Abstract

The energy transition toward Net Zero Emission by 2060 hinges on the renewable energy power plants in Indonesia. Good practices in several countries suggest a peer-to-peer (P2P) energy trading system using blockchain technology, supported by renewable energy (solar panels), an innovation to provide equal access to sustainable electricity while reducing the impact of climate change. The P2P energy trading concept has a higher social potential than the conventional electricity buying and selling approach, such as that of PLN (the state-owned electricity company in Indonesia), which applies the network management concept but does not have a sharing element. This model implements a solar-powered mini-grid system and produces a smart contract that facilitates electricity network users to buy, sell, and trade electricity in rural areas via smartphones. This study aims to measure the stakeholders’ perceptions of the peer-to-peer (P2P) energy trading model using blockchain technology in the Gumelar District, Banyumas Regency, Central Java Province, Indonesia. The stakeholders in question are representatives of Households (producers and consumers), Government, State Electricity Company (PLN), Non-Governmental Organizations, Private Sector and Academician. Measurement of perception in this study used a questionnaire approach with a Likert scale. The results of filling out the questionnaire were analyzed using four methods: IFE/EFE matrix; IE matrix; SWOT matrix; and SPACE matrix to assess the results and their suitability to each other. The results of the stakeholder perception assessment show that there are 44 internal factors and 33 external factors that can influence this model. We obtained an IFE and EFE score of 2.92 and 2.83 for the internal and external results using the IE matrix. These place the model in quadrant V, meaning the P2P model can survive in the long term to generate profits. Based on the SWOT analysis results, this model is located at the coordinate point −0.40, 0.31, placing it in quadrant II. This means that the P2P model is in a competitive situation and faces threats but still has internal strengths. Based on the SPACE matrix, stakeholder perception states that the P2P model is at coordinate point 1, −0.3. This shows that the P2P model has the potential to be a competitive advantage in its type of activity that continues to grow. In conclusion, our findings show that stakeholders’ perceptions of P2P models using blockchain technology can be implemented effectively and provide social, economic, and environmental incentives.

1. Introduction

The energy transition toward Net Zero Emission by 2060 hinges on the renewable energy power plants in Indonesia. The Indonesian government has set ambitious targets for increasing the usage of renewable energy. Their goal is to reach 23% renewable energy usage by 2025 and 31% by 2050 to align with the objectives of the 2016 Paris Climate Agreement and reduce greenhouse gas emissions. However, based on data from PLN’s Electricity Supply Business Plan (RUPTL) until the end of 2020, it is estimated that the portion of new renewable energy in Indonesia stands at around 11.51%, which falls short of the target of 13.4%. Indicates the need for more substantial efforts to achieve the 23% target by 2025. According to the 2019 IRENA publication, the country has only installed solar panels at a rate of 0.55%, equivalent to around 80 MWp. These installations include small solar panel setups in remote areas and 1 to 5 MW grids connected in Kupang, East Nusa Tenggara. The Indonesian government’s 2019 RUPTL targets solar energy development to reach 6500 MWp by 2025.

Solar energy in Indonesia offers great potential for renewable energy capacity. Future of Renewable Energy Roadmap (REMap) identified the potential for an installed capacity of 47 GW by 2030. This includes plans to use solar energy to provide electricity to nearly 1.1 million households in remote areas without electricity. Furthermore, solar energy is expected to be used on a significant scale by 2030 in three ways: large utility-scale, on residential and commercial rooftops, and off-grid to replace expensive diesel power plants. This potential is assumed to be developed by 2030 through the efforts of the government and the state-owned electricity company [1]. Several studies and practices in several countries suggest switching to a peer-to-peer (P2P) energy trading system based on blockchain technology supported by the use of renewable energy—in this case, solar panels as one of the innovations in equalizing access to electricity that uses renewable energy while reducing the impact of climate change. Some of these examples are Piclo in the UK, Vandebron in the Netherlands, Sonnen Community in Germany, and Yeloha and TransActive Grid in the USA [2,3,4,5,6].

In various Southeast Asian countries such as Thailand, Malaysia, and Singapore, previous trials of peer-to-peer (P2P) energy trading have been carried out. Specifically in Malaysia, P2P energy trading utilizing blockchain technology was implemented, involving four producers and eight consumers under the leadership of the Sustainable Energy Development Authority (SEDA) 2022. The project’s initial phase involved a centralized approach, with SEDA overseeing the energy transactions between producers and consumers. This initiative is aligned with the Renewable Energy Transition Roadmap (RETR) 2035, which aims to foster the growth of the rooftop solar market by exploring P2P energy trading as a potential solution.

In 2018, the Metropolitan Electricity Authority (MEA) of the Thai government collaborated with Power Ledger on a blockchain-based P2P energy trading pilot project. The pilot project involved a dental clinic as the sole consumer, with a local mall, school, and apartment complex acting as additional large prosumers. A 635 kWP solar panel was installed on the roofs of the mall, school, and housing complex to generate renewable energy for the pilot project. The MEA, as the energy utility company, devised a centrally designed P2P marketplace for this initiative. In the Alpha phase, Electrify developed a pilot retail P2P energy trading platform in Singapore. The marketplace had fifteen members in Singapore’s national grid, consisting of three producers and twelve consumers. It successfully met its technical test objective by simulating the end-use of P2P energy trading in Singapore’s main electricity grid while adhering to the energy regulations.

Energy utilities are increasingly exploring the potential of blockchain to enhance the efficiency of electricity markets. The Russian national grid operator is currently conducting tests on the technology to enhance the efficiency of electricity metering, billing, and payments for end users. This solution will empower consumers to monitor their energy consumption in real time through a mobile app and automate payments within the grid. In addition, cities are also getting involved in this trend. For example, Chuncheon in South Korea is piloting a blockchain platform process that issues tokens for implementing sustainable energy practices, which can be exchanged for various goods and services [7]. Similarly, in Bangladesh, a blockchain-based peer-to-peer energy trading network is being created for rural households to enhance access to sustainable, reliable, and affordable electricity [8].

Blockchain technology and P2P trading have been widely discussed in the context of climate change policy and applied in many different climate-related sectors, from climate investment to carbon pricing. With the falling prices of solar panel modules, the number of households installing solar panel systems has increased; P2P energy trading has become one of the most popular applications powered by blockchain technology. However, there are concerns about the carbon footprint generated by blockchain. Concerns also arise from the transaction fees required to maintain the integrity of a decentralized blockchain. Several studies have embraced mathematical evidence and projected that blockchain emissions could drive global warming and consume more energy than mining minerals to produce equivalent market value [9].

Numerous studies examining the reasons for participating in collective prosumer initiatives have consistently highlighted the significant influence of environmental concerns [10]. For instance, an investigation into the motivations of individuals joining renewable energy cooperatives in Flanders revealed that the support for renewable energy production outweighs the importance of financial returns or electricity prices as a motivating factor. Similarly, a survey of members of a community-based renewable energy initiative in Germany demonstrated that participant engagement is primarily driven by environmental considerations rather than financial incentives [11]. Multiple studies have reinforced the idea that environmental benefits are the primary drivers for participation in peer-to-peer electricity markets [12,13,14]. Furthermore, a motivational psychology framework for peer-to-peer energy trading aimed to increase producers and consumers (prosumer) participation. Their findings indicated that the proposed model could potentially reduce carbon emissions by 18.38% and 9.82% during summer and winter, respectively, compared to the feed-in-tariff scheme.

Although peer-to-peer (P2P) trading reduces energy costs for local consumers, the limited energy generation in local microgrids means that the average consumer still needs to purchase energy from the traditional grid. Increased strain on non-renewable energy sources, such as coal-fired or solar power plants, contributes to greenhouse gas emissions. Introducing energy trading between microgrids offers a promising solution to alleviate the reliance on polluting utility grid generation. Previous research has consistently highlighted environmental concerns, particularly the aspiration for a more sustainable lifestyle, as a significant motivator for individuals to invest in renewable energy [15,16].

P2P energy trading is currently in an experimental and pre-competitive phase. The regulatory approach adopted around this model will determine its future success. According to IRENA and personal research, to date, the countries that have involved state and private institutions in piloting P2P energy trading schemes are Australia, Bangladesh, Colombia, Germany, Japan, Malaysia, Thailand, Singapore, the Netherlands, Spain, the United Kingdom, and the United States. Most of these [1] countries do not have regulations on P2P energy trading. Only a few of the above countries have touched the regulatory stage, even if only superficially. In contrast, more countries, including the UK, Japan, and the Netherlands, are embracing a regulatory sandbox approach. This approach permits governments to experiment with innovative concepts that are not yet regulated for a limited duration to gain insights. Currently, trials for peer-to-peer energy trading, often leveraging blockchain technology, are being conducted under regulatory sandboxes in the UK and the Netherlands.

The concept of P2P energy trading has a greater social potential compared to the traditional electricity trading methods, like those used by PLN (incorporating grid management principles such as direct load control and time-varying tariffs). On the contrary, P2P electricity trading contained a sharing element concept. It has the potential to generate compelling narratives, such as the notion of buying and selling electricity in underserved communities, remote islands, and beyond. Nevertheless, further in-depth research is essential to validate these ideas. One of them is through measuring the perceptions of stakeholders from the implementation of the P2P energy trading model based on blockchain technology. Thus, the prescriptive position of the model, which can provide social, economic, and environmental incentives, can be known comprehensively and thus provide an alternative solution to improve the quality of equitable electricity access in Indonesia, with a focus on low emissions and improving the quality of life.

The structure of this paper reflects the researcher’s background in studying peer-to-peer energy trading. Arguments and evidence from previous research are explained in Section 2. The Section 3 explains the materials, instruments, respondents and method approaches used in this study. In Section 4 of this study, the results of the perception analysis are presented based on the four method approaches, the IFE/EFE matrix, the IE matrix, the SWOT matrix, and the SPACE matrix. The final section of this paper presents the conclusions of stakeholders’ perceptions of the use of the P2P blockchain model.

2. Literature Review

2.1. Peer-to-Peer (P2P) Energy Trading

Over the past few decades, there have been several proposals for improving the quality of electricity access in Indonesia. Pekik Argo Dahono, a Professor from the Bandung Institute of Technology, has gained attention for promoting the “Nusantara Supergrid” concept, which involves connecting the large islands in Indonesia to the electricity network with a focus on renewable energy sources [17]. This concept, commonly known as Supergrid, involves the large-scale transmission of renewable electricity over long distances. Indonesia has substantial potential for renewable energy, which could potentially meet the country’s electricity needs. However, the sources are not evenly distributed across the islands. In alignment with the 2060 Net Zero Emission Targets, the Ministry of Energy and Mineral Resources plans to gradually transition to renewable energy by creating a roadmap for “Energy Transition Towards Carbon Neutral”. As part of this plan, the government intends to establish a “Super Grid” for interconnecting the islands using renewable energy sources, with the initiative set to begin after 2025. The government emphasizes that the implementation of this plan will require private sector involvement due to the limited state finances.

In recent years, peer-to-peer energy trading using solar power has emerged as an alternative for prosumers (producers and consumers) to actively participate in the energy market. This has been driven by the growing popularity of solar power worldwide [18]. P2P enables prosumers to trade excess energy production with their neighbors through microgrids, thereby increasing consumer profits. P2P energy trading offers greater flexibility to end users, more opportunities to utilize clean renewable energy, and contributes to reducing greenhouse gas emissions in the context of climate change. Furthermore, it brings additional benefits such as reducing peak electricity demand, lowering maintenance and operating costs, and enhancing the reliability of the electricity system [5,19].

This study, which implemented peer-to-peer energy trading in local markets, has the potential to create socioeconomic incentives that encourage local renewable energy generation. This can offer an alternative incentive for potential prosumers who are unable to invest in renewable energy due to limited capital or space. By enabling consumers to purchase certified green energy at affordable prices, it addresses the demand for green energy. Currently, consumers are often willing to pay a premium for green energy, but there is no guarantee about the origin of the purchased energy, and it likely still comes from the nearest fossil fuel power plant. Community-based microgrids based on blockchain technology facilitate local energy trading between consumers in a secure and pre-determined manner, free from interference. Similar to an open market economy, suppliers seek the highest possible price, considering costs and benefits, and consumers choose the lowest possible price based on their needs and preferences. In the traditional model, consumers purchase electricity from a utility at a fixed tariff or time-of-use tariff, while prosumers can sell excess electricity back to the grid at a buyback rate that is generally much lower than consumer tariffs. The implementation of the peer-to-peer model will have a significant impact on society, affecting lifestyles and cultural practices related to electricity supply and demand. It will also create local training and employment opportunities for administrative and maintenance work within the peer-to-peer system. Additionally, it will foster greater social trust, increase transparency in transactions, and reduce fraudulent activities. Ultimately, fostering greater community engagement will create a more direct connection among participants, enhancing their sense of belonging to the community. They will encourage them to coordinate with each other to optimize their profits [20]. Due to these and other advantages, numerous projects worldwide are dedicated to P2P energy trading. Notable initiatives include Piclo in the UK, Vandebron in the Netherlands, Sonnen Community in Germany, and Yeloha and TransActive Grid in the United States America [4,5,6].

2.2. Microgrids and Consumer-Centric Markets

Local-based energy projects and microgrids are expected to play an increasingly important role in the energy system. Local-scale energy projects have great potential to provide socioeconomic and environmental benefits to the communities involved [21]. In a microgrid, distributed generators, storage devices, and uncontrolled and controlled loads form an interconnected system that can operate in synchronization with the main grid or full autonomy if operating in island mode [22]. From a control perspective, a microgrid acts as a single system that has a different electrical boundary from the main grid [23]. In addition to the formal definition, virtual microgrids can also be considered, providing aggregate control over supply and demand beyond the electrical and physical boundaries. Microgrids promote local-scale energy production and consumption, which can lead to significant reductions in distribution and transmission losses [24]. When combined with sustainable resources, microgrids can further enhance the integration of renewable energy power generation [25].

Local-scale microgrids can improve grid resilience, providing additional services such as frequency and voltage support to aging power systems with the potential to defer expensive grid upgrade investments. They can also provide energy services to consumers in cases of grid contingencies. The efficient operation of microgrids at a technical level, such as optimal control strategies and system architectures, has been extensively studied [26,27,28,29,30,31].

Peer-to-peer energy trading in local markets can provide socioeconomic incentives that promote local renewable generation and therefore can form an alternative incentive for potential prosumers [4]. Consumers who are unable to invest in renewable energy generation, either due to limited capital or space, can purchase certified green energy at affordable prices. However, consumers are often willing to pay a premium for green energy, but currently, there is no guarantee about the origin of the purchased energy, and most likely, the energy used by the end consumer still comes from the nearest fossil fuel power plant [32]. Community-based microgrids based on blockchain essentially enable local energy trading between consumers, which is recorded in a secure and transparent manner.

2.3. Indonesian Context of P2P Energy Trading Using Blockchain Technology

The Center for Innovation Policy and Governance has proposed a set of principles and policy recommendations on big data, artificial intelligence, blockchain, and financial technology in Indonesia for the Directorate General of Informatics Applications, Ministry of Communication and Informatics. It is noteworthy that in Indonesia, blockchain is still primarily associated with Bitcoin and is often misunderstood due to the misuse of Bitcoin for illicit activities reported in the media. Moreover, there is limited involvement from key stakeholders such as universities and research institutions in blockchain research, and the country’s supporting industries, particularly the electronics and telecommunications sectors, have not been optimally engaged in addressing blockchain-related issues. While the Indonesian government informally acknowledges the potential of blockchain in supporting a sustainable and democratic energy network by eliminating intermediaries and fostering trust between networks, there has been no formal policy or strategy developed for P2P energy trading or blockchain. The absence of a domestic track record of blockchain utilization has hindered the formulation of appropriate policies and regulations, thereby impeding the potential benefits of P2P energy trading and blockchain technology for Indonesians.

The National Research and Innovation Agency (BRIN) is a governmental organization established to succeed the Ministry of Research and Technology. BRIN operates as a non-ministerial institution accountable to the President. President Joko Widodo created this agency through Presidential Regulation Number 74 of 2019. Its primary responsibilities include conducting research, development, assessment, and implementation, as well as promoting integrated inventions and innovations. It remains uncertain whether the inclusion of P2P energy trading and blockchain technology is a prominent topic within the agenda of the BRIN institution.

In Indonesia, the current electricity solution adopted by PLN involves constructing medium-large scale power plants, which is expensive and ineffective in ensuring equal distribution of electricity. The geographical challenges, with over 17,500 islands and more than 6000 inhabited islands, make creating an electricity network on each island a formidable task in terms of cost, ecosystem, and technology. According to the World Resources Institute, Indonesia is among the largest greenhouse gas (GHG) emitters globally. Over the past two decades, GHG emissions have increased across various sectors, including land use, energy, agriculture, industry, and waste. Currently, land use and energy sectors contribute 80 percent of greenhouse gas emissions in Indonesia.

The Constitutional Court, in a Judicial Review decision, invalidated Article 10, paragraph 2, and Article 11, paragraph 1, of the 2009 Law on Electricity, which emphasized the state’s dominance, particularly that of PLN, in controlling electricity. The Court emphasized that the decision should not be interpreted as a reduction in the state’s role. The coordination of electricity provision and distribution will continue to be managed by the government through state-owned enterprises (BUMN) operating in the electricity sector, such as PLN, and should not be unbundled. However, providing equitable and quality access to electricity in eastern Indonesia seems to be a challenge for PLN. Tri Mumpuni, also known as Ibu Puni, an entrepreneur and environmental activist, has been instrumental in bringing electricity to at least 61 remote villages in Indonesia, including isolated villages in NTT and eastern Indonesia, through the Institute for People’s Business and Economics (IBEKA) since the 1990s. Mumpuni and her husband, through IBEKA, have established Micro-Hydro Power Plants (PLTMH) to provide electrical energy to areas not covered by PLN, using water and turbine energy sources. One of the crucial aspects of lighting up remote villages is the acknowledgment of electricity as a form of social capital rather than just infrastructure or a commodity. Additionally, investments need to be made in partnership with the community, a concept referred to as community partnership investment [33].

In the context of an archipelagic nation, off-grid peer-to-peer (P2P) electricity trading combined with blockchain technology is highly significant. A secure blockchain can eliminate intermediaries, replacing them with a distributed network of users who collaborate to validate, consolidate, and synchronize data in a ledger through a consensus mechanism. Smart contracts enable automatic execution under specific conditions [9]. The potential of blockchain can be fully realized when combined with data from Internet of Things (IoT) devices and analyzed using machine learning or artificial intelligence techniques. In regions such as the Indonesian islands, the potential of the blockchain market in the mini-grid market is nearly as substantial as the mini-grid market itself, particularly given Indonesia’s rapid economic growth among G20 countries and the accompanying rise in energy demand. Demonstrating the effectiveness of blockchain here creates enormous opportunities for scalability across mini-grid and micro-solar systems of all sizes and geographic distributions, as the technology can be applied to any smart meter network.

3. Materials and Methods

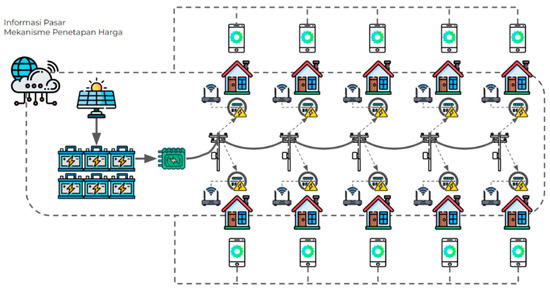

In this study, the Peer-to-Peer Energy Trading Model using Blockchain Technology applied solar microgrid system materials installed in rural areas of Gumelar, Banyumas, Central Java Province, Indonesia. The model generated a smart contract that facilitates grid users to buy, sell, and trade electricity through a mobile application (Figure 1). The program examined the impact of the model on users compared to previous electricity access methods, as well as the operation and billing techniques of the mini-grid. At the end of the program, the system was handed over to the local community, and its management was handed over to a cooperative formed to operate sustainably and integrate it with broader community service delivery to maximize sustainable development impact. The ultimate goal was to reach the entire microgrid industry. The users of the model focused on low-income households that struggle to access affordable energy and receive minimal fuel subsidies. Additionally, the model aimed to assist communities with access to the grid that experiences frequent power outages, occurring at least twice a week for approximately 2 h each time. By examining the impact on these areas, the model sought to gain a better understanding of the potential for expansion in Indonesia, considering the adaptability of the core technology to various scenarios and operational cases.

Figure 1.

Peer-to-Peer Energy Trading System Design in Gumelar.

The research approach used a mixed method of qualitative and quantitative research. The analysis utilized four methods: IFE/EFE matrix; IE matrix; SWOT matrix; and SPACE matrix. This research material used the P2P model and questionnaire instrument. Specifically, in this study, the model built involved houses (prosumers) that will be installed with solar panels to form a microgrid, each of which will be built in the Gumelar District, Banyumas Regency, Central Java. A simple blockchain-based application was built to conduct P2P energy trading (purchase and sale of electricity). The questionnaire instrument was created through an in-depth interview process conducted with expert users (Appendix A). The insights from the interviews were transformed into a SWOT-based questionnaire and used to survey application model users, allowing for comparisons of different responses. The study involved various stakeholders related to the operation of a model, including homeowners with solar panels in two locations in Indonesia. Semi-structured interviews were conducted with the following stakeholders:

- Homeowners (10 households) at one location who are given 3 KWh of electricity to be bought and sold for 30 consecutive days.

- Regulatory and electricity provider—the Ministry of Energy and Mineral Resources (ESDM).

- State-owned electricity company in Indonesia—PLN.

- A Non-Governmental Organization (NGO) working in renewable energy and community empowerment—Institute for Essential Services Reform (IESR).

- Private companies engaged in the energy business (IPP) and solar panels—Awina Sinergi International Company, South Jakarta, Indonesia.

- Academics—IPB University.

4. Results and Discussion

4.1. Implementation of a Peer-to-Peer Energy Trading Model Using Blockchain Technology in Central Java

This study involved prosumers from 10 households living in the Gumelar District. Each prosumer’s electricity system was connected to a single energy supply sourced from solar panels. The solar panels were installed in a compact manner located in the Gumelar District office. The implementation process of the P2P blockchain model installation can be seen in Figure 2. The energy generated from the solar panels was distributed through the battery system. This system was designed so that the solar panel array produces energy, which is then transferred to the storage system. The power generated through the electricity meter then transfers the data to the back-end software system. Power from the battery storage is then distributed to homes as needed. Each home has its own electricity supply meter, which combines its electricity supply, which can be viewed by residents through the front-end application.

Figure 2.

Implementation of a peer-to-peer energy trading model using blockchain technology in the Gumelar District, Banyumas Regency, Central Java Province. (a) Gumelar District office. (b) Solar panel. (c) Battery. (d) Solar-powered mini-grid system. (e) Smart meter. (f) Installation process.

The front-end application functions to monitor the electricity generated, stored, and distributed to each prosumer’s residence. All these activities can be monitored by the system operator, and individual activities can be monitored by individuals through the front-end application. This process allows prosumers not only to consume electricity, but also to make buying and selling transactions. Thus, the P2P blockchain model is not only a source of renewable energy but can also provide added economic value to its users.

4.2. Stakeholders’ Perceptions

The model trial was conducted twice: (a) from 15 December 2023 to 13 January 2024, and (b) from 15 January to 13 February 2024. A perception test was carried out on 10 prosumers in the Gumelar District. They were asked to complete a questionnaire (Appendix A) and then participate in a semi-structured interview to ensure that all questions were answered properly and correctly. The questionnaire filled out by the prosumers and expert users was then tested for validity and reliability. The results were analyzed using four methods: (a) IFE/EFE matrix, (b) IE matrix, (c) SWOT matrix, and (d) SPACE matrix to assess the results and their suitability with each other. Through the analysis of these various matrices, the stakeholder’s perceptions will be assessed to understand the potential development of P2P energy trading using blockchain technology and the factors that affect it.

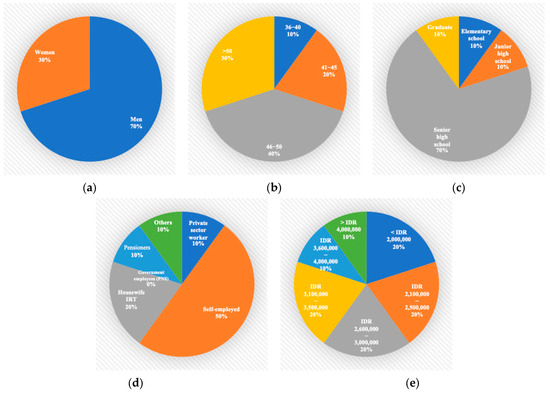

The survey participants (Figure 3) were predominantly male, accounting for 70% of the total respondents (7 people). There were three female respondents, comprising 30% of the total. Notably, these three women were using an electricity buying and selling application on behalf of their absent husbands. The highest number of respondents, four people (40%), fell within the 46–50 age range, followed by three people (30%) in the over 50 age range. Additionally, two people (20%) were in the 41–45 age range, while one person (10%) fell in the 36–40 age range. It is important to mention that there are few young people in the Gumelar District (aged 18–35) as most individuals in this age range work as Indonesian Migrant Workers abroad. The majority have a high school education, comprising 70%. Additionally, there is a person (10%) with an elementary school (SD), junior high school (SMP), and bachelor’s degree (Sarjana). It is noteworthy that although most of them have a high school education, on average they are former Indonesian Migrant Workers who have worked abroad. Their level of technological literacy and software usage is quite promising. Providing training to each of these individuals should not take long. According to the survey, the majority of respondents, five people (50%), are self-employed. Additionally, two respondents work as housewives. The following categories are private employees, retirees, and others, represented by a person (10%). It is worth noting that many of the respondents were former Indonesian Migrant Workers abroad who, upon returning to Indonesia, tended to start their businesses or become small entrepreneurs contributing to their respective regional economies. The respondents have varying income levels: 10% of respondents earn below Rp. 2,000,000, while another 10% earn above Rp. 4,000,000. The majority, which is 20% of the respondents, earn between Rp. 2,100,000 and Rp. 3,500,000, with two people falling into this category.

Figure 3.

Participants Profile. (a) Gender category. (b) Age category. (c) Education category. (d) Work category. (e) Income category.

4.3. Internal Factors Evaluation and External Factors Evaluation Matrix Analysis

Identification of internal and external factors was carried out to obtain information related to the Strengths, Weaknesses, Opportunities, and Threats factors in this model. This identification was carried out using in-depth interviews or brainstorming from various sources who meet the stakeholder’s criteria related to the model, including the following parties:

- Regulatory and electricity provider—the Ministry of Energy and Mineral Resources (ESDM).

- State-owned electricity company in Indonesia—PLN Persero Company.

- A Non-Governmental Organization (NGO) working in renewable energy and community empowerment—Institute for Essential Services Reform (IESR).

- Private companies engaged in the energy business (IPP) and solar panels— Awina Sinergi International Company, South Jakarta, Indonesia.

- Academic—IPB University.

The next step involved assigning weights and ranks to each variable. The findings from the IFE and EFE analyses were then organized into a matrix for assessing the key factors influencing the model. This provided a clear understanding of the model’s current position and served as valuable input for devising an effective strategy for its implementation.

4.4. Internal Factors Evaluation Analysis

Identification of the internal factors of this model involved assessing its strengths and weaknesses, assigning them weights and ratings, and then processing them to obtain a score on the IFE matrix. The IFE matrix identification is detailed in the Table 1.

Table 1.

Internal factors evaluation matrix.

There are fifteen significant strength factors and twenty-nine key weakness factors that influence this model. The IFE matrix indicates a score of 2.92. According to the IFE matrix, the main strength factor crucial to this model is the freedom to generate and sell electricity (0.1). This factor introduces transparency in the electricity usage and sales by disclosing the amount, duration, and price of electricity (0.1). This internal advantage is highly influential in driving the adoption of this model by stakeholders. The concept of transparency is at the core of blockchain technology, enabling public participation in the electricity trading process without fear of deception due to the recording of all transactions in the application. Regarding weakness factors, the IFE matrix suggests that this model is primarily suitable for the lower-middle class residing in rural or remote areas (0.02). Additionally, the intermittent electricity production to meet the substantial demand is a major weakness (0.03). Furthermore, the weak and relatively expensive internet network, low penetration of sophisticated mobile phones, and complex system management contribute to a negative impact on the model’s adoption. Currently, P2P energy trading using blockchain technology remains at the level of simulation and has not involved large prosumers (more than 100 people). The prospect of simulations involving numerous participants and advanced technology is indeed intriguing.

4.5. External Factors Evaluation Matrix Analysis

Identification of external strategy factors includes opportunity and threat factors that influence the strategy of this model. The results are then processed to obtain a score on the EFE matrix. The EFE matrix identification is detailed in the Table 2.

Table 2.

External factors evaluation matrix.

There are 19 key opportunity factors and 14 threat factors that significantly influence this model. The IFE matrix results indicate a total score of 2.83. According to the EFE matrix, the opportunity factors for the program is the increase in public awareness and cooperation in using environmentally friendly, pollution-free electricity (0.12). Furthermore, there is an opportunity for additional income (0.12) and new business investment (0.12). This particular opportunity factor is crucial as it can expand market share and generate public interest in the model. Regarding threat factors, the EFE matrix indicates that the model faces significant threats from the implementation aspect involving multiple parties (0.04). Additionally, there is a potential threat in the form of losses for state utilities such as PLN or individuals who have already established electricity infrastructure if this program implemented on a large scale (0.04). This threat could jeopardize the sustainability and profitability of PLN’s state utility business and thus impede the implementation of this model.

4.6. Internal–External Matrix Analysis

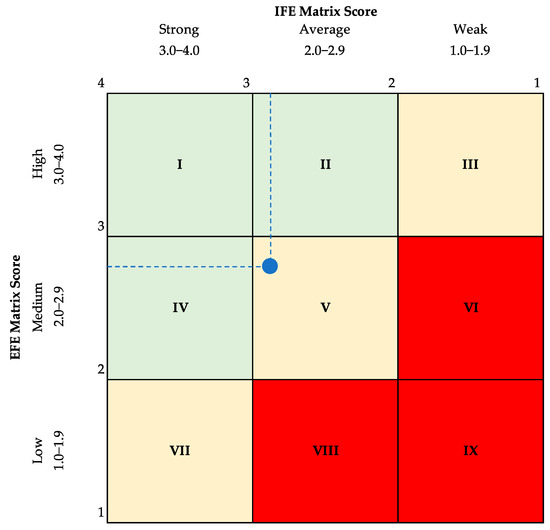

For the internal and external results using the IFE-EFE matrix, we obtained an IFE matrix score of 2.92 and an EFE matrix score of 2.83. This places the model in quadrant V in the IE matrix (Figure 4). The IE matrix theory, the recommended strategy for quadrants III, V, and VII, is the hold and maintain strategy. Based on stakeholder assessments, the suggested strategies for this model are market penetration and product development [34]. Market penetration could involve increasing the number of prosumers from 10 to 100 or 1000, or expanding to one district or province at a time to assess the effectiveness of systems. Encouraging existing prosumers to buy and sell electricity more frequently is also recommended.

Figure 4.

Internal–external matrix.

To expand the market share of prosumer products, product development can focus on creating high-selling items. For instance, offering solar panels to urban communities with higher incomes through a program involving PLN as an intermediary, similar to the trial conducted by “Tenaga National Berhad” (TNB), a Malaysian state-owned electricity utility company, can be beneficial. This approach allows the sale of environmentally friendly electricity at a premium price to specific consumer groups. It is important to view this program as a complement to PLN’s existing system, rather than a direct competitor. Furthermore, addressing the current issue of power wheeling, where PLN’s transmission and distribution networks can be jointly utilized, with a business model like this could be a viable solution. Despite PLN’s current reluctance to utilize the concept of power wheeling, this approach holds promise.

4.7. SWOT Analysis

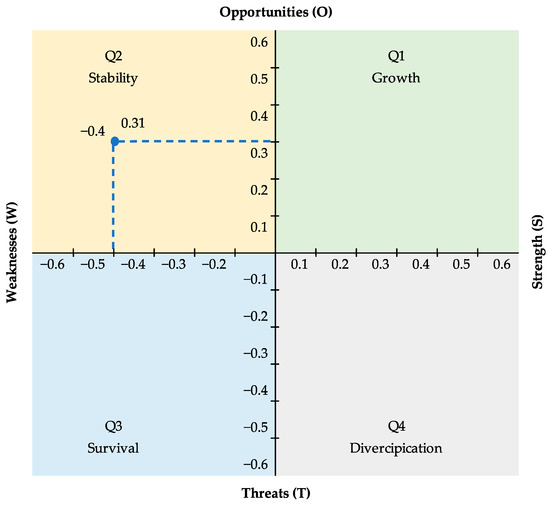

To assess stakeholder perceptions of this model, a SWOT analysis was conducted. The aim was to identify both internal and external aspects of the P2P blockchain program, mapping out potential opportunities and challenges. This involved taking stock of factors influencing the model within the planning strategy, serving as a foundation for determining necessary corrective actions for future developments. The study’s SWOT analysis involved comparing factors impacting the model, comprising Strengths (S), Weaknesses (W), Opportunities (O), and Threats (T). The detailed mapping of SWOT factors, derived from the results of brainstorming with expert users as stakeholders, is presented in the following table. The basic concept of SWOT analysis was developed by assessing weighted scores using EFE/IFE analysis. Stakeholders from the government, private sector, academic, non-governmental organizations, and the community acted as assessors. They assigned a weight of 0.00 to 1.00 to each aspect of SWOT. Each factor (internal/external) was then summed to produce a weight of 1. Once the criteria were weighted, the next step was to rate them to indicate their level of importance (1 = less important, 2 = quite important, 3 = important, and 4 = very important). The weighting value was then multiplied by the specified rating. The position of the SWOT quadrant was determined by calculating each factor (internal/external) to produce a diagram indicating the program’s future quadrant position. The quantitative SWOT analysis used results from the IFE and EFE matrix approaches obtained in the previous analysis. Based on the IFE matrix, the total S-W score was −0.40, and the total O-T score was 0.31. The detailed results of the IFE and EFE matrix analysis are presented in the following Table 3.

Table 3.

IFE-EFE matrix analysis.

Based on the analysis results, this model located at the coordinate point (−0.40, 0.31), placing it in quadrant II (Figure 5). This indicates that the model should apply the STABILITY strategy, with a specific focus on the “Selective Maintenance Strategy” for improvement. This involves internal consolidation to address weaknesses and sustain accomplishments. The goal of the Stability strategy is to maintain the current situation by leveraging opportunities and addressing weaknesses.

Figure 5.

SWOT matrix.

This model enables equitable electricity distribution in remote and marginalized areas. Despite PLN’s claim that Indonesia’s electrification rate is 99%, sporadic power outages persist in Java, including in the Gumelar District. The program aims to achieve two objectives: first, to increase the adoption of this model in energy-deprived areas by focusing on energy quality, reliability, sufficiency, affordability, community acceptance, environmental feasibility, and the multiple socioeconomic benefits of energy access; and second, to allow PLN to act as an intermediary, supplying clean electricity at a competitive price, when targeting urban or industrial areas.

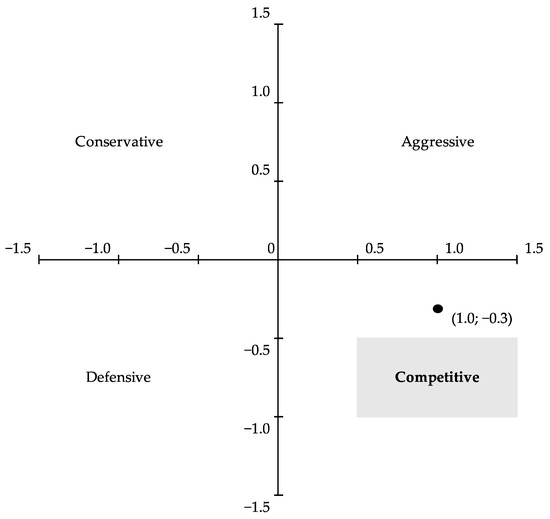

4.8. SPACE Matrix Analysis

The SPACE (Strategic Position and Action Evaluation) matrix consists of a 2 × 2 table with four quadrants: aggressive, conservative, defensive, and competitive strategies. The matrix’s axes are determined by internal factors such as financial strength (FS) and competitive advantage (CA), as well as by external factors including environmental stability (ES) and industry strength (IS). The financial strength factor evaluates all indicators of an organization’s financial capability. The environmental stability and industry strength factors analyze their respective content and material. The strategy can be formulated as follows: environmental stability (ES), represented by the highest score of market entry barriers (−4), is a significant concern. The Constitutional Court, through a judicial review decision, annulled Article 10 Paragraph 2 and Article 11 Paragraph 1 of the 2009 Law on Electricity, which further confirms that PLN has control over electricity. The coordination of electricity provision and distribution remains with the government, specifically through state-owned enterprise (BUMN) operating in the electricity sector (i.e., PLN) and unbundling. Protective regulations act as the primary barrier hindering the development of this program. And PLN’s support for renewable energy, such as solar power, is currently inadequate. The core of this program revolves around the installation of solar panels. PLN’s policy prohibiting the direct sale of electricity from solar panels to PLN, in addition to the uncompetitive prices offered to IPP solar panels, pose significant challenges. Moreover, the high initial cost and lengthy payback period deter consumer adoption of solar panels, thus prolonging the decision-making process.

The competitive advantage (CA) of controlling suppliers is rated (−3). This advantage stems from PLN’s monopoly over the sale and purchase of electricity, enabling it to offer affordable and uninterrupted electricity to the community by leveraging fossil fuels and an extensive network. The superiority of technology and product quality holds a rated (−3) also. An existing advantage lies in the transparent implementation of a program that allows the community to buy, sell, and track energy transactions, thereby promoting the transition from fossil fuels to clean energy through used solar panels. As for financial strength (FS), the working capital is rated at (+5) due to the substantial initial investment required, balanced by low operational costs and reliance on solar energy for electricity generation. This program is also beneficial for remote areas and only necessitates an application and a smart meter tool for distribution. The return on investment (ROI) is similarly rated at (+5). Despite the initial investment, the program’s benefits for the community, particularly in areas not covered by PLN electricity, and its positive impact on the environment and society, are expected to surpass the initial investment value. Regarding industrial strength (IS), financial stability is rated at (+5) owing to the P2P electricity regulation buying and selling program, ensuring the sustainability of the independent system, community empowerment, and environmental benefits from solar energy use. And this can help improve the scale of the P2P markets and motivate the formation of new business models for community.

X-axis = Average CA score + Average IS score = 1

Y-axis = Average FS score + Average ES score = −0.3

Therefore, the coordinate point xy = (1, −0.3).

Based on the SPACE matrix (Figure 6), it is evident that the vector line points toward the COMPETITIVE quadrant (bottom right) of the matrix. This suggests that the model holds the potential for a competitive advantage in its evolving activity type. Consequently, it inferred that the model is well-positioned to capitalize on internal strengths to leverage external opportunities, address internal weaknesses, and mitigate external threats. Collaborating with PLN is a crucial aspect of the widespread adoption of this model, enabling it to operate in areas where the PLN network does not reach. The stakeholder perception analysis used the IFE-EFE matrix, IE matrix, SWOT matrix, and SPACE matrix. The conclusion is that the P2P energy trading model, supported by blockchain technology, can grow and evolve by meeting various existing requirements. Additionally, strategic steps for future development, including collaboration with PLN, have been clearly outlined.

Figure 6.

SPACE matrix.

4.9. Sustainability Policy Strategies to Model Implementation

The sustainability policy strategies in the model use the SWOT matrix approach. This involves describing the various external and internal factors that impact the model’s sustainability, based on EFAS (External Factors Analysis Summary) and IFAS (Internal Factors Analysis Summary) conclusions. The SWOT matrix helps to depict how the model can adapt to external opportunities and threats by leveraging its strengths and addressing its weaknesses.

To determine the priority of each alternative strategy, the researcher utilized the Quantitative strategic planning matrix (QSPM), a highly suitable tool for prioritizing crucial internal, external, and competitive information essential for crafting an effective strategic plan. Then, the decision-making stage relied on the key indicators or factors outlined in the input stage, IFAS and EFAS. These factors prepared an alternative strategy in the second stage (matching stage). Following the QSPM assessment of each alternative strategy, they were sorted from the largest to the smallest value to identify a priority strategy for implementation. A total of 12 vital strategies had to be executed to effectively promote the P2P energy trading model using blockchain technology for systematic development in society. The strategy priorities are shown in the Table 4.

Table 4.

SWOT matrix alternative strategy.

4.10. Peer-to-Peer Energy Trading Model Strategy Priorities

The model is considered economically feasible. On the other hand, the model can effectively reduce CO2 due to the use of solar panels. Furthermore, this model will work more effectively if it can build cooperation with PLN, which is legally the only utility company in Indonesia that has the largest electricity network. For the initial stage, the regulatory sandbox model will be an ideal forum to start a dialogue and experiment between regulators and innovators to learn and exchange insights about testing a product before it is suitable for use in the wider community. A trial like this was conducted by “Tenaga Nasional Berhad” (TNB), a Malaysian state-owned electricity utility company, in 2019 on a P2P energy trading model using blockchain technology in collaboration with the renewable energy authority SEDA (Sustainable Energy Development Authority). And, P2P energy trading using blockchain algorithms can be successfully implemented considering real-time scenarios and economically benefits smart sustainable societies. Thus, this might be an entry point in collaborating with PLN as the electricity sold is environmentally friendly energy and is sold at a higher price to certain consumers by involving PLN as part of its business model. This program should not be considered a competitor to PLN but rather as a complement to the existing PLN system. The energy trading model’s twelve priority strategies are represented using the triangular relationship between environmental, social, and economic dimensions, which are interconnected and mutually influential. The Peer-to-Peer Energy Trading Model Strategy Priorities are shown in the Table 5.

Table 5.

Peer-to-Peer Energy Trading Model Strategy Priorities.

4.11. Discussion

This study has potential limitations. The estimation of stakeholder perception measurement is influenced by the number of prosumer users of the P2P blockchain model as respondents and the level of expertise of the experts. Therefore, they are susceptible to bias and confounding factors that may affect the assessment of perception of this model. The limited funding in the research resulted in the number of respondents in this study being relatively small, with only 10 user families. Including the criteria of experts involved in the assessment of the perception of this study, it was based only on work experience. However, the researcher believes that these limitations are still within tolerable limits and can still represent actual conditions.

5. Conclusions

This study demonstrated the effectiveness of the microgrid system for peer-to-peer energy trading using blockchain technology in the Gumelar District, Banyumas Regency, Central Java Province, tasted to 10 Prosumers. The results showed that this model effectively addresses the challenges of sustainable electricity. The model has proven to be environmentally, economically, and socially beneficial, serving as a valuable reference for addressing energy access inequality comprehensively. Based on the analysis of the IFE-EFE matrix, the strength factors of this model are the freedom to generate and sell electricity (0.1) and transparency in electricity usage and sales by disclosing the amount, duration, and price of electricity (0.1). Regarding weakness factors, this model is primarily suitable for the lower-middle class residing in rural or remote areas (0.02). Additionally, the intermittent electricity production to meet the substantial demand is a weakness (0.03). The opportunity factor for the model is the increase in public awareness and cooperation in using environmentally friendly, pollution-free electricity (0.12). Furthermore, there is an opportunity for additional income (0.12) and new business investment (0.12). Regarding threat factors, the model faces significant threats from the implementation aspect involving multiple parties (0.04). There is a potential threat in the form of losses for state utilities such as PLN or individuals who have already established electricity infrastructure if this program is implemented on a large scale (0.04).

We obtained an IFE and EFE score of 2.92 and 2.83 for the internal and external results using the IE matrix. These scores place the model in quadrant V, meaning the P2P model can survive in the long term to generate profits. According to the SWOT analysis results, this model is located at the coordinate point −0.40, 0.31, placing it in quadrant II. This means that the P2P model is in a competitive situation and faces threats but still has internal strengths. Based on the SPACE matrix, stakeholder perception states that the P2P model is at coordinate point 1, −0.3. This shows that the P2P model has the potential to be a competitive advantage in its type of activity that continues to grow. Based on the three approaches, it provides positive model position results that can be developed in the future. Here, the assessment of stakeholder perceptions of the P2P model using blockchain technology might be implemented effectively, with the potential to provide social, economic, and environmental incentives. This indicates that the model should apply the stability strategy, with a specific focus on the selective maintenance strategy for improvement. The stability strategy goal is to maintain the current situation by leveraging opportunities and addressing weaknesses.

The peer-to-peer energy trading model using blockchain technology is believed by stakeholders to provide greater benefits to the user community, expand opportunities to consume renewable energy, and contribute to reducing climate change in Indonesia. This can be an alternative for the government to fulfill electricity needs, especially those that are difficult to reach by conventional networks. For the effectiveness and efficiency of the model, this strategy is needed to emphasize collaborative training with PLN, which holds legal authority as the only utility company in Indonesia with an extensive electricity network, as well as advocating for regulations that support independent purchase and sale of solar-powered electricity, especially in areas without PLN network coverage. Regulatory sandboxes can be tried in several targeted areas. Regulatory sandboxes provide an ideal platform for regulatory authorities and innovators to engage in dialogue and experimentation, allowing for mutual learning and exchange of ideas about a product before it is approved for public use. The potential for blockchain in the mini-grid market is enormous, especially in the Indonesian archipelago, given the country’s rapid economic growth and substantial increase in energy demand among G20 countries. By demonstrating the effectiveness of this approach, there is significant potential for scalability across microgrid systems of varying sizes and geographic distribution, as this technology can be implemented across any smart meter network.

Author Contributions

This study was conducted by F.Y. as the main author; he is a doctor candidate at the School of Environmental Science Universitas Indonesia. The co-authors R.F.S., P.Y. and T.E.B.S. have contributed in guiding the main author during his study and provided the editorial and proofreading assistance. All authors have read and agreed to the published version of the manuscript.

Funding

This publication has partially recieved a funding from the School of Environmental Science, Universitas Indonesia.

Data Availability Statement

The original contributions presented in the study are included in the article, further inquiries can be directed to the corresponding author.

Conflicts of Interest

The authors declare no conflicts of interest.

Correction Statement

This article has been republished with a minor correction to the existing affiliation information. This change does not affect the scientific content of the article.

Appendix A

Table A1.

Internal Factors Questionnaire (Strengths).

Table A1.

Internal Factors Questionnaire (Strengths).

| No. | Indicators | Assessment | |||

|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | ||

| 1 | The model gives you the freedom to choose to generate and sell electricity. | ||||

| 2 | The model is environmentally friendly and has pollution-free electricity. | ||||

| 3 | The model will become a solution for remote communities with difficulty accessing electricity and finances. | ||||

| 4 | The model creates transparency such as the amount of electricity, duration, usage, and selling prices. | ||||

| etc. | |||||

Table A2.

Internal Factors Questionnaire (Weakness).

Table A2.

Internal Factors Questionnaire (Weakness).

| No. | Indicators | Assessment | |||

|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | ||

| 1 | The model produces limited electrical energy during the day. | ||||

| 2 | The installation of the model requires a large place/room. | ||||

| 3 | The model is only suitable for lower-middle class society who live in areas far from the city center or rural. | ||||

| 4 | The more model users there are, the more difficult it will be to manage. | ||||

| etc. | |||||

Table A3.

External Factors Questionnaire (Opportunities).

Table A3.

External Factors Questionnaire (Opportunities).

| No. | Indicators | Assessment | |||

|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | ||

| 1 | The model increases public awareness and cooperation in using environmentally friendly electricity (pollution-free). | ||||

| 2 | The model opens up new business opportunities. | ||||

| 3 | The model becomes additional income. | ||||

| 4 | The model opens up opportunities for new business investment. | ||||

| etc. | |||||

Table A4.

External Factors Questionnaire (Threats).

Table A4.

External Factors Questionnaire (Threats).

| No. | Indicators | Assessment | |||

|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | ||

| 1 | The implementation of the model involves many parties. | ||||

| 2 | PLN’s free electricity service program for public facilities hinders the implementation of the model. | ||||

| 3 | The losses of people who have installed PLN electricity infrastructure hinder the implementation of the model. | ||||

| 4 | People who fail to pay for electricity hinder the development of the model. | ||||

| etc. | |||||

References

- International Renewable Energy Agency. Renewable Capacity Statistics 2019; IRENA: Abu Dhabi, United Arab Emirates, 2019. Available online: https://www.irena.org/publications/2019/Mar/Renewable-Capacity-Statistics-2019 (accessed on 7 July 2024).

- Soto, E.A.; Bosman, L.B.; Wollega, E.; Leon-salas, W.D. Peer-to-peer energy trading: A review of the literature. Appl. Energy 2021, 283, 116268. [Google Scholar] [CrossRef]

- Tushar, W.; Yuen, C.; Mohsenian-Rad, H.; Saha, T.; Poor, H.V.; Wood, K.L. Transforming energy networks via peer-to-peer energy trading: The potential of game- theoretic approaches. IEEE Signal Process. Mag. 2018, 35, 90–111. [Google Scholar] [CrossRef]

- Mengelkamp, E.; Garttner, J.; Rock, K.; Kessler, S.; Orsini, L.; Weinhardt, C. Designing microgrid energy markets: A case study: The Brooklyn microgrid. Appl. Energy 2018, 210, 870–880. [Google Scholar] [CrossRef]

- Zhang, C.; Wu, J.; Zhou, Y.; Cheng, M.; Long, C. Peer-to-peer energy trading in a microgrid. Appl. Energy 2018, 220, 1–12. [Google Scholar] [CrossRef]

- Zhou, Y.; Wu, J.; Long, C. Evaluation of peer-to-peer energy sharing mechanisms based on a multiagent simulation framework. Appl. Energy 2018, 222, 993–1022. [Google Scholar] [CrossRef]

- Andoni, M.; Robu, V.; Flynn, D.; Abram, S.; Geach, D.; Jenkins, D.; McCallum, P.; Peacock, A. Blockchain technology in the energy sector: A systematic review of challenges and opportunities. Renew. Sustain. Energy Rev. 2019, 100, 143–174. [Google Scholar] [CrossRef]

- Khan, I. Drivers, enablers, and barriers to prosumerism in Bangladesh: A sustainable solution to energy poverty? Energy Res. Soc. Sci. 2019, 55, 82–92. [Google Scholar] [CrossRef]

- Krause, M.J.; Tolaymat, T. Quantification of energy and carbon costs for mining cryptocurrencies. Nat. Sustain. 2018, 1, 711–718. [Google Scholar] [CrossRef]

- Bauwens, T. Analyzing the determinants of the size of investments by community renewable energy members: Findings and policy implications from Flanders. Energy Policy 2019, 129, 841–852. [Google Scholar] [CrossRef]

- Radtke, J. A closer look inside collaborative action: Civic engagement and participation in community energy initiatives. People Place Policy 2014, 8, 235–248. Available online: https://ppp-online.org/ (accessed on 10 July 2024). [CrossRef]

- Hackbarth, A.; Lobbe, S. Attitudes, preferences, and intentions of German households concerning participation in peer-to-peer electricity trading. Energy Policy 2020, 138, 111238. [Google Scholar] [CrossRef]

- Reuter, E.; Loock, M. Empowering Local Electricity Markets: A survey study from Switzerland, Norway, Spain and Germany; R Institute for Economy and the Environment, University of St. Gallen: St. Gallen, Switzerland, 2017. [Google Scholar]

- Wilkinson, S.; Hojckova, K.; Eon, C.; Morrison, G.M.; Sanden, B. Is peer-to-peer electricity trading empowering users?: Evidence on motivations and roles in a prosumer business model trial in Australia. Energy Res. Soc. Sci. 2020, 66, 101500. [Google Scholar] [CrossRef]

- Palm, J.; Tengvard, M. Motives for and barriers to household adoption of small-scale production of electricity: Examples from Sweden. Sustain. Sci. Pract. Policy 2017, 7, 6–15. [Google Scholar] [CrossRef]

- Wittenberg, I.; Matthies, E. Solar policy and practice in Germany: How do residential households with solar panels use electricity? Energy Res. Soc. Sci. 2016, 21, 199–211. [Google Scholar] [CrossRef]

- Dahono, P.A. Indonesia Supergrid: A Key to 100% Renewable; School of Electrical Engineering and Informatics, Bandung Institute of Technology: Bandung, Indonesia, 2021. [Google Scholar]

- International Renewable Energy Agency. Innovation Landscape Brief: Peer-to-Peer Electricity Trading; IRENA: Abu Dhabi, United Arab Emirates, 2020. Available online: https://www.irena.org/-/media/Files/IRENA/Agency/Publication/2020/Jul/IRENA_Peer-to-peer_electricity_trading_2020 (accessed on 7 July 2024).

- Morstyn, T.; Farrell, N.; Darby, S.J.; McCulloch, M.D. Using peer-to-peer energy-trading platforms to incentivize prosumers to form federated power plants. Nat. Energy 2018, 3, 94–101. [Google Scholar] [CrossRef]

- Fell, M.J. Social Impacts of Peer-to-Peer Energy Trading: A Rapid Realist Review Protocol; Centre for Research into Energy Demand Solutions, Environmental Change Institute, University of Oxford: Oxford, UK, 2019; Available online: https://www.creds.ac.uk/ (accessed on 6 July 2024).

- Berka, A.L.; Creamer, E. Taking stock of the local impacts of community owned renewable energy: A review and research agenda. Renew. Sustain. Energy Rev. 2017, 82, 3400–3419. [Google Scholar] [CrossRef]

- Marnay, C.; Chatzivasileiadis, S.; Abbey, C.; Iravani, R.; Joos, G.; Lombardi, P.A.; Mancarella, P.; Appen, J.V. Microgrid evolution roadmap. In International Symposium on Smart Electric Distribution Systems and Technologies (EDST); IEEE: Piscataway, NJ, USA, 2015; pp. 139–144. [Google Scholar]

- Ton, D.T.; Smith, M.A. The US Department of Energy’s microgrid initiative. Electr. J. 2012, 25, 84–94. [Google Scholar] [CrossRef]

- Kamel, R.M.; Chaouachi, A.; Nagasaka, K. Carbon emissions reduction and power losses saving besides voltage profiles improvement using microgrids. Low Carbon Econ. 2010, 1, 1–7. [Google Scholar] [CrossRef]

- Mihaylov, M.; Jurado, S.; Avellana, N.; Razo-Zapata, I.; Van Moffaert, K.; Canadas, A.; Arco, L.; Grau, I.; Nowe, A. SCANERGY. A scalable and modular system for energy trading between prosumers. In Proceedings of the International Conference on Autonomous Agents and Multiagent Systems 2015, Istanbul, Turkey, 4–8 May 2015; Available online: https://www.ifaamas.org/Proceedings/aamas2015/aamas/p1917 (accessed on 12 July 2024).

- Lasseter, R.H.; Paigi, P. Microgrid: A conceptual solution. In Proceedings of the 2004 IEEE 35th Annual Power Electronics Specialists Conference (IEEE Cat. No.04CH37551), Aachen, Germany, 20–25 June 2004. [Google Scholar]

- Katiraei, F.; Iravani, M.R. Power management strategies for a microgrid with multiple distributed generation units. IEEE Trans. Power Syst. 2016, 21, 1821–1831. [Google Scholar] [CrossRef]

- Nosratabadi, S.M.; Hooshmand, R.A.; Gholipour, E. A comprehensive review on microgrid and virtual power plant concepts employed for distributed energy resources scheduling in power systems. Renew. Sustain. Energy Rev. 2017, 67, 341–363. [Google Scholar] [CrossRef]

- Stadler, M.; Cardoso, G.; Mashayekh, S.; Forget, T.; DeForest, N.; Agarwal, A.; Schonbein, A. Value streams in microgrids: A literature review. Appl. Energy 2016, 162, 980–989. [Google Scholar] [CrossRef]

- Palizban, O.; Kauhaniemi, K.; Guerrero, J.M. Microgrids in active network management Part I: Hierarchical control, energy storage, virtual power plants, and market participation. Renew. Sustain. Energy Rev. 2014, 36, 428–439. [Google Scholar] [CrossRef]

- Dimeas, A.L.; Hatziargyriou, N.D. Operation of a multiagent system for microgrid control. IEEE Trans. Power Syst. 2005, 20, 1447–1455. [Google Scholar] [CrossRef]

- Mihaylov, M.; Jurado, S.; Avellana, N.; Van Moffaert, K.; de Abril, I.M.; Nowe, A. NRGcoin: Virtual currency for trading of renewable energy in smart grids. In Proceedings of the 11th International Conference on the European Energy Market (EEM14), Krakow, Poland, 28–30 May 2014. [Google Scholar]

- Institute of People’s Business and Economics. Renewable Energi Project Development; IBEKA: West Jakarta, Indonesia, 2021; Available online: https://ibeka.or.id/solar-photovoltaic/ (accessed on 7 July 2024).

- David, F.R.; David, F.R.; David, M.E. Strategic Management: A Competitive Advantage Approach, Concepts & Cases, 17th ed.; Harlow Pearson Education: London, UK, 2023. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).