1. Introduction

The world scientific community has demonstrated constant concern for issues related to the environment, either the undesirable impacts that economic activities cause, given that climate change arises from the emission of greenhouse gases or because of possible changes in the world energy matrix due to the future scarcity of the fossil energy sources that form the basis of the current matrix, thus pointing to the need for renewable energy sources. Approximately 87% of the fuel consumed in the world is of fossil origin: mineral coal, oil and natural gas [

1].

Although biofuels have gained strength as alternative sources of renewable energy, mainly due to their environmental benefits, it is considered necessary by Ferreira Filho and Horridge [

2] to take into account that the worldwide expansion of biofuel production has caused concerns about its impact on food safety and supply due to competition for agricultural land. Researchers have linked this competition to recent increases in food prices. França and Gurgel [

3] emphasize that the discussion about biofuels becomes even more heated when the issue of food security emerges. The evolution of food prices in the last ten years, mainly between 2005 and 2008, is a unanimous cause for concern, since food prices have risen dramatically around the world during this period.

In this context, fuel ethanol is the main biofuel globally. Thus, it becomes necessary to conduct further studies related to development of the ethanol market, since this has become an important topic in discussions regarding the global energy matrix. Such studies should aim to analyze how the effects of increased production are related to changes in the prices of agricultural commodities. To do so, studies should provide reasoning for the drafting of public policies that take into account not only environmental issues but also concerns with the increasing prices of food commodities, so that these commodities are more efficient in terms of supporting the production and commercialization of ethanol.

According to Cardoso and Bittencourt [

4], becoming more familiar with the ethanol market as well as the parameters of its short- and long-term demands is essential for the preparation of public policies, especially those related to reducing fossil fuel consumption. However, the literature on ethanol demand is still scarce compared to that for gasoline, which is to be expected due to its importance as a substitute for gasoline outside Brazil, even in the United States, which is its main consumer. Compared with gasoline, the market share of ethanol was 9.84% in 2016, according to USDOE data [

5].

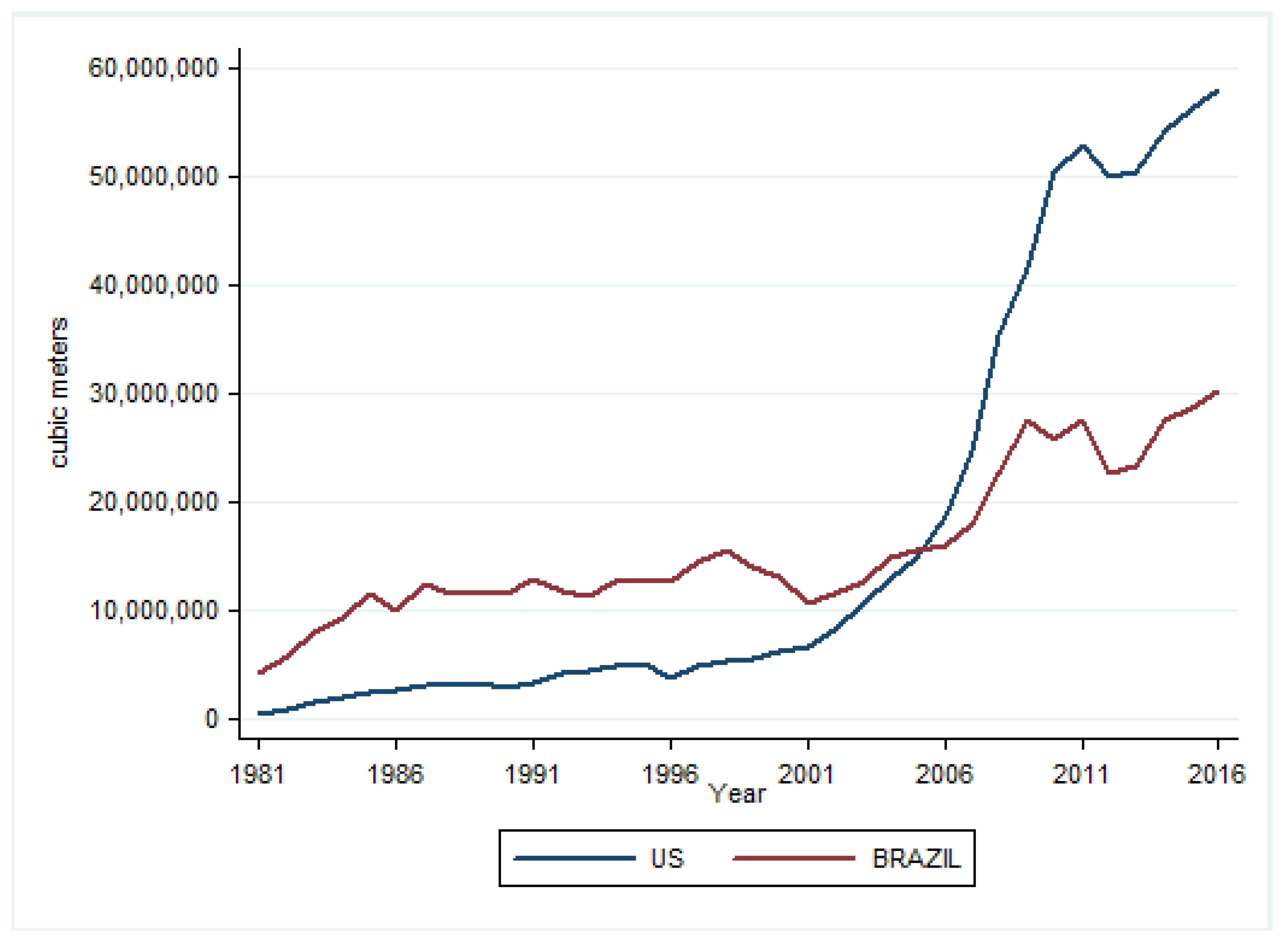

The ethanol market is led by the United States (US) and Brazil, which together account for approximately 85% of world production. According to data from the Renewable Fuels Association [

6], the world production of ethanol surpassed 100 million cubic meters in 2016, equivalent to more than 100 billion liters and ethanol production in the US, at around 58 million cubic meters, represents almost 58% of world production. In that same year, Brazil accounted for around 27% of global ethanol production, with its market share reducing 10 percentage points in ten years, while the European Union accounted for just over 5% of the total volume, followed by China (3.18%) and Canada (1.64%), which were the other main producers.

The Brazilian ethanol market is one of the main ethanol markets in the world due to characteristics and specificities in terms of production and potential related mainly to the input used: sugarcane. To meet the rising demand for ethanol in other markets such as the US, large amounts of corn, soybeans, sugarcane and other plants must be used for ethanol production [

7].

In this sense, Roberts and Schlenker [

8] estimated the effects of the ethanol mandate in the US, suggesting that it could lead to an increase in food prices of around 30% and an increase of about 2% in the global area used for production. The price transfer occurs mainly through the use of corn as an input for ethanol production in the US and also by the substitution of other cultures for the production of corn, considering the increase in the demand for corn and the subsidies offered by the North American government. The US ethanol mandate requires that about five percent of the world’s caloric production of corn, wheat, rice and soy be used for ethanol production.

In the US, ethanol is produced from corn. In 1986, around 3.5% of corn production was destined for ethanol production and in 2016 this percentage reached just over 36% (USDOE, 2017). This shows the change in the allocation of the share produced from corn used for ethanol production. The increase in ethanol production is shown in

Figure A2 and we highlight 2007 as the year in which the US became the world’s largest producer, maintaining this position until the end of the analyzed period. From 2007 onward, an upward trend in the prices of agricultural commodities can also be observed (

Figure A4).

Some studies have not found evidence that the price of ethanol significantly affects the price of agricultural commodities [

9,

10], with others pointing out that the increased price of commodities is related to the price of oil or that it has an influence on ethanol prices [

11,

12]; even so, there is empirical literature relating the increase in prices, or at least part of it, to the production of biofuels [

8,

13,

14,

15,

16,

17]. Considering such an effect, the present study aimed to analyze the ethanol market and agricultural commodities (basic food) to identify whether or not this effect exists more broadly by considering the two main players of the ethanol market. Hence, from the results, it should be possible to point out the socially optimal result in terms of impacts and/or the interrelation of these markets in the world population.

Thus, the central point this study makes, already pointed out as a possible alternative by other studies [

18], is how sugarcane-based Brazilian ethanol fits in this context either by enabling a real reduction in CO2 emissions or through benefits associated with not being directly related to the prices of the main food commodities in the world. The hypothesis that guides this study is that Brazilian ethanol may facilitate a reduction in or at least help to control the current price increases that affect the main agricultural commodities in the world (corn, wheat, rice and soy) via a reduction in the demand for corn used for ethanol production in the US.

To empirically analyze the relationship between ethanol production and the prices of agricultural commodities, this study adopted the methodology used by Roberts and Schlenker [

8]. The authors presented a supply and demand model to determine the elasticity of storable commodities worldwide. The estimated elasticity is used to assess the impacts of the 2009 Renewable Fuel Standard in the US on the prices of commodities, quantities and consumer surplus.

Thus, the focus of this study was to develop a synthesis of the global ethanol market, empirically identify the elasticity of supply and demand and evaluate the relationship between world ethanol production and the prices of both the main agricultural commodities (wheat, rice, corn and soy) and also commodities linked to this sector (sugarcane).

The empirical strategy adopted here is to analyze how Brazilian and North American production are interrelated with the world market, evaluating the relationship between world production and prices. Therefore, the objective is also to estimate the supply and demand elasticity for global ethanol production based on the proposed synthesis using caloric equivalence in the analysis of interactions between the ethanol market and the main agricultural commodities.

The main results for the world market indicate that ethanol production and demand exhibit an elastic response to changes in prices. World ethanol production did not have a significant relationship with food prices, but when evaluating the ethanol market and its interaction with the agricultural commodities market, the hypothesis that Brazilian ethanol is more weakly related to food prices was verified, thus representing new empirical evidence that is the main contribution of this research.

3. Results and Discussion

This section presents the results for the ethanol supply and demand models as well as for the relationship between the models and the food commodities market. The procedure adopted for estimations and the presentation of results (

Table 1,

Table 2 and

Table 3) consisted of initially analyzing the ethanol market in the US and Brazil separately, estimating (2SLS) the supply and demand equations of ethanol in the respective markets using the base input price (monetary values for quantity). In the analysis of the relationship with the agricultural market, the procedure considered the price according to caloric equivalence (monetary value per calorie). After individually analyzing the markets considering their specifications and caloric equivalence, a panel data model containing the 2SLS estimator was used by applying the Baltagi [

34] estimator (EC2SLS) to assess the market in an aggregate manner.

Table 1 shows the results for the US ethanol market. At first, models were estimated using ordinary least squares (columns 1 and 2) and, later, the instrumental variables estimator (columns 3 to 6).

As

Table 1 shows, the elasticity price coefficients of supply in non-instrumented models (panel A) are not statistically significant and present a sign contrary to the theory (indicating a negative trend in supply elasticity when the estimation does not consider endogeneity) in addition to being highly inelastic. However, by instrumenting the model, the price elasticity of supply becomes positive, indicating that increases in the price of ethanol (

and

) have a positive effect on its supply (models in columns 3 to 6). However, it becomes statistically significant only when considering caloric equivalence (columns 5 and 6). Thus, the supply response to price changes is elastic (1.98 and 1.25 for columns 3 and 4, respectively) for the model without caloric equivalence and inelastic (0.49 and 0.48 for columns 5 and 6, respectively) for the caloric equivalence models.

Therefore, increases in the price of ethanol lead to positive variation in the ethanol supply, which is in accordance with the theory and with the results found by Luchansky and Monks [

7]. The supply price elasticity for the US is estimated considering the price of ethanol paid to the producer and the subsidized price of ethanol (

and

, respectively), which results from government subsidies that are discounted in the final composition of the price.

Regarding the ethanol supply model, the positive and statistically significant relationship with the price of food (0.74 and 0.65), that is, increases in equivalent food prices (

) by 1%, leads to an increase in the supply of ethanol of approximately 0.74% (column 5, panel A) when keeping the other variables constant. This shows a strong positive relationship (they are positively correlated) with the prices of the other commodities under analysis, since for the price of corn, the main input of American ethanol, prices have a negative relationship with the supply of ethanol (−0.80 and −0.82, columns 3 and 4, respectively), even if they have no statistical significance, which makes the analysis limited in terms of these coefficients. However, they are in accordance with the economic theory and with the results reported by Luchansky and Monks [

7] for the price of corn (

) in the US.

With respect to the variable food prices (), there is a positive effect in relation to the increase in ethanol production; that is, there is a significant relationship between increasing food prices in the US and the expansion of North American ethanol supply.

As for the ethanol demand model for the US (

Table 1), as the demand is instrumentalized, the elasticity of demand becomes more elastic and negatively related (according to the theory) to the demand for ethanol and this is significant (with the exception of the model in column 6, which considers subsidized prices). This result was also observed by Luchansk and Monks [

7] upon analyzing the ethanol market in the US. The price elasticity of demand of −4.34 indicates that a 1% increase in the price of ethanol leads to a 4.34% decrease in the demand for ethanol, ceteris paribus. Therefore, the magnitude of the response to price changes is greater on the demand side.

There is a positive and statistically significant relationship between gasoline cross price elasticity in relation to ethanol demand, in addition to being elastic in both models (3.01 and 3.26 for models without and with caloric equivalence, respectively, considering the model of non-subsidized prices), showing that it is an adequate substitute in the North American market. Therefore, increases in the price of gasoline lead to a greater demand for ethanol.

The same effect also occurs with respect to increases in per capita income, which were shown to be statistically significant in almost all models (with the exception of column 5) in explaining variations in the demand for US ethanol. When the price of ethanol with subsidies is considered in the analysis (, columns 4 and 6), the results are not statistically significant with respect to the elasticity of demand price, which was expected since these are not the prices practiced in the market. Thus, they cannot explain the variations in ethanol demand.

The results presented in

Table 2 refer to the supply and demand model for the Brazilian ethanol market from 1981 to 2016. For the supply model (panel A), when the model is not instrumentalized, the price elasticity of supply (

) is inelastic, negative and not significant. However, after instrumentalization, it increases in magnitude, becoming elastic (3.5615 and 3.4183) and statistically significant for both models (with and without caloric equivalence: columns 3 and 4, respectively). The effect is in accordance with the theory, since the elasticity of supply is positive. Therefore, the price elasticity of supply indicates that changes in the price of ethanol have a greater effect on the supply side, with a 1% change in the price of ethanol leading to an increase of approximately 3.4% to 3.6% in the supply of ethanol.

In the supply model (panel A, columns 1 and 2), the results for the sugar and sugarcane price coefficients showed a negative relationship with the ethanol production in Brazil, as expected. In the Brazilian market there is the possibility of sugarcane (input) being used for the production of sugar or ethanol, this decision depends on the relative price ratio between the two products. When there is a favorable price ratio for sugar in relation to ethanol, it reduces the supply of ethanol. As an example, the results show if the price of sugar increases by 1%, the supply quantity of ethanol will reduce by approximately 0.92%, ceteris paribus.

For the caloric equivalence model, the variable for food prices () is found to be statistically significant in explaining the Brazilian ethanol supply, with a negative relationship. Therefore, the increase in the ethanol supply in the Brazilian market has a significant and negative relationship with the prices of the agricultural commodities under analysis, showing that when food prices increase by one percentage point and keeping the other variables constant, there is a reduction of 1.64% in the supply of ethanol.

Regarding the demand model (panel B,

Table 2), the price elasticity of demand has a positive relationship for the non-instrumentalized model (IV). However, for the models with IV, it becomes negative, which is in accordance with the theory, since price increases reduce the demand for ethanol. However, it was not significant and inelastic (−0.8548 and −0.3124) even in the calorie equivalence model (column 4).

For the cross price elasticity of gasoline, a contradictory result is observed in the caloric equivalence model: it was negative. However, for the model without equivalence, its coefficient is positive, indicating that increases in the price of the substitute good lead to a greater demand for ethanol, as expected. However, there the price increase is relatively low, since the response is inelastic (0.2683). This partially contradictory effect may result from a good portion of the ethanol produced and consumed in the Brazilian market being used together with gasoline (as a mixture), which results in these fuels being listed as complementary.

The demand response to variations in income is elastic (2.99 and 3.59), indicating that ethanol can be considered a normal good in Brazil. Therefore, the income elasticity shows that a 1% change in the income leads to an increase of approximately 2.99% to 3.59% in the demand quantity of ethanol. However, this relationship is not statistically significant. Population growth showed a positive relationship with ethanol demand quantity, but also not significant.

Finally, the variable created to capture the change in the ethanol demand pattern after the introduction of flex-fuel (D2003) cars was not significant, indicating that there is no change in the pattern. However, the results for demand models with IV did not present a statistical significance for the considered variables, which makes their analysis limited. However, a possible explanation for this is related to the time window (annual data), which presents limitations due to the period under analysis and data availability, which does not invalidate the economic sense of the results given the series available and used in the present analysis.

Table 3 shows the results for the ethanol supply and demand model for the world market. Based on the caloric equivalence, with respect to the variables linked to the analyzed agricultural commodities, all estimated models (

Table 3) use aggregation and are instrumented with caloric yield shocks induced by the specific climate of each country. The specifications and variables were presented in the previous section.

In panel A (column 2), the global ethanol supply model shows an elastic and significant response to changes in price (1.3464), which is in line with expectations, since price increases should lead to a greater quantity to be produced in the next period. The cross price elasticity with food was negative and without a statistical significance. The negative relationship of food prices () with the supply of ethanol is to be expected given the relationship with the input of this variable. However, this variable has no statistically significant relationship for explaining the variations in the supply of ethanol. Therefore, when the market is analyzed in an aggregate way, there is no significance of this variable in explaining the ethanol supply. Differently, when the markets are individually analyzed, there is an indication of price relationship between ethanol production and food prices, though with divergent signs for the US and Brazil.

Regarding the demand model (panel b, column 4), a statistically significant, highly elastic response (−5.35) to changes in price was found, showing a negative relationship between ethanol price and demand; that is, price increases lead to a reduction in consumption (demand), as theoretically expected. Therefore, an increase in the average ethanol price of 1% is associated with a reduction in ethanol demand quantity in the world of 5.35%.

The cross price elasticity of gasoline in relation to demand presents a positive (3.65) and statistically significant relationship, showing that gasoline is an adequate substitute for ethanol in the world market. Therefore, positive price variations of gasoline lead to a greater demand for ethanol consumption in replacing gasoline. In the same way, they increase the price of ethanol while reducing the demand for ethanol, increasing the demand for gasoline, in light of the substitution effect.

The demand elasticity income coefficient () also shows a positive sign (1.54), which is significant and greater than the unit, indicating that ethanol is a normal good for which the demand is positively affected by increases in income. For each rise of 1% in the average income, an increase of 1.54% is expected in the demand for ethanol in the world.

In summary, the results of ethanol supply and demand models show that when the ethanol market is analyzed in aggregate, ethanol production does not present a significant relationship with the price of agricultural commodities. When analysis is individually conducted for countries, such as in the case of the US, this relationship becomes significant and is positive; for Brazil, the relationship, besides being significant, is negative. This shows that positive variations in the price of food imply an increase in ethanol production in the US and, conversely, a reduction for Brazil. In this sense, increased use of Brazilian ethanol, to the detriment of US ethanol, could contribute to the existing price ratio, softening the impact on the price of food or even ceasing to be significant when the market is analyzed together.

4. Conclusions

This study aimed to estimate the supply and demand elasticity in global ethanol production based on the proposed synthesis using caloric equivalence in the analysis of interactions between the ethanol market and the main agricultural commodities.

An important growth in world production and demand for ethanol was identified for the period from 1981 to 2016, as well as a consolidation that occurred gradually in the US as the largest producer, consumer and exporter of ethanol in the world.

For the US ethanol market, ethanol production shows an inelastic relationship to price that is statistically significant when caloric equivalence is used in the analysis and the relationship is elastic and not significant when equivalence is not taken into account. A positive relationship was found in all instrumented models, indicating that changes in demand are reflected as price increases that are relatively larger than the actual changes in production (inelastic response). Although no significant relationship between corn price and ethanol production was found in the equivalence model, the production of ethanol shows a positive and significant relationship with the price of food. The price elasticity of demand indicates a strong relationship between consumption and the price of ethanol, as well as the elasticity of income. The results also indicate that gasoline is considered an adequate substitute for ethanol in the US market.

The Brazilian ethanol market showed statistically significant price elasticity in response to supply, indicating that the efforts dedicated to production are highly influenced by the predicted prices. The production (supply) of ethanol in Brazil shows a significantly negative relationship with the price of food, in contrast to that verified for production in the US. The demand is inelastic with respect to price and there is a negative, though insignificant, relationship between ethanol consumption (demand) and price. The cross price elasticity shows that gasoline is a substitute for ethanol in Brazil in the model without caloric equivalence. However, the coefficient is not statistically significant.

Among the main results for the global ethanol market, there is a statistically significant elastic response of ethanol production to changes in ethanol price. Therefore, changes in demand will mainly lead to changes in ethanol production instead of variations in the price of ethanol. Another interesting result is that world ethanol production is not statistically significantly related to food prices. On the demand side, the high price elasticity of demand suggests that ethanol prices have a strong effect on the quantity of demanded ethanol.

Therefore, regarding the study hypothesis that Brazilian ethanol may facilitate a reduction in or at least help control the price increases affecting the main agricultural commodities in the world by reducing the demand for corn for use in ethanol production in the US, it appears that this may be an alternative to possible public policies aimed at increasing use of Brazilian ethanol relative to North American ethanol; that is, larger-scale use of the Brazilian product to the detriment of the American product may have a comparatively lower impact on food price.

The contribution of this work is estimates of supply and demand elasticity at the international (worldwide) level for the ethanol market, thus representing a novel contribution not yet documented in the existing literature. Among the main results, it is worth highlighting that the results of this study demonstrate that the Brazilian product can have a possible positive influence if used on a larger scale and to the detriment of the North American product in the current scenario of rising prices of food commodities worldwide. In addition, regarding the ethanol market, there is an empirical contribution in relation to the calorie equivalence model, analyzed individually for Brazil and the US, with aggregation of the global ethanol market, which had so far been unexplored.

The results also contribute to future studies evaluating the effects of using more corn on Brazilian ethanol production, which still has a low percentage of corn use as input in ethanol production (less than 5% in 2019 [

35]). This reduced percentage of corn use in Brazilian ethanol production is one of the factors that explain why the ethanol production has no relation with the increase in the Brazilian food prices. This aspect is different from the American market, where most of the input used for ethanol production is corn.

Regarding possible limitations, future studies should strive for advances in relation to the amplitude of the global ethanol market in a way not limited only to the two main consuming and producing countries. However, for this, ethanol use should be increased in these markets on a continuous basis and there must be greater monitoring in terms of statistical information in the countries that have more recently become part of the market. Another possible limitation is the aggregation of food commodities in relation to the prices and equivalent yields (caloric) of the analyzed variables. However, an “approximate” dimension of the expansion of the world market and its interaction with the agricultural commodities market is becoming necessary.