3.1. Fuzzy Delphi for Risk Identification

The Delphi method was first proposed by Dalky and Helmer in 1963, and it can integrate the opinions of various experts to achieve evaluation through anonymous voting [

31]. The traditional Delphi method requires experts to carry out four rounds of consultations; however, repeated discussions will greatly waste time and decrease efficiency [

32]. In addition, it is often difficult to obtain consistent results due to the different experiences of experts. In this paper, we introduced the fuzzy theory into the traditional Delphi method, forming the fuzzy Delphi method; this method can help to cope with the aforementioned problems. Through the use of the membership function instead of expert opinion, experts do not need to repeatedly revise their opinions [

33]. Meanwhile, there is no loss of useful information, because all expert opinions are given via the membership function. The steps of the fuzzy Delphi method for risk identification are introduced as follows:

- ➢

Step 1: Questionnaire design.

The value range of the conservative value and optimistic value of each indicator should be determined by the experts. Usually, the value range is 0–10.

- ➢

Step 2: Construct the triangular fuzzy number (TFN)

Collect the maximum and minimum values of each indicator scored by experts, and calculate the geometric mean value. The conservative TFN and optimistic TFN of each indicator are constructed.

Of these, , and , respectively, represent the minimum conservative value, maximum conservative value, and the geometric mean of the conservative value of experts on the indicator . Correspondingly, , and , respectively, represent the minimum optimistic value, maximum optimistic value, and geometric mean of the optimistic value of all experts on the indicator .

- ➢

Step 3: Judge the consistency of each expert’s scoring, and calculate the indicator’s consistent significance value .

(1) If

, it indicates that the expert scoring of the indicator is consistent, and

can be calculated as follows:

(2) If

, the corresponding gray interval values

and

need to be calculated as follows:

If

,

can be obtained as follows:

If , it means that the evaluation of indicator by the experts is not consistent, and cannot be calculated. Hence, it is necessary to re-score the indicator and repeat the previous steps until the experts can converge on the evaluation of the indicator.

- ➢

Step 4: Filter indicators according to .

Set the threshold of , and compare the indicator’s consistent significance value of each indicator with the threshold. The indicators with values greater than the threshold value are retained, and the indicators with values less than the threshold value are discarded. In this paper, the threshold is set to 5.5.

3.2. Bayesian Best–Worst Method for Risk Indicator Weighting

Compared with the traditional AHP method, BWM can help decrease the comparison numbers between indicators [

34]. However, it also faces outlier sensitivity and restricted information provision issues [

35]. In 2019, Mohammadi and Rezaei combined the Bayesian theory and the traditional BWM method to form the Bayesian BWM approach, which can solve the aforementioned problems [

36]. Considering the space limitation, the specific steps of the traditional BWM method will not be introduced; interested readers can consult Rezaei’s reference [

37]. The basic steps of Bayesian BWM are given as follows:

- ➢

Step 1: Determine the best (most important) indicator and worst (least important) indicator for HPGE.

The best indicator means the risk factor that has the greatest impact on the HPGE, and the worst indicator means the risk factor that has the least impact on the HPGE.

- ➢

Step 2: Determine the “Best-to-Others (BO)” vector

and the “Others-to-Worst (OW)” vector .

Compare

with other indicators

, and use 1 to 9 to represent the importance of

with other indicators. The 1 means that the importance of

and

is equal, 9 means that

is far more important than

. Similarly, compare

with other indicators

, of which, 1 means that the importance of

and

is equal, and 9 means that the importance of

is much higher than that of

. The BO and OW vectors can be expressed as follows:

Through Equation (4), we can clearly understand the judgment results of various experts on the importance of various HPGE risk indicators.

- ➢

Step 3: Construct a multinomial probability distribution function.

Different from the traditional BWM, Bayesian BWM considers the probability interpretation of input and output. In other words, the indicators can be regarded as random events and the weights can be considered as the probability of events. Taking the worst indicator as an example, the multinomial probability distribution function of

can be constructed as follows:

where

represents the probability distribution.

- ➢

Step 4: Calculate the occurrence probability of indicators for HPGE.

The occurrence probability

is positively correlated with the number of occurrences of the event

, which can be expressed as follows:

Therefore, the probability of occurrence of

can be expressed as follows:

Then, it can be obtained through Equations (6) and (7), as follows:

Similarly, can be also modeled by the probability distribution function, but its probability distribution is opposite to the probability distribution of .

- ➢

Step 5: Determination of the indicator weights for HPGE.

So far, we have already converted the traditional weight determination process into the probability distribution estimation issues. Then, the problem can be solved by using the hierarchical Bayesian model.

Suppose that the expert group is composed of

decision-makers; then, the optimal comparison vector and worst comparison vector of the

-th decision-maker can be represented as

and

. Then, the weights of each risk indicator can be expressed as

, and the comprehensive weights

determined by all decision-makers can be obtained from the weights of each decision-maker. The joint probability distribution is shown as follows:

Then, the probability of each random variable is shown as follows:

where

and

, respectively, represent random variables.

- ➢

Step 6: Consistency inspection.

Different from the consistency ratio, the credal ranking method is proposed to judge the importance of comparison probability between indicators, which is shown as follows:

where

represents the posterior distribution of

. When the subscript condition of

is met, the value is 1; otherwise, it is 0. The closer the value is to 1, the more consistent the opinions of experts are. Referring to the previous studies, we set the threshold of credal ranking value as 0.5, which means that there is a big difference among experts when the value is less than 0.5. Then, the experts need to continue to discuss and re-compare the importance of indicators. Based on Equation (11), we can understand whether experts have consistent judgments on the importance of HPGE risk indicators. If the credal ranking is less than 0.5, i.e., the opinions of the experts on HPGE risk indicators are not consistent, then the above process needs to be repeated.

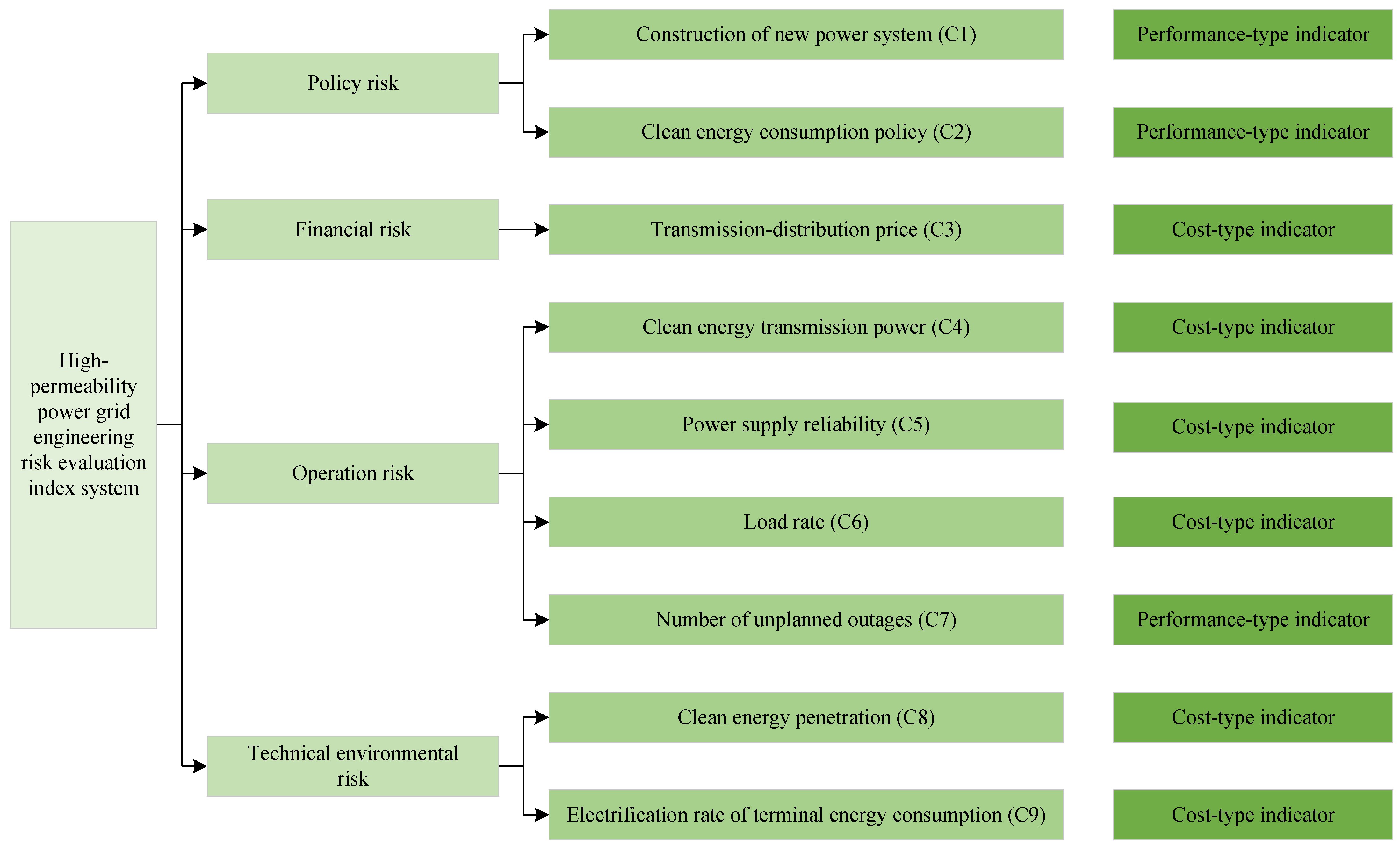

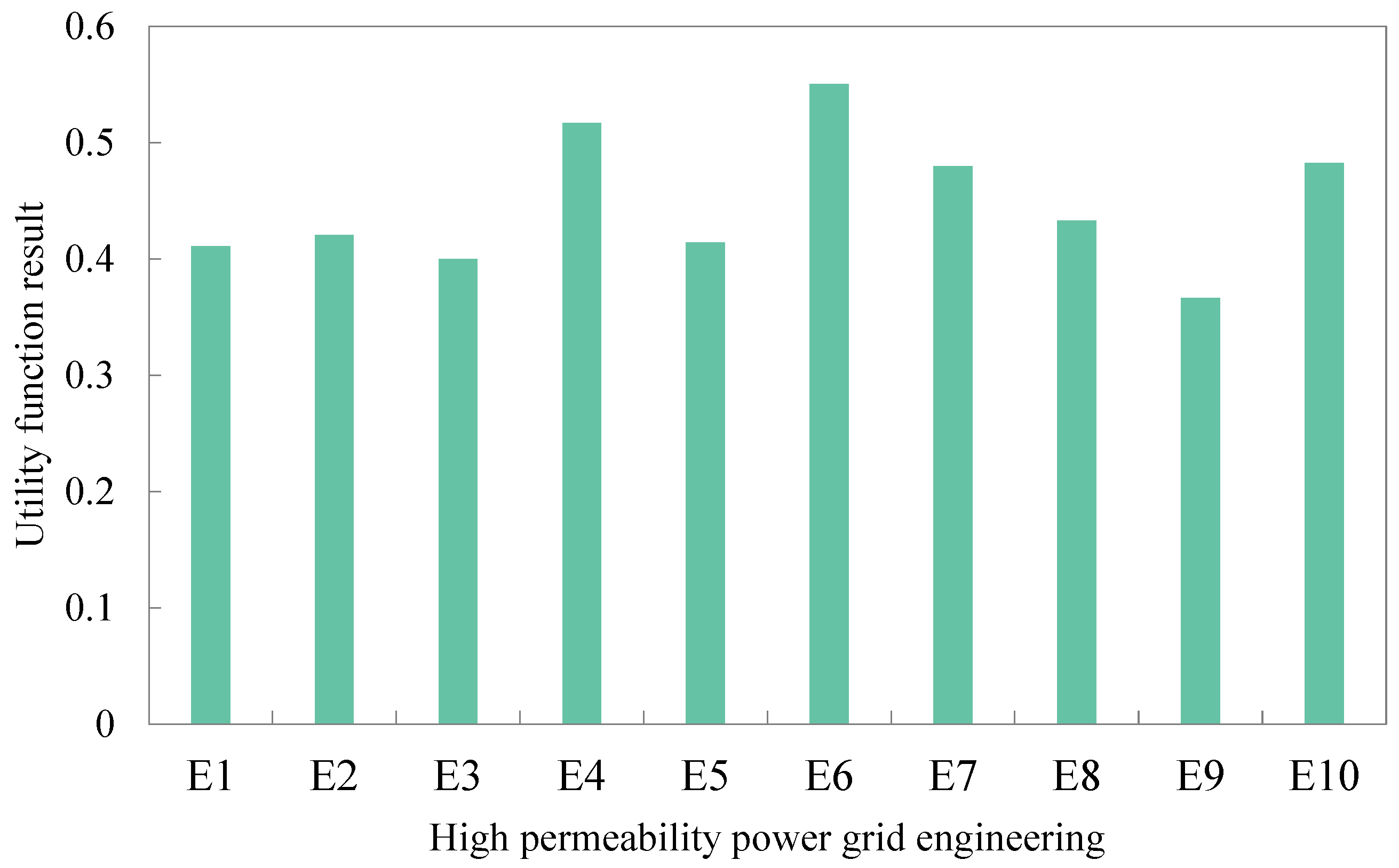

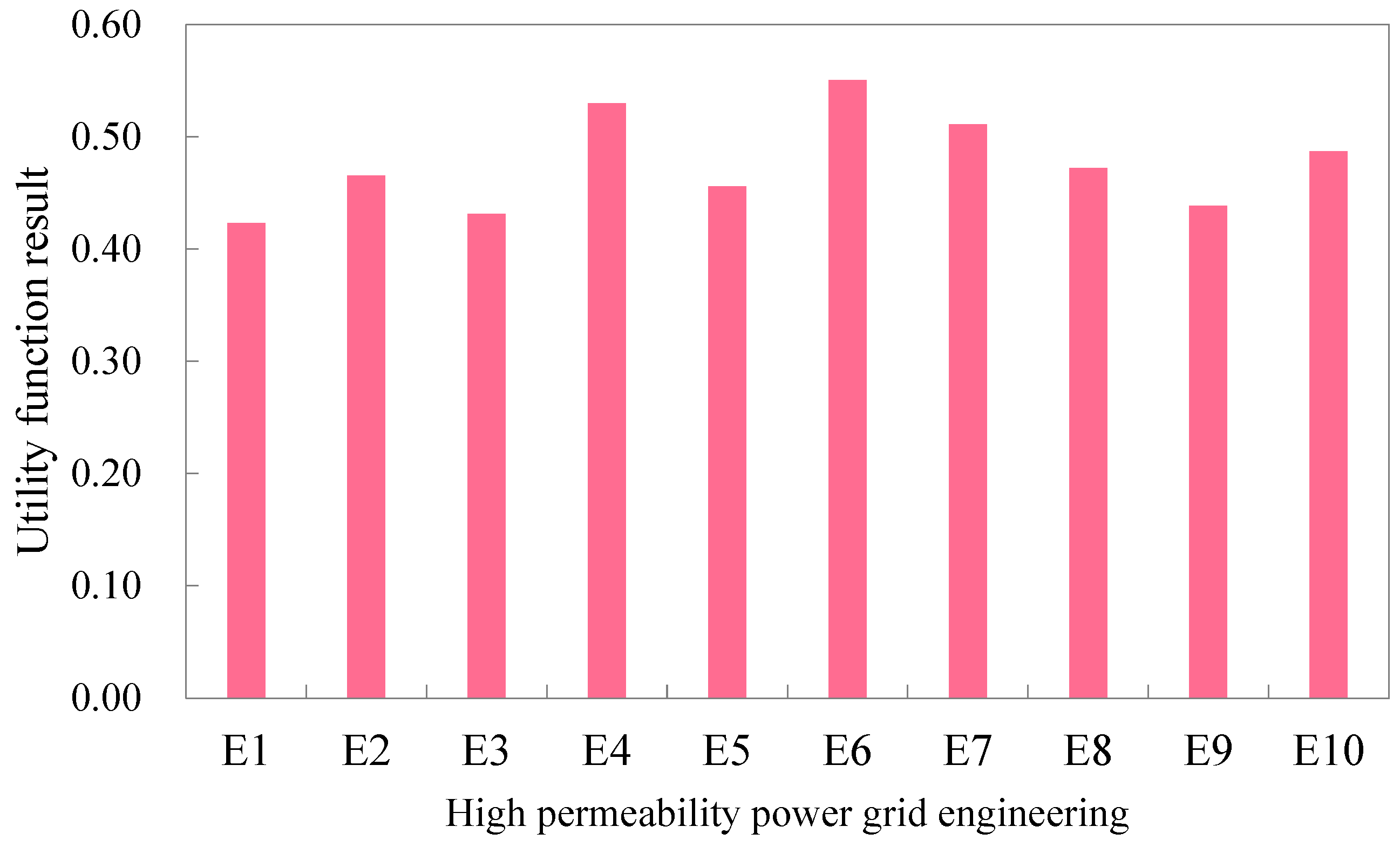

3.3. MARCOS Approach for Risk Evaluation

Among various evaluation methods, TOPSIS is widely used for scheme ranking due to its simple steps and easy operation. However, it mainly concentrates on the anti-ideal solution, while ignoring the ideal one [

38]. To solve this problem, the MARCOS approach considering both the ideal and anti-ideal solution is adopted in this paper. The core principle of the MARCOS method is to calculate the comprehensive utility function of alternatives and to rank options according to the utility function [

39]. The steps of MARCOS can be expressed as follows:

- ➢

Step 1: Construct the initial decision-making matrix.

Suppose there are risk indicators and HPGE to be evaluated. Then, the initial decision-making matrix can be expressed as .

- ➢

Step 2: Matrix normalization.

Different types of risk indicators have different normalization methods. Specifically, the cost-type indicators are normalized by Equation (12) and the performance-type indicators are normalized by Equation (13), as follows:

Of these, the cost-type indicators mean that the larger the indicator value, the greater the risk level of HPGE. While the performance-type indicator is exactly the opposite, the smaller the indicator value, the lower the risk of HPGE.

- ➢

Step 3: Weighting matrix determination by Equation (14).

where

represents the weight of the

-th indicator obtained through the Bayesian BWM approach.

- ➢

Step 4: Ideal solution and anti-ideal solution determination by Equation (15):

where

and

, respectively, represent the ideal solution and anti-ideal solution. In other words, the former represents the best performance HPGE and the latter means the highest risk HPGE (maybe the ideal and anti-ideal solutions do not really exist, but the set of all HPGe indicators does).

- ➢

Step 5: Calculate the utility of each HPGE by Equation (16).

where

represents the utility degree of the engineering relative to the ideal solution, and

represents the utility degree of the engineering relative to the anti-ideal solution.

- ➢

Step 6: Utility function calculation.

Based on Equation (16), the utility function

can be expressed as follows:

where

represents the utility function relative to the ideal solution, and

represents the utility function relative to the anti-ideal solution.

- ➢

Step 7: HPGE ranking.

3.4. Early Risk Warning Model Based on the Non-Compensation Principle

A two-layer HPGE early risk warning model based on the non-compensation principle [

40] is constructed as follows.

- ➢

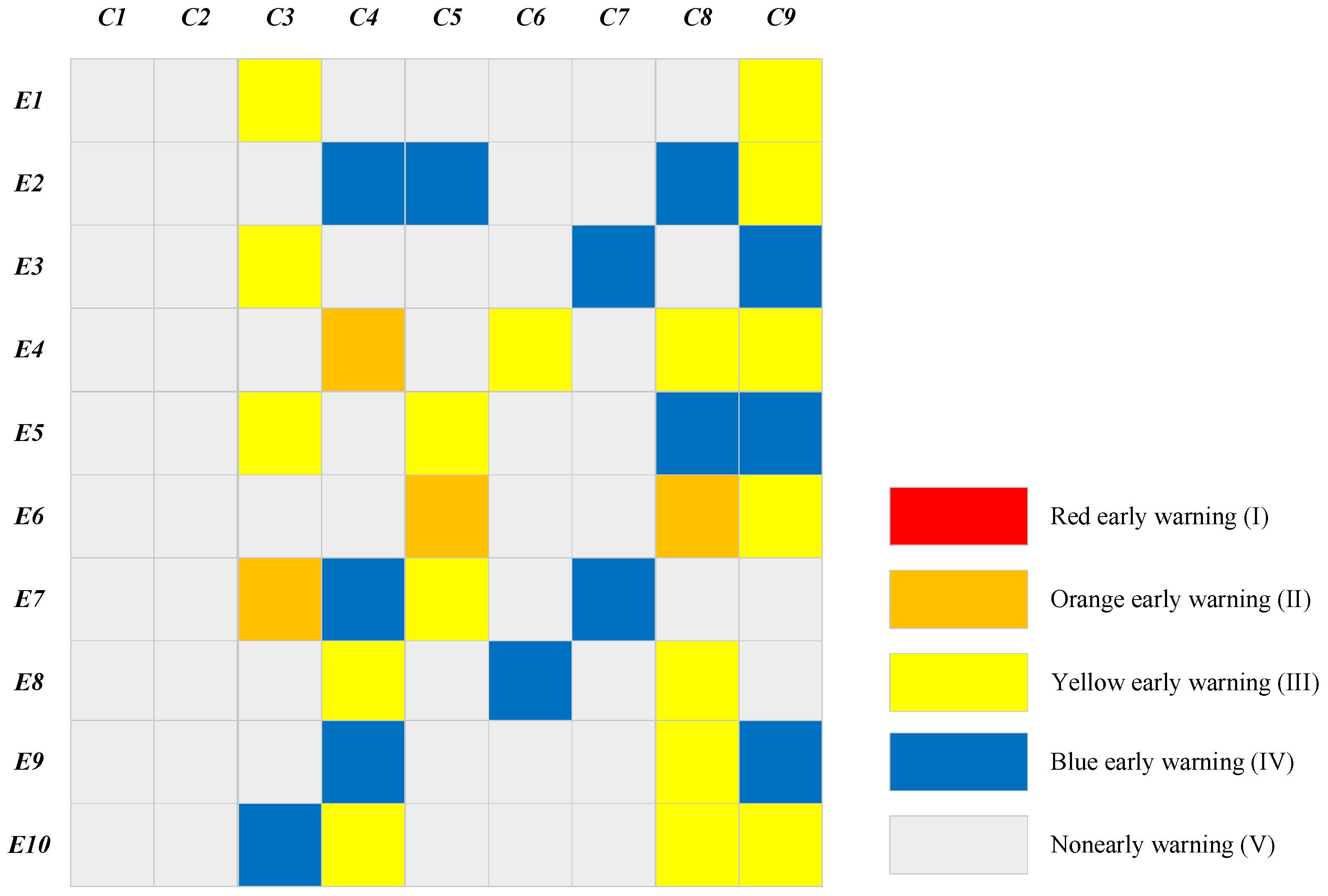

Construction of a single risk indicator early warning model

Suppose the risk of indicator

is

, and the risk early warning threshold of

is

. Then, the early warning value

of

can be calculated as follows:

According to Equation (18), the early risk warning value is 0 if the risk of the indicator is less than the threshold, indicating that the indicator

has no early risk warning. On the contrary, if

is greater than the threshold, then the early risk warning value will be greater than 0. The higher the risk value of the indicator, the greater the calculated early warning value and the higher the early risk warning level. The standard for the early warning level of the single risk indicator is listed in

Table 2.

- ➢

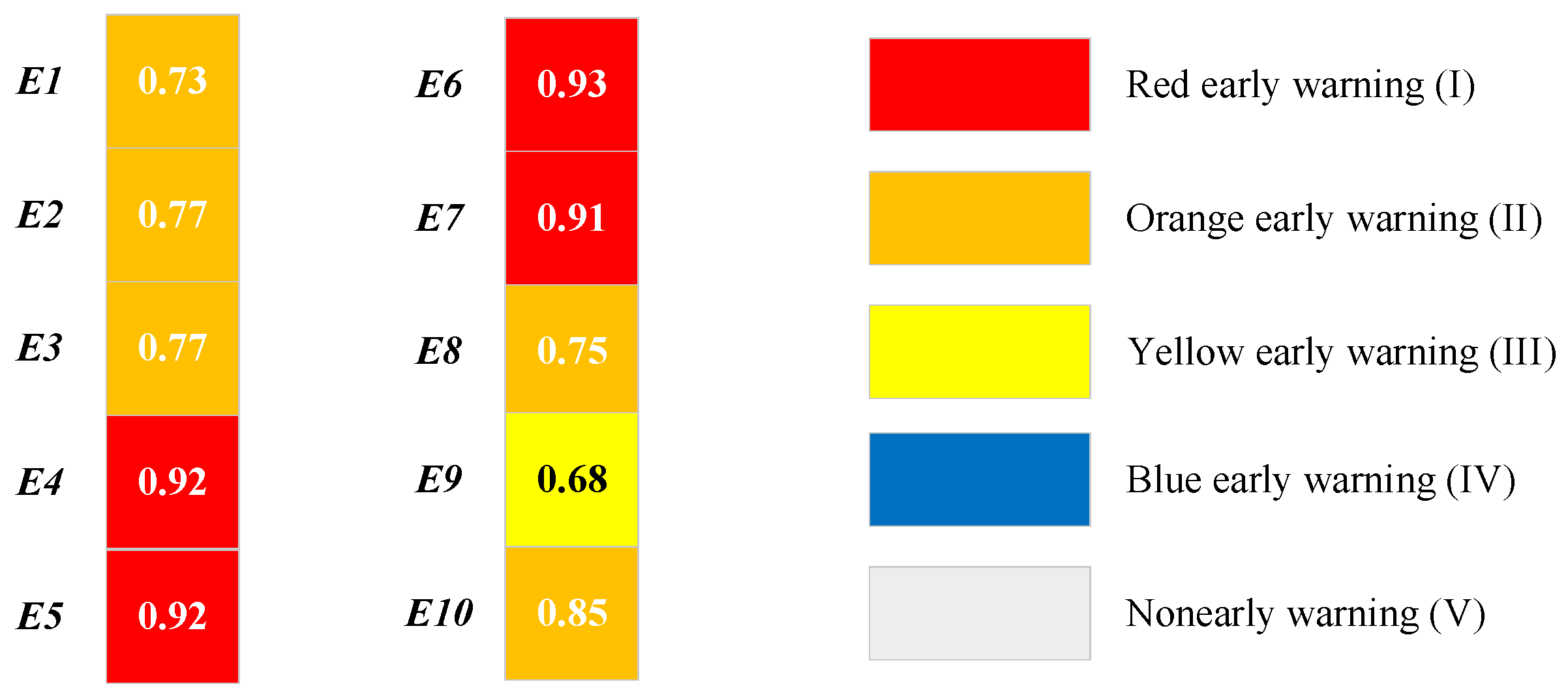

Construction of engineering comprehensive early risk warning model

Based on the early warning value of the single indicator, the engineering comprehensive early risk warning model is shown as follows:

where

represents the comprehensive early risk warning value of the HPGE.

Traditional early risk warning only judges the quantitative relationship between the comprehensive risk assessment results and the comprehensive risk threshold of the project. In this case, even if the risk value of one indicator reaches its maximum value, it is possible that the overall comprehensive risk of the project will be reduced due to the low risk of other indicators. However, in the actual engineering construction and operation, if an indicator has extremely serious risks, we cannot ignore the risk brought about by this indicator. Therefore, an HPGE comprehensive early risk warning model based on the principle of non-compensation is adopted in this paper. As shown in Equation (18), if the early risk warning value of any indicator is 1, no matter what the early risk warning value of the other indicators is, the comprehensive early risk warning value is 1.

The early warning level evaluation standard for the comprehensive risk level is listed in

Table 3.

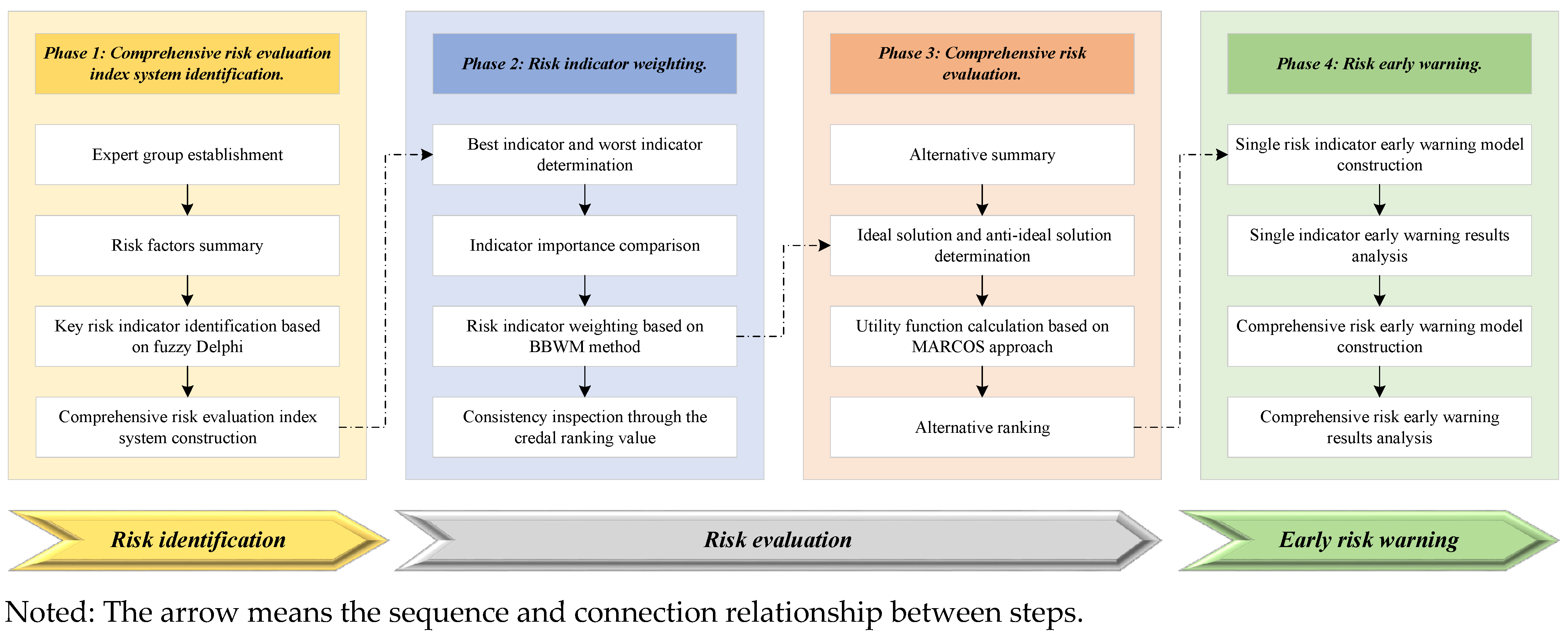

3.5. Comprehensive Risk Management Framework of HPGE

In this paper, a comprehensive risk management framework of HPGE is constructed, as shown in

Figure 1.

- ➢

Phase 1: Comprehensive risk evaluation index system identification.

First, practitioners of power grid engineering and university professors engaged in relevant fields are invited to be members of the expert group. Then, the risk factors affecting high-permeability power grid engineering are summarized. Next, the key risk indicators are identified based on the fuzzy Delphi method. Finally, the comprehensive risk assessment index system is constructed.

- ➢

Phase 2: Risk indicator weighting.

First, the experts need to determine the best and worst indicators. Then, they should compare the importance of the best and worst indicators with other indicators. Next, the Bayesian BWM method is adopted to determine the weight of each risk indicator. Finally, the consistency of the experts’ opinions is checked by calculating the credal ranking value.

- ➢

Phase 3: Comprehensive risk evaluation.

First, the alternatives are summarized and the performance of each alternative on each risk indicator is sorted out. Then, both the ideal and anti-ideal solutions are determined. Next, the utility function based on the MARCOS approach is calculated. Finally, all the alternatives are ranked.

- ➢

Phase 4: Early risk warning.

Based on the previous risk assessment results, the early risk warning of HPGE can be further processed. First, the single risk indicator early warning model is constructed. Then, the single indicator early warning results of each indicator for all the alternatives are analyzed. Next, the comprehensive early risk warning model is constructed. Finally, the comprehensive early warning results for all the alternatives are analyzed.