1. Introduction

In recent years, environmental problems have become increasingly prominent. Under the influence of policy and social awareness of environmental protection, energy saving and emission reduction have become important goals of enterprise development. China has put forward a 2030 Peak Carbon action plan to curb corporate carbon emissions. With increasingly strict policies and regulations and increasing public awareness of environmental protection, manufacturers have to increase green production technology to improve the green level of their products. Green production technology is an important way to help enterprises reduce pollution and provides the possibility for the secondary creation of low-carbon technology. However, green technologies lead to higher initial investment costs. Therefore, it is necessary for the state to provide corresponding green financing support to make up for the high cost of green innovation.

China has been implementing green credit policies since 2007 by issuing low-interest loans to encourage enterprises to engage in energy-efficient production. Macro-policies can determine regional output and cost of emission reduction through active emission reduction incentives so as to achieve lower emissions [

1]. At present, the positive incentive implemented by the government is mainly green financing, which makes up for the high cost of green innovation through low interest rate of green financing [

2,

3,

4]. One of the purposes of this paper is to analyze the advantages and disadvantages of green financing in promoting emission reduction and to try to find its scope of use.

The green energy supply chain financing has the following problems.

First of all, it is difficult for banks to grasp the real information about the green level of products, which makes the approval of green loans difficult to become one of the problems affecting the development of the green energy saving supply chain. The successful implementation of green credit policies has two preconditions: First, banks should collect environmental information about enterprises. Second, enterprises should participate in environmental protection [

5]. Chao (2021) [

6] discusses the relationship between external environmental disclosure factors and green credit. Based on panel data analysis of 1086 listed manufacturing companies in China, the study showed that companies with higher quality environmental information disclosure did not get more loans. The root cause of this phenomenon is corporate “greenwashing”, which prevents enterprises from obtaining loans. The interference of enterprise “greenwashing” on commercial banks’ green credit should be avoided, and a framework linking enterprise behavior, green finance, and global environmental development should be established. The researchers argued that local governments need to set up databases to collect data on the environment, emissions and environmental protection of local enterprises. In fact, the key to the successful practice of green credit policy is the disclosure of environmental protection data by enterprises [

7]. Although commercial banks have the basic ability to collect information [

8], the disclosure of environmental protection information by companies contains symbolic information, which is confusing [

9]. Other scholars call for reducing the asymmetry of information disclosure by enterprises [

10,

11]. A green credit business needs strategic coordination between the upstream and downstream, and information asymmetry and member relationship inequality have become hindrance-plaguing green credit problems.

Secondly, this is based on the consumer perspective. Although consumers have environmental awareness, it is difficult to distinguish the green level of products. The “greenwashing” behavior of enterprises will increase consumers’ suspicion of green products and negatively affect their purchase intention. Based on this perspective, Zamagni A. (2022) [

12] studied the mediating role of green letters in the suspicion of green advertising and the willingness to buy green products. Hyoshin K. (2022) [

13] considered the product price problem that “high value means environmental protection” and tested the impact of subsidy policies on the consumption of environmental protection products with an intuitive standard. The research showed that selective subsidy programs could distinguish environmentally friendly products from non-environmentally friendly products.

From the perspective of enterprises manufacturing green products, although consumers have a high intention of environmental protection, enterprises often find it difficult to find effective strategies to guide consumers to buy green products. Tong Z (2021) [

14] conducted research from the perspective of psychological distance scenario, and the research showed that product information framework would have an impact on consumers’ willingness to buy green products. Some scholars analyze the motivation of consumers to buy green products from the perspective of policy subsidies. I-Hsuan (2021) [

15] derived green product purchase decisions under the two scenarios of corporate subsidies and consumer subsidies by referring to the dependency preference theory. Research shows that corporate subsidies are more likely to induce consumers to buy green products.

Most importantly, green level information is private manufacturer information. For their own benefit, manufacturers may misrepresent information about green levels, commonly known as “greenwashing”. Manufacturers exaggerate green levels to raise wholesale prices and secure cheap borrowing rates from banks, destabilizing the market for green products. Scholars believe that “greenwashing” is a strategic and premeditated corporate lie designed to mislead consumers and exaggerate the environmental benefits of products [

16]. Lucia G. (2021) [

17], based on the cases of “greenwashing” in recent years, discussed the influence of cheating behavior on investment intention and proposed a typology of “greenwashing” cheating. Green information misreporting will affect the response of stakeholders [

18], but the existing literature has not studied why consumers and other stakeholders are affected by “greenwashing”.

To sum up, there are three problems in China’s green energy supply chain financing: the disclosure of enterprise environmental protection information is misleading and interferes with the implementation of green credit policy. Although consumers have environmental awareness, it is difficult to distinguish the green level of products, which reduces consumers’ purchase intention. The “green washing” behavior of green product manufacturers will mislead consumers and lead to turbulence in the green product market. Based on the above adverse phenomena and influences, there is an urgent need for a reliable way to verify the greenness of products, break through the “green fortress” of traditional industrial transformation, and help the financing of green supply chain.

One potential solution to the greenness concealment is to use blockchain technology [

19]. Unlike traditional mechanisms to build trust among supply chain members, blockchain technology achieves information transparency among participants by sharing distributed digital ledgers and is able to ensure the security and traceability of information [

20]. This means that no party in the green supply chain can unilaterally change the system [

21]. Therefore, blockchain-based systems are better at preventing malicious activities such as fraud than systems that rely on human monitoring and control to ensure transparency of green information [

22]. Blockchain technology is a digital technology of distributed data structure, which realizes information transparency among participants by sharing distributed digital ledger. Blockchain technology can ensure the security and traceability of information. With blockchain as the under support, new technologies that integrate various exchange mechanisms are gradually affecting the social and economic structure. Blockchain technology covers a wide range of fields, including the financial industry, supply chain management, equipment network security, and so on. Renee (2023) discussed the organizational trust in the strategic alliance based on blockchain technology through the case study of two eastern banks [

23]. The research showed that blockchain technology can help reduce ambiguous behavior and improve trust between organizations. Henry (2018) [

24] examined the privacy challenges of blockchain access, such as the trade-offs between personal data protection, privacy, and crime prevention. Aste (2017) [

25] studied the foreseeable impact of blockchain technology on society and industry, pointing out that blockchain is a new technology for future social and government. Kiyomoto (2017) [

26] et al. proposed a blockchain-based data distribution scheme for anonymous data management. Blockchain technology is very attractive for promoting the traceability of green energy-efficient supply chain information and transparent management, and provides innovative solutions for the development and monitoring of the green supply chain.

The application of blockchain can solve the problem of unbalanced profit distribution among supply chain members caused by information asymmetry. References to blockchain technology can give supply chain members an idea of the extent to which everyone is profiting from it. Blockchain can reduce the strength difference between game subordinate members and core supply chain members and protect the fairness and equality between supply chain members. With the support of blockchain technology, Starbucks has realized the traceability of information among production endpoints, retailer endpoints, and consumer endpoints so as to fairly compensate producers [

27].

However, we found that research on blockchains took a primarily technological determinist perspective and focused on examining the technical design of blockchains while ignoring the commercial implications [

28,

29]. In fact, there is still a lack of relevant research on how a blockchain impacts green energy-efficient supply chain financing, specifically whether supply chain members are motivated to adopt blockchain technology. Will the use of blockchains improve the financing efficiency of green supply chain and help manufacturers obtain lower bank loan interest rates? In addition, how does the greenness level of products, consumers’ sensitivity to green information about products, and consumers’ sensitivity to price-affect the adoption of blockchain technology?

Based on the above research objectives, we propose a green financing problem for a green energy-efficient supply chain consisting of manufacturers with limited capital, green credit banks, and consumers with green preferences. Considering green manufacturers’ misrepresentation of the green level of their products, it proposes the introduction of blockchain technology with “smart contracts” to monitor the actual amount of carbon emissions of enterprises. At the same time, the application of this technology can improve banks’ ability to identify green products and help improve the efficiency of green credit execution. Consumers can also enhance their green sensitivity and eliminate the negative impact of “green washing” enterprises on their purchase intention. We believe that the adoption of blockchain technology can improve the green sensitivity of customers to products and help obtain green credit support from banks. The paper sets up and compares two scenarios with or without blockchain technology. In this paper, two cases of cooperation game and Stackelberg game were set up to analyze the role of blockchain technology in green supply chain financing. Most importantly, we introduced a carbon emission measurement formula to measure the efficiency of enterprises in reducing emissions. On this basis, the optimal financing range of green credit was sought to achieve the optimal profit of green manufacturers and retailers, as well as the optimal emission reduction. Finally, we introduced a practical case of green transformation of Jinyuan New Technology Company enterprise to prove the correctness and applicability of the model.

The main contributions of this paper can be summarized in the following four aspects. First of all, this paper fills the literature gap between blockchain technology and green supply chain financing. Green financing can effectively solve the financial constraints of manufacturers. The research shows that when the coverage of green financing is greater than a certain threshold, the emission reduction efficiency brought by green financing is better than that of traditional production. When the cost of financing exceeds a certain value, the economic reporting generated by the introduction of blockchain technology is superior to the scenario without blockchain technology. The blockchain’s function of information transparency and disclosure improves the fairness of profit distribution among supply chain members.

Second, consider the financing decision when the manufacturer misrepresents the green level. In the production activities of green energy-saving products, manufacturers may lie about the greenness level. This paper proposes a green supply chain financing scheme based on blockchain technology to prevent manufacturers from lying and compares it with the traditional green supply chain financing scheme.

Third, the introduction of blockchain technology into green energy-efficient supply chain financing schemes has improved banks’ judgment on green industries. In addition, we have innovatively analyzed consumers’ sensitivity to green levels and provided useful management guidelines.

Finally, in the model we found a key condition for using blockchain technology to help enterprises in green transformation—when the intensity of green financing exceeds a certain value, there is an optimal green financing coverage to ensure the realization of corporate profits and emission reduction targets at the same time. This condition can avoid the failure of enterprises’ green transformation due to the reason of green information concealment and can affect the development of emission reduction.

The structure of this paper is as follows. The relevant literature is reviewed in

Section 2. In

Section 3, the model and hypothesis are described, the financing mode of green energy-efficient supply chain is constructed, and the sequence of events is analyzed.

Section 4 discusses the cooperative game and Stackelberg game scenarios without blockchain technology.

Section 5 discusses the cooperative game and Stackelberg game scenarios using blockchain technology.

Section 6 compares the optimal decision of

Section 4 and

Section 5 analyzes the effect of emission reduction, and the role of blockchain technology in green supply chain financing.

Section 7 summarizes the thesis.

2. Literature Review

2.1. Green Energy-Efficient Supply Chain Management

With increasingly serious environmental problems such as global warming, energy conservation and emission reduction have become the key to human sustainable survival and development. Green supply chain management is widely concerned by the industry and academia. Some developing countries have implemented green emission reduction projects by optimizing industrial and energy structure based on financial input and technical support. However, there are many risk factors associated with green emission reduction projects, leading to high transaction costs. Based on China’s current national conditions, China has not fully established an independent carbon trading market to purchase emission reduction credits. Therefore, projects to reduce greenhouse gas emissions need financial support from the state. Based on this, this paper takes enterprises in green transformation as the research objective and makes a simulation analysis on the capital investment and technical support in the green supply chain.

In order to improve environmental performance, manufacturers are accelerating the green transformation of their industries to produce more environmentally friendly products. In February 2023, China’s Chongqing Economic Development Zone cooperated with Green Energy Development Co., Ltd. (Tianmen, China) and other enterprises to jointly build new energy vehicles and carbon neutral industrial clusters. Some scholars have studied the performance changes brought by green energy-efficient supply chain management for enterprises from different angles. Some scholars have studied the performance changes brought by green energy-efficient supply chain management for enterprises from different angles [

30].

Some scholars focus on the motivation of adopting green supply chain [

31]. First of all, macro-policies and institutions are the main motivation for enterprises to promote green transformation. Secondly, social environmental factors and consumers’ green preference are another motivation for enterprises’ green transformation. Guo (2019) [

32] studied that consumers are willing to buy green products and pay higher prices. Consumers’ green preference and social factors will promote manufacturers to carry out green production.

However, the obstacles to the development of enterprise green energy-efficient supply chain are multifaceted. Low willingness to pay, high development cost, and high business uncertainty are important obstacles to the development of a green supply chain. The lack of cooperation between enterprises and the government and environmental agencies, and the lack of rules and regulations on green practices, are obstacles to the green transformation of enterprises [

33]. Small- and medium-sized manufacturers may not be able to obtain green credit support from banks due to a lack of collateral and low credit ratings. In fact, manufacturers are often unable to make the green transition because of financial constraints.

Many scholars have focused on the impact of green energy-efficient supply chain management decisions on environmental issues. Lee’s (2008) [

34] research shows that consumers’ environmental requirements play an important role in enterprises’ willingness to participate in green supply chain. Zhu and He (2017) [

35] studied the optimal decision of product greenness level and pricing under horizontal and vertical supply chain competition based on game theory. Madani (2017) [

36] studied the impact of tariffs on green strategy and product pricing in green and non-green supply chains. Wu et al. (2018) [

37] studied a green supply chain based on wholesale price contracts, in which manufacturers have enough money to invest in green, and cash-constrained retailers place orders from manufacturers. Hong and Guo (2019) [

38] studied a green energy-efficient supply chain collaboration and found that cooperative contracts are more valuable for improving environmental performance.

From the perspective of governance mechanism, the most common governance method was administrative means, that is, the government directly participates in environmental governance decisions as a game party [

39]. For example, under the dynamic Cournot game, Benchekroun (1998) [

40] analyzed the production strategy of oligarchic enterprises facing the implementation of carbon tax by the government. Kennedy (1994) [

41] studied the impact of carbon tax strategy and carbon emission trading system on enterprises’ emission reduction. This paper finds that if green products can improve corporate earnings and the production of green products can obtain a lower loan interest rate, enterprises are more likely to carry out green transformation. Although the above studies discussed the problems of enterprise green transformation from different angles, there are still some shortcomings.

First of all, when it comes to corporate green financing, the above literature ignores the reality that enterprises need financing. However, this assumption is too ideal and inconsistent with the reality. When dealing with the green level of products, the above literatures assume that the green level information of products is transparent and known, and the bank can judge whether the enterprise is the one producing green products. However, this assumption is too ideal. The greenness of the product has concealment and lag. It is difficult for banks and consumers to directly understand the environmental protection of products. Therefore, by embedding blockchain technology into green supply chain, this paper discusses the financing mode of green supply chain under different game conditions and makes an in-depth comparison of supply chain profits and production emission reduction effects under blockchain technology. Therefore, this paper can be regarded as an extension of the above work to some extent.

Secondly, the efficiency analysis and comparison of enterprise green transformation. Whether green financing positively affects the emission reduction of enterprises, the definition of financing scope, and whether enterprises are willing to carry out green transformation are questions we sought to answer. How do these benefit the analysis and comparison of blockchain technology to the green supply chain? How do we define the application scope of blockchain technology? None of these questions have been well answered. Therefore, we considered a financially constrained manufacturer borrowing from a bank, and the manufacturer determined the quantity and greenness of the product to be produced. In addition, this paper considers that green products will prove to have a positive impact on consumer demand.

2.2. Application of Blockchain in Green Energy-Efficient Supply Chain Management

The rapid development of digital technologies and the government’s macro-guidance on energy efficiency provide significant opportunities for the transition to low carbon energy systems. Blockchain technology is a digital technology that distributes data structures and prevents information tampering through anti-counterfeiting traceability technology. With the development and maturity of blockchain technology application, the technology has begun to disrupt various industries and business models, and the field of green energy is no exception. Energy companies around the world have begun to explore the use of blockchain technology in green energy project financing, supply chain asset management, and other applications [

42]. Energy service companies are using blockchain technology to reduce the complexity of energy performance contracts. Pun et al. (2021) [

43] studied consumer acceptance of blockchain technology. Research shows that consumers pay attention to a product’s digital footprint. Blockchain can meet the needs of users and improve social welfare. Shen et al. (2022) [

44] adopted blockchain to help customers identify the quality of products in order to reduce the price squeeze of counterfeit products on genuine ones.

Blockchain technology can also increase the transparency of information and thus increase consumers’ willingness to pay. Fan et al. (2022) [

45] found that blockchain technology can improve consumers’ purchase utility and realize Pareto improvement of all staff in the supply chain. Another scholar introduced blockchain technology to improve consumers’ understanding of online products based on the competition between offline and online platforms. Shen et al. (2021) [

46] considered the interaction between consumers’ willingness to pay and privacy concerns based on the application of blockchain technology.

To sum up, China’s energy sector is undergoing a green transformation and faces the challenge of embedding green energy production models into primitive industry systems. Blockchain is a technological solution to issues such as data transparency, and it improves process efficiency by providing a decentralized concept of authority [

47]. Blockchain is gradually becoming a technology enabler for the green transformation of enterprises, thus creating a win-win situation for all stakeholders. This is different from the study of blockchain technology in supply chain management discussed above. However, the green energy saving transformation of enterprises involves multiple stakeholders who have different energy baseline data, costs, expenses, and requirements of energy-saving levels achieved, resulting in disputes among stakeholders. This paper considers how blockchain technology can improve the problem of product green information asymmetry and introduces the variables of consumers’ experience of product digital information.

2.3. The Relationship between Blockchain and Green Energy System

The energy industry is a very large and complex industry, and almost all industries are built on the basis of energy industry. However, the scale and complexity of the energy industry brings problems, such as opaque data. In a traditional energy system, all coordination and management decisions are centralized on a single server or aggregator, with a central authority or entity required to process information, accounts, and payments. The centralized method has a single point of failure which seriously threatens the availability and reliability of the system. The application of blockchain technology solves part of the problem for the energy industry.

Blockchain technology provides transparent data between participants to help them understand the movement of the energy market. In April 2018, Chile’s National Energy Board announced the launch of an energy-focused blockchain project. Governments will use the Ethereum blockchain to record, store and track energy data. We can use smart contracts to sell excess renewable energy to other network participants, enabling peer-to-peer trading of energy. Currently, the world’s more well-known projects are Power Ledger, Greenium, and Rowan Energy. In 2020, Power Ledger announced a sustainable project to build an apartment and a blockchain platform with 39 apartments. The platform will be equipped with solar rooftop photovoltaics and local battery storage, allowing apartment owners to use it to sell excess solar energy they generate back into the grid.

2.4. The Relationship between Blockchain Technology and Bank Green Credit

In recent years, China has been increasing its financial support for green transformation. According to data released by the People’s Bank of China, by the end of 2022, the balance of green loans was 22.03 trillion yuan, up 38.5% year on year. The stock of green bonds reached 1.5 trillion yuan, up 32.7% year on year. Green credit is a typical green finance policy. Banks will consider the business environment as an important consideration when making loans rather than simply focusing on financial solvency [

48]. It is understood that in order to solve the green transformation loan problem of Jinyuan new materials company, the Bank of Communications won the policy support of equipment renewal and re-loan and gave the preferential interest rate of 3.2%. China’s carbon emission dual control index requirements, high energy consumption, and high carbon emission projects will make it difficult to obtain preferential policies and financial support from banks. The Industrial and Commercial Bank of China has built a comprehensive green credit framework, offering a portfolio of special loans to environmentally friendly enterprises.

However, the low level of green data sharing and application is one of the problems limiting financial institutions to carry out green transformation credit and green finance. According to the ESG Information Database of Yong ‘an Enterprises, the proportion of A-share listed enterprises issuing ESG reports is 32.81%, among which 323 enterprises carry out carbon emission measurement and disclose specific data, accounting for only 7.19% of the A-share market. Carbon emission measurement is still not widely adopted as the first step in energy conservation and emission reduction. At present, finding out their own carbon emissions, and establishing carbon emission tracking and management framework, are the basic work of enterprises’ green development road.

At present, the rapid transaction through blockchain technology has gradually become the main driving force of the traditional banking revolution [

49]. The World Economic Forum estimates (2015) [

50] that by 2025, 10% of global GDP will be stored on blockchain-related technologies. Hossein (2018) [

51] discusses the impact of blockchain technology on bank data analysis from the perspective of banks, and shows the importance of signal extraction for the banking industry. Studies have shown that blockchain technology can provide banks with the right to verify data consistency and access data in real time [

52]. Based on this, bank green credit embedded with blockchain technology will realize green data sharing, real-time monitoring of corporate carbon emissions, and break through the financing difficulties of green transformation enterprises.

4. There Is No Underlying Model of Blockchain

4.1. Situation of Cooperative Game

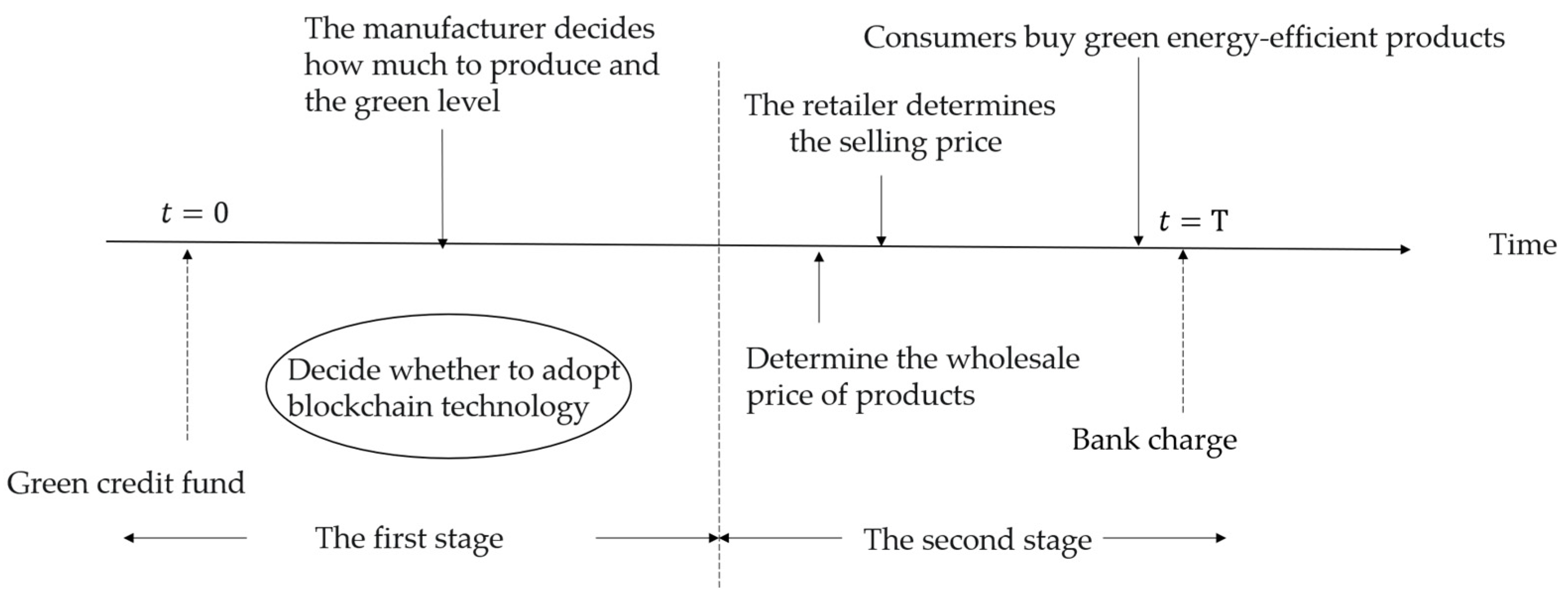

Manufacturers borrow from banks to invest in green production. In the first stage, the retailer determines the optimal wholesale price by knowing the greenness level of the product and placing an order with the manufacturer based on actual market demand. This section examines how cash-strapped manufacturers complete green production through financing. In order to complete the production of green products, the manufacturer needs to apply for a loan from the bank, and the loan amount is

. Manufacturers in a green energy-efficient supply chain facing financial constraints first determine their level of green effort before production and apply for loans. If the loan application is approved, the supplier decides on the production quantity

and the retailer decides on its own order quantity

. After that, the manufacturer will complete production and deliver the product. In this section, we mainly study supply chain equilibrium solution and revenue, retailer profit, and manufacturer profit under the cooperation game between manufacturers, retailers, and the Stackelberg game. In the green energy-efficient supply chain, the profit function of the manufacturer and the retailer is:

The manufacturer’s optimization goal is

Proposition 1. Under the manufacturer financing model, the optimal solution exists, and the optimal solution is.

In the green credit financing scenario, cash-strapped manufacturers borrow from banks to invest in green production. According to the total cost of green production, the manufacturer must obtain a loan from the bank. Manufacturers receive payments from retailers during the last part of the selling season. If the manufacturer’s income cannot pay the loan and interest, the manufacturer will go bankrupt and lose all income. Thanks to green investments, manufacturers can benefit from multiple rounds of trade. However, in the one-off green investment, the decision-making of supply chain members remained stable because no new members were involved. Therefore, we assumed a single cycle in this study, which is widely used in the literature of green energy-efficient supply chain management. Manufacturer’s expected profit:

Lemma 1. Proposes a method to determine the manufacturer bankruptcy threshold.

On this basis, Proposition 1 was put forward to demonstrate the manufacturer’s optimal joint decision on production quantity and greenness level.

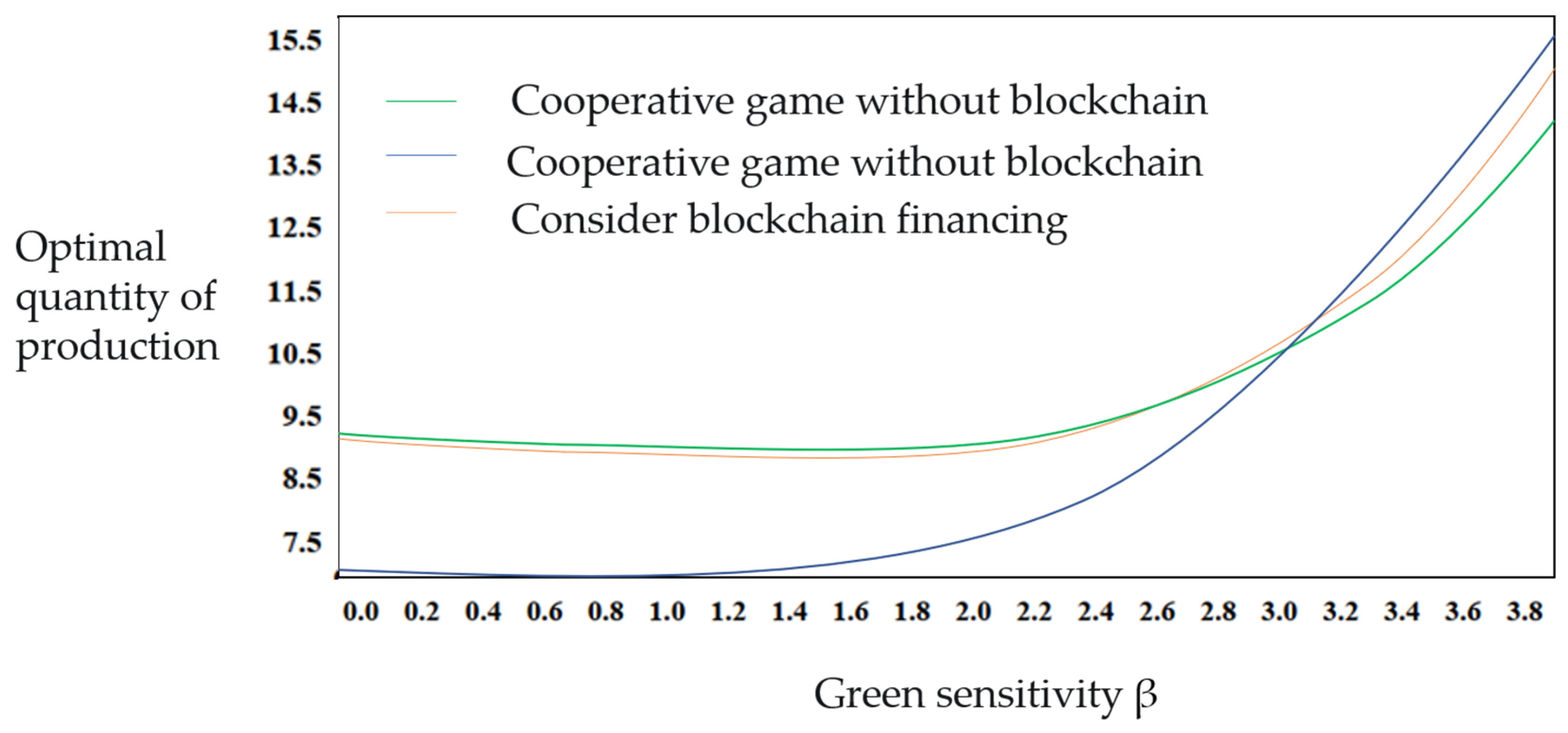

Proposition 2. Given the interest rate and wholesale price, (1) the manufacturer’s optimal production quantity decision is , green degree of decision making for . (2) increases with the increase of decreases with , and is not affected by . (3) decreases with increase.

It can be seen that the output of manufacturers was affected by the subsidy rate and the emission reduction cost factor. The higher the subsidy rate, the higher the output, while the higher the cost of emission reduction, the lower the output.

We assume that the environmental damage caused by cumulative carbon emissions is a linear function of

, denoted as alpha

. Carbon emissions will accumulate over time, then

is a continuous function over time. Therefore, the green emission reduction performance function can be expressed as

where

is the total output of the manufacturer and

is the total amount of green credit subsidies. Following that, the optimization objectives of emission reduction performance are:

s.t.

Consider the green credit subsidy of banks as a linear function of cumulative emissions, i.e.,

where

represents the cumulative impact of each additional unit of carbon emissions on total performance.

The green technique is called the feedback Nash equilibrium solution. The equilibrium solution varies with time and is related to emission accumulation. The enterprise green investment cost is negatively correlated with the enterprise carbon emission factor. That is, the higher the emission reduction efficiency, the greater the demand for green technology. In addition, the investment cost of enterprises is also related to the green price sensitivity of consumers. The more sensitive users are to price, the greater the demand of enterprises for green emission reduction technologies. In addition, emission reduction cost coefficient and pollution cost coefficient also affect the optimal green input.

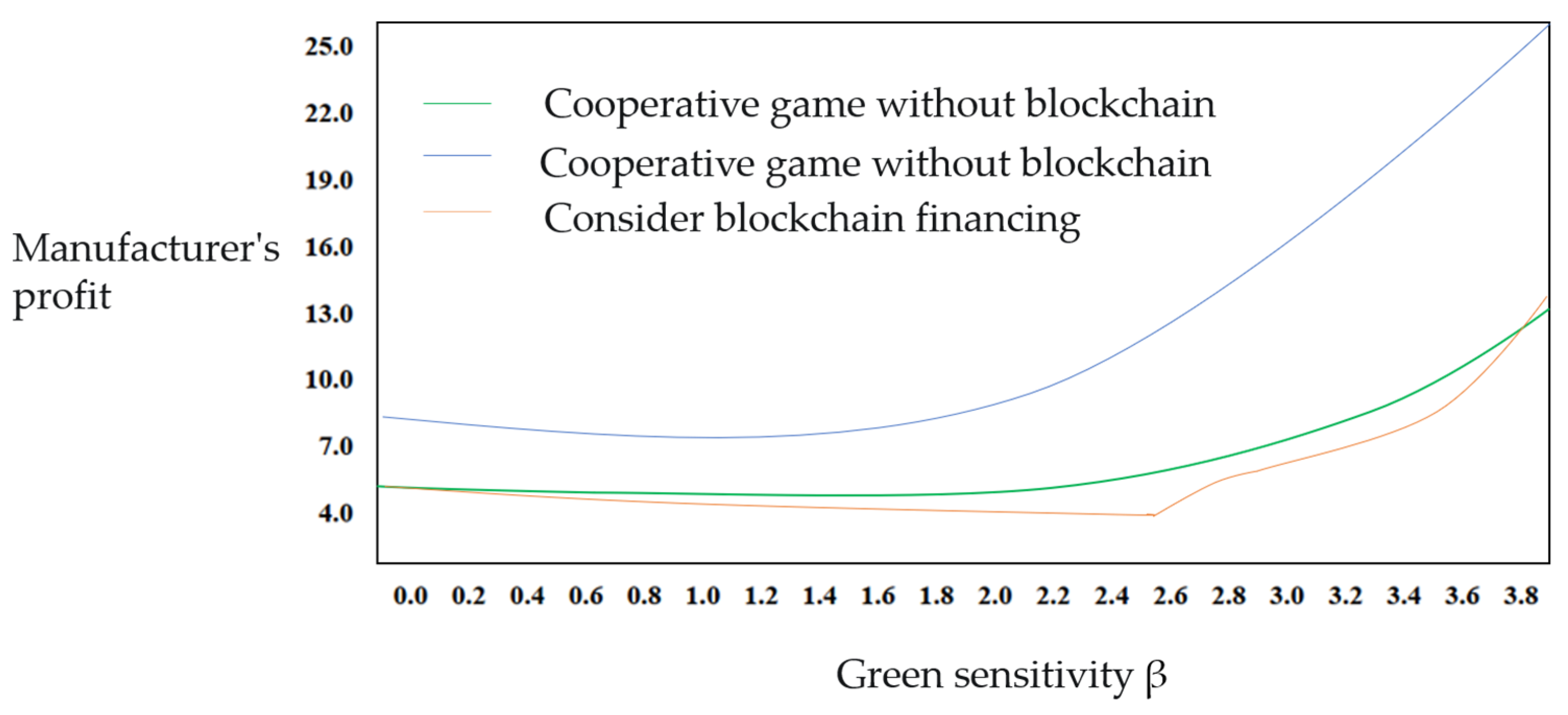

Under green credit financing, part (1) of Proposition 1 shows that the manufacturer’s optimal output depends on unit production costs, retailers’ wholesale prices, bank interest rates, and bankruptcy risk. Parts (2) and (3) of Proposition 1 show that retailers can induce financially constrained manufacturers to raise their greenness level and produce more products by raising wholesale prices. In addition, when consumers become more sensitive to green, manufacturers will have an incentive to increase production and greenness levels due to increased market demand. However, when the green cost factor of ν increases, manufacturers will reduce the output and greenness level due to the increase of greening cost. In addition, when the initial capital of the manufacturer increases, the manufacturer reduces production due to the limited liability of the cash-strapped manufacturer to the bank and the repayment of loans and interest. If the manufacturer’s income fails to cover the interest and loans, the manufacturer will declare bankruptcy and lose all initial funding. In other words, the more initial capital a manufacturer has, the more it loses. Therefore, as initial funding increases, manufacturers may make more conservative decisions on production volumes to avoid losing all of their initial funding.

For manufacturers seeking to maximize profits, higher interest rates increase the risk of bankruptcy. However, the manufacturer’s radical decision may lead to a number of legal and ethical issues that could be explored in future research. Retailers set wholesale prices based on the manufacturer’s response to production volume and greenness, aiming to achieve the maximum desired profit. Retailers’ expected profits are as follows:

Proposition 3. Under the condition of green credit financing, the optimal wholesale price determined by the retailer satisfies the following equation.

The optimal wholesale price of the retailer under green credit financing is more complex than that under the benchmark. Retailers take into account manufacturers’ practices, greening decisions, and bankruptcy thresholds when determining wholesale prices. Recalling part (3) of Proposition 1, with a given wholesale price, manufacturers make more conservative decisions about how much to produce as initial funding increases. Therefore, retailers can spur cash-strapped manufacturers to greener production by raising wholesale prices.

Manufacturer’s carbon emission

is

is the shadow price of emissions when enterprises manufacture goods, and is the loss caused by cumulative increase of unit carbon emissions. Each additional unit of carbon emissions reduces the benefits of reducing emissions. Therefore, .

As can be seen from the above equation, there is not a simple linear relationship between green credit funds of banks and emission reduction.

When , the green transformation of production by manufacturers can rapidly reduce the carbon emission of enterprises. When , which means that relying only on manufacturers to make the green transition will not reduce emissions. With the addition of the bank’s green credit fund , manufacturers will gain new impetus for green emission reduction.

The cumulative carbon emission of the enterprise is

4.2. Stackelberg Game Situation

Cash-strapped manufacturers borrow from banks to invest in green production. Manufacturers, retailers, and banks make their own decisions. Before the start of the sales season, the bank first considers the manufacturer’s bankruptcy costs to determine the interest rate, for manufacturers engaged in green manufacturing enterprises to offer low preferential rates. By knowing the greenness level of the product, the retailer determines the optimal wholesale price and orders the manufacturer according to the actual market demand. Therefore, in the Stackelberg scenario, the product greenness information has vendor privacy. In order to obtain more favorable low interest rate and higher wholesale price from the bank, the manufacturer may lie about the greenness. At the end of the season, if the manufacturer has earned enough revenue, it pays back the loan to the bank, pays interest, and makes a profit. Otherwise, the manufacturer must pay the proceeds to the bank and declare bankruptcy. In this section, we focus on the manufacturers’ misrepresentation behavior, the impact of applying blockchain information on supply chain equilibrium and revenue, and the equilibrium strategy of the three players. For comparative analysis, the basic model under the green level information symmetry scenario without the application of blockchain technology is first presented.

When the product’s greenness information is asymmetric, the supplier may lie about the product’s greenness for its own benefit, that is, the announced greenness of the product is , where , while the actual green level of the product is e. The market demand function is modified to on the basis of the original. In the case of information asymmetry, the game model of supply chain members is:

The retailer’s revenue function is:

The optimal response function of retailers is:

Substituted into the decision function of the manufacturer, the optimal wholesale price can be obtained, and can be substituted into the optimal reflection function of the retailer. Then:

Retailers ordered more because suppliers lied about the greenness of their products. Due to the influence of greenness, the actual demand of the market will be less than the ordered quantity of the retailer, so the actual income of the retailer in this case is

The retailer’s and supplier’s earnings can be written as:

Therefore, it can be seen that manufacturers’ misreporting behavior can increase their own earnings and reduce retailers’ earnings.

In the Stackelberg game scenario, carbon emission performance is as follows:

However, , which means that with the addition of green credit funds, the proportion of capital in net profit increases. Manufacturers will blindly overproduce green products so that they squeeze, and retailers suffer.

5. Contains the Underlying Model of Blockchain

In this section, we will consider the adoption of blockchain technology for a green energy-efficient supply chain. Similar to

Section 4, we will analyze two cases of product green information withholding and non-withholding, namely cooperation game and Stackelberg game, to explore how blockchain technology affects green energy-efficient supply chain performance. This article uses the lower corner label “B” to indicate the case with blockchain.

Blockchain technology enhances transparency among members of the green supply chain by facilitating information sharing. Through blockchain technology, consumers can better understand the information of green products, prevent products from being “fake green”, and thus improve consumers’ purchase effectiveness. In order to characterize the impact of blockchain technology on demand, this section changes consumer demand to

Based on the 2030 Peak Carbon Action Plan, the integration of economic performance and environmental performance has become a consensus in practice. The application of blockchain technology can not only improve the financing predicament but can also help Chinese enterprises to break through the “green fortress” in international competition. Several scholars have shown that governments that adopt blockchain in their supply chains will reduce or even exempt companies from environmental taxes [

25]. Against this background, this paper assumes that when implementing blockchain technology, the bank lending rate in the profit function is set to 0.

Blockchain technology can not only eliminate the influence of the information asymmetry of upstream and downstream members of the green energy-efficient supply chain, but also its “consensus mechanism” can provide a real-time tracking function of the whole process of green products from development to delivery, realizing the information traceability of green products. However, blockchain technology can be expensive. It was assumed that the input cost of blockchain technology required for a unit product was θ. To ensure that vendors have an incentive to adopt blockchain, assume that a/b.

In decentralized decision-making, the application of blockchain technology can realize the sharing of product green information through the decentralization of information and can ensure that the true information of product green degree cannot be hidden through the “smart contract” mechanism embedded in blockchain technology. Therefore, in the application scenario based on blockchain technology, the game model of retailers and manufacturers is:

The retailer’s revenue function is:

The revenue function of the manufacturer is:

The retailer’s decision function can be written:

The optimal decision of the retailer is:

The system of equation above can be substituted into the decision function of the supplier to obtain the optimal wholesale price, and can then be substituted into the reflection function of the retailer in reverse, then:

Thus, the benefits of supply chain members are as follows:

Therefore, if the manufacturer adopts blockchain technology, the profit of the manufacturer and retailer can be expressed as:

With blockchain, the sequence of events is the same as without blockchain, except that the manufacturer needs to decide whether to adopt blockchain at the beginning of the first phase. To study the impact of blockchain technology on green energy-efficient supply chain financing this paper first deduces the optimal decision in the cooperative game scenario, then considers the optimal decision in the Stackelberg game.

After discussing the above two formulas separately, the conclusion can be obtained as shown in

Table 2.

Among them , .

For suppliers, there are

, which then make the difference between

and

respectively, available:

A discussion of the two formulas above leads to a conclusion, as shown in

Table 3.

Among them

,

. For suppliers, it is easy to know that

. Therefore, the difference between

,

, and

can be obtained:

A discussion of the two formulas above leads to a conclusion, as shown in

Table 4.

Among them , .

The research shows that the supplier’s false declaration of greenness will affect the wholesale price it sets, and the wholesale price after the application of blockchain technology is jointly determined by the input cost of blockchain technology per unit product. When suppliers misreport information, the actual order quantity of retailers will increase, but, affected by the level of green products, the actual demand of the market will decrease, which will lead to the decrease of retailers’ earnings, resulting in manufacturers’ encroachment on retailers’ earnings, leading to the instability of the supply chain. In the Stackelberg game, it is up to the manufacturer to decide whether to use the blockchain, and as long as the manufacturer is willing to use it, the retailer will benefit as well. In addition, when retailers can obtain large profits by using blockchain technology, they can jointly promote blockchain technology by subsidizing manufacturers.

The manufacturer’s carbon emissions

are as follows:

Compared with the equation without considering blockchain technology, it can be seen that under the same market environment, the optimal carbon emission based on blockchain technology is lower than the optimal carbon emission . This can demonstrate the advantages of blockchain technology.

It is worth noting that there is a certain contradiction between the profit target of enterprises’ green transformation and the emission reduction target. When the coverage of green funds of banks is large, manufacturing enterprises will have a larger income, but there will be an extreme situation of overproduction, leading to a decline in emission reduction performance.

According to the

, we can obtain the optimal green credit financing range of banks:

Within this range, there is a green credit financing quantity satisfying the optimal emission reduction performance and the optimal green supply chain performance, namely , to ensure that corporate profit targets and emissions reduction targets are met simultaneously.

7. Conclusions

This paper studied a green energy-efficient supply chain system composed of manufacturers of green and energy-saving products, retailers, and banks. We derived a green energy-efficient supply chain financing equilibrium with blockchain technology and compare it with a benchmark without blockchain technology. From the analysis and numerical results, we obtained the management inspiration of manufacturers and retailers. First, manufacturers should opt for green investments, even if that makes financial constraints even more severe. The adoption of blockchain can achieve Pareto improvement of green energy-efficient supply chain members. Manufacturers have an incentive to adopt blockchain if the cost of blockchain investment falls below a certain threshold and consumer green sensitivity increases below that threshold.

When suppliers falsely report the green degree, the wholesale price they set will be affected, and the actual order quantity of retailers will increase. However, affected by the level of green products, the actual demand of the market will decrease, thus leading to the decrease of the retailer’s income. When there is a wide range of demand for products, the risk of bankruptcy for cash-strapped manufacturers is reduced. Setting higher wholesale prices and encouraging cash-strapped manufacturers is beneficial for retailers.

There is not a simple linear relationship between bank green credit funds and emission reduction. With the addition of the bank’s green credit fund T, manufacturers will gain new impetus for green emission reduction. Considering the manufacturer’s false report, with the addition of green credit funds, the proportion of capital in net profit increases. Manufacturers will blindly overproduce green products, making green products squeezed.

In the same market environment, the optimal carbon emission based on blockchain technology is lower than the optimal carbon emission without considering blockchain technology, which reflects the advantages of blockchain technology. In practice, it is largely up to manufacturers to decide whether to use blockchain, and as long as manufacturers are willing to use it, retailers will benefit as well.

It is worth noting that there is a certain contradiction between the profit target of enterprises’ green transformation and the emission reduction target. When the coverage of green funds of banks is large, manufacturing enterprises will have a larger income, but there will be an extreme situation of overproduction, leading to a decline in emission reduction performance. On this basis, the paper deduces that there is a green credit financing quantity satisfying the optimal emission reduction performance and the optimal green supply chain performance, , to ensure that corporate profit targets and emissions reduction targets are met simultaneously.

Some limitations of this paper can be considered in future research. First, like most studies, this study assumes that there is only one manufacturer, one retailer, and one bank in the supply chain financing system. However, according to the current globalization trend, a supply chain network consisting of any number of members is more realistic. However, it is difficult to derive an equilibrium strategy for a supply chain network with capital constraints. Therefore, this is a promising research direction. Second, it is an interesting perspective to explore the optimal point in time to identify green energy-saving supply chain members and provide useful decision-making insights. However, this is also difficult to solve because it requires complex calculations, so we leave this to future research. Third, we can further integrate consumer utility into our model to discuss the issue of retail pricing.