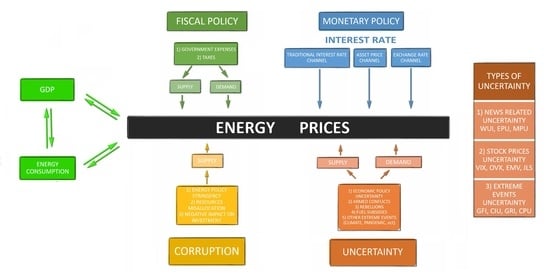

Macroeconomic and Uncertainty Shocks’ Effects on Energy Prices: A Comprehensive Literature Review

Abstract

1. Introduction

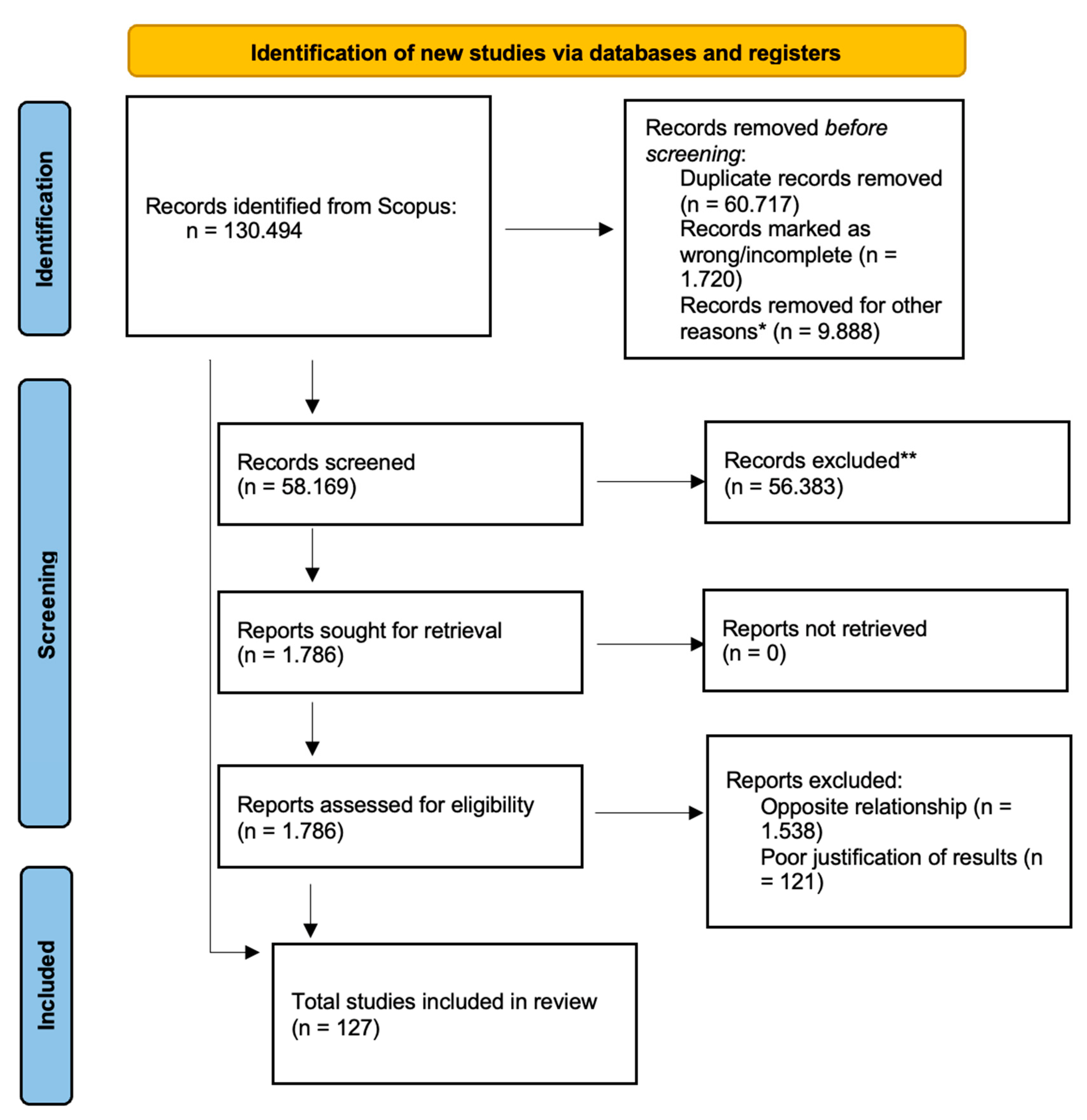

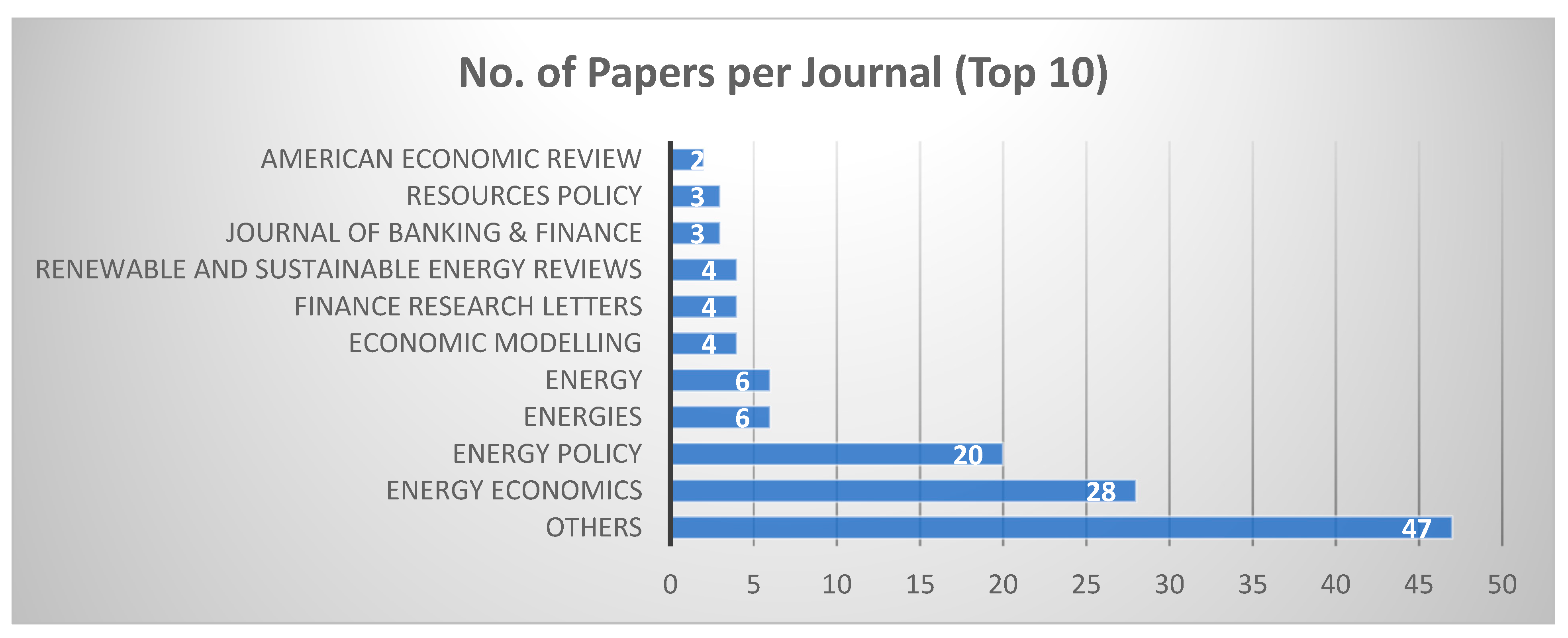

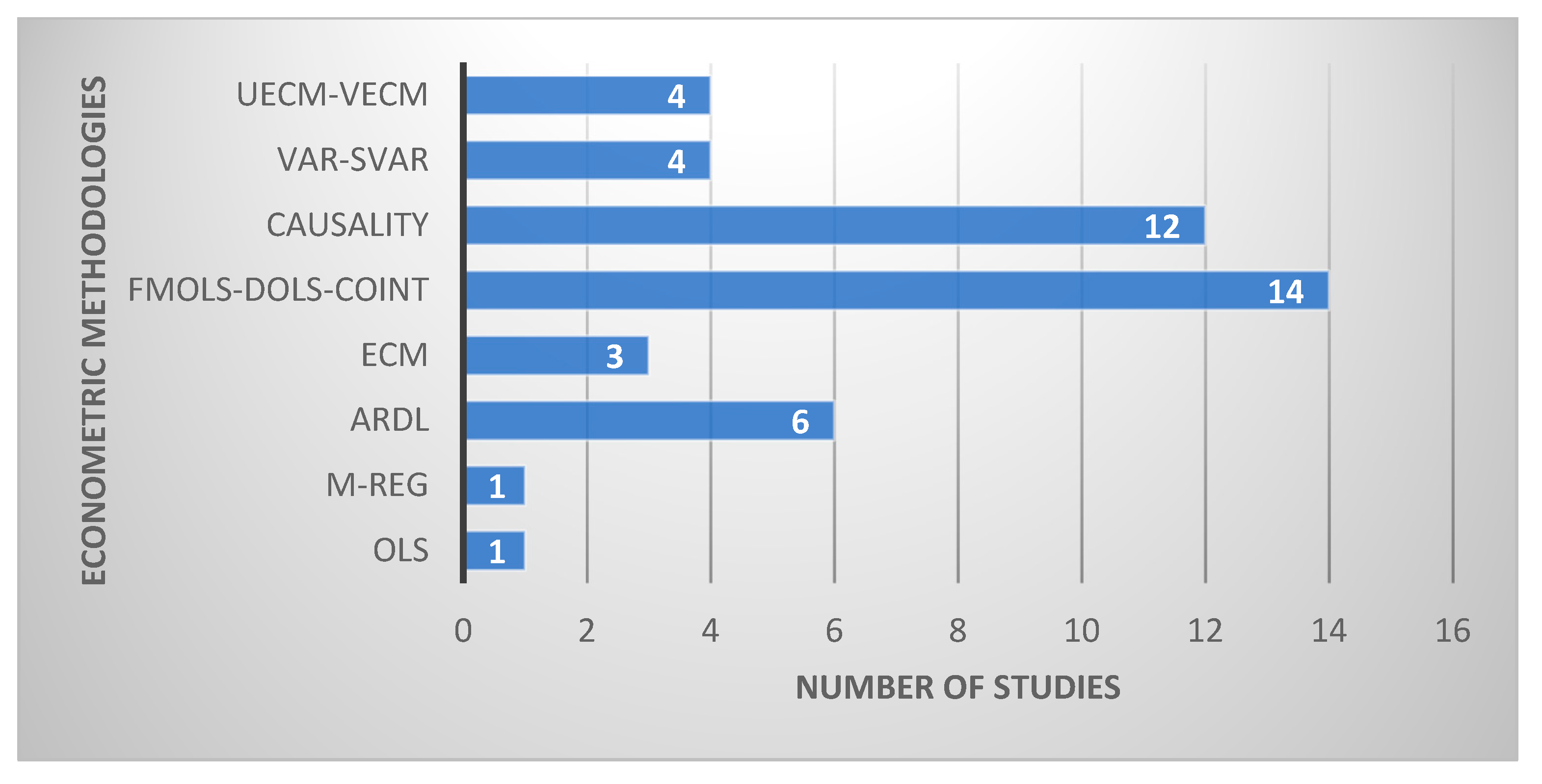

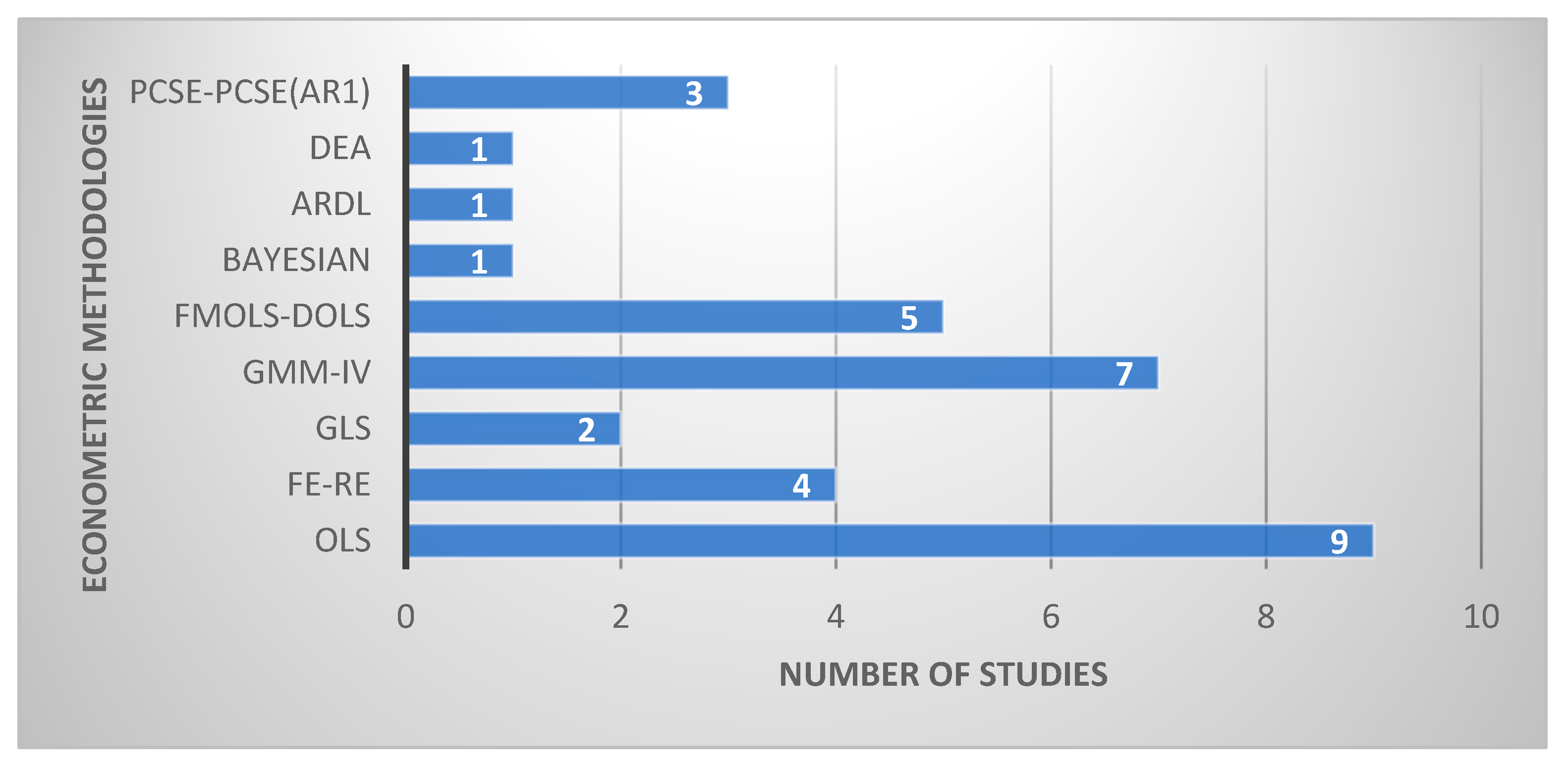

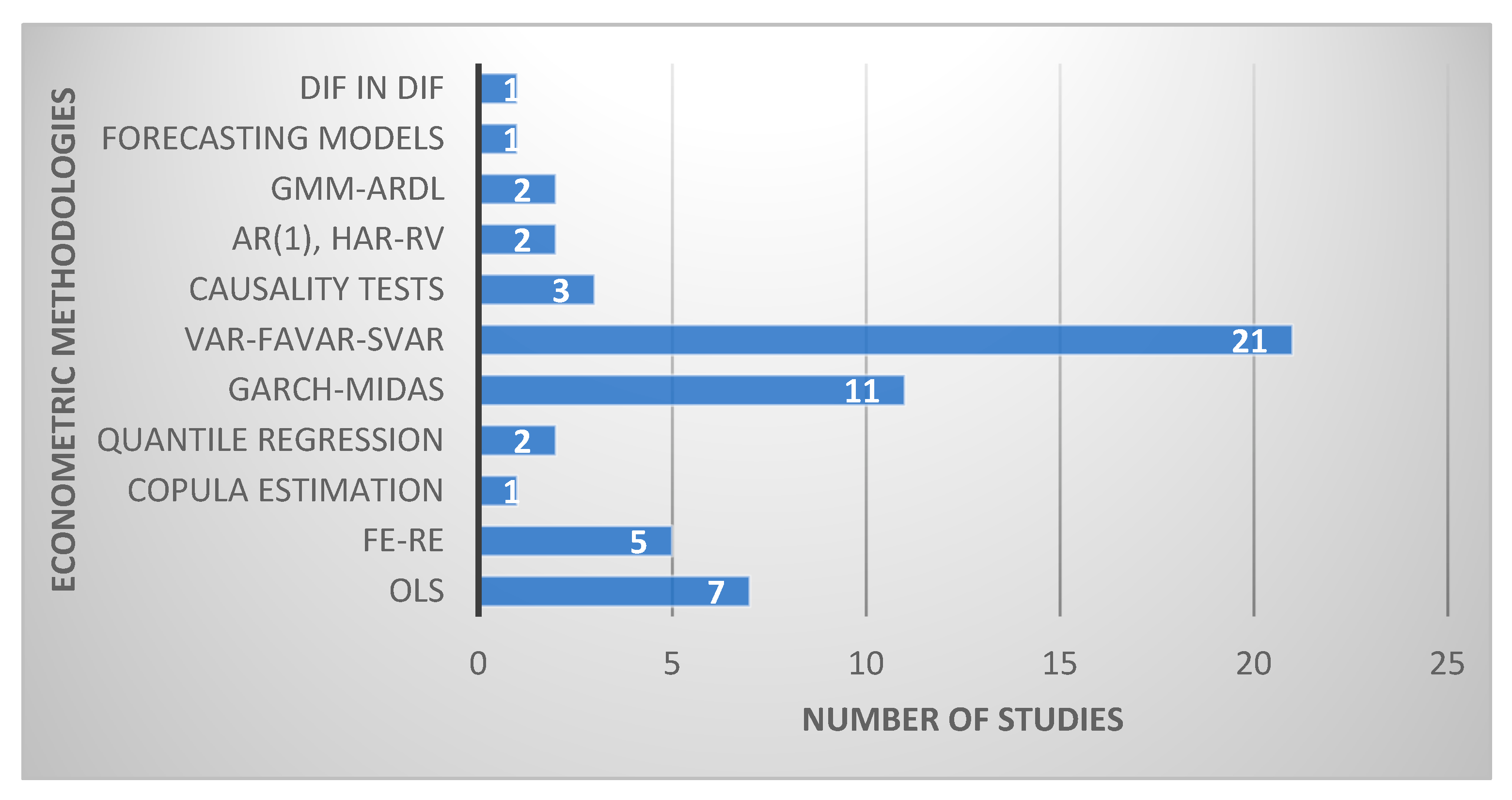

2. Materials and Methods

3. Energy–Growth Nexus

4. The Role of Fiscal Policy in Energy Prices

5. The Role of Monetary Policy in Energy Prices

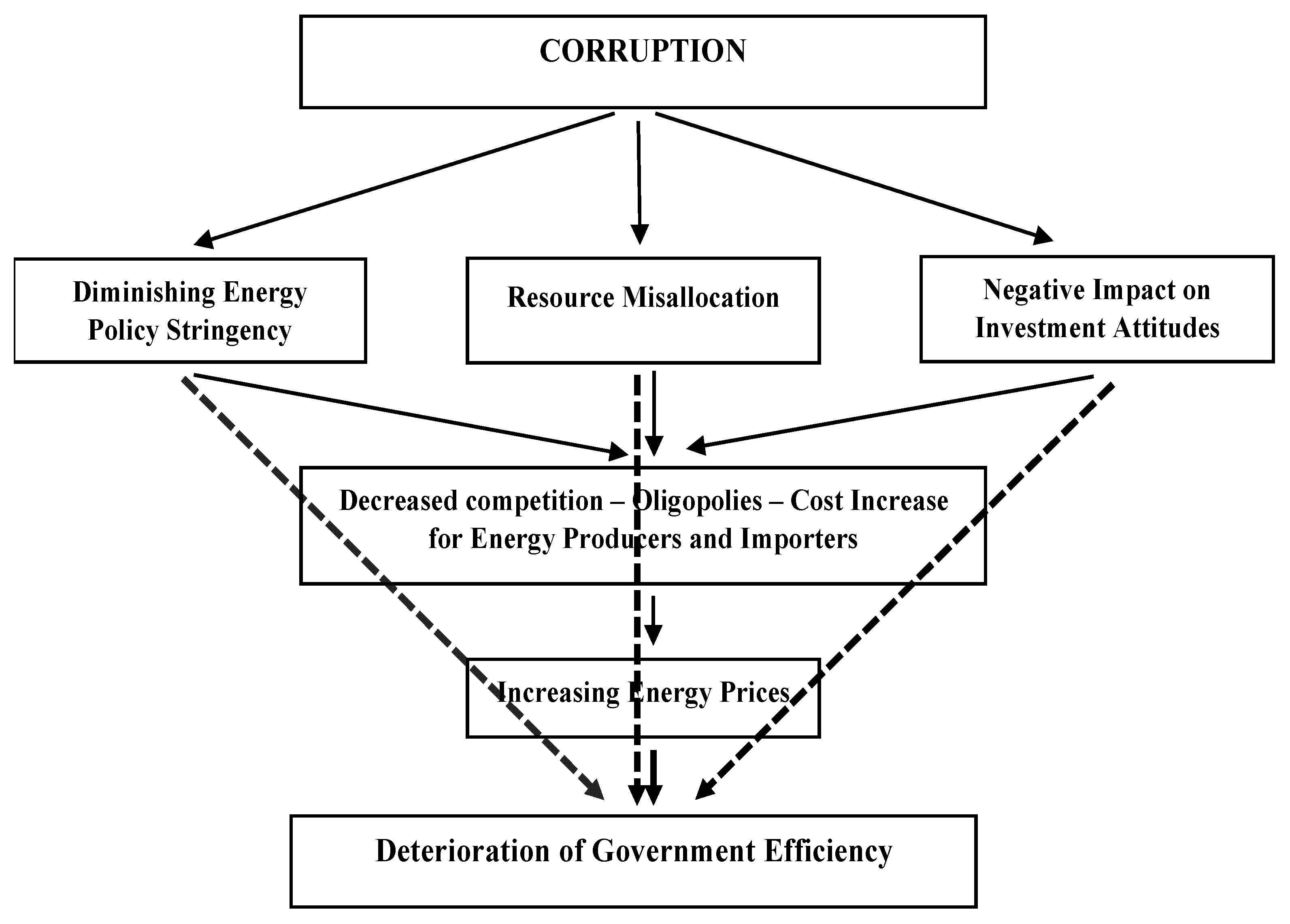

6. Corruption

7. Uncertainty

7.1. Types of Uncertainty

7.2. Economic Shocks

7.3. Supply and Demand

7.4. The Impact of EPU on Energy Market Prices and Volatility

7.5. Extreme Events, Armed Conflicts, Rebellion, Fuel Subsidies, and Energy Prices

8. Discussion and Future Directions

9. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Omri, A. An international literature survey on energy-economic growth nexus: Evidence from country-specific studies. Renew. Sustain. Energy Rev. 2014, 38, 951–959. [Google Scholar] [CrossRef]

- Bernanke, B.; Mishkin, F. Central bank behavior and the strategy of monetary policy: Observations from six industrialized countries. NBER Macroecon. Annu. 1992, 1, 183–228. [Google Scholar] [CrossRef]

- Arestis, P.; Sawyer, M. Can monetary policy affect the real economy? Univ. Libr. Munich Ger. 2002. [Google Scholar] [CrossRef]

- Ireland, P.N. The Monetary Transmission Mechanism. In The New Palgrave Dictionary of Economics; Bloom, L., Durlauf, S., Eds.; Palgrave-MacMillan: Hampshire, UK, 2008; pp. 721–725. [Google Scholar]

- Yıldırım-Karaman, S. Uncertainty shocks, central bank characteristics and business cycles. Econ. Syst. 2017, 41, 379–388. [Google Scholar] [CrossRef]

- Mauro, P. Corruption and Growth. Q. J. Econ. 1995, 110, 681–712. [Google Scholar] [CrossRef]

- Al-Marhubi, F.A. Corruption and Inflation. Econ. Lett. 2000, 66, 199–202. [Google Scholar] [CrossRef]

- Alesina, A.; Campante, F.R.; Tabellini, G. Why is fiscal policy often procyclical? J. Eur. Econ. Assoc. 2008, 6, 1006–1036. [Google Scholar] [CrossRef]

- Damania, R.; Fredriksson, P.G.; List, J.A. Trade liberalization, corruption, and environmental policy formation: Theory and evidence. J. Environ. Econ. Manag. 2003, 46, 490–512. [Google Scholar] [CrossRef]

- Fredriksson, P.G.; Vollebergh, H.R.; Dijkgraaf, E. Corruption and energy efficiency in OECD countries: Theory and evidence. J. Environ. Econ. Manag. 2004, 47, 207–231. [Google Scholar] [CrossRef]

- Arminen, H.; Menegaki, A.N. Corruption, climate, and the energy-environment-growth nexus. Energy Econ. 2019, 80, 621–634. [Google Scholar] [CrossRef]

- Vasylieva, T.; Lyulyov, O.; Bilan, Y.; Streimikiene, D. Sustainable economic development and greenhouse gas emissions: The dynamic impact of renewable energy consumption, GDP, and corruption. Energies 2019, 12, 3289. [Google Scholar] [CrossRef]

- Fredriksson, P.G.; Svensson, J. Political instability, corruption and policy formation: The case of environmental policy. J. Public Econ. 2003, 87, 1383–1405. [Google Scholar] [CrossRef]

- Laffont, J.J.; Tirole, J. The politics of government decision-making: A theory of regulatory capture. Q. J. Econ. 1991, 106, 1089–1127. [Google Scholar] [CrossRef]

- Dokas, I.; Panagiotidis, M.; Papadamou, S.; Spyromitros, E. The Determinants of Energy and Electricity Consumption in Developed and Developing Countries: International Evidence. Energies 2022, 15, 2558. [Google Scholar] [CrossRef]

- Keefer, P.; Stasavage, D. The limits of delegation: Veto players, central bank independence, and the credibility of monetary policy. Am. Political Sci. Rev. 2003, 97, 407–423. [Google Scholar] [CrossRef]

- Fredriksson, P.G.; Vollebergh, H.R. Corruption, federalism, and policy formation in the OECD: The case of energy policy. Public Choice 2009, 140, 205–221. [Google Scholar] [CrossRef]

- Kaller, A.; Bielen, S.; Marneffe, W. The impact of regulatory quality and corruption on residential electricity prices in the context of electricity market reforms. Energy Policy 2018, 123, 514–524. [Google Scholar] [CrossRef]

- Sekrafi, H.; Sghaier, A. Examining the relationship between corruption, economic growth, environmental degradation, and energy consumption: A panel analysis in MENA region. J. Know. Econ. 2018, 9, 963–979. [Google Scholar] [CrossRef]

- Ozturk, I.; Al-Mulali, U.; Solarin, S.A. The control of corruption and energy efficiency relationship: An empirical note. Environ. Sci. Pollut. Res. 2019, 26, 17277–17283. [Google Scholar] [CrossRef]

- Liu, J.; Guo, J.; Liu, X.; Bai, X.; Taghizadeh-Hesary, F. Does Anti-corruption Policy Influence Energy Efficiency in China? Front. Energy Res. 2021, 9, 634556. [Google Scholar] [CrossRef]

- Halkos, G.E.; Tzeremes, N.G. Carbon dioxide emissions and governance: A nonparametric analysis for the G-20. Energy Econ. 2013, 40, 110–118. [Google Scholar] [CrossRef]

- Rose-Ackerman, S.; Palifka, B.J. Corruption and Government: Causes, Consequences, and Reform; Cambridge University Press: Cambridge, UK, 2016. [Google Scholar]

- Rafaty, R. Perceptions of corruption, political distrust, and the weakening of climate policy. Glob. Environ. Politics 2018, 18, 106–129. [Google Scholar] [CrossRef]

- Sinha, A.; Gupta, M.; Shahbaz, M.; Sengupta, T. Impact of corruption in public sector on environmental quality: Implications for sustainability in BRICS and next 11 countries. J. Clean. Prod. 2019, 232, 1379–1393. [Google Scholar] [CrossRef]

- Uzar, U. Is income inequality a driver for renewable energy consumption? J. Clean. Prod. 2020, 255, 120287. [Google Scholar] [CrossRef]

- Boamah, F.; Williams, D.A.; Afful, J. Justifiable energy injustices? Exploring institutionalised corruption and electricity sector “problem-solving” in Ghana and Kenya. Energy Res. Soc. Sci. 2021, 73, 101914. [Google Scholar] [CrossRef]

- Balmaceda, M.M. Energy Dependency, Politics and Corruption in the Former Soviet Union: Russia’s Power, Oligarchs’ Profits and Ukraine’s Missing Energy Policy 1995–2006; Routledge: London, UK, 2007. [Google Scholar]

- Baker, S.R.; Bloom, N.; Davis, S.J. Measuring economic policy uncertainty. Q. J. Econ. 2016, 131, 1593–1636. [Google Scholar] [CrossRef]

- Jurado, K.; Ludvigson, S.C.; Ng, S. Measuring uncertainty. Am. Econ. Rev. 2015, 105, 1177–1216. [Google Scholar] [CrossRef]

- Pástor, Ľ.; Veronesi, P. Political uncertainty and risk premia. J. Financ. Econ. 2013, 110, 520–545. [Google Scholar] [CrossRef]

- Al-Thaqeb, S.A.; Algharabali, B.G. Economic policy uncertainty: A literature review. J. Econ. Asymmetries 2019, 20, e00133. [Google Scholar] [CrossRef]

- Alfaro, I.; Bloom, N.; Lin, X. The Finance Uncertainty Multiplier (No. w24571); National Bureau of Economic Research: Cambridge, MA, USA, 2018. [Google Scholar]

- Bakas, D.; Triantafyllou, A. The impact of uncertainty shocks on the volatility of commodity prices. J. Int. Money Financ. 2018, 87, 96–111. [Google Scholar] [CrossRef]

- Ji, Q.; Fan, Y. Modelling the joint dynamics of oil prices and investor fear gauge. Res. Int. Bus. Financ. 2016, 37, 242–251. [Google Scholar] [CrossRef]

- Bouri, E.; Demirer, R.; Gupta, R.; Pierdzioch, C. Infectious diseases, market uncertainty and oil market volatility. Energies 2020, 13, 4090. [Google Scholar] [CrossRef]

- Salisu, A.A.; Akanni, L.O. Constructing a global fear index for the COVID-19 pandemic. Emerg. Mark. Financ. Trade 2020, 56, 2310–2331. [Google Scholar] [CrossRef]

- Olubusoye, O.E.; Ogbonna, A.E.; Yaya, O.S.; Umolo, D. An information-based index of uncertainty and the predictability of energy prices. Int. J. Energy Res. 2021, 45, 10235–10249. [Google Scholar] [CrossRef]

- Ahir, H.; Bloom, N.; Furceri, D. The World Uncertainty Index (No. w29763); National Bureau of Economic Research: Cambridge, MA, USA, 2022. [Google Scholar]

- Gavriilidis, K. Measuring Climate Policy Uncertainty. 2021. Available online: https://ssrn.com/abstract=3847388 (accessed on 2 October 2022).

- Li, X.; Wei, Y.; Chen, X.; Ma, F.; Liang, C.; Chen, W. Which uncertainty is powerful to forecast crude oil market volatility? New evidence. Int. J. Financ. Econ. 2022, 27, 4279–4297. [Google Scholar] [CrossRef]

- Arbatli, E.C.; Davis, S.J.; Ito, A.; Miake, N. Policy Uncertainty in Japan (No. w23411); National Bureau of Economic Research: Cambridge, MA, USA, 2017. [Google Scholar]

- Baker, S.R.; Bloom, N.; Davis, S.J.; Kost, K.J. Policy News and Stock Market Volatility (No. w25720); National Bureau of Economic Research: Cambridge, MA, USA, 2019. [Google Scholar]

- Caldara, D.; Iacoviello, M. Measuring geopolitical risk. Am. Econ. Rev. 2022, 112, 1194–1225. [Google Scholar] [CrossRef]

- Havranek, T.; Irsova, Z.; Janda, K. Demand for gasoline is more price-inelastic than commonly thought. Energy Econ. 2012, 34, 201–207. [Google Scholar] [CrossRef]

- Wang, Q.; Su, M.; Li, R.; Ponce, P. The effects of energy prices, urbanization and economic growth on energy consumption per capita in 186 countries. J. Clean. Prod. 2019, 225, 1017–1032. [Google Scholar] [CrossRef]

- Fisher-Vanden, K.; Jefferson, G.H.; Liu, H.; Tao, Q. What is driving China’s decline in energy intensity? Resour. Energy Econ. 2004, 26, 77–97. [Google Scholar] [CrossRef]

- Hang, L.; Tu, M. The impacts of energy prices on energy intensity: Evidence from China. Energy Policy 2007, 35, 2978–2988. [Google Scholar] [CrossRef]

- Yuan, C.; Liu, S.; Wu, J. The relationship among energy prices and energy consumption in China. Energy Policy 2010, 38, 197–207. [Google Scholar] [CrossRef]

- Ferreira, P.; Soares, I.; Araújo, M. Liberalisation, consumption heterogeneity and the dynamics of energy prices. Energy Policy 2005, 33, 2244–2255. [Google Scholar] [CrossRef]

- Pengfei, Y.; Jilin, W. The synthetical characteristics of energy consumption and economic fluctuation in the scenes of energy price rising. Stat. Res. 2011, 28, 57–65. [Google Scholar]

- Tang, W.; Wu, L.; Zhang, Z. Oil price shocks and their short-and long-term effects on the Chinese economy. Energy Econ. 2010, 32, 3–14. [Google Scholar] [CrossRef]

- Ozturk, I. A literature survey on energy–growth nexus. Energy Policy 2010, 38, 340–349. [Google Scholar] [CrossRef]

- Fuinhas, J.A.; Marques, A.C. Energy consumption and economic growth nexus in Portugal, Italy, Greece, Spain and Turkey: An ARDL bounds test approach (1965–2009). Energy Econ. 2012, 34, 511–517. [Google Scholar] [CrossRef]

- Yuan, J.H.; Kang, J.G.; Zhao, C.H.; Hu, Z.G. Energy consumption and economic growth: Evidence from China at both aggregated and disaggregated levels. Energy Econ. 2008, 30, 3077–3094. [Google Scholar] [CrossRef]

- Ferguson, R.; Wilkinson, W.; Hill, R. Electricity use and economic development. Energy Policy 2000, 28, 923–934. [Google Scholar] [CrossRef]

- Sarwar, S.; Chen, W.; Waheed, R. Electricity consumption, oil price and economic growth: Global perspective. Renew. Sustain. Energy Rev. 2017, 76, 9–18. [Google Scholar] [CrossRef]

- Chen, S.T.; Kuo, H.I.; Chen, C.C. The relationship between GDP and electricity consumption in 10 Asian countries. Energy Policy 2007, 35, 2611–2621. [Google Scholar] [CrossRef]

- Lee, C.C.; Chang, C.P. Energy consumption and economic growth in Asian economies: A more comprehensive analysis using panel data. Resour. Energy Econ. 2008, 30, 50–65. [Google Scholar] [CrossRef]

- Narayan, P.K.; Prasad, A. Electricity consumption–real GDP causality nexus: Evidence from a bootstrapped causality test for 30 OECD countries. Energy Policy 2008, 36, 910–918. [Google Scholar] [CrossRef]

- Mehrara, M. Energy consumption and economic growth: The case of oil exporting countries. Energy Policy 2007, 35, 2939–2945. [Google Scholar] [CrossRef]

- Lee, C.C.; Chang, C.P.; Chen, P.F. Energy-income causality in OECD countries revisited: The key role of capital stock. Energy Econ. 2007, 30, 2359–2373. [Google Scholar] [CrossRef]

- Yoo, S.H.; Kwak, S.Y. Electricity consumption and economic growth in seven South American countries. Energy Policy 2010, 38, 181–188. [Google Scholar] [CrossRef]

- Kahsai, M.S.; Nondo, C.; Schaeffer, P.V.; Gebremedhin, T.G. Income level and the energy consumption–GDP nexus: Evidence from Sub-Saharan Africa. Energy Econ. 2012, 34, 739–746. [Google Scholar] [CrossRef]

- Narayan, P.K.; Singh, B. The electricity consumption and GDP nexus for the Fiji Islands. Energy Econ. 2007, 29, 1141–1150. [Google Scholar] [CrossRef]

- Erdal, G.; Erdal, H.; Esengün, K. The causality between energy consumption and economic growth in Turkey. Energy Policy 2008, 36, 3838–3842. [Google Scholar] [CrossRef]

- Odhiambo, N.M. Energy consumption, prices and economic growth in three SSA countries: A comparative study. Energy Policy 2010, 38, 2463–2469. [Google Scholar] [CrossRef]

- Alam, M.J.; Begum, I.A.; Buysse, J.; Van Huylenbroeck, G. Energy consumption, carbon emissions and economic growth nexus in Bangladesh: Cointegration and dynamic causality analysis. Energy Policy 2012, 45, 217–225. [Google Scholar] [CrossRef]

- Shahbaz, M.; Nasreen, S.; Abbas, F.; Anis, O. Does foreign direct investment impede environmental quality in high-, middle-, and low-income countries? Energy Econ. 2015, 51, 275–287. [Google Scholar] [CrossRef]

- Wasti, S.K.; Zaidi, S.W. An empirical investigation between CO2 emission, energy consumption, trade liberalization and economic growth: A case of Kuwait. J. Build. Eng. 2020, 28, 101104. [Google Scholar] [CrossRef]

- Tatom, J.A. Energy Prices and Short-Run Economic Performance. Fed. Reserve Bank St. Louis Rev 1981, 63, 3–17. [Google Scholar] [CrossRef]

- Finn, M.G. Perfect Competition and the Effects of Energy Price Increases on Economic Activity. J. Money Credit. Bank 2000, 32, 400–416. [Google Scholar] [CrossRef]

- Chai, J.; Yang, Y.; Xing, L. Oil price and economic growth: An improved asymmetric co-integration approach. Int. J. Glob. Energy 2015, 38, 278–285. [Google Scholar] [CrossRef]

- Brown, S.P.; Yücel, M.K. Energy prices and aggregate economic activity: An interpretative survey. Q. Rev. Econ. Financ 2002, 42, 193–208. [Google Scholar] [CrossRef]

- Kliesen, K.L. Rising natural gas prices and real economic activity. Fed. Reserve Bank St. Louis Rev. 2006, 88, 511–526. [Google Scholar] [CrossRef]

- Asafu-Adjaye, J. The relationship between energy consumption, energy prices and economic growth: Time series evidence from Asian developing countries. Energy Econ. 2000, 22, 615–625. [Google Scholar] [CrossRef]

- Kırca, M.; Canbay, Ş.; Pirali, K. Is the relationship between oil-gas prices index and economic growth in Turkey permanent? Resour. Policy 2020, 69, 101838. [Google Scholar] [CrossRef]

- Berk, I.; Yetkiner, H. Energy prices and economic growth in the long run: Theory and evidence. Renew. Sustain. Energy Rev. 2014, 36, 228–235. [Google Scholar] [CrossRef]

- Ferdaus, J.; Appiah, B.K.; Majumder, S.C.; Martial, A.A. A Panel Dynamic Analysis on Energy Consumption, Energy Prices and Economic Growth in Next 11 Countries. Int. J. Energy Econ. Policy 2020, 10, 87. [Google Scholar] [CrossRef]

- Grave, K.; Breitschopf, B.; Ordonez, J.; Wachsmuth, J.; Boeve, S.; Smith, M.; Schubert, T.; Friedrichsen, N.; Herbst, A.; Eckartz, K.; et al. Prices and Costs of EU Energy; Report of European Commission; 29 April 2016, Ecofys 2016 by order of: European Commission. Available online: https://www.isi.fraunhofer.de/content/dam/isi/dokumente/ccx/2016/report_ecofys2016.pdf (accessed on 5 October 2022).

- Kapusuzoğlu, A. Causality Relationships between Carbon Dioxide Emissions and Economic Growth: Results from a Multi-Country Study. Int. J. Econ. Perspect. 2014, 8, 5–15. [Google Scholar]

- Anatasia, V. The Causal Relationship between GDP, Exports, Energy Consumption, and CO2 in Thailand and Malaysia. Int. J. Econ. Perspect. 2015, 9, 37–48. [Google Scholar]

- Balcilar, M.; Çiftçioğlu, S.; Güngör, H. The effects of financial development on Investment in Turkey. Singap. Econ. Rev. 2016, 61, 1650002. [Google Scholar] [CrossRef]

- Dongyan, L. Fiscal and tax policy support for energy efficiency retrofit for existing residential buildings in China’s northern heating region. Energy Policy 2009, 37, 2113–2118. [Google Scholar] [CrossRef]

- Fischer, C.; Fox, A.K. Climate policy and fiscal constraints: Do tax interactions outweigh carbon leakage? Energy Econ. 2012, 34, 218–227. [Google Scholar] [CrossRef]

- Bletsas, K.; Oikonomou, G.; Panagiotidis, M.; Spyromitros, E. Carbon Dioxide and Greenhouse Gas Emissions: The Role of Monetary Policy, Fiscal Policy, and Institutional Quality. Energies 2022, 15, 4733. [Google Scholar] [CrossRef]

- Calbick, K.S.; Gunton, T. Differences among OECD countries’ GHG emissions: Causes and policy implications. Energy Policy 2014, 67, 895–902. [Google Scholar] [CrossRef]

- Lopez, R.; Palacios-Lopez, A. Have Government Spending and Energy Tax Policies Contributed to make Europe Environmentally Cleaner? Department of Agricultural and Resource Economics, The University of Maryland: College Park, MD, USA, 2010. [Google Scholar]

- López, R.; Galinato, G.I.; Islam, A. Fiscal spending and the environment: Theory and empirics. J. Environ. Econ. Manag. 2011, 62, 180–198. [Google Scholar] [CrossRef]

- Halkos, G.E.; Paizanos, E.A. The effect of government expenditure on the environment: An empirical investigation. Ecol. Econ. 2013, 91, 48–56. [Google Scholar] [CrossRef]

- Heyes, A. A proposal for the greening of textbook macro:‘IS-LM-EE’. Ecol. Econ. 2000, 32, 1–7. [Google Scholar]

- Lawn, P.A. Environmental macroeconomics: Extending the IS–LM model to include an ‘environmental equilibrium’curve. Aust. Econ. Pap. 2003, 42, 118–134. [Google Scholar] [CrossRef]

- Sim, N.C. Environmental Keynesian macroeconomics: Some further discussion. Ecol. Econ. 2006, 59, 401–405. [Google Scholar] [CrossRef]

- Glick, R.; Leduc, S. Central bank announcements of asset purchases and the impact on global financial and commodity markets. J. Int. Money Financ. 2012, 31, 2078–2101. [Google Scholar] [CrossRef]

- Soriano, P.; Torró, H. The response of Brent crude oil to the European central bank monetary policy. Financ. Res. Lett. 2022, 46, 102353. [Google Scholar] [CrossRef]

- Barsky, R.B.; Kilian, L. Do we really know that oil caused the great stagflation? A monetary alternative. NBER Macroecon. Annu. 2001, 16, 137–183. [Google Scholar] [CrossRef]

- Frankel, J.A. The effect of monetary policy on real commodity prices. In Asset Prices and Monetary Policy; Campbell, J.Y., Ed.; University of Chicago Press: Chicago, IL, USA, 2008; pp. 291–333. [Google Scholar]

- Hotelling, H. The economics of exhaustible resources. J. Political Econ. 1931, 39, 137–175. [Google Scholar] [CrossRef]

- Rosa, C. The high-frequency response of exchange rates to monetary policy actions and statements. J. Bank. Financ. 2011, 35, 478–489. [Google Scholar] [CrossRef]

- Rosa, C. The high-frequency response of energy prices to US monetary policy: Understanding the empirical evidence. Energy Econ. 2014, 45, 295–303. [Google Scholar] [CrossRef]

- Basistha, A.; Kurov, A. The impact of monetary policy surprises on energy prices. J. Futur. Mark. 2015, 35, 87–103. [Google Scholar]

- Alesina, A.; Summers, L.H. Central bank independence and macroeconomic performance: Some comparative evidence. J. Money Credit Bank. 1993, 25, 151–162. [Google Scholar] [CrossRef]

- Eijffinger, S.C.; Hoeberichts, M.; Schaling, E. Why money talks and wealth whispers: Monetary uncertainty and mystique. J. Money Credit Bank. 2000, 32, 218–235. [Google Scholar] [CrossRef]

- Crowe, C.; Meade, E.E. The evolution of central bank governance around the world. J. Econ. Perspect. 2007, 21, 69–90. [Google Scholar] [CrossRef]

- Demertzis, M.; Hughes-Hallett, A. Central bank transparency in theory and practice. J. Macroecon. 2007, 29, 760–789. [Google Scholar] [CrossRef]

- Dincer, N.N.; Eichengreen, B. Central Bank Transparency and Independence: Updates and New Measures. Int. J. Cent. Bank. 2014, 10, 189–259. [Google Scholar] [CrossRef]

- Papadamou, S.; Sidiropoulos, M.; Spyromitros, E. Determinants of central bank credibility and macroeconomic performance: Evidence from Eastern European and Latin American countries. East. Eur. Econ. 2014, 52, 5–31. [Google Scholar]

- Papadamou, S.; Sidiropoulos, M.; Spyromitros, E. Central bank transparency and the interest rate channel: Evidence from emerging economies. Econ. Model. 2015, 48, 167–174. [Google Scholar] [CrossRef]

- Arnone, M.; Romelli, D. Dynamic central bank independence indices and inflation rate: A new empirical exploration. J. Financ. Stab. 2013, 9, 385–398. [Google Scholar] [CrossRef]

- Oikonomou, G.; Papadamou, S.; Spyromitros, E. The effect of central bank transparency on inflation persistence. Econ. Bus. Lett. 2021, 10, 58–68. [Google Scholar] [CrossRef]

- Ulman, S.R.; Bujancă, G.V. The corruption influence on the macroeconomic environment. Empirical analysis on countries development stages. Procedia Econ. Financ. 2014, 16, 427–437. [Google Scholar] [CrossRef]

- Wei, S.J. How Taxing is Corruption on International Investors? Rev. Econ. Stat. 2000, 82, 1–11. [Google Scholar] [CrossRef]

- Ruth, M. Corruption and the Energy Sector; Management Systems International: Arlington, VA, USA, 2002. [Google Scholar]

- Rimšaitė, L. Corruption risk mitigation in energy sector: Issues and challenges. Energy Policy 2019, 125, 260–266. [Google Scholar] [CrossRef]

- Treisman, D. The causes of corruption: A cross-national study. J. Public Econ. 2000, 76, 399–457. [Google Scholar] [CrossRef]

- Lu, J.; Ren, L.; Qiao, J.; Yao, S.; Strielkowski, W.; Streimikis, J. Corporate social responsibility and corruption: Implications for the sustainable energy sector. Sustainability 2019, 11, 4128. [Google Scholar] [CrossRef]

- Liu, Q.; Lu, R.; Ma, X. Corruption, financial resources and exports. Rev. Int. Econ. 2015, 23, 1023–1043. [Google Scholar] [CrossRef]

- Pailler, S. Re-election incentives and deforestation cycles in the Brazilian Amazon. J. Environ. Econ. Manag. 2018, 88, 345–365. [Google Scholar] [CrossRef]

- Yao, X.; Yasmeen, R.; Hussain, J.; Shah, W.U.H. The repercussions of financial development and corruption on energy efficiency and ecological footprint: Evidence from BRICS and next 11 countries. Energy 2021, 223, 120063. [Google Scholar] [CrossRef]

- Kuper, G.H.; Van Soest, D.P. Path-dependency and input substitution: Implications for energy policy modeling. Energy Econ. 2003, 25, 397–407. [Google Scholar] [CrossRef]

- Bättig, M.B.; Bernauer, T. National institutions and global public goods: Are democracies more cooperative in climate change policy? Int. Organ. 2009, 63, 281–308. [Google Scholar] [CrossRef]

- Persily, N.; Lammie, K. Perceptions of corruption and campaign finance: When public opinion determines constitutional law. Univ. Pa. Law Rev. 2004, 153, 119. [Google Scholar] [CrossRef]

- Jenkins, J.D. Political economy constraints on carbon pricing policies: What are the implications for economic efficiency, environmental efficacy, and climate policy design? Energy Policy 2014, 69, 467–477. [Google Scholar] [CrossRef]

- Cadoret, I.; Padovano, F. The political drivers of renewable energies policies. Energy Econ. 2016, 56, 261–269. [Google Scholar] [CrossRef]

- Engelken, M.; Römer, B.; Drescher, M.; Welpe, I.M.; Picot, A. Comparing drivers, barriers, and opportunities of business models for renewable energies: A review. Renew. Sustain. Energy Rev. 2016, 60, 795–809. [Google Scholar] [CrossRef]

- Gennaioli, C.; Tavoni, M. Clean or dirty energy: Evidence of corruption in the renewable energy sector. Public Choice 2016, 166, 261–290. [Google Scholar] [CrossRef]

- Akintande, O.J.; Olubusoye, O.E.; Adenikinju, A.F.; Olanrewaju, B.T. Modeling the determinants of renewable energy consumption: Evidence from the five most populous nations in Africa. Energy 2020, 206, 117992. [Google Scholar] [CrossRef]

- Ren, S.; Hao, Y.; Wu, H. Government corruption, market segmentation and renewable energy technology innovation: Evidence from China. J. Environ. Manag. 2021, 300, 113686. [Google Scholar] [CrossRef]

- Amoah, A.; Asiama, R.K.; Korle, K.; Kwablah, E. Corruption: Is it a bane to renewable energy consumption in Africa? Energy Policy 2022, 163, 112854. [Google Scholar] [CrossRef]

- Dec, P.; Wysocki, J. In Search of Non-Obvious Relationships between Greenhouse Gas or Particulate Matter Emissions, Renewable Energy and Corruption. Energies 2022, 15, 1347. [Google Scholar] [CrossRef]

- Zhang, D. Oil shocks and stock markets revisited: Measuring connectedness from a global perspective. Energy Econ. 2017, 62, 323–333. [Google Scholar] [CrossRef]

- Baker, S.R.; Bloom, N.; Davis, S.J.; Kost, K.; Sammon, M.; Viratyosin, T. The unprecedented stock market reaction to COVID-19. Rev. Asset Pricing Stud. 2020, 10, 742–758. [Google Scholar] [CrossRef]

- Barrero, J.M.; Bloom, N.; Wright, I. Short and Long Run Uncertainty (No. w23676); National Bureau of Economic Research: Cambridge, MA, USA, 2017. [Google Scholar]

- Ji, Q.; Liu, B.Y.; Nehler, H.; Uddin, G.S. Uncertainties and extreme risk spillover in the energy markets: A time-varying copula-based CoVaR approach. Energy Econ. 2018, 76, 115–126. [Google Scholar] [CrossRef]

- Wisniewski, T.P.; Lambe, B.J. Does economic policy uncertainty drive CDS spreads? Int. Rev. Financ. Anal. 2015, 42, 447–458. [Google Scholar] [CrossRef]

- Aastveit, K.A.; Natvik, G.J.; Sola, S. Economic uncertainty and the influence of monetary policy. J. Int. Money Financ. 2017, 76, 50–67. [Google Scholar] [CrossRef]

- Demir, E.; Ersan, O. Economic policy uncertainty and cash holdings: Evidence from BRIC countries. Emerg. Mark. Rev. 2017, 33, 189–200. [Google Scholar] [CrossRef]

- Li, X.M. New evidence on economic policy uncertainty and equity premium. Pac.-Basin Financ. J. 2017, 46, 41–56. [Google Scholar] [CrossRef]

- Bloom, N. The impact of uncertainty shocks. Econometrica 2009, 77, 623–685. [Google Scholar]

- Whaley, R.E. Understanding the VIX. J. Portf. Manag. 2009, 35, 98–105. [Google Scholar] [CrossRef]

- Giot, P. Relationships between implied volatility indexes and stock index returns. J. Portf. Manag. 2005, 31, 92–100. [Google Scholar] [CrossRef]

- Liu, M.L.; Ji, Q.; Fan, Y. How does oil market uncertainty interact with other markets? An empirical analysis of implied volatility index. Energy 2013, 55, 860–868. [Google Scholar] [CrossRef]

- Fernandes, M.; Medeiros, M.C.; Scharth, M. Modeling and predicting the CBOE market volatility index. J. Bank. Financ. 2014, 40, 1–10. [Google Scholar] [CrossRef]

- Adedoyin, F.F.; Zakari, A. Energy consumption, economic expansion, and CO2 emission in the UK: The role of economic policy uncertainty. Sci. Total Environ. 2020, 738, 140014. [Google Scholar] [CrossRef]

- Stulz, R. Interest rates and monetary policy uncertainty. J. Monet. Econ. 1986, 17, 331–347. [Google Scholar] [CrossRef]

- Bekaert, G.; Hoerova, M.; Duca, M.L. Risk, uncertainty and monetary policy. J. Monet. Econ. 2013, 60, 771–788. [Google Scholar] [CrossRef]

- Creal, D.D.; Wu, J.C. Monetary policy uncertainty and economic fluctuations. Int. Econ. Rev. 2017, 58, 1317–1354. [Google Scholar] [CrossRef]

- Kurov, A.; Stan, R. Monetary policy uncertainty and the market reaction to macroeconomic news. J. Bank. Financ. 2018, 86, 127–142. [Google Scholar] [CrossRef]

- Husted, L.; Rogers, J.; Sun, B. Monetary policy uncertainty. J. Monet. Econ. 2020, 115, 20–36. [Google Scholar] [CrossRef]

- De Pooter, M.; Favara, G.; Modugno, M.; Wu, J. Reprint: Monetary policy uncertainty and monetary policy surprises. J. Int. Money Financ. 2021, 114, 102401. [Google Scholar] [CrossRef]

- Bauer, M.D.; Lakdawala, A.; Mueller, P. Market-based monetary policy uncertainty. Econ. J. 2022, 132, 1290–1308. [Google Scholar] [CrossRef]

- Li, Y.; Liang, C.; Ma, F.; Wang, J. The role of the IDEMV in predicting European stock market volatility during the COVID-19 pandemic. Financ. Res. Lett. 2020, 36, 101749. [Google Scholar] [CrossRef]

- Bai, L.; Wei, Y.; Wei, G.; Li, X.; Zhang, S. Infectious disease pandemic and permanent volatility of international stock markets: A long-term perspective. Financ. Res. Lett. 2021, 40, 101709. [Google Scholar] [CrossRef]

- Dutta, A.; Bouri, E.; Saeed, T. News-based equity market uncertainty and crude oil volatility. Energy 2021, 222, 119930. [Google Scholar] [CrossRef]

- Song, Y.; He, M.; Wang, Y.; Zhang, Y. Forecasting crude oil market volatility: A newspaper-based predictor regarding petroleum market volatility. Resour. Policy 2022, 79, 103093. [Google Scholar] [CrossRef]

- Balcilar, M.; Bekiros, S.; Gupta, R. The role of news-based uncertainty indices in predicting oil markets: A hybrid nonparametric quantile causality method. Empir. Econ. 2017, 53, 879–889. [Google Scholar] [CrossRef]

- Bakas, D.; Triantafyllou, A. Commodity price volatility and the economic uncertainty of pandemics. Econ. Lett. 2020, 193, 109283. [Google Scholar] [CrossRef]

- Mumtaz, H. Does uncertainty affect real activity? Evidence from state-level data. Econ. Lett. 2018, 167, 127–130. [Google Scholar] [CrossRef]

- Shin, M.; Zhang, B.; Zhong, M.; Lee, D.J. Measuring international uncertainty: The case of Korea. Econ. Lett. 2018, 162, 22–26. [Google Scholar] [CrossRef]

- Shi, X.; Shen, Y. Macroeconomic uncertainty and natural gas prices: Revisiting the Asian Premium. Energy Econ. 2021, 94, 105081. [Google Scholar] [CrossRef]

- Xu, B.; Fu, R.; Lau, C.K.M. Energy market uncertainty and the impact on the crude oil prices. J. Environ. Manag. 2021, 298, 113403. [Google Scholar] [CrossRef]

- Aboura, S.; Chevallier, J. Leverage vs. feedback: Which effect drives the oil market? Financ. Res. Lett. 2013, 10, 131–141. [Google Scholar] [CrossRef]

- Sadiq, M.; Hsu, C.C.; Zhang, Y.; Chien, F. COVID-19 fear and volatility index movements: Empirical insights from ASEAN stock markets. Environ. Sci. Pollut. Res. 2021, 28, 67167–67184. [Google Scholar] [CrossRef]

- Subramaniam, S.; Chakraborty, M. COVID-19 fear index: Does it matter for stock market returns? Rev. Behav. Financ. 2021, 13, 40–50. [Google Scholar] [CrossRef]

- Salisu, A.A.; Ogbonna, A.E.; Oloko, T.F.; Adediran, I.A. A new index for measuring uncertainty due to the COVID-19 pandemic. Sustainability 2021, 13, 3212. [Google Scholar] [CrossRef]

- Kwilinski, A.; Lyulyov, O.; Dzwigol, H.; Vakulenko, I.; Pimonenko, T. Integrative smart grids’ assessment system. Energies 2022, 15, 545. [Google Scholar] [CrossRef]

- Altig, D.; Baker, S.; Barrero, J.M.; Bloom, N.; Bunn, P.; Chen, S.; Davis, S.J.; Leather, J.; Meyer, B.; Mihaylov, E.; et al. Economic uncertainty before and during the COVID-19 pandemic. J. Public Econ. 2020, 191, 104274. [Google Scholar] [CrossRef]

- Adedoyin, F.F.; Ozturk, I.; Agboola, M.O.; Agboola, P.O.; Bekun, F.V. The implications of renewable and non-renewable energy generating in Sub-Saharan Africa: The role of economic policy uncertainties. Energy Policy 2021, 150, 112115. [Google Scholar] [CrossRef]

- Hassan, T.A.; Hollander, S.; Van Lent, L.; Tahoun, A. Firm-level political risk: Measurement and effects. Q. J. Econ. 2019, 134, 2135–2202. [Google Scholar] [CrossRef]

- Wang, Y.; Bouri, E.; Fareed, Z.; Dai, Y. Geopolitical risk and the systemic risk in the commodity markets under the war in Ukraine. Financ. Res. Lett. 2022, 49, 103066. [Google Scholar] [CrossRef]

- Bouri, E.; Iqbal, N.; Klein, T. Climate policy uncertainty and the price dynamics of green and brown energy stocks. Financ. Res. Lett. 2022, 47, 102740. [Google Scholar] [CrossRef]

- Ding, Y.; Liu, Y.; Failler, P. The Impact of Uncertainties on Crude Oil Prices: Based on a Quantile-on-Quantile Method. Energies 2022, 15, 3510. [Google Scholar] [CrossRef]

- Ye, L. The effect of climate news risk on uncertainties. Technol. Forecast. Soc. Change 2022, 178, 121586. [Google Scholar] [CrossRef]

- Scarcioffolo, A.R.; Etienne, X.L. Regime switching energy price volatility: The role of economic policy uncertainty. Int. Rev. Econ. Financ. 2021, 76, 336–356. [Google Scholar] [CrossRef]

- Kilian, L. Not all oil price shocks are alike: Disentangling demand and supply shocks in the crude oil market. Am. Econ. Rev. 2009, 99, 1053–1069. [Google Scholar] [CrossRef]

- Barsky, R.B.; Kilian, L. Oil and the macroeconomy since the 1970s. J. Econ. Perspect. 2004, 18, 115–134. [Google Scholar] [CrossRef]

- Peersman, G.; Van Robays, I. Cross-country differences in the effects of oil shocks. Energy Econ. 2012, 34, 1532–1547. [Google Scholar] [CrossRef]

- Baumeister, C.; Peersman, G. Time-varying effects of oil supply shocks on the US economy. Am. Econ. J. Macroecon. 2013, 5, 1–28. [Google Scholar] [CrossRef]

- Pástor, L.; Veronesi, P. Uncertainty about government policy and stock prices. J. Financ. 2012, 67, 1219–1264. [Google Scholar] [CrossRef]

- Efimova, O.; Serletis, A. Energy markets volatility modelling using GARCH. Energy Econ. 2014, 43, 264–273. [Google Scholar] [CrossRef]

- Degiannakis, S.; Filis, G. Forecasting oil price realized volatility using information channels from other asset classes. J. Int. Money Financ. 2017, 76, 28–49. [Google Scholar] [CrossRef]

- Ozcan, B.; Ozturk, I. Renewable energy consumption-economic growth nexus in emerging countries: A bootstrap panel causality test. Renew. Sustain. Energy Rev. 2019, 104, 30–37. [Google Scholar] [CrossRef]

- Destek, M.A.; Aslan, A. Renewable and non-renewable energy consumption and economic growth in emerging economies: Evidence from bootstrap panel causality. Renew. Energy 2017, 111, 757–763. [Google Scholar] [CrossRef]

- da Silva, P.P.; Cerqueira, P.A.; Ogbe, W. Determinants of renewable energy growth in Sub-Saharan Africa: Evidence from panel ARDL. Energy 2018, 156, 45–54. [Google Scholar] [CrossRef]

- Guiso, L.; Parigi, G. Investment and demand uncertainty. Q. J. Econ. 1999, 114, 185–227. [Google Scholar] [CrossRef]

- Singleton, K.J. Investor flows and the 2008 boom/bust in oil prices. Manag. Sci. 2014, 60, 300–318. [Google Scholar] [CrossRef]

- Alquist, R.; Kilian, L. What do we learn from the price of crude oil futures? J. Appl. Econom. 2010, 25, 539–573. [Google Scholar] [CrossRef]

- Baumeister, C.; Peersman, G. The role of time-varying price elasticities in accounting for volatility changes in the crude oil market. J. Appl. Econom. 2013, 28, 1087–1109. [Google Scholar] [CrossRef]

- Guo, H.; Kliesen, K.L. Oil price volatility and US macroeconomic activity. Rev.-Fed. Reserve Bank St. Louis 2005, 87, 669. [Google Scholar]

- Pindyck, R.S. Volatility in natural gas and oil markets. J. Energy Dev. 2004, 30, 1–19. [Google Scholar]

- Regnier, E. Oil and energy price volatility. Energy Econ. 2007, 29, 405–427. [Google Scholar] [CrossRef]

- Radetzki, M. The anatomy of three commodity booms. Resour. Policy 2006, 31, 56–64. [Google Scholar] [CrossRef]

- Cooper, R.N.; Lawrence, R.Z.; Bosworth, B.; Houthakker, H.S. The 1972-75 commodity boom. Brook. Pap. Econ. Act. 1975, 3, 671–723. [Google Scholar] [CrossRef]

- Güntner, J.H. How do oil producers respond to oil demand shocks? Energy Econ. 2014, 44, 1–13. [Google Scholar] [CrossRef]

- Clements, A.; Shield, C.; Thiele, S. Which oil shocks really matter in equity markets? Energy Econ. 2019, 81, 134–141. [Google Scholar] [CrossRef]

- Gil-Alana, L.A.; Monge, M. Crude oil prices and COVID-19: Persistence of the shock. Energy Res. Lett. 2020, 1, 13200. [Google Scholar] [CrossRef]

- Antonakakis, N.; Chatziantoniou, I.; Filis, G. Dynamic spillovers of oil price shocks and economic policy uncertainty. Energy Econ. 2014, 44, 433–447. [Google Scholar] [CrossRef]

- Dash, S.R.; Maitra, D. Do oil and gas prices influence economic policy uncertainty differently: Multi-country evidence using time-frequency approach. Q. Rev. Econ. Financ. 2021, 81, 397–420. [Google Scholar] [CrossRef]

- Hamilton, J.D. Causes and Consequences of the Oil Shock of 2007–2008 (No. w15002); National Bureau of Economic Research: Cambridge, MA, USA, 2009. [Google Scholar]

- Kang, W.; Ratti, R.A. Structural oil price shocks and policy uncertainty. Econ. Model. 2013, 35, 314–319. [Google Scholar] [CrossRef]

- Kang, W.; Ratti, R.A.; Vespignani, J.L. Oil price shocks and policy uncertainty: New evidence on the effects of US and non-US oil production. Energy Econ. 2017, 66, 536–546. [Google Scholar] [CrossRef]

- Arouri, M.; Roubaud, D. On the determinants of stock market dynamics in emerging countries: The role of economic policy uncertainty in China and India. Econ. Bull. 2016, 36, 760–770. [Google Scholar]

- Shahzad, S.J.H.; Raza, N.; Balcilar, M.; Ali, S.; Shahbaz, M. Can economic policy uncertainty and investors sentiment predict commodities returns and volatility? Resour. Policy 2017, 53, 208–218. [Google Scholar] [CrossRef]

- Gao, R.; Zhao, Y.; Zhang, B. The spillover effects of economic policy uncertainty on the oil, gold, and stock markets: Evidence from China. Int. J. Financ. Econ. 2021, 26, 2134–2141. [Google Scholar] [CrossRef]

- Ringim, S.H.; Alhassan, A.; Güngör, H.; Bekun, F.V. Economic Policy Uncertainty and Energy Prices: Empirical Evidence from Multivariate DCC-GARCH Models. Energies 2022, 15, 3712. [Google Scholar] [CrossRef]

- Hailemariam, A.; Smyth, R.; Zhang, X. Oil prices and economic policy uncertainty: Evidence from a nonparametric panel data model. Energy Econ. 2019, 83, 40–51. [Google Scholar] [CrossRef]

- Aloui, R.; Gupta, R.; Miller, S.M. Uncertainty and crude oil returns. Energy Econ. 2016, 55, 92–100. [Google Scholar] [CrossRef]

- You, W.; Guo, Y.; Zhu, H.; Tang, Y. Oil price shocks, economic policy uncertainty and industry stock returns in China: Asymmetric effects with quantile regression. Energy Econ. 2017, 68, 1–18. [Google Scholar] [CrossRef]

- Chu, L.K.; Le, N.T.M. Environmental quality and the role of economic policy uncertainty, economic complexity, renewable energy, and energy intensity: The case of G7 countries. Environ. Sci. Pollut. Res. 2022, 29, 2866–2882. [Google Scholar] [CrossRef]

- Lin, B.; Bai, R. Oil prices and economic policy uncertainty: Evidence from global, oil importers, and exporters’ perspective. Res. Int. Bus. Financ. 2021, 56, 101357. [Google Scholar] [CrossRef]

- Yin, L. Does oil price respond to macroeconomic uncertainty? New Evid. Empir. Econ. 2016, 51, 921–938. [Google Scholar] [CrossRef]

- Yang, L. Connectedness of economic policy uncertainty and oil price shocks in a time domain perspective. Energy Econ. 2019, 80, 219–233. [Google Scholar] [CrossRef]

- Yergin, D. The Prize: The Epic Quest for Oil, Money & Power; Simon Schuster: New York, NY, USA, 2011. [Google Scholar]

- Kilian, L. Oil Price Volatility: Origins and Effects (No. ERSD-2010-02); WTO Staff Working Paper No. ERSD-2010-02; WTO: Geneva, Switzerland, 2010. [Google Scholar]

- Hamilton, J.D. Oil and the macroeconomy since World War II. J. Political Econ. 1983, 91, 228–248. [Google Scholar] [CrossRef]

- Rahman, S.; Serletis, A. The asymmetric effects of oil price shocks. Macroecon. Dyn. 2011, 15, 437–471. [Google Scholar] [CrossRef]

- Wang, Q.; Sun, X. Crude oil price: Demand, supply, economic activity, economic policy uncertainty and wars–From the perspective of structural equation modelling (SEM). Energy 2017, 133, 483–490. [Google Scholar] [CrossRef]

- Zhang, Y.J.; Fan, Y.; Tsai, H.T.; Wei, Y.M. Spillover effect of US dollar exchange rate on oil prices. J. Policy Model. 2008, 30, 973–991. [Google Scholar] [CrossRef]

- Zhang, X.; Yu, L.; Wang, S.; Lai, K.K. Estimating the impact of extreme events on crude oil price: An EMD-based event analysis method. Energy Econ. 2009, 31, 768–778. [Google Scholar] [CrossRef]

- Wen, J.; Zhao, X.X.; Chang, C.P. The impact of extreme events on energy price risk. Energy Econ. 2021, 99, 105308. [Google Scholar] [CrossRef]

- Le Billon, P.; Cervantes, A. Oil prices, scarcity, and geographies of war. Ann. Assoc. Am. Geogr. 2009, 99, 836–844. [Google Scholar] [CrossRef]

- Energy Information Agency. Annual oil market chronology. In Country Analysis Briefs; Energy Information Agency: Washington, DC, USA, 2007. Available online: http://www.eia.doe.gov/emeu/cabs/AOMC/Overview.html (accessed on 8 November 2022).

- McCulloch, N.; Natalini, D.; Hossain, N.; Justino, P. An exploration of the association between fuel subsidies and fuel riots. World Dev. 2022, 157, 105935. [Google Scholar] [CrossRef]

- Natalini, D.; Bravo, G.; Newman, E. Fuel riots: Definition, evidence and policy implications for a new type of energy-related conflict. Energy Policy 2020, 147, 111885. [Google Scholar] [CrossRef]

- Dube, O.; Vargas, J.F. Commodity price shocks and civil conflict: Evidence from Colombia. Rev. Econ. Stud. 2013, 80, 1384–1421. [Google Scholar] [CrossRef]

- Blair, G.; Christensen, D.; Rudkin, A. Do commodity price shocks cause armed conflict? A meta-analysis of natural experiments. Am. Political Sci. Rev. 2021, 115, 709–716. [Google Scholar] [CrossRef]

- Ortiz, I.; Burke, S.; Berrada, M.; Cortés, H. World Protests 2006–2013; Initiative for Policy Dialogue and Friedrich-Ebert-Stiftung New York Working Paper; Friedrich-Ebert-Stiftung: New York, NY, USA, 2013. [Google Scholar]

- Ortiz, I.; Burke, S.; Berrada, M.; Saenz Cortés, H. World Protests: A Study of Key Protest Issues in the 21st Century; Springer Nature: Berlin/Heidelberg, Germany, 2022; p. 185. [Google Scholar]

- Schneider, G.; Troeger, V.E. War and the world economy: Stock market reactions to international conflicts. J. Confl. Resolut. 2006, 50, 623–645. [Google Scholar] [CrossRef]

- Brune, A.; Hens, T.; Rieger, M.O.; Wang, M. The war puzzle: Contradictory effects of international conflicts on stock markets. Int. Rev. Econ. 2015, 62, 1–21. [Google Scholar] [CrossRef]

- Deng, M.; Leippold, M.; Wagner, A.F.; Wang, Q. Stock Prices and the Russia-Ukraine War: Sanctions, Energy and ESG 2022; Swiss Finance Institute: Zurich, Switzerland, 2022. [Google Scholar]

- Zhang, J.; Huang, W. A pilot assessment of new energy usage behaviors: The impacts of environmental accident, cognitions, and new energy policies. Front. Environ. Sci. 2022, 10, 1035. [Google Scholar] [CrossRef]

- International Monetary Fund (IMF). World Economic Outlook: War Sets Back the Global Recovery; April 2022; International Monetary Fund: Washington, DC, USA, 2022; Available online: https://www.imf.org/en/Publications/WEO/Issues/2022/04/19/world-economic-outlook-april-2022 (accessed on 5 October 2022).

- International Monetary Fund (IMF). Fiscal Monitor: Fiscal Policy from Pandemic to War; International Monetary Fund: Washington, DC, USA, 2022. [Google Scholar]

- Ari, A.; Arregui, N.; Black, S.; Celasun, O.; Iakova, D.; Mineshima, A.; Mylonas, V.; Parry, I.; Teodoru, I.; Zhunussova, K. Surging Energy Prices in Europe in the Aftermath of the War: How to Support the Vulnerable and Speed up the Transition Away from Fossil Fuels. IMF Work. Pap. 2022, WP/22/152, 1–41. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4184693 (accessed on 10 August 2022).

- Rossi, B.; Sekhposyan, T. Macroeconomic uncertainty indices for the euro area and its individual member countries. Empir. Econ. 2017, 53, 41–62. [Google Scholar] [CrossRef]

- Spyromitros, E.; Panagiotidis, M. The impact of corruption on economic growth in developing countries and a comparative analysis of corruption measurement indicators. Cogent Econ. Financ. 2022, 10, 2129368. [Google Scholar] [CrossRef]

| Journal | No. of Papers | Journal | No. of Papers |

|---|---|---|---|

| Energy Economics | 28 | Frontiers in Energy Research | 1 |

| Energy Policy | 20 | Global Environmental Politics | 1 |

| Energies | 6 | International Journal of Energy Economics and Policy | 1 |

| Energy | 6 | International Journal of Energy Research | 1 |

| Economic Modelling | 4 | International Journal of Finance & Economics | 1 |

| Finance Research Letters | 4 | International Organization | 1 |

| Renewable and Sustainable Energy Reviews | 4 | International Review of Economics & Finance | 1 |

| Journal of Banking & Finance | 3 | Journal of Building Engineering | 1 |

| Resources Policy | 3 | Journal of Cleaner Production | 1 |

| American Economic Review | 2 | Journal of Cleaner Production | 1 |

| International Journal of Economic Perspectives | 2 | Journal of Economic Perspectives | 1 |

| Journal of Applied Econometrics | 2 | Journal of Futures Markets | 1 |

| Journal of Environmental Economics and Management | 2 | Journal of Money Credit & Banking | 1 |

| Journal of Environmental Management | 2 | Journal of Policy Modeling | 1 |

| Journal of International Money and Finance | 2 | Journal of Public Economics | 1 |

| Public Choice | 2 | Journal of the Knowledge Economy | 1 |

| Research in International Business and Finance | 2 | Management Science | 1 |

| Resource and Energy Economics | 2 | Renewable Energy | 1 |

| The Quarterly Review of Economics and Finance | 2 | Routledge | 1 |

| American Political Science Review | 1 | Science of the Total Environment | 1 |

| Annals of the Association of American Geographers | 1 | Sustainability | 1 |

| Econometrica | 1 | The Journal of Energy and Development | 1 |

| Energy Research & Social Sci | 1 | The Review of Economic Studies | 1 |

| Environmental Science and Pollution Research | 1 | World Development | 1 |

| Author | Countries or Territories | Period | Main Objective | Method | Major Findings |

|---|---|---|---|---|---|

| Cadoret and Padovano [124] | 26 EU countries | 2004–2011 | It investigates the impact of political factors and corruption on the use of renewable energy (RE) sources. | OLS regression, with LSDV estimators | The manufacturing industry’s lobbying has a negative impact on RE deployment, but it has a positive impact on government quality standards. |

| Engelken et al. [125] | It examines renewable energy business models in developing and developed nations. | Review | Corruption and poor electricity grids hinder developing nations. Industrialised nations face stuck thought patterns and high energy storage costs. | ||

| Gennaioli and Tavoni [126] | 34 Italian provinces | 1990–2007 | The correlation between renewable energy sector subsidies (wind power) and corruption. | OLS, difference-in-difference strategy | Criminal association activity increased in high-wind provinces (after the introduction of a favourable market-based regime of public incentives). |

| Rafaty [24] | 20 Industrialised Countries | 1990–2012 | The impact of political corruption on the strength of national climate change mitigation policies and prices. | Theoretical | Lax market-based climate policies are significantly linked to greater corruption, but they are associated with the size of domestic energy industries, which have received substantial environmental tax exemptions. |

| Sekrafi and Sghaier [19] | 13 MENA countries | 1984–2012 | The effect of corruption, economic growth, and environmental degradation on energy consumption and prices. | Fixed and Random effects, GMM | Corruption and economic growth positively affect CO2 emissions, energy consumption, and renewable energy prices. |

| Sinha et al. [25] | BRICS and the next 11 countries | 1990–2017 | The impact of public sector corruption on energy prices and carbon emissions in the presence of energy use segregation. | FMOLS, GMM. | Corruption enhances environmental degradation by reducing the positive impact of renewable energy consumption and prices on environmental quality. |

| Vasylieva et al. [12] | 28 European countries and Ukraine | 1996–2007 | The dynamic impact of renewable energy consumption, GDP, and corruption on gas emissions. | FMOLS, DOLS | Renewable energy consumption and corruption negatively affect GHG emissions. |

| Akintande et al. [127] | 4 countries | 1996–2016 | The factors influencing renewable energy consumption in Africa’s five most populous countries. | Bayesian Model Averaging (BMA) procedures | Population growth, urbanisation, government effectiveness, political stability, GDP, and corruption control increase renewable energy consumption. |

| Uzar [26] | 43 countries | 2000–2015 | The impact of income inequality and corruption on renewable energy consumption is examined. | Panel ARDL-PMG model, error correction model | Corruption will raise the prices, demand, and consumption of renewable energy. |

| Boamah et al. [27] | Kenya and Ghana | 2017–2019 | The relationship between corruption and the electricity sector. | Comparative Research | Energy injustice and corruption are inherent in both countries’ “power regimes;” corruption can also lead to increased electricity consumption and prices. |

| Ren et al. [128] | China provinces | 2006–2017 | The correlation between corruption, market segmentation, and the advancement of renewable energy technology. | GMM on VAR AND PVAR models | Regional renewable energy technology innovation is hampered by government corruption and market segmentation. |

| Amoah et al. [129] | 32 African countries | 1996–2019 | The relationship between corruption and renewable energy consumption. | GMM and IV | Corruption is detrimental to Africa’s share of renewable energy consumption in total final energy consumption. |

| Dec and Wysocki [130] | EU countries, Norway, Un. Kingdom | 2012–2019 | The interactions between the emissions of greenhouse gases, the use of renewable energy, and perceptions of corruption. | Basic descriptive statistics and correlations | Emissions and climate change from greenhouse gas emissions are sufficient reasons to reduce corruption. |

| Symbols | Uncertainty Index | Time | Data Sources | Literature |

|---|---|---|---|---|

| VIX | Implied Volatility Index. A real-time index that represents the market’s expectations for the relative strength of price changes of the S&P 500 Index (SPX) | 1993 | Chicago Board Options Exchange (CBOE) | Whaley [140]; Giot [141]; Liu et al. [142]; Fernandes et al. [143]; Ji et al. [134], |

| EPU GEPU | Economic Policy Uncertainty. (Global). Quantify press coverage of policy-related economic uncertainty, federal tax law expiration, and economic forecaster disputes about the CPI. | 1985 | Baker et al. [29] | Wisniewski and Lambe [135]; Aastveit et al. [136]; Demir and Ersan [137]; Li [138]; Adedoyin and Zakari [144], |

| MPU | Monetary Policy Uncertainty. It calculates the frequency of newspaper articles reporting uncertainty about the direction of monetary policy and its consequences on the economy. | 1985 US 1987 JP | Baker et al. [29]; Arbatli et al. [42] | Stulz [145]; Bekaert et al. [146]; Creal et al. [147]; Kurov and Stan [148]; Husted et al. [149]; De Pooter et al. [150]; Bauer et al. [151]; |

| EMV | Equity Market Volatility. A suite of more than 30 EMV trackers that quantify the importance of each category in the level of US stock market volatility. | 1985 | Baker et al. [43] | Baker et al. [132]; Bouri et al. [36]; Li et al. [152]; Bai et al. [153]; Dutta et al. [154]; Song et al. [155], |

| JLN | Jurado, Ludvigson, and Serena Ng index. A model-free index of macroeconomic uncertainty that can be tracked over time and used for evaluating any DSGE model with stochastic volatility shocks. | Over time | Jurado et al. [30] | Balcilar, et al. [156]; Bakas and Triantafyllou [34,157]; Mumtaz [158]; Shin et al. [159]; Shi and Shen [160]; Xu et al. [161]. |

| OVX | Oil Volatility Index. The Cboe Crude Oil ETF Volatility IndexSM (OVX) is an estimate of the expected 30-day volatility of crude oil as priced by the United States Oil Fund (USO) | 2009 | Chicago Board Options Exchange (CBOE) | Aboura and Chevallier [162]; Liu et al. [142]; Ji and Fan [35]; Ji et al. [134]; Dutta et al. [154], |

| GFI | Global Fear Index. The COVID-19 GFI assesses daily concerns about COVID-19 spread and severity. Excessive fear could affect investment decisions, as well as stock and oil prices. | 2019 | Salisu and Akanni [37] | Bouri et al. [36]; Sadiq et al. [163]; Subramaniam and Chakraborty [164]; Li et al. [41]; |

| CIU | COVID-19 Induced Uncertainty Index. Empirically examines the vulnerability of energy prices amidst the COVID-19 pandemic. | 2019 | Olubusoye et al. [38] | Salisu et al. [165]; Kwilinski et al. [166] |

| WUI | World Uncertainty Index. Quarterly indices of economic uncertainty for 143 countries using frequency counts of “uncertainty” in the Economist Intelligence Unit country reports | 1996 | Ahir, Bloom and Furceri [39] | Altig et al. [167]; Bakas and Triantafyllou [157]; Baker et al. [132]; Adedoyin et al. [168]; |

| GRI | Geopolitical Risk Index. Measures unfavourable geopolitical events and related risks and evaluates their development and economic implications. | 1900 | Caldara and Iacoviello [44] | Hassan et al. [169]; Bakas and Triantafyllou [157]; Bouri et al. [36]; Ahir et al. [39]; Wang et al. [170] |

| CPU | The Climate Policy Uncertainty Index flags important events related to climate policies, such as new emissions legislation, global strikes about climate change, and presidents’ statements about climate policies | 2010–2018 | Gavriilidis [40] | Bouri et al. [171]; Ding et al. [172]; Ye [173] |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Dokas, I.; Oikonomou, G.; Panagiotidis, M.; Spyromitros, E. Macroeconomic and Uncertainty Shocks’ Effects on Energy Prices: A Comprehensive Literature Review. Energies 2023, 16, 1491. https://doi.org/10.3390/en16031491

Dokas I, Oikonomou G, Panagiotidis M, Spyromitros E. Macroeconomic and Uncertainty Shocks’ Effects on Energy Prices: A Comprehensive Literature Review. Energies. 2023; 16(3):1491. https://doi.org/10.3390/en16031491

Chicago/Turabian StyleDokas, Ioannis, Georgios Oikonomou, Minas Panagiotidis, and Eleftherios Spyromitros. 2023. "Macroeconomic and Uncertainty Shocks’ Effects on Energy Prices: A Comprehensive Literature Review" Energies 16, no. 3: 1491. https://doi.org/10.3390/en16031491

APA StyleDokas, I., Oikonomou, G., Panagiotidis, M., & Spyromitros, E. (2023). Macroeconomic and Uncertainty Shocks’ Effects on Energy Prices: A Comprehensive Literature Review. Energies, 16(3), 1491. https://doi.org/10.3390/en16031491