The Implications of Triple Transformation on ESG in the Energy Sector: Fuzzy-Set Qualitative Comparative Analysis (fsQCA) and Structural Equation Modeling (SEM) Findings

Abstract

1. Introduction

- Exploring the implications of the triple transformation (people, business, and technology) for the energy sector, with a focus on ESG performance;

- Combining fuzzy-set qualitative comparative analysis (fsQCA) and structural equation modeling (SEM) to provide a comprehensive understanding of ESG performance in the context of triple transformation;

- Uncovering the fundamental drivers and mechanisms that influence ESG performance in the energy sector;

- Investigating synergies across various ESG dimensions.

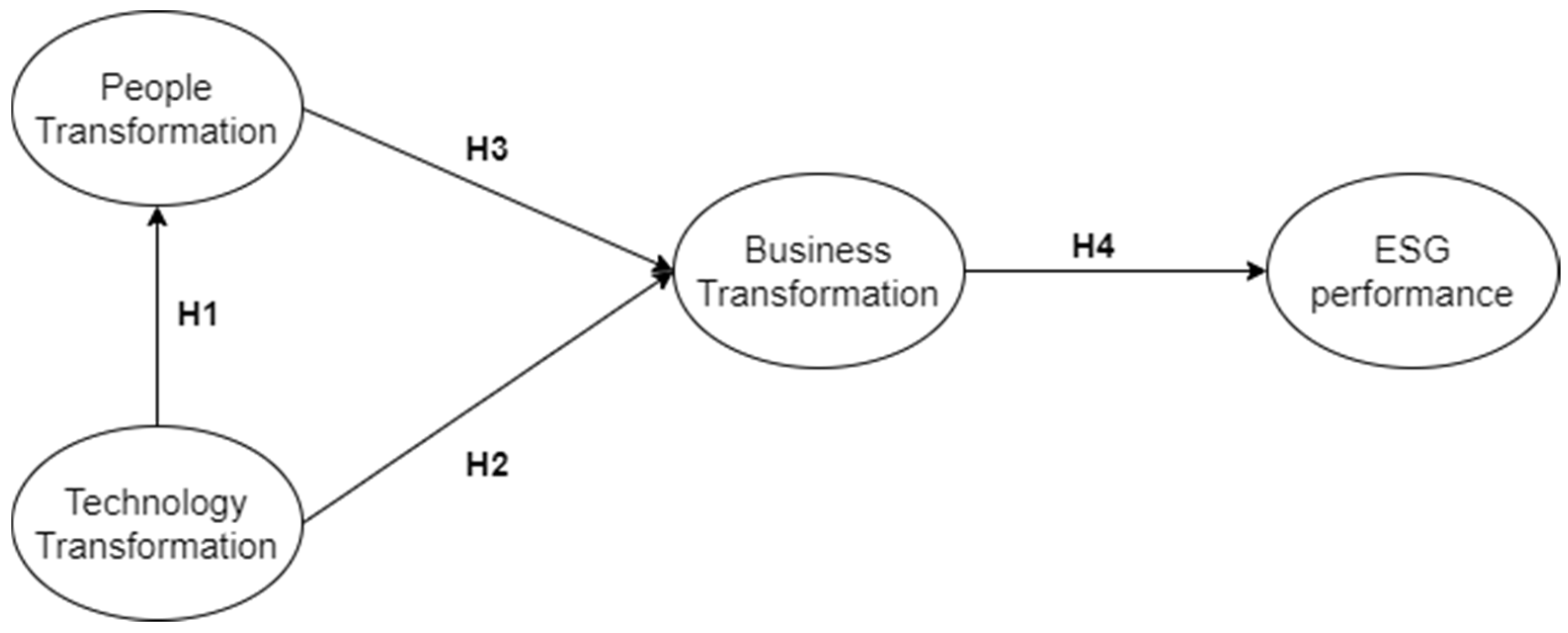

2. Literature Review and Hypothesis Development

2.1. Technology Transformation

2.2. People Transformation

2.3. Business Transformation

2.4. The Triple Transformation and Social Responsibility of the Energy Sector

3. Materials and Methods

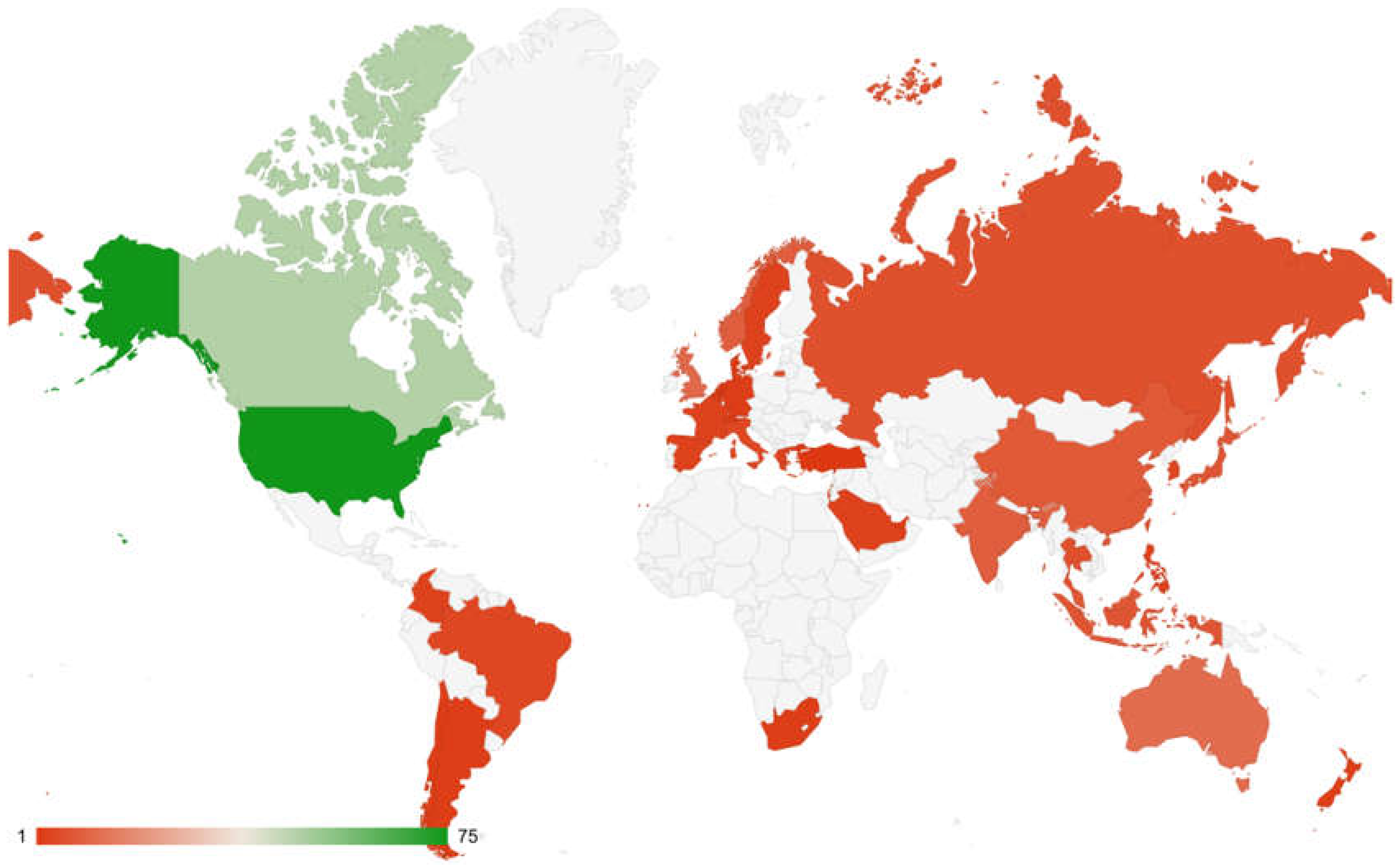

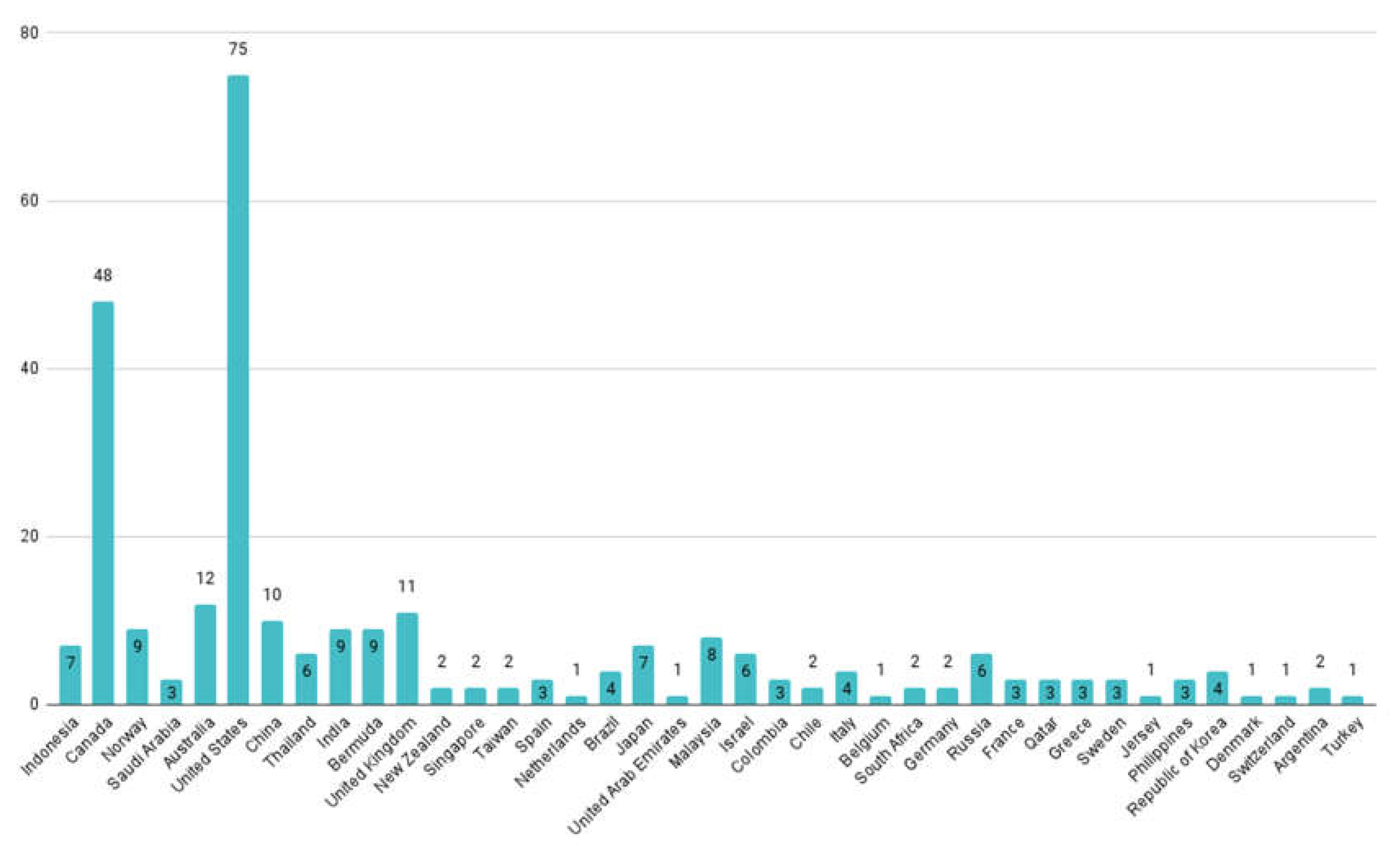

3.1. Data Collection and Analysis

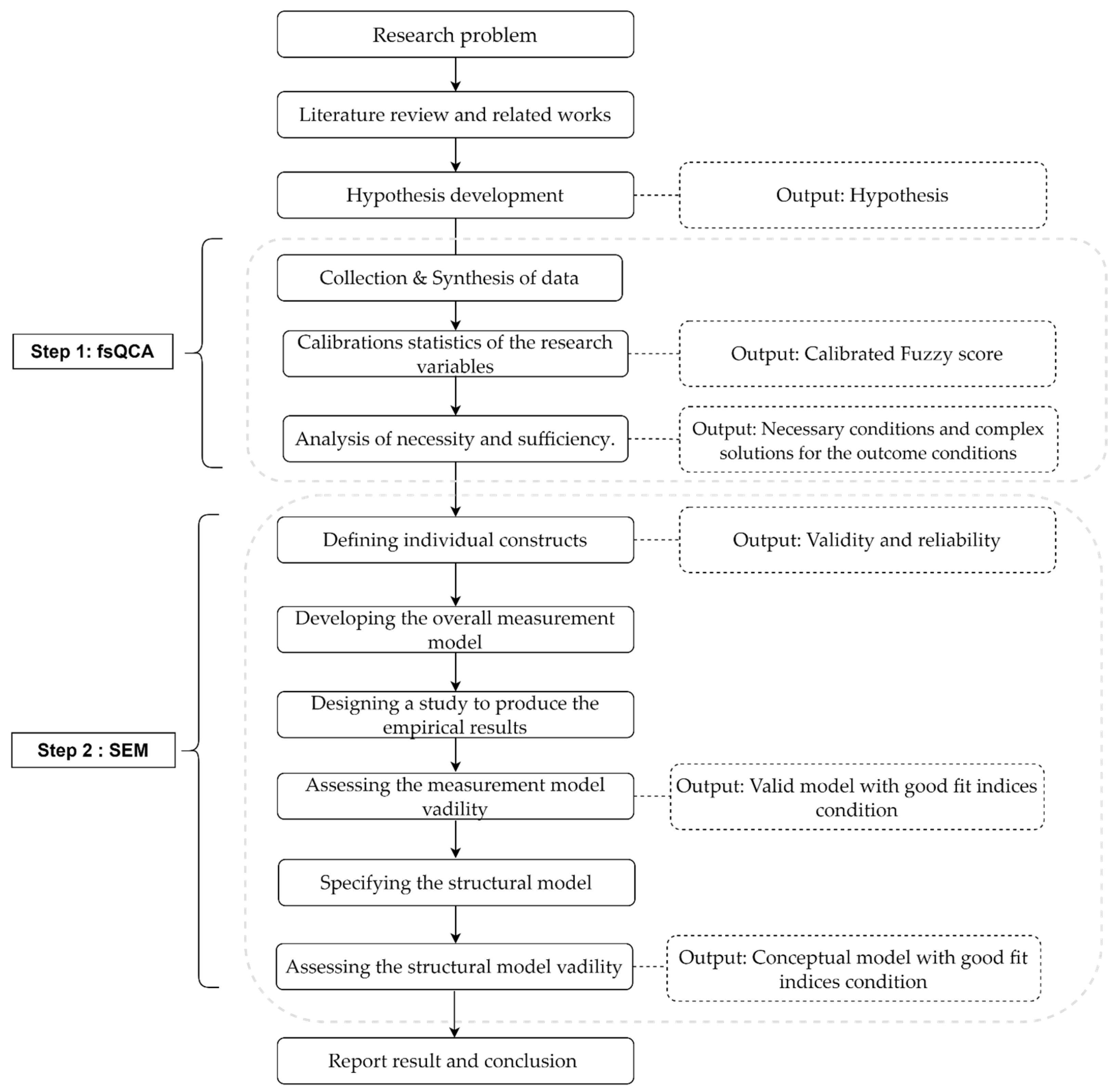

3.2. Fuzzy-Set Qualitative Comparative Analysis (fsQCA) and Structural Equation Modeling (SEM)

3.3. Asymmetric Analysis Using the fsQCA Approach

3.4. Symmetric Analysis Using the SEM Approach

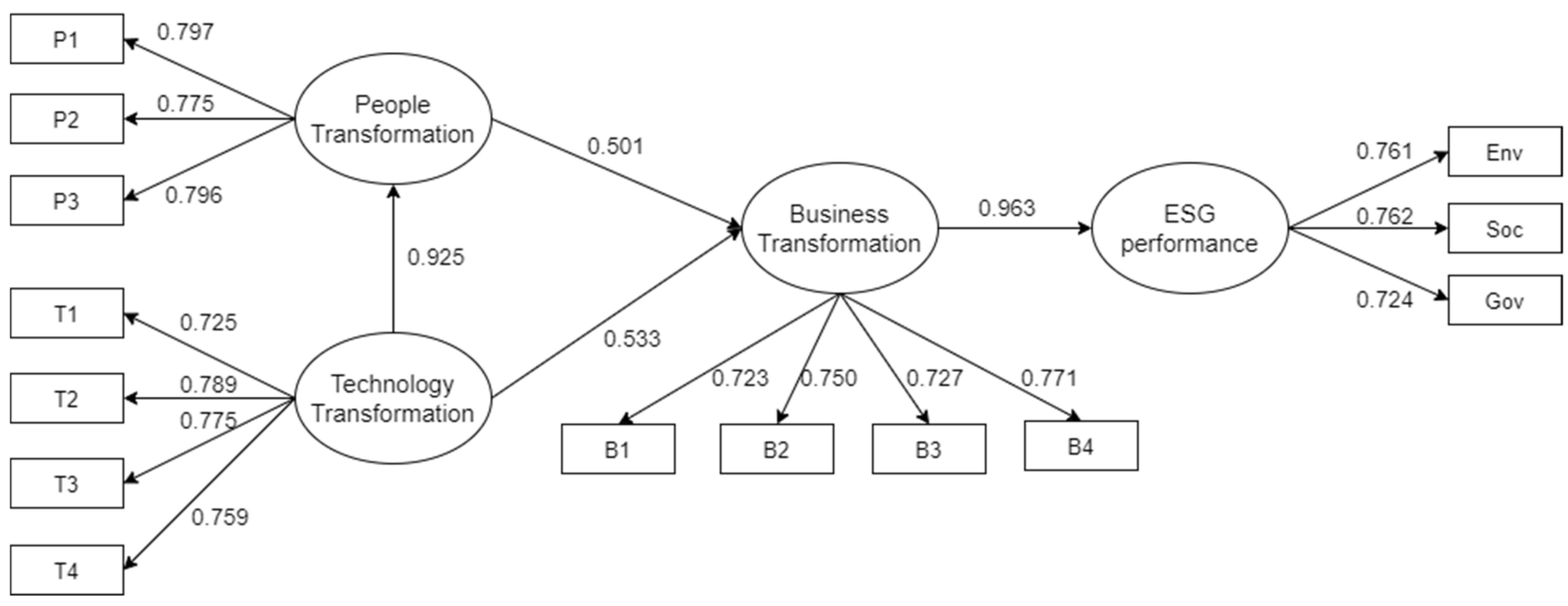

3.4.1. Measurement of the Variables and Evaluation of the SEM

3.4.2. First-Order Confirmatory Factor Analysis

4. Results and Discussion

4.1. The Implications of Triple Transformation on ESG Performance in the Energy Sector

4.2. Business Transformation and ESG

4.3. People Transformation and ESG

4.4. Technology Transformation and ESG

5. Conclusions

5.1. Limitations

5.2. Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| Area of Study | |||||||

|---|---|---|---|---|---|---|---|

| Source | Title | Key Finding | Environmental | Social | Governance | Energy Sector | Digital/Industry 4.0 |

| AG Frank et al. (2019) [87] | Industry 4.0 Technologies: Implementation Patterns in Manufacturing Companies | Structure of Industry 4.0 technology layers | X | X | |||

| R Morrar et al. (2017) [60] | The Fourth Industrial Revolution (Industry 4.0): A Social Innovation Perspective | Framework | X | X | |||

| JM Müller et al. (2018) [88] | What Drives the Implementation of Industry 4.0? The Role of Opportunities and Challenges in the Context of Sustainability | Hypothesized model | X | X | X | ||

| D Kiel et al. (2018) [89] | Sustainable Industrial Value Creation: Benefits and Challenges of Industry 4.0 | Comprehensive and structured picture | X | X | |||

| KC Lin et al. (2017) [23] | A Cross-Strait Comparison of Innovation Policy under Industry 4.0 and Sustainability Development Transition | Framework | X | X | X | ||

| AM Braccini and EG Margherita (2019) [57] | Exploring Organizational Sustainability of Industry 4.0 under the Triple Bottom Line: The Case of a Manufacturing Company | Identifying two trajectories | X | X | X | X | |

| S Bag et al. (2021) [90] | Industry 4.0 Adoption and 10R Advance Manufacturing Capabilities for Sustainable Development | Hypothesized model | X | X | X | ||

| J Oláh et al. (2020) [14] | Impact of Industry 4.0 on Environmental Sustainability | Framework | X | X | |||

| FE. García-Muiña et al. (2020) [24] | Sustainability Transition in Industry 4.0 and Smart Manufacturing with the Triple-Layered Business Model Canvas | Illustrate diagram | X | X | X | X | |

| M Sony et al. (2020) [91] | Industry 4.0 Integration with Socio-Technical Systems Theory: A Systematic Review and Proposed Theoretical Model | Designing architecture | X | X | |||

| M Chen et al. (2021) [92] | Impact of Technological Innovation on Energy Efficiency in Industry 4.0 Era: Moderation of Shadow Economy in Sustainable Development | Impact factor | X | X | X | ||

| J Vrchota et al. (2020) [93] | Sustainability Outcomes of Green Processes in Relation to Industry 4.0 in Manufacturing: Systematic Review | Conceptual Model | X | X | |||

| AK Feroz et al. (2021) [94] | Digital Transformation and Environmental Sustainability: A Review and Research Agenda | Framework | X | X | |||

| M Nasiri et al. (2020) [95] | Shaping Digital Innovation via Digital-Related Capabilities | Framework | X | X | |||

| YJ Fan et al. (2021) [96] | Corporate sustainability: Impact Factors on organizational innovation in the industrial area | Impact factor | X | X | |||

| M Baran et al. (2022) [84] | Does ESG Reporting Relate to Corporate Financial Performance in the Context of the Energy Sector Transformation? Evidence from Poland | Impact factor | X | X | |||

| N Valaei et al. (2017) [66] | Examining Learning Strategies, Creativity, and Innovation at SMEs Using Fuzzy-Set Qualitative Comparative Analysis and PLS Path Modeling | Finding factors using fsQCA and PLS-SEM | X | ||||

| Main Criteria | Acronym | Variable | Description | Literature |

|---|---|---|---|---|

| Business | B1 | Digitization of the supply chain | The extent of digitization of the supply chain | [97,98,99] |

| B2 | Senior executives | Make digital a priority for senior executives | [11,44,46,47] | |

| B3 | Regulations | Create clear regulatory frameworks | [11,44,46,47] | |

| B4 | Collaboration | Identify opportunities to deepen collaboration and understanding of sharing-economy platforms. | [11,44,46,47] | |

| People | P1 | Transformation office | Enterprise-wide transformation office in place with the bankable plan and quarterly targets to drive 4IR implementation across the company | [9,11,100,101,102] |

| P2 | Culture of innovation | Drive a culture of innovation and technology adoption | [9,11,100,101,102] | |

| P3 | Workforce development | Invest in human capital and development Programs that promote new, digital thinking | [9,11,100,101,102] | |

| Technology | T1 | The Industrial Internet of Things stack | Pilot of IIoT architecture designed for advanced use cases development (e.g., requiring latency, streaming, and security capabilities) and scale-up | [11,17,19,26,34,103] |

| T2 | Reform the company’s data architecture | This includes decisions about whether to build or buy capabilities and a program-management approach to scale-up the technology and digital platforms | [11,17,19,26,34,103] | |

| T3 | Develop global data standards | This includes policies related to data sharing and security and encouraging transparency in operations | [11,17,19,26,34,103] | |

| T4 | Foster an ecosystem for innovation. | Policymakers, governments, and wider society have an important role in driving future prosperity | [11,17,19,26,34,103] | |

| ESG | Env | Environment | Reviving and transforming the enabling environment | [3,9,11,13,46] |

| Soc | Social | Rethink labor laws and social protection for the new economy and the new needs of the workforce | [11,17,48,104] | |

| Gov | Governance | Increase incentives to direct financial resources toward long-term investments, strengthen stability, and expand inclusion | [11,62,97,98,99,105,106] |

| B1 | B2 | B3 | B4 | P1 | P2 | P3 | T1 | T2 | T3 | T4 | Env | Soc | Gov | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| B1 | 1.000 | 0.549 | 0.623 | 0.521 | 0.596 | 0.528 | 0.583 | 0.515 | 0.580 | 0.530 | 0.558 | 0.537 | 0.523 | 0.552 |

| B2 | 0.549 | 1.000 | 0.551 | 0.563 | 0.573 | 0.561 | 0.618 | 0.553 | 0.568 | 0.589 | 0.588 | 0.530 | 0.590 | 0.524 |

| B3 | 0.623 | 0.551 | 1.000 | 0.518 | 0.589 | 0.549 | 0.529 | 0.531 | 0.558 | 0.589 | 0.577 | 0.548 | 0.540 | 0.547 |

| B4 | 0.521 | 0.563 | 0.518 | 1.000 | 0.643 | 0.567 | 0.592 | 0.569 | 0.643 | 0.586 | 0.593 | 0.547 | 0.571 | 0.552 |

| P1 | 0.596 | 0.573 | 0.589 | 0.643 | 1.000 | 0.535 | 0.635 | 0.521 | 0.583 | 0.538 | 0.578 | 0.589 | 0.557 | 0.515 |

| P2 | 0.528 | 0.561 | 0.549 | 0.567 | 0.535 | 1.000 | 0.616 | 0.514 | 0.550 | 0.554 | 0.534 | 0.580 | 0.631 | 0.570 |

| P3 | 0.583 | 0.618 | 0.529 | 0.592 | 0.635 | 0.616 | 1.000 | 0.547 | 0.623 | 0.587 | 0.553 | 0.597 | 0.542 | 0.567 |

| T1 | 0.515 | 0.553 | 0.531 | 0.569 | 0.521 | 0.514 | 0.547 | 1.000 | 0.568 | 0.554 | 0.574 | 0.533 | 0.529 | 0.449 |

| T2 | 0.580 | 0.568 | 0.558 | 0.643 | 0.583 | 0.550 | 0.623 | 0.568 | 1.000 | 0.613 | 0.580 | 0.597 | 0.554 | 0.548 |

| T3 | 0.530 | 0.589 | 0.589 | 0.586 | 0.538 | 0.554 | 0.587 | 0.554 | 0.613 | 1.000 | 0.600 | 0.540 | 0.594 | 0.538 |

| T4 | 0.558 | 0.588 | 0.577 | 0.593 | 0.578 | 0.534 | 0.553 | 0.574 | 0.580 | 0.600 | 1.000 | 0.481 | 0.553 | 0.504 |

| Env | 0.537 | 0.530 | 0.548 | 0.547 | 0.589 | 0.580 | 0.597 | 0.533 | 0.597 | 0.540 | 0.481 | 1.000 | 0.577 | 0.577 |

| Soc | 0.523 | 0.590 | 0.540 | 0.571 | 0.557 | 0.631 | 0.542 | 0.529 | 0.554 | 0.594 | 0.553 | 0.577 | 1.000 | 0.530 |

| Gov | 0.552 | 0.524 | 0.547 | 0.552 | 0.515 | 0.570 | 0.567 | 0.449 | 0.548 | 0.538 | 0.504 | 0.577 | 0.530 | 1.000 |

| Variables | Factor Loading | B1 | B2 | B3 | B4 | P1 | P2 | P3 | T1 | T2 | T3 | T4 | Env | Soc | GoV |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| B1 | 0.759 | ||||||||||||||

| B2 | 0.775 | 0.549 | |||||||||||||

| B3 | 0.764 | 0.623 | 0.551 | ||||||||||||

| B4 | 0.786 | 0.521 | 0.563 | 0.518 | |||||||||||

| P1 | 0.785 | 0.596 | 0.573 | 0.589 | 0.643 | ||||||||||

| P2 | 0.768 | 0.528 | 0.561 | 0.549 | 0.567 | 0.535 | |||||||||

| P3 | 0.798 | 0.583 | 0.618 | 0.529 | 0.592 | 0.635 | 0.616 | ||||||||

| T1 | 0.736 | 0.515 | 0.553 | 0.531 | 0.569 | 0.521 | 0.514 | 0.547 | |||||||

| T2 | 0.796 | 0.58 | 0.568 | 0.558 | 0.643 | 0.583 | 0.55 | 0.623 | 0.568 | ||||||

| T3 | 0.78 | 0.53 | 0.589 | 0.589 | 0.586 | 0.538 | 0.554 | 0.587 | 0.554 | 0.613 | |||||

| T4 | 0.767 | 0.558 | 0.588 | 0.577 | 0.593 | 0.578 | 0.534 | 0.553 | 0.574 | 0.58 | 0.6 | ||||

| Env | 0.763 | 0.537 | 0.53 | 0.548 | 0.547 | 0.589 | 0.58 | 0.597 | 0.533 | 0.597 | 0.54 | 0.481 | |||

| Soc | 0.769 | 0.523 | 0.59 | 0.54 | 0.571 | 0.557 | 0.631 | 0.542 | 0.529 | 0.554 | 0.594 | 0.553 | 0.577 | ||

| GoV | 0.737 | 0.552 | 0.524 | 0.547 | 0.552 | 0.515 | 0.57 | 0.567 | 0.449 | 0.548 | 0.538 | 0.504 | 0.577 | 0.53 |

| B1 | B2 | B3 | B4 | P1 | P2 | P3 | T1 | T2 | T3 | T4 | Env | Soc | Gov | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Anti-Image Covariance | ||||||||||||||

| B1 | 0.458 | −0.024 | −0.103 | 0.017 | −0.061 | −0.009 | −0.043 | −0.025 | −0.047 | 0.005 | −0.038 | −0.012 | −0.012 | −0.059 |

| B2 | −0.024 | 0.449 | −0.023 | −0.012 | −0.027 | −0.021 | −0.070 | −0.045 | −0.013 | −0.043 | −0.055 | −0.001 | −0.064 | −0.021 |

| B3 | −0.103 | −0.023 | 0.446 | 0.024 | −0.063 | −0.037 | 0.029 | −0.037 | −0.016 | −0.066 | −0.050 | −0.031 | −0.010 | −0.049 |

| B4 | 0.017 | −0.012 | 0.024 | 0.409 | −0.102 | −0.034 | −0.012 | −0.057 | −0.085 | −0.035 | −0.048 | 0.002 | −0.029 | −0.052 |

| P1 | −0.061 | −0.027 | −0.063 | −0.102 | 0.409 | 0.014 | −0.078 | 0.007 | −0.005 | 0.017 | −0.041 | −0.062 | −0.027 | 0.016 |

| P2 | −0.009 | −0.021 | −0.037 | −0.034 | 0.014 | 0.442 | −0.077 | −0.014 | 0.001 | −0.009 | −0.017 | −0.048 | −0.108 | −0.059 |

| P3 | −0.043 | −0.070 | 0.029 | −0.012 | −0.078 | −0.077 | 0.396 | −0.027 | −0.051 | −0.039 | −0.004 | −0.043 | 0.023 | −0.040 |

| T1 | −0.025 | −0.045 | −0.037 | −0.057 | 0.007 | −0.014 | −0.027 | 0.503 | −0.039 | −0.034 | −0.071 | −0.052 | −0.025 | 0.036 |

| T2 | −0.047 | −0.013 | −0.016 | −0.085 | −0.005 | 0.001 | −0.051 | −0.039 | 0.410 | −0.057 | −0.032 | −0.061 | −0.007 | −0.019 |

| T3 | 0.005 | −0.043 | −0.066 | −0.035 | 0.017 | −0.009 | −0.039 | −0.034 | −0.057 | 0.435 | −0.061 | −0.011 | −0.062 | −0.029 |

| T4 | −0.038 | −0.055 | −0.050 | −0.048 | −0.041 | −0.017 | −0.004 | −0.071 | −0.032 | −0.061 | 0.449 | 0.040 | −0.026 | −0.013 |

| Env | −0.012 | −0.001 | −0.031 | 0.002 | −0.062 | −0.048 | −0.043 | −0.052 | −0.061 | −0.011 | 0.040 | 0.452 | −0.057 | −0.079 |

| Soc | −0.012 | −0.064 | −0.010 | −0.029 | −0.027 | −0.108 | 0.023 | −0.025 | −0.007 | −0.062 | −0.026 | −0.057 | 0.444 | −0.019 |

| GoV | −0.059 | −0.021 | −0.049 | −0.052 | 0.016 | −0.059 | −0.040 | 0.036 | −0.019 | −0.029 | −0.013 | −0.079 | −0.019 | 0.495 |

| Anti-Image Correlate | ||||||||||||||

| B1 | 0.970 | −0.052 | −0.229 | 0.039 | −0.140 | −0.019 | −0.101 | −0.052 | −0.109 | 0.011 | −0.084 | −0.026 | −0.027 | −0.125 |

| B2 | −0.052 | 0.977 | −0.050 | −0.028 | −0.062 | −0.047 | −0.166 | −0.095 | −0.030 | −0.097 | −0.122 | −0.002 | −0.142 | −0.044 |

| B3 | −0.229 | −0.050 | 0.964 | 0.056 | −0.147 | −0.084 | 0.068 | −0.078 | −0.037 | −0.151 | −0.112 | −0.068 | −0.023 | −0.103 |

| B4 | 0.039 | −0.028 | 0.056 | 0.962 | −0.248 | −0.081 | −0.031 | −0.126 | −0.206 | −0.082 | −0.113 | 0.005 | −0.067 | −0.116 |

| P1 | −0.140 | −0.062 | −0.147 | −0.248 | 0.959 | 0.033 | −0.193 | 0.016 | −0.011 | 0.041 | −0.096 | −0.143 | −0.064 | 0.035 |

| P2 | −0.019 | −0.047 | −0.084 | −0.081 | 0.033 | 0.967 | −0.184 | −0.029 | 0.002 | −0.020 | −0.038 | −0.108 | −0.244 | −0.127 |

| P3 | −0.101 | −0.166 | 0.068 | −0.031 | −0.193 | −0.184 | 0.964 | −0.062 | −0.127 | −0.095 | −0.009 | −0.103 | 0.055 | −0.090 |

| T1 | −0.052 | −0.095 | −0.078 | −0.126 | 0.016 | −0.029 | −0.062 | 0.976 | −0.085 | −0.073 | −0.150 | −0.109 | −0.053 | 0.073 |

| T2 | −0.109 | −0.030 | −0.037 | −0.206 | −0.011 | 0.002 | −0.127 | −0.085 | 0.972 | −0.134 | −0.074 | −0.142 | −0.017 | −0.041 |

| T3 | 0.011 | −0.097 | −0.151 | −0.082 | 0.041 | −0.020 | −0.095 | −0.073 | −0.134 | 0.973 | −0.138 | −0.024 | −0.141 | −0.062 |

| T4 | −0.084 | −0.122 | −0.112 | −0.113 | −0.096 | −0.038 | −0.009 | −0.150 | −0.074 | −0.138 | 0.972 | 0.089 | −0.059 | −0.028 |

| Env | −0.026 | −0.002 | −0.068 | 0.005 | −0.143 | −0.108 | −0.103 | −0.109 | −0.142 | −0.024 | 0.089 | 0.968 | −0.128 | −0.168 |

| Soc | −0.027 | −0.142 | −0.023 | −0.067 | −0.064 | −0.244 | 0.055 | −0.053 | −0.017 | −0.141 | −0.059 | −0.128 | 0.968 | −0.040 |

| Gov | −0.125 | −0.044 | −0.103 | −0.116 | 0.035 | −0.127 | −0.090 | 0.073 | −0.041 | −0.062 | −0.028 | −0.168 | −0.040 | 0.972 |

References

- Shaaban, M.; Scheffran, J. Selection of sustainable development indicators for the assessment of electricity production in Egypt. Sustain. Energy Technol. Assess. 2017, 22, 65–73. [Google Scholar] [CrossRef]

- KPMG Impact The Time Has Come: The KPMG Survey of Sustainability Reporting 2020. 2020. Available online: https://assets.kpmg.com/content/dam/kpmg/be/pdf/2020/12/The_Time_Has_Come_KPMG_Survey_of_Sustainability_Reporting_2020.pdf (accessed on 19 December 2022).

- Fortune Fortune Global 500. 2022. Available online: www.fortune.com/global500/ (accessed on 12 November 2022).

- World Economic Forum and Boston Consulting Group. Net-Zero Challenge: The Supply Chain Opportunity; World Economic Forum: Colony, Switzerland, 2021. [Google Scholar]

- Nitlarp, T.; Kiattisin, S. The Impact Factors of Industry 4.0 on ESG in the Energy Sector. Sustainability 2022, 14, 9198. [Google Scholar] [CrossRef]

- Lokuwaduge, C.S.d.S.; De Silva, K.M. ESG Risk Disclosure and the Risk of Green Washing. Australas. Account. Bus. Financ. J. 2022, 16, 146–159. [Google Scholar] [CrossRef]

- Choi, M.; Hong, S. Another Form of Greenwashing: The Effects of Chaebol Firms’ Corporate Governance Performance on the Donations. Sustainability 2022, 14, 3373. [Google Scholar] [CrossRef]

- Gillan, S.L.; Koch, A.; Starks, L.T. Firms and social responsibility: A review of ESG and CSR research in corporate finance. J. Corp. Financ. 2021, 66, 101889. [Google Scholar] [CrossRef]

- World Economic Forum and Accenture Digital Transformation Initiative Oil and Gas Industry In Collaboration with Accenture; World Economic Forum: Colony, Switzerland, 2017.

- dos Santos, M.C.; Pereira, F.H. ESG performance scoring method to support responsible investments in port operations. Case Stud. Transp. Policy 2022, 10, 664–673. [Google Scholar] [CrossRef]

- Schwab, K.; Zahidi, S. How Countries Are Performing on the Road to Recovery. Glob. Compet. Rep. 2020, 95. [Google Scholar]

- Busu, M.; Nedelcu, A.C. Sustainability and Economic Performance of the Companies in the Renewable Energy Sector in Romania. Sustainability 2017, 10, 8. [Google Scholar] [CrossRef]

- Orenstein, M.; Millington, D.; Cooke, B. ESG and the Canadian Energy Sector; Canada West Foundation: Calgary, AB, Canada, 2021. [Google Scholar]

- Oláh, J.; Aburumman, N.; Popp, J.; Khan, M.A.; Haddad, H.; Kitukutha, N. Impact of Industry 4.0 on Environmental Sustainability. Sustainability 2020, 12, 4674. [Google Scholar] [CrossRef]

- Kazancoglu, Y.; Sezer, M.D.; Ozkan-Ozen, Y.D.; Mangla, S.K.; Kumar, A. Industry 4.0 impacts on responsible environmental and societal management in the family business. Technol. Forecast. Soc. Chang. 2021, 173, 121108. [Google Scholar] [CrossRef]

- Schröder, M. The performance of socially responsible investments: Investment funds and indices. Financ. Mark. Portf. Manag. 2004, 18, 122–142. [Google Scholar] [CrossRef]

- Alkaraan, F.; Albitar, K.; Hussainey, K.; Venkatesh, V. Corporate transformation toward Industry 4.0 and financial performance: The influence of environmental, social, and governance (ESG). Technol. Forecast. Soc. Chang. 2021, 175, 121423. [Google Scholar] [CrossRef]

- Statman, M.; Glushkov, D. The Wages of Social Responsibility. Financ. Anal. J. 2009, 65, 33–46. [Google Scholar] [CrossRef]

- Benitez, G.B.; Ayala, N.F.; Frank, A.G. Industry 4.0 innovation ecosystems: An evolutionary perspective on value cocreation. Int. J. Prod. Econ. 2020, 228, 107735. [Google Scholar] [CrossRef]

- Yang, Q.; Du, Q.; Razzaq, A.; Shang, Y. How volatility in green financing, clean energy, and green economic practices derive sustainable performance through ESG indicators? A sectoral study of G7 countries. Resour. Policy 2021, 75, 102526. [Google Scholar] [CrossRef]

- Cormier, D.; Magnan, M. The revisited contribution of environmental reporting to investors’ valuation of a firm’s earnings: An international perspective. Ecol. Econ. 2007, 62, 613–626. [Google Scholar] [CrossRef]

- Dainienė, R.; Dagilienė, L. A TBL Approach Based Theoretical Framework for Measuring Social Innovations. Procedia Soc. Behav. Sci. 2015, 213, 275–280. [Google Scholar] [CrossRef]

- Lin, K.C.; Shyu, J.Z.; Ding, K. A Cross-Strait Comparison of Innovation Policy under Industry 4.0 and Sustainability Development Transition. Sustainability 2017, 9, 786. [Google Scholar] [CrossRef]

- García-Muiña, F.E.; Medina-Salgado, M.S.; Ferrari, A.M.; Cucchi, M. Sustainability transition in Industry 4.0 and Smart Manufacturing with the triple-layered business model canvas. Sustainability 2020, 12, 2364. [Google Scholar] [CrossRef]

- Kraus, S.; Schiavone, F.; Pluzhnikova, A.; Invernizzi, A.C. Digital transformation in healthcare: Analyzing the current state-of-research. J. Bus. Res. 2020, 123, 557–567. [Google Scholar] [CrossRef]

- Frank, A.G.; Mendes, G.H.S.; Ayala, N.F.; Ghezzi, A. Servitization and Industry 4.0 convergence in the digital transformation of product firms: A business model innovation perspective. Technol. Forecast. Soc. Chang. 2019, 141, 341–351. [Google Scholar] [CrossRef]

- CSA Invited Companies. Available online: https://www.spglobal.com/esg/csa/invited-companies (accessed on 27 May 2022).

- Kagermann, H.; Helbig, J.; Hellinger, A.; Wahlster, W. Recommendations for Implementing the Strategic Initiative INDUSTRIE 4.0: Securing the Future of German Manufacturing Industry; Final Report of the Industrie 4.0 Working Group; Forschungsunion: Berlin, Germany, 2013. [Google Scholar]

- Hermann, M.; Pentek, T.; Otto, B. Design Principles for Industrie 4.0 Scenarios. In Proceedings of the Annual Hawaii International Conference on System Sciences, Koloa, HI, USA, 7 March 2016; pp. 3928–3937. [Google Scholar]

- Wollschlaeger, M.; Sauter, T.; Jasperneite, J. The Future of Industrial Communication: Automation Networks in the Era of the Internet of Things and Industry 4.0. IEEE Ind. Electron. Mag. 2017, 11, 17–27. [Google Scholar] [CrossRef]

- Vial, G. Understanding digital transformation: A review and a research agenda. J. Strateg. Inf. Syst. 2019, 28, 118–144. [Google Scholar] [CrossRef]

- Hinings, B.; Gegenhuber, T.; Greenwood, R. Digital innovation and transformation: An institutional perspective. Inf. Organ. 2018, 28, 52–61. [Google Scholar] [CrossRef]

- Schallmo, D.; Williams, C.A.; Boardman, L. Digital Transformation of Business Models-Best Practice, Enablers, and Roadmap. Int. J. Innov. Manag. 2017, 21. [Google Scholar] [CrossRef]

- Yu, W.; Gu, Y.; Dai, J. Industry 4.0-Enabled ESG Reporting: A Case from a Chinese Energy Company. J. Emerg. Technol. Account. 2022. Available online: www.ssrn.com/abstract=4063071 (accessed on 15 April 2022). [CrossRef]

- Bonilla, S.H.; Silva, H.R.O.; Terra da Silva, M.; Gonçalves, R.F.; Sacomano, J.B. Industry 4.0 and Sustainability Implications: A Scenario-Based Analysis of the Impacts and Challenges. Sustainability 2018, 10, 3740. [Google Scholar] [CrossRef]

- Scott Burger Future of Energy. Available online: https://intelligence.weforum.org/topics/a1Gb00000038oN6EAI?tab=publications (accessed on 31 March 2021).

- Kettunen, P.; Mäkitalo, N. Future smart energy software houses. Eur. J. Futur. Res. 2019, 7, 1–25. [Google Scholar] [CrossRef]

- Sohag, K.; Begum, R.A.; Abdullah, S.M.S.; Jaafar, M. Dynamics of energy use, technological innovation, economic growth and trade openness in Malaysia. Energy 2015, 90, 1497–1507. [Google Scholar] [CrossRef]

- Aflaki, S.; Basher, S.A.; Masini, A. Technology-push, demand-pull and endogenous drivers of innovation in the renewable energy industry. Clean Technol. Environ. Policy 2021, 23, 1563–1580. [Google Scholar] [CrossRef]

- Longo, F.; Nicoletti, L.; Padovano, A. Smart operators in industry 4.0: A human-centered approach to enhance operators’ capabilities and competencies within the new smart factory context. Comput. Ind. Eng. 2017, 113, 144–159. [Google Scholar] [CrossRef]

- Sivathanu, B.; Pillai, R. Smart HR 4.0—How Industry 4.0 Is Disrupting HR. Hum. Resour. Manag. Int. Dig. 2018, 26, 7–11. [Google Scholar] [CrossRef]

- Brougham, D.; Haar, J. Smart Technology, Artificial Intelligence, Robotics, and Algorithms (STARA): Employees’ perceptions of our future workplace. J. Manag. Organ. 2017, 24, 239–257. [Google Scholar] [CrossRef]

- Eccles, R.G.; Ioannou, I.; Serafeim, G. The Impact of Corporate Sustainability on Organizational Processes and Performance. Manag. Sci. 2014, 60, 2835–2857. [Google Scholar] [CrossRef]

- World Bank. Sustainability Review 2021. 2021. Available online: www.openknowledge.worldbank.org/handle/10986/36352 (accessed on 19 December 2022).

- Cretchley, J.; Gallois, C.; Chenery, H.; Smith, A. Conversations Between Carers and People With Schizophrenia: A Qualitative Analysis Using Leximancer. Qual. Health Res. 2010, 20, 1611–1628. [Google Scholar] [CrossRef] [PubMed]

- KPMG. The Business Case for Climate Action. 2020. Available online: https://assets.kpmg/content/dam/kpmg/ie/pdf/2020/01/ie-the-business-case-for-climate-action.pdf (accessed on 19 December 2022).

- Bonini, S.; Görner, S. The Business of Sustainability: Putting It into Practice. McKinsey Glob. Surv. Results 2011. Available online: www.mckinsey.com/~/media/mckinsey/dotcom/client_service/sustainability/pdfs/putting_it_into_practice.pdf (accessed on 19 December 2022).

- Lock, I.; Seele, P. The credibility of CSR (corporate social responsibility) reports in Europe. Evidence from a quantitative content analysis in 11 countries. J. Clean. Prod. 2016, 122, 186–200. [Google Scholar] [CrossRef]

- Rooney, D. Knowledge, economy, technology and society: The politics of discourse. Telematics Informatics 2005, 22, 405–422. [Google Scholar] [CrossRef]

- Westerman, G.; Bonnet, D.; Mcafee, A. The Nine Elements of Digital Transformation Opinion & Analysis. MITSloan Manag. Rev. 2014, 55, 1–6. [Google Scholar]

- World Economic Forum Seeking Return on ESG Advancing the Reporting Ecosystem to Unlock Impact for Business and Society Produced in Collaboration with Allianz SE and Boston Consulting Group; World Economic Forum: Colony, Switzerland, 2019.

- World Economic Forum. Two Degrees of Transformation Businesses Are Coming Together to Lead on Climate Change. 2018. Available online: https://www.weforum.org/reports/two-degrees-of-transformation-businesses-are-coming-together-to-lead-on-climate-change-will-you-join-them (accessed on 1 May 2021).

- de Man, J.C.; Strandhagen, J.O. An Industry 4.0 Research Agenda for Sustainable Business Models. Procedia CIRP 2017, 63, 721–726. [Google Scholar] [CrossRef]

- Müller, J.M.; Buliga, O.; Voigt, K.-I. Fortune favors the prepared: How SMEs approach business model innovations in Industry 4.0. Technol. Forecast. Soc. Chang. 2018, 132, 2–17. [Google Scholar] [CrossRef]

- Butt, J. A Conceptual Framework to Support Digital Transformation in Manufacturing using an Integrated Business Process Management Approach. Designs 2020, 4, 17. [Google Scholar] [CrossRef]

- Braccini, A.M.; Margherita, E.G. Exploring Organizational Sustainability of Industry 4.0 under the Triple Bottom Line: The Case of a Manufacturing Company. Sustainability 2019, 11, 36. [Google Scholar] [CrossRef]

- Bouten, L.; Everaert, P.; Van Liedekerke, L.; De Moor, L.; Christiaens, J. Corporate social responsibility reporting: A comprehensive picture? Account. Forum 2011, 35, 187–204. [Google Scholar] [CrossRef]

- Burritt, R.; Christ, K. Industry 4.0 and environmental accounting: A new revolution? Asian J. Sustain. Soc. Responsib. 2016, 1, 23–38. [Google Scholar] [CrossRef]

- Rabeh Morrar, H.A.M. The Fourth Industrial Revolution (Industry 4.0): A Social Innovation Perspective. Technol. Innov. Manag. Rev. 2017, 7, 12–20. [Google Scholar] [CrossRef]

- Garcia-Sanchez, I.-M.; Gómez-Miranda, M.-E.; David, F.; Rodríguez-Ariza, L. The explanatory effect of CSR committee and assurance services on the adoption of the IFC performance standards, as a means of enhancing corporate transparency. Sustain. Accounting, Manag. Policy J. 2019, 10, 773–797. [Google Scholar] [CrossRef]

- Waworuntu, S.R.; Wantah, M.D.; Rusmanto, T. CSR and Financial Performance Analysis: Evidence from Top ASEAN Listed Companies. Procedia Soc. Behav. Sci. 2014, 164, 493–500. [Google Scholar] [CrossRef]

- Zhang, J.; Long, J.; von Schaewen, A.M.E. How Does Digital Transformation Improve Organizational Resilience?—Findings from PLS-SEM and fsQCA. Sustainability 2021, 13, 11487. [Google Scholar] [CrossRef]

- Kaya, B.; Abubakar, A.M.; Behravesh, E.; Yildiz, H.; Mert, I.S. Antecedents of innovative performance: Findings from PLS-SEM and fuzzy sets (fsQCA). J. Bus. Res. 2020, 114, 278–289. [Google Scholar] [CrossRef]

- Mikalef, P.; Pateli, A. Information technology-enabled dynamic capabilities and their indirect effect on competitive performance: Findings from PLS-SEM and fsQCA. J. Bus. Res. 2017, 70, 1–16. [Google Scholar] [CrossRef]

- Valaei, N.; Rezaei, S.; Ismail, W.K.W. Examining learning strategies, creativity, and innovation at SMEs using fuzzy set Qualitative Comparative Analysis and PLS path modeling. J. Bus. Res. 2017, 70, 224–233. [Google Scholar] [CrossRef]

- Afonso, C.; Silva, G.M.; Gonçalves, H.M.; Duarte, M. The role of motivations and involvement in wine tourists’ intention to return: SEM and fsQCA findings. J. Bus. Res. 2018, 89, 313–321. [Google Scholar] [CrossRef]

- Ragin, C.C.; Sonnett, J. Between Complexity and Parsimony: Limited Diversity, Counterfactual Cases, and Comparative Analysis. In Redesigning Social Inquiry; Ragin, C.C., Ed.; University of Chicago Press: Chicago, IL, USA, 2004; pp. 180–197. [Google Scholar] [CrossRef]

- Charles, C. Ragin Redesigning Social Inquiry: Fuzzy Sets and Beyond; University of Chicago Press: Chicago, IL, USA, 2008. [Google Scholar]

- Hair, J.F.; Ringle, C.M.; Sarstedt, M. PLS-SEM: Indeed a Silver Bullet. J. Mark. Theory Pract. 2011, 19, 139–152. [Google Scholar] [CrossRef]

- Rigdon, E.E.; Sarstedt, M.; Ringle, C.M. On Comparing Results from CB-SEM and PLS-SEM on JSTOR. J. Res. Manag. 2017, 39, 4–16. [Google Scholar]

- Astrachan, C.B.; Patel, V.K.; Wanzenried, G. A comparative study of CB-SEM and PLS-SEM for theory development in family firm research. J. Fam. Bus. Strat. 2014, 5, 116–128. [Google Scholar] [CrossRef]

- Hair, J.F.; Risher, J.J.; Sarstedt, M.; Ringle, C.M. When to use and how to report the results of PLS-SEM. Eur. Bus. Rev. 2019, 31, 2–24. [Google Scholar] [CrossRef]

- Salem, I.E.; Elbaz, A.M.; Al-Alawi, A.; Alkathiri, N.A.; Rashwan, K.A. Investigating the Role of Green Hotel Sustainable Strategies to Improve Customer Cognitive and Affective Image: Evidence from PLS-SEM and fsQCA. Sustainability 2022, 14, 3545. [Google Scholar] [CrossRef]

- Hair, J.F. Multivariate Data Analysis: A Global Perspective, 7th ed.; Prentice Hall: Hoboken, NJ, USA, 2009. [Google Scholar]

- Llanos-Contreras, O.; Alonso-Dos-Santos, M.; Ribeiro-Soriano, D. Entrepreneurship and risk-taking in a post-disaster scenario. Int. Entrep. Manag. J. 2019, 16, 221–237. [Google Scholar] [CrossRef]

- Schneider, C.Q.; Wagemann, C. Set-Theoretic Methods for the Social Sciences: A Guide to Qualitative Comparative Analysis; Cambridge University Press: Cambridge, UK, 2012. [Google Scholar]

- Hu, L.T.; Bentler, P.M. Cutoff criteria for fit indexes in covariance structure analysis: Conventional criteria versus new alternatives. Struct. Equ. Model. Multidiscip. J. 1999, 6, 1–55. [Google Scholar] [CrossRef]

- Wheaton, B.; Muthén, B.; Alwin, D.F.; Summers, G.F. Assessing Reliability and Stability in Panel Models. In Sociological Methodology; Heise, D.R., Ed.; Jossey Bass: San Francisco, CA, USA, 1977; pp. 84–136. [Google Scholar]

- Tabachnick, B.G.; Fidell, L.S. Using Multivariate Statistics Title: Using Multivariate Statistics. 2019. Available online: https://scirp.org/reference/referencespapers.aspx?referenceid=3132273 (accessed on 19 December 2022).

- Jackson, D.L.; Gillaspy, J.A., Jr.; Purc-Stephenson, R. Reporting practices in confirmatory factor analysis: An overview and some recommendations. Psychol. Methods 2009, 14, 6–23. [Google Scholar] [CrossRef]

- Timothy, A. Brown Confirmatory Factor Analysis for Applied Research, 2nd ed.; Pearson: Boston, MA, USA, 2006. [Google Scholar]

- Williams, B.; Onsman, A.; Brown, T. Exploratory factor analysis: A five-step guide for novices. Australas. J. Paramed. 2010, 8, 1–13. [Google Scholar] [CrossRef]

- Almanasreh, E.; Moles, R.; Chen, T.F. Evaluation of methods used for estimating content validity. Res. Soc. Adm. Pharm. 2019, 15, 214–221. [Google Scholar] [CrossRef] [PubMed]

- Baran, M.; Kuźniarska, A.; Makieła, Z.J.; Sławik, A.; Stuss, M.M. Does ESG Reporting Relate to Corporate Financial Performance in the Context of the Energy Sector Transformation? Evidence from Poland. Energies 2022, 15, 477. [Google Scholar] [CrossRef]

- Awan, U.; Arnold, M.G.; Gölgeci, I. Enhancing green product and process innovation: Towards an integrative framework of knowledge acquisition and environmental investment. Bus. Strateg. Environ. 2021, 30, 1283–1295. [Google Scholar] [CrossRef]

- Fatemi, A.; Glaum, M.; Kaiser, S. ESG performance and firm value: The moderating role of disclosure. Glob. Finance J. 2018, 38, 45–64. [Google Scholar] [CrossRef]

- Frank, A.G.; Dalenogare, L.S.; Ayala, N.F. Industry 4.0 technologies: Implementation patterns in manufacturing companies. Int. J. Prod. Econ. 2019, 210, 15–26. [Google Scholar] [CrossRef]

- Müller, J.M.; Kiel, D.; Voigt, K.-I. What Drives the Implementation of Industry 4.0? The Role of Opportunities and Challenges in the Context of Sustainability. Sustainability 2018, 10, 247. [Google Scholar] [CrossRef]

- Kiel, D.; Müller, J.M.; Arnold, C.; Voigt, K.I. Sustainable industrial value creation: Benefits and challenges of Industry 4.0. Int. J. Innov. Manag. 2017, 21, 1740015. [Google Scholar] [CrossRef]

- Bag, S.; Gupta, S.; Kumar, S. Industry 4.0 adoption and 10R advance manufacturing capabilities for sustainable development. Int. J. Prod. Econ. 2020, 231, 107844. [Google Scholar] [CrossRef]

- Sony, M.; Naik, S. Industry 4.0 integration with socio-technical systems theory: A systematic review and proposed theoretical model. Technol. Soc. 2020, 61, 101248. [Google Scholar] [CrossRef]

- Chen, M.; Sinha, A.; Hu, K.; Shah, M.I. Impact of technological innovation on energy efficiency in industry 4.0 era: Moderation of shadow economy in sustainable development. Technol. Forecast. Soc. Chang. 2020, 164, 120521. [Google Scholar] [CrossRef]

- Vrchota, J.; Pech, M.; Rolínek, L.; Bednář, J. Sustainability Outcomes of Green Processes in Relation to Industry 4.0 in Manufacturing: Systematic Review. Sustainability 2020, 12, 5968. [Google Scholar] [CrossRef]

- Feroz, A.K.; Zo, H.; Chiravuri, A. Digital Transformation and Environmental Sustainability: A Review and Research Agenda. Sustainability 2021, 13, 1530. [Google Scholar] [CrossRef]

- Nasiri, M.; Saunila, M.; Ukko, J.; Rantala, T.; Rantanen, H. Shaping Digital Innovation Via Digital-related Capabilities. Inf. Syst. Front. 2020, 1–18. [Google Scholar] [CrossRef]

- Fan, Y.-J.; Liu, S.-F.; Luh, D.-B.; Teng, P.-S. Corporate Sustainability: Impact Factors on Organizational Innovation in the Industrial Area. Sustainability 2021, 13, 1979. [Google Scholar] [CrossRef]

- Oprean-Stan, C.; Oncioiu, I.; Iuga, I.C.; Stan, S. Impact of Sustainability Reporting and Inadequate Management of ESG Factors on Corporate Performance and Sustainable Growth. Sustainability 2020, 12, 8536. [Google Scholar] [CrossRef]

- López, M.V.; Garcia, A.; Rodriguez, L. Sustainable Development and Corporate Performance: A Study Based on the Dow Jones Sustainability Index. J. Bus. Ethic- 2007, 75, 285–300. [Google Scholar] [CrossRef]

- Raucci, D.; Tarquinio, L. Sustainability Performance Indicators and Non-Financial Information Reporting. Evidence from the Italian Case. Adm. Sci. 2020, 10, 13. [Google Scholar] [CrossRef]

- Xie, C.L. Institutional Investors, Shareholder Activism, and ESG in the Institutional Investors, Shareholder Activism, and ESG in the Energy Sector Energy Sector. Whart. Res. Sch. 2020, 196. Available online: https://repository.upenn.edu/wharton_research_scholars/196 (accessed on 19 December 2022).

- Khan, M. Corporate Governance, ESG, and Stock Returns around the World. Financ. Anal. J. 2019, 75, 103–123. [Google Scholar] [CrossRef]

- Amel-Zadeh, A.; Serafeim, G. Why and How Investors Use ESG Information: Evidence from a Global Survey. Financ. Anal. J. 2018, 74, 87–103. [Google Scholar] [CrossRef]

- Osterrieder, P.; Budde, L.; Friedli, T. The smart factory as a key construct of industry 4.0: A systematic literature review. Int. J. Prod. Econ. 2020, 221, 107476. [Google Scholar] [CrossRef]

- Camilleri, M.A. Environmental, social and governance disclosures in Europe. Sustain. Account. Manag. Policy J. 2015, 6, 224–242. [Google Scholar] [CrossRef]

- Schreck, P. Reviewing the Business Case for Corporate Social Responsibility: New Evidence and Analysis. J. Bus. Ethic- 2011, 103, 167–188. [Google Scholar] [CrossRef]

- Landau, A.; Rochell, J.; Klein, C.; Zwergel, B. Integrated reporting of environmental, social, and governance and financial data: Does the market value integrated reports? Bus. Strat. Environ. 2020, 29, 1750–1763. [Google Scholar] [CrossRef]

| Variable [Range] | Fuzzy-Set Calibrations | |||||||

|---|---|---|---|---|---|---|---|---|

| Top Quartile | Median | Bottom Quartile | Mean | SD | Min. | Max. | N-Case | |

| Business (1–9) | 7.8 | 3 | 1.3 | 0.49964 | 0.28846 | 0.05 | 0.95 | 280 |

| People (1–9) | 7.7 | 3 | 1 | 0.50675 | 0.29232 | 0.05 | 0.95 | 280 |

| Technology (1–9) | 7.8 | 3 | 1 | 0.49442 | 0.27922 | 0.05 | 0.95 | 280 |

| ESG (1–9) | 9 | 4 | 2 | 0.50557 | 0.30147 | 0.05 | 0.95 | 280 |

| Business | People | Technology | Number | ESG | Raw Consist. | PRI Consist. | SYM Consist. |

|---|---|---|---|---|---|---|---|

| 0 | 1 | 0 | 2 | 1 | 0.93995 | 0.75312 | 0.75313 |

| 0 | 0 | 1 | 4 | 1 | 0.94371 | 0.74011 | 0.74011 |

| 0 | 1 | 1 | 14 | 1 | 0.97010 | 0.89061 | 0.89619 |

| 0 | 0 | 0 | 91 | 0 | 0.43158 | 0.08946 | 0.09047 |

| 1 | 0 | 0 | 2 | 1 | 0.94471 | 0.75081 | 0.75081 |

| 1 | 1 | 0 | 15 | 1 | 0.96648 | 0.88707 | 0.90223 |

| 1 | 0 | 1 | 19 | 1 | 0.96748 | 0.87596 | 0.88771 |

| 1 | 1 | 1 | 65 | 1 | 0.94787 | 0.87651 | 0.93076 |

| Condition | Consistency | Coverage |

|---|---|---|

| Business | 0.852146 | 0.862259 |

| ~Business | 0.509678 | 0.514989 |

| People | 0.862319 | 0.860315 |

| ~People | 0.502119 | 0.514662 |

| Technology | 0.840279 | 0.859217 |

| ~Technology | 0.524159 | 0.524159 |

| Complex solutions for the outcome conditions | ||

| Model: ESG = f (Business, Technology, People) Algorithm: Quine–McCluskey Frequency Cutoff: 2 Consistency Cutoff: 0.939953 Solution Coverage: 0.950763 Solution Consistency: 0.796438 | ||

| Terms | Consistency | Coverage | Combined |

|---|---|---|---|

| Business × Technology × People | 0.947877 | 0.734811 | 0.848596 |

| Business × Technology | 0.914713 | 0.777337 | 0.868342 |

| Technology × People | 0.921854 | 0.774159 | 0.866565 |

| Business × People | 0.915025 | 0.787298 | 0.873887 |

| Technology | 0.859217 | 0.840279 | 0.874445 |

| Business | 0.862259 | 0.852146 | 0.885423 |

| People | 0.860315 | 0.862319 | 0.885839 |

| Observed | N | Minimum | Maximum | Mean | SD |

|---|---|---|---|---|---|

| B1 | 280 | 0.05 | 0.95 | 0.4914 | 0.31271 |

| B2 | 280 | 0.05 | 0.95 | 0.4804 | 0.30293 |

| B3 | 280 | 0.05 | 0.95 | 0.4936 | 0.31583 |

| B4 | 280 | 0.05 | 0.95 | 0.4916 | 0.31989 |

| P1 | 280 | 0.05 | 0.95 | 0.4960 | 0.31022 |

| P2 | 280 | 0.05 | 0.95 | 0.4992 | 0.31541 |

| P3 | 280 | 0.05 | 0.95 | 0.5130 | 0.31454 |

| T1 | 280 | 0.05 | 0.95 | 0.4719 | 0.29637 |

| T2 | 280 | 0.05 | 0.95 | 0.5086 | 0.32224 |

| T3 | 280 | 0.05 | 0.95 | 0.5113 | 0.32025 |

| T4 | 280 | 0.05 | 0.95 | 0.4941 | 0.30798 |

| Env | 280 | 0.03 | 0.82 | 0.3612 | 0.26829 |

| Soc | 280 | 0.03 | 0.82 | 0.3727 | 0.27465 |

| Gov | 280 | 0.03 | 0.82 | 0.3382 | 0.25660 |

| Valid N (listwise) | 280 |

| Statistics Test | Result | |

|---|---|---|

| N of Items | 14 | |

| Cronbach’s Alpha | 0.947 | |

| Cronbach’s Alpha Based on Standardized Items | 0.947 | |

| Kaiser–Meyer–Olkin Measure of Sampling Adequacy | 0.969 | |

| Bartlett’s Test of Sphericity | Approx. Chi-Square | 2469.861 |

| df | 91 | |

| Sig. | 0.000 | |

| Main Criteria | Cronbach’s Alpha | AVE | CR | N of Items |

|---|---|---|---|---|

| Overall | 0.947 | 0.593 | 0.953 | 14 |

| Business Transformation | 0.832 | 0.594 | 0.854 | 4 |

| People Transformation | 0.815 | 0.6142 | 0.826 | 3 |

| Technology Transformation | 0.847 | 0.593 | 0.853 | 4 |

| ESG | 0.793 | 0.572 | 0.800 | 3 |

| Observed | β | bi | SE | r2 |

|---|---|---|---|---|

| People | ||||

| Relative X2 = 16.175, p-value = 0.000, TLI = 0.843, CFI = 0.948, GFI = 0.964, NFI = 0.945, and RMR = 0.006 | ||||

| P1 | 0.626 | 0.635 | 0.046 | 0.403 |

| P2 | 0.617 | 0.616 | 0.047 | 0.379 |

| P3 | 1.000 | 1.000 | - | 1.000 |

| Business | ||||

| Relative X2 = 5.800, p-value = 0.055, TLI = 0.972, CFI = 0.991, GFI = 0.989, NFI = 0.986, and RMR = 0.002 | ||||

| B1 | 0.991 | 0.771 | 0.084 | 0.594 |

| B2 | 1.000 | 0.77 | - | 0.542 |

| B3 | 0.917 | 0.736 | 0.081 | 0.593 |

| B4 | 0.922 | 0.701 | 0.085 | 0.491 |

| Technology | ||||

| Relative X2 = 1.133, p-value = 0.568, GFI = 0.998, NFI = 0.997, RMSEA = 0.000, and RMR = 0.001 | ||||

| T1 | 0.868 | 0.731 | 0.074 | 0.534 |

| T2 | 0.999 | 0.773 | 0.081 | 0.598 |

| T3 | 1.000 | 0.779 | - | 0.606 |

| T4 | 0.947 | 0.767 | 0.077 | 0.589 |

| ESG | ||||

| Relative X2 = 25.494, p-value = 0.000, TLI = 0.704, CFI = 0.901, GFI = 0.945, NFI = 0.899, and RMR = 0.006 | ||||

| Env | 1.000 | 1.000 | - | 1.000 |

| Soc | 0.591 | 0.577 | 0.05 | 0.333 |

| Gov | 0.551 | 0.577 | 0.047 | 0.332 |

| Latent | Technology | People | Business | ESG | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Observed | Total Effect | Direct Effect | Indirect Effect | Total Effect | Direct Effect | Indirect Effect | Total Effect | Direct Effect | Indirect Effect | Total Effect | Direct Effect | Indirect Effect | r2 |

| T1 | 0.725 | 0.725 | 0.525 | ||||||||||

| T2 | 0.789 | 0.789 | 0.623 | ||||||||||

| T3 | 0.775 | 0.775 | 0.600 | ||||||||||

| T4 | 0.759 | 0.759 | 0.577 | ||||||||||

| P1 | 0.737 | 0.737 | 0.797 | 0.797 | 0.635 | ||||||||

| P2 | 0.717 | 0.717 | 0.775 | 0.775 | 0.601 | ||||||||

| P3 | 0.736 | 0.736 | 0.796 | 0.796 | 0.633 | ||||||||

| B1 | 0.72 | 0.72 | 0.362 | 0.362 | 0.723 | 0.723 | 0.522 | ||||||

| B2 | 0.747 | 0.747 | 0.375 | 0.375 | 0.75 | 0.75 | 0.562 | ||||||

| B3 | 0.724 | 0.724 | 0.364 | 0.364 | 0.727 | 0.727 | 0.529 | ||||||

| B4 | 0.768 | 0.768 | 0.386 | 0.386 | 0.771 | 0.771 | 0.594 | ||||||

| Env | 0.73 | 0.73 | 0.367 | 0.367 | 0.733 | 0.733 | 0.761 | 0.761 | 0.579 | ||||

| Soc | 0.731 | 0.731 | 0.367 | 0.367 | 0.734 | 0.734 | 0.762 | 0.762 | 0.581 | ||||

| Gov | 0.735 | 0.694 | 0.349 | 0.349 | 0.697 | 0.697 | 0.724 | 0.724 | 0.524 | ||||

| Latent | Technology | People | Business | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Effect | Total Effect | Direct Effect | Indirect Effect | Total Effect | Direct Effect | Indirect Effect | Total Effect | Direct Effect | Indirect Effect | R2 |

| Business | 0.996 | 0.533 | 0.463 | 0.501 | 0.501 | 0.981 | ||||

| ESG | 0.959 | 0.959 | 0.482 | 0.482 | 0.963 | 0.963 | 0.927 | |||

| People | 0.925 | 0.925 | 0.855 | |||||||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Nitlarp, T.; Mayakul, T. The Implications of Triple Transformation on ESG in the Energy Sector: Fuzzy-Set Qualitative Comparative Analysis (fsQCA) and Structural Equation Modeling (SEM) Findings. Energies 2023, 16, 2090. https://doi.org/10.3390/en16052090

Nitlarp T, Mayakul T. The Implications of Triple Transformation on ESG in the Energy Sector: Fuzzy-Set Qualitative Comparative Analysis (fsQCA) and Structural Equation Modeling (SEM) Findings. Energies. 2023; 16(5):2090. https://doi.org/10.3390/en16052090

Chicago/Turabian StyleNitlarp, Theerasak, and Theeraya Mayakul. 2023. "The Implications of Triple Transformation on ESG in the Energy Sector: Fuzzy-Set Qualitative Comparative Analysis (fsQCA) and Structural Equation Modeling (SEM) Findings" Energies 16, no. 5: 2090. https://doi.org/10.3390/en16052090

APA StyleNitlarp, T., & Mayakul, T. (2023). The Implications of Triple Transformation on ESG in the Energy Sector: Fuzzy-Set Qualitative Comparative Analysis (fsQCA) and Structural Equation Modeling (SEM) Findings. Energies, 16(5), 2090. https://doi.org/10.3390/en16052090