Application Prospect, Development Status and Key Technologies of Shared Energy Storage toward Renewable Energy Accommodation Scenario in the Context of China

Abstract

1. Introduction

- The application prospect of SES in the renewable energy accommodation scenario, i.e., the renewable energy that can be accommodated by SES, in China in 2030, is quantitatively analyzed according to the REG planning under the carbon peaking goal and the guarantee mechanism of renewable energy accommodation.

- Combined with the rules of ESSs for the peak-regulation ancillary service and the actual market data of Qinghai province and Gansu province, the latest development status of SES for renewable energy accommodation in China is summarized.

- To counter the existing issues and deficiencies, three key technologies of SES in the renewable energy accommodation scenario are presented, aiming at the further development and promotion of the SES business model.

2. SES Business Model toward Renewable Energy Accommodation Scenario

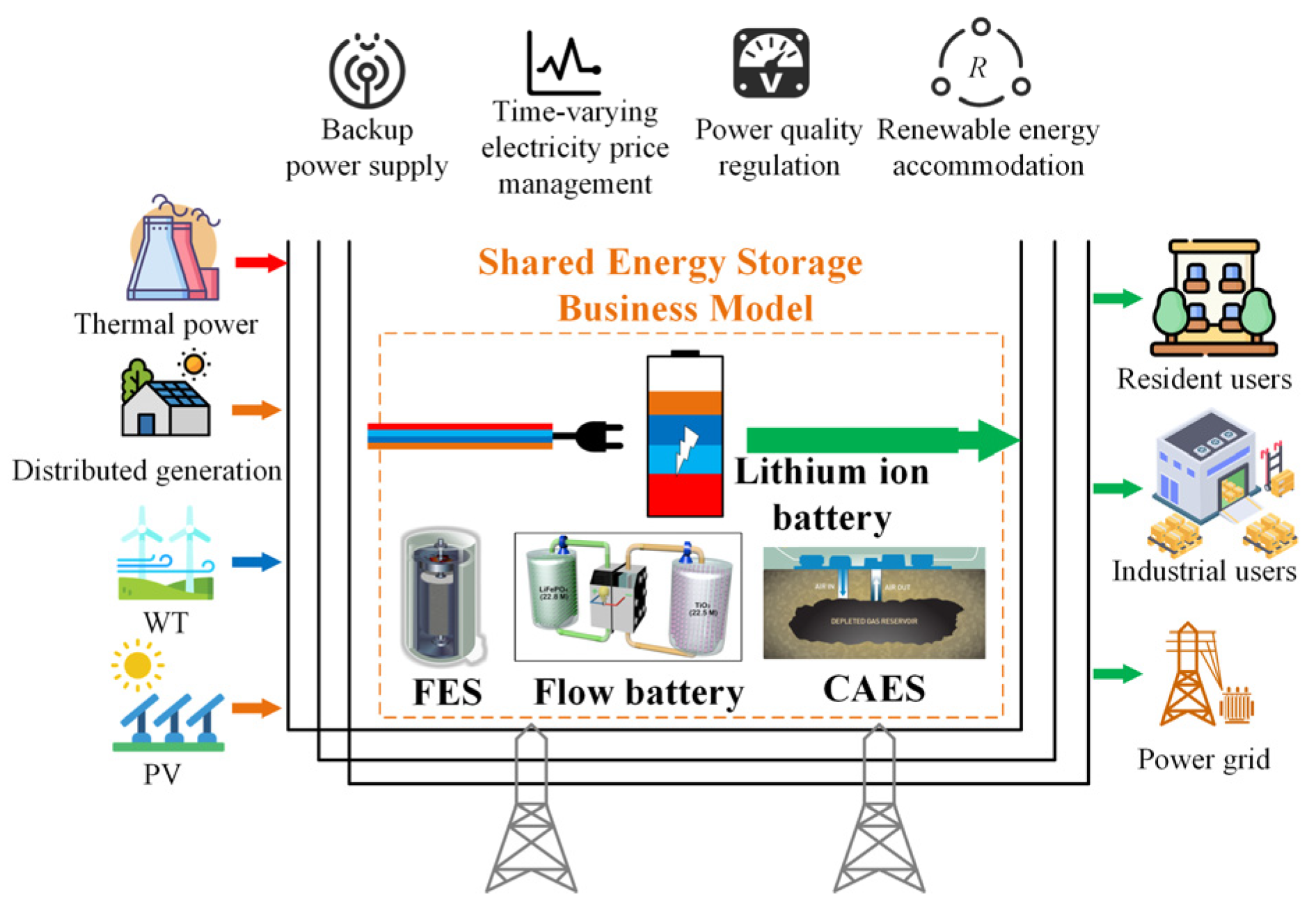

2.1. Energy Storage Business Model under the Concept of Sharing Economy

- The problem of idle energy storage resources is serious. The functional orientation of ESSs in the power system is to provide energy storage services, including emergency power supply, electricity price management, load tracking and power quality regulation [7]. The energy storage services provided by ESSs are generally intermittent. Moreover, the great majority of ESSs only provide energy storage services to a single user, i.e., the owner of the ESS [22]. Therefore, the utilization hours of ESSs are relatively low in most application scenarios. It is difficult for the owners of ESSs to quickly recover the investment cost through self-use energy storage services.

- The potential of the energy storage services market is huge. Currently, REG users, traditional thermal generation (TG) users and power users with distributed generation constitute the core consumer group of the energy storage services market due to the frequent demands for energy storage services. Actually, massive power entities outside the core consumer group also have the demands for energy storage services to improve their electric behaviors. However, for the non-core consumer group, the economy is the main reason that hinders the investment and deployment of ESSs because of the low frequency of use. In this context, the non-core consumer group is eager for a market that can provide a short-term lease of the use rights of energy storage resources. On the other hand, energy storage services have certain heterogeneous characteristics due to the different equipment parameters of energy storage technologies [23]. In some special scenarios, power entities may generate demands for heterogeneous energy storage services that cannot be fully satisfied by their own ESSs. At this time, the above demands will constitute the long-tailed market of energy storage services, which also has great commercial potential.

- An effective business model for energy storage technologies is lacking. The profit channel of energy storage is restricted in the current power systems, which can only bring a very limited return on energy storage investment. Peak-valley electricity price arbitrage is the more mature business model of energy storage [24], but its profit is highly dependent on the difference between the electricity prices at peak time and valley time. With the rapid decline of energy storage costs in recent years and the growth of the installed capacity of REG, many provinces in China have begun to require new grid-connected REG users to deploy a certain proportion of energy storage resources [15]. However, the revenue from the increasing on-grid electricity and the reduced penalty costs cannot fully cover the investment costs of energy storage. Moreover, the investment and construction of large-scale ESSs have become an important measure to stimulate the local economy and create jobs in some cities. Based on this, exploring an effective business model has become the key to the sustainable development of these ESSs.

2.2. Typical Framework and Basic Forms of SES for Renewable Energy Accommodation

- Independent ESSs. Independent ESSs refer to energy storage facilities that are not attached to any grid-connected entities and operate independently. In terms of dispatching, independent ESSs can directly sign the dispatching agreement with the power dispatching agency as an independent entity, rather than be regarded as the auxiliary equipment of REG users and TG users [32]. Currently, the government of China holds a conservative attitude toward the incorporation of independent ESSs into power transmission and distribution assets to prevent the unrestricted investment of power companies. Therefore, independent ESSs cannot obtain stable revenue from the transmission and distribution price, i.e., fixed tariff. In fact, any energy storage service generated by independent ESSs can be considered as being provided to REG users, TG users, power users, power companies or all entities in the power system. In other words, the use rights of independent ESSs are shared with different entities in different periods. Thus, SES is the most common business model for independent ESSs. In many provinces in China, independent ESSs are equivalent to SES. In the renewable energy accommodation scenario, independent ESSs are allowed to sign medium and long-term lease contracts for the energy storage capacity with multiple REG users to share the use rights of energy storage resources. On the other hand, independent ESSs can participate in the peak-regulation ancillary service market as independent entities and realize the sharing of the short-term use rights through centralized bidding (CB), dispatching on demand by power systems (DDPS) and other trading methods [15].

- ESSs attached to REG. There is no doubt that REG will occupy more and more power generation space in the future. However, while undertaking power generation rights and enjoying benefits from traditional TG, REG should also undertake various responsibilities to ensure the overall safe and stable operation of the power system, i.e., provide peak regulation, frequency regulation, voltage regulation and other ancillary services, which are formerly provided by TG [33]. Therefore, in the context of the insufficient regulation capability of power systems, many provinces and cities issue policies to require REG users to be equipped with ESSs. The power capacity of the ESSs ranges from 5% to 25% of the installed capacity of REG users, and the charging duration ranges from one hour to four hours. As we know, the deployment of ESSs can reduce the prediction error and stabilize the output of REG, and renewable energy to be curtailed can be stored to improve the accommodation level [12]. However, there may be no demand for storing the curtailed renewable energy every day for an REG user. In addition, there is also some regularity in the period when wind and solar power curtailment occur, making energy storage resources difficult to be fully utilized and seriously idle. In this circumstance, ESSs attached to REG can lease the short-term use rights of idle energy storage resources to different types of REG users in different regions. Moreover, several REG users can form an alliance to realize the sharing and mutual aid of energy storage resources through long-term agreements [34]. Furthermore, the ESSs attached to REG can also provide the peak-regulation ancillary service as the REG users. In summary, the SES business model will improve the utilization rate of ESSs attached to REG, increase the overall regulation capability of the power system, as well as enable REG users to obtain benefits to reduce the financial pressure caused by the deployment of ESSs.

- Aggregated user-side ESSs. Due to the clear profit channel, user-side ESSs are the earliest development in China. The revenue of user-side ESSs is mainly from peak-valley electricity price arbitrage. The daily usage period of the user-side ESSs in the arbitrage mode is relatively fixed, which means that there are regular idle periods every day to accommodate renewable energy for different REG users [35]. In general, user-side ESSs cannot directly provide the peak-regulation ancillary service due to the smaller installed capacity. Therefore, it is necessary to aggregate several user-side ESSs to meet the access conditions of the peak-regulation ancillary service. Finally, the aggregated user-side ESSs, which can be seen as a virtual power plant, can provide the peak-regulation ancillary service as a whole.

3. Application Prospect of SES in the Renewable Energy Accommodation Scenario under the Carbon Peaking Goal

3.1. Overview of REG in China under the Carbon Peaking Goal

3.2. Analysis of the Application Prospect of SES in China Considering the Guarantee Mechanism of Renewable Energy Accommodation

- For , the difference in the growth rate of the total electricity consumption in different provincial administrative regions is not considered in this work. Based on the total electricity consumption of China in 2021 and the estimated total electricity consumption of China in 2030, can be obtained by enlarging by an equal scale, which can be expressed aswhere denotes the estimated total electricity consumption of China in 2030. According to the data released by GEIDCO, is 10,700 TWh.

- This work does not consider the incremental proportion of wind and solar energy in non-water renewable energy in 2030. can be determined according to the actual proportion in 2021, which can be expressed aswhere , , and denote the wind energy, the solar energy, the biomass energy and the feed-in non-water renewable energy from other regions in the provincial administrative region in 2021, respectively. The above data have been released by the National Energy Administration (NEA) of China.

- Considering the completeness of the data, the data of the peak-regulation ancillary service market in Shaanxi province in 2021 are utilized to calculate , which can be expressed aswhere , and denote the renewable energy accommodated by the deep peak-regulation ancillary service, start-stop peak-regulation ancillary service and cross-province peak-regulation ancillary service in Shaanxi province in 2021, respectively. and denote the wind energy and the solar energy in Shaanxi province in 2021, respectively. Finally, the calculated value of is 0.95%.

- Flexibility reformation of TG units and pumped storage construction are also important means to improve the regulation capability of power systems, which can occupy the shares of accommodating renewable energy [41]. Therefore, it is assumed that is 30%, that is, energy storage resources with the SES business model will accommodate the 30% of incremental wind and solar energy in 2030.

4. Development Status of SES for Renewable Energy Accommodation in China

5. Key Technologies of SES in the Renewable Energy Accommodation Scenario

5.1. Operation Mechanism of Peak-Regulation Ancillary Service Considering Multi-Form SES Participation

5.2. SES Operation Platform Considering Diversified Power Services

5.3. Multi-Time Scale Evaluation Systems of SES Business Model for Requirements of Multiple Entities

6. Conclusions

- To achieve the carbon peaking goal in 2030, the installed capacity and share of REG will maintain the rapid growth trend in China. Constrained by the guarantee mechanism of renewable energy accommodation, all provincial administrative regions need to vigorously develop regulation resources in the power system to accommodate more renewable energy. Thus, the SES business model has a broad application prospect in the renewable energy accommodation scenario. Based on the target RWNWREA of China in 2030 and the energy balance principle, it is conservatively estimated that the total SES scale for renewable energy accommodation is 17.06 GW/34.12 GWh in China.

- In China, AES projects have shown an explosive growth in recent years. Many regions and provincial administrative regions have successively released the rules of ESSs for the peak-regulation ancillary service, laying a policy foundation for SES users to participate in the renewable energy accommodation scenario. By analyzing the actual market data of Qinghai province and Gansu province, it can be seen that SES can effectively improve the regulation capability of the power systems and promote the accommodation of renewable energy. Meanwhile, SES users can also obtain good revenues from the peak-regulation ancillary service, as a reliable profit channel, shortening the cost recovery period.

- To further promote the development and promotion of the SES business model in the renewable energy accommodation scenario, it is necessary to carry out research on key technologies in the operation mechanism of the peak-regulation ancillary service, SES operation platform and evaluation systems of the SES business model. These key technologies will make more energy storage users provide the regulation capability to the power system under the SES business model and improve the allocative efficiency of energy storage resources.

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Liu, S.; Lin, Z.; Jiang, Y.; Zhang, T. Market, Policy, and Technology Requirements for Power Systems Under ‘30–60’ Decarbonization Goal of China. Energy Sustain. Dev. 2022, 70, 339–341. [Google Scholar] [CrossRef]

- Kouveliotis-Lysikatos, I.; Hatziargyriou, N.; Liu, Y.; Wu, F. Towards an Internet-like Power Grid. J. Mod. Power Syst. Clean Energy 2022, 10, 1–11. [Google Scholar] [CrossRef]

- IRENA. Renewable Capacity Statistics 2022; IRENA: Abu Dhabi, United Arab Emirates, 2022; Available online: https://www.irena.org/Publications/2022/Jul/Renewable-Energy-Statistics-2022 (accessed on 25 November 2022).

- Zhang, T.; Liu, S.; Qiu, W.; Lin, Z.; Zhu, L.; Zhao, D.; Qian, M.; Yang, L. KPI-based Real-time Situational Awareness for Power Systems with High Proportion of Renewable Energy Sources. CSEE J. Power Energy Syst. 2022, 8, 1060–1073. [Google Scholar]

- Mao, T.; Zhou, B.; Zhang, X.; Yao, W.; Zhu, Z. Accommodation of Clean Energy: Challenges and Practices in China Southern Region. IEEE Open J. Power Electron. 2020, 1, 198–209. [Google Scholar] [CrossRef]

- Lai, C.S.; Locatelli, G.; Pimm, A.; Wu, X.; Lai, L.L. A Review on Long-term Electrical Power System Modeling with Energy Storage. J. Clean. Prod. 2021, 280, 124298. [Google Scholar] [CrossRef]

- Hossain, E.; Faruque, H.M.R.; Sunny, M.S.H.; Mohammad, N.; Nawar, N. A Comprehensive Review on Energy Storage Systems: Types, Comparison, Current Scenario, Applications, Barriers, and Potential Solutions, Policies, and Future Prospects. Energies 2020, 13, 3651. [Google Scholar] [CrossRef]

- Zhang, Z.; Ding, T.; Zhou, Q.; Sun, Y.; Qu, M.; Zeng, Z.; Ju, Y.; Li, L.; Wang, K.; Chi, F. A Review of Technologies and Applications on Versatile Energy Storage Systems. Renew. Sustain. Energy Rev. 2021, 148, 111263. [Google Scholar] [CrossRef]

- Lombardi, P.; Schwabe, F. Sharing Economy as a New Business Model for Energy Storage Systems. Appl. Energy 2017, 188, 485–496. [Google Scholar] [CrossRef]

- Kalathil, D.; Wu, C.; Poolla, K.; Varaiya, P. The Sharing Economy for the Electricity Storage. IEEE Trans. Smart Grid 2017, 10, 556–567. [Google Scholar] [CrossRef]

- Dai, R.; Esmaeilbeigi, R.; Charkhgard, H. The Utilization of Shared Energy Storage in Energy Systems: A Comprehensive Review. IEEE Tran. Smart Grid 2021, 12, 3163–3174. [Google Scholar] [CrossRef]

- Gao, J.; Wang, Y.; Huang, N.; Wei, L.; Zhang, Z. Optimal Site Selection Study of Wind-photovoltaic-shared Energy Storage Power Stations Based on GIS and Multi-criteria Decision Making: A Two-stage Framework. Renew. Energy 2022, 201, 1139–1162. [Google Scholar] [CrossRef]

- Walker, A.; Kwon, S. Design of Structured Control Policy for Shared Energy Storage in Residential Community: A Stochastic Optimization Approach. Appl. Energy 2021, 298, 117182. [Google Scholar] [CrossRef]

- Wang, Q.; Zhang, X.; Yi, C.; Li, Z.; Xu, D. A Novel Shared Energy Storage Planning Method Considering the Correlation of Renewable Uncertainties on the Supply Side. IEEE Trans. Sustain. Energy 2022, 13, 2051–2063. [Google Scholar] [CrossRef]

- Fang, B.; Qiu, W.; Wang, M.; Zhou, W.; Lin, Z.; Wen, F. Evaluation Index System of Shared Energy Storage Market Towards Renewable Energy Accommodation Scenario: A China’s Qinghai Province Context. Glob. Energy Interconnect. 2022, 5, 77–95. [Google Scholar] [CrossRef]

- Chang, H.C.; Ghaddar, B.; Nathwani, J. Shared Community Energy Storage Allocation and Optimization. Appl. Energy 2022, 318, 119160. [Google Scholar] [CrossRef]

- Elliott, R.T.; Fernandez-Blanco, R.; Kozdras, K.; Kaplan, J.; Lockyear, B.; Zyskowski, J.; Kirschen, D.S. Sharing Energy Storage Between Transmission and Distribution. IEEE Trans. Power Syst. 2018, 34, 152–162. [Google Scholar] [CrossRef]

- Cui, S.; Wang, Y.W.; Liu, X.K.; Wang, Z.; Xiao, J.W. Economic Storage Sharing Framework: Asymmetric Bargaining-based Energy Cooperation. IEEE Trans. Ind. Inform. 2021, 17, 7489–7500. [Google Scholar] [CrossRef]

- Rifkin, J. The Zero Marginal Cost Society: The Internet of Things, the Collaborative Commons, and the Eclipse of Capitalism; St. Martin’s Press: New York, NY, USA, 2014. [Google Scholar]

- Curtis, S.K.; Lehner, M. Defining the Sharing Economy for Sustainability. Sustainability 2019, 11, 567. [Google Scholar] [CrossRef]

- Song, M.; Meng, J.; Lin, G.; Cai, Y.; Gao, C.; Chen, T.; Xu, H. Applications of Shared Economy in Smart Grids: Shared Energy Storage and Transactive Energy. Electr. J. 2022, 35, 107128. [Google Scholar] [CrossRef]

- Walker, A.; Kwon, S. Analysis on Impact of Shared Energy Storage in Residential Community: Individual Versus Shared Energy Storage. Appl. Energy 2021, 282, 116172. [Google Scholar] [CrossRef]

- Tan, K.M.; Babu, T.S.; Ramachandaramurthy, V.K.; Kasinathan, P.; Solanki, S.G.; Raveendran, S.K. Empowering Smart Grid: A Comprehensive Review of Energy Storage Technology and Application with Renewable Energy Integration. J. Energy Storage 2021, 39, 102591. [Google Scholar] [CrossRef]

- Cao, J.; Harrold, D.; Fan, Z.; Morstyn, T.; Healey, D.; Li, K. Deep Reinforcement Learning-based Energy Storage Arbitrage with Accurate Lithium-ion Battery Degradation Model. IEEE Trans. Smart Grid 2020, 11, 4513–4521. [Google Scholar] [CrossRef]

- Liu, J.; Zhang, N.; Kang, C.; Kirschen, D.; Xia, Q. Cloud Energy Storage for Residential and Small Commercial Consumers: A Business Case Study. Appl. Energy 2017, 188, 226–236. [Google Scholar] [CrossRef]

- Ma, J.; Summers, K.; Wen, F. Joint Energy and Reserve Market Design with Explicit Consideration on Frequency Quality. Energy Convers. Econ. 2021, 2, 25–34. [Google Scholar] [CrossRef]

- Zhang, S.; Andrews-Speed, P.; Li, S. To What Extent will China’s Ongoing Electricity Market Reforms Assist the Integration of Renewable Energy? Energy Policy 2018, 114, 165–172. [Google Scholar] [CrossRef]

- Ma, H.; Yan, Z.; Li, M.; Han, D.; Han, X.; Song, Y.; Wei, P.; Li, G.; Liu, Y. Benefit Evaluation of the Deep Peak-regulation Market in the Northeast China Grid. CSEE J. Power Energy Syst. 2019, 5, 533–544. [Google Scholar]

- Yin, S.; Zhang, S.; Andrews-Speed, P.; Li, W. Economic and Environmental Effects of Peak Regulation Using Coal-fired Power for the Priority Dispatch of Wind Power in China. J. Clean. Prod. 2017, 162, 361–370. [Google Scholar] [CrossRef]

- Michaelides, E.E. Transition to Renewable Energy for Communities: Energy Storage Requirements and Dissipation. Energies 2022, 15, 5896. [Google Scholar] [CrossRef]

- Mediwaththe, C.P.; Shaw, M.; Halgamuge, S.; Smith, D.B.; Scott, P. An Incentive-compatible Energy Trading Framework for Neighborhood Area Networks with Shared Energy Storage. IEEE Trans. Sustain. Energy 2019, 11, 467–476. [Google Scholar] [CrossRef]

- Peña, A.A.; Romero-Quete, D.; Cortes, C.A. Sizing and Siting of Battery Energy Storage Systems: A Colombian Case. J. Mod. Power Syst. Clean Energy 2022, 10, 700–709. [Google Scholar] [CrossRef]

- Zhang, C.; Liu, L.; Cheng, H.; Liu, D.; Zhang, J.; Li, G. Frequency-constrained Co-planning of Generation and Energy Storage with High-penetration Renewable Energy. J. Mod. Power Syst. Clean Energy 2021, 9, 760–775. [Google Scholar] [CrossRef]

- Zhang, T.; Qiu, W.; Zhang, Z.; Lin, Z.; Ding, Y.; Wang, Y.; Wang, L.; Yang, L. Optimal Bidding Strategy and Profit Allocation Method for Shared Energy Storage-assisted VPP in Joint Energy and Regulation Markets. Appl. Energy 2023, 329, 120158. [Google Scholar] [CrossRef]

- Qiu, W.; Zhou, T.; Yu, S.; Ma, J.; Zhang, T.; Liu, S.; Lin, Z. Decentralized Trading Mechanism of Shared Energy Storage in a Residential Community Considering Preference of Trading Subjects. Energy Rep. 2022, 8, 474–484. [Google Scholar] [CrossRef]

- Gao, T.; Jin, P.; Song, D.; Chen, B. Tracking the Carbon Footprint of China’s Coal-fired Power System. Resour. Conserv. Recycl. 2022, 177, 105964. [Google Scholar] [CrossRef]

- Liu, B.; Zhu, B.; Guan, Z.; Mao, C.; Wang, D. Energy Router Interconnection System: A solution for New Distribution Network Architecture Toward Future Carbon Neutrality. Energy Convers. Econ. 2022, 3, 181–200. [Google Scholar] [CrossRef]

- IEA. Global Energy Review: CO2 Emissions in 2021; IEA: Paris, France, 2022. Available online: https://www.iea.org/reports/global-energy-review-co2-emissions-in-2021-2 (accessed on 25 November 2022).

- Li, D.; Cheng, X.; Ge, L.; Huang, W.; He, J.; He, Z. Multiple Power Supply Capacity Planning Research for New Power System Based on Situation Awareness. Energies 2022, 15, 3298. [Google Scholar] [CrossRef]

- Fan, J.L.; Wang, J.X.; Hu, J.W.; Yang, Y.; Wang, Y. Will China Achieve its Renewable Portfolio Standard Targets? An Analysis from the Perspective of Supply and Demand. Renew. Sustain. Energy Rev. 2021, 138, 110510. [Google Scholar] [CrossRef]

- Alizadeh, M.I.; Moghaddam, M.P.; Amjady, N.; Siano, P.; Sheikh-El-Eslami, M.K. Flexibility in Future Power Systems with High Renewable Penetration: A Review. Renew. Sustain. Energy Rev. 2016, 57, 1186–1193. [Google Scholar] [CrossRef]

- Kong, Y.; Kong, Z.; Liu, Z.; Wei, C.; Zhang, J.; An, G. Pumped Storage Power Stations in China: The Past, the Present, and the Future. Renew. Sustain. Energy Rev. 2017, 71, 720–731. [Google Scholar] [CrossRef]

- Qiu, W.; Chen, C.; Zhang, Z.; Wang, Y.; Wang, L.; Lin, Z.; Yang, L. Pricing Model of Reactive Power Services of Shared Energy Storage Considering Baseline Power for Renewable Energy Accommodation. Energy Rep. 2022, 8, 427–436. [Google Scholar] [CrossRef]

- Sakti, A.; Botterud, A.; O’Sullivan, F. Review of Wholesale Markets and Regulations for Advanced Energy Storage Services in the United States: Current Status and Path Forward. Energy Policy 2018, 120, 569–579. [Google Scholar] [CrossRef]

- Yang, J.; Dong, Z.Y.; Wen, F.; Chen, Q.; Liang, B. Spot Electricity Market Design for a Power System Characterized by High Penetration of Renewable Energy Generation. Energy Convers. Econ. 2021, 2, 67–78. [Google Scholar] [CrossRef]

- Wang, Y.; Qiu, W.; Dong, L.; Zhou, W.; Pei, Y.; Yang, L.; Nian, H.; Lin, Z. Proxy Signature-based Management Model of Sharing Energy Storage in Blockchain Environment. Appl. Sci. 2020, 10, 7502. [Google Scholar] [CrossRef]

- Qiu, W.; Jiang, X.; Lin, Z.; Li, L.; Pei, Y.; Tao, Y. A Contract-based, Decentralized, and Privacy-Preserving Computation Scheme of Evaluation Indices of Shared Energy Storage Market for Renewable Energy Accommodation. IEEE Trans. Ind. Appl. 2022, 1–17. [Google Scholar] [CrossRef]

| Northeast China 1 | Qinghai 1 | Gansu 1 | Fujian 1 | Southern Region 2 | |

|---|---|---|---|---|---|

| Access Conditions | ≥10 MW/40 MWh | ≥10 MW/20 MWh | ≥10 MW/40 MWh | ≥10 MW/40 MWh | ≥5 MW/5 MWh |

| ESS type | Independent ESSs; ESSs attached to REG; ESSs attached to TG; User-side ESSs | Independent ESSs | Independent ESSs; ESSs attached to REG; ESSs attached to TG | Independent ESSs | Independent ESSs |

| Trading Methods | BN; DDPS | BN; CB; DDPS | DDPS | DDPS | DDPS |

| Pricing Mechanism | BN: Negotiated decision with a price ceiling of 200 CNY/MWh and a price floor of 100 CNY/MWh. DDPS: Fixed price, i.e., 150 CNY/MWh | BN: Negotiated decision CB: ESSs and REG users declare the price. The BCB settlement price is equal to the average price of the matched ESS and REG user. DDPS: Fixed price; 700 CNY/MWh | DDPS: ESSs declare the charging price with a price ceiling of 500 (300) CNY/MWh when the spot market is running (stopping). The settlement price is the marginal clearing price. | DDPS: Settlement price is equal to the average clearing price of the deep peak regulation of TG | DDPS: Fixed price for different provinces (CNY/MWh) Guangdong: 792 Guangxi: 396 Yunnan: 662.4 Guizhou: 684 Hainan: 595.2 |

| Settlement Revenue | charging electricity of BN × BN price + charging electricity of DDPS × DDPS price | discharging electricity of BN × BN price + discharging electricity of BCB × BCB settlement price + discharging electricity of DDPS × fixed price | charging electricity × settlement price | charging electricity × settlement price | (charging electricity × fixed price) for different provinces |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Qiu, W.; Zhou, S.; Yang, Y.; Lv, X.; Lv, T.; Chen, Y.; Huang, Y.; Zhang, K.; Yu, H.; Wang, Y.; et al. Application Prospect, Development Status and Key Technologies of Shared Energy Storage toward Renewable Energy Accommodation Scenario in the Context of China. Energies 2023, 16, 731. https://doi.org/10.3390/en16020731

Qiu W, Zhou S, Yang Y, Lv X, Lv T, Chen Y, Huang Y, Zhang K, Yu H, Wang Y, et al. Application Prospect, Development Status and Key Technologies of Shared Energy Storage toward Renewable Energy Accommodation Scenario in the Context of China. Energies. 2023; 16(2):731. https://doi.org/10.3390/en16020731

Chicago/Turabian StyleQiu, Weiqiang, Sheng Zhou, Yang Yang, Xiaoying Lv, Ting Lv, Yuge Chen, Ying Huang, Kunming Zhang, Hongfei Yu, Yunchu Wang, and et al. 2023. "Application Prospect, Development Status and Key Technologies of Shared Energy Storage toward Renewable Energy Accommodation Scenario in the Context of China" Energies 16, no. 2: 731. https://doi.org/10.3390/en16020731

APA StyleQiu, W., Zhou, S., Yang, Y., Lv, X., Lv, T., Chen, Y., Huang, Y., Zhang, K., Yu, H., Wang, Y., Ma, Y., & Lin, Z. (2023). Application Prospect, Development Status and Key Technologies of Shared Energy Storage toward Renewable Energy Accommodation Scenario in the Context of China. Energies, 16(2), 731. https://doi.org/10.3390/en16020731