Abstract

Based on the spillover index and an improved spillover asymmetric measure method, this paper studies the volatility spillover and its asymmetric effect between crude oil and agricultural commodity futures in pre- and post-outbreak of COVID-19. We find that the total volatility spillover is higher with pre-outbreak of COVID-19. In addition, the volatility spillover caused by China’s crude oil is more prominent than international crude oil around the COVID-19, which highlights the necessity of risk control through the establishment of an energy financial market in China. Finally, although the asymmetric effect of volatility spillover has always existed, crude oil was less impacted by good news post-outbreak of COVID-19, indicating that the outbreak of COVID-19 makes assets dominated by commodity attributes more sensitive to bad news. These findings are beneficial for investors to establish a cross-sector risk hedging portfolio, and provide empirical evidence for policymakers to ensure energy and food security.

1. Introduction

If crude oil is the blood of industry—it has provided vital power for economic growth for hundreds of years—then agricultural products have provided essential power for the development of human society for thousands of years. These two goods play a strategic role in economic security and social stability and have attracted extensive attention in the field of academia [1]. As typical commodities in the financial market, crude oil and agricultural commodity futures not only have commodity attributes but also financial attributes. Commodity attributes refer to assets as physical objects, which can be reflected by the structure of supply and demand. Financial attributes refer to the functions of commodities to provide their holders with hedge, portfolio, and capital financing. They determine the price and volatility of assets jointly. Meanwhile, volatility means risk, and the volatility spillover between different assets in the financial market represents its risk connectedness. For most assets, their commodity attributes and financial attributes are stable over a period of time, so the risk connectedness between different assets is mainly affected by external shocks.

It must be noted that economic slowdown and undesirable events (e.g., the food price crisis in 2005, the global financial crisis in 2008–2009, the European debt crisis in 2010, the oil price crisis in 2014, and the COVID-19 pandemic crisis in 2020–2021) are the central external shocks which will change the risk connectedness between different assets. For crude oil, under the impact of those undesirable events, the uncertainty of oil prices is no longer accidental but caused by the extremely low elasticity of crude oil supply [2]. Because economic growth is highly dependent on crude oil in China and the production of domestic petrochemical companies is insufficient, the external dependence on crude oil remains high [3]. This is one of the vital reasons for the increased risks in China’s financial market caused by the shock of international crude oil prices, which further affects energy and economic security. To counter the risk transfer caused by the uncertainty of international crude oil prices on the financial market, China has tried to establish and improve its crude oil futures and energy financial market [4,5] (Shanghai International Energy Exchange. http://www.ine.cn/en/, accessed on 30 July 2021).

For agricultural commodities, as the foundation of human survival and economic growth, their price stability and risk control are undoubtedly essential issues related to national well-being. China became the largest importer of agricultural products in 2011. With the increasing dependence of agricultural products on foreign countries, issues such as food security and seed security have gradually become prominent. This is because the shock of international crude oil prices can affect the agricultural commodity market through the following mechanisms: Firstly, increases in crude oil prices will inevitably push up the prices of fuel oil and chemical fertilizers, which will increase the transportation and production costs of agricultural products, leading to growth in their prices and risk [6]. Secondly, the uncertainty of crude oil prices is bound to lead to an increase in demand for biomass energy, which will increase the price of agricultural products such as corn and soybean and lead to an increase in risk in the financial market [7,8].

In addition, since the outbreak of COVID-19, people have been facing a survival crisis, which has caused a transformation in people’s attitudes towards the financial market. It is unclear how this undesirable event will affect oil and agricultural commodities [9,10]. Although some studies have discussed the impact of the COVID-19 pandemic [11,12,13], there are still many questions to be answered. For example, what is the impact of the COVID-19 pandemic crisis on the volatility spillover between crude oil and agricultural commodities futures at the high-frequency data level? Will the asymmetric effect of volatility spillover between crude oil and agricultural commodities futures change due to the shock of the COVID-19 pandemic crisis? Consequently, the purpose of this paper is to explore the risk connectedness between crude oil and agricultural commodity futures in China before and after the COVID-19 pandemic and to explore whether there is an asymmetric effect on risk connectedness to capture the possible correlation between energy and food security.

This paper is organized as follows: the literature review is presented in Section 2, the methodology is shown in Section 3, Section 4 shows the data and preliminary analysis, Section 5 includes the empirical results and discussion, and the conclusions and policy implications are provided in Section 6.

2. Literature Review

In general, research on the connectedness in returns and volatility between crude oil and agricultural products is aplenty, and although the empirical results are mixed, it is undeniable that undesirable events will change the connectedness in returns and volatility between them. It has become a hot topic whereby researchers pay attention to the impact of undesirable events on the volatility spillover between crude oil and agricultural futures.

Some researchers believe that there is a volatility spillover between crude oil and agricultural futures and that undesirable events will affect the volatility spillover effect. Ref. [14] employed a semiparametric GARCH method to study the volatility links between crude oil, ethanol, and sugar in Brazil’s financial market after the European debt crisis. The study found that there was a significant volatility spillover between crude oil and agricultural commodities. Ref. [8] studied the relationship between the crude oil market and the agricultural market before and after the global financial crisis based on the EGARCH model and believed that the application of biomass fuels supported the volatility spillover between crude oil and agricultural commodity futures. Their study also found evidence that global financial crises increase volatility spillover. Ref. [15] also investigated the volatility transmission between crude oil and agricultural commodity prices before and after the food price crisis and found that the volatility transmission between them was weak; however after the outbreak of this crisis, the volatility of the crude oil market spread to the agricultural market. Ref. [3] not only discuss the impact of international crude oil price shocks on China’s agricultural commodities but also believe that the volatility spillover caused by price shocks in agricultural commodities has an asymmetric effect. Their research also found that the global financial crisis increased the jump intensity of crude oil prices. Ref. [16] go further and maintain that the volatility spillover between oil prices and agricultural commodities is asymmetric and that the bad news caused by financial turmoil intensifies the risk transmission between them. Their data cover a period of events causing financial turmoil such as the global financial crisis and the oil price crisis. Moreover, based on the frequency domain method, Ref. [17] found that the crude oil and agricultural commodity markets have bidirectional and asymmetric risk connectedness in different frequency bands. Their study also found that the overall risk connectedness peaked during the global financial crisis and the European debt crisis but not during the oil price crisis. It can be considered that different events have different effects on volatility spillovers. Ref. [18] also found that there is a bidirectional volatility linkage between energy and agricultural futures and that this linkage is from the co-movement effect caused by external shocks rather than the substitution effect caused by biofuel application.

Other studies maintain that the linkage of volatility between crude oil and agricultural commodities is not steady, so the impact of undesirable events on the linkage is overestimated. Based on the VAR system and Granger test, Ref. [19] found that oil prices have no volatility spillover on agricultural products and food but instead affect only the interaction between agricultural products and food. Ref. [20] used the asymmetric DCC-GARCH method to analyze the volatility spillover between energy and agricultural products in the German financial market and found that only in the long term can evidence of a positive correlation between risk connectedness be found and that the global financial crisis had not changed the correlation in the long term. Ref. [21] employed the method of the spillover index to training and believe that the volatility transmission between crude oil and agricultural products is lower than that between crude oil and precious metals and between crude oil and exchange rates. Ref. [22] explained the impact of oil prices on agricultural food prices for eight Asian countries in 2000–2016 and believe that there was a low degree of linkage between price volatility in energy and food security for most countries. Ref. [10] upgraded the VAR system in the spillover index to a time-varying parameter VAR system to analyze the interdependence between oil prices and various agricultural commodities in returns and volatility. The empirical results show that the start of the global financial crisis and the outbreak of the COVID-19 pandemic crisis made the attributes of different agricultural commodities as risk receivers and transmitters more prominent. Ref. [11] explored the volatility spillover between oil and the food market during the COVID-19 pandemic crisis period based on the frequency spillover index method. They believe that the spillover effect between oil and food is only strong in the short term and that spillovers during the pandemic have been significantly weaker than during the global financial crisis.

Compared with previous studies, the potential contributions of this paper are as follows: First, we employed multi-stage analysis as a way to distinguish the volatility spillover effects of crude oil and agricultural commodity futures before and after the outbreak of COVID-19. Secondly, we not only focus on international crude oil futures but also examine the risk connectedness caused by China’s crude oil futures in relation to agricultural commodity futures. Thirdly, based on the spillover index, we further modify the volatility spillover asymmetric measure method and employ it to explore the asymmetric effect of volatility spillover between crude oil and agricultural commodity futures.

3. Methodology

The methods used in this paper are mainly based on the measurement and decomposition of volatility spillover. Before a detailed explanation of the methods employed in this paper is provided, the application logic of these methods should be explained first to avoid the blind mixture of different methods. Firstly, we process the high-frequency data (intraday 5 min closing price) to the daily data of realized volatility and semi-variance based on Section 3.1. Secondly, we employ a spillover index to achieve multi-stage analysis in the time domain based on Section 3.2 with the above daily data, which is consistent with the study of [23] in concept. Thirdly, we measure the asymmetric effect of volatility spillover under multi-stage analysis based on Section 3.3. Therefore, the application logic of the following method realizes the investigation of multi-stage risk connectedness between crude oil and agricultural commodities in this paper.

3.1. Measuring Realized Variance and Semi-Variance

This paper uses realized variance to measure realized volatility. When the density of data is large enough, the sum of square returns is similar to the integrated volatility [24]. Consequently, a complete realized volatility () series is defined as the sum of square returns on high-frequency data, as follows [25]:

where is the intraday returns defined as the difference between consecutive intraday 5 min log closing prices (P), and n in Equation (1) represents the number of observations of intraday returns.

Then, the realized semi-variance can be obtained by complete decomposition of the realized volatility (), which is the prerequisite to measure the asymmetric effect of volatility spillover [26,27,28,29]). Therefore, the positive and negative realized semi-variance ( and ) are defined as follows:

where in Equations (2) and (3) is an indicator function that limits the positive and negative of . To some extent, the positive returns could be seen as good news, and the negative returns could be seen as bad news.

3.2. Measuring Volatility Spillover

This paper measures volatility spillover based on the method of [23], which belongs to the generalized vector autoregressive (VAR) system of order p, as follows:

where represents the N × 1 vector of time series variables of , , and with crude oil and agricultural commodity futures, is the N × N autoregressive coefficient matrices, and is the independently and identically distributed residual vector that is assumed to zero of the mean value and the same for covariance. Then, based on the moving average of Equation (4), we show the entries of connectedness by and estimate the contribution of variable j to the generalized H-step-ahead forecast error variance decompositions of variable i as:

where is the variance matrix for the residual vector , is the standard deviation of the residual term of the autoregressive equation corresponding to the jth variable, is an N × 1 vector, which has 1 as the ith element and zeros otherwise and is the moving average coefficient matrix from the forecast at time t. Because in the generalized VAR system, the variance contribution of the own and cross variables does not add up to 1, normalization of the matrix is necessary:

where and . Consequently, the index of total volatility spillover (TVS) is defined as the ratio of the contributions of spillovers from volatility shocks across variables in the VAR system to the total forecast error variance [23]:

Similarly, the index of directional volatility spillover (DVS) received by variable i from all other variables j is called “From index” (), defined as:

The index of directional volatility spillover transmitted by variable i to all other variables j is called “To index” (), defined as:

According to Equations (8) and (9), the index of net volatility spillover (NVS) with variable i is obtained as follows:

Therefore, Equation (10) is employed to determine whether a variable i is the receiver () or transmitter () of the volatility spillover.

3.3. Measuring the Asymmetric Effect

To investigate the asymmetric effect of volatility spillover, we employ the vector of realized semi-variances ( and ) to replace the vector of realized volatility () and re-estimate the index of volatility spillover.

With and , Ref. [30] define the index of the spillover asymmetric measure (SAM) as

where and are indices of volatility spillovers from the vector of and , respectively. It must be pointed out that Equation (11) measures the asymmetric effect of volatility spillover. However, to measure asymmetric volatility spillovers from variable i, an extended method has been generally employed to measure the asymmetric effect of volatility spillover, which is based on the research [27,28,29,31,32].

Specifically, if we need to explore the asymmetric spillover effect of good or bad news from variable i on other variables, we replace the vector of realized volatility () in the VAR system with and . Consequently, the asymmetric effect of volatility spillover of variable i to other variables can be measured according to Equation (12), and it is called asymmetric volatility spillover to other variables () as follows:

where and are indices of volatility spillovers from the vector of and , respectively. shows the cumulative volatility spillovers caused by good news and bad news. When , the value of is 0, and the volatility spillover is symmetric. When , the index of can be employed to measure the asymmetric effect of volatility spillover caused by good news () and bad news () from variable i.

4. Data and Preliminary Analysis

High-frequency data contain more abundant volatility information, and investors can use high-frequency trading to quickly obtain trading opportunities and adjust their portfolio strategies in a timely manner to gain returns. Given the logical balance between microstructure noise and accurate estimation, referring to the study of [33], the intraday 5 min sample dataset (closing price data) is used in the empirical analysis of this paper. All of the high-frequency data series were collected from the Wind Financial Database and the Resset Financial Database (www.resset.cn/, accessed on 30 July 2021). The supply elasticity of the above commodities is low, and the price changes are mainly caused by demand, while futures well reflect the demand for these commodities in the financial market. Additionally, intraday 5 min sample data are employed to obtain the daily measure of realized variance and semi-variances. For realized variance or volatility, using 5 min sample data can achieve balance in signal structure noise and measurement accuracy [33,34]. The data period includes the time before and after the outbreak of COVID-19, which covers the period of October 8 2018 to June 30, 2021, including 660 daily observations. We used the announcement made by the World Health Organization (WHO) on 30 January 2020, when the epidemic crisis was listed as a public health emergency of international concern (PHEIC) to define the pre- and post-outbreak periods of COVID-19.

For crude oil, this paper used Shanghai International Energy Exchange (INE) crude oil futures and West Texas Intermediate (WTI) crude oil futures to compare the volatility spillover effects of domestic and international crude oil on agricultural commodity futures [5,35].

For agricultural commodities, we adopted five futures with the largest trading volumes, which are strong gluten wheat, corn, soybean, cotton, and bean pulp [3,36,37]. Some studies believe that the application of agricultural products (e.g., corn, soybean, and wheat) in biofuel feedstock supports the growth of correlations between fossil fuel futures and agricultural commodity futures [7,8].

To sum up, the VAR system in this paper contains seven variables, which are WTI, INE, wheat, corn, soybean, cotton, and bean pulp. We constructed descriptive statistics and conducted unit root tests based on realized volatility () and realized semi-variances ( and ). Table 1 and Table 2 show descriptive statistics and the results of unit root tests of the pre- and post-COVID-19 periods. Several stylized facts emerge, including the following: (1) Whether before or after the outbreak of COVID-19, the data exhibit stationarity, and all variables can enter the VAR system. (2) Following the outbreak of the pandemic, the realized volatility of domestic and international crude oil has changed greatly. (3) A positive skewness shows that the probability of extreme negative returns is less than that of normal distribution, and the kurtosis of all variables is greater than 3, indicating that the probability distributions of realized volatility series are skewed and leptokurtic.

Table 1.

Descriptive statistics and unit root test of the pre-outbreak period of the COVID-19 pandemic.

Table 2.

Descriptive statistics and unit root test of the post-outbreak period of the COVID-19 pandemic.

In addition, two forms of data organization were employed in the empirical analysis, including full sample data and rolling sample data [10,23,27,28,29,38,39]. In general, full sample data are used for static analysis, while rolling sample data are used for dynamic analysis [9,40,41].

5. Empirical Results

This section examines the empirical results for the pre- and post-outbreak periods of the COVID-19 pandemic. In Section 5.1, we carry out an empirical analysis of risk connectedness on the total level based on realized volatility, and in Section 5.2, research on the asymmetric volatility spillover is based on positive and negative realized semi-variance. For full sample and rolling sample data, the optimal order for lags of the VAR system is four, which was selected according to the Akaike Information Criterion (AIC). Latterly, based on the framework of the DY spillover index [23], the size of rolling sample data in most studies is kept at 1/3 to 1/15 of the observations [16,18,27,29,42,43,44]. Consequently, the size of rolling sample data in this paper is 80 days (The rolling sample data run from point t-80 to point t, which result in a dynamic or time-varying analysis), and the horizon (H) of steps ahead forecasting error variance decomposition is 10.

5.1. Risk Connectedness at the Total Level

5.1.1. Full Sample Static Analysis

Based on Equation (7) to Equation (9) and the full sample data, we obtained the indexes of total static volatility spillovers among the seven variables, that is, the features of total risk connectedness, as shown in Table 3. It should be noted that the volatility spillovers between different agricultural commodity futures are much lower than that of precious metals, stock markets, energy futures, and other financial assets, which is similar to the studies of [10,37]. For example, both before and after the outbreak of COVID-19, the volatility spillover of wheat from other variables was negligible (0.14 and 0.26), and its risk mainly comes from itself (99.01 and 98.19). In contrast with energy futures, precious metal futures, and stock markets, which focus on financial attributes, agricultural commodity futures are more inclined to their commodity attributes. In general, the volatility spillover between the assets that stress financial attributes is stronger than that of assets that stress commodity attributes [38,39,42].

Table 3.

Total static volatility spillover between oil and agricultural commodity.

In addition, the total volatility spillover before the outbreak of COVID-19 was greater than after the outbreak (21.90 > 11.50). This is due to the systemic shock caused by the outbreak of COVID-19, which led to a decline in trading in the financial market [16]. Both before and after the outbreak of COVID-19, it is obvious to all that the two crude oil futures commodities are the main body of volatility spillovers of each other. Meanwhile, the risk transfer caused by China’s crude oil futures is more significant (13.14 > 6.43, 9.76 > 5.34). In other words, the energy financial market in China effectively reflects supply and demand and can carry out risk control. However, before the outbreak of COVID-19, wheat caused a large volatility spillover to China’s crude oil futures (26.87), which disappeared after the outbreak of COVID-19. A potential explanation is that the price of crude oil is closely related to agricultural production. A rise in oil prices will increase the cost of agricultural products. Wheat is the most important agricultural product in China, so its risk connectedness with crude oil is higher than that of other agricultural commodity futures. After the outbreak of COVID-19, the volatility spillover between corn, cotton, and crude oil increased (0.75 to 3.95; 0.49 to 5.52), which is related to the extensive application of corn and cotton in epidemic protection products (masks and alcohol).

5.1.2. Rolling Sample Dynamic Analysis

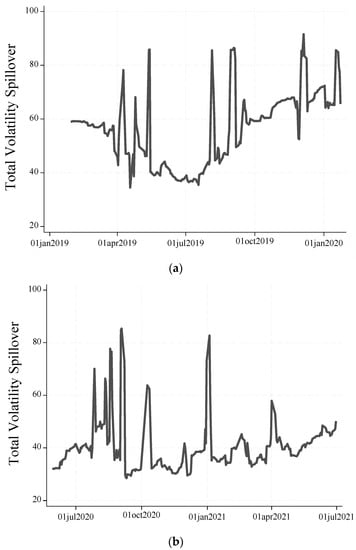

Based on the rolling sample data, we realized the dynamic description of the total volatility spillover. Figure 1 plot the total dynamic volatility spillover before and after the outbreak of COVID-19.

Figure 1.

(a) Total dynamic volatility spillover before the outbreak of COVID-19 (b). Total dynamic volatility spillover after the outbreak of COVID-19.

When comparing the results of Figure 1a,b, some stylized facts emerge. First, the total volatility spillover before the outbreak of COVID-19 is greater than that after the outbreak, which is consistent with the result of the full sample static analysis. Second, in the six months before the outbreak of COVID-19, the total volatility spillover in the VAR system showed a continuous upward trend, while after the outbreak, the total volatility spillover did not increase immediately but instead showed an increasing and decreasing trend only a few months later. This can be attributed to the discontinuity of COVID-19 on the financial markets [38]. Third, whether the epidemic broke out or not, the total volatility spillover may fluctuate greatly, and most studies believe that this is related to economic policies [23,29,30].

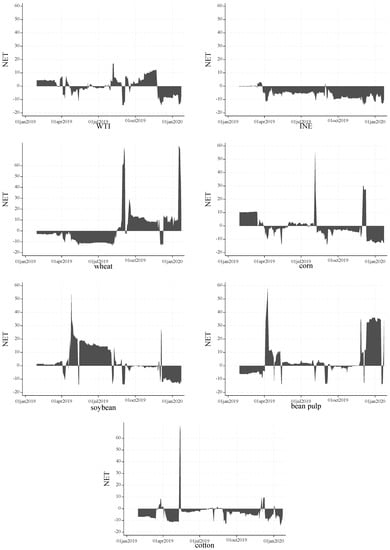

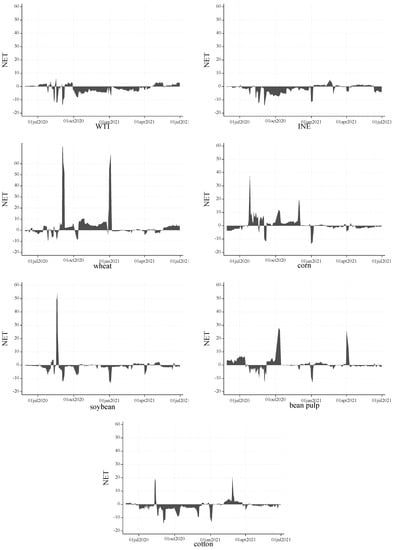

Next, Figure 2 and Figure 3 show the dynamic net volatility spillover, which is employed to explore whether a variable in the VAR system is the transmitter or receiver of volatility spillover. The shadow area can intuitively distinguish the difference formed by Equation (10), so both Figure 2 and Figure 3 are represented by the shadow area. Compared with Figure 2, the shadow area in Figure 3 is reduced, indicating that it is easier to observe which variables belong to the risk transmitter or receiver before the outbreak of COVID-19. Most of the time, China’s crude oil futures (INE) are the receiver of risk transfer, which is different from WTI. The reason may be that, on the one hand, INE is greatly influenced by the international crude oil market, while on the other hand, with the rapid development of biofuels, the correlation between agricultural products and oil prices has increased. It is worth noting that when agricultural commodity futures act as a risk transmitter, they may cause very violent volatility spillover (60 and above) in some periods. This feature is reflected in wheat, corn, soybean, bean pulp, and cotton and has been enhanced following the outbreak of COVID-19.

Figure 2.

Dynamic NET volatility spillover before the outbreak of COVID-19.

Figure 3.

Dynamic NET volatility spillover after the outbreak of COVID-19.

5.2. Asymmetric Risk Connectedness

5.2.1. Full Sample Static Analysis

Based on Equation (12) and the full sample data, we mainly discuss the total static asymmetric risk connectedness caused by good news and bad news from two kinds of crude oil futures. Therefore, “Total”, “To index”, and “From index” in Panel C of Table 4 and Table 5 are our focus.

Table 4.

Total static asymmetric volatility spillover (before the outbreak of COVID-19).

Table 5.

Total static asymmetric volatility spillover (after the outbreak of COVID-19).

As shown in Table 4, the total static asymmetric volatility spillover is −1.53 in the pre-outbreak period of the COVID-19 pandemic, which indicates that the volatility spillover caused by bad news regarding domestic and international crude oil futures is slightly higher than that caused by good news. Specifically, the volatility spillover caused by bad news regarding domestic crude oil futures (−125.61) is much higher than that of international crude oil futures (−43.57), which is positive for independent risk control. One of the purposes of establishing and improving the energy financial market in China is to restrict risk transfer in order to increase the security of strategic commodity trading.

In addition, wheat, corn, and bean pulp are more sensitive to bad news concerning crude oil (−18.18, −14.72, and −12.38), and cotton futures are more affected by good news (0.74). As a result, wheat, corn, and bean pulp may be oversupplied while cotton may be undersupplied. In the year and a half before the outbreak of COVID-19, the total asymmetric volatility spillover of soybean was 0, which may indicate the inelastic demand for soybean commodities in China, that is, whether good news or bad news will not additionally affect the risk of soybean trading.

The total static asymmetric volatility spillover in Table 5 following the outbreak of COVID-19 is −35.52; the risk transfer caused by bad news concerning crude oil futures is also greater than good news. Meanwhile, compared with before the outbreak of COVID-19, the volatility spillover caused by bad news is more prominent (−35.52 < −1.53). It must be noted that the increase in volatility spillover does not come from crude oil futures (−20.90 > −43.57, and −121.69 > −125.61) but rather from the systemic shock caused by COVID-19. It can be considered that the early COVID-19 outbreak inhibited the trading behavior in the financial market, thus reducing the risk transfer between different assets. Similar results can be found from the total spillover index caused by good news (20.72 > 8.82) and bad news (21.04 > 12.63) in Table 4 and Table 5.

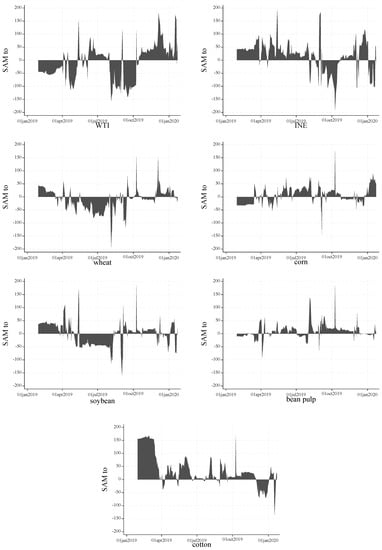

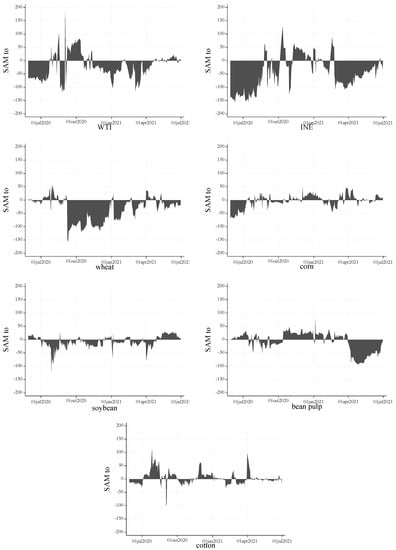

5.2.2. Rolling Sample Dynamic Analysis

The dynamic analysis was realized through the use of rolling sample data. Figure 4 and Figure 5 show the dynamic asymmetric volatility spillovers in the pre- and post-outbreak periods of the COVID-19 pandemic. Firstly, the asymmetric volatility spillover effect shows time-varying features in all of the variables, and before the COVID-19 outbreak, China’s crude oil futures (INE) were more sensitive to good news, while after the COVID-19 outbreak the situation has been the opposite. Although the volatility spillover of international crude oil (WTI) also shows an asymmetric effect, it is not clear whether it is good news or bad news that is dominating. Secondly, compared with before the outbreak of COVID-19, the asymmetric volatility spillover effects of corn, soybean, and cotton became weaker, which is due to the inhibitory effect of the epidemic on financial market trading activities. It should be noted that the asymmetric volatility spillover of wheat and bean pulp increased after the outbreak of COVID-19 and that this spillover is more sensitive to bad news. Wheat is mostly used to make food, while more than 80% of bean pulp is used to make animal feed. Consequently, compared with crude oil, agricultural commodity futures have prominent commodity attributes and weak financial attributes, especially those of wheat and bean pulp. We believe that the outbreak of COVID-19 made assets dominated by commodity attributes more sensitive to bad news.

Figure 4.

Dynamic asymmetric volatility spillover before the outbreak of COVID-19.

Figure 5.

Dynamic asymmetric volatility spillover after outbreak of COVID-19.

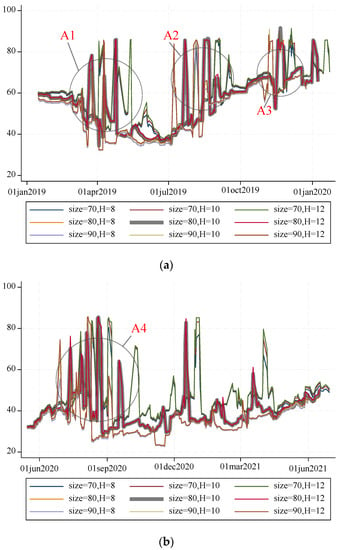

5.3. Robustness Checks

We checked the robustness of the empirical results by shifting the size of the rolling sample data and forecasting horizon [16,28,43]. To check that the empirical results did not deviate seriously from the prediction due to the size of the rolling sample (size) and forecasting horizon (H), we set the following parameters to check the robustness: and . Consequently, in addition to the parameter combinations used in this paper (), there are also the following parameter combinations: (1) ; (2) ; (3) ; (4) ; (5) ; (6) ; (7) ; and (8) . We then plotted the total dynamic volatility spillover in the pre- and post-outbreak periods of the COVID-19 pandemic under different parameter combinations, as shown in Figure 6a,b.

Figure 6.

(a) Total dynamic volatility spillover robustness tests before the outbreak of COVID-19 (b) Total dynamic volatility spillover robustness tests after the outbreak of COVID-19. A1: February 2019 to May 2019. A2: July 2019 to September 2019. A3: November 2019 to December 2019. A4: July 2020 to October 2020.

The parameter combinations employed in this paper are shown in bold in Figure 6a,b to form a contrast. In most periods, the change in the parameter will not cause the total dynamic volatility spillover to deviate significantly, especially as H is only moved in the case of fixed size; thus, the transformation of the graph is minor. Before the outbreak of COVID-19, for all parameter combinations, the uncertainty of total volatility spillover is concentrated in February 2019 to May 2019 (A1), July 2019 to September 2019 (A2), and November 2019 to December 2019 (A3) in Figure 6a. Similar evidence is shown in A4 in Figure 6b. Consequently, both Figure 6a and Figure 6b provide evidence that the empirical results in this paper are not dependent on the size of rolling sample data (size) or the forecasting horizon (H).

6. Conclusions and Policy Implications

Risk can be reflected by volatility, so the risk connectedness between different assets can be explained by volatility spillover. As typical commodities, precious metals, crude oil, and agricultural commodity futures are regarded as unique asset categories because they have both commodity attributes and financial attributes. In the case of a global disaster like the COVID-19 pandemic crisis, investors’ preference for assets such as stocks and bonds will decline and the mobility of people will be restricted, which will weaken all trading activities in the financial market. Therefore, based on the spillover index and an improved spillover asymmetric measurement method, this paper studies risk connectedness and its asymmetric effect between crude oil and agricultural commodity futures before and after the outbreak of COVID-19.

We found that (1) after the outbreak of COVID-19, the total volatility spillover in the VAR system became less important, which can be found from the full sample static analysis and rolling sample dynamic analysis. (2) Whether the pandemic crisis occurs or not, China’s crude oil futures are the receiver of risk most of the time, which is different from international crude oil. It is not difficult to find that China has partially achieved risk control and restraint by establishing an independent energy financial market. (3) Regardless of the outbreak occurring or not, there is always an asymmetric effect in the risk connectedness between crude oil and agricultural commodities; however, since the outbreak of COVID-19, agricultural commodity futures have become more sensitive to bad news than crude oil. When encountering economic crises and pandemic crises, assets with prominent commodity attributes are more susceptible to bad news.

This research may have the following policy implications for stakeholder decision making: Firstly, when crude oil and China’s agricultural commodity futures are under extreme conditions of uncertainty, the energy financial market in China can provide positive and effective risk management tools to cut the risk propagation caused by the shocks to international crude oil prices. It is imperative to constantly improve the independent energy financial market and enrich the transaction subjects. Secondly, in the face of the epidemic crisis, although the total vitality of the financial market has declined, the impact on agricultural commodity futures is more prominent than that on crude oil, which reflects the golden rule of survival first. Consequently, it is necessary to improve the monitoring and warning mechanism of China’s agricultural commodity market to improve its ability to respond to shocks to crude oil prices and the impact of undesirable events like the outbreak of COVID-19.

Author Contributions

Conceptualization, F.Q.; methodology, F.Q.; validation, D.Z.; formal analysis, D.Z., W.S. and C.H.; investigation, F.Q. and C.H.; data curation, D.Z. and F.Q.; writing—original draft, F.Q.; writing—review & editing, D.Z. and W.S.; visualization, C.H. All authors have read and agreed to the published version of the manuscript.

Funding

This work was supported by the Open Fund of Sichuan Oil and Gas Development Research Center (SKB23-06), Institute for Healthy Cities of Chengdu (2023ZC06), and the Research Center for Modernization of Urban and Rural Governance (CXZL202304).

Data Availability Statement

Data will be made available on request.

Acknowledgments

The authors would like to thank the anonymous referee for reading the paper carefully and giving several constructive suggestions.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Baffes, J. Oil spills on other commodities. Resour. Policy 2007, 32, 126–134. [Google Scholar] [CrossRef]

- Hamilton, J.D. Understanding Crude Oil Prices. Energy J. 2009, 30, 179–206. [Google Scholar] [CrossRef]

- Zhang, C.; Qu, X. The effect of global oil price shocks on China’s agricultural commodities. Energy Econ. 2015, 51, 354–364. [Google Scholar] [CrossRef]

- Lv, F.; Yang, C.; Fang, L. Do the crude oil futures of the Shanghai International Energy Exchange improve asset allocation of Chinese petrochemical-related stocks? Int. Rev. Financ. Anal. 2020, 71, 101537. [Google Scholar] [CrossRef]

- Yang, C.; Lv, F.; Fang, L.; Shang, X. The pricing efficiency of crude oil futures in the Shanghai International Exchange. Financ. Res. Lett. 2020, 36, 101329. [Google Scholar] [CrossRef]

- Tyner, W.E. The integration of energy and agricultural markets. Agric. Econ. 2010, 41, 193–201. [Google Scholar] [CrossRef]

- Alsaleh, M.; Abdul-Rahim, A.; Mohd-Shahwahid, H. Determinants of technical efficiency in the bioenergy industry in the EU28 region. Renew. Sustain. Energy Rev. 2017, 78, 1331–1349. [Google Scholar] [CrossRef]

- Ji, Q.; Fan, Y. How does oil price volatility affect non-energy commodity markets? Appl. Energy 2012, 89, 273–280. [Google Scholar] [CrossRef]

- Sun, Y.; Mirza, N.; Qadeer, A.; Hsueh, H.-P. Connectedness between oil and agricultural commodity prices during tranquil and volatile period. Is crude oil a victim indeed? Resour. Policy 2021, 72, 102131. [Google Scholar] [CrossRef]

- Umar, Z.; Jareño, F.; Escribano, A. Agricultural commodity markets and oil prices: An analysis of the dynamic return and volatility connectedness. Resour. Policy 2021, 73, 102147. [Google Scholar] [CrossRef]

- Cao, Y.; Cheng, S. Impact of COVID-19 outbreak on multi-scale asymmetric spillovers between food and oil prices. Resour. Policy 2021, 74, 102364. [Google Scholar] [CrossRef] [PubMed]

- Hung, N.T. Oil prices and agricultural commodity markets: Evidence from pre and during COVID-19 outbreak. Resour. Policy 2021, 73, 102236. [Google Scholar] [CrossRef]

- Zhu, B.; Lin, R.; Deng, Y.; Chen, P.; Chevallier, J. Intersectoral systemic risk spillovers between energy and agriculture under the financial and COVID-19 crises. Econ. Model. 2021, 105, 105651. [Google Scholar] [CrossRef]

- Serra, T. Volatility spillovers between food and energy markets: A semiparametric approach. Energy Econ. 2011, 33, 1155–1164. [Google Scholar] [CrossRef]

- Nazlioglu, S.; Erdem, C.; Soytas, U. Volatility spillover between oil and agricultural commodity markets. Energy Econ. 2013, 36, 658–665. [Google Scholar] [CrossRef]

- Shahzad, S.J.H.; Hernandez, J.A.; Al-Yahyaee, K.H.; Jammazi, R. Asymmetric risk spillovers between oil and agricultural commodities. Energy Policy 2018, 118, 182–198. [Google Scholar] [CrossRef]

- Kang, S.H.; Tiwari, A.K.; Albulescu, C.T.; Yoon, S.-M. Exploring the time-frequency connectedness and network among crude oil and agriculture commodities V1. Energy Econ. 2019, 84, 104543. [Google Scholar] [CrossRef]

- Han, L.; Jin, J.; Wu, L.; Zeng, H. The volatility linkage between energy and agricultural futures markets with external shocks. Int. Rev. Financ. Anal. 2020, 68, 101317. [Google Scholar] [CrossRef]

- Kaltalioglu, M.; Soytas, U. Volatility Spillover from Oil to Food and Agricultural Raw Material Markets. Mod. Econ. 2011, 2, 71–76. [Google Scholar] [CrossRef]

- Cabrera, B.L.; Schulz, F. Volatility linkages between energy and agricultural commodity prices. Energy Econ. 2016, 54, 190–203. [Google Scholar] [CrossRef]

- Awartani, B.; Aktham, M.; Cherif, G. The connectedness between crude oil and financial markets: Evidence from implied volatility indices. J. Commod. Mark. 2016, 4, 56–69. [Google Scholar] [CrossRef]

- Taghizadeh-Hesary, F.; Rasoulinezhad, E.; Yoshino, N. Energy and Food Security: Linkages through Price Volatility. Energy Policy 2019, 128, 796–806. [Google Scholar] [CrossRef]

- Diebold, F.X.; Yilmaz, K. Better to give than to receive: Predictive directional measurement of volatility spillovers. Int. J. Forecast. 2012, 28, 57–66. [Google Scholar] [CrossRef]

- Andersen, T.G.; Bollerslev, T.; Diebold, F.X.; Labys, P. Modeling and Forecasting Realized Volatility. Econometrica 2003, 71, 579–625. [Google Scholar] [CrossRef]

- Andersen, T.G.; Bollerslev, T. Answering the Skeptics: Yes, Standard Volatility Models do Provide Accurate Forecasts. Int. Econ. Rev. 1998, 39, 885. [Google Scholar] [CrossRef]

- Barndorff-Nielsen, O.E.; Kinnebrock, S.; Shephard, N. Measuring downside risk: Realised semivariance. In Volatility and Time Series Econometrics: Essays in Honor of Robert Engle; University of Oxford: Oxford, UK, 2010. [Google Scholar]

- Li, W. COVID-19 and asymmetric volatility spillovers across global stock markets. N. Am. J. Econ. Financ. 2021, 58, 101474. [Google Scholar] [CrossRef]

- Maitra, D.; Guhathakurta, K.; Kang, S.H. The good, the bad and the ugly relation between oil and commodities: An analysis of asymmetric volatility connectedness and portfolio implications. Energy Econ. 2021, 94, 105061. [Google Scholar] [CrossRef]

- Qu, F.; Chen, Y.; Zheng, B. Is new energy driven by crude oil, high-tech sector or low-carbon notion? New evidence from high-frequency data. Energy 2021, 230, 120770. [Google Scholar] [CrossRef]

- Baruník, J.; Kočenda, E.; Vácha, L. Asymmetric connectedness on the U.S. stock market: Bad and good volatility spillovers. J. Financ. Mark. 2016, 27, 55–78. [Google Scholar] [CrossRef]

- Chen, Y.; Li, W.; Qu, F. Dynamic asymmetric spillovers and volatility interdependence on China’s stock market. Phys. A Stat. Mech. Its Appl. 2019, 523, 825–838. [Google Scholar] [CrossRef]

- BenSaïda, A. Good and bad volatility spillovers: An asymmetric connectedness. J. Financ. Mark. 2019, 43, 78–95. [Google Scholar] [CrossRef]

- Andersen, T.G.; Todorov, V. Realized Volatility and Multipower Variation. In Encyclopedia of Quantitative Finance; John Wiley & Sons, Ltd.: New York, NY, USA, 2010. [Google Scholar] [CrossRef]

- Bollerslev, T.; Zhou, H. Volatility puzzles: A simple framework for gauging return-volatility regressions. J. Econom. 2006, 131, 123–150. [Google Scholar] [CrossRef]

- Klein, T. Trends and contagion in WTI and Brent crude oil spot and futures markets—The role of OPEC in the last decade. Energy Econ. 2018, 75, 636–646. [Google Scholar] [CrossRef]

- Hau, L.; Zhu, H.; Huang, R.; Ma, X. Heterogeneous dependence between crude oil price volatility and China’s agriculture commodity futures: Evidence from quantile-on-quantile regression. Energy 2020, 213, 118781. [Google Scholar] [CrossRef]

- Luo, J.; Ji, Q. High-frequency volatility connectedness between the US crude oil market and China’s agricultural commodity markets. Energy Econ. 2018, 76, 424–438. [Google Scholar] [CrossRef]

- Hung, N.T.; Vo, X.V. Directional spillover effects and time-frequency nexus between oil, gold and stock markets: Evidence from pre and during COVID-19 outbreak. Int. Rev. Financ. Anal. 2021, 76, 101730. [Google Scholar] [CrossRef]

- Mensi, W.; Shafiullah, M.; Vo, X.V.; Kang, S.H. Volatility spillovers between strategic commodity futures and stock markets and portfolio implications: Evidence from developed and emerging economies. Resour. Policy 2021, 71, 102002. [Google Scholar] [CrossRef]

- Jebabli, I.; Arouri, M.; Teulon, F. On the effects of world stock market and oil price shocks on food prices: An empirical investigation based on TVP-VAR models with stochastic volatility. Energy Econ. 2014, 45, 66–98. [Google Scholar] [CrossRef]

- Su, C.W.; Wang, X.-Q.; Tao, R.; Oana-Ramona, L. Do oil prices drive agricultural commodity prices? Further evidence in a global bio-energy context. Energy 2019, 172, 691–701. [Google Scholar] [CrossRef]

- Dahl, R.E.; Oglend, A.; Yahya, M. Dynamics of volatility spillover in commodity markets: Linking crude oil to agriculture. J. Commod. Mark. 2020, 20, 100111. [Google Scholar] [CrossRef]

- Gong, X.; Liu, Y.; Wang, X. Dynamic volatility spillovers across oil and natural gas futures markets based on a time-varying spillover method. Int. Rev. Financ. Anal. 2021, 76, 101790. [Google Scholar] [CrossRef]

- Lovcha, Y.; Perez-Laborda, A. Dynamic frequency connectedness between oil and natural gas volatilities. Econ. Model. 2020, 84, 181–189. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).