Abstract

This paper investigates the economic competitiveness of hydrogen-powered trucks. It reviews the growing number of papers that provide an estimate of the total cost of ownership (TCO) of hydrogen-powered trucks relative to their diesel equivalents. It examines the methodology applied, the variables considered, the data used for estimation, and the results obtained. All reviewed studies conclude that hydrogen-powered trucks are not currently cost-competitive, while they might become competitive after 2030. The conclusion holds across truck types and sizes, hydrogen pathways, mission profiles, and countries. However, we find that there is still a huge area of uncertainty regarding the purchase price of hydrogen-powered trucks and the cost of hydrogen, which hampers the reliability of the results obtained. Various areas of methodological improvements are suggested.

1. Introduction

Hydrogen-powered trucks can be an interesting alternative to diesel-powered trucks [1,2,3,4,5,6]. They have at least three important properties: (i) in their fuel-cell configuration they do not emit air pollutants but only water vapor, (ii) recharging times are very similar (slightly longer) to those of their diesel counterparts, and (iii) they can transport a load for distances of 1000 km, even on a single charge.

Though, from a technological point of view, hydrogen-powered trucks are a very promising alternative, it is not at all clear whether they are also promising from an economic point of view, i.e., whether their purchase and operation can be carried out with costs equivalent to those currently incurred by trucks with combustion engines powered by fossil fuels.

The purpose of this paper is precisely to investigate the economic competitiveness of hydrogen-powered trucks. The most common model used in the literature to assess the competitiveness of a technological solution is the total cost of ownership (TCO) model. This is a model that essentially focuses on the present and future monetary costs and revenues related to the means of production, which we will describe in detail in Section 3. Although the TCO model accounts for only some of the variables at play, since it does not include non-monetary variables such as external environmental costs and perceived costs/risks, it is rightly the focus of attention of truck fleet managers and public decision-makers aiming to reduce transport-related pollutant emissions.

Although hydrogen-powered trucks are in the early stages of commercialization, a growing number of studies have explored the topic, proposing various assessments of the TCO of hydrogen-powered trucks, usually comparing them with other propulsion systems (including diesel, electric, and natural gas). The topic is complex as there are many truck configurations, some operating over short distances (local and regional) and others over medium and long distances. Hydrogen can be produced according to many pathways: from renewable sources such as solar and wind, to fossil fuels such as methane via the steam reforming method (SMR), with carbon capture and storage (CCS) and different types of electrolyzers. Furthermore, it can be distributed in gas form with different pressure levels or in liquid form: each pathway implies different energy, environmental, and economic costs. In addition, there are several national specificities that affect the TCO of hydrogen trucks, related both to natural endowments, and the resulting electricity mix, and to incentive policies for energy transition, based on a mix of subsidies and taxes, which can significantly affect the relative competitiveness of different forms of truck fueling. Last but not least, there is the issue of the hydrogen recharging infrastructure, still in the start-up phase in many countries, which has an important effect on the actual and perceived costs of using hydrogen trucks.

The various studies we have identified address these issues, estimating both current costs and possible future developments. This paper reviews the available studies, classifying them and analyzing two important aspects: the data or assumptions on the basis of which the estimates are made, and the results obtained, comparing the main determinants of the TCO of hydrogen trucks.

To the best of our knowledge, a review of hydrogen truck TCO studies has not yet been presented in the literature. At this historical stage, when the first hydrogen trucks are entering the market at the disposal of transport companies and policy makers have to design policies for the decarbonization of transport, having a summary of the competitiveness of hydrogen trucks seems very timely.

The organization of the paper is as follows. Section 2 outlines the methodology employed for conducting the systematic literature review concerning hydrogen-powered trucks. Section 3 delineates the total cost of ownership (TCO) model. Section 4 analyses the data utilized across various studies. Section 5 is dedicated to comparing the outcomes of these studies. Section 6 addresses the principal limitations identified in the existing research and suggests potential areas for future enhancement. Finally, Section 7 presents the key conclusions and recommendations derived from this study.

2. A Systematic Review of the Literature

We firstly carry out a preliminary systematic review of the available academic research focusing our search on the hydrogen technology applied to the transport sector, in particular on fuel cell trucks, cost analysis, and TCO [7,8]. We then provide a narrative review of a selected set of papers and reports [9].

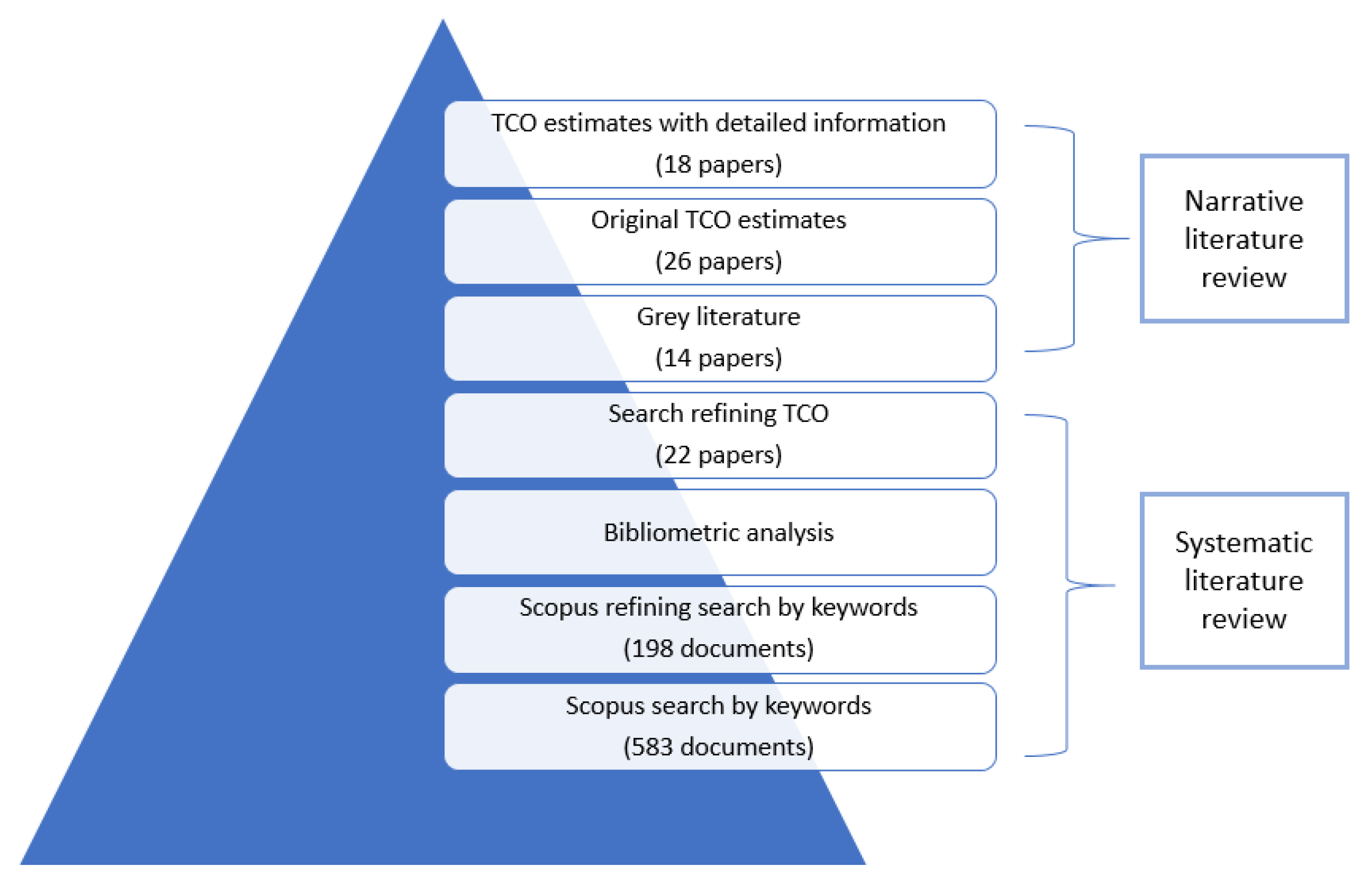

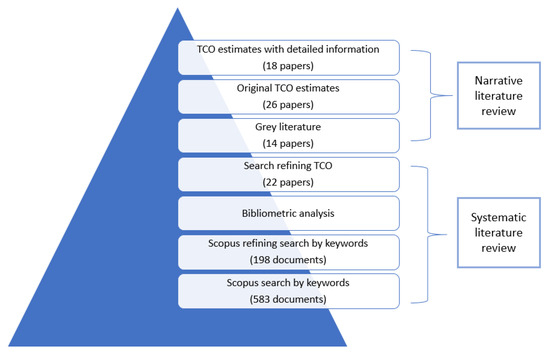

The search for relevant papers, articles, proceedings, and reviews was carried out in the Scopus database with no temporal restrictions, making use of different scenarios in the search query and with a funnel approach. We started with the keywords hydrogen AND truck* AND fuel AND cell in the ‘title, abstracts and keywords’ search field, which resulted in 583 documents. In a second step, we restricted the field of research to investigate cost analyses using the keywords hydrogen AND truck* AND fuel AND cell AND cost*, which resulted in 198 documents (Figure 1). The search was performed on 8 February 2024.

Figure 1.

Search query ‘funnel approach’.

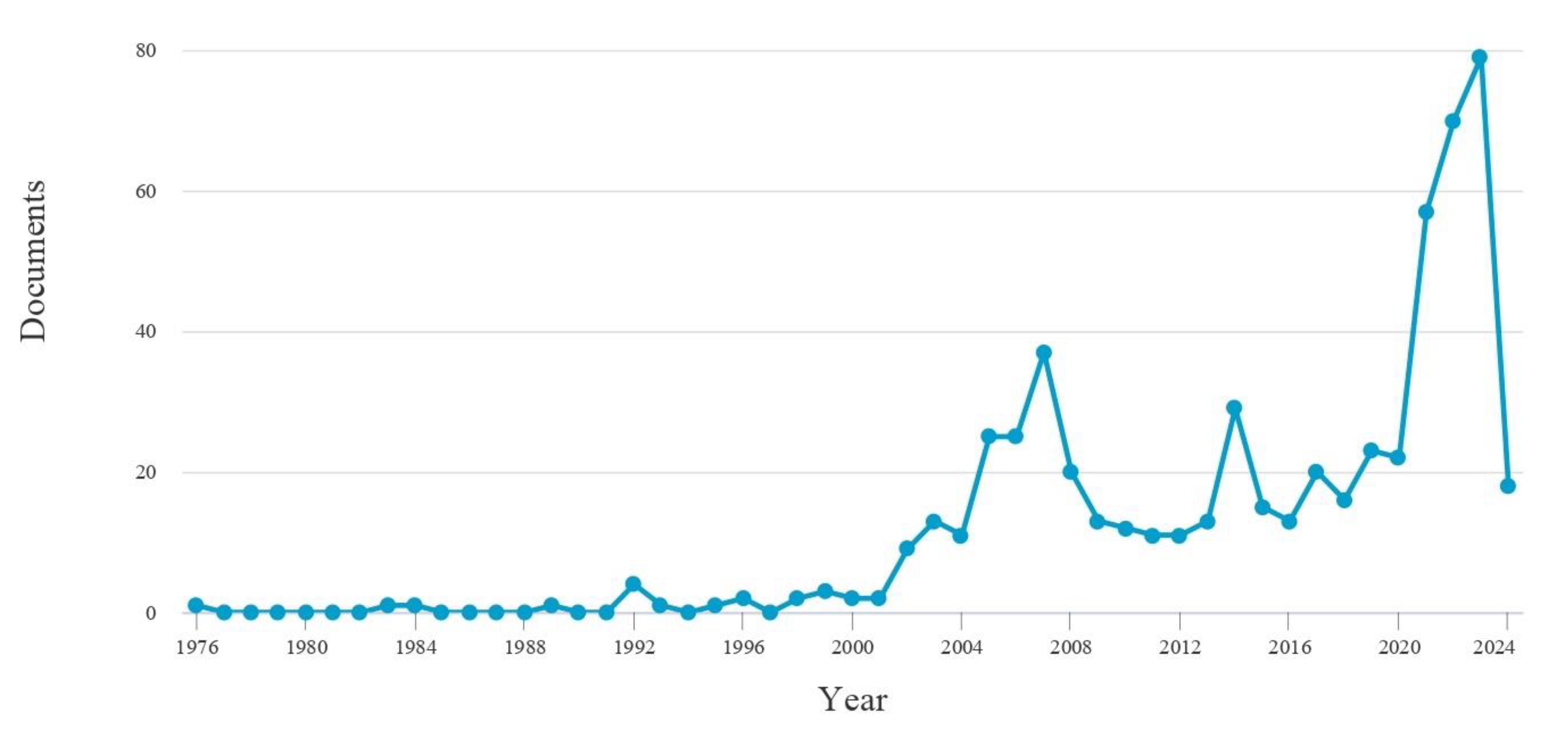

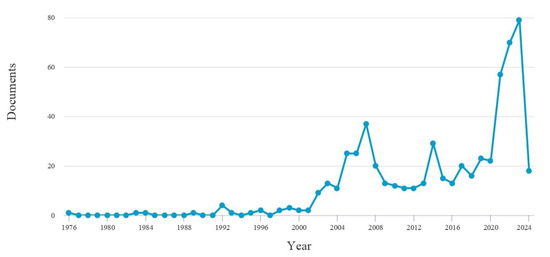

We carried out a bibliometric analysis on these documents using the tools available on Scopus to obtain a general overview of research trends. In the period 1984 to 2003, the number of studies was limited and infrequent, with a peak in 2007 (Figure 2). The number of publications increased noticeably starting from 2019.

Figure 2.

Scopus analytics.

Analysis of the subject areas of the retrieved documents showed that the majority of documents have a technical subject: 121 (29.9%) papers pertain to the energy sector, 110 (27.2%) to engineering, and 54 (13, 3.6%) to environmental science. Business management and social science represent only eight percent of publications. The top three contributing institutions were Argonne National Laboratory (USA, 10 publications), followed by the University of Victoria (Canada, 8 publications), and Forschungszentrum Jülich (Germany, 8 publications). Indeed, most active authors in this field of research came from USA (with 59 publications), followed by China (29), and Germany (25). The type of documents analyzed were papers (52.5%), conference papers (28.8%), review papers (8.1%), and book chapters (5%).

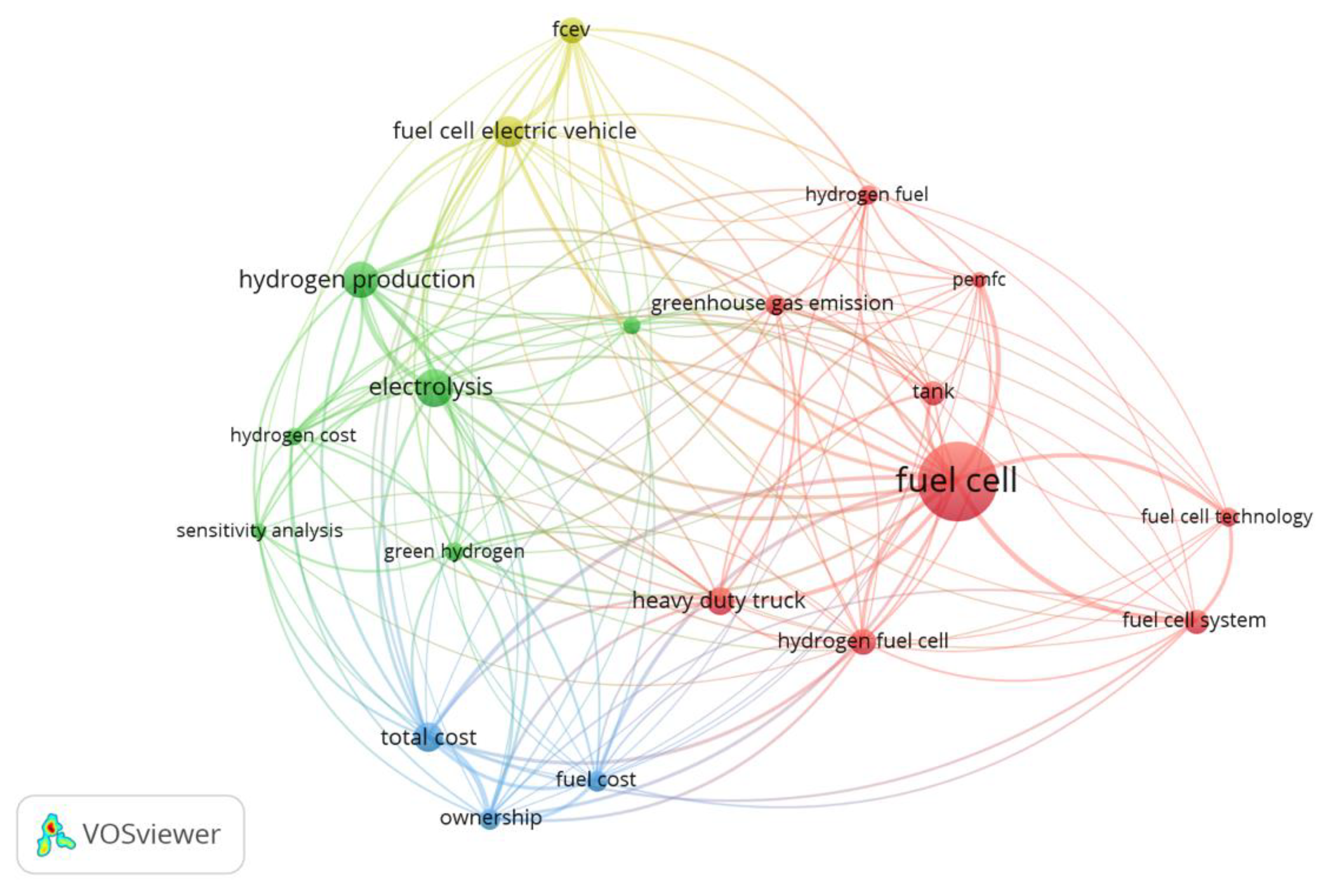

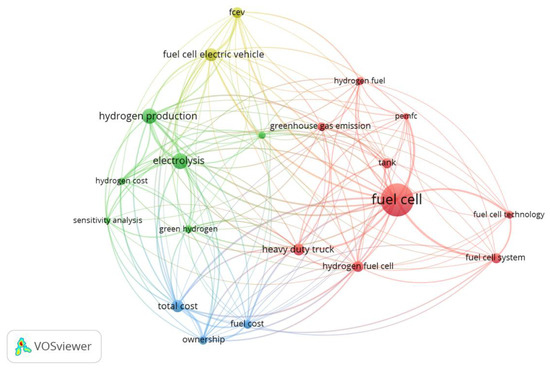

To explore the thematic groupings, we used VOSviewer [10]. For the most frequently encountered terms in abstracts, a minimum of ten occurrences was set as the threshold.

As displayed in Figure 3, the co-occurrences network of terms/words is composed of four clusters, highlighted in different colors. The red cluster, labeled ‘Fuel cell’, contains nine items. The green cluster, labeled ‘Electrolysis and hydrogen production’, contains six items. The blue cluster, labeled ‘Cost analysis’, contains three items. The yellow cluster, labeled ‘Fuel cell electric vehicle’, with items complementary to other clusters, contains two items. The most cited words were: ‘fuel cell’ (76 occurrences), ‘hydrogen production’ (29), ‘electrolysis’ (21), ‘fuel cell electric vehicle’ (44), ‘total cost’ (23), and ‘heavy duty truck’ (22).

Figure 3.

VOSviewer term co-occurrences for SCOPUS publication sample of ‘fuel cell hydrogen truck cost’ keywords.

The visualization map clearly delineates the primary areas of research, which are predominantly technical. The red cluster underscores a significant emphasis on hydrogen fuel cell research, particularly in relation to heavy-duty trucks, fuel cell systems, and their implications for greenhouse gas emissions. The blue cluster focuses on cost analysis, closely interlinked with the utilization of fuel cells in heavy-duty trucks. The green cluster is dedicated to exploring hydrogen production. It is noteworthy that the nodes within the blue network are relatively small, reflecting that scholarly output focusing on the economic aspects and total cost of ownership (TCO) of this technology is a more recent development.

The next step included a further focusing of the analysis, with a more restricted keyword search: hydrogen AND truck* AND fuel AND cell AND cost* AND total AND ownership, resulting in 22 documents. Reading the papers carefully, we found references to 14 documents and reports not published in scientific papers. Out of these 36 papers, 26 presented an original TCO estimate but only 18 of them (reported in Table S1) provided sufficiently detailed information for the analysis we describe in coming sections.

3. The Total Cost of Ownership Model

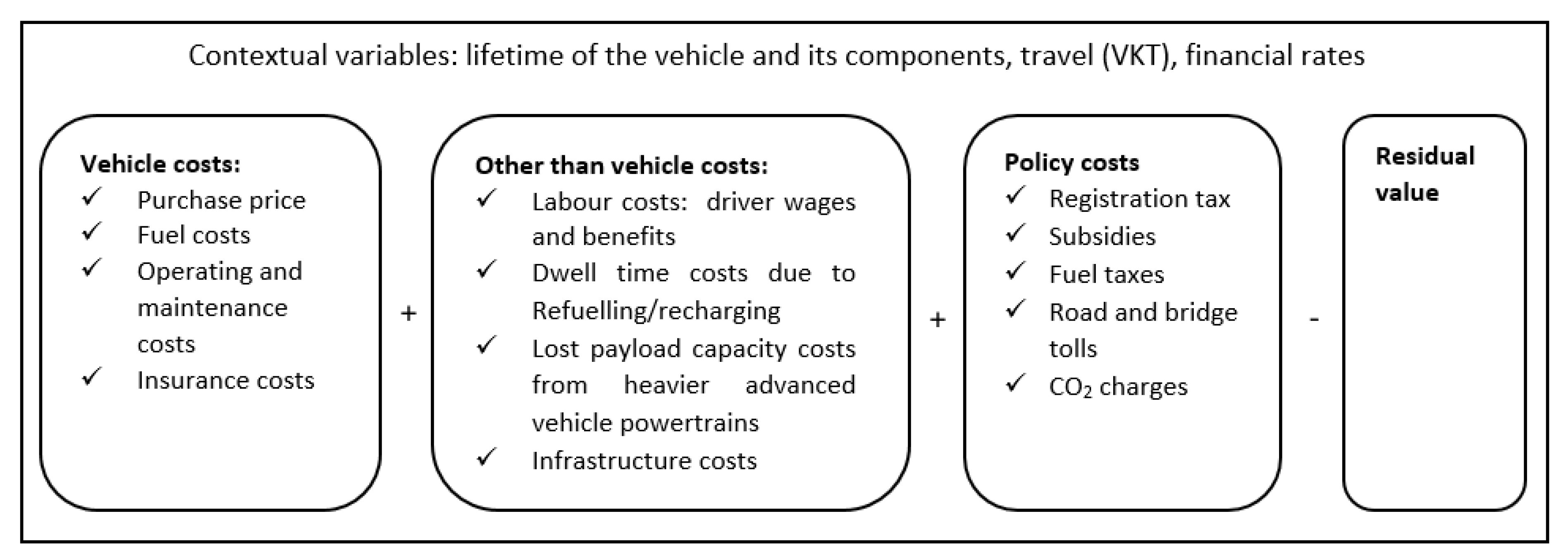

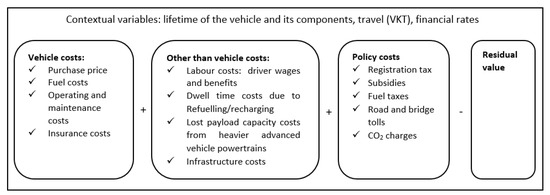

The TCO model consists of adding (or subtracting) all monetary costs (revenues) incurred during the life of a consumer good or means of production (truck) (Figure 4). Because they occur at different points in time, such costs/revenues should be appropriately discounted [11].

Figure 4.

Graphical representation of the components of the TCO model.

In the case of a truck, it is common, especially in the engineering literature, to identify two types of costs: fixed capital costs (CAPEX) and operating costs (OPEX). The main fixed cost is the acquisition cost of the truck, paid at the time of purchase or accrued.

The formula typically reported in this case is:

where CAPEX includes vehicle and infrastructure costs, SUB is the purchase subsidy and RC is the registration cost. OPEX are the annual expenses and RV is the residual value at the end of the ownership period. CRF is the capital recovery factor and ADT represents the annual distance travelled.

The acquisition cost to be considered is the net of any rebates or subsidies but must include any sales tax (VAT) and registration fees. The type of payment, equity, or credit is important because in the latter case the discount rate must take into account the rate charged by the creditor (APR).

Operating costs include, in particular, the cost of fuel used and routine maintenance costs, to which one must add circulation taxes and insurance premiums, usually on an annual basis, and extraordinary maintenance and replacement costs. In the case of hydrogen trucks, these are related to the possible failure or replacement of parts subject to degradation, such as fuel cell stacks or the battery, the cadence of which is difficult to predict.

The cost of fuel is usually a variable that is as important as it is difficult to predict. The cost depends on the price of fuel and on the amount of fuel consumed per kilometer driven, i.e., the efficiency of the vehicle. The current price of fuel is known, but the future trend is unknown, so there is a large element of uncertainty. The fuel consumption per km is usually declared by the manufacturer on the basis of coded test procedures (e.g., WLTP). However, there are usually significant differences between the certified and real-world consumption as many other variables come into play, such as road orography, traffic conditions, and driving style.

Finally, there are a number of costs associated with transport policy, such as road tolls, tolls for crossing a bridge or a mountain area, and parking fees, which can be differentiated according to the vehicle’s drivetrain. Typically, public authorities exempt vehicles with lower emissions in order to encourage their market penetration.

To integrate operating costs with initial fixed costs, it is necessary to apply a discount rate, chosen according to the appropriate interest rate. When fixed costs are financed through equity, the most suitable discount rate is the opportunity cost of capital, or the weighted average cost of capital (WACC). Conversely, if financing is obtained through the banking system, the applicable rate should be the interest rate paid to the lender.

Finally, we must take into account the residual value, i.e., the revenue from a potential resale of the truck. This component is highly uncertain for a new technology such as hydrogen powered trucks, which are only just beginning to appear on the market and for which no real data or time series exist. As the literature on the residual value of electric cars shows, this value is highly dependent on technological progress and the commercial policies of vehicle manufacturers.

To sum up, in estimating the TCO of a truck there are multiple areas of uncertainty, some related to specific conditions (traffic, weather conditions), some related to market variables (fuel price), and some others dependent on present and future traffic policies. Furthermore, since TCO estimates are generally made for several types of fuel (diesel, electric) to guide private and public decision-makers in their choices, the uncertainty inherent to one type of fuel must be added to the uncertainty for the other types. For instance, the evolution of oil prices alters the relative competitiveness of hydrogen-powered trucks.

In the case of hydrogen trucks, as we will see in the next sections, there is a further complication. Hydrogen is currently available at very few refueling stations. In the countries with the most widespread refueling infrastructure, the number is still limited (California: 55 hydrogen refueling stations in 2023 versus 10,423 petrol stations in 2021; Germany: 96 hydrogen refueling stations versus 14,453 petrol stations in 2023; Italy: 1 hydrogen refueling station versus 22,700 petrol stations in 2023). This creates both costs and opportunities.

The costs are related to the additional kilometers needed to reach the hydrogen refueling station if it is not available on the chosen commute route. These costs can be quantified either as additional fuel consumption and/or as the time taken to reach the refueling station, subtracted from the normal work activity. The former is easier to estimate, while the latter requires an assessment of the time lost.

The opportunity lies in the possibility to produce hydrogen independently, having greater control over costs and being able to choose the most appropriate and convenient hydrogen production technique. The option of integrating the production and use of hydrogen for one’s own truck fleet leads to a more extensive TCO analysis, not only concerning the vehicle, but including hydrogen production, storage, and distribution. Independent hydrogen production might lead to a levelized cost of hydrogen significantly different from the hydrogen price at the pump, as well as having specific energy contents and environmental impacts.

The topic of uncertainty was approached in two ways in the reviewed papers [12]. Some papers made estimates based on the central or most probable values and then performed simulation analyses using the maximum and minimum values of the variable subject to uncertainty. Other papers performed sensitivity analyses to estimate the outcome of the model as the variables subject to uncertainty change.

Two TCO metrics can be used:

- The absolute TCO value, referring to a moment in time (at the present time or at the time of the end of the simulation), given an annual distance travelled and under specific operational, economic, and financial conditions;

- Or, more commonly, the TCO\km (or miles) for an average year, which allows for easy comparison between studies in the literature but does not allow for a temporal description of the financial commitment associated with the vehicle.

Common analyses performed with the TCO models are:

- The breakdown of the TCO by cost components, which makes it possible to highlight differences in the composition of, for example, fixed and variable costs between alternative fuels;

- The calculation of the break-even value with respect to the conventional powertrain (diesel in the case of trucks), which makes it possible to assess, for example, what price of hydrogen per kg or what amount of subsidy would allow hydrogen trucks to achieve cost parity relative to diesel trucks.

4. Data

A crucial part in evaluating the TCO estimates is understanding the data assumptions and sources. We discuss the findings below and report the data in the Supplementary Materials.

4.1. Vehicle Costs

The current hydrogen truck used in the TCO studies are much higher than those of diesel trucks (Table S2). The difference ranges from 20% [13] in the UK to 400% in China according to [14]. Because, at the time of the writing of the studies, almost no hydrogen trucks were sold in the market, most studies relied on a bottom up modeling approach (e.g., FASTSim is used by [15]). The approach consists of identifying the specific components of a truck (those being, for a hydrogen truck fuel cell system: the hydrogen storage tank, battery, power electronics, electric machine, transmission, differential, etc.), estimating their value, and summing up the total costs, including or not including the manufacturers’ markup. An advantage of this approach is that it can generate very many configurations of a truck. Ref. [15], for instance, generated estimates for a Class 8 tractor truck, a Class 8 day cab, a Class 8 sleeper cab and a Class 8 tractor cab. Its main limitation is that it does not consider the industrial strategy of the truck manufacturer and the potential economies of scale in production.

Ref. [16], using mixed sources (partly relying on the bottom up modeling approach and partly on market information), provided estimates for six truck types: (1) a long-haul tractor-trailer 5-LH (500 km); (2) a long-haul tractor-trailer 5-LH (800 km); (3) a long-haul tractor-trailer 5-LH (1000 km); (4) a regional heavy-duty truck 4-RD; (5) an urban medium-duty truck 3, and (6) an urban light-duty truck 54. They found that they currently cost 3.2 to 3.9 times more than a diesel truck of the corresponding type. Only the “urban medium-duty truck 3” is estimated to be just 2.5 times more expensive.

The higher costs of hydrogen trucks relative to diesel equivalents are a common result across countries, including the USA, EU, UK, and China. As for future costs, all studies predict a reduction in the price differential (Table S3). However, on average, the authors assume that, in the period 2025–2030, hydrogen trucks will be 30% more expensive than their diesel counterparts. By 2040, they predict that the differential will reduce to 12%.

4.2. Hydrogen Cost

In Table S4, we report the hydrogen prices assumed by the authors who have carried out the TCO studies. We observe that some authors carried out their TCO analyses assuming minimum and maximum values and central (or most probable) values. Ref. [17] is the only one to use a triangular distribution that takes into account the degree of plant utilization.

An important element that affects the price of hydrogen is the hydrogen pathway used to produce it. Most authors use values referring to electrolysis used to produce so-called “green hydrogen”. Ref. [18] went into even more detail and distinguished between nine pathways. Ref. [19] used diversified values depending on the type of hydrogen used, distinguishing between pipeline, compressed, liquid, and liquid organic carrier.

With reference to the current costs (i.e., to the years 2022–2023) of compressed hydrogen from renewable sources, the values range between 6 and 10 EUR /kg, with values close to the lowest threshold in China and the highest in some European countries such as Italy. Relative to 2020, the study by [20] in the United States assumed a value greater than 11 EUR /kg. Ref. [18] found values of the same order of magnitude also using steam methane reforming (SMR) and carbon capture and storage (CCS) as pathways. Ref. [19], distinguishing by type of hydrogen, found the lowest value when hydrogen is distributed via pipeline (EUR 5.45) and the highest value in the case in which it is transformed into liquid form (EUR 18.49).

The hydrogen price might vary from station to station and day by day, thus affecting TCO. None of the reviewed papers incorporated price volatility into their models.

4.3. Maintenance Cost

The hypotheses that the authors formulated on maintenance and repair costs for hydrogen trucks tend to align with the prevailing hypotheses formulated for electric cars, based on more than ten years of experience: that they are lower than those of ICEVs thanks to the lower number of moving parts. The uncertainties are obviously considerable. Ref. [21] assumed a constant value over time proportional to the cost of the vehicle (1%). Ref. [13] based their estimates on sources that indicate savings of 30% compared to diesel trucks, similarly to [14] for the Chinese case. Ref. [15], on the other hand, assumed values similar to those of diesel trucks for hybrid trucks. Ref. [16] hypothesized values similar to those of diesel trucks for the vehicles currently produced, while for those produced after 2030, values that are close to those of electric vehicles, thanks to the technological improvements that may occur.

4.4. Fuel Efficiency

Fuel efficiency is a crucial determinant of the TCO of a truck. With a focus on hydrogen trucks, we report in Table S5 the assumptions made in the examined studies. Most studies rely on simulation models [14,15] rather than on certified fuel consumption values. Ref. [14] argued that such an approach has two advantages: (1) the technical specifications for the few zero-emission truck models currently on the market differ significantly from their diesel counterparts, and (2) there is in some countries (they cite China) a proven gap between the certified and real-world energy consumption of diesel trucks arising from the certification procedures. The authors use two metrics to report their assumptions about fuel efficiency: (i) kg/100 km or km/kg; and (ii) tank-to-well efficiency. Fuel efficiency depends crucially on the type and size of the hydrogen truck. Most authors make assumptions regarding the potential fuel efficiency gains. Ref. [14] estimated potential fuel efficiency savings of about 40% between 2020 and 2030. Any traffic disturbance, including congestion, affects the fuel consumption of the truck. Hence, it increases the operating costs in the TCO metric for any propulsion system. There are technical reasons to believe that internal combustion engine trucks would suffer more from traffic disturbances than electric or hydrogen trucks. However, such a factor was not considered in any of the TCO models that we reviewed.

4.5. Dwell Time Cost

Ref. [15] discussed in detail the costs due to the working time that a truck driver loses for refueling/recharging a truck. They assumed that it is equal to 5–10 min for conventional or hydrogen trucks and to 30–60 min for electric trucks. Ref. [22] proposed the concept of perceived TCO by adding to the monetary costs the implicit costs connected to charging, which include both the time to recharge and the time to search for the charging station, in addition to range anxiety.

However, the issue is quite complex since it must be taken into account that in many countries truck drivers have an obligation to stop after a given number of hours of driving. Consequently, the possibility exists that they charge the hydrogen truck during these mandatory stops without incurring additional costs.

Other authors [13,14,16,21] do not explicitly consider these costs. Instead, they include the cost of labor that is assumed to be differentiated by size of truck but not by type of fuel.

4.6. Lost Payload Capacity

If the truck weight increases, the allowable payload for that truck decreases, representing a potential loss to the owner/operator/carrier that should be factored into the TCO analysis. However, US legislation (the Fixing America’s Surface Transportation Act, signed in 2015, allows CNG powertrains to have a gross vehicle weight up to 82,000 lbs (U.S. Department of Transportation 2015), and California’s Assembly Bill No. 2061 extends that to zero-emissions vehicles (ZEVs) (California Legislative Information 2018)) and European legislation (in 2023, the European Commission published the Greening Transport Package, which includes the revision of the maximum authorized dimensions in national and international traffic: the maximum authorized weight is set at 44 tonnes for zero emission trucks) has been enacted to compensate for such a disadvantage. It allows alternative-fueled trucks (CNG, hydrogen, and electric) to be heavier than the conventional trucks, thus making up for the lost payload capacity. Ref. [15] assumed alternative powertrain trucks to have no lost payload capacity cost associated with a heavier powertrain up to the 2000-lb difference between diesel powertrains and alternative powertrains. Comparing electric and hydrogen trucks, the issue of lost payload capacity due to truck weight is thought to only slightly affect hydrogen trucks, whereas it is a more serious issue for electric trucks.

4.7. Resale and Salvage Value

The resale and salvage value is an extremely important component of the TCO calculation. In the case of alternative drivetrains, this value is extremely difficult to predict due to its very rapid fluctuations because of technological improvements and economies of scale in vehicle production.

In the specific case of hydrogen trucks, which are produced and sold in limited quantities, the task of estimating the resale value is extremely difficult, even for short periods of time. So much so that [15] opted not to include it in the model, because of the lack of reliable information. Other authors [13,21] resorted to supporting hypotheses, such as assuming the same depreciation rate as diesel trucks, therefore giving up the idea of taking into account the differences between engines. Alternatively, ref. [14] used theoretical modeling in the absence of statistical evidence on which to base estimates. Notably, ref. [16] produced a full table of depreciation rates differentiated by truck type at different time horizons. They assumed, for the models entering the market in 2023, a retention value between 14% and 24%, while for the models that will enter the market in 2030 and 2040 the retention value is higher, based on the assumption that technology progresses less rapidly.

4.8. Infrastructure Cost

Hydrogen, unlike other energy carriers, does not currently have an established production and distribution network sufficient to guarantee the refueling of hydrogen trucks in all regions of a country. For this reason, several countries are financing electrolyzers for the production of green hydrogen and hydrogen distribution networks and plants [23,24,25]. It is not yet clear whether companies that could operate hydrogen trucks have the interest or convenience of equipping themselves with their own hydrogen production/distribution plants. If they have, they would obviously incur considerable infrastructure costs, which should be appropriately accounted for in the total cost of owning the vehicles, taking into account their coefficient of use and depreciation over time. In the absence of this data, most of the TCO studies assume that infrastructure costs are included in the price of hydrogen paid at the pump, so transport companies are exempt from incurring specific infrastructure costs.

Other technical-economic studies, however, describe the entire hydrogen supply chain, examining the different technological possibilities for the production (from fossil or renewable sources), storage (at different pressure levels or in liquid form), and distribution of hydrogen (pipelines, etc.). These studies arrive at the so-called levelized cost of hydrogen (LCOH), which, if more correct from a technical point of view, does not focus sufficiently on the commercial dimension of the hydrogen production and distribution activity.

4.9. Road Tolls

Ref. [16] included in their TCO analysis the road tolls imposed in many European countries. Road tolls are generally based on gross vehicle weight, axle configuration, and emissions class. In general, these road charges are either distance-based or time-based. The recent reform of the Eurovignette Directive proposes replacing time-based charges with distance-based tolling, as tolling based on the duration of vehicle stay in a given country does not truly reflect road use. The recent reform also dictates that zero-emission trucks be exempted from 50 to 75% of distance-based road tolls as of 2023. Refs. [21,26] moved along the same lines.

The inclusion of road tolls also requires the researcher to make an assumption on the share of tolled and untolled travel for each truck type and mission profile. Trucks operating locally or regionally are likely to have no or a very low share of tolled road travel, while trucks operating long haul might have a very large share of their travel subject to a road toll.

5. Results

5.1. Overall Results

We derived detailed quantitative TCO estimates under different scenarios from 11 studies. We extracted numerical information from the papers, their appendices, or Supplementary Materials. In two papers, we derived the TCO estimated from the graph. Other papers did not provide the information with sufficient completeness and detail to be included in our database (which is available from the authors). Overall, we collected 113 TCO estimates for hydrogen and diesel trucks, differentiated by author, truck type, hydrogen pathway, year, and country. In order to compare across studies, we expressed all estimates in euros per km, using current exchange rates and converting the values provided per mile to values per kilometer. The values are not adjusted for inflation or purchasing power, so that they are not exactly comparable. However, they provide an order of magnitude. To enhance comparability, we calculated the ratio between the TCO of the hydrogen and the diesel truck, and most of the discussion will be based on such a ratio. In order to facilitate the formatting of the paper, larger tables are reported in the Supplementary Materials section.

5.2. Current and Future TCO

Grouping the estimates by year of reference (Table 1 and Tables S6 and S7), we found that up to the year 2035, no authors obtained an estimate for the TCO of hydrogen trucks lower, on average, than that of the diesel trucks [27,28,29,30,31]. Only from 2035 do hydrogen trucks start becoming 10 to 20% competitive [32].

Table 1.

Current and future TCO estimates—euros per km, current values.

5.3. Type and Size of Trucks

The cost of a hydrogen truck depends on its size and on the energy storage system needed to provide a given daily driving range. One might wonder whether the larger the size and the higher the driving range, the higher would be the TCO per km. This does not seem to be the case as Table S8 indicates. Ref. [16] is one of the few studies that allowed us to explore such an issue. They predicted that in 2030 long-haul (800 km) trucks will have the highest TCO/km (EUR 1.24/km), followed by the long-haul (500 km) trucks with EUR 1.22/km. The long haul (1000 km) truck has a TCO/km equal to EUR 1.16/km that is, interestingly, lower than that of the light-duty urban truck which is equal to EUR 1.18/km. Evidently, the higher fixed costs connected with vehicle acquisition are compensated by the longer travel distance. The lowest value (EUR 1.06/km) is predicted for the heavy-duty regional truck.

However, this does not mean that the larger trucks are more competitive than the smaller trucks relative to their diesel counterparts. Quite the contrary, ref. [16] estimated the following hydrogen/diesel truck ratios for the different sized truck types ranking in increased order by range: 0.99, 0.96, 1.08, 1.06, 1.10, and 1.09. This implies that the smaller hydrogen trucks are predicted to be more competitive than the larger ones.

In 2040, the lowest TCOs/km will be realized by medium-duty urban and heavy-duty regional hydrogen trucks, with the light-duty urban truck having, surprisingly, the highest value among all hydrogen truck types.

Ref. [21] came to a similar finding. They documented a decreasing TCO/km with size and driving range: the light-duty urban truck (EUR 1.78), medium-duty regional truck (EUR 1.37), and heavy-duty long-haul truck (EUR 1.19). Again, this does not mean that the larger trucks are more competitive than the smaller trucks relative to the diesel ones. In fact, ref. [21] also estimated the following hydrogen/diesel truck ratios for the three truck types: 1.22, 1.26, and 1.44. These findings hold true for all 10 European countries except Switzerland.

Similarly, with reference to the US, [20] estimated a TCO/km value slightly higher for long-haul 300 mile hydrogen trucks with respect to long-haul 500 mile hydrogen trucks. However, in terms of competitiveness with their diesel counterparts, the smaller range trucks are less competitive (with 2.23 vs. 2.10 hydrogen/diesel truck ratios). Hence, the issue of whether smaller or larger hydrogen trucks will enter the market first cannot be settled on the basis of the relative TCO/km metric.

5.4. Hydrogen Pathways and Distribution

The technology used to produce hydrogen largely affects the hydrogen price and, in turn, the TCO/km of the hydrogen trucks relative to diesel trucks. Ref. [18] performed an analysis for Italy in 2022. No hydrogen production technologies allowed hydrogen trucks to become competitive with diesel trucks. They found hydrogen trucks to be from 1.41 to 2.11 times more expensive. The lowest value is achieved by alkaline electrolysis cell (AEC) technology with electricity drawn from the grid (Table 2).

Table 2.

TCO/km of hydrogen and diesel trucks with alternative hydrogen production technologies—euros per km, current values.

Two studies, refs [13,19], performed a TCO estimate using different hydrogen types and distribution channels. Ref. [19] found that in China, hydrogen sourced via solar photovoltaic and delivered via pipeline and via compressed hydrogen would be the least costly pathway. Hydrogen delivered via liquid hydrogen and liquid organic hydrogen carrier truck would be more expensive. Ref. [13] found that the cheapest pathway is to produce hydrogen via SMR (with or without CCS) and distribute it via pipeline. Still, it would result in a hydrogen truck being more expensive than a conventional diesel truck (Table 3).

Table 3.

TCO/km of hydrogen and diesel trucks with alternative hydrogen distribution channels—euros per km, current values.

5.5. Policy Measures

Since hydrogen trucks are currently and, perhaps in this decade, not market competitive with diesel trucks, public policies can play a very important role in stimulating their diffusion. The list of possible policies is very wide, including:

- Purchase subsidies for fuel cell trucks. Such a policy is already implemented in several countries [26];

- Partial or full exemption from road tolls for fuel cell trucks, as suggested by European directives [26] and already implemented in Germany;

- Addition of CO2 external costs to road tolls, allowed by European directives [26];

- potential subsidies on hydrogen fuel price (hypothetical).

Ref. [26] used the TCO model to estimate the impact of a policy on the TCO. They estimated the break-even hydrogen price that would allow achieving TCO parity between hydrogen and diesel trucks in a number of European countries and compared them with the existing hydrogen price. Then, they estimated the hydrogen fuel subsidy needed to achieve TCO parity. The hydrogen subsidy needed ranges from 4.18 EUR /kg in the Netherlands to 7.6 EUR /kg in Germany in 2025, with the other European countries following in between. The amounts are huge and represent 63% to 78% of the production costs. In 2030, the amount of the subsidies needed reduce to 1.18 EUR /kg in the Netherlands to 4.4 EUR /kg in Germany, representing 19% to 52% of the production costs.

Since it is quite unrealistic to maintain such a strong incentives on hydrogen prices only, ref. [26] proposed a set of combined policies to support hydrogen truck uptake. Thanks to the TCO modelling, they estimated that in 2025 in Germany a EUR 100,000 purchase subsidy would be needed combined with a 75% exemption of road tolls for fuel cell trucks, a 16 cents/km addition of CO2 external costs to road tolls, and a 3 EUR /kg hydrogen fuel subsidy. In 2030, thanks to the hydrogen truck costs reduction, the needed purchase subsidy would reduce to about EUR 70,000.

Ref. [21] analyzed the impact of road tolls on the TCO analysis for a series of European countries, as described in the next section.

Further suggested policies include: (i) providing fiscal incentives for renewable electricity used for hydrogen production; (ii) extending the European Emissions Trading Systems (ETS) to cover transport, as indicated by the “Fit for 55 package”; (iii) incentivizing demonstration projects of fuel cell trucks in real-world applications. The impact of these policies could be estimated within the TCO modeling framewor5.6. Geographical Context

Geography matters for a number of reasons. Countries are endowed with different natural resources, have difference sizes, and consequently different travel distances. They might have different electricity and diesel prices, both as a result of the natural endowments (e.g., higher share of hydro power or nuclear power in the electricity mix) or because of different indirect taxation. Such differences translate to the different hydrogen prices that we have described above. Importantly, countries differ in terms of transport policies, granting purchase subsidies to zero-emission trucks or applying differentiated road tolls. All these factors are reflected in country-specific TCO metrics, and the TCO components can be analyzed to explore the impact of the geography on hydrogen truck competitiveness. Ref. [21] have performed such an analysis, contrasting electric and diesel trucks.

Table 4 and Table S9 report the findings of the analyzed studies grouped by geographical area and country, respectively. Concerning the current period (2020–2023), hydrogen trucks are estimated to be 20% to 68% more expensive than diesel trucks in the different scenarios. The lack of competitiveness is stronger in North America and Asia. The main difference might lie in the so-far more generous purchasing subsidies provided by European governments. Both for Europe and the USA, the prediction is that hydrogen trucks will become competitive after 2030, while we could not find TCO studies for Asian countries making predictions of the future.

Table 4.

TCO values for different geographical areas and years.

Analyzing the estimates at country level from Table S9, the most striking finding is that [21] estimate that, in the case of Switzerland, the competitiveness of hydrogen trucks is currently quite good (only 7% more expensive). The main reason appears to be the higher cost of the diesel alternative. Ref. [21] explained such anomaly with the existing road tolls. They estimated that nearly 40% of the ICE-D TCO in Switzerland comes from tolls. In fact, Switzerland charges per km fees based on gross vehicle weight and emissions class, exempting zero-emission (hydrogen or electric) vehicles from such tolls.

6. Discussion and Further Aspects

6.1. Incorporating Subjective and External Costs in the TCO Framework

The discussion so far has focused almost exclusively on present and future monetary costs. The result has been that hydrogen-powered trucks currently cannot compete from a TCO perspective with their diesel counterparts.

It can thus be posited that, under current conditions, fleet managers of trucks may have limited incentive to incorporate vehicles powered by this type of fuel into their operations, unless considerations related to external branding or political imperatives are dominant.

To gain a deeper understanding of fleet managers’ choices, the suggestion by [22] to include nonmonetary elements in the analysis is certainly interesting. These include various types of annoyance costs related to charging times, the need to reach charging stations that may not be located along the route, but also the risk of finding them occupied or not working and thus having waiting times (and interruptions to one’s transportation service) longer than planned. Such issues are unavoidable if one cannot rely on one’s own hydrogen charging stations and until the network of stations is as dense as that of diesel vehicle service stations.

To these costs, one should add the risks and price and quantity uncertainties associated with hydrogen availability, a factor that is currently holding back hydrogen trucks more than any other. On the other hand, the unfortunate hydrogen car affair (with California drastically reducing investment in hydrogen refueling stations) can only raise concerns and make transport companies even more cautious. In this sense, electric trucks may share, at least from a technological point of view, the successes of battery production with electric cars. This is not the case for fuel cells.

To complement analyses based on monetary cost components, one should add the positive aspects associated with the environmental benefits of switching from diesel to hydrogen trucks, since most of the studies we have reviewed found clear benefits in terms of LCA, although differing across pathways [33,34,35,36,37,38].

A possible monetization of these non-monetary components (perceived costs, risks, contingencies, and environmental benefits) can be easily achieved by using valuation methods derived from discrete choice models.

6.2. Mission Profiles

An interesting question is whether the market prospects for hydrogen vehicles vary according to the mission profile [39].

The annual distance travelled (ADT) represents a crucial variable of the TCO model. The studies we reviewed account for such a variable using as a proxy either the truck type (hence, its maximum range) or the mission profile (that is, the logistic function performed by the truck). However, the ADT could be considered explicitly as a variable in its own right that affects the competitiveness of a given truck powertrain.

Most of the estimates reviewed so far refer to transportation and distribution activities. Ref. [40] evaluated the performance and costs of fuel cells for off-road heavy-duty vehicles such as tractors, wheel loaders, and excavators in the agriculture, construction, and mining sectors. Their estimates are encouraging. They concluded that state-of-the-art fuel-cell-powered wheel loaders and excavators are currently cost competitive with diesel platforms in terms of TCO. Concerning tractors, they could become cost competitive if improvements to the cost, performance, and durability of fuel cell stacks and storage systems are achieved.

6.3. Single Truck vs. Truck Fleet Level Analysis

In most of the TCO studies we examined, the choice between alternative powertrains does not distinguish between single trucks or truck fleet level analysis.

Ref. [16] assumed a fleet of ten trucks for all depots. The smaller trucks (classes 54, 3, and 4-RD) rely entirely on depot charging, while larger trucks (classes 5-LH 500 km and 5-LH 800 km) fulfil 80% of their energy needs at depots and 20% at public charging stations. The class 5-LH 1000 km trucks are assumed to rely entirely on public charging stations. However, the cost economies associated with fleet charging vs. single-truck charging are not explicitly explored. Ref. [41] examined the case of a large UK food and consumer goods retailer who considers transitioning a fleet of over 2000 HGVs currently operating mainly on diesel, and to a lesser degree, liquefied natural gas (LNG) and compressed natural gas (CNG) to zero-emission trucks. However, the economies of scale of operating a large fleet are not estimated.

As we have seen, the studies we have analyzed in detail have generally assumed that infrastructure costs are included in the price of hydrogen at the pump. Thus, the benefits of the integration of hydrogen production and distribution with the operation of a truck fleet have not been explored. Currently, we have not found any papers that analyze this aspect either theoretically or empirically, although we believe it is a crucial issue especially in the case of hydrogen. This is because hydrogen is complex and expensive to distribute, so integration between the different stages of the supply chain appears to be both a challenge and an opportunity that needs to be examined and exploited.

7. Conclusions and Recommendations

Hydrogen trucks, together with electric trucks, represent an important alternative to diesel trucks. Over the past decade, technical-economic feasibility studies on the properties and potential of this technological solution have gradually increased. Among them, some studies have estimated the TCO, an interesting measure for making comparisons between different powertrains. Such studies have had the merit of offering public and private decision makers an initial indication of the competitiveness of this form of powertrain compared to those currently used.

In this paper, after reviewing the extensive technical and economic literature on hydrogen trucks, we have identified 22 papers that present TCO estimates. We have examined the methodology applied, the variables considered, the data used for estimation, and the results obtained.

The main difficulty is the fact that when these papers were prepared, hydrogen truck technology was still in its infancy. Although some hydrogen-powered passenger cars have been commercialized for several years (e.g., the Toyota Mirai), so that the technology was known, hydrogen trucks were still at the prototype stage. Consequently, their technical characteristics (their efficiency, the durability of their components, etc.) and especially their economic characteristics were not fully grasped.

As we have pointed out, the purchasing price of hydrogen trucks—arguably the most important economic variable—is mostly the result of bottom-up simulative models. Although they have undoubted advantages, as argued by [14], they lack comparison with market data. This problem is exacerbated by the need to have reliable estimates of the purchasing costs for various vehicle configurations in order to verify their competitiveness in the different market segments served by freight transport. The recent start of production and market placement of hydrogen trucks (cf., Nikola delivering 35 hydrogen trucks to transportation companies in 2023; or Daimler), even if their sale prices are kept confidential, may gradually clarify whether the costs of hydrogen trucks obtained by modeling are comparable with actual market values. It is therefore desirable for the literature to continue to explore the topic, accumulate empirical evidence, carry out meta-analysis studies as performed by [26], and update TCO estimates.

In our view, the price of hydrogen represents a second element of considerable uncertainty. Correctly, many of the studies we analyzed report the assumptions they made regarding this variable. Again, this is a product that was not commercially available at the time the studies were conducted. Therefore, the authors proceeded to estimate it and made assessments by assuming price ranges, oscillating between a minimum and a maximum. TCO estimates for hydrogen trucks are therefore much more uncertain than those for electric trucks, given the different availability and geographical diffusion of the two energy carriers.

A further complication is related to the fact that hydrogen can be produced in different ways, from fossil or renewable sources, and distributed in gaseous, liquid, or solid form, as many authors have pointed out. Obviously, each pathway has different energy, environmental and economic properties, which TCO analyses can take into account. On this aspect, hydrogen trucks present a greater articulation of opportunities than electric trucks because they use both electricity that can come from different sources and storage approaches, and distribution methods that are more complex than those available for electricity.

One point still to be refined, in our opinion, is how to incorporate infrastructure costs into TCO analyses. The strategy of many studies has been to look at the price at the pump, but this causes infrastructure aspects and even opportunities to remain outside the TCO analysis. Moreover, this overlooks the opportunity to assess the possible efficiencies from integrating hydrogen production and use. A potential advantage of hydrogen vehicles is, in fact, that of powering fleets of vehicles that insist on using the same depot. In this regard, the TCO studies on hydrogen trucks could benefit from the TCO studies on hydrogen buses, which by their nature insist on a more limited area and whose operation is designed in conjunction with the infrastructure for their recharging. In the case of hydrogen trucks, however, one needs to take into account that a part of their operation, especially for long-distance trucks, might not allow returning to the home depot.

Associated with the latter point, a question arises on how to incorporate issues such as locating the charging infrastructure along a nation’s main arteries, its financing, and the role of public subsidies.

In commenting on the results of the studies reviewed, we sought to understand and report for which types of trucks, for which applications, over which distances, and in which countries hydrogen-powered trucks are most competitive. It turned out that the distance travelled is not necessarily related to the lowest TCO. If this finding is confirmed, it is possible that the market segment in which hydrogen-powered trucks are most likely to be deployed is not the long-distance segment, but the medium-distance one. In this case, the advantages associated with fast charging may not be fully exploited and may play a smaller role in the choice of transport operators. However, it is also possible that the results we have presented depend on the fact that the perceived costs are not fully included in the TCO calculation. The combination of TCO analysis and studies on the importance of non-monetary factors (e.g., through discrete choice models) could be useful. In our opinion, this topic deserves further investigation.

The prevailing literature predominantly forecasts future developments in this field. The key insight is that while hydrogen-powered trucks are not currently as cost-effective as conventional trucks, they are projected to become competitive within the next decade. Given the significance of this finding, which could potentially influence both public- and private-sector investment decisions, it is imperative that total cost of ownership (TCO) studies meticulously delineate their future scenarios. This detailed analysis is crucial to identify the specific factors that could render hydrogen-powered trucks economically viable in the foreseeable future.

As is often observed in review studies, the quality of a comparative assessment is closely related to the quality and quantity of data associated with all stages and assumptions of the estimation process. Among the TCO studies we reviewed, research reports were found to be richer in information than journal papers. While this is to some extent unavoidable and related to the nature of the information medium, the addition of a rich Supplementary Materials section could improve the quality of the comparative reviews.

Supplementary Materials

The following supporting information can be downloaded at: https://www.mdpi.com/article/10.3390/en17112509/s1. Table S1: Paper providing TCO data and estimates; Table S2: Current hydrogen truck price (in euro); Table S3: Future hydrogen truck price (in euro); Table S4: Hydrogen price; Table S5: Fuel consumption of hydrogen trucks; Table S6: TCO estimates for hydrogen and diesel trucks for the years 2020 to 2023; Table S7: TCO estimates for hydrogen and diesel trucks for the years 2025, 2030 and 2040; Table S8: TCO estimates by truck type; Table S9: TCO values for different countries for the year 2021–2023.

Author Contributions

Conceptualization, R.D. and M.S.; methodology, R.D. and M.S.; formal analysis, R.D. and M.S.; investigation, R.D., M.S., M.M., A.M.A. and A.M.K.N.; data curation, R.D., M.S., M.M., A.M.A., and A.M.K.N.; writing—original draft preparation, R.D., M.S., M.M., A.M.A. and A.M.K.N.; writing—review and editing, R.D., M.S., M.M., A.M.A. and A.M.K.N.; visualization, M.M. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

The data presented in this study are available on request from the corresponding author.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Burke, A.; Sinha, A.K. Technology, Sustainability, and Marketing of Battery Electric and Hydrogen Fuel Cell Medium-Duty and Heavy-Duty Trucks and Buses in 2020–2040; UC Davis: Davis, CA, USA, 2020. [Google Scholar] [CrossRef]

- Wilson, S. Hydrogen-Powered Heavy-Duty Trucks: A Review of the Environmental and Economic Implications of Hydrogen Fuel for on-Road Freight; Union of Concerned Scientists: Cambridge, MA, USA, 2023. [Google Scholar]

- Martin, J.; Neumann, A.; Ødegård, A. Renewable Hydrogen and Synthetic Fuels versus Fossil Fuels for Trucking, Shipping and Aviation: A Holistic Cost Model. Renew. Sustain. Energy Rev. 2023, 186, 113637. [Google Scholar] [CrossRef]

- Li, S.; Djilali, N.; Rosen, M.A.; Crawford, C.; Sui, P.C. Transition of Heavy-Duty Trucks from Diesel to Hydrogen Fuel Cells: Opportunities, Challenges, and Recommendations. Int. J. Energy Res. 2022, 46, 11718–11729. [Google Scholar] [CrossRef]

- Camacho, M.d.L.N.; Jurburg, D.; Tanco, M. Hydrogen Fuel Cell Heavy-Duty Trucks: Review of Main Research Topics. Int. J. Hydrogen Energy 2022, 47, 29505–29525. [Google Scholar] [CrossRef]

- Unterlohner, F. How to Decarbonize Long-Haul Trucking in Germany; Transport & Environment; Square de Meeûs: Brussels, Belgium, 2021. [Google Scholar]

- Snyder, H. Literature Review as a Research Methodology: An Overview and Guidelines. J. Bus. Res. 2019, 104, 333–339. [Google Scholar] [CrossRef]

- Donthu, N.; Kumar, S.; Mukherjee, D.; Pandey, N.; Lim, W.M. How to Conduct a Bibliometric Analysis: An Overview and Guidelines. J. Bus. Res. 2021, 133, 285–296. [Google Scholar] [CrossRef]

- Baumeister, R.F.; Leary, M.R. Writing Narrative Literature Reviews. Rev. Gen. Psychol. 1997, 1, 311–320. [Google Scholar] [CrossRef]

- van Eck, N.J.; Waltman, L. Software Survey: VOSviewer, a Computer Program for Bibliometric Mapping. Scientometrics 2010, 84, 523–538. [Google Scholar] [CrossRef]

- Scorrano, M.; Danielis, R.; Giansoldati, M. Dissecting the Total Cost of Ownership of Fully Electric Cars in Italy: The Impact of Annual Distance Travelled, Home Charging and Urban Driving. Res. Transp. Econ. 2020, 80, 100799. [Google Scholar] [CrossRef]

- Danielis, R.; Giansoldati, M.; Rotaris, L. A Probabilistic Total Cost of Ownership Model to Evaluate the Current and Future Prospects of Electric Cars Uptake in Italy. Energy Policy 2018, 119, 268–281. [Google Scholar] [CrossRef]

- Rout, C.; Li, H.; Dupont, V.; Wadud, Z. A Comparative Total Cost of Ownership Analysis of Heavy Duty On-Road and off-Road Vehicles Powered by Hydrogen, Electricity, and Diesel. Heliyon 2022, 8, e12417. [Google Scholar] [CrossRef]

- Mao, S.; Basma, H.; Ragon, P.-L.; Zhou, Y.; Rodríguez, F. Total Cost of Ownership for Heavy Trucks in China: Battery Electric, Fuel Cell Electric and Diesel Trucks. Int. Counc. Clean Transp. 2021, 4, 2023. [Google Scholar]

- Hunter, C.; Penev, M.; Reznicek, E.; Lustbader, J.; Birky, A.; Zhang, C. Spatial and Temporal Analysis of the Total Cost of Ownership for Class 8 Tractors and Class 4 Parcel Delivery Trucks; National Renewable Energy Lab.: Golden, CO, USA, 2021. [Google Scholar]

- Basma, H.; Rodríguez, F. A Total Cost of Ownership Comparison of Truck Decarbonization Pathways in Europe; International Council on Clean Transportation: Washington, DC, USA, 2023; pp. 1–35. [Google Scholar]

- Gray, N.; O’Shea, R.; Wall, D.; Smyth, B.; Lens, P.N.L.; Murphy, J.D. Batteries, Fuel Cells, or Engines? A Probabilistic Economic and Environmental Assessment of Electricity and Electrofuels for Heavy Goods Vehicles. Adv. Appl. Energy 2022, 8, 100110. [Google Scholar] [CrossRef]

- Mio, A.; Barbera, E.; Massi Pavan, A.; Danielis, R.; Bertucco, A.; Fermeglia, M. Analysis of the Energetic, Economic, and Environmental Performance of Hydrogen Utilization for Port Logistic Activities. Appl. Energy 2023, 347, 121431. [Google Scholar] [CrossRef]

- Li, Y.; Taghizadeh-Hesary, F. The Economic Feasibility of Green Hydrogen and Fuel Cell Electric Vehicles for Road Transport in China. Energy Policy 2022, 160, 112703. [Google Scholar] [CrossRef]

- Burke, A.F.; Zhao, J.; Miller, M.R.; Sinha, A.; Fulton, L.M. Projections of the Costs of Medium- and Heavy-Duty Battery-Electric and Fuel Cell Vehicles (2020–2040) and Related Economic Issues. Energy Sustain. Dev. 2023, 77, 101343. [Google Scholar] [CrossRef]

- Noll, B.; del Val, S.; Schmidt, T.S.; Steffen, B. Analyzing the Competitiveness of Low-Carbon Drive-Technologies in Road-Freight: A Total Cost of Ownership Analysis in Europe. Appl. Energy 2022, 306, 118079. [Google Scholar] [CrossRef]

- Hao, X.; Ou, S.; Lin, Z.; He, X.; Bouchard, J.; Wang, H.; Li, L. Evaluating the Current Perceived Cost of Ownership for Buses and Trucks in China. Energy 2022, 254, 124383. [Google Scholar] [CrossRef]

- Yaıci, W.; Longo, M. Hydrogen Gas Refueling Infrastructure for Heavy-Duty Trucks: A Feasibility Analysis. J. Energy Resour. Technol. Trans. ASME 2022, 144, 070906. [Google Scholar] [CrossRef]

- De-León Almaraz, S.; Rácz, V.; Azzaro-Pantel, C.; Szántó, Z.O. Multiobjective and Social Cost-Benefit Optimisation for a Sustainable Hydrogen Supply Chain: Application to Hungary. Appl. Energy 2022, 325, 119882. [Google Scholar] [CrossRef]

- Liu, N.; Xie, F.; Lin, Z.; Jin, M. Evaluating National Hydrogen Refueling Infrastructure Requirement and Economic Competitiveness of Fuel Cell Electric Long-Haul Trucks. Mitig. Adapt. Strat. Glob. Chang. 2020, 25, 477–493. [Google Scholar] [CrossRef]

- Basma, H.; Zhou, Y.; Rodríguez, F. Fuel-Cell Hydrogen Long-Haul Trucks in Europe: A Total Cost of Ownership Analysis; International Council on Clean Transportation: Washington, DC, USA, 2022. [Google Scholar]

- den Boer, E.; Aarnink, S.; Kleiner, F.; Pagenkopf, J. Zero Emissions Trucks: An Overview of State-of-the-Art Technologies and Their Potential; CE Delft, Delft, The Netherlands, 2013.

- Zhang, X.; Lin, Z.; Crawford, C.; Li, S. Techno-Economic Comparison of Electrification for Heavy-Duty Trucks in China by 2040. Transp. Res. Part D Transp. Environ. 2022, 102, 103152. [Google Scholar] [CrossRef]

- Teng, F.; Zhang, Q.; Chen, S.; Wang, G.; Huang, Z.; Wang, L. Comprehensive Effects of Policy Mixes on the Diffusion of Heavy-Duty Hydrogen Fuel Cell Electric Trucks in China Considering Technology Learning. Energy Policy 2024, 185, 113961. [Google Scholar] [CrossRef]

- Li, Y.; Kimura, S. Economic Competitiveness and Environmental Implications of Hydrogen Energy and Fuel Cell Electric Vehicles in ASEAN Countries: The Current and Future Scenarios. Energy Policy 2021, 148, 111980. [Google Scholar] [CrossRef]

- Wang, Z.; Acha, S.; Bird, M.; Sunny, N.; Stettler, M.E.J.; Wu, B.; Shah, N. A Total Cost of Ownership Analysis of Zero Emission Powertrain Solutions for the Heavy Goods Vehicle Sector. J. Clean. Prod. 2024, 434, 139910. [Google Scholar] [CrossRef]

- Anselma, P.G.; Belingardi, G. Fuel Cell Electrified Propulsion Systems for Long-Haul Heavy-Duty Trucks: Present and Future Cost-Oriented Sizing. Appl. Energy 2022, 321, 119354. [Google Scholar] [CrossRef]

- O’Connell, A.; Pavlenko, N.; Bieker, G.; Searle, S. A Comparison of the Life-Cycle Greenhouse Gas Emissions of European Heavy-Duty Vehicles and Fuels; International Council on Clean Transportation: Washington, DC, USA, 2023; pp. 1–36. [Google Scholar]

- Feng, Y.; Dong, Z. Comparative Lifecycle Costs and Emissions of Electrified Powertrains for Light-Duty Logistics Trucks. Transp. Res. Part D Transp. Environ. 2023, 117, 103672. [Google Scholar] [CrossRef]

- Gunawan, T.A.; Monaghan, R.F.D. Techno-Econo-Environmental Comparisons of Zero- and Low-Emission Heavy-Duty Trucks. Appl. Energy 2022, 308, 118327. [Google Scholar] [CrossRef]

- Alonso-Villar, A.; Davíðsdóttir, B.; Stefánsson, H.; Ásgeirsson, E.I.; Kristjánsson, R. Technical, Economic, and Environmental Feasibility of Alternative Fuel Heavy-Duty Vehicles in Iceland. J. Clean. Prod. 2022, 369, 133249. [Google Scholar] [CrossRef]

- Wolff, S.; Seidenfus, M.; Brönner, M.; Lienkamp, M. Multi-Disciplinary Design Optimization of Life Cycle Eco-Efficiency for Heavy-Duty Vehicles Using a Genetic Algorithm. J. Clean. Prod. 2021, 318, 128505. [Google Scholar] [CrossRef]

- Mojtaba Lajevardi, S.; Axsen, J.; Crawford, C. Comparing Alternative Heavy-Duty Drivetrains Based on GHG Emissions, Ownership and Abatement Costs: Simulations of Freight Routes in British Columbia. Transp. Res. Part D Transp. Environ. 2019, 76, 19–55. [Google Scholar] [CrossRef]

- Jones, J.; Genovese, A.; Tob-Ogu, A. Hydrogen Vehicles in Urban Logistics: A Total Cost of Ownership Analysis and Some Policy Implications. Renew. Sustain. Energy Rev. 2020, 119, 109595. [Google Scholar] [CrossRef]

- Ahluwalia, R.K.; Wang, X.; Star, A.G.; Papadias, D.D. Performance and Cost of Fuel Cells for Off-Road Heavy-Duty Vehicles. Int. J. Hydrogen Energy 2022, 47, 10990–11006. [Google Scholar] [CrossRef]

- Li, K.; Acha, S.; Sunny, N.; Shah, N. Strategic Transport Fleet Analysis of Heavy Goods Vehicle Technology for Net-Zero Targets. Energy Policy 2022, 168, 112988. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).