Economic Assessment of Coal-Fired Power Unit Decarbonization Retrofit with High-Temperature Gas-Cooled Reactors

Abstract

1. Introduction

2. Materials and Methods

2.1. Coal-Fired Reference Unit and HTGR

2.2. Economic Assessment

- It is the capital expenditures in the period t;

- FUELt is the fuel expenditures in the period t;

- O&Mt is the operation and maintenance expenditures in the period t;

- D&Dt is the decommissioning and demolition expenditures in the period t;

- Et is the electric energy production in the period t;

- r is the discount rate.

- FCR is the constant fixed charge rate;

- TCIC is the total capital investment cost.

- TCIC, which is the sum of overnight costs and construction loan costs, is converted to a mortgage that recovers all of the capital investment (principal plus interest) over the operational life of the plant.

- X is the real discount rate (5%);

- Lecon is the economic or regulatory life of the plant (years), assumed to be the same as the number of years of commercial operation.

2.3. C2N Projects’ Cost Estimation

2.3.1. Site and Component Reutilization

2.3.2. CPP Decommissioning and Demolition (D&D)

2.3.3. Potential Reduction in System Efficiency

2.3.4. Operation and Maintenance (O&M)

2.3.5. Alternative Electricity Use during Retrofitting

- Ca is the alternative electricity cost during retrofitting;

- ta is the time of consumer use alternative electricity;

- ΔC is the additional cost of dispatching electricity from the grid.

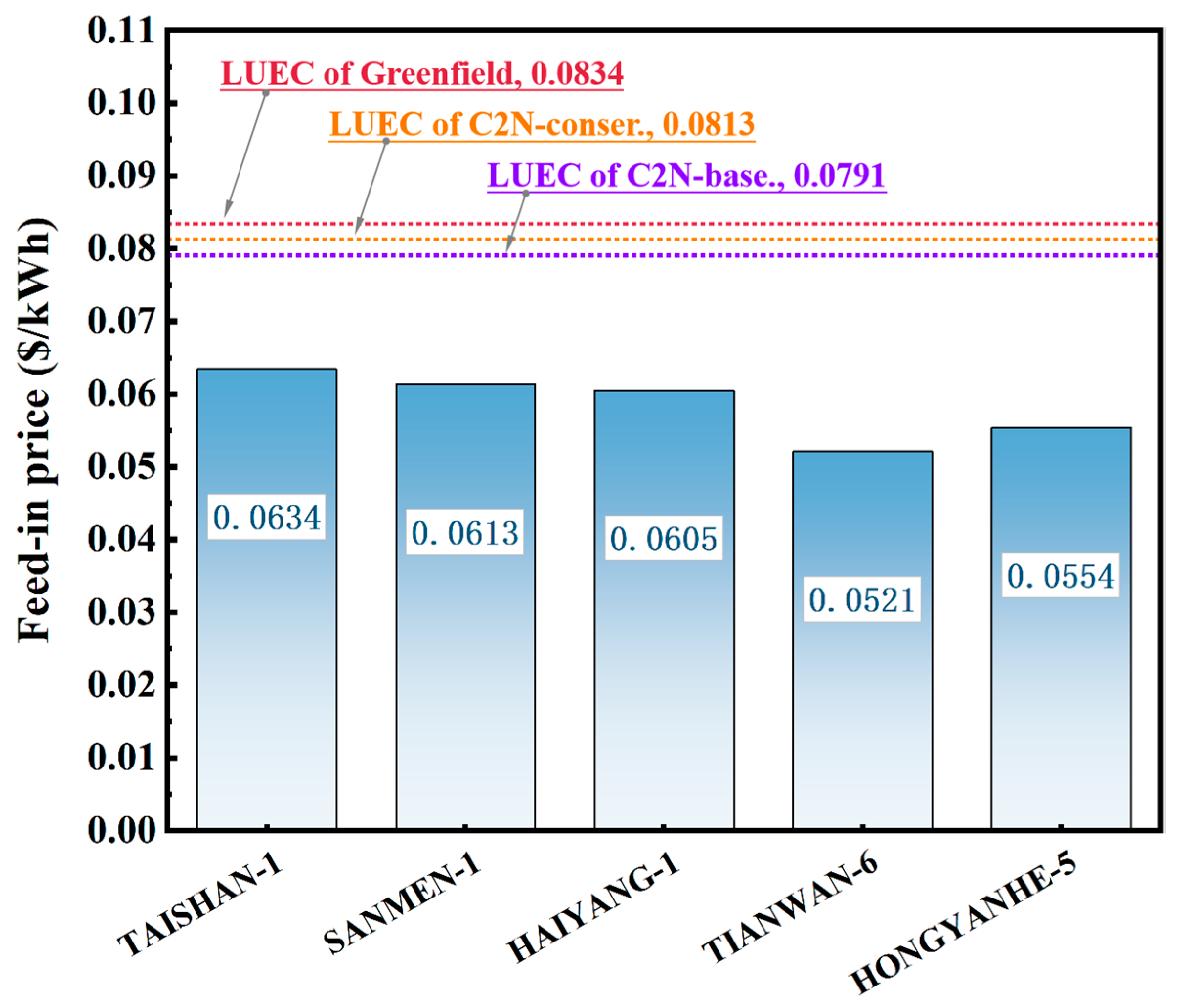

3. Results and Discussion

3.1. C2N Project Timelines

3.2. Additional Cost of Dispatched Electricity from the Grid

3.3. Total Capitalized Cost and LUEC for C2N Project

4. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Abbreviations

| C2N | Coal-to-nuclear |

| CPP | Coal power plant |

| D&D | Decommissioning and demolition |

| EMWG | Economic Modeling Working Group |

| FCR | Constant fixed charge rate |

| G4-ECONS | Generation IV Excel Calculation of Nuclear Systems |

| HTGR | High-temperature gas-cooled reactor |

| HTR-PM | High-temperature gas-cooled reactor–pebble-bed modules |

| LCC | Levelized cost of capital |

| LUEC | Levelized unit of electricity cost |

| NPP | Nuclear power plant |

| OECD | Organisation for Economic Cooperation and Development |

| O&M | Operation and maintenance |

| PBMR | Pebble-bed modular reactor |

| SC-HTGR | Steam cycle high-temperature gas-cooled reactor |

| TCIC | Total capital investment cost |

References

- Cruz, C.J.G.; Yim, M.S. Retrofitting coal power in the Philippines using Korean SMR—Feasibility evaluation. In Proceedings of the Transactions of the Korean nuclear society spring meeting, Jeju, Republic of Korea, 17–19 May 2023. [Google Scholar]

- Pathways for the Construction of a New Power System. Available online: http://www.nrdc.cn/Public/uploads/2023-08-07/64d06cd279c05.pdf (accessed on 10 June 2024).

- Global Energy Monitor. Global Coal Plant Tracker. Available online: https://globalenergymonitor.org/projects/global-coal-plant-tracker/ (accessed on 10 June 2024).

- Cui, R.Y.; Hultman, N.; Cui, D.; McJeon, H.; Yu, S.; Edwards, M.R.; Sen, A.; Song, K.; Bowman, C.; Clarke, L.; et al. A plant-by-plant strategy for high-ambition coal power phaseout in China. Nat. Commun. 2021, 12, 1468. [Google Scholar] [CrossRef] [PubMed]

- Wang, J.; Chen, L.; Tan, Z.; Du, E.; Liu, N.; Ma, J.; Sun, M.; Li, C.; Song, J.; Lu, X.; et al. Inherent spatiotemporal uncertainty of renewable power in China. Nat. Commun. 2023, 14, 5379. [Google Scholar] [CrossRef] [PubMed]

- Nuclear Energy Agency. Uranium 2020: Resources, Production and Demand. A Joint Report by the Nuclear Energy Agency and the International Atomic Energy Agency; Nuclear Energy Agency: Paris, France, 2020.

- Łukowicz, H.; Bartela, Ł.; Gładysz, P.; Qvist, S. Repowering a coal power plant steam cycle using modular light-water reactor Technology. Energies 2023, 16, 3083. [Google Scholar] [CrossRef]

- Weng, T.; Zhang, G.; Wang, H.; Qi, M.; Qvist, S.; Zhang, Y. The impact of coal to nuclear on regional energy system. Energy 2024, 302, 131765. [Google Scholar] [CrossRef]

- Cothron, E. Resources for Coal Repowering with Nuclear Energy. 2023. Available online: https://policycommons.net/artifacts/8189957/resources-for-coal-repowering-with-nuclear-energy/9100366/ (accessed on 10 June 2024).

- IAEA. Repurposing Fossil Fuel Power Plant Sites with Smrs to Ease Clean Energy Transition. 2022. Available online: https://www.iaea.org/newscenter/news/repurposing-fossil-fuel-power-plant-sites-with-smrs-to-ease-clean-energy-transition (accessed on 10 June 2024).

- Bartela, Ł.; Gładysz, P.; Andreades, C.; Qvist, S.; Zdeb, J. Techno-economic assessment of coal-fired power unit decarbonization retrofit with KP-FHR small modular reactors. Energies 2021, 14, 2557. [Google Scholar] [CrossRef]

- Bartela, Ł.; Gładysz, P.; Ochmann, J.; Qvist, S.; Sancho, L.M. Repowering a coal power unit with small modular reactors and thermal energy storage. Energies 2022, 15, 5830. [Google Scholar] [CrossRef]

- Xu, S.; Lu, Y.; Mutailipu, M.; Zhang, Y.; Qvist, S. Repowering coal power in China by nuclear energy—Implementation strategy and potential. Energies 2022, 15, 1072. [Google Scholar] [CrossRef]

- Feasibility Assessment and Economic Evaluation: Repurposing a Coal Power Plant Site to Deploy an Advanced Small Modular Reactor Power Plant. Available online: https://energy.maryland.gov/Reports/MD%20Feasibility%20Assessment%20and%20Economic%20Evaluation%20(Jan2023).pdf (accessed on 10 June 2024).

- Pathways to Cost-effective Advanced Nuclear Technology. Available online: https://www.energy-proceedings.org/pathways-to-cost-effective-advanced-nuclear-technology/ (accessed on 3 August 2024).

- Delrue, J.; Shahrokhi, F.; Lommers, L. The Framatome SC-HTGR Heat Transport System. In Proceedings of the HTR 2018, Warsaw, Poland, 8–10 October 2018. [Google Scholar]

- Cost Estimating Guidelines for Generation IV Nuclear Energy Systems. 2007. Available online: https://www.gen-4.org/gif/upload/docs/application/pdf/2013-09/emwg_guidelines.pdf (accessed on 10 June 2024).

- Qin, S.; Song, M.; Vietz, S.H.; Pham, C.B.T.; Plummer, M.A.; Strydom, G. High-Temperature Gas-Cooled Reactor Research Survey and Overview: Preliminary Data Platform Construction for the Nuclear Energy University Program; Idaho National Lab.: Idaho Falls, ID, USA, 2022. [Google Scholar]

- Demick, L.; Vandel, D. Next Generation Nuclear Plant Pre-Conceptual Design Report; Idaho National Lab.: Idaho Falls, ID, USA, 2007. [Google Scholar]

- Reitsma, F.; Woods, P.; Fairclough, M.; Kim, Y.; Tulsidas, H.; Lopez, L.; Zheng, Y.; Hussein, A.; Brinkmann, G.; Haneklaus, N.; et al. On the sustainability and progress of energy neutral mineral processing. Sustainability 2018, 10, 235. [Google Scholar] [CrossRef]

- Zhang, Z.; Dong, Y.; Li, F.; Zhang, Z.; Wang, H.; Huang, X.; Li, H.; Liu, B.; Wu, X.; Wang, H.; et al. The Shandong Shidao Bay 200 MWe high-temperature gas-cooled reactor pebble-bed module (HTR-PM) demonstration power plant: An engineering and technological innovation. Engineering 2016, 2, 112–118. [Google Scholar] [CrossRef]

- Subki, H. Advances in Small Modular Reactor Technology Developments. 2020. Available online: https://aris.iaea.org/Publications/SMR_Book_2020.pdf (accessed on 10 June 2024).

- IAEA. Advanced Reactors Information System. Available online: https://aris.iaea.org/sites/GCR.html (accessed on 10 June 2024).

- Projected Costs of Generating Electricity—Update 1998. Available online: https://www.oecd-nea.org/jcms/pl_13158/projected-costs-of-generating-electricity-update-1998?details=true (accessed on 10 June 2024).

- Delene, J.G.; Hudson, C.R. Cost Estimate Guidelines for Advanced Nuclear Power Technologies; Oak Ridge National Lab.: Oak Ridge, TN, USA, 1993. [Google Scholar]

- Hansen, J.K.; Jenson, W.D.; Wrobel, A.M.; Stauff, N.; Biegel, K.; Kim, T.; Belles, R.; Omitaomu, F. Investigating Benefits and Challenges of Converting Retiring Coal Plants into Nuclear Plants; Idaho National Lab.: Idaho Falls, ID, USA, 2022. [Google Scholar]

- Raimi, D. Decommissioning US Power Plants: Decisions, Costs, and Key Issues. Resources for the Future. 2017. Available online: https://www.rff.org/publications/reports/decommissioning-us-power-plants-decisions-costs-and-key-issues/ (accessed on 10 June 2024).

- U.S. Department of Energy, Energy Information Administration. An analysis of Nuclear Plant Operating Costs: A 1995 Update. Available online: https://digital.library.unt.edu/ark:/67531/metadc711072/m2/1/high_res_d/67785.pdf (accessed on 10 June 2024).

- IAEA Power Reactor Information System. Available online: https://pris.iaea.org/PRIS/CountryStatistics/CountryDetails.aspx?current=CN (accessed on 10 June 2024).

| Item | Parameter |

|---|---|

| Gross Electrical capacity, MW | 600 |

| Thermal capacity, MW | 1450 |

| Main Steam Flow Rat, t−1 | 1724.8 |

| Main Steam Pressure, MPa | 24.2 |

| Main Steam Temperature, °C | 566 |

| Acronym | HTR-PM [21] | PBMR [22] | Prismatic HTR [23] | SC-HTGR [16] |

|---|---|---|---|---|

| full name | High-Temperature GC–Pebble-Bed Module | Pebble-Bed Modular Reactor | Prismatic Modular High-Temperature GCR | Steam Cycle High-Temperature Gas-cooled Reactor |

| Design Org. | Tsinghua University (China) | Pebble Bed Modular Reactor SOC Ltd. (Sunninghill, South Africa) | General Atomics (San Diego, CA, USA) | AREVA NP (Richland, WA, USA) |

| Thermal capacity | 500 MWth | 400 MWth | 350 MWth | 625 MWth |

| Gross Electrical capacity | 210 MW | 165 MW | 150 MW | 272 MW |

| Primary coolant flow rate | Helium 96 Kg/s | Helium 96 Kg/s | Helium 157.1 Kg/s | Helium 282 Kg/s |

| Core coolant outlet/inlet temperature | 750/250 °C (7 MPa) | 750/250 °C (6 MPa) | 750/322 °C (6.39 MPa) | 750/320 °C (6 MPa) |

| Steam temperature/pressure | 567 °C/13.25 MPa | 540 °C/12 MPa (195 Kg/s) | 541 °C/17.3 MPa | 560 °C/16.7 MPa (140.7 kg/s) |

| Feedwater temperature/pressure | 205 °C | 200 °C | 193 °C/21.0 MPa | 281 °C/24.3 MPa |

| Reduced Cost | Increased Cost |

|---|---|

| site and components reutilization | CPP decommissioning and demolition |

| potential reduction in system efficiency | |

| operation and maintenance | |

| alternative electricity use during retrofitting |

| Code of Accounts [17] | Items | C2N Estimated Cost Savings (%) | |

|---|---|---|---|

| Conservative | Baseline | ||

| 21 | Buildings, Structures, and Improvements on Site | 12. | 16.9 |

| 22 | Reactor Plant equipment | 0 | 0 |

| 23 | Turbine/Generator Plant equipment | 3 | 40 |

| 24 | Electrical equipment | 8 | 90 |

| 25 | Water intake and heat rejection plant | 60 | 70 |

| 26 | Miscellaneous plant equipment | 28. | 36.8 |

| Electricity Trading Platform | Retail Market (Lowest Prices, USD/kWh) | Medium- and Long-Term Market (Annual Average Price, USD/kWh) | ||||

|---|---|---|---|---|---|---|

| Province | Liaoning | Shandong | Zhejiang | Fujian | Jiangsu | Guangdong (Pearl River Delta region) |

| Electricity feed-in price | 0.0569 | 0.0522 | 0.0646 | 0.0581 | 0.0629 | 0.0647 |

| Transmission and distribution price | 0.0290 | 0.0287 | 0.0298 | 0.0227 | 0.0296 | 0.0239 |

| General line loss rate | 4.71% | 3.31% | 3.53% | 3.60% | 3.18% | 3.31% |

| Governmental funds and surcharges | 0.0037 | 0.0045 | 0.0041 | 0.0038 | 0.0041 | 0.0038 |

| Total dispatched electricity price | 0.0939 | 0.0882 | 0.1019 | 0.0876 | 0.0997 | 0.0955 |

| Normal sale price (flat) | 0.0869 | 0.0846 | 0.0925 | 0.0800 | 0.0890 | 0.0938 |

| Increased percecnt | 8.0% | 4.3% | 10.1% | 9.5% | 12.0% | 1.8% |

| Items | Greenfield | C2N-Conservative | C2N-Baseline |

|---|---|---|---|

| Capitalized Pre-construction Costs | $148.7/kW | $148.7/kW | $148.7/kW |

| NPP Construc. Capitalized Direct Cost | $3288.0/kW | $2532.3/kW | $2391.6/kW |

| NPP Construc. Capitalized Indirect Cost | $1874.2/kW | $1443.3/kW | $1363.2/kW |

| First Fuel Load Cost | $326.5/kW | $326.5/kW | $326.5/kW |

| Financial Costs | $939.0/kW | $811.4/kW | $748.5/kW |

| CPP D&D (including ash removel) | —— | $186.1/kW | $186.1/kW |

| Dispatching Electricity Costs during retrofitting | —— | $398.9/kW | $133.0/kW |

| Total Capitalized Cost | $6576.5/kW | $5847.2/kW | $5297.6/kW |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Luo, B.; Zhang, L.; Li, W.; Su, Y.; Ye, Y.; Wang, C.; Liu, Y.; Zhang, Y.; Zhu, X. Economic Assessment of Coal-Fired Power Unit Decarbonization Retrofit with High-Temperature Gas-Cooled Reactors. Energies 2024, 17, 4232. https://doi.org/10.3390/en17174232

Luo B, Zhang L, Li W, Su Y, Ye Y, Wang C, Liu Y, Zhang Y, Zhu X. Economic Assessment of Coal-Fired Power Unit Decarbonization Retrofit with High-Temperature Gas-Cooled Reactors. Energies. 2024; 17(17):4232. https://doi.org/10.3390/en17174232

Chicago/Turabian StyleLuo, Bixiong, Li Zhang, Wei Li, Yanlin Su, Yongjian Ye, Chenyu Wang, Yixuan Liu, Yi Zhang, and Xinwei Zhu. 2024. "Economic Assessment of Coal-Fired Power Unit Decarbonization Retrofit with High-Temperature Gas-Cooled Reactors" Energies 17, no. 17: 4232. https://doi.org/10.3390/en17174232

APA StyleLuo, B., Zhang, L., Li, W., Su, Y., Ye, Y., Wang, C., Liu, Y., Zhang, Y., & Zhu, X. (2024). Economic Assessment of Coal-Fired Power Unit Decarbonization Retrofit with High-Temperature Gas-Cooled Reactors. Energies, 17(17), 4232. https://doi.org/10.3390/en17174232