Does Environmental Regulation Promote Eco-Innovation Performance of Manufacturing Firms?—Empirical Evidence from China

Abstract

1. Introduction

2. Literature Review and Theoretical Background

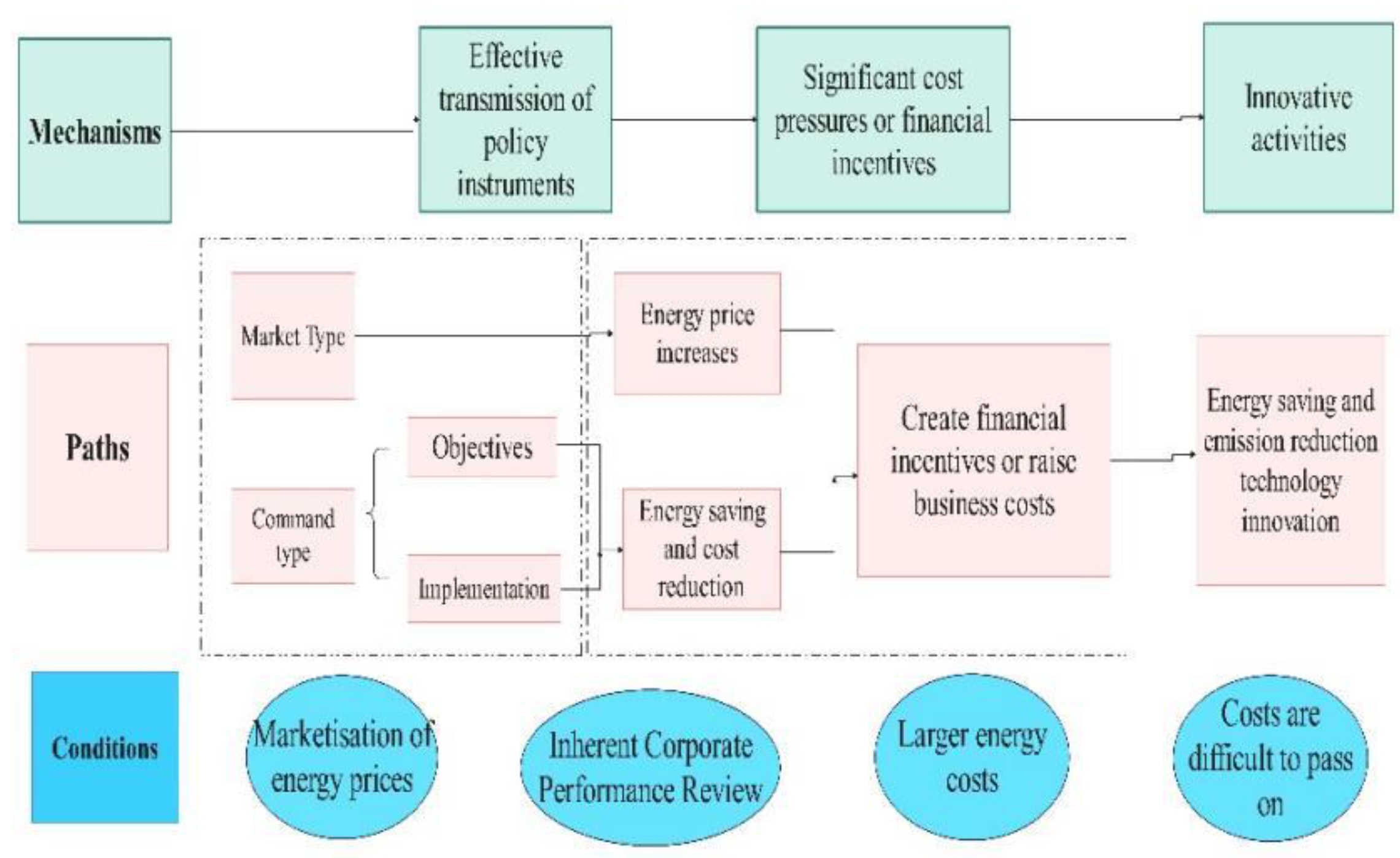

2.1. Eco-Innovation Performance and Environmental Regulation

2.2. Industry and Regional Heterogeneity of Environmental Regulatory Instruments

2.3. Industrial Clustering with Eco-Innovation Performance

3. Research Design

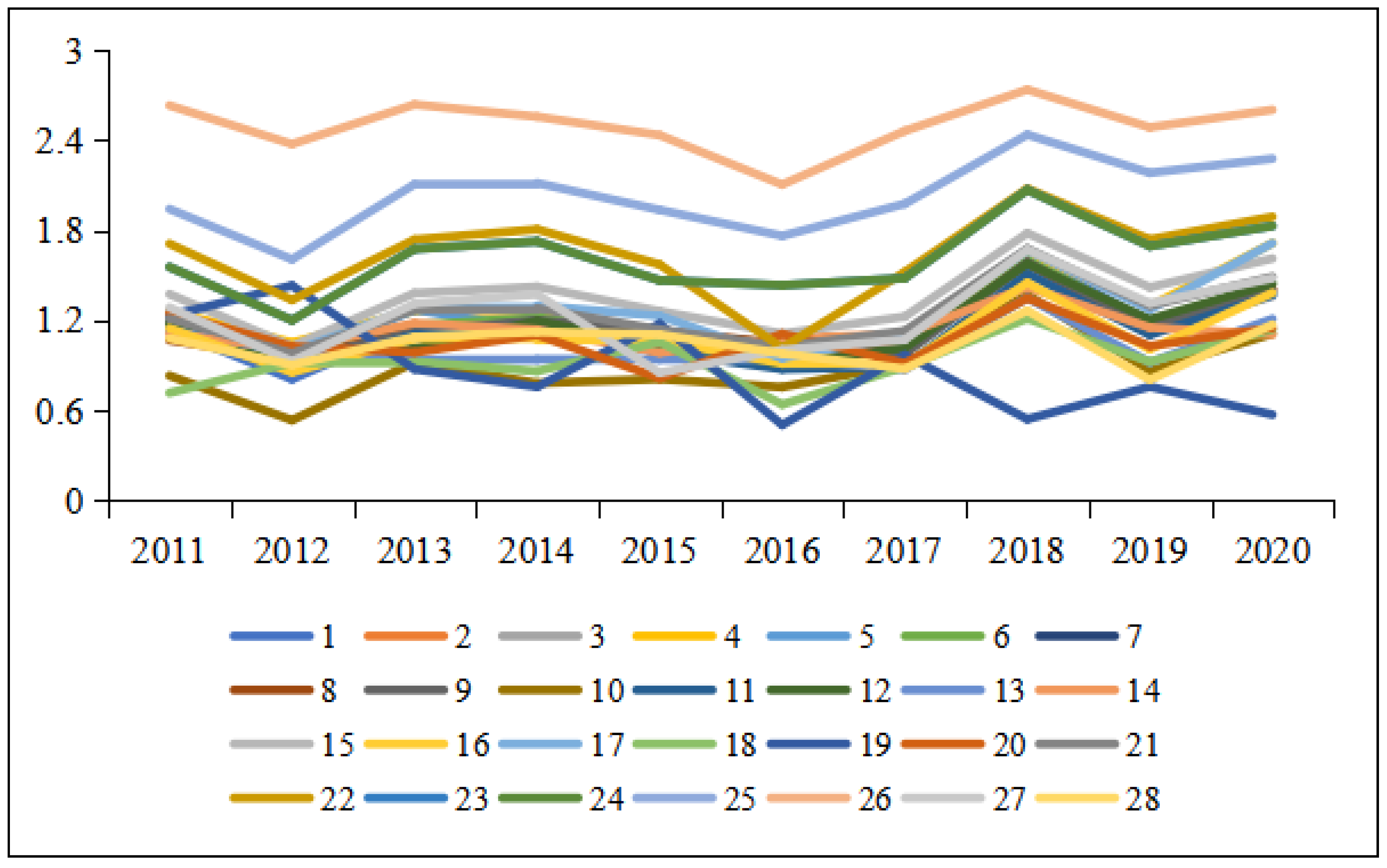

3.1. Solutions and Comparative Statistics

- Models

- 2.

- Variables

3.2. Data Sources

4. Results

4.1. Panel Regression

4.2. Threshold Model Test and Threshold Estimation

4.3. Mediation Effect

4.4. Robustness Test

5. Conclusions and Policy Suggestions

5.1. Conclusions

5.2. Policy Suggestions

5.3. Dicussion

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Lee, J.; Veloso, F.M.; Hounshell, D.A.; Rubin, E.S. Forcing technological change: A case of automobile emissions control technology development in the US. Technovation 2010, 30, 249–264. [Google Scholar] [CrossRef]

- Rubashkina, Y.; Galeotti, M.; Verdolini, E. Environmental regulation and competitiveness:empirical evidence on the Porter hypothesis from European manufacturing sectors. Energy Policy 2015, 839, 288–300. [Google Scholar] [CrossRef]

- Fussler&James. Environmental Regulation and Industrial Performance: Evidence from China; Mimeo: New York, NY, USA, 1996. [Google Scholar]

- Vollebergh, H. Impacts of Environmental Policy Instruments on Technological Change; OECD: Paris, France, 2007. [Google Scholar]

- Bergquist, A.K.; Söderholm, K.; Kinneryd, H.; Lindmark, M.; Söderholm, P. Command-and-Control Revisited: Environmental Compliance and Technological Change in Swedish Industry 1970–1990. Ecol. Econ. 2013, 85, 6–19. [Google Scholar] [CrossRef]

- Chang, C.H. The Influence of Corporate Environmental Ethics on Competitive Advantage: The Mediation Role of Green Innovation. J. Bus. Ethics 2011, 104, 361–370. [Google Scholar] [CrossRef]

- Park, Y.S. A Study on the Determinants of Environmental Innovation in Korean Energy Intensive Industry. Int. Rev. Public Adm. 2005, 9, 89–101. [Google Scholar] [CrossRef]

- Noail, Y.K.; Ryfisch, D. Multinational Firms and Internationalization of Green R & D: A Review of the Evidence and Policy Implications. Energy Policy 2015, 83, 218–228. [Google Scholar]

- Zheng, D.; Shi, M. Multiple Environmental Policies and Pollution Haven Hypothesis: Evidence from China’s polluting Indstries. J. Clean. Prod. 2017, 141, 295–304. [Google Scholar] [CrossRef]

- Wheeler, D. Racing to the bottom? Foreign investment and air pollution in developing contries. J. Environ. Dev. 2001, 10, 225–245. [Google Scholar] [CrossRef]

- Wagner, M. On the relationship between environmental management, environmental innovation and patenting: Evidence from German manufacturing firms. Res. Policy 2007, 10, 1587–1602. [Google Scholar] [CrossRef]

- Wurlod, J.D.; Noailly, J. The Impact of Green Innovation on Energy Intensity: An Empirical Analysis for 14 Industrial Sectors in OECD Countries. Energy Econ. 2018, 71, 47–61. [Google Scholar] [CrossRef]

- Porter, M.E.; Linde, C.V.D. Toward a New Conception of the Environment-Competitiveness Relationship. J. Econ. Perspect. 1995, 9, 97–118. [Google Scholar] [CrossRef]

- Bu, M.L.; Qiao, Z.Z.; Liu, B. Voluntary Environmental Regulation and Firm Innovation in China. Econ. Model. 2020, 89, 10–18. [Google Scholar] [CrossRef]

- Zhuge, L.Q.; Richard, B.F.; Matthew, T.H. Regulation and Innovation: Examining Outcomes in Chinese Polution Control Policy Areas. Econ. Model. 2019, 89, 19–31. [Google Scholar] [CrossRef]

- Shi, X.; Xu, Z. Environmental Regulation and Firm Exports: Evidence from the Eleventh Five-Year Plan in China. J. Environ. Econ. Manag. 2018, 89, 187–200. [Google Scholar] [CrossRef]

- Testa, F.; Iraldo, F.; Frey, M. The Effect of Environmental Regulation on Firms’ Competitive Performance: The Case of the Buliding and Construction Sector in Some EU Regions. J. Environ. Manag. 2011, 92, 2136–2144. [Google Scholar] [CrossRef] [PubMed]

- Steinhorst, J.; Matthies, E. Monetary or environmental appeals for saving electricity? Potentials for spillover on low carbon policy acceptability. Energy Pol. 2016, 93, 335–344. [Google Scholar] [CrossRef]

- Stucki, T.; Woerter, M.; Arvanitis, S.; Peneder, M.; Rammer, C. How different policy instruments affect green product innovation: A differentiated perspective. Energy Policy 2018, 114, 245–261. [Google Scholar] [CrossRef]

- Yuan, B.; Ren, S.; Chen, X. Can environmental regulation promote the coordinated development of economy and environment in China’s manugacturing industry? a panel data analysis of 28 sub-sectors. J. Clean. Prod. 2022, 149, 11–21. [Google Scholar] [CrossRef]

- Zaman, K.; Moemen, M.A. Energy Consumption, Carbon Dioxide Emissions and Economic Development: Evaluating Alternative and Plausible Environment Hypothesis for Sustainable Growth. Renew. Sustain. Energy Rev. 2022, 41, 237–247. [Google Scholar] [CrossRef]

- Yuan, R.L.; Wen, W. Managerial Foreign Experience and Corporate Innovation. J. Corp. Financ. 2019, 48, 752–777. [Google Scholar] [CrossRef]

- Yang, L.; Hamori, S. The role of the carbon market in relation to the cryptocurrency market: Only diversification or more? Int. Rev. Financ. Anal. 2023, 77, 101864. [Google Scholar] [CrossRef]

- Ren, Y.Y.; Zhang, G.L. Can city innovation dispel haze? Evidence from the perspective of spatial spillover. China Popul. Resour. Environ. 2021, 30, 111–120. [Google Scholar]

- Zhang, J.T.; Xu, Y.J. Environmental regulation, agricultural green TFP and grain security. China Popul. Resour. Environ. 2022, 29, 167–176. [Google Scholar]

- Ma, J.; Wang, G.J. Impact of environmental regulation on the upgrading of industrial structure: Empirical analysis based on China’s costal city systematic GMM. Sci. Technol. Manag. Res. 2019, 39, 163–169. [Google Scholar]

- Chen, Z.; Kahn, M.E.; Liu, Y.; Wang, Z. The consequences of spatially differentiated water pollution regulation in China. J. Environ. Econ. Manag. 2022, 88, 468–485. [Google Scholar] [CrossRef]

- Brunel, C.; Levison, A. Measuring the stringency of environmental regulations. Rev. Environ. Econ. Policy 2023, 10, 47–67. [Google Scholar] [CrossRef]

- Zhong, M.C.; Li, M.J.; Du, W.J. Can environmental regulation force industrial structure adjustment: An empirical analysis based on provincial panel data. China Popul. Resour. Environ. 2023, 25, 107–115. [Google Scholar]

- Fu, J.Y.; Li, L.S.A. case study on the environmental regulation, the factor endowment and the international competitiveness in industries. Manag. World 2010, 10, 87–98. [Google Scholar]

- Zhu, P.F.; Zhang, Z.Y.; Jiang, G.L. Empirical study of the relationship between FDI and environmental regulation: An intergovernmental competition perspective. Econ. Res. J. 2011, 46, 133–145. [Google Scholar]

- Li, L.; Tao, F. Selection of optimal environmental regulation intensity for Chinese manufacturing industry: Based on the green TFP perspective. China Ind. Econ. 2012, 5, 70–82. [Google Scholar]

- Porter, M.E. America’s Green Strategy. Sci. Ameracian 1991, 4, 168–264. [Google Scholar] [CrossRef]

- Chintrakarn, P. Environmental Regulation and U.S. Stata’s Technical Inefficiency. Econ. Lett. 2018, 100, 363–365. [Google Scholar] [CrossRef]

- Kemp, R.; Pontoglio, S. The Innovation Effects of Environmental Policy Instruments-a Typical Case of the Blind Men and the Elephant. Ecol. Econ. 2019, 72, 28–36. [Google Scholar] [CrossRef]

- Gray, W.B. The Cost of Regulation: OSHA, EPA and the Productivity Slowdown. Am. Econ. Rev. 1987, 77, 998–1006. [Google Scholar]

- Apay, E.; Buccola, S.; Kerkvliet, J. Productivity Growth and Environmental Regulation in Mexican and U.S. Food Manufacturing. Am. J. Agric. Econ. 2020, 84, 887–901. [Google Scholar]

- Ramanathan, R.; He, Q.; Black, A.; Ghobadian, A.; Gallear, D. Environmental regulations, innovation and firm performance: A revisit of the Porter hypothesis. J. Clean. Prod. 2017, 155, 79–92. [Google Scholar] [CrossRef]

- Ramanathan, R.; Black, A.; Nath, P.; Muyldermans, L. Impact of environmental regulations on innovation and performance in the UK industrial sector. Mangement Decis. 2019, 28, 299–312. [Google Scholar]

- Yang, L.; Wang, L.; Ren, X. Assessing the impact of digital financial inclusion on PM2.5 concentration: Evidence from China. Environ. Sci. Pollut. Res. 2022, 29, 22547–22554. [Google Scholar] [CrossRef] [PubMed]

- Brandt, L.; Biesebroeck, J.V.; Zhang, Y. Creative Accounting or Creative Destruction? Firm-Level Productivity Growth in Chinese Manufacting. J. Dev. Econ. 2019, 97, 339–351. [Google Scholar] [CrossRef]

- Lu, J.; Tao, Z. Trends and determinants of China’s industial agglomeration. J. Urban Econ. 2020, 65, 167–180. [Google Scholar] [CrossRef]

- Yuan, B.; Xiang, Q. Environmental regulation, industrial innovation and green development of Chinese manufacturing:Based on an extended CDM model. J. Clean. Prod. 2018, 176, 895–908. [Google Scholar] [CrossRef]

- Sun, L.Y.; Miao, C.L.; Yang, L. Ecological-economic efficiency evaluation of green technology innovation in strategic emerging industries based on entropy weighted TOPSIS method. Ecol. Indic. 2017, 73, 554–558. [Google Scholar] [CrossRef]

- Yang, L. Idiosyncratic information spillover and connectedness network between the electricity and carbon markets in Europe. J. Commod. Mark. 2022, 25, 100185. [Google Scholar] [CrossRef]

- Yang, L.; Xu, H. Climate value at risk and expected shortfall for Bitcoin market. Clim. Risk Manag. 2021, 32, 100310. [Google Scholar] [CrossRef]

- Cai, X.; Hamori, S.; Yang, L.; Tian, S. Multi-Horizon dependence between crude oil and East Asian stock markets and implications in risk management. Energies 2020, 13, 294. [Google Scholar] [CrossRef]

- Yang, L.; Yang, L.; Ho, K.C.; Hamori, S. Dependence structures and risk spillover in China’s credit bond market: A copula and CoVaR approach. J. Asian Econ. 2020, 68, 101200. [Google Scholar] [CrossRef]

- Xu, H. Regional R&D Investment and New Product Development Performance of Enterprises under the Background of Knowledge Activities. Open J. Soc. Sci. 2018, 3, 183–199. [Google Scholar]

- Yang, L. Connectedness of economic policy uncertainty and oil price shocks in a time domain perspective. Energy Econ. 2019, 80, 219–233. [Google Scholar] [CrossRef]

- Yang, L.; Yang, L.; Ho, K.C.; Hamori, S. Determinants of the long-term correlation between crude oil and stock markets. Energies 2019, 12, 4123. [Google Scholar] [CrossRef]

- Meadows, D.; Randers, J. The Limits to Growths; Universe Books: New York, NY, USA, 1972. [Google Scholar]

- Chassagnon, V.; Haned, N. The relevance of innovation leadership for environmental benefits:A firm-level empirical analysis on French firms. Technol. Forecast. Soc. Change 2015, 91, 194–207. [Google Scholar] [CrossRef]

- Andersen, M.M. Eco-innovation-towards a taxonomy and a theory. In Proceedings of the 25th Celebration DRUID Conference, Copenhagen, Denmark, 17–20 June 2008. [Google Scholar]

- Pereira, Á.; Vence, X. Key Business Factors for Eco-innovation: An Overview of Recent Firm-level Empirical Studies. Cuad. Gest. 2012, 12, 73–103. [Google Scholar] [CrossRef]

- Jaffe, A.B.; Newell, R.G.; Stavins, R.N. A tale of two market failures: Technology and environmental policy. Gen. Inf. 2021, 54, 164–174. [Google Scholar] [CrossRef]

- Requate, T.; Unold, W. Environmental policy incentives to adopt advanced abatement technology. Will the true ranking please stand up? Eur. Econ. Rev. 2022, 47, 125–146. [Google Scholar] [CrossRef]

- Coria, J.; Hennlock, M. Taxes, permits and costly policy response to technological change. Environ. Econ. Policy Stud. 2021, 31, 35–60. [Google Scholar] [CrossRef]

| Tier 1 Indicators | Tier 2 Indicators | Tier 3 Indicators | Unit | Indicator Type |

|---|---|---|---|---|

| Eco-innovation input | R & D investment | R & D staff ) | People | + |

| R & D staff ) | Million CNY | + | ||

| Investment in pollution control | ) | Million CNY | + | |

| Eco-innovation output | Economic benefit output | ) | Million CNY | + |

| ) | % | + | ||

| ) | Pieces | + | ||

| R & D output level ) | - | + | ||

| Environmental benefit output | ) | Million tons | - | |

| ) | Billion cubic meters | - | ||

| ) | Million tons | - | ||

| ) | % | + | ||

| Million t standard/billion CNY | - |

| Number | Segmentation | Number | Segmentation |

|---|---|---|---|

| 1 | Agricultural and sideline food processing industry | 15 | Pharmaceutical manufacturing |

| 2 | Food manufacturing | 16 | Chemical fiber manufacturing |

| 3 | Wine, beverage, and refined tea manufacturing | 17 | Rubber and plastic products industry |

| 4 | Tobacco product industry | 18 | Non-financial mineral products industry |

| 5 | Textile industry | 19 | Ferrous metal smelting and rolling industry |

| 6 | Textile and apparel industry | 20 | Non-ferrous metal smelting and rolling industry |

| 7 | Leather, fur, feathers (and their products), and footwear industry | 21 | Metal products industry |

| 8 | Wood processing and wood, bamboo, rattan, palm, and grass products industry | 22 | General equipment manufacturing |

| 9 | Furniture manufacturing | 23 | Specialised equipment manufacturing |

| 10 | Paper and paper products industry | 24 | Transportation equipment manufacturing |

| 11 | Printing and recording media reproduction industry | 25 | Electrical machinery and equipment manufacturing |

| 12 | Culture, education, industry, sports, and recreational goods manufacturing | 26 | Computer, communications, and other electronic equipment manufacturing |

| 13 | Oil, coal, and other fuel processing industries | 27 | Instrument manufacturing |

| 14 | Chemical raw materials and chemical product manufacturing | 28 | Other manufacturing industries |

| Explanatory Variable | |||

|---|---|---|---|

| RE | FE | OLS | |

| *** (−10.42) | *** (−10.45) | *** (−8.90) | |

| *** (4.20) | *** (4.20) | *** (3.75) | |

| *** (18.62) | *** (18.56) | *** (16.58) | |

| *** (5.34) | *** (5.37) | *** (4.46) | |

| *** (4.83) | *** (4.43) | *** (−5.61) | |

| Constant term | *** (−6.17) | *** (−6.73) | *** (−5.61) |

| Hausman test p-value | 0.7551 | - | - |

| Turning point | 0.0165 | 0.0166 | 0.0157 |

| 280 | 280 | 280 | |

| 0.6971 | 0.6972 | 0.6269 | |

| Explanatory Variable | |||

|---|---|---|---|

| RE | FE | OLS | |

| *** (−9.98) | *** (−10.14) | *** (−7.72) | |

| *** (5.69) | *** (5.80) | *** (4.40) | |

| *** (16.78) | *** (16.83) | *** (14.42) | |

| *** (4.85) | *** (4.88) | *** (4.05) | |

| *** (4.51) | *** (4.01) | *** (7.06) | |

| Constant term | *** (−5.66) | *** (−6.291) | *** (−5.12) |

| Hausman test p-value | 0.1516 | - | - |

| Turning point | 0.0027 | 0.0027 | 0.0025 |

| 280 | 280 | 280 | |

| 0.6371 | 0.6374 | 0.5508 | |

| Region | Midwest (FE) | East(FEE) |

|---|---|---|

| * (1.58) | * (0.70) | |

| ** (−2.05) | (−1.11) | |

| ** (1.99) | ** (2.12) | |

| * (−1.71) | (−1.49) | |

| *** (4.76) | *** (6.06) | |

| *** (4.76) | *** (6.06) | |

| *** (4.16) | *** (1.06) | |

| *** (−2.50) | (−4.87) | |

| 110 | 86 |

| Threshold Variables | ||||||

|---|---|---|---|---|---|---|

| Yangtze River Delta City Cluster | Single-threshold test | 26.07 (0.1007) | 11.31 (0.6433) | ** (0.0167) | ** (0.0362) | 15.01 (0.2833) |

| Double-threshold test | - | - | * (1457.59) | (0.3167) | - | |

| ) (corresponding actual value) | - | - | (45002) | 9.2199 (10112) | - | |

| Middle Reaches of Yangtze River City Cluster | Single-threshold Inspection | ** (0.0103) | * (0.0833) | ** (0.0333) | 19.31 (0.1200) | 15.38 (0.1833) |

| Dual-threshold inspection | 17.74 (0.1067) | * (0.0600) | 11.78 (0.3133) | - | - | |

| Three-threshold tests | - | 8.91 (0.17467) | - | - | - | |

| ) (corresponding actual value) | 3.4557 (−13.32) | 6.2265 (506) | 9.5122 (9435) | - | - | |

| ) (corresponding actual value) | - | 6.7093 (820) | - | - | - | |

| Chengdu–Chongqing City Group | Single-threshold inspection | 8.77 (0.3933) | 11.68 (0.1900) | 14.15 (0.1600) | 11.83 (0.1833) | 6.20 (0.6167) |

| Dual-threshold inspection | - | - | - | - | - | |

| ) (corresponding actual value) | - | - | - | - | - |

| Threshold Variables | ||||||

|---|---|---|---|---|---|---|

| Yangtze River Delta City Cluster | Single-threshold test | 26.07 (0.1007) | 11.31 (0.6433) | ** (0.0167) | ** (0.0362) | 15.01 (0.2833) |

| Double-threshold test | - | - | * (1457.59) | (0.3167) | - | |

| ) (corresponding actual value) | - | - | (45,002) | 9.2199 (10,112) | - | |

| Middle Reaches of Yangtze River City Cluster | Single-threshold inspection | ** (0.0103) | * (0.0833) | ** (0.0333) | 19.31 (0.1200) | 15.38 (0.1833) |

| Dual-threshold inspection | 17.74 (0.1067) | * (0.0600) | 11.78 (0.3133) | - | - | |

| Three-threshold tests | - | 8.91 (0.17467) | - | - | - | |

| ) (corresponding actual value) | 3.4557 (−13.32) | 6.2265 (506) | 9.5122 (9435) | - | - | |

| ) (corresponding actual value) | - | 6.7093 (820) | - | - | - | |

| Chengdu–Chongqing City Group | Single-threshold inspection | 8.77 (0.3933) | 11.68 (0.1900) | 14.15 (0.1600) | 11.83 (0.1833) | 6.20 (0.6167) |

| Dual-threshold inspection | - | - | - | - | - | |

| ) (corresponding actual value) | - | - | - | - | - |

| Variable | Cofficient | Prob. |

|---|---|---|

| C | 0.224626 | 0.0005 |

| LQ(−1) | 0.713787 | 0.0000 |

| ERC | 0.026772 | 0.0093 |

| ERM | 0.561149 | 0.0367 |

| TRAN | 0.134464 | 0.0001 |

| EO | 0.012062 | 0.2103 |

| PRO | −0.004193 | 0.6840 |

| BA | 0.087433 | 0.2681 |

| R-squared | 0.982243 | |

| Adjusted R-squared | 0.979411 | |

| F-statistic | 346.8382 | |

| Prob (F-statistic) | 0.000000 | |

| Variable | Cofficient | Prob. |

|---|---|---|

| C | −11.83417 | 0.0000 |

| LQ | −0.558971 | 0.0215 |

| HCI | 1.117242 | 0.4781 |

| EO | 37.88712 | 0.0000 |

| RGDP | 1.498992 | 0.0367 |

| PRO | −0.053620 | 0.4220 |

| SIZE | 0.429312 | 0.0002 |

| R-squared | 0.984579 | |

| Adjusted R-squared | 0.982534 | |

| F-statistic | 481.5717 | |

| Prob (F-statistic) | 0.00000 | |

| Variable | Cofficient | Prob. |

|---|---|---|

| C | −12.16398 | 0.0000 |

| ERM | 0.130238 | 0.0203 |

| LQ | −0.512816 | 0.0155 |

| ERC | 1.355343 | 0.4008 |

| RD | 36.45062 | 0.0000 |

| RGDP | 1.540402 | 0.0000 |

| PRO | −0.061813 | 0.3627 |

| SIZE | 0.418076 | 0.0003 |

| R-squared | 0.984313 | |

| Adjusted R-squared | 0.982165 | |

| F-statistic | 468.3895 | |

| Prob (F-statistic) | 0.000000 | |

| TSLS | TSLS | TSLS | TSLS | GMM | GMM | |

|---|---|---|---|---|---|---|

| ** (38.81) | −253,277 (1.73) | |||||

| −0.090 (0.057) | * (1457.59) | |||||

| ** (273.53) | ||||||

| *** (75,004.8) | *** (43,061.9) | |||||

| *** (8.33) | *** (8.55) | *** (8.98) | *** (8.87) | *** (7.92) | *** (8.25) | |

| *** (0.0000) | *** (0.0000) | *** (0.0000) | *** (0.0000) | *** (0.0000) | *** (0.0000) | |

| * (24.56) | ** (0.31) | * (0.32) | ** (0.31) | *** (0.28) | ** (0.29) | |

| *** (2.94) | *** (2.42) | *** (2.42) | *** (2.39) | *** (2.30) | *** (2.25) | |

| *** (1.08) | *** (2.38) | *** (2.17) | *** (2.08) | *** (1.90) | *** (1.90) | |

| N | ||||||

| 0.25 | 0.24 | 0.22 | 0.22 | 0.22 | 0.18 | |

| F | 15.32 | 13.85 | 15.53 | 14.53 | ||

| P | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Wald test | No weak knowledge | No weak knowledge | No weak knowledge | No weak knowledge |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, J.; Hu, S.; Zhang, Z. Does Environmental Regulation Promote Eco-Innovation Performance of Manufacturing Firms?—Empirical Evidence from China. Energies 2023, 16, 2899. https://doi.org/10.3390/en16062899

Wang J, Hu S, Zhang Z. Does Environmental Regulation Promote Eco-Innovation Performance of Manufacturing Firms?—Empirical Evidence from China. Energies. 2023; 16(6):2899. https://doi.org/10.3390/en16062899

Chicago/Turabian StyleWang, Jieqiong, Shichao Hu, and Ziyi Zhang. 2023. "Does Environmental Regulation Promote Eco-Innovation Performance of Manufacturing Firms?—Empirical Evidence from China" Energies 16, no. 6: 2899. https://doi.org/10.3390/en16062899

APA StyleWang, J., Hu, S., & Zhang, Z. (2023). Does Environmental Regulation Promote Eco-Innovation Performance of Manufacturing Firms?—Empirical Evidence from China. Energies, 16(6), 2899. https://doi.org/10.3390/en16062899