Abstract

This research leverages bibliometric methodologies, enhanced by the visual analytics capabilities of CiteSpace, to meticulously examine the evolution and current trends in energy trading within power markets, analyzing 642 scholarly articles from the Web of Science Core Collection spanning from 1996 to 2023. The study aims to illuminate the prevailing research landscape, growth patterns, and future directions in energy trading dynamics. Key findings include: (1) A noticeable escalation in the volume of publications, especially from 2021 to 2023, indicating a burgeoning interest and rapid evolution in this research area; (2) The author and institutional collaboration networks are in a nascent stage, with a predominantly China-centric international collaboration pattern, including significant partnerships with the United States, Australia, and the United Kingdom; (3) The focal points of research are centered around themes such as “energy management”, “demand-side innovation”, “decentralized energy trading”, and “strategic optimization”, covering areas such as intelligent grid technologies, energy market dynamics, and sustainable energy solutions. The study recommends enhancing collaborative networks, fusing technological and strategic dimensions in research, increasing focus and funding for emerging technologies, and promoting wider international and cross-disciplinary collaborations to enrich the understanding of energy trading dynamics in the context of electricity markets.

1. Introduction

The global energy sector is on the cusp of a profound transformation, propelled by the dual forces of technological innovation and the unyielding pursuit of sustainability. Within this context, power markets have risen to prominence as pivotal arenas where complex market dynamics, technological integration, and strategic policy frameworks converge to steer the trajectory of the energy transition. This paper embarks on an analytical journey through the intricate and ever-shifting landscape of energy trading in power markets, recognizing the multifaceted nature that encompasses a myriad of market types across the globe.

1.1. Motivation for the Study

Energy trading in power markets is of paramount importance due to its profound implications for the operational efficiency, reliability, and sustainability of electricity supply systems. It serves as a linchpin in efforts to balance supply and demand, assimilate renewable energy sources, and ensure the economic viability of the power sector. The urgency of this field is further amplified by the pressing need for decarbonization and the development of resilient energy systems that can adeptly handle the variability inherent in renewable energy generation. The motivation for this study is multi-pronged, arising from the necessity to decipher the developmental trajectory of energy trading against the backdrop of swift technological innovations and evolving policy landscapes. The current literature, Despite the wealth of academic inquiry into energy trading and power markets, the literature lacks a cohesive analysis that weaves together historical developments with contemporary trends. while expansive, exhibits gaps in synthesizing a comprehensive historical and emerging trend analysis of energy trading using bibliometric and visual analytics methods.

1.2. Objectives of the Study

Our study is designed with the following objectives:

- Trace the developmental trajectory of energy trading in power markets.

- Identify key trends and strategies within the field.

- Analyze the impact of technological advancements and policy changes on energy trading.

- Provide insights into future challenges and opportunities in energy trading.

By addressing these objectives, this study aims to offer a comprehensive and insightful analysis of the developmental trajectory of energy trading in power markets, contributing to the ongoing discourse in the field and offering practical implications for its future development.

1.3. Contribution of the Current Work

This study aspires to make a substantive contribution to the extant literature by presenting a sophisticated bibliometric and visual analysis of energy trading in power markets. Through the meticulous tracing of developmental trajectories, the identification of pivotal trends, and the incisive analysis of the impacts of technological and policy shifts, this research endeavors to offer invaluable insights for policymakers, academicians, and industry practitioners alike. Moreover, by casting light on future challenges and opportunities, this work aspires to inform strategic planning and the development of robust and efficacious energy trading systems. Our research introduces a novel analytical lens, harnessing the power of bibliometric and visual analytics to provide a nuanced overview that encapsulates the historical trajectory, emerging trends, and prospective future pathways of energy trading in power markets.

2. Literature Review

2.1. Energy Trading Model

Research on energy trading models primarily focuses on real-time energy trading models, low-carbon scheduling models, community-based energy trading models, and peer-to-peer (P2P) energy trading business models. Gianfreda and Grossi [1] posited that within the realm of energy trading, price analysis, model development, and the accuracy of predictions are crucial for formulating trading strategies and implementing risk control. By drawing on diverse models and theoretical frameworks from economics and finance, one can deepen their understanding and predictive capabilities regarding the dynamics of the energy market from multiple perspectives. In the study by Gong et al. [2], an innovative Full Infinite Interval Two-Stage Credibility Constrained Programming (FITCP) method was developed to optimize Electric Power System Management (EPS) while addressing both carbon dioxide reduction and limitations on emissions of atmospheric pollutants. This method has been further applied in electric power system planning, integrating carbon emission trading (CET) mechanisms and restrictions on atmospheric pollutants to more effectively meet the challenges of reducing carbon emissions and atmospheric pollution. Liu et al. [3] established a real-time energy trading model based on non-cooperative game theory with a proportional allocation approach, where buyers distribute electric power resources based on their bid proportions and sellers allocate revenue according to the proportions of electricity sold, revealing the transaction operation mechanisms and strategies under a multi-microgrid interconnected mode.

Considering the uncertain costs of renewable energy, Zhang et al. [4] utilized the Cournot Oligopoly game to propose a new local energy transaction decision model for suppliers, promoting transactions between various power generation technologies and customers to achieve local balance, benefiting all market participants through increased revenues and reduced energy costs. Xiang et al. [5] introduced a low-carbon economic dispatch model for integrated electricity and natural gas systems, which includes Carbon Capture Systems (CCS), carbon emission trading (CET), demand response (DR), and renewable energy generation, demonstrating a new path for the optimized configuration of energy systems in the context of energy conservation and emission reduction [6]. Calamaro et al. [7] employed two smart metering approaches to offer diverse energy metering methods that simplify energy trading and unify billing. Li et al. [8] innovatively applied Stochastic Programming (SP) to construct and analyze a three-tier energy bidding strategy based on Cournot Nash equilibrium, particularly suited for energy transactions between multi-energy microgrids, optimizing the balance between competition and risk management. Pu et al. [9] proposed a peer-to-peer energy trading method between community energy sellers and consumers based on Multi-Agent Reinforcement Learning (MARL), which is profitable for both parties in society. García-Muñoz et al. [10] evaluated the potential for distributed energy resources to provide reactive power support services to distribution system operators by proposing an energy community trading model based on two-stage stochastic programming, offering a new perspective for coordination and trading in day-ahead and intraday markets. Furthermore, many studies address the business models of peer-to-peer (P2P) energy trading. As an emerging business model, the novel concept of peer-to-peer energy trading provides an online marketplace for participants to exchange energy directly [11]. Ali et al. [12] have proposed blockchain-based energy trading models to promote P2P energy trading. On one hand, guidelines for the business model of P2P electricity trading were introduced, aiming to facilitate the use of open-source electricity with blockchain technology [13,14]. On the other hand, P2P energy trading platforms were proposed to enhance user participation in transactions and achieve low-cost, high-efficiency renewable energy trading [15]. To allow consumers and producers to engage in local energy trading within microgrids that integrate IoT and blockchain technologies [16]. To reduce energy trading costs, Qayyum et al. [17] put forth a nanogrid energy trading model based on predictive optimization. Noorfatima et al. [18] improved the performance of P2P energy trading operations by adopting an operator-oriented P2P model with an appropriate Network Cost Allocation (NCA) method.

2.2. Energy Trading Mechanism

Research on energy trading mechanisms primarily focuses on areas such as carbon trading, integrated demand response, and the interplay between carbon markets and energy markets. Initially, with environmental issues becoming increasingly prominent, the introduction of carbon trading mechanisms has become an important means to realize the decarbonization of the energy industry. Yu et al. [19] constructed a Two-Stage Interval Parameter Programming (TIPP) model specifically designed for planning the carbon emission trading (CET) within the electric power system of Qingdao City in China. This model is capable of effectively dealing with dual uncertainties, which manifest as interval stochastic variables and interval probability parameters. Studies show that after the introduction of the CET policy, carbon emissions from Qingdao’s power system are expected to reduce by about 5%, which fully demonstrates the potential benefits of carbon trading mechanisms in promoting the shift towards clean production in the power industry. Lin and Chen [20] applied the VAR(1)-DCC-GARCH(1,1) model and VAR(1)-BEKK-AGARCH(1,1) model to analyze Beijing’s carbon emission trading (CET) market, finding significant time-varying correlations between Beijing’s CET market, the coal market, and the new energy stock market, with the latter two showing strong volatility; a bidirectional market effect exists between the coal market and the new energy stock market, consistent with the results of Granger causality tests. Jiang et al. [21] discovered that in the high-frequency domain, carbon emission trading market prices are primarily influenced by coal prices; in the medium-frequency domain, the prices are mainly affected by new energy stock prices, revealing the complex interconnection between the carbon market and energy market. These empirical studies aid in understanding the complexity of market dynamics within trading mechanisms. Secondly, under the carbon trading mechanism, Integrated Energy Systems (IES) have shown advantages and a promising developmental outlook. Sun et al. [22] were among the early discoverers that, under a carbon trading mechanism, IES can not only reduce carbon emissions but also decrease the annual total cost through carbon trade-offs. It is noteworthy that in IES, the coordinated optimization of carbon trading mechanisms (CTM) and Integrated Demand Response (IDR) has not been sufficiently considered [23]. Therefore, Lu et al. [24] proposed an optimal scheduling method for community IES based on these two concepts, using a Stackelberg game model. Yang et al. [25] established a carbon trading model for IES that considers actual carbon emissions and a tiered carbon trading mechanism; simulation results indicated that the introduction of demand response (DR) and a tiered carbon trading mechanism can flexibly shift loads, reduce gas purchases, and cut system carbon emissions. Thirdly, peer-to-peer (P2P) plays a critical role in the construction of effective transaction mechanisms in interactive energy markets. Muhsen et al. [26], and Das et al. [27] view peer-to-peer energy trading as a promising energy transaction mechanism that facilitates the exchange of energy between consumers and producers without reliance on an intermediary medium. Khorasany, et al. [28] introduced a distributed market clearing mechanism and a network utility charging function for P2P energy transactions in transactional energy markets. Li et al. [29] proposed two highly efficient P2P energy trading mechanisms based on cooperative game theory principles. Wang et al. [30] proposed a P2P multi-energy market mechanism that allows peers to trade electricity and thermal energy, benefiting both the energy system and end-users. Zha et al. [31] explored from a corporate perspective how changes in the design of carbon trading mechanisms affect corporate participation willingness. Subsequently, Khorasany, et al. [32] proposed a mechanism design for energy trading within energy communities, showing that the mechanism is Bayes-Nash incentive compatible, helping to lower the community’s energy costs and reduce dependence on upstream networks. Wang et al. [33] presented an efficient and secure distributed community energy trading mechanism based on blockchain (CE-SDT), which helps to reduce the carbon footprint of residents and promote a low-carbon or zero-carbon configuration of the power system. The same study implemented an Energy Trading Blockchain (ETB) and Block Alliance Consensus (BAC) mechanism on the Hyperledger Fabric platform [34]. Ping et al. [35] designed an energy reserve peer-to-peer joint trading mechanism, proving the efficacy of blockchain transaction mechanisms and the performance of blockchain-based trading algorithms. Zhang et al. [36] utilized Nash negotiation theory to establish an improved ladder-type carbon trading mechanism (ILCTM), which can further reduce CO2 emissions from the multi-park integrated energy system (M-PIES). Satar et al. [37] observed that green bonds (S and P Green and Sol Green) positively influence the carbon market under conditions of high as well as low volatility. Conversely, within contexts of elevated volatility, traditional bonds (S and P Agg) and energy commodities (DJCI En) demonstrate a comparatively reduced capacity to stabilize the carbon market.

2.3. Tradable Green Certificates (TGC)

Research on energy trading policies has primarily concentrated on the area of Tradable Green Certificates (TGC). Enhancing the effectiveness of carbon emission trading (CET) policies, augmenting social welfare in the electricity market, and achieving predetermined emission reduction targets have attracted considerable attention from scholars [38]. Vogstad [39] combined system dynamics and experimental economics to analyze the design of Tradable Green Certificates, conducting a dynamic analysis of the TGC market. Oikonomou and Mundaca [40] argue that it is essential to ensure a fluid market for Tradable Certificates, where transaction costs are kept low and energy efficiency targets promote innovation [41]. Marzooni and Hosseini [42] proposed a time simulation model for long-term wind energy investment decisions in the presence of electricity markets and Tradable Green Certificates (TGC) markets. The different strategies of market participants for trading green certificates were analyzed, and recommendations for the optimal combination of strategies were made to achieve the objectives of the participants.

Hence, Tradable Green Certificates (TGC) are market-oriented policy instruments for achieving renewable energy targets in deregulated electricity markets [43]. Feng et al. [44] utilized a complex theoretical framework of equilibrium and system dynamics to conduct an in-depth analysis of the joint effects of Tradable Green Certificates (TGC) and carbon emission trading (CET) policies in China’s electricity market. Their study presented possible scenarios of changes in power structure and CO2 emissions reduction under the interaction of these two policies and discussed their complex impact on market operations, revealing new market challenges that could be triggered by policy overlap. Zhou et al. [45] took the sulfur dioxide (SO2) emission trading scheme as a case study to research the trend of emission permit prices in Jiangsu Province, China, under the influence of new emission trading policies and Tradable Green Certificates (TGC). The study provided a dynamic quantification method for pricing to assist power generation companies in optimizing their trading strategies for TGC and emission rights. Zhao and Zhou [46] simulated the evolution of power producers’ behavior based on subjective game models and assessed the performance of the “Renewable Portfolio Standard” (RPS) based on the shared mental models of the power producers. The research found that when fines were twice the price of TGC, the trading of TGC by power producers became a collective mindset, and RPS began to take effect. Tu et al. [47], while examining the changes in the cost of offshore wind power in China before and after the COVID-19 pandemic, paid special attention to the positive role of green financial policies, such as Tradable Green Certificates (TGC), in cost efficiency and project profitability, suggesting that such policies could help alleviate economic pressure brought about by the pandemic through low-cost financing. Moreover, there is an intrinsic connection between power production and economic development. Jha et al. [48] contend that a strategy to promote the growth of renewable energy is to strengthen cross-border electricity trade (CBET); hence, trade partners adopt coordinated policy interventions to overcome barriers to promoting CBET.

In addition, the geopolitical landscape has a profound and often direct impact on the energy market. The Russia Ukraine conflict studied by Nerlinger and Utz [49] is a recent example of how regional disputes have significantly changed the dynamics of international energy trade, especially in Europe. Chen et al. [50] pointed out that economic activity is another external event that may disrupt the energy market. Their case studies on the Russian energy industry provide a subtle understanding of how economic activities can reconfigure trade flows, influence market participants, and influence policy responses. Therefore, in the process of seeking stability under external shocks, renewable energy is increasingly seen as a buffer. Shang et al. [51] discussed the role of renewable energy in mitigating the impact of these shocks on the energy market. Their research emphasizes the increasing importance of diversified energy combinations in improving resilience and sustainability.

As advancements continue in relevant fields and methodologies, bibliometrics has gradually revealed its unique value as a tool for analyzing literature data and excavating the developmental laws of disciplines. This study selects core literature related to energy trading in the electricity market in recent years as the research subject. Utilizing the CiteSpace. v.6.2.R4 software tool, an in-depth bibliometric analysis of the literature has been conducted, aiming to answer the following questions: (1) What are the research themes and trends related to energy trading in the electricity market? (2) Which are the core literatures and authors within these studies? (3) What are the potential future research directions and hotspots in this field? It is hoped that through this study, a macroscopic, comprehensive, and profound perspective can be provided for research related to energy trading in the electricity market, while also offering valuable reference information for researchers and practitioners in the field.

3. Materials and Methods

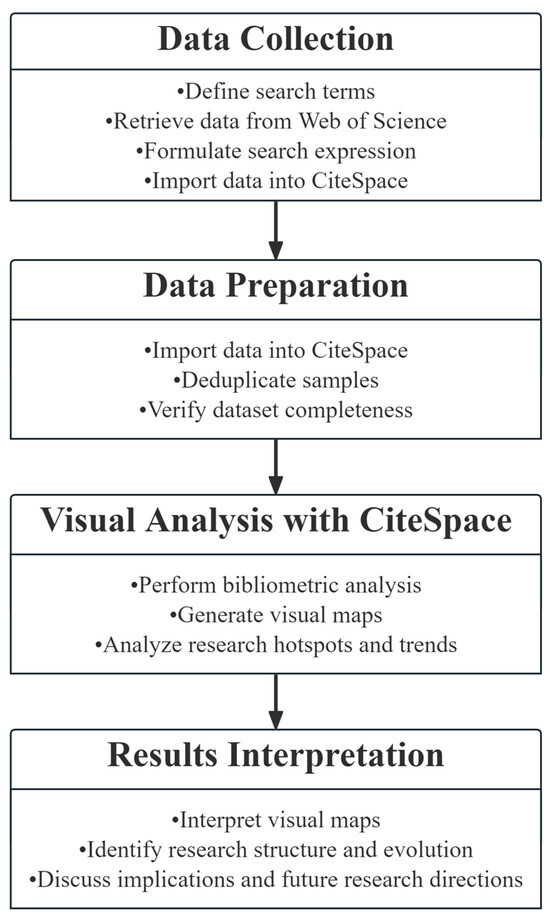

This study aims to utilize the CiteSpace software tool for a visual analysis of literature related to energy trading in the electricity market in order to reveal its research structure, hotspots, and evolutionary trends.

3.1. Data Collection

This article retrieves data from two core databases of Web of Science (SCI and SSCI) and primarily conducts bibliometric and statistical analyses on the relevant literature from these databases. The data acquisition and verification steps are as follows:

First, we determine the search expression. A preliminary search is conducted using broad subject terms to identify relevant vocabulary. For the electricity market, keywords include “electricity market” and “power market”, while for energy trading, keywords include “energy trading” and “energy transaction”. These initial searches help refine the vocabulary, ensuring comprehensive coverage of relevant literature.

Next, we construct the search formula. Combining the identified keywords, we create the final search expression: TS = (electricity market or power market) and (energy trading or energy transaction). This expression is designed to capture all pertinent articles within the scope of our study.

We then implement the search using the refined search expression across the Web of Science databases, specifically targeting the Science Citation Index Expanded (SCI-EXPANDED) and Social Sciences Citation Index (SSCI). The search parameters are set to include articles and reviews written in English and published between 1996 and 2023. This period is chosen to capture the historical development and recent trends in energy trading and electricity markets.

The search yields 642 articles, which are subsequently imported into CiteSpace for processing. CiteSpace’s deduplication function ensures that only unique articles are included, resulting in a clean dataset for analysis. This rigorous data preparation step is crucial for maintaining the integrity and reliability of the subsequent bibliometric analysis.

To ensure the quality and relevance of the collected data, we manually verify the search results. This involves checking for any irrelevant articles that may have been included due to overlapping terminology or ambiguous keywords. By refining the dataset through this verification process, we enhance the accuracy of our analysis. The comprehensive dataset is then structured and prepared for visual analysis in CiteSpace. The details of the search process, including the language, literature type, time span, and search results, are summarized in Table 1.

Table 1.

Research data retrieval process in Web of Science.

By following these detailed steps in data collection, we ensure that our study covers a comprehensive and accurate representation of the existing literature on energy trading in the electricity market. This thorough approach provides a robust foundation for the subsequent bibliometric and visual analysis.

3.2. Research Methods

Bibliometric analysis is a fundamental and effective method for detecting and investigating the development of research fields [52]. This paper employs CiteSpace.5.8. R3 to conduct a visual analysis of 642 papers in the field of energy trade dynamics within the electricity market. It encompasses a basic overview analysis of the field (including distributions of countries/regions, co-cited journals, co-cited authors, institutional co-authorships, and keyword clusters), as well as an examination of research hotspots and the overall evolution of the research. The time frame is set from 1 January 1996 to 31 December 2023, with a one-year time slice. CiteSpace is a citation visualization analysis software focused on analyzing scientific knowledge across various fields through “science knowledge maps”, integrating scientometrics and data visualization [53]. CiteSpace is capable of displaying the trends and directions of a discipline or field over a certain period, analyzing the evolution of the discipline, identifying the knowledge base, research hotspots, and research frontiers, discerning the relationships in the literature, and presenting these relationships through maps. It can be utilized to reflect the objective situation of scientific development [54,55].

4. Results and Discussion

4.1. Worldwide Publication Analysis

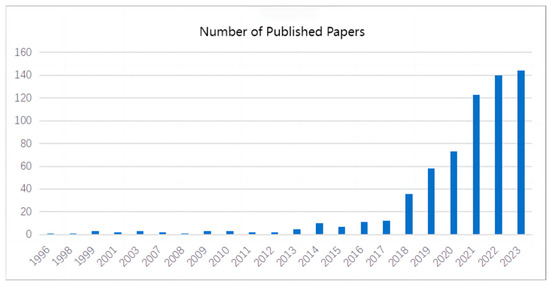

In this section, we achieve research objective RQ1. The temporal distribution of scholarly publications within a given research domain can provide macroscopic insights into the periodicity, trends, and pace of academic inquiry. An examination of publication volumes over time can reveal the evolution and scholarly interest in the field. Figure 1 illustrates the research trajectory in the domain of energy trade dynamics within the electricity market across a 28-year period (1996 to 2023).

Figure 1.

Flowchart of the Research Methodology.

As depicted in Figure 1, the academic inquiry into energy trade dynamics within the electricity market can be delineated into three distinct phases. The initial phase extends from 1996 to 2013, characterized by a modest number of publications and a relatively low annual average. This period appears to represent an exploratory phase, where foundational concepts of energy trading were being established and had yet to achieve widespread academic recognition.

The second phase, from 2013 to 2021, marks a notable upswing in publication output, with an especially pronounced increase leading up to 2021. This surge in scholarly output may be attributed to a confluence of factors, including a heightened global energy crisis, the emergence of new energy sources, and significant shifts within the electricity market landscape. It is plausible that these internal dynamics within the field, coupled with external events such as the Russian invasion of Ukraine in 2021, which sent shockwaves through energy markets, contributed to the heightened research activity and academic focus on energy trade dynamics.

The third and most recent phase, from 2021 to 2023, despite being only three years in duration, has sustained a high volume of publications with a continued upward trend. Research during this phase likely intensified its focus, probing deeper into the nuances, strategies, and technological advancements within energy trading.

In reflection, Figure 1 encapsulates the developmental trajectory of the field over the past two decades and a half, transitioning from an exploratory phase to a current era marked by robust research endeavors. It underscores the growing prominence of the electricity market and energy trading in both academic discourse and practical applications, mirroring the broader shifts in the global energy landscape.

4.2. Output of Publications

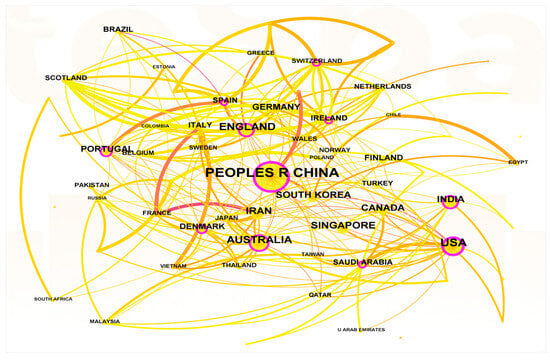

The distribution of research outcomes by country (region) can reflect the level of development of the field in specific countries (regions). The national (regional) distribution map of the research field of energy trade dynamics within the electricity market, obtained via the Citespace software, is illustrated in Figure 2 (to answer research objectives 1 and 2). Herein, the size of a node represents the number of publications from a country (region), while the lines between nodes indicate collaboration between countries (regions), with the thickness of the lines denoting the strength of the cooperative relationship. Centrality measures the importance of a country within the map.

Figure 2.

The number of published papers from 2001 to 2022.

Table 2 lists the top 10 countries (regions) in terms of publication volume. Combining the results of Figure 3 and Table 2, it is evident that the majority of literature in the field of energy trade dynamics within the electricity market originates from China, with a contribution of 217 publications. Subsequently, the United States, Australia, and the United Kingdom also have a significant number of publications, amounting to 112, 69, and 58, respectively. Other countries, such as Iran, Singapore, and India, also have a notable presence, demonstrating the depth and breadth of their involvement in the research field. The centrality values of China (0.29), the United States (0.31), Australia (0.10), the United Kingdom (0.14), and India (0.10) are all above 0.1, indicating that these five countries have particularly prominent research outputs in the field of energy trade dynamics within the electricity market.

Table 2.

Top 10 countries (regions) in terms of the number of publications.

Figure 3.

CiteSpace-based mapping of national (regional) cooperation.

Furthermore, there is substantial collaboration between countries in this domain. For example, scholars from the United Kingdom and France have conducted in-depth research and cooperation on issues of energy trading. In summary, the research field of energy trade dynamics within the electricity market is characterized by a geographical layout that positions China at the core, with the United States, Australia, the United Kingdom, and other countries as the primary research forces.

The relationship between the volume of research and the nature of the energy markets in these leading countries merits further discussion. In countries where energy markets are predominantly state-controlled, such as China, there is a tendency towards research focusing on top-down programming and policy analysis, reflecting the central role of governmental planning. Conversely, in countries with privatized energy markets, such as the United States and the United Kingdom, there is more emphasis on market competition and efficiency.

It is important to note that while England is a region within the United Kingdom, for the purposes of this study, we have used “United Kingdom” to represent the country’s collective research output. This approach ensures accuracy in our geographical analysis and avoids any confusion regarding the independence of countries.

4.3. Authors and Institutional Analysis

4.3.1. Co-Authorship Analysis

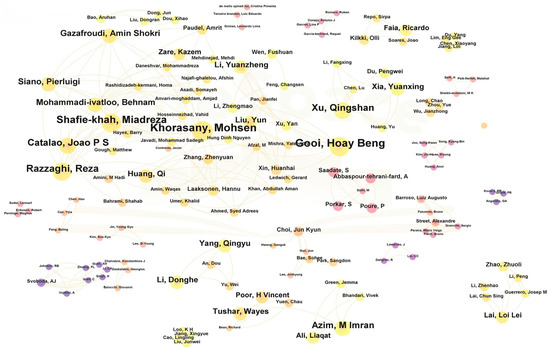

Initially, the CiteSpace. v.6.2.R4 software was employed to construct a visualization graph of author collaborations and a clustering view of author cooperation in the field of energy trade dynamics within the electricity market. The author collaboration network reflects the cooperative relationships among scholars in this field, while the number of publications demonstrates the scholars’ research investment in this domain (to answer research objectives RQ1 and RQ2).

On one hand, Table 3 displays the publication counts of individual authors, with the top-ranked scholars contributing significantly to this domain. For instance, Khorasany Mohsen, Gooi Hoay Beng, and Shafie-khah Miadreza have been widely cited for their research in this field. Khorasany, et al. [28] proposed a framework for joint scheduling and electricity trading for prosumer communities within the Transactional Energy Market (TEM). Prosumers manage energy ahead of time to arrange flexible energy resources, aiming to reduce energy expenditure. Moreover, prosumers may engage in an event-driven flexibility market, responding to the flexibility demands of grid operators. The results indicate that community energy trading lowers the energy costs for prosumers, while grid operators can utilize prosumer flexibility for managing grid constraints. Shafie-khah et al. [56] introduced an agent-based model that uses different Demand Response Programs (DRPs) to enhance the efficiency of electricity markets. The findings suggest that various types of DRPs affect market entities’ oligopolistic behaviors differently, and the proposed DRP optimization model could mitigate the potential of market power in the electrical system. Numerical studies demonstrate higher efficiency when regulatory bodies consider both economic and market power objectives, applying a combination of DRPs.

Table 3.

Volume of publications by high-frequency authors.

On the other hand, Figure 4 indicates that the size of nodes positively correlates with the number of publications by authors in the field of dynamics of energy trading in the electricity market, with the connecting lines representing collaborative relationships and the thickness of these lines indicating the strength of collaboration. There are 277 nodes and 299 ties in this research domain, with a network density of 0.0079. This suggests that while many scholars are researching and exploring this field, having formed certain collaborations, the relationships are not very close-knit yet. Further, the clustering view illustrates the main research teams and directions in the field of energy trade dynamics in the electricity market, such as certain teams focusing on market strategies while others investigating pricing mechanisms and transactional rules.

Figure 4.

CiteSpace-based author collaboration mapping.

Overall, in the research area of the dynamics of energy trading within the electricity market, cooperative relationships among scholars are poised for strengthening, particularly in interdisciplinary collaborations. The relatively low publication count for most scholars indicates that research in this field is still in the developmental stage. However, as the complexity and importance of the electricity market continue to rise, it is anticipated that more scholars will join this field and enhance cooperation, providing more valuable research contributions to the development of the electricity market.

4.3.2. Institutional Analysis

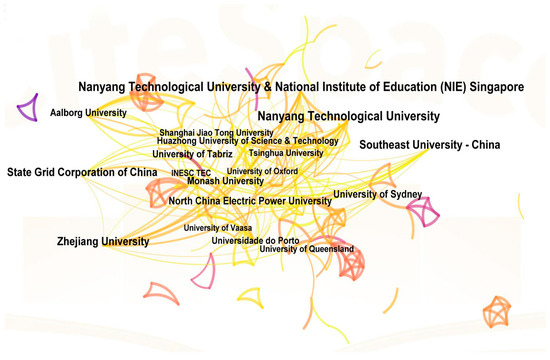

The visualization analysis of institutional collaboration in the research of energy trading dynamics in the electricity market provides a macroscopic perspective on the research outputs and collaboration status of numerous research institutions within this academic field. Initially, observing the density of institutional collaboration, Figure 5 displays the visualization of institutional cooperation in the research field of energy trading dynamics in the electricity market. In the figure, nodes represent various research institutions, with a total of 247 nodes and 239 connections, while the network density is only 0.0122. The size of these nodes intuitively presents the number of papers published by each institution; that is, the larger the node, the more papers published. Concurrently, the lines in the figure represent the collaborative relationships between institutions, with the thickness of the lines being directly proportional to the closeness of the collaboration. From Figure 4, it can be observed that although there are a multitude of research institutions and cooperative relationships in this field, the overall network density remains low, not reaching 0.02, indicating that cooperation between institutions in the research of energy trading dynamics in the electricity market is relatively scattered. Many institutions only have minimal collaboration or even a single collaborative relationship.

Figure 5.

CiteSpace-based organizational collaboration mapping.

Further analyzing the publication volume of research institutions, Table 4 lists the top ten research institutions in this field and their corresponding number of published papers. Institutions such as Nanyang Technological University, the National Institute of Education Singapore, and Southeast University have made significant contributions within this field, and their nodes are relatively large. Also ranking highly are Zhejiang University, the State Grid Corporation of China, the University of Sydney, and others, which also have comparatively high publication volumes. It is particularly worth mentioning that there are obviously more research institutions from China in this field, and these institutions are often the main research forces within the domain.

Table 4.

Number of articles issued by research organizations.

In general, although research on the dynamics of energy trading in the electricity market is gradually gaining attention in academia, with an increasing number of institutions engaging in it, the research intensity in this field, judging from publication volume and institutional collaboration density, still needs to be enhanced.

4.4. Journal Analysis

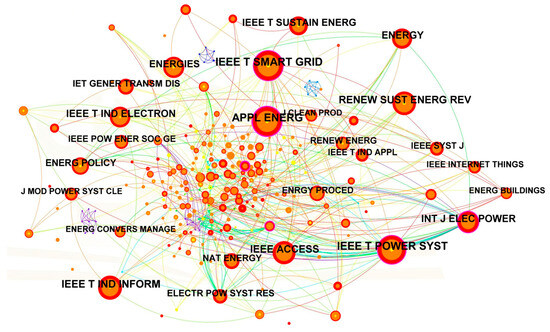

Figure 6, generated via the CiteSpace software, presents the co-citation journal map for the research on energy trading dynamics in the electricity market (to answer research objectives RQ1 and RQ2). As depicted in the map, the journals are represented by the abbreviations of their names. Nodes denote the cited journals, with more frequently cited journals having larger nodes. It is evident that in the field of energy trading dynamics research within the electricity market, there are many highly cited journals. Table 5 lists the top 10 journals in the research of energy trading dynamics within the electricity market according to their co-citation frequency, centrality, and impact factor, showing the full names of the journals. It has been observed that several journals have been cited over 100 times. Notably, “IEEE Transactions on Smart Grid” has been the most cited journal in the period from 1996 to 2023, with an outstanding co-citation count (487) and significant centrality (0.19), making it a core journal in the research of electricity markets and related technologies. This journal focuses on the architecture and design of smart grids, smart meters, and advanced metering infrastructure (AMI), the integration of renewable and distributed energy resources, the economics and policies of electrical grids, and the data analytics, simulation, and modeling of grids, among other aspects. Simultaneously, “IEEE Transactions on Power Systems” and “Applied Energy” follow closely, with high co-citation frequencies of 480 and 455, respectively, and centralities greater than 0.1 (0.12 and 0.22, respectively). Notably, “Applied Energy”, an internationally renowned interdisciplinary journal, aims to provide a platform for the exchange and collaboration in the fields of clean energy conversion technologies, optimization of energy processes and systems, energy efficiency, smart energy, environmental pollutants and greenhouse gas emissions reduction, cross-disciplinary integration with energy, and sustainable energy development. On the other hand, “IEEE Transactions on Power Systems” primarily covers various aspects of power systems, including planning and operation, stability and control, protection and safety, and the integration of new and renewable energy sources. Moreover, as indicated in the map, other journals such as “Renewable and Sustainable Energy Reviews”, “International Journal of Electrical Power & Energy Systems”, and “Energy” also have high citation frequencies in the field of energy trading dynamics research in the electricity market. These journals encompass multiple aspects including, energy policy formulation, the application of Internet of Things (IoT) technologies in the electricity market, and research on electrical technologies in industrial applications. Overall, these highly-cited journals all possess excellent impact factors, signifying that they are of high quality within their respective disciplinary fields, with substantial research quality and impact. This further confirms that the research field of energy trading dynamics in the electricity market is a multidisciplinary and integrated field that combines technology and strategy. These journals collectively provide valuable research findings and reference material for the study of energy trading dynamics in the electricity market.

Figure 6.

CiteSpace-based co-citation mapping of journals.

Table 5.

Top 10 co-cited journals.

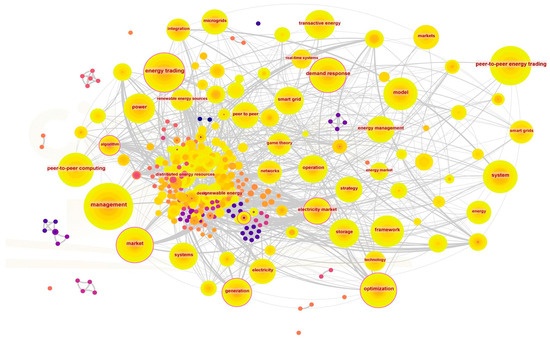

4.5. Keyword Analysis

4.5.1. Keyword Co-Linearity Analysis

The keywords in the research field of energy transaction dynamics in the power market serve as a high-level summary and refinement of the research themes in this domain, revealing the hotspots and developmental trends of the discipline (to answer research objectives RQ1 and RQ2). To delve deeper into these research hotspots, we imported relevant literature into the CiteSpace software and configured the parameters: ‘Node Types’ was set to ‘Keyword’, and ‘Timeslicing’ was configured for the period from January 1996 to October 2023, with a one-year slice. This produced a co-occurrence knowledge map of keywords in the energy transaction dynamics research field in the power market (refer to Figure 7). From the map, it can be observed that the size of a node represents the frequency of the keyword’s occurrence. The more frequently a keyword appears, the larger the node’s ring, indicating its importance in research. The lines between nodes represent the co-occurrence of keywords, with the number and thickness of the lines reflecting the strength of the association between them. The map comprises 292 nodes and 928 links, indicating a relatively wide variety of research themes and hotspots in the domain. The network density of the knowledge map is 0.0281, a relatively low value, suggesting that the connections among keywords in this research field are not particularly tight. However, as seen in Figure 6, keywords such as “management”, “energy trading”, “peer-to-peer energy trading”, and “market” are of deep concern, constituting focal points of research in the field of energy transaction dynamics within the power market. Combining this with the frequency of keyword appearances as shown in Table 6, we can further confirm that “management” (appearing 129 times), “energy trading” (101 times), and “peer-to-peer energy trading” (89 times) are among the hotspots of the field. Furthermore, the knowledge map’s centrality metrics reflect each keyword’s importance within the network structure. For instance, the centrality values for hot keywords such as “market” (0.18), “management” (0.15), “energy trading” (0.11), “optimization” (0.11), and “demand response” (0.11) all exceed 0.1, further confirming their core positions in the research domain of energy transaction dynamics in the power market.

Figure 7.

CiteSpace-based keyword co-linearity mapping.

Table 6.

Centrality and frequency of Top 10 keywords.

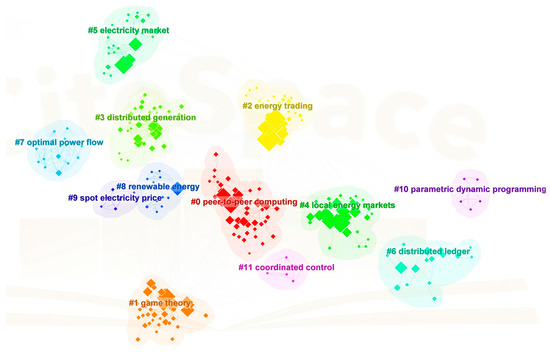

4.5.2. Keyword Clustering Analysis

In CiteSpace, the keyword co-occurrence knowledge map in energy transaction dynamics within the power market has been successfully generated. To evaluate the efficacy of the map’s construction, we commonly employ the modularity value (Q value) and the mean silhouette value (S value). In academia, a Q value greater than 0.3 usually indicates significant clustering; an S value above 0.5 implies that the clustering is reasonable; and an S value exceeding 0.7 denotes that the clustering is convincing. Observing the provided map (see Figure 8), we note a Q value of 0.5678 and an S value of 0.8111. These metrics suggest that the knowledge map’s clustering structure is significant and highly convincing. Within the field of energy transaction dynamics in the power market, the map reveals 12 principal clusters representing 12 major research themes synthesized from the myriad of keywords in the domain. This indicates that most scholars conduct their research around these 12 themes. These themes are: “peer-to-peer computing”, “local energy markets”, “energy trading”, “distributed generation”, “electricity market”, “distributed ledger”, “optimal power flow”, “renewable energy”, “spot electricity price”, “parametric dynamic programming”, “game theory”, and “coordinated control”. These themes reveal that scholars primarily focus on various mechanisms of energy trading, smart grids and distributed energy systems, computational and optimization methods for energy systems, and renewable energy and sustainability in their research within the dynamic field of energy transactions in the power market. These research themes are interrelated and collectively propel the development of smart grids, energy markets, and renewable energy technologies. In summary, the knowledge map generated via CiteSpace clearly delineates the research hotspots and developmental trends within the field of energy transaction dynamics in the power market, offering robust guidance for further research.

Figure 8.

CiteSpace based keyword clustering mapping.

4.5.3. Timeline Visualization Map Analysis

Utilizing the CiteSpace software, a Timeline visualization map of the research field about the power market and energy transactions was developed, building upon the foundation of Figure 8 (refer to Figure 9). To the right of Figure 9, 12 clusters are displayed, representing the diverse research directions that have emerged within this domain. From the keywords depicted in the map, it is discernible that based on prior studies, “peer-to-peer computing”, “local energy markets”, “energy trading”, “distributed generation”, “electricity market”, “distributed ledger”, “optimal power flow”, “renewable energy”, “spot electricity price”, “parametric dynamic programming”, “game theory”, and “coordinated control” have constituted the research frontier from 2020 to 2023. Through a meticulous review and analysis of 642 retrieved scholarly articles, in conjunction with a table of high-frequency keywords, the keywords in Figure 8 have been categorized into the following three research domains: smart grids, energy markets, and renewable energy technologies.

Figure 9.

CiteSpace-based timeline mapping.

The core of smart grid research can be summarized into several interrelated cluster areas: First, “#0 peer-to-peer computing” (P2P computing) highlights the decentralized trend in modern energy transactions, allowing direct energy exchange between different entities; closely connected are “#2 energy trading” and “#9 spot electricity price”, which collectively explore the core of energy transactions—the buying and selling process and price fluctuations. Among these, the study of spot electricity prices is particularly important, as it represents the immediate price information of the energy market, playing a crucial role in traders’ decisions. Subsequently, “#3 distributed generation” focuses on using numerous small-scale power sources to replace traditional centralized large power stations, with the distributed nature of these power sources being the foundation for building smart grids. Meanwhile, “#4 local energy markets” and “#5 electricity market” examine energy trading from micro and macro perspectives. Local energy markets discuss the micro-management of supply and demand relationships within specific geographical areas, whereas electricity market research provides a macro perspective, analyzing the macroeconomic relationships between supply, demand, and prices. These areas are independent and interact with each other, constituting a multidimensional and interconnected academic framework for smart grid research. Within the framework of the China-Pakistan Economic Corridor, Ul-Haq et al. [57] identified the critical driving factors for smart grid deployment and confirmed the financial viability of these projects through rapid investment returns. Gomes et al. [58] further revealed customer readiness for participation in smart grid programs, with the vast majority willing to adjust their energy usage and accept device control to meet demand response needs. Complementing these insights, Oprea and Bâra [59] indicate that such customer engagement is crucial, as the academic focus has increasingly centered since 2010 on the impact of prosumers on grid connection, system integration, market dynamics, and technological advancements.

The core of energy market research can be summarized into several interconnected cluster areas: “#6 distributed ledger” (distributed ledger technology) plays a pivotal role, providing an immutable record for every transaction in energy trading, ensuring transparency and security of the transactions. Related to this are “#7 optimal power flow” (optimal power flow) and “#11 coordinated control” (coordinated control), which together explore how to achieve efficient allocation and transfer of power in electrical systems. Optimal power flow focuses on effective path planning for power, while coordinated control concentrates on the coordinated operation among various system components to ensure the stability and efficient operation of the electrical system. Furthermore, “#1 game theory” (game theory) and “#10 parametric dynamic programming” (parametric dynamic programming) provide the theoretical foundation and methodological tools for the analysis of energy markets. Parametric dynamic programming offers decision optimization means under complex scenarios for tuning and operational management of power systems, and the application of game theory reveals the strategic interactions and competitive-cooperative relationships among market participants. By analyzing these interactions and strategies, researchers can gain a deeper understanding of the complex dynamics of power markets, supporting market design and policy formulation. Monroe et al. [60] developed an agent-based modeling (ABM) framework to simulate peer-to-peer electricity trading behaviors in distributed residential energy markets. Implementing fair pricing mechanisms in these energy trading markets is crucial, yet establishing effective pricing strategies becomes more complex and challenging with diverse energy systems entering trading. Consequently, the novel forward electricity market framework proposed by Ratha et al. [61], which introduces second-order cone constraints, enhances the market’s cognizance of uncertainties, assets, and networks. Numerical studies indicate that this conic constraint-based market design does not sacrifice the economic efficiency of the electricity market while having advantages over traditional linear programming electricity market frameworks in managing uncertainties.

The core research in the field of renewable energy technology can be summarized into several interconnected cluster areas: “#8 renewable energy” (renewable energy) takes center stage, emphasizing the importance of sustainable energy development and utilization in the power market. This technology not only facilitates the progress of clean energy but also has a profound impact on the future direction of the electricity market. “#3 distributed generation” (distributed generation) is closely linked with renewable energy technology, advocating for the establishment of small-scale power generating facilities at multiple locations, which compared to traditional centralized large power plants, enhances the resilience of the energy system and promotes diversity in energy distribution. Moreover, the study of “#7 optimal power flow” (optimal power flow) provides key insights into the effective distribution and transmission of power within the electrical system, which is crucial for integrating dispersed renewable energy sources. Radpour et al. [62] designed a new framework, MAPLET-PS, to assess the impact of policies such as carbon taxes and fiscal incentives on promoting the adoption of renewable energy technologies and applied it to a case study in the power sector of a Canadian province. It was found that the implementation of carbon taxes and other incentive measures could significantly reduce greenhouse gas emissions by 2050, with the share of renewable energy expected to grow from 12% in 2030 to 78% in 2050. Additionally, Calise et al. [63] studied two energy storage technologies, lithium-ion batteries, and reversible solid oxide fuel cells, and analyzed them through modeling and dynamic simulation in TRNSYS 18 software. Case studies indicated that these systems perform remarkably in saving primary energy, meeting 74–77% of the energy demand for a smart energy district. The payback periods for both systems ranged between 3.5 to 4.4 years, demonstrating good economic benefits.

In summary, the recent research frontier in the field of electricity markets and energy trading has concentrated on energy trading mechanisms, dynamics of the electricity market, and power system management. The integration of AI, blockchain, and renewable energy technologies presents a fertile ground for future research, offering direction and a foundation for policymakers and researchers to navigate the evolving landscape of energy markets (to answer research objectives RQ2 and RQ3).

5. Conclusions and Future Research Directions

5.1. Conclusions

This article conducts a visual analysis of 642 literature entries from 1996 to 2023 in the field of energy trading dynamics within the electricity market, utilizing CiteSpace software. The analysis covers publication volume, authors, institutions, keywords, countries (regions), journals, and other aspects to deeply study the current state, evolutionary trajectory, and development trends of this research field. The following main conclusions are drawn:

Firstly, regarding the number of publications, the literature on energy trading dynamics within the electricity market shows an increasing trend with rapid growth. According to the retrieval method of this paper, there were 642 entries in the Web of Science’s two core databases (SCI, SSCI) between 1996 and 2023. The early volume of publications was low, with the total number of publications in the three years from 2021 to 2023 exceeding 410. Currently, a research fervor has formed in this field, with a positive research momentum and a significant increase in the number of publications.

Secondly, in terms of the authors and institutions publishing in this field, core authors include Gazafroudi, Amin Shokri, and Catalao, Joao P S, among others. Although many scholars in this field conduct research and discussion, forming a certain level of collaboration, the cooperative relationships are not very close. Further clustering views have revealed the main research teams and directions in the field of energy trading dynamics within the electricity market; for instance, certain teams focus on market strategies, while others study pricing mechanisms and trading rules. Moreover, institutions with a relatively high number of publications, such as Nanyang Technological University and National Institute of Education Singapore and State Grid Corporation of China, are noteworthy. Among the top ten research institutions, there is a predominance of Chinese institutions, with universities such as Tsinghua University and Shanghai Jiao Tong University leading. Although the dynamic research on energy trading in the electricity market is gradually gaining attention in the academic world with an increasing number of institutions involved, the research intensity in this field still needs to be strengthened, as seen by the volume of publications and the density of cooperation between institutions.

Thirdly, looking at the distribution of countries (regions) and the journals of publication, the research in the field of energy trading dynamics in the electricity market has formed a national (regional) layout centered around China, with Italy, the United States, the United Kingdom, Germany, and other Western countries as significant forces. This field is a comprehensive domain that combines multidisciplinary intersections with technology and strategy. International top-tier journals such as “IEEE Transactions on Power Systems”, “Applied Energy”, “IEEE Transactions on Smart Grid”, and “Energy Policy” constitute significant carriers for research on energy trading dynamics in the electricity market.

Fourthly, in terms of research hotspots and trends, keywords such as “management”, “demand response”, “peer-to-peer energy trading”, and “optimization” are research hotspots in the field of energy trading dynamics within the electricity market. The research focus includes “peer-to-peer computing”, “local energy markets”, “energy trading”, “distributed generation”, “electricity market”, etc. This field has undergone a process from preliminary exploration to rapid development, with the research mainly divided into three stages: the initial stage (1996–2013), the growth stage (2013–2021), and the development stage (2021–2023).

Fifthly, from the perspective of research content and frontiers, by clustering and integrating various keywords, the research in the field of energy trading dynamics within the electricity market primarily involves three research categories: energy trading, electricity market dynamics, and power system management, with these categories being consistently interwoven throughout. “Blockchain”, “framework”, “smart grid”, “operation”, “game theory”, etc., are the current research frontiers in this field.

5.2. Future Research Directions

In this section, we achieve research objective RQ4.

Integration of Artificial Intelligence in Market Operations: Future research should focus on leveraging AI to enhance market operations and forecasting. Developing AI-powered price forecasts can improve decision-making processes and market efficiency, providing more accurate and reliable data for market participants.

Blockchain and Local Energy Markets: Exploring the implementation of blockchain technology in local energy markets can offer secure and transparent transaction frameworks. Research should aim to devise trading mechanisms with joint price adjustments and investigate the implications for policy-making and market operations.

Consumer Participation and Smart Grid Developments: Further studies are needed to understand the economic returns of smart grid developments and the factors influencing consumer participation in demand response programs. Investigating the willingness of consumers to engage with these programs and the associated economic benefits can guide the development of more effective strategies.

Regulatory Policies and Market Dynamics: Examining the impact of different regulatory environments on energy market dynamics can provide valuable insights into how policies shape market behavior and investment in renewable energy technologies. Research should explore the correlation between market structures (state-controlled vs. privatized) and research focus areas.

Multidisciplinary Approaches: The study of energy trading dynamics should incorporate multidisciplinary approaches, integrating insights from computer science, economics, sociology, and other fields. Cross-disciplinary cooperation can enhance the understanding of technological applications, market strategies, and social impacts, leading to more comprehensive research outcomes.

International Collaboration and Expansion: Strengthening international cooperation and expanding research areas to include more countries and regions can enrich the global understanding of energy trading dynamics. Collaborations should focus on power market strategies, trading regulations, and technological applications, fostering a more inclusive and diversified research landscape.

In summary, energy trading dynamics in the power market possess tremendous research potential and practical value for the future. Continuous investment in research, technological application, strategic optimization, and international cooperation is essential to advancing this field and contributing to the stability and prosperity of the global power market.

Funding

Supported by Social Science Funding Project of Jiangsu Province (23XZB028), China Postdoctoral Science Foundation(2022M711378), Zhenjiang Soft Science Research Program (RK2023025), National Natural Science Foundation of China (71774071) and Key Program of National Social Science Fund of China(21AZD067).

Acknowledgments

This study was supported by the Key Research Base of Universities in Jiangsu Province for Philosophy and Social Science “Research Center for Green Development and Environmental Governance”. The authors would like to express their sincere gratitude to Qingyue Yu, a student from the School of Computer Science and Technology at Nanjing University of Aeronautics and Astronautics, for her invaluable contributions to this research.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Gianfreda, A.; Grossi, L. Quantitative analysis of energy markets. Energy Econ. 2013, 35, 1–4. [Google Scholar] [CrossRef]

- Gong, J.; Li, Y.; Suo, C. Full-infinite interval two-stage credibility constrained programming for electric power system management by considering carbon emission trading. Int. J. Electr. Power Energy Syst. 2019, 105, 440–453. [Google Scholar] [CrossRef]

- Liu, Z.; Gao, J.; Yu, H.; Wang, X. Operation Mechanism and Strategies for Transactive Electricity Market With Multi-Microgrid in Grid-Connected Mode. IEEE Access 2020, 8, 79594–79603. [Google Scholar] [CrossRef]

- Zhang, Y.; Gu, C.; Yan, X.; Li, F. Cournot oligopoly game-based local energy trading considering renewable energy uncertainty costs. Renew. Energy 2020, 159, 1117–1127. [Google Scholar] [CrossRef]

- Xiang, Y.; Wu, G.; Shen, X.; Ma, Y.; Gou, J.; Xu, W.; Liu, J. Low-carbon economic dispatch of electricity-gas systems. Energy 2021, 226, 120267. [Google Scholar] [CrossRef]

- Zhu, Y.; Li, Y.; Huang, G. Planning carbon emission trading for Beijing’s electric power systems under dual uncertainties. Renew. Sustain. Energy Rev. 2013, 23, 113–128. [Google Scholar] [CrossRef]

- Calamaro, N.; Donko, M.; Shmilovitz, D. Algorithms that transfer between different energy metering methods for simplification of energy trading and unified billing. Heliyon 2022, 8, e11542. [Google Scholar] [CrossRef] [PubMed]

- Li, Z.; Wu, L.; Xu, Y.; Wang, L.; Yang, N. Distributed tri-layer risk-averse stochastic game approach for energy trading among multi-energy microgrids. Appl. Energy 2023, 331, 120282. [Google Scholar] [CrossRef]

- Pu, L.; Wang, S.; Huang, X.; Liu, X.; Shi, Y.; Wang, H. Peer-to-Peer Trading for Energy-Saving Based on Reinforcement Learning. Energies 2022, 15, 9633. [Google Scholar] [CrossRef]

- García-Muñoz, F.; Teng, F.; Junyent-Ferre, A.; Díaz-González, F.; Corchero, C. Stochastic energy community trading model for day-ahead and intraday coordination when offering DER’s reactive power as ancillary services. Sustain. Energy Grids Netw. 2022, 32, 100951. [Google Scholar] [CrossRef]

- Domènech Monfort, M.; De Jesús, C.; Wanapinit, N.; Hartmann, N. A Review of Peer-to-Peer Energy Trading with Standard Terminology Proposal and a Techno-Economic Characterisation Matrix. Energies 2022, 15, 9070. [Google Scholar] [CrossRef]

- Ali, F.S.; Aloqaily, M.; Alfandi, O.; Ozkasap, O. Cyberphysical Blockchain-Enabled Peer-to-Peer Energy Trading. Computer 2020, 53, 56–65. [Google Scholar] [CrossRef]

- Gupta, J.; Jain, S.; Chakraborty, S.; Panchenko, V.; Smirnov, A.; Yudaev, I. Advancing Sustainable Energy Transition: Blockchain and Peer-to-Peer Energy Trading in India’s Green Revolution. Sustainability 2023, 15, 13633. [Google Scholar] [CrossRef]

- Vanderveen, R.A.C.; Hakvoort, R.A. The electricity balancing market: Exploring the design challenge. Util. Policy 2016, 43, 186–194. [Google Scholar] [CrossRef]

- Lei, Y.; Ma, C.; Mirza, N.; Ren, Y.; Narayan, S.W.; Chen, X. A renewable energy microgrids trading management platform based on permissioned blockchain. Energy Econ. 2022, 115, 106375. [Google Scholar] [CrossRef]

- Condon, F.; Franco, P.; Martínez, J.M.; Eltamaly, A.M.; Kim, Y.C.; Ahmed, M.A. EnergyAuction: IoT-Blockchain Architecture for Local Peer-to-Peer Energy Trading in a Microgrid. Sustainability 2023, 15, 13203. [Google Scholar] [CrossRef]

- Qayyum, F.; Jamil, H.; Jamil, F.; Kim, D.H. Predictive Optimization Based Energy Cost Minimization and Energy Sharing Mechanism for Peer-to-Peer Nanogrid Network. IEEE Access 2022, 10, 23593–23604. [Google Scholar] [CrossRef]

- Noorfatima, N.; Choi, Y.J.; Onen, O.A.; Jung, J. Network cost allocation methods for pay-as-bid peer-to-peer energy trading: A comparison. Energy Rep. 2022, 8, 14442–14463. [Google Scholar] [CrossRef]

- Yu, L.; Li, Y.; Huang, G.; Li, Y.; Nie, S. Planning carbon dioxide mitigation of Qingdao’s electric power systems under dual uncertainties. J. Clean. Prod. 2016, 139, 473–487. [Google Scholar] [CrossRef]

- Lin, B.; Chen, Y. Dynamic linkages and spillover effects between CET market, coal market and stock market of new energy companies: A case of Beijing CET market in China. Energy 2019, 172, 1198–1210. [Google Scholar] [CrossRef]

- Jiang, C.; Wu, Y.; Li, X.; Li, X. Time-frequency Connectedness between Coal Market Prices, New Energy Stock Prices and CO2 Emissions Trading Prices in China. Sustainability 2020, 12, 2823. [Google Scholar] [CrossRef]

- Sun, P.; Hao, X.; Wang, J.; Shen, D.; Tian, L. Low-carbon economic operation for integrated energy system considering carbon trading mechanism. Energy Sci. Eng. 2021, 9, 2064–2078. [Google Scholar] [CrossRef]

- Guo, W.; Xu, X. Comprehensive Energy Demand Response Optimization Dispatch Method Based on Carbon Trading. Energies 2022, 15, 3128. [Google Scholar] [CrossRef]

- Lu, Q.; Guo, Q.; Zeng, W. Optimal dispatch of community integrated energy system based on Stackelberg game and integrated demand response under carbon trading mechanism. Appl. Therm. Eng. 2023, 219, 119508. [Google Scholar] [CrossRef]

- Yang, P.; Jiang, H.; Liu, C.; Kang, L.; Wang, C. Coordinated optimization scheduling operation of integrated energy system considering demand response and carbon trading mechanism. Int. J. Electr. Power Energy Syst. 2023, 147, 108902. [Google Scholar] [CrossRef]

- Muhsen, H.; Allahham, A.; Al-Halhouli, A.a.; Al-Mahmodi, M.; Alkhraibat, A.; Hamdan, M. Business Model of Peer-to-Peer Energy Trading: A Review of Literature. Sustainability 2022, 14, 1616. [Google Scholar] [CrossRef]

- Das, A.; Peu, S.D.; Mannan, A.; Abu, R.M. Peer-to-Peer Energy Trading Pricing Mechanisms: Towards a Comprehensive Analysis of Energy and Network Service Pricing (NSP) Mechanisms to Get Sustainable Enviro-Economical Energy Sector. Energies 2023, 16, 2198. [Google Scholar] [CrossRef]

- Khorasany, M.; Najafi-Ghalelou, A.; Razzaghi, R. A Framework for Joint Scheduling and Power Trading of Prosumers in Transactive Markets. IEEE Trans. Sustain. Energy 2021, 12, 955–965. [Google Scholar] [CrossRef]

- Li, J.; Ye, Y.; Papadaskalopoulos, D.; Strbac, G. Computationally Efficient Pricing and Benefit Distribution Mechanisms for Incentivizing Stable Peer-to-Peer Energy Trading. IEEE Internet Things J. 2021, 8, 734–749. [Google Scholar] [CrossRef]

- Wang, N.; Liu, Z.; Heijnen, P.; Warnier, M. A peer-to-peer market mechanism incorporating multi-energy coupling and cooperative behaviors. Appl. Energy 2022, 311, 118572. [Google Scholar] [CrossRef]

- Zha, D.; Feng, T.; Kong, J. Effects of enterprise carbon trading mechanism design on willingness to participate——Evidence from China. Front. Environ. Sci. 2022, 10, 986862. [Google Scholar] [CrossRef]

- Khorasany, M.; Razzaghi, R.; Gazafroudi, A.S. Two-stage mechanism design for energy trading of strategic agents in energy communities. Appl. Energy 2021, 295, 117036. [Google Scholar] [CrossRef]

- Wang, B.; Xu, J.; Jin, K.; Chen, P.; Wang, J.; Wang, N.; Li, X.; Zhang, F.; Li, L. CE-SDT: A new blockchain-based distributed community energy trading mechanism. Front. Energy Res. 2023, 10, 1091350. [Google Scholar] [CrossRef]

- Wang, Y.; Li, Y.; Jiao, W.; Wang, G.; Zhao, J.; Wang, Y.; Li, K. An Efficient, Secured, and Infinitely Scalable Consensus Mechanism for Peer-to-Peer Energy Trading Blockchain. IEEE Trans. Ind. Appl. 2023, 59, 5215–5229. [Google Scholar] [CrossRef]

- Ping, J.; Li, D.; Yan, Z.; Wu, X.; Chen, S. A trusted peer-to-peer market of joint energy and reserve based on blockchain. Electr. Power Syst. Res. 2023, 214, 108802. [Google Scholar] [CrossRef]

- Zhang, W.; Wang, W.; Fan, X.; He, S.; Wang, H.; Wu, J.; Shi, R. Low-carbon optimal operation strategy of multi-park integrated energy system considering multi-energy sharing trading mechanism and asymmetric Nash bargaining. Energy Rep. 2023, 10, 255–284. [Google Scholar] [CrossRef]

- Satar, A.; Musadiq, M.A.; Hutahayan, B.; Solimun. A systematic literature review: Determinants of sustainability competitive advantage. Bus. Strategy Environ. 2024, 33, 1675–1687. [Google Scholar] [CrossRef]

- Kanakasabapathy, P. Economic impact of pumped storage power plant on social welfare of electricity market. Int. J. Electr. Power Energy Syst. 2013, 45, 187–193. [Google Scholar] [CrossRef]

- Vogstad, K.O. Combining System Dynamics and Experimental Economics to Analyse the Design of Tradable Green Certificates. In Proceedings of the 38th Annual Hawaii International Conference on System Sciences, Big Island, HI, USA, 3–6 January 2005. [Google Scholar] [CrossRef]

- Oikonomou, V.; Mundaca, L. Tradable white certificate schemes: What can we learn from tradable green certificate schemes? Energy Effic. 2008, 1, 211–232. [Google Scholar] [CrossRef][Green Version]

- Madlener, R.; Gao, W.; Neustadt, I.; Zweifel, P. Promoting renewable electricity generation in imperfect markets: Price vs. quantity policies. In RePEc: Research Papers in Economics; SOI-Working Papers 0809; Socioeconomic Institute-University of Zurich: Zurich, Switzerland, 2008. [Google Scholar] [CrossRef]

- Marzooni, M.H.; Hosseini, S.H. Trading strategies for wind capacity investment in a dynamic model of combined tradable green certificate and electricity markets. IET Gener. Transm. Distrib. 2012, 6, 320–330. [Google Scholar] [CrossRef]

- Liu, G.; Yu, C.; Li, X.; Wen, F. Impacts of emission trading and renewable energy support schemes on electricity market operation. IET Gener. Transm. Distrib. 2011, 5, 650. [Google Scholar] [CrossRef]

- Feng, T.-t.; Yang, Y.-s.; Yang, Y.-h. What will happen to the power supply structure and CO2 emissions reduction when TGC meets CET in the electricity market in China? Renew. Sustain. Energy Rev. 2018, 92, 121–132. [Google Scholar] [CrossRef]

- Zhou, Y.; Wu, Y.; Zhang, B.; Bi, J. Understanding the Price Dynamics in the Jiangsu SO2 Emissions Trading Program in China: A Multiple Periods Analysis. Environ. Model. Assess. 2012, 18, 285–297. [Google Scholar] [CrossRef]

- Zhao, X.; Zhou, Y. Analysis of the effectiveness of Renewable Portfolio Standards: A perspective of shared mental model. J. Clean. Prod. 2021, 278, 124276. [Google Scholar] [CrossRef]

- Tu, Q.; Mo, J.; Liu, Z.; Gong, C.; Fan, Y. Using green finance to counteract the adverse effects of COVID-19 pandemic on renewable energy investment-The case of offshore wind power in China. Energy Policy 2021, 158, 112542. [Google Scholar] [CrossRef] [PubMed]

- Jha, A.P.; Mahajan, A.; Singh, S.K.; Kumar, P. Renewable energy proliferation for sustainable development: Role of cross border electricity trade. Renew. Energy 2022, 201, 1189–1199. [Google Scholar] [CrossRef]

- Nerlinger, M.; Utz, S. The impact of the Russia-Ukraine conflict on energy firms: A capital market perspective. Financ. Res. Lett. 2022, 50, 103243. [Google Scholar] [CrossRef]

- Chen, Y.; Jiang, J.; Wang, L.; Wang, R. Impact assessment of energy sanctions in geo-conflict: Russian–Ukrainian war. Energy Rep. 2023, 9, 3082–3095. [Google Scholar] [CrossRef]

- Shang, Y.; Sang, S.; Tiwari, A.K.; Khan, S.; Zhao, X. Impacts of renewable energy on climate risk: A global perspective for energy transition in a climate adaptation framework. Appl. Energy 2024, 362, 122994. [Google Scholar] [CrossRef]

- Li, M.; Wang, X.; Wang, Z.; Maqbool, B.; Hussain, A.; Khan, W.A. Bibliometric Analysis of the Research on the Impact of Environmental Regulation on Green Technology Innovation Based on CiteSpace. Int. J. Environ. Res. Public Health 2022, 19, 13273. [Google Scholar] [CrossRef]

- Chen, Y.; Chen, C.; Liu, Z.; Hu, Z.; Wang, X. The methodology function of Cite Space mapping knowledge domains. Stud. Sci. Sci. 2015, 33, 242–253. [Google Scholar] [CrossRef]

- Chen, C. CiteSpace II: Detecting and visualizing emerging trends and transient patterns in scientific literature. J. Am. Soc. Inf. Sci. Technol. 2006, 57, 359–377. [Google Scholar] [CrossRef]

- Chen, C.; Ibekwe-SanJuan, F.; Hou, J. The Structure and Dynamics of Co-Citation Clusters: A Multiple-Perspective Co-Citation Analysis. J. Am. Soc. Inf. Sci. Technol. 2010, 61, 1386–1409. [Google Scholar] [CrossRef]

- Shafie-khah, M.; Siano, P.; Catalao, J.P.S. Optimal Demand Response Strategies to Mitigate Oligopolistic Behavior of Generation Companies Using a Multi-Objective Decision Analysis. IEEE Trans. Power Syst. 2018, 33, 4264–4274. [Google Scholar] [CrossRef]

- Ul-Haq, A.; Jalal, M.; Hassan, M.S.; Sindi, H.; Ahmad, S.; Ahmad, S. Implementation of Smart Grid Technologies in Pakistan under CPEC Project: Technical and Policy Implications. IEEE Access 2021, 9, 61594–61610. [Google Scholar] [CrossRef]

- Gomes, L.; Coelho, A.; Vale, Z. Assessment of Energy Customer Perception, Willingness, and Acceptance to Participate in Smart Grids—A Portuguese Survey. Energies 2023, 16, 270. [Google Scholar] [CrossRef]

- Oprea, S.-V.; Bâra, A. Generative literature analysis on the rise of prosumers and their influence on the sustainable energy transition. Util. Policy 2024, 90, 101799. [Google Scholar] [CrossRef]

- Monroe, J.G.; Hansen, P.; Sorell, M.; Berglund, E.Z. Agent-Based Model of a Blockchain Enabled Peer-to-Peer Energy Market: Application for a Neighborhood Trial in Perth, Australia. Smart Cities 2020, 3, 1072–1099. [Google Scholar] [CrossRef]

- Ratha, A.; Pinson, P.; Le Cadre, H.; Virag, A.; Kazempour, J. Moving from linear to conic markets for electricity. Eur. J. Oper. Res. 2022, 309, 762–783. [Google Scholar] [CrossRef]

- Radpour, S.; Gemechu, E.D.; Ahiduzzaman, M.; Kumar, A.M.S. Developing a framework to assess the long-term adoption of renewable energy technologies in the electric power sector: The effects of carbon price and economic incentives. Renew. Sustain. Energy Rev. 2021, 152, 111663. [Google Scholar] [CrossRef]

- Calise, F.; Cappiello, F.L.; Cimmino, L.; Dentice d’Accadia, M.; Vicidomini, M. Renewable smart energy network: A thermoeconomic comparison between conventional lithium-ion batteries and reversible solid oxide fuel cells. Renew. Energy 2023, 214, 74–95. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).