1. Introduction

It is a challenge for modern economic policies to decouple energy production from carbon emissions in order to combat Human-Caused Climate Change (HCCC). The case for an economy in its developing phase is that energy use, specifically electricity generation, occurs primarily from fossil fuels (FFs), like coal and oil [

1]. This is especially true due to the structural integration of FFs with economic growth ever since the industrial revolution, with all developed nations of the world banking on FF use to power their economies over the past century [

2,

3]. With HCCC having palpable and long-term detrimental effects on the environment, it is economically difficult to structurally decouple FFs and introduce alternative clean energy, such as renewable energy (RE), for electricity generation in developing economies, like India and China [

1,

4,

5,

6]. Both India and China have large populations and a fast-growing economy, which is dependent on tremendous amounts of energy generation to keep the economic machinery functioning [

7]. Rapid structural change can lead to drastic short-term socioeconomic shocks, making energy transition a non-straightforward solution [

3].

Decoupling is achievable not only by clean RE, which involves intermittent sources like wind and solar energy [

3,

8], but also by advancing cleaner generation from oil and gas and increasing production efficiency [

9]. However, continual technological advancement needs innovation, which must be powered by economic growth, implying that there needs to be an incentive for the same. From a macroeconomic perspective, levels of CO

2 emissions can be an indicator of the propensity for energy transition [

8]. As a result, most macroeconomic models measure decoupling as either energy intensity reduction or emission intensity reduction [

3]. However, it has been argued in the literature that the Gross Domestic Product (GDP) is not necessarily an indicator for growth [

10], with studies often pointing that the total capital is what determines the capability to innovate [

11]. Thus, the first issue within an economy–electricity–emissions (3E) nexus is to establish the behaviour of how each macroeconomic determinant affects CO

2 emission levels with the complexity of the GDP, capital, and even international trade being part of dynamic feedback systems [

12,

13,

14]. This paper attempts to create several control systems to approximate the real-world behaviour of the Indian 3E system to gauge the exact level of decoupling in electricity generation.

The second aspect of this paper tackles the main deficiency in the current literature. While GDP is treated by existing econometric models as linear or exponential while estimating the causality with emissions [

3,

14,

15], higher-order phenomena are seen in economic growth. Specifically, bi-stage cyclic patterns of growth and recession in business cycles are prevalent [

16]. At the peak of a business cycle, interest rates are the lowest, leading to expanding GDP growth and simultaneous energy use, which also causes inflation [

17]. It may be pointed out that innovation also hits a peak at this point. However, to control inflation, interest rates are risen by federal banks, which contracts the GDP and production (ultimately energy use), termed as the recession phase [

16]. To the best of our knowledge, the existing research fails to address how the decoupling of emissions in power generation changes within the business cycle. Thus, the second target of this paper is to empirically analyse various 3E control systems to identify the dynamics of CO

2 emissions in business cycle phases and their relationship to macroeconomic variables. For achieving decoupling in a developing economy, it is imperative to identify how the status of decarbonization changes in the higher-order behaviour of economic systems [

6,

9].

The third issue of measuring the decarbonization of electricity in developing countries is the impact of exogenous shocks on the incentive of decoupling, which has not been addressed in the macroeconomic literature. For example, the sub-prime mortgage crisis of 2008 was a global phenomenon that changed the course of RE development sharply, with Chinese solar panels overtaking Japanese and European production sharply [

18]. At the same time, developing nations’ carbon emissions and the emission intensity of electricity use sharply increased post-2008 crisis [

18,

19], implying that there was lesser incentive to generate clean power over FF power. While many previous studies have revealed how decarbonization patterns changed in the aftermath of the 2008 crisis [

18,

20,

21,

22], the macroeconomic linkages that accelerate CO

2 emissions are not known. In the rebound of COVID-19, we have also seen a rebound of emissions. While it may be argued that COVID-19 is vastly different from the sub-prime mortgage crisis, a macroeconomic lens will visualize both crises as a sudden shock to the GDP and consumer demand [

18,

23,

24].

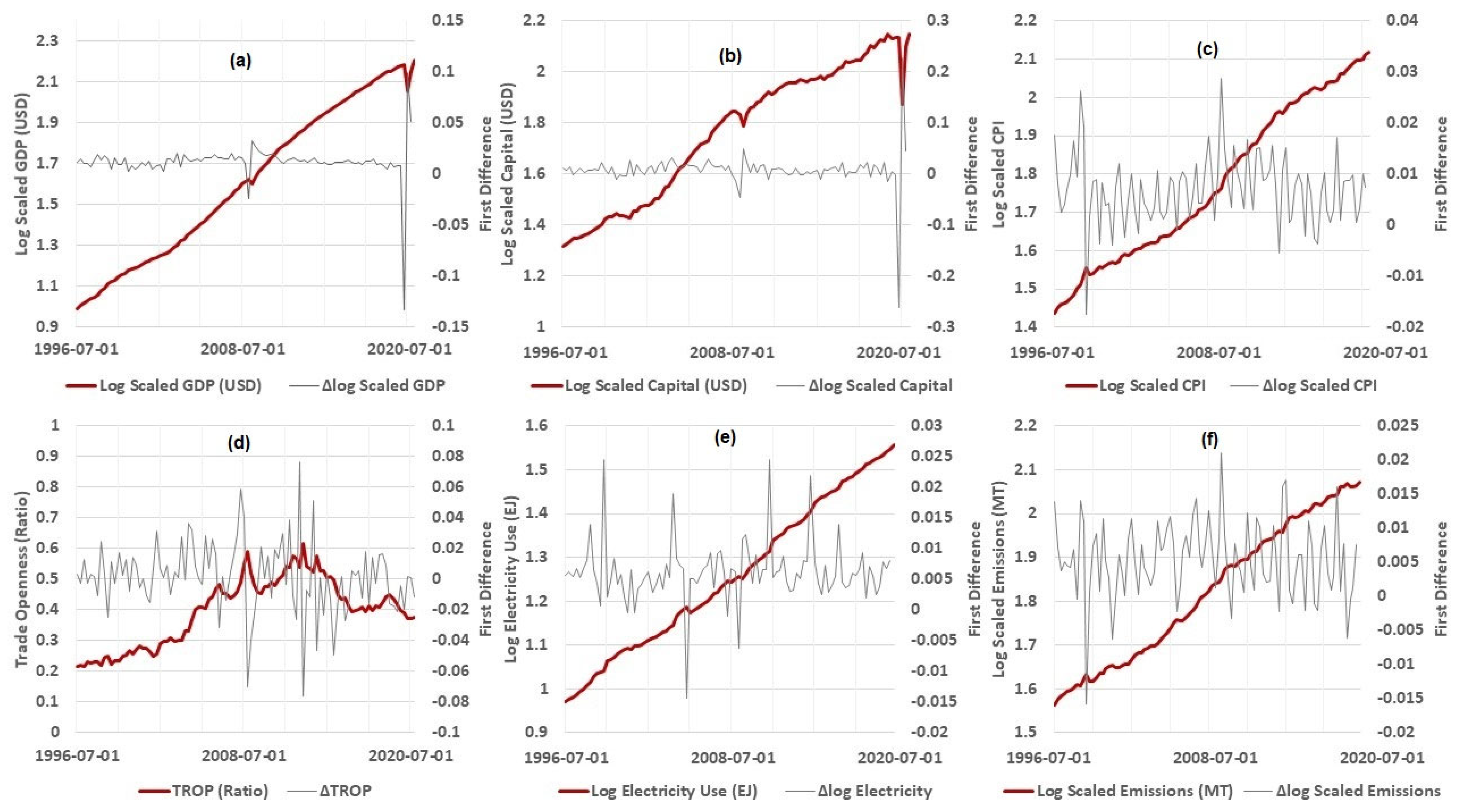

This paper focuses on the causalities of the decarbonization of power generation in India in relation to macroeconomic variables and how such causalities are impacted by higher-order economic behaviour and economic shocks. India was chosen as the case study because it is the most populous country, with a significant portion of the country being below the poverty line [

25], which affects the incentive for decoupling. With FF penetration increasing from 11.7 TJ (2000) to 29.6 TJ (2020) [

26], more than a third of the total power generation comes from coal [

27], which suggests that a fast-growing economy is not necessarily boosting RE [

28]. Simultaneously, economic growth has been noticeable, with the GDP increasing by 550% in this period [

29,

30], notwithstanding that inflation has increased by 5.8% [

31] and cumulative emissions have increased by 250% [

32] from 2000 to 2020. Secondly, unlike other fast-growing developing economies like China, the 2008 crisis did not significantly contract the GDP or cumulative emissions in India [

33], but CO

2 emissions decreased by 6% in the year following COVID-19 [

34]. This has drastic impacts on the 3E nexus’ decarbonization efforts, which previous research has not addressed with higher-order GDP growth [

3,

9,

20,

21]. Thirdly, India is a much larger net importer of oil products than China [

28], which raises the question as to how electricity-related emissions have changed in relation to Trade Openness (TROP) during higher-order movements and before and after economic shocks.

The importance of this paper is to delineate the interplay of the incentive for innovation in decoupling in the electricity sector of a fast-growing, developing economy during business cycle movements and the economic shocks of 2008 (financial crisis) and 2020 (COVID-19), such that economic policies for net-zero targets can be identified in a post-pandemic world. This research explores the key macroeconomic pathways that can eventually lead to a stable achievement of net-zero targets and the continued decarbonization of electricity generation [

35]. The rest of the paper is organized as follows:

Section 2 shows a literature review to introduce the theoretical basis of macroeconomic frameworks in order to build the hypothesis across economic events.

Section 3 shows the methodology that is used to analyse the linkages within the 3E nexus, and

Section 4 introduces the data of the analysis.

Section 5 presents the results and discussions of policy implications, and

Section 6 shows a robustness analysis of the results. The final section concludes the main findings of this paper.

2. Literature Review, Hypothesis Development, and Macroeconomic Frameworks

The theoretical basis for this paper lies on the inverted U-shaped Environmental Kuznets Curve (EKC) hypothesis. The ‘inverted U’ postulate of the EKC hypothesis implies that, in the initial stages of economic growth, CO

2 emissions increase, while upon economic maturity, emissions decrease [

8,

36]. The primary concern with this hypothesis is that there are several studies which do claim the existence of the EKC, specifically in high-income and high-RE-penetrated economies [

6,

8,

21,

24]. However, about 20% of the studies refute the existence of the EKC, mainly in developing countries [

12,

37,

38,

39]. A major gap in the literature is that most studies focus on total energy use across all sectors and do not focus specifically on electricity generation, which is responsible for the maximum energy use and emissions among the economic sectors in India [

37].

The literature on the EKC can be divided into four strands. The first strand deals with reduction in the energy intensity of the economy, mainly comprising bivariate models employing energy use and GDP as the functional variables. The basis of this hypothesis lies in the fact that higher economic growth results in higher energy use, which leads to efficient methods of energy use, further increasing economic growth [

40,

41,

42,

43,

44]. Granger causality has been extensively used in these studies, but mixed evidence has been found in such cases [

43,

44]. The second strand combines the first type with CO

2 emissions, focusing on the reduction in emission intensity. Normally, such studies are bivariate or trivariate with an energy–economy–emissions nexus approach [

5,

8,

9,

45,

46], with very few studies focusing on the electricity aspect in developing countries [

37,

47]. One particular recent study confirmed that both economic growth and energy use significantly degraded the environment in eight developing Asian nations, including India [

5]. However, the question of the extent of economic shock impact was not analysed, even though the time interval was studied extensively [

5,

9,

45,

48,

49].

The third strand of the literature is a generational advancement of the EKC hypothesis. The dynamic relationships underscoring the pathways for decoupling are examined through the lens of the Cobb-Douglas production theory (which suggests that the GDP is a result of capital formation, labour, and productivity [

50]). The main hypothesis of the studies is not only limited to emission intensity reduction in the GDP but is also extended to emission intensity reduction in capital formation [

50]. Since productivity is ultimately a result of the efficiency of energy conversion, energy use acts as a proxy for factor productivity [

45,

51,

52,

53,

54]. Labor is often proxied by employment [

22,

48,

51,

55], with one study attempting to evaluate the dynamic relationship between electricity-use and employment in India [

56]. A major drawback of most studies in this strand is that the stochastic nature of labour and productivity variation with business cycles is not incorporated into these studies. More so, very few studies have tested the dynamic links with regard to electricity generation [

55,

56].

The final branch deals with the highly stochastic nature of trade (or TROP, as defined in most studies). TROP is non-deterministic and may have completely different trends from business cycle fluctuations, yet very few studies have addressed how the decarbonization of energy use varies with TROP during growth and recession phases. While considering a control system, multiple studies found that increased trade has a beneficial effect on the 3E nexus in the long-run, reducing emissions [

57,

58,

59,

60]. However, in terms of energy transition, increased imports can be a sign of a lack of energy security.

Within the 3E nexus, it has been stated that ‘short-term’ economic growth is aligned with ‘long-term’ decarbonization goals [

18,

61,

62], but the macroeconomic pathway to achieve the same has not been provided. The authors of [

62] argue that economic shocks change RE policy direction, but they fail to empirically show how exactly such a change is sustained in the long-run. While structural breaks do exemplify the change in policy directions [

59,

63], they do not explain which factor aids in the rebound of energy use and how the status of decoupling adapts. Moreover, GDP, TROP, capital, etc. needs to be pivoted to an economic shock to empirically determine the exact pathway of decarbonization in the post-crisis macroeconomy. Decarbonization has second priority compared to economic recovery after COVID-19 [

23], and past studies have only shown the symptoms of COVID-19-related impact on electricity-related emissions [

64,

65]. A clear post-pandemic macroeconomic theory for ensuring decoupling is yet to be empirically determined.

The second gap in the literature is the focus on the specific macroeconomics of India, as the third highest global CO

2 emitter [

32]. While there have been a few studies on the dynamics of electricity production and the GDP in India [

4,

37], no previous research has addressed how inflation affects the dynamics of electricity-related CO

2 emissions. As business cycles change inflation along with the GDP, it is imperative to also answer what the causality of CO

2 emissions and inflation is and how it changes with growth and recession phases. The existing models have mostly used a GDP deflator, ignoring how inflation specifically plays a part in decarbonization [

8,

9,

44,

47,

59]. Specifically, inflation increases after the rebound from a shock [

61,

65], but previous studies have not delineated how the feedback from inflation to the GDP to CO

2 emissions plays out. This is a key contribution of this paper, showing the dynamic links between inflation and emissions, within production and trade models, affected by the 2008 financial and COVID-19 crises in the Indian electricity sector. The modelling framework is schematically shown in

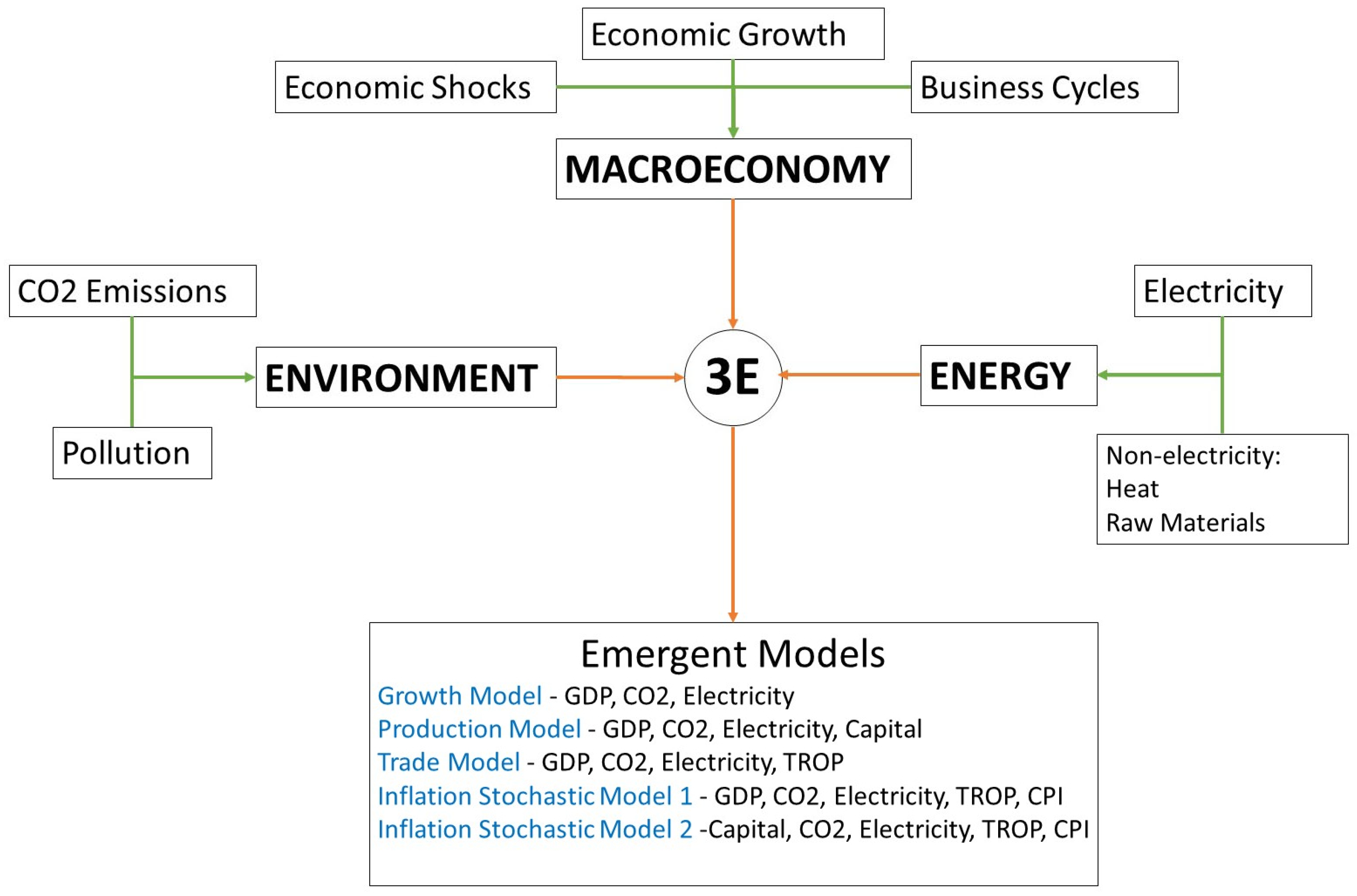

Figure 1.

Within the modelling framework of

Figure 1, this paper will explore five specific macroeconomic models, with specific hypotheses in regard to economic shocks. While the growth model, production theory, and trade stochasticity has been explored in the literature, this study adds inflation stochasticity to examine the specific aforementioned research gap. The 3E nexus comes with expected behaviours, and, from a macroeconomic perspective, the following hypothesis can be adopted, extending the purview of the EKC:

In business cycle movements, GDP and energy use/emissions tend to move in the same direction due to increased money supply during the growth phase, which is where interest rates tend to decrease. Similarly, this causes inflation to rise, which ultimately leads to the reversal of the cycle into the recession phase. As a result, the first hypothesis can be written as follows:

Hypothesis 1. The decoupling of emissions from economic growth is independent of the linkage to inflation emissions.

The second consideration is one of the key foci of this study, which is economic shocks. During economic shocks, economic growth contracts, and the rebound in the economy results from production increase [

18]. The incentive for decarbonization in this rebound phase (or even after a crisis) has not been explained in the past literature; therefore, we can build the second hypothesis, based on the interaction of emissions with the GDP, capital, and TROP.

Hypothesis 2. The decoupling of emissions is inversely related between pre- and post-phases of shocks.

The third hypothesis is built around the higher-order behaviour of economic movements and the information contained in a model representing the 3E nexus. While the growth model captures the long-run behaviour of GDP-CO

2 causalities, it does not necessarily represent the impulse response as real-world behaviour [

5,

49,

55]. We can assume that a stochastic model will represent a real-world impulse response much better than a deterministic growth model.

Hypothesis 3. Decoupling emerges from stochasticity instead of linear relationships with the macroeconomy.

5. Robustness Discussion and Policy Implications

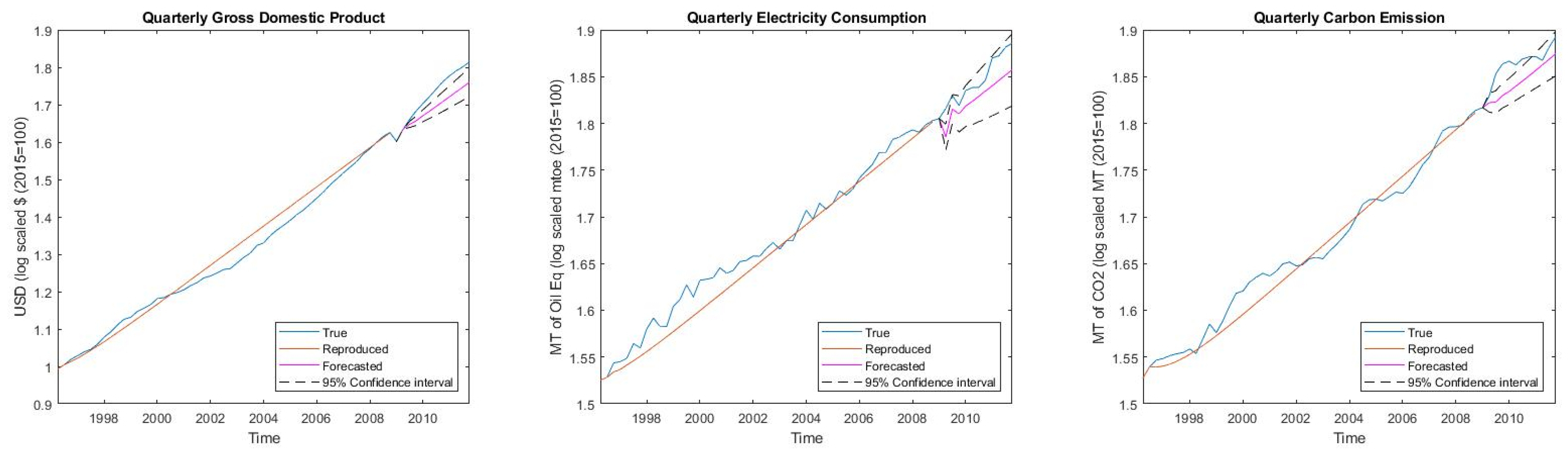

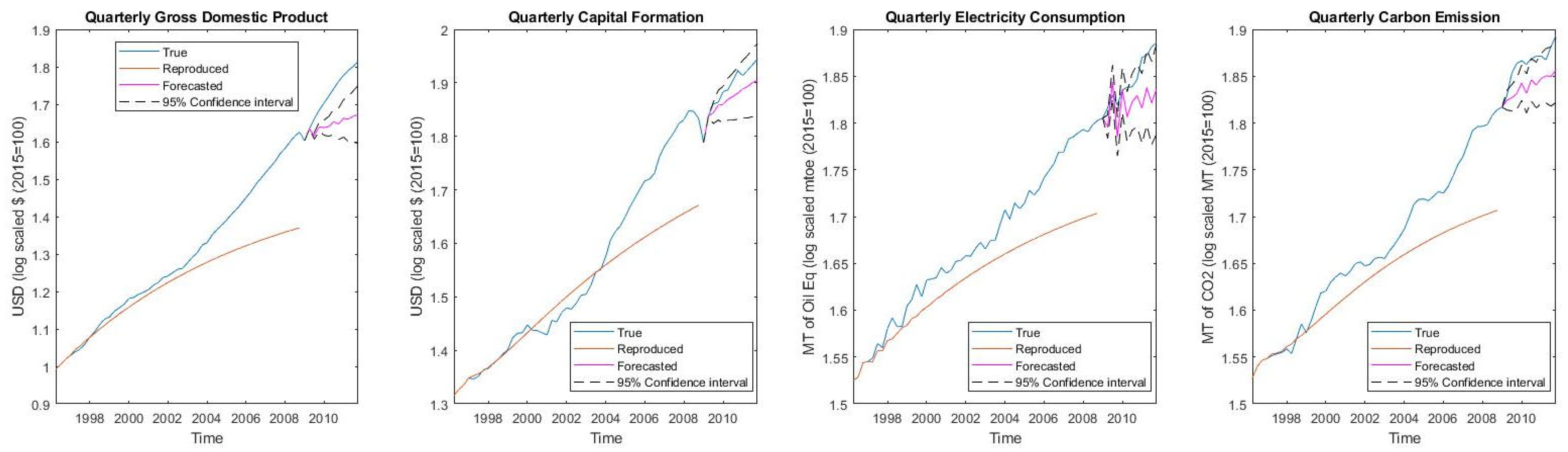

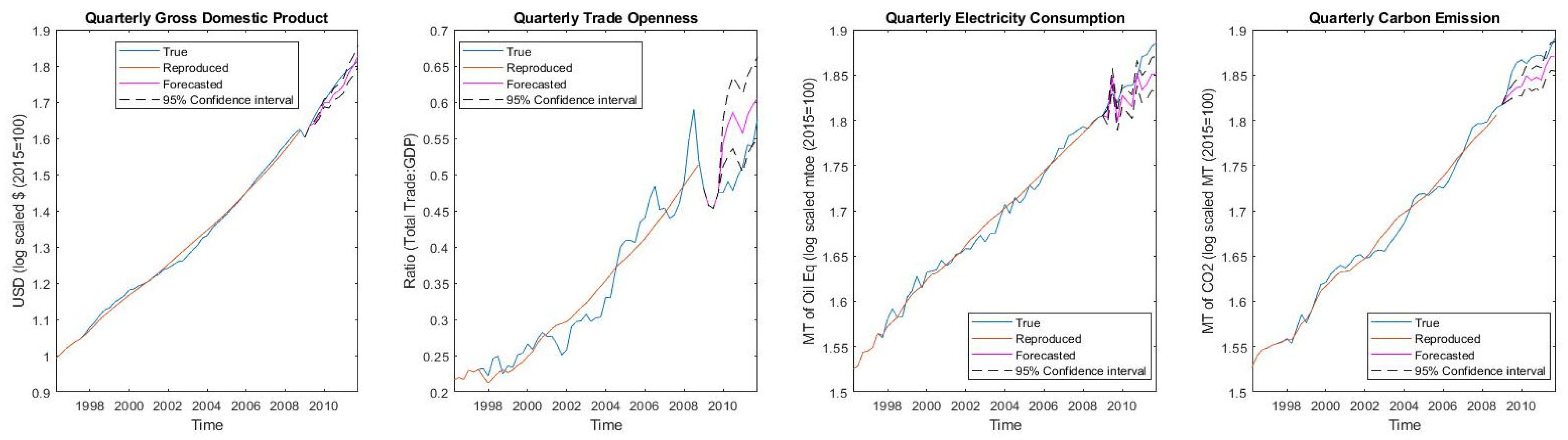

Robustness of the 3E nexus models is required to hold up against the reproduction and forecasting of business cycle movements of macroeconomic variables and rebound from the 2008 financial crisis to ascertain the results of decoupling in the electricity sector.

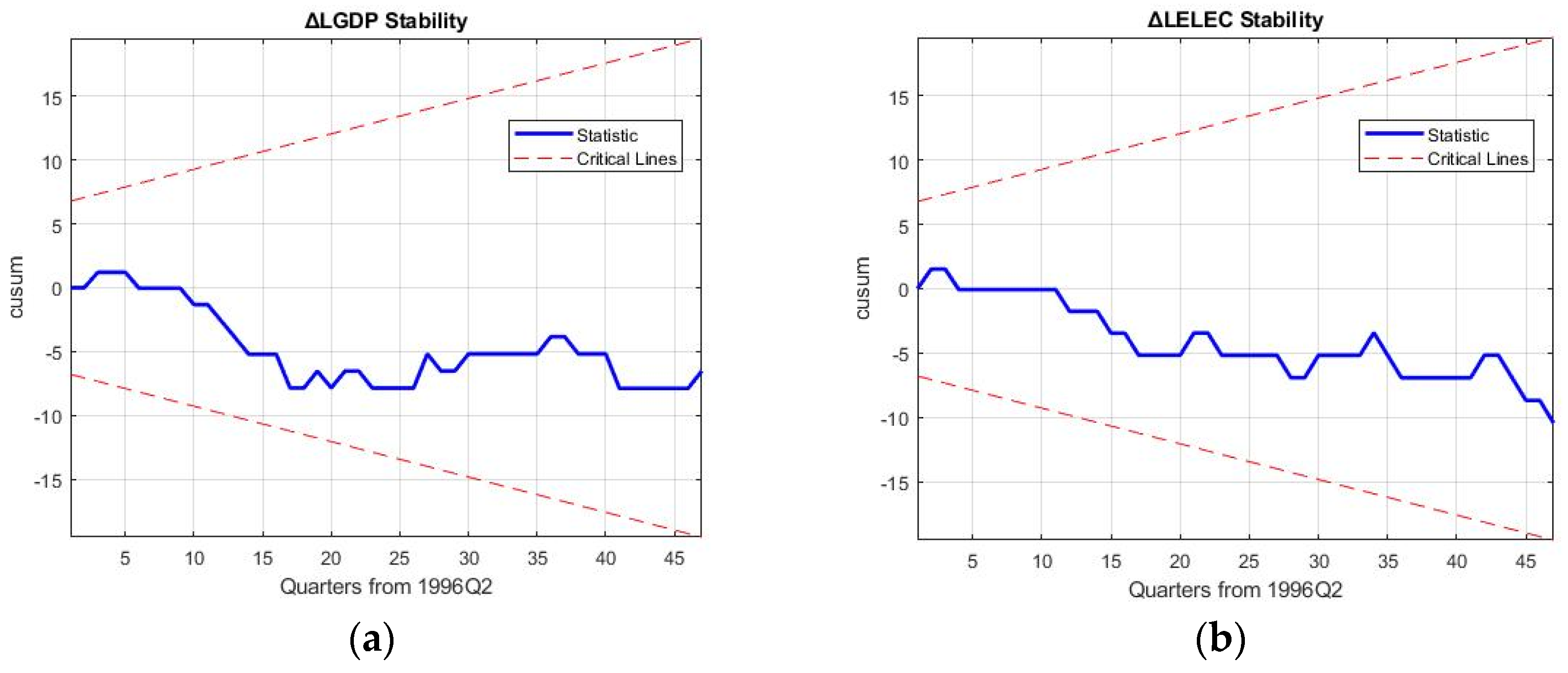

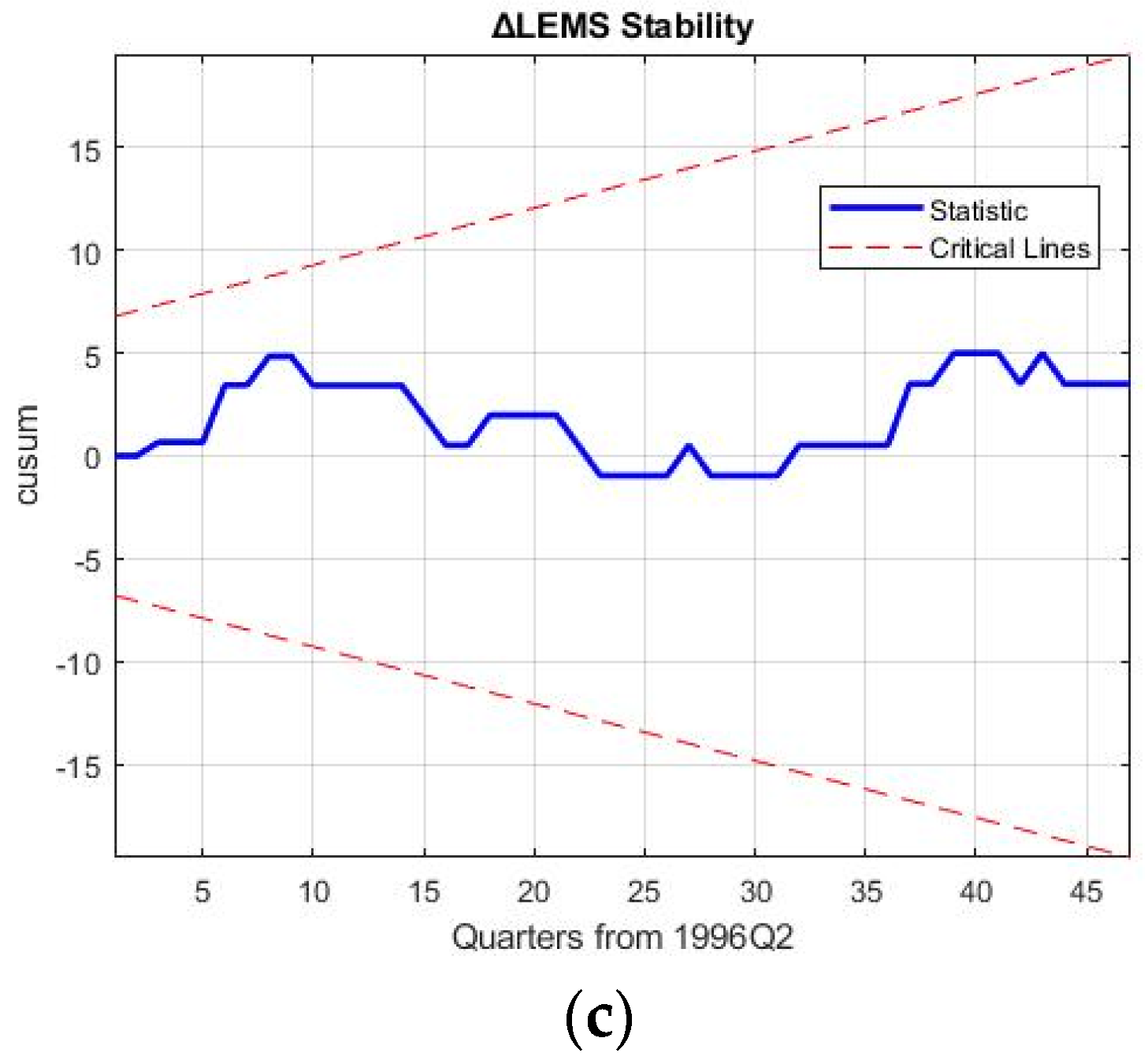

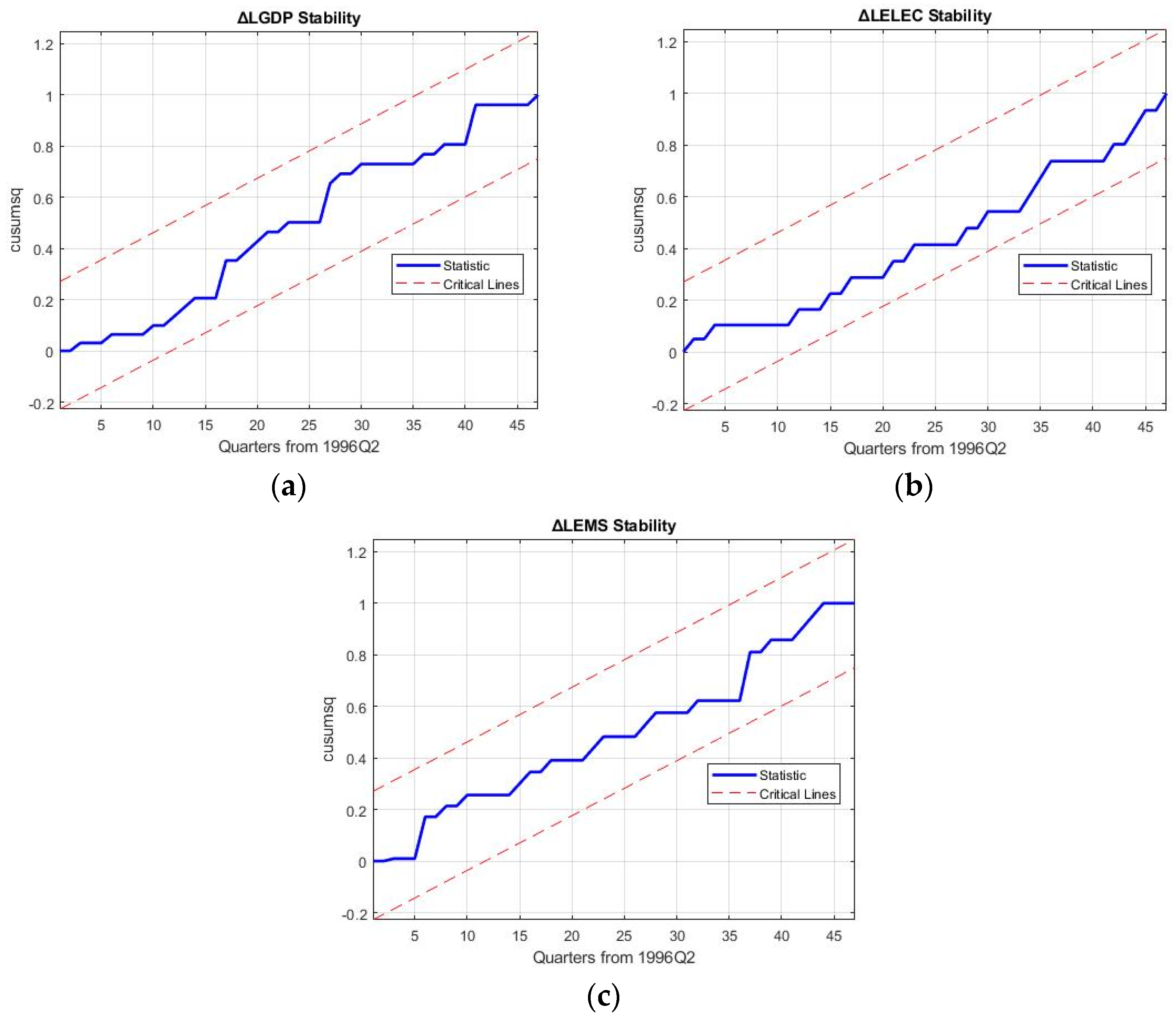

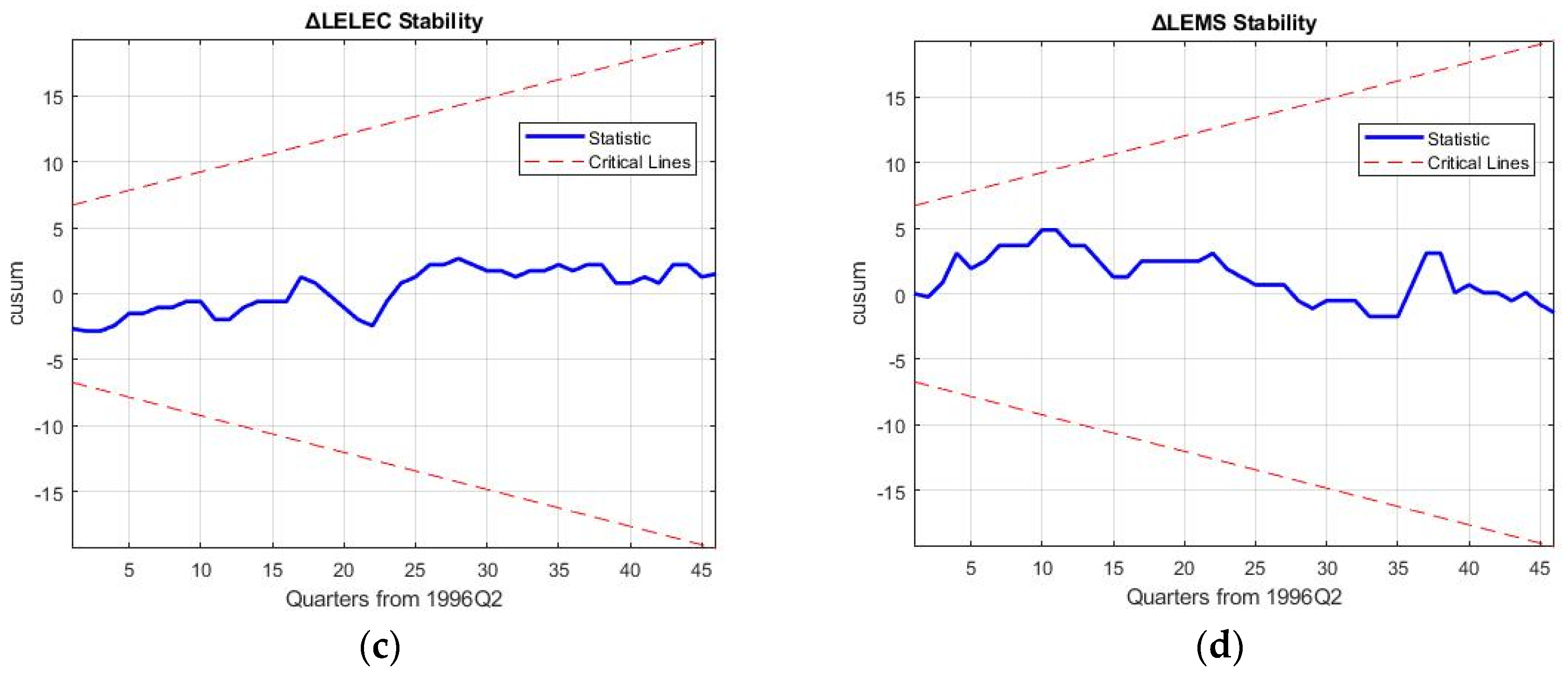

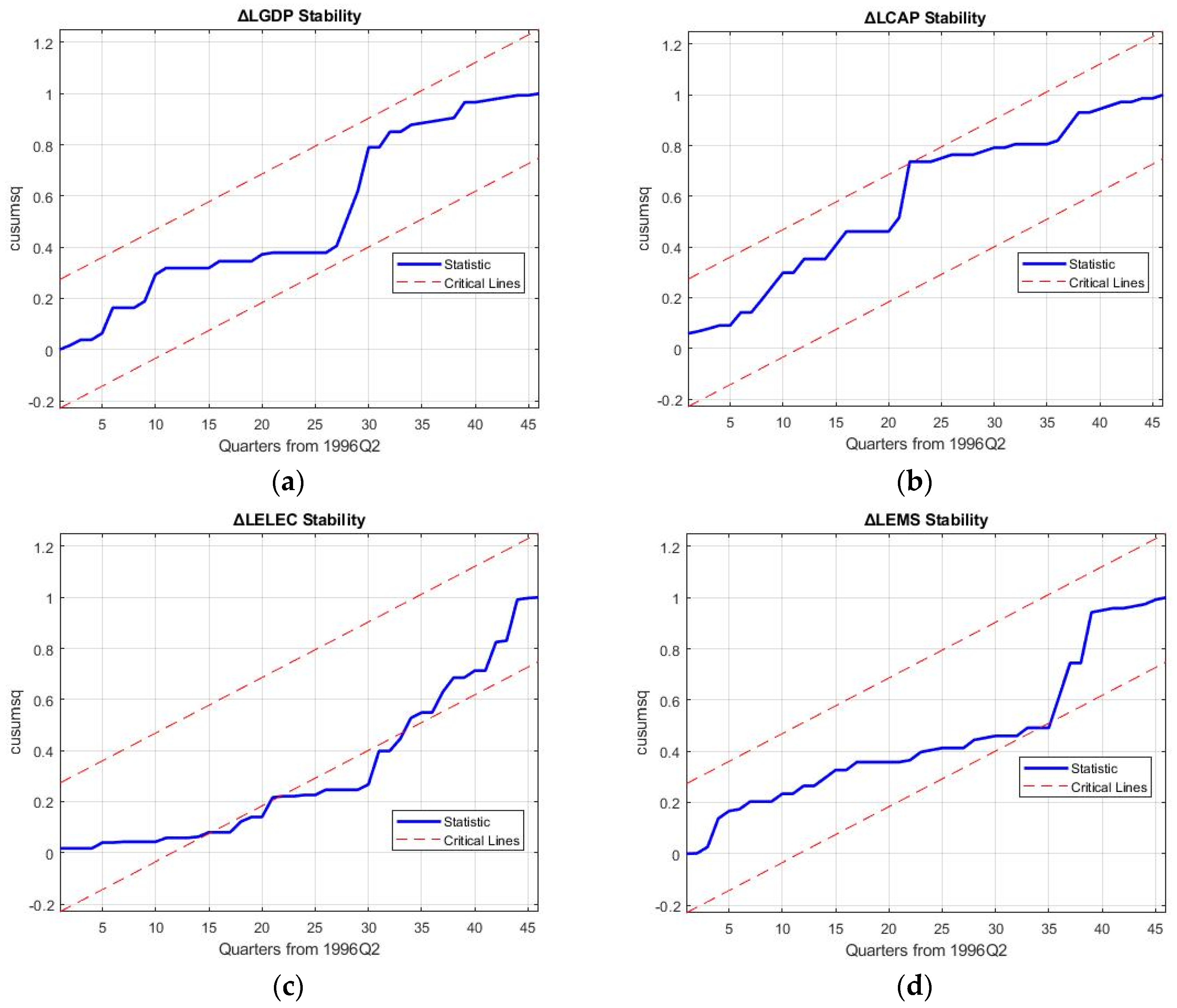

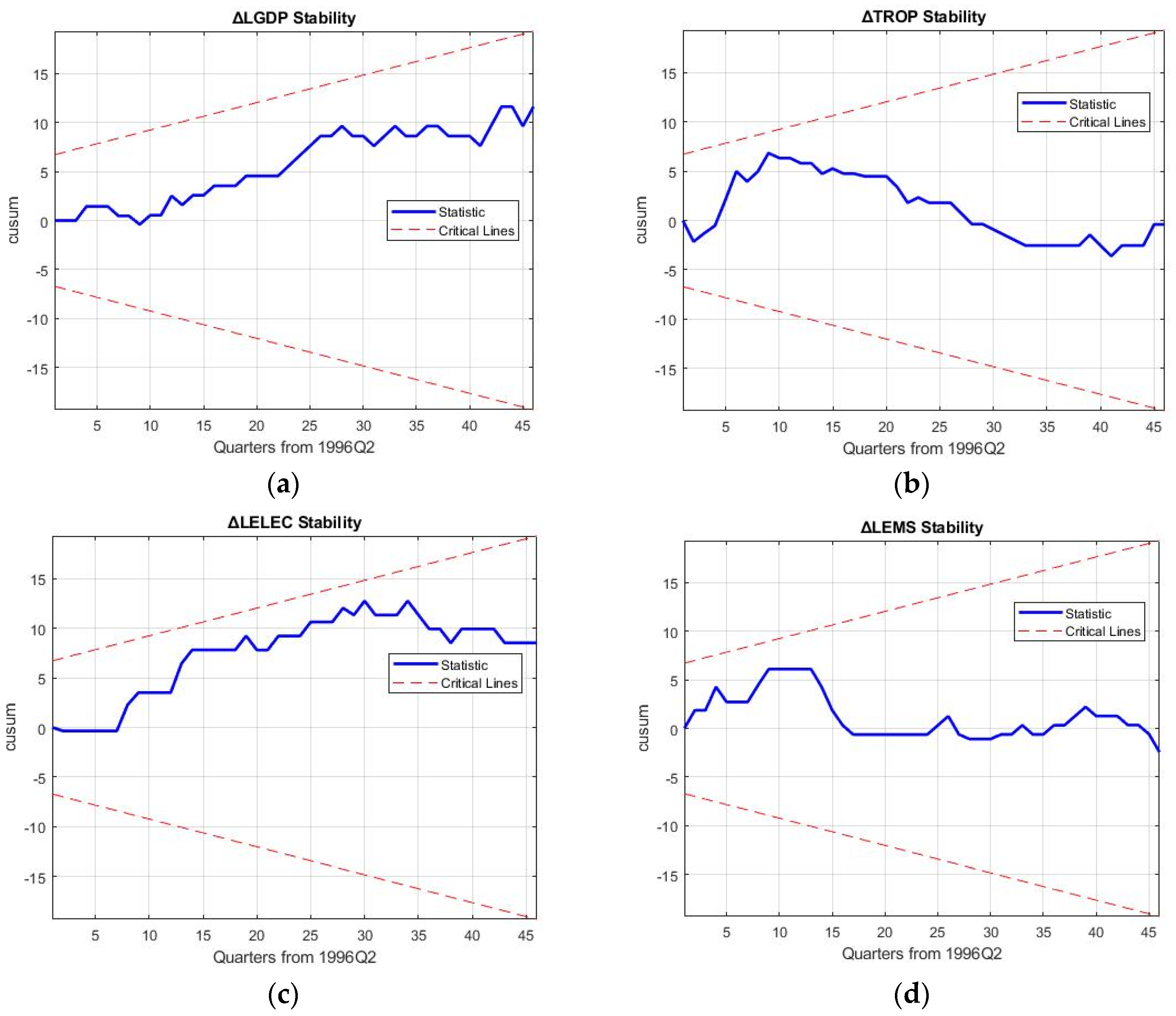

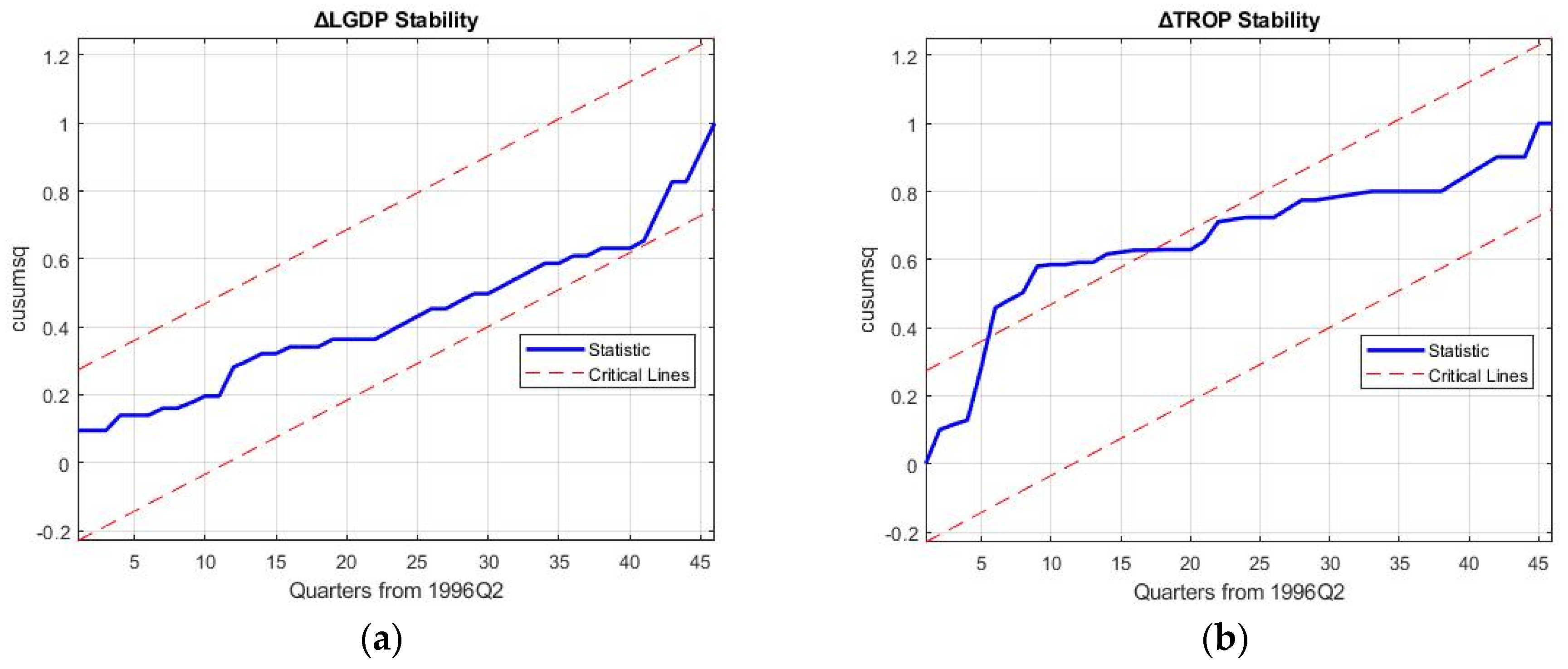

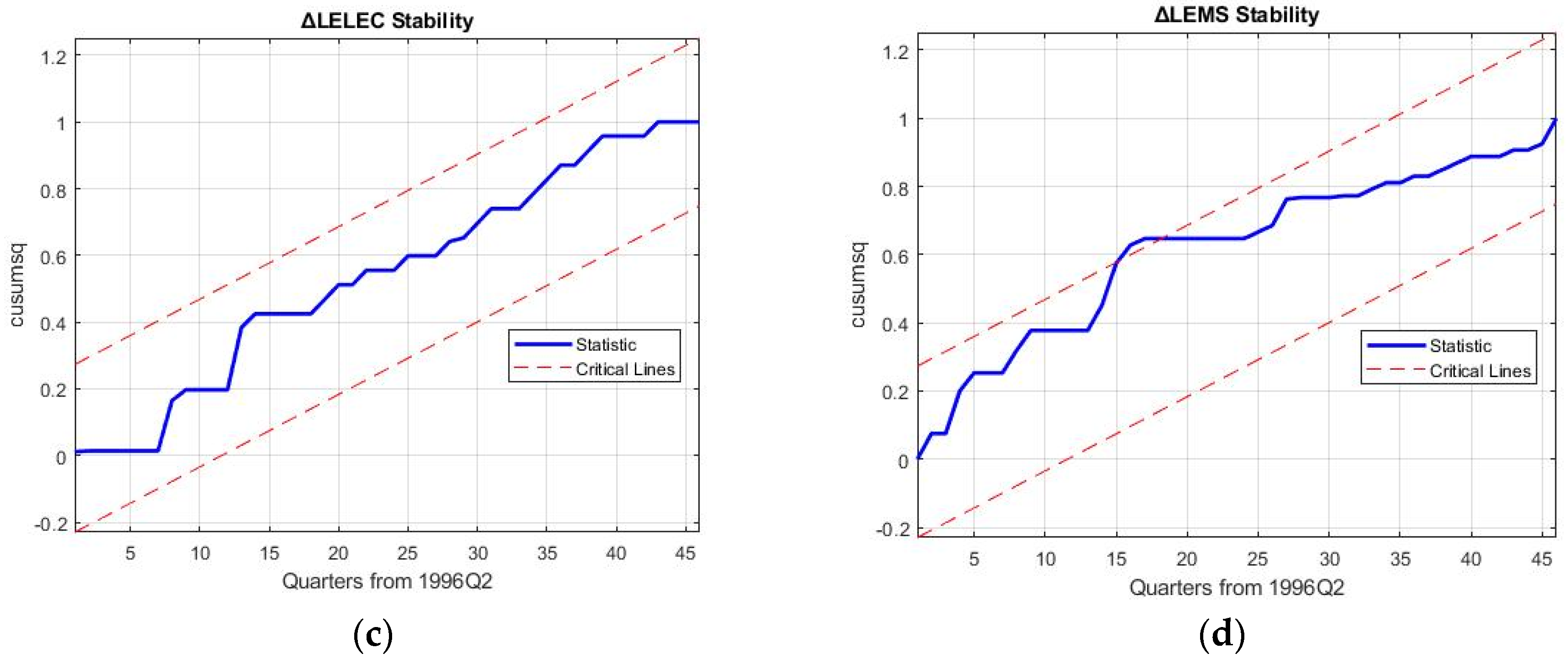

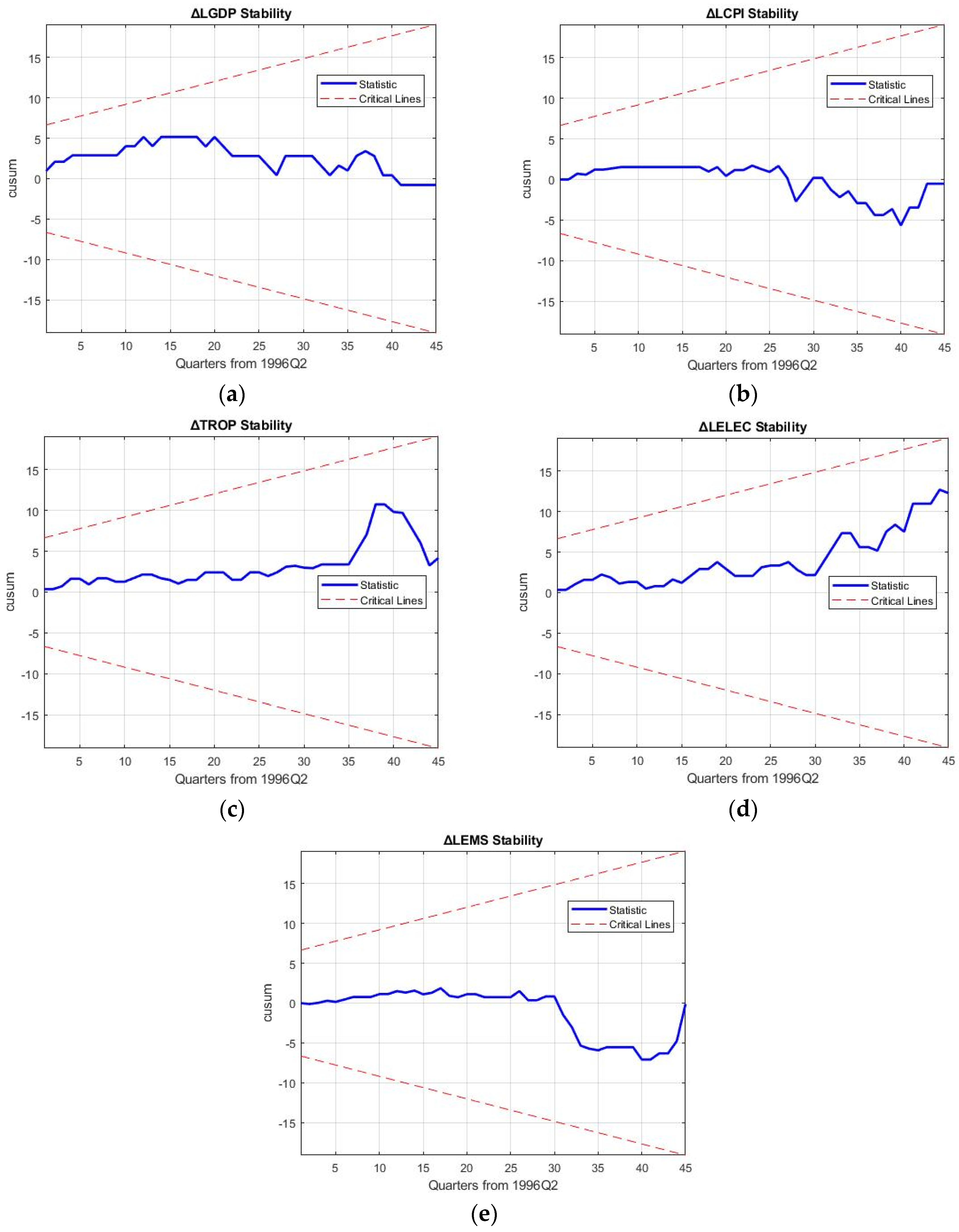

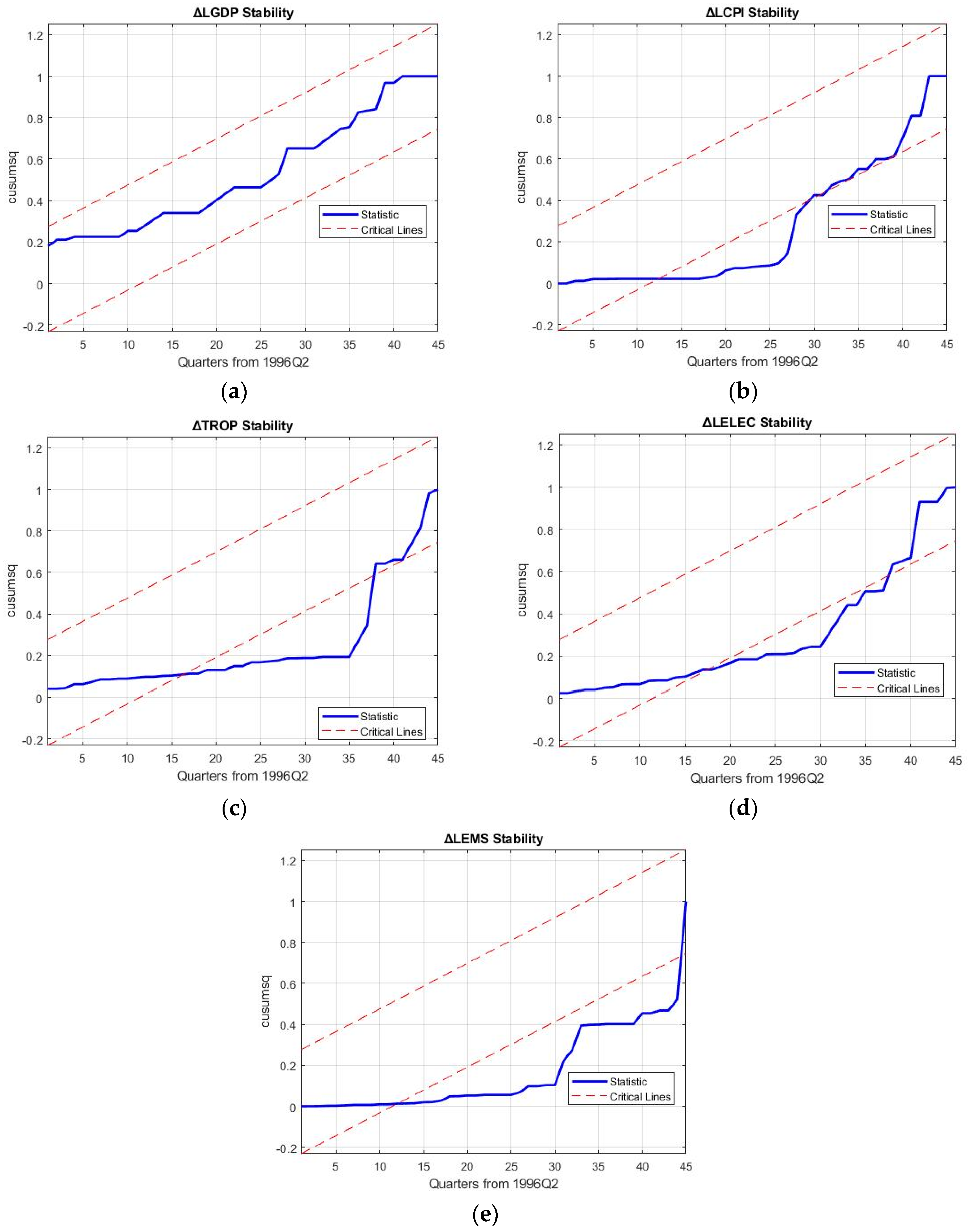

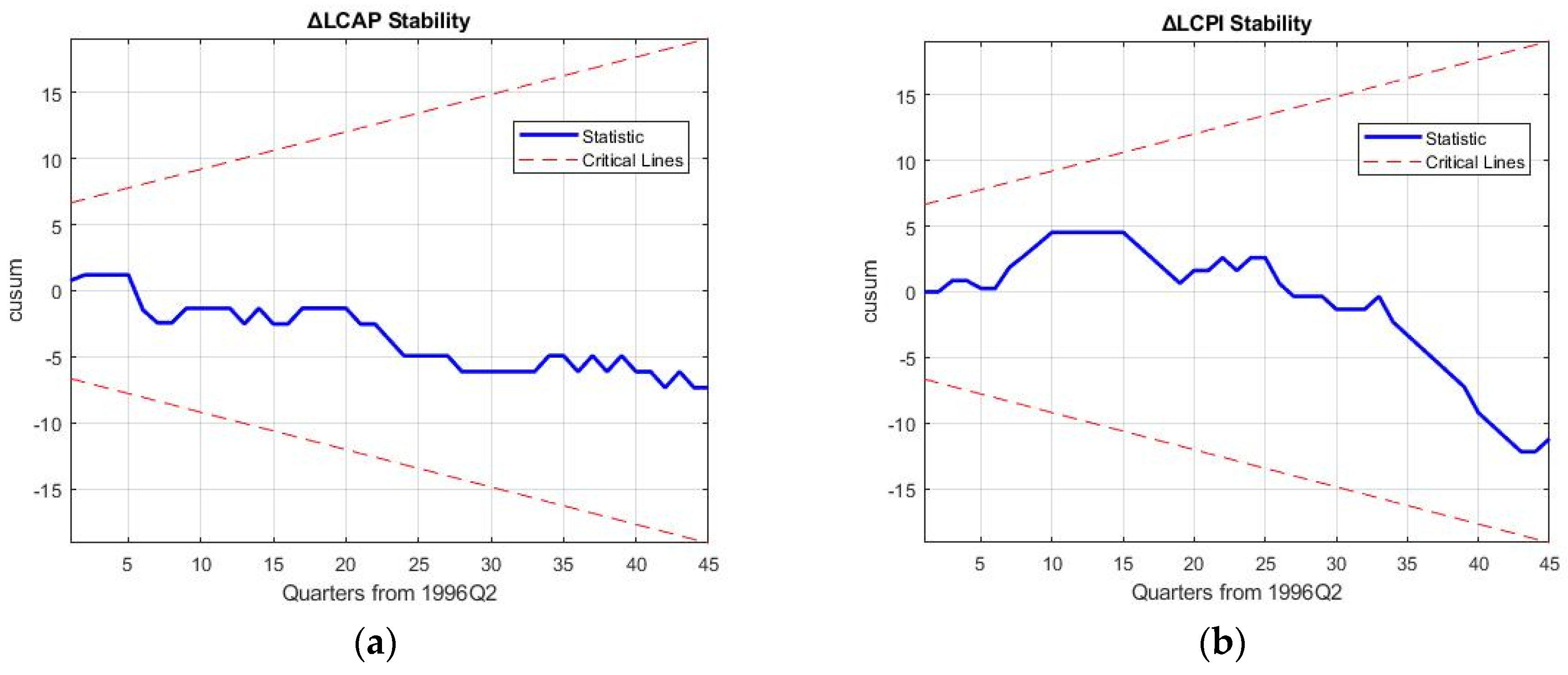

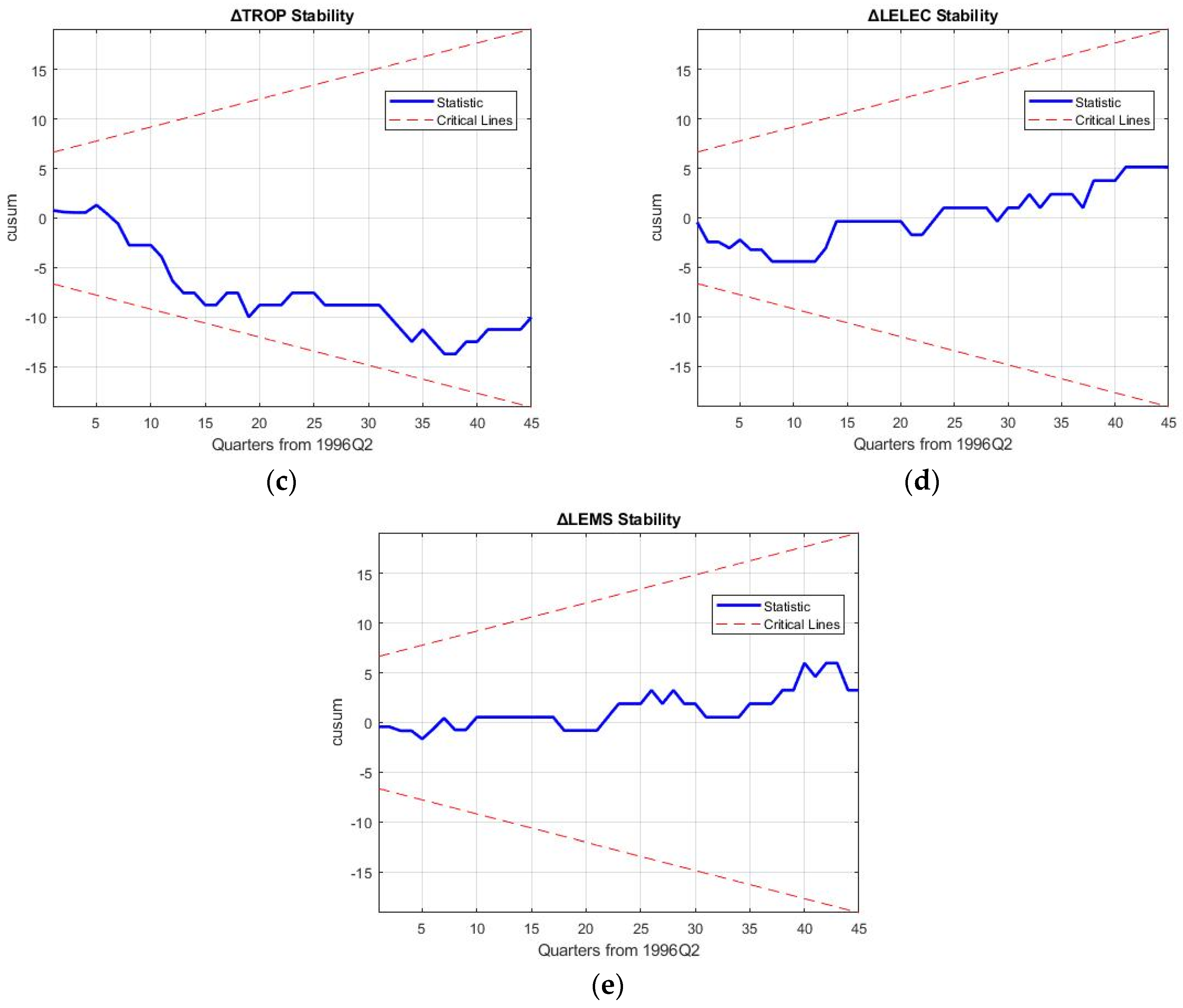

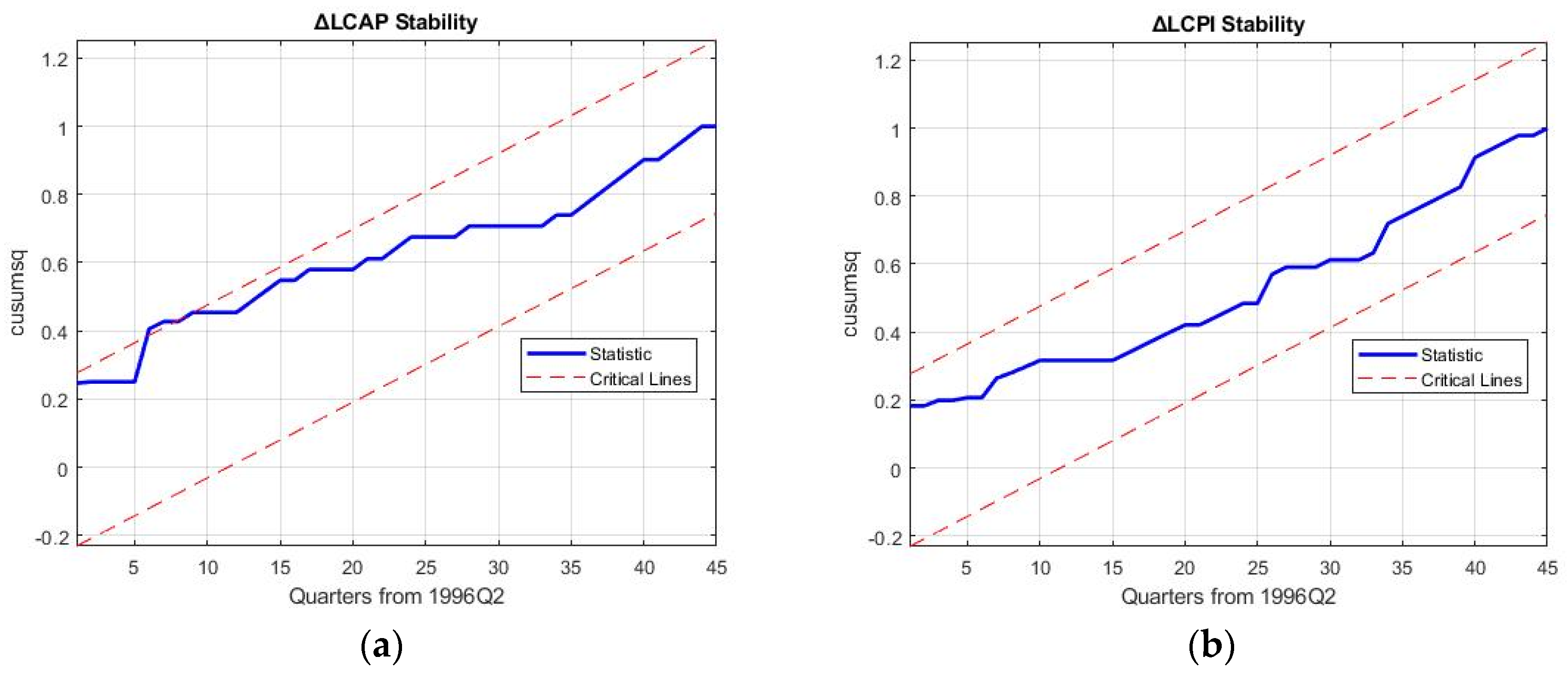

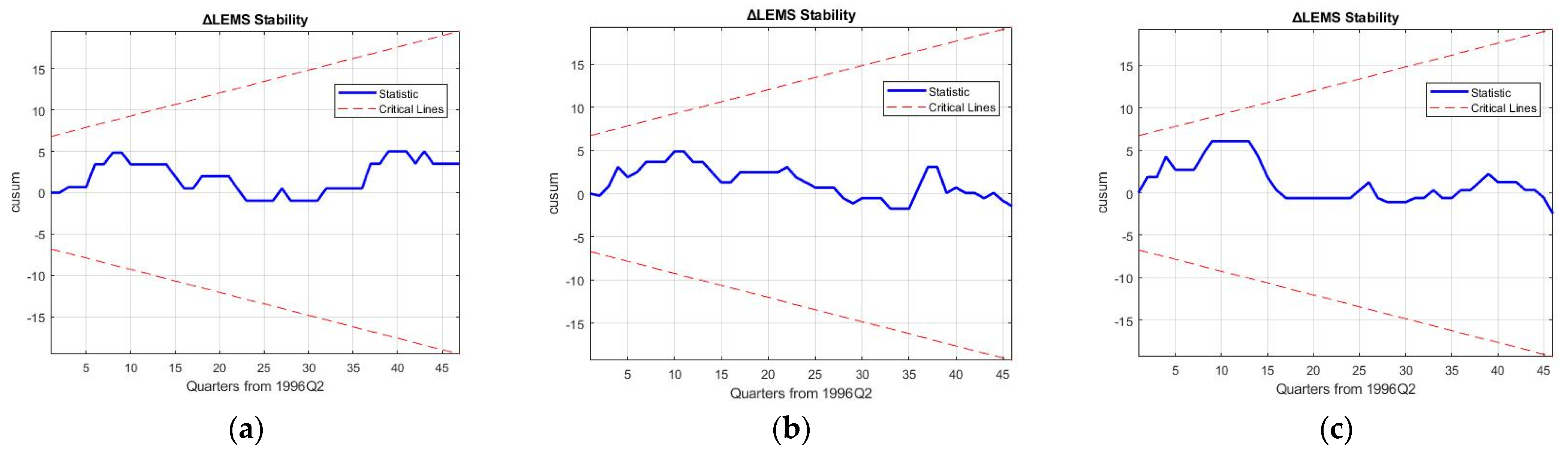

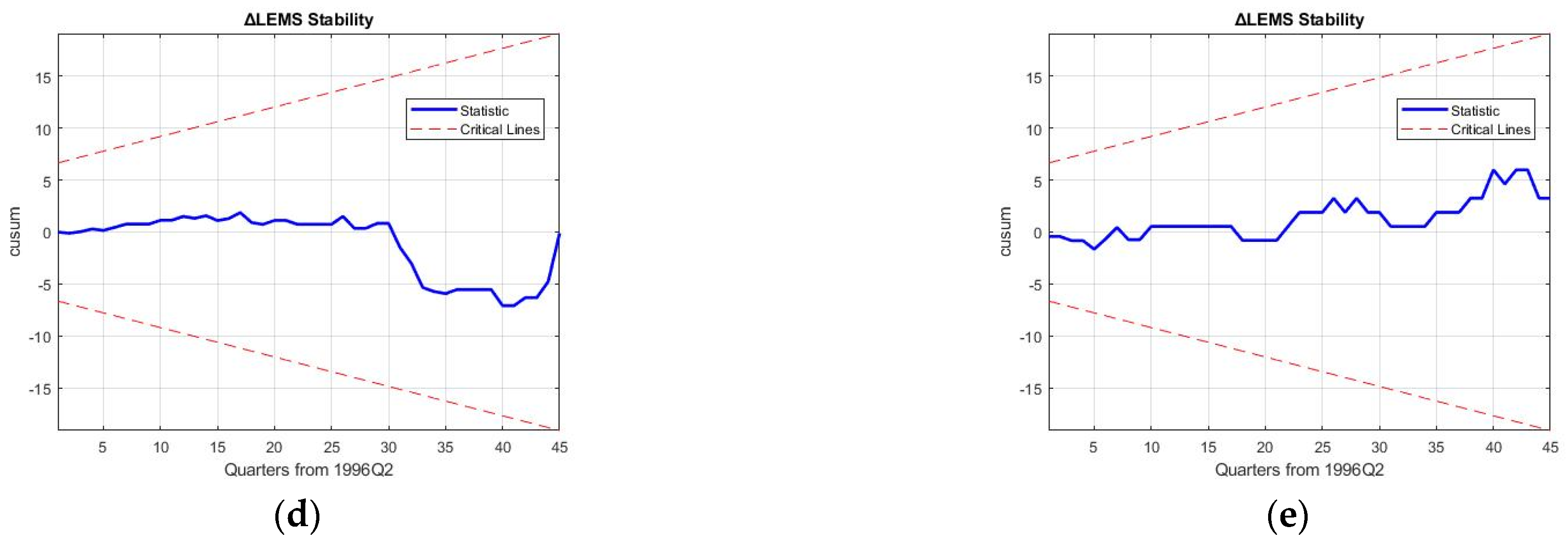

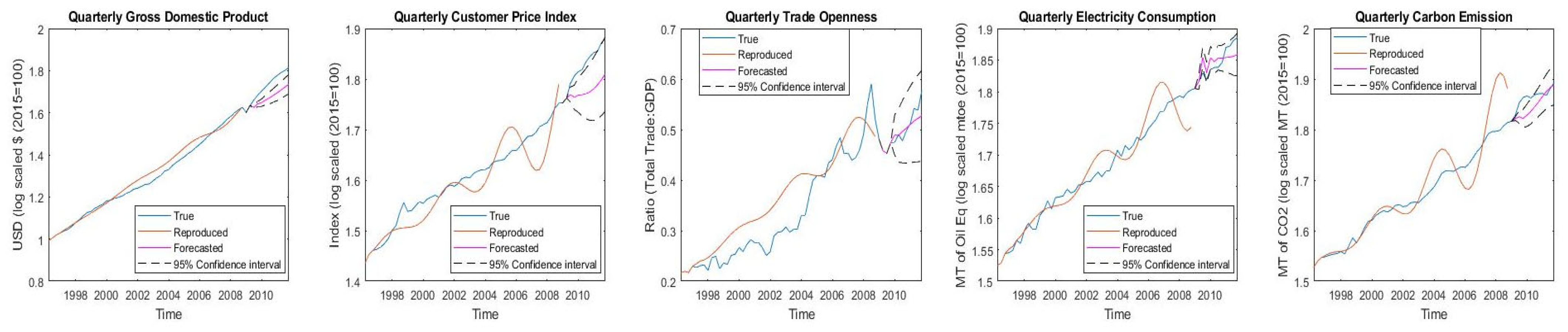

Figure 5,

Figure 6,

Figure 7,

Figure 8 and

Figure 9 show reproduction from the 1996Q2 to 2008Q3 training period and forecasts from the 2009Q1 to 2011Q4 testing period for the five a-VECMs. Exogenous shock is applied to the GDP and K in the 2008Q4 period. The detailed coefficients of all the a-VECMs are given in

Appendix A,

Appendix B,

Appendix C,

Appendix D and

Appendix E, along with the residual diagnostic tests for all the variables.

Table 11 shows the mean aggregated percentage reproduction error (MAPRE), mean aggregated percentage forecasting error (MAPFE) and approximate entropy (ApEn) for the five models, which are the key robustness tests of this study. Specifically, ApEn is a measure of the amount of information contained in the modelled values, giving an indication of the independence of the variables in the 3E nexus considered.

Confirming the results, Model 4 (trade stochastic 3E system) is seen to oscillate out-of-bounds in

Figure 8, and Model 2 (production 3E system) is seen to reproduce large errors in

Figure 6. As a result, the discussion on robustness will be limited to models 1, 3, and 5. While MAPRE of the simple growth 3E nexus is seen to be the best at an aggregated level for all the variables, ApEn is considerably less at 0.015. This implies that the amount of information in the modelling system is significantly less; it is exactly in

Figure 5 where it is seen that higher-dimensional business cycle movements are not captured by this nexus. As a result, the causalities examined by previous research using the trivariate nexus of GDP-El-C can be inferred to not be representative of real-world movement [

4,

88,

89]. Moreover, the rebound effect post-2008 crisis is also directionally opposite in the forecast for Model 1, although the forecasting error is the smallest.

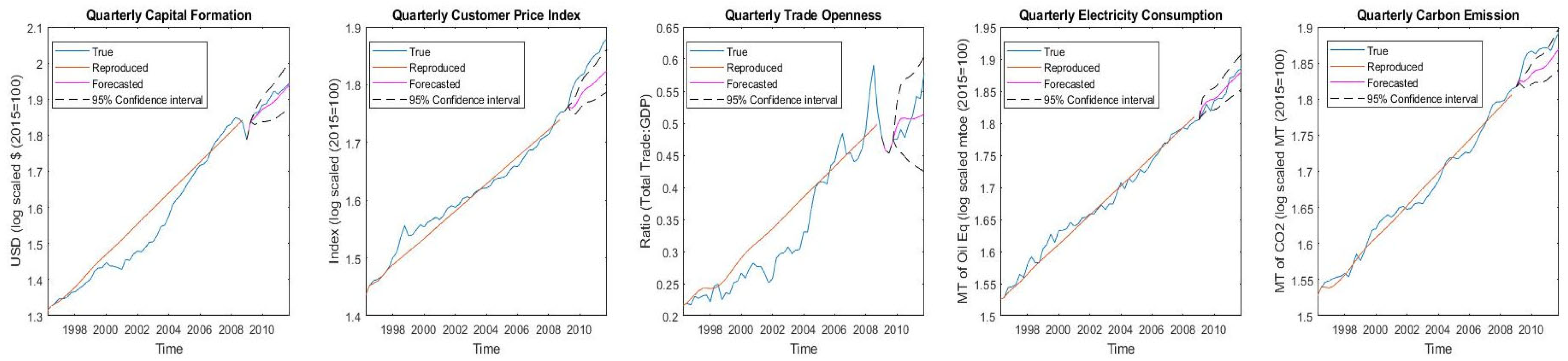

The advocacy that international trade is highly impactful on nexus modelling by the authors of [

90] is highly agreeable with the results of Model 3 (

Figure 7). The cyclic movements of El, C, and GDP itself is captured by the inclusion of TROP in both growth and recession periods, with a MAPRE of just 1.93%. The GDP–TROP–El–C nexus can indeed be considered an important 3E nexus policy tool with the highest entropy value of 0.47. The reason for high levels of information content in this model is that the Indian electricity sector depends on coal generation, which mainly depends on international trade. The results of [

47,

57,

90] for the economy and electricity linkage of Italy, Ghana, and Indonesia is, thus, in agreement with the reproducibility and information quantity (entropy) of Model 3. However, the downside of the trade model is its forecasting error, which is the largest among all the considered 3E nexus systems at 3.06%, showing that the forecasting capability is limited for this model in the face of an economic shock.

Finally, inflation stochastic Model 5 has a slightly larger MAPRE than the trade Model 3 (

Table 11) but still captures the cyclic movements of the variables, as seen in

Figure 9. This is because the CPI (inflation) is associated with inherent stochasticity, which affects the predictive accuracy of any modelling system. Model 5 maintains a similar ApEn value as Model 3, indicating a high content of information in the modelled variables towards representing the 3E nexus for India. Where Model 5 is superior to Model 3 is in forecasting accuracy after the application of the 2008Q4 shock, which is greatly improved. Therefore, a stochastic model internalizing inflation and TROP is capable of capturing higher-dimensional business cycle movement, as well as the rebound effect of an exogenous shock better than growth, production, and trade models, confirming Hypothesis 3 of this research.

To ascertain Hypothesis 3, we utilize Equation (17) to calculate the R factors in four identified economic phases, as shown in

Table 12, with respect to models 1, 3, and 5.

R factors reveal some interesting dynamics of the capability of the models to represent higher-order business cycle movements and crisis rebound effects in different regimes. As seen in

Figure 5,

Figure 6,

Figure 7,

Figure 8 and

Figure 9, the most significant R factors are reported by all the models in the first growth phase of the business cycle, at the start of the modelling period. It is in the recession phase where we see fewer significant R factors greater than 0.01 for all the modelling variables, which, again, shows improvement for models 3 and 5 in the second growth phase. Thus, it can be concluded that cointegration modelling is limited in capturing economic movement from a growth to recession phase, but it accurately predicts the opposite movement from a recession to growth phase. This is because cointegration models tend to correct errors in the direction of the overall trend in the training data, which, in this case, is an incremental direction, as opposed to the recession phase. This adds valuable insight to existing structural cointegration models [

9,

37,

38,

68]. Where Model 5 contains more significant R factors than Model 3 is in the post-crisis recovery phase, which can be attributed to the stochastic nature of the CPI and TROP being internalized to more accurately approximate the rebound from an exogenous shock to a 3E nexus system [

63], affirming Hypothesis 3.

Several policy implications for the current status and future of decoupling in the Indian electricity sector can be derived from this study. Firstly, unlike previous studies in the literature where the EKC is measured solely against economic growth (GDP) [

8,

44,

58,

59], the dimensions of EKC interpretation are extended here. From 1996 to 2020, which encompasses two distinct economic periods—the pre-2008 and post-2008 financial crisis periods and multiple business cycle movements—the GDP and electricity-related CO

2 emissions are absolutely not decoupled. However, decoupling is observed through production and inflation stochastic models with respect to capital formation over a long-run cointegrated relationship. Moreover, trade openness and inflation promote decoupling in the short-run, while TROP shows evidence of coupling with emissions in the long-run. Therefore, it can be confirmed that the incentive of decoupling lies in boosting the capability of the manufacturing sector and ensuring resiliency in domestic RE markets, which builds the equity of entities invested in reducing the emission intensity of power generation [

3]. Capital can also be accelerated by promoting innovation in the RE sector, which is exactly what policy programs like ‘make in India’ [

91] and ‘surya ghar muft Bijli yojana’ (free electricity from rooftop solar panels) [

92] aim to promote. Not only can capital formation be ensured by domestic production but also stabilized domestic markets can ensure foreign direct investment (FDI), which also boosts capital [

14].

On the other hand, inflation has been rising constantly with the fast-growing GDP of India, and while short-run decoupling was seen in the post-crisis period with the CPI, it ultimately inhibited decarbonization of the electricity sector. The novel policy pathway that is uncovered in Model 5 unveils the negative feedback loop involving TROP, CPI, and emissions. Looking at

Table A23 and

Table A25, when inflation peaks and a recession phase begins, GDP growth is ensured through FF imports, which boosts TROP and ultimately reduces the CPI. However, this causes an increase in CO

2 emissions from power generation, which is where we see a long-run positive association between the CPI and TROP and between TROP and C. This resembles a death spiral with the positive effect of capital reducing CO

2 emissions during recession phases. This loop was also magnified during the rebound from the 2008 economic shock, which can also be thought to have been replicated during the COVID-19 shock, as the macroeconomic dynamics in the 3E nexus are similar to those before the 2008 financial crisis (as seen in

Table 9 and

Table 10). This is coupled with the fact that economic shocks destabilize RE stock markets [

65], which further nullifies the positive effect of capital on decoupling, magnifying the negative feedback in the process.

6. Conclusions

This study explores the macroeconomic dynamics of decoupling in the Indian electricity sector through long-term cointegration models from 1996Q2 to 2020Q3 across the economic shocks of the 2008 financial crisis and the COVID-19 pandemic. Five models covering aspects of economic growth, Cobb-Douglas production, trade, and inflation stochasticity within the economy–electricity–emissions (3E) nexus were tested for their robustness to reproduce higher-order business cycle movements and to forecast the rebound from an economic shock. Robustness was analysed using a novel information-theory-based approximate entropy (ApEn) approach to the 3E systems and R factors in economic phases.

The key findings of the study are as follows:

An inflation stochastic 3E system can detect higher-order behaviour in decoupling dynamics better than linear growth nexuses by containing more information in the coefficients (ApEn value of 0.441 as opposed to 0.015 of a simple growth model).

Cointegration models can approximate decoupling and 3E dynamics more accurately in growth phases of business cycles than recession phases, with the inflation stochastic model again being superior to the other 3E systems.

AN EKC hypothesis for the Indian electricity sector is non-existent from the period of 1996–2020 with respect to the GDP but decouples from capital growth on either side of the 2008 financial crisis.

Inflation and TROP decoupling directions are inversely related in economic regimes across economic shocks, showing recoupling in the post-crisis regime. These factors are responsible for the rebound of the economy, at the expense of decarbonization incentives in the Indian 3E nexus.

GDP and CO2 emissions are not directly causal. This study found the existence of a negative feedback loop from the CPI to TROP to CO2 emissions that inhibits the positive effect of decoupling by capital growth.

The following policy pathway can be proposed for the fast-growing, developing economy of India from the empirical evidence that was gathered in this study to ensure continued progress towards ‘net-zero’ targets in the post-COVID-19 regime:

Risk hedging of RE investments and energy sustainability markets must be practiced during a crisis, such that the recoupling of emissions with increasing inflation in a post-crisis demand surge can be prevented.

Macroeconomic decoupling of power generation should be tied to capital formation, rather than GDP growth incentives. Capital growth, both domestic and FDI, can accelerate RE infrastructure and introduce innovations in capacity factors, such as giga-scale solar projects and thorium-based heavy-water nuclear power reactors.

Economic rebound should not be fostered by increased FF imports in the post-crisis period but by investments in energy transition technologies like electric vehicles and solar manufacturing, which ultimately creates capital that enables decoupling.

Post-crisis reliance on FF imports can be reduced by removing all forms of subsidies on oil and gas sectors, such that a quick turnaround of the economy does not occur at the expense of decarbonization efforts in the electricity sector.

In terms of the limitations of this study, the tested cointegration models were not able to reproduce economic movements that lay in recession phases. Future studies should consider stochastic time series that exhibit complimentary trends during growth and recession periods, such that 3E systems are able to minimize the reproduction errors of recession phases. A second limitation is that the impact of inflation on overall energy use needs to be delineated to introduce comprehensive decoupling pathways in the face of economic shocks. More expansive theoretical bases, involving factors that were not considered in the modelling in this paper or using more critical methodological approaches, such as data assimilation, should be explored. Thirdly, the financial policies of every major developing nation are vastly different, implying that the macroeconomic dynamics of inflation and CO2 emissions may be quite different than those of India. There are several macroeconomic dynamics that are required to be addressed in future studies for developing the progression of economies’ decoupling processes. How can social engineering be performed to artificially control inflation with a rebound effect in crisis regimes and prevent it from affecting decarbonization initiatives? The interplay of labour dynamics, wage equity, and social justice as concerns CPI-TROP-CO2 emissions needs to be explored to determine the role of human and social capital in decoupling dynamics.

It is indeed easy to foster economic growth from imported FFs and subsidies on oil use in a post-COVID-19 recovery scenario, but this study clearly shows that such actions will inhibit decoupling in the long-run. Such short-run economic growth will ultimately lead to uneconomic growth in the pathway to achieve net-zero targets.