Energy Intensity, Energy Efficiency and Economic Growth among OECD Nations from 2000 to 2019

Abstract

1. Introduction

2. Literature Review

2.1. EI and EE in OECD Nations

2.2. Convergence of EI and EE

2.3. DEA Applied Energy

2.4. Position of This Study

| Author(s) | Year | Summary | Data | Methods | Main Topic |

|---|---|---|---|---|---|

| Keskin | 2021 [30] | Discussed social prosperity concept for the OPEC countries and evaluated whether OPEC member countries effectively use the wealth provided by oil to improve social prosperity. | OPEC member countries for the year of 2019 | Network DEA slack based measure approach | DEA application to energy |

| Ziolo, Jednak, Savić ad Kragulj | 2020 [31] | Tried to show the link between energy efficiency and sustainable economic and financial development. Showed a slight upward trend of total factor energy efficiency. | OECD countries for the period 2000–2018 | DEA and regression analysis | DEA application to energy |

| Li, Chien, Hsu, Zhang, Nawaz, Iqbal, Mohsin | 2021 [34] | Measured the energy efficiency, energy poverty and social welfare of developed and developing countries. Explained how energy poverty is linked with the energy efficiency. | 14 developed and developing countries | DEA and entropymethod | DEA application to energy |

| Zhu, Lin | 2022 [35] | Examined the impact of pressure brought by economic growth target on energy efficiency improvement. Suggested that economic growth pressure has hindered the improvement of energy efficiency. | 188 Chinese cities | DEA, regression analysis | DEA application to energy |

| Zhao, Mahendru, Ma, Rao, Shang | 2022 [36] | Indicated a U-shaped non-linear effect of energy efficiency-related environmental regulation on green economic growth as well as a spatial spillover effect and spatial feedback effect. | Panel data of 286 prefecture-level cities in China from 2003 to 2018 | Metafrontier-Global-SBM super-efficient DEA model, spatial econometric model | DEA application to energy |

| Zhang, Patwary, Sun, Raza, Taghizadeh-Hesary, Iram | 2021 [37] | Measured energy and environmental efficiency. Measured cross-sectional efficiency using two inputs (energy consumption, labor force), a desirable output (gross domestic product), and an undesirable output (CO2 emission). Found that the UK ranks the highest position in terms of energy and environmental efficiency. | Some selected countries in central and western Europe from 2010 to 2014 | DEA | DEA application to energy |

| Yu, He | 2020 [38] | Provided a comprehensive overview of all publications about the researches on energy efficiency based on data envelopment analysis (DEA) retrieved from the Web of Science database. | A total of 1206 documents in this field, published until 2018 | Bibliometrics | DEA application to energy |

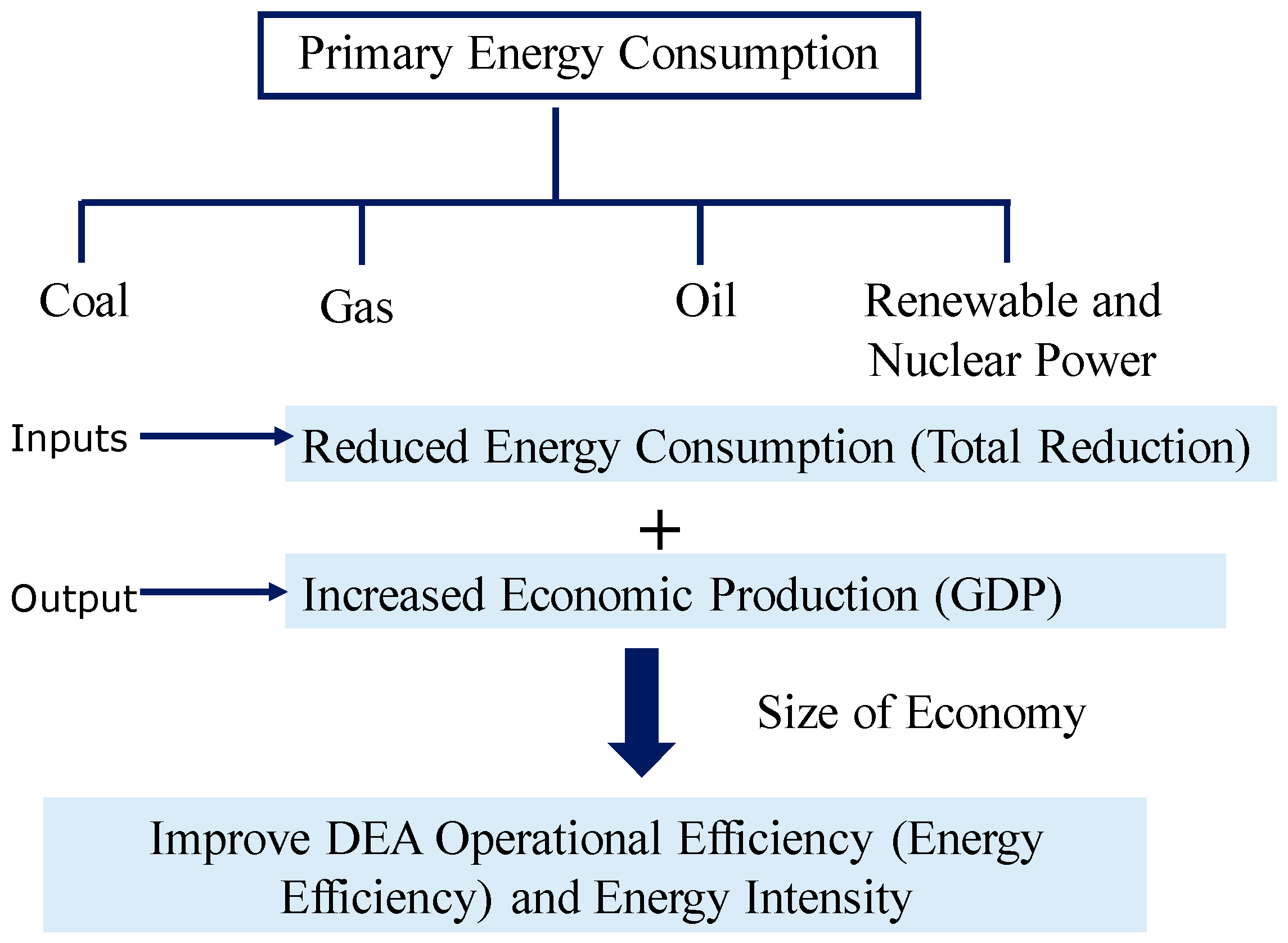

3. Underlying Concepts

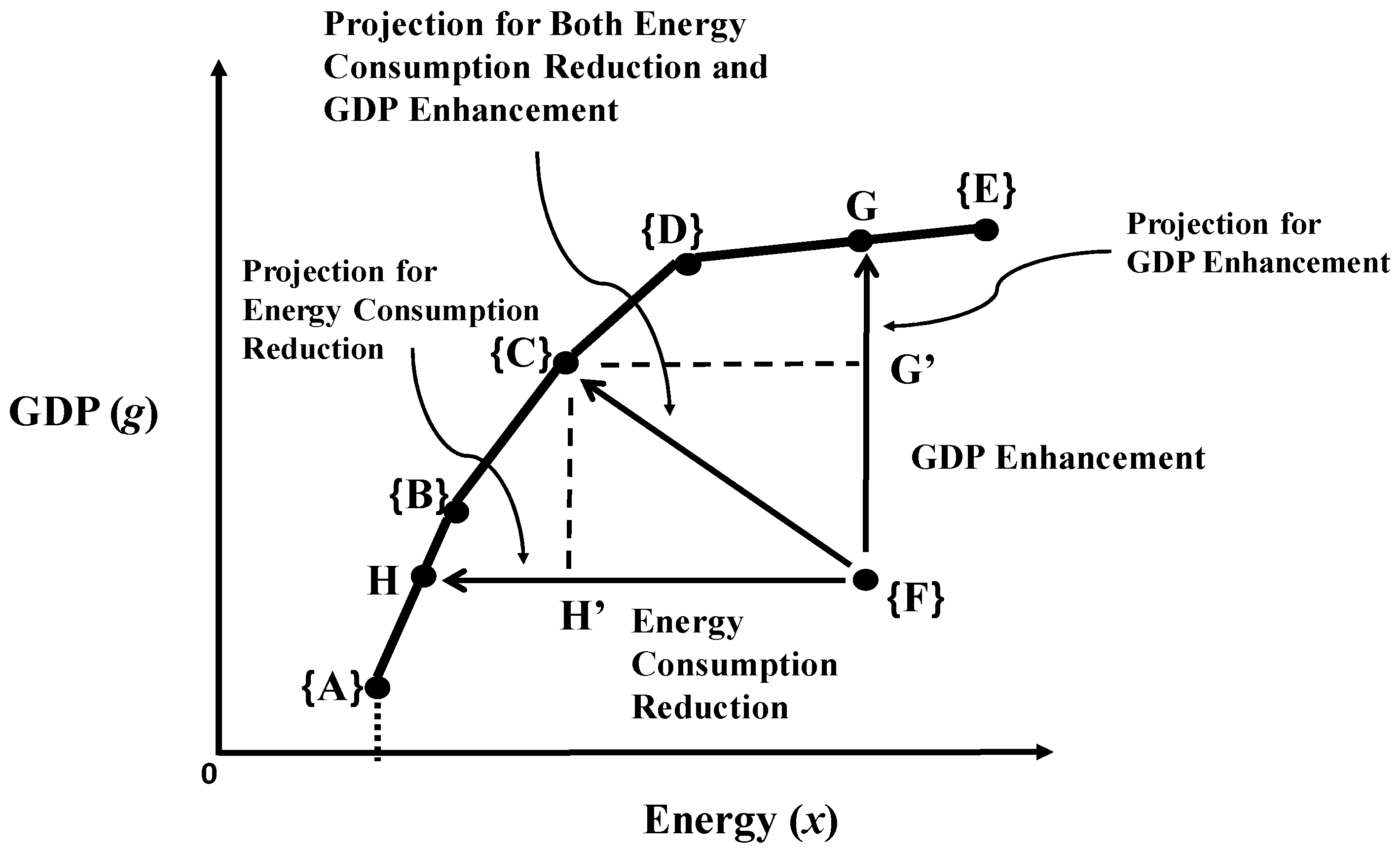

3.1. Energy Consumption Reduction and Economic Efficiency Enhancement

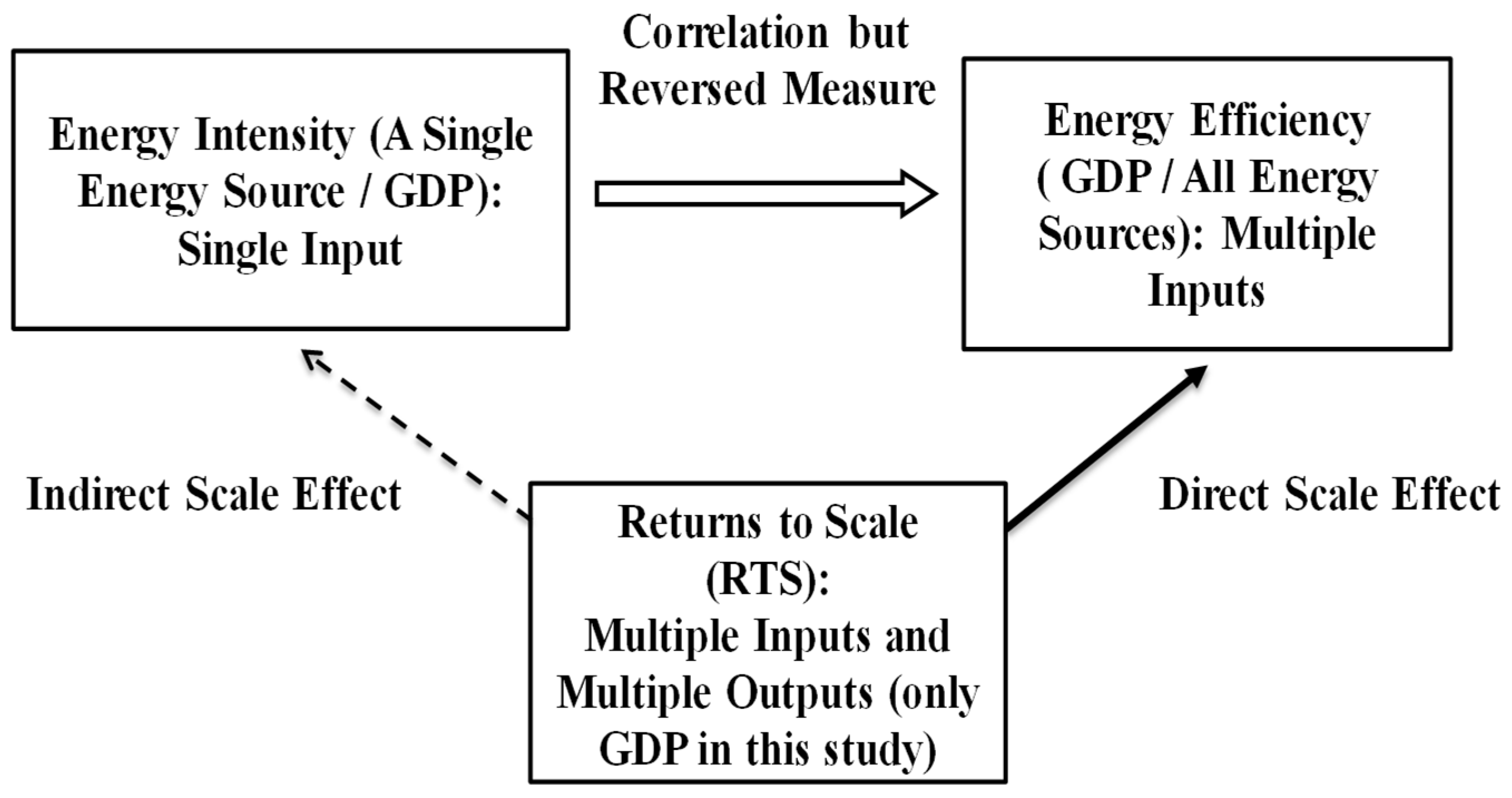

3.2. A Scale Effect on Energy Intensity and Energy Efficiency

3.3. Strengths and Shortcomings of DEA

4. Formulations for Measurement in a Time Horizon

4.1. Cross-Sectional Operational Efficiency (CSOE)

4.2. Window-Based Operational Efficiency (WOE)

5. EI and RTS

5.1. DEA-Based EI

5.2. Return to Scale (RTS)

6. Empirical Study

6.1. Data

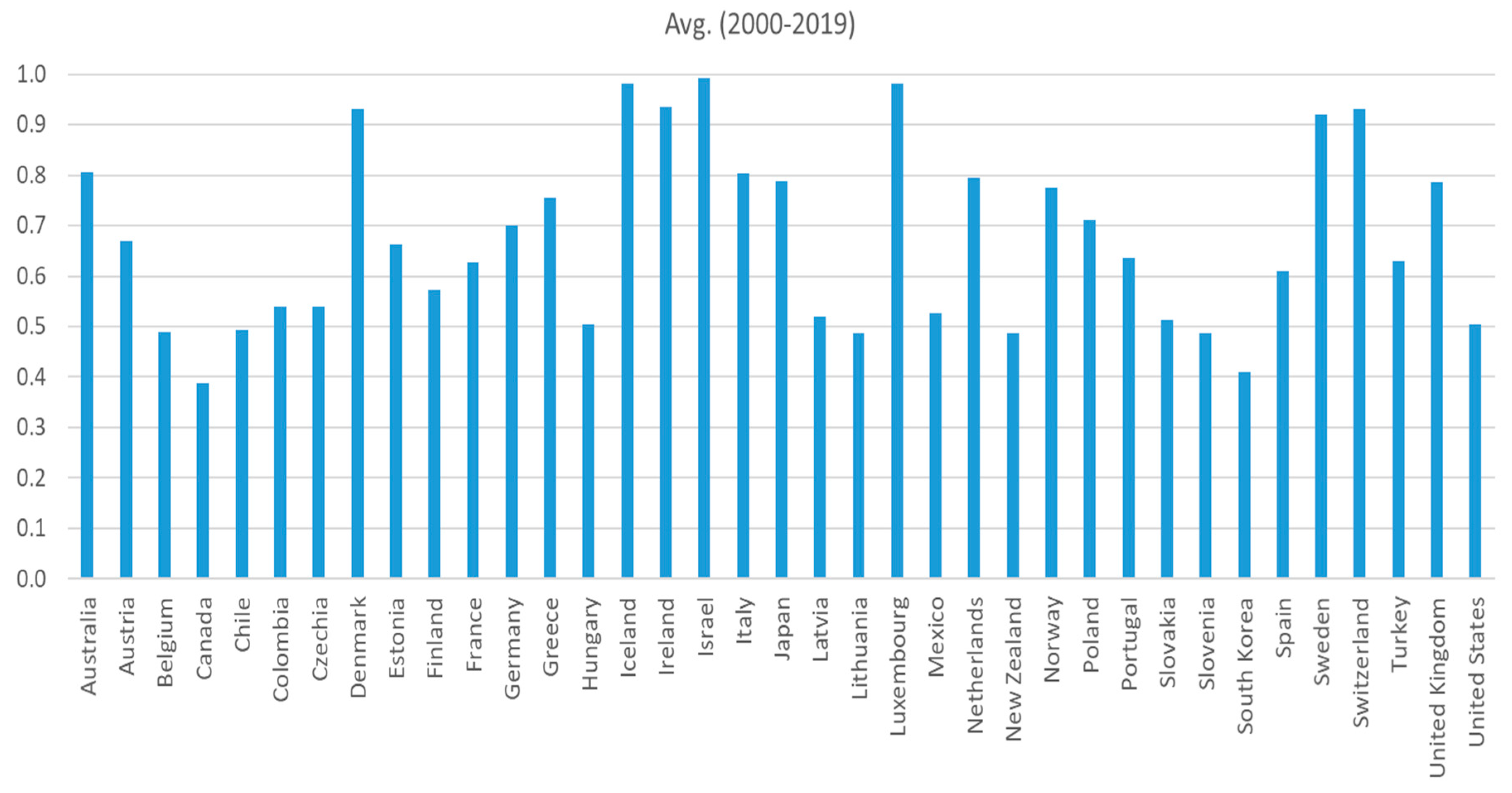

6.2. OE, EI, and RTS Measures

7. Conclusions and Future Extensions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Abbreviations

References

- International Energy Agency. Net Zero by 2050: A Roadmap for the Global Energy Sector, 4th ed.; International Energy Agency: Paris, France, 2021. [Google Scholar]

- Sueyoshi, T.; Zhang, R.; Li, A. Measuring and analyzing operational efficiency and returns to scale in a time horizon: Assessment of China’s electricity generation & transmission at provincial levels. Energies 2023, 16, 1006. [Google Scholar] [CrossRef]

- Glover, F.; Sueyoshi, T. Contributions of Professor William W. Cooper in operations research and management science. Eur. J. Oper. Res. 2009, 197, 1–16. [Google Scholar] [CrossRef]

- Sueyoshi, T.; Goto, M. Environmental Assessment on Energy and Sustainability by Data Envelopment Analysis; John Wiley & Sons: London, UK, 2018. [Google Scholar]

- Azhgaliyeva, D.; Liu, Y.; Liddle, B. An empirical analysis of energy intensity and the role of policy instruments. Energy Policy 2020, 145, 111773. [Google Scholar] [CrossRef]

- Chakraborty, S.K.; Mazzanti, M. Energy intensity and green energy innovation: Checking heterogeneous country effects in the OECD. Struct. Change Econ. Dyn. 2020, 52, 328–343. [Google Scholar] [CrossRef]

- Filippini, M.; Hunt, L.C. Energy demand and energy efficiency in the OECD countries: A Stochastic demand frontier approach. Energy J. 2011, 32, 59–80. [Google Scholar] [CrossRef]

- Voigt, S.; De Cian, E.; Schymura, M.; Verdolini, E. Energy intensity developments in 40 major economies: Structural change or technology improvement? Energy Econ. 2014, 41, 47–62. [Google Scholar] [CrossRef]

- Wurloda, J.D.; Noailly, J. The impact of green innovation on energy intensity: An empirical analysis for 14 industrial sectors in OECD countries. Energy Econ. 2018, 71, 47–61. [Google Scholar] [CrossRef]

- Fidanoski, F.; Simeonovsk, K.; Cvetkoska, V. Energy efficiency in OECD countries: A DEA approach. Energies 2021, 14, 1185. [Google Scholar] [CrossRef]

- Irfan, M. Low-carbon energy strategies and economic growth in developed and developing economies: The case of energy efficiency and energy diversity. Environ. Sci. Pollut. Res. 2021, 28, 54608–54620. [Google Scholar] [CrossRef]

- Santos, J.; Borges, A.S.; Domingos, T. Exploring the links between total factor productivity and energy efficiency: Portugal, 1960–2014. Energy Econ. 2021, 101, 105407. [Google Scholar] [CrossRef]

- Zhong, Z.; Peng, B.; Xu, L.; Andrews, A.; Elahi, E. Analysis of regional energy economic efficiency and its influencing factors: A case study of Yangtze river urban agglomeration. Sustain. Energy Technol. Assess. 2020, 41, 100784. [Google Scholar] [CrossRef]

- Sehrawat, M.; Singh, S.K. Do corruption and income inequality play spoilsport in the energy efficiency-growth relationship in BRICS countries? J. Quant. Econ. 2021, 19, 727–746. [Google Scholar] [CrossRef]

- Pan, X.X.; Chen, M.L.; Ying, L.M.; Zhang, F.F. An empirical study on energy utilization efficiency, economic development, and sustainable management. Environ. Sci. Pollut. Res. 2020, 27, 12874–12881. [Google Scholar] [CrossRef] [PubMed]

- He, Y.; Liao, N.; Lin, K. Can China’s industrial sector achieve energy conservation and emission reduction goals dominated by energy efficiency enhancement? A multi-objective optimization approach. Energy Policy 2021, 149, 112108. [Google Scholar] [CrossRef]

- Razzaq, A.; Sharif, A.; Najmi, A.; Tseng, M.L.; Lim, M.K. Dynamic and causality interrelationships from municipal solid waste recycling to economic growth, carbon emissions and energy efficiency using a novel bootstrapping autoregressive distributed lag. Resour. Conserv. Recycl. 2021, 166, 105372. [Google Scholar] [CrossRef]

- Bao, Z.; Ferraz, B.D.; do Nascimento Rebelatto, D.A. Energy efficiency and China’s sustainable carbon neutrality target: Evidence from novel research methods quantile on quantile regression approach. Econ. Res. 2022, 35, 6985–7007. [Google Scholar] [CrossRef]

- Matahir, H.; Yassin, J.; Marcus, H.R.; Shafie, N.A.; Mohammed, N.F. Dynamic relationship between energy efficiency, health expenditure and economic growth: In pursuit for SDGs in Malaysia. Int. J. Ethics Syst. 2022, in press. [Google Scholar] [CrossRef]

- Zhao, L.; Chau, K.Y.; Tran, T.K.; Sadiq, M.; Xuyen, N.T.M.; Phan, T.T.H. Enhancing green economic recovery through green bonds financing and energy efficiency investments. Econ. Anal. Policy 2022, 76, 488–501. [Google Scholar] [CrossRef]

- Zhang, L.; Huang, F.; Lu, L.; Ni, X. Testing how financial development led to energy efficiency? Environmental consideration as a mediating concern. Environ. Sci. Pollut. Res. 2022, 29, 14665–14676. [Google Scholar] [CrossRef]

- Pehlivanoglu, F.; Kocbulut, O.; Akdag, S.; Alola, A.A. Toward a sustainable economic development in the EU member states: The role of energy efficiency-intensity and renewable energy. Energy Res. 2021, 45, 21219–21233. [Google Scholar] [CrossRef]

- Ibrahim, M.D.; Alola, A.A. Integrated analysis of energy-economic development-environmental sustainability nexus: Case study of MENA countries. Sci. Total Environ. 2020, 737, 139768. [Google Scholar] [CrossRef]

- Zhang, D.; Mohsin, M.; Rasheed, A.K.; Chang, Y.; Taghizadeh-Hesary, F. Public spending and green economic growth in BRI region: Mediating role of green finance. Energy Policy 2021, 153, 112256. [Google Scholar] [CrossRef]

- Mulder, P.; de Groot, H.L.F. Structural change and convergence of energy intensity across OECD countries, 1970–2005. Energy Econ. 2012, 34, 1910–1921. [Google Scholar] [CrossRef]

- Liddle, B. Revisiting world energy intensity convergence for regional differences. Appl. Energy 2010, 87, 3218–3225. [Google Scholar] [CrossRef]

- Meng, M.; Payne, J.E.; Lee, J. Convergence in per capita energy use among OECD countries. Energy Econ. 2013, 36, 536–545. [Google Scholar] [CrossRef]

- Ouyang, W.; Yang, J. The network energy and environment efficiency analysis of 27 OECD countries: A multiplicative network DEA model. Energy 2020, 197, 117161. [Google Scholar] [CrossRef]

- Guo, X.; Lu, C.; Lee, J.; Chiu, Y. Applying the dynamic DEA model to evaluate the energy efficiency of OECD countries and China. Energy 2017, 134, 392–399. [Google Scholar] [CrossRef]

- Keskin, B. An efficiency analysis on social prosperity: OPEC case under network DEA slack-based measure approach. Energy 2021, 231, 120832. [Google Scholar] [CrossRef]

- Ziolo, M.; Jednak, S.; Savić, G.; Kragulj, D. Link between energy efficiency and sustainable economic and financial development in OECD countries. Energies 2020, 13, 5898. [Google Scholar] [CrossRef]

- Mo, F.; Wang, D. Environmental sustainability of road transport in OECD countries. Energies 2019, 12, 3525. [Google Scholar] [CrossRef]

- Sueyoshi, T.; Goto, M. Intermediate approach for sustainability Enhancement and scale related measures in environmental assessment. Eur. J. Oper. Res. 2019, 276, 744–756. [Google Scholar] [CrossRef]

- Li, W.; Chien, F.; Hsu, C.C.; Zhang, Y.Q.; Nawaz, M.A.; Iqbal, S.; Mohsin, M. Nexus between energy poverty and energy efficiency: Estimating the long-run dynamics. Resour. Policy 2021, 72, 102063. [Google Scholar] [CrossRef]

- Zhu, J.; Lin, B. Economic growth pressure and energy efficiency improvement: Empirical evidence from Chinese cities. Appl. Energy 2022, 307, 118275. [Google Scholar] [CrossRef]

- Zhao, X.; Mahendru, M.; Ma, X.; Rao, A.; Shang, Y. Impacts of environmental regulations on green economic growth in China: New guidelines regarding renewable energy and energy efficiency. Renew. Energy 2022, 187, 728–742. [Google Scholar] [CrossRef]

- Zhang, J.; Patwary, A.K.; Sun, H.; Raza, M.; Taghizadeh-Hesary, F.; Iram, R. Measuring energy and environmental efficiency interactions towards CO2 emissions reduction without slowing economic growth in central and western Europe. J. Environ. Manag. 2021, 279, 111704. [Google Scholar] [CrossRef] [PubMed]

- Yu, D.; He, X. A bibliometric study for DEA applied to energy efficiency: Trends and future challenges. Appl. Energy 2020, 268, 115048. [Google Scholar] [CrossRef]

- Sueyoshi, T.; Yuan, Y.; Goto, M. A literature study for DEA applied to energy and environment. Energy Econ. 2017, 62, 104–124. [Google Scholar] [CrossRef]

| Author(s) | Year | Summary | Data | Methods | Main Topic |

|---|---|---|---|---|---|

| Azhgaliyeva, Liu, and Liddle | 2020 [5] | Studied the determinants of EI. Found both GDP per capita and economy-wide energy prices are negatively associated with EI. | 44 countries over the period 1990–2016 | Common correlated effects mean group estimator | EI and economy, economic growth |

| Chakraborth and Mazzanti | 2020 [6] | Found the existence of both short-term and long-term relationships between energy intensity and green energy innovative activities. | 21 OECD countries over 1975–2014 | Econometric analysis | EI and innovation |

| Filippini and Hunt | 2011 [7] | Estimated a measure of the “underlying energy efficiency” for each country. | 29 OECD countries over the period 1978 to 2006 | Energy demandmodeling and frontier analysis | EI measurement |

| Voigt, De Cian, Schymura, and Verdolini | 2014 [8] | Attributed energy efficiency changes to either changes in technology or changes in the structure of the economy, studied trends in global energy intensity, and highlighted sectoral and regional differences. | 40 major economies between 1995 and 2007 | Logarithmic mean Divisia index decomposition | EI and economy, economic growth |

| Fidanoski, Simeonovski and Cvetkoska | 2021 [10] | Examined energy efficiency through an integrated model that links energy with environment, technology, and urbanization. Found that taking care about environment does not affect efficiency in general, while the reliance on energy produced from renewable sources does slightly reduce it. | 30 OECD member states during the period from 2001 to 2018 | DEA | EI and renewable energy |

| Irfan | 2021 [11] | Found that economic growth discourages energy efficiency for developed economies but encourages energy efficiency for developing economies. Found that economic growth promotes energy diversity for both developed and developing economies. | Developed (28 countries) and developing (34 countries) economies over the period 1990–2017 | Panel Granger causality test, panel autoregressive distributed lag modeling | EI and economy, economic growth |

| Santos, Borges, Domingos | 2021 [12] | Indicated that total factor productivity can be adequately accounted for by energy efficiency, from the final to the useful stage of energy flows, and measured in exergy terms. | Portugal economy from 1960 to 2014 | Econometric techniques | EI and economy, economic growth |

| Zhong, Peng, Xu, Andrews, Elahi | 2020 [13] | Measured and discussed energy economic efficiency, pure technical efficiency, and scale efficiency of each city of Yangtze River Urban Agglomeration. | Yangtze river urban agglomeration from 2008 to 2017 | Slack-Based Model (SBM), Tobit regression model | EI and economy, economic growth |

| Sehrawat and Singh | 2021 [14] | Revealed that long term co-integrating relationship exists between energy efficiency, income inequality, economic growth, and corruption in BRICS countries. | Brazil-Russia-India-China-South Africa (BRICS) countries during 1996–2015 | Co-integration test and the other econometric analysis | EI and economy, economic growth |

| Pan, Chen, Ying, Zhang | 2020 [15] | Analyzed the concept of environmental Kuznets curve, and analyzed the relationship between energy efficiency and economic development. Showed that labor has a significant negative impact on energy efficiency and the increase in labor input will reduce energy efficiency. | 35 European countries from 1990 to 2013 | Econometirc analysis | EI and economy, economic growth |

| He, Liao, Lin | 2021 [16] | Explored how industrial sector could achieve the goals on the premise of maintaining certain economic growth from the perspective of energy efficiency enhancement. Indicated that regardless of the expected high-speed or medium-speed economic growth, the optimized path could achieve the goal of carbon emission peak, mainly depends on energy efficiency improvement. | Chaina’s 31 sub-sectors | The industrial correlation model and multi-objective optimization model | EI and economy, economic growth |

| Razzaq, Sharif, Najmi, Tseng, Lim | 2021 [17] | Estimated the municipal solid waste (MSW) recycling effect on environmental quality and economic growth in the United States. Showed a one percent improvement in energy efficiency stimulates economic growth by 0.489% (0.281%) and mitigates carbon emissions by 0.285% (0.197%) in the long-run (short-run). | Quarterly data in the US from 1990 to 2017 | Bootstrapping autoregressive distributed lag modeling | EI and economy, economic growth |

| Bao, Ferraz, Nascimento Rebelatto | 2022 [18] | Investigated the association of energy efficiency and economic growth on the energy related GHG emissions. Asserted that energy efficiency holds a weaker relationship in the lower and medium quantiles, while relatively higher association to energy-related emission in the upper quantiles. | DEA application to ecological efficiency | Quantile-on-Quantile regression approach | EI and economy, economic growth, DEA application to energy |

| Matahir, Yassin, Marcus, Shafie, and Mohammed | 2022 [19] | Tried to examine the dynamic relationship among energy efficiency, health expenditure and economic growth in Malaysia. | Over the sample period of 1980–2016 | Autoregressive distributed lag cointegration analysis and the causality approach by the vector error correction model | EI and economy, health care |

| Zhao, Chau, Tran, Sadiq, Xuyen, Phan | 2022 [20] | Showed that green bonds are currently the primary financing source for energy efficiency projects, enhancing economic growth and potentially increasing green economic recovery. | BRI nations from 2010 to 2019 | Fuzzy analytic hierarchy process (AHP) | EI and economy, finance |

| Zhang, Huang, Lu, Ni | 2022 [21] | Investigated the relationship of financial development with energy efficiency and economic growth. Showed a long-term relationship of Indonesia’s CO2 emissions with five macroeconomic factors. | Turkey and Indonesia from 1971 to 2017 | Johansen cointegration, error correction, and Granger causality tests | EI and economy, finance |

| Pehlivanoglu, Kocbulut, Akdag, Alola | 2021 [22] | Examined both the regional and country-specific impacts of energy intensity, energy dependency, and renewable energy utilization on economic expansion. | 21 EU member countries over the 1995–2016 period | Panel causality test | EI and economy, renewable energy |

| Ibrahim, Alola | 2020 [23] | Found that energy efficiency, economic growth and total natural resource rent exerts environmental hazard in the panel countries in the long-run. | 13 Middle East and North African region countries over the period of 1990 to 2014 | DEA, autoregressive distributed lag (ARDL) pooled mean group (PMG) approach | EI and economy, renewable energy |

| Zhang, Mohsin, Rasheed, Chang, Taghizadeh-Hesary | 2021 [24] | Assessed the relationship between public spending on R&D and green economic growth and energy efficiency. Showed that public spending on human resources and R&D of green energy technologies prompts a sustainable green economy through labor and technology-oriented production activities and different effects in different countries. | Panel data of BRI (Belt and Road Initiative) member countries from 2008 to 2018 | Generalized method of moments (GMM) method and DEA | EI and economy, innovation |

| GDP | Coal Consumption | Gas Consumption | Oil Consumption | Zero Carbon Emission Sources Consumption | |

|---|---|---|---|---|---|

| Constant 2010 mio.US$ | TWhs | TWhs | TWhs | TWhs | |

| Australia | 1,139,924 | 586.01 | 324.93 | 526.39 | 82.59 |

| Austria | 391,592 | 40.38 | 86.54 | 151.70 | 122.92 |

| Belgium | 476,111 | 51.46 | 166.95 | 386.10 | 136.19 |

| Canada | 1,598,909 | 286.78 | 968.83 | 1206.86 | 1271.01 |

| Chile | 217,702 | 58.72 | 62.49 | 186.02 | 74.64 |

| Colombia | 288,823 | 45.03 | 88.25 | 152.79 | 116.13 |

| Czechia | 204,762 | 215.23 | 84.33 | 109.39 | 82.62 |

| Denmark | 330,312 | 39.50 | 43.98 | 101.32 | 34.15 |

| Estonia | 21,057 | 41.37 | 6.77 | 16.95 | 2.15 |

| Finland | 245,769 | 63.54 | 34.55 | 122.32 | 128.90 |

| France | 2,649,855 | 128.25 | 443.61 | 1003.75 | 1348.82 |

| Germany | 3,466,168 | 920.45 | 856.37 | 1392.02 | 668.00 |

| Greece | 273,841 | 86.65 | 34.41 | 220.06 | 23.94 |

| Hungary | 136,254 | 32.76 | 111.58 | 85.87 | 44.40 |

| Iceland | 14,314 | 1.19 | 0.00 | 9.80 | 37.44 |

| Ireland | 246,765 | 25.17 | 46.68 | 94.86 | 11.94 |

| Israel | 234,283 | 82.16 | 44.93 | 140.22 | 1.53 |

| Italy | 2,125,333 | 156.37 | 724.88 | 886.69 | 210.17 |

| Japan | 5,758,128 | 1317.09 | 1005.60 | 2600.68 | 793.26 |

| Latvia | 25,631 | 0.97 | 14.49 | 19.33 | 8.49 |

| Lithuania | 38,902 | 2.25 | 26.39 | 32.28 | 18.18 |

| Luxembourg | 53,713 | 0.79 | 11.09 | 33.17 | 0.85 |

| Mexico | 1,088,080 | 134.35 | 647.08 | 1053.43 | 138.03 |

| Netherlands | 841,267 | 96.79 | 394.27 | 512.33 | 40.13 |

| New Zealand | 150,280 | 18.56 | 46.44 | 87.37 | 81.98 |

| Norway | 431,867 | 9.04 | 42.86 | 116.72 | 342.94 |

| Poland | 469,979 | 616.37 | 157.72 | 298.35 | 35.13 |

| Portugal | 232,759 | 33.44 | 44.40 | 157.76 | 55.18 |

| Slovakia | 86,220 | 44.23 | 56.66 | 42.92 | 55.85 |

| Slovenia | 47,036 | 15.73 | 9.28 | 30.23 | 26.21 |

| South Korea | 1,112,004 | 800.79 | 401.46 | 1331.39 | 399.25 |

| Spain | 1,384,216 | 172.23 | 307.71 | 817.83 | 358.53 |

| Sweden | 494,886 | 28.61 | 9.95 | 181.36 | 394.15 |

| Switzerland | 598,081 | 1.57 | 32.22 | 139.01 | 165.29 |

| Turkey | 840,468 | 351.76 | 344.53 | 424.75 | 149.53 |

| United Kingdom | 2,528,091 | 345.04 | 887.31 | 916.94 | 308.79 |

| United States | 15,233,144 | 5336.45 | 6715.74 | 10,308.63 | 3659.59 |

| Total Average | 1,197,734 | 329.38 | 413.12 | 699.93 | 308.47 |

| Avg. (2000–2019) | 2000 | 2019 | |

|---|---|---|---|

| Australia | 0.8063 | 0.7998 | 0.7598 |

| Austria | 0.6691 | 0.6267 | 0.7152 |

| Belgium | 0.4889 | 0.4423 | 0.5184 |

| Canada | 0.3869 | 0.3311 | 0.4413 |

| Chile | 0.4926 | 0.3874 | 0.5258 |

| Colombia | 0.5402 | 0.4711 | 0.5816 |

| Czechia | 0.5391 | 0.5191 | 0.5923 |

| Denmark | 0.9303 | 0.9197 | 0.9985 |

| Estonia | 0.6626 | 0.7462 | 0.6989 |

| Finland | 0.5728 | 0.4759 | 0.7091 |

| France | 0.6286 | 0.5296 | 0.7356 |

| Germany | 0.7009 | 0.6336 | 0.7686 |

| Greece | 0.7556 | 0.7917 | 0.6584 |

| Hungary | 0.5052 | 0.4372 | 0.5287 |

| Iceland | 0.9807 | 0.9441 | 1.0000 |

| Ireland | 0.9357 | 0.8761 | 1.0000 |

| Israel | 0.9934 | 1.0000 | 0.9715 |

| Italy | 0.8033 | 0.7880 | 0.8132 |

| Japan | 0.7874 | 0.7013 | 0.8426 |

| Latvia | 0.5199 | 0.3768 | 0.6066 |

| Lithuania | 0.4879 | 0.2966 | 0.6194 |

| Luxembourg | 0.9815 | 1.0000 | 1.0000 |

| Mexico | 0.5266 | 0.4876 | 0.5852 |

| Netherlands | 0.7942 | 0.8228 | 0.7996 |

| New Zealand | 0.4863 | 0.4308 | 0.5347 |

| Norway | 0.7749 | 0.7426 | 0.8802 |

| Poland | 0.7111 | 0.7602 | 0.6709 |

| Portugal | 0.6369 | 0.7286 | 0.5933 |

| Slovakia | 0.5128 | 0.3780 | 0.6036 |

| Slovenia | 0.4861 | 0.4194 | 0.5696 |

| South Korea | 0.4104 | 0.3754 | 0.4447 |

| Spain | 0.6099 | 0.6472 | 0.6345 |

| Sweden | 0.9210 | 0.8583 | 0.9943 |

| Switzerland | 0.9300 | 0.9003 | 1.0000 |

| Turkey | 0.6293 | 0.5984 | 0.6357 |

| United Kingdom | 0.7859 | 0.7003 | 0.8569 |

| United States | 0.5045 | 0.4338 | 0.5632 |

| Total Average | 0.6727 |

| 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | Avg. | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Australia | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 0.9957 | 1.0000 | 1.0000 | 1.0000 | 0.9856 | 0.9529 | 0.9468 | 0.9215 | 0.9179 | 0.9188 | 0.9087 | 0.8996 | 0.8804 | 0.8836 | 0.9562 |

| Austria | 0.8349 | 0.8218 | 0.8142 | 0.8058 | 0.8149 | 0.8225 | 0.8267 | 0.8116 | 0.7988 | 0.8305 | 0.7953 | 0.7874 | 0.7909 | 0.7782 | 0.7368 | 0.7360 | 0.7360 | 0.7152 | 0.7921 |

| Belgium | 0.6530 | 0.6494 | 0.6612 | 0.6688 | 0.6857 | 0.6944 | 0.7043 | 0.7228 | 0.6918 | 0.7026 | 0.7478 | 0.7374 | 0.8182 | 0.8304 | 0.6912 | 0.6818 | 0.7299 | 0.6539 | 0.7069 |

| Canada | 0.6428 | 0.6386 | 0.6395 | 0.6601 | 0.6716 | 0.6654 | 0.6664 | 0.6760 | 0.6416 | 0.6323 | 0.6452 | 0.6441 | 0.6328 | 0.6327 | 0.6252 | 0.6322 | 0.6208 | 0.6256 | 0.6441 |

| Chile | 0.5762 | 0.6052 | 0.6102 | 0.5785 | 0.5560 | 0.6253 | 0.7345 | 0.7404 | 0.6212 | 0.6247 | 0.6220 | 0.6278 | 0.6460 | 0.6613 | 0.6157 | 0.6005 | 0.5586 | 0.5535 | 0.6199 |

| Colombia | 0.7108 | 0.6991 | 0.7000 | 0.6922 | 0.7131 | 0.7048 | 0.6861 | 0.7274 | 0.6940 | 0.6605 | 0.6398 | 0.6716 | 0.6653 | 0.6385 | 0.6129 | 0.5801 | 0.5809 | 0.5966 | 0.6652 |

| Czechia | 0.7345 | 0.6998 | 0.6632 | 0.6630 | 0.6877 | 0.6880 | 0.6941 | 0.6735 | 0.6886 | 0.6649 | 0.6523 | 0.6646 | 0.6414 | 0.6611 | 0.6770 | 0.6207 | 0.6133 | 0.6134 | 0.6667 |

| Denmark | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 0.9943 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 0.9888 | 1.0000 | 1.0000 | 0.9991 |

| Estonia | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 0.9729 | 1.0000 | 0.9929 | 0.9628 | 1.0000 | 1.0000 | 1.0000 | 0.9818 | 1.0000 | 1.0000 | 0.9950 |

| Finland | 0.6938 | 0.6817 | 0.6981 | 0.6849 | 0.7161 | 0.6907 | 0.6936 | 0.6910 | 0.6693 | 0.6731 | 0.6780 | 0.6595 | 0.6674 | 0.7008 | 0.7575 | 0.7965 | 0.7361 | 0.7541 | 0.7023 |

| France | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 |

| Germany | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 0.9908 | 0.9803 | 0.9947 | 1.0000 | 1.0000 | 0.9933 | 1.0000 | 0.9942 | 0.9866 | 0.9772 | 0.9932 | 0.9810 | 0.9940 |

| Greece | 1.0000 | 0.9909 | 1.0000 | 0.9998 | 1.0000 | 1.0000 | 0.9884 | 1.0000 | 0.9436 | 0.8786 | 0.7838 | 0.7712 | 0.8521 | 0.8956 | 0.8040 | 0.7702 | 0.7508 | 0.7393 | 0.8982 |

| Hungary | 0.7195 | 0.7639 | 0.7506 | 0.6866 | 0.6781 | 0.6629 | 0.6794 | 0.6639 | 0.6810 | 0.6553 | 0.6672 | 0.6824 | 0.6467 | 0.6124 | 0.6090 | 0.5884 | 0.5705 | 0.5697 | 0.6604 |

| Iceland | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 |

| Ireland | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 0.9834 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 0.9991 |

| Israel | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 0.9979 | 1.0000 | 1.0000 | 1.0000 | 0.9815 | 0.9989 |

| Italy | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 0.9915 | 1.0000 | 0.9888 | 1.0000 | 0.9989 |

| Japan | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 |

| Latvia | 1.0000 | 1.0000 | 1.0000 | 0.9647 | 1.0000 | 0.9902 | 0.9815 | 1.0000 | 0.9260 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 0.9845 | 0.9915 |

| Lithuania | 0.6680 | 0.6456 | 0.6435 | 0.6801 | 0.7062 | 0.7146 | 0.6877 | 0.7151 | 0.9429 | 0.9333 | 0.9367 | 0.9258 | 0.9192 | 0.8496 | 0.7907 | 0.7752 | 0.7593 | 0.7804 | 0.7819 |

| Luxembourg | 1.0000 | 1.0000 | 0.9791 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 0.9988 |

| Mexico | 0.7678 | 0.7834 | 0.7822 | 0.7431 | 0.7469 | 0.7684 | 0.7864 | 0.7730 | 0.7314 | 0.7505 | 0.8128 | 0.8427 | 0.8574 | 0.8901 | 0.8892 | 0.8550 | 0.8491 | 0.8483 | 0.8043 |

| Netherlands | 0.9928 | 0.9921 | 0.9852 | 0.9855 | 1.0000 | 0.9943 | 0.9795 | 0.9661 | 0.9938 | 1.0000 | 0.9990 | 1.0000 | 1.0000 | 0.9810 | 0.9913 | 1.0000 | 1.0000 | 1.0000 | 0.9922 |

| New Zealand | 0.6931 | 0.6842 | 0.6753 | 0.6738 | 0.6786 | 0.6555 | 0.6484 | 0.6517 | 0.6390 | 0.6143 | 0.6355 | 0.6429 | 0.6254 | 0.6092 | 0.5823 | 0.5841 | 0.5782 | 0.5806 | 0.6362 |

| Norway | 0.9749 | 0.9621 | 0.9765 | 0.9861 | 0.9796 | 0.9261 | 0.9349 | 0.9211 | 0.8877 | 0.8823 | 0.9001 | 0.8957 | 0.8888 | 0.8875 | 0.8789 | 0.8955 | 0.8527 | 0.8898 | 0.9178 |

| Poland | 0.9818 | 1.0000 | 0.9783 | 0.9538 | 0.9535 | 0.9434 | 0.8593 | 0.8328 | 0.8099 | 0.8206 | 0.7944 | 0.8113 | 0.7933 | 0.7536 | 0.7312 | 0.7227 | 0.7533 | 0.7615 | 0.8475 |

| Portugal | 0.9384 | 0.8717 | 0.8925 | 0.8939 | 0.8249 | 0.8251 | 0.8378 | 0.7716 | 0.7181 | 0.7110 | 0.7174 | 0.6451 | 0.6304 | 0.6370 | 0.5833 | 0.6057 | 0.5942 | 0.5942 | 0.7385 |

| Slovakia | 0.6752 | 0.7206 | 0.7535 | 0.6888 | 0.7722 | 0.7568 | 0.7450 | 0.7613 | 0.7461 | 0.7525 | 0.7834 | 0.7815 | 0.8082 | 0.7888 | 0.7485 | 0.7085 | 0.7061 | 0.7361 | 0.7463 |

| Slovenia | 0.7813 | 0.7987 | 0.7796 | 0.7821 | 0.7902 | 0.8022 | 0.7668 | 0.7906 | 0.8075 | 0.8300 | 0.8625 | 0.8380 | 0.8125 | 0.8483 | 0.7968 | 0.8048 | 0.7990 | 0.8471 | 0.8077 |

| South Korea | 0.6045 | 0.5902 | 0.5687 | 0.5614 | 0.5771 | 0.5900 | 0.5947 | 0.6141 | 0.5890 | 0.5780 | 0.5501 | 0.5509 | 0.5910 | 0.6177 | 0.6074 | 0.6034 | 0.5621 | 0.5684 | 0.5844 |

| Spain | 0.9300 | 0.8769 | 0.8601 | 0.8731 | 0.8988 | 0.8923 | 0.9254 | 0.9557 | 0.9481 | 0.9048 | 0.8622 | 0.8942 | 0.8974 | 0.8937 | 0.9079 | 0.8873 | 0.9002 | 0.9056 | 0.9008 |

| Sweden | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 0.9647 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 0.9980 |

| Switzerland | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 |

| Turkey | 0.7876 | 0.7947 | 0.8019 | 0.8352 | 0.8206 | 0.8240 | 0.8273 | 0.7891 | 0.8043 | 0.8566 | 0.8375 | 0.8416 | 0.8855 | 0.7853 | 0.7594 | 0.7770 | 0.7886 | 0.7509 | 0.8093 |

| United Kingdom | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 |

| United States | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 |

| Total Average | 0.8746 | 0.8722 | 0.8706 | 0.8665 | 0.8721 | 0.8713 | 0.8709 | 0.8711 | 0.8618 | 0.8624 | 0.8612 | 0.8593 | 0.8645 | 0.8612 | 0.8455 | 0.8398 | 0.8352 | 0.8355 | 0.8609 |

| EI (Coal) | EI (Gas) | EI (Oil) | EI (Zero Emission) | |

|---|---|---|---|---|

| Australia | 0.54 | 0.47 | 0.79 | 0.79 |

| Austria | 0.12 | 0.37 | 0.56 | 0.56 |

| Belgium | 0.49 | 0.49 | 0.34 | 0.49 |

| Canada | 0.31 | 0.32 | 0.46 | 0.46 |

| Chile | 0.13 | 0.38 | 0.31 | 0.38 |

| Colombia | 0.16 | 0.28 | 0.43 | 0.43 |

| Czechia | 0.10 | 0.25 | 0.44 | 0.44 |

| Denmark | 1.00 | 1.00 | 1.00 | 1.00 |

| Estonia | 1.00 | 1.00 | 1.00 | 1.00 |

| Finland | 0.03 | 0.61 | 0.47 | 0.61 |

| France | 1.00 | 1.00 | 1.00 | 1.00 |

| Germany | 0.77 | 0.85 | 0.96 | 0.96 |

| Greece | 0.22 | 0.59 | 0.33 | 0.59 |

| Hungary | 0.40 | 0.22 | 0.40 | 0.40 |

| Iceland | 1.00 | 1.00 | 1.00 | 1.00 |

| Ireland | 1.00 | 1.00 | 1.00 | 1.00 |

| Israel | 0.91 | 0.94 | 0.96 | 0.96 |

| Italy | 1.00 | 1.00 | 1.00 | 1.00 |

| Japan | 1.00 | 1.00 | 1.00 | 1.00 |

| Latvia | 0.89 | 0.89 | 0.89 | 0.89 |

| Lithuania | 0.64 | 0.42 | 0.64 | 0.64 |

| Luxembourg | 1.00 | 1.00 | 1.00 | 1.00 |

| Mexico | 0.74 | 0.49 | 0.56 | 0.74 |

| Netherlands | 1.00 | 1.00 | 1.00 | 1.00 |

| New Zealand | 0.41 | 0.33 | 0.41 | 0.41 |

| Norway | 0.12 | 0.51 | 0.80 | 0.36 |

| Poland | 0.21 | 0.61 | 0.59 | 0.61 |

| Portugal | 0.42 | 0.42 | 0.42 | 0.42 |

| Slovakia | 0.58 | 0.15 | 0.58 | 0.58 |

| Slovenia | 0.73 | 0.73 | 0.73 | 0.73 |

| South Korea | 0.26 | 0.40 | 0.31 | 0.40 |

| Spain | 0.83 | 0.83 | 0.56 | 0.83 |

| Sweden | 1.00 | 1.00 | 1.00 | 1.00 |

| Switzerland | 1.00 | 1.00 | 1.00 | 1.00 |

| Turkey | 0.18 | 0.52 | 0.60 | 0.60 |

| United Kingdom | 1.00 | 1.00 | 1.00 | 1.00 |

| United States | 1.00 | 1.00 | 1.00 | 1.00 |

| Ave. | 0.29 | 0.52 | 0.61 | 0.65 |

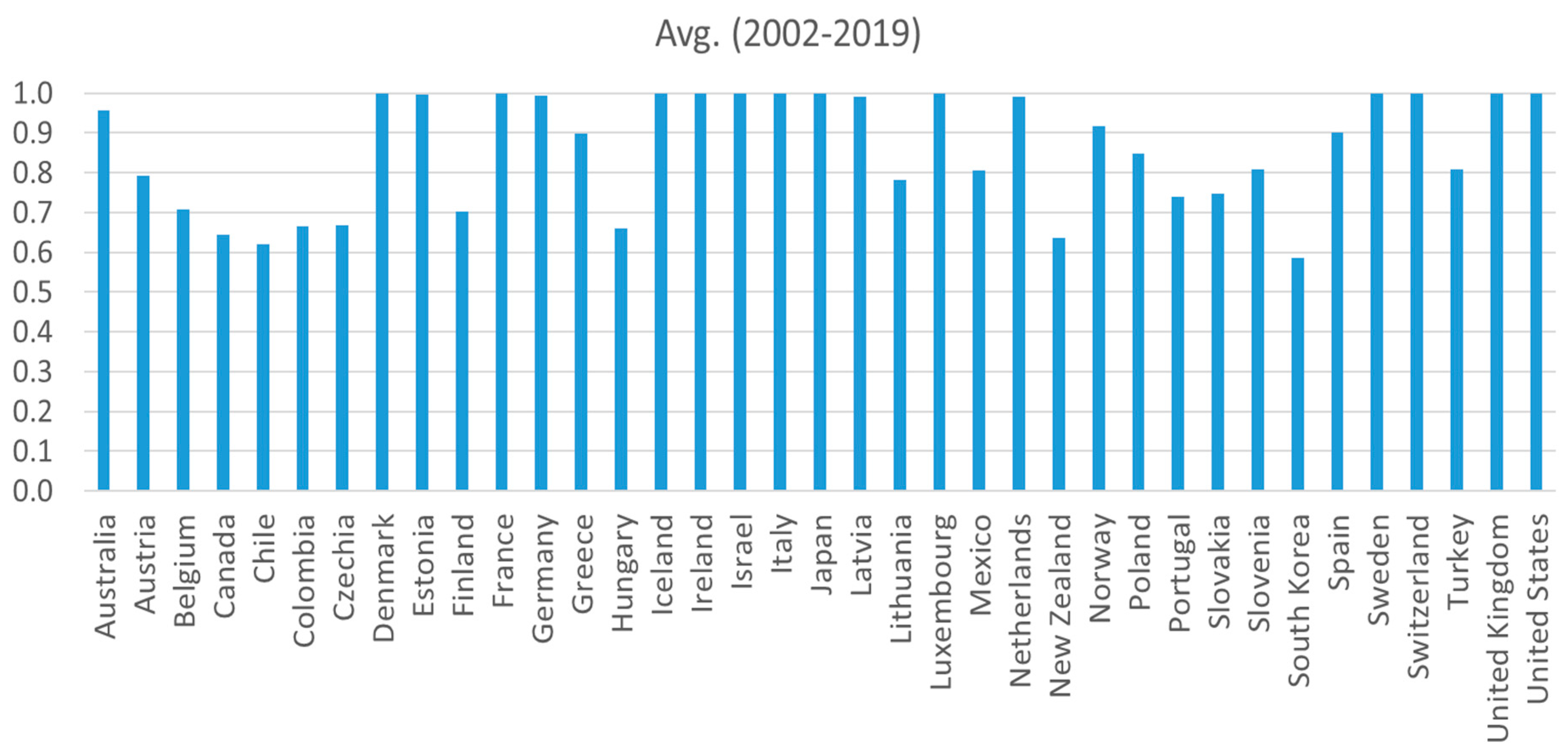

| 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | Avg. | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Australia | 1.000 | 1.000 | 1.000 | 1.000 | 0.991 | 1.000 | 1.000 | 1.000 | 0.972 | 0.910 | 0.899 | 0.854 | 0.848 | 0.850 | 0.833 | 0.817 | 0.786 | 0.791 | 0.920 |

| Austria | 0.717 | 0.698 | 0.687 | 0.675 | 0.688 | 0.698 | 0.705 | 0.683 | 0.665 | 0.710 | 0.660 | 0.649 | 0.654 | 0.637 | 0.583 | 0.582 | 0.582 | 0.557 | 0.657 |

| Belgium | 0.485 | 0.481 | 0.494 | 0.502 | 0.522 | 0.532 | 0.544 | 0.566 | 0.529 | 0.542 | 0.597 | 0.584 | 0.692 | 0.710 | 0.528 | 0.517 | 0.575 | 0.486 | 0.549 |

| Canada | 0.304 | 0.337 | 0.363 | 0.336 | 0.378 | 0.375 | 0.356 | 0.381 | 0.462 | 0.462 | 0.476 | 0.475 | 0.463 | 0.455 | 0.455 | 0.462 | 0.450 | 0.455 | 0.414 |

| Chile | 0.405 | 0.434 | 0.439 | 0.407 | 0.385 | 0.455 | 0.580 | 0.588 | 0.451 | 0.454 | 0.451 | 0.458 | 0.477 | 0.494 | 0.445 | 0.429 | 0.388 | 0.383 | 0.451 |

| Colombia | 0.551 | 0.537 | 0.538 | 0.529 | 0.554 | 0.544 | 0.522 | 0.572 | 0.531 | 0.493 | 0.470 | 0.506 | 0.498 | 0.469 | 0.442 | 0.409 | 0.409 | 0.425 | 0.500 |

| Czechia | 0.580 | 0.538 | 0.496 | 0.496 | 0.524 | 0.524 | 0.532 | 0.508 | 0.525 | 0.498 | 0.484 | 0.498 | 0.472 | 0.494 | 0.512 | 0.450 | 0.442 | 0.442 | 0.501 |

| Denmark | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 0.989 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 0.978 | 1.000 | 1.000 | 0.998 |

| Estonia | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 0.947 | 1.000 | 0.953 | 0.928 | 1.000 | 1.000 | 1.000 | 0.964 | 1.000 | 1.000 | 0.988 |

| Finland | 0.531 | 0.517 | 0.536 | 0.521 | 0.558 | 0.528 | 0.531 | 0.528 | 0.503 | 0.507 | 0.513 | 0.492 | 0.501 | 0.539 | 0.610 | 0.662 | 0.582 | 0.605 | 0.542 |

| France | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 |

| Germany | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 0.982 | 0.961 | 0.989 | 1.000 | 1.000 | 0.971 | 1.000 | 0.924 | 0.974 | 0.956 | 0.987 | 0.963 | 0.984 |

| Greece | 1.000 | 0.982 | 1.000 | 1.000 | 1.000 | 1.000 | 0.977 | 1.000 | 0.893 | 0.783 | 0.645 | 0.628 | 0.742 | 0.811 | 0.672 | 0.626 | 0.601 | 0.586 | 0.830 |

| Hungary | 0.562 | 0.618 | 0.601 | 0.523 | 0.513 | 0.496 | 0.515 | 0.497 | 0.516 | 0.487 | 0.501 | 0.518 | 0.478 | 0.441 | 0.438 | 0.417 | 0.399 | 0.398 | 0.495 |

| Iceland | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 |

| Ireland | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 0.967 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 0.998 |

| Israel | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 0.996 | 1.000 | 1.000 | 1.000 | 0.964 | 0.998 |

| Italy | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 0.983 | 1.000 | 0.978 | 1.000 | 0.998 |

| Japan | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 |

| Latvia | 1.000 | 1.000 | 1.000 | 0.932 | 1.000 | 0.981 | 0.964 | 1.000 | 0.836 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 0.888 | 0.978 |

| Lithuania | 0.395 | 0.477 | 0.474 | 0.515 | 0.546 | 0.556 | 0.524 | 0.557 | 0.779 | 0.866 | 0.850 | 0.862 | 0.850 | 0.738 | 0.654 | 0.633 | 0.612 | 0.640 | 0.640 |

| Luxembourg | 1.000 | 1.000 | 0.959 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 0.998 |

| Mexico | 0.623 | 0.644 | 0.642 | 0.591 | 0.596 | 0.624 | 0.648 | 0.630 | 0.577 | 0.601 | 0.685 | 0.728 | 0.750 | 0.802 | 0.801 | 0.747 | 0.738 | 0.737 | 0.676 |

| Netherlands | 0.986 | 0.984 | 0.971 | 0.971 | 1.000 | 0.989 | 0.960 | 0.934 | 0.988 | 1.000 | 0.998 | 1.000 | 1.000 | 0.963 | 0.983 | 1.000 | 1.000 | 1.000 | 0.985 |

| New Zealand | 0.530 | 0.520 | 0.510 | 0.508 | 0.514 | 0.488 | 0.480 | 0.483 | 0.469 | 0.443 | 0.466 | 0.474 | 0.455 | 0.438 | 0.411 | 0.413 | 0.407 | 0.409 | 0.468 |

| Norway | 0.896 | 0.462 | 0.444 | 0.322 | 0.389 | 0.368 | 0.364 | 0.401 | 0.411 | 0.377 | 0.330 | 0.368 | 0.373 | 0.349 | 0.309 | 0.317 | 0.327 | 0.365 | 0.398 |

| Poland | 0.964 | 1.000 | 0.957 | 0.912 | 0.911 | 0.893 | 0.753 | 0.713 | 0.681 | 0.696 | 0.659 | 0.682 | 0.657 | 0.605 | 0.576 | 0.566 | 0.604 | 0.615 | 0.747 |

| Portugal | 0.884 | 0.773 | 0.806 | 0.808 | 0.702 | 0.702 | 0.721 | 0.628 | 0.560 | 0.552 | 0.559 | 0.476 | 0.460 | 0.467 | 0.412 | 0.434 | 0.423 | 0.423 | 0.599 |

| Slovakia | 0.510 | 0.563 | 0.605 | 0.525 | 0.622 | 0.609 | 0.594 | 0.615 | 0.595 | 0.603 | 0.644 | 0.641 | 0.678 | 0.651 | 0.598 | 0.549 | 0.546 | 0.582 | 0.596 |

| Slovenia | 0.641 | 0.665 | 0.639 | 0.642 | 0.653 | 0.670 | 0.622 | 0.654 | 0.677 | 0.709 | 0.758 | 0.721 | 0.684 | 0.737 | 0.662 | 0.673 | 0.665 | 0.735 | 0.678 |

| South Korea | 0.433 | 0.419 | 0.397 | 0.390 | 0.406 | 0.418 | 0.423 | 0.443 | 0.417 | 0.406 | 0.379 | 0.380 | 0.419 | 0.447 | 0.436 | 0.432 | 0.391 | 0.397 | 0.413 |

| Spain | 0.869 | 0.781 | 0.755 | 0.775 | 0.816 | 0.806 | 0.861 | 0.915 | 0.901 | 0.826 | 0.758 | 0.809 | 0.814 | 0.808 | 0.831 | 0.797 | 0.819 | 0.827 | 0.820 |

| Sweden | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 0.865 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 0.992 |

| Switzerland | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 |

| Turkey | 0.650 | 0.659 | 0.669 | 0.717 | 0.696 | 0.701 | 0.705 | 0.652 | 0.673 | 0.749 | 0.721 | 0.727 | 0.794 | 0.647 | 0.612 | 0.635 | 0.651 | 0.601 | 0.681 |

| United Kingdom | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 |

| United States | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 |

| Total Average | 0.798 | 0.786 | 0.783 | 0.773 | 0.783 | 0.783 | 0.779 | 0.781 | 0.768 | 0.775 | 0.769 | 0.768 | 0.777 | 0.769 | 0.750 | 0.742 | 0.739 | 0.737 | 0.770 |

| 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | Avg. | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Australia | 0.0618 | 0.0576 | 0.0574 | 0.0611 | 0.1643 | 0.0337 | 0.0572 | 0.0573 | 0.0471 | 0.0405 | 0.0144 | 0.0173 | 0.0130 | 0.0296 | 0.0261 | 0.0321 | 0.0366 | 0.0409 | 0.0471 |

| Austria | −0.0260 | 0.0618 | 0.0755 | 0.0802 | 0.0791 | 0.0527 | 0.0450 | −0.0352 | 0.0529 | 0.0534 | −0.0378 | 0.0529 | 0.0445 | 0.0769 | −0.0400 | −0.0428 | 0.1082 | −0.0292 | 0.0318 |

| Belgium | 0.0877 | 0.0719 | 0.0671 | 0.0849 | 0.0933 | 0.0672 | 0.0614 | 0.0286 | 0.0316 | 0.0442 | 0.0386 | 0.0335 | 0.0643 | 0.0561 | 0.1023 | 0.1210 | 0.1525 | 0.1502 | 0.0754 |

| Canada | 0.0607 | 0.0614 | 0.0605 | 0.0584 | 0.0584 | 0.0649 | 0.0624 | 0.0645 | 0.0593 | 0.0650 | 0.0625 | 0.0575 | 0.0630 | 0.0574 | 0.0631 | 0.0601 | 0.0631 | 0.0602 | 0.0612 |

| Chile | −0.0001 | 0.0001 | 0.0008 | −0.0462 | −0.0349 | −0.0044 | −0.0751 | −0.0849 | −0.0080 | 0.0082 | 0.0026 | 0.1002 | −0.0285 | 0.0021 | 0.1006 | 0.0173 | 0.0920 | 0.0703 | 0.0062 |

| Colombia | −0.0503 | −0.0508 | −0.0526 | −0.0527 | −0.0437 | −0.0385 | −0.0377 | −0.0435 | −0.0391 | −0.0347 | 0.0616 | 0.0556 | 0.0442 | 0.0734 | 0.0699 | 0.0873 | 0.1012 | 0.1159 | 0.0092 |

| Czechia | −0.0478 | −0.0568 | −0.0554 | −0.0504 | −0.0517 | −0.0467 | −0.0476 | −0.0530 | −0.0522 | −0.0491 | −0.0571 | −0.0588 | −0.0593 | −0.0674 | −0.0636 | −0.0608 | −0.0607 | −0.0645 | −0.0557 |

| Denmark | −0.0355 | −0.0460 | −0.0483 | −0.0456 | −0.0462 | −0.0518 | −0.0453 | −0.0523 | −0.0655 | −0.0494 | −0.0583 | −0.0584 | −0.0678 | −0.0290 | −0.0237 | 0.0327 | −0.0222 | −0.0037 | −0.0398 |

| Estonia | −0.6438 | −0.4601 | −0.4641 | −0.4320 | −0.4542 | −0.3112 | −0.4231 | −0.4765 | −0.5227 | −0.4714 | −0.9929 | −0.5829 | −0.5173 | −0.4152 | −0.4595 | −0.5437 | −0.4466 | −0.3991 | −0.5009 |

| Finland | −0.0337 | −0.0420 | −0.0446 | −0.0454 | −0.0436 | −0.0380 | −0.0393 | −0.0466 | −0.0431 | −0.0419 | −0.0594 | −0.0583 | −0.0644 | −0.0606 | −0.0593 | −0.0489 | −0.0438 | −0.0440 | −0.0476 |

| France | 0.0477 | 0.0493 | 0.0497 | 0.0482 | 0.0485 | 0.0564 | 0.0546 | 0.0556 | 0.0546 | 0.0544 | 0.0515 | 0.0503 | 0.0844 | 0.1101 | 0.0885 | 0.0904 | 0.0965 | 0.0954 | 0.0659 |

| Germany | 0.0374 | 0.0393 | 0.0401 | 0.0403 | 0.0399 | 0.0433 | 0.1385 | 0.0454 | 0.0443 | 0.0427 | 0.0436 | 0.1546 | 0.0487 | 0.1115 | 0.0899 | 0.0677 | 0.0685 | 0.0818 | 0.0654 |

| Greece | 0.2887 | 0.1622 | 0.2484 | 0.1326 | 0.2295 | 0.2211 | 0.2242 | 0.0509 | −0.0345 | 0.0574 | 0.1449 | 0.0194 | 0.0091 | 0.0194 | 0.0333 | 0.0331 | 0.0352 | 0.0340 | 0.1061 |

| Hungary | −0.0834 | −0.0836 | −0.0872 | −0.0859 | −0.0790 | −0.0785 | −0.0823 | −0.0971 | −0.1000 | −0.0976 | −0.1136 | −0.1144 | −0.1008 | −0.1048 | −0.1039 | −0.1082 | −0.1011 | −0.1019 | −0.0957 |

| Iceland | 0.0632 | −0.7790 | −0.6083 | −0.6226 | −0.4898 | −0.5286 | −0.5402 | −0.5811 | −0.6583 | −0.6722 | −0.6704 | −0.0037 | −0.7679 | −0.1700 | −0.6380 | −0.1433 | −0.8306 | −0.6914 | −0.5185 |

| Ireland | 0.0666 | 0.0151 | −0.0184 | −0.0288 | −0.0033 | −0.0052 | −0.0037 | −0.0100 | −0.0358 | −0.0440 | −0.0828 | −0.0584 | 0.0547 | 0.0169 | 0.0912 | 0.1056 | −0.0695 | −0.0870 | −0.0054 |

| Israel | 0.4971 | 0.5433 | −0.0415 | −0.0232 | 0.2575 | 0.2202 | 0.1290 | 0.0360 | −0.0287 | 0.1938 | 0.8371 | −0.0333 | 0.1067 | 0.0889 | 0.1541 | 0.5215 | 0.1343 | 0.1562 | 0.2083 |

| Italy | 0.0288 | 0.0910 | 0.0203 | 0.0834 | 0.0522 | 0.0091 | 0.0087 | 0.0103 | 0.0094 | 0.0167 | 0.0870 | 0.0537 | 0.0361 | 0.0166 | 0.0297 | 0.0394 | 0.0439 | 0.0395 | 0.0375 |

| Japan | 0.0111 | 0.1701 | 0.0147 | 0.0143 | 0.0540 | 0.0103 | 0.0101 | 0.0172 | 0.0142 | 0.0088 | 0.0306 | 0.0180 | 0.0122 | 0.0224 | 0.0097 | 0.0377 | 0.0382 | 0.0195 | 0.0285 |

| Latvia | −0.5456 | −1.0000 | −0.5383 | −0.5324 | −0.4025 | −0.4368 | −0.4593 | −1.0000 | −0.9260 | −0.4957 | −0.5424 | −0.4661 | −1.0000 | −1.0000 | −0.6574 | −0.6942 | −1.0000 | −0.9845 | −0.7045 |

| Lithuania | −0.4954 | −0.2253 | −0.2283 | −0.2393 | −0.2324 | −0.2446 | −0.2372 | −0.2848 | −0.9429 | −0.9333 | −0.9367 | −0.3594 | −0.3385 | −0.3515 | −0.3184 | −0.3308 | −0.3223 | −0.3391 | −0.4089 |

| Luxembourg | −0.6460 | 0.1636 | 0.6666 | 0.6088 | −0.2068 | −0.2261 | −0.3802 | −0.2634 | −1.0000 | −1.0000 | −1.0000 | −0.3228 | −0.3030 | −0.3398 | −0.3252 | 0.5165 | 0.2913 | 0.2845 | −0.1935 |

| Mexico | 0.0440 | 0.0151 | 0.0149 | 0.0287 | 0.0103 | 0.0121 | 0.0162 | 0.0168 | 0.0118 | 0.0565 | 0.1545 | 0.1611 | 0.0360 | 0.1669 | 0.1392 | 0.1334 | 0.1373 | 0.1508 | 0.0725 |

| Netherlands | 0.1221 | 0.0452 | 0.0241 | 0.0238 | 0.0239 | 0.0662 | 0.0208 | 0.0251 | 0.0265 | 0.0981 | 0.0426 | 0.2276 | 0.0455 | 0.0441 | 0.0719 | 0.2305 | 0.2389 | 0.2587 | 0.0909 |

| New Zealand | −0.0769 | −0.0773 | −0.0752 | −0.0815 | −0.0772 | −0.0740 | −0.0763 | −0.0874 | −0.0857 | −0.0988 | −0.0958 | −0.0948 | −0.0859 | −0.0922 | −0.0867 | −0.0944 | −0.0916 | −0.0951 | −0.0859 |

| Norway | −0.0277 | −0.0262 | −0.0285 | −0.0287 | −0.0291 | −0.0321 | −0.0282 | −0.0261 | −0.0250 | −0.0257 | −0.0250 | −0.0246 | −0.0279 | −0.0288 | −0.0335 | −0.0372 | −0.0425 | −0.0443 | −0.0301 |

| Poland | 0.0982 | 0.1335 | 0.1464 | 0.1232 | 0.2849 | 0.2772 | 0.0539 | 0.0395 | 0.0400 | 0.0848 | 0.0296 | 0.0226 | 0.0276 | 0.0599 | 0.0429 | 0.0307 | 0.0281 | 0.0414 | 0.0869 |

| Portugal | 0.0309 | 0.0252 | 0.0927 | 0.1371 | −0.0208 | −0.0049 | 0.0178 | 0.0179 | 0.0367 | 0.0427 | 0.0033 | −0.0097 | 0.0073 | 0.0148 | −0.0208 | −0.0084 | −0.0196 | −0.0054 | 0.0187 |

| Slovakia | −0.1014 | −0.1361 | −0.1478 | −0.1322 | −0.1099 | −0.1454 | −0.1418 | −0.1525 | −0.1507 | −0.1557 | −0.1595 | −0.1583 | −0.1839 | −0.1779 | −0.1788 | −0.1911 | −0.1916 | −0.1971 | −0.1562 |

| Slovenia | −0.2193 | −0.2465 | −0.2210 | −0.2360 | −0.2565 | −0.2597 | −0.2453 | −0.2915 | −0.3339 | −0.3833 | −0.4056 | −0.3578 | −0.3474 | −0.3614 | −0.3559 | −0.3584 | −0.3623 | −0.3846 | −0.3126 |

| South Korea | 0.0719 | 0.0687 | 0.0289 | 0.0298 | 0.0291 | 0.0318 | 0.0329 | 0.0464 | 0.0280 | 0.0380 | 0.0770 | 0.0922 | 0.1172 | 0.1224 | 0.1207 | 0.1232 | 0.0732 | 0.0435 | 0.0653 |

| Spain | 0.0389 | 0.1004 | 0.0282 | 0.0337 | 0.1356 | 0.1303 | 0.1396 | 0.1476 | 0.1497 | 0.1502 | 0.1481 | 0.1562 | 0.1561 | 0.1593 | 0.1677 | 0.1613 | 0.1638 | 0.1603 | 0.1293 |

| Sweden | 0.6397 | 0.6991 | 0.6915 | 0.7157 | 0.7204 | 0.7431 | 0.7718 | −0.0078 | −0.0048 | 0.7682 | 0.8014 | 0.7795 | 0.7661 | 0.7002 | 0.6909 | 0.7205 | 0.7764 | 0.7652 | 0.6521 |

| Switzerland | 0.4655 | 0.4295 | 0.5284 | 0.5448 | 0.5534 | 0.5643 | 0.5555 | −0.0129 | −0.0041 | 0.5660 | 0.6957 | 0.4811 | 0.5455 | 0.5250 | 0.5193 | 0.5473 | 0.5757 | 0.5708 | 0.4806 |

| Turkey | 0.0873 | 0.0781 | 0.0751 | 0.0645 | 0.0689 | 0.0270 | 0.0233 | 0.0630 | 0.0260 | 0.0249 | 0.0267 | 0.0225 | 0.0183 | 0.0276 | 0.0262 | 0.0325 | 0.0375 | 0.0717 | 0.0445 |

| United Kingdom | 0.0353 | 0.0221 | 0.0227 | 0.0201 | 0.0227 | 0.0094 | 0.0082 | 0.0505 | 0.0099 | 0.0098 | 0.0111 | 0.0099 | 0.0078 | 0.0568 | 0.0171 | 0.0478 | 0.0530 | 0.0392 | 0.0252 |

| United States | 0.0864 | 0.0920 | 0.0831 | 0.0721 | 0.0574 | 0.0679 | 0.0907 | 0.0912 | 0.0970 | 0.0890 | 0.0744 | 0.0827 | 0.0863 | 0.0533 | 0.0561 | 0.0557 | 0.0546 | 0.0514 | 0.0745 |

| Total Average | −0.0017 | −0.0009 | 0.0102 | 0.0087 | 0.0109 | 0.0049 | −0.0092 | −0.0741 | −0.1168 | −0.0551 | −0.0486 | −0.0031 | −0.0405 | −0.0159 | −0.0177 | 0.0320 | −0.0055 | −0.0046 | −0.0182 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sueyoshi, T.; Goto, M. Energy Intensity, Energy Efficiency and Economic Growth among OECD Nations from 2000 to 2019. Energies 2023, 16, 1927. https://doi.org/10.3390/en16041927

Sueyoshi T, Goto M. Energy Intensity, Energy Efficiency and Economic Growth among OECD Nations from 2000 to 2019. Energies. 2023; 16(4):1927. https://doi.org/10.3390/en16041927

Chicago/Turabian StyleSueyoshi, Toshiyuki, and Mika Goto. 2023. "Energy Intensity, Energy Efficiency and Economic Growth among OECD Nations from 2000 to 2019" Energies 16, no. 4: 1927. https://doi.org/10.3390/en16041927

APA StyleSueyoshi, T., & Goto, M. (2023). Energy Intensity, Energy Efficiency and Economic Growth among OECD Nations from 2000 to 2019. Energies, 16(4), 1927. https://doi.org/10.3390/en16041927