, I.; Sovacool, B.K. Palm oil-based biofuels and sustainability in southeast Asia: A review of Indonesia, Malaysia, and Thailand. Renew. Sustain. Energy Rev. 2014, 37, 1–12. [Google Scholar] [CrossRef]

- Malins, C. Driving Deforestation the Impact of Expanding Palm Oil Demand through Biofuel Policy; Cerulogy and Rainforest Foundation: Oslo, Norway, 2018. [Google Scholar]

- European Parliament. European Parliament Resolution of 4 April 2017 on Palm Oil and Deforestation of Rainforests (2016/2222(INI)). 2017. Available online: https://www.europarl.europa.eu/doceo/document/TA-8-2017-0098_EN.html (accessed on 2 October 2023).

- Resource Trade. Palm. 2023. Available online: https://resourcetrade.earth/?year=2020&category=85&units=value&autozoom=1 (accessed on 3 February 2023).

- Papilo, P.; Marimin, M.; Hambali, E.; Machfud, M.; Yani, M.; Asrol, M.; Evanila, E.; Prasetya, H.; Mahmud, J. Palm oil-based bioenergy sustainability and policy in Indonesia and Malaysia: A systematic review and future agendas. Heliyon 2022, 8, e10919. [Google Scholar] [CrossRef]

- Hussin, M.H.; Iberahim, M.M. Indonesia’s Interest in Winning Biodiesel Disputes in the World Trade Organization. UNISCI 2022, 58, 75–105. [Google Scholar] [CrossRef]

- IEA. Renewable Energy Market Update Outlook for 2022 and 2023. 2022. Available online: https://iea.blob.core.windows.net/assets/d6a7300d-7919-4136-b73a-3541c33f8bd7/RenewableEnergyMarketUpdate2022.pdf (accessed on 2 February 2023).

- IEA. Renewables 2022 Analysis and Forecast to 2027. 2023. Available online: https://iea.blob.core.windows.net/assets/ada7af90-e280-46c4-a577-df2e4fb44254/Renewables2022.pdf (accessed on 2 February 2023).

- EUR-Lex. Directive 2009/28/EC of the European Parliament and of the Council of 23 April 2009 on the Promotion of the Use of Energy from Renewable Sources and Amending and Subsequently Repealing Directives 2001/77/EC and 2003/30/EC (Text with EEA Relevance). 2009. Available online: https://eur-lex.europa.eu/legal-content/EN/ALL/?uri=CELEX:32009L0028 (accessed on 2 February 2023).

- EUR-Lex. Directive (EU) 2015/1513 of the European Parliament and of the Council of 9 September 2015 Amending Directive 98/70/EC Relating to the Quality of Petrol and Diesel Fuels and Amending Directive 2009/28/EC on the Promotion of the Use of Energy from Renewabl. 2015. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=celex%3A32015L1513 (accessed on 3 February 2023).

- EEEAS. European Union Delegation of the European Union to Indonesia. 2019. Available online: https://www.eeas.europa.eu/sites/default/files/20190321_press_release_palm_oil_en.pdf (accessed on 3 February 2023).

- EUR-Lex. Directive (EU) 2023/2413 of the European Parliament and of the Council of 18 October 2023 Amending Directive (EU) 2018/2001, Regulation (EU) 2018/1999 and Directive 98/70/EC as Regards the Promotion of Energy from Renewable Sources, and Repealing Council. 2023. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=OJ:L_202302413 (accessed on 3 January 2024).

- Kilian, B.; Elgström, O. Still a green leader? The European Union’s role in international climate negotiations. Coop. Confl. 2010, 45, 255–273. [Google Scholar] [CrossRef]

- Lenschow, A.; Sprungk, C. The Myth of a Green Europe. J. Common Mark. Stud. 2010, 48, 133–154. [Google Scholar] [CrossRef]

- Eckert, E.; Kovalevska, O. Sustainability in the European Union: Analyzing the Discourse of the European Green Deal. Risk Financ. Manag. 2021, 14, 80. [Google Scholar] [CrossRef]

- Schunz, S. The ‘European Green Deal’—A paradigm shift? Transformations in the European Union’s sustainability meta-discourse. Political Res. Exch. 2022, 4, 2085121. [Google Scholar] [CrossRef]

- Pye, O. A Plantation Precariat: Fragmentation and Organizing Potential in the Palm Oil Global Production Network. Dev. Chang. 2017, 48, 942–964. [Google Scholar] [CrossRef]

- Brønd, F. Territory and trade networks in the small-scale oil-palm industry in rural Ghana. Appl. Geogr. 2018, 100, 90–100. [Google Scholar] [CrossRef]

- Coca, N. As Palm Oil for Biofuel Rises in Southeast Asia, Tropical Ecosystems Shrink. 2020. Available online: https://chinadialogue.net/en/energy/11957-as-palm-oil-for-biofuel-rises-in-southeast-asia-tropical-ecosystems-shrink/ (accessed on 2 February 2023).

- United Nations Statiscs Division. UN Comtrade Wiki. 2023. Available online: https://unstats.un.org/wiki/display/comtrade (accessed on 2 October 2023).

- Braun, M. Europeanization of Environmental Policy in the New Europe: Beyond Conditionality; Routledge: London, UK, 2013. [Google Scholar]

- Kinseng, R.A.; Nasdian, F.T.; Mardiyaningsih, D.I.; Dharmawan, A.H.; Hospes, O.; Pramudya, E.P.; Putri, E.I.K.; Amalia, R.; Yulian, B.E.; Rahmadian, F. Unraveling disputes between Indonesia and the European Union on Indonesian palm oil: From environmental issues to national dignity. Sustain. Sci. Pract. Policy 2022, 19, 2152626. [Google Scholar] [CrossRef]

- Blue Book. Blue Book 2018 EU-Indonesia Development Cooperation; EU-Indonesia Development Cooperation: Jakarta, Indonesia, 2018. [Google Scholar]

- Green Recovery. Green Recovery EU-Indonesia Partnership 2021; Delegation of the European Union to Indonesia and Brunei Darussalam: Jakarta, Indonesia, 2021. [Google Scholar]

| Commodity | Exporter | Top Importers | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 |

|---|---|---|---|---|---|---|---|---|---|

| Palm Oil (Billion kg) | IDN | China | 3.5 | 2.3 | 3.2 | 3.6 | 5.2 | 3.8 | 4.5 |

| India | 5.7 | 5.3 | 7.2 | 6.2 | 4.7 | 4.6 | 3.2 | ||

| EU 27 | 3.6 | 3.2 | 3.8 | 3.5 | 3.4 | 3.4 | 2.8 | ||

| MAL | India | 3.7 | 2.9 | 2.0 | 2.1 | 4.1 | 2.4 | 3.4 | |

| China | 2.1 | 1.3 | 1.5 | 1.4 | 2.0 | 2.2 | 1.4 | ||

| EU 27 | 2.1 | 1.8 | 1.5 | 1.7 | 1.9 | 1.8 | 1.4 | ||

| Biodiesel (Million kg) | IDN | EU 27 | 23.4 | 42.9 | 157.6 | 803.2 | 645.8 | 94.5 | 95.2 |

| China | 11.7 | 1.0 | 0.0 | 655.3 | 621.9 | 9.0 | 82.4 | ||

| Peru | 25.6 | 16.7 | 139.6 | 45.4 | 0.0 | 0.0 | 30.8 | ||

| MAL | EU 27 | 360.1 | 249.7 | 358.0 | 422.1 | 722.5 | 436.7 | 418.0 | |

| China | 1.9 | 2.7 | 1.8 | 112.3 | 159.5 | 26.2 | 61.8 | ||

| UK | 0.0 | 5.0 | 0.0 | 5.0 | 0.0 | 0.0 | 27.3 | ||

| ARG * | EU 27 | 12.5 | 0.0 | 307.7 | 1839.5 | 1106.1 | 895.0 | 1438.5 | |

| USA | 626.4 | 1479.2 | 967.7 | 0.0 | 0.0 | 0.0 | 0.0 | ||

| Peru | 203.3 | 153.0 | 46.7 | 23.8 | 0.0 | 0.0 | 0.0 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Waters, K.; Altiparmak, S.O.; Shutters, S.T.; Thies, C. The Green Mirage: The EU’s Complex Relationship with Palm Oil Biodiesel in the Context of Environmental Narratives and Global Trade Dynamics. Energies 2024, 17, 343. https://doi.org/10.3390/en17020343

Waters K, Altiparmak SO, Shutters ST, Thies C. The Green Mirage: The EU’s Complex Relationship with Palm Oil Biodiesel in the Context of Environmental Narratives and Global Trade Dynamics. Energies. 2024; 17(2):343. https://doi.org/10.3390/en17020343

Chicago/Turabian StyleWaters, Keith, Suleyman O. Altiparmak, Shade T. Shutters, and Cameron Thies. 2024. "The Green Mirage: The EU’s Complex Relationship with Palm Oil Biodiesel in the Context of Environmental Narratives and Global Trade Dynamics" Energies 17, no. 2: 343. https://doi.org/10.3390/en17020343

APA StyleWaters, K., Altiparmak, S. O., Shutters, S. T., & Thies, C. (2024). The Green Mirage: The EU’s Complex Relationship with Palm Oil Biodiesel in the Context of Environmental Narratives and Global Trade Dynamics. Energies, 17(2), 343. https://doi.org/10.3390/en17020343