Long-Term Energy System Modelling for a Clean Energy Transition in Egypt’s Energy Sector

Abstract

1. Introduction

- (1)

- To generate six scenarios that investigate the impact of upscaling RETs on Egypt’s energy system using the long-term energy system model OSeMOSYS.

- (2)

- To determine the technologies and policies that are required to ensure a CET.

- (3)

- To identify the main economic and socio-political barriers that may prevent Egypt from achieving a CET.

2. Literature Review

2.1. Current Egyptian Energy Policies

2.2. Previous Modelling Work

3. Experimental Section

3.1. Constraints

3.2. Scenarios

3.3. Temporal Structure

3.4. Reference Energy System

3.5. Model Data Sources

3.6. Limitations

4. Results and Discussion

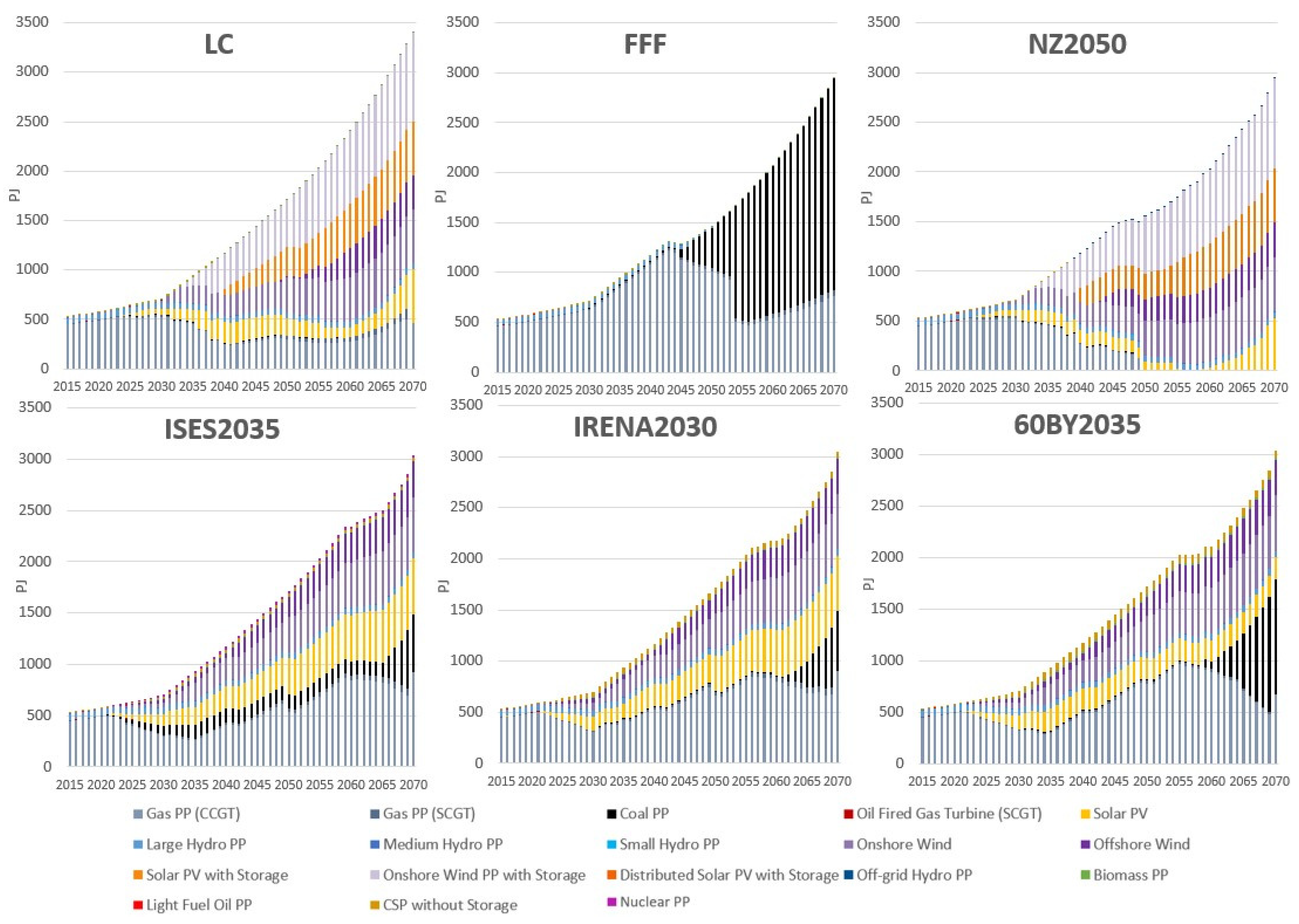

4.1. Electricity Production

4.2. Installed Capacity

4.3. Further Findings from the FFF, LC, and NZ2050 Scenario Data

4.4. Further Findings from the ISES2035 Scenario Data

4.5. Further Findings from the IRENA2030 and 60BY2035 Scenario Data

4.6. Upscaling Renewable Energy Technologies: Private Investment and Bilateral Investment Treaties

4.7. Barriers to a Clean Energy Transition in Egypt

4.8. Policy Recommendations

- Integrate RETs, particularly onshore wind and solar PV, into the energy system via technical, financial, and regulatory recommendations.

- To reduce CO2 emissions sooner, update Egypt’s national renewable energy target from 42% by 2035 to 53% by 2030, as recommended by IRENA.

- To eliminate coal as a future option for Egypt, adopt the COP26 mandate of phasing out coal by introducing an energy-sector ban.

- Based on environmental and financial analyses, extend national renewable energy targets into the second half of the 21st century to prevent an increase in fossil fuel production.

- As the quantity of renewable projects increases, expand the grid as required through international bilateral projects or financial assistance from the government.

- Alongside the extension of renewable targets, identify financial and regulatory mechanisms to phase out natural gas production.

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

References

- World Bank Group. Egypt, Arab Rep. 2021. Available online: https://data.worldbank.org/country/EG (accessed on 19 July 2022).

- World Bank. Middle East and North Africa; World Bank Group: Washington, DC, USA, 2021; Available online: https://www.worldbank.org/en/region/mena/overview#1 (accessed on 3 July 2022).

- United Nations Development Programme (UNDP). Sustainable Development Goals Report: Egypt 2030. 2018. Available online: https://www.undp.org/sites/g/files/zskgke326/files/migration/eg/Sustainable-Development-Goals-Report.-Egypt-2030.pdf (accessed on 4 June 2022).

- World Bank. Maximising Finance for Development in Egypt’s Energy Sector. 2019. Available online: https://documents1.worldbank.org/curated/en/780061567532224696/pdf/Maximizing-Finance-for-Development-in-Egypts-Energy-Sector.pdf (accessed on 8 June 2022).

- World Bank. Unemployment, Total (% of Labour Force—Egypt, Arab Rep. 2021. Available online: https://data.worldbank.org/indicator/SL.UEM.TOTL.ZS?locations=EG (accessed on 5 May 2022).

- IEA. Egypt; International Energy Agency: Paris, France, 2022; Available online: https://www.iea.org/countries/egypt (accessed on 14 May 2022).

- IRENA. Renewable Energy Outlook Egypt; International Renewable Energy Agency: Masdar City, United Arab Emirates, 2018; Available online: https://www.irena.org/-/media/Files/IRENA/Agency/Publication/2018/Oct/IRENA_Outlook_Egypt_2018_En.pdf (accessed on 20 June 2022).

- European Union (EU). ‘Integrated Sustainable Energy Strategy’ for Technical Assistance to Support the Reform of the Energy Sector (TARES); European Delegation of the European Union to Egypt: Cairo, Egypt, 2015; Available online: https://eeas.europa.eu/archives/delegations/egypt/press_corner/all_news/news/2016/20160718_en.pdf (accessed on 18 June 2022).

- New and Renewable Energy Authority (NREA). Annual Report—2020; New and Renewable Energy Authority, 2020. Available online: http://nrea.gov.eg/Content/reports/Annual%20Report%202020%20En.pdf (accessed on 15 June 2022).

- Arab Development Portal Egypt’s Vision 2030. 2016. Available online: https://arabdevelopmentportal.com/sites/default/files/publication/sds_egypt_vision_2030.pdf (accessed on 19 June 2022).

- Egyptian Environmental Affairs Agency (EEAA). Summary for Policymakers: Egypt National Climate Change Strategy (NCCS) 2050. 2021. Available online: https://www.eeaa.gov.eg/Uploads/Topics/Files/20221206130720583.pdf (accessed on 30 July 2022).

- EgyptToday. Overview of Egypt’s Green Projects within Vision 2030. 2021. Available online: https://www.egypttoday.com/Article/3/99857/Overview-of-Egypt-s-green-projects-within-Vision-2030 (accessed on 14 July 2022).

- Daily News Egypt. Egypt Has $26bn Development Portfolio under 2030 Vision: Al-Mashat. 2022. Available online: https://dailynewsegypt.com/2022/04/23/egypt-has-26bn-development-portfolio-under-2030-vision-al-mashat/ (accessed on 19 July 2022).

- UNFCCC. Egyptian Intended Nationally Determined Contribution. United Nations Convention on Climate Change. 2017. Available online: https://unfccc.int/sites/default/files/NDC/2022-06/Egyptian%20INDC.pdf (accessed on 19 April 2022).

- UNFCCC. Egypt’s First Updated Nationally Determined Contributions. United Nations Convention on Climate Change. 2022. Available online: https://unfccc.int/sites/default/files/NDC/2022-07/Egypt%20Updated%20NDC.pdf.pdf (accessed on 17 July 2022).

- Barnes, T.; Shivakumar, A.; Brinkerink, M.; Niet, T. OSeMOSYS Global, an open-source, open data global electricity system model generator. Sci. Data 2020, 9, 623. [Google Scholar] [CrossRef]

- Plazas-Nino, F.; Ortiz-Pimiento, N.; Montes-Paez, E. National energy system optimisation modelling for decarbonisation pathways analysis: A systematic literature review. Renew. Sustain. Energy Rev. 2022, 162, 112406. [Google Scholar] [CrossRef]

- Paiboonsin, P.; Oluleye, G.; Howells, M.; Yeganyan, R.; Canoone, C.; Patterson, S. Pathways to Clean Energy Transition in Indonesia’s Electricity Sector with Open-Source Energy Modelling System Modelling (OSeMOSYS). Energies 2024, 17, 75. [Google Scholar] [CrossRef]

- Hersaputri, L.; Yeganyan, R.; Cannone, C.; Plazas-Nino, F.; Osei-Owusu, S.; Kountouris, Y.; Howells, M. Reducing Fossil Fuel Dependence and Exploring Just Energy Transition Pathways in Indonesia Using OSeMOSYS (Open-Source Energy Modelling System). Climate 2024, 12, 37. [Google Scholar] [CrossRef]

- Taliotis, C.; Rogner, H.; Ressl, S.; Howells, M.; Gardumi, F. Natural Gas in Cyprus: The need for consolidated planning. Energy Policy 2017, 107, 197–209. [Google Scholar] [CrossRef]

- UNFCCC (n.d.). Intended Nationally Determined Contribution from the Plurinational State of Bolivia. Available online: https://www.un.org/development/desa/dpad/wp-content/uploads/sites/45/post/INDC-Bolivia-english.pdf (accessed on 18 June 2022).

- Taliotis, C.; Shivakumar, A.; Ramos, E.; Howells, M.; Mentis, D.; Sridharan, V.; Broad, O.; Mofor, L. An indicative analysis of investment opportunities in the African electricity supply sector—Using TEMBA (The Electricity Model Base for Africa). Energy Sustain. Dev. 2016, 31, 50–66. [Google Scholar] [CrossRef]

- Löffler, K.; Hainsch, K.; Burandt, T.; Oei, P.; Kemfert, C.; von Hirschhausen, C. Designing a Model for the Global Energy System—GENeSYS-MOD: An Application of the Open-Source Energy Modelling System (OSeMOSYS). Energies 2017, 10, 1468. [Google Scholar] [CrossRef]

- Mondal, M.; Ringler, C.; Al-Riffai, P.; Eldidi, H.; Breisinger, C.; Wiebelt, M. Long-term optimisation of Egypt’s power sector: Policy implications. Energy 2018, 166, 1063–1073. [Google Scholar] [CrossRef]

- Rady, Y.; Rocco, M.; Serag-Eldin, M.; Colombo, E. Modelling for power generation sector in Developing Countries: Case of Egypt. Energy 2018, 165, 198–209. [Google Scholar] [CrossRef]

- Moksnes, N.; Welsch, M.; Gardumi, F.; Shivakumar, A.; Broad, O.; Howells, M.; Taliotis, C.; Sridharan, V. 2015 OSeMOSYS User Manual; KTH Royal Institute of Technology: Stockholm, Sweden, 2015; Available online: http://www.osemosys.org/uploads/1/8/5/0/18504136/new-website_osemosys_manual_-_working_with_text_files_-_2015-11-05.pdf (accessed on 14 May 2022).

- Gardumi, F.; Shivakumar, A.; Morrison, R.; Taliotis, C.; Broad, O.; Beltramo, A.; Sridharan, V.; Howells, M.; Hörsch, J.; Niet, T.; et al. From the development of an open-source energy modelling tool to its application and the creation of communities of practice: The example of OSeMOSYS. Energy Strategy Rev. 2018, 20, 209–228. [Google Scholar] [CrossRef]

- Howells, M.; Rogner, H.; Roehrl, A.; Strachan, N.; Heaps, C.; Huntington, H.; Kypreos, S.; Hughes, A.; Silveira, S.; Decarolis, J.; et al. OSeMOSYS: The Open Source Energy Modelling System An introduction to its ethos, structure and development. Energy Policy 2011, 39, 5850–5870. [Google Scholar] [CrossRef]

- Gardumi, F.; Welsch, M.; Howells, M.; Emanuela, C. Representation of Balancing Options for Variable Renewables in Long-Term Energy System Models: An Application to OSeMOSYS. Energies 2019, 12, 2366. [Google Scholar] [CrossRef]

- Allington, L.; Cannone, C.; Pappis, I.; Cervantes, K.; Usher, W.; Pye, S.; Howells, M.; Taliotis, C.; Sundin, C.; Sridharah, V.; et al. Selected ‘Starter Kit’ Energy System Modelling Data for Egypt (#CCG). 2021. Available online: https://www.researchsquare.com/article/rs-479263/v2 (accessed on 10 June 2022).

- Gibson, A. CCG Egypt Scenarios. Zenodo Repository. 2023. Available online: https://doi.org/10.5281/zenodo.7743874 (accessed on 17 March 2023).

- UK Government. COP26 Energy Transition Council: 2022 Strategic Priorities; UK Government: London, UK, 2022. Available online: https://www.gov.uk/government/publications/cop26-energy-transition-council-2022-strategic-priorities/cop26-energy-transition-council-2022-strategic-priorities#strategic-priorities (accessed on 24 October 2022).

- Climate Compatible Growth (CCG). About Us. 2022. Available online: https://climatecompatiblegrowth.com/about-us/ (accessed on 16 June 2022).

- Brinkerink, M.; Deane, P. PLEXOS-World 2015. 2020. Available online: https://dataverse.harvard.edu/dataset.xhtml?persistentId=doi:10.7910/DVN/CBYXBY (accessed on 12 June 2022). [CrossRef]

- Brinkerink, M.; Gallachóir, B.; Deane, P. Building and Calibrating a Country-Level Detailed Global Electricity Model Based on Public Data. Energy Strategy Rev. 2021, 33, 100592. [Google Scholar] [CrossRef]

- Byers, L.; Friedrich, J.; Hennig, A.; Kressig, L.; McCormick, C.; Malaguzzi, L. A Global Database of Power Plants; World Resources Institute: Washington, DC, USA, 2018; Available online: https://www.wri.org/publication/global-power-plant-database (accessed on 17 June 2022).

- IRENA. Renewable Energy Statistics 2020; The International Renewable Energy Agency: Masdar City, United Arab Emirates, 2020; Available online: https://www.irena.org/-/media/Files/IRENA/Agency/Publication/2020/Jul/IRENA_Renewable_Energy_Statistics_2020.pdf (accessed on 18 June 2022).

- Pappis, I.; Howells, M.; Sridharan, V.; Usher, W.; Shivakumar, A.; Gardumi, F.; Ramos, E. Energy Projections for African Countries. Joint Research Centre Technical Report. 2019. Available online: https://www.researchgate.net/profile/Ioannis-Pappis/publication/337154878_Energy_projections_for_African_countries/links/5dc847e3a6fdcc57503dd5c1/Energy-projections-for-African-countries.pdf (accessed on 19 June 2022).

- Energy Information Administration (EIA). Annual Energy Outlook 2020 with Projections to 2050; Energy Information Administration: Washington, DC, USA, 2020. Available online: https://www.eia.gov/outlooks/aeo/pdf/AEO2020%20Full%20Report.pdf (accessed on 18 June 2022).

- IRENA. Planning and Prospects for Renewable Power: West Africa; International Renewable Energy Agency: Masdar City, United Arab Emirates, 2018; Available online: https://www.irena.org/publications/2018/Nov/Planning-and-prospects-for-renewable-power (accessed on 10 July 2022).

- Allington, L.; Cannone, C.; Pappis, I.; Cervantes, K.; Usher, W.; Pye, S.; Howells, M.; Taliotis, C.; Sundin, C.; Sridharah, V.; et al. CCG Starter Data Kit: Egypt. Zenodo Repository. 2023. Available online: https://zenodo.org/record/7526341#.ZBcIu3bP1Pb (accessed on 15 February 2023).

- Zayed, D.; Sowers, J. The Campaign Against Coal in Egypt. Middle East Rep. 2014, 271, 29–35. [Google Scholar]

- Burki, T. “Phasedown” of coal use after COP26 negotiations. Lancet Respir. Med. 2022, 10, 10–11. [Google Scholar] [CrossRef] [PubMed]

- Davies, M.; Hodge, B.; Ahmad, S.; Wang, Y. Developing Renewable Energy Projects: A Guide to Achieving Success in the Middle East; PwC and Eversheds: Bucharest, Romania, 2016; Available online: https://www.pwc.com/m1/en/publications/documents/eversheds-pwc-developing-renewable-energy-projects.pdf (accessed on 19 August 2022).

- Fadly, D. Low-carbon transition: Private sector investment in renewable energy projects in developing countries. World Dev. 2019, 122, 552–569. [Google Scholar] [CrossRef]

- International Renewable Energy Agency (IRENA). Unlocking Renewable Energy Investment: The Role of Risk Mitigation and Structured Finance; International Renewable Energy Agency: Masdar City, United Arab Emirates, 2016; Available online: https://www.irena.org/-/media/Files/IRENA/Agency/Publication/2016/IRENA_Risk_Mitigation_and_Structured_Finance_2016.pdf (accessed on 19 August 2022).

- Hafner, M.; Tagliapietra, S.; de Strasser, L. Prospects for Renewable Energy in Africa. In Energy in Africa Challenges and Opportunities; Springer International Publishing: Cham, Switzerland, 2018; pp. 47–73. [Google Scholar]

- El Shayeb, H.; Abdel-Gawad, G.; Noah, A.; Abuelhasan, M.; Ataallah, M. Comparative study between density porosity and density magnetic resonance porosity: A case study of Sequoia gas reservoir, Mediterranean offshore gas, Egypt. Arab. J. Geosci. 2020, 13, 316. [Google Scholar] [CrossRef]

- Lottaroli, F.; Meciani, L. The rejuvenation of hydrocarbon exploration in the Eastern Mediterranean. Pet. Geosci. 2022, 28, 1–17. [Google Scholar] [CrossRef]

- Abdelkader, H. Political Instability and Economic Growth in Egypt. Rev. Middle East Econ. Financ. 2017, 13, 20170019. [Google Scholar] [CrossRef]

- Mayer, M.; Zhao, Y. Do Political Instability and Military Expenditure Undermine Economic Growth in Egypt? Evidence from the ARDL Approach. Def. Peace Econ. 2021, 33, 956–979. [Google Scholar] [CrossRef]

- Bos, J.; Gonzalez, L.; Thwaites, J. Are Countries Providing Enough to the $100 Billion Climate Finance Goal? World Resources Institute: Washington, DC, USA, 2021; Available online: https://www.wri.org/insights/developed-countries-contributions-climate-finance-goal (accessed on 18 August 2022).

- Green Climate Fund (GCF). GCF-EBRD Egypt Renewable Energy Financing Framework. 2022. Available online: https://www.greenclimate.fund/project/fp039 (accessed on 19 August 2022).

| Technologies | Commodities | ||

|---|---|---|---|

| Code | Description | Code | Description |

| PWRBIO001 | Biomass Power Plant | OIL | Crude Oil |

| PWRCOA001 | Coal Power Plant | BIO | Biomass |

| PWRGEO | Geothermal Power Plant | COA | Coal |

| PWROHC001 | Light Fuel Oil Power Plant | LFO | Light Fuel Oil |

| PWROHC002 | Oil Fired Gas Turbine (Simple Cycle Gas Turbine (SCGT)) | NGS | Natural Gas |

| PWRNGS001 | Gas Power Plant (Combined Cycle Gas Turbine (CCGT)) | HFO | Heavy Fuel Oil |

| PWRNGS002 | Gas Power Plant (SCGT) | SOL | Solar |

| PWRSOL001 | Solar PV (Utility) | HYD | Hydropower |

| PWRSOL002 | Solar PV (Distributed with Storage) | WND | Wind |

| PWRCSP001 | CSP without Storage | URN | Uranium |

| PWRCSP002 | CSP with Storage | GEO | Geothermal |

| PWRHYD001 | Large Hydropower Plant (Dam) (>100 MW) | ELC001 | Electricity from Power Plants |

| PWRHYD002 | Medium Hydropower Plant (10–100 MW) | ELC002 | Electricity after Transmission |

| PWRHYD003 | Small Hydropower Plant (<10 MW) | ELC003 | Electricity after Distribution |

| PWRHYD004 | Off-grid Hydropower | ||

| PWRWND001 | Onshore Wind | ||

| PWRWND002 | Offshore Wind | ||

| PWRNUC | Nuclear Power Plant | ||

| PWRSOL001S | Utility-scale PV with 2-h Storage | ||

| PWRWND001S | Onshore Wind Power Plant with Storage | ||

| Scenario Code | Scenario Name | Description/Purpose |

|---|---|---|

| LC | Least Cost | Represents the least cost future for Egypt’s energy system with no policy interventions. |

| FFF | Fossil Fuel Future | Quantifies the emissions generated and the cost of relying on fossil fuels. |

| NZ2050 | Net Zero by 2050 | Identifies the range of technologies needed to decrease CO2 emissions to net zero by 2050. |

| ISES2035 | Integrated Sustainable Energy Strategy 2035 | Models Egypt’s ISES 2035 target of reaching 42% of electricity generation from renewables by 2035. |

| IRENA2030 | IRENA’s REmap 2030 Analysis | Models IRENA’s suggestion that the ISES 2035 renewables target should be upgraded to 53% by 2030. |

| 60BY2035 | 60% Renewables by 2035 | Models the scenario where 60% of Egypt’s electricity generation comes from renewables by 2035. |

| Scenario Code | OSeMOSYS Constraints | ||||||

|---|---|---|---|---|---|---|---|

| Reduced Time Slices (96→8) | Transport Technologies Removed | PWRTRNIMP Removed | PWRBIO001 (Biomass) Constrained to x% of 2030 Demand | New Investment into RETs Removed | Annual Emissions Limited | Production Limited per Technology | |

| LC | ✓ | ✓ | ✓ | 1.4 | N/A | N/A | N/A |

| FFF | ✓ | ✓ | ✓ | 1.4 | ✓ (Geothermal, solar PV, CSP, hydro, and wind) | N/A | N/A |

| NZ2050 | ✓ | ✓ | ✓ | 1.4 | N/A | ✓ | N/A |

| ISES2035 | ✓ | ✓ | ✓ | 1.4 | N/A | N/A | ✓ (Solar PV, CSP, wind, biomass, hydro, coal, nuclear) |

| IRENA2030 | ✓ | ✓ | ✓ | 1.4 | N/A | N/A | ✓ (Solar PV, CSP, wind, biomass, hydro) |

| 60BY2035 | ✓ | ✓ | ✓ | 2.0 | N/A | N/A | ✓ (Solar PV, CSP, wind, biomass, hydro) |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gibson, A.; Makuch, Z.; Yeganyan, R.; Tan, N.; Cannone, C.; Howells, M. Long-Term Energy System Modelling for a Clean Energy Transition in Egypt’s Energy Sector. Energies 2024, 17, 2397. https://doi.org/10.3390/en17102397

Gibson A, Makuch Z, Yeganyan R, Tan N, Cannone C, Howells M. Long-Term Energy System Modelling for a Clean Energy Transition in Egypt’s Energy Sector. Energies. 2024; 17(10):2397. https://doi.org/10.3390/en17102397

Chicago/Turabian StyleGibson, Anna, Zen Makuch, Rudolf Yeganyan, Naomi Tan, Carla Cannone, and Mark Howells. 2024. "Long-Term Energy System Modelling for a Clean Energy Transition in Egypt’s Energy Sector" Energies 17, no. 10: 2397. https://doi.org/10.3390/en17102397

APA StyleGibson, A., Makuch, Z., Yeganyan, R., Tan, N., Cannone, C., & Howells, M. (2024). Long-Term Energy System Modelling for a Clean Energy Transition in Egypt’s Energy Sector. Energies, 17(10), 2397. https://doi.org/10.3390/en17102397