5.1. Results of Copulas Models

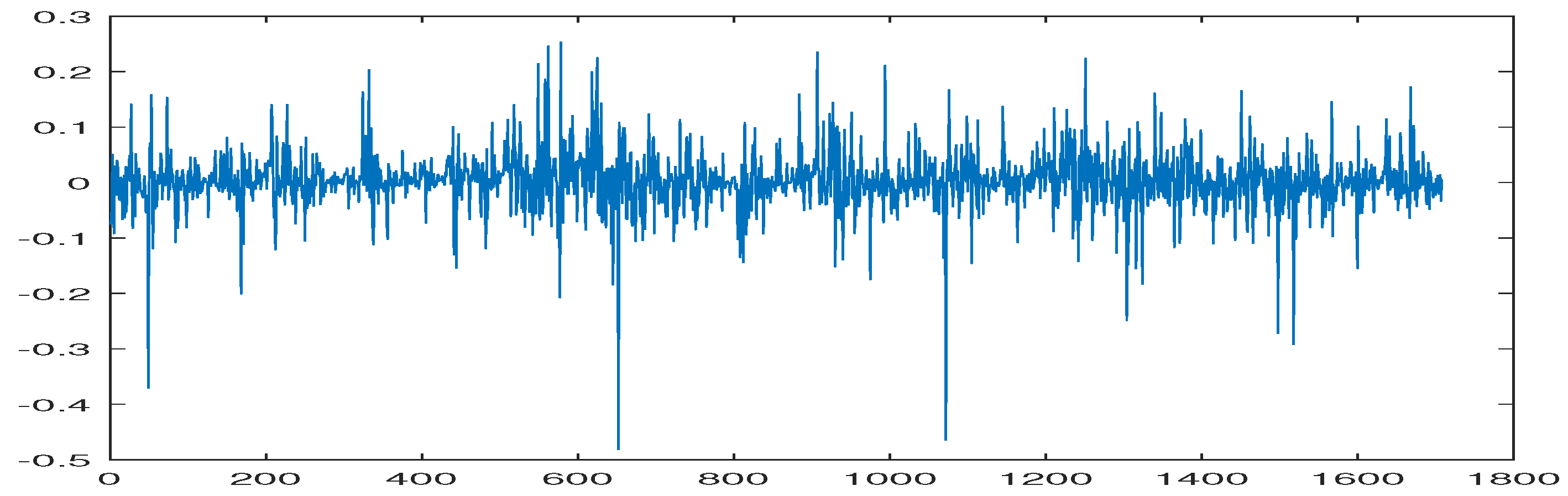

Table 1 provides descriptive statistics of the three returns, TASI, BTC, and WTI. The TASI returns present a mean of

, indicating a slightly negative average return. The standard deviation is

, suggesting a moderately high level of volatility in the TASI returns. The skewness value of

indicates a highly skewed distribution, where the tail is longer on the left side. The kurtosis value of

suggests a highly leptokurtic distribution. This means that there are more observations near the center and the tails are heavier than a normal distribution.

Bitcoin returns present a mean of , which means that the average value is positive and close to zero. The standard deviation of is relatively high, highlighting significant variability in returns. Thus, returns fluctuate substantially, implying the potential for both gains and losses. The skewness value of is very close to 0, suggesting a nearly symmetrical distribution. Returns are likely distributed evenly around the mean without strong tails. The kurtosis is , which means that the Bitcoin return distribution is moderately peaked and has heavy tails compared to a normal distribution.

The average return of indicates that WTI prices generally declined slightly over the analyzed period. The standard deviation of highlights significant price fluctuations, suggesting a volatile market with both potential gains and losses. The skewness value of reveals a distribution skewed towards negative returns. This means larger losses were more frequent than larger gains. The kurtosis is , indicating that the distribution of the returns of WTI crude oil is highly peaked and has heavy tails compared to a normal distribution.

Table 2 provides the estimation results of different copula families between Bitcoin and the TASI. The table presents the parameters for various copula families, including the lower tail dependence, upper tail dependence, LL, AIC, and BIC for each copula family. The estimation results provide insights into the dependence structure between Bitcoin and TASI returns, which is crucial for understanding the joint distribution of these two assets. By analyzing the parameters of different copula families, we can determine the most suitable copula for modeling the dependence between Bitcoin and TASI returns.

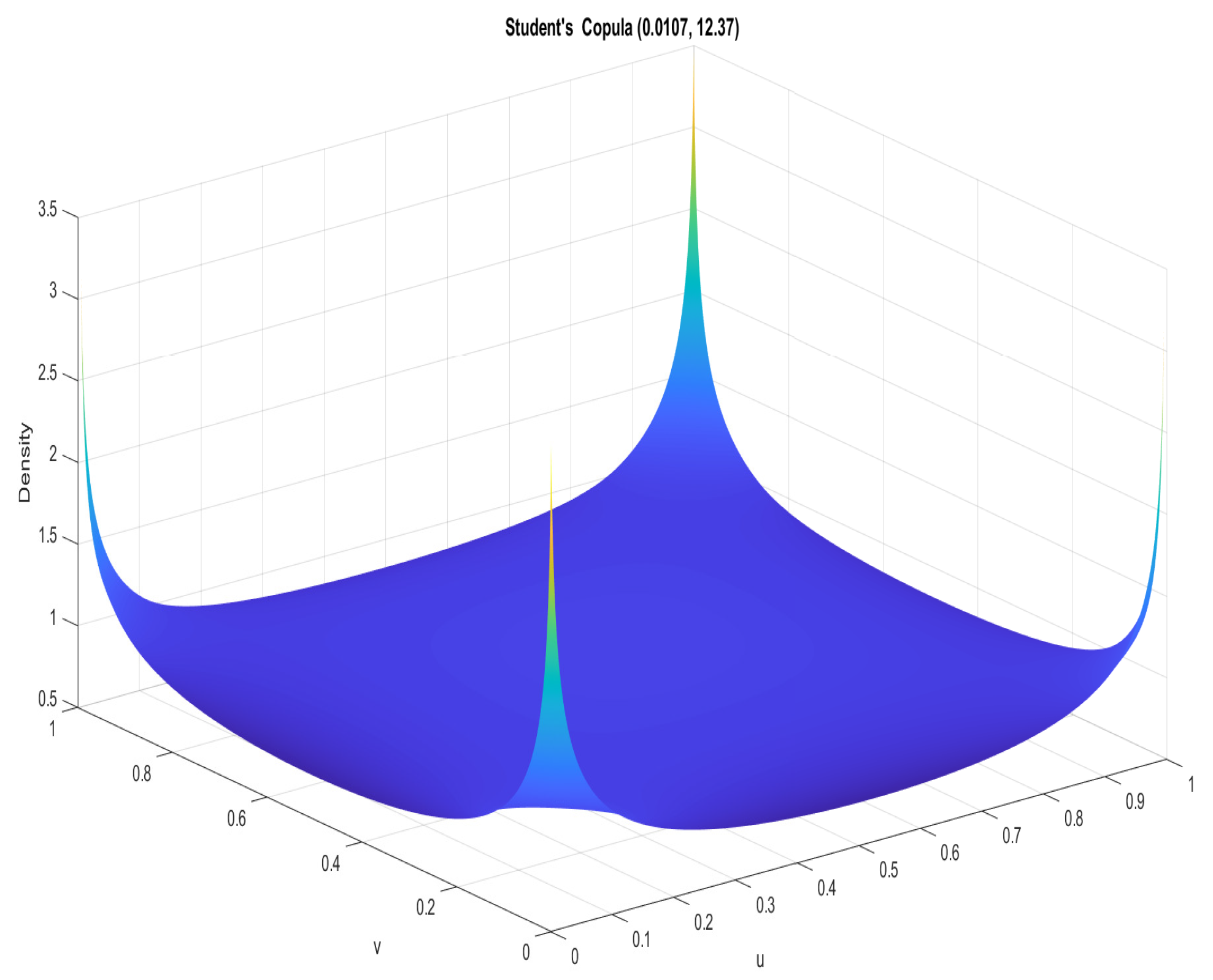

The Student’s copula presents the lowest LL, AIC, and BIC. Thus, the optimal copula between TASI and BTC is the Student’s t copula, with a correlation of 0.0107 and 12.37 degrees of freedom. This low value of correlation indicates weak linear dependence between Bitcoin and TASI returns. The returns are not closely aligned, so they might not move together dramatically during market downturns. This weak correlation suggests potential diversification benefits from including both assets in a portfolio.

The degrees-of-freedom value of 12.37 indicates a moderately heavy-tailed distribution for the joint behavior of Bitcoin and TASI returns. It is more flexible than a normal distribution but not extremely heavy-tailed. It implies that risk models based on a Gaussian assumption might underestimate the likelihood of tail risks in this context. This is often relevant in finance, where moderate tail heaviness allows for capturing both regular and moderately extreme events. These heavy tails highlight the importance of considering tail risks when managing a portfolio that includes both Bitcoin and TASI assets.

The presence of a positive lower tail parameter of in the copula model suggests that, in the event of a notable negative return in Bitcoin, there is a moderate probability of observing a similarly significant negative event in the TASI. This indicates a certain degree of positive dependence in the lower tail, where extreme negative events in one asset are moderately correlated with extreme negative events in the other. Conversely, the positive upper tail parameter of implies that with the occurrence of a substantial positive return in Bitcoin, there is a moderate probability of encountering a significant positive event in the TASI. This signifies a positive dependence in the upper tail, indicating that extreme positive events in one asset are moderately correlated with extreme positive events in the other.

In

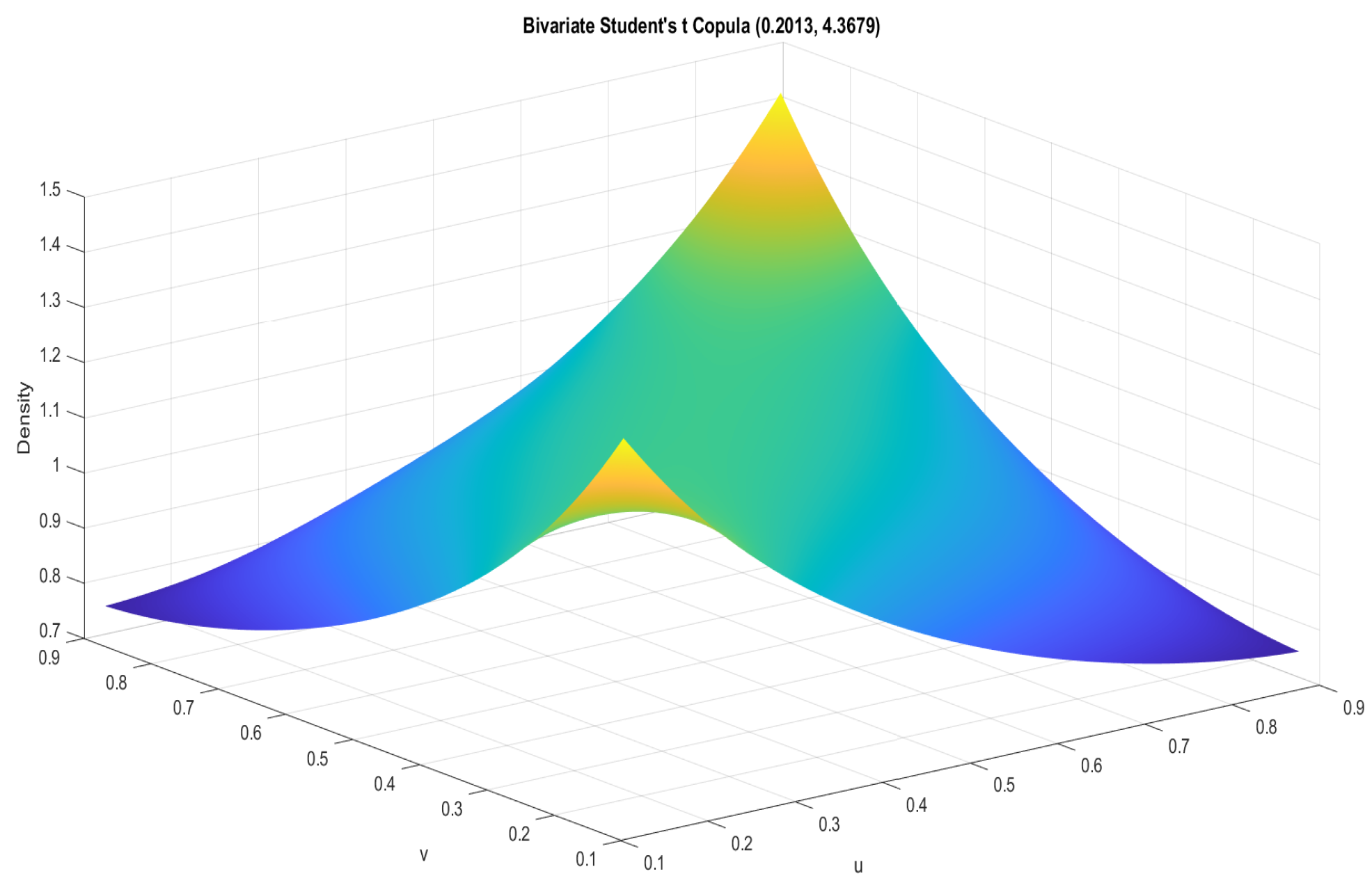

Table 3, the optimal copula between the TASI and WTI crude oil is represented by a Student’s t copula with specific parameters. The correlation coefficient of 0.2013 indicates a mild positive linear relationship between the returns of the TASI and WTI crude oil, implying that, when one asset’s return increases, there is a tendency for the other to increase as well. The degrees-of-freedom parameter of 4.3676 suggests that the copula accommodates heavier tails in the joint distribution, allowing for a more flexible modeling of extreme events. Additionally, both lower and upper tail parameters of 0.1135 indicate a moderate level of positive tail dependence, suggesting that significant negative or positive events in one asset are moderately correlated with corresponding events in the other.

In

Table 4, the optimal copula between BTC and WTI crude oil is the Frank copula with a parameter of

, which indicates that the joint dependence structure between these two assets is best represented by a copula that allows for both positive and negative dependencies without tail dependence. The positive dependence between BTC and WTI crude oil is indicated by the positive parameter value of

, which suggests that these assets tend to move in the same direction. The magnitude of the parameter provides insights into the strength of the dependence. In this instance, the parameter value of

implies a moderately strong positive dependence between BTC and WTI crude oil, reflecting a significant but not perfect association between the two assets.

Figure 4 presents the Student’s copula density of the TASI and BTC. The concentration of higher density values towards the center suggests a higher probability of joint occurrences of median values of TASI and BTC returns, while the tails of the plot indicate the probabilities of extreme values occurring together.

Figure 5 presents the graph of a Student’s copula illustrating the dependence structure between the TASI and WTI. The color gradient from blue to yellow indicates increasing density values. The peak of the graph suggests a higher density and thus a higher probability of joint occurrences around those particular values of TASI and WTI returns.

A comparison of

Figure 4 and

Figure 5 shows that the parameters and the shapes of the copula densities are different, reflecting the distinct dependence structures between the TASI–BTC and TASI–WTI pairs. The degrees-of-freedom parameter is lower in

Figure 5, which suggests a heavier tail and possibly more extreme joint behavior between TASI and WTI than between TASI and BTC.

Figure 6 presents the Frank copula density of the BTC and WTI. This particular figure compares the density of the returns of BTC and WTI and could help investors to assess which asset has a greater likelihood of significant losses or gains in a short period. Understanding this information can help investors better manage their portfolio risk.

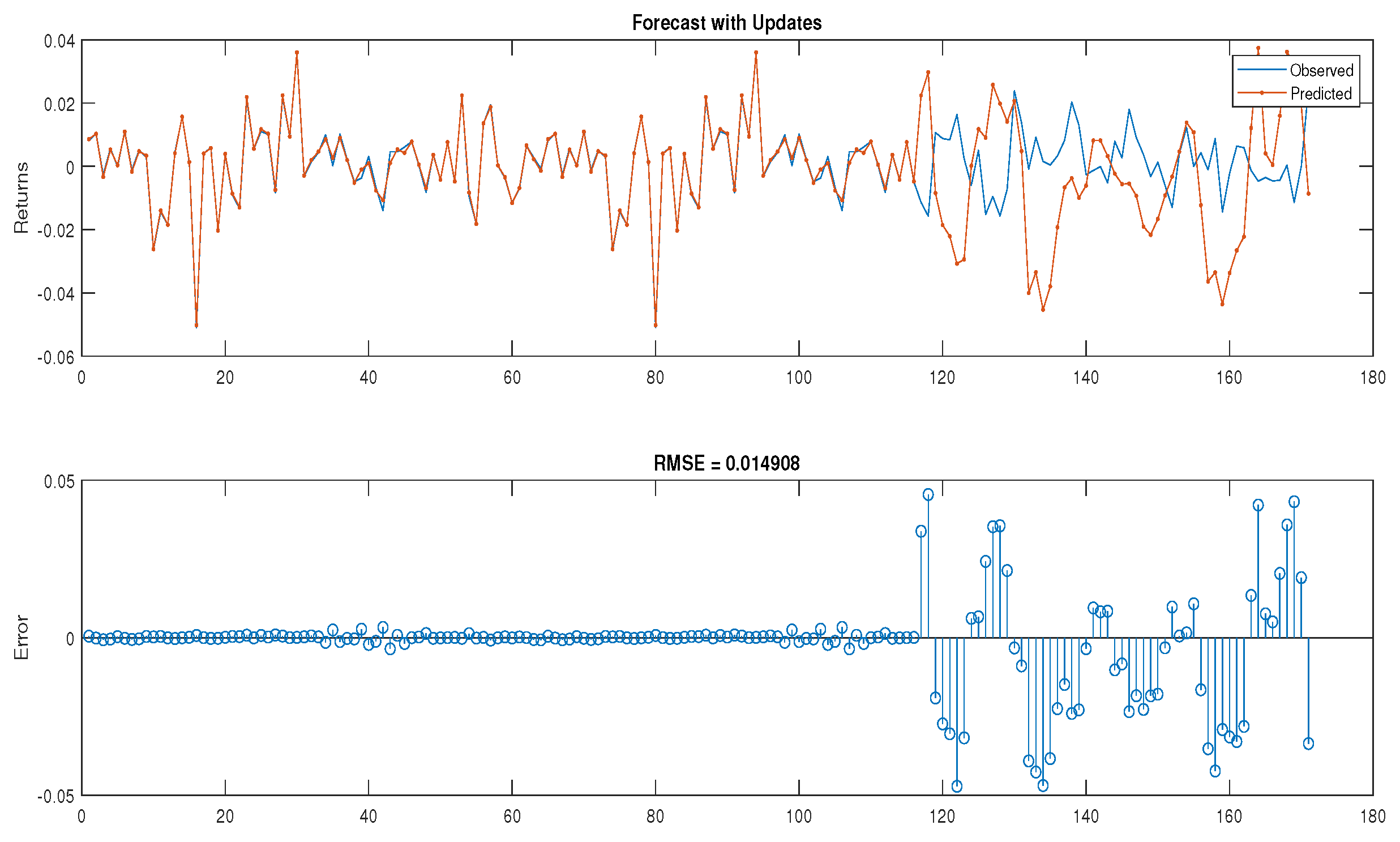

5.3. Comparison between Copulas and LSTM Models

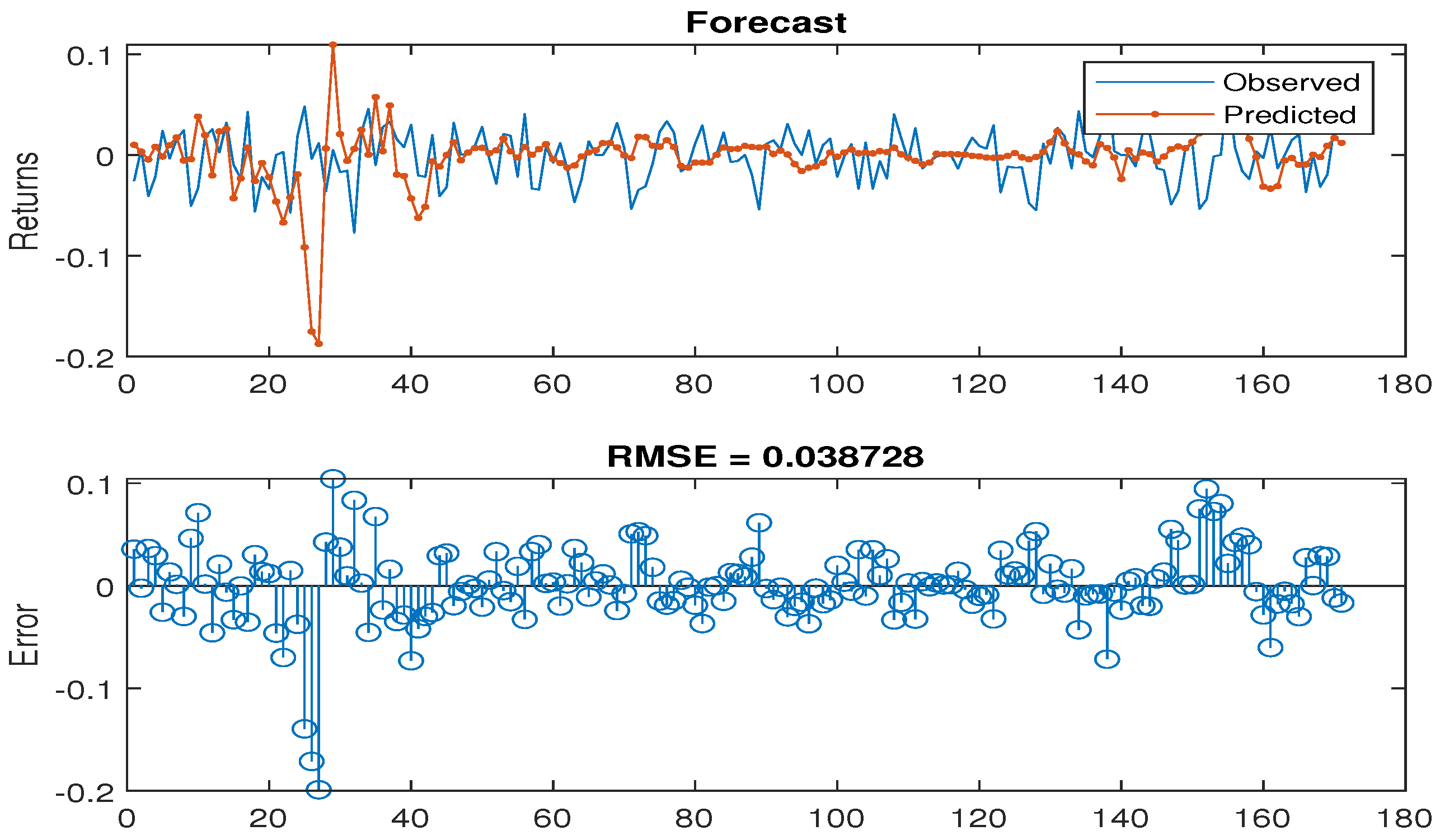

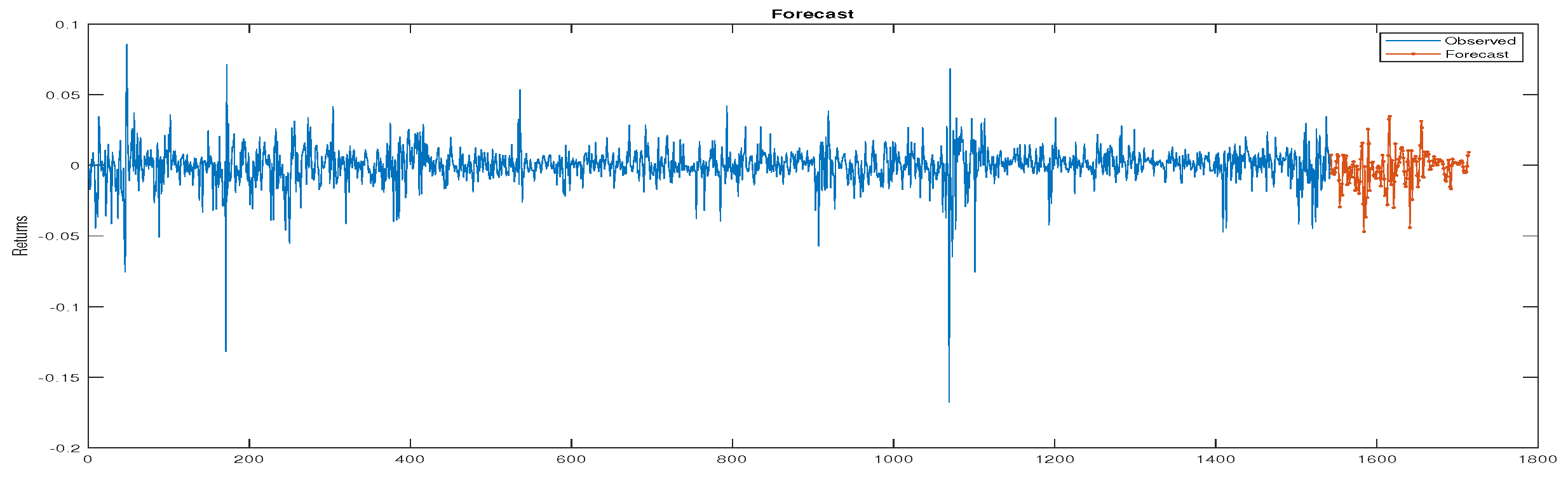

To evaluate the predictive performance of the copulas and LSTM models, we computed the RMSE, MAE, and MASE. Lower values of RMSE, MAE, and MASE indicate better predictive performance, reflecting the closeness of predicted values to the actual data observations.

Table 5,

Table 6 and

Table 7 display the copula models’ accuracy in terms of RMSE, MAE, and MASE for the TASI, BTC, and WTI returns, and

Table 8 displays the LSTM model’s RMSE, MAE, and MASE for the same returns.

Our results show the superior predictive power of LSTM models over copula-based approaches for predicting TASI, BTC, and WTI returns. The consistently lower RMSE, MAE, and MASE values achieved by the LSTM on all assets emphasize its ability to effectively capture the complex, non-linear dynamics of these financial time series. This better performance emphasizes the advantage of using a model that is able to learn complex temporal dependencies over methods that rely on static dependency structures. While the LSTM shows consistent improvements over copulas in predicting BTC and WTI, the MASE score for TASI (1.2), which indicates slightly worse performance than a naive forecast, is worth careful consideration. This result is likely due to the prevalence of near-zero returns in the TASI data, which can have a disproportionate effect on percentage error metrics such as MASE. However, the relatively low RMSE and MAE values for TASI suggest that the model’s predictions are still quite accurate in absolute terms. Overall, our study highlights the promising capabilities of LSTM models for financial forecasting while emphasizing the importance of understanding the data characteristics and using a combination of error metrics to effectively evaluate model performance.