Balancing Portfolios with Metals: A Safe Haven for Green Energy Investors?

Abstract

:1. Introduction

2. Literature Review

2.1. Prices of Renewable and Conventional Energy Stocks

2.2. Precious Metals as Hedge for Stocks

3. Materials and Methods

3.1. Materials

3.2. Methods

4. Results

4.1. Descriptive Statistics

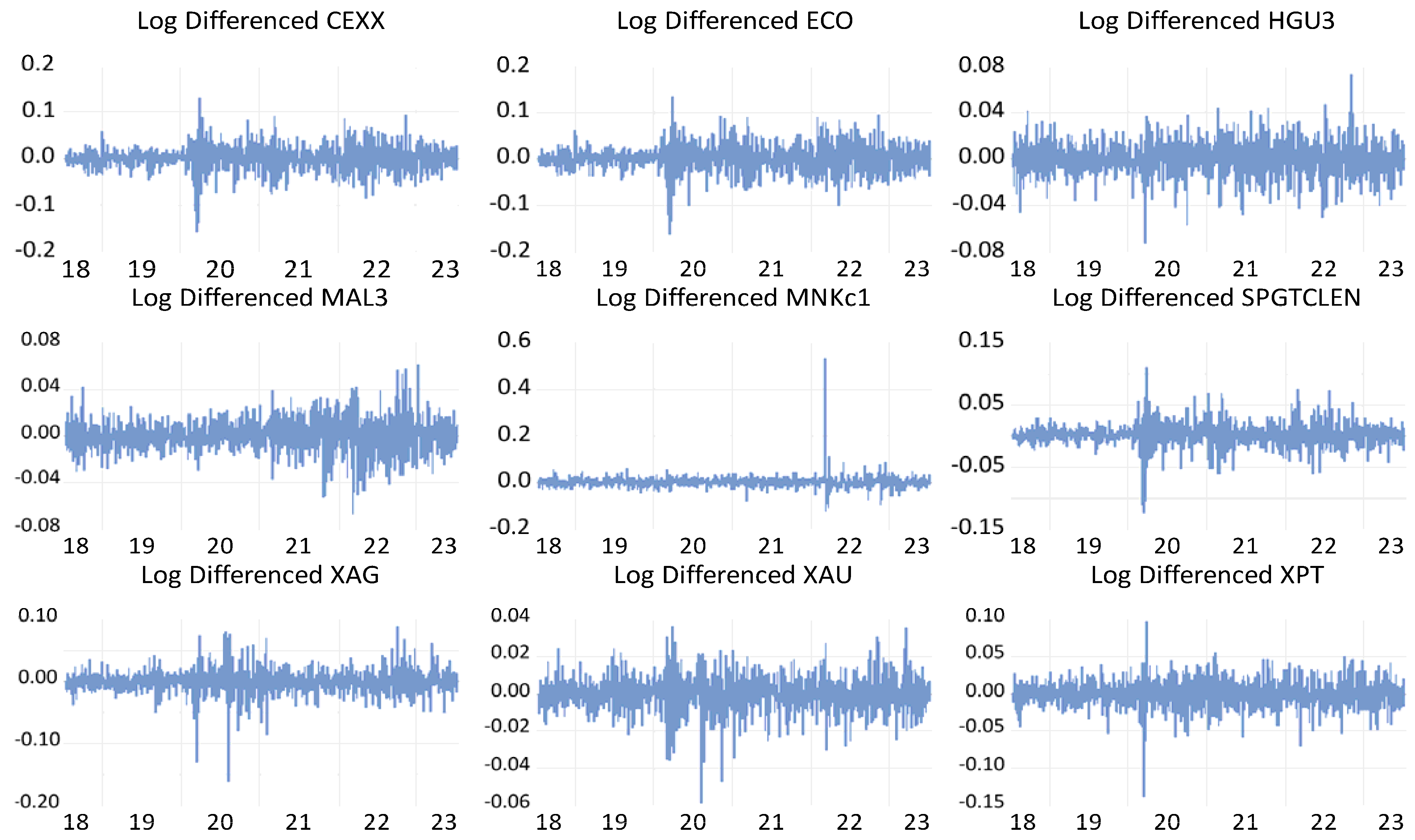

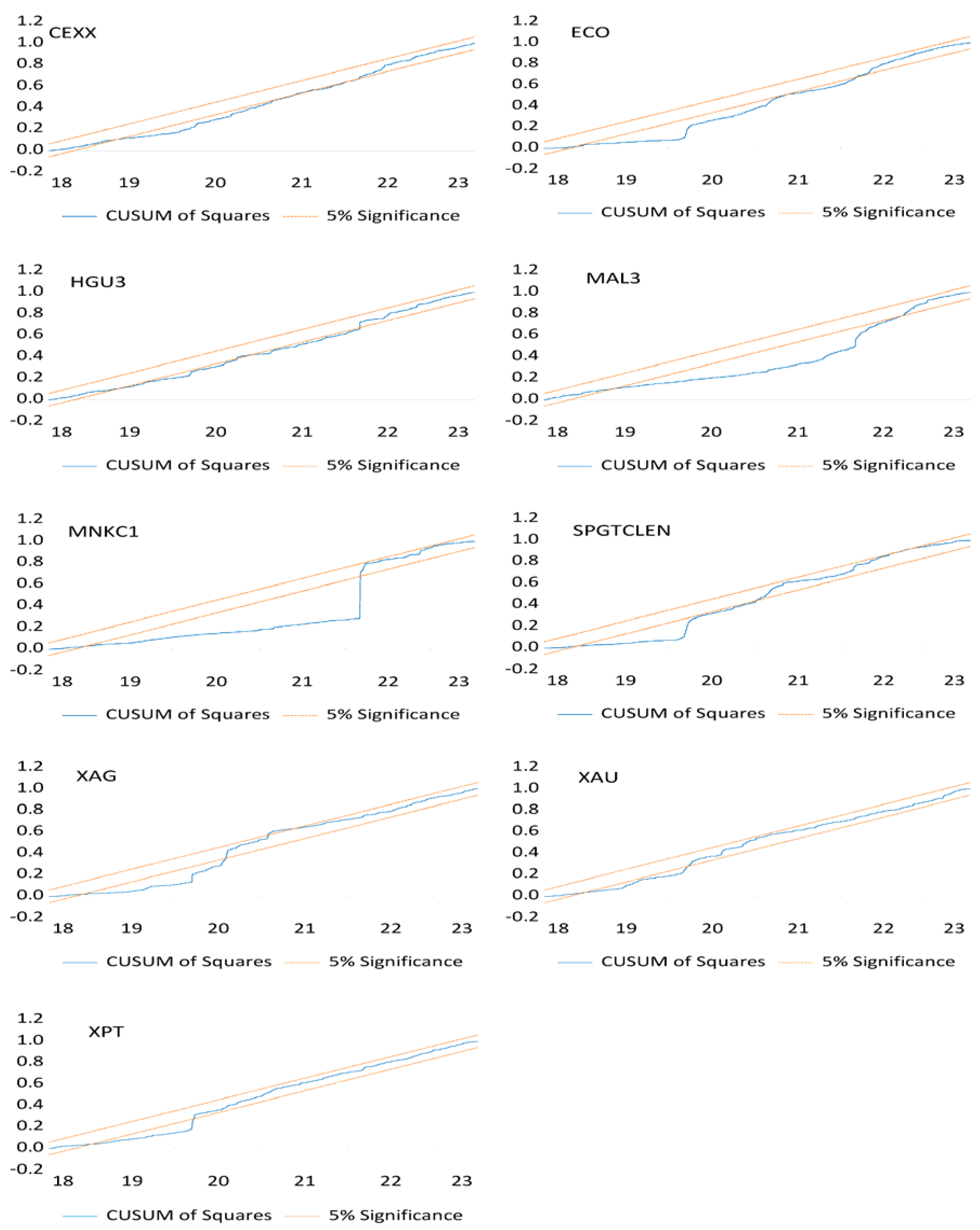

4.2. Diagnostic

Time Series Stationarity

4.3. Methodological Results

5. Discussion

6. Conclusions

7. Practical Implications

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Ahmad, W. On the Dynamic Dependence and Investment Performance of Crude Oil and Clean Energy Stocks. Res. Int. Bus. Financ. 2017, 42, 376–389. [Google Scholar] [CrossRef]

- Reboredo, J.C.; Ugolini, A. The Impact of Energy Prices on Clean Energy Stock Prices. A Multivariate Quantile Dependence Approach. Energy Econ. 2018, 76, 136–152. [Google Scholar] [CrossRef]

- Dawar, I.; Dutta, A.; Bouri, E.; Saeed, T. Crude Oil Prices and Clean Energy Stock Indices: Lagged and Asymmetric Effects with Quantile Regression. Renew. Energy 2021, 163, 288–299. [Google Scholar] [CrossRef]

- Ritchie, J.; Dowlatabadi, H. Divest from the Carbon Bubble? Reviewing the Implications and Limitations of Fossil Fuel Divestment for Institutional Investors. Rev. Econ. Financ. 2015, 5, 59–80. [Google Scholar]

- Henriques, I.; Sadorsky, P. Investor Implications of Divesting from Fossil Fuels. Glob. Financ. J. 2018, 38, 30–44. [Google Scholar] [CrossRef]

- Blitz, D. Betting Against Oil: The Implications of Divesting from Fossil Fuel Stocks. SSRN Electron. J. 2021, 2, 95–106. [Google Scholar] [CrossRef]

- Ahmad, W.; Rais, S. Time-Varying Spillover and the Portfolio Diversification Implications of Clean Energy Equity with Commodities and Financial Assets. Emerg. Mark. Financ. Trade 2018, 54, 1837–1855. [Google Scholar] [CrossRef]

- Aslam, F.; Aziz, S.; Nguyen, D.K.; Mughal, K.S.; Khan, M. On the Efficiency of Foreign Exchange Markets in Times of the COVID-19 Pandemic. Technol. Forecast. Soc. Chang. 2020, 161, 120261. [Google Scholar] [CrossRef]

- Alves Dias, P.; Blagoeva, D.; Pavel, C.; Arvanitidis, N. Cobalt: Demand-Supply Balances in the Transition to Electric Mobility; EU: Maastricht, The Netherlands, 2018. [Google Scholar]

- Dutta, A. Impact of Silver Price Uncertainty on Solar Energy Firms. J. Clean. Prod. 2019, 225, 1044–1051. [Google Scholar] [CrossRef]

- Yahya, M.; Ghosh, S.; Kanjilal, K.; Dutta, A.; Uddin, G.S. Evaluation of Cross-Quantile Dependence and Causality between Non-Ferrous Metals and Clean Energy Indexes. Energy 2020, 202, 117777. [Google Scholar] [CrossRef]

- Baur, D.G.; McDermott, T.K. Is Gold a Safe Haven? International Evidence. J. Bank. Financ. 2010, 34, 1886–1898. [Google Scholar] [CrossRef]

- Bulut, L.; Rizvanoghlu, I. Is Gold a Safe Haven? The International Evidence Revisited. Acta Oeconomica 2020, 70, 531–549. [Google Scholar] [CrossRef]

- Chemkha, R.; BenSaïda, A.; Ghorbel, A.; Tayachi, T. Hedge and Safe Haven Properties during COVID-19: Evidence from Bitcoin and Gold. Q. Rev. Econ. Financ. 2021, 82, 71–85. [Google Scholar] [CrossRef]

- Caporale, G.M.; Gil-Alana, L.A. Gold and Silver as Safe Havens: A Fractional Integration and Cointegration Analysis. PLoS ONE 2023, 18, e0282631. [Google Scholar] [CrossRef]

- Azimli, A. Degree and Structure of Return Dependence among Commodities, Energy Stocks and International Equity Markets during the Post-COVID-19 Period. Resour. Policy 2022, 77, 102679. [Google Scholar] [CrossRef] [PubMed]

- Hasan, M.B.; Hassan, M.K.; Rashid, M.M.; Alhenawi, Y. Are Safe Haven Assets Really Safe during the 2008 Global Financial Crisis and COVID-19 Pandemic? Glob. Financ. J. 2021, 50, 100668. [Google Scholar] [CrossRef]

- Gregory, A.W.; Hansen, B.E. Residual-Based Tests for Cointegration in Models with Regime Shifts. J. Econ. 1996, 70, 99–126. [Google Scholar] [CrossRef]

- Wang, Y.; Liu, Y.; Gu, B. COP26: Progress, Challenges, and Outlook. Adv. Atmos. Sci. 2022, 39, 1209–1216. [Google Scholar] [CrossRef]

- Arora, N.K.; Mishra, I. COP26: More Challenges than Achievements. Environ. Sustain. 2021, 4, 585–588. [Google Scholar] [CrossRef]

- Lennan, M.; Morgera, E. The Glasgow Climate Conference (COP26). Int. J. Mar. Coast. Law 2022, 37, 137–151. [Google Scholar] [CrossRef]

- Jacobs, M. Reflections on COP26: International Diplomacy, Global Justice and the Greening of Capitalism. Political Q. 2022, 93, 270–277. [Google Scholar] [CrossRef]

- Dwivedi, Y.K.; Hughes, L.; Kar, A.K.; Baabdullah, A.M.; Grover, P.; Abbas, R.; Andreini, D.; Abumoghli, I.; Barlette, Y.; Bunker, D.; et al. Climate Change and COP26: Are Digital Technologies and Information Management Part of the Problem or the Solution? An Editorial Reflection and Call to Action. Int. J. Inf. Manag. 2022, 63, 102456. [Google Scholar] [CrossRef]

- Dias, R.; Horta, N.; Chambino, M. Clean Energy Action Index Efficiency: An Analysis in Global Uncertainty Contexts. Energies 2023, 16, 3937. [Google Scholar] [CrossRef]

- Dias, R.; Teixeira, N.; Alexandre, P.; Chambino, M. Exploring the Connection between Clean and Dirty Energy: Implications for the Transition to a Carbon-Resilient Economy. Energies 2023, 16, 4982. [Google Scholar] [CrossRef]

- Dias, R.; Alexandre, P.; Teixeira, N.; Chambino, M. Clean Energy Stocks: Resilient Safe Havens in the Volatility of Dirty Cryptocurrencies. Energies 2023, 16, 5232. [Google Scholar] [CrossRef]

- Santana, T.P.; Horta, N.; Revez, C.; Dias, R.M.T.S.; Zebende, G.F. Effects of Interdependence and Contagion on Crude Oil and Precious Metals According to ΡDCCA: A COVID-19 Case Study. Sustainability 2023, 15, 3945. [Google Scholar] [CrossRef]

- Henriques, I.; Sadorsky, P. Oil Prices and the Stock Prices of Alternative Energy Companies. Energy Econ. 2008, 30, 998–1010. [Google Scholar] [CrossRef]

- Kumar, S.; Managi, S.; Matsuda, A. Stock Prices of Clean Energy Firms, Oil and Carbon Markets: A Vector Autoregressive Analysis. Energy Econ. 2012, 34, 215–226. [Google Scholar] [CrossRef]

- Sadorsky, P. Modeling Renewable Energy Company Risk. Energy Policy 2012, 40, 39–48. [Google Scholar] [CrossRef]

- Managi, S.; Okimoto, T. Does the Price of Oil Interact with Clean Energy Prices in the Stock Market? Jpn. World Econ. 2013, 27, 1–9. [Google Scholar] [CrossRef]

- Bondia, R.; Ghosh, S.; Kanjilal, K. International Crude Oil Prices and the Stock Prices of Clean Energy and Technology Companies: Evidence from Non-Linear Cointegration Tests with Unknown Structural Breaks. Energy 2016, 101, 558–565. [Google Scholar] [CrossRef]

- Vrînceanu, G.; Horobeț, A.; Popescu, C.; Belaşcu, L. The Influence of Oil Price on Renewable Energy Stock Prices: An Analysis for Entrepreneurs. Stud. Univ. Vasile Goldis Arad Econ. Ser. 2020, 30, 24–35. [Google Scholar] [CrossRef]

- Asl, M.G.; Canarella, G.; Miller, S.M. Dynamic Asymmetric Optimal Portfolio Allocation between Energy Stocks and Energy Commodities: Evidence from Clean Energy and Oil and Gas Companies. Resour. Policy 2021, 71, 101982. [Google Scholar] [CrossRef]

- Kanamura, T. A Model of Price Correlations between Clean Energy Indices and Energy Commodities. J. Sustain. Financ. Investig. 2022, 12, 319–359. [Google Scholar] [CrossRef]

- Farid, S.; Karim, S.; Naeem, M.A.; Nepal, R.; Jamasb, T. Co-Movement between Dirty and Clean Energy: A Time-Frequency Perspective. Energy Econ. 2023, 119, 106565. [Google Scholar] [CrossRef]

- Baur, D.G.; Lucey, B.M. Is Gold a Hedge or a Safe Haven? An Analysis of Stocks, Bonds and Gold. Financ. Rev. 2010, 45, 217–229. [Google Scholar] [CrossRef]

- Beckmann, J.; Berger, T.; Czudaj, R. Does Gold Act as a Hedge or a Safe Haven for Stocks? A Smooth Transition Approach. Econ. Model. 2015, 48, 16–24. [Google Scholar] [CrossRef]

- Junttila, J.-P.; Pesonen, J.M.; Raatikainen, J. Commodity Market Based Hedging against Stock Market Risk in Times of Financial Crisis: The Case of Crude Oil and Gold. SSRN Electron. J. 2017, 56, 255–280. [Google Scholar] [CrossRef]

- Chen, K.; Wang, M. Is Gold a Hedge and Safe Haven for Stock Market? Appl. Econ. Lett. 2019, 26, 1080–1086. [Google Scholar] [CrossRef]

- Chang, B.H.; Rajput, S.K.O.; Ahmed, P.; Hayat, Z. Does Gold Act as a Hedge or a Safe Haven? Evidence from Pakistan. Pak. Dev. Rev. 2020, 59, 69–80. [Google Scholar] [CrossRef]

- Gargallo, P.; Lample, L.; Miguel, J.A.; Salvador, M. Dynamic Risk Management in European Energy Portfolios: Evolution of the Role of Clean and Carbon Markets. Energy Rep. 2022, 8, 15654–15668. [Google Scholar] [CrossRef]

- Ozdurak, C.; Umut, A.; Ozay, T. The Interaction of Major Crypto-Assets, Clean Energy, and Technology Indices in Diversified Portfolios. Int. J. Energy Econ. Policy 2022, 12, 480–490. [Google Scholar] [CrossRef]

- Elie, B.; Naji, J.; Dutta, A.; Uddin, G.S. Gold and Crude Oil as Safe-Haven Assets for Clean Energy Stock Indices: Blended Copulas Approach. Energy 2019, 178, 544–553. [Google Scholar] [CrossRef]

- Jiang, S.; Li, Y.; Lu, Q.; Wang, S.; Wei, Y. Volatility Communicator or Receiver? Investigating Volatility Spillover Mechanisms among Bitcoin and Other Financial Markets. Res. Int. Bus. Financ. 2022, 59, 101543. [Google Scholar] [CrossRef]

- Sharma, U.; Karmakar, M. Are Gold, USD, and Bitcoin Hedge or Safe Haven against Stock? The Implication for Risk Management. Rev. Financ. Econ. 2023, 41, 43–64. [Google Scholar] [CrossRef]

- Mensi, W.; Maitra, D.; Selmi, R.; Vo, X.V. Extreme Dependencies and Spillovers between Gold and Stock Markets: Evidence from MENA Countries. Financ. Innov. 2023, 9, 47. [Google Scholar] [CrossRef]

- Bahloul, S.; Mroua, M.; Naifar, N. Re-Evaluating the Hedge and Safe-Haven Properties of Islamic Indexes, Gold and Bitcoin: Evidence from DCC–GARCH and Quantile Models. J. Islam. Account. Bus. Res. 2023. [Google Scholar] [CrossRef]

- Yousaf, I.; Plakandaras, V.; Bouri, E.; Gupta, R. Hedge and Safe-Haven Properties of FAANA against Gold, US Treasury, Bitcoin, and US Dollar/CHF during the Pandemic Period. N. Am. J. Econ. Financ. 2023, 64, 101844. [Google Scholar] [CrossRef]

- Tsay, R.S. Analysis of Financial Time Series; Wiley: Hoboken, NJ, USA, 2002. [Google Scholar]

- Jarque, C.M.; Bera, A.K. Efficient Tests for Normality, Homoscedasticity and Serial Independence of Regression Residuals. Econ. Lett. 1980, 6, 255–259. [Google Scholar] [CrossRef]

- Ljung, G.M.; Box, G.E.P. On a Measure of Lack of Fit in Time Series Models. Biometrika 1978, 65, 297–303. [Google Scholar] [CrossRef]

- Inclán, C.; Tiao, G.C. Use of Cumulative Sums of Squares for Retrospective Detection of Changes of Variance. J. Am. Stat. Assoc. 1994, 89, 913–923. [Google Scholar] [CrossRef]

- Breitung, J. The Local Power of Some Unit Root Tests for Panel Data. Adv. Econom. 2000, 15, 161–177. [Google Scholar] [CrossRef]

- Levin, A.; Lin, C.F.; Chu, C.S.J. Unit Root Tests in Panel Data: Asymptotic and Finite-Sample Properties. J. Econ. 2002, 108, 1–24. [Google Scholar] [CrossRef]

- Im, K.S.; Pesaran, M.H.; Shin, Y. Testing for Unit Roots in Heterogeneous Panels. J. Econ. 2003, 115, 53–74. [Google Scholar] [CrossRef]

- Dickey, D.; Fuller, W. Likelihood Ratio Statistics for Autoregressive Time Series with a Unit Root. Econometrica 1981, 49, 1057–1072. [Google Scholar] [CrossRef]

- Phillips, P.C.B.; Perron, P. Testing for a Unit Root in a Time Series Regression. Biometrika 1988, 75, 335–346. [Google Scholar] [CrossRef]

- Choi, I. Unit Root Tests for Panel Data. J. Int. Money Financ. 2001, 20, 249–272. [Google Scholar] [CrossRef]

| Indexes | Definitions | |

|---|---|---|

| WilderHill Clean Energy | ECO | The purpose of this index is to represent the success of clean energy enterprises in the United States. |

| S&P Global Clean Energy | SPGTCLEN | This index, which is part of the S&P 500 and Dow Jones Indexes, measures the performance of global clean energy companies. |

| Nasdaq Clean Edge Green Energy | CEXX | It is an index that tracks the performance of green energy companies listed on the NASDAQ market. |

| Gold | XAU | The international symbol for gold in financial markets is the XAU. Gold is a precious metal that is traded in international troy ounce commodity markets (31.1035 g) and is commonly utilized as a hedge asset and safe haven. |

| Silver | XAG | The chemical symbol XAG is used to represent silver in financial markets and price quotations around the world. Silver’s price, like gold’s, is stated in international commodity markets and is measured per troy ounce (31.1035 g). Silver, like gold, is seen as a safe haven in times of economic uncertainty and financial market instability. |

| Platinum | XPT | The XPT is both the chemical symbol and the symbol used to symbolize platinum in financial markets around the world. Platinum, like gold and silver, is a precious metal that may be utilized in a range of industrial applications. Its price is measured in troy ounces (31.1035 g). |

| Aluminium | MAL3 | Aluminium is a metal that is utilized in a variety of industrial and consumer purposes, but its primary market commercialization happens through futures and options in the primary material markets. |

| Nickel Futures | NICKELc1 | Nickel is a metal that is used in a range of industrial applications, including the production of stainless steel and batteries, and its price is affected by a variety of factors, including industrial demand, supply, and worldwide demand. |

| Copper Futures | HGU3 | Copper futures are traded on commodity exchanges and are denoted by unique symbols, such as “HGU3.” The symbol “HG” stands for copper while “U3” stands for the month and year in which the future contract expires. In this scenario, “U3” could indicate a copper future contract with a maturity date of September 2023, but it is important to double-check the specific maturity date because these contracts have multiple maturities throughout the year. |

| Mean | Std. Dev. | Skewness | Kurtosis | JB | Probability | Observations | |

|---|---|---|---|---|---|---|---|

| CEXX | 0.000818 | 0.025233 | −0.344916 | 6.583154 | 699.0304 | 0.000000 | 1260 |

| ECO | 0.000412 | 0.027667 | −0.303020 | 5.930867 | 470.2566 | 0.000000 | 1260 |

| HGU3 | 0.000242 | 0.014330 | −0.182271 | 4.602964 | 141.8751 | 0.000000 | 1260 |

| MAL3 | 5.46 × 10−5 | 0.013571 | −0.042690 | 5.078401 | 227.1697 | 0.000000 | 1260 |

| MNKC1 | 0.000491 | 0.024283 | 8.135917 | 185.9311 | 1770749. | 0.000000 | 1260 |

| SPGTCLEN | 0.000639 | 0.018158 | −0.439446 | 9.671195 | 2377.058 | 0.000000 | 1260 |

| XAG | 0.000303 | 0.018690 | −0.582112 | 11.71614 | 4059.640 | 0.000000 | 1260 |

| XAU | 0.000351 | 0.009164 | −0.430383 | 6.273462 | 601.4647 | 0.000000 | 1260 |

| XPT | 8.94 × 10−5 | 0.018104 | −0.570660 | 8.079954 | 1423.198 | 0.000000 | 1260 |

| Group Unit Root Test: Summary | ||||

|---|---|---|---|---|

| Method | Statistic | Prob * | Cross- Sections | Obs. |

| Null: Unit root (assumes common unit root process) | ||||

| Levin, Lin & Chu t | −184.570 | 0.0000 | 9 | 11,319 |

| Breitung t-stat | −90.1528 | 0.0000 | 9 | 11,310 |

| Null: Unit root (assumes individual unit root process) | ||||

| Im, Pesaran and Shin W-stat | −118.841 | 0.0000 | 9 | 11,319 |

| ADF—Fisher Chi-square | 2370.52 | 0.0000 | 9 | 11,319 |

| PP—Fisher Chi-square | 2370.52 | 0.0000 | 9 | 11,322 |

| Markets | Test | Stat. | Method | Lags | Break Date | Results |

|---|---|---|---|---|---|---|

| MAL3|HGU3 | Zt | −5.91 *** | Trend | 2 | 25 October 2028 | Shocks |

| MAL3|NICKELc1 | ADF | −5.57 *** | Trend | 2 | 2 November 2018 | Shocks |

| MAL3|XAU | ADF | −5.76 *** | Trend | 2 | 2 November 2018 | Shocks |

| MAL3|XPT | Za | −57.86 *** | Trend | 0 | 24 October 2018 | Shocks |

| MAL3|XAG | ADF | −5.60 *** | Trend | 2 | 2 November 2018 | Shocks |

| MAL3|ECO | Zt | −5.71 *** | Trend | 0 | 2 January 2019 | Shocks |

| MAL3|SPGTCLEN | ADF | −5.59 *** | Trend | 2 | 23 October 2018 | Shocks |

| MAL3|CEXX | Zt | −6.21 *** | Trend | 0 | 2 January 2019 | Shocks |

| HGU3|MAL3 | Zt | −3.97 | Trend | 0 | Non-existent | |

| HGU3|NICKELc1 | Zt | −4.20 | Trend | 0 | Non-existent | |

| HGU3|XAU | ADF | −4.93 * | Trend | 0 | 1 May 2019 | Shocks |

| HGU3|XPT | ADF | −4.27 | Trend | 0 | Non-existent | |

| HGU3|XAG | ADF | −4.94 * | Trend | 0 | 1 May 2019 | Shocks |

| HGU3|ECO | ADF | −5.05 ** | Trend | 0 | 22 May 2019 | Shocks |

| HGU3|SPGTCLEN | ADF | −4.70 | Trend | 0 | Non-existent | |

| HGU3|CEXX | ADF | −4.72 * | Trend | 1 | 2 October 2018 | Shocks |

| NICKELc1|MAL3 | Zt | −3.29 | Trend | 2 | Non-existent | |

| NICKELc1|HGU3 | Za | −19.65 | Trend | 3 | Non-existent | |

| NICKELc1|XAU | Za | −24.67 | Trend | 1 | Non-existent | |

| NICKELc1|XPT | Zt | −3.14 | Trend | 0 | Non-existent | |

| NICKELc1|XAG | Zt | −4.17 | Trend | 0 | Non-existent | |

| NICKELc1|ECO | Zt | −3.48 | Trend | 2 | Non-existent | |

| NICKELc1|SPGTCLEN | Zt | −3.72 | Trend | 2 | Non-existent | |

| NICKELc1|CEXX | Zt | −3.23 | Trend | 2 | Non-existent | |

| XAU|MAL3 | Zt | −5.71 *** | Regime | 2 | 27 June 2019 | Shocks |

| XAU|HGU3 | Zt | −3.47 | Regime | 0 | Non-existent | |

| XAU|NICKELc1 | ADF | −3.36 | Regime | 1 | Non-existent | |

| XAU|XPT | Zt | −3.26 | Regime | 0 | Non-existent | |

| XAU|XAG | Zt | −3.64 | Regime | 5 | Non-existent | |

| XAU|ECO | Zt | −3.49 | Regime | 0 | Non-existent | |

| XAU|SPGTCLEN | Zt | −4.02 | Regime | 0 | Non-existent | |

| XAU|CEXX | Zt | −3.38 | Trend | 1 | Non-existent | |

| XPT|MAL3 | Zt | −4.77 * | Regime | 1 | 22 August 2019 | Shocks |

| XPT|HGU3 | ADF | −4.95 ** | Regime | 3 | 8 August 2019 | Shocks |

| XPT|NICKELc1 | ADF | −3.85 | Regime | 0 | Non-existent | |

| XPT|XAU | Zt | −4.00 | Regime | 0 | Non-existent | |

| XPT|XAU | ADF | −3.78 | Regime | 0 | Non-existent | |

| XPT|ECO | Zt | −4.30 | Regime | 0 | Non-existent | |

| XPT|SPGTCLEN | Zt | −4.42 | Regime | 0 | Non-existent | |

| XPT|CEXX | Zt | −4.29 | Regime | 5 | Non-existent | |

| XAG|MAL3 | Zt | −4.69 | Regime | 1 | Non-existent | |

| XAG|HGU3 | ADF | −4.35 | Regime | 1 | Non-existent | |

| XAG|NICKELc1 | Zt | −4.66 | Regime | 0 | Non-existent | |

| XAG|XAU | ADF | −4.40 | Regime | 5 | Non-existent | |

| XAG|XPT | Zt | −3.77 | Regime | 0 | Non-existent | |

| XAG|ECO | Zt | −4.44 | Regime | 1 | Non-existent | |

| XAG|SPGTCLEN | Zt | −4.47 | Regime | 1 | Non-existent | |

| XAG|CEXX | Zt | −4.39 | Regime | 1 | Non-existent | |

| ECO|MAL3 | Zt | −4.68 | Trend | 0 | Non-existent | |

| ECO|HGU3 | Zt | −4.30 | Trend | 1 | Non-existent | |

| ECO|NICKELc1 | Zt | −3.95 | Trend | 1 | Non-existent | |

| ECO|XAU | Zt | −3.83 | Trend | 1 | Non-existent | |

| ECO|XPT | Zt | −3.66 | Trend | 1 | Non-existent | |

| ECO|XAU | Zt | −4.03 | Trend | 1 | Non-existent | |

| ECO|SPGTCLEN | ADF | −3.41 | Trend | 0 | Non-existent | |

| ECO|CEXX | Zt | −3.65 | Trend | 0 | Non-existent | |

| SPGTCLEN|MAL3 | Zt | −3.76 | Trend | 0 | Non-existent | |

| SPGTCLEN|HGU3 | Zt | −3.67 | Trend | 1 | Non-existent | |

| SPGTCLEN|NICKELc1 | Zt | −3.69 | Trend | 1 | Non-existent | |

| SPGTCLEN|XAU | Zt | −3.83 | Trend | 1 | Non-existent | |

| SPGTCLEN|XPT | Zt | −3.39 | Trend | 1 | Non-existent | |

| SPGTCLEN|XAU | Zt | −3.59 | Trend | 1 | Non-existent | |

| SPGTCLEN|ECO | Zt | −3.82 | Trend | 0 | Non-existent | |

| SPGTCLEN|CEXX | Za | −4.28 | Trend | 2 | Non-existent | |

| CEXX|MAL3 | ADF | −5.01 ** | Trend | 0 | 4 February 2019 | Shocks |

| CEXX|HGU3 | ADF | −5.12 ** | Trend | 0 | 3 October 2019 | Shocks |

| CEXX|NICKELc1 | Zt | −3.97 | Trend | 1 | Non-existent | |

| CEXX|XAU | Zt | −3.95 | Trend | 1 | Non-existent | |

| CEXX|XPT | Zt | −3.93 | Trend | 1 | Non-existent | |

| CEXX|XAU | Zt | −3.89 | Trend | 1 | Non-existent | |

| CEXX|ECO | ADF | −3.93 | Trend | 0 | Non-existent | |

| CEXX|SPGTCLEN | ADF | −3.72 | Trend | 0 | Non-existent |

| Markets | Test | Stat. | Method | Lags | Break Date | Results |

|---|---|---|---|---|---|---|

| MAL3|HGU3 | ADF | −3.84 | Regime | 0 | Non-existent | |

| MAL3|NICKELc1 | Zt | −6.66 *** | Trend | 5 | 2 March 2022 | Shocks |

| MAL3|XAU | Zt | −4.19 | Trend | 5 | Non-existent | |

| MAL3|XPT | Za | −27.73 | Trend | 0 | Non-existent | |

| MAL3|XAG | Zt | −3.78 | Trend | 1 | Non-existent | |

| MAL3|ECO | Zt | −3.58 | Trend | 1 | Non-existent | |

| MAL3|SPGTCLEN | ADF | −3.49 | Trend | 1 | Non-existent | |

| MAL3|CEXX | Zt | −3.51 | Trend | 1 | Non-existent | |

| HGU3|MAL3 | Zt | −4.32 | Regime | 0 | Non-existent | |

| HGU3|NICKELc1 | Zt | −5.61 *** | Trend | 0 | 1 March 2022 | Shocks |

| HGU3|XAU | Zt | −4.77 * | Trend | 0 | 5 February 2021 | Shocks |

| HGU3|XPT | ADF | −5.04 ** | Trend | 0 | 20 June 2022 | Shocks |

| HGU3|XAG | Za | −39.08 | Trend | 0 | Non-existent | |

| HGU3|ECO | Zt | −4.61 | Trend | 0 | Non-existent | |

| HGU3|SPGTCLEN | Zt | −4.63 | Trend | 0 | Non-existent | |

| HGU3|CEXX | Zt | −4.57 | Trend | 1 | Non-existent | |

| NICKELc1|MAL3 | Zt | −8.14 *** | Trend | 0 | 2 March 2022 | Shocks |

| NICKELc1|HGU3 | Za | −7.04 *** | Trend | 0 | 28 February 2022 | Shocks |

| NICKELc1|XAU | Za | −44.38 * | Trend | 0 | 21 January 2022 | Shocks |

| NICKELc1|XPT | Za | −48.32 ** | Trend | 0 | 21 January 2022 | Shocks |

| NICKELc1|XAG | ADF | −5.10 ** | Trend | 0 | 21 January 2022 | Shocks |

| NICKELc1|ECO | Zt | −5.19 ** | Trend | 0 | 21 January 2022 | Shocks |

| NICKELc1|SPGTCLEN | Zt | −5.23 ** | Trend | 0 | 21 January 2022 | Shocks |

| NICKELc1|CEXX | Zt | −5.40 ** | Trend | 0 | 21 January 2022 | Shocks |

| XAU|MAL3 | Zt | −4.04 | Trend | 1 | Non-existent | |

| XAU|HGU3 | Zt | −5.01 ** | Trend | 1 | 5 February 2021 | Shocks |

| XAU|NICKELc1 | Zt | −3.55 | Trend | 0 | Non-existent | |

| XAU|XPT | Zt | −3.56 | Trend | 0 | Non-existent | |

| XAU|XAG | Zt | −4.03 | Trend | 0 | Non-existent | |

| XAU|ECO | Zt | −3.95 | Trend | 1 | Non-existent | |

| XAU|SPGTCLEN | Zt | −3.97 | Trend | 1 | Non-existent | |

| XAU|CEXX | Zt | −4.35 | Trend | 1 | Non-existent | |

| XPT|MAL3 | Zt | −4.36 | Trend | 2 | Non-existent | |

| XPT|HGU3 | Zt | −4.75 * | Trend | 0 | 13 July 2021 | Shocks |

| XPT|NICKELc1 | ADF | −4.15 | Trend | 1 | Non-existent | |

| XPT|XAU | Zt | −4.31 | Trend | 2 | Non-existent | |

| XPT|XAG | ADF | −4.83 | Regime | 2 | 22 December 2020 | Shocks |

| XPT|ECO | Zt | −4.32 | Trend | 0 | Non-existent | |

| XPT|SPGTCLEN | Zt | −3.90 | Regime | 0 | Non-existent | |

| XPT|CEXX | Zt | −4.35 | Trend | 0 | Non-existent | |

| XAG|MAL3 | Zt | −3.61 | Regime | 0 | Non-existent | |

| XAG|HGU3 | ADF | −4.41 | Regime | 0 | Non-existent | |

| XAG|NICKELc1 | Zt | −4.42 | Trend | 0 | Non-existent | |

| XAG|XAU | Zt | −4.28 | Trend | 0 | Non-existent | |

| XAG|XPT | Zt | −4.51 | Trend | 0 | Non-existent | |

| XAG|ECO | Zt | −4.28 | Trend | 0 | Non-existent | |

| XAG|SPGTCLEN | Zt | −4.21 | Trend | 0 | Non-existent | |

| XAG|CEXX | Zt | −4.40 | Trend | 0 | Non-existent | |

| ECO|MAL3 | Zt | −4.21 | Trend | 2 | Non-existent | |

| ECO|HGU3 | Zt | −3.83 | Trend | 2 | Non-existent | |

| ECO|NICKELc1 | Zt | −4.77 * | Regime | 0 | 23 February 2021 | Shocks |

| ECO|XAU | Zt | −4.37 | Trend | 2 | Non-existent | |

| ECO|XPT | Zt | −4.16 | Trend | 2 | Non-existent | |

| ECO|XAG | Zt | −4.61 | Trend | 2 | Non-existent | |

| ECO|SPGTCLEN | Zt | −4.33 | Trend | 4 | Non-existent | |

| ECO|CEXX | Zt | −4.39 | Trend | 0 | Non-existent | |

| SPGTCLEN|MAL3 | Zt | −4.60 | Trend | 2 | Non-existent | |

| SPGTCLEN|HGU3 | Zt | −5.91 *** | Regime | 5 | 25 February 2021 | Shocks |

| SPGTCLEN|NICKELc1 | Zt | −6.20 *** | Regime | 2 | 24 February 2021 | Shocks |

| SPGTCLEN|XAU | Zt | −3.50 | Regime | 1 | Non-existent | |

| SPGTCLEN|XPT | Zt | −4.66 | Regime | 2 | Non-existent | |

| SPGTCLEN|XAG | Zt | −3.64 | Regime | 2 | Non-existent | |

| SPGTCLEN|ECO | Zt | −5.86 *** | Regime | 1 | 11 February 2021 | Shocks |

| SPGTCLEN|CEXX | Za | −41.10 | Regime | 0 | Non-existent | |

| CEXX|MAL3 | Zt | −4.10 | Trend | 3 | Non-existent | |

| CEXX|HGU3 | Zt | −3.94 | Trend | 0 | Non-existent | |

| CEXX|NICKELc1 | Zt | −4.21 | Trend | 0 | Non-existent | |

| CEXX|XAU | Zt | −4.20 | Trend | 0 | Non-existent | |

| CEXX|XPT | Zt | −4.03 | Trend | 0 | Non-existent | |

| CEXX|XAG | Zt | −4.26 | Trend | 0 | Non-existent | |

| CEXX|ECO | Zt | −4.45 | Trend | 0 | Non-existent |

| Market | Tranquil Subperiod | Stress Subperiod | Evolution |

|---|---|---|---|

| SPGTCLEN | 0/8 possibilities | 3/8 possibilities | ↑ |

| CEXX | 2/8 possibilities | 0/8 possibilities | ↓ |

| ECO | 0/8 possibilities | 1/8 possibilities | ↑ |

| XAU | 1/8 possibilities | 1/8 possibilities | = |

| XAG | 0/8 possibilities | 0/8 possibilities | = |

| XPT | 2/8 possibilities | 2/8 possibilities | = |

| MAL3 | 8/8 possibilities | 1/8 possibilities | ↓ |

| NICKELc1 | 0/8 possibilities | 8/8 possibilities | ↑ |

| HGU3 | 4/8 possibilities | 3/8 possibilities | ↓ |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Dias, R.M.; Chambino, M.; Teixeira, N.; Alexandre, P.; Heliodoro, P. Balancing Portfolios with Metals: A Safe Haven for Green Energy Investors? Energies 2023, 16, 7197. https://doi.org/10.3390/en16207197

Dias RM, Chambino M, Teixeira N, Alexandre P, Heliodoro P. Balancing Portfolios with Metals: A Safe Haven for Green Energy Investors? Energies. 2023; 16(20):7197. https://doi.org/10.3390/en16207197

Chicago/Turabian StyleDias, Rui Manuel, Mariana Chambino, Nuno Teixeira, Paulo Alexandre, and Paula Heliodoro. 2023. "Balancing Portfolios with Metals: A Safe Haven for Green Energy Investors?" Energies 16, no. 20: 7197. https://doi.org/10.3390/en16207197

APA StyleDias, R. M., Chambino, M., Teixeira, N., Alexandre, P., & Heliodoro, P. (2023). Balancing Portfolios with Metals: A Safe Haven for Green Energy Investors? Energies, 16(20), 7197. https://doi.org/10.3390/en16207197