A Bi-Level Optimization Model for Inter-Provincial Energy Consumption Transfer Tax in China

Abstract

:1. Introduction

2. Literature Review

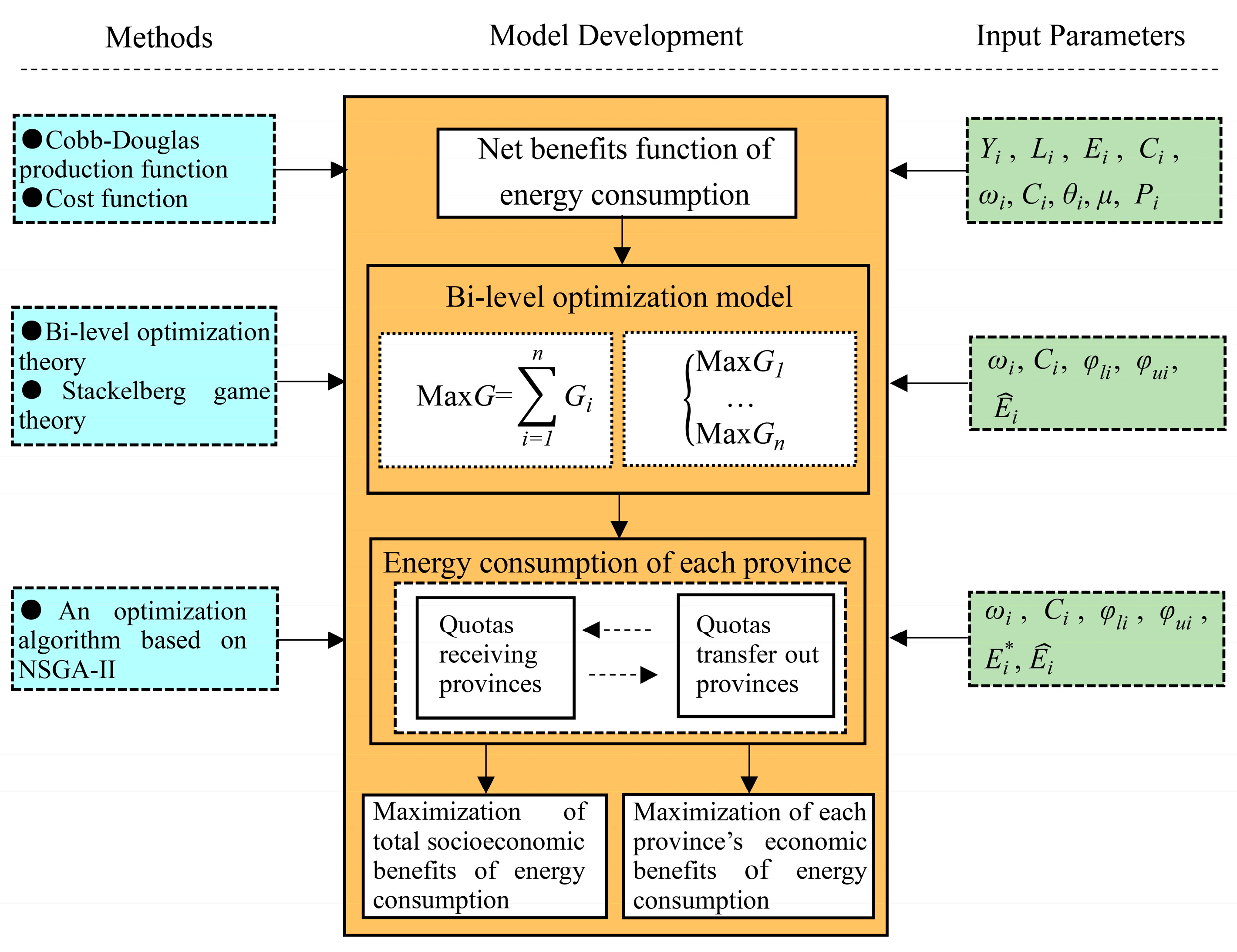

3. Model Development

3.1. Construction of Net Benefits Function for Energy Consumption

3.2. Construction of the ECTTM

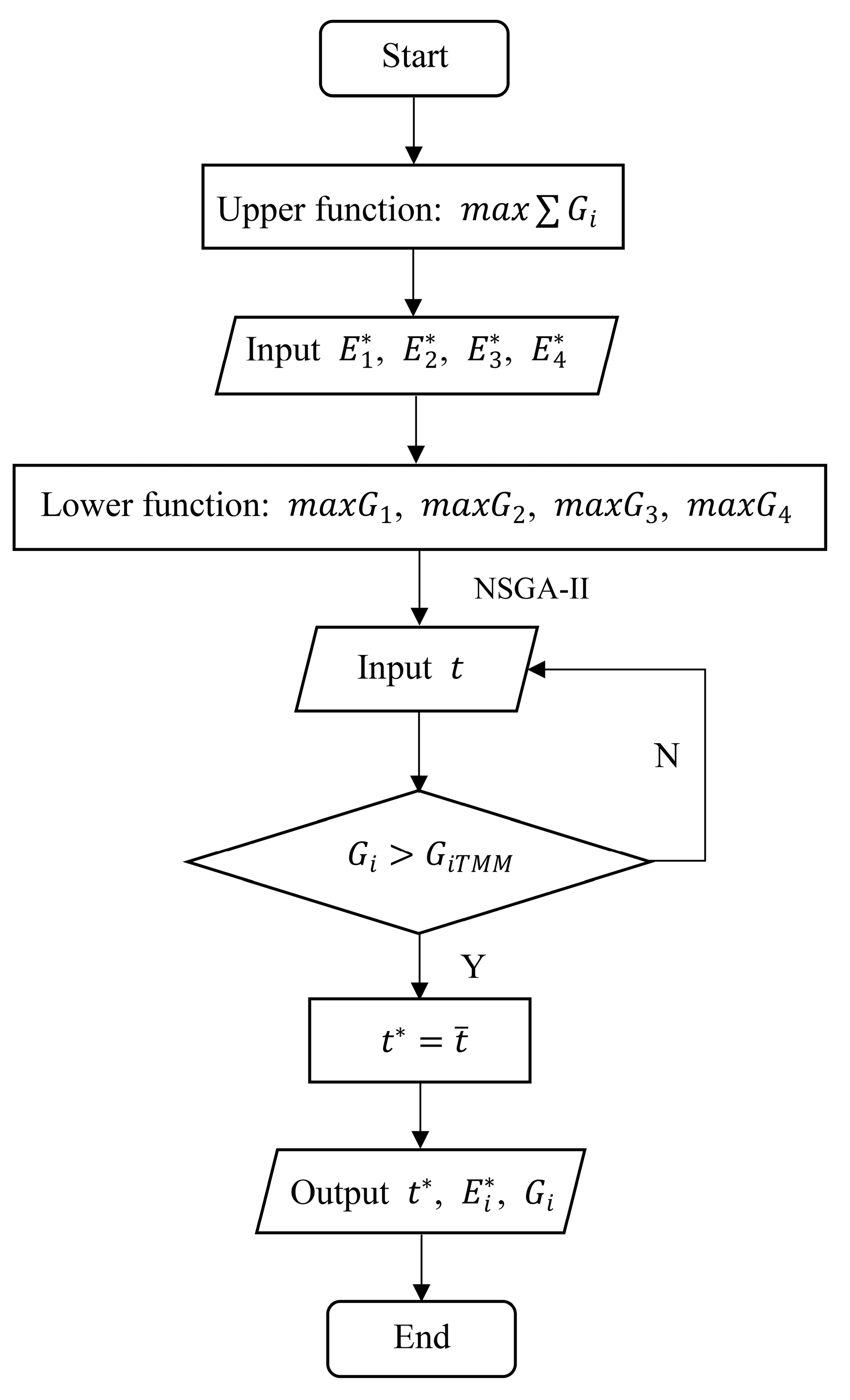

3.3. Solution Approach: An Optimization Algorithm Based on NSGA-II

4. Results

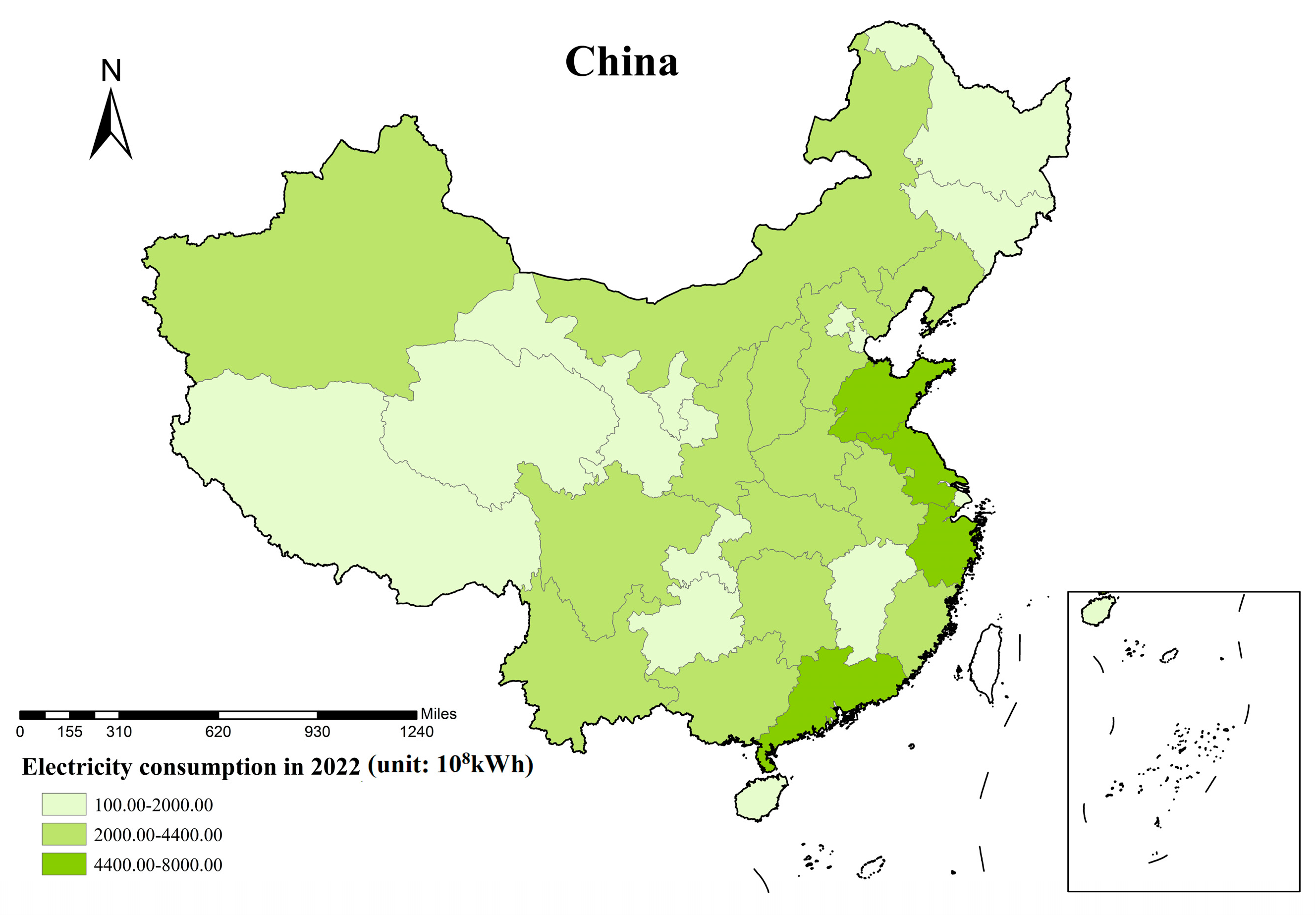

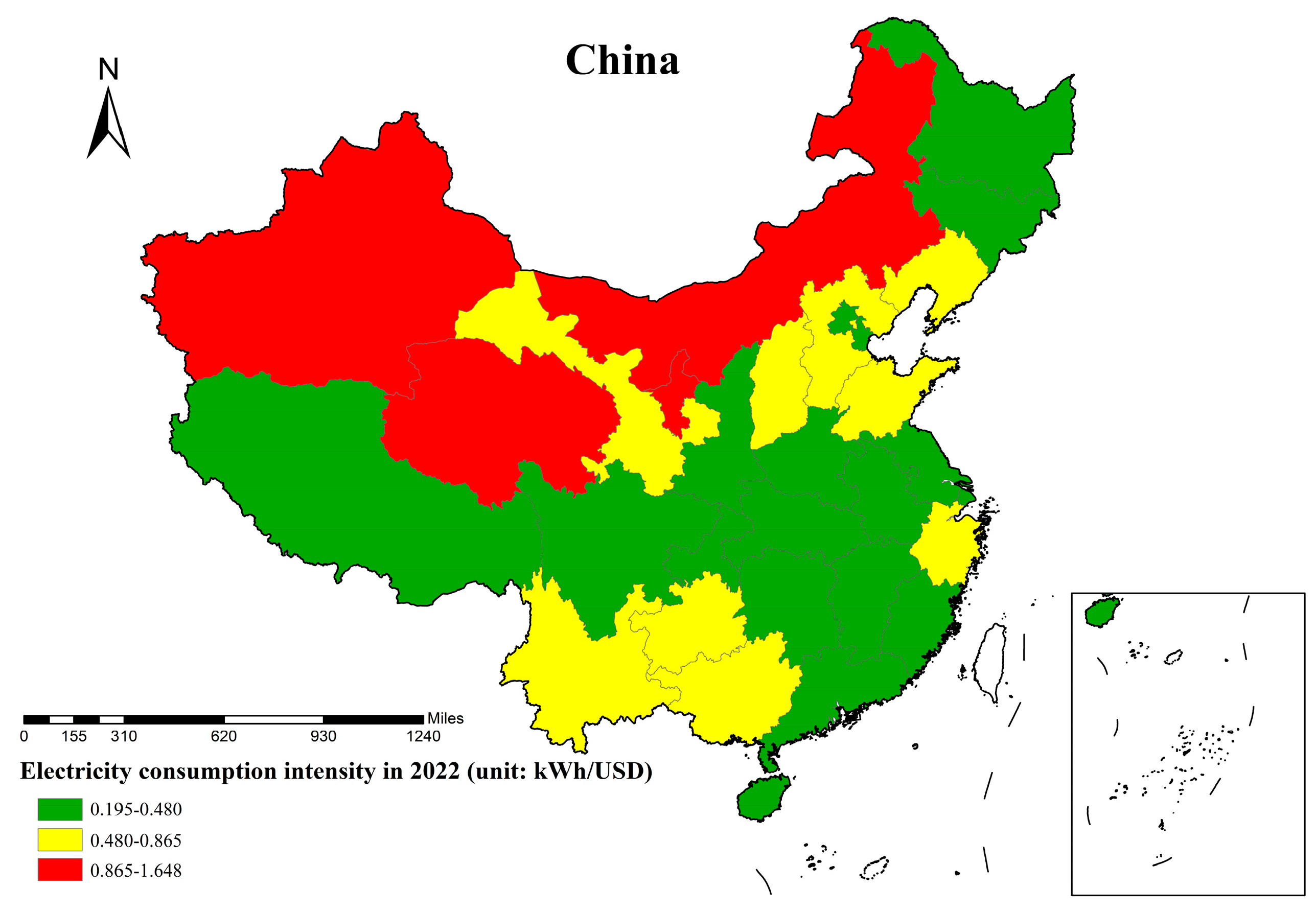

4.1. Sample Selection and Data Sources

4.2. Net Benefits Function of Electricity Consumption in Each Province

4.3. ECTTM in the Four Provinces

5. Discussion

5.1. Comparison of the TMM and the ECTTM

5.2. Sensitivity Analysis

6. Conclusions and Policy Recommendations

- (1)

- Establishing transfer tax levying and management departments.

- (2)

- Strengthening the process management of transfer tax coordination.

- (3)

- Formulating the energy classification system on the supply side.

- (4)

- Adopting a transfer fee as a transition to transfer tax.

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A. Solution Algorithm Flow

References

- Zhao, H.R.; Guo, S.; Zhao, H.R. Provincial energy efficiency of China quantified by three-stage data envelopment analysis. Energy 2019, 166, 96–107. [Google Scholar] [CrossRef]

- Xiong, J.; Xu, D. Relationship between energy consumption, economic growth and environmental pollution in China. Environ. Res. 2021, 194, 110718. [Google Scholar] [CrossRef] [PubMed]

- Yan, J.N.; Su, B. What drive the changes in China’s energy consumption and intensity during 12th Five-Year Plan period? Energy Policy 2020, 140, 111383. [Google Scholar] [CrossRef]

- Tang, S.Y.; Qi, S.Z.; Zhou, C.B. Impact of dual control system of energy consumption and intensity on cost of debt financing: Micro-evidence from Chinese listed companies. Environ. Sci. Pollut. Res. 2023, 30, 56969–56983. [Google Scholar] [CrossRef]

- Li, Y.M.; Sun, L.Y.; Zhang, H.L.; Liu, T.T.; Fang, K. Does industrial transfer within urban agglomerations promote dual control of total energy consumption and energy intensity? J. Clean. Prod. 2018, 204, 607–617. [Google Scholar] [CrossRef]

- Zhu, B.Z.; Jiang, M.X.; Wang, K.F.; Chevallier, J.; Wang, P.; Wei, Y.M. On the road to China’s 2020 carbon intensity target from the perspective of “double control”. Energy Policy 2018, 119, 377–387. [Google Scholar] [CrossRef]

- Ouyang, X.; Mao, X.; Sun, C.; Du, K. Industrial energy efficiency and driving forces behind efficiency improvement: Evidence from the Pearl River Delta urban agglomeration in China. J. Clean. Prod. 2019, 220, 899–909. [Google Scholar] [CrossRef]

- Song, M.; Wang, J.; Zhao, J. Coal endowment, resource curse, and high coal-consuming industries location: Analysis based on large-scale data. Resour. Conserv. Recycl. 2018, 129, 333–344. [Google Scholar] [CrossRef]

- Sun, C.; Ding, D.; Fang, X.; Zhang, H.; Li, J. How do fossil energy prices affect the stock prices of new energy companies? Evidence from Divisia energy price index in China’s market. Energy 2019, 169, 637–645. [Google Scholar] [CrossRef]

- Yang, F.; Dian, J. Macro-Economic Impact of Policies for Controlling Fossil Energy Consumption in China. Energies 2022, 15, 1051. [Google Scholar] [CrossRef]

- Bilgen, S.; Sarıkaya, İ. Energy conservation policy and environment for a clean and sustainable energy future. Energy Sources, Part B Econ. Plan. Policy 2018, 13, 183–189. [Google Scholar] [CrossRef]

- Zeng, L.; Zhao, L.; Wang, Q.; Wang, B.; Xie, Y.; Ma, Y.; Cui, W. Modeling interprovincial cooperative energy saving in China: An electricity utilization perspective. Energies 2018, 11, 241. [Google Scholar] [CrossRef]

- Zhang, L.; Feng, Y.; Zhao, B. Disaggregation of energy-saving targets for China’s provinces: Modeling results and real choices. J. Clean. Prod. 2015, 103, 837–846. [Google Scholar] [CrossRef]

- Dong, K.; Sun, R.; Hochman, G.; Li, H. Energy intensity and energy conservation potential in China: A regional comparison perspective. Energy 2018, 155, 782–795. [Google Scholar] [CrossRef]

- Shahbaz, M.; Zakaria, M.; Shahzad, S.J.H.; Mahalik, M.K. The Energy Consumption and Economic Growth Nexus in Top Ten Energy-Consuming Countries: Fresh Evidence from Using the Quantile-on-Quantile Approach. Energy Econ. 2018, 71, 282–301. [Google Scholar] [CrossRef]

- Huang, J.; Lai, Y.; Wang, Y.; Hao, Y. Energy-saving research and development activities and energy intensity in China: A regional comparison perspective. Energy 2020, 213, 118758. [Google Scholar] [CrossRef]

- Yang, M.; Hou, Y.; Ji, Q.; Zhang, D. Assessment and optimization of provincial CO2 emission reduction scheme in China: An improved ZSG-DEA approach. Energy Econ. 2020, 91, 104931. [Google Scholar] [CrossRef]

- Landis, F.; Rausch, S.; Kosch, M.; Bohringer, C. Efficient and Equitable Policy Design: Taxing Energy Use or Promoting Energy Savings? Energy J. 2019, 40, 73–104. [Google Scholar] [CrossRef]

- Guo, H.; Wang, B.; Jin, C. Research on the effect of Market Mechanism for Industrial Energy Conservation. IOP Conf. Ser. Earth Environ. Sci. 2021, 634, 012021. [Google Scholar] [CrossRef]

- Wang, J.; Huang, W.B.; Hu, Y.L.; Chen, S.J.; Li, J.D. Analysis of China’s new energy conservation policy and the provincial decom-position of the energy consumption target. J. Renew Sustain. Ener. 2014, 6, 53117. [Google Scholar] [CrossRef]

- Chai, Q.; Zhang, X. Technologies and policies for the transition to a sustainable energy system in china. Energy 2010, 35, 3995–4002. [Google Scholar] [CrossRef]

- Zhao, X.G.; Meng, X.; Zhou, Y.; Li, P.L. Policy inducement effect in energy efficiency: An empirical analysis of China. Energy 2020, 211, 118726. [Google Scholar]

- Zhao, X.F.; Li, H.M.; Ma, X. Assessment of administrative measures for climate change in China since the 12th Five Year Plan. Chinese. J. Popul. Resour. Environ. 2020, 30, 9–15. (In Chinese) [Google Scholar]

- Zhou, A.; Li, J. Investigate the impact of market reforms on the improvement of manufacturing energy efficiency under China’s provincial-level data. Energy 2021, 228, 120562. [Google Scholar] [CrossRef]

- Guo, B.; Hu, P.; Zhang, H.; Weng, X.; Hu, F. The improvement of energy-consuming right trading policy on the efficiency of urban green development. Front. Environ. Sci. 2023, 11, 1123608. [Google Scholar] [CrossRef]

- Xu, S.; Fang, L.; Govindan, K. Energy performance contracting in a supply chain with financially asymmetric manufacturers under carbon tax regulation for climate change mitigation. Omega 2022, 106, 102535. [Google Scholar] [CrossRef]

- Che, S.; Wang, J. Policy effectiveness of market-oriented energy reform: Experience from China energy-consumption permit trading scheme. Energy 2022, 261, 125354. [Google Scholar] [CrossRef]

- Yang, M.; Hou, Y.R.; Fang, C.; Duan, H.B. Constructing energy-consuming right trading system for China’s manufacturing industry in 2025. Energy Policy 2020, 144, 111602. [Google Scholar] [CrossRef]

- Qi, X.; Han, Y. Energy quota trading can achieve energy savings and emission reduction: Evidence from China’s pilots. Environ. Sci. Pollut. Res. 2021, 28, 52431–52458. [Google Scholar] [CrossRef]

- Meng, F.Y.; Zhou, D.Q.; Zhou, P.; Bai, Y. Sectoral comparison of electricity-saving potentials in China: An analysis based on provincial input–output tables. Energy 2014, 72, 772–782. [Google Scholar] [CrossRef]

- Gu, G.; Zheng, H.; Tong, L.; Dai, Y. Does carbon financial market as an environmental regulation policy tool promote regional energy conservation and emission reduction? Empirical evidence from China. Energy Policy 2022, 163, 112826. [Google Scholar] [CrossRef]

- Safarzadeh, S.; Hafezalkotob, A.; Jafari, H. Energy supply chain empowerment through tradable green and white certificates: A pathway to sustainable energy generation. Appl. Energy 2022, 323, 119601. [Google Scholar] [CrossRef]

- Philippe, Q. Tradable instruments to fight climate change: A disappointing outcome. WIREs Clim. Chang. 2021, 12, e705. [Google Scholar]

- Xu, L.; Deng, S.-J.; Thomas, V.M. Carbon emission permit price volatility reduction through financial options. Energy Econ. 2014, 53, 248–260. [Google Scholar] [CrossRef]

- Zhao, X.-G.; Jiang, G.-W.; Nie, D.; Chen, H. How to improve the market efficiency of carbon trading: A perspective of China. Renew. Sustain. Energy Rev. 2016, 59, 1229–1245. [Google Scholar] [CrossRef]

- Borenstein, S.; Bushnell, J.; Wolak, F.A.; Zaragoza-Watkins, M. Expecting the Unexpected: Emissions Uncertainty and Environ-mental Market Design. Am. Econ. Rev. 2019, 109, 3953–3977. [Google Scholar] [CrossRef]

- Flachsland, C.; Pahle, M.; Burtraw, D.; Edenhofer, O.; Elkerbout, M.; Fischer, C.; Tietjen, O.; Zetterberg, L. How to avoid history re-peating itself: The case for an EU Emissions Trading System (EU ETS) price floor revisited. Clim. Policy 2019, 20, 133–142. [Google Scholar] [CrossRef]

- Yu, S.W.; Zheng, S.H.; Zhang, X.J.; Gong, C.Z.; Cheng, J.H. Realizing China’s goals on energy saving and pollution reduction: Industrial structure multi-objective optimization approach. Energy Policy 2018, 122, 300–312. [Google Scholar] [CrossRef]

- Xue, J.; Guo, N.; Zhao, L.; Zhu, D.; Ji, X. A cooperative inter-provincial model for energy conservation based on futures trading. Energy 2020, 212, 118635. [Google Scholar] [CrossRef]

- Zheng, Q.; Lin, B. Achieving energy conservation targets in a more cost-effective way: Case study of pulp and paper industry in China. Energy 2020, 191, 116483. [Google Scholar] [CrossRef]

- Zhang, P.; Shi, X.P.; Sun, Y.P.; Cui, J.B.; Shao, S. Have China’s provinces achieved their targets of energy intensity reduction? Reas-sessment based on nighttime lighting data. Energy Policy 2019, 128, 276–283. [Google Scholar] [CrossRef]

- Cantore, N.; Nussbaumer, P.; Wei, M.; Kammen, D.M. Promoting renewable energy and energy efficiency in Africa: A framework to evaluate employment generation and cost effectiveness. Environ. Res. Lett. 2017, 12, 035008. [Google Scholar] [CrossRef]

- Xue, J.; Zhang, W.; Zhao, L.; Zhu, D.; Li, L.; Gong, R. A cooperative inter-provincial model for energy conservation that accounts for employment and social energy costs. Energy 2022, 239, 122118. [Google Scholar] [CrossRef]

- Lu, C.; Zhang, S.; Tan, C.; Li, Y.; Liu, Z.; Morrissey, K.; Adger, W.; Sun, T.; Yin, H. Reduced health burden and economic benefits of cleaner fuel usage from household energy consumption across rural and urban China. Environ. Res. Lett. 2022, 17, 014039. [Google Scholar] [CrossRef]

- Rey, D.; Pérez-Blanco, C.D.; Escriva-Bou, A.; Girard, C.; Veldkamp, T.I.E. Role of economic instruments in water allocation reform: Lessons from Europe. Int. J. Water Resour. Dev. 2018, 35, 206–239. [Google Scholar] [CrossRef]

- Liu, Y.; Lu, Y. The Economic impact of different carbon tax revenue recycling schemes in China: A model-based scenario analysis. Appl. Energy 2015, 141, 96–105. [Google Scholar] [CrossRef]

- Tong, J.; Yue, T.; Xue, J. Carbon taxes and a guidance-oriented green finance approach in China: Path to carbon peak. J. Clean. Prod. 2022, 367, 133050. [Google Scholar] [CrossRef]

- Zhou, D.; An, Y.; Zha, D.; Wu, F.; Wang, Q. Would an increasing block carbon tax be better? A comparative study within the Stackelberg Game framework. J. Environ. Manag. 2019, 235, 328–341. [Google Scholar] [CrossRef] [PubMed]

- Niu, T.; Yao, X.; Shao, S.; Li, D.; Wang, W. Environmental tax shocks and carbon emissions: An estimated DSGE model. Struct. Chang. Econ. Dyn. 2018, 47, 9–17. [Google Scholar] [CrossRef]

- Zhao, L.; Qian, Y.; Huang, R.; Li, C.; Xue, J.; Hu, Y. Model of transfer tax on transboundary water pollution in China’s river basin. Oper. Res. Lett. 2012, 40, 218–222. [Google Scholar] [CrossRef]

- Li, C.; Wang, H.; Xie, X.; Xue, J. Tiered transferable pollutant pricing for cooperative control of air quality to alleviate cross-regional air pollution in China. Atmos. Pollut. Res. 2018, 9, 857–863. [Google Scholar] [CrossRef]

- Zhao, L.; Li, C.; Huang, R.; Si, S.; Xue, J.; Huang, W.; Hu, Y. Harmonizing model with transfer tax on water pollution across regional boundaries in a China’s lake basin. Eur. J. Oper. Res. 2013, 225, 377–382. [Google Scholar] [CrossRef]

- Zhao, L.; Xue, J.; Li, C. A bi–level model for transferable pollutant prices to mitigate China’s interprovincial air pollution control problem. Atmos. Pollut. Res. 2013, 4, 446–453. [Google Scholar] [CrossRef]

- Vlasis, O.; Catrinus, J.; Franco, B.; Daniele, R. White Certificates for energy efficiency improvement with energy taxes: A theoretical economic model. Energy Econ. 2008, 30, 3044–3062. [Google Scholar]

- Martín-Herrán, G.; Rubio, S.J. Second-best taxation for a polluting monopoly with abatement investment. Energy Econ. 2018, 73, 178–193. [Google Scholar] [CrossRef]

- Zhao, L.; Xu, X.; Gao, H.O.; Wang, J.; Xie, Y. A bi-level model for GHG emission charge based on a continuous distribution of travelers’ value of time (VOT). Transp. Res. Part D Transp. Environ. 2016, 47, 371–382. [Google Scholar] [CrossRef]

- Köppen, M.; Yoshida, K. Substitute distance assignments in NSGA-II for handling many-objective optimization problems. In International Conference on Evolutionary Multi-Criterion Optimization; Springer: New York, NY, USA, 2007; pp. 727–741. [Google Scholar]

- Zhang, X.; Huang, X.; Zhang, D.; Geng, Y.; Tian, L.; Fan, Y.; Chen, W. Research on the Pathway and Policies for China’s Energy and Economy Transformation toward Carbon Neutrality. J. Manag. World 2022, 38, 35–66. (In Chinese) [Google Scholar]

- Lin, B.; Wu, Y.; Zhang, L. Electricity saving potential of the power generation industry in China. Energy 2012, 40, 307–316. [Google Scholar] [CrossRef]

- Wang, Y.; Gong, X. Analyzing the difference evolution of provincial energy consumption in China using the functional data analysis method. Energy Econ. 2022, 105, 105753. [Google Scholar] [CrossRef]

| Variables | Definition | Units | Data Sources |

|---|---|---|---|

| Annual energy consumption in province i | 108 kWh | ||

| Annual socioeconomic benefit of energy consumption in province i under ECTTM | United States dollar (USD) billion | ||

| Annual socioeconomic benefit of energy consumption in province i under TMM | USD billion | ||

| Annual gross benefits from energy consumption in province i | USD billion | ||

| Annual production cost of energy in province i | USD billion | ||

| Annual energy consumption quotas in province i | 108 kWh | ||

| GDP in province i | USD billion | China Statistical Yearbook, Provincial Statistical Yearbooks (2002–2020) | |

| Quantity of employment in province i | 104 people | China Statistical Yearbook, Provincial Statistical Yearbooks (2002–2020) | |

| Fixed capital stock in province i | USD billion | China Statistical Yearbook, Provincial Statistical Yearbooks (2002–2020) | |

| Energy price for end consumers in province i | USD/kWh | ||

| Transfer tax rate | USD/kWh | ||

| Parameters | Definition | Units | |

| Annual contribution rate of energy consumption to GDP in province i | - | ||

| Cost-to-income ratio of energy producers in province i | - | China Electric Power Yearbook | |

| Lower limit coefficient of energy consumption in province i | - | ||

| Upper limit coefficient of energy consumption in province i | - |

| Province | Coefficient | Std. Error | ||||||

|---|---|---|---|---|---|---|---|---|

| Shanghai | 0.668 *** | 0.368 *** | 0.675 *** | −4.8 *** | 0.042 | 0.094 | 0.050 | 0.255 |

| Zhejiang | 0.673 *** | 0.340 ** | 0.381 *** | −3.150 *** | 0.058 | 0.136 | 0.082 | 0.999 |

| Shaanxi | 0.574 *** | 2.909 *** | 0.195 ** | −20.550 *** | 0.051 | 0.393 | 0.087 | 2.841 |

| Guizhou | 0.641 *** | −1.188 *** | 0.364 *** | 8.597 *** | 0.051 | 0.169 | 0.087 | 1.362 |

| Province | |

|---|---|

| Shanghai | 0.428 |

| Zhejiang | 0.337 |

| Shaanxi | 0.134 |

| Guizhou | 0.269 |

| Province | F-Test | R2 | |

|---|---|---|---|

| Shanghai | 1185.32 *** | 0.986 | |

| Zhejiang | 159.367 *** | 0.952 | |

| Shaanxi | 95.21 *** | 0.929 | |

| Guizhou | 107.829 *** | 0.956 |

| Province | Electricity Production Cost Function |

|---|---|

| Shanghai | |

| Zhejiang | |

| Shaanxi | |

| Guizhou |

| Province | Shanghai | Zhejiang | Shaanxi | Guizhou |

|---|---|---|---|---|

| 0.0101 *** | 0.0099 *** | 0.0079 *** | 0.0083 *** | |

| −0.819 *** | −2.528 *** | −0.716 *** | −1.762 *** | |

| 0.993 | 0.991 | 0.986 | 0.967 | |

| 2400.924 *** | 1800.607 *** | 1318.229 *** | 538.511 *** |

| Province | Socioeconomic Benefits Function for Electricity Consumption |

|---|---|

| Shanghai | |

| Zhejiang | |

| Shaanxi | |

| Guizhou |

| Province | Shanghai | Zhejiang | Shaanxi | Guizhou |

|---|---|---|---|---|

| Quotas of electricity consumption | 1611.620 | 4810.573 | 2007.35 | 1622.286 |

| Lower limit of electricity consumption | 1450.458 | 4329.516 | 1806.615 | 1460.057 |

| Upper limit of electricity consumption | 1772.782 | 5291.630 | 2208.085 | 1784.515 |

| Province | TMM | ECTTM | Increased Benefits (USD billion) | ||

|---|---|---|---|---|---|

| Quantity of Electricity Consumption (108 kWh) | Benefits from Electricity Consumption (USD billion) | Quantity of Electricity Consumption (108 kWh) | Benefits from Electricity Consumption (USD billion) | ||

| Shanghai | 1611.620 | 151.360 | 1772.782 | 192.675 | 41.315 |

| Zhejiang | 4810.573 | 133.755 | 5012.379 | 135.219 | 1.464 |

| Shaanxi | 2007.350 | 18.510 | 1806.611 | 22.748 | 4.238 |

| Guizhou | 1622.286 | 26.063 | 1460.057 | 27.420 | 1.357 |

| Total | 10,051.829 | 329.689 | 10,051.829 | 378.062 | 48.373 |

| Province | Electricity Consumption of Quotas (108 kWh) | Optimal Electricity Consumption (108 kWh) | Direction of Power Quotas Transfer | Quantity of Transfer (108 kWh) | Tax of Transfer (USD million) |

|---|---|---|---|---|---|

| Shanghai | 1611.620 | 1772.782 | 161.162 | 6.145 | |

| Zhejiang | 4810.573 | 5012.379 | 201.806 | 7.695 | |

| Shaanxi | 2007.350 | 1806.611 | Shaanxi → Shanghai, Zhejiang | −200.739 | −7.654 |

| Guizhou | 1622.286 | 1460.057 | Guizhou → Shanghai, Zhejiang | −162.229 | −6.186 |

| Total | 10,051.829 | 10,051.829 | 0 | 0 |

| Parameter | Shanghai | Zhejiang | Shaanxi | Guizhou | Tax Rate (USD/kWh) | Total Benefits of Energy Consumption | Increase | |

|---|---|---|---|---|---|---|---|---|

| Baseline | [0.90, 1.10] | 192.675 | 135.219 | 22.748 | 27.419 | 0.381 | 378.062 | 14.67% |

| [0.80, 1.10] | 192.575 | 138.106 | 27.980 | 28.599 | 0.388 | 387.259 | 17.46% | |

| [0.85, 1.10] | 192.575 | 136.892 | 25.340 | 28.638 | 0.388 | 383.446 | 16.31% | |

| [0.88, 1.10] | 192.625 | 135.829 | 23.764 | 27.878 | 0.384 | 380.095 | 15.29% | |

| [0.93, 1.10] | 192.750 | 134.388 | 21.328 | 26.845 | 0.377 | 375.311 | 13.84% | |

| [0.95, 1.10] | 192.775 | 133.883 | 20.466 | 26.553 | 0.375 | 373.678 | 13.34% | |

| [0.90, 1.05] | 170.437 | 135.579 | 22.748 | 26.966 | 0.381 | 355.730 | 7.90% | |

| [0.90, 1.08] | 183.354 | 135.480 | 22.779 | 27.445 | 0.383 | 369.058 | 11.94% | |

| [0.90, 1.13] | 207.778 | 134.854 | 22.686 | 27.369 | 0.378 | 392.687 | 19.11% | |

| [0.90, 1.15] | 218.620 | 134.601 | 22.655 | 27.344 | 0.377 | 403.220 | 22.30% | |

| [0.90, 1.18] | 236.117 | 134.250 | 22.624 | 27.319 | 0.375 | 420.310 | 27.49% | |

| [0.90, 1.20] | 248.631 | 134.020 | 22.624 | 27.319 | 0.375 | 432.594 | 31.21% | |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zeng, L.; Zhang, W.; Yang, M. A Bi-Level Optimization Model for Inter-Provincial Energy Consumption Transfer Tax in China. Energies 2023, 16, 7328. https://doi.org/10.3390/en16217328

Zeng L, Zhang W, Yang M. A Bi-Level Optimization Model for Inter-Provincial Energy Consumption Transfer Tax in China. Energies. 2023; 16(21):7328. https://doi.org/10.3390/en16217328

Chicago/Turabian StyleZeng, Lijun, Wencheng Zhang, and Muyi Yang. 2023. "A Bi-Level Optimization Model for Inter-Provincial Energy Consumption Transfer Tax in China" Energies 16, no. 21: 7328. https://doi.org/10.3390/en16217328

APA StyleZeng, L., Zhang, W., & Yang, M. (2023). A Bi-Level Optimization Model for Inter-Provincial Energy Consumption Transfer Tax in China. Energies, 16(21), 7328. https://doi.org/10.3390/en16217328