Impact of the New Electricity Remuneration Scheme on the Waste-to-Energy Recovery Activity in Portugal

Abstract

:1. Introduction

2. Waste-to-Energy Activity

3. Technical and Economic Framework

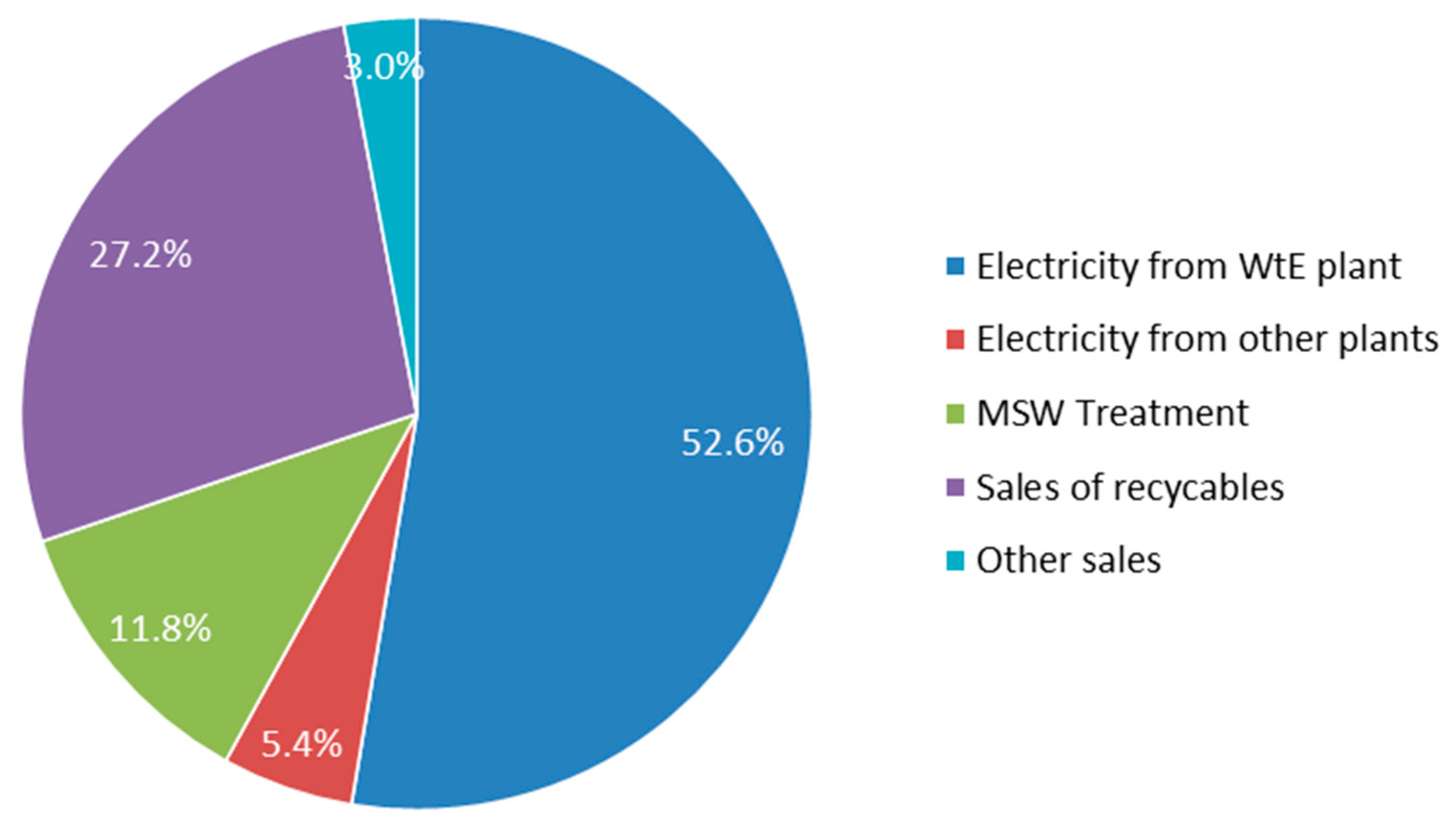

3.1. Valorsul’s WtE Plant

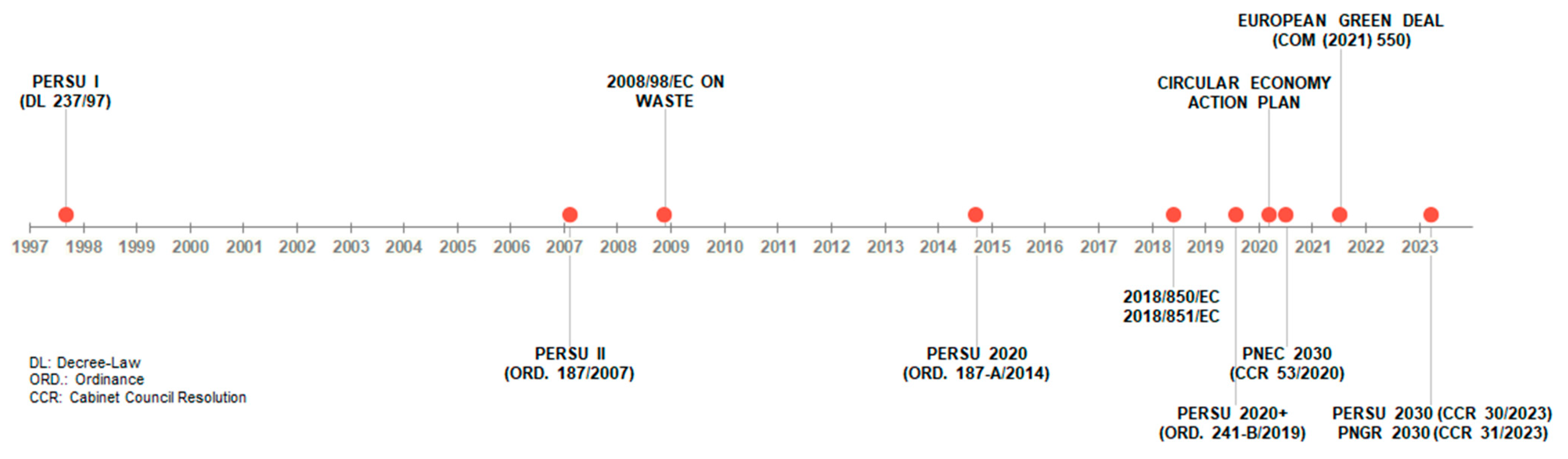

3.2. Regulatory Framework for Electricity and Waste

3.2.1. Regulatory Framework for Electricity

3.2.2. Regulatory Framework for Waste

4. Methodology

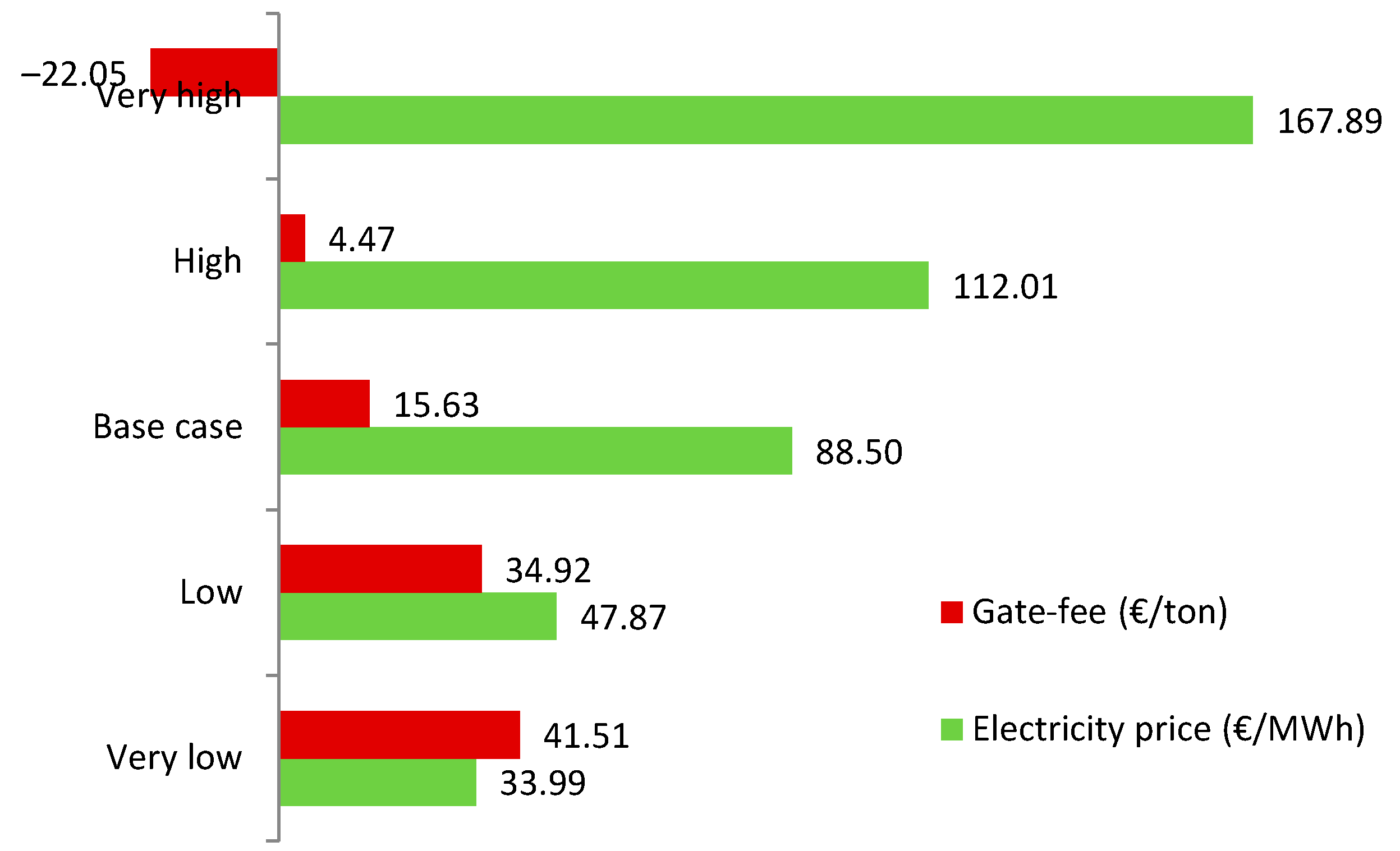

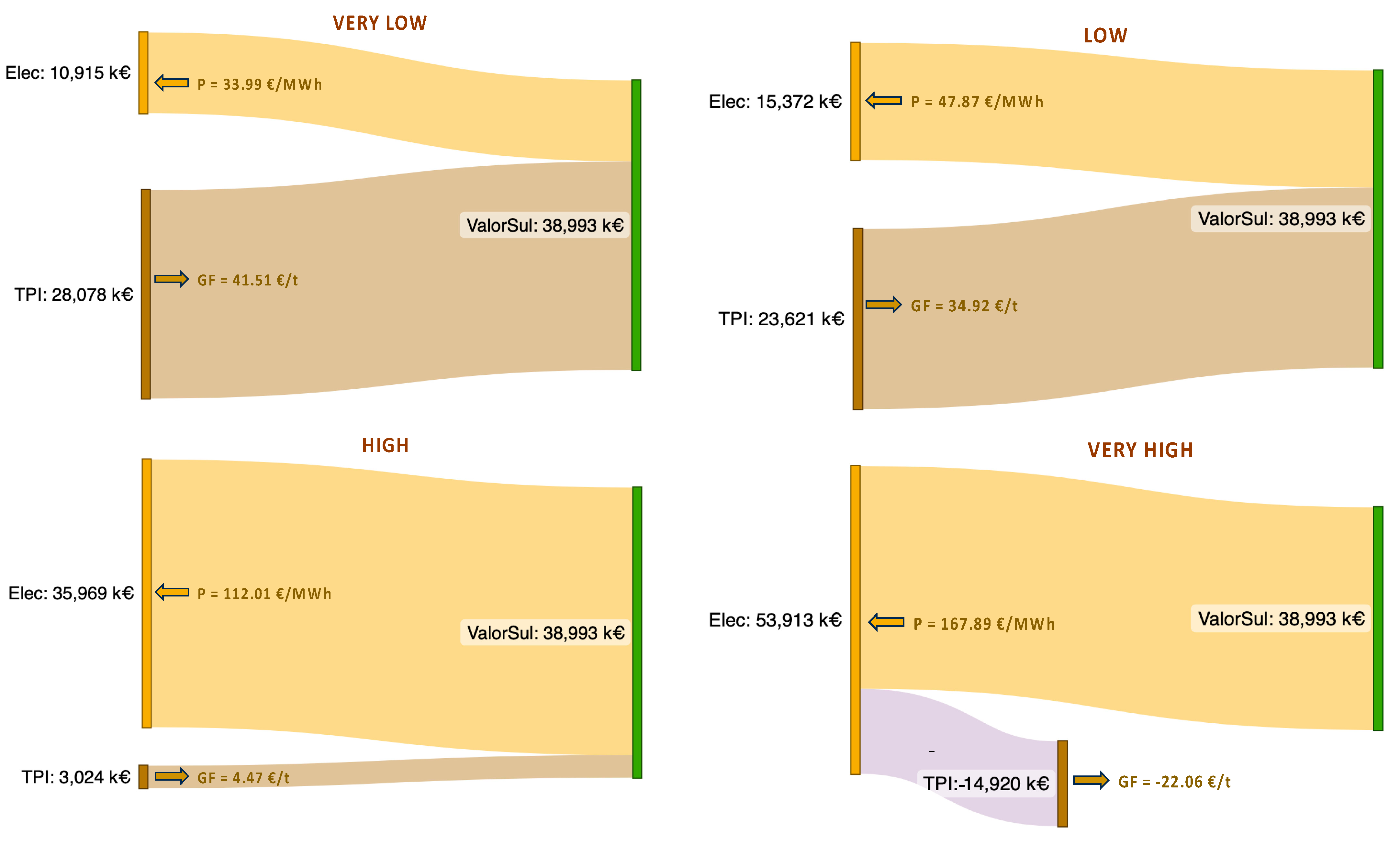

- Base case scenario: The regulated electricity price considered by ERSAR in the calculation for 2019, of 88.5 €/MWh, which corresponds to the previous remuneration model.

- Very Low Scenario: The average electricity market price in 2020, of 33.99 €/MWh. This is the lowest electricity price in the period 2019–2022.

- Low Scenario: The average electricity market price in 2019, of 47.87 €/MWh. This is the second-lowest electricity price in the period 2019–2022.

- High Scenario: Average electricity market price in 2021, of 112.01 €/MWh. This is the second-highest electricity price in the period 2019–2022.

- Very High Scenario: Average electricity market price in 2022, of 167.89 €/MWh. This is the highest electricity price in the period 2019–2022.

5. Results

6. Discussion

7. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- European Commission. ‘Fit for 55’: Delivering the EU’s 2030 Climate Target on the Way to Climate Neutrality (Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions No. 550); European Commission: Brussels, Belgium, 2021. [Google Scholar]

- European Commission. A New Circular Economy Action Plan. For a Cleaner and More Competitive Europe (Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions No. 98); European Commission: Brussels, Belgium, 2020. [Google Scholar]

- European Commission. Directive 2008/98/EC of the European Parliament and of the Council of 19 November 2008 on Waste and Repealing Certain Directives; European Commission: Brussels, Belgium, 2008. [Google Scholar]

- European Commission. Directive 2018/851/EC of the European Parliament and of the Council of 30 May 2018 Amending Directive 2008/98/EC on Waste; European Commission: Brussels, Belgium, 2018. [Google Scholar]

- European Commission. Directive 2018/850/EC of the European Parliament and of the Council of 30 May 2018 Amending Directive 1999/31/EC on the Landfill of Waste; European Commission: Brussels, Belgium, 2018. [Google Scholar]

- Chioatto, E.; Sospiro, P. Transition from waste management to circular economy: The European Union roadmap. Environ. Dev. Sustain. 2023, 25, 249–276. [Google Scholar] [CrossRef]

- Presidência de Conselho de Ministros. Cabinet Council Resolution No. 53/2020 of 10 July 2020. Plano Nacional Energia e Clima 2030 (PNEC 2030); Presidência de Conselho de Ministros: Lisbon, Portugal, 2020. [Google Scholar]

- Ministério do Ambiente. Decree-Law No. 239/97, of 9 September 1997; Ministério do Ambiente: Lisbon, Portugal, 1997. [Google Scholar]

- Ministério do Ambiente, do Ordenamento do Território e do Desenvolvimento Regional. Ordinance No. 187/2007 of 12 February 2007; Ministério do Ambiente, do Ordenamento do Território e do Desenvolvimento Regional: Lisbon, Portugal, 2007. [Google Scholar]

- Ministério do Ambiente, Ordenamento do Território e Energia. Ordinance No. 187-A/2014 of 17 September 2014; Ministério do Ambiente, Ordenamento do Território e Energia: Lisbon, Portugal, 2014. [Google Scholar]

- Ministério do Ambiente e Transição Energética. Ordinance No. 241-B/2019, of 31 July 2020; Ministério do Ambiente e Transição Energética: Lisbon, Portugal, 2020. [Google Scholar]

- Presidência de Conselho de Ministros. Cabinet Council Resolution No. 11-C/2015 of 16 March 2015. Plano Nacional de Gestão de Resíduos (PNGR); Presidência de Conselho de Ministros: Lisbon, Portugal, 2015. [Google Scholar]

- Agência Portuguesa do Ambiente. Plano Estratégico para os Resíduos Urbanos. 2030. Available online: https://participa.pt/pt/consulta/persu-2030 (accessed on 15 February 2023).

- Presidência do Conselho de Ministros. Cabinet Council Resolution No. 31/2023; Presidência do Conselho de Ministros: Lisbon, Portugal, 2023. [Google Scholar]

- Presidência de Conselho de Ministros. Cabinet Council Resolution No. 30/2023; Presidência do Conselho de Ministros: Lisbon, Portugal, 2023. [Google Scholar]

- European Commission. The Role of Waste-to-Energy in the Circular Economy. (Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions No. 34); European Commission: Brussels, Belgium, 2017. [Google Scholar]

- Ministério do Ambiente e Ação Climática. Ordinance No. 244/2020 of 15 October 2020; Ministério do Ambiente e Ação Climática: Lisbon, Portugal, 2017. [Google Scholar]

- Valorsul, Relatório e Contas. 2019. Available online: http://www.valorsul.pt/pt/seccao/a-valorsul/planos-e-relatorios/ (accessed on 15 February 2023).

- ERSAR, Entidade Reguladora dos Serviços de Águas e Resíduos. Decisão Sobre os Proveitos Permitidos e Tarifas Reguladas para o Período Regulatório 2019–2021. Available online: https://www.ersar.pt/pt/o-que-fazemos/decisoes-e-pareceres/fixacao-de-tarifas (accessed on 15 February 2023).

- Brunner, P.H.; Rechberger, H. Waste to energy—Key element for sustainable waste management. Waste Manag. 2014, 37, 3–12. [Google Scholar] [CrossRef] [PubMed]

- US Department of Energy. Waste-to-Energy from Municipal Solid Wastes. Available online: https://www.energy.gov/eere/bioenergy/articles/waste-energy-municipal-solid-wastes-report (accessed on 15 February 2023).

- Scarlat, N.; Fahl, F.; Dallemand, J.F. Status and Opportunities for Energy Recovery from Municipal Solid Waste in Europe. Waste Biomass Valori 2019, 10, 2425–2444. [Google Scholar] [CrossRef]

- World Energy Council. World Energy Resources: Waste to Energy. 2016. Available online: https://www.worldenergy.org/assets/images/imported/2016/10/World-Energy-Resources-Full-report-2016.10.03.pdf (accessed on 15 January 2023).

- Hicks, M.; Rawlinson, S. Cost Model: Energy from Waste. Building Magazine. Available online: https://www.building.co.uk/cost-model-energy-from-waste/3162156.article (accessed on 11 December 2022).

- Paul, T.; Soren, N. An overview of municipal solid waste-to-energy application in Indian scenario. Environ. Dev. Sustain. 2018, 22, 575–592. [Google Scholar] [CrossRef]

- Zhang, X.; Liu, C.; Chen, Y.; Zheng, G.; Chen, Y. Source separation, transportation, pretreatment, and valorization of municipal solid waste: A critical review. Environ. Dev. Sustain. 2021, 24, 11471–11513. [Google Scholar] [CrossRef] [PubMed]

- CEWEP, Confederation of European Waste-to-Energy Plants. Landfill Taxes and Restrictions—Overview. Available online: https://www.cewep.eu/wp-content/uploads/2021/10/Landfill-taxes-and-restrictions-overview.pdf (accessed on 15 February 2023).

- Zhang, D.; Huang, G.; Xu, Y.; Gong, Q. Waste-to-Energy in China: Key Challenges and Opportunities. Energies 2015, 8, 14182–14196. [Google Scholar] [CrossRef]

- Aziz, S.A.; Astrini, N.; Rianawati, E.; Halog, A.; Al Irsyad, M.I. Challenges in Adopting Successful Waste-to-Energy Policies in EU Countries: Indonesia study case. In Proceedings of the 2022 IEEE Electrical Power and Energy Conference (EPEC), Victoria, BC, Canada, 5–7 December 2022; pp. 278–283. [Google Scholar]

- Malav, L.C.; Yadav, K.K.; Gupta, N.; Kumar, S.; Sharma, G.K.; Krishnan, S.; Rezania, S.; Kamyab, H.; Pham, Q.B.; Yadav, S.; et al. A review on municipal solid waste as a renewable source for waste-to-energy project in India: Current practices, challenges, and future opportunities. J. Clean. Prod. 2020, 277, 123227. [Google Scholar] [CrossRef]

- Mukherjee, C.; Denney, J.; Mbonimpa, E.G.; Slagley, J.; Bhowmik, R. A review on municipal solid waste-to-energy trends in the USA. Renew. Sustain. Energy Rev. 2020, 119, 109512. [Google Scholar] [CrossRef]

- Ramos, A.; Afonso Teixeira, C.; Rouboa, A. Environmental Analysis of Waste-to-Energy—A Portuguese Case Study. Energies 2018, 11, 548. [Google Scholar] [CrossRef]

- Entidade Reguladora dos Serviços de Águas e Resíduos. Revisão do Regulamento Tarifário do Serviço de Gestão de Resíduos Urbanos. Available online: https://www.ersar.pt/pt/site-o-que-fazemos/site-consultas-publicas/documents/rtr.pdf (accessed on 15 February 2023).

- Ministério da Economia e Inovação. Decree-Law No. 225/2007, of 31 May 2007; Ministério da Economia e Inovação: Lisbon, Portugal, 2007. [Google Scholar]

| Treatment of Waste Resulting from Undifferentiated Collection (UC) | |||

|---|---|---|---|

| 1 | Capital costs (k€) | 10,307 | |

| 2 | Operating costs associated with the activity (k€) | 20,412 | |

| 3 | Additional revenues (k€) | 31,784 | |

| 4 | Electricity price (€/MWh) | 88.5 | |

| 5 | Electricity generated by the WtE (GWh) | 321.12 | |

| 6 | Total electricity revenues from WtE (k€) | 28,419 | |

| 7 | Other revenues (k€) | 3365 | |

| 8 | Benefits of complementary activities (k€) | 1900 | |

| 9 | Permitted Income UC (k€) | −2965 | |

| Selective Collection (SC) | |||

| 10 | Capital costs (k€) | 738 | |

| 11 | Operating costs associated with the activity (k€) | 9800 | |

| 12 | Additional revenues (k€) | 0 | |

| 13 | Benefits of complementary activities (k€) | 0 | |

| 14 | Permitted Income SC (k€) | 10,538 | |

| Treatment of Waste Resulting from Selective Collection (ST) | |||

| 15 | Capital costs (k€) | 1857 | |

| 16 | Operating costs associated with the activity (k€) | 8369 | |

| 17 | Additional revenues (k€) | 15,463 | |

| 18 | Benefits of complementary activities (k€) | 0 | |

| 19 | Permitted Income ST (k€) | −5237 | |

| 20 | Permitted Income UC (k€) | -2965 | |

| 21 | Permitted Income SC (k€) | 10,538 | |

| 22 | Permitted Income ST (k€) | −5237 | |

| 23 | Operating costs associated with the structure (k€) | 1701 | |

| 24 | Adjustments (k€) | 2037 | |

| 25 | Incentives (k€) | 0 | |

| 26 | Use of regulatory balance (k€) | −4500 | |

| 27 | Total permitted income (k€) | 10,574 | |

| 28 | Total permitted income excluding electricity revenues (k€) | 38,993 | |

| 29 | Amount of undifferentiated waste (ton) | 676,438 | |

| 30 | Gate-fee (€/ton) | 15.63 | |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Silva, M.; Lagarto, J.; Sousa, J.; Mil-Homens, F.; Viveiros, C.; Barata, F. Impact of the New Electricity Remuneration Scheme on the Waste-to-Energy Recovery Activity in Portugal. Energies 2023, 16, 6624. https://doi.org/10.3390/en16186624

Silva M, Lagarto J, Sousa J, Mil-Homens F, Viveiros C, Barata F. Impact of the New Electricity Remuneration Scheme on the Waste-to-Energy Recovery Activity in Portugal. Energies. 2023; 16(18):6624. https://doi.org/10.3390/en16186624

Chicago/Turabian StyleSilva, Mário, João Lagarto, Jorge Sousa, Feliz Mil-Homens, Carla Viveiros, and Filipe Barata. 2023. "Impact of the New Electricity Remuneration Scheme on the Waste-to-Energy Recovery Activity in Portugal" Energies 16, no. 18: 6624. https://doi.org/10.3390/en16186624

APA StyleSilva, M., Lagarto, J., Sousa, J., Mil-Homens, F., Viveiros, C., & Barata, F. (2023). Impact of the New Electricity Remuneration Scheme on the Waste-to-Energy Recovery Activity in Portugal. Energies, 16(18), 6624. https://doi.org/10.3390/en16186624