Structural and Investment Funds of the European Union as an Instrument for Creating a Low-Carbon Economy by Selected Companies of the Energy Sector in Poland

Abstract

:1. Introduction

2. Literature Review

2.1. Low-Carbon Economy

2.2. EU Policies and Support Measures for a Low-Carbon Economy

2.3. Situation of the Energy Sector—The Case of Poland

3. Materials and Methods

3.1. Materials

3.2. Research Procedure

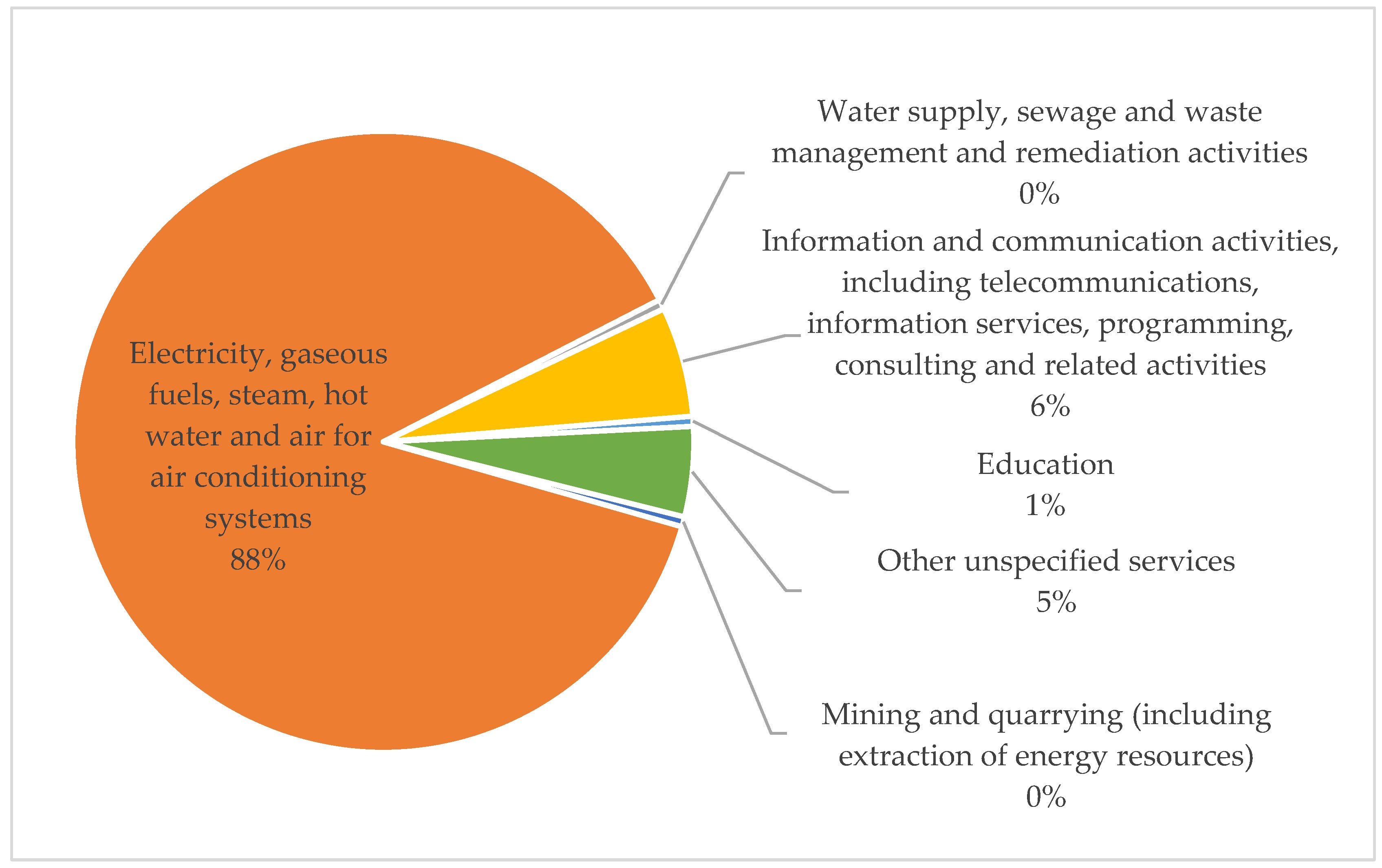

3.3. Characteristics of Selected Energy Sector Operators

4. Analysis

- −

- investments in infrastructure, capacity and equipment in SMEs directly related to research and innovation activities;

- −

- research and innovation processes in SMEs (including voucher systems, process innovation, design innovation, service innovation and social innovation);

- −

- development of SME activities, support for entrepreneurship and enterprise creation (including support for spin-off and spin-out enterprises).

5. Discussion

6. Conclusions

- −

- EU funds have been important in financing investments to decarbonize the economy. However, this did not apply to the sector as a whole but to the main players in the energy market.

- −

- The level of co-financing of investments made by energy companies was high, most often exceeding half of the investment value.

- −

- The surveyed companies, with the support of EU funds, aimed to achieve the objectives of Directive 2012/27/EU of the European Parliament and of the Council for energy efficiency, primarily concerned with bringing a low-carbon economy into reality.

- −

- Most of the EU support funds have been allocated to infrastructure investments. These are important but insufficient to accelerate the energy transition. A greater share of investments in the research and development sphere would be needed, through which the level of innovation in the energy sector could be raised.

- −

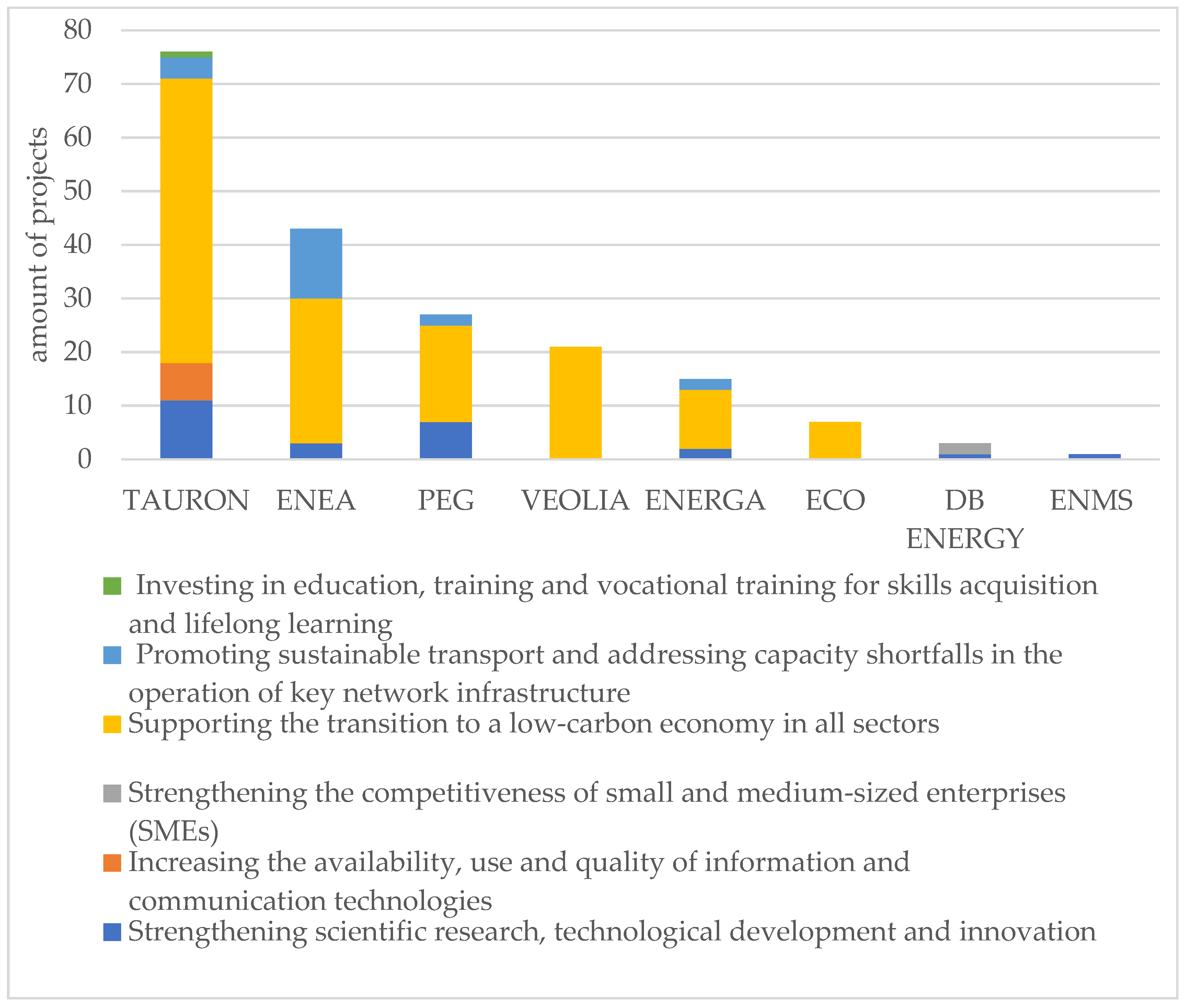

- Projects implemented by companies were closely aligned with the objectives of Directive 2012/27/EU of the European Parliament and of the Council for energy efficiency and most pursued the objective of supporting the transition to a low-carbon economy. Under this objective, half of the projects involved investments related to renewable energy sources.

- −

- There was little involvement of enterprises in the implementation of projects aimed at creating and using innovative solutions, as well as in shaping human competence and building public awareness of the implementation of solutions to reduce the carbon intensity of the economy,

- −

- Research on financing projects for shaping the low-carbon economy of key players in the energy sector in Poland needs to be continued and developed.

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Kabeyi, M.J.B.; Olanrewaju, A.O. Sustainable Energy Transition for Renewable and Low Carbon Grid Electricity Generation and Supply. Front. Energy Res. 2022, 9, 743114. [Google Scholar] [CrossRef]

- Framework Convention on Climate Change: Adoption of the Paris Agreement, Paris. 2015. Available online: https://digitallibrary.un.org/record/831039 (accessed on 24 June 2022).

- Jankiewicz, S. Gospodarka niskoemisyjna jako podstawa rozwoju regionu. Nierówności Społeczne A Wzrost Gospod. 2017, 49, 160–167. [Google Scholar] [CrossRef]

- Węglarz, A. Co Kryje się Pod Pojęciem Gospodarki Niskoemisyjnej; Energii, S.A., Ed.; Krajowa Agencja Poszanowania: Warsaw, Poland, 2013. [Google Scholar]

- EU COM. Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee, the Committee of the Regions, and the European Investment Bank. Accelerating Clean Energy Innovation. European Commission (EU COM): Brussels, Belgium, 2016, 763 Final. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/HTML/?uri=CELEX:52016DC0763&rid=4 (accessed on 11 January 2022).

- Szyja, P. Transition to a Low Carbon Economy at the Level of Local Government. Res. Pap. Wrocław Univ. Econ. 2016, 437, 447–463. [Google Scholar]

- Fuchs, G. The governance of innovations in the energy sector: Between adaptation and exploration. Sci. Technol. Stud. 2014, 27, 34–53. [Google Scholar] [CrossRef]

- Innovation Policy. Fact Sheets on the European Union, European Parliament. Available online: https://www.europarl.europa.eu/ftu/pdf/en/FTU_2.4.6.pdf (accessed on 16 January 2022).

- Energy Policy: General Principles. Fact Sheets on the European Union, European Parliament. Available online: https://www.europarl.europa.eu/ftu/pdf/pl/FTU_2.4.7.pdf (accessed on 16 January 2022).

- EU COM. Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee, the Committee of the Regions and the European Investment Bank a framework Strategy for a Sustainable Energy Union Based on a Forward-Looking Climate Policy; European Commission (EU COM): Brussels, Belgium, 2015. [Google Scholar]

- Standar, A.; Kozera, A.; Satoła, Ł. The Importance of Local Investments Co-Financed by the European Union in the Field of Renewable Energy Sources in Rural Areas of Poland. Energies 2021, 14, 450. [Google Scholar] [CrossRef]

- Kozera, A.; Satoła, Ł.; Standar, A.; Dworakowska-Raj, M. Regional diversity of low-carbon investment support from EU funds in the 2014–2020 financial perspective based on the example of Polish municipalities. Renew. Sustain. Energy Rev. 2022, 168, 112863. [Google Scholar] [CrossRef]

- Durst, S.; Gerstlberger, W. Financing Responsible Small- and Medium-Sized Enterprises: An International Overview of Policies and Support Programmes. J. Risk Financ. Manag. 2021, 14, 10. [Google Scholar] [CrossRef]

- Florkowski, W.J.; Rakowska, J. Review of Regional Renewable Energy Investment Projects: The Example of EU Cohesion Funds Dispersal. Sustainability 2022, 14, 17007. [Google Scholar] [CrossRef]

- Lakatos, E.; Arsenopoulos, A. Investigating EU financial instruments to tackle energy poverty in households: A SWOT analysis. Energy Sources Part B Econ. Plan. Policy 2019, 14, 235–253. [Google Scholar] [CrossRef]

- Bertoldi, P.; Rezessy, S.; Vine, E. Energy service companies in European countries: Current status and a strategy to foster their development. Energy Policy 2006, 34, 1818–1832. [Google Scholar] [CrossRef]

- York, R.; McGee, J.A. Understanding the Jevons paradox. Environ. Sociol. 2016, 2, 77–87. [Google Scholar] [CrossRef]

- Sorrell, S. Jevons’ Paradox revisited: The evidence for backfire from improved energy efficiency. Energy Policy 2009, 37, 1456–1469. [Google Scholar] [CrossRef]

- Dinda, S. Environmental Kuznets curve hypothesis: A survey. Ecol. Econ. 2004, 49, 431–455. [Google Scholar] [CrossRef] [Green Version]

- Yuan, H.; Zhou, P.; Zhou, D. What is Low-Carbon Development? A Conceptual Analysis. Energy Procedia 2011, 5, 1706–1712. [Google Scholar] [CrossRef] [Green Version]

- Gradziuk, P.; Gradziuk, B. Gospodarka niskoemisyjna–nowe wyzwanie dla gmin wiejskich. Wieś I Rol. 2016, 1, 105–126. [Google Scholar] [CrossRef] [PubMed]

- Baleta, J.; Mikulcic, H.; Klemeš, J.J.; Urbaniec, K.; Duic, N. Integration of energy, water and environmental systems for a sustainable development. J. Clean. Prod. 2019, 215, 1424–1436. [Google Scholar] [CrossRef]

- Papadopoulou, C.A.; Papadopoulou, M.P.; Laspidou, C.; Munaretto, S.; Brouwer, F. Towards a Low-Carbon Economy: A Nexus-Oriented Policy Coherence Analysis in Greece. Sustainability 2020, 12, 373. [Google Scholar] [CrossRef] [Green Version]

- Xin, X.; Yuding, W.; Jianzhong, W. The Problems and Strategies of the Low Carbon Economy Development. Energy Procedia 2011, 5, 1831–1836. [Google Scholar] [CrossRef] [Green Version]

- Lugo-Morin, D.R. Global Future: Low-Carbon Economy or High-Carbon Economy? World 2021, 2, 175–193. [Google Scholar] [CrossRef]

- UN. Decade of EVALUATION for Action to Deliver the SDGs by 2030. United Nations (UN) Campaign Concept Note; UN: Geneva, Switzerland, 2019; p. 2. [Google Scholar]

- UN. Decade of Action—United Nations Sustainable Development. Available online: https://www.un.org/sustainabledevelopment/decade-of-action/ (accessed on 7 June 2021).

- 2030 Climate & Energy Framework. Climate Action. European Commision. Available online: https://ec.europa.eu/clima/policies/strategies/2030_pl (accessed on 3 June 2022).

- 2020 Climate & Energy Package. Climate Action. European Commision. Available online: https://climate.ec.europa.eu/eu-action/climate-strategies-targets/2020-climate-energy-package_en (accessed on 3 June 2022).

- Allen, M.L.; Allen, M.M.C.; Cumming, D.; Johan, S. Comparative Capitalisms and Energy Transitions: Renewable Energy in the European Union. Br. J. Manag. 2021, 32, 611–629. [Google Scholar] [CrossRef]

- McEvoy, D.; Gibbs, D.C.; Longhurst, J.W.S. The employment implications of a low-carbon economy. Sustain. Dev. 2000, 8, 27. [Google Scholar] [CrossRef]

- Bridge, G.; Bouzarovski, S.; Bradshaw, M.; Eyre, N. Geographies of energy transition: Space, place and the low-carbon economy. Energy Policy 2013, 53, 331–340. [Google Scholar] [CrossRef]

- Tavoni, M.; De Cian, E.; Luderer, G.; Steckel, J.C.; Waisman, H. The value of technology and of its evolution towards a low carbon economy. Clim. Chang. 2011, 114, 39–57. [Google Scholar] [CrossRef]

- Słupik, S.; Kos-Łabędowicz, J.; Trzesiok, J. Energy-Related Behaviour of Consumers from the Silesia Province (Poland) Towards a Low-Carbon Economy. Energies 2021, 14, 2218. [Google Scholar] [CrossRef]

- Kowal, B.; Domaracká, L.; Tobór-Osadnik, K. Innovative Activity of Companies in the Raw Material Industry on the Example of Poland and Slovakia—Selected Aspects. J. Pol. Miner. Eng. Soc. 2020, 2, 70–77. [Google Scholar]

- Standar, A.; Kozera, A.; Jabkowski, D. The Role of Large Cities in the Development of Low-Carbon Economy—The Example of Poland. Energies 2022, 15, 595. [Google Scholar] [CrossRef]

- Morata, F.; Sandoval, S.I. European Energy Policy; Edward Elgar: Northampton, UK, 2012. [Google Scholar]

- Miciuła, I. Polityka energetyczna Unii Europejskiej do 2030 roku w ramach zrównoważonego rozwoju. Stud. I Pr. Wydziału Nauk. Ekon. I Zarządzania 2015, 42, 57–67. [Google Scholar] [CrossRef]

- Perez-Arriaga, I. Regulation of the Power Sector. In Loyola de Palacio Series on European Energy Policy; Edward Elgar Publishing: Cheltenham, UK, 2014. [Google Scholar]

- Leveque, F.; Glachant, J.M.; Barquin, J.; Holz, F.; Nuttall, W. Security of Energy Supply in Europe Natural Gas, Nuclear and Hydrogen. In Loyola de Palacio Series on European Energy Policy; Edward Elgar Publishing: Cheltenham, UK, 2010. [Google Scholar]

- Paska, J.; Surma, T. “Pakiet Zimowy” Komisji Europejskiej a kierunki i realizacja polityki energetycznej do 2030 roku. Rynek Energii 2017, 2, 21–28. [Google Scholar]

- Paska, J.; Surma, T. Wpływ polityki energetycznej Unii Europejskiej na funkcjonowanie przedsiębiorstw energetycznych w Polsce. Rynek Energii 2016, 2, 17–26. [Google Scholar]

- Korbutowicz, T. Polityka pomocy publicznej UE w odniesieniu do energii. Przedsiębiorczość I Zarządzanie 2018, XIX/ 2, 293–304. [Google Scholar]

- Commission Regulation (EU). No 651/2014 of 17 June 2014 Declaring Certain Categories of Aid Compatible with the Internal Market in Application of Articles 107 and 108 of the Treaty Text with EEA Relevance. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=OJ:L:2014:187:FULL&from=IT (accessed on 17 November 2022).

- Official Journal of the European Union C 200. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=OJ:C:2018:200:FULL&from=EN (accessed on 18 November 2022).

- Janowski, K. Mechanizmy finansowania inwestycji energetycznych ze źródeł europejskich. Rynek Energii 2011, 3, 64–73. [Google Scholar]

- EU COM. Report from the Commission to the European Parliament and the Council: Financial Support for Energy Efficiency in Buildings; COM: Brussels, Belgium, 2013; Volume 225, Available online: https://eur-lex.europa.eu/legal-content/PL/TXT/PDF/?uri=CELEX:52013DC0225&from=CS (accessed on 21 November 2022).

- Kochański, M. Finansowanie instrumentów poprawy efektywności energetycznej w Polsce w latach 2014–2020. Acta Innov. 2014, 10, 65–86. [Google Scholar]

- Directive 2012/27/Eu of the European Parliament and of the Council, of 25 October 2012, on Energy Efficiency, Amending Directives 2009/125/EC and 2010/30/EU and Repealing Directives 2004/8/EC and 2006/32/EC. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/HTML/?uri=CELEX:32012L0027&from=EN (accessed on 17 November 2022).

- Operational Program Infrastructure and Environment 2007–2013, National Strategic Reference Framework 2007–2013, version 5.0. Available online: https://www.pois.gov.pl/media/92372/POIS_2007_2013_wersja_5_0.pdf (accessed on 15 November 2022).

- Operational Program Infrastructure and Environment 2014–2020, Ministry of Funds and Regional Policy, Version 24.0. 2022. Available online: https://www.pois.gov.pl/media/110770/POIiS_v_24_0.docx (accessed on 13 November 2022).

- Grabiec, O. Charakterystyka i funkcjonowanie grup kapitałowych polskiego sektora energetycznego. Zesz. Nauk. Wyższej Szkoły Humanitas. Zarządzanie 2009, 2, 70–79. [Google Scholar]

- Energy Policy of Poland until 2030, Ministry of Economy, Warsaw, 10 November 2009 r. Available online: https://isap.sejm.gov.pl/isap.nsf/download.xsp/WMP20210000264/O/M20210264.pdf (accessed on 21 November 2022).

- Finansowanie Inwestycji Energetycznych w Polsce; Pricewaterhouse Coopers i ING Bank Śląski: Warsaw, Poland, 2011.

- Lipski, M. Wyzwania sektora energetycznego w Polsce z perspektywy akcjonariuszy. Zesz. Nauk. PWSZ W Płocku Nauk. Ekon. 2016, XXIII, 269–279. [Google Scholar]

- Jaworski, J.; Czerwonka, L. Determinants of Enterprises’ Capital Structure in Energy Industry: Evidence from European Union. Energies 2021, 14, 1871. [Google Scholar] [CrossRef]

- Grabińska, B.; Kędzior, M.; Kędzior, D.; Grabiński, K. The Impact of Corporate Governance on the Capital Structure of Companies from the Energy Industry. Case Pol. Energy 2021, 14, 7412. [Google Scholar] [CrossRef]

- Piwowarczyk-Ściebura, K.; Olkuski, T. Wdrażanie polityki klimatyczno-energetycznej w TAURON POLSKA ENERGIA SA. Polityka Energetyczna 2016, 19, 93–108. [Google Scholar]

- Local Data Bank. Central Statistical Office: Warsaw, Poland. Available online: https://bdl.stat.gov.pl/BDL/dane/podgrup/temat (accessed on 11 April 2022).

- National Court Register. Available online: https://ekrs.ms.gov.pl/web/wyszukiwarka-krs/strona-glowna/index.html (accessed on 1 July 2022).

- National Report of the President of the Energy Regulatory Authority 2015. Available online: file:///C:/Users/Agnieszka/Downloads/Raport_Roczny_Prezesa_URE_-_2015-1.pdf (accessed on 11 April 2022).

- National Report of the President of the Energy Regulatory Authority 2020. Available online: https://www.ure.gov.pl/download/9/11395/Raport2020.pdf (accessed on 11 April 2022).

- Electricity and Gas Market in Poland Report TOE. 2022. Available online: https://toe.pl/pl/wybrane-dokumenty/rok-2022?download=1601:rynek-energii-elektrycznej-i-gazu-w-polsce-stan-na-31-marca-2022-raport-toe (accessed on 11 April 2022).

- Database of Implemented EU Projects; Ministry of Development Funds and Regional Policy: Warsaw, Poland. Available online: https://www.funduszeeuropejskie.gov.pl/media/112582/Lista_projektow_FE_2014_2020_011222.xlsx (accessed on 11 April 2022).

- Pakuła, J. Raport sektorowy—energetyka. Profit J. Mag. Finans. 2020, 31. Available online: https://profit-journal.pl/raport-sektorowy-energetyka/ (accessed on 3 September 2022).

- Jarosz, S.; Gawlik, K.; Gozdecki, K. Pozyskanie Finansowania Dla Działalności Przedsiębiorstw—Analiza Sektora Energetycznego. Zarządzanie I Jakość 2022, 4, 61–79. [Google Scholar]

- Cucchiella, F.; Condemi, A.; Rotilio, M.; Annibaldi, V. Energy Transitions in Western European Countries: Regulation Comparative Analysis. Energies 2021, 14, 3940. [Google Scholar] [CrossRef]

- Candelise, C.; Ruggieri, G. Status and Evolution of the Community Energy Sector in Italy. Energies 2020, 13, 1888. [Google Scholar] [CrossRef] [Green Version]

- Kazak, J.K.; Kamińska, J.A.; Madej, R.; Bochenkiewicz, M. Where Renewable Energy Sources Funds are Invested? Spatial Analysis of Energy Production Potential and Public Support. Energies 2020, 13, 5551. [Google Scholar] [CrossRef]

- Bointner, R.; Pezzutto, S.; Grilli, G.; Sparber, W. Financing innovations for the renewable energy transition in Europe. Energies 2016, 9, 990. [Google Scholar] [CrossRef] [Green Version]

- Carfora, A.; Romano, A.A.; Ronghi, M.; Scandurra, G. Renewable generation across Italian regions: Spillover effects and effectiveness of European Regional Fund. Energy Policy 2017, 102, 132–141. [Google Scholar] [CrossRef]

- Bostan, I.; Lazar, C.M.; Asalos, N.; Munteanu, I.; Horga, G.M. The three-dimensional impact of the absorption effects of European funds on the competitiveness of the SMEs from the Danube Delta. Ind. Crops Prod. 2019, 132, 460–467. [Google Scholar] [CrossRef]

- Bostan, I.; Moroşan, A.A.; Hapenciuc, C.V.; Stanciu, P.; Condratov, I. Are Structural Funds a Real Solution for Regional Development in the European Union? A Study on the Northeast Region of Romania. J. Risk Financ. Manag. 2022, 15, 232. [Google Scholar] [CrossRef]

- Streimikiene, D.; Klevas, V.; Bubeliene, J. Use of EU structural funds for sustainable energy development in new EU member states. Renew. Sustain. Energy Rev. 2007, 11, 1167–1187. [Google Scholar] [CrossRef]

- Mexis, F.D.; Papapostolou, A.; Karakosta, C.; Psarras, J.; Psarras, J. Financing Sustainable Energy Efficiency Projects: The Triple-A Case. Environ. Sci. Proc. 2021, 11, 22. [Google Scholar]

- Kern, F.; Rogge, K.S.; Howlett, M. Policy mixes for sustainability transitions: New approaches and insights through bridging innovation and policy studies. Res. Policy 2019, 48, 103832. [Google Scholar] [CrossRef]

- Szczepaniak, K. Finansowanie inwestycji w energetykę odnawialną i poprawę efektywności energetycznej—atrakcyjność, ryzyko, bariery. Pr. Nauk. Wyższej Szkoły Bank. W Gdańsku 2013, 27, 261–272. [Google Scholar]

- Carrillo-Hermosilla, J.; del Río, P.; Könnölä, T. Diversity of eco-innovations: Reflections from selected case studies. J. Clean. Prod. 2010, 18, 1073–1083. [Google Scholar] [CrossRef]

- Khatoon, A.; Verma, P.; Southernwood, L.; Massey, B.; Corcoran, P. Blockchain in Energy Effciency: Potential Applications and Benefits. Energies 2019, 12, 3317. [Google Scholar] [CrossRef] [Green Version]

- Borowski, P.F. Digitization, Digital Twins, Blockchain, and Industry 4.0 as Elements of Management Process in Enterprises in the Energy Sector. Energies 2021, 14, 1885. [Google Scholar] [CrossRef]

- Kretek, H. Przyszłość energetyki w Polsce w drodze transformacji ku OZE. Etyka Bizn. I Zrównoważony Rozw. Interdyscyplinarne Stud. Teor. Empiryczne 2018, 1, 69–78. [Google Scholar]

- Thon, F. Energetyka Potrzebuje “Nowej Pary Oczu”. Przyszłość to Innowacje. Available online: http://www.rp.pl/artykul/1163332-Energetyka-potrzebuje-nowej-pary-oczu-Przyszlosc-to-innowacje.html (accessed on 18 November 2022).

- Zawada, M.; Pabian, A.; Bylok, F.; Chichobłaziński, L. Innowacje w sektorze energetycznym. Res. Rev. Czest. Univ. Technol. Manag. 2015, 19, 7–21. [Google Scholar]

- Wolsink, M. Distributed energy systems as common goods: Socio-political acceptance of renewables in intelligent microgrids. Renew. Sustain. Energy Rev. 2020, 127, 109841. [Google Scholar] [CrossRef]

- Neska, E.; Kowalska-Pyzalska, E. Conceptual design of energy market topologies for communities and their practical applications in EU: A comparison of three case studies. Renew. Sustain. Energy Rev. 2022, 169, 112921. [Google Scholar] [CrossRef]

- Parag, Y.; Sovacool, B. Electricity market design for the prosumer era. Nat. Energy 2016, 1, 16032–16053. [Google Scholar] [CrossRef]

- Sterlacchini, A. Energy R&D in private and state-owned utilities: An analysis of the major world electric companies. Energy Policy 2012, 494–506. [Google Scholar] [CrossRef] [Green Version]

- Cortez, M.C.; Andrade, N.; Silva, F. The environmental and financial performance of green energy investments: European evidence. Ecol. Econ. 2022, 197, 107427. [Google Scholar] [CrossRef]

| Company Name | Legal Form | Headquarters | Start Date of Activities | Scope of Activity | Numbers of Employees 1 |

|---|---|---|---|---|---|

| PEG 2 | joint-stock company | Warsaw | 1990 | Electricity transmission Distribution of electricity | >1000 |

| Tauron Wytwarzanie S.A | joint-stock company | Jaworzno | 2001 | Electricity generation | >1000 |

| ENEA | joint-stock company | Poznań | 1945 | Energy trading and power generation | >1000 |

| Veolia 3 | joint-stock company | Warsaw | 1997 | Electricity generation and distribution Transmission of electricity | >1000 |

| ENERGA | joint-stock company | Gdańsk | 1993 | Electricity transmission Distribution of electricity | >1000 |

| ECO 4 | joint-stock company | Opole | 2001 | Electricity generation and distribution Distribution of electricity | 250–1000 |

| DB Energy 5 | joint-stock company | Wrocław | 2017 6 | Regulation of fuel and energy management Technical research and analysis Architecture, engineering and related technical consulting Electrical and electronic engineering | 10–49 |

| EnMS Polska 7 | limited liability company | Mielec | 2012 | Other business and management consulting | 10–49 |

| Name of Group Company | Name of Company | Numbers of Projects | % of Total Projects | |

|---|---|---|---|---|

| DB ENERGY | DB ENERGY S.A. | 3 | 1.5% | 1.5% |

| ENEA | ENEA CIEPŁO S.P. Z O.O. | 4 | 22.3% | 2.1% |

| ENEA ELEKTROWNIA POŁANIEC S.A. | 1 | 0.5% | ||

| ENEA OPERATOR SP. Z O.O. | 38 | 19.7% | ||

| ECO | ENERGETYKA CIEPLNA OPOLSZCZYZNY S.A. (ECO) | 7 | 3.6% | 3.6% |

| ENMS | ENMS POLSKA S.P. Z O.O. | 1 | 0.5% | 0.5% |

| PEG | PEG DYSTRYBUCJA S.A. | 14 | 14.0% | 7.3% |

| PEG ENERGIA CIEPŁA S.A. | 6 | 3.1% | ||

| PEG ENERGIA ODNAWIALNA S.A. | 1 | 0.5% | ||

| PEG GÓRNICTWO I ENERGETYKA KONWENCJONALNA S.A. | 2 | 1.0% | ||

| PEG TORUŃ S.A. | 4 | 2.1% | ||

| TAURON | TAURON CIEPŁO SP. Z O.O. | 2 | 39.4% | 1.0% |

| TAURON DYSTRYBUCJA S.A. | 60 | 31.1% | ||

| TAURON EKOENERGIA SPÓŁKA Z OGRANICZONĄ ODPOWIEDZIALNOŚCIĄ | 1 | 0.5% | ||

| TAURON OBSŁUGA KLIENTA SPÓŁKA Z OGRANICZONĄ ODPOWIEDZIALNOŚCIĄ | 7 | 3.6% | ||

| TAURON POLSKA ENERGIA S.A. | 3 | 1.6% | ||

| TAURON WYTWARZANIE S.A. | 3 | 1.6% | ||

| VEOLIA | VEOLIA ENERGIA ŁÓDŹ S.A. | 5 | 10.9% | 2.6% |

| VEOLIA ENERGIA POZNAŃ S.A. | 4 | 2.1% | ||

| VEOLIA ENERGIA WARSZAWA S.A. | 6 | 3.1% | ||

| VEOLIA MAŁA KOGENERACJA WARSZAWA S.P.Z O.O. | 1 | 0.5% | ||

| VEOLIA POŁUDNIE | 5 | 2.6% | ||

| Energa | ENERGA-OPERATOR SA | 13 | 7.8% | 6.7% |

| ENERGA INVEST SPÓŁKA Z OGRANICZONĄ ODPOWIEDZIALNOŚCIĄ | 1 | 0.5% | ||

| ENERGA WYTWARZANIE S.A. | 1 | 0.5% | ||

| Operational Program | European Funds | Sum | ||

|---|---|---|---|---|

| ERDF | ESF | CF | ||

| Operational Program Infrastructure and Environment | 27 | 86 | 113 | |

| Operational Program Intelligent Development | 24 | 24 | ||

| Operational Program Digital Poland | 7 | 7 | ||

| Operational Program Knowledge Education Development | 1 | 1 | ||

| Regional Operational Programs | 48 | 48 | ||

| sum | 106 | 1 | 86 | 193 |

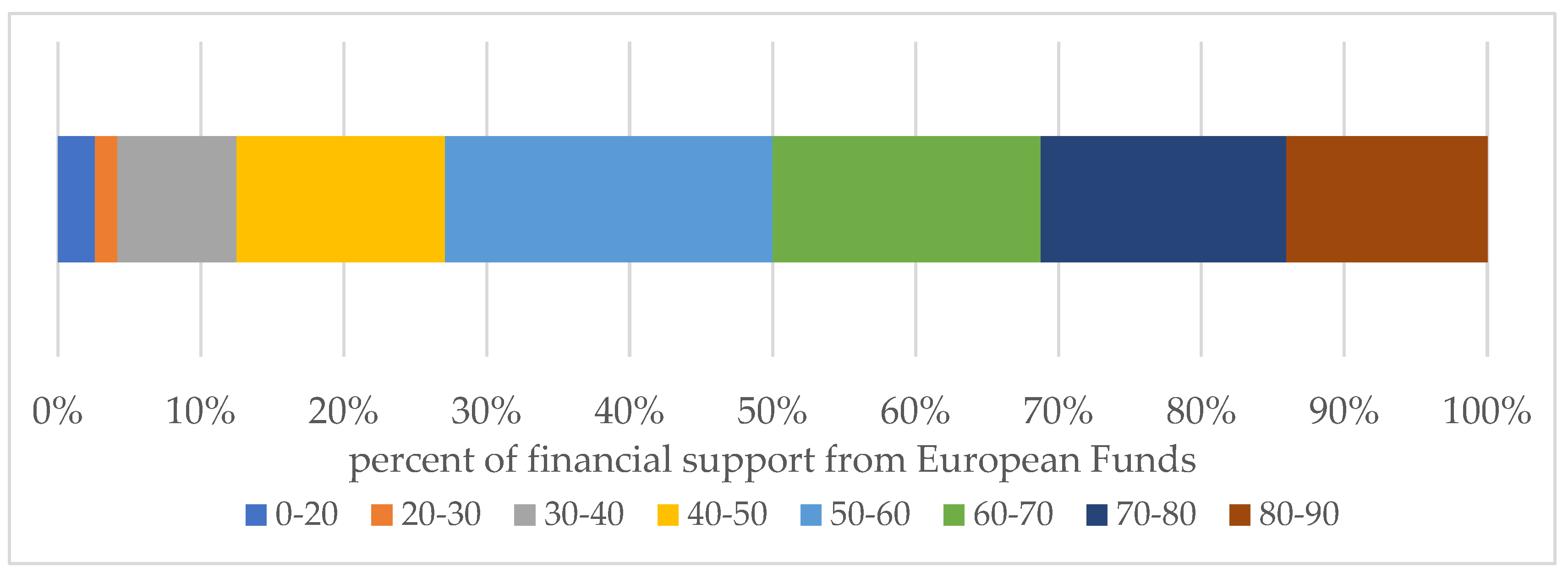

| Project Objective | Average Funding Level (%) |

|---|---|

| 01 Strengthening scientific research, technological development and innovation | 54 |

| 02 Increasing the availability, use and quality of information and communication technologies | 85 |

| 03 Strengthening the competitiveness of small- and medium-sized enterprises (SMEs) | 61 |

| 04 Supporting the transition to a low-carbon economy in all sectors | 57 |

| 07 Promoting sustainable transport and addressing capacity shortfalls in the operation of key network infrastructure | 65 |

| 10 POWR Investing in education, training and vocational training for skills acquisition and lifelong learning | 84 |

| other | 68 |

| Project Objective Symbol | Quantity of Projects | Amount of EU Co-Financing (PLN) | Average Funding Value (PLN) |

|---|---|---|---|

| 01 | 23 | 92,852,483 | 4,037,064 |

| 02 | 7 | 187,841,164 | 26,834,452 |

| 03 | 2 | 495,475 | 247,738 |

| 04 | 126 | 1,015,084,996 | 8,056,230 |

| 07 | 19 | 280,930,277 | 14,785,804 |

| 10 | 1 | 625,047 | 625,047 |

| other | 15 | 230,423,115 | 15,361,541 |

| sum | 193 | 1,808,252,556 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Dembicka-Niemiec, A.; Szafranek-Stefaniuk, E.; Kalinichenko, A. Structural and Investment Funds of the European Union as an Instrument for Creating a Low-Carbon Economy by Selected Companies of the Energy Sector in Poland. Energies 2023, 16, 2031. https://doi.org/10.3390/en16042031

Dembicka-Niemiec A, Szafranek-Stefaniuk E, Kalinichenko A. Structural and Investment Funds of the European Union as an Instrument for Creating a Low-Carbon Economy by Selected Companies of the Energy Sector in Poland. Energies. 2023; 16(4):2031. https://doi.org/10.3390/en16042031

Chicago/Turabian StyleDembicka-Niemiec, Agnieszka, Edyta Szafranek-Stefaniuk, and Antonina Kalinichenko. 2023. "Structural and Investment Funds of the European Union as an Instrument for Creating a Low-Carbon Economy by Selected Companies of the Energy Sector in Poland" Energies 16, no. 4: 2031. https://doi.org/10.3390/en16042031

APA StyleDembicka-Niemiec, A., Szafranek-Stefaniuk, E., & Kalinichenko, A. (2023). Structural and Investment Funds of the European Union as an Instrument for Creating a Low-Carbon Economy by Selected Companies of the Energy Sector in Poland. Energies, 16(4), 2031. https://doi.org/10.3390/en16042031