Future Challenges of the Electric Vehicle Market Perceived by Individual Drivers from Eastern Poland

Abstract

1. Introduction

2. Literature Review

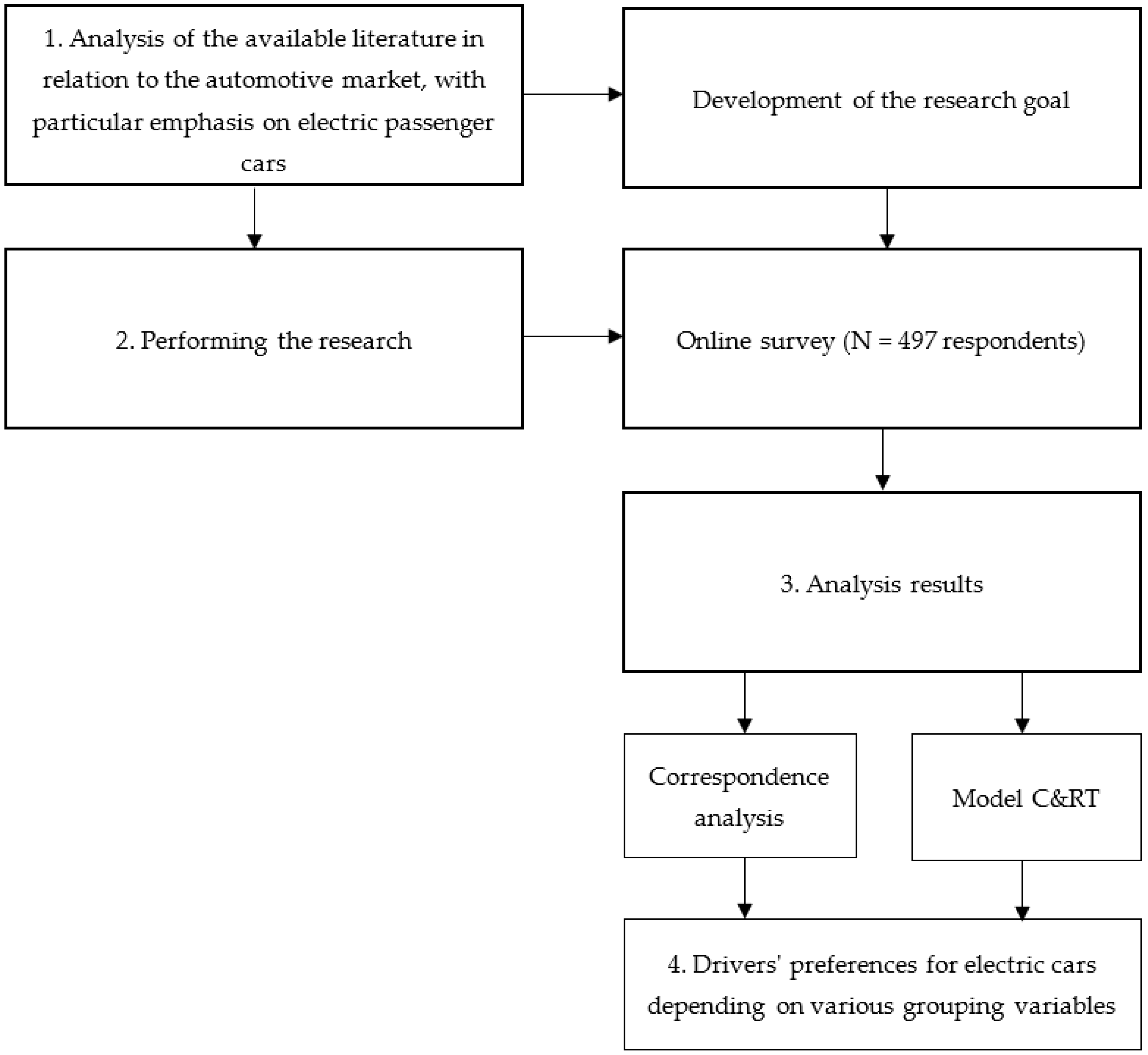

3. Materials and Methods

3.1. Study Design—The Selection of the Research Method

3.2. Survey Questionnaire as a Research Tool

3.3. Research Sample

3.4. Research Methods

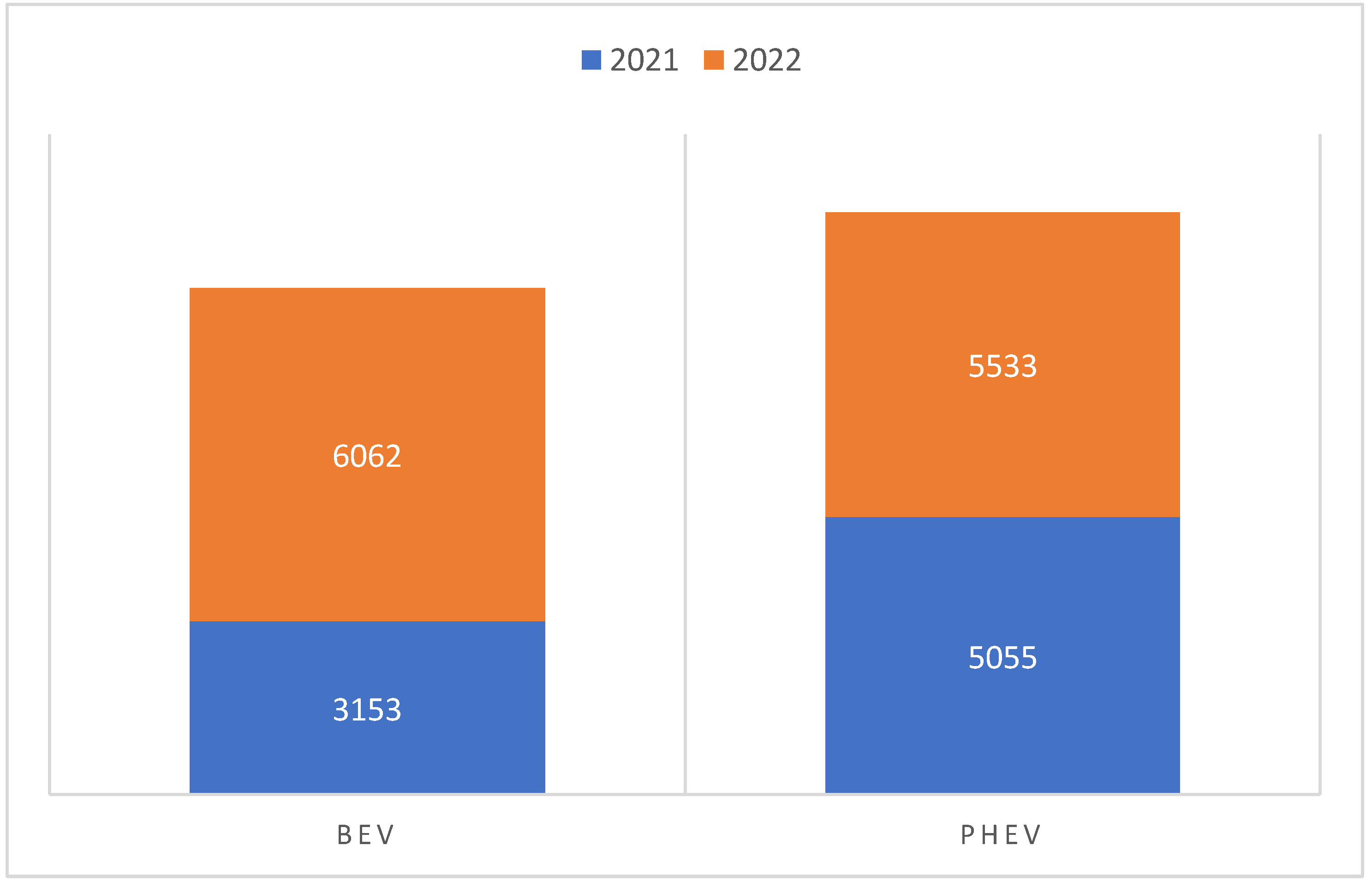

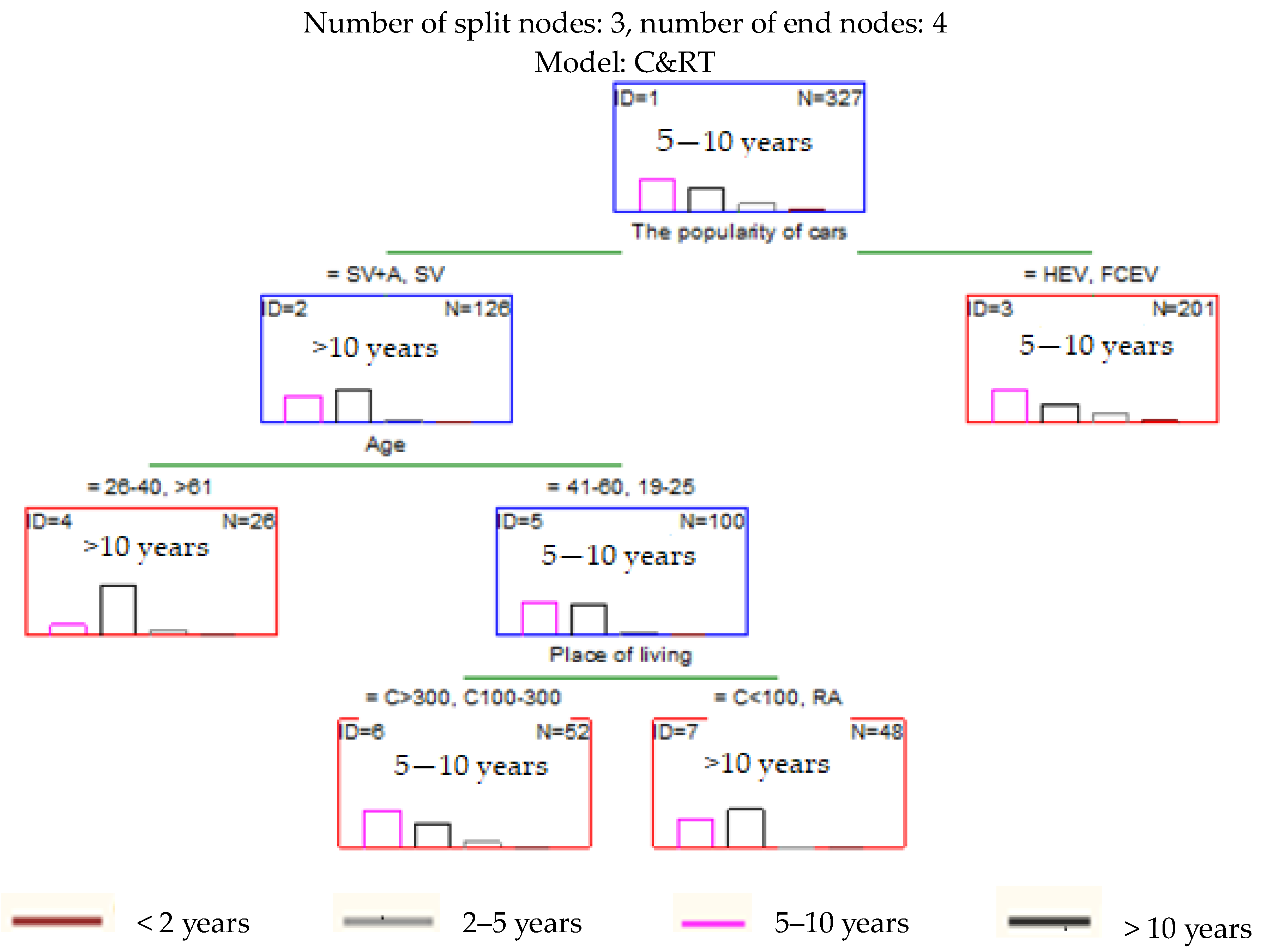

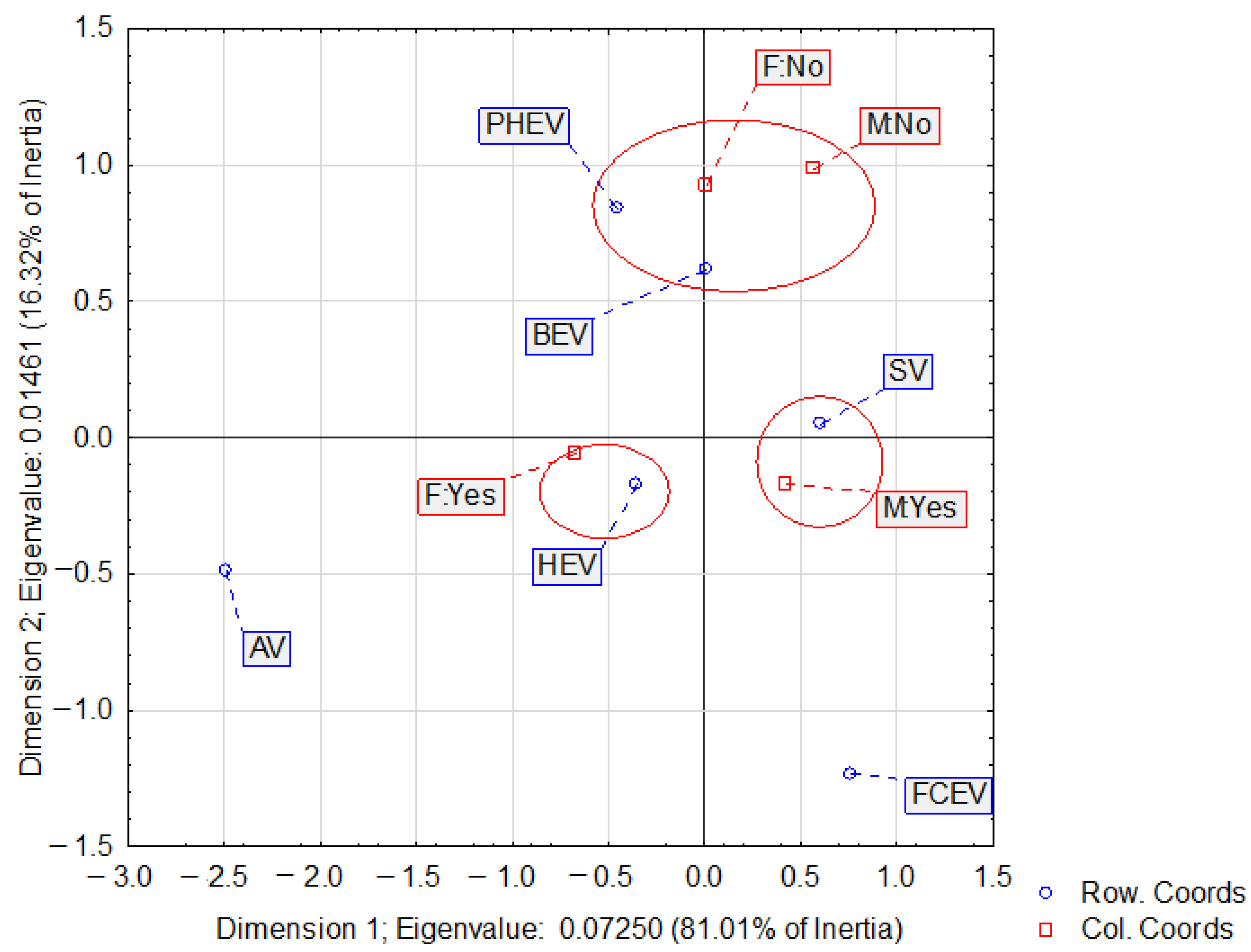

4. Results and Discussion

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Webb, J. The Future of Transport: Literature Review and Overview. Econ. Anal. Policy 2019, 61, 1–6. [Google Scholar] [CrossRef]

- Shigeta, N.; Hosseini, S.E. Sustainable Development of the Automobile Industry in the United States, Europe, and Japan with Special Focus on the Vehicles’ Power Sources. Energies 2020, 14, 78. [Google Scholar] [CrossRef]

- Sanguesa, J.A.; Torres-Sanz, V.; Garrido, P.; Martinez, F.J.; Marquez-Barja, J.M. A Review on Electric Vehicles: Technologies and Challenges. Smart Cities 2021, 4, 372–404. [Google Scholar] [CrossRef]

- Sikora, A. European Green Deal–Legal and Financial Challenges of the Climate Change. Era Forum 2021, 21, 681–697. [Google Scholar] [CrossRef]

- Li, J.; Jiao, J.; Tang, Y. An Evolutionary Analysis on the Effect of Government Policies on Electric Vehicle Diffusion in Complex Network. Energy Policy 2019, 129, 1–12. [Google Scholar] [CrossRef]

- O’Driscoll, R.; Stettler, M.E.; Molden, N.; Oxley, T.; ApSimon, H.M. Real World CO2 and NOx Emissions from 149 Euro 5 and 6 Diesel, Gasoline and Hybrid Passenger Cars. Sci. Total Environ. 2018, 621, 282–290. [Google Scholar] [CrossRef]

- Kryzia, D.; Kuta, M.; Matuszewska, D.; Olczak, P. Analysis of the Potential for Gas Micro-Cogeneration Development in Poland Using the Monte Carlo Method. Energies 2020, 13, 3140. [Google Scholar] [CrossRef]

- Nazarko, Ł.; Žemaitis, E.; Wróblewski, Ł.K.; Šuhajda, K.; Zajączkowska, M. The Impact of Energy Development of the European Union Euro Area Countries on CO2 Emissions Level. Energies 2022, 15, 1425. [Google Scholar] [CrossRef]

- Keleş, A.E.; Güngör, G. Overview of Environmental Problems Caused by Logistics Transportation: Example of European Union Countries. Teh. Glas. 2021, 15, 569–573. [Google Scholar] [CrossRef]

- Zimakowska-Laskowska, M.; Laskowski, P. Emission from Internal Combustion Engines and Battery Electric Vehicles: Case Study for Poland. Atmosphere 2022, 13, 401. [Google Scholar] [CrossRef]

- Sato, F.E.K.; Nakata, T. Energy Consumption Analysis for Vehicle Production through a Material Flow Approach. Energies 2020, 13, 2396. [Google Scholar] [CrossRef]

- Statharas, S.; Moysoglou, Y.; Siskos, P.; Zazias, G.; Capros, P. Factors Influencing Electric Vehicle Penetration in the EU by 2030: A Model-Based Policy Assessment. Energies 2019, 12, 2739. [Google Scholar] [CrossRef]

- European Commission. A European Strategy for Low-Emission Mobility; Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions: Brussels, Belgium, 2016. [Google Scholar]

- Roadmap to a Single European Transport Area—Towards a Competitive and Resource Efficient Transport System—European Environment Agency. Available online: https://www.eea.europa.eu/policy-documents/roadmap-to-a-single-european (accessed on 22 March 2023).

- COM(2011) 112—A Roadmap for Moving to a Competitive Low Carbon Economy in 2050—European Environment Agency. Available online: https://www.eea.europa.eu/policy-documents/com-2011-112-a-roadmap (accessed on 22 March 2023).

- Lee, B. Highlights of the Clean Air Act Amendments off 1990. J. Air Waste Manag. Assoc. 1991, 41, 16–19. [Google Scholar] [CrossRef][Green Version]

- United States Environmental Protection Agency. The Plain English Guide to the Clean Air Act; Office of Air Quality Planning and Standards: Research Triangle Park, NC, USA, 2007. [Google Scholar]

- Arimura, T.H.; Iwata, K.; Arimura, T.H.; Iwata, K. Does Environmental Regulation Affect on Outside of the Regulated Areas? Empirical Analysis of Japanese Automobile NOx-PM Act. In An Evaluation of Japanese Environmental Regulations: Quantitative Approaches from Environmental Economics; Springer: Dordrecht, The Netherlands, 2015; pp. 71–85. [Google Scholar]

- Iwata, K.; Arimura, T.H. Economic Analysis of Japanese Air Pollution Regulation: An Optimal Retirement Problem under the Vehicle Type Regulation in the NOx–Particulate Matter Law. Transp. Res. Part Transp. Environ. 2009, 14, 157–167. [Google Scholar] [CrossRef]

- Singh, S.; Kulshrestha, M.J.; Rani, N.; Kumar, K.; Sharma, C.; Aswal, D.K. An Overview of Vehicular Emission Standards. Mapan 2022, 38, 241–263. [Google Scholar] [CrossRef]

- Tögel, M.; Spicka, L. Low-Emission Zones in European Countries. Trans. Transp. Sci. 2014, 7, 97. [Google Scholar] [CrossRef]

- Ku, D.; Bencekri, M.; Kim, J.; Leec, S.; Leed, S. Review of European Low Emission Zone Policy. Chem. Eng. 2020, 78, 241–246. [Google Scholar]

- Andwari, A.M.; Pesiridis, A.; Rajoo, S.; Martinez-Botas, R.; Esfahanian, V. A Review of Battery Electric Vehicle Technology and Readiness Levels. Renew. Sustain. Energy Rev. 2017, 78, 414–430. [Google Scholar] [CrossRef]

- Wróblewski, P.; Lewicki, W. A Method of Analyzing the Residual Values of Low-Emission Vehicles Based on a Selected Expert Method Taking into Account Stochastic Operational Parameters. Energies 2021, 14, 6859. [Google Scholar] [CrossRef]

- Yakovlev, V.F. Early Electric Vehicle Charging: A Survey. Int. J. Electr. Hybrid Veh. 2022, 14, 219–230. [Google Scholar] [CrossRef]

- Bladh, M. Origin of Car Enthusiasm and Alternative Paths in History. Environ. Innov. Soc. Transit. 2019, 32, 153–168. [Google Scholar] [CrossRef]

- Helmers, E.; Marx, P. Electric Cars: Technical Characteristics and Environmental Impacts. Environ. Sci. Eur. 2012, 24, 14. [Google Scholar] [CrossRef]

- Bradley, T.H.; Frank, A.A. Design, Demonstrations and Sustainability Impact Assessments for Plug-in Hybrid Electric Vehicles. Renew. Sustain. Energy Rev. 2009, 13, 115–128. [Google Scholar] [CrossRef]

- Al-Alawi, B.M.; Bradley, T.H. Review of Hybrid, Plug-in Hybrid, and Electric Vehicle Market Modeling Studies. Renew. Sustain. Energy Rev. 2013, 21, 190–203. [Google Scholar] [CrossRef]

- Woo, J.; Magee, C.L. Forecasting the Value of Battery Electric Vehicles Compared to Internal Combustion Engine Vehicles: The Influence of Driving Range and Battery Technology. Int. J. Energy Res. 2020, 44, 6483–6501. [Google Scholar] [CrossRef]

- Kumar, A.; Jadon, J.K.S. A Review on Electric Vehicles and Its Future. S. Asian J. Mark. Manag. Res. 2021, 11, 85–91. [Google Scholar] [CrossRef]

- Kambli, R.O. Electric Vehicles in India: Future and Challenges. Int. J. Res. Appl. Sci. Eng. Technol. 2022, 10, 398–402. [Google Scholar] [CrossRef]

- Kalghatgi, G. Is It Really the End of Internal Combustion Engines and Petroleum in Transport? Appl. Energy 2018, 225, 965–974. [Google Scholar] [CrossRef]

- Ehrenberger, S.I.; Dunn, J.B.; Jungmeier, G.; Wang, H. An International Dialogue about Electric Vehicle Deployment to Bring Energy and Greenhouse Gas Benefits through 2030 on a Well-to-Wheels Basis. Transp. Res. Part Transp. Environ. 2019, 74, 245–254. [Google Scholar] [CrossRef]

- Hofmann, J.; Guan, D.; Chalvatzis, K.; Huo, H. Assessment of Electrical Vehicles as a Successful Driver for Reducing CO2 Emissions in China. Appl. Energy 2016, 184, 995–1003. [Google Scholar] [CrossRef]

- Ke, W.; Zhang, S.; He, X.; Wu, Y.; Hao, J. Well-to-Wheels Energy Consumption and Emissions of Electric Vehicles: Mid-Term Implications from Real-World Features and Air Pollution Control Progress. Appl. Energy 2017, 188, 367–377. [Google Scholar] [CrossRef]

- Ambrose, H.; Kendall, A.; Lozano, M.; Wachche, S.; Fulton, L. Trends in Life Cycle Greenhouse Gas Emissions of Future Light Duty Electric Vehicles. Transp. Res. Part Transp. Environ. 2020, 81, 102287. [Google Scholar] [CrossRef]

- Dižo, J.; Blatnický, M.; Semenov, S.; Mikhailov, E.; Kostrzewski, M.; Droździel, P.; Šťastniak, P. Electric and Plug-in Hybrid Vehicles and Their Infrastructure in a Particular European Region. Transp. Res. Procedia 2021, 55, 629–636. [Google Scholar] [CrossRef]

- Poullikkas, A. Sustainable Options for Electric Vehicle Technologies. Renew. Sustain. Energy Rev. 2015, 41, 1277–1287. [Google Scholar] [CrossRef]

- Hannan, M.A.; Azidin, F.A.; Mohamed, A. Hybrid Electric Vehicles and Their Challenges: A Review. Renew. Sustain. Energy Rev. 2014, 29, 135–150. [Google Scholar] [CrossRef]

- Singh, P.A.; Singh, P.L.; Pundir, A.K.; Saini, A. Mild Hybrid Technology in Automotive: A Review. Int. Res. J. Eng. Technol. 2021, 8, 4405–4410. [Google Scholar]

- Basheerd, Z. The Difference between Plug-in, Mild and Hybrid Vehicle Technologies: A Detailed Guide. Available online: https://www.motorfinity.uk/blog/difference-in-mild-plugin-fullhybrids/ (accessed on 20 April 2023).

- Dornoff, J.; German, J.; Deo, A.; Dimaratos, A. Mild-Hybrid Vehicles: A Near Term Technology Trend for CO₂ Emissions Reduction; International Council on Clean Transportation: San Francisco, CA, USA, 2022. [Google Scholar]

- Amjad, S.; Neelakrishnan, S.; Rudramoorthy, R. Review of Design Considerations and Technological Challenges for Successful Development and Deployment of Plug-in Hybrid Electric Vehicles. Renew. Sustain. Energy Rev. 2010, 14, 1104–1110. [Google Scholar] [CrossRef]

- Ding, N.; Prasad, K.; Lie, T.T. The Electric Vehicle: A Review. Int. J. Electr. Hybrid Veh. 2017, 9, 49–66. [Google Scholar] [CrossRef]

- Parikh, A.; Shah, M.; Prajapati, M. Fuelling the Sustainable Future: A Comparative Analysis between Battery Electrical Vehicles (BEV) and Fuel Cell Electrical Vehicles (FCEV). Environ. Sci. Pollut. Res. 2023, 30, 57236–57252. [Google Scholar] [CrossRef] [PubMed]

- Asif, U.; Schmidt, K. Fuel Cell Electric Vehicles (FCEV): Policy Advances to Enhance Commercial Success. Sustainability 2021, 13, 5149. [Google Scholar] [CrossRef]

- Wang, Y.; Yuan, H.; Martinez, A.; Hong, P.; Xu, H.; Bockmiller, F.R. Polymer Electrolyte Membrane Fuel Cell and Hydrogen Station Networks for Automobiles: Status, Technology, and Perspectives. Adv. Appl. Energy 2021, 2, 100011. [Google Scholar] [CrossRef]

- Yuan, Y.; Yuan, X. Does the Development of Fuel Cell Electric Vehicles Be Reviving or Recessional? Based on the Patent Analysis. Energy 2023, 272, 127104. [Google Scholar] [CrossRef]

- Fernández, R.Á.; Pérez-Dávila, O. Fuel Cell Hybrid Vehicles and Their Role in the Decarbonisation of Road Transport. J. Clean. Prod. 2022, 342, 130902. [Google Scholar] [CrossRef]

- Xiao, B.; Ruan, J.; Yang, W.; Walker, P.D.; Zhang, N. A Review of Pivotal Energy Management Strategies for Extended Range Electric Vehicles. Renew. Sustain. Energy Rev. 2021, 149, 111194. [Google Scholar] [CrossRef]

- Puma-Benavides, D.S.; Izquierdo-Reyes, J.; Calderon-Najera, J.d.D.; Ramirez-Mendoza, R.A. A Systematic Review of Technologies, Control Methods, and Optimization for Extended-Range Electric Vehicles. Appl. Sci. 2021, 11, 7095. [Google Scholar] [CrossRef]

- Ren, X.; Tang, J.; Liu, X.; Liu, Q. Effects of Microplastics on Greenhouse Gas Emissions and the Microbial Community in Fertilized Soil. Environ. Pollut. 2020, 256, 113347. [Google Scholar] [CrossRef]

- Evelyn, E.; Aziz, A.R.A.; Sambegoro, P.L. A Review of Range Extender Technologies in Electric Vehicles. Int. J. Sustain. Transp. Technol. 2020, 3, 7–11. [Google Scholar] [CrossRef]

- Chan, C.C. The State of the Art of Electric, Hybrid, and Fuel Cell Vehicles. Proc. IEEE 2007, 95, 704–718. [Google Scholar] [CrossRef]

- Ajanovic, A. The Future of Electric Vehicles: Prospects and Impediments. Wiley Interdiscip. Rev. Energy Environ. 2015, 4, 521–536. [Google Scholar] [CrossRef]

- Colmenar-Santos, A.; Muñoz-Gómez, A.-M.; Rosales-Asensio, E.; López-Rey, Á. Electric Vehicle Charging Strategy to Support Renewable Energy Sources in Europe 2050 Low-Carbon Scenario. Energy 2019, 183, 61–74. [Google Scholar] [CrossRef]

- Stopka, O.; Stopková, M.; Ližbetin, J.; Soviar, J.; Caban, J. Development Trends of Electric Vehicles in the Context of Road Passenger and Freight Transport; IEEE: Piscataway, NJ, USA, 2020; pp. 1–8. [Google Scholar]

- Bibra, E.M.; Connelly, E.; Dhir, S.; Drtil, M.; Henriot, P.; Hwang, I.; Le Marois, J.-B.; McBain, S.; Paoli, L.; Teter, J. Global EV Outlook 2022: Securing Supplies for an Electric Future; IEA: Paris, France, 2022. [Google Scholar]

- Bibra, E.M.; Connelly, E.; Gorner, M.; Lowans, C.; Paoli, L.; Tattini, J.; Teter, J. Global EV Outlook 2021: Accelerating Ambitions Despite the Pandemic; IEA: Paris, France, 2021. [Google Scholar]

- MacDonald, J. Electric Vehicles to Be 35% of Global New Car Sales by 2040. Bloomberg New Energy Finance. 2016. Available online: https://about.bnef.com/blog/electric-vehicles-to-be-35-of-global-new-car-sales-by-2040/ (accessed on 22 March 2023).

- Germany: Plug-In Car Share at 26%: Records Everywhere in December 2020. Available online: https://insideevs.com/news/466566/germany-plugin-car-sales-december-2020/ (accessed on 22 March 2023).

- Top 10 Plug-In Vehicle Adopting Countries of 2016. Available online: https://www.gm-volt.com/threads/top-10-plug-in-vehicle-adopting-countries-of-2016.338144/ (accessed on 22 March 2023).

- Norway Sets Plug-In Car Sales Record for the End of the Year 2021. Available online: https://insideevs.com/news/558447/norway-plugin-car-sales-december2021/ (accessed on 22 March 2023).

- Paulraj, P. The Netherlands Has the Highest Density of Electric Vehicle Chargers in the World|EOY-2019 EV—EVSE Statistics. E-Mobility Simplified|Basics of Electric Vehicles and Charging. Available online: https://www.emobilitysimplified.com/2019/12/netherlands-highest-density-ev-charging-infrastructure.html (accessed on 22 March 2023).

- Tilles, D. Number of Electric Cars in Poland Grows 63% in a Year but Remains Well below Government Target. Notes from Poland. 2023. Available online: https://notesfrompoland.com/2023/02/18/number-of-electric-cars-in-poland-grows-63-in-a-year-but-remains-well-below-government-target/ (accessed on 22 March 2023).

- Licznik Elektromobilności/Rynek Motoryzacyjny/Home—Polski Związek Przemysłu Motoryzacyjnego. Available online: https://www.pzpm.org.pl/pl/Rynek-motoryzacyjny/Licznik-elektromobilnosci/Luty-2023 (accessed on 22 March 2023).

- Ziemba, P. Multi-Criteria Approach to Stochastic and Fuzzy Uncertainty in the Selection of Electric Vehicles with High Social Acceptance. Expert Syst. Appl. 2021, 173, 114686. [Google Scholar] [CrossRef]

- Gajewski, J.M.; Paprocki, W.; Pieriegud, J. Elektromobilność w Polsce na Tle Tendencji Europejskich i Globalnych; CeDeWu: Warszawa, Poland, 2019. [Google Scholar]

- Szumska, E.M. Electric Vehicle Charging Infrastructure along Highways in the EU. Energies 2023, 16, 895. [Google Scholar] [CrossRef]

- Jankowska, M.; Pawełczyk, M.; Badura, E. Electromobility, Automation and Digitalisation–The Legal Challenges of New Business Models in Poland. Eur. Bus. Law Rev. 2023, 34, 181–192. [Google Scholar]

- Burchart-Korol, D.; Gazda-Grzywacz, M.; Zarębska, K. Research and Prospects for the Development of Alternative Fuels in the Transport Sector in Poland: A Review. Energies 2020, 13, 2988. [Google Scholar] [CrossRef]

- Grzegórska-Szpyt, L. Carsmile: W 2023 r. Udział Elektryków w Łącznej Sprzedaży Samochodów Wzrośnie do 5–7 Proc.—ZielonaGospodarka.pl. Available online: https://zielonagospodarka.pl/carsmile-w-2023-r-udzial-elektrykow-w-lacznej-sprzedazy-samochodow-wzrosnie-do-5-7-proc-10756 (accessed on 27 April 2023).

- Tran, M.; Banister, D.; Bishop, J.D.; McCulloch, M.D. Simulating Early Adoption of Alternative Fuel Vehicles for Sustainability. Technol. Forecast. Soc. Change 2013, 80, 865–875. [Google Scholar] [CrossRef]

- Bjerkan, K.Y.; Nørbech, T.E.; Nordtømme, M.E. Incentives for Promoting Battery Electric Vehicle (BEV) Adoption in Norway. Transp. Res. Part Transp. Environ. 2016, 43, 169–180. [Google Scholar] [CrossRef]

- Wan, Z.; Sperling, D.; Wang, Y. China’s Electric Car Frustrations. Transp. Res. Part Transp. Environ. 2015, 34, 116–121. [Google Scholar] [CrossRef]

- Sierzchula, W. Factors Influencing Fleet Manager Adoption of Electric Vehicles. Transp. Res. Part Transp. Environ. 2014, 31, 126–134. [Google Scholar] [CrossRef]

- Dijk, M.; Orsato, R.J.; Kemp, R. The Emergence of an Electric Mobility Trajectory. Energy Policy 2013, 52, 135–145. [Google Scholar] [CrossRef]

- Haddadian, G.; Khodayar, M.; Shahidehpour, M. Accelerating the Global Adoption of Electric Vehicles: Barriers and Drivers. Electr. J. 2015, 28, 53–68. [Google Scholar] [CrossRef]

- Hardman, S.; Chandan, A.; Tal, G.; Turrentine, T. The Effectiveness of Financial Purchase Incentives for Battery Electric Vehicles–A Review of the Evidence. Renew. Sustain. Energy Rev. 2017, 80, 1100–1111. [Google Scholar] [CrossRef]

- Langbroek, J.H.; Franklin, J.P.; Susilo, Y.O. The Effect of Policy Incentives on Electric Vehicle Adoption. Energy Policy 2016, 94, 94–103. [Google Scholar] [CrossRef]

- DeShazo, J.R.; Sheldon, T.L.; Carson, R.T. Designing Policy Incentives for Cleaner Technologies: Lessons from California’s Plug-in Electric Vehicle Rebate Program. J. Environ. Econ. Manag. 2017, 84, 18–43. [Google Scholar] [CrossRef]

- Ziemba, P. Selection of Electric Vehicles for the Needs of Sustainable Transport under Conditions of Uncertainty—A Comparative Study on Fuzzy MCDA Methods. Energies 2021, 14, 7786. [Google Scholar] [CrossRef]

- Patton, M.Q. Qualitative Evaluation and Research Methods; SAGE Publications, Inc.: Newcastle upon Tyne, UK, 1990. [Google Scholar]

- Greenacre, M.J. Theory and Applications of Correspondence Analysis; Academic Press: Cambridge, MA, USA, 1984. [Google Scholar]

- Stanimir, A. Analiza Korespondencji jako Narzędzie do Badania Zjawisk Ekonomicznych (Correspondence Analysis as a Tool for the Study Economic Factors); Akademii Ekonomicznej w Poznaniu: Poznań, Poland, 2005. [Google Scholar]

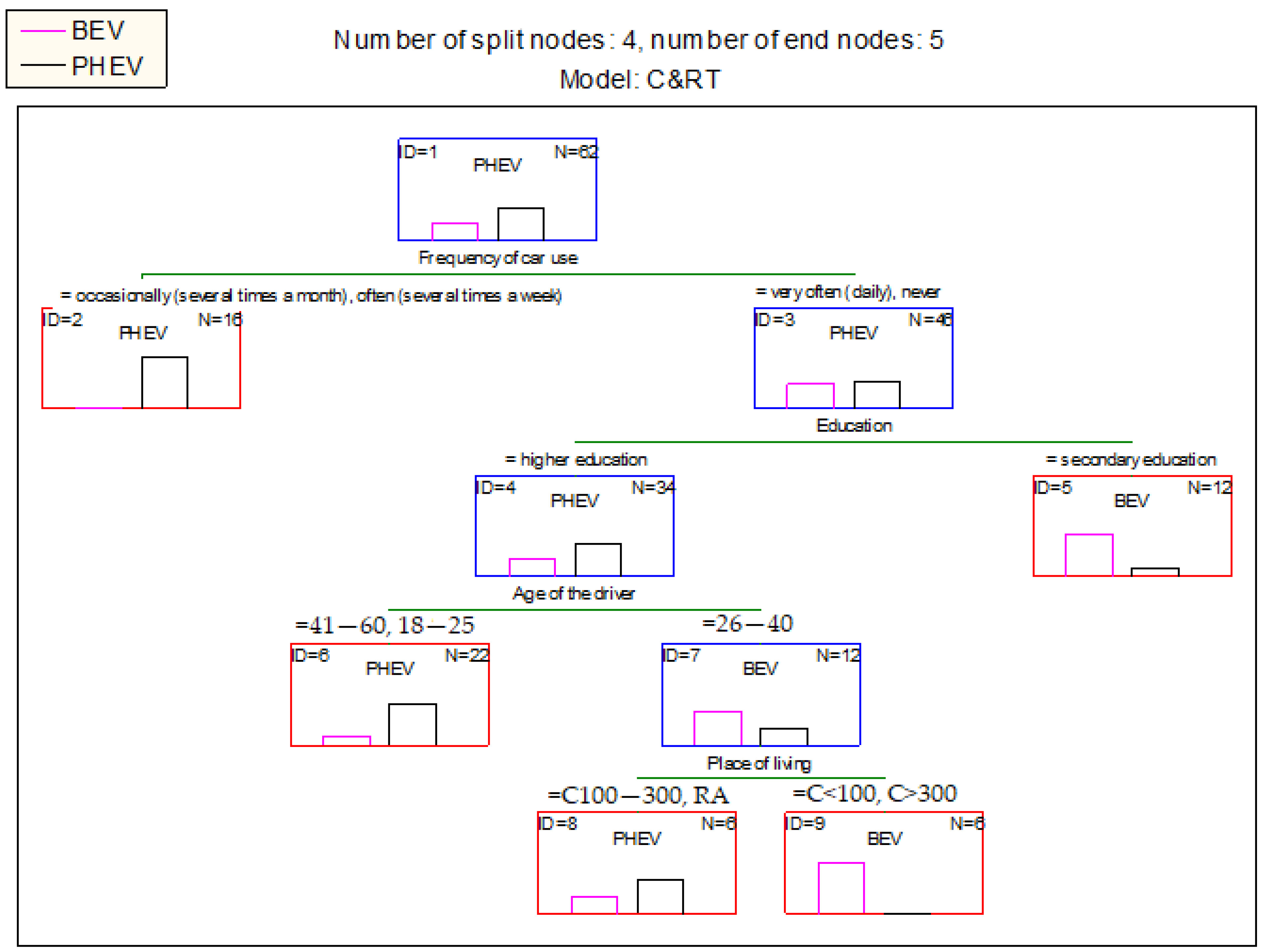

- Gocheva-Ilieva, S.G.; Voynikova, D.S.; Stoimenova, M.P.; Ivanov, A.V.; Iliev, I.P. Regression Trees Modeling of Time Series for Air Pollution Analysis and Forecasting. Neural Comput. Appl. 2019, 31, 9023–9039. [Google Scholar] [CrossRef]

- Choubin, B.; Moradi, E.; Golshan, M.; Adamowski, J.; Sajedi-Hosseini, F.; Mosavi, A. An Ensemble Prediction of Flood Susceptibility Using Multivariate Discriminant Analysis, Classification and Regression Trees, and Support Vector Machines. Sci. Total Environ. 2019, 651, 2087–2096. [Google Scholar] [CrossRef] [PubMed]

- Zhao, Q.; Dong, X.; Li, G.; Jin, Y.; Yang, X.; Qu, Y. Classification and Regression Tree Models for Remote Recognition of Black and Odorous Water Bodies Based on Sensor Networks. Sci. Program. 2022, 2022, 7390098. [Google Scholar] [CrossRef]

- McManus, W.S.; Senter, R., Jr. Market Models for Predicting PHEV Adoption and Diffusion; University of Michigan, Transportation Research Institute: Ann Arbor, MI, USA, 2009. [Google Scholar]

- Jeon, S.Y. Hybrid & Electric Vehicle Technology and Its Market Feasibility. Ph.D. Thesis, Massachusetts Institute of Technology, Cambridge, MA, USA, 2010. [Google Scholar]

- Becker, T.A.; Sidhu, I.; Tenderich, B. Electric Vehicles in the United States: A New Model with Forecasts to 2030. 2009. Available online: https://citeseerx.ist.psu.edu/document?repid=rep1&type=pdf&doi=afa0bad9602fbf152011c2c88cd67ad209446b22 (accessed on 22 March 2023).

- Won, J.-R.; Yoon, Y.-B.; Lee, K.-J. Prediction of Electricity Demand Due to PHEVs (Plug-In Hybrid Electric Vehicles) Distribution in Korea by Using Diffusion Model. In Proceedings of the 2009 Transmission & Distribution Conference & Exposition: Asia and Pacific, Seoul, Republic of Korea, 26–30 October 2009; IEEE: Piscataway, NJ, USA, 2009; pp. 1–4. [Google Scholar]

- Balducci, P. Plug-In Hybrid Electric Vehicle Market Penetration Scenarios; PNNL-17441; Pacific Northwest National Laboratory Richland: Washington, DC, USA, 2008. [Google Scholar]

- Eggers, F.; Eggers, F. Where Have All the Flowers Gone? Forecasting Green Trends in the Automobile Industry with a Choice-Based Conjoint Adoption Model. Technol. Forecast. Soc. Change 2011, 78, 51–62. [Google Scholar] [CrossRef]

- Majchrzak, K.; Olczak, P.; Matuszewska, D.; Wdowin, M. Economic and Environmental Assessment of the Use of Electric Cars in Poland. Polityka Energ. Energy Policy J. 2021, 24, 153–168. [Google Scholar] [CrossRef]

- Bienias, K.; Kowalska-Pyzalska, A.; Ramsey, D. What Do People Think about Electric Vehicles? An Initial Study of the Opinions of Car Purchasers in Poland. Energy Rep. 2020, 6, 267–273. [Google Scholar] [CrossRef]

- Sendek-Matysiak, E. Najważniejsze Bariery Rozwoju Elektromobilności w Polsce. Przegląd Komun. 2020, 75, 8–15. [Google Scholar]

- Kowalska-Pyzalska, A.; Kott, J.; Kott, M. Why Polish Market of Alternative Fuel Vehicles (AFVs) Is the Smallest in Europe? SWOT Analysis of Opportunities and Threats. Renew. Sustain. Energy Rev. 2020, 133, 110076. [Google Scholar] [CrossRef]

- Tulumba, C. 2019 US Vehicle Sales Figures by Model. 3 January 2020. Available online: https://www.goodcarbadcar.net/2019-us-vehicle-sales-figures-by-model/ (accessed on 22 March 2023).

- Bekker, H. 2019 Japan: Best-Selling Car Models—Car Sales Statistics. 9 January 2020. Available online: https://www.best-selling-cars.com/japan/2019-full-year-japan-best-selling-car-models/ (accessed on 22 March 2023).

- Bekker, H. 2017 Europe: Top-Selling Car Models—Car Sales Statistics. 29 January 2018. Available online: https://www.best-selling-cars.com/europe/2017-full-year-europe-top-selling-car-models/ (accessed on 22 March 2023).

| Type of an Electric Car | Drive Source and Type | Internal Combustion Engine | Connection to the Electricity Grid | Typical Range on Electricity |

|---|---|---|---|---|

| BEV | 100% electrically powered | No | Yes | 160–250 km |

| HEV | powered via a conventional internal combustion engine and an electric motor | Yes | No | a few kilometers |

| MHEV | a vehicle equipped with both an internal combustion engine and one electric motor/generator—the electric motor has only a supporting function | Yes | No | - |

| PHEV | have a hybrid drive using two engines: conventional (combustion engine) and electric | Yes | Yes | about 50 km |

| FCEV | hydrogen-powered vehicles, equipped with an electric motor | No | No | up to several hundred kilometers |

| ER-EV | their main drive is the electric motor, but they have an additional internal combustion engine that acts as a generator to charge the vehicle’s battery | Yes | No | 500–600 km |

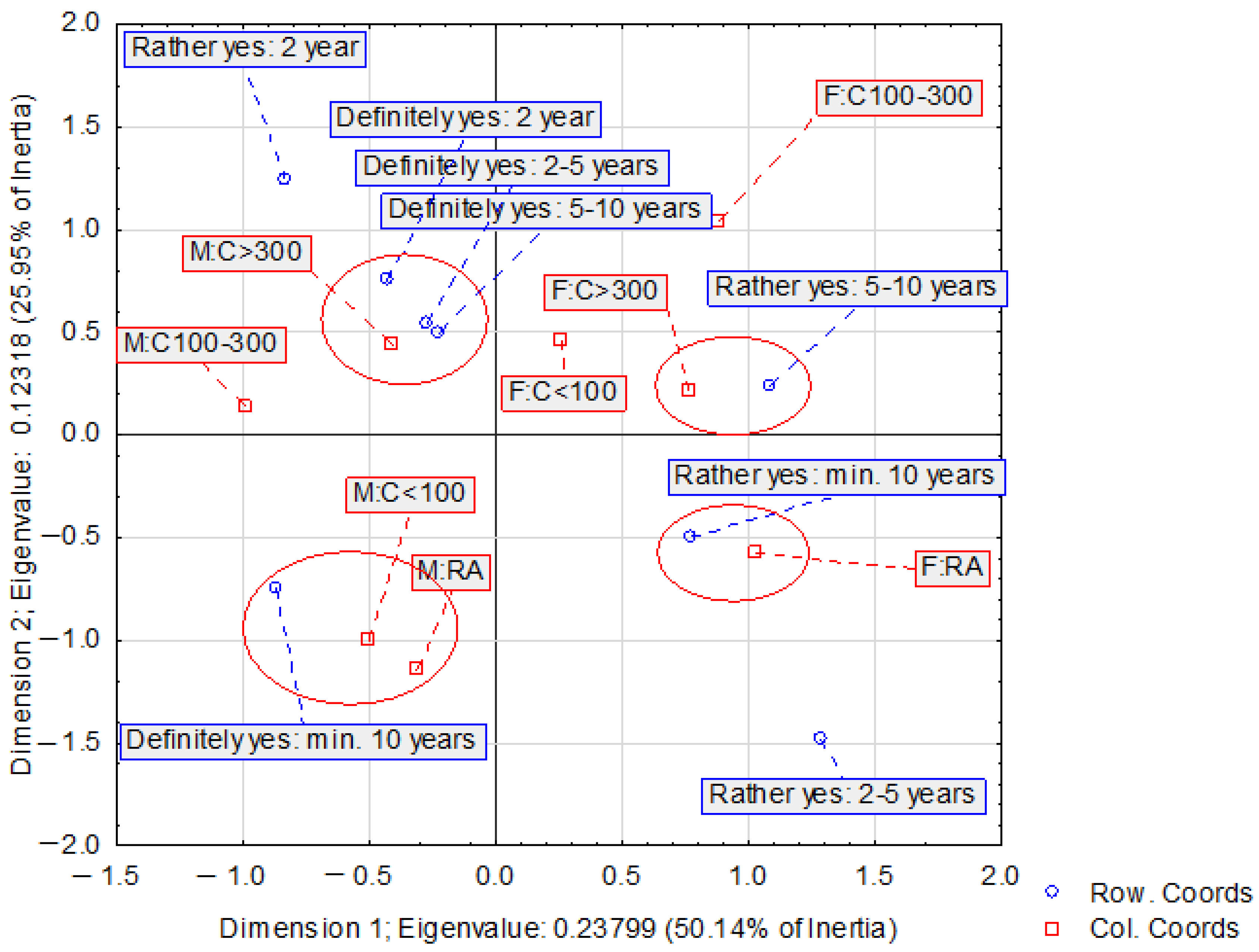

| Number of Dimensions | Eigenvalues and Inertia, Total Inertia = 0.08950 χ2 = 44.480 df = 15 p = 0.00009 | ||||

|---|---|---|---|---|---|

| Singular Value | Eigenvalues | Percentage of Inertia | Cumulative Percentage | Chi2 | |

| 1 | 0.269253 | 0.072497 | 81.00561 | 81.0056 | 36.03123 |

| 2 | 0.120855 | 0.014606 | 16.31996 | 97.3256 | 7.25910 |

| 3 | 0.048924 | 0.002394 | 2.67442 | 100.0000 | 1.18958 |

| Number of Dimensions | Eigenvalues and Inertia, Total Inertia = 0.47466 χ2 = 155.21 df = 49 p = 0.0000 | ||||

|---|---|---|---|---|---|

| Singular Value | Eigenvalues | Percentage of Inertia | Cumulative Percentage | Chi2 | |

| 1 | 0.487844 | 0.237992 | 50.13940 | 50.1394 | 77.82339 |

| 2 | 0.350963 | 0.123175 | 25.95015 | 76.0896 | 40.27827 |

| 3 | 0.238411 | 0.056840 | 11.97481 | 88.0644 | 18.58659 |

| 4 | 0.177165 | 0.031387 | 6.61260 | 94.6770 | 10.26369 |

| 5 | 0.130685 | 0.017078 | 3.59804 | 98.2750 | 5.58466 |

| 6 | 0.090075 | 0.008114 | 1.70934 | 99.9843 | 2.65313 |

| 7 | 0.008622 | 0.000074 | 0.01566 | 100.0000 | 0.02431 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Stoma, M.; Dudziak, A. Future Challenges of the Electric Vehicle Market Perceived by Individual Drivers from Eastern Poland. Energies 2023, 16, 7212. https://doi.org/10.3390/en16207212

Stoma M, Dudziak A. Future Challenges of the Electric Vehicle Market Perceived by Individual Drivers from Eastern Poland. Energies. 2023; 16(20):7212. https://doi.org/10.3390/en16207212

Chicago/Turabian StyleStoma, Monika, and Agnieszka Dudziak. 2023. "Future Challenges of the Electric Vehicle Market Perceived by Individual Drivers from Eastern Poland" Energies 16, no. 20: 7212. https://doi.org/10.3390/en16207212

APA StyleStoma, M., & Dudziak, A. (2023). Future Challenges of the Electric Vehicle Market Perceived by Individual Drivers from Eastern Poland. Energies, 16(20), 7212. https://doi.org/10.3390/en16207212