Abstract

The accelerated digitization of the third decade of the twenty-first century poses a challenge both for science and for practice. The study presents partial results of continuous research on online reputation management of entities operating in the environment of low-carbon economy. The aim of the study is the application of a standardized methodology for calculating the Total level of Online Reputation (TOR) to determine the market position of selected Electric Vehicles (EVs) compared to the market position of conventional Vehicles with Internal Combustion Engines (ICEVs) in the online environment. The research sample consists of the ten best-selling Vehicles and the ten best-selling Electric Vehicles in the world by sales in the year 2021. Based on the measurement results and the subsequent analysis of the context, it can be concluded that the EV market shows the parameters of a developing market not only from the point of view of sales but also in terms of the overall level of Online Reputation as such. At the same time, it is possible to point out a high geographical specificity and significant disproportionality of the EV market compared to ICEVs. From the overall market perspective, the future of cars in the EV category is still unclear, as building trust in low-carbon products is limited by historical tradition. The main representatives of the EV industry thus represent the first forays of the onset of the low-carbon era in individual transport. The description of the issue will require the monitoring of status indicators over time. The results of the presented study can thus serve as a baseline and methodological framework for further research of the adoption of low-carbon policies in common practice.

1. Introduction

Corporate reputation in the context of its possible management is the subject of research by academics across the economic and management sciences [1,2,3]. The relative stability of the knowledge base from the end of the 1990s experienced new challenges with the arrival of the new millennium. These challenges had the form of the emerging digital market, which, even in the first decade of the twenty-first century, began to show a significantly dynamic character [4]. Search engines have made static websites more transparent, which accelerated the dynamics from the perspective of real-time information availability. Reputation management in such an environment required the modification of the conventional tools; it was largely a modification of offline practices for the online environment. However, with the advent of virtual social networks, the practices developed in an offline environment reached the limits of their usefulness. The factors that needed to be monitored encompassed a disproportionate number of resources. This led to the preference of selected media at the expense of others. Specific industries preferred specific media, mostly based on historical tradition [5,6]. Such media, subsequently, received considerable support in the online environment to be able to compete in the market dynamics. Over time, they were able to connect numerous consumer tribes, for whom they thus were ambassadors of proven and high-quality content. Thus, in the purchase decision-making process, customers used these media to rationalize their decisions, especially for the decisions concerning the purchase of other-than-daily-consumption products. A textbook example of such products is the passenger car market. For example, within the national economies of the EU countries, the automotive industry represents the backbone of the national economies of selected countries. Especially those operating on the Central European market [7,8]. In addition to the challenge of changes in the usual communication portfolio, the automotive industry is undergoing a transition towards low-carbon forms of transport [9]. The product line of cars with internal combustion engines is complemented by electric cars from renowned car companies, where the drive unit is a combination of batteries and electric motors or uses strictly electric motors. However, the market also offers room for new players. An interesting paradox arises, with renowned car companies with significant infrastructures spending a significant proportion of their resources in the production of traditional cars. Electric cars represent a relatively subtle segment in their portfolio. On the other hand, newly established car companies that have built their product lines exclusively on electromobility are leaving out the traditional automotive industry. Cumulatively, the market capitalization of the largest car companies in the traditional segment can hardly compete with the main representative cars of electric vehicle producers [10]. From the point of view of global cumulative sales, the main representative cars of the electric car industry occupy only the tenth position in the ranking of the best-selling cars [11].

Does this asymmetry have a rational character?

This question was at the beginning of our reflections on the presented research. From the perspective of the research problem, we hypothesize that if there is a significant asymmetry in the market capitalization of traditional car manufacturers and one electric car manufacturer, this asymmetry must also be visible at the level of corporate reputation of car manufacturers through their best-selling models in the online environment. Based on numerous studies carried out in the past [12,13,14] as part of the investigation of reputation management, the level of the online reputation of the subject is quantified through selected reputation indicators. At this point, it is possible to formulate the research question as follows:

Do electric vehicles show a higher level of online reputation compared to their ICE competitors?

Despite the seemingly dichotomous nature of the question, the authors do not assume that it will be possible to answer the question with a simple yes/no statement. Corporate reputation, or online reputation building, is a complex construct that is formed at several product levels. The following chapters will deal with the issue to answer the research question.

In terms of view of the presentation of the research results, we will build on the introduction by developing the theoretical basis and specifying the key areas and contexts within the issue of electro mobility. Subsequently, the methodological apparatus that will be used in the empirical analysis will be presented in detail. The analysis will focus on the status of the reputation level of the sample reviewed, while key quantities as well as key findings will be visualized. In the discussion of the findings, the key facts will be placed in the context of comprehensive reputation research. In the Conclusion, the findings are summarized, and further research will be outlined.

2. Analysis of the State of Knowledge-Selected Perspectives on Electromobility

Electromobility is believed to be one of the solutions for the transition to a low-carbon economy, whose main goal is combating environmental problems. As such, the issue is showing signs of development across the global market [15]. Currently, the issue of electromobility is a highly discussed topic, especially in the context of reducing greenhouse gas emissions. Throughout the developed world, the efforts of the governments of many countries are aimed at supporting electromobility to achieve decarbonization goals [16]. For example, the long-term goal of the European Union (EU), as one of the main ambassadors of the transition to green technologies, is to achieve a competitive low-carbon economy. This goal is mainly based on enabling environmentally sustainable investments, especially when it comes to reducing energy consumption in buildings, developing smart electrical networks, or transitioning to electric vehicles. The priority is to reduce greenhouse gas emissions by at least 80% by 2050 compared to the 1990s levels [16].

The transport sector is one of the main producers of emissions, and the expansion of electric vehicles in regular transport should enable a significant reduction in these emissions. Since 2009, when the 2050 climate neutrality roadmap was announced, the number of studies on the feasibility of the transition to electromobility in a pan-European context increased significantly, identifying the common factors and variables. The process of converting variables into feasible policies is not easy. A high degree of importance is attached to barriers and motivators. [17]. The crisis caused by the COVID-19 pandemic has affected the economic situation in all EU countries but has not slowed down the pace of the introduction of electromobility. In all EU countries, the first year of the COVID-19 pandemic saw an increase in the uptake of EVs. The growth rate in the EU was 86% in 2020, compared to 48% year-on-year in 2019 [18]. The change in mobility behavior patterns during the pandemic thus positions COVID-19 as a catalyst for positive changes. The outlook for the introduction of low-carbon forms of transport is favorable, as activities related to the development of the electromobility sector correspond to the needs associated with the reduction in the environmental burden in the form of greenhouse gas emissions [18].

2.1. Electric Vehicles and the Perspectives for Market Development

The technology of hybrid or fully electric vehicles is still under development and thus still in the stage of searching for optimal solutions [19,20,21]. The promotion of electric vehicles is an important measure to ensure energy security, improve air quality, and mitigate global climate change. The impact of electric vehicles on reducing emissions is discussed, while the conclusions of existing studies are still controversial [22]. Discussions are mainly sparked by a holistic approach to the issue, which considers the life cycle assessment method to evaluate emissions from vehicle manufacturing through vehicle use to the end of the vehicle’s life.

Another perspective of electromobility is car sharing. This type of product is aimed at users who want to rent a vehicle for a short period of time. One-way car sharing, where the vehicle can be dropped off at a location other than where it was picked up, is growing rapidly these days. The important factor is that one-way car sharing enables passengers to use car sharing when travelling together with other modes of transport, such as public transport. However, this is only possible with the existing intermodal connections [23].

One of the biggest obstacles to the development of electromobility is the concern of consumers arising from the relatively shorter range of electric cars compared to traditional vehicles [24]. In any case, electromobility, electric vehicles, and charging infrastructures are, according to some experts [25], the main building blocks for a sustainable energy future. A demand-based electric vehicle fast charging network provides an opportunity to remove the large barriers to their adoption and thus increase the penetration of electromobility into the market [26]. In cities with a low level of electromobility, it is particularly important to plan the most efficient distribution of the first established charging stations, as this contributes to building trust in electric vehicles. The location of charging stations should thus correspond to the actual needs of users to promote electromobility and maximize its implementation [27]. The development of electromobility includes the development of electric charging infrastructure. The increase in the number of chargers places new demands on the electrical network, especially regarding its capacity to deliver high peak power. As an alternative for the public electricity grid, urban electrified transport systems can be used for supply [28].

Environmental concerns and energy security have led governments to introduce many incentive policies to promote electric vehicles. In 2015, the global threshold of one million electric cars on the road was exceeded. Within these incentive policies, the subsidy system was considered the most important and effective. However, many governments consider abolishing subsidies for electric vehicles. Wang, Tang, and Pan [29] analyzed the key factors including incentive measures to promote the adoption of electric vehicles. They used multiple linear regression to investigate the relationship between the variables. The results showed that the number of charging stations, fuel price, and road traffic prioritization are significantly positive factors that correlate with a country’s EV market share. However, financial incentives no longer cause huge differences.

2.2. Electric Vehicles in the Context of the Passenger Car Market

By examining the basic theoretical framework of the issue, it can be concluded that electromobility as a solution to environmental problems is still in the phase of penetrating into the market. Legislative regulations combined with the ambassadors of the lighthouse customer category, or users of shared electric vehicles, are popularizing the issue of low-emission forms of transport closer relatively slowly. Real market demand is dampened by the higher price of electric cars compared to conventional cars. From the point of view of global sales published by the Statista portal based on the data from the global automotive database Focus2move [11], the sales of the most popular electric car reach only about 50% of the sales of the most popular passenger car regardless of the type of engine. From the point of view of the overall sales ranking, the best-selling electric vehicle ranks 10th in the top ten best-selling cars for 2021. As for the electric car market, the situation is even more interesting. The entire market is dominated by one car company, with only two products necessary to achieve this dominance. As such, the market shows significant signs of regional specificity, where 6 of the 10 best-selling products in total are localized to the Asian market [30].

The automotive market as such has significant growth potential. Based on the data published on the Cleantechnica portal [31], it can be concluded that while the total sales of cars in the first half of 2022 decreased globally by approximately 8% compared to the reference period in 2021, the global electric car market, despite this decrease, grew to 62% compared to reference period. The fastest-growing market for electric cars was China, followed by Europe. As for car companies, the Chinese car manufacturer BYD showed the biggest growth, reaching up to 320%. Tesla, which dominates the automotive sector with its market capitalization, grew by 40% in the first half of 2022 compared to the reference period. It should be noted here that Tesla is a producer of fully electric cars compared to BYD, while BYD also offers cars with a hybrid drive system. From the point of view of the largest single market of the Western world, it can be stated that only the results of Chevrolet and Ford are close to the results of the electric mobility leader Tesla in the third quarter of 2022 in the US electric mobility market; however, their sales of electric vehicles reach only a fraction of Tesla’s sales [32]. However, it is necessary to be consider the distortion in the form of market size: while the leader of the electric mobility segment Tesla sold approximately 0.5 million cars of its Model 3 worldwide in 2021, according to the Kelley Blue Book Portal, almost 15 million vehicles were sold in in the United States alone in 2021. The share of the Ford car company amounted to 726,000 sold units of the F-150 model; as for the Chevrolet car company, there were almost 520,000 sold units of the Silverado model [33]. Here, we return to the assumption of asymmetry between market capitalization and economic activity as expressed in the defined research problem. In the monitored period of 2021, it was possible to observe a significant asymmetry, when the market capitalization of the Tesla car company corresponded approximately to the cumulative market capitalization of its five largest competitors [10]. Considering the specifics of the market, social demand for environmental change, the priorities of the green transition across political–economic units [34], or the demand for innovations [35,36,37], it is necessary to examine the specifics of the online reputation of automotive industry entities in the context of the EV and ICEV segment. In the following part, the basic methodological apparatus for the implementation of empirical research will be described.

2.3. Reputation in the Context of Recent Trends and Accelerated Digitization

Electromobility, especially when it comes to electromobility in individual transport, represents one of the most significant trends in modern times. Seth Godin [38], the popularizer of trends and modern marketing approaches, stated that the penetration of trends towards the public follows a bell curve where the trend is first adopted by innovators and early adopters and after that by the general public. We are of the opinion that the trend in the form of electromobility is not and will not be an exception. Anyhow, the adaptation of a trend by the general public requires a certain degree of trust in the trend itself, and reputation level is one of the indicators of trust. The combination of ecology-driven technological trends and accelerated digitization of the information space creates a rather turbulent environment.

Professional literature offers a wide portfolio of procedures for quantifying the level of reputation in the online environment. Among others, it is possible to mention Systems based on counting and averaging: the Bayesian method, Fuzzy concept, ReGreT model, Flow Model, Recommendation systems, Peer-to-peer reputation algorithms, Dissemination of trust and distrust, Net promoter score, and/or, finally, Sentiment Analysis. The usability and applicability of these systems is mostly complicated. For the purposes of empirical research with a high degree of specificity, considering the application potential of the results, the last two mentioned approaches prove themselves.

Net promoter score is a reputation measurement system based on a fundamental perspective. Within the perspective, it is assumed that the customers of each company can be divided into three categories, according to how willing they are to recommend the products or services of the given company to their acquaintances or family [39]. This reputation rating system uses direct questioning, relying on the so-called ultimate question: “How willing are you to recommend the product to your friends?” Asking this question allows companies to trace three fundamental groups of customers: (i) promoters; (ii) passives; and (iii) dissenters. While the system as such produces a pure measurement of organizational performance from the perspective of the customers of this company. However, the methodology itself is dominantly based on primary questioning, which ties up considerable resources necessary for the implementation of quantitative questionnaire surveys. For empirical analysis, procedures based on secondary data are offered as more relevant. Such a method is Sentiment Analysis.

Sentiment analysis, or also referred to as Opinion Mining, can be defined as the quantification of subjective content expressed in textual form in order to determine the attitudes of the commentator or recorder regarding the given topic. It is one of the oldest and most frequently used methods of measuring reputation. In general, it can be said that sentiment analysis aims to determine the attitude of the speaker or writer, focusing on a certain topic or the overall conceptual polarity of the document [40]. The methodology has a wide range of application areas, typical of which are services, consumer goods, measurability of the impact of online evaluations, monitoring of social media, monitoring of evaluations of products, services, or brands, and the like. Among its priority tasks can be included the identification of subjectivity, orientation, strength and bearer of sentiment, classification of emotions, detection of sarcasm, or various comparisons [41]. It thus represents an ideal methodological apparatus for the purposes of empirical research. We, as researchers, started to develop this apparatus a decade ago for the purpose of obtaining empirical material. Later, we proceeded to refine the methodology itself, which formed the basis of the presented study.

3. Materials and Methods

The aim of the study was to use a standardized methodology for calculating the total level of online reputation (TOR) to determine the position of selected electric vehicles (EVs) in the online environment compared to their competitors operating based on internal combustion engines (ICE). From the perspective of the research problem, the assumption was made that if there was a significant asymmetry in the market capitalization of traditional car manufacturers and one electric car manufacturer, this asymmetry was also reflected in the level of corporate reputation of car companies in the online environment. The research problem was analyzed through the formulated research question:

Do Electric Vehicles have a higher level of online reputation compared to their ICE competitors?

The research set included all car models that were available to customers in the global market. The research sample consisted of the ten best-selling vehicles worldwide and the ten best-selling electric vehicles worldwide, by sales, in 2021. The individual models of cars in the research sample and their sales are shown in Table 1:

Table 1.

Worldwide best-selling vehicles of 2021–Vehicles (without distinction) vs. EVs.

Regarding the used methodology, the authors built on the previous research [14], where advanced sentiment analysis (ASA) was used to for the analysis of reputation within the measurement of the total level of online reputation (TOR).

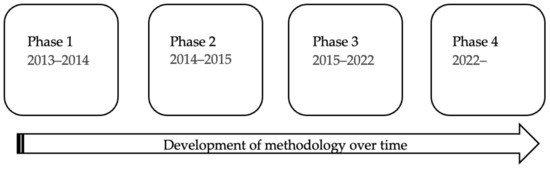

At this point, we considered it necessary to note that the used online reputation quantification methodology was the product of a decade of research. The first phase was carried out between 2013 and 2014, where we, as researchers, followed up on the work of practitioners and marketing experts on e-communication. The use of sentiment analysis (SA) procedures for the needs of academic research was primarily tested. Procedures were specified in the process of producing empirical material, which was presented to a wide professional public through numerous studies.

Phase 2 took place in 2014 and 2015. During this period, the methodology was first expanded to include another tested parameter, as we as researchers reflected on the development of the methodology in research from practice. As part of our research, we, therefore, started working with the term Advanced Sentiment Analysis (ASA). At the same time, the ASA parameter served as a tool for refining the results, as well as an accelerator for the development of the idea of developing a complex methodology in the future.

The third phase represented a seven-year period in which we presented a comprehensive methodology for measuring the total level of online reputation TOR.

The fourth, currently ongoing, phase specified the complex TOR methodology, while sector specifics were identified to maximize its application potential.

The following Figure 1. approximates the individual phases of the development of general methodology for comprehensive analysis of the level of online reputation as follows:

Figure 1.

Comprehensive analysis of the level of online reputation; Development over time.

The methodology in its current form thus represents a comprehensive approach to the quantification of online reputation. This approach is complemented by defining the basic limitations to refine sentiment analysis in its simple (SA) and advanced form (ASA).

The process was as follows:

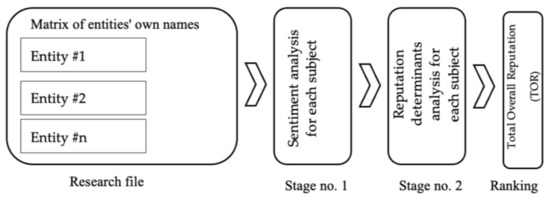

The first step in the comprehensive analysis of TOR online reputation level was to identify a relevant and homogeneous research sample consisting of relevant entities with at least a basic presence in the online environment. Subsequently, the selected entities were clearly defined based on their own name or designation used. The names were compiled into a matrix, which was then subjected to a multi-stage analysis. The process of multistage analysis can be seen in Figure 2 below:

Figure 2.

Comprehensive analysis of the level of online reputation.

The product of the analysis was the TOR coefficient for each of the analyzed entities. Based on this coefficient, it was possible to evaluate the research sample by ranking the entities for subsequent benchmarking by the level of the overall online reputation of individual entities. Prior to the presentation of the analysis results, the methodology used in the analysis shall be presented in more detail to quantify the partial reputation indicators of phases 1 to 2, as well as the formula for calculating the TOR parameters.

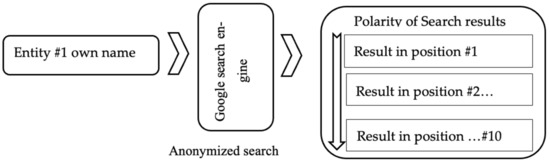

At this point, the Sentiment Analysis (SA) will be described, which represented the starting point for comprehensive examination of the issue. The main reputation determinant was assumed to be the virtual presence of the entities in the search results in the Google search engine environment. At the same time, the sentiment, i.e., the polarity of the result of searching for a given subject’s name among the first ten positions in the search engine, was considered.

The following diagram shows the sequence of steps in the sentiment analysis (see Figure 3):

Figure 3.

The process of Sentiment analysis–one entity.

From the point of view of the polarity of the search result, there were four levels of sentiment, namely, (i) positive sentiment, (ii) the entity’s own website, (iii) neutral sentiment, and (iv) negative sentiment.

At this point, however, in comparison with the source study [14], limiting factors were added, which enabled the more accurate quantification of the research sample. This was referred to as precise quantification (PQ) within the sentiment analysis in its basic (SA) and advanced (ASA) form. Prior to the actual analysis through PQ, it was necessary to define the basic framework of work procedures so that each of the investigated entities within the sample could be examined in the same way, which should guarantee the relevance of the resulting order. The initial evaluation key for the allocation of result points on the positions distinguished four levels of sentiment, namely, (i) the subject’s own side; (ii) neutral sentiment; (iii) positive sentiment; and (iv) negative sentiment.

- (i)

- The first occurrence in the sequence that would directly link to the product presented through the site of its manufacturer was considered as the own page. Any further occurrences of a similar nature were classified at the neutral sentiment level.

- (ii)

- Any occurrence in the search where it could not be clearly determined whether the reputation of the analyzed product was affected positively or negatively would also be classified as neutral sentiment, as well as results irrelevant to the subject under investigation. In the case of results having the nature of an evaluation or giving a score, a score around the mean value of the presented scale was evaluated as a neutral sentiment.

- (iii)

- As for positive sentiment, it was attributed to results clearly supporting the product, as well as results referring to the traditions and reputable nature of the product, such as links to the Wikipedia platform and the like. Furthermore, results linking to mainstream social networks such as Facebook, Twitter, Instagram, YouTube, and LinkedIn were be considered positive links. If such links contained a rating or evaluation, they were evaluated in the same way as in the case of general results of an evaluation nature. Additionally, results having the nature of enlightenment and social benefit were considered a positive sentiment.

- (iv)

- Negative sentiment was attributed to results that directly or indirectly damaged the reputation of the products under review. In terms of results containing scores or ratings, ratings to the right of the scale mean were considered negative sentiment. The analysis was carried out from the customers’ point of view; therefore, both results concerning the increasing price (without a clear indication of compensation by additional added value) and results concerning the reduced or limited utility or availability were negatively evaluated.

In terms of ranking, the first ten positions in the Google search result were considered. Table 2 presents the key for quantification of measured variables:

Table 2.

Sentiment analysis quantification table [14].

Based on the chosen methodology, the first ten search results of the given entity were gradually quantified by scoring. For the purpose of ranking the analyzed entities, the same process was used for the entire examined sample.

Regarding the market localization, the selected language of the search was English, with the Google search platform being localized to the market of the United States of America, which represented the largest English-speaking market within the possibilities of localization of the search. Finally, it should be noted that only the first ten search results of both an organic and textual nature were considered. Paid advertisements, as well as results having the nature of images, maps, and other graphic elements that could not be clearly quantified by the chosen methodology at the level of the assigned score, were excluded.

In any case, it should be noted at this point that the basic form of sentiment analysis was insufficient for more sophisticated measurements. As for highly significant entities, approximately the same results in terms of the positions were recorded. In terms of point-quantifiable values, the values close to the possible maximum were reached. Ranking and subsequent benchmarking were difficult in such cases; it was thus necessary to repeat the measurements using more sophisticated reputation parameters. In such cases, the resulting ranking was determined based on the sum of the values of partial measurements in percentages. For measurements using one parameter (basic analysis of SA sentiment), it was assumed that each entity could obtain a maximum of 155 points, accounting for 0.645% for 1 point. In the presented analysis, an extended two-level sentiment analysis was used, where the basic polarity of search results was considered. This was then complemented with the polarity of search results in the Google tab News. When using two parameters, one point had a value of 0.322%. The sentiment analysis in this advanced form (ASA) was used as the first input parameter when calculating the TOR score.

At this point, we could proceed to the second stage of measuring the level of reputation, namely, the measurement based on the reputation scores of entities through Reputation Determinants (RD or simply R). In our measurement, the reputator (R), or the reputation determinant (RD) in other words, was a significant media player in the online environment capable of independently influencing the reputation of a given entity. Traditionally, these were large media players. It was necessary to define its own reputator for each sample, as the methodology represented a relatively stable and universal static key, while the environment as such developed dynamically. For each survey, a set of reputators was specified by expert estimation. In this analysis, the set of reputators consisted of:

- (i)

- Score of a particular car according to the electronic version of MotorTrend magazine, referred to in the research as R1;

- (ii)

- Score of a particular car according to the Edmunds portal, referred to in the research as R2;

- (iii)

- Score of a particular car according to the J.D. Power portal, referred to in research as R3;

- (iv)

- Score of a particular car according to the electronic version of Car and Diver magazine, referred to in the research as R4;

- (v)

- Score of a particular car according to the electronic version of Forbes magazine, referred to in the research as R5;

- (vi)

- Score of a particular car according to the Kelley Blue Book portal, referred to in research as R6;

- (vii)

- Score of a particular car according to the U.S. News & World Report portal, referred to in the research as R7;

Each of these parameters entered the calculation separately. The calculation of the TOR parameter itself was based on the following formula:

where:

TOR—total online reputation in%,

RASA—reputator ASA (% score based on the advanced sentiment analysis),

Ri—reputator (% score based on a given i-th determinant of online reputation),

n—number of indicators.

In a specific case, where a total of eight parameters were included in the calculation, the formula for calculating the TOR value for a specific entity had the following form:

At this point, it should be noted that zero values did not enter the calculation, unless it is impossible to quantify any of the entities in the research sample according to a specific reputator or reputators. Only the reputators that could be numerically quantified in the TOR calculation for a specific subject were considered. Their sum was then divided by the number of quantifiable variables. To work with the data, it was necessary to perform a robustness test.

Usually, the robustness was tested via t-procedures, which expected fulfillment of 2 assumptions. One of them was normal distribution of the sample that was not confirmed using Shapiro–Wilk test (W = 0.840; p < 0.01). For this purpose, we used multiple non-parametric methods for testing the robustness of selected moment characteristics, see the following Table 3 (10 times random division of the evaluated sample into 2 files).

Table 3.

Robustness testing via selected moment characteristics.

In our analyzed sample of the ten best-selling vehicles and the ten best-selling electric vehicles, with a 10 times random divided sample into two components, we found no differences in the median value, and we also found no differences in the distribution function. The Levene test also did not find differences, while confirming the homoscedasticity of the tested samples. After testing the robustness via selected moment characteristics, it was possible to proceed to the actual quantification of the investigated indicators.

Based on the quantification of the total level of online reputation, it was possible to create a ranking of the analyzed entities for further processing, visualization, or simple benchmarking. If it was possible to repeat the measurements over time, there was room for trend identification.

Regarding the time frame of the research, the data were collected in the Fall of 2022. The results were, subsequently, subjected to in-depth analysis. The data were collected through interested students and researchers. None of the parts of data collection within the sentiment analysis were automated. The results of the analysis were interpreted through overview tables and histograms.

4. Results and Discussion

Based on an extensive empirical study, and using the described methodology, both partial (SA and ASA) and total online reputation (TOR) values were identified for the research sample. Prior to moving on to the presentation of results through summary tables, it is necessary to describe the analyzed subjects.

The first analyzed model and the world’s best-selling car was the Toyota Corolla, a compact car manufactured by Toyota Motor Corporation. Its first version was launched onto the market in November 1966.

The second was the Toyota RAV4, a compact crossover, also manufactured by Toyota Motor Corporation. It was launched onto the market in 1994.

The third was the Ford F-Series. The model line was represented in our analysis by the F-150 model. It was a full-size pickup truck, produced by the American company Ford from 1948 to the present.

The fourth model was the Honda CR-V, such as the RAV4. It was a Japanese compact crossover, a vehicle produced by the Honda company, available on the market since 1995.

The fifth model was the Toyota Camry mid-class sedan, produced by the Toyota Motor Corporation since 1982.

The sixth model was the Ram Pick-up, specifically the 1500 model. Similar to the F-150, it was a full-size pickup truck, while the Ram, referred to as the Dodge Ram until 2010, was manufactured by Stellantis, originally the Chrysler Group. The car had been on the market since 1981.

The seventh model was the fourth and the last model of the Toyota Motor Corporation in the Top 10 world’s best-selling cars. It was a Toyota Yaris model and was representative of the supermini segment, available on the market since 1999.

The eighth model was the Japanese car Honda Civic, belonging to the segment of compact cars. It had been available on the market since 1972.

The ninth model is the Chevrolet Silverado, the third full-size pickup truck in the sample. The car was produced by General Motors under the Chevrolet brand since 1998.

The tenth model in the group of 10 best-selling cars and, at the same time, first in the order of the best-selling electric vehicles was Tesla’s Model 3. It was a fully battery powered compact sedan. It had been available on the market since 2017.

The second best-selling electric vehicle was the Wuling HongGuang Mini EV. It was an electric car of the city car category, manufactured by the Chinese company SAIC Motor in cooperation with the American General Motors. It was launched into the Chinese market in 2020.

The third best-selling electric car was the Tesla Model Y, a car in the electric compact crossover category, available on the market since 2020.

The fourth best-selling electric car was the Volkswagen ID.4. This model, similar to the Tesla Model Y, was included in the category of compact crossovers. It was manufactured by Volkswagen and had been available on the market since 2020.

The fifth best-selling model was the BYD Qin Plus PHEV. It was representative of the second generation of the Chinese compact sedan produced by the BYD company. It had been available on the market since 2021.

The sixth model was the Li Xiang One EREV, also known as Li Auto One. It was a Chinese car, representative of the luxury mid-sized crossover segment, produced by Li Auto, also known as Li Xiang, and had been available on the market since 2019.

The seventh best-selling model was the BYD Han EV car. It was the second representative car of the Chinese corporation BYD among the best-selling electric cars. This four-door sedan had been available on the market since 2020.

The eight best-selling model was the third representative car of the Chinese company BYD, specifically, the BYD Song Pro/Plus PHEV car. It was a car of the Crossover utility vehicle category. Its second generation had been available on the market since 2019.

The ninth best-selling model was the Changan Benni EV. It was a Chinese city hatchback manufactured by Changan Automobile, available on the market since 2020.

The tenth model was the Volkswagen ID.3. This was the second European electric car in the ranking, a model produced by the Volkswagen concern. It was a small family car, available on the market since 2020.

Each of the vehicles was subject to in-depth analysis, whose results are presented in Table 4.

Table 4.

Overall (Total) online reputation.

The table provides a comprehensive picture of the reputation of the investigated entities. To clarify the interpretations, the discussion is divided into chapters based on the individual steps of calculating the total online reputation (TOR).

4.1. Sentiment Analysis

In the first step, a comprehensive reputation analysis in basic (SA) and advanced form (ASA) was carried out. The results are presented below:

Toyota Corolla. Regarding the world’s best-selling car, a link to Toyota’s own website is at the top of the general search results. This link is assigned 10 points according to the chosen key. In the second position, there is a link to the Wikipedia page. This type of link enhances the reputation by pointing out the traditions and importance of the brand in the market. In the presented analytical report, it is assigned 19 points for the position of positive sentiment in the second place in the search results. In third position, there is a link to consumer reports that highlights the positives of the product; it is assigned 18 points. The fourth position in the search is occupied by one of the leaders in terms of car ratings, namely, the Kelley Blue Book platform, where a particular car achieves a rating in the upper spectrum above the average and is assigned 17 points for a positive sentiment result in the fourth place of the search results. The fifth and sixth positions are occupied by the ratings and scores of the CarAndDriver and Forbes platforms, both of which have the character of positive sentiment. Therefore, 16 and 15 points are added to the total number of points. The seventh position is occupied by an important market entity, namely, the US News platform, which also has the character of positive sentiment and is assigned 14 points for positive sentiment in the seventh position of the search results. In the eighth place, there is a link to the manufacturer’s subpage, regardless of the nature of the sentiment, which would fall into the “own page” category, or the “positive sentiment” category. This is assigned two points and the nature of neutral sentiment. The ninth position is of a similar character, occupied by a link to the manufacturer’s global site. It is again assigned two points for neutral sentiment. The last position is occupied by a link to the Autoblog platform, which, however, cannot be assigned an unambiguously positive sentiment, due to the neutral nature of the information presented on the site. The quantification of the first of the two parameters within the extended sentiment analysis is thus concluded with two assigned points. The car evaluated is assigned 115 points out of a total of 155 possible. The quantification continues with the search result positions in the News category. The first position is occupied by the report of the HotCars portal, which rather ambiguously refers to the positive tone of the presentation, when, in the preview, the authors of the article mention that it is not a particularly exciting car but, at the same time, noting that the car poses a nice surprise. This combination of information in the result provides rather a neutral result, expressed by two points assigned according to the selected key. The second result refers to The Drive platform, where the choice of words in the title is much clearer. The result can be assigned positive sentiment in the second position, and thus also 19 points to the second of the partial evaluations of the parameter. In the third position, there is a press release published in a national newspaper, which does not optimally communicate the advantages of the product in terms of the choice of words in the headline. Adverbs such as “a little” or “a lot” can add ambiguity, and, in the context, they might reduce the desired emphasis of the message. In a specific case, the wording “offers a small piece of entertainment” rather weakens the power of the overall message, while it is not possible at first glance (which is important when it comes to fast information, which is the domain of the Internet) to unequivocally state a positive or a clearly negative context. The result can thus be quantified at the level of neutral sentiment, and two points are added to the score. The following five links appropriately point out the advantages of a particular car, compactness, economic side of driving, and overall price. They are thus evaluated positively and are attributed 17 and 16, 15, 14, and 13 points for positive sentiment in the fourth to eighth place. The ninth position is occupied by a link to a long-term car test within the Auto Express platform, while its results are presented significantly positively. This ensures the product under review a positive sentiment in the ninth place in the search, which is expressed by attributing 12 points. In the tenth place in the search, there is a comparison of two similar products, while neither of them is presented as significantly better in the link, even though both are presented in a positive context. This link is assigned 2 points for neutral sentiment, thus providing the overall score of 112 points. Within the extended sentiment analysis, the entity under review thus achieves an almost identical score in both monitored parameters. The resulting ASA reputation level is 72%

The second entity is the Toyota RAV4. From the point of view of the nature of the search results in positions 1–6 in the first step, the product almost completely mirrors the results of its corporate sibling, the Toyota Corolla, achieving the first neutral mention on the corporate page one position earlier. Positive sentiment values recorded at the 8–9 position, complemented by neutral sentiment, close the measurement based on the first parameter at the level of 124 points. From the perspective of the search results in the News category, the analyzed model achieves a positive sentiment in the first place among the search results. This is a link of a comparative nature, comparing this model with another product, but, unlike the previous case, the optimal choice of words when creating a preview of the content is visible. It is thus assigned a positive sentiment in the first place and 20 points. In the second position, there is a reference of a comparative nature, without a clear sentiment. In the third position, there is a press release discussing the specifics of the model, including a mention concerning the significant price increase without pointing to an increase in added value, thus recording the first negative sentiment within the monitored parameter. In the fourth to sixth positions, there are two positive and one neutral sentiments. The seventh position contains a sentiment of a negative nature mentioning the possible problems of the models. The last three positions show diverse values where the sentiment of the results has a neutral, positive, and negative character. The ranking ends with a report of production suspension due to supply chain issues. This mix of results is represented by the second of the partial scores at the level of 28 points out of a total of 155 possible. This results in an ASA reputation level determined at 49%.

The third model analyzed is the Ford F-series. As we want to avoid possible incompatibility of results, its most popular model F-150 from the given series was selected and, subsequently, tested as a keyword within the entire measurement for a specific subject. When it comes to the sentiment values measured according to the first parameter, the manufacturer’s own page is again in the first position in the search, but, for the first time as part of the measurement, the variants of this page are also in the second and third positions. This results in a situation where the first sentiment of the own page level is followed by two sentiments of a neutral nature. The relative loss in the second and third positions is offset by positive sentiment in the fourth to tenth positions. As for the second monitored parameter, a significantly positive mention of the electric variant of the product is in the first position in the News category. The situation is similar in the second position. In third place, there is the mention concerning the problems with windscreen wipers on models from two previous years. This situation is repeated in one more case, specifically, in the fifth place of the search results. Four positive sentiments are assigned to the tenth search result, which is negative in nature and related to the automaker’s notice regarding possible engine problems in more than 500,000 cars of the series. In general, it shall be noted that a significant part of the positive search sentiments within the second parameter comes from the publicity of the upcoming electric car models, which are not found within the sales reports for sales in the finished calendar year. Regarding the score based on the second of the parameters, the monitored entity gains 66 points, which corresponds to a level of approximately 40% of possible reputation. From the point of view of the overall ASA level, the entity achieves a value of 57% of its possible level based on the polarity of the sentiment of the search results.

Fourth in line, the Honda CR-V fits the imaginary template of the two Japanese predecessors. If not considering the own website in the first position of the search results and the occurrence of neutral sentiment in the fourth position, the first seven positions are occupied by results of positive sentiments. The eighth and ninth positions are occupied by the links to the social media YouTube. This type of link is perceived significantly positively, provided that the links are not of a negative nature. A perfectly mastered optimization of the first page of Google searches concludes with a link to the website of the company containing positive sentiment keywords. In terms of the first parameter, the analyzed model thus achieves a score of 145 points, which accounts for 97% of the possible reputation. Regarding the second monitored parameter, there are reports of a comparative nature in positions one and three. Both can be assigned neutral sentiment. In the second position, there is a link discussing high value for money. The fourth to ninth positions contain exclusively references of positive sentiment. This means 121 points for the second monitored parameter and a total of 86% reputation level according to ASA.

The fifth model is another representative of Japanese brands, namely, the Toyota Camry. In the first three positions, there are two links to the company’s own website. The positions four to nine contain exclusively references of positive sentiments. The tenth position is a link to the corporate variant of the own page, which is assigned neutral sentiment. The Camry thus achieves 120 points in the first monitored parameter and 77% of the possible reputation potential. As for the second observed parameter, except for three irrelevant results, the given model achieves exclusively positive sentiment in all links. This is expressed by a total score of 113 points and 75% of the possible reputation.

The sixth model is the Ram Pick-up. As in the case of Ford, the best-selling 1500 model is selected from the portfolio to avoid possible data inconsistency. The first position is occupied by the manufacturer’s own page, the other five positions are occupied by the results of positive sentiments. In the seventh position, there is the manufacturer’s own website, which is followed by two other variants of the corporate website. The tenth position is occupied by a link to Wikipedia. The product thus achieves a total of 112 points, or 72% of the possible score. As for the second of the monitored parameters, with the exception of neutral sentiment in the seventh position, the media optimization of the analyzed product reaches the maximum possible value. With a gain of 143 points, the overall level for both parameters is 82%.

The seventh analyzed model is the Toyota Yaris. The first position is occupied by the manufacturer’s own page, and the second to fourth positions are occupied search results of positive nature. According to the selected methodology, the fifth result is of neutral nature, followed by the results with positive sentiment in the sixth to tenth positions. The model thus obtains a total of 131 points and 84% of the possible reputation value. The News tab contains a relevant but neutral result in the first position. In the second position, there is a negative article about the models from the previous generation. The next three results are of a positive sentiment nature, which is followed by an article of unclear polarity. In the seventh position, there is an article with a negative connotation discussing problems with one of the elements of the mandatory equipment. The seventh to ninth positions are occupied by reports of positive sentiment, with the last report presenting irrelevant news of a neutral nature. The total score is thus 46 points and a total of 57% of possible level reputation based on the measurement of both parameters.

The eighth analyzed model is another representative of the Japanese automobile industry, namely, the Honda Civic. The first position is occupied by the manufacturer’s own website, then, except for the fifth and sixth positions occupied by reports of neutral links, the product achieves exclusively positive polarized results in terms of the monitored positions. This provides a total score of 118 points and a 76% level of possible reputation level. As for the News tab, the model reaches its maximum possible potential, with the result of positive sentiment in each of the positions. With a total score of 155 points, this model achieves an overall ASA reputation level of 88%.

The penultimate example, in terms of the first parameter and, at the same time, the last representative of the ICEV segment, is the Chevrolet Silverado. Similar to the previous two representatives of American Pick-Ups, again, the best-selling model within the group, the 1500 model specifically, is selected. As part of the measurement, an interesting paradox can be seen where the first five search results are the variants of the manufacturer’s website. Three links of positive sentiment follow, and the order is closed by two dominantly neutral links. In numerical terms, this means a gain of 64 points and reaching 41% of possible reputation level. In terms of media presence, the product records dominantly corporate communication in the first ranks, which has the nature of neutral occurrences. Achieving the polarity of a positive nature is not possible due to the lack of a more optimal choice of words in headlines and previews. Positive sentiment can be assigned to the report in the seventh position of the search, mainly thanks to a more optimal choice of keywords for the headlines in the media. With a positive sentiment in the tenth position, the total point score is 47 points and a total of 36% of the possible reputation level was reached according to the two monitored parameters.

The first car in the EV category and, at the same time, the tenth in the order, regardless of the type of engine, is the Tesla Model 3. The first position belongs to the manufacturer’s website, while the second to fourth positions are occupied by the results of significantly positive sentiment. The fifth and seventh positions are occupied by mentions of neutral sentiment. The last three positions alternate positive and neutral sentiment. This makes the vehicle the first and, at the same time, the most significant representative of the EV category, achieving 109 points and a 70% reputation level, according to the first monitored parameter. The second of the parameters provides an image of the media communication of the product. The first mention is a report with a neutral sentiment. This refers to the availability of the product in the Australian market. The second mention refers to a significant notice in connection with the optimal functionality of the car. In the third and fourth positions, there are also results of neutral sentiment caused either by product irrelevance of the link or poor optimization of keywords and messages concerning the content of the report. The first significantly positive sentiment is recorded only in the fifth position of the search. However, the following four results are of negative sentiment, related to reliability or the drop in the price of used cars of the analyzed model. The ranking is closed with a relatively vague report concerning the promised driving mode. Due to the time-bound nature of the given report, it is evaluated based on its content at the maximum level of a neutral sentiment polarity result. This composition of search results in terms of scoring represents -49 points, with the first recorded negative overall ranking within the entire measure and the overall reputation at the level of 19% of the maximum possible level. The second analyzed car in the EV category in terms of the number of units sold worldwide is the Wuling HongGuang Mini EV. Here, we encounter the first paradox in the measurement, probably due to the geographical localization to the United States market. The manufacturer’s own website is not in the first position of the search results. The first result is a link to Wikipedia. The second result is of a neutral nature. Two positive reports are followed by a report of a neutral nature. Positive results can be also found in the sixth and seventh positions. In the eighth position, there is a link to the social network Facebook, which is evaluated as positive according to a predefined key. The ninth and tenth positions provide results of positive sentiment referring to the availability and popularity of the product. The Google News tab is mostly positive, except for a neutral mention in the tenth position. This makes the analyzed model a significantly positive example of a well-communicated innovation. In terms of points, the model achieves a total of 146 points and the overall level of ASA of 87%.

The Tesla Model Y is the third analyzed model. The manufacturer´s own page is again in the first position, followed by Wikipedia, and a link with a significantly neutral sentiment. For the remaining positions, neutral and positive sentiment alternate. In total, 104 points and a 67% reputation level are achieved according to the first parameter. The News tab contains the first mention of positive sentiment. This is followed by a report of negative sentiment, followed by a neutral mention, and then a series of four negative reports. This is followed by a positive report about a reduction in product waiting time, followed by a report with significantly negative sentiment. The ranking is closed with a relatively neutral mention about the new color variant of the product. In terms of points, similarly to Model 3, a negative score of -56 points was achieved, which in the total sum of both parameters means a score at the level of 15%.

The fourth in the order is the first representative of European cars, regardless of the type of the drive unit, the Volkswagen ID.4. The manufacturer’s own page is followed by links of positive sentiments. The ranking is closed with news of relatively neutral sentiment, and the total score is at the level of 122 points, or 79% level of SA reputation. Media mentions of the product are of a different nature. In the first position, there is news with relatively neutral sentiment, followed by three other neutral reports. Three positive reports and one relatively neutral report follow. Overall, however, a total of 83 points and 66% of the total ASA reputation level are achieved.

The fifth car analyzed is the BYD Qin Plus PHEV. As with the HongGuang Mini EV, a link to Wikipedia occupies the first place. The second neutral mention is followed by a link to the Facebook social network. In the following positions, there are six rather neutral references. The ranking is closed with a link to a report concerning an increase in sales, which can be assigned positive sentiment. The product reached a total of 63 points and 41% of the possible reputation level. Media communication of the product is represented exclusively by positive sentiment results. The results concern mainly pointing out the growth potential and market indicators of the product. With a score of 155 points and an overall reputation level of 70%, this is a positive result.

The sixth analyzed electric car is the Li Xiang One EREV. Even in this case, Wikipedia occupies the first position instead of the manufacturer’s own website. The following links are neutral. In the fourth position, there is a link to the social network Facebook. In the search results, six links of a neutral sentiment follow. The resulting score is thus 51 points, which represents approximately 33% of the possible reputation level. As for the second parameter, the search results in the News tab, the results of a neutral nature occupy the first three positions. These are followed by four results of positive sentiment, traditionally referring to growing sales and growth of the market as such. The last three results are of all available sentiments, starting with a negative sentiment through neutral to positive sentiment. The total product score is 68 points in the second parameter, which accounts for 39% of the overall ASA reputation level.

The seventh car is the BYD Han EV. The manufacturer’s website occupies the first position, unlike the previous representatives of Chinese car companies. The following position is occupied by Wikipedia and a link of a positive sentiment nature. There are three neutral references in the fourth to sixth positions. In the seventh position in the search results, there is a report on the appreciation of car design, classified as positive. Two neutral reports precede the report with positive sentiment in the tenth position, specifically a link to the social network Facebook. In the first measurement, the product score is 83 points, or 54% of the possible reputation level. As in the case of the BYD Qin Plus PHEV, the media mentions are at the maximum possible level. The factor of expansion and, at the same time, rapid growth is a significant factor of media dominance in the online environment. With a total score of 155 points, the product reaches the overall ASA reputation level of 77%.

The eight tested vehicle is the BYD Song Pro/Plus PHEV. The first mention is a link to Wikipedia, followed by four results of a neutral nature. The fifth in order is a link to the social media YouTube, which is followed by five results with a significantly neutral sentiment. These are the technical specifications of the product on different websites. Overall, in terms of the score, the product reaches 51 points, which corresponds to 33% of the possible reputation level. As for the second of the monitored parameters, in this case too, the entity’s online presence is characterized by positive communication concerning both market and sales growth. This is the case for all except for the penultimate position, which is occupied by a neutral search result. Out of 145 points, the product reaches an overall reputation level of 63%.

The ninth analyzed model is the last representative of Chinese automakers, specifically the Changan Benni EV model. Similarly, as in the previous cases, Wikipedia is followed by five links concerning mostly technical specifications. These results are assigned the nature of neutral sentiments. The seventh position in the search is occupied by a link to YouTube. The results in the eighth to tenth positions are also predominantly neutral in nature. A score at the level of 50 points corresponds to 32% of the possible reputation level, according to the first of the parameters. In the Google News tab, except for the second position, there are mostly positive sentiments concerning the growing trend in the market. With one neutral and nine positive results, the product reaches the level of 138 points, or 61% of the reputation level based on the two monitored parameters.

The ranking is closed by the second European car in the whole ranking, specifically, a Volkswagen ID.3. It is paradoxical that, despite the geographical and linguistic compatibility of the market, a link to the rating of the British platform TopGear occupies the first position in the search. The result is of a positive nature, represented by the rating, which guarantees the product a full point rating in the first position. The manufacturer’s own page is in the second position of the search results. Next is Wikipedia. In the fourth position, there is a variant of the manufacturer’s own website. The following two links are dominantly neutral, resulting in neutral sentiment being recorded in the fourth to sixth positions in the search results. The seventh to tenth results have positive sentiment, with the first two representing evaluations. The ninth and tenth positions refer to the social media YouTube. From a total score of 103 points, the product achieves a reputation level of 66% of SA. The News tab contains dominantly neutral sentiments in the first five positions. This is especially due to the not quite optimal wording of the texts. The links in the sixth and seventh positions are dominantly positive in nature. The last three reports in the rating are of a neutral nature. Again, this is mainly due to the non-optimal wording of the headings and preview texts. Achieving the score of 45 points, ID.3 closes the ranking with 48% of the total level of ASA reputation, measured based on the two monitored parameters.

4.2. Analysis of Reputational Determinants

In the second step, the reputation of individual entities is analyzed based on the seven pre-defined reputation determinants. As part of the analysis, these determinants are represented by the selection of the most significant players from the environment of opinion leaders established in the online environment of the investigated market. The tested entities achieved various scores within individual evaluations, namely:

Toyota Corolla, as the best-selling vehicle in the ranking, achieves relatively solid ratings across all monitored media. A score lower than 80% appears in two cases only, namely, on the Forbes platform and on the Edmunds platform.

The Toyota RAV4 scores below 80% on the Kelley Blue Book platform, while, on all the other platforms, it achieves a higher partial score than its rival from the concern.

The Ford F-Series, represented by the F-150 model, achieves a score of over 80% in all partial evaluations on the monitored platforms. In two cases, namely, on the CarAndDriver platform and the US News platform, the entity achieves a value of 90%.

The Honda CR-V achieves an even better score in the monitored reports, where a value exceeding 90% is achieved on the Motortrend platform.

The Toyota Camry achieves the maximum rating on the CarAndDriver platform, while the minimum value of 77% is reached on the Edmunds platform.

The Ram Pick-up, represented by the 1500 model, is the only one of the evaluated cars that achieves a partial score of 100%. The score is achieved on the CarAndDriver platform.

The Toyota Yaris is the first car from the selection without considering the type of a drive unit that does not have all the partial ratings of the reputators. In particular, the Forbes platform does not provide the rating for this model.

The Honda Civic is the highest-rated vehicle among those presented on the Forbes platform, where it achieves a total score of 91%.

From the point of view of the tested models, the Chevrolet Silverado is the best-rated vehicle on the J.D. Power platform, where it reaches a score of 83%. The car also closes the ICEV category as the tenth best-selling car, and the first best-selling electric car is the Tesla Model 3.

The Tesla Model 3 achieves high values within the monitored platforms. In the part of the platforms, it appears among the top half of the evaluated cars. At the same time, however, it ranks last among the Toyota Yaris on the J.D. Power platform.

The Wuling HongGuang Mini EV, as the first representative of Chinese electric cars, is not visible on any of the monitored platforms.

The Tesla Model Y shares first place with the Honda Civic on the Motortrend platform, with a score of 92%.

The Volkswagen ID.4, as the last of the entities that achieves a partial score on all monitored platforms except for J.D. Power, can be rated significantly positively. From the point of view of partial indicators, with a score of 98%, it is the best-rated vehicle on the Kelley Blue Book platform.

The vehicles BYD Qin Plus PHEV, Li Xiang One EREV, BYD Han EV, BYD Song Pro/Plus PHEV, Changan Benni EV, and Volkswagen ID.3 do not have any ratings on the monitored platforms. The implications of this condition will be described in the following sections of the study.

4.3. Overall Level of Online Reputation TOR

In the last step of the calculation, it was possible to calculate the total level of reputation (TOR). Prior to the interpretation of the ratings, it should be noted that there were two dominant vehicle segments in the sample. The first segment contained all relevant sub-evaluations. In the overview, it could be labeled as organic. The second segment achieved the overall level of reputation based only on the value from the extended sentiment analysis. In the overview, it could be labeled as artificial. However, based on the chosen methodology, we approached the sample holistically, and the rankings were determined regardless of the number of variables considered in the calculation. The implications of the evaluation of the organic and artificial part of the review will be discussed in the following chapter of the study. In this chapter, the entities will be evaluated based on the overall levels of reputation, which are simplified in Table 5.

Table 5.

Simplified table of the order.

Based on the simplified table presenting the total level of reputation of the analyzed entities, it can be concluded that electric cars did not have a significantly higher reputation compared to cars of the ICEV category. From the point of view of the overall ranking, electric cars were in the second position, and, subsequently, in the shared fourth and sixth positions, while the entity creating a significant asymmetry within the level of market capitalization achieved a shared sixth and ninth position in terms of the overall level of online reputation. This reflected the actual level of online reputation based both on the ASA parameter and Reputators R1–7. This situation was understandable, as both models of the Tesla car company have been on the market for a very short time, specifically since 2017 (Model 3) and 2020 (Model Y). The optimization of production, as well as research and development in the process, resulted in animosities that were reflected in the form of negative publicity or a relative decrease in the evaluation parameters. Traditionally, this status was replaced by positive publicity of brand ambassadors. In summary, however, we could not talk about a significant or even a relative lead in terms of reputation compared to the competitors powered by an internal combustion engine. This enabled answering the research question.

Electric Vehicles do not have a higher level of online reputation compared to their ICE competitors.

Except for the Tesla Model 3 and Volkswagen ID.4, electric cars were ranked 7th and 9–14th in the presented comparison. The electric car market is still undergoing a significant development and is strongly geographically specific in nature. With this statement, the selected contexts arising from the conducted research can be discussed.

4.4. Discussion and Interpretation of Selected Contexts

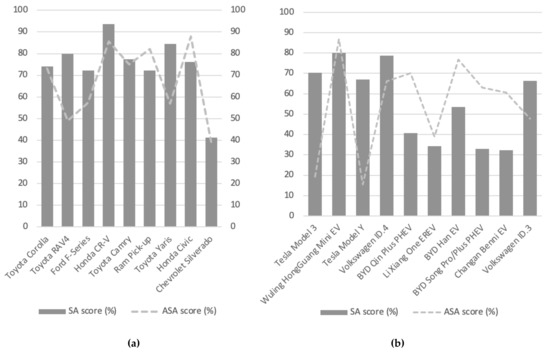

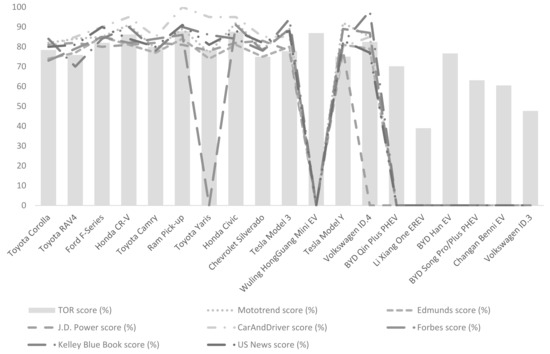

In the framework of the performed analyses, several connections have been identified that need to be discussed in the context of continuous reputation research. Specifically, this is a connection between the one-factor SA and two-factor ASA analysis for the reputation of selected entities, as well as the specificity in the form of the absence of evaluation by Reputators for some of the entities analyzed. The following figures present the analysis of these facts in the context of knowledge identified in reference analyzes [12,13,14]. Figure 4 shows the individual entities ranked based on sales and, subsequently, also their reputation characteristics in the form of simple and advanced sentiment analysis, especially for the ICEV and EV categories.

Figure 4.

Interpretation of selected relationships: (a) ICEVs; (b) EVs.

In the figure, it can be seen how the second measured parameter, the Google News tab, affects the level of extended sentiment analysis compared to the single-factor measurement. In the case of cars in the ICE category, the two-stage analysis, which also considers the results of the sentiment analysis of the Google News tab, increases the value of the achieved score in two cases only, specifically, the RAM 1500 and Honda Civic models. Both models have mastered media communication at a high level; in the case of the Civic model, it is about reaching the maximum, with positive sentiment assigned to all ten results in the News Table. Based on the results of the reference research [14], it can be concluded that companies are generally better at optimizing the first ten results on the main page of the Google search engine. This can be confirmed also in the case of seven out of the nine analyzed brands of ICE vehicles. As for the EV category, an interesting paradox can be seen, probably resulting from the geographical specificity and language availability of the content. In the case of the Tesla Models, the maximums achieved by simple optimization are largely reduced by publicity. This can be seen as a standard for most entities trying to manage their online reputation. Subsequently, the paradox occurs in the case of Chinese car models, where there is a significant mismatch between the achieved reputation based on the first ten results of a Google search and the first ten results in the Google News Table. This is since the organic search results, according to the SA parameter, usually have the nature of neutral technical information for Chinese producers within the sample, while Wikipedia saturates the organizations’ own webpages on the English-speaking market. In contrast, this slight disadvantage is a significant advantage in the News Table. Relatively artificial and, in principle, static information about market performance and growth in the number of units sold in the country of manufacture provide selected cars with a significant advantage in the form of positive and well-controllable publicity with the absence of traditional competition from ICE cars. Producers are thus able to achieve relatively high levels of reputation without the need for significant optimization of electronic communication towards search results in the Google search engine environment. As part of the analysis, another paradox can be seen in the form of the absence of Reputators for part of the examined sample of electric cars. This fact is presented in Figure 5.

Figure 5.

Interpretation of selected relationships; Reputational determinants.

Except for the Toyota Yaris, which does not have a rating on the Forbes platform within the category of ICE cars, all traditional car manufacturers achieve ratings on important platforms at the level of 70–100%. This phenomenon can be also seen in the case of the Tesla Model 3 and Y electric cars and in the Volkswagen ID.4 model, where, however, the evaluation of the J.D. Power platform is absent. By default, Reputations have a positive effect on the overall level of reputation. Based on the data visualized in Figure, it can be confirmed again that electric vehicles do not show a higher level of online reputation compared to their ICEVs competitors, even in the case of Reputators. Once again, there is a paradox of strong regional specificity and the developing nature of the electric car market, where six Chinese electric cars do not have a rating on any of the globally respected automotive platforms. With this statement, this discussion can be closed. In the last chapter, the conclusions of the presented research will be discussed.

5. Conclusions

The accelerated digitization of the first two decades of the twenty-first century poses a challenge for both sides of the market. The demand side of the market has an ever-increasing information base that is accessible in real time. The supply side of the market is trying to actively manage this information base. In doing so, an effort to manage a construct with an indefinite number of variables can be seen. As part of prioritization, key information nodes are selected, which are then filled in with content and resources. These nodes, subsequently, create kinds of media gatekeepers, known to the experts especially from the time of traditional mass media in the second half of the twentieth century [42]. The automotive sector is no exception in this regard. In terms of the supply of the automotive industry, these are not standard daily consumption products. The process of consumer behavior is characterized by customers spending a considerable amount of time researching the market and evaluating alternatives before creating an actual demand. As in every industry, new trends appear in cycles in the automotive industry as well. The current trend in the form of electro-mobility is partly caused by technological advances and partly by society’s efforts for the transition to a low-carbon economy. Similar to any trend, electromobility also encompasses many challenges. Economic challenges in the form of a generally higher purchase price of electric cars are complemented by infrastructural challenges. Seth Godin [30], the popularizer of trends and modern marketing approaches, states that the penetration of trends towards the public follows a bell curve, where the trend is first adopted by innovators and early adopters and by the general public after that. We are of the opinion that the trend in the form of electromobility is not and will not be an exception. Anyhow, adaptation of a trend by the general public requires a certain degree of trust in the trend itself, and reputation level is one of the indicators of trust.