1. Introduction

With economic growth and urbanization, energy issues are becoming particularly important. In China, energy carbon emissions account for 80% of total carbon emissions [

1], seriously hindering the achievement of the ‘double carbon’ goals. Previous studies have shown that the reduction in China’s carbon emissions will be dominated by energy efficiency improvements before carbon peaks in 2030, contributing over 60% of the reduction [

2]. Yu et al. [

3] calculated that the energy efficiency in advanced and emerging economies is low, averaging 0.44. Energy efficiency refers to the ratio of energy output to energy input [

4]. Improving energy efficiency means obtaining more energy output with as little energy input as possible, which will reduce fossil fuel consumption and contribute to the realization of the “double carbon” goals [

5]. Industry is a high-energy-consuming, polluting, and high-emission sector in China. At the end of 2021, industrial energy consumption still accounted for 66.75% of China’s total energy consumption [

6]. The IEE in China represents about CNY 95 million/10,000 tons of standard coal, and there is still capacity for further improvement [

6]. Therefore, it is urgent to reduce energy consumption in all areas of industry, thereby reducing industrial CO

2 emissions. However, improving IEE requires a significant amount of capital investment [

7]. In addition to government investment, it is necessary to fully utilize market-oriented instruments such as GF to solve the funding shortage problem.

GF can balance economic growth, environmental protection, and sustainable development [

8]. GF provides a financial service for investment, financing, operations, risk management, and others for environmental protection, energy conservation, and clean energy projects [

9] to realize environmentally sustainable economic development [

10]. Green financial products principally comprise green credit, bonds, insurance, investment, and carbon finance [

11]. The essence of GF is to use those instruments to promote the transfer of funds to energy conservation and environmental protection, thereby reducing the dependence of economic activities on fossil fuels [

12]. For the Chinese industry, GF currently principally provides green capital investment for clean production projects such as green upgrading and the renovation of industrial parks [

13], green low-carbon and high-efficiency equipment manufacturing projects, clean energy industry projects such as the clean and efficient utilization of traditional energy, and the efficient operation of energy systems, thereby promoting industrial low-carbon transition. However, due to the limitations in data and information availability, there is currently no publicly available evidence to confirm whether and to what extent GF has actually played a role in these green projects. Azhgaliyeva et al. [

14] believes that the Association of South-East Asian Nations’ green bond policy might not necessarily be effective in promoting energy efficiency projects, as its green bonds can be used to refinance past loans. The promoting role of GF in the industrial low-carbon transition process has not been fulfilled.

Under the above circumstances, much academic research has been conducted on GF, energy efficiency, and the relationship between the two. Among the studies, in terms of GF measurement, some scholars have used a single indicator or a fusion degree of two indicators to measure GF [

10,

15]; however, these cannot comprehensively and effectively measure the level of GF. Scholars have gradually recognized the necessity for a GF indicator system to measure the level of GF [

8,

11,

16]. In terms of energy efficiency measurement, scholars have usually strived to use a one-dimensional indicator for measurement purposes, including, for example, energy macro-efficiency (the inverse of energy intensity) [

17], energy thermodynamic efficiency (energy’s thermal efficiency) [

18], energy physical efficiency (energy consumption per unit of product or process) [

19], and energy value efficiency (energy input and output measured by value quantity) [

5]. Some scholars have also used total factor energy efficiency [

20] or energy return on investment (EROI) to measure energy utilization efficiency [

21]. When calculating the overall energy efficiency level of a country, region, or industry, scholars have often used macro energy efficiency, which is the reciprocal of energy intensity [

17].

In terms of the relationship between the two, scholars have not currently reached a consensus on whether GF can promote energy efficiency. Some experts have found that GF can promote improvements in IEE. For example, Guo et al. [

20] used the spatial Durbin model (SDM) to study the GF’s impact on total factor energy efficiency. They found that GF positively affects energy efficiency, and Internet development and ER can help GF to further improve energy efficiency. Lee and Lee adopted a two-way fixed effects model to study GF’s impact on green total factor productivity (GTFP). They also concluded that GF significantly improves green productivity [

22]. Lee and Wang [

23] used the fixed effects model to study GF’s impact on energy efficiency, and found that GF significantly contributes to energy efficiency. Xu et al. [

24] used the same model as Lee and Wang [

23] to study GF’s impact on GTFP. They found that GF positively promotes GTFP. Tan et al. [

25] adopted a difference-in-differences model to study the green credit policy on energy efficiency of 36 sectors in China, and found that it could improve energy efficiency. Liu et al. [

26] found that GF was a highly supportive financing tool for energy efficiency of E7 economies. However, some experts believe that GF cannot promote energy efficiency. For instance, Wang et al. [

27] used the Tobit model to study GF’s impact on China’s regional energy efficiency. They concluded that GF cannot promote energy efficiency nationally and has a regional heterogeneity. Yu et al. [

3] used the same model as Xu et al. [

24] to study GF’s impact on the energy efficiency of developing and developed economies. They found that GF negatively affects energy efficiency. Hou et al. [

28] used the panel autoregressive distributed lag model to study the nexus between GF, Fintech, and energy efficiency of 10 Asian economies. They found that Fintech negatively affects energy efficiency, and increasing GF leads to a decline in energy efficiency in the long run. In addition, Meng et al. [

29] used the generalized method of moments (GMMs) system to study GF’s impact on energy efficiency. They agreed that GF and energy efficiency had a positive U-shaped relationship. In addition, only a few scholars have included some moderating variables in their research on direct effects to study how these variables moderate GF’s effect on energy efficiency [

20]. In summary, scholars have focused on GF’s impact on energy efficiency at the macro level, but little research exists on the relationship between the two in the industrial field. Moreover, there are more studies on China and fewer comparative studies on other countries and regions. Also, econometric methods are commonly used for empirical testing. Regarding the research viewpoint, scholars have yet to reach a consensus on the relationship between the two.

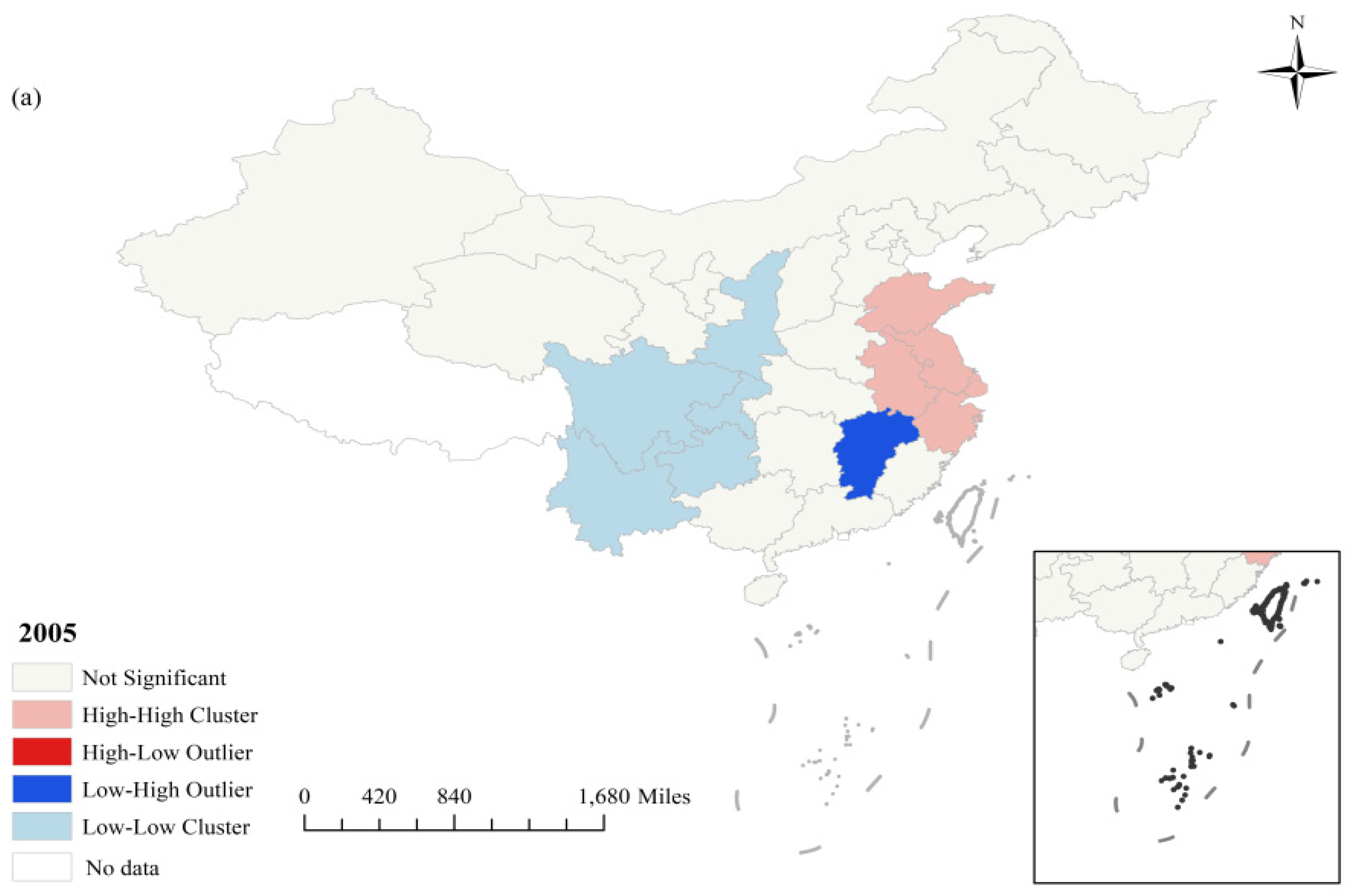

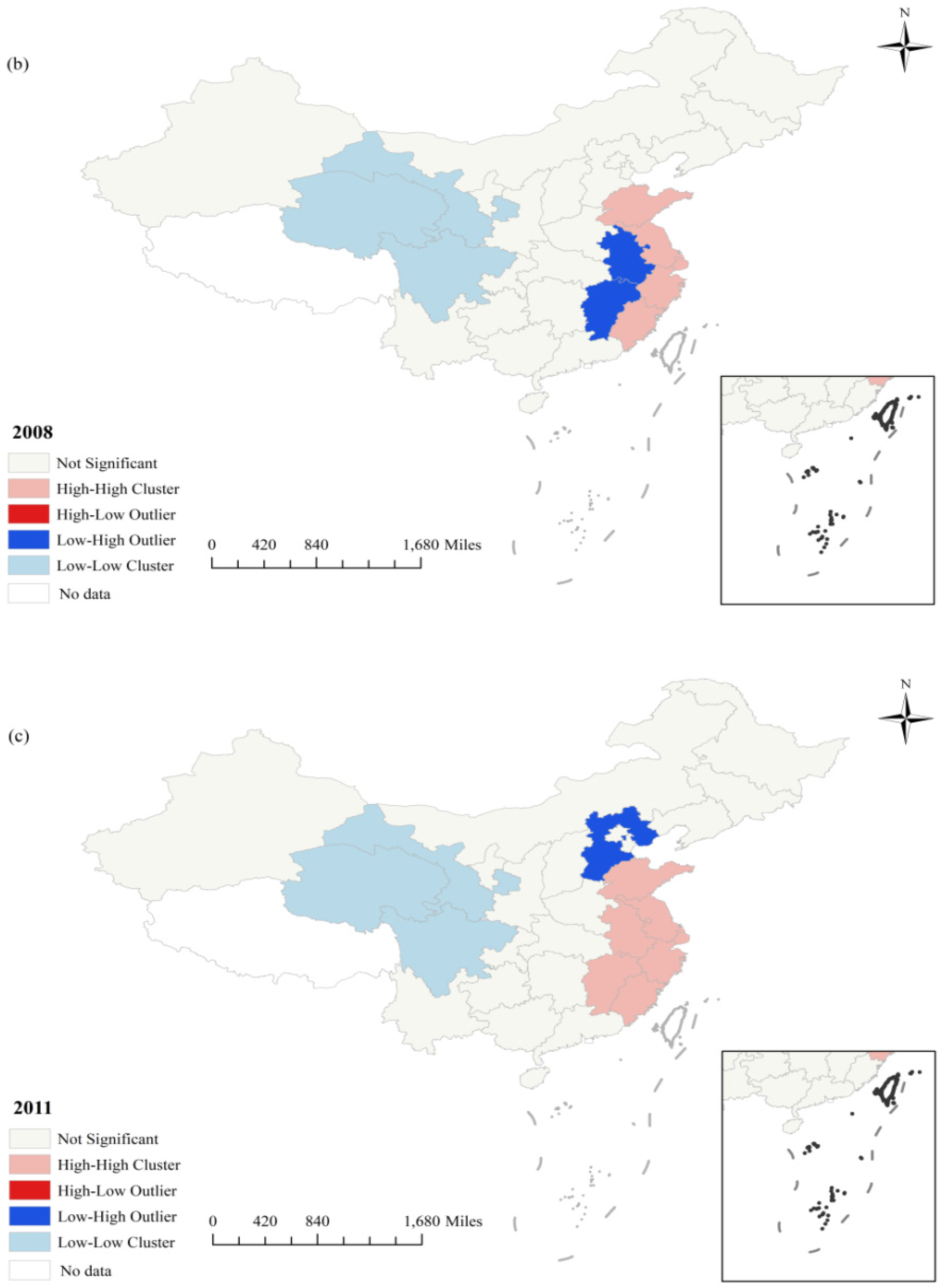

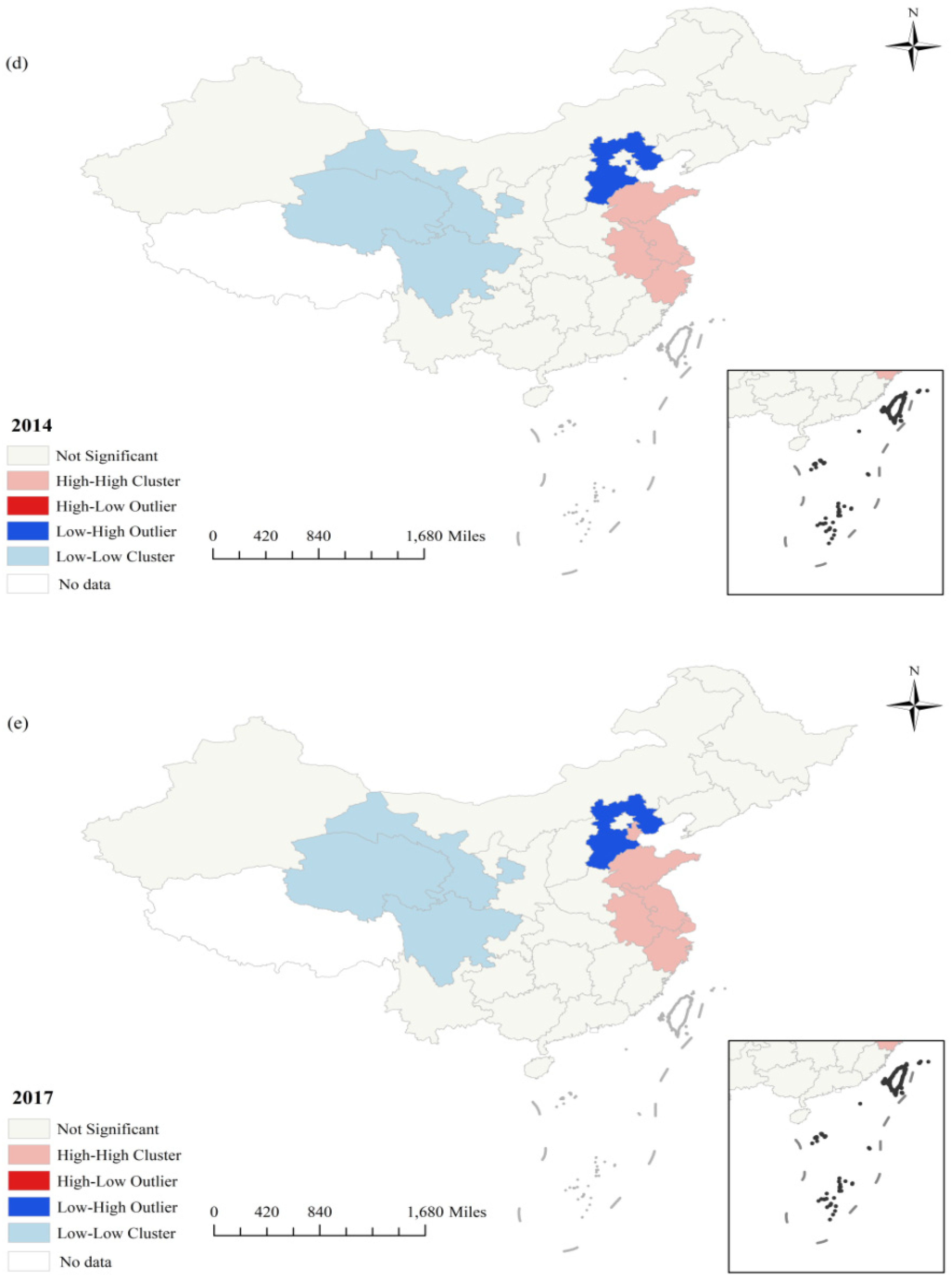

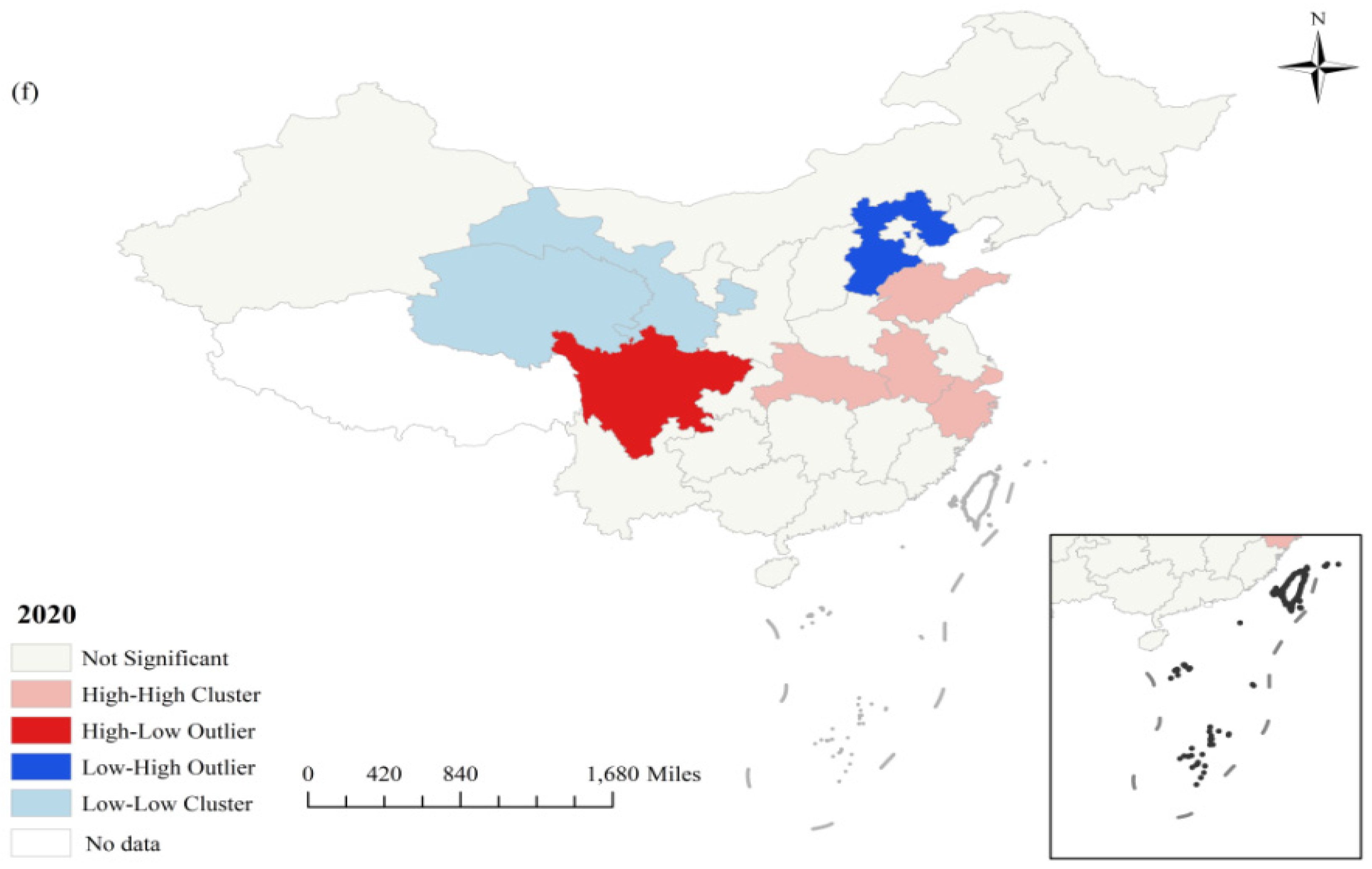

Therefore, the question arises as to whether GF promotes energy efficiency improvement in the industrial sector? If this is correct, then how strong is that effect? Moreover, further research is still required, such as that on the impact of heterogeneity, moderating effects, nonlinear effects, and spatial spillover effects of GF on IEE. In light of this, to further test the relationships between GF and IEE, we selected the panel data from the period 2005–2020 from 30 of China’s provinces to investigate GF’s direct impact, heterogeneity, and other various effects on IEE and the spatial clustering characteristics of IEE. In this study, we aim to clarify the mechanisms of GF that affect IEE to help accelerate China’s industrial green low-carbon transition process and provide a reference for optimizing relevant policy design and experience for other countries or regions to use GF to promote IEE improvement.

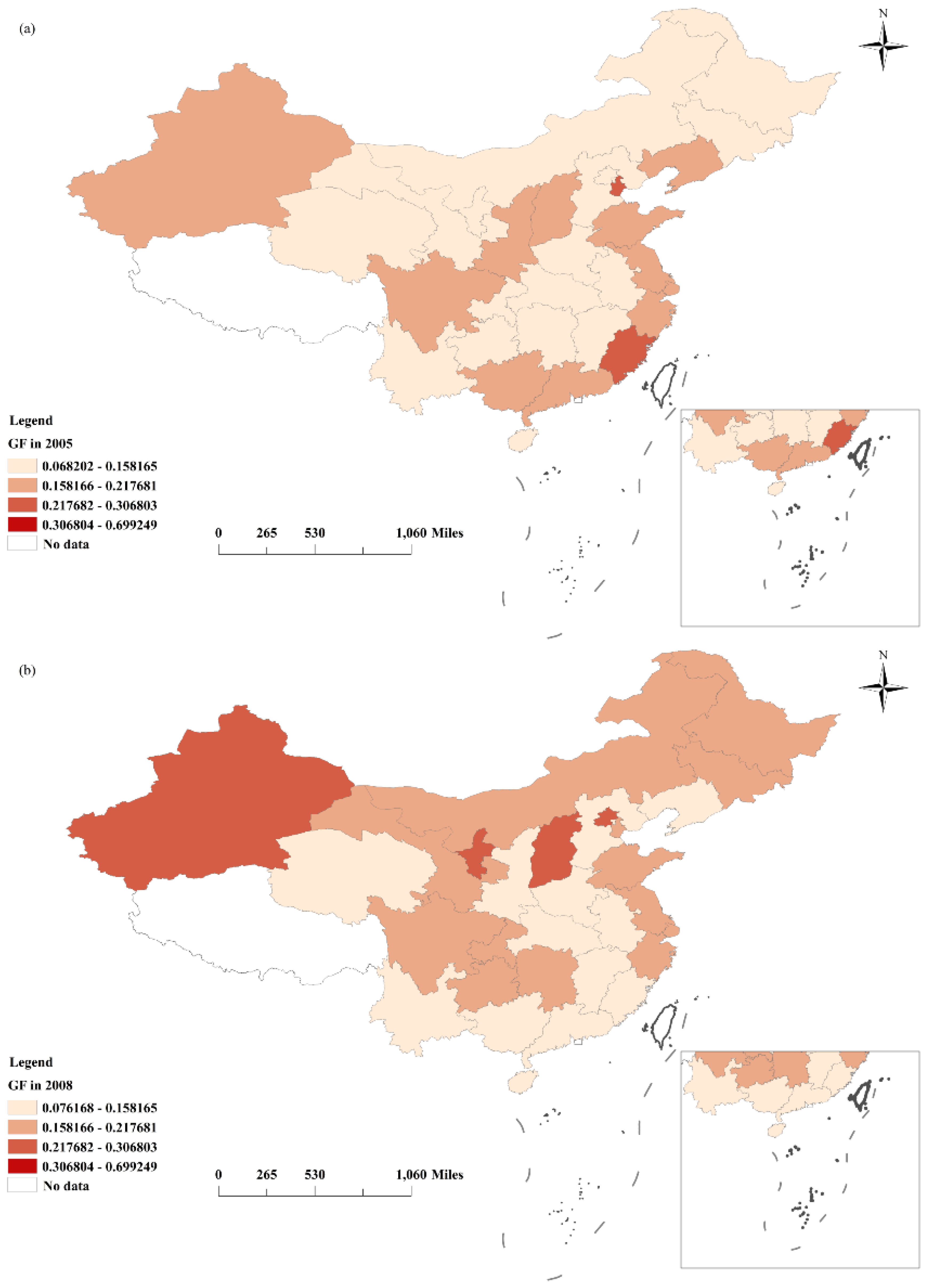

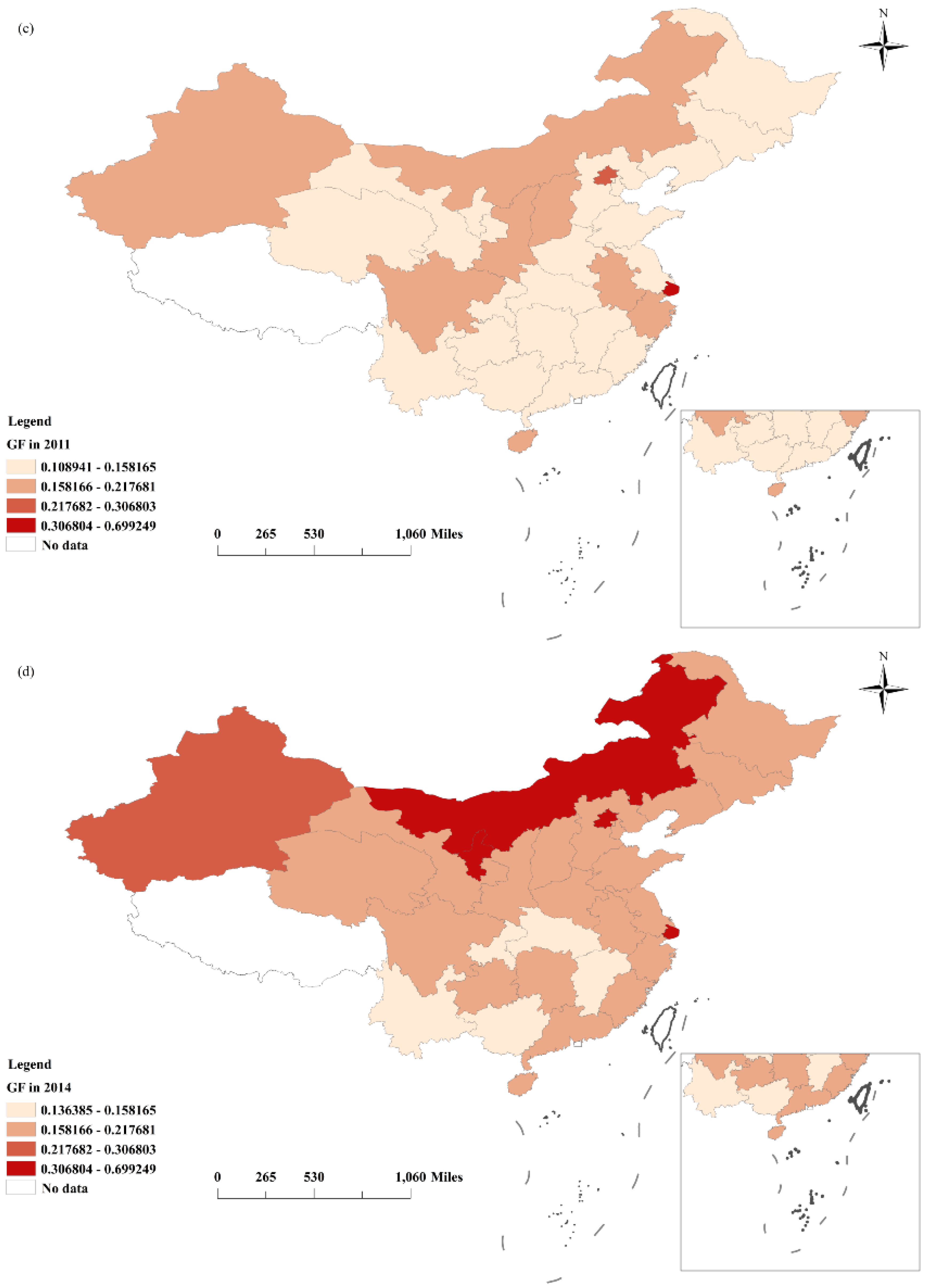

This study has made several contributions. First, based on an industrial level, the effects of GF on IEE are clarified, which has complemented the theoretical study of GF’s effects on energy efficiency. Second, the regional heterogeneity, moderating, nonlinear, and spatial spillover effects of GF on IEE are verified through empirical tests, which have enriched the existing studies [

20,

27,

30], and provide empirical evidence for GF’s improving effects on IEE. Third, the spatial clustering characteristics of IEE on the map are also taken into account using ArcGIS 10.8 software. Such results will help us to develop more effective policy measures to improve IEE.

The study is organized as follows. The next section presents the theoretical hypotheses.

Section 3 describes the methodology, which mainly includes the main models, variables, processing explanations, and data sources.

Figure 1 shows the methodological framework of this paper.

Section 4 summarizes and analyzes the main research findings while conducting robust tests.

Section 5 discusses the policy recommendations. In

Section 6, the conclusions are provided.

5. Discussion

In this section, we discuss several policy recommendations and illustrate how our results will affect further research.

First, more policies should be instituted so that GF can effectively improve IEE. The previous research has revealed that the most significant obstacle to energy efficiency improvement is insufficient investment; therefore, the limitations of green financing and renewable energy policies must be addressed [

8]. The GF system of China is still in its initial stages; consequently, more policy support should be provided [

9]. Specifically, the policymakers should introduce policies that encourage banking institutions to innovate and develop diversified and flexible GF portfolio products. For example, measures such as relaxing loan conditions, lowering interest rates, and providing longer loan terms and flexible repayment methods should be put in place to guarantee that industrial green and low-carbon transition projects have sufficient funding support [

13]. Moreover, the local government must deliver policy documents to encourage industrial enterprises to increase their annual R&D expenditure. For instance, cooperation between government, industry, and the academic community should be strengthened [

5] to solve those bottleneck problems that industrial enterprises face through the performance of significant scientific research projects. In addition, policymakers should formulate and revise differentiated GF and energy-efficiency improvement policies based on the actual industrial situation, and the corresponding supporting mechanisms should be provided to maximize policy implementation effectiveness.

Second, it is crucial to increase the marketization level. Our results suggest that ML significantly positively regulates the promotional effect of GF on IEE. Therefore, the government should accelerate the market-oriented reform based on the regional marketization process. For example, government interventions in resource allocation should gradually be reduced. Additionally, the institutional barriers should be eliminated, and competition mechanisms should be introduced, creating a favorable market environment for the development of various industries. In addition, market-oriented mechanisms should be fully employed to stimulate green innovation in state-owned and private enterprises and to improve their overall competitiveness. For example, economic incentive policies should be prepared to encourage industrial enterprises to develop green and highly efficient equipment and processes [

7], helping to obtain GF support to improve IEE.

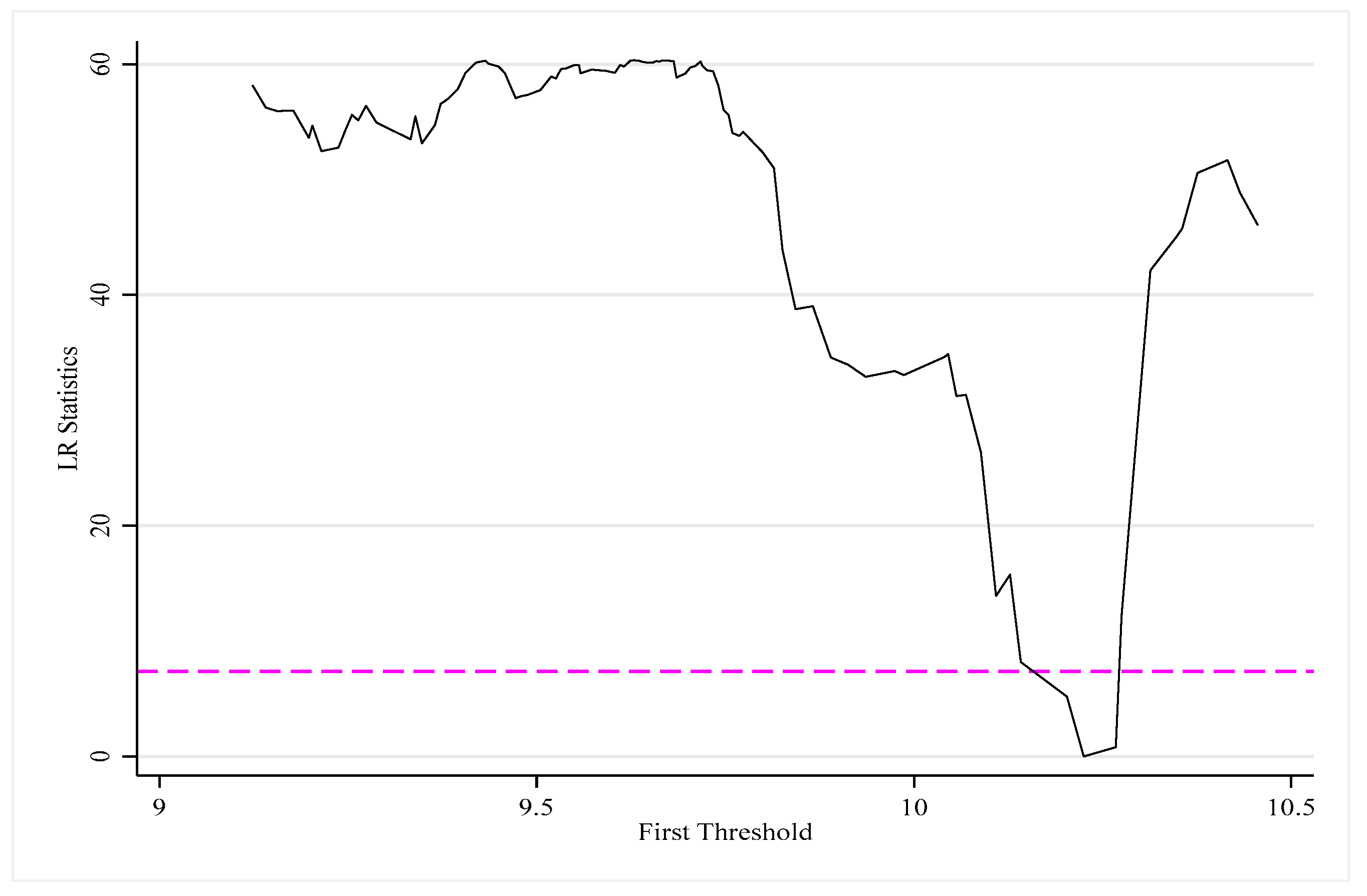

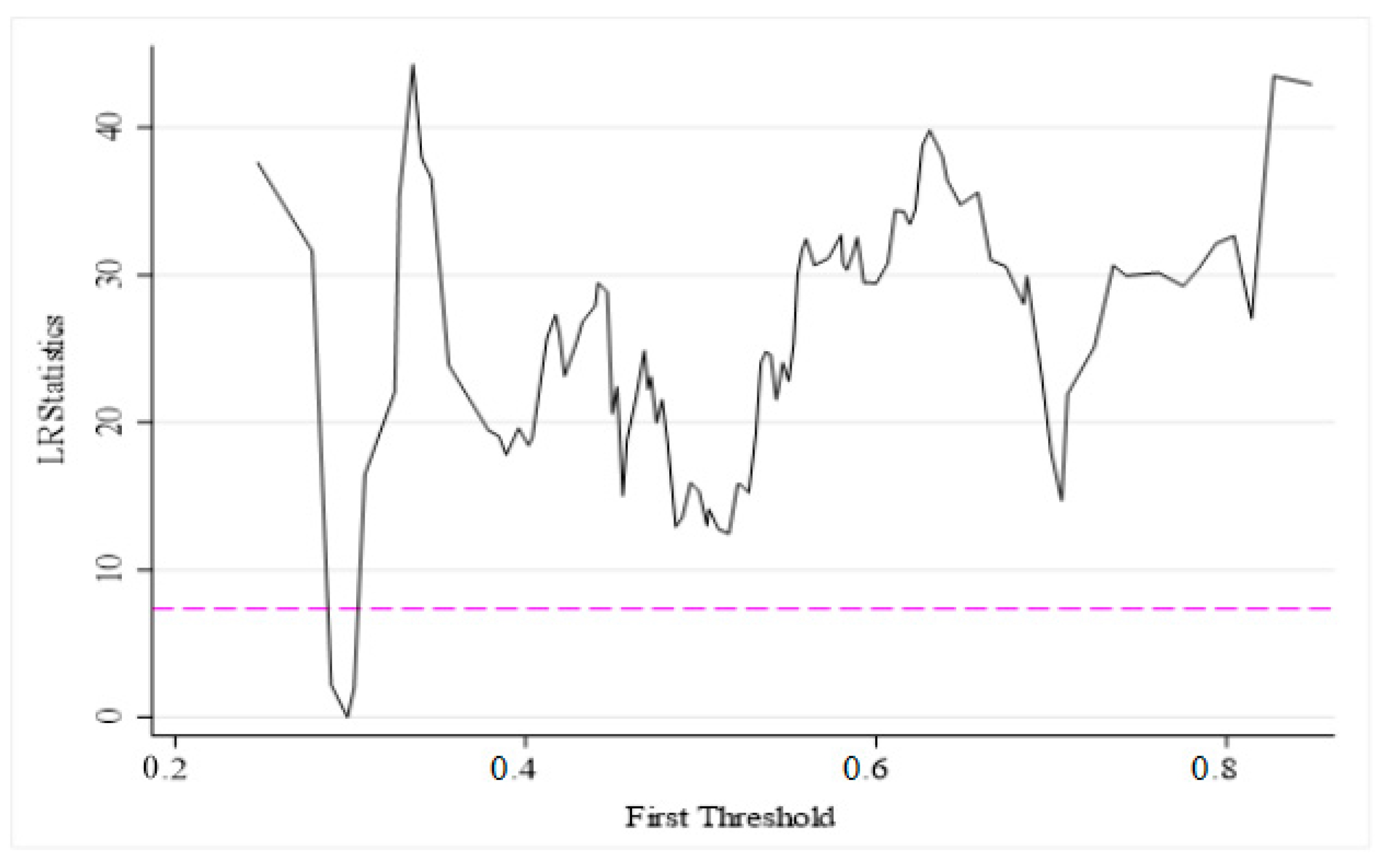

Third, it is critical to improve the level of GF. Our results indicate that GF’s impact on IEE exhibits a single threshold effect of EDL and GCL. China‘s economic growth rate has declined. Zhou et al. [

8] found that GF can significantly improve economic development; therefore, improving the level of GF is crucial. However, GF is still in its early stages and so the GF levels in various provinces must be accelerated for improvement. A key responsibility of the provincial governments is to define clearly the scope of GF’s project support and payment standards, thereby helping to ensure that GF is used effectively. Moreover, the provincial statistical departments should strive to perform excellent annual statistical monitoring related to GF, such as identifying which projects in the industrial sector receive GF investment every year and accurately calculating the total investment amount. In addition, a tracking mechanism should be established to conduct the post-evaluation of the invested projects, the timely disclosure of the effectiveness of GF-supported projects, and the further optimization and adjustment of GF’s relevant policy design. Moreover, the government should accelerate the establishment of provincial and regional integrated GF service platforms, strengthen deep cooperation among banks, insurance companies, professional institutions, and leading enterprises in the green industry, and improve GF levels in various provinces.

Last, it is critical to encourage cooperation and exchanges between industrial enterprises. Specifically, the industrial enterprises in the western area could accelerate the transition and perform upgrades through learning from the advanced experiences of the eastern and central areas. The central area should play a bridging role, and the eastern region could obtain rewards by providing guidance services for industrial enterprises in the western and central regions, achieving win–win development. Moreover, strengthening the cooperation of industrial enterprises within the same region [

56] would promote the overall regional improvements in IEE. In addition, the local government should eliminate regional barriers, further accelerate the free flow of elements, and optimize the resource allocation between regions [

40].

The results of this study will influence future research through the following aspects:

(1) Our study has strengthened the determination of the Chinese government and enterprises to enhance IEE by leveraging GF. Researchers should increase their research on the optimization design of policy systems for GF and energy efficiency improvement, and conduct simulation of policy effects to help the government revise general and differentiated policy documents. (2) Scholars should strengthen the exploration of achieving market-oriented operation mechanisms in the industrial sector and help GF improve its role in improving IEE. (3) Scholars need to increase research on improving or reconstructing traditional economic growth models and find long-term stable economic growth conditions and paths in the digital economy era. At the same time, they should increase research on the theoretical models of how GF can effectively support industrial green and low-carbon transformation. (4) The government should enhance research on communication and cooperation mechanisms among industrial enterprises in different regions of China and achieve win–win development for industrial enterprises.