How to Construct a Carbon Asset Management System for Chinese Power Enterprises: A Survey-Based Approach

Highlights

- Obtaining the carbon management status of Beijing’s power enterprises at the end of the first compliance period in the national carbon market of China.

- Identifying the factors that significantly impact carbon management performance, providing references for improving the current management status of enterprises and formulating policies.

- Provide a theoretical framework for power companies to comply with regulations and enhance the value of carbon assets. Additionally, provide a reference for other companies that are about to join the carbon market.

Abstract

1. Introduction

1.1. Carbon Assets

1.2. Carbon Asset Management Systems and Achieving Effective Carbon Emission Reduction

1.3. Discussion on the Current Situation and the Content of a Carbon Asset Management System

2. Background Description

- (1)

- Data Aspect

- (2)

- Technical Aspect

- (3)

- Trading and Financial Aspect

3. Investigation into the Construction of Carbon Asset Management Systems in Some Power Generation Enterprises in Beijing

3.1. The Basis for the Questionnaire Design

- (1)

- The Process of Power Generation Enterprises Participating in Carbon Trading:

- (2)

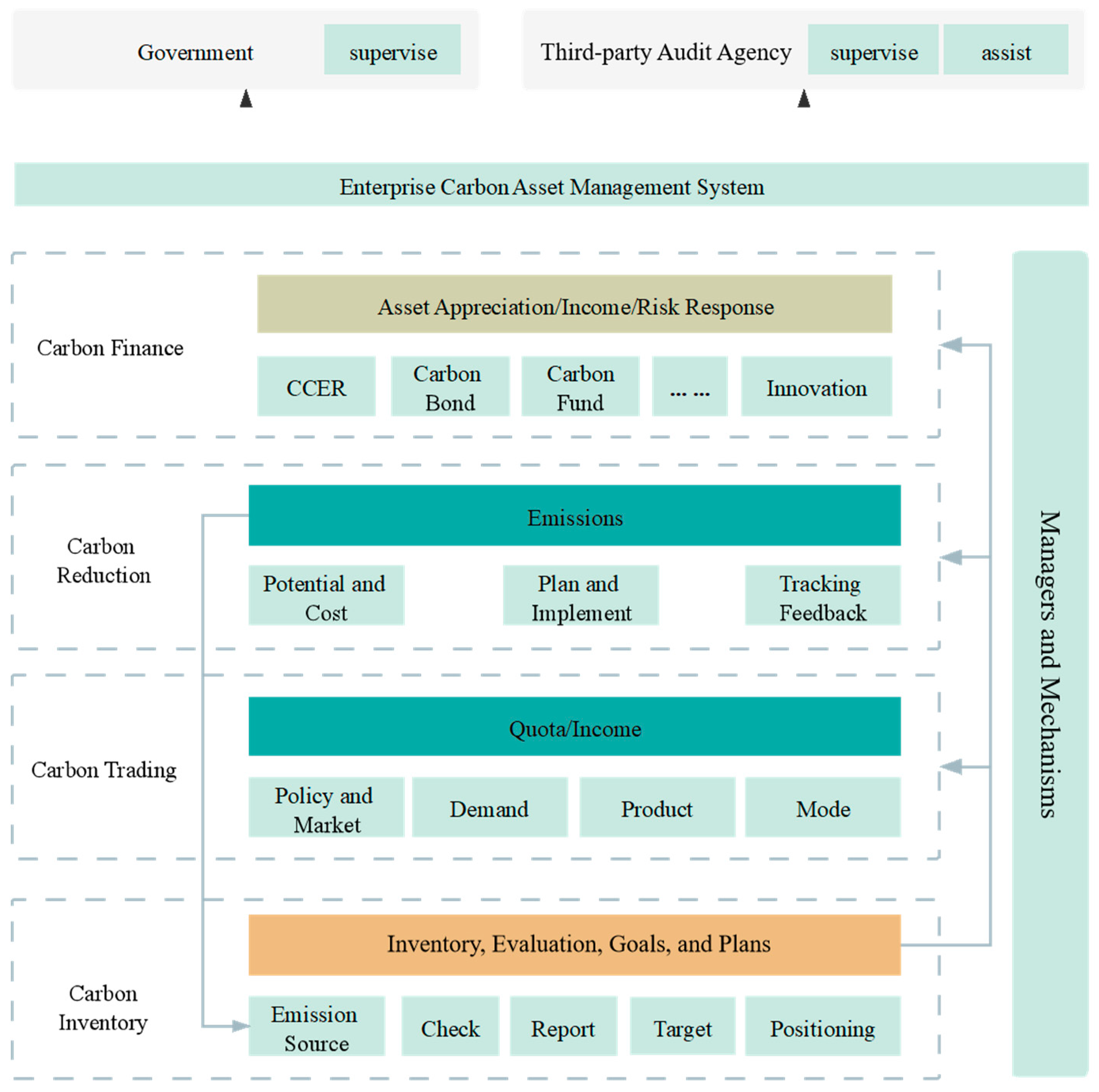

- Carbon Asset Management System for Power Enterprises:

3.2. Questionnaire and Research Design

3.3. Descriptive Statistical Analysis of Sample

3.4. The Analysis Results of Goal, Attitude, Management Status, and Effect

- (1)

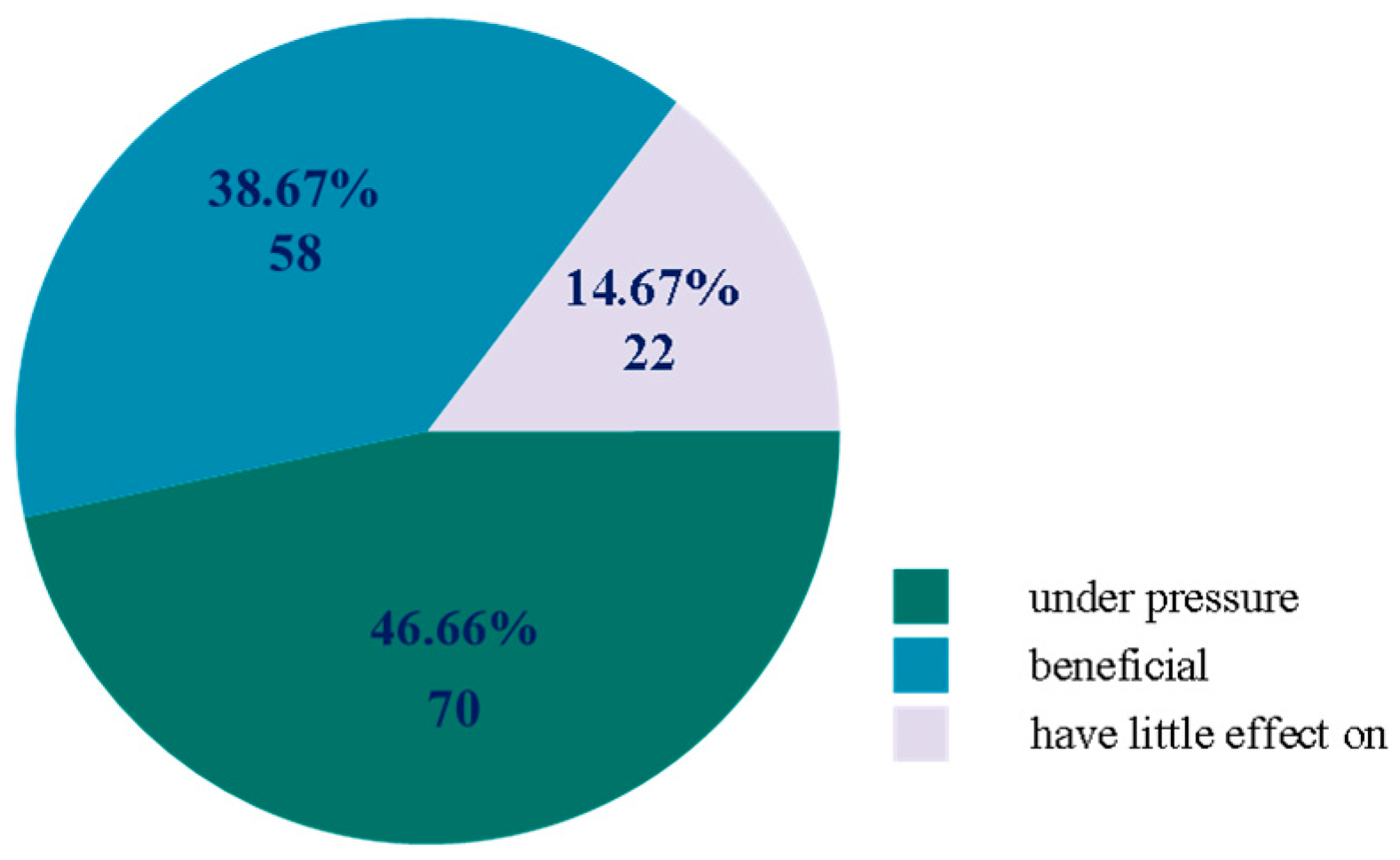

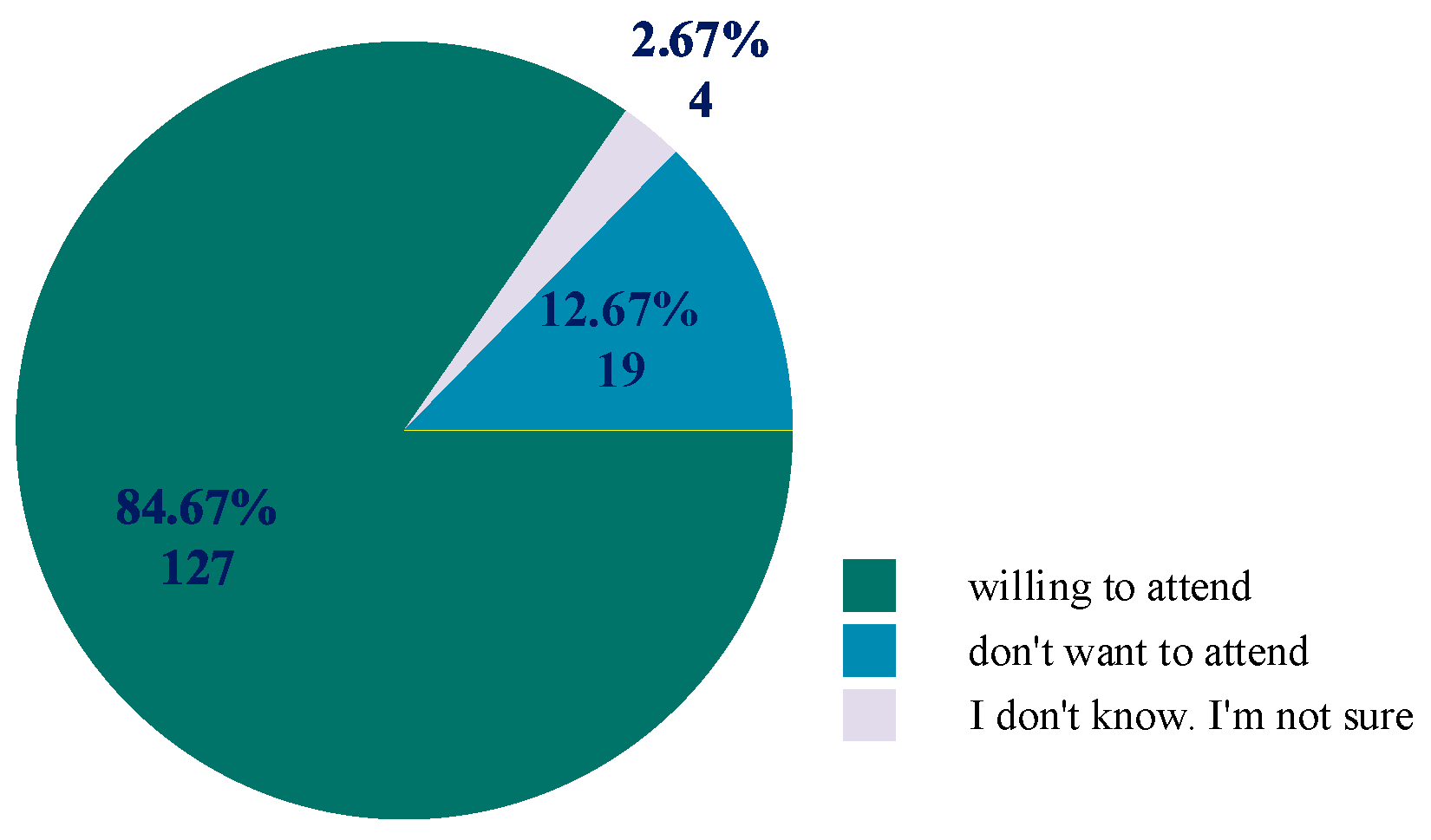

- Analysis of Enterprises’ Attitudes Toward the Carbon Market

- (2)

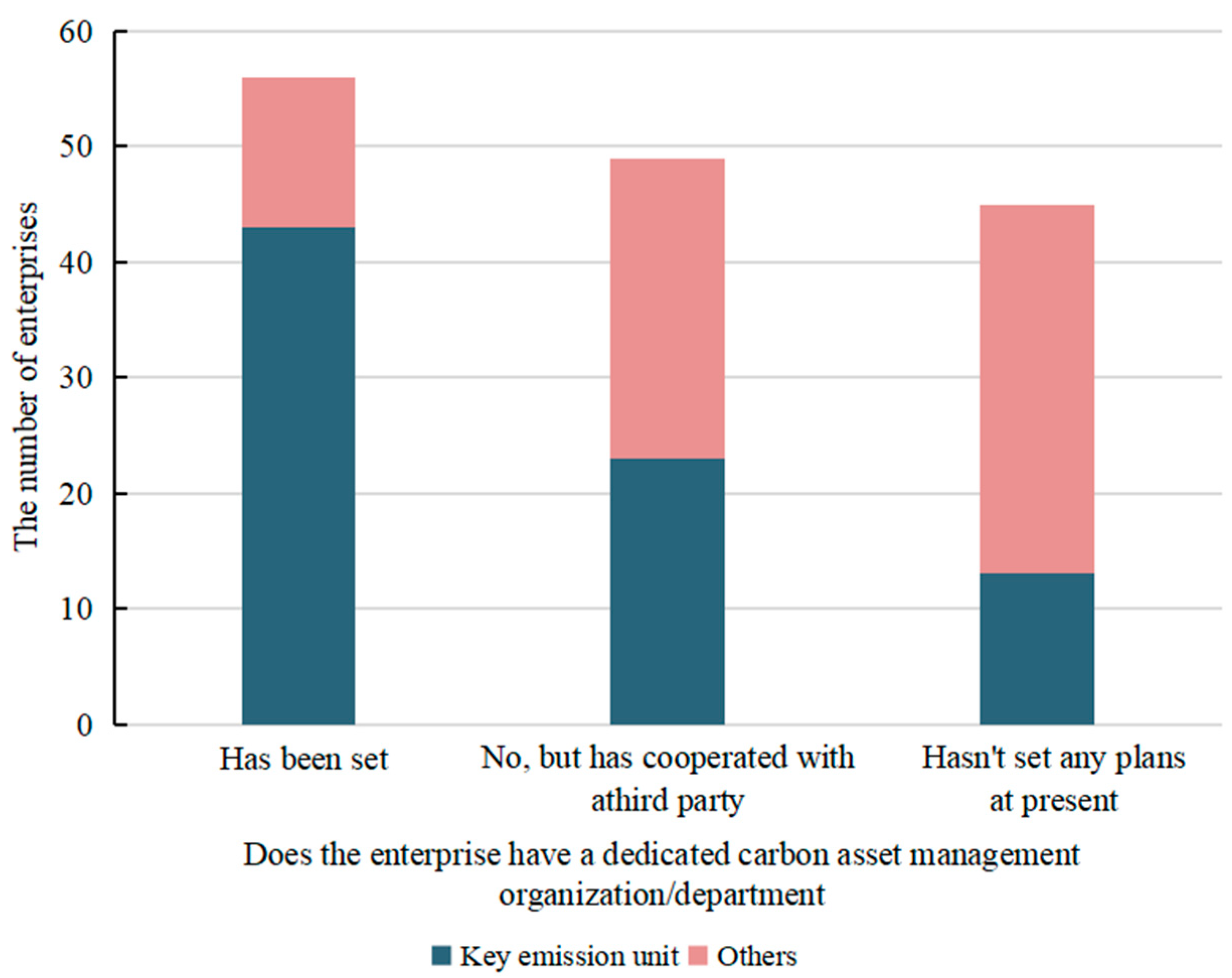

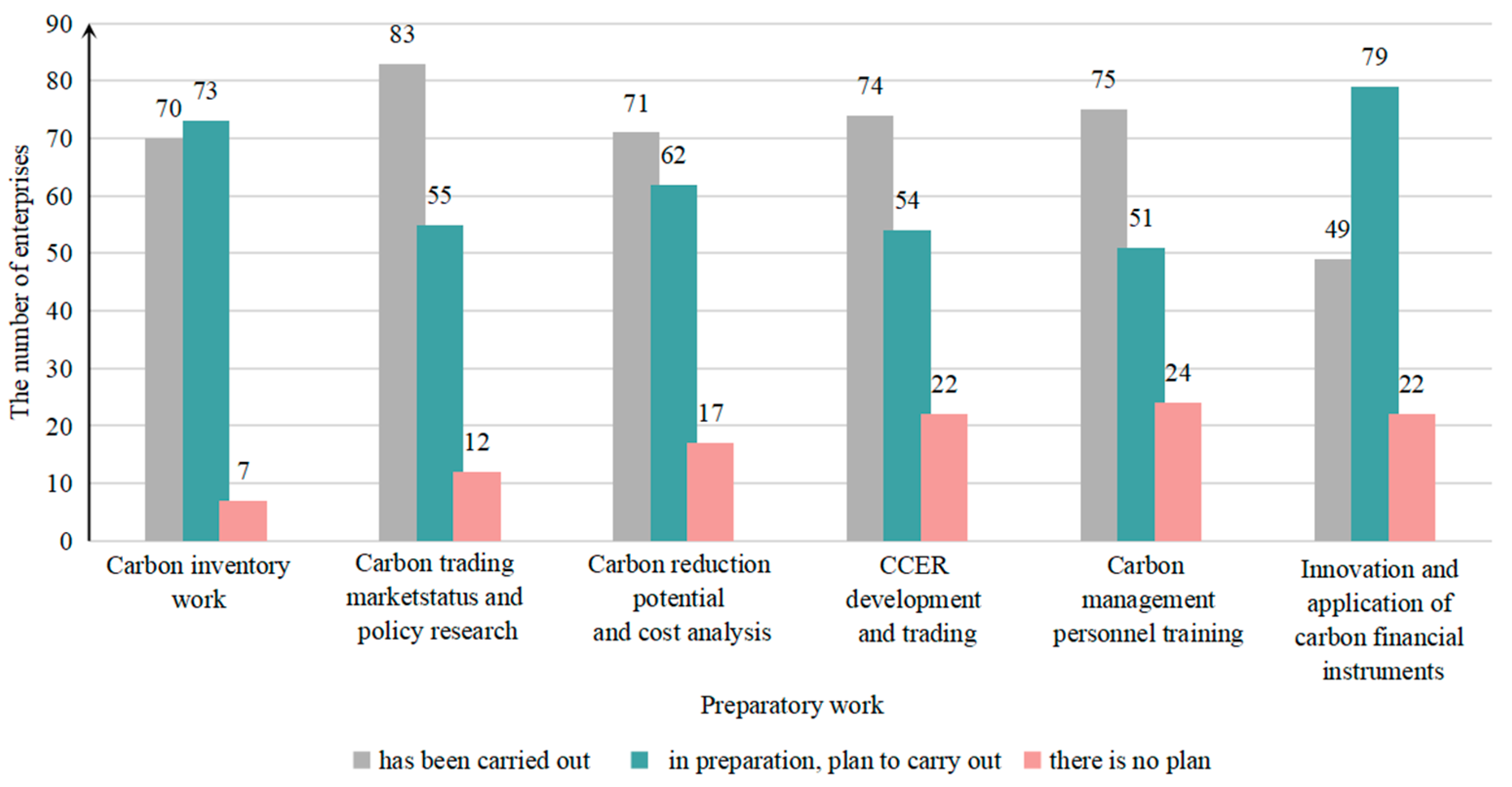

- Analysis of the Current Status of Carbon Asset Management in Surveyed Enterprises

- (3)

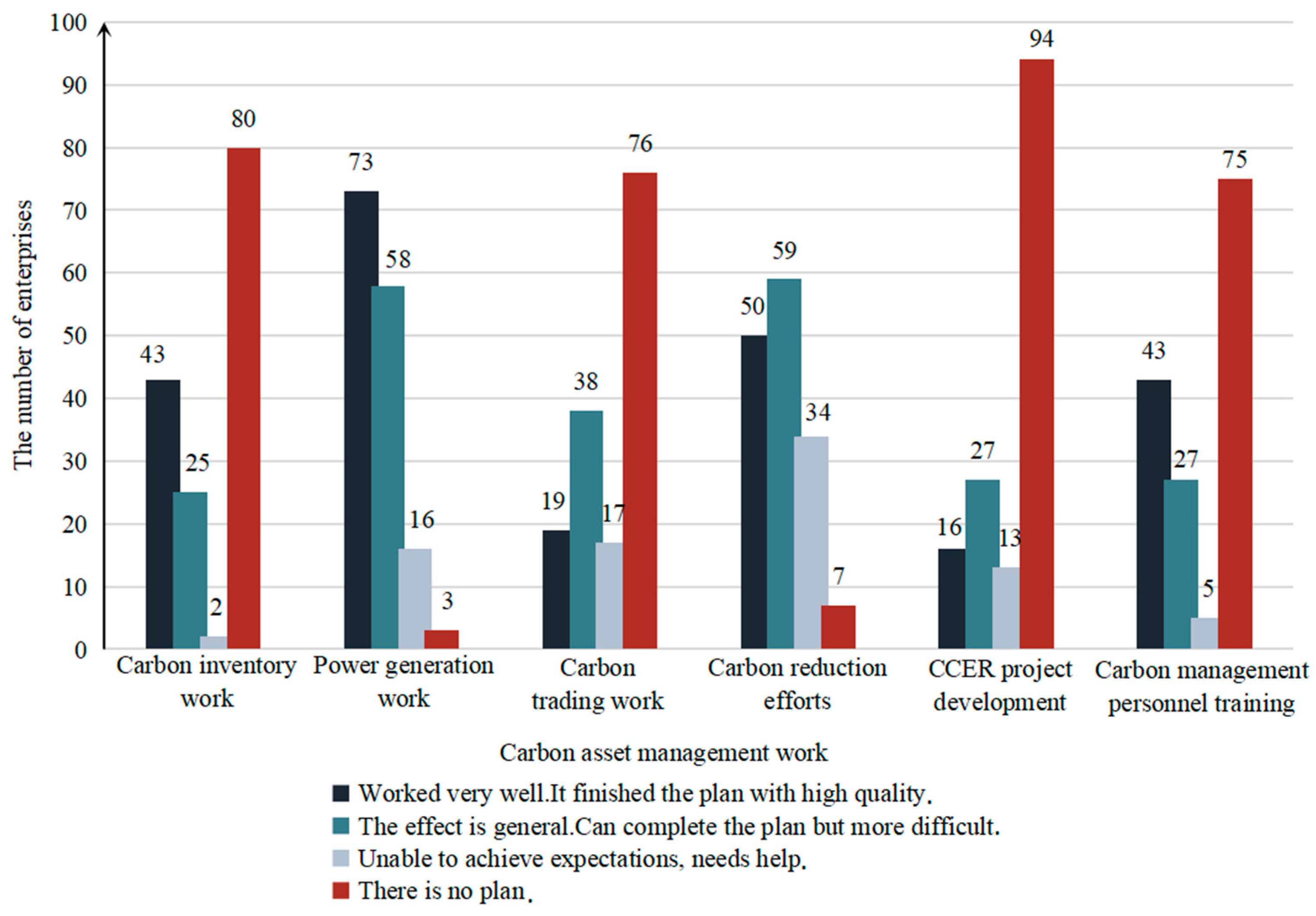

- Analysis of the differences in the implementation and effects of various works

- (4)

- Correlation of the completion effects of various carbon management works in the surveyed enterprises

3.5. Factors Affecting Actual Carbon Management Effectiveness

4. Summary of Carbon Management Issues in Power Enterprises

- (1)

- Incomplete coverage of carbon inventory: The overall preparation and implementation of carbon inventory work among the surveyed enterprises are relatively good compared to the other mentioned carbon management tasks in this document. However, half of the surveyed enterprises still do not possess relevant system documents for carbon inventory. This is an important safeguard and reference in carbon asset management work, which affects the effectiveness of carbon management for enterprises. Currently, the coverage is still not comprehensive.

- (2)

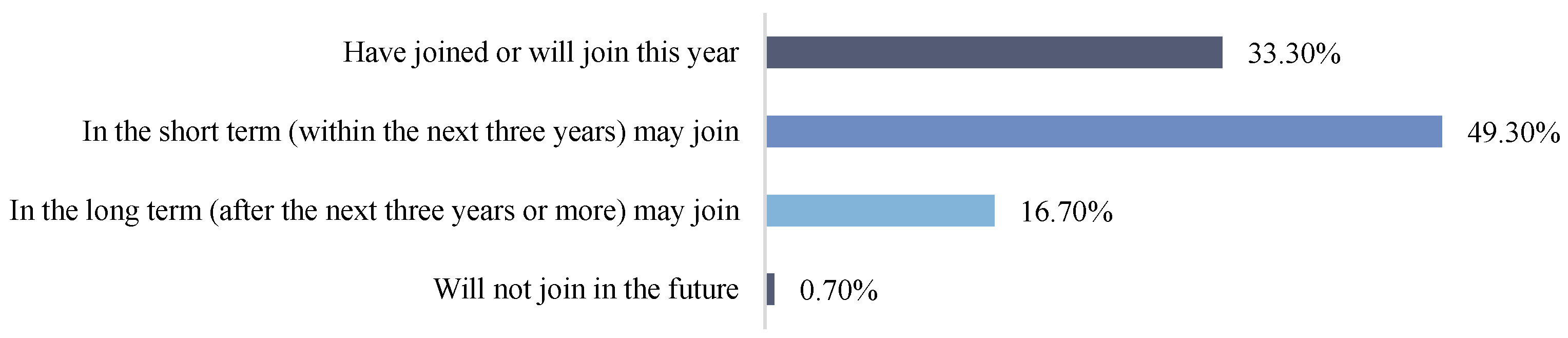

- Low planning for carbon trading: Power enterprises have a strong willingness to participate in trading. According to the survey, it is expected that a large portion of enterprises will join carbon trading within the next three years, and in the longer term, all power enterprises may eventually join carbon trading. However, the plans for carbon trading are unclear. In 2021, carbon trading exhibited obvious peak values and long tails, and the carbon price could not truly reflect the market supply and demand [35]. Not only is the planning for trading weak, but the preparation and completion of trading work also vary significantly among different enterprises, especially between control-emission and non-control-emission enterprises.

- (3)

- Lack of carbon management systems and personnel: The preparation of enterprises in terms of carbon management systems is not ideal, with only 12% of the surveyed enterprises having all the required system documents for the mentioned tasks. Furthermore, there is a shortage of dedicated carbon asset management personnel in power generation enterprises in Beijing, with nearly half of the surveyed enterprises having almost no dedicated personnel for carbon asset management; the carbon management work is mostly handled by part-time staff from other business departments, such as finance [36]. This could be due to the scarcity of existing professional talent in carbon management and the cost of hiring dedicated personnel.

- (4)

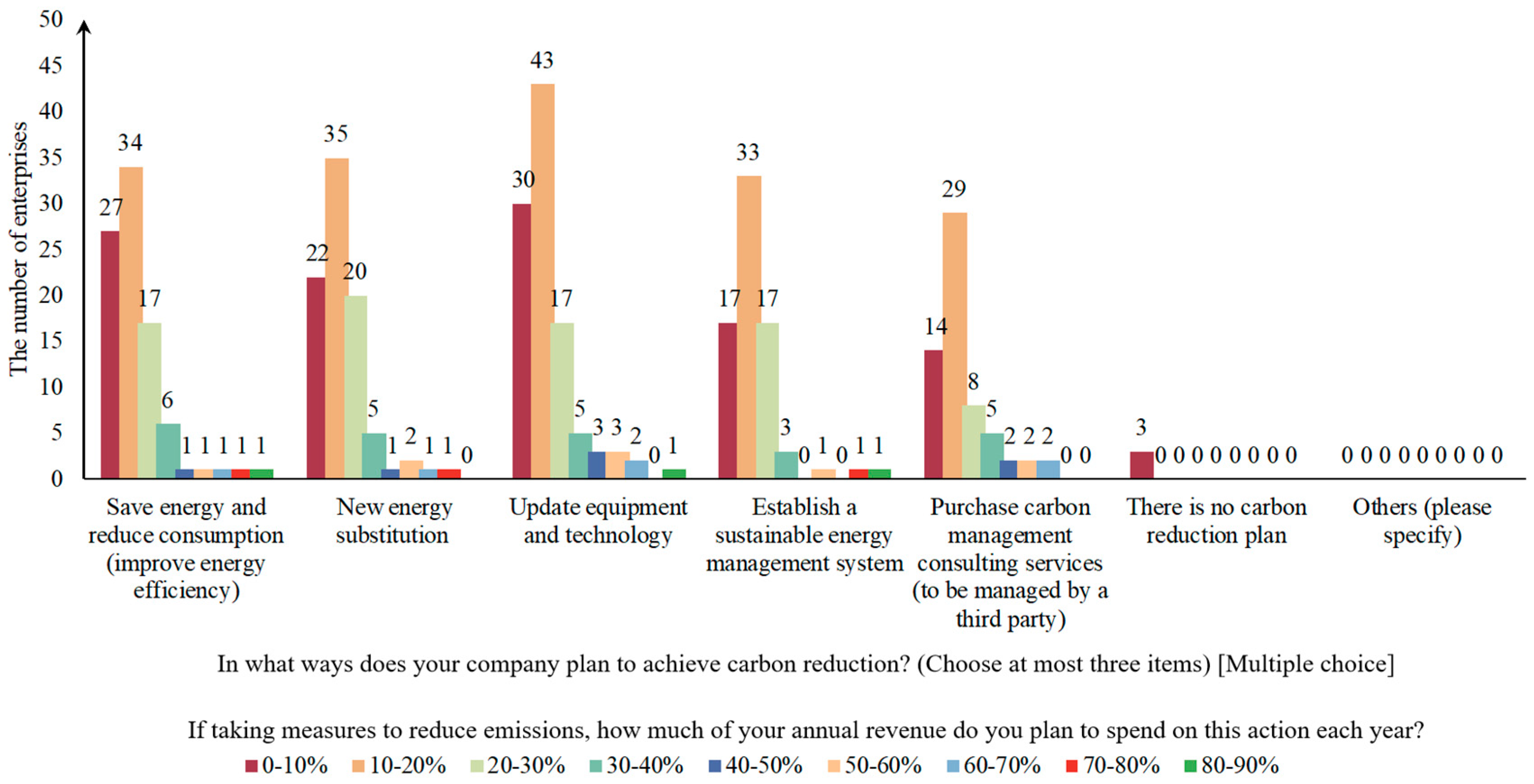

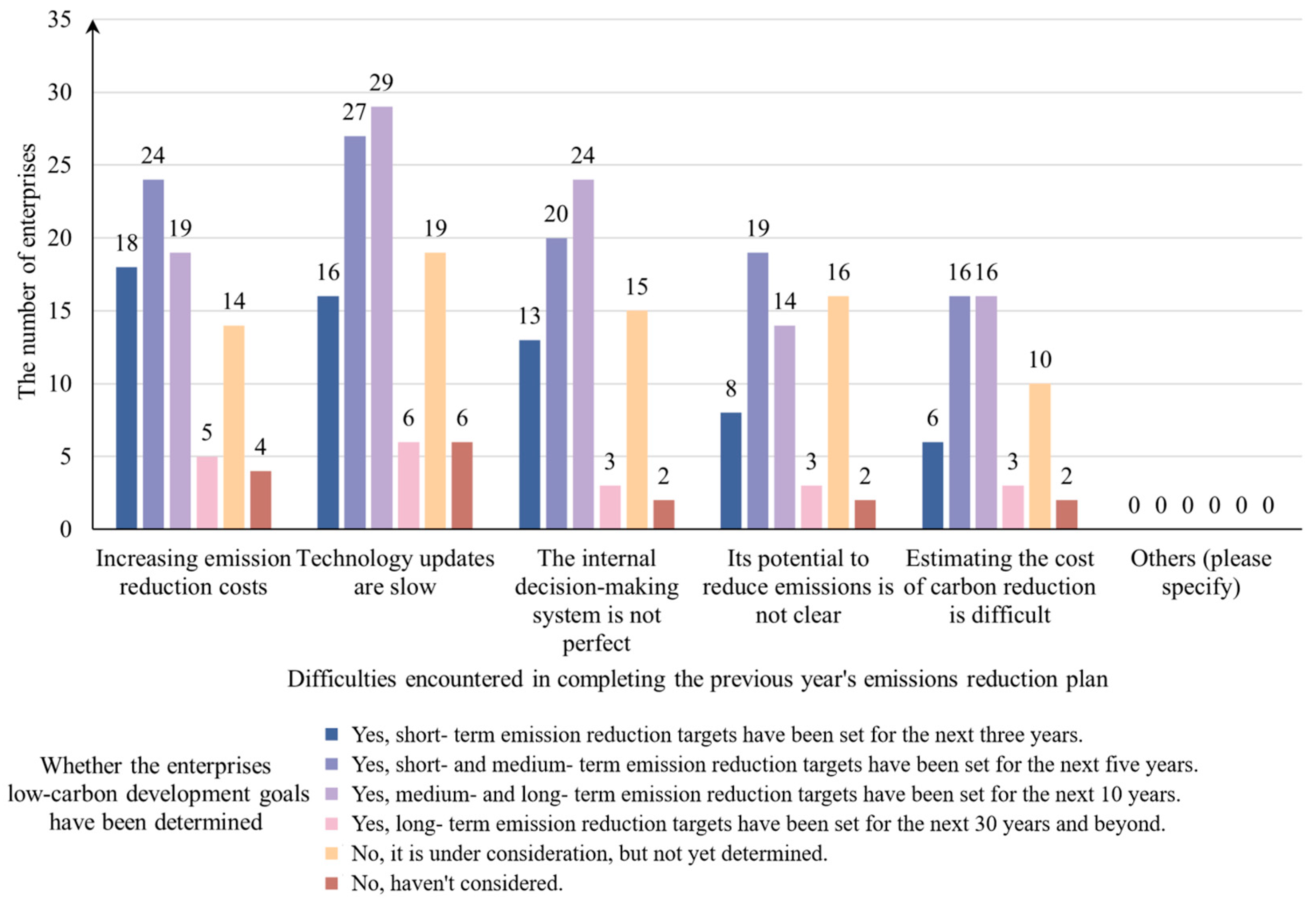

- Difficulty in achieving carbon emission reduction targets: The preparation and implementation of emission reduction work reflect no difference between control-emission and different energy consumption levels of enterprises, indicating that, against the backdrop of reducing carbon costs and increasing carbon trading chips, power generation enterprises in Beijing generally attach importance to emission reduction work. In 2021, most power generation enterprises in Beijing had carbon emission reduction plans, with the annual carbon reduction budget for most enterprises being roughly between 10% and 20% of annual revenue. However, many enterprises find it challenging to meet their reduction targets. The high cost of emission reduction and slow technological updates are the two main reasons for the currently low efficiency and challenging nature of emission reduction for enterprises.

- (5)

- Low understanding and application of carbon financial tools: The current Chinese carbon financial market generally suffers from inadequate legal and institutional systems, with few financial market products and uncertain returns on low-carbon industries. Power enterprises’ exploration and trust in carbon financial tools are still insufficient. Coupled with the scarcity of professional talent, this has led to a generally low level of understanding and insufficient preparation for joining the carbon financial market among power enterprises. Many power enterprises are still in the understanding stage, expressing plans to engage, but only a very small portion have actually initiated such efforts.

5. Enterprise Carbon Asset Management System Construction

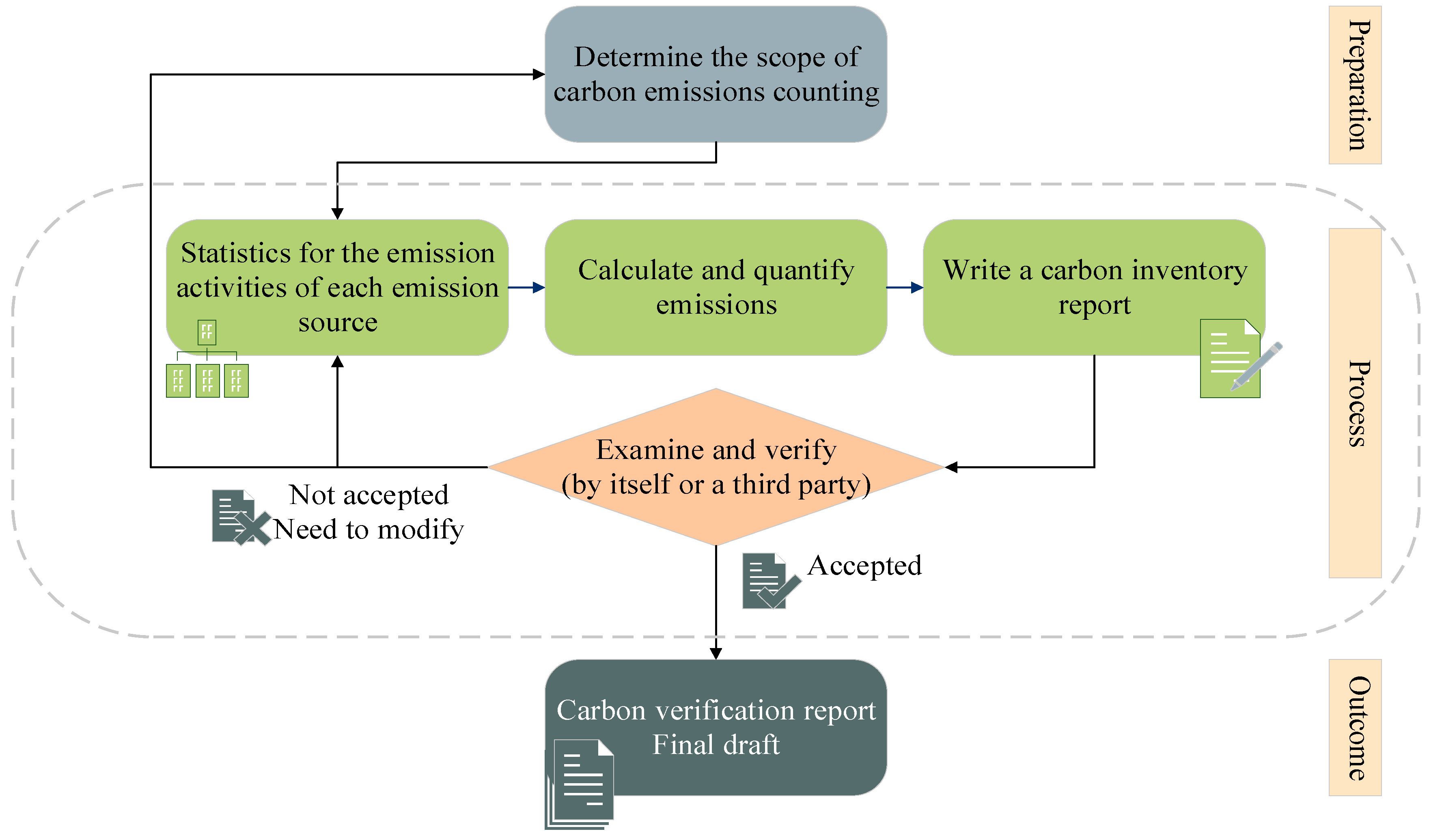

5.1. Enterprise Carbon Asset Inventory

- (1)

- Enterprise Self-Planning and Positioning

- (2)

- Establishing a Carbon Inventory System

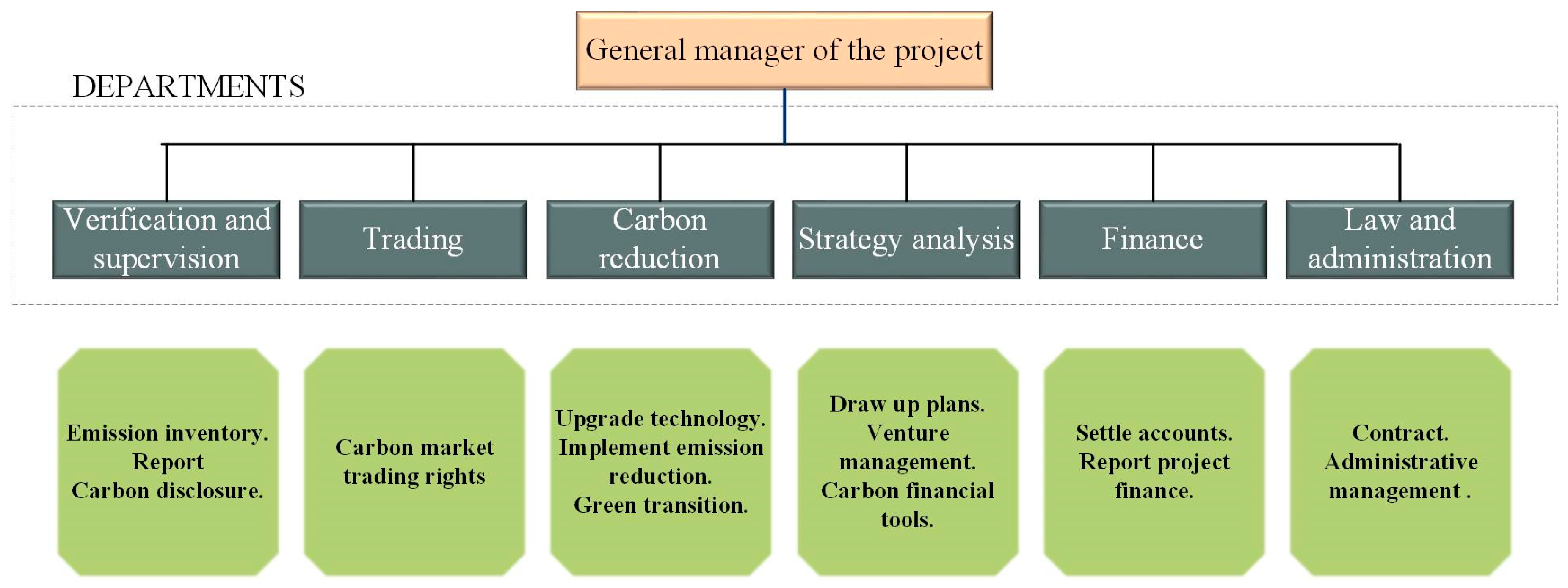

5.2. Establishing a Carbon Management Mechanism

- (1)

- Determine the carbon management organizational structure and actively train personnel

- (2)

- Formulate the enterprise’s carbon asset management system

5.3. Establishing a Carbon Trading System

- (1)

- Mastering Trading Rules and Market Dynamics

- (2)

- Determining the Trading Demand and Trading Strategies

- (3)

- Determining Trading Products and Methods

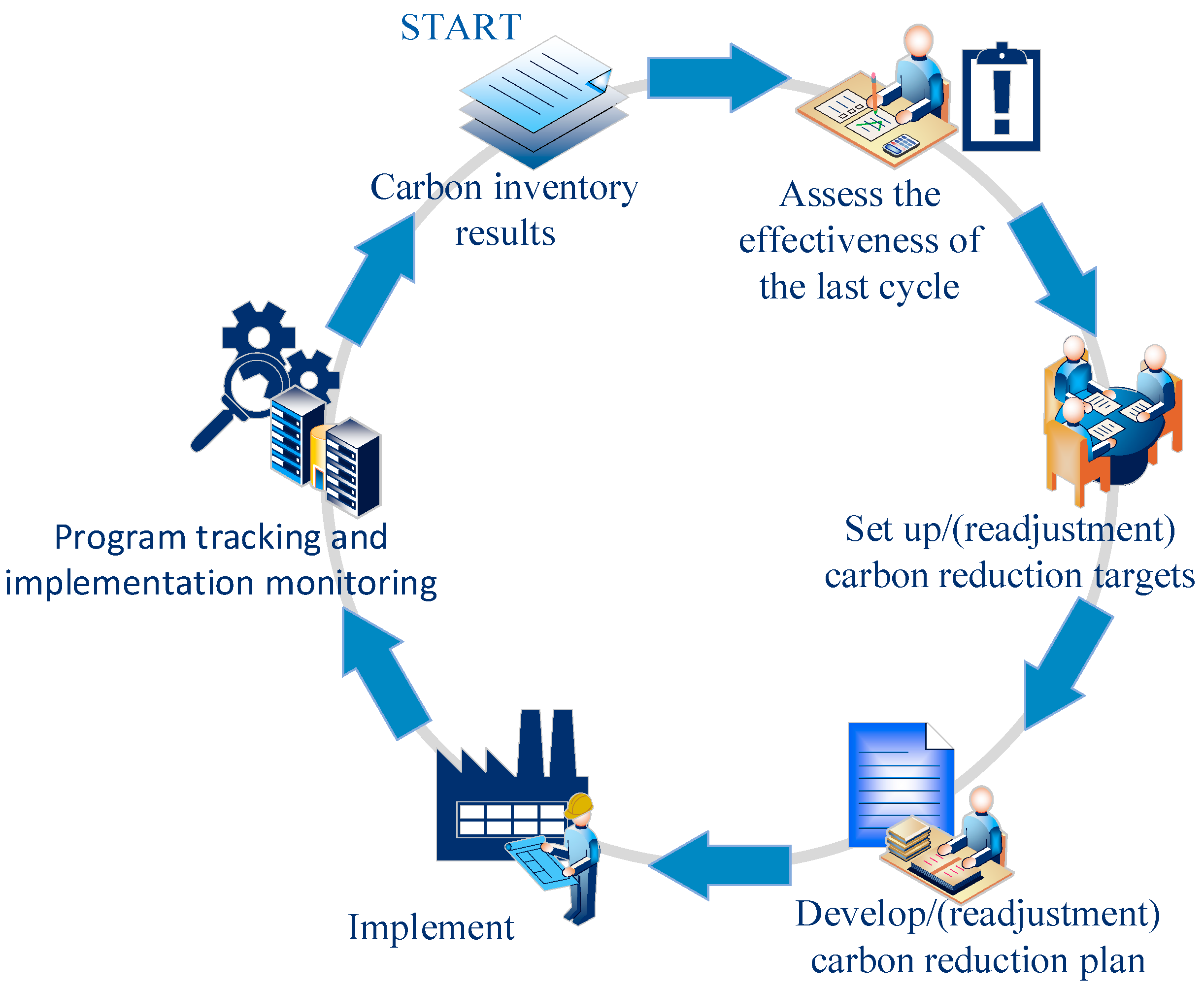

5.4. Establishing a Carbon Emission Reduction System

- (1)

- Analysis of the Carbon Emission Reduction Potential and Costs

- (2)

- Developing and implementing a Carbon Emission Reduction Plan

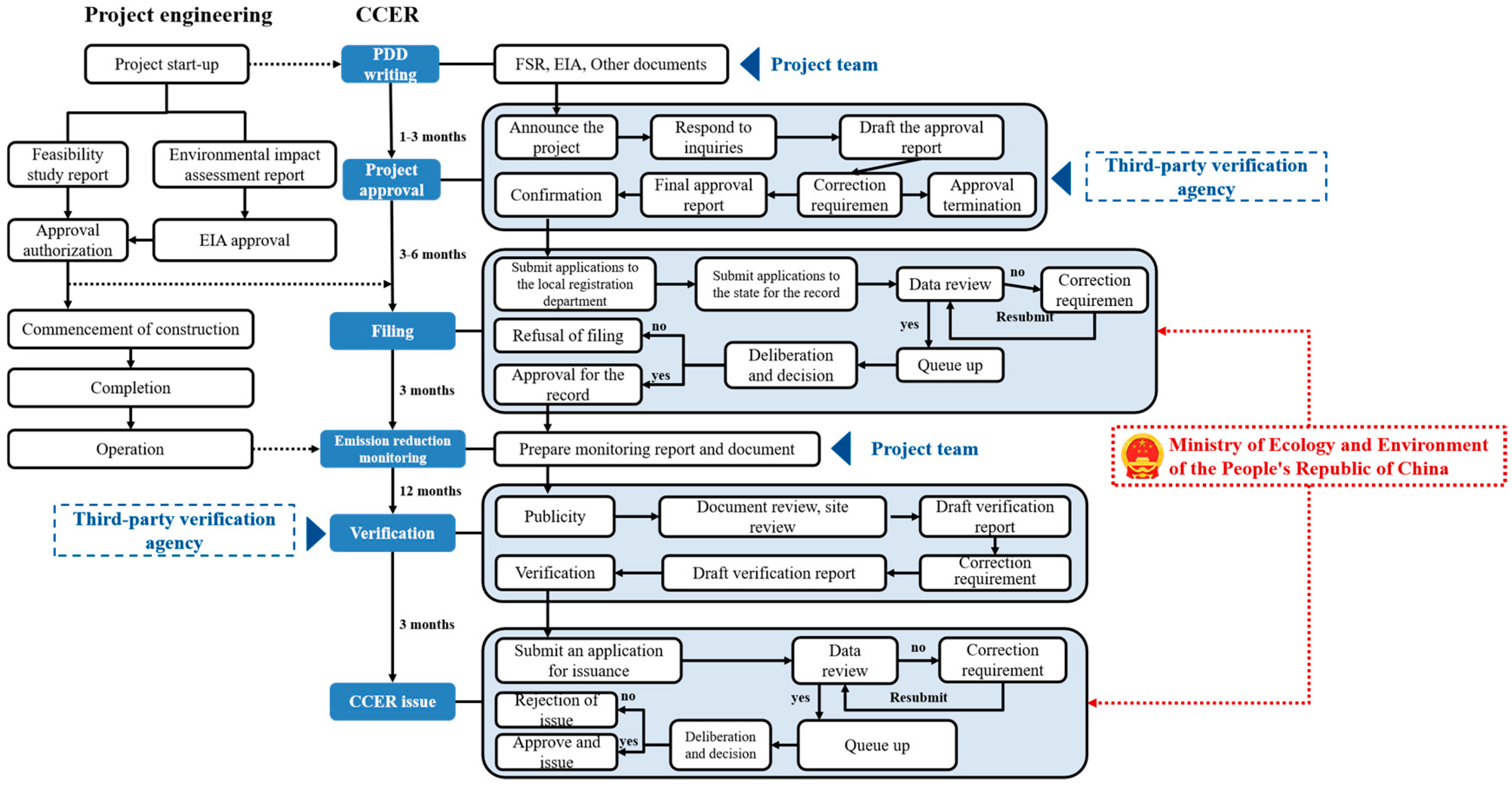

5.5. Constructing a Carbon Financial System

- (1)

- The Development and Reservation of CCER Projects

- (2)

- Functions and roles of carbon financial tools

- (3)

- Participate in carbon financial innovation to increase the value of carbon assets

5.6. Policy and Institutional Level Recommendations

6. Conclusions

- The overall carbon management effectiveness of Beijing power enterprises is generally average.

- 2.

- Regarding internal work,

- The effectiveness of carbon inventory work is of significant importance, and its effectiveness is positively correlated with the effectiveness of other internal work within the system. The situation of carbon inventory work in power enterprises is generally good.

- The ownership rate of carbon management mechanisms and institutional documents is low.

- Participation in carbon trading lacks planning.

- Carbon emission reduction work receives the most attention among the five mentioned in this article. Enterprises actively seek emission reduction strategies, but the actual emission reduction effectiveness is average, and enterprises find emission reduction to be extremely challenging.

- The potential of the carbon financial market has not been fully explored, and power enterprises have low trust in the carbon financial market and adopt a wait-and-see attitude.

- 3.

- Having a dedicated carbon management team and carbon asset management system is important for conducting related work.

- 4.

- Different characteristics of Beijing power enterprises, such as their low-carbon development goals, the presence of a dedicated carbon asset management department/team, and whether they are key emission units, affect the independent conduct and preparation of work such as carbon inventory, CCER development, and the allocation and training of carbon management personnel, thereby affecting the actual carbon management effectiveness of enterprises.

- ①

- Overall assessment of carbon management effectiveness

- Other countries and regions can refer to the carbon management effectiveness evaluation system of Beijing’s electric power companies to establish evaluation standards suitable for their own national conditions, which can be used to measure the carbon management performance of enterprises; by comparing the carbon management effectiveness of different regions and industries, other countries can set corresponding baselines and encourage enterprises to meet or exceed these standards.

- ②

- Specific analysis of the work within the system

- Other countries and regions should strengthen their work on carbon inventory to ensure the accuracy and completeness of data to provide a reliable basis for carbon emissions trading, strengthen the internal management mechanism of enterprises, develop institutional documents to ensure that carbon management activities are based on evidence, and improve the management level of enterprises. Although enterprises attach importance to carbon emission reduction, the actual effect is general, which suggests that other countries and regions need to strengthen their technological innovation and technology transfer to improve the efficiency of emission reduction.

- ③

- Importance of a full-time carbon management team

- Other countries and regions can learn from Beijing’s experience and encourage enterprises to establish full-time carbon management teams to improve the specialization of carbon asset management. By establishing a comprehensive carbon asset management system, enterprises can better integrate various carbon management tasks and improve the overall management effect.

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A. Investigation into the Construction, Improvement, and Existing Problems of Carbon Asset Management Systems in Power Generation Enterprises in Beijing

- Your company name is: (optional) [Fill in the blanks] (Optional)______________________________Ⅰ. Basic information of enterprises

- According to the “Carbon Emission Trading Administration Measures (Trial)”, is your enterprise a key emission unit? [Single choice]○ Yes○ No

- The number of official employees in your enterprise is approximately: [Single choice]○ Under 50○ 50–100○ 101–150○ 151–200○ More than 200

- At present, the main way of generating electricity in your enterprise is __________ (Choose at most 2 items) [Multiple choice]□ Thermal power generation□ Hydroelectric power generation□ Wind power generation□ Photovoltaic power generation□ Biological power generation□ Geothermal power generation□ Tidal power□ Other green electricity

- Annual comprehensive average energy consumption range of your enterprise in the last three years (unit: tons of standard coal/year) [Single choice]○ <5000○ 5000–10,000○ >=10,000

- Which of the following is most closely related to your enterprise’s carbon emission status? [Single choice]○ Almost achieved carbon neutrality within the company.○ Already peaked, but not yet achieved carbon neutrality within the company, and continuing to reduce emissions.○ Not yet peaked, and is expected to peak by 2025.○ Not yet peaked, and is expected to peak by 2030.○ Not yet peaked, uncertain about the time to reach carbon peak.

- Has your enterprise participated in carbon emission rights trading in 2021? [Single choice]○ Yes○ NoⅡ. Attitude and goal

- How does your enterprise view the impact of “carbon peak and carbon neutrality” on your company? [Single choice]○ Under pressure○ Beneficial○ Have little effect on○ Have not paid attention to

- Your enterprise thinks that “carbon peak and carbon neutrality” puts pressure on the company, mainly because the dual-carbon target makes the company __________ (Choose at most 3 items) [Multiple choice]□ Limited scale of development□ Faced with increasingly stringent emission reduction policies□ Facing more fierce market competition□ Power generation costs are rising and profit expectations are falling□ The economic and human costs of carbon management increase□ Others (please add)

- Your enterprise believes that “Carbon peak · Carbon neutrality” is beneficial to the company, mainly because the two-carbon target enables the company __________. (Choose at most 3 items) [Multiple choice]□ Have more development opportunities□ The emission reduction work has received strong policy support□ The market demand in the industry is increasing□ Market competitiveness has increased, and profit expectations have risen□ We will accelerate industrial transformation and upgrading□ Others (please add)

- Whether your enterprise low-carbon development goals have been determined? [Single choice]○ Yes, short-term emission reduction targets have been set for the next three years○ Yes, short- and medium-term emission reduction targets have been set for the next five years○ Yes, medium- and long-term emission reduction targets have been set for the next 10 years○ Yes, long-term emission reduction targets have been set for the next 30 years and beyond○ No, it is under consideration, but not yet determined○ No, haven’t considered

- If given the opportunity, would your company be willing to participate in carbon trading? [Single choice]○ Willing to attend○ Don’t want to attend○ I don’t know. I’m not sureⅢ. Regime and management system

- Whether your enterprise has a dedicated carbon asset management organization/department? [Single choice]○ Has been set○ Hasn’t set any plans at present○ No, but we has cooperated with a third party

- The number of full-time carbon asset management personnel in your enterprise accounts for about all the employees of the enterprise [Single choice]○ 1% and below○ 1–5% (including 5%)○ 5–10% (including 10%)○ 10–15% (including 15%)○ 15–20% (including 20%)○ More than 20%

- In which of the following tasks does your enterprise have a clear management system document? (Choose at most 3 items) [Multiple choice]□ Carbon inventory□ Carbon trading□ Carbon reduction□ Carbon finance□ The above work has a clear management system documents□ None

- How is your enterprise prepared to participate in the carbon emission trading system in the following aspects? [Matrix Single choice]

| Has Been Carried Out | In Preparation, Plan to Carry Out | There Is No Plan | |

| Carbon inventory work | ○ | ○ | ○ |

| Carbon trading market status, and policy research | ○ | ○ | ○ |

| Carbon reduction potential and cost analysis | ○ | ○ | ○ |

| CCER development and trading | ○ | ○ | ○ |

| Carbon management personnel training | ○ | ○ | ○ |

| Innovation and application of carbon financial instruments | ○ | ○ | ○ |

- 17.

- Please rank the following options from strong to weak in terms of the likelihood that your enterprise will trade carbon in the future. [Ranking question] (Please fill in 1–4 numeric order)_____ Carbon emission rights and CCER spot trading_____ carbon asset mortgage financing_____ Buy financial futures products_____ Trusteeship of carbon assets to specialist companies and agreement of incomeⅣ. Running process

- 18.

- The main ways for your enterprise to obtain carbon trading information are (Choose at most 3 items) [Multiple choice]□ Government propaganda□ News media (including traditional media such as TV programs, newspapers and new media such as public accounts and short videos)□ Industry/trading website□ Training institution□ Haven’t looked at the carbon market□ Others (please specify)

- 19.

- In what ways does your company plan to achieve carbon reduction? (Choose at most 3 items) [Multiple choice]□ Save energy and reduce consumption (improve energy efficiency)□ New energy substitution (Such as coal to gas, coal to electricity, the use of hydrogen energy, wind energy, photovoltaic and other new energy)□ Update equipment and technology□ Establish a sustainable energy management system□ Purchase carbon management consulting services (to be managed by a third party)□ There is no carbon reduction plan□ Others (please specify)

- 20.

- If takes measures to reduce emissions, how much of your annual revenue do you plan to spend on this action each year? (Please fill in 1–100 numbers) [Marking question]Please slide according to the proportion, if no budget please slide to “0” _____

- 21.

- Has your company ever designed and developed CCER projects or considered developing them? [Single choice]○ Designed and developed, has been registered successfully and produces emission reduction○ Considering development, waiting for more clear policy (or project design planning)○ No, hasn’t considered

- 22.

- Does your company have financing needs in addition to its own funds for low-carbon transformation [Single choice]○ Yes, the financing capital requirement is about ____ yuan○ NoⅤ. Effect

- 23.

- In terms of the following work in carbon asset management, how is your company’s completion status in 2021? [Matrix Single choice]

| Worked very Well, It Finished the Plan with High Quality | The Effect Is General, Can Complete the Plan but More Difficult | Unable to Achieve Expectations, Needs Help | There Is No Plan | |

| Carbon inventory work | ○ | ○ | ○ | ○ |

| Power generation work(Production business) | ○ | ○ | ○ | ○ |

| Carbon trading work(If you do not participate, please select “No plan”) | ○ | ○ | ○ | ○ |

| Carbon reduction efforts | ○ | ○ | ○ | ○ |

| CCER project development | ○ | ○ | ○ | ○ |

| Carbon management personnel training | ○ | ○ | ○ | ○ |

- 24.

- According to the actual effect of your company’s current management and emission reduction, does your company expect to join carbon emission trading in the future? (The Measures for the Administration of Carbon Emission Trading (Trial) stipulate that enterprises with annual energy consumption of more than 1000 tons of standard coal or annual carbon emissions of more than 26,000 tons of equivalent are key emission units) [Single choice]○ Have joined or will join this year○ In the short term (within the next three years) may join○ In the long term (after the next three years or more) may join○ Will not join in the future

- 25.

- What are the main difficulties your company encountered by enterprises in achieving emission reduction plans in 2021 (if there is no plan, what difficulties do you think you may encounter if you carry out emission reduction work?) (Choose at most 3 items) [Multiple choice]□ Increasing emission reduction costs□ Technology updates are slow□ The internal decision-making system is not perfect□ Its potential to reduce emissions is not clear□ Estimating the cost of carbon reduction is difficult□ Others (please specify)

- 26.

- What problems or difficulties do you think exist in the current financial support for low-carbon projects (Choose at most 3 items) [Multiple choice]□ Financial institutions lack the awareness to support green and low-carbon□ Financial institutions have shown little support for green projects□ Information asymmetry between banks and enterprises□ The relevant financial markets (such as mortgage, factoring, etc.) are not well developed□ Lack of professional technical consulting services□ Others (please specify)

- 27.

- Based on the effectiveness of your carbon management, which of the following services does your company require from a third party organization/company? (Multiple options available) [Multiple choice]□ Guidance on formulating low-carbon development strategies and plans for enterprises□ Carbon emissions accounting Agency and Guidance Report□ Carbon reduction potential analysis and carbon reduction work□ Carbon asset management and trading personnel training□ No third party services are required□ Others (please specify)

- 28.

- Based on the effectiveness of your carbon asset management, what other help does your company need? What are the suggestions for China to achieve “carbon peak, carbon neutrality”? (For example, which incentives for the research and development of clean energy power generation technologies can be given by the state, and which aspects require the cooperation of other industries, etc.) Please give at least one [Fill in the blanks]______________________________

Appendix B

| Indicator | Factor | Level | N | Average Value | Standard Deviation | F | Sig | Multiple Comparisons |

|---|---|---|---|---|---|---|---|---|

| CCER development and trading | Carbon emission status | 1. Almost achieved carbon neutrality within the company. | 6 | 1.17 | 0.41 | 5.232 | 0.001 | 1 < 5, 2 < 5, 3 < 5 |

| 2. Already peaked, but not yet achieved carbon neutrality within the company, and continuing to reduce emissions. | 13 | 1.15 | 0.38 | |||||

| 3. Not yet peaked, and is expected to peak by 2025. | 19 | 1.32 | 0.58 | |||||

| 4. Not yet peaked, and is expected to peak by 2030. | 25 | 1.64 | 0.86 | |||||

| 5. Not yet peaked, uncertain about the time to reach carbon peak. | 87 | 1.84 | 0.70 | |||||

| Comprehensive average energy consumption range in the past three years (ton of standard coal/year) | 1. <5000 | 65 | 1.97 | 0.68 | 17.579 | 0 | 3 < 2 < 1 | |

| 2. 5000–10,000 | 68 | 1.51 | 0.70 | |||||

| 3. >=10,000 | 17 | 1.00 | 0.00 | |||||

| Whether the enterprise low-carbon development goals have been determined | 1. Yes, short-term emission reduction targets have been set for the next 3 years. | 24 | 1.67 | 0.70 | 2.883 | 0.016 | 1 < 6, 2 < 3, 2 < 6, 4 < 6 | |

| 2. Yes, short-and medium-term emission reduction targets have been set for the next five years. | 41 | 1.39 | 0.63 | |||||

| 3. Yes, medium-and long-term emission reduction targets have been set for the next 10 years. | 41 | 1.80 | 0.75 | |||||

| 4. Yes, long-term emission reduction targets have been set for the next 30 years and beyond. | 9 | 1.44 | 0.73 | |||||

| 5. No, it is under consideration, but not yet determined. | 29 | 1.72 | 0.75 | |||||

| 6. No, haven’t considered. | 6 | 2.33 | 0.52 | |||||

| Whether the enterprise has a dedicated carbon asset management organization/department | 1. Has been set | 56 | 1.23 | 0.54 | 19.096 | 0 | 1 < 2, 1 < 3 | |

| 2. Has nott set any plans at present | 45 | 1.96 | 0.64 | |||||

| 3. No, but we have cooperated with a third party. | 49 | 1.86 | 0.76 | |||||

| Carbon trading market status, and policy research | Comprehensive average energy consumption range in the past three years (ton of standard coal/year) | 1. <5000 | 65 | 1.43 | 0.61 | 4.96 | 0.008 | 3 < 2 |

| 2. 5000–10,000 | 68 | 1.69 | 0.68 | |||||

| 3. >=10,000 | 17 | 1.24 | 0.44 | |||||

| Whether the enterprise has a dedicated carbon asset management organization/department | 1. Has been set. | 56 | 1.36 | 0.52 | 8.273 | 0 | 1 < 3, 2 < 3 | |

| 2. Has not set any plans at present. | 45 | 1.42 | 0.69 | |||||

| 3. No, but we has cooperated with a third party. | 49 | 1.82 | 0.64 | |||||

| Carbon reduction potential and cost analysis | Whether the enterprise has a dedicated carbon asset management organization/department | 1. Has been set | 56 | 1.46 | 0.57 | 3.095 | 0.048 | 1 < 2, 1 < 3 |

| 2. Has not set any plans at present. | 45 | 1.73 | 0.75 | |||||

| 3. No, but we have cooperated with a third party. | 49 | 1.76 | 0.69 |

| Indicator | Factor | Level | N | Average Value | Standard Deviation | F | Sig | Multiple Comparisons |

|---|---|---|---|---|---|---|---|---|

| Carbon trading | Whether the enterprise has a dedicated carbon asset management organization/department | 1. Has been set. | 56 | 2.21 | 1.04 | 30.877 | 0 | 1 < 2, 1 < 3 |

| 2. Has not set any plans at present. | 45 | 3.58 | 0.87 | |||||

| 3. No, but we have cooperated with a third party. | 49 | 3.37 | 0.93 | |||||

| Power generation | Whether the enterprise low-carbon development goals have been determined | 1. Yes, short-term emission reduction targets have been set for the next 3 years. | 24 | 1.46 | 0.51 | 4.756 | 0 | 1 < 3, 2 < 3, 2 < 6, 3 > 4, 3 > 5 |

| 2. Yes, short- and medium-term emission reduction targets have been set for the next 5 years. | 41 | 1.37 | 0.58 | |||||

| 3. Yes, medium- and long-term emission reduction targets have been set for the next 10 years. | 41 | 2.05 | 0.89 | |||||

| 4. Yes, long-term emission reduction targets have been set for the next 30 years and beyond. | 9 | 1.44 | 0.73 | |||||

| 5. No, it is under consideration, but not yet determined. | 29 | 1.69 | 0.71 | |||||

| 6. No, have not considered. | 6 | 2.00 | 0.63 | |||||

| Carbon emission reduction | Whether the enterprise low-carbon development goals have been determined | 1. Yes, short-term emission reduction targets have been set for the next 3 years. | 24 | 1.63 | 0.82 | 2.522 | 0.032 | 1 < 3, 1 < 5, 1 < 6, 2 < 3, 2 < 6 |

| 2. Yes, short- and medium-term emission reduction targets have been set for the next 5 years. | 41 | 1.83 | 0.77 | |||||

| 3. Yes, medium- and long-term emission reduction targets have been set for the next 10 years. | 41 | 2.22 | 0.85 | |||||

| 4. Yes, long-term emission reduction targets have been set for the next 30 years and beyond. | 9 | 1.78 | 0.83 | |||||

| 5. No, it is under consideration, but not yet determined. | 29 | 2.14 | 0.92 | |||||

| 6. No, have not considered. | 6 | 2.5 | 1.05 | |||||

| Whether the enterprise has a dedicated carbon asset management organization/department | 1. Has been set. | 56 | 1.66 | 0.67 | 8.088 | 0 | 1 < 2, 1 < 3 | |

| 2. Has not set any plans at present. | 45 | 2.04 | 0.85 | |||||

| 3. No, but we have cooperated with a third party. | 49 | 2.31 | 0.96 | |||||

| Carbon inventory | Whether the enterprise has a dedicated carbon asset management organization/department | 1. Has been set. | 56 | 2.45 | 1.40 | 3.497 | 0.033 | 1 < 3 |

| 2. Has not set any plans at present. | 45 | 2.87 | 1.38 | |||||

| 3. No, but we have cooperated with a third party. | 49 | 3.12 | 1.18 |

References

- National Development and Reform Commission. Notice on Carbon Emission Trading Pilot Work (NDRC QI [2011] 2601). Available online: https://zfxxgk.ndrc.gov.cn/web/iteminfo.jsp?id=1349 (accessed on 27 July 2024).

- Ministry of Ecology and Environment of the People’s Republic of China. Measures for the Administration of Carbon Emission Trading (for Trial Implementation). Available online: https://www.gov.cn/zhengce/2021-01/05/content_5711435.htm (accessed on 27 July 2024).

- Marland, G.; Sedijo, R.; Fruit, K. Accounting for sequestered carbon: The question of permanence. Environ. Sci. Policy 2001, 4, 259–268. [Google Scholar] [CrossRef]

- Julien, C. Carbon futures and macroeconomic risk factors: A view from the EUETS. Energy Econ. 2009, 31, 614–625. [Google Scholar]

- Tao, C.H. Carbon assets: A new concept of eco-environmental protection--research on concept, significance and implementation path. Acad. Forum 2016, 39, 64–67. [Google Scholar]

- Zhao, Y.F.; Li, J.J.; Zhang, J. Recognition and Measurement of Carbon Assets Based on Carbon Emission Right Attributes. Financ. Theory Pract. 2018, 466, 1–4. [Google Scholar]

- Yuan, G.D.; Xu, D.Y. Carbon accounting research on the convergence of dual-carbon objectives. Friends Account. 2023, 698, 101–107. [Google Scholar]

- Wang, C.; Liao, L.G.; Li, X.W. Can environmental protection and banking development be synergized?—An analysis based on the low-carbon city pilot in China. Environ. Sci. Pollut. Res. 2022, 31, 10016–10031. [Google Scholar]

- Wang, H.; Yang, H.; Liu, D. Research on the Countermeasures for Power Generation Enterprises under the Impact of Carbon Emission Trading System. IOP Conf. Ser. Earth Environ.Sci. 2019, 237, 062017. [Google Scholar] [CrossRef]

- Xu, X.; Guan, C.; Jin, J. Valuing the carbon assets of distributed photovoltaic generation in China. Energy Policy 2018, 121, 374–382. [Google Scholar] [CrossRef]

- Liu, Y.; Tian, L.; Xie, Z.; Sun, H. Option to survive or surrender: Carbon asset management and optimization in thermal power enterprises from China. J. Clean. Prod. 2021, 314, 128006. [Google Scholar] [CrossRef]

- Burritt, R.L.; Schaltegger, S.; Zvezdov, D. Carbon management accounting: Explaining practice in leading German companies. Aust. Acc. Rev. 2011, 21, 80–98. [Google Scholar] [CrossRef]

- Zhang, C.P.; Randhir, T.O.; Zhang, Y. Theory and practice of enterprise carbon asset management from the perspective of low-carbon transformation. Carbon Manag. 2018, 9, 87–94. [Google Scholar] [CrossRef]

- Shen, Y.; Su, Z.-W.; Huang, G.; Khalid, F.; Farooq, M.B.; Akram, R. Firm market value relevance of carbon reduction targets, external carbon assurance and carbon communication. Carbon Manag. 2020, 11, 549–563. [Google Scholar] [CrossRef]

- Naranjo Tuesta, Y.; Crespo Soler, C.; Ripoll Feliu, V. The Influence of Carbon Management on the Financial Performance of European Companies. Sustainability 2022, 12, 4951. [Google Scholar] [CrossRef]

- Nishitani, K.; Kokubu, K. Why does the reduction of greenhouse gas emissions enhance firm value? The case of Japanese manufacturing firms. Bus. Strateg. Environ. 2012, 21, 517–529. [Google Scholar] [CrossRef]

- Zhen, G. Carbon asset management of key emitting enterprises under the national carbon market. Mod. Commer. Trade 2021, 42, 87–88. [Google Scholar]

- Yang, G.J.; Xu, Z.; Shen, F.H. Current situation analysis and prospect of carbon emissions reduction and participation in carbon trading market in the power generation industry. Environ. Prot. 2018, 46, 22–26. [Google Scholar]

- Li, Y.S.; Cai, T.L.; Wang, L.; Zhao, S.; Zhang, L. A review of research on the planning and construction of carbon asset management system. Electr. Power Electr. Eng. 2023, 11, 14–18. [Google Scholar]

- Hrasky, S. Carbon footprints and legitimation strategies: Symbolism or action? Account. Audit. Account. J. 2012, 25, 174–198. [Google Scholar] [CrossRef]

- Liu, Z.; Zhang, C. Quality evaluation of carbon information disclosure of public companies in China’s electric power sector based on ANP-Cloud model. Environ. Impact Assess. Rev. 2022, 96, 106818. [Google Scholar] [CrossRef]

- Chen, N. Construction and Application of Carbon Asset Management System for H Power Enterprises Based on Enterprise Value Creation. Master’s Thesis, Lanzhou University of Technology, Lanzhou, China, 2023. [Google Scholar]

- Jiang, Y.; Hu, Y.; Asante, D.; Ampaw, E.M.; Asante, B. The Effects of Executives’ low-carbon cognition on corporate low-carbon performance: A study of managerial discretion in China. J. Clean. Prod. 2022, 357, 132015. [Google Scholar] [CrossRef]

- Hu, X.Y.; Cao, W.W.; Qin, Z. Research on the current situation of domestic carbon emission trading market. China Explor. Des. 2023, S1, 64–68. [Google Scholar]

- Song, H.Y.; Zhang, X.X.; Zhang, G. The Development and Problems of China’s Carbon Market. IOP Conf. Ser. Earth Environ. Sci. 2020, 440, 042100. [Google Scholar] [CrossRef]

- Wang, P. Research on Multi-Market Coupled Trading Model for Wind and Solar Energy Generation Companies. Ph.D. Thesis, North China Electric Power University, Beijing, China, 2023. [Google Scholar]

- Tao, C.H. Research on Enterprise Carbon Asset Management Oriented to Value Creation. Ph.D. Thesis, Beijing Jiaotong University, Beijing, China, 2016. [Google Scholar]

- Yu, C.X. Research on Carbon Trading Model of Multi-Energy Coupled System in Carbon Financial Market. Master’s Thesis, Kunming University of Science and Technology, Kunming, China, 2023. [Google Scholar]

- Wang, L.P.; Long, Y.; Li, C. Research on the impact mechanism of heterogeneous environmental regulation on enterprise green technology innovation. J. Environ. Manag. 2022, 322, 116127. [Google Scholar] [CrossRef] [PubMed]

- Pricewaterhouse Coopers. [State-Owned Enterprise Reform Observatory] Thoughts on the Management of Carbon Emissions in State-Owned Enterprises. Available online: https://mp.weixin.qq.com/s/UQ-ImQaoU_3gu1tjBocaQA (accessed on 10 May 2023).

- Xinxiangxin. Current Situation and Breakthrough of Carbon Asset Management in China. Available online: https://mp.weixin.qq.com/s/ygcguD-sd4dOJRph6nfbLA (accessed on 10 February 2022).

- Ministry of Ecology and Environment. Notice on the Issuance of the “Implementation Plan for the Total Quota Setting and Allocation of National Carbon Emission Trading in 2019–2020 (Power Generation Industry)” and the “List of Key Emission Units included in the Management of National Carbon Emission Trading Quotas in 2019–2020” and the Pre-Allocation of Quotas for the Power Generation Industry (Guohuan Climate [2020] No. 3). Available online: https://www.mee.gov.cn/xxgk2018/xxgk/xxgk03/202012/t20201230_815546.html (accessed on 10 February 2022).

- Liu, Y.; Xu, L.; Sun, H.; Chen, B.; Wang, L. Optimization of carbon performance evaluation and its application to strategy decision for investment of green technology innovation. J. Environ. Manag. 2023, 325 Pt A, 116593. [Google Scholar] [CrossRef]

- Ma, M. The first compliance period “ends”, and the national carbon market starts a new journey. Financial Times, 6 January 2022. [Google Scholar]

- Zhang, T.; Zou, S.H. Carbon Market Evaluation Based on Random Walk Hypothesis in China. Math. Probl. Eng. 2022, 2022, 726108. [Google Scholar] [CrossRef]

- Hou, B.J. Current situation analysis and countermeasures for energy-saving and environmental protection enterprises participating in the carbon market. Resour. Conserv. Environ. Prot. 2020, 8, 141. [Google Scholar]

- Liu, Z. Research on Carbon Inventory Methods and Index System in the Power Industry. Master’s Thesis, North China Electric Power University, Beijing, China, 2013. [Google Scholar]

- Li, R.; Zhang, Y.Q.; Liu, C.Q.; Tang, X.M. Ideas and suggestions for large power groups to build a carbon management system. Mod. State-Own. Enterp. Res. 2017, 24, 220–221. [Google Scholar]

- Cao, Y.; Zha, D.L.; Wang, Q.W.; Wen, L. Probabilistic carbon price prediction with quantile temporal convolutional network considering uncertain factors. J. Environ. Manag. 2023, 342, 118137. [Google Scholar] [CrossRef]

- Liu, Y.; Tian, L.; Sun, H.; Yuan, L.; Zhang, X. Marginal return-ability measurement of carbon emission right and its application to unification route analysis of carbon markets. Clean. Prod. 2022, 345, 130684. [Google Scholar] [CrossRef]

- Liu, J.; Zhang, C. A Neural Network Model for Digitizing Enterprise Carbon Assets Based on Multimodal Knowledge Mapping. Comput. Intell. Neurosci. 2022, 2022, 4485168. [Google Scholar] [CrossRef]

- Shang, N.; Chen, Z.; Lu, Z.L.; Leng, Y. Interaction mechanism and coordination mechanism of power market, carbon market and green certificate market. Power Syst. Technol. 2022, 9, 1–13. [Google Scholar]

- Zhang, Y.X.; Zhao, X.H.; Fu, B.W. Impact of energy saving on the financial performance of industrial enterprises in China: An empirical analysis based on propensity score matching. J. Environ. Manag. 2022, 317, 115377. [Google Scholar] [CrossRef] [PubMed]

- Meng, Z.M.; Ge, X.A. Practical Operation of Carbon Emission Trading in China; Chemical Industry Press: Beijing, China, 2016; Volume 270, p. 292. [Google Scholar]

- Ding, L.L. Research on Enterprise Carbon Emission Reduction Decision-Making Based on Multi-Level Equilibrium. Master’s thesis, Jiangsu University, Zhenjiang, China, 2020. [Google Scholar]

- Chen, J.; Li, H.P.; Lin, J.H.; Li, S.Y. Research on low-carbon transformation problems and paths of China’s power industry under the carbon neutrality target. In Proceedings of the 2021 Annual Conference of the Chinese Society for Environmental Sciences, Tianjin, China, 19–21 October 2021. [Google Scholar]

- Peng, Y.H. Analysis of the Decoupling Effect of Carbon Emissions and Economic Growth in China’s Power Industry. Master’s Thesis, North China University of Water Resources and Electric Power, Zhengzhou, China, 2021. [Google Scholar]

- Lu, Y.G. Study on carbon efficiency and carbon emission reduction cost of China’s thermal power enterprises. Master’s Thesis, Zhejiang University, Hangzhou, China, 2019. [Google Scholar]

- Wolf-Peter, S.; Alexander, Z. Long-run power storage requirements for high shares of renewables: Results and sensitivities. Renew. Sustain. Energy Rev. 2018, 83, 156–171. [Google Scholar]

- Wang, K.; Li, S. China’s Carbon Market: Reviews and Prospects (2022). J. Beijing Univ. Technol. (Soc. Sci. Ed.) 2022, 24, 33–42. [Google Scholar]

- Xia, M.Y.; Chuai, X.W.; Xu, H.B.; Cai, H.H.; Xiang, A.; Lu, J.; Li, M. Carbon deficit checks in high resolution and compensation under regional inequity. J. Environ. Manag. 2023, 328, 116986. [Google Scholar] [CrossRef] [PubMed]

- Sun, Q.F.; Nian, Z.Q. Practice and system construction of green finance under the “dual carbon” vision. J. Fujian Norm. Univ. (Philos. Soc. Sci. Ed.) 2022, 1, 71–79. [Google Scholar]

- Ma, Y.R.; Chen, B. On the current development and operation mechanism of China’s carbon funds. Acad. Exch. 2011, 10, 131–135. [Google Scholar]

- Chen, Y.F. Enterprise Competition and Cooperation in Supply Chain Carbon Finance. Master’s Thesis, South China University of Technology, Guangzhou, China, 2017. [Google Scholar]

- Shi, B.B.; Li, N.; Gao, Q.; Li, G.Q. Market incentives, carbon quota allocation and carbon emission reduction: Evidence from China’s carbon trading pilot policy. J. Environ. Manag. 2022, 319, 115650. [Google Scholar] [CrossRef]

- Zou, S.; Zhang, T. Correlation and dynamic volatility spillover between green investing market, coal market, and CO2 emissions: Evidence from Shenzhen carbon market in China. Adv. Civ. Eng. 2022, 2022, 7523563. [Google Scholar] [CrossRef]

| Option | Frequency | Percentage | Average Value | Standard Deviation | |

|---|---|---|---|---|---|

| Whether it is a key emission unit | Yes | 79 | 53% | 1.47 | 0.50 |

| No | 71 | 47% | |||

| Number of official employees | Under 50 | 44 | 29% | 2.61 | 1.40 |

| 50–100 | 33 | 22% | |||

| 101–150 | 32 | 21% | |||

| 151–200 | 20 | 13% | |||

| More than 200 | 21 | 14% | |||

| The main way of generating electricity (up to two) | Thermal power generation | 63 | 42% | 0.42 | 0.50 |

| Hydroelectric power generation | 53 | 35% | 0.35 | 0.48 | |

| Wind power generation | 54 | 36% | 0.36 | 0.48 | |

| Photovoltaic power generation | 25 | 17% | 0.17 | 0.37 | |

| Biological power generation | 18 | 12% | 0.12 | 0.33 | |

| Geothermal power generation | 8 | 5% | 0.05 | 0.23 | |

| Tidal power | 4 | 3% | 0.03 | 0.16 | |

| Other green electricity | 23 | 15% | 0.15 | 0.36 | |

| Comprehensive average energy consumption range in the past three years (ton of standard coal/year) | <5000 | 65 | 43% | 1.68 | 0.67 |

| 5000–10,000 | 68 | 45% | |||

| ≥10,000 | 17 | 11% | |||

| Carbon emission status | Almost achieved carbon neutrality within the company. | 6 | 4% | 4.16 | 1.18 |

| Already peaked, but not yet achieved carbon neutrality within the company, and continuing to reduce emissions. | 13 | 9% | |||

| Not yet peaked, and is expected to peak by 2025. | 19 | 13% | |||

| Not yet peaked, and is expected to peak by 2030. | 25 | 17% | |||

| Not yet peaked, uncertain about the time to reach carbon peak. | 87 | 58% | |||

| Whether participated in carbon emission rights trading (2021) | Yes | 74 | 49% | 1.51 | 0.50 |

| No | 76 | 51% | |||

| Total | 150 | 100% | — | — | |

| Whether It Is a Key Emission Unit | N | Average Value | Standard Deviations | t | Conspicuousness Sig | |

|---|---|---|---|---|---|---|

| Carbon inventory work | Yes | 79 | 1.43 | 0.523 | −3.437 | 0.001 |

| No | 71 | 1.75 | 0.603 | |||

| Carbon trading market status and policy research | Yes | 79 | 1.41 | 0.494 | −2.437 | 0.016 |

| No | 71 | 1.66 | 0.755 | |||

| Carbon reduction potential and cost analysis | Yes | 79 | 1.56 | 0.594 | −1.57 | 0.119 |

| No | 71 | 1.73 | 0.755 | |||

| CCER development and trading | Yes | 79 | 1.14 | 0.445 | −13.781 | 0 |

| No | 71 | 2.23 | 0.513 | |||

| Carbon management personnel training | Yes | 79 | 1.51 | 0.638 | −2.705 | 0.008 |

| No | 71 | 1.83 | 0.81 | |||

| Innovation and application of carbon financial instruments | Yes | 79 | 1.62 | 0.626 | −4.065 | 0 |

| No | 71 | 2.04 | 0.642 |

| Variable | Relativity | Carbon Inventory | Power Generation | Carbon Trading | Carbon Emission Reduction | CCER Project Development | Carbon Management Personnel Training |

|---|---|---|---|---|---|---|---|

| Carbon inventory | Pearson correlation | 1 | |||||

| Power generation | Pearson correlation | 0.196 * | 1 | ||||

| Carbon trading | Pearson correlation | 0.357 ** | 0.127 | 1 | |||

| Carbon emission reduction | Pearson correlation | 0.434 ** | 0.355 ** | 0.350 ** | 1 | ||

| CCER project development | Pearson correlation | 0.234 ** | 0.123 | 0.436 ** | 0.138 | 1 | |

| Carbon management personnel training | Pearson correlation | 0.300 ** | 0.263 ** | 0.147 | 0.439 ** | 0.138 | 1 |

| Order | Level | Assign Points |

|---|---|---|

| 1 | Has been carried out. | 100.00 |

| 2 | In preparation, plan to carry out. | 66.67 |

| 3 | There is no plan. | 33.33 |

| Order | Level | Assign Points |

|---|---|---|

| 1 | Worked very well, it finished the plan with high quality. | 100.00 |

| 2 | The effect is general, can complete the plan but more difficult. | 75.00 |

| 3 | Unable to achieve expectations, needs help. | 50.00 |

| 4 | There is no plan. | 25.00 |

| Carbon Inventory | Carbon Trading | Carbon Reduction | CCER Project Development | Carbon Management Personnel Training | |

|---|---|---|---|---|---|

| Carbon inventory | 1 | 1.367 | 0.833 | 3.4 | 2.1 |

| Carbon trading | 0.732 | 1 | 0.717 | 2.167 | 1.867 |

| Carbon reduction | 1.2 | 1.395 | 1 | 3.1 | 2.6 |

| CCER project development | 0.294 | 0.462 | 0.323 | 1 | 0.9 |

| Carbon management personnel training | 0.476 | 0.536 | 0.385 | 1.111 | 1 |

| Work | Carbon Inventory | Carbon Trading | Carbon Reduction | CCER Project Development | Carbon Management Personnel Training |

|---|---|---|---|---|---|

| 0.27491 | 0.21012 | 0.30423 | 0.09469 | 0.11605 |

| Grade | Frequency | Frequency (%) |

|---|---|---|

| 25–50 | 58 | 39% |

| 50–75 | 50 | 33% |

| 75–100 | 42 | 28% |

| Total | 150 | 100% |

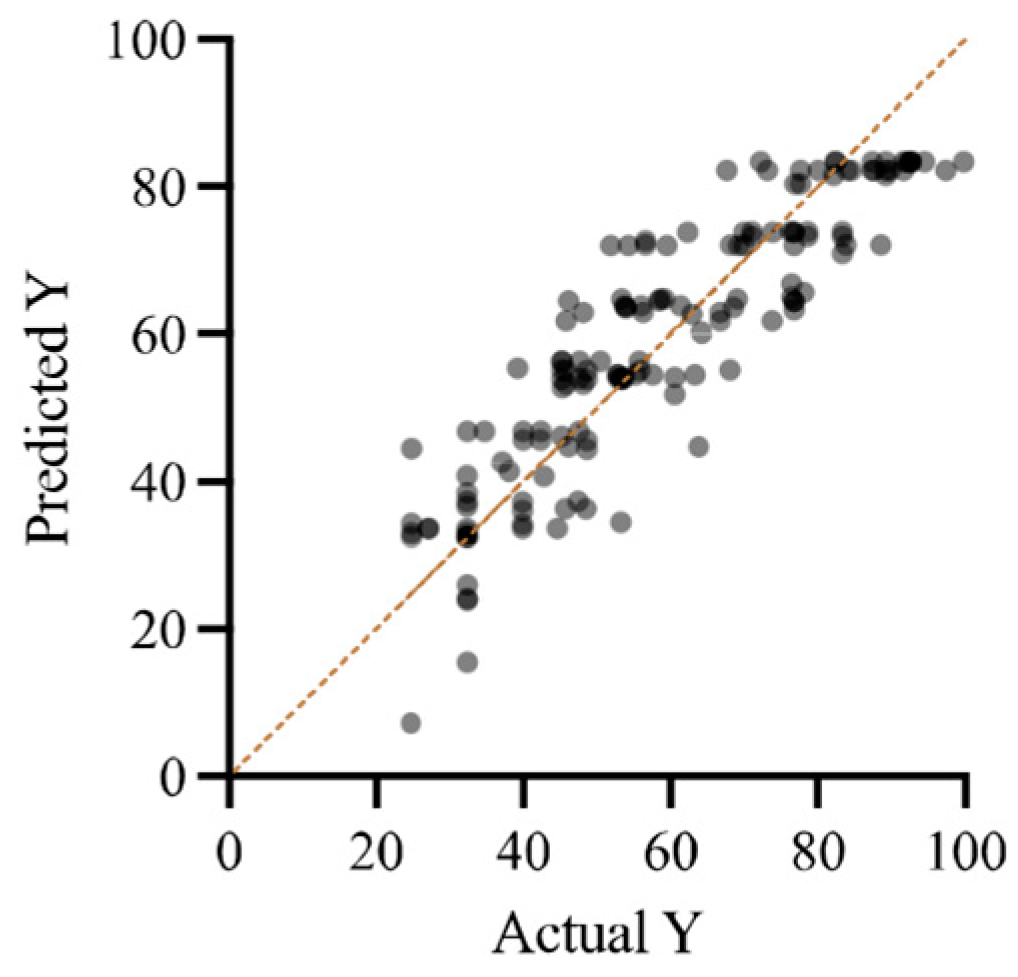

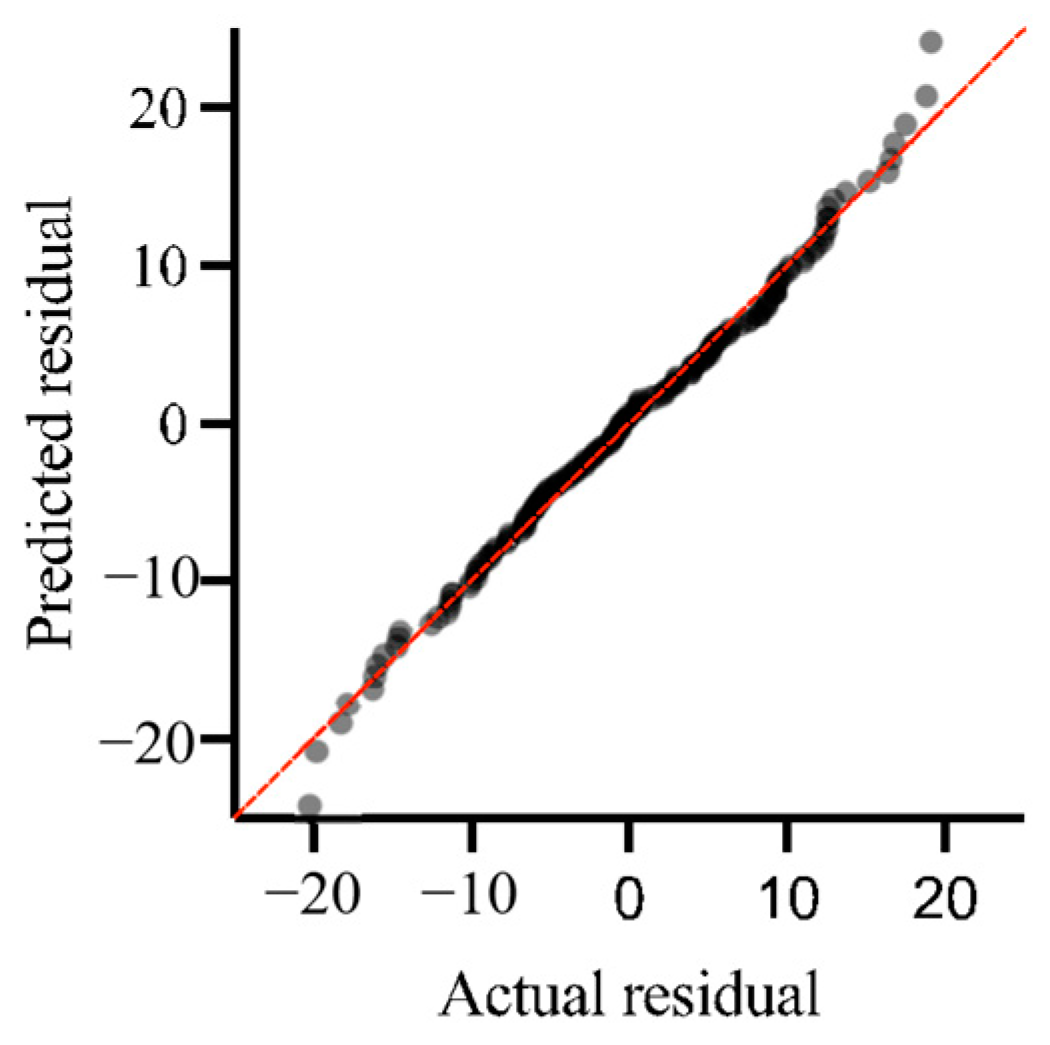

| Model Summary b | ||||

|---|---|---|---|---|

| R | R2 | Adjusted R2 | Error in the Standard Estimation | Durbin–Watson |

| 0.892 a | 0.796 | 0.789 | 9.0557898 | 2.003 |

| Unstandardized Coefficients | Standardization Coefficient | t | Significance | Collinearity Statistics | |||

|---|---|---|---|---|---|---|---|

| B | Standard Error | Beta | Allowance | VIF | |||

| (Constant) | −35.130 | 4.447 | −7.900 | 0.000 | |||

| Carbon inventory work | 0.563 | 0.040 | 0.554 | 14.018 | 0.000 | 0.907 | 1.103 |

| Carbon trading market status, and policy research | 0.055 | 0.040 | 0.059 | 1.376 | 0.171 | 0.758 | 1.319 |

| Carbon reduction potential and cost analysis | 0.035 | 0.035 | 0.040 | 1.006 | 0.316 | 0.892 | 1.121 |

| CCER development and trading | 0.286 | 0.033 | 0.350 | 8.660 | 0.000 | 0.869 | 1.151 |

| Carbon management personnel training | 0.249 | 0.034 | 0.312 | 7.257 | 0.000 | 0.767 | 1.305 |

| Compliance Type | Trading Profit-Making | Strategic Development | |

|---|---|---|---|

| Primary objective | Compliance performance | Compliance performance, carbon asset appreciation profit | Long-term low carbon development |

| Trade enthusiasm | Lower | Higher | Higher |

| The attitude towards carbon trading | Means of performance, transaction on demand | The means of profit is a form of business | Strategic needs |

| Carbon financial tools | Almost no use | Try to use | Lead the innovation, skilled use |

| Scope | Multi-numerical control enterprise | Actively control and order enterprises | Large group enterprises |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Feng, T.; Cui, M.; Zhang, M.; Liu, L. How to Construct a Carbon Asset Management System for Chinese Power Enterprises: A Survey-Based Approach. Energies 2024, 17, 3978. https://doi.org/10.3390/en17163978

Feng T, Cui M, Zhang M, Liu L. How to Construct a Carbon Asset Management System for Chinese Power Enterprises: A Survey-Based Approach. Energies. 2024; 17(16):3978. https://doi.org/10.3390/en17163978

Chicago/Turabian StyleFeng, Tiantian, Mingli Cui, Mengxi Zhang, and Lili Liu. 2024. "How to Construct a Carbon Asset Management System for Chinese Power Enterprises: A Survey-Based Approach" Energies 17, no. 16: 3978. https://doi.org/10.3390/en17163978

APA StyleFeng, T., Cui, M., Zhang, M., & Liu, L. (2024). How to Construct a Carbon Asset Management System for Chinese Power Enterprises: A Survey-Based Approach. Energies, 17(16), 3978. https://doi.org/10.3390/en17163978